Bridge Report:(3110)NITTO BOSEKI the Fiscal Year March 2019

Representative and Chief Executive Officer Yuichi Tsuji | NITTO BOSEKI CO., LTD. (3110) |

|

Company Information

Market | TSE 1st Section |

Industry | Glass and ceramics products (manufacturing) |

Representative and Chief Executive Officer | Yuichi Tsuji |

HQ Address | Kojimachi-odori Bldg., 2-4-1, Kojimachi, Chiyoda-ku, Tokyo |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥2,349 | 39,935,512 shares | ¥93,808 million | 9.1% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥40.00 | 1.7% | ¥159.78 | 14.7 x | ¥2,312.06 | 1.0 x |

*The share price is the closing price on July 11. Shares Outstanding, ROE, DPS, EPS, BPS are taken from the financial settlement report for 2019/3.

Earnings Trend

Fiscal Year | Net Sales | Operating Profit | Ordinary Profit | Net Profit | EPS | DPS |

2016/Mar Act. | 86,199 | 10,893 | 10,974 | 5,598 | 140.50 | 30.00 |

2017/Mar Act. | 83,324 | 11,148 | 11,396 | 7,479 | 188.57 | 35.00 |

2018/Mar Act. | 84,526 | 10,837 | 11,071 | 10,253 | 263.97 | 40.00 |

2019/Mar Act. | 82,292 | 8,198 | 8,934 | 7,984 | 205.76 | 40.00 |

2020/Mar Forecast | 90,000 | 8,500 | 8,800 | 6,200 | 159.78 | 40.00 |

*Unit: million yen. The estimates are from the company.

This report introduces the company overview, earnings trends, the progress of mid-term business plan, etc. of NITTO BOSEKI CO., LTD.

Table of Contents

Key Points

1. Company Overview

2. Results for Fiscal Year Ending March 2019

3. Forecast for Fiscal Year Ending March 2020

4. Progress of the <<Go for Next 100>> Mid-Term Business Plan

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

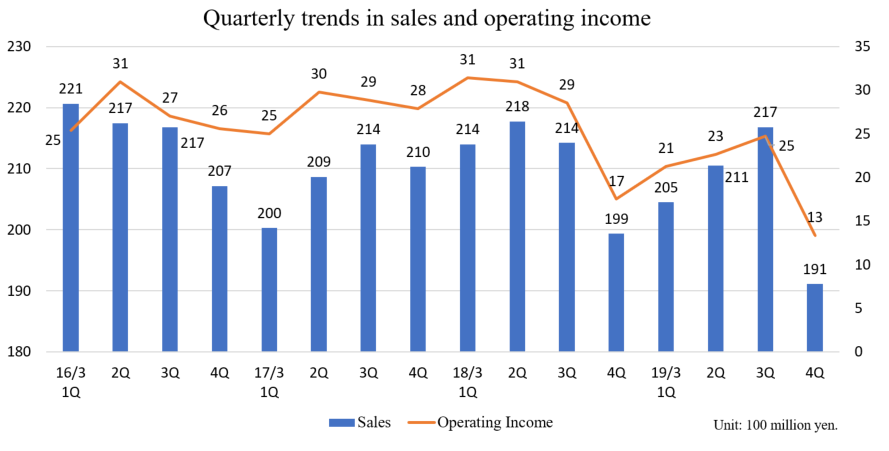

- Net Sales for the Fiscal Year Ending March 2019 were 82,200 million yen, down 2.6% year on year. Net Sales of Textile Business and Glass Fiber Yarn Business decreased. Operating Profit dropped 24.3% year on year to 8,100 million yen. Net Sales decreased mainly due to sluggish sales of ultrafine yarns and ultra-thin cloth associated with the production adjustment of smartphones, despite strong sales of special glass (T and NE glass). Increase in fuel costs also gave negative impacts. The company made an investment for the business reinforcement as planned. Ordinary Profit declined 19.3% year on year to 8,900 million yen. There were no longer foreign exchange losses, which were posted in the previous year, and foreign exchange gains of 200 million yen were posted instead. Net Profit decreased 22.1% year on year to 7,900 million yen. A gain on sales of investment securities of 800 million yen was posted as extraordinary income, while an impairment loss of 1,000 million yen was posted as extraordinary loss. As a whole, the results were almost same as the revised forecast announced in February 2019.

- For the Fiscal Year Ending March 2020, Net Sales are estimated to rise 9.4% year on year to 90 billion yen. The “Glass Fiber Yarn Business,” “Grass Fiber Cloth Business” and “Life Science Business” will lead the sales. Operating Profit is projected to grow 3.7% year on year to 8.5 billion yen. Operating Profit is forecasted to increase year on year as the capital investment effects of special glass will appear from the second half. The company will continuously reinforcing the business base for the mid to long-term growth including depreciation costs for new investments. It is also estimated that there will be some effects of the yen appreciation and the rises in oil price, distribution cost, etc. like in the previous year. Estimated dividend is 40 yen/share, the same level as the previous term. The estimated payout ratio is 25.0%. The premise of exchange rate is 108.0 yen/USD, which is 2.7 yen higher than 110.7 yen/USD in the previous term.

- In the previous report, we have stated that “in the short term, we would like to pay attention to the sales growth in the third and fourth quarter.” Although the sales of special glass, a high value-added product, were strong, Net Sales and Operating Profit decreased in the Fiscal Year Ending March 2019 mainly due to sluggish sales of ultrafine yarns and ultra-thin cloth associated with the production adjustment of smartphones. Similarly, in the first half of the Fiscal Year Ending March 2020, slow business continues and the growth of Net Sales and Operating Profit in full-term will be minor. However, the business performance will rapidly recover from second half with “sales of 96 billion yen and operating profit of 11 billion yen” on the year-base conversion in the second half as strengthened production of special glass will generate profit from the second half. Therefore, the company believes that goals of the Mid-Term Business plan “Go for Next 100” which will end in the Fiscal Year Ending March 2021 is attainable. We would like to watch the progress of this term as a solid foundation towards the final year of Mid-Term Business Plan. We will also pay attention to the progress of various measures under the Mid-Term Business Plan “Go for Next 100”, in particular, strengthening “T glass” and “NE glass” and the growth speed of the Medical Business, which is considered as the second pillar.

1. Company Overview

The company succeeded in the first industrialization of glass fiber in Japan through technologies of the textiles business which is its original business. It provides products for a wide range of applications, such as electronic materials and industrial materials, with consistent coverage from yarn manufacturing to glass cloth processing.

Above all, micro unit, ultrathin glass cloth, manufactured by the company’s unique technology, is employed as an important precision material for electronic devices that are constantly being downsized, light-weighted and functionally improved such as PC and smart phones, and is highly competitive.

Furthermore, for “in vitro diagnostic reagents” in the life science business, have the top share in more than 10 items in Japan.

1-1 Corporate History

“Koriyama Kenshi Boseki Co., Ltd” founded in Koriyama, Fukushima Prefecture in 1898, is the predecessor. The company has a history of 120 years.

