Bridge Report:(3110)NITTO BOSEKI Fiscal Year 2020

Representative and Chief Executive Officer Yuichi Tsuji | NITTO BOSEKI CO., LTD. (3110) |

|

Company Information

Market | TSE 1st Section |

Industry | Glass and ceramics products (manufacturing) |

Director, Representative and Chief Executive Officer | Yuichi Tsuji |

HQ Address | Kojimachi-odori Bldg., 2-4-1, Kojimachi, Chiyoda-ku, Tokyo |

Year-end | March |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥3,535 | 39,935,512 shares | ¥141,172 million | 8.4% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥45.00 | 1.3% | ¥103.10 | 34.3 x | ¥2,555.06 | 1.4 x |

*The share price is the closing price on May 18. Each number are from the brief financial report of the Fiscal Year ended March 2021.

Earnings Trend

Fiscal Year | Net Sales | Operating Profit | Ordinary Profit | Net Profit | EPS | DPS |

2018/Mar Act. | 84,526 | 10,837 | 11,071 | 10,253 | 263.97 | 40.00 |

2019/Mar Act. | 82,292 | 8,198 | 8,934 | 7,984 | 205.76 | 40.00 |

2020/Mar Act. | 85,722 | 8,160 | 8,202 | 5,771 | 148.73 | 45.00 |

2021/Mar Act. | 78,727 | 5,964 | 6,274 | 8,100 | 208.77 | 45.00 |

2022/Mar Est. | 85,000 | 6,000 | 5,600 | 4,000 | 103.10 | 45.00 |

*Unit: million yen, yen. Net profit is net profit attributable to shareholders of the parent company. The same as below. Units are rounded down.

This report introduces an overview of earnings results for the Fiscal Year 2020, forecast for the Fiscal Year 2021, New Mid-Term Business Plan etc. of NITTO BOSEKI CO., LTD.

Table of Contents

Key Points

1. Company Overview

2. Results for the Fiscal Year 2020

3. Forecast for the Fiscal Year 2021

4. [Big VISION 2030] and The New Mid-Term Business Plan (FY 2021-FY 2023)

5. Focus Points in the Future

<Reference: Regarding Corporate Governance>

(※)The amounts (100 million yen) and percentages in the text are rounded to the nearest unit.

Key Points

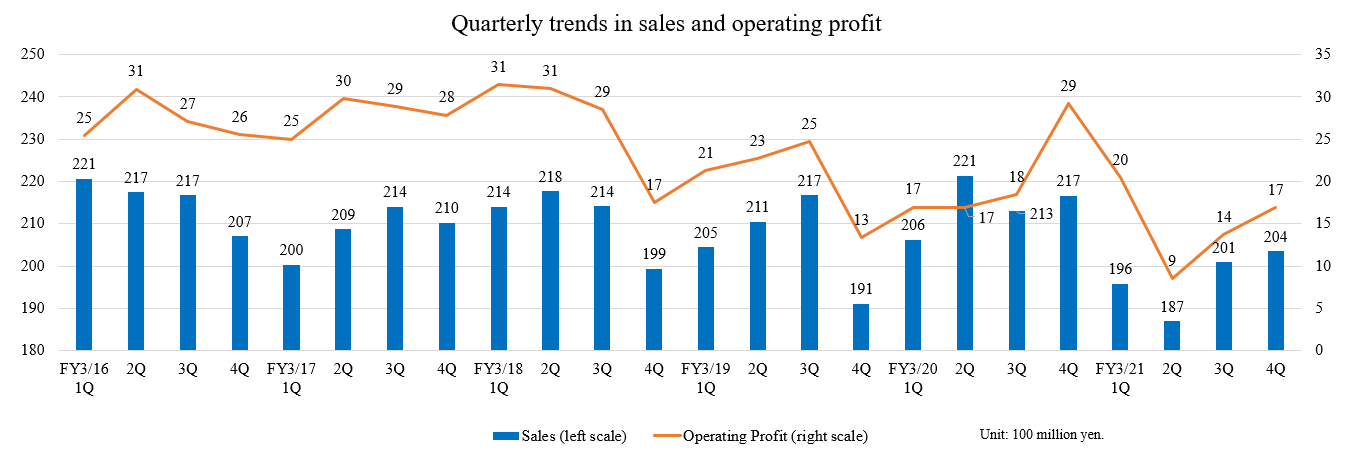

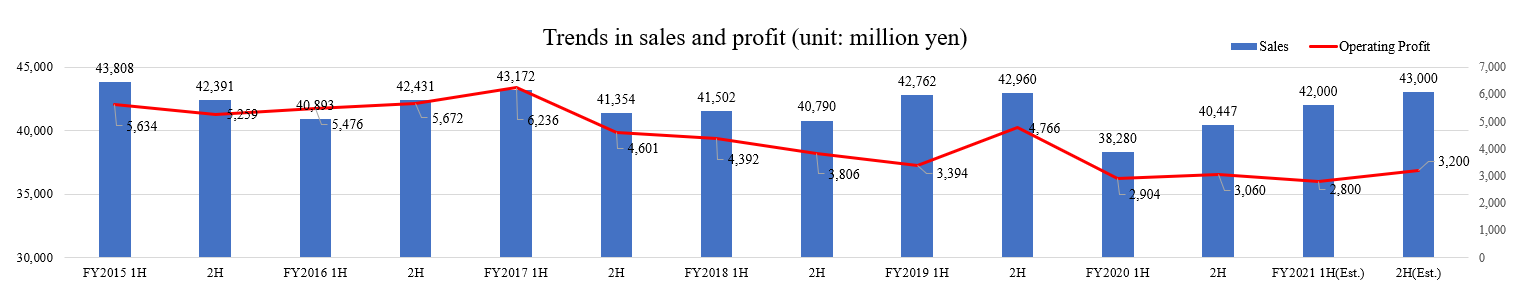

- Net Sales for the Fiscal Year 2020 were 78.7 billion yen, down 8.2% year on year. Sales volume dropped, because all businesses were affected by COVID-19, and the growth speed of the Special Glass business became sluggish, due to the fire at Fukushima Factory No. 2 in July 2020 and the U.S.-China trade friction. Operating profit declined 26.9% year on year to 6 billion yen. The reinforcement cost augmented 2 billion yen year on year. Among high value-added products, Special Glass contributed to profit, as the operation of new melting furnaces started, but the performance of ultrafine yarns and ultra-thin cloth was stagnant. Quarterly performance bottomed out in the second quarter (July to September), and is recovering.

- For the Fiscal Year 2021, it is estimated that sales will be 85 billion yen, up 8.0% year on year, operating profit will be 6 billion yen, unchanged from the previous fiscal year, and that ordinary profit will be 5.6 billion yen, down 10.8% year on year. In most segments, sales volume is projected to recover, but it is not expected that the business environment will recover significantly. The Special Glass for data centers is healthy, but full-scale growth based on the demand for base stations, etc. is estimated to resume in the next fiscal year or later. Operating profit is estimated to be unchanged from the previous fiscal year, due to the upfront cost for commencing the operation of a new factory for Special Glass in Taiwan and the temporary drop in revenues caused by the periodic repair of large-sized melting furnace in Japan. Sales bottomed out in the first half of the previous fiscal year, and are recovering, but will not reach the level in Fiscal Year 2019 before the pandemic outbreak. Sales are steadily growing, and operating profit is stagnant due to the above-mentioned temporary factors, but the company considers that the development of the revenue base is progressing, as the structural reform, which was started in the current fiscal year, is paying off.

- The company announced a New Mid-Term Business Plan (FY 2021-2023) in February 2021. The New Mid-Term Business Plan will be the first stage for actualizing the ideal state in 2030 [Big VISION 2030] while following the policy set in the previous Mid-Term Business Plan. As a milestone, the company disclosed concrete measures and financial goals in this plan. The major numerical goals for Fiscal Year 2023 are “net sales for 100 billion yen, an operating profit of 14 billion yen, and an EBITDA of 25 billion yen.”

- In the Fiscal Year 2020, which is the last fiscal year of the Mid-Term Business Plan, sales and profit decreased, due to the impact of COVID-19 and the sluggish growth of the Special Glass business amid the U.S.-China trade friction, etc. In Fiscal Year 2021, sales and profit will be on a plateau, almost unchanged from the previous fiscal year. However, quarterly performance bottomed out in the second quarter of Fiscal Year 2020 and is recovering, and Special Glass is increasingly adopted, although we have to wait until Fiscal Year 2022 to see its full-scale growth. While monitoring the trend of quarterly performance, we would like to pay attention to how they will implement the four priority measures set in the New Mid-Term Business Plan and especially how they will conduct growth strategies for achieving growth by expanding high value-added products.

1. Company Overview

The company succeeded in the first industrialization of glass fiber in Japan through technologies of the textiles business which is its original business. It provides products for a wide range of applications, such as electronic materials and industrial materials, with consistent coverage from yarn manufacturing to glass fiber cloth processing.

