Bridge Report:(3254)Pressance the second quarter of the fiscal year ending March 2021

President Yutaka Doi | Pressance Corporation Co., Ltd. (3254) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Real estate business |

President | Yutaka Doi |

Address | Crystal Tower, 1-2-27 Shiromi, Chuo-ku, Osaka |

Year-end | End of March |

URL |

Stock Information

Share Price | Number of shares issued | Total market cap. | ROE(Actual) | Trading Unit | |

¥1,750 | 65,336,739 shares | ¥114,339 million | 21.1% | 100 shares | |

DPS(Est.) | Dividend yield (Est.) | EPS(Est.) | PER(Est.) | BPS(Actual) | PBR(Actual) |

¥26.00 | 1.5% | ¥283.11 | 6.2x | ¥1,791.63 | 1.0x |

*The share price is the closing price on December 4. Each number is taken from the brief financial report for the second quarter of the fiscal year ending March 2021. ROE and BPS are the values as of the end of the previous term.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Profit | Ordinary Income | Net Income | EPS | DPS |

Mar. 2016 (Actual) | 78,990 | 14,057 | 13,798 | 9,194 | 152.31 | 15.00 |

Mar. 2017 (Actual) | 101,083 | 15,645 | 15,414 | 10,526 | 178.99 | 21.15 |

Mar. 2018 (Actual) | 134,059 | 20,362 | 19,858 | 13,757 | 232.58 | 29.40 |

Mar. 2019 (Actual) | 160,580 | 27,118 | 26,531 | 18,296 | 296.43 | 40.50 |

Mar. 2020(Actual) | 224,011 | 32,609 | 31,985 | 21,892 | 347.45 | 39.00 |

Mar. 2021(Forecast) | 234,496 | 26,728 | 26,433 | 18,239 | 283.11 | 26.00 |

*Unit: Million yen or yen.

*4-for-1 share split was conducted on Oct. 1, 2016. EPS and DPS has been revised retroactively.

*Net income is profit attributable to owners of the parent. Hereinafter the same applies.

This report introduces Pressance Corporation’s earnings results for the second quarter of the fiscal year ending March 2021, etc.

Table of Contents

Key Points

1. Company Overview

2. The Second Quarter of Fiscal Year ending March 2021 Earnings Results

3. Fiscal Year ending March 2021 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales for the second quarter of the fiscal year ending March 2021 were 135.4 billion yen, up 8.0% year on year. Sales decreased for studio condominiums while sales increased for family-type condominiums. Gross profit margin dropped 7.1 points, and gross profit declined 19.8% year on year due to the augmentation of cost of goods, the changes in product mix, the sale of land and write-down of inventory assets to cope with the uncertainty caused by the spread of COVID-19. SG&A expenses were 9.3 billion yen, down 13.5% year on year, and operating profit was 18.3 billion yen, down 22.6% year on year. Despite the impact of the spread of COVID-19, sales and respective profits exceeded the forecast made at the beginning of the term.

- The full-year forecast for the fiscal year ending March 2021, which had been undetermined, was disclosed in November 2020. Sales are expected to be 234.4 billion yen, up 4.7% year on year, and operating profit is expected to be 26.7 billion yen, down 18.0% year on year. Sales of studio condominiums, which fell in the first half, are projected to recover and increase during the second half, resulting in the rise for the full fiscal year. The dividend forecast has also been disclosed. The company has paid an interim dividend of 13.00 yen/share and plans to pay a term-end dividend of 13.00 yen/share, for a total of 26.00 yen/share, down 13.00 yen/share from the previous term. The estimated payout ratio is 9.2%. The company plans to offer the same shareholder benefits as in the previous term.

- The COVID-19 crisis has restricted the company’s sales activities, decreasing profit, but the results until the second quarter of the current fiscal year exceeded the sales and profit forecasts made at the beginning of the term. Despite the spread of COVID-19 remaining as a risk factor, customer needs for both studio and family-type condominiums appear to be solid, and their sales are expected to progress steadily. As of the end of the second quarter, the percentage of sales secured was 87.3%. While this is lower than in the past few fiscal years, its absolute value is still high. We will also be watching the sales condition from the third quarter onward.

- We are also interested to see how quickly the synergy effects of becoming a subsidiary of Open House will manifest themselves.

1. Company Overview

Pressance Corporation is an independent condominium developer that plans, develops, sells, and manages family-type and studio condominiums mainly in the Kinki and Tokai-Chukyo regions, based on the business model of “creating high added value for real estate.” The company supplies the largest number of condominium units in the Kinki region for ten consecutive years as well as Tokai-Chukyo region for eight consecutive years. In Japan, the company was ranked in the 2nd place for three consecutive years. Its major strengths include plentiful supply volume of condominiums, large market share, outstanding sales capabilities and an excellent product appeal.

【1-1 Corporate history】

President Shinobu Yamagishi, who had accumulated experience in a leading condominium developer, established Nikkei Prestige Co., Ltd., the predecessor of Pressance Corporation, for the purpose of conducting real estate business in October 1997. The company released the first original brand condominium “Pressance Namba East” in 1998, and then the first originally developed condominium “Pressance Shinsaibashi East” in 2000, accumulating experience steadily.