Nitto Boseki Co., Ltd. was established in 1923 when Fukushima Boshoku Co., Ltd. (formerly Fukushima Seiren Seishi Co., Ltd.) acquired the ownership of the Iwashiro Spinning Plant of Katakura Seishi (formerly Koriyama Kenshi Boseki Co., Ltd) in 1918.

In 1938, it succeeded in industrialization (mass production) of glass fiber for the first time in Japan. In the world, Owens Corning Glass Fiber of the United States has achieved the industrialization of glass fiber around the same time.

In 1949, it began manufacturing glass wool for the first time in Japan.

In 1969, utilizing the technologies cultivated in the textile business, the company began manufacturing glass cloth for printed wiring board. In 1982, it began manufacturing test reagents for blood coagulation factors. And in 1983, it succeeded in industrializing functional polymers “PAA®” for the first time in the world. As such, the company has continued to challenge new fields and expanded its business fields.

It has established the Mid to Long Term Business Plan “Vision 101” and Mid-Term Business Plan “Go for Next 100” targeting its 100th anniversary in April 2023 and is currently implementing them.

1-2 Management Philosophy

Its corporate philosophy is as follows: “Nittobo Group will, as a corporate group, enhance its significance by striving to create healthy and comfortable lifestyles, and thereby continue to contribute to the realization of prosperous communities.”

Furthermore, under the following Nittobo Declaration, it is aiming to be society’s “best partner” in collaboration with all stakeholders.

Nittobo Group aims to become the “Best Partner” of your community. (Nittobo BP Declaration) |

We will relentlessly strive to identify our customers’ needs and will find great satisfaction in steadfastly earning their Confidence and Trust. In addition, we will attach importance to sharing this satisfaction with all of our stakeholders (communities) through our products and services, including shareholders, investors, public administrations and regional communities. |

We are committed to becoming a corporate group in which the potential of our respective, independent employees is valued and thereby inspires our employees to freely and willingly share their own ideas, ultimately achieving greater results through teamwork. Our corporate group will provide its’ employees with an opportunity for progress and self-realization based on the belief that their progress leads to everyone’s success. |

We will encourage our employees to be good citizens, think deeply, observe widely, act courageously and to approach their jobs with resolve and determination. |

(From the company’s website)

1-3 Business Description

(1)Business Description

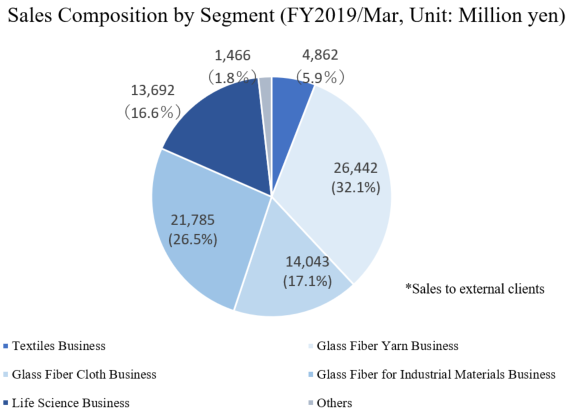

The company’s business can be largely divided into three categories, namely, the “Textiles Business” which manufactures and sells textile products mainly for the apparel industry, the “Glass Fiber Business” which manufactures and sells various products using glass fiber, and the “Life Science Business” that manufactures Immunological in vitro diagnostic reagents and specialty chemicals products.

As for the reporting segments, the “Glass Fiber Business” is divided into three categories, namely, the “Glass Fiber Yarn Business,” “Glass Fiber Cloth Business,” and “Glass Fiber for Industrial Materials Business.” Together with the “Textiles Business” and “Life Science Business,” there are a total of 5 reporting segments. In addition, there is a category called “Others” which consists of the real estate business and service business that are not included in the reporting segment.

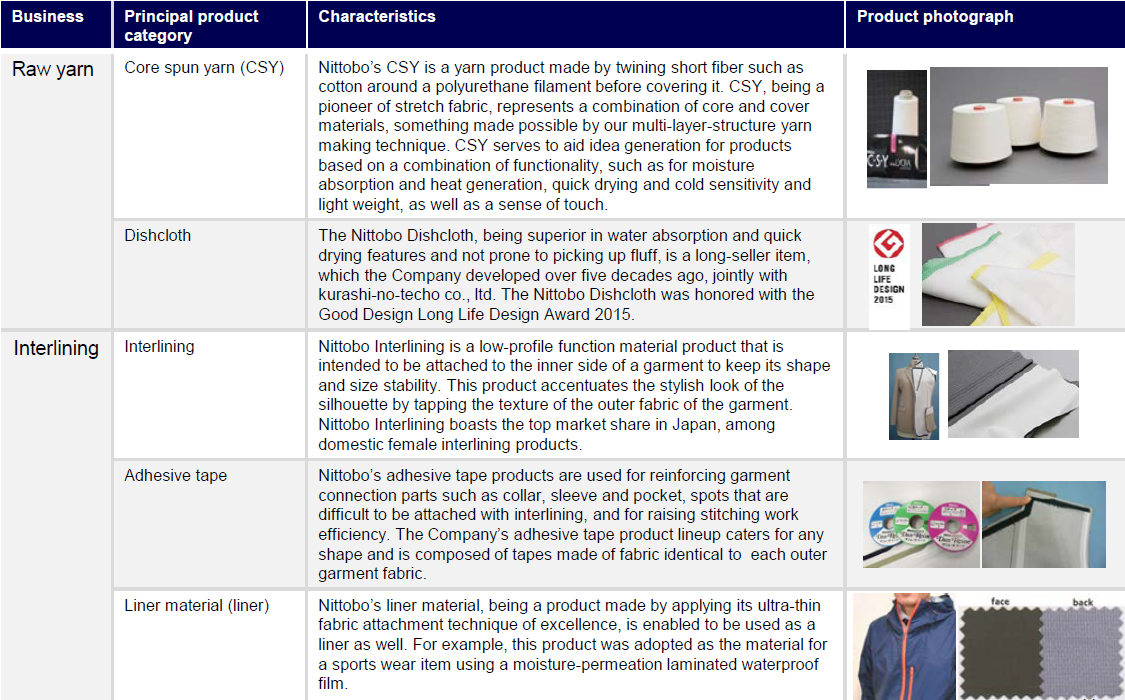

①Textiles Business

The company provides products utilizing its unique technologies to respond to the diversifying needs of customers, from yarns that are indispensable for clothing, to secondary materials and products. “C·S·Y (Core Spun Yarn)” is the double-structured textile which is the precursor of stretch fabrics. “Dan Reine” is adhesive interlining for women and has been boasting high market share. And “Nittobo Dishcloth” won the 2015 Good Design Long Life Design Award.

(Source: the company)

②Glass Fiber Business

The company succeeded in the first industrialization of glass fiber in Japan. It provides products for a wide range of applications with consistent coverage from yarn manufacturing to glass cloth processing.

Above all, micro unit, ultra-thin glass cloth is employed as an important precision material for electronic devices that are constantly being downsized, light-weighted and functionally improved such as PC and smart phones, and its quality receiving high appraisal throughout the world.