Among them, Special Glass (NE-glass, T-glass) which achieves low dielectric and low thermal expansion by special composition is used in server base station and precision material for electronic devices such as smartphone and has high competitiveness. Furthermore, for “in vitro diagnostic reagents” in the Life Science Business, have the top share in more than 10 items in Japan.

1-1 Corporate History

“Koriyama Kenshi Boseki Co., Ltd” founded in Koriyama, Fukushima Prefecture in 1898, is the predecessor. The company has a history of 120 years.

Nitto Boseki Co., Ltd. was established in 1923 when Fukushima Boshoku Co., Ltd. (formerly Fukushima Seiren Seishi Co., Ltd.) acquired the ownership of the Iwashiro Spinning Plant of Katakura Seishi (formerly Koriyama Kenshi Boseki Co., Ltd) in 1918.

In 1938, it succeeded in industrialization (mass production) of glass fiber for the first time in Japan. In the world, Owens Corning Glass Fiber of the United States has achieved the industrialization of glass fiber around the same time.

In 1949, it began manufacturing glass wool for the first time in Japan.

In 1969, the company began manufacturing glass fiber cloth for printed wiring board. In 1982, it began manufacturing test reagents for blood coagulation factors. And in 1983, it succeeded in industrializing functional polymers “PAA®” for the first time in the world. As such, the company has continued to challenge new fields and expanded its business fields.

In February 2021, the company announced the ideal way that Nittobo Group aspires to be in 2030 [Big VISION 2030] and the “New Mid-Term Business Plan (FY 2021 to 2023)” for achieving sustainable growth, and engages in various activities, including business strategies, to attain environmental goals.

1-2 Management Philosophy

Its management philosophy is as follows.

“Nittobo Group will, as a corporate group, enhance its significance by striving to create healthy and comfortable lifestyles, and thereby continue to contribute to the realization of prosperous communities.”

Furthermore, under the following Nittobo Declaration, it is aiming to be society’s “best partner” in collaboration with all stakeholders.

Nittobo Declaration

Nittobo Group aims to become the “Best Partner” of your community. (Nittobo BP Declaration) |

We will relentlessly strive to identify our customers’ needs and will find great satisfaction in steadfastly earning their Confidence and Trust. In addition, we will attach importance to sharing this satisfaction with all of our stakeholders (communities) through our products and services, including shareholders, investors, public administrations and regional communities. |

We are committed to becoming a corporate group in which the potential of our respective, independent employees is valued and thereby inspires our employees to freely and willingly share their own ideas, ultimately achieving greater results through teamwork. |

Our corporate group will provide its’ employees with an opportunity for progress and self-realization based on the belief that their progress leads to everyone’s success. We will encourage our employees to be good citizens, think deeply, observe widely, act courageously and to approach their jobs with resolve and determination. |

(From the company’s website)

1-3 Business Description

(1)Business description

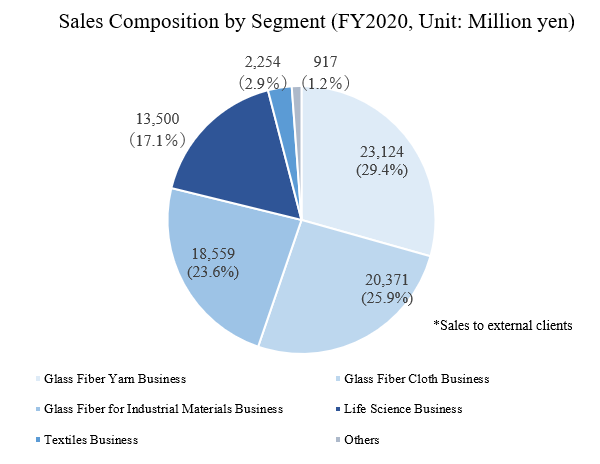

The company’s business can be largely divided into three categories, namely, the “Glass Fiber Business” which manufactures and sells various products using glass fiber, “Life Science Business,” which is composed of the Medical business for manufacturing and selling in-vitro diagnostic reagents and the Beverage business for producing and bottling beverages, “Textiles Business”, which manufactures and sells textile products for clothing.

As for the reporting segments, the “Glass Fiber Business” is divided into three categories, namely, the “Glass Fiber Yarn Business,” “Glass Fiber Cloth Business,” and “Glass Fiber for Industrial Materials Business.” Together with the “Life Science Business” and “Textiles Business,” there are a total of 5 reporting segments. In addition, there is a category called “Others” which consists of the service business that are not included in the reporting segment.

Segment | Amount | Composition rate |

Glass Fiber Yarn Business | 23,124 | 29.4% |

Glass Fiber Cloth Business | 20,371 | 25.9% |

Glass Fiber for Industrial Materials Business | 18,559 | 23.6% |

Life Science Business | 13,500 | 17.1% |

Textiles Business | 2,254 | 2.9% |

Others | 917 | 1.2% |

Total Sales | 78,727 | 100.0% |

*Unit: million yen. Units are rounded down.

① Glass Fiber Business

The company succeeded in the first industrialization of glass fiber in Japan. It provides products for a wide range of applications with consistent coverage from yarn manufacturing to glass fiber cloth processing.

Especially, Special Glass (NE-glass, T-glass) has low dielectric and low thermal expansion characteristics due to its special composition. It is employed as a precision material for electronic devices such as base stations, high-performance servers and smartphones, and is highly competitive.

In addition, micron-level super ultra-thin glass fiber cloth is used in smartphones and other devices that are becoming smaller, lighter, and more sophisticated, and is highly regarded for its quality.

The company also spearheaded the manufacturing of glass wool in Japan to be used as insulation for housing and is regarded as the pioneer of heat insulation materials with its unique technologies. In particular, high performance glass wool contributes to an energy-saving society as heat insulation materials for very airtight and highly heated insulating houses.

(Major uses)

High function electronic substrate | NE-glass has low dielectric characteristics that reduce transmission loss and is used in electronic substrates for servers in data centers and base stations. T-glass has low thermal expansion characteristics and high tensile elasticity and is used in electronic substrates for semiconductor packages that are mounted on smartphones and high-performance servers. |

Glass fiber for composite material of smartphone body (FF) | With its unique technology, the company succeeded in making the cross section of glass fiber an oblong shape, instead of an ordinary circular shape. When used as a composite material, it helps avoid warpage and twist of molded products. It is used in the body of small electronic devices such as smartphones for which even a small distortion cannot be allowed. |

Automobile | “FRP (fiber reinforced plastic)” is widely used in various parts of automobiles as a light weight and high strength material. The company's glass fiber not only has high shape stability and workability, but also has high impact and heat resistance. The company provide new value to vehicles as they evolve toward automation and advanced driving support. |

Resin coating film material | Glass fiber cloth for membrane materials made with super ultrafine grass fiber is widely used for multipurpose stadiums, soccer fields, indoor tennis courts, membrane materials for tent warehouse, and various events. |

Residential insulation (glass wool) | Glass wool exerts high insulation performance and is excellent in airtightness and soundproofing. Hence, it is used as heat insulation materials for houses and buildings to enhance the energy-saving effect. It is an environmentally friendly product since it uses 80% recycled glass and is recyclable after use. |

<What is glass fiber?>

Glass fiber is a product for which glass raw material is melted at a high temperature of 1,300℃ or higher and stretched to be fibrous.

The company succeeded in the industrialization of glass fiber for the first time in 1938 in Japan, and it developed rapidly thereafter.

Its characteristics include strength, heat resistance, non-flammability, electrical insulation and chemical resistance, and it is used for various purposes such as printed wiring boards, FRP, and building materials. For its excellent characteristics, it is being used in a wide range of industries.

(Composition, property)

As described earlier, it has characteristics such as strength, heat resistance, non-flammability, and electrical insulation. Especially for electronic materials related to high-speed high-volume communications, the product needs to have high levels of strength, elasticity, low-dielectric property, etc.

(Manufacturing method)

After raw materials of glass are melted at a high temperature of 1,300 to 1,600℃, they pass through a spinning nozzle and are reeled up to form a filament. A very precise control technique is required.The thinness of the glass fiber, which is a glass base pulled out from the machine at high speed, is 3.5 to 24 μm in diameter. (*The thinness of a human hair is about 50 to 100 μm.)