In 2002, the company was renamed “Pressance Corporation Co., Ltd.” From the Kinki region, the company expanded its business area and released “Pressance Nagoyajo-mae,” the first originally developed condominium in the Tokai area, in 2003, expanding its operations steadily. Then, it was listed on the second section of Tokyo Stock Exchange in December 2007.

In 2008, it opened Tokyo Branch, commencing business operation in the Tokyo Metropolitan Area. Thanks to the steady expansion of its business, the company withstood the effects of the bankruptcy of Lehman Brothers and kept growing. Then, it was listed on the first section of the Tokyo Stock Exchange in October 2013.

【1-2 Corporate philosophy, etc.】

Based on the corporate philosophy “Light up your corner” that has been in place since the company’s foundation, a new management philosophy was established under President Doi, who took office in December 2019, to clarify the company's significance of existence (purpose) and to contribute to society through the expansion of its business.

◎Corporate philosophy

The “Light up your corner” spirit

“Light up your corner” is a teaching by one Buddhist monk called Saicho, the founder of Enryaku-Ji Temple in Shiga Prefecture and the Tendai sect of Buddhism. The slogan means that each and every individual should try their hardest in their own place and shine a light around by working for others, which in turn will brighten up society as a whole and eventually bring peace and happiness to the whole world. It is the original and still valid company motto proposed by President Yamagishi, himself a Shiga native.

Developing and supplying high-value real estate properties with the “light up your corner” spirit We believe that our mission as professionals in condominium development is to deliver “more comfortable and valuable condominiums” to residents. With the unshaken belief, we accurately grasp the needs of customers; also, all of our group companies join hands to deliver condominiums with high added value for the coming decades. |

Spirit of “good for 3 parties” derived from the “light up your corner” spirit We believe that it is possible to contribute to the improvement of customers’ quality of life and foster mutually trusting relationships with all the stakeholders by developing condominiums in the sincere manner. This follows the principle of “being beneficial for sellers, buyers and society.” |

From lighting up “your corner” to “your society” By continuously creating high-quality condominiums, we hope to vitalize regional communities and contribute to create convenient and comfortable towns. As a result, we aim to significantly promote the sustainable growth of our society. |

◎Management philosophy

“We will contribute to the creation of vibrant cities by providing homes”

The company is a developer of condominiums, offering studio and family-type condominiums.

The company identifies the areas that have not been developed enough yet at a certain point in time but are expected to grow in the future due to their convenient location. The company also develops studio condominiums in such areas. With the increase in the number of residents, such as students and new working people who are attracted by lower rent fee than the ones in other already developed areas, convenience stores, supermarkets, restaurants, and other stores are opened in order to satisfy their diverse needs while public infrastructures are exploited. These developments in the living environment will attract families, and many developers, including the company, will supply family-type condominiums, which will further develop the living environment. Thus, the company’s supply of condominiums is contributing to the development of a vibrant city, generating such positive cycle.

Cultivating “discernment” in identifying areas with potential and “competitiveness” of high value-added condominiums over the years, the company can provide the impetus for this kind of unique urban development.

【1-3 Market environment, etc.】

◎Favorable market environment

The overall population continues to decline in Japan; however , the population in the central parts of cities is on the rise due to the growing need for the housings at a convenient location.

Real estate prices have skyrocketed in the Tokyo metropolitan area, but in the Kinki, Tokai, and Chukyo areas (Pressance’s main areas of operation), they are still within an affordable price range for ordinary income groups.

In addition to the external environment, the company’s sales of studio condominiums has advantages of superior products (locations, price and quality), brand recognition, outstanding after-sales service (rental management), solid performance records and sales volume.

◎High share in the number of units supplied

According to data provided by the company (Source: Real Estate Economic Institute), the number of condominium units provided during 2019 in Kinki area is 18,042 and that in Tokai-Chukyo area is 4,650.

Pressance has provided 3,825units in the Kinki area and 804 units in the Tokai-Chukyo area. It has held the number one market share in Kinki area for ten consecutive years and in Tokai-Chukyo area for eight consecutive years.

It is the second largest provider of condominiums in Japan for the three consecutive years; with a total of 5,305 units nationwide.

Ranking for the supply of condominiums for sale by areas in 2019

Kinki area (Share 21.2%) | Tokai-Chukyo area (Share 17.3%) | ||||

Rank | Corporate name | No. of units | Rank | Corporate name | No. of units |

1 | Pressance Corporation | 3,825 | 1 | Pressance Corporation | 804 |

2 | ESLEAD CORPORATION | 2,121 | 2 | Nissho Estem Co., Ltd. | 598 |

3 | Sumitomo Realty & Development Co., Ltd. | 744 | 3 | Sumitomo Realty & Development Co., Ltd. | 441 |

4 | Kintetsu Real Estate Co., Ltd. | 704 | 4 | Mitsui Fudosan Residential Co., Ltd. | 340 |

5 | Nissho Estem Co., Ltd. | 646 | 5 | Nomura Real Estate Development Co., Ltd. | 275 |

Japan (Share 7.5%) | |||||

Rank | Corporate name | No. of units | |||

1 | Sumitomo Realty & Development Co., Ltd. | 5,690 | |||

2 | Pressance Corporation | 5,305 | |||

3 | Nomura Real Estate Development Co., Ltd. | 3,941 | |||

4 | Mitsubishi Jisho Residence Co., Ltd. | 3,365 | |||

5 | Mitsui Fudosan Residential Co., Ltd. | 2,365 | |||

(Calculated and prepared Pressance Corporation based on materials from Real Estate Economic Research Institute)

◎ Competitors

Below is a comparison between Pressance Corporation and major competitors from various aspects.

