| Pressance Corporation Co., Ltd. (3254) |

|

||||||||

Company |

Pressance Corporation Co., Ltd. |

||

Code No. |

3254 |

||

Exchange |

TSE 1st Section |

||

Industry |

Real estate business |

||

President |

Shinobu Yamagishi |

||

Address |

Crystal Tower, 1-2-27 Shiromi, Chuo-ku, Osaka |

||

Year-end |

End of March |

||

URL |

|||

*The share price is the closing price on May 30. The number of shares issued was taken from the latest brief financial report.

ROE and BPS are the values for the previous term. |

||||||||||||||||||||||||

|

|

* The forecast is from the company.

*From the FY 3/16, net income is profit attributable to owners of the parent. Hereinafter the same applies. |

| Key Points |

|

| Company Overview |

|

In 2002, the company was renamed "Pressance Corporation Co., Ltd." From the Kinki region, the company expanded its business area, and released "Pressance Nagoyajo-mae," the first originally developed condominium in the Tokai area, in 2003, expanding its operations steadily. Then, it was listed in the second section of Tokyo Stock Exchange in 2007. In 2008, it opened Tokyo Branch, commencing business operation in the Tokyo Metropolitan Area. Thanks to the steady expansion of its business area, the company withstood the effects of the bankruptcy of Lehman Brothers, and kept growing. Then, it was listed in the first section of the Tokyo Stock Exchange in 2013. The "Light up your corner" spirit  (For more details, refer to "5. Interview with Senior Managing Director Doi") ◎ Market environment According to the company's data (source: Real Estate Economic Institute) in the category of condominiums for sale, the company enjoys high market shares; it ranks first in the Kinki region for the sixth consecutive year (1,669 in 2015), ranks first in the Tokai and Chukyo regions for the fifth consecutive year (695 in 2015), and ranks sixth nationwide (2,512 in 2015).  ◎ Competitors

Pressance Corporation was compared with the enterprises listed in the above table from various aspects.

Meanwhile, PBR exceeds 1, but PER remains low. It is necessary to further increase investors' awareness of the company. ◎ Product mix

The outlines of the condominiums handled by the company are as follows:The approximate average price is 16 million yen for single-room condominiums, and 32 million yen for family condominiums.    ◎ Sales by region

The cumulative sales volume during a period from November 1998, in which the company started selling original brand condominiums, to the end of March 2016 are 437 buildings and 27,698 condominium units nationwide, especially in the Kinki, Tokai, and Chukyo regions.

The company plans to enhance its brand power and market share further in the Kinki, Tokai, and Chukyo regions, and discuss the expansion to other regions. (1) Plentiful experience of supplying condominiums and large market share Its large share brings some significant advantages, including the reduction in construction cost and the enhancement of information gathering capability, with the advantage of scale. (2) Strong selling power

As for the sale of single-room condominiums, the entire sales section is selling the same real estate intensively. Because all of the sales staff sell real estate under the same conditions, in-company competitions are intensified and the morale of sales staff improves.Since sales staffs sell only the same brand developed in-house, they are versed in the specs and features of real estate, and so they won the trust of customers. In addition, the company makes efforts to find potential users in various ways, and flexibly responds to the changes in demand and market situations. Thanks to these factors, the company sells out condominiums early and has stable sales. (3) Sound financial position

Pressance Corporation keeps capital-to-asset ratio high, based on high profit rate, the small amount of completed inventory, early recouping of funds, early repayment of project loans, etc., and can procure land in an advantageous manner.

In addition, land was procured actively, increasing debts and then decreasing capital-to-asset ratio, but this was not so serious as to affect the financial soundness of the company. (4) Excellent product competitiveness

The satisfaction level of buyers is high in the three aspects of "locations," "specs," and "prices." As for "locations," the company puts importance on convenience and advance property, and rigorously selects real estate within 10 minutes on foot from a major station in the urban area. As for "specs," the company puts emphasis on luxury, comfort, and functionality, and places high added value on real estate by equipping condominiums with a modular bathroom with a built-in dryer ventilator, floor heating systems based on gas-heated hot water, soundproof sashes, and noise insulation wooden floors as standard amenities. As for "prices," the company has achieved high cost-effectiveness by setting reasonable prices while keeping luxury. Through these efforts, its condominiums possess high asset and brand values in the long term.  (5) Outstanding information gathering capability