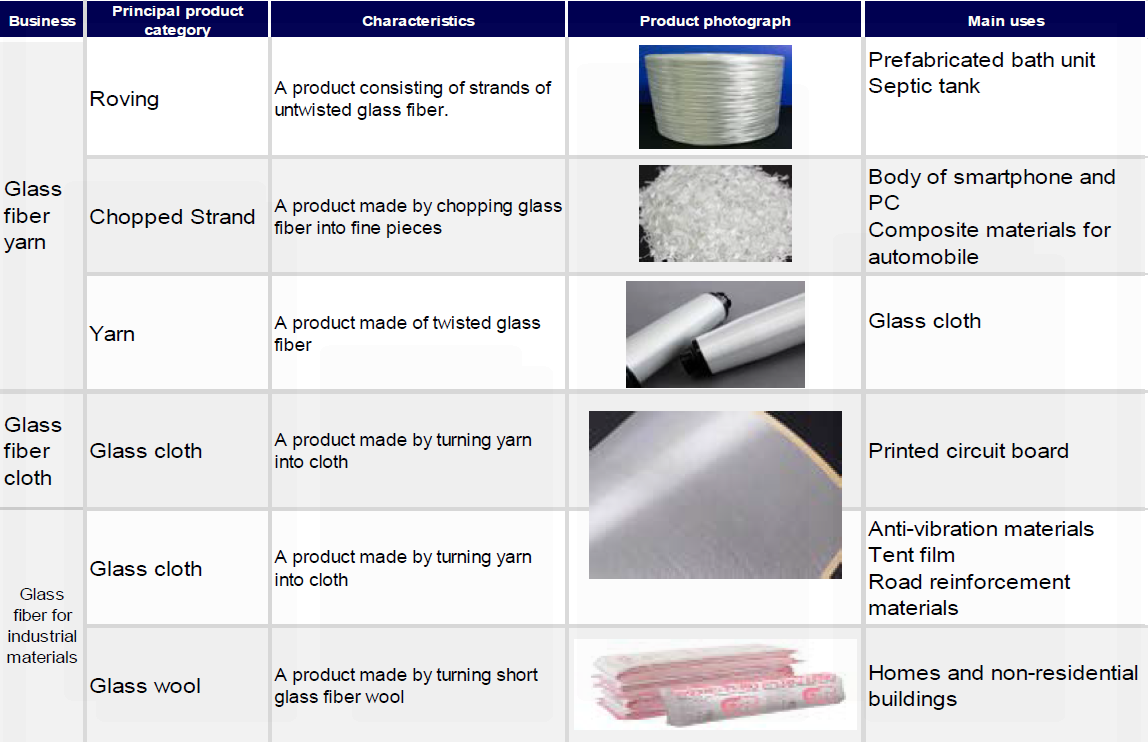

The spun glass fiber is processed into product forms according to the application.

(Major product forms)

◎Glass fiber yarn

Glass fiber yarns (twisted yarns) include a single yarn which is a strand composed of several hundred filaments that are simultaneously spun and twisted in the same direction and a twisted yarn which is made by twisting several single yarns.

The “E-glass yarn,” a single yarn made of twisted strands mainly composed of filaments of 3.5 to 7.4μm, has excellent electrical insulation, heat resistance, tensile strength, and dimensional stability, and is generally used for printed wiring boards. In addition, it is highly compatible with resins due to its unique surface treatment technology for industrial materials. It is highly evaluated as a base material with good workability.

◎Glass fiber cloth

Glass fiber cloth, which is fabric (cloth form) made of glass fiber yarns, is used for a wide range of applications such as printed wiring boards, damping materials, tent films, and road reinforcement materials.

Among them, the glass fiber cloth used for printed wiring boards and electronic parts is the company’s flagship product that it boasts worldwide.

【Glass fiber cloth for printed wiring boards】

A printed wiring board is formed of the fine wiring of metals such as copper on the surface of a base body such as resin, and components including resistors, capacitors and IC chips are fixed by soldering on the wiring. It is an important part that influence the performance of all electronic facility, including PC, smartphones, servers, medical facility, industrial robots, automobiles, and aircraft.

Glass fiber cloth, which has characteristics of high insulation, high strength, heat resistance, and dimensional stability, is thought to be the most suitable material for a printed wiring board.

Along with remarkable development of digital technologies, electronic devices such as PC and smartphones are becoming lighter, thinner, smaller and more sophisticated, and the need for the improvement of glass fiber cloth performance is increasing.

In response to such needs, the company developed highly functional glass fiber cloth products, such as “low dielectric glass cloth (NE-glass),” “low thermal expansion glass fiber cloth (T-glass),” and “ultra-thin glass fiber cloth,” by utilizing the forte of the maker that manufactures yarns and even cloth based on its original technologies for glass composition development, glass fiberization, and weaving, and has a significant market share.

“Low dielectric glass fiber cloth (NE-glass)”

Higher speed transmission with higher frequency is becoming more common, and low dielectric materials that reduce transmission loss is required for printed wiring boards.

To address the need, the company has developed the “NE-glass” that is excellent in low dielectric constant and dissipation factor with the same characteristics as “E-glass” by lowering the component ratio of alkaline-earth elements (CaO, MgO) as compared with the conventional “E-glass” while enhancing the component ratio of boric acid (B2O3).

It is mainly used for electronic boards for data centers and base station servers.

“Low thermal expansion glass fiber cloth (T-glass)”

“T-glass” has the higher component ratio of silica (SiO2) and alumina (Al2O3) compared with the standard “E-glass” and provides significantly advanced mechanical and thermal performance of glass fiber.

Utilizing its low thermal expansion characteristics and high tensile elasticity, it realizes excellent dimensional stability and increased rigidity, and it is used as an electronic substrate for semiconductor packages mainly mounted on smartphones, high-performance servers as a high-performance electronic material. Like carbon fiber and aramid fiber, it also works well as a reinforcing material for advanced composite materials, so it is used by itself or as a hybrid material with carbon fiber in the fields of aviation, space and sports.

“Ultra-thin glass fiber cloth”

Demand for thinner glass fiber cloth is increasing as a material to respond to the trend of making lighter, thinner and smaller printed wiring boards with high density packaging. In addition to its thinness, the company’s ultra-thin glass fiber cloth has superb capacities to process fine holes both for laser and drill processing and offers great dimensional stability and surface smoothness as a laminated plate.

The product forms and uses by segment in the glass fiber business are as follows.

(Source: the company)

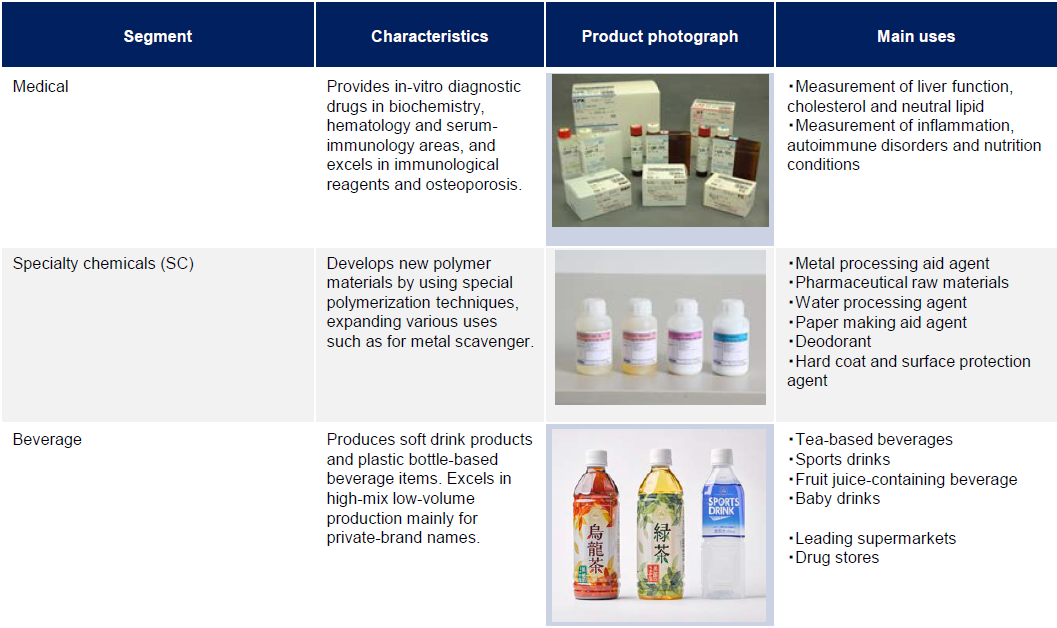

② Life Science Business

It is composed of the Medical business, the Specialty chemicals business, and the Beverage business.

The Medical business manufactures and sells in vitro diagnostics reagents used for blood and urine tests and specialty chemicals products centered on functional polymers.

The company is achieving high quality and stable supply of the “in vitro diagnostic reagents” that are used in health checkups and thorough physical examinations to examine health status using blood or urine, by integrally manufacturing them from the antisera as the raw material to the diagnostic reagents as the final product within the Group.

The products’ high quality has been recognized, and they are supplied in medical fields globally. In Japan, the company is winning the top share with more than 10 items.

As for the Specialty chemicals business, the company develops products, and sells unique functional polymers (polyallylamine and polyamine series). The characteristics of this business are R&D together with chemical products/pharmaceutical manufacturers and research institutes and product proposals that capture customer needs. The company is strong in niche markets and is actively expanding the business not only in Japan but also in the global market.

In the Beverage business, centered on the private brands, it is working on development of plastic bottles, beverage production and bottling, using the technologies that have been cultivated over many years.