Code | Corporate name | Sales | Ordinary income | Total assets | Real estate for sale (A) | Real estate in process for sale (B) | Interest-bearing liabilities |

1925 | Daiwa House Industry Company, Limited | 4,380,209 | 367,669 | 4,627,388 | 795,396 | 212,850 | 1,040,877 |

1928 | Sekisui House, Ltd. | 2,415,186 | 213,905 | 2,634,748 | 884,118 | 94,827 | 579,107 |

3231 | Nomura Real Estate Holdings, Inc. | 676,495 | 73,077 | 1,801,273 | 234,973 | 298,787 | 870,000 |

3254 | Pressance Corporation | 224,011 | 31,985 | 310,779 | 27,074 | 217,964 | 158,988 |

3289 | Tokyu Fudosan Holdings Corporation | 963,198 | 67,499 | 2,487,369 | 287,345 | 366,591 | 453,558 |

8804 | Tokyo Tatemono Co., Ltd. | 323,036 | 44,611 | 1,564,049 | 151,004 | 98,216 | 922,051 |

8830 | Sumitomo Realty & Development Co., Ltd. | 1,013,512 | 220,520 | 5,317,623 | 351,368 | 286,254 | 3,440,908 |

8877 | ESLEAD CORPORATION | 61,638 | 8,000 | 80,494 | 12,320 | 40,119 | 22,347 |

8897 | Takara Leben CO., LTD. | 168,493 | 11,201 | 195,448 | 23,861 | 46,102 | 114,023 |

Code | Corporate name | Inventory asset ratio (A ÷ B) | Capital-to-asset ratio | Dependence on interest-bearing debts | Ordinary income margin | ROE | Market cap | Estimated PER | PBR |

1925 | Daiwa House Industry Co, Ltd | 373.7% | 37.3% | 22.5% | 8.4% | 14.1% | 2,292,525 | 17.4 | 1.3 |

1928 | Sekisui House, Ltd. | 932.3% | 48.1% | 22.0% | 8.9% | 11.5% | 1,329,312 | 11.6 | 1.0 |

3231 | Nomura Real Estate Holdings, Inc. | 78.6% | 30.5% | 48.3% | 10.8% | 9.1% | 441,165 | 13.4 | 0.8 |

3254 | Pressance Corporation | 12.4% | 37.1% | 51.2% | 14.3% | 21.1% | 115,384 | 6.2 | 1.0 |

3289 | Tokyu Fudosan Holdings Corporation | 78.4% | 23.5% | 18.2% | 7.0% | 6.7% | 380,790 | 22.4 | 0.7 |

8804 | Tokyo Tatemono Co., Ltd. | 153.7% | 24.0% | 59.0% | 13.8% | 8.2% | 315,215 | 10.2 | 0.9 |

8830 | Sumitomo Realty & Development Co., Ltd. | 122.7% | 24.4% | 64.7% | 21.8% | 11.3% | 1,694,389 | 12.0 | 1.3 |

8877 | ESLEAD CORPORATION | 30.7% | 58.6% | 27.8% | 13.0% | 11.3% | 20,924 | 5.2 | 0.4 |

8897 | Takara Leben CO., LTD. | 51.8% | 25.9% | 58.3% | 6.6% | 10.9% | 36,179 | 9.5 | 0.6 |

*unit: million yen, times.

*The values compared are from the results of the previous fiscal year. Market cap, PER, and PBR are based on the closing price on November 27, 2020

Although there are other companies with larger sales volumes, Pressance stands out with their small inventory (completed real estate for sale), high profitability and high capital efficiency.

【1-4 Business contents】

Pressance Corporation has two business segments: “real estate sale business,” in which the company plans, develops, sells and manages studio condominiums for investment and family-type condominiums for actual residency. And in “other business,” the company manages the lease of studio condominiums for the benefit of the owners and the building maintenance.

◎Product mix

The lineup of the condominiums supplied by the company are as follows:

The approximate average price of a property is 19 million yen for studio condominiums and 37 million yen for family-type condominiums.