For condominium developers with the desire for business expansion, it is essential to gather information on good sites for building condominiums from brokers, financial institutions, etc. ahead of any other competitors.In the wake of the bankruptcy of Lehman Brothers, while many competitors became unable to procure land, Pressance Corporation had good financial standing, so it actively procured land by taking advantage of the situation. For brokers, etc., the existence of Pressance Corporation, which actively procured land amid the economic downturn, was very important. In addition, the company could make a swift decision compared with leading developers, which also was very attractive to brokers, etc. Accordingly, Pressance Corporation won a reputation as "a trade partner that would bring significant advantages." Consequently, brokers, etc. started "offering the latest information on land to Pressance." This relation is even stronger now after the aftershock of Lehman's fall subsided, which is one of the reasons why the company is highly competitive. Because of Pressance Corporation's swift decision-making and improved brand power, an increasing number of clients first contact Pressance even for large-scale projects, rather than leading developers. (6) Stable earning capability

Pressance Corporation was listed in the stock market in December 2007, and it has released its financial statements 8 times from the term ended March 2009 to the term ended March 2016. The comparison between the initial estimates and actual results of sales and ordinary income indicates that sales did not reach the initial estimates 4 times, while ordinary income has never failed to reach the initial estimates since the listing in the stock market.Without being affected by the real estate market situation, the company can earn profit stably and continuously. This is a remarkable characteristic of this company.   Since the three indices (i.e. operating income, ROE, and market capitalization) in the past 3 years satisfied certain criteria, Pressance Corporation was included in JPX-Nikkei Index 400* in August 2015. The company plans to make efforts to keep ROE high. *JPX-Nikkei Index 400

This is the share price index composed of the shares of "400 companies with high appeal for investors" which meet requirements of global investment standards, such as efficient use of capital use and investor-focused management perspectives. |

| Fiscal Year March 2016 Earnings Results |

Sales and profit grew for the 6th consecutive term, both marking record highs.

Sales were 78,990 million yen, up 20.3% year on year. The sales of single-room condominiums increased considerably by 46.4% year on year, and the sales of family condominiums grew healthily by 9.1% year on year. Due to the augmentation of procurement cost, etc., gross profit rate declined slightly. Although SG&A expenses including the cost for selling tower condominiums to be completed in the next term and personnel expenses including incentives rose, this increase was offset by sales growth. As a result, operating income increased by 14.6% year on year to 14,057 million yen, and ordinary income grew by 14.4% year on year to 13,798 million yen. Sales and profit increased for the 6th consecutive term and both marked record highs, exceeding their initial estimates.  Real Estate Sale Business

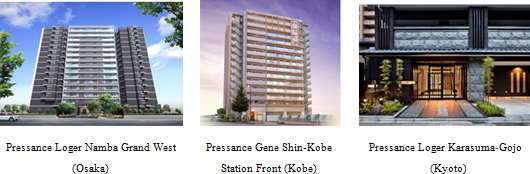

The sales of Pressance Loger Namba Grand West (194 condominium units in total) of the family condominium "Pressance Loger Series," etc. have been healthy.

Others

The performance of real estate for lease owned by the company has been healthy, and the income from rents increased.

Short-term interest-bearing liabilities are nearly equal to the value at the end of the previous term. Since the company conducted procurement actively, long-term interest-bearing liabilities were 51,297 million yen, up 23,465 million yen from the end of the previous term, and total interest-bearing liabilities were 56,706 million yen, up 23,158 million yen from the end of the previous term. As a result, capital-to-asset ratio dropped by 3.5% to 40.4%. The inventory assets of acquired sites, which is calculated by subtracting construction fees, etc. from the inventory assets in the BS (sum of real estate for sale and real estate for sale in process), was 17,684 million yen (5,083 units) for single-room condominiums, and 36,465 million yen (4,881 units) for family condominiums. Under the assumption that the company will sell 1,600-1,700 single-room condominiums and 1,500-1,800 family condominiums every term from now on, it can be said that the company has already secured the sites for the two kinds of condominiums for the coming three terms till the term ending March 2019.  Financing CF increased, because of the increase in the income from long-term debts. The cash position has not changed significantly. |

| Fiscal Year March 2017 Earnings Estimates |

Sales and profit are estimated to grow for the 7th consecutive term, both marking record highs.