In addition, the company spearheaded the manufacturing of glass wool in Japan to be used as insulation for housing, and is regarded as the pioneer of heat insulation materials with its unique technologies. In particular, high performance glass wool contributes to an energy-saving society as heat insulation materials for very airtight and highly heated insulating houses.

(Major uses)

High function electronic substrate | Ultra-thin glass cloth is excellent in insulation, heat resistance and dimensional stability, and is mainly used as an insulating layer of electronic substrate. It contributes to miniaturization and higher functionality of electronic equipment by thinner and uniform fiber distribution. |

Glass fiber for composite material of smartphone body (FF) | With its unique technology, the company succeeded in making the cross section of glass fiber an oblong shape, instead of an ordinary circular shape. When used as a composite material, it helps avoid warpage and twist of molded products. It is used in the body of small electronic devices such as smartphones for which even a small distortion cannot be allowed. |

Automobile | “FRP (fiber reinforced plastic)” is widely used in various parts of automobiles as a light weight and high strength material. |

Resin coating film material | Glass cloth for membrane materials made with glass fiber is widely used for indoor tennis courts, membrane materials for tent warehouse, and various events. It is also adopted in multipurpose stadiums and soccer fields. |

Residential insulation (glass wool) | Glass wool exerts high insulation performance and is excellent in airtightness and soundproofing. Hence, it is widely used for houses and buildings as well as ships and vehicles. |

<What is glass fiber?>

Glass fiber is a product for which glass is melted at a high temperature of 1,300℃ or higher and stretched to be fibrous.

The company succeeded in the industrialization of glass fiber for the first time in 1938 in Japan, and it developed rapidly thereafter.

Its characteristics include strength, heat resistance, non-flammability, electrical insulation and chemical resistance, and it is used for various purposes such as printed wiring boards, and building materials. For its excellent characteristics, it is being used in a wide range of industries.

(Composition, property)

As described earlier, it has characteristics such as strength, heat resistance, non-flammability, and electrical insulation. However, to be applied as electronic materials, higher level of performance including high strength, high elasticity, and low dielectric is required.

(Manufacturing method)

After raw materials of glass are melted at a high temperature of 1,300 to 1,600℃, they pass through a spinning nozzle and are reeled up to form a filament. A very precise control technique is required.The thinness of the glass fiber, which is a glass base pulled out from the machine at high speed, is 4 to 24 micrometers in diameter. (*The thinness of a human hair is about 50 to 100 micrometers.)

The spun glass fiber is processed into product forms according to the application.

(Major product forms)

◎Yarns

Yarns (twisted yarns) include a single yarn which is a strand composed of several hundred filaments that are simultaneously spun and twisted in the same direction and a twisted yarn which is made by twisting several single yarns.

The “E glass yarn,” a single yarn made of twisted strands mainly composed of filaments of 4.0 μm to 7.4 μm, has excellent electrical insulation, heat resistance, tensile strength, and dimensional stability, and is generally used for printed wiring boards. In addition, it is highly compatible with resins due to its unique surface treatment technology for industrial materials. It is highly evaluated as a composite material base material with good workability.

◎Glass fiber cloth

Glass cloth, which is fabric (cloth form) made of glass fiber yarns, is used for a wide range of applications such as printed wiring boards, damping materials, tent films, and road reinforcement materials.

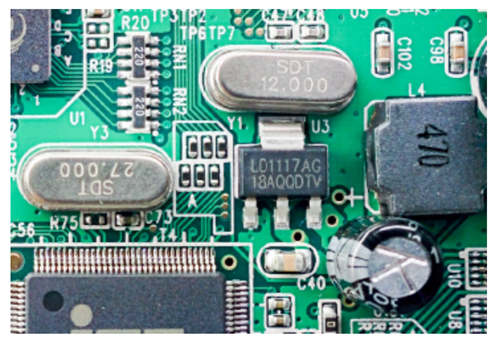

Among them, the glass cloth used for printed wiring boards and electronic parts is the company’s flagship product that it boasts worldwide.

【Glass cloth for printed wiring boards】

A printed wiring board is formed of the fine wiring of metals such as copper on the surface of a base body such as resin, and components including resistors, capacitors and IC chips are fixed by soldering on the wiring. It is an important parts that influence the performance of all electronic equipment, including PC, smartphones, servers, medical equipment, industrial robots, automobiles, and aircraft.

For the insulator of the board body, various materials such as glass and polyester resin are used. Glass fiber, which has characteristics of high insulation, high strength, heat resistance, and dimensional stability, is thought to be the most suitable material for a printed wiring board.

Along with remarkable development of digital technologies, electronic devices such as PC and smartphones are becoming lighter, thinner, smaller and more sophisticated, and the need for the improvement of glass cloth performance is increasing.

In response to these needs, the company develops high performance glass cloth products such as “Low dielectric glass cloth (NE-glass),” “Low CTE (Coefficient of Thermal Expansion) glass cloth (T-glass),” and “Ultra-thin glass cloth,” using the strengths of integrated manufacturing based on its unique technologies including glass composition development technology, fiber development technology and textile processing technology and has a high market share.

“Low dielectric glass cloth (NE-glass)”

Higher speed transmission with higher frequency is becoming more common, and low dielectric materials that reduce transmission loss is required for printed wiring boards.

To address the need, the company has developed the “NE-glass” that is excellent in low dielectric constant and dissipation factor with the same characteristics as “E-glass” by lowering the component ratio of alkaline-earth elements (CaO, MgO) as compared with the conventional “E-glass” while enhancing the component ratio of boric acid (B2O3).

It is mainly used for electronic boards for data centers and base station servers.

“Low CTE glass cloth (T-glass)”

“T glass” has the higher component ratio of silica (SiO2) and alumina (Al2O3) compared with the standard “E-glass” and provides significantly advanced mechanical and thermal performance of glass fiber.

Utilizing its low thermal expansion characteristics and high tensile elasticity, it realizes excellent dimensional stability and increased rigidity, and it is used as an electronic substrate for semiconductor packages mainly mounted on smartphones as a high-performance electronic material.

Like carbon fiber and aramid fiber, it also works well as a reinforcing material for advanced composite materials, so it is used by itself or as a hybrid material with carbon fiber in the fields of aviation, space and sports.

“Ultra-thin glass cloth”

Demand for thinner glass cloth is increasing as a material to respond to the trend of making lighter, thinner and smaller printed wiring boards with high density packaging. In addition to its thinness, the company’s ultra-thin glass cloth has superb capacities to process fine holes both for laser and drill processing and offers great dimensional stability and surface smoothness as a laminated plate.