Type | Residential area | Layout | Features | Criteria for selection |

Studio | About 20 to 50m2 | 1ROOM to 1LDK (L: living, D: dining, K: kitchen) | Urban type Within 5 min. on foot from a major station | Convenient location (Colleges, vocational schools, enterprises, commercial facilities, etc.) |

Family-type | About 50 to 100m2 | 1LDK to 4LDK | Urban and suburban types Within 10 min. on foot from a major station | Environment-rich location (Elementary and middle school areas, enterprises, commercial facilities, etc.) |

Combined | About 20 to 100m2 | 1ROOM to 4LDK | Urban and suburban types Within 5 min. on foot from a major station | Criteria similar to those for studio condominiums |

(Sales results for the fiscal year ended March 2020)

Product Type | Amount sold | Percentage | No. of units | Percentage |

Studio condominiums | 67,255 | 30.0% | 3,479 | 42.6% |

Family-type condominiums | 78,587 | 35.1% | 2,109 | 25.8% |

Condominium buildings | 27,299 | 12.2% | 1,532 | 18.8% |

Hotel property | 19,292 | 8.6% | 793 | 9.7% |

Other housing | 4,726 | 2.1% | 248 | 3.0% |

Other real estate | 18,364 | 8.2% | - | - |

Business accompanying real estate sale | 1,158 | 0.5% | - | - |

Real estate sale business, Total | 216,684 | 96.7% | 8,161 | 100.0% |

Others | 7,327 | 3.3% | - | - |

Total | 224,011 | 100.0% | 8,161 | 100.0% |

* unit: million yen

* The sale of condominium building refers to the method of wholesaling the whole or part of each condominium building mainly to condominium dealers

* The sale of other type of housing refers to the sale of houses, including used houses and detached houses, other than newly built condominiums.

* The sale of other real estate refers to the sale of real estate, including commercial stores and lands for development, other than housing

* Business accompanying real estate sales include fees for optional post deli very work, such as floor coating, and agent commissions for real estate sales.

◎Sales by region

The cumulative supply volume from November 1998, in which the company started selling original brand condominiums, to the end of March 2020 are 781buildings which consist of 52,862 condominium units nationwide, mainly in the Kinki and Tokai-Chukyo regions.

|

|

|

Prefecture | No. of buildings | No. of units |

Osaka | 354 | 24,577 |

Aichi | 187 | 12,215 |

Kyoto | 80 | 4,115 |

Hyogo | 76 | 5,640 |

Shiga | 12 | 1,601 |

Okinawa | 21 | 1,105 |

Tokyo | 21 | 1,336 |

Hiroshima | 5 | 410 |

Fukuoka | 3 | 170 |

Others | 22 | 1,693 |

Total | 781 | 52,862 |

*Accumulated supply volume from November 1998 to the end of March 2020

The company plans to enhance its brand and increase market share further in the Kinki and Tokai-Chukyo regions.

【1-5 Feature and strength】

①Abundant past record of supplying condominiums and large market share

As mentioned above, the company supplies the largest number of condominiums consecutively not only in the Kinki region, where it is headquartered, but also in the Tokai-Chukyo region. It also ranked second nationwide in 2019.

Its large share brings some significant advantages, including construction cost advantage and the competitiveness to collect the information of land on sale.

②Strong sales force

The company’s basic sales policy is to “sell all units before construction is completed,” and it has mostly executed.

On the sale of studio condominiums, the entire salespersons sell a piece of real estate during the same period. This way can intensify in-company competitions and motivated sales forces.

Since sales staffs sell only the brand developed by the company, they are the experts at the specs and features of their condominiums so that customers rely on them.

In addition, the company makes efforts to cultivate potential customers in various ways such as holding a seminar and also flexibly responds to the changes in demand and market conditions.

Personnel are the driving force for growth. Therefore, the company puts considerable energy into personnel education. The strong sales force of the company originates from its vast educational effort.

It is important to train new employees in order to make them beneficial in actual business as soon as possible. The company trains new employees to accompany their seniors and experience vital business scenes, such as talking with customers and making documents. Consequently, accumulating successful experiences makes new employees to grow to complete deals by themselves in a short period of time.

Because of these factors above, the company has sold out condominiums at an early point and has achieved stable sales.

③Competitive products

The customers are highly satisfied with “locations,” “facilities” and “prices.”

As for “locations,” the company puts importance on convenience within 5 minutes on foot for studio condominiums and 10 minutes on foot for family condominiums from a major station, especially in the urban area.

As for “facilities,” the company puts emphasis on luxury, comfort and functionality, placing high added value on real estate by equipping a modular bathroom with a built-in dryer ventilator, floor heating systems with gas-heated hot water, soundproof window and noise insulation wooden floors, etc. as standard facilities.

As for “prices,” the company has achieved high cost-effectiveness by setting reasonable prices while keeping luxury.

Through these works, its condominiums possess high asset and brand values in the long term.

④Outstanding information-gathering ability

For condominium developers, in order to expand their business, it is vital to attain good information from brokers or financial institutions ahead of any other competitors.

When other companies in the industry were stuck with a lot of finished goods inventory and could no longer procure new land due to the Financial crisis, Pressance Corporation was financially doing well and recognized such situations as a good opportunity to begin actively purchasing land. For land brokers, Pressance Corporation is the most important customer since it actively procured lands even during the downturn in economy.

It is also beneficial to brokers that Pressance Corporation makes quick decisions, compared with other large companies. As a result, Pressance Corporation won a reputation from land brokers as a trade partner with significant benefits. Consequently, brokers started offering the latest information on land to Pressance first.

This relation has grown stronger and stronger after the aftershock of Lehman’s fall subsided and is one of the reasons why the company is highly competitive.