(Source: the company)

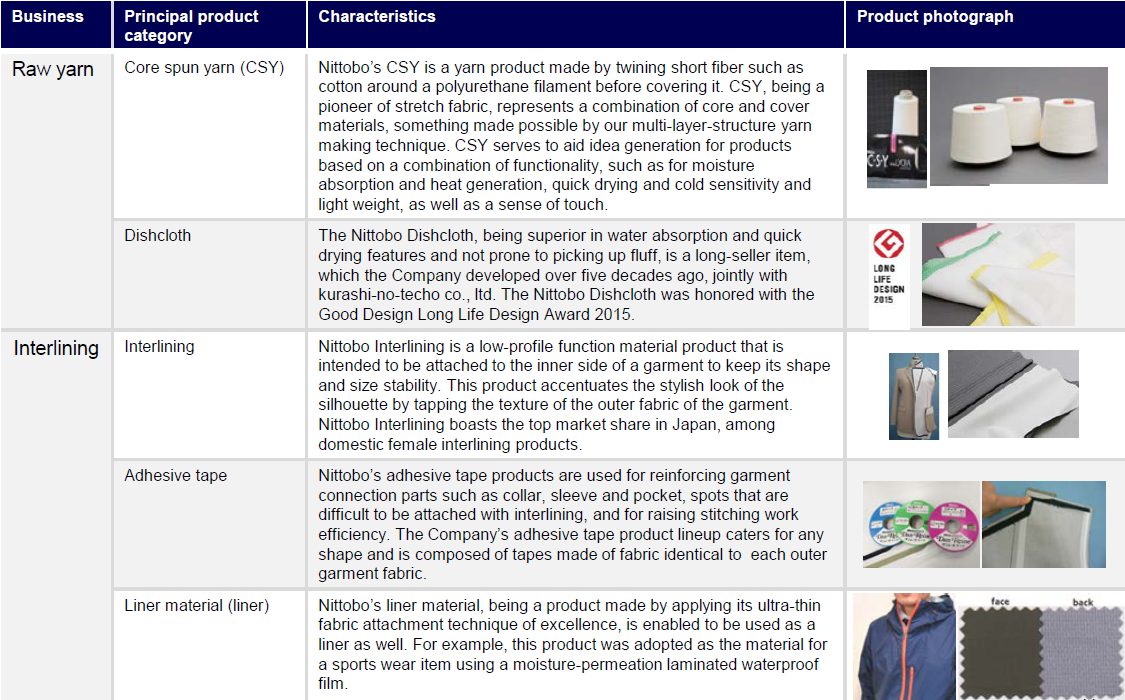

③Textiles Business

The company provides products utilizing its unique technologies to respond to the diversifying needs of customers, from yarns that are indispensable for clothing, to secondary materials and products. “C·S·Y (Core Spun Yarn)” is the double-structured textile which is the precursor of stretch fabrics. “Dan Reine” is adhesive interlining for women and has been boasting high market share. And “Nittobo Dishcloth” won the Good Design Long Life Design Award 2015.

(Source: the company)

(2)Research and development (R&D)

Since its founding, the Group has been actively promoting R&D and delivering unique products to the world.

R&D will continue to be a source of enhancing the company’s competitiveness and corporate value.

In recent years, while the needs of customers are becoming more sophisticated and diversified, global competition is intensifying. Under these circumstances, the company established new research and development site in 2017 to provide products and services with high value-added and strong originality in a timely manner with its characteristics and strengths, and to promote R&D toward the future.

The Group will continuously work on R&D from the viewpoint of expertise in each business division. At the same time, it will promote cross-sectional management by the research laboratory to pursue synergy among businesses with a focus on speed.

Furthermore, in each field, in order to accelerate research speed and expand the perspectives, the company is actively promoting joint research on industry, government and academia from the viewpoint of open innovation.

In July 2018, the satellite laboratory “NI-Tech” was opened at the Innovation Center of Nano Medicine in Kawasaki City as a new research and development site to strengthen the Life Sciences Business.

In order to further strengthen company-wide R&D capabilities, the company decided to construct a new building called “NI-CoLabo,” in Koriyama City, Fukushima Prefecture. The total cost of the construction was 2.7 billion yen and the construction were completed in April 2020. In addition to consolidating R&D divisions of each business segment into one location, it will enhance collaboration with external users. The building will be a symbol of the company’s R&D system.

1-4 Characteristics and Strengths

◎ Supply products by accurately grasping needs of the times

In addition to succeeding in the industrialization of glass fiber for the first time in Japan, the company began manufacturing glass wool for the first time in Japan. As such, the company has been always leading the global and Japanese markets in the field of glass fiber. In the history of over ninety years, it has always been capturing the changes and needs of the world accurately and developing and supplying various products centered on glass fiber.

Since the company’s product is not the final product, people do not see the company’s products directly. However, it supplies many materials that are indispensable to the world and supports our lives behind the scenes.

◎ High competitiveness by unique technologies

Among many manufacturers of glass fiber in the world, it is almost the only company that realized excellent low dielectric constant and low dielectric loss tangent (NE-glass) and high dimensional stability and higher rigidity (T-glass) in the field of glass fiber cloth for electronic materials and has established a system that can stably supply sufficient volume.

In addition, having acquired the top share in Japan for more than 10 items with in vitro diagnostic reagents in the Medical Division also shows its high competitiveness with its unique technologies.

1-5 ROE Analysis

| FY 2013 | FY 2014 | FY 2015 | FY 2016 | FY 2017 | FY 2018 | FY 2019 | FY 2020 |

ROE(%) | 6.3 | 6.8 | 7.6 | 9.8 | 12.5 | 9.1 | 6.3 | 8.4 |

Net Profit margin (%) | 4.53 | 5.09 | 6.49 | 8.98 | 12.13 | 9.70 | 6.73 | 10.29 |

Total asset turnover [times] | 0.63 | 0.64 | 0.60 | 0.59 | 0.59 | 0.55 | 0.53 | 0.44 |

Leverage [times] | 2.21 | 2.09 | 1.96 | 1.86 | 1.75 | 1.69 | 1.77 | 1.85 |

*Rounded to the nearest unit.

The rise in ROE in Fiscal Year 2020 is attributable to the increase in net profit thanks to the posting of a gain on sale of investment securities of 6.5 billion yen and an insurance amount received of 2.7 billion yen as extraordinary profit.

2. Results for the Fiscal Year 2020

(1) Consolidated business results

| FY 2019 | Ratio to sales | FY 2020 | Ratio to sales | YoY change | forecast ratio 1 | forecast ratio 2 |

Net Sales | 85,722 | 100.0% | 78,727 | 100.0% | -8.2% | -1.6% | +0.3% |

Gross profit | 28,094 | 32.8% | 25,661 | 32.6% | -8.7% | - | - |

SG&A | 19,933 | 23.3% | 19,697 | 25.0% | -1.2% | - | - |

Operating Profit | 8,160 | 9.5% | 5,964 | 7.6% | -26.9% | +8.4% | +8.4% |

Ordinary Profit | 8,202 | 9.6% | 6,274 | 8.0% | -23.5% | +16.2% | +16.2% |

Net Profit | 5,771 | 6.7% | 8,100 | 10.3% | +40.4% | -19.0% | +24.6% |

*Unit: million yen. Forecast ratio 1, forecast ratio 2 are the increase/decrease of actual results compared to the forecasts announced in November 2020 and February 2021, respectively.

Sales and profit decreased

Net Sales for the Fiscal Year 2020 were 78.7 billion yen, down 8.2% year on year. Sales volume dropped, because all businesses were affected by COVID-19. Operating profit declined 26.9% year on year to 6 billion yen due to the sluggish growth speed of the Special Glass business caused by the U.S.-China trade friction, and the fire at Fukushima Factory No. 2 in July 2020. The reinforcement cost augmented 2 billion yen year on year. Among high value-added products, Special Glass contributed to profit, as the operation of new melting furnaces started, but the performance of ultrafine yarns and ultra-thin cloth was stagnant.

Net profit increased 40.4% year on year to 8.1 billion yen. In addition to the selling of shares and idle land to secure capital for investment for growth, the company posted the insurance claim incomes for typhoon and a fire accident that has occurred in the previous year.

Quarterly performance bottomed out in the second quarter (July to September), and is recovering.

(2) Trend by segments

| FY 2019 | Ratio to sales | FY 2020 | Ratio to sales | YoY change |

Total Sales | 85,722 | 100.0% | 78,727 | 100.0% | -8.2% |

Glass Fiber Yarn | 25,017 | 29.2% | 23,124 | 29.4% | -7.6% |

Glass Fiber Cloth | 19,843 | 23.1% | 20,371 | 25.9% | +2.7% |

Glass Fiber for Industrial Materials | 21,396 | 25.0% | 18,559 | 23.6% | -13.3% |

Life Science | 15,052 | 17.6% | 13,500 | 17.1% | -10.3% |

Textiles | 3,616 | 4.2% | 2,254 | 2.9% | -37.7% |

Others | 796 | 0.9% | 917 | 1.2% | +15.2% |

Total Operating Profit | 8,160 | 9.5% | 5,964 | 7.6% | -26.9% |

Glass Fiber Yarn | 3,091 | 12.4% | 2,368 | 10.2% | -23.4% |

Glass Fiber Cloth | 2,919 | 14.7% | 2,626 | 12.9% | -10.0% |

Glass Fiber for Industrial Materials | 444 | 2.1% | 307 | 1.7% | -30.9% |

Life Science | 2,878 | 19.1% | 2,147 | 15.9% | -25.4% |

Textiles | -221 | - | -718 | - | - |

Others Adjustments | -951 | - | -768 | - | - |

*Unit: million yen. Total sales mean sales to external clients. Ratio to sales (in profit) means the ratio of profit to sales.