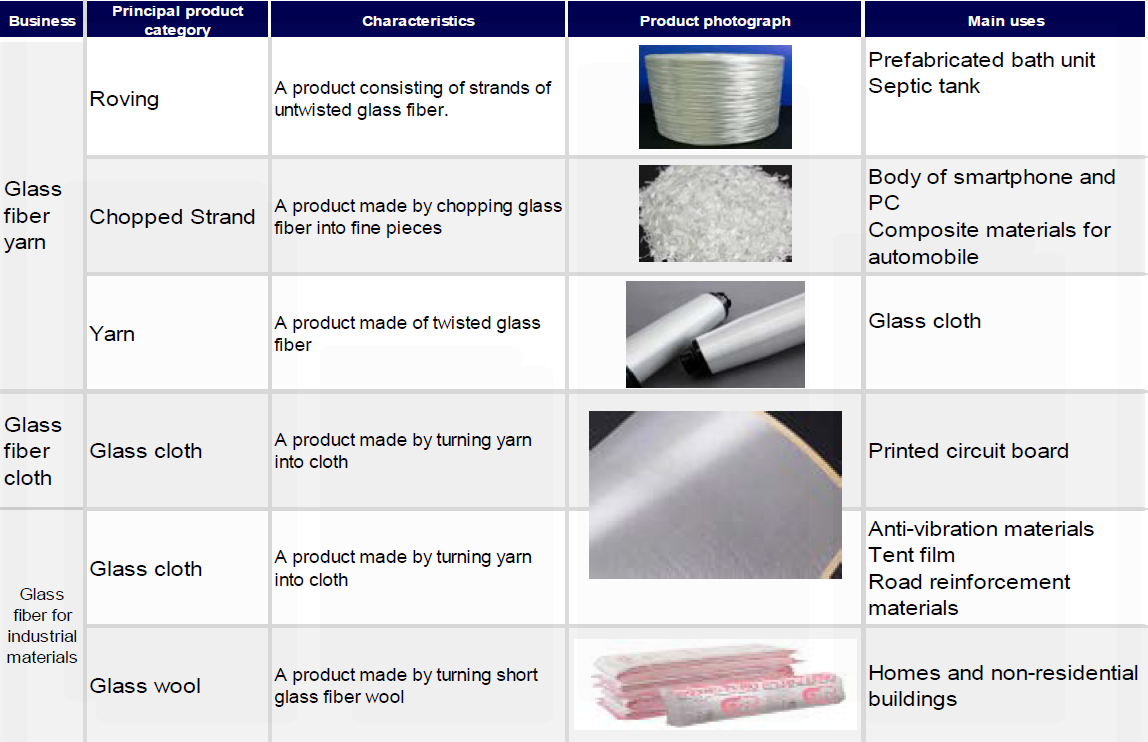

The product forms and uses by segment in the glass fiber business are as follows.

(Source: the company)

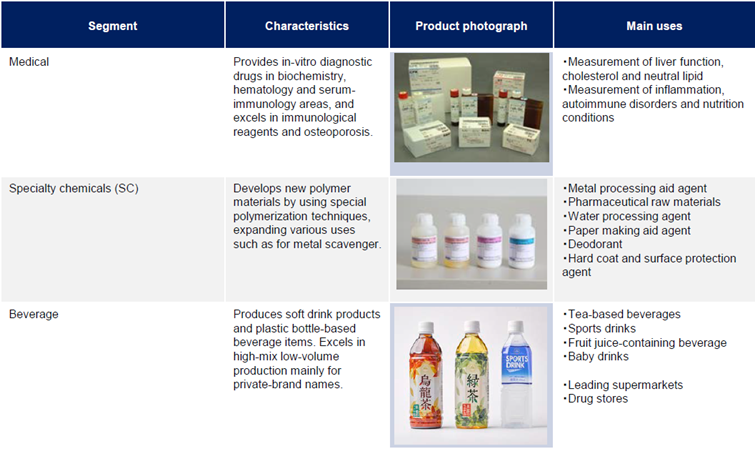

③Life Science Business

The Life Science Business consists of the Medical Division and the Environment and Health Division.

The Medical Division manufactures and sells in vitro diagnostic reagents used for blood and urine tests and specialty chemicals products centered on functional polymers.

The company is achieving high quality and stable supply of the “in vitro diagnostic reagents” that are used in health checkups and thorough physical examinations to examine health status using blood or urine, by integrally manufacturing them from the antiserum as the raw material to the diagnostic reagents as the final product within the Group.

The products’ high quality has been recognized, and they are supplied in medical fields globally. In Japan, the company is winning the top share with more than 10 items.

As for the Specialty Chemicals Business, the company develops and sells unique functional polymers (polyallylamine and polyamine series). The characteristics of this business are R&D together with chemical products/pharmaceutical manufacturers and research institutes and product proposals that capture customer needs. The company is strong in niche markets and is actively expanding the business not only in Japan but also in the global market.

For the Environment and Health Business, the company utilizes the technologies that have been cultivated over many years to develop a business in the beverage industry.

In the beverage business, centered on the private brands, it is working on development of plastic bottles, beverage production and bottling.

(Source: the company)

(2)Research and development (R&D)

Since its founding, the Group has been actively promoting R&D and delivering unique products to the world.

R&D will continue to be a source of enhancing the company’s competitiveness and corporate value.

In recent years, while the needs of customers are becoming more sophisticated and diversified, global competition is intensifying. Under these circumstances, the company established its general research laboratory in 2017 to provide products and services with high value-added and strong originality in a timely manner with its characteristics and strengths, and to promote R&D toward the future.

The Group will continuously work on R&D from the viewpoint of expertise in each business division. At the same time, it will promote cross-sectional management by the research laboratory to pursue synergy among businesses with a focus on speed.

Furthermore, in each field, in order to accelerate research speed and expand the perspectives, the company is actively promoting joint research on industry, government and academia from the viewpoint of open innovation.

In order to further strengthen company-wide R&D capabilities, the company decided to construct a new building called “NI-CoLabo,” in Koriyama City, Fukushima Prefecture. The total cost of the construction will be 2.7 billion yen and the construction will be completed in April 2020. In addition to consolidating R&D divisions of each business segment into one location, it will enhance collaboration with external users. The building will be a symbol of the company’s R&D system.

Also, in July 2018, the satellite laboratory “NI-Tech” was opened at the Kawasaki Nanomedical Innovation Center as a new research and development base to strengthen the Life Sciences Business.

1-4 Characteristics and strengths

◎ Supply products by accurately grasping needs of the times

In addition to succeeding in the industrialization of glass fiber for the first time in Japan, the company began manufacturing glass wool for the first time in Japan. As such, the company has been always leading the global and Japanese markets in the field of glass fiber. In the history of over ninety years, it has always been capturing the changes and needs of the world accurately and developing and supplying various products centered on glass fiber.

Since the company is not manufacturing final products, people do not see the company’s products. However, it supplies materials that are indispensable to the world and supports our lives behind the scenes.

◎ High competitiveness by unique technologies

Among many manufacturers of glass fiber in the world, it is almost the only company that realized excellent low dielectric constant and low dielectric loss tangent (NE-glass) and high dimensional stability and higher rigidity (T-glass) in the field of glass cloth for electronic materials and has established a system that can stably supply sufficient volume.

In addition, having acquired the top share in Japan for more than 10 items with in vitro diagnostic reagents in the Medical Division also shows its high competitiveness with its unique technologies.