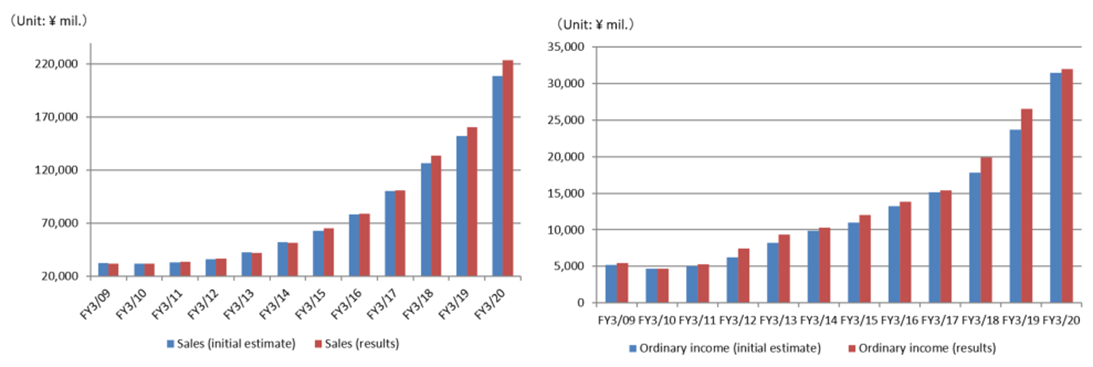

⑤Stable earning power

Pressance Corporation was listed on the stock market in December 2007, and it has released its financial forecast 12 times from the fiscal year ended March 2009 to the fiscal year ended March 2020. Comparing the initial forecasts and the actual results of sales and ordinary income, sales did not reach the initial forecasts a few times, but ordinary income has never failed to reach the initial forecasts. Without being affected by the real estate market condition, the company can earn profit stably and continuously. This is a remarkable feature of the company.

【1-6 ROE analysis】

| FY 3/13 | FY 3/14 | FY 3/15 | FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 |

ROE (%) | 18.5 | 18.2 | 18.9 | 19.4 | 19.2 | 20.8 | 22.1 | 21.1 |

Net income margin [%] | 12.64 | 12.15 | 11.82 | 11.64 | 10.41 | 10.26 | 11.39 | 9.77 |

Total asset turnover [times] | 0.74 | 0.75 | 0.74 | 0.70 | 0.65 | 0.62 | 0.59 | 0.73 |

Leverage [times] | 1.98 | 2.01 | 2.17 | 2.38 | 2.83 | 3.25 | 3.30 | 2.95 |

Demand is strong, and Pressance has achieved healthy sales and a consistently high net profit-to-sales ratio. They have also achieved a high ROE through efficient financing using leverage.

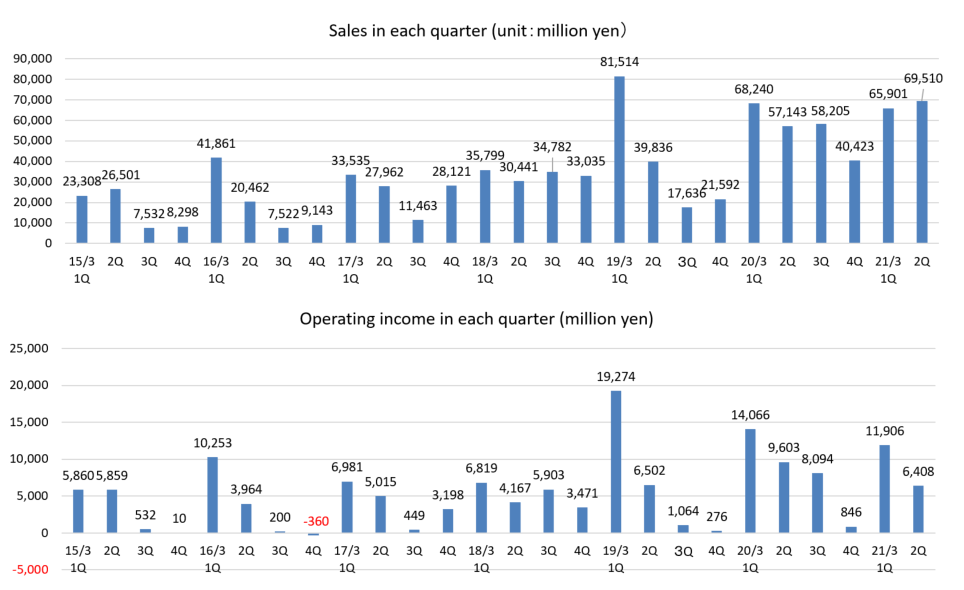

2. The Second Quarter of Fiscal Year ending March 2021 Earnings Results

(1) Consolidated Business Results

| 2Q of FY 3/20 | Ratio to sales | 2Q of FY 3/21 | Ratio to sales | YOY | Compared to the forecasts |