Sales are estimated to increase by 27.7% year on year to 100,839 million yen, exceeding the 100 billion yen mark. The cost for acquiring sites for development has augmented and the expenses for building condominiums remain high, but the system for supporting the acquisition of housing is still effective and the employment situation is improving. Accordingly, Pressance Corporation expects that the rate of selling condominiums in the urban area will remain healthy. Due to the augmentation of the costs for acquiring sites and construction, gross profit rate is estimated to decline this term, too, and SG&A is estimated to grow about 30%, due to the increases in sales promotion expenses, including the expenses for advertisement and show houses, and employees in response to the expansion of business scale, etc. However, this is offset by sales growth, and operating income is estimated to rise 10.0% year on year to 15,466 million yen. From this term, the company will pay an interim dividend. The interim and term-end dividends will be both 35 yen/share, and the annual dividend will be 70 yen/share, up 10 yen per share year on year. Payout ratio is forecasted to be 10.0%. Recently, construction cost has started decreasing slightly, and this is expected to increase gross profit rate from the second half of the term after the next. In addition, the augmentation of SG&A stems from the advertisement cost for large-scale projects in Shiga and Osaka Prefectures, which would lead to the growth of sales in the next term and also the term after the next.  Since the sales of single-room condominiums are favorable, progress rate is higher than usual.  Sales volume is estimated to rise about 40%. It would rank third in the above-mentioned ranking in Japan.  As mentioned above, the plentiful experience of supplying condominiums and larger market share of Pressance Corporation are highly evaluated, and so an increasing number of clients offer information on large-scale real estate to the company. Others

Due to the increase of real estate for lease, the income from rents will grow. Accordingly, sales are estimated to be 3,661 million yen, up 12.9% year on year, indicating a double-digit increase.

|

| Future endeavors |

|

Pressance Corporation has increased the number of managed condominium buildings and condominium units steadily by supplying condominiums continuously. It will increase the numbers of managed condominium buildings and condominium units further by concentrating on the sale of single-room and family condominiums. As of the end of March 2016, the company has 241 managed condominium buildings and 12,204 rental apartments. By utilizing these accumulated assets, the company plans to secure a stable revenue source based on stock business, including the business of managing rental real estate or buildings, and the apartment rental business, in which the company owns excellent apartments and earns profit from rents.  (2) Operation of hotel business

Due to the growth of demand from foreign visitors to Japan, the shortage of hotels is now a pressing issue. Under these circumstances, in case that Pressance Corporation finds it more profitable, the company will convert some of the sites for single-room condominiums around major stations in Osaka and Kyoto into the sites for hotels, by utilizing the know-how to acquire sites, select locations, and estimate construction cost, which has been nurtured through the construction of condominiums. The company is undergoing discussions from diverse perspectives on specifically how to progress, while considering the options of (1) sale to hotel companies, (2) owning hotels by itself and entrusting hotel operation companies with hotel operation, and (3) owning and operating hotels all by itself. In the term ending March 2018, two buildings in Osaka and one building in Kyoto are scheduled to be completed, and in the term ending March 2019, two buildings in Osaka are to be completed. One of the five buildings will be entrusted to a hotel operation company, and Pressance will accumulate hotel operation know-how. (3) Major projects from the next term

The following two large-scale projects are underway.

◎ Pressance Legend Lake Biwa

A family condominium building with a total of 497 units is to be built on the shore of the Lake Biwa. This is one of the largest projects ever in the area, and every condominium unit will enjoy a lake view. The location has an easy access not only to Kyoto but also to Osaka. There are plentiful community facilities such as large shopping complex in the surrounding areas.It is scheduled to be completed in the middle of February 2018.

◎ Pressance Legend Sakaisuji Honmachi Tower

This is a project to build an earthquake-resistant residential skyscraper, the first of its kind in Osaka, which is 30 stories tall with 337 units. The size of each unit is planned to range from a 40 m2 compact type to an over 130 m2 family type. This tower condominium is also planned to have various shared facilities such as party rooms, sky lounges and fitness rooms. The tower is scheduled to be completed in late January 2018.

|

| Interview with Senior Managing Director Doi |

|

In this interview session, Investment Bridge asked him about the source of the company's strength, future endeavors, etc. "Without exception whatsoever, don't cut corners and do what needs to be done. 'Do all the common tasks properly' is our company's principle of action."

"We focus on personnel training, which increases growth potential."

"Please watch us. We are growing steadily."

|

| Conclusions |

|

Its business performance is estimated to be stable in the short term, considering the progress of orders received, site acquisition, etc. at the beginning of the term, and its characteristic profitability is forecasted to remain high. We would like to pay attention to its efforts for further diversifying its business in the mid to long terms, including the entry to other regions. |

| <Reference: regarding corporate governance> |

◎ Corporate governance report

Pressance Corporation submitted a corporate governance report on the period from the application of the corporate governance code, on November 30, 2015.

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2016, Investment Bridge Co., Ltd. All Rights Reserved. |