1-5 ROE Analysis

| 2014/Mar | 2015/ Mar | 2016/ Mar | 2017/ Mar | 2018/ Mar | 2019/ Mar |

ROE (%) | 6.3 | 6.8 | 7.6 | 9.8 | 12.5 | 9.1 |

Net Profit margin (%) | 4.53 | 5.09 | 6.49 | 8.98 | 12.13 | 9.70 |

Total asset turnover [times] | 0.63 | 0.64 | 0.60 | 0.59 | 0.59 | 0.55 |

Leverage [times] | 2.21 | 2.09 | 1.96 | 1.86 | 1.75 | 1.69 |

The company’s goal is to achieve 8% or more in the Fiscal Year Ending March 2021 and 10% or more in the Fiscal Year Ending March 2024.

The ROE for the Fiscal Year Ending March 2019 was 9.1%.

Expansion of sales for high value-added products and cost reduction will be the keys.

2. Results for Fiscal Year Ending March 2019

(1) Consolidated Business Results

| FY2018/ Mar | Ratio to sales | FY2019/ Mar | Ratio to sales | YY change | Compared with the initial forecasts | Compared with revised forecasts |

Net Sales | 84,526 | 100.0% | 82,292 | 100.0% | -2.6% | -7.5% | -0.9% |

Gross profit | 30,214 | 35.7% | 27,660 | 33.6% | -8.5% | - | - |

SG&A | 19,376 | 22.9% | 19,461 | 23.6% | +0.4% | - | - |

Operating Profit | 10,837 | 12.8% | 8,198 | 10.0% | -24.3% | -24.1% | -3.6% |

Ordinary Profit | 11,071 | 13.1% | 8,934 | 10.9% | -19.3% | -18.8% | -0.7% |

Net Profit | 10,253 | 12.1% | 7,984 | 9.7% | -22.1% | +3.7% | +5.1% |

*Unit: million yen. Net Profit means the profit attributable to owners of parent. Compared with revised forecasts means the ratio to the forecast announced in February 2019.

Sales and profit dropped.

Net Sales for the Fiscal Year Ending March 2019 were 82,200 million yen, down 2.6% year on year. Net Sales of Textile Business and Glass Fiber Yarn Business decreased. Operating Profit dropped 24.3% year on year to 8,100 million yen. Net Sales decreased mainly due to sluggish sales of ultrafine yarns and ultra-thin cloth associated with the production adjustment of smartphones, despite strong sales of special glass (T and NE glass). Increase in fuel costs also gave negative impacts. The company made an investment for the business reinforcement as planned. Ordinary Profit declined 19.3% year on year to 8,900 million yen. There were no longer foreign exchange losses, which were posted in the previous year, and foreign exchange gains of 200 million yen were posted instead. Net Profit decreased 22.1% year on year to 7,900 million yen. A gain on sales of investment securities of 800 million yen was posted as extraordinary income, while an impairment loss of 1,000 million yen was posted as extraordinary loss. As a whole, the results were almost same as the revised forecast announced in February 2019.

(2) Trend by segments

| FY2018/ Mar | Ratio to sales | FY2019/ Mar | Ratio to sales | YY change | Compared with the initial forecasts | Compared with revised forecasts |

Total Sales | 84,526 | 100.0% | 82,292 | 100.0% | -2.6% | -7.5% | -0.9% |

Textiles | 4,945 | 5.9% | 4,862 | 5.9% | -1.7% | -10.0% | -2.8% |

Glass Fiber Yarn | 29,172 | 34.5% | 26,442 | 32.1% | -9.4% | -15.3% | -3.8% |

Glass Fiber Cloth | 13,750 | 16.3% | 14,043 | 17.1% | +2.1% | -5.1% | +0.3% |

Glass Fiber for Industrial Materials | 21,622 | 25.6% | 21,785 | 26.5% | +0.8% | -5.3% | +1.3% |

Life Science | 12,992 | 15.4% | 13,692 | 16.6% | +5.4% | +2.2% | +0.7% |

Other | 2,041 | 2.4% | 1,466 | 1.8% | -28.2% | +22.2% | +4.7% |

Total Operating Profit | 10,837 | 12.8% | 8,198 | 10.0% | -24.3% | -24.1% | -3.6% |

Textiles | -452 | - | -373 | - | - | - | - |

Glass Fiber Yarn | 6,559 | 22.5% | 3,937 | 14.9% | -40.0% | -36.5% | -1.6% |

Glass Fiber Cloth | 2,130 | 15.5% | 2,031 | 14.5% | -4.6% | -11.7% | -7.7% |

Glass Fiber for Industrial Materials | 831 | 3.8% | 629 | 2.9% | -24.3% | -21.4% | -10.1% |

Life Science | 2,858 | 22.0% | 2,644 | 19.3% | -7.5% | -7.2% | -2.1% |

Other | -139 | - | 211 | 14.4% | - | - | - |

*Unit: million yen. Total sales mean the sales to external clients. Ratio to sales (in profit) means the ratio of profit to sales. “Compared with the initial forecasts” was calculated by our company with reference to the documents of the company.

①Textiles Business

Sales grew, and loss shrank.

The sales of interlining cloth were strong especially for ladies’ clothing in the first half, but severe conditions continued in the second half due to bad weather and the effect of warm winters. Profitability improved due to the penetration of price increases and the transfer of production from China to Japan. Sales of core spun yarn (CSY) under raw yarn products for casual clothing were sluggish.

②Glass Fiber Yarn Business

Sales and profit declined.

Net sales declined mainly due to composite materials for reinforced plastics and glass fiber yarns for electronic materials (both mainly high-value added products) sales decreased associated with the production adjustment of smartphone. In addition, large-scale facility repairs implemented in Q1 reduced the profit.

③Glass Fiber Cloth Business

Sales grew but profit dropped.

Although demad for special glass which contributes to high-speed, high capacity communications remained favorable, damages of typhoon for Nittobo Macau Glass Weaving Co., Ltd. impacted the profit.

④Glass Fiber for Industrial Materials Business

Sales increased but profit shrank.

The sales of glass cloth for facilities and construction materials remained stable, however, profits from residential heat insulation materials decreased due to the effects of the large-scale equipment repair carried out in the first quarter and the rise in distribution, material, and fuel costs.

⑤Life Science Business

Sales increased, while profit dropped.

*Medical

Profit declined mainly due to the cost incurred for enhancement of R&D and Sales function (for the future growth), while focusing on sales of immunological in vitro diagnostic reagents for both domestic and oversea markets.

*Specialty chemicals

High value-added producst have been steadly supplied for both domestic and oversea markets.

*Beverages

While focusing on production of variety of small lot products to meet the demand, raw materials and distribution costs increased.