Sales | 125,383 | 100.0% | 135,411 | 100.0% | +8.0% | +32.4% |

Gross profit | 34,453 | 27.5% | 27,643 | 20.4% | -19.8% | - |

SG&A expenses | 10,783 | 8.6% | 9,329 | 6.9% | -13.5% | - |

Operating income | 23,669 | 18.9% | 18,314 | 13.5% | -22.6% | +13.9% |

Ordinary income | 23,398 | 18.7% | 18,416 | 13.6% | -21.3% | +19.1% |

Quarterly net income | 15,660 | 12.5% | 12,769 | 9.4% | -18.5% | +19.7% |

*unit: million yen

Increase in sales and decrease in profit, but exceeding the forecast

The sales for the second quarter of the fiscal year ending March 2021 were 135.4 billion yen, up 8.0% year on year. Sales decreased for studio condominiums while sales increased for family-type condominiums. Gross profit margin dropped 7.1 points, and gross profit declined 19.8% year on year due to the augmentation of cost of goods, changes in product mix, the sale of land and write-down of inventory assets to cope with the uncertainty caused by the spread of COVID-19. SG&A expenses were 9.3 billion yen, down 13.5% year on year, and operating profit was 18.3 billion yen, down 22.6% year on year. Despite the impact of the spread of COVID-19, sales and respective profits exceeded the forecast made at the beginning of the term.

(2) Condominium sales business trends

◎Sales results

Type | No. of units | YOY | Sales | YOY |

Studio condominiums | 2,734 | -3.5% | 47,833 | -10.5% |

Family-type condominiums | 1,756 | +25.2% | 63,079 | +19.5% |

Hotel property | 150 | +16.3% | 5,380 | +76.4% |

Total condo sales business | 4,640 | +6.3% | 116,294 | +6.5% |

*unit: million yen. “Condominium buildings” until the previous term is now included in “Studio condominiums.” As there were some cases in which the company sold some units directly to individual customers (labeled “studio condominiums” until the previous term) and others were wholesaled to dealers, etc. (labeled “Condominium buildings” until the previous term) within a single studio condominium building, figures for the same period of the previous fiscal year have been reclassified in the same manner to show year-on-year comparison.

The sales of studio condominiums dropped due to the impact of voluntary restraint of activities following the spread of COVID-19, but family-type condominiums maintained a high-level of sales due to the delivery of Pressance Loger Kashihara-Jingu-mae (114 units in total) and other units.

As for hotels, sales of one property were recorded. The condominium sales business saw a rise in sales.

(3) Financial position and cash flow

◎ Main BS

| End of Mar. 2020 | End of Sep. 2020 |

| End of Mar. 2020 | End of Sep. 2020 |

Current assets | 296,066 | 268,761 | Current liabilities | 107,318 | 98,017 |

Cash and deposits | 44,774 | 74,313 | Short-term interest-bearing debts | 73,084 | 72,075 |

Real estate for sale | 27,074 | 19,857 | Noncurrent liabilities | 86,770 | 57,978 |

Real estate for sale in process | 217,964 | 169,816 | Long-term interest-bearing debts | 85,903 | 57,190 |

Noncurrent assets | 14,712 | 16,093 | Total liabilities | 194,088 | 155,996 |

Property, plant and equipment | 7,640 | 8,895 | Net assets | 116,690 | 128,857 |

Intangible assets | 254 | 202 | Equity | 115,306 | 127,418 |

Investments and other assets | 6,817 | 6,995 | Total liabilities and net assets | 310,779 | 284,854 |

Total assets | 310,779 | 284,854 | Balance of interest-bearing debts | 158,987 | 129,265 |

*unit: million yen

Total assets were 284.8 billion yen, down 25.9 billion yen from the end of the previous term due to decrease in real estate for sale and real estate for sale in process. Total liabilities decreased 38 billion yen to 155.9 billion yen due to the decrease in interest-bearing liabilities, etc. Net assets rose 12.1 billion yen to 128.8 billion yen due to the rise in retained earnings, etc. As a result, capital-to-asset ratio rose 7.6 points from the end of the previous term to 44.7%.

As of the end of September 2020, the amount of acquired lands for condominiums, which is calculated by subtracting construction fees and other related fees from the inventory assets, the sum of real estate for sale and real estate for sale in process, in the balance sheet, was 61,888 million yen (12,692 units) for studio condominiums and 49,714 million yen (4,753 units) for family-type condominiums.

◎Cash Flow

| 2Q of FY 3/20 | 2Q of FY 3/21 | Change |

Operating CF | 7,129 | 59,523 | +52,394 |

Investing CF | -1,023 | 471 | +1,494 |

Free CF | 6,106 | 59,994 | +53,888 |

Financing CF | -4,527 | -30,455 | -25,928 |

Cash and equivalents | 40,974 | 71,223 | +30,249 |

*unit: million yen

Operating CF and free CF increased due to a decrease in inventory assets, etc. Cash position is improved.

(4) Topics

◎Concluded a new capital and business alliance agreement with Open House Co., Ltd.

In November 2020, the company concluded a new capital and business alliance agreement with Open House Co., Ltd. The two companies have decided to move forward with the following new activities and initiatives.

<Purpose of the new alliance>

The purpose of this new capital and business alliance is “to build a stronger capital relationship, further enhance the feasibility of business synergies, promote the sustainability as well as sustainable business growth of Pressance Corporation’s business operations and continuously improve corporate value and shareholder value over the medium to long term.