*Ratio to sales: For sales, ratio in total sales. For profit, operating profit margin.

①Glass Fiber Yarn Business

Sales and profit dropped.

Thanks to the increase of melting furnaces for Special Glass, the production amount of Special Glass for electronic materials (NE-glass yarns and T-glass yarns) increased, but the sale of composite materials for reinforced plastics and general-purpose yarns for electronic materials was sluggish. Personnel expenses and depreciation augmented through the measures for reinforcing the business foundation, and profit dropped.

②Glass Fiber Cloth Business

Sales grew, but profit declined.

As the operation of new melting furnaces for Special Glass started in the second half of the previous fiscal year, the production amount of yarns increased, therefore the sales volume of Special Glass cloth for electronic materials for high-speed large-volume communications grew. Baotek Industrial Materials Ltd., which became a consolidated subsidiary in Taiwan in the first half of Fiscal Year 2019, contributed to the sales growth. Profit dropped, due to the fire at Fukushima Factory No. 2 and the augmentation in R&D costs.

③Glass Fiber for Industrial Materials Business

Sales and profit decreased.

Due to COVID-19, the sales volume of glass fiber cloth for facilities and construction materials and heat insulating materials for housing dropped.

④Life Science Business

Sales and profit dropped.

*Medical

Due to COVID-19, outpatients refrained from going to a hospital and regular health checkups were postponed in enterprises, schools, etc., so the sales volume of in-vitro diagnostic reagents was stagnant. In Japan, performance recovered to the level of the previous fiscal year, but outside Japan, it is still sluggish. The cost for fortifying the business foundation (personnel expenses and depreciation) increased.

*Beverages

The volume of contracts for beverage production decreased as people refrained from going out.

⑤Textiles Business

Sales dropped, and loss augmented.

This business was affected by the restraint in operation of department stores, etc. in response to the declaration of a state of emergency in the COVID-19 pandemic. Through the shift to new lifestyles, the consumption of apparel was stagnant. Nittobo (China) Co., Ltd. was transferred.

(3) Financial standing and cash flows

◎Balance Sheet

| End of 2020/Mar | End of 2021/Mar |

| End of 2020/Mar | End of 2021/Mar |

Current Assets | 80,899 | 93,887 | Current liabilities | 29,808 | 33,875 |

Cash | 22,874 | 30,320 | Payables | 6,290 | 6,570 |

Receivables | 25,164 | 23,985 | ST Interest Bearing Liabilities | 13,281 | 13,148 |

Inventories | 29,364 | 34,345 | Noncurrent liabilities | 44,311 | 46,387 |

Noncurrent Assets | 91,925 | 90,764 | LT Interest Bearing Liabilities | 27,033 | 31,012 |

Tangible Assets | 63,292 | 65,506 | Total Liabilities | 74,120 | 80,262 |

Intangible Assets | 2,705 | 2,595 | Net Assets | 98,704 | 104,389 |

Investment, Others | 25,927 | 22,661 | Retained earnings | 55,574 | 61,831 |

Total assets | 172,824 | 184,652 | Total Liabilities and Net Assets | 172,824 | 184,652 |

|

|

| Total Interest-Bearing Liabilities | 40,314 | 44,160 |

*Unit: million yen

Total assets increased 11.8 billion yen from the end of the previous fiscal year to 184.7 billion yen, due to the rise in cash and deposits through the sale of assets, etc. and the growth of tangible fixed assets through capital investment.

Total liabilities augmented 6.1 billion yen from the end of the previous fiscal year to 80.3 billion yen, due to the rise in long-term debts. Net assets rose 5.7 billion yen from the end of the previous fiscal year to 104.4 billion yen, as retained earnings increased 6.3 billion yen.

As a result, capital-to-asset ratio dropped 0.5 points from the end of the previous fiscal year to 53.7%.

◎Cash Flows

| FY 2019 | FY 2020 | Increase/decrease |

Operating CF | 10,614 | 7,815 | -2,799 |

Investing CF | -16,917 | -1,867 | +15,050 |

Free CF | -6,303 | 5,948 | +12,251 |

Financing CF | 12,628 | 1,862 | -10,766 |

Term End Cash and Equivalents | 22,695 | 30,163 | +7,468 |

*Unit: million yen

The deficit in investing CF shrank and Free CF turned positive, due to the sale of investment securities and fixed assets, etc.

The cash position improved.

(4) Review of the previous Mid-Term Business Plan (FY 2017 - FY 2020)

During the four years of the previous Mid-Term Business Plan, the company proactively engaged in facility investment and M&A in regard to the Special Glass in the Glass Fiber Business and Medical Business, which will support its growth, based on the high value-added strategy, and thus reinforced its foundation for future growth.

On the other hand, earnings in all businesses deteriorated due to the spread of COVID-19 and the U.S.-China trade friction in Fiscal Year 2020, the last fiscal year of the plan. Therefore, the goals set in the Mid-Term Business Plan could not be achieved.

Concrete achievements and challenges pertaining to the previous Mid-Term Business Plan are as follows.

Achievements | Implementing the high value-added strategy and building the foundation for future growth *Glass Fiber Business: Enhancing production capacity for Special Glass (yarn), securing a production system for glass fiber cloth *Medical Business: Strengthening the business model of vertical integration from the development of raw materials to research/production, through strategic alliances and M&A promotion

Developing a system for the promotion of mid-term and long-term research topics through the establishment of a new research site and the increase in personnel |

Challenges | Reaping outcomes of investment in growth: Cash out preceded, so that outcomes deferred to the new Mid-Term Business Plan

Review of unprofitable businesses: Implementing structural reforms in the business of glass fiber composite materials and textiles business

Securing “toughness” of the business foundation: Reinforcing the ability to deal with risks related to the supply chain, natural disasters, outbreaks of fire, etc. |

The situation concerning the achievement of numerical goals is as follows. Due to COVID-19, etc., the results fall below the goals for most items.

| FY 2016 | FY 2019 | FY 2020 | FY 2020 the previous Mid-Term Business Plan target |

Net Sales | 833 | 857 | 787 | 1,000 |

Operating Profit | 111 | 82 | 60 | 120 |

Ordinary Profit | 114 | 82 | 63 | 120 |

Quarterly Net Profit | 75 | 58 | 81 | 80 |

EBITDA | 153 | 135 | 123 | 200 |

EBITDA Margin | 18% | 16% | 16% | 20% |

ROE | 10% | 6% | 8% | Over 8% |

Shareholders' equity ratio | 55% | 54% | 54% | Over 60% |

R&D Sales Ratio | 1.7% | 2.0% | 2.7% | Over 2.0% |

Capital Expenditure (Accepted Amount) | 164 | - | 568 | 550 |

Unit: 100 million yen. Figures were rounded to the closest unit.

*Capital Expenditure means the cumulative total in 4 years.

3. Forecast for the Fiscal Year 2021

(1) Earnings and dividend forecast

| FY 2020 | Ratio to sales | FY 2021 (forecast) | Ratio to sales | YoY change |

Net Sales | 78,727 | 100.0% | 85,000 | 100.0% | +8.0% |

Operating Profit | 5,964 | 7.6% | 6,000 | 7.1% | +0.6% |

Ordinary Profit | 6,274 | 8.0% | 5,600 | 6.6% | -10.8% |

Net Profit | 8,100 | 10.3% | 4,000 | 4.7% | -50.6% |

*Unit: million yen. The forecasted values were provided by the company.

Sales is estimated to increase, but operating profit is unchanged from the previous fiscal year. Ordinary profit is expected to decrease.

It is estimated that sales will be 85 billion yen, up 8.0% year on year, operating profit will be 6 billion yen, unchanged from the previous fiscal year, and ordinary profit will be 5.6 billion yen, down 10.8% year on year.

While sales volume is expected to recover in most segments, it is not projected that the business environment will improve significantly. Although Special Glass is increasingly adopted in data centers, full-scale growth based on the demand for base centers, etc. is estimated to resume in the next fiscal year or later.

Operating profit will remain unchanged from the previous year due to factors causing a temporary drop in profit (1.5 billion yen), such as the upfront costs for launching a new factory for Special Glass in Taiwan, including labor and depreciation costs, and the plan for periodic repair of large-sized melting furnace in Japan, in addition to continuous investment in reinforcing the management foundation. As exchange gain in the previous fiscal year is not expected, it is estimated that ordinary profit will be 5.6 billion yen, down 10.8% year on year. As the profit from selling fixed assets and received insurance claim incomes, which were reported as extraordinary profit in the previous fiscal year, will not be included, it is expected that net profit will be 4 billion yen, down 50.6% year on year.

The dividend is to be 45 yen/share, the same as in the previous fiscal year. The estimated payout ratio is 43.6%.

Sales bottomed out in the first half of the previous fiscal year and are recovering but will not reach the level in Fiscal Year 2019 before the pandemic outbreak.

While Special Glass will resume full-scale growth in the next fiscal year or later, sales are steadily growing, and although operating profit is stagnant due to the above-mentioned temporary factors, the company believes that the development of the revenue base is progressing

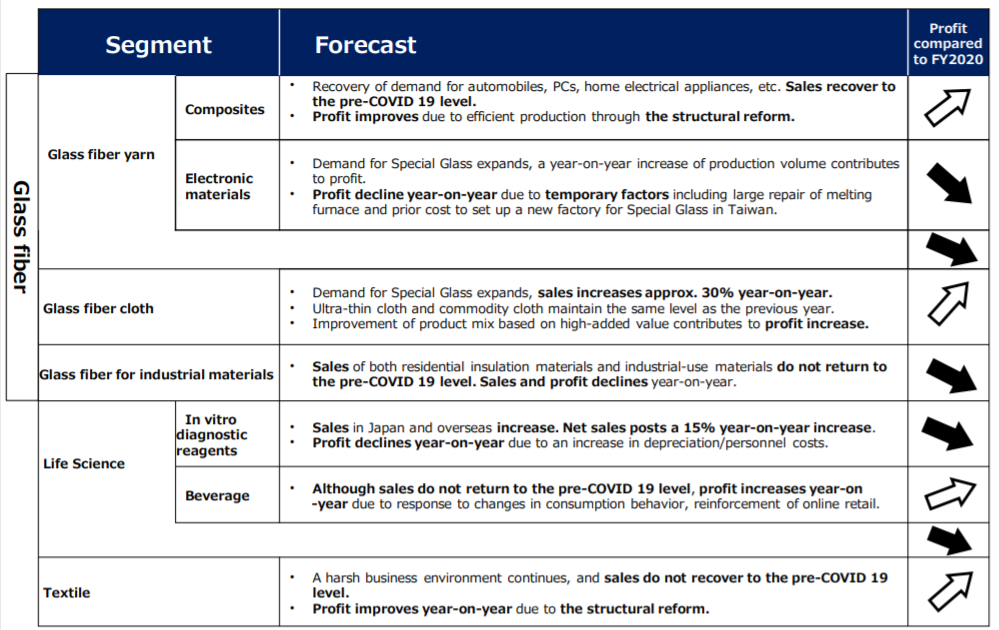

(2) Outlook for each segment

As for profit, it is estimated that the profit in Glass Fiber Cloth Business will increase due to the improvement of product mix with high added value, in addition to the expansion of demand for Special Glass, while the profit in Glass Fiber Yarn Business will decrease due to the above-mentioned temporary factors. The deficit in Textiles Business will be reduced due to structural reform.

(Source: the company)

| FY 2020 | Ratio to sales | FY 2021 (forecast) | Ratio to sales | YoY change |

Total Sales | 78,727 | 100.0% | 85,000 | 100.0% | +8.0% |

Glass Fiber Yarn | 23,124 | 29.4% | 24,000 | 28.2% | +3.8% |

Glass Fiber Cloth | 20,371 | 25.9% | 24,000 | 28.2% | +17.8% |

Glass Fiber for Industrial Materials | 18,559 | 23.6% | 18,000 | 21.2% | -3.0% |

Life Science | 13,500 | 17.1% | 15,500 | 18.2% | +14.8% |

Textiles | 2,254 | 2.9% | 2,500 | 2.9% | +10.9% |

Others | 917 | 1.2% | 1,000 | 1.2% | +9.1% |

Total Operating Profit | 5,964 | 7.6% | 6,000 | 7.1% | +0.6% |

Glass Fiber Yarn | 2,368 | 10.2% | 1,000 | 4.2% | -57.8% |

Glass Fiber Cloth | 2,626 | 12.9% | 3,800 | 15.8% | +44.7% |

Glass Fiber for Industrial Materials | 307 | 1.7% | 0 | 0.0% | - |

Life Science | 2,147 | 15.9% | 1,900 | 12.3% | -11.5% |

Textiles | -718 | - | -200 | - | - |

Others Adjustments | -768 | - | -500 | - | - |

*Unit: million yen. Total sales mean sales to external clients.

*Ratio to sales: For sales, ratio in total sales. For profit, operating profit margin.

4. [Big VISION 2030] and The New Mid-Term Business Plan (FY 2021-FY 2023)

【4-1 Big VISION 2030】

Aiming for sustainable growth and the realization of a prosperous society as a corporate group that creates a healthy and comfortable living culture for the next 100 years while responding to the rapid changes in the business environment, Nittobo Group set the [Big VISION 2030], which defines the group’s vision for 2030.

Nittobo Group’s vision in 2030 [Big VISION 2030]

As a corporate group that continues to create a global No.1 niche businesses, we aspire to contribute to “Environment/Energy,” “Digital Society,” and “Healthy/Security/Safety” for realizing a sustainable society |

Addressing various issues relating to the business environment, such as global warming, the aggravation of environmental problems, the arrival of an ultra-smart society (acceleration in communication and evolution of AI technology), and problems relating to social structure (decreasing birthrate, aging population, and other population problems), they offer products and services that contribute to “Environment/Energy,” “Digital Society,” and “Healthy/Security/Safety,” which help realize a sustainable society. They aim to continue to produce No.1 products in the global niche market, so that the group will be recognized as worthwhile by all stakeholders.

The No.1 positions the company aims to achieve are as follows.

*To be the No. 1 sensitive company by listening to, grasping and responding swiftly to the demands of the market

*To be the No. 1 company providing high value-added products that match the market needs by refining and tempering its own technology

In detail, they have refined their core competence regarding each business and set the following goals.

Glass Fiber | In the electronic materials, which supports a super smart society, refine technology/product capability, and become the global No. 1 company in the area of ultrafine/ultra-thin/Special Glasses.

In the composite materials and industrial materials, contribute to customers’ value creation, and become the global No. 1 company in terms of client satisfaction with proposition/response capabilities (speed)/quality. |

Life Science | Become the global No. 1 company for immunochemistry IVD (in vitro diagnostic) products in plasma protein, through global vertical integration from manufacturing of antisera to sales of finished IVD reagents. |

Textiles | Become the global No.1 company in the area of high-function materials that use adhesive technology. |

【4-2 New Mid Term Business Plan (FY 2021 – FY 2023)】

(1) Positioning

The New Mid-Term Business Plan will be the first stage for executing long-term strategies for actualizing the ideal state in 2030 [Big VISION 2030], while following the policy set in the previous Mid-Term Business Plan for the Fiscal Year 2023, which will mark the 100th anniversary of business start-up. As a milestone, the company disclosed concrete measures and financial goals for 3 years from FY 2021 to FY 2023.

In addition, they announced measures for addressing environmental issues as social issues and set environmental goals toward 2030.

(2) Basic strategies for 2030

Basic strategies for each stage leading up to [Big VISION 2030] are as follows.

Stage | Previous Mid-Term Business Plan (FY 2017 to FY 2020) | New Mid-Term Business Plan (FY 2021 to FY 2023) |

Theme | Challenges for Change and Creation | Realization of Change and Creation |

Basic strategies/ Ideal state | *Building the foundation for growth *Capital expenditure (including M&A, 56.8 billion yen/4 years) | *Growth Strategy Implementation *Management Foundation Reinforcement *Actions for Environment Issues *Human Resources Development |

(3) Priority strategies and initiatives in the New Mid-Term Business Plan

The following four items were stated.

Priority strategy | Main initiatives |

Growth Strategy Implementation -Create further business growth through high value-added products | *Increase revenue from Special Glass *Expand sales channels in vitro diagnostic reagents *Reinforce development capabilities of new products (Focus on the planning/developing further high value-added products) *Strengthen solution sales force to enhance customer values |

Management Foundation Reinforcement -Evolve into a lean business entity (secure resiliency) | *Lean management that can does not give in the economic changes (Strengthen cost competitiveness/renovate production process/ Asset Compression) Optimize the business portfolio; review unprofitable businesses *Encourage technological development by introducing IT/DX /renovation of production technology |

Actions for Environment Issues -Make efforts to address environmental issues for a sustainable society | *Reduction of CO2 emissions *Promotion of recycling and reuse *Develop new eco-friendly products |

Human Resources Development -Foster human resources/organizations/work environment that bring about changes | *Foster human resources for innovation *Facilitate diversity and inclusion *Workstyle reform and operation reform (use of digital tools/IT) *Enhance employees’ engagement |

(4)Financial goals

◎Overall

| FY 2020 (actual) | Goal for FY 2023 | CAGR Increase/Decrease |

Net Sales | 787 | 1,000 | +8.3% |

Operating Profit | 60 | 140 | +32.6% |

EBITDA | 123 | 250 | +26.7% |

EBITDA Margin | 15.6% | 25% | +9.4pt |

ROE | 8.4% | 10% | +1.6pt |

ROIC | 2.9% | 6% | +3.1pt |

Shareholders' equity ratio | 53.7% | 55% | +1.3pt |

D/E Ratio | 0.4x | 0.4x | 0pt |

*Unit: 100 million yen. CAGR was calculated by Investment Bridge Co., Ltd.

*Figures were rounded to the closest unit.

◎Segments

| FY 2020 (actual) | Goal for FY 2023 | Increase/Decrease | CAGR |

Total Sales | 787 | 1,000 | +213 | +8.3% |

Glass Fiber Yarn | 231 | 260 | +29 | +4.0% |

Glass Fiber Cloth | 204 | 330 | +126 | +17.4% |

Glass Fiber for Industrial Materials | 186 | 200 | +14 | +2.4% |

Life Science | 135 | 170 | +35 | +8.0% |

Textiles | 23 | 30 | +7 | +9.3% |

Others | 9 | 10 | +1 | +3.6% |

Total Operating Profit | 60 | 140 | +80 | +32.6% |

Glass Fiber Yarn | 24 | 50 | +26 | +27.7% |

Glass Fiber Cloth | 26 | 60 | +34 | +32.1% |

Glass Fiber for Industrial Materials | 3 | 5 | +2 | +18.6% |

Life Science | 21 | 30 | +9 | +12.6% |

Textiles | -7 | 3 | +10 | - |

Others | -8 | -8 | 0 | - |

*Unit: 100 million yen. CAGR was calculated by Investment Bridge Co., Ltd.

(5) Detailed Strategies in the New Medium-Term Business Plan

① Growth Strategy Implementation

【Glass Fiber】

◎ Growth Strategy

In response to the expanding 5G market, the company aims to expand the sales for glass fiber, which is its leading high value-added product.

With the rise in demand for 5G, the demand for Special Glass (with low dielectric properties) is increasing.

In addition to facility for infrastructures such as data centers, NE-glass cloth has been adopted for antenna modules of 5G terminals, and it has also begun to be deployed in edge devices connected to the Internet, such as smartphones and tablets.

Furthermore, the demand for Special Glass (with low thermal expansion properties) and super ultra-thin glass is increasing for semiconductor packages such as graphic memory for handling large volume of videos, and the company will rigorously take in these demands related to high-speed communications.

◎ Responding to 5G Roadmap

With the growing needs for the high-speed communications from cellphones to cars and industrial fields, 5G devices are expected to become even more high-functioning.

The company is one of the few self-contained manufacturers in the world that designs and develops glass compositions, and manufactures yarns and cloths all by itself. By taking advantage of this strength, the company can continuously develop the next-generation products that are needed to advance the communication technologies.

The New Mid-Term Business Plan aims to develop these next-generation low-dielectric glass and put it in mass production.

◎ Adding higher values to production bases

The company expects demands to remain high during the New Mid-Term Business Plans, and will continue to expand its production capacity of Special Glass. The company will increase the production ratio of high value-added products by adding the Special Glass melting furnaces and installing mass production facilities for the next-generation Special Glass to the surplus spaces generated by optimizing the production systems as part of the structural reforms of composite materials. In addition, by establishing an integrated yarn-to-cloth production system of Special Glass in Taiwan – the hub for electronic materials – and establishing the Special Glass production sites in Japan and Taiwan, the company plans to enhance the value-added product composition in Taiwan while strengthening its response capacity to risks such as natural disasters and improving competitiveness.

◎ Boosting sales for high value-added products

The company plans to increase the production capacity of Special Glass (NE glass-yarn, T-glass yarn) by about 90% over three years compared to the end of Fiscal Year 2020, and increase the ratio of high value-added products such as Special Glass, ultrafine, ultra-thin, and flat fibers in the Glass Fiber Yarn Business and Glass Fiber Cloth Business.

The company plans to double the sales for the Special Glass yarn and cloth products compared with Fiscal Year 2020.

In addition, the New Mid-Term Business Plan will witness the input from the next-generation Special Glass to begin, which will contribute to the expansion of high value-added products.

【Life Science (in-vitro diagnostic reagents)】

As a long-term goal, the company plan to make this area the second pillar after glass fiber.

On the back of its aggressive investments over the past four years, the company aims to become the world No. 1 company in the field of immune system plasma protein diagnostics, taking advantage of global vertical integration from antisera to reagent manufacturing and sales.

The company’s specific development and sales strategies are as follows.

Development Strategy | *Facilitate the generalization of highly sensitive reagents by strengthening our latex technology *Globally roll out bone metabolism marker business with a No.1 domestic market share *Enrich immunochemistry IVD products lineup, and reinforce the development of raw materials (antigen/antisera) |

Sales Strategy | (Domestic) Further expand the share of immunochemistry reagents (Overseas) Expand business with global majors Develop Chinese/Indian/Southeast Asian markets Promotion of awareness-raising activities |

In order to strengthen its global marketing strategies, the company set up the Marketing Strategy Department under the direct control of the General Manager of the Medical Division on January 1, 2021. The new department’s key mission is to promote sales in the growing Asian market, and specifically, the company will strengthen its capacities to find new themes, create strategic business growth opportunities, and build new business models.

【R&D System】

The digital and environmental technologies are the main pillars of R&D in the New Mid-Term Business Plan.

The company will strengthen its company-wide and long-term initiatives with its new research site Ni-CoLabo completed in April 2020 at the core.

The “DX-Strategy Office” was established to promote the use of digital technology through the company.

Its aim is to analyze the big data obtained from the company operations as well as improving productivity through AI utilization and the company plans to implement them in the operation of glass melting furnaces within three years

The “Environment Technology Strategy Office”, established to adopt and evaluate environmental technologies, provides technical support mainly under the “Sustainability Committee” chaired by the CEO, including the introduction of new technologies and the search for the use of external technologies, with the aim of achieving the goals of CO2 reduction and recycling promotion.

The company also set up the “Medical SC Newtech Strategy Office” to explore the new regions in the medical field.

Other areas on which the company will focus include: the development of company-wide technical human resources, intellectual property strategies utilizing IP (intellectual property) landscapes, and the promotion of science and technology to the local youths.

The company plans to spend a total of 7.2 billion yen over three years on R&D during the New Mid-Term Business Plan, mainly for Glass Fiber and Life Sciences.

② Management Foundation Reinforcement

◎ Structural reforms in the Composite Materials Business

The company’s basic strategies are “optimizing the production structure and improving cost competitiveness” and “Develop the use of high value-added products and focus on developing new product development (upgrading product composition).”

• Optimizing production structure and improving cost competitiveness

The company will reduce its composite materials facilities at the Fukushima Plant and expand the production system at the Fuji Fiber Glass in order to streamline the business management based on the appropriate capacity of its composite materials business. The company is considering adding a Special Glass melting furnace to the surplus space generated at the Fukushima Plant.

• Develop the use of high value-added products and focus on new product development (upgrading product composition)

The company will focus on expanding the use of high value-added products (FF etc.) through the utilization of external marketing organizations and the expansion of its product lineup, and drive market expansion.

As for specific product applications, the company believes that this is an area where the opportunities will increase as the weight-reduction trend of cars and aircrafts continues from the global environmental perspectives such as energy saving and CO2 emissions reduction, and the company will push on with developing its unique new products and expansion of applications of existing high value-added products by accurately grasping the market’s needs.

The company will also accelerate R&D for the development of high-function resins (super engineering plastics).

◎ Structural reforms in the Textiles Business

The company’s basic strategies are “restructure the interlining business” and “withdraw from the raw yarn business.”

• Restructure the interlining business”

Since the company owns the unique, core technical capabilities in its interlining business and currently has a relatively high domestic market share, it was deemed that the business can continue if the company can establish the system which can respond positively and flexibly to customer needs. The company will convert its adhesive interlining business into the “adhesive materials business” and develop products for industrial and living materials as well as clothing utilizing its own adhesive technologies.

In order to give management even more mobility, the interlining business was separated from the Nittobo main body and transferred to “Nittobo Advantex Co., Ltd. (NAT)”, a subsidiary established in April 2021. The employees in the interlining business were transferred to a new subsidiary accordingly.

• Withdraw from the raw yarn business

The company made the decision to withdraw from this business area as it had become increasingly difficult to generate profits due to the intensified competition from overseas products as well as the aging factory buildings and facility. Accordingly, Nittobo Niigata Co., Ltd. (NNK) is scheduled to be dissolved at the end of Fiscal Year 2021.

The manufacturing and sales for “Nittobo’s dishcloth” will be transferred to the newly established subsidiary that inherits the interlining business.

◎ Improving capital efficiency

The company aims to improve capital efficiency by using ROE and ROIC as KPIs, while working to “improving profitability/efficiency” and “securing financial soundness.”