(3) Financial standing and cash flows

◎Main BS

| End of 2018/Mar | End of 2019/Mar |

| End of 2018/Mar | End of 2019/Mar |

Current Assets | 73,065 | 72,674 | Current liabilities | 32,726 | 32,066 |

Cash | 18,673 | 16,145 | Payables | 9,331 | 9,415 |

Receivables | 25,891 | 25,353 | LT Interest Bearing Liabilities | 10,274 | 12,998 |

Inventories | 25,118 | 28,585 | Noncurrent liabilities | 26,886 | 28,193 |

Noncurrent Assets | 74,095 | 78,326 | ST Interest Bearing Liabilities | 6,383 | 9,696 |

Tangible Assets | 42,693 | 47,523 | Total Liabilities | 59,612 | 60,259 |

Intangible Assets | 1,510 | 1,680 | Net Assets | 87,548 | 90,740 |

Investment, Others | 29,890 | 29,122 | retained earnings | 45,105 | 51,440 |

Total assets | 147,160 | 151,000 | Total Liabilities and Net Assets | 147,160 | 151,000 |

|

|

| Total borrowings | 16,657 | 22,694 |

*Unit: million yen

Although cash and deposits decreased, total assets increased 3.8 billion yen to 151.0 billion yen compared to the end of the previous year due to the increase in property, plant, and equipment.

Total liabilities increased 0.6 billion yen to 60.2 billion yen.

While retained earnings increased 6.3 billion yen, valuation difference on available-for-sale securities decreased 2.5 billion yen and net assets increased 3.1 billion yen to 90.7 billion yen.

As a result, the equity ratio increased by 0.5 points from the end of the previous year to 59.4%.

◎Cash Flow

| FY2018/Mar | FY2019/Mar | Increase/decrease |

Operating CF | 7,791 | 5,317 | -2,474 |

Investing CF | 2,524 | -11,389 | -13,913 |

Free CF | 10,315 | -6,072 | -16,387 |

Financing CF | -9,467 | 3,948 | +13,415 |

Term End Cash and Equivalents | 18,324 | 16,145 | -2,179 |

*Unit: million yen

Investing CF and Free CF turned negative due to the increase in purchase of property, plant, and equipment.

Financing CF turned positive with the increase in debt.

The cash position decreased.

3. Forecast for Fiscal Year Ending March 2020

①Consolidated Earnings Forecasts

| FY2019/Mar | Ratio to sales | FY2020/Mar Forecast | Ratio to sales | YY change |

Net Sales | 82,292 | 100.0% | 90,000 | 100.0% | +9.4% |

Operating Profit | 8,198 | 10.0% | 8,500 | 9.4% | +3.7% |

Ordinary Profit | 8,934 | 10.9% | 8,800 | 9.8% | -1.5% |

Net Profit | 7,984 | 9.7% | 6,200 | 6.9% | -22.3% |

*Unit: million yen. The estimates are from the company

*Variations in the first and second halves

| FY2020/Mar H1 Forecast | YoY change | FY2020/Mar 2H Forecast | YY change |

Net Sales | 42,000 | +1.2% | 48,000 | +17.7% |

Operating Profit | 3,000 | -31.7% | 5,500 | +44.5% |

*Unit: million yen

Sales and operating profit will increase. They will recover in the second half.

Net Sales are estimated to rise 9.4% year on year to 90 billion yen. The “Glass Fiber Yarn Business,” “Grass Fiber Cloth Business” and “Life Science Business” will lead the sales. Operating Profit is projected to grow 3.7% year on year to 8.5 billion yen. Operating Profit is forecasted to increase year on year as the capital investment effects of special glass will appear from the second half. The company will continuously reinforcing the business base for the mid- to long-term growth including depreciation costs for new investments. It is also estimated that there will be some effects of the yen appreciation and the rises in oil price, distribution cost, etc. like in the previous year. Estimated dividend is 40 yen/share, the same level as the previous term. The estimated payout ratio is 25.0%. The premise of exchange rate is 108.0 yen/USD, which is 2.7 yen higher than 110.7 yen/USD in the previous term.

(Business environment, market environment)

The company believes that the operating climate will be severer due to US-China trade friction, concerns over a slowdown in the Chinese economy, withdrawal of the UK from the EU, and an increase in the consumption tax rate.

In the electronic materials market, it is also anticipated that the demand for special glass will increase for base stations and high-performance servers in data centers due to expanded applications of 5G high-speed, high-capacity communications.

On the other hand, sales of ultrafine yarns, which were sluggish in the previous fiscal year, is expected to recover from smartphone performance improvement and liquidation of distribution inventory.

(Measures of the company)

Enhancement of special glass production will contribute to revenue from the second half.

In addition, the company will continue to strengthen the Glass Fiber Business and the Medical Business.

②Trends by segment

| FY2019/Mar | FY2020/Mar Forecast | YY change |

Net Sales | 822 | 900 | +9.4% |

Textiles | 48 | 40 | -16.7% |

Glass Fiber Yarn | 264 | 290 | +9.8% |

Glass Fiber Cloth | 140 | 200 | +42.9% |

Glass Fiber for Industrial Materials | 217 | 210 | -3.2% |

Life Science | 136 | 150 | +10.3% |

Other | 14 | 10 | -28.6% |

Operating Profit | 82 | 85 | +3.7% |

Textiles | -4 | -1 | - |

Glass Fiber Yarn | 39 | 34 | -12.8% |

Glass Fiber Cloth | 20 | 28 | +40.0% |

Glass Fiber for Industrial Materials | 6 | 2 | -66.7% |

Life Science | 26 | 30 | +15.4% |

Other | -7 | -8 | - |

*Unit: 100 million yen. Sales to external clients

4. Progress of the <<Go for Next 100>> Mid-Term Business Plan

(1) Mid to Long Term Business Plan “Vision 101” and the Mid-Term Business Plan “Go for Next 100”

The company decided on Mid to Long Term Business Plan “Vision 101” for surviving and growing sustainably while seeing overseas markets, as Japan is faced with the declining birthrate, the super aging population, and the decline in total demand, and defined the ideal corporate vision in Fiscal Year Ending March 2024, which is the 101st anniversary of establishment of the company, as follows: “Nittobo delivers the unique products and innovations globally from Fukushima in Japan based on customer relations and technology.”

As the first stage for achieving Mid to Long Term Business Plan “Vision 101,” the company formulated the Mid-Term Business Plan “Go for Next 100,” whose final year is Fiscal Year Ending March 2021, and this plan is ongoing.

The company will first establish the foundation for keeping profitability at the current level, seize a chance to grow, identify the advantages of the corporate group, and pursue it thoroughly.

(2) Activities in each business

Mid to Long Term Business Plan “Vision 101” defines the ideal corporate vision of each business in Fiscal Year Ending March 2024 as follows.

Glass Fiber Business | Stable provision of high value-added products in the rapidly changing environment to consolidate our presence as market leader. |

Medical Business | Supply of high quality in vitro diagnostic reagents for self-medication |

Textiles Business | Acceleration of high value-added strategy and expansion of the application of textile technology to industrial fields with proper business volume and profitability. |

① Glass Fiber Business

The themes are “reinforcing the field of electronic materials” and “reinforcing the field of industrial materials,” taking advantage of the strengths of the Glass Fiber Business.

(Strengths of the Business)

◎Product characteristics

*Superfine count yarn

Produce the world's finest yarn with a stable quality for the realization of smaller and thinner electronics.