☆ | To strengthen the financial base of Pressance Corporation through credit enhancement by Open House Co., Ltd., and allocation of new shares to a third party. |

☆ | In addition to stabilizing Pressance Corporation’s financing by enhancing its financial position, to strengthen its condominium land procurement and also to resume and expand new projects in a full-scale operation. |

☆ | To further enhance the feasibility of business synergies through the mutual complement in terms of region and product. Pressance Corporation acquired the opportunity to establish and expand the business of condominiums for investment in the Kanto region which has a huge market volume. As Pressance Corporations has the business base and extensive know-how of the rental management and property management business, in which stock revenue are generated., it is expected to support Open House grow its stock business. |

☆ | To reduce costs by standardizing equipment and increasing the transaction volume of materials. |

<Open House to make Pressance Corporation its consolidated subsidiary and raise funds for Pressance Corporation>

Through a takeover bid by Open House Co., Ltd. for the shares of Pressance Corporation and a third-party allotment of new shares to Open House, Open House will acquire approx. 65% (upper limit) of the voting rights in Pressance Corporation, making Pressance Corporation a consolidated subsidiary.

By setting the upper limit, the company intends to maintain the listing of Pressance Corporation’s shares on the First Section of the Tokyo Stock Exchange.

In order to avoid the significant dilution of shares, it decided to combine the takeover bid and the third-party allotment.

Outline of TOB and third-party allotment of new shares:

TOB | - Offer price: 1,850 yen/common share - Max. number of shares to be purchased: 19,881,500 shares - TOB period: November 16, 2020 to January 14, 2021 - Commencement date of settlement of TOB: January 20, 2021 - Open House has already entered into the Tender Agreement with Shinobu Yamagishi, the former president of Pressance Corporation, and Pacific Corporation. All of the 4,621,700 shares held by Pacific and 183,200 shares held by Shinobu Yamagishi are expected to be the subject to the takeover bid. |

Third-party allotment | - Type of shares for subscription: Common stock - No. of shares for subscription: 3,508,772 shares (Dilution rati 5.37% based on the no. of shares, 5.42% based on the no. of voting rights) - Amount to be paid per share: 1,425 yen (10% discount from the closing price of 1,583 yen on November 12, 2020) - Total amount to be paid: 5 billion yen - Payment period: January 15, 2021 to January 19, 2021 - Purpose of use of funds: Purchase of lands for condominiums |

<Additional details of the capital and business alliance>

The expected synergies disclosed at the time of the conclusion of the capital and business alliance on April 6, 2020 included “regional complementarity,” “product complementarity,” “management and administration of rental and sale properties” and “cost reduction,” but the following factors were newly added.

(1) In order to enter the real estate fund business, the two companies will jointly establish a real estate asset management company and consider offering real estate investment products developed by each company to institutional investors and the financial market.

(2) The two companies will discuss the change of Pressance Corporation’s fiscal year to October 1 through September 30 each year and the company’s shareholder return policy.

<Matters concerning executives>

After the settlement of the takeover bid, Mr. Masaaki Arai, President and Representative Director of Open House, will assume the position of Chairman of Pressance Corporation. The company will submit a proposal for the election of Mr. Arai as a candidate for its directors at the ordinary General Meeting of Shareholders.

After the settlement of the takeover bid, discussions will be held regarding the appointment of officers to be dispatched to Pressance Corporation.

◎Progress in management reform (measures to prevent recurrence)

With regard to the arrest of the former president on suspicion of complicity in a case of business embezzlement related to a land transaction with Meijo Gakuin, the company announced measures to prevent recurrence of such cases on May 14, 2020, based on the recommendations of the External Management Reform Committee.

“Review of the state of important meetings, including the board of directors, and decision-making processes ”

“Establishment of an environment to ensure the effective execution of duties by outside directors”

“Design and education of rules regarding transactions with conflicts of interest and competitive transactions”

“Redesign of control activities in the land purchase process”

“Review of internal audits”

The company is making steady progress in the five areas outlined above.

3. Fiscal Year ending March 2021 Earnings Forecasts

(1) Earnings Forecasts

| FY 3/20 | Ratio to sales | FY 3/21(forecast) | Ratio to sales | YoY | Progress rate |

Sales | 224,011 | 100.0% | 234,496 | 100.0% | +4.7% | 57.7% |

Gross profit | 53,124 | 23.7% | 45,856 | 19.6% | -13.7% | 60.3% |

SG&A expenses | 20,515 | 9.2% | 19,128 | 8.2% | -6.8% | 48.8% |

Operating income | 32,609 | 14.6% | 26,728 | 11.4% | -18.0% | 68.5% |

Ordinary income | 31,985 | 14.3% | 26,433 | 11.3% | -17.4% | 69.7% |

Net income | 21,892 | 9.8% | 18,239 | 7.8% | -16.7% | 70.0% |

*unit: million yen

*The estimated amounts are from the company.