To “improving profitability and efficiency,” the company will increase operating profit/EBITDA, earn operating CF that can cover investments, generate CF from past investments, and reduce costs and working capital. The company is looking to achieve a surplus in the 3-year total of Free CF.

By “improving profitability and efficiency,” the company will create further business growth through high value-added products.

To “securing financial soundness,” the company focuses on financial discipline, reduce assets, and strengthening its cash management capabilities, thereby suppressing in interest-bearing debts.

The company aims to evolve into a lean business entity (secure resiliency) by “securing financial soundness.”

③ Shareholder Return Policy

Currently, the company is implementing shareholder returns with an emphasis on stable growth, but in the medium term, the company will move to a payout rate of 30% as a guide on steady earnings from Fiscal Year 2023, when the company are on a profit growth trajectory.

④ Actions for Environment Issues

The company takes its responsibility to address environmental issues seriously.

To ensure its environmental targets are being met, the company will set up the Sustainability Committee in order to understand and promote its initiatives to solve environmental issues and make decisions quickly as a whole.

Specific initiatives and goals are as follows.

Goals | Efforts |

CO2 emissions reduction | By reviewing energy sources and promoting energy conservation, the company aims to reduce emissions per consolidated sales by 30% and total emissions by 8% in 2030 (compared to FY 2013). |

Waste glass reduction | By 2030, the company aims to achieve virtually zero waste glass volume with its new slogan “Utilize all, turn all into products.” |

Development of new environmentally responsive products | The company is developing highly insulated glass wool, biosoluble yarn/cloth, bioplastic chopped strands, etc.

(Examples of products compatible with the global environment) *Glass wool An insulation material that contributes to improving the energy efficiency of houses, and contributes to resource recycling as it uses recycled glass.

*Composite materials Contributes to the weight reduction of various parts such as cars and aircrafts by utilizing lightweight, high-strength glass fiber.

*Textiles & sustainability products The company will promote the development of products such as recycled products using recycled raw materials and interlining that are friendly to the global environment. |

⑤ Human Resources Development

The company will “improve employee engagement” by fostering an organizational culture in which employees can work in a positive environment and achieve results through “foster human resources for innovation” and “facilitate diversity and inclusion,” which are the foundations to secure technological innovations and business growths.

Foster human resources for innovation : strengthening professional skills | Cultivate: - professional human resources - next-generation leaders - global human resources |

Facilitate diversity and inclusion : use diverse human resources regardless of gender, their career at Nittobo, etc. | <2030 targets for women’s participation> *Ratio of female managers (section managers and above): 10% *Aiming for a ratio of female assistant managers and above of 20% |

Work style reform (new ways of working) : improving both productivity and employee QOL | *Facilitate work-style innovation *Facilitate the enhancement of indirect productivity (RPA utilization, paperless, hanko-less) |

The company aims to improve employee engagement by more than 30% in the 2023 score index compared to 2019.

⑥ Corporate Governance

The form of organization is a company with nominating committees, which comprises seven persons, including four external directors.

In addition to holding a prior reporting session of the Board of Directors to deepen the understanding of pressing issues and further enhance deliberations, the company is further improving the oversight function of the Board of Directors and strengthening its corporate governance system by introducing an effectiveness evaluation of the Board of Directors.

The Board of Directors is composed of internal directors with the knowledge of individual businesses and the general management, and the majority external directors who can offer discussions from multifaceted perspectives. One of the four external directors is female. They are respectively a person with management experience, a public accountant, a tax accountant and a lawyer, whose choice reflects the diversity awareness of the company, and helps to deepen their discussions on management policies, long-term strategies, and other issues from wider perspectives.

5. Focus Points in the Future

In the Fiscal Year 2020, which is the last fiscal year of the Mid-Term Business Plan, sales and profit decreased, due to the impact of COVID-19 and the sluggish growth of the Special Glass business amid the U.S.-China trade friction, etc. In Fiscal Year 2021, sales and profit will be on a plateau, almost unchanged from the previous fiscal year. However, quarterly performance bottomed out in the second quarter of Fiscal Year 2020 and is recovering, and Special Glass is increasingly adopted, although we have to wait until Fiscal Year 2022 to see its full-scale growth. While monitoring the trend of quarterly performance, we would like to pay attention to how they will implement the four priority measures set in the New Mid-Term Business Plan and especially how they will conduct growth strategies for achieving growth by expanding high value-added products.

<Reference: Regarding Corporate Governance>

◎Organization type, Directors, and Auditors

Organization type | Company with audit and supervisory committee |

Directors | 7 directors, including 4 external ones |

◎Corporate Governance Report

Updated on June 26, 2020

<Basic Policy>

Our Group aims to establish a fair and transparent management system in order to conduct business activities that put importance onto social trust from our stakeholders including shareholders and investors and undertake constant review of corporate governance.

Our company introduced an executive officer system in June 2003 with the intention to make the Board of Directors more effective and expedite decision-making. As a result, a system which maximizes the effect of consolidated management has been established. Since June 2008, the business has been operated with further clarification of functions and responsibilities for business administration and business execution. Having received an approval at the ordinary general meeting of shareholders on June 26, 2014, our company has shifted to a company with committees (currently, a company with nominating committee, etc.). In the new form, our company clearly separates supervising and business execution even further and aims at “supervisory functions reinforcement and transparent business administration” and “swift execution of business and improvement of management mobility.” Our company has also built functional systems, which allow us to respond more effectively to expectations of our stakeholders including our customers, shareholders, business partners, and employees and promotes further improvement of the corporate value.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

All Principles of the Corporate Governance Code that were revised in June 2018 are implemented.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle | Disclosure contents |

Principle 1-4 The so-called cross-shareholdings | [Policy concerning cross-shareholdings] Our company may hold shares of listed companies as cross-shareholdings when we determine that it will contribute to the establishment of good relationships with the Group’s important business partners for sale, material procurement, finance, etc., facilitation of smooth business activities of the Group, and maintenance and improvement of the corporate value of the Group. Meanwhile, the share of the companies that do not contribute to the maintenance and improvement of the corporate value of the Group and are judged to have little significance in holding their shares will be sold while considering the impact on the market. [Method to validate rationality of possession] Concerning holding listed stocks, for each stock, the Board of Directors regularly verifies the holding policy, which comprehensively takes into account qualitative factors such as importance of transactions, existence of technical cooperation and joint investment, and implementation of joint ventures as well as quantitative assessments that compare the overall return on investment calculated based on the dividend yield and the business profit with capital cost. Based on this examination, the company sold three stocks worth 783 million yen in the Fiscal Year 2019 and a total of 14 stocks worth 4,138 million yen in three years from the Fiscal Year 2017.

[Exercise of voting rights of cross-shareholdings] With regard to the exercise of voting rights of cross-shareholdings, our company will decide on the matter based on the factors such as whether the issuing company has an appropriate governance system and makes appropriate decisions that lead to enhancing its corporate value over the medium- and long-term, as well as whether it contributes to the enhancement of corporate value of the Group, and exercise the voting right appropriately. |

Principle 5-1 Policy for promoting constructive dialogue with shareholders | <<Policy for developing systems and implementing measures for promoting constructive dialogue with shareholders> (1) The executive officer responsible for corporate communication is assigned to supervise overall dialogue with our shareholders, and the Corporate Communication Department is a responsible department for assisting it. Being led by the executive officer, our group endeavors to create opportunities for dialogue with our shareholders, which should contribute to the continuous growth and mid/long-term improvement of the corporate value. In addition, together with the Corporate Communication Department, other departments associated with IR activities promote ongoing collaboration among departments. (2) The Group strives to continuously disclose information in a timely and appropriate manner so that parties including our customers, shareholders and investors will accurately be informed of and understand the state of the Group. To achieve this, we comply with laws and regulations related to information disclosure, stock exchange rules, etc. as well as establishing and operating appropriate systems for information disclosure. a) The Group publishes information that needs to be disclosed in accordance with domestic and international laws and regulations, stock exchange rules, etc. through our business reports, annual securities reports and annual reports for shareholders as well as making an announcement through information transmission systems at the stock exchange and press releases. b) The Group seeks to engage in fairer and broader information disclosure through our website, etc. in principle. c) Briefings for analysts and institutional investors are held immediately after announcement of half-yearly and final financial statements. d) The company issues an integrated report that integrates financial information and non-financial information, including CSR, so that the Group's medium- to long-term value creation mechanism can be better understood. (3) Feedback including opinions and concerns from shareholders and investors received through dialogue with them is collected at the Corporate Communication Department. The Department then reports to the responsible executive officer while feeding it back to the management team and Board of Directors by reporting at executive meetings when necessary. (4) The Group deals with individual inquiries and dialogue by paying sufficient attention to insider information and using only previously published and publicly known information. |

This report is intended solely for informational purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

You can see previous Bridge Reports and Bridge Salon (IR seminar) contents of (NITTO BOSEKI: 3110), etc. at www.bridge-salon.jp/.