*NE glass

Low-dielectric feature and reduce transmission loss and noise. Contribute to high-speed/high capacity communications using 5G which is expected to rapidly spread from this Fiscal Year.

*T glass

Actualize high-strength, low thermal expansion. It is essential for high density package substrate.

◎Technical characteristics

*Have both a spinning process and a weaving process and making the integrated production possible. There are fewer companies that have both a spinning process and a weaving process on a large-scale basis.

*In the spinning process, stable production of the world's finest glass yarn (4), NE glass yarn, T glass yarn.

*In the weaving process, actualize the optimum weaving process or processing process in line with characteristics of individual yarns, making use of the know-how of the spinning process

“Reinforcing the field of electronic materials”

The demand for high value-added special glass will continue to grow as the miniaturization technologies and performance of semiconductor advance with the realization of a high-speed, large-volume communication society represented by 5G. In response, the company will find more purposes of use of special glass such as high value-added products “T glass” and “NE glass,” enhance its production capacity, produce finer and thinner “E glass,” and reinforce production capacity through M&A.

“Reinforcing the field of industrial materials”

The company plans to introduce special glass to the field of industrial materials, actively enter overseas markets, and establish the customer solution section.

With the establishment of the customer solution section, the company will promote new purposes of use of “T Glass,” which is now used in electronic substrates for semiconductor packages, and “NE Glass,” which is now used in electronic substrates for servers in data centers and base stations.

The company will enhance the business for industrial materials, to meet the needs for composite materials made from high-strength glass for aircraft and automobiles with “T Glass” and the needs for low dielectric and low transmission loss with “NE Glass.”

As for investment, the company will make investments mainly for making “E Glass” ultra-fine, boosting the production capacity for the high value-added products “T Glass and NE Glass,” and increasing their purposes of use.

Major activities of each business for the glass fiber business are as follows.

Glass Fiber Yarn | *Enhance yarn production capacity ・Enhance production capability of special glass (T/NE) yarn (Nitto Glass Fiber Manufacturing Co., Ltd.:2020/Mar H2~) (Fukushima No.1 factory:2021/Mar~) (NITTOBO ASIA Glass Fiber(Taiwan):2022/Mar~) ・Enhance production capacity of fine count yarn (NITTOBO ASIA Glass Fiber:2020/Mar H2~)

*Introduce facility of special glass (NE) for composite material (Fuji Fiber Glass Co., Ltd.:2019/Mar H1~) |

Glass Fiber Cloth | *Enhance production capacity of high value-added glass cloth (Fukushima No.2 factory/Enhance weaving machine's processing ability:2019/Mar H2~) *Acquired shares of Baotek Industrial Materials Ltd. (Taiwan) (August 2018)(Processing process:Super-thin cloth manufacturing:2020/Mar H2~) |

Glass Fiber for Industrial Material | *Ramp up production capacity of thin GW *Ramp up production capacity of non-formaldehyde GW |

*In order to ensure to capture the increasing demand for NE glass and T glass, the company began to consider the details of installing a new furnace in Taiwan and Fukushima by the Fiscal Year Ending March 2023.

*The company will increase production capacity in Japan, Taiwan, and locations close to the market.

②Medical Business

The two business strategies are “strengthening each function in the value chain, especially improving the capability to procure raw materials” and “establishing a supply chain for global production, sales, and regulatory approval.”

The company will refine its integrated production system in Japan and the United States, which is its strength, and supply high value-added reagents that respond to diversification and refinement to contribute to self-medication.

In these circumstances, the company will implement the following measures for the in vitro diagnostic reagents business.

Construction of new factories | Construction of new factories in the production bases at Nittobo Medical (Japan) and Nittobo America (US). Production capacity expansion will start from 2020. |

Reinforce research production capability | *Investment in Rimco Corporation (Development and production of in vitro diagnostic reagents by using genetically modified silkworms) *Acquired Frontier Institute Co., Ltd. (R&D and production of monoclonal antibodies) *Establishment of FAN Co., Ltd. (JV with Fujikura Kasei Co., Ltd., R&D of materials for in vitro diagnostic reagents) |

Sales | Strengthen know-how of US sales network (acquiring Kamiya Biomedical Company as a subsidiary) |

③ Textiles Business

To undertake two structural reforms.

<Structural reform 1>

Nittobo established Nittobo (China) Co., Ltd., a wholly owned subsidiary, in Wuxi, Jiangsu Province, China in 1995. It has been producing high quality and high function interlining cloth since the start of operation in 1997, but the business was sluggish due to intensifying price competition in the market of general-purpose products due to rising labor cost, cost to comply with environmental regulations and progress of appreciation of the yen against RMB.

Under these circumstances, the company decided to transfer Nittobo (China) Co., Ltd. to a Chinese local company called ZhejiangYinyu Spinning Co., Ltd.

It will receive support for sales, production, and development from Nittobo Trading Wuxi Co., Ltd., and continue to supply products to the existing customers.

The intention of this action is to streamline the operation of the Textile Business and improve competitiveness.

<Structural reform 2>

The company will develop following high value-added products.

Development of new functional products | *Develop interlining with functionality (deodorization, antibacterial, antifouling, cool feel, antistatic treatment), raw yarn (deodorization, water absorption, quick drying, lightweight) *Reinforce innovative fabric (windproof, cotton lining, chambray) *Develop products other than fashion clothing including sports application (e.g., backing, bandage) |

Develop environmentally-friendly products | *Fluorine-free interlinings *Expand product lineup using recycled materials *Take measures to save water in the dyeing process |

Expand into the industrial-use material field | *Reinforce collaboration with Glass Fiber Business *Early launch of products with industrial-use materials |

(3) Numerical goals

The numerical goals in “Go for Next 100” for Fiscal Year Ending March 2021 and “Vision 101” for Fiscal Year Ending March 2024 are as follows.

(Earnings targets)

| FY2018/Mar | FY2019/Mar | FY2020/Mar Forecast | FY2021/Mar Plan | FY2024/Mar Plan |

Net Sales | 845 | 822 | 900 | 1,000 | 1,500 |

Operating Profit | 108 | 82 | 85 | 120 | 150 |

Ordinary Profit | 111 | 89 | 88 | 120 | 150 |

Net Profit | 103 | 79 | 62 | 80 | 100 |

EBITDA | 150 | 122 | 139 | 200 | - |

ROE | 12.5% | 9.1% | - | 8% or over | 10% or over |

Net Interest-bearing Liabilities | 11 | 88 | - | 100 or less | Virtually zero |

Equity ratio | 58.8% | 59.4% | - | 60% or over | 70% |

*Unit: 100 million yen.

(Capital expenditures and research & development)

| FY2018/Mar | FY2019/Mar | FY2020/Mar Forecast | FY2021/Mar Plan |

Research and development expenses | 16 | 15 | 18 | At least 20 |

Research expenses to sales ratio | 1.9% | 1.8% | 2.0% | At least 2.0% |

Capital expenditures (acceptance inspection value) | 70 | 119 | 213 | 550 |

*Unit: 100 million yen. The capital expenditures for FY2020 means the cumulative total in 4 years.