Sales increase and profit decrease

The full-year forecast for the fiscal year ending March 2021, which had been undetermined, was disclosed in November 2020. Sales are expected to be 234.4 billion yen, up 4.7% year on year, and operating profit is expected to be 26.7 billion yen, down 18.0% year on year. Sales of studio condominiums, which fell in the first half, are projected to recover and increase during the second half, resulting in the rise for the full fiscal year. The dividend forecast has also been disclosed. The company has paid an interim dividend of 13.00 yen/share and plans to pay a term-end dividend of 13.00 yen/share, for a total of 26.00 yen/share, down 13.00 yen/share from the previous term. The estimated payout ratio is 9.2%. The company plans to offer the same shareholder benefits as in the previous term.

◎Sales forecast for condominium sales business

Type | FY 3/20 | FY 3/21(forecast) | YoY | Progress rate |

Studio condominiums | 94,555 | 99,271 | +4.9% | 48.2% |

Family-type condominiums | 78,587 | 94,600 | +20.4% | 66.7% |

Hotel | 19,292 | 11,380 | -41.0% | 47.3% |

Total | 192,435 | 205,252 | +6.7% | 56.7% |

*unit: million yen

◎Progress

Classification |

| |||

Sales already made and scheduled to be booked during the current fiscal year | Condominium sales business | |||

No. of units | Sales(A) | Sales forecast for the current fiscal year(B) | Percentage secured against forecast(A ÷ B) | |

Studio condominiums | 4,630 | 78,534 | 99,271 | 79.1% |

Family-type condominiums | 2,403 | 88,158 | 94,600 | 93.2% |

Hotel | 427 | 11,167 | 11,380 | 98.1% |

others | 192 | 18,317 | 19,389 | 94.5% |

total | 7,652 | 196,177 | 224,642 | 87.3% |

*unit: million yen

*Others are other housing and real estate sales.

The percentage of sales secured was 87.3% as of the end of the second quarter.

4. Conclusions

The COVID-19 crisis has restricted the company’s sales activities and resulted in decreasing profit. However, the results until the second quarter of the current fiscal year exceeded the sales and profit forecasts made at the beginning of the term. Despite the spread of COVID-19 remaining as a risk factor, customer needs for both studio and family-type condominiums appear to be solid, and their sales are expected to progress steadily. As of the end of the second quarter, the percentage of sales secured was 87.3%. While this is lower than in the past few fiscal years, its absolute value is still high. We will also be watching the sales condition from the third quarter onward.

We are also interested to see how quickly the synergy effects of becoming a subsidiary of Open House will manifest themselves.

<Reference: Regarding Corporate Governance>

◎Organization category, and the composition of directors and auditors

Organization category | Company that has an audit and supervisory committee, etc. |

Directors | 9 directors, including 4 external ones |

◎Corporate governance report

Last modified: June 30, 2020.

<Basic policy>

We consider corporate governance as the principal framework within which the corporate management of the relationship with various stakeholders, such as shareholders, customers, employees, business partners and local communities, is conducted and believe that putting the followings into practice will shape such a framework.

We recognize the maximization of shareholder profit as our most important duty while putting the followings into practice at the same time.

*Compliance with laws and regulations

We believe that good practice of compliance helps avoid direct damage caused by scandals and improve our brand value and corporate image as the “trustworthy” and “sincere” company and further leads to enhancement of financial performance from the medium to long-term perspective and higher corporate value.

*Risk management

We think risk management is about taking control of threats and risks of events or actions that prevent the company from accomplishing its objectives with considering its cost-effectiveness.

*Accountability

As the word commonly means the responsibility to explain, we consider it as our duty to provide a logical explanation for the consequences caused by the action authorities took and did not take.

<Major principles that have not been followed, and reasons>

The company states, “Our company conducts all the principle of the Corporate Governance Code.”

<Major disclosed principles>

Principle | Disclosed content |

【Principle 1-4 So-called strategically-held shares】 | (1) Pressance may hold the shares of a business counterparty, in order to foster a good relation with the counterparty and conduct business smoothly. The company will keep holding the shares of business counterparty as long as they are considered to improve the corporate value of the company, but every year, the company will verify propriety of holding shares by considering whether or not the profit from each held share surpasses its risk and capital cost as well as if the reasons of holding shares, such as strengthening the relationships with clients, are reasonable, and discuss the sale of the shares that are not worth holding while considering share prices, etc. (2) The basic policy is to exercise the voting rights for the owned shares while considering whether or not business partners’ decisions would improve the corporate value of Pressance. |

【Principle 5-1 Policy for construction dialogue with shareholders】 | Pressance considers shareholders and investors as important stakeholders and will make constructive communications with shareholders and investors by using various opportunities, including general meetings of shareholders, in order to achieve sustainable growth and improve its corporate value. ・The communications with shareholders and IR activities are managed by the president and representative director, making efforts to actualize constructive communications with shareholders. For smooth communications with shareholders, the accounting and general affairs departments are supporting IR activities. ・As a means for communications with shareholders and investors, the company holds interviews with shareholders and institutional investors via securities firms. ・The president and representative director reports the opinions and worries of shareholders, which are grasped through the communications with them, to the board of directors if necessary. And the company reflects them to the business. ・The insider information in communications is handled in accordance with the regulations for the management of insider transactions. |

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

The back number of Bridge Reports (Pressance Corporation Co., Ltd.: 3254) and contents of Bridge Salon (IR seminars) can be seen at https://www.bridge-salon.jp/