(Inflation assumptions)

| 2018/Mar | 2019/Mar | 2020/Mar Forecast | 2021/Mar Plan |

Foreign exchange rate (¥/$) | 111.2 | 110.7 | 108.0 | 100 |

Oil price | 55.9 | 69.4 | - | 60 |

*Oil price means the price of crude oil from Dubai. The unit is USD/BBL.

The company sets forth the business portfolio of the Fiscal Year Ending March2024 as “development of high value-added products and expansion of overseas sales ratio” and “establishment of the Medical Business as the second pillar” to establish a stable profit structure.

As for EBITDA, the company will make investment to improve profitability by executing growth investment as follows, to aim earning about 16 billion yen this fiscal year, 20 billion yen in Fiscal Year Ending March 2021.

Glass Fiber Business:

・Enhance production for ultrafine yarns and ultra-thin cloth (inside Japan)

・Start production for thinner yarn (outside Japan)

・Fortify an integrated manufacturing system for products ranging from yarns to cloth through M&A with Baotek (Taiwan)

・Enhance the production capacity for special glass (inside and outside Japan)

Medical Business:

・Upgrade the integrated production system in Japan and the U.S.

・Intensify overseas business expansion

(Capital expenditures, Research and development expenses, and depreciation costs)

As for equipment investment, the company plans to invest 55 billion yen in the 4-year Mid-Term Business Plan. The company has already decided to invest about 50 billion yen, about 90% of the planned amount by end of this fiscal year.

The number of staff members at the research institute also increased from 95 in the previous year to 106 in the current fiscal year. They will continue to increase the number.

5. Conclusions

In the previous report, we have stated that “in the short term, we would like to pay attention to the sales growth in the third and fourth quarter.” Although the sales of special glass, a high value-added product, were strong, Net Sales and Operating Profit decreased in the term ending March 2019 due to sluggish sales of ultrafine yarns and ultra-thin cloth associated with the production adjustment of smartphones. Similarly, in the first half of the Fiscal Year Ending March 2020, slow business continues and the growth of Net Sales and Operating Profit in full-term will be minor. However, the business performance will rapidly recover from second half with “sales of 96 billion yen and operating profit of 11 billion yen” on the year-base conversion in the second half as strengthened production of special glass will generate profit from the second half. Therefore, the company believes that goals of the Mid-Term Business plan “Go for Next 100” which will end in the Fiscal Year Ending March 2021 is attainable. We would like to watch the progress of this term as a solid foundation towards the final year of Mid-Term Business Plan. We will also pay attention to the progress of various measures under the medium-term business plan “Go for Next 100”, in particular, strengthening “T glass” and “NE glass” and the growth speed of the Medical Business, which is considered as the second pillar.

<Reference: Regarding Corporate Governance>

◎Organization type, Directors, and Auditors

Organization type | Company with audit and supervisory committee |

Directors | 6 directors, including 3 external ones |

◎Corporate Governance Report

Updated on June 27, 2019

<Basic Policy>

Our Group aims to establish a fair and transparent management system in order to conduct business activities that put importance onto social trust from our stakeholders including shareholders and investors and undertake constant review of corporate governance.

Our company introduced an executive officer system in June 2003 with the intention to make the Board of Directors more effective and expedite decision-making. As a result, a system which maximizes the effect of consolidated management has been established. Since June 2008, the business has been operated with further clarification of functions and responsibilities for business administration and business execution. Having received an approval at the ordinary general meeting of shareholders on June 26, 2014, our company has shifted to a company with committees (currently, a company with nominating committee, etc.). In the new form, our company clearly separates supervising and business execution even further and aims at “supervisory functions reinforcement and transparent business administration” and “swift execution of business and improvement of management mobility.” Our company has also built functional systems, which allow us to respond more effectively to expectations of our stakeholders including our customers, shareholders, business partners, and employees and promotes further improvement of the corporate value.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

All Principles of the Corporate Governance Code that were revised in June 2018 are implemented.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle | Disclosure contents |

Principle 1-4 The so-called cross-shareholdings | [Policy concerning cross-shareholdings] Our company may hold shares of listed companies as cross-shareholdings when we determine that it will contribute to the establishment of good relationships with the Group’s important business partners for sale, material procurement, finance, etc., facilitation of smooth business activities of the Group, and maintenance and improvement of the corporate value of the Group. Meanwhile, the share of the companies that do not contribute to the maintenance and improvement of the corporate value of the Group and are judged to have little significance in holding their shares will be sold while considering the impact on the market. [Method to validate rationality of possession] Concerning holding listed stocks, for each stock, the Board of Directors regularly verifies the holding policy, which comprehensively takes into account qualitative factors such as importance of transactions, existence of technical cooperation and joint investment, and implementation of joint ventures as well as quantitative assessments that compare the overall return on investment calculated based on the dividend yield and the business profit with capital cost. Based on the verification, our company sold 13 stocks of 2,050 million yen in Fiscal Year Ending March 2019, and sold a total of 13 stocks of 3,355 million yen in two years from Fiscal Year Ending March 2018. [Exercise of voting rights of cross-shareholdings] With regard to the exercise of voting rights of cross-shareholdings, our company will decide on the matter based on the factors such as whether the issuing company has an appropriate governance system and makes appropriate decisions that lead to enhancing its corporate value over the medium- and long-term, as well as whether it contributes to the enhancement of corporate value of the Group, and exercise the voting right appropriately. |

Principle 5-1 Policy for promoting constructive dialogue with shareholders | <Policy for developing systems and implementing measures for promoting constructive dialogue with shareholders> (1) The executive officer responsible for corporate communication is assigned to supervise overall dialogue with our shareholders, and the Corporate Communication Department is a responsible department for assisting it. Being led by the executive officer, our group endeavors to create opportunities for dialogue with our shareholders, which should contribute to the continuous growth and mid/long-term improvement of the corporate value. In addition, together with the Corporate Communication Department, other departments associated with IR activities promote ongoing collaboration among departments. (2) The Group strives to continuously disclose information in a timely and appropriate manner so that parties including our customers, shareholders and investors will accurately be informed of and understand the state of the Group. To achieve this, we comply with laws and regulations related to information disclosure, stock exchange rules, etc. as well as establishing and operating appropriate systems for information disclosure. a) The Group publishes information that needs to be disclosed in accordance with domestic and international laws and regulations, stock exchange rules, etc. through our business reports, annual securities reports and annual reports for shareholders as well as making an announcement through information transmission systems at the stock exchange and press releases. b) The Group seeks to engage in fairer and broader information disclosure through our website, etc. in principle. c) Briefings for analysts and institutional investors are held immediately after announcement of half-yearly and final financial statements. (3) Feedback including opinions and concerns from shareholders and investors received through dialogue with them is collected at the Corporate Communication Department. The Department then reports to the responsible executive officer while feeding it back to the management team and Board of Directors by reporting at executive meetings, etc. when necessary. (4) The Group deals with individual inquiries and dialogue by paying sufficient attention to insider information and using only previously published and publicly known information. |

This report is intended solely for informational purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |