Bridge Report: (3300) AMBITION

President Takeshi Shimizu | AMBITION (3300) |

|

Company Information

Market | TSE Mothers |

Industry | Real estate business |

President | Takeshi Shimizu |

HQ Address | 2-34-7 Jingumae, Shibuya-ku, Tokyo |

Year-end | June |

Homepage |

Stock Information

Share price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Act.) | Trading Unit | |

¥1,062 | 6,804,396 shares | ¥7,226 million | 38.6% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥25.00 | 2.4% | ¥124.42 | 8.5 x | ¥300.73 | 3.5 x |

*Share price as of closing on February 19. Number of shares outstanding as of most recent quarter end, excluding treasury shares. ROE and BPS as of the end of the previous term.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Profit | Ordinary Profit | Net Profit | EPS | DPS |

Jun. 2015 (Act.) | 6,953 | 185 | 175 | 110 | 38.56 | 20.00 |

Jun. 2016 (Act.) | 9,841 | 199 | 195 | 109 | 36.25 | 10.00 |

Jun. 2017 (Act.) | 14,578 | 291 | 268 | 148 | 49.21 | 10.00 |

Jun. 2018 (Act.) | 23,278 | 1,141 | 1,017 | 611 | 90.27 | 16.50 |

Jun. 2019 (Est.) | 29,268 | 1,536 | 1,346 | 846 | 124.42 | 25.00 |

*The forecasted values were provided by the company. From the fiscal year ended June 2016, net profit is profit attributable to owners of parent. Hereinafter the same shall apply.

*2-for-1 stock split was conducted in April 2016 and April 2018 (EPS was revised retroactively).

*(Unit: Million yen, yen)

This report outlines the financial results of AMBITION, which is listed in Mothers of Tokyo Stock Exchange, for the first half of the fiscal year ending June 2019, and reports its full-year forecast as well as the interview with the president Shimizu.

Table of contents

Key Points

1. Company Overview

2. First Half of Fiscal Year June 2019 Earnings Results

3. Third Quarter of Fiscal Year June 2019 Earnings Results

4. Fiscal Year June 2019 Earnings Estimates

5. Interview with the President Shimizu

6. Conclusions

Reference: Regarding Corporate Governance

Key Points

- AMBITION is a real estate venture, which concentrates on lease management and sublease (of condominium units) and established a recurring-revenue business model worth over 10 billion yen in just 10 years. Partially thanks to M&A, the company has accelerated its growth by brokering lease, developing and selling condominiums for investment, and utilizing technologies with its recurring-revenue business being the revenue base. In the past 4 years from the term ended June 2015 to the term ended June 2018, sales grew from 6.95 billion yen to 23.27 billion yen, and operating profit rose from 180 million yen to 1.14 billion yen.

- In the first half of the term ending June 2019, sales grew 48.4% year on year, and operating profit was 557 million yen (9 million yen in the same period of the previous term). The sale of new designer condominiums for investment, which are handled by Veritas Investment Co., Ltd., a consolidated subsidiary, is progressing at a pace higher than the initial plan. The synergy with the property management business, which is their mainstay, occurred, and the number of subleased units managed by the company was 9,776, up 8.6% (774 units) from the end of the same period of the previous year. The total number of units managed by the company was 18,094, up 13.0% (2,082) from the end of the same period of the previous year, and occupancy rate was as high as 95.3%. According to the full-year forecast that has been revised upwardly considering the results for the first half, sales and operating profit are projected to increase 25.7% and 34.6%, respectively, year on year. The estimated dividend has been revised upwardly to 25 yen/share, up 8.5 yen/share.

- The real estate business is labor-intensive. The installation of IT is delayed, but the company has concentrated on the investment in IT since the establishment of the company, while considering IT as a growth driver. Business is becoming more efficient through robotic process automation (RPA), and the company is preparing for field sales as a solution for streamlining business processes in the real estate field. The company aims to achieve sales of 100 billion yen and an operating profit of 10 billion yen early, by expanding existing businesses, carrying out M&A, and offering solutions for streamlining business operations.

1. Company Overview

AMBITION deals with development, planning, procurement, lease management, brokerage of lease and sale, sale, private residence lease, and insurance on a one-stop basis, and proceeds with “real estate SPA” to meet a variety of needs from customers. Based on the recurring revenue from lease management and the sublease business under the brand name “Kariage-Oh,” the company has accelerated its growth by brokering lease, developing and selling condominiums for investment, and utilizing technologies. As characteristics, the company has fortified its competitiveness through appropriate M&A and streamlined its business operation based on IT at the early stage, while adopting the RPA technology. By expanding its existing businesses and developing new businesses based on real estate technologies, the company aims to achieve sales of 100 billion yen and an operating profit of 10 billion yen as soon as possible.

The AMBITION group is composed of AMBITION, 7 consolidated subsidiaries, and 1 non-consolidated subsidiary. The consolidated subsidiaries are Ambition ROOMPIA, Co., Ltd. and VALOR, Co., Ltd., which broker lease, Veritas Investment Co., Ltd., which develops condominiums for investment, Not Found Co., Ltd., which mediates sale and purchase, Vision Inc., which trades real estate on behalf of clients, AMBITION VIETNAM CO. LTD., which deals with BPO and develops systems, and Hope Small Amounts and Short-Term Insurance Co., Ltd. The non-consolidated subsidiary is Room Guarantee Co., Ltd., which conducts the rent guarantee business.

1-1 Mission “Target a dream! Target reality!”

With the “ambition” to create a future of “housing,” the company aims to become a “real company” for bringing “dreams” to all people they have encountered.

1-2 Corporate History

AMBITION was established in September 2007, and started operating the property management business and Shibuya Branch in December 2007, starting the rental brokerage business. In April 2008, the company released “SUPER ZERO PLAN,” which does not require security deposits, key money, guarantee charges, initial rents, or update fees, and then opened Ikebukuro, Ueno, and Shinjuku Branches. By improving product plans and enriching the network of shops, the company put the two businesses on a growth track, and established the base for recurring-revenue business. In January 2010, it acquired Joint ROOMPIA Co., Ltd. (5 shops; currently, Ambition ROOMPIA Co., Ltd.) as a subsidiary, to enhance its marketing capability. Under the “real estate SPA” strategy, the company founded Room Guarantee Co., Ltd., which conducts the rent guarantee business, in December 2011, and established the Transaction and Brokerage Department (currently, the Investment Department) in the headquarters in May 2012.

In September 2014, it was listed in Mothers of Tokyo Stock Exchange. In October, the company launched “Kariage-Oh” and “Kaitori-King,” to develop the brands of sublease and trade of real estate. In April 2015, it established AMBITION VIETNAM for BPO and system development in Ho Chi Minh City, Vietnam, and in June 2015, it reorganized VALOR Co., Ltd., which had been brokering lease (5 shops) in Kanagawa Prefecture into a 100% subsidiary. As part of “real estate SPA” strategy, it established Hope Small Amounts and Short-Term Insurance Co., Ltd. in September 2017, and reorganized VERITAS Investment Co., Ltd., which develops and sells designer condominiums for investment mainly in 23 wards of Tokyo, into a subsidiary in October.

Sep. 2007 | Ambition Corporation established | Apr. 2015 | AMBITION VIETNAM (Ho Chi Minh) |

Jan. 2010 | Joint ROOMPIA Co., Ltd. transformed into a subsidiary | Jun. 2015 | VALOR Co., Ltd. transformed into a subsidiary |

May 2012 | Transaction and Brokerage Department (currently the Investment Department) established at head office | Sep. 2017 | Hope Small Amounts and Short-Term Insurance Co., Ltd. established |

Sep. 19, 2014 | Listed on Tokyo Stock Exchange Mothers Market | Oct. 2017 | VERITAS Investment Co., Ltd. transformed into a subsidiary |

1-3 Business Segment

The business of AMBITION is classified into the property management business, the rental brokerage business, the investment business, and other businesses (not included in segments to be reported), including the businesses of AMBITION VIETNAM CO., LTD. and Hope Small Amounts and Short-Term Insurance Co., Ltd.

Property management business AMBITION, VERITAS Investment Co., Ltd., VALOR Co., Ltd., Room Guarantee Co., Ltd.

The company offers agency services of lease management, including the maintenance and management of real estate, the management of occupants, lease management, etc. and sublease, which means that the company leases real estate from owners while guaranteeing rents and subleases them to general consumers. The company carries out marketing activities targeting VERITAS Investment Co., Ltd., a subsidiary, NISSHIN FUDOSAN Investment Advisors, Inc., in which the company invests, and “companies that sell real estate for investment” that do not have a lease brokerage business division, to increase client owners. The company sets high guaranteed rents by keeping occupancy rates high, by utilizing the lease brokerage capability of the corporate group and product competitiveness based on rent plans, including “ALL ZERO PLAN” (no security deposits, key money, or guarantee fees required) and “SUPER ZERO PLAN” (no security deposits, key money, guarantee fees, initial rents, or update fees required), which curb the initial cost for relocation.

Rental brokerage business Ambition ROOMPIA Co., Ltd., VALOR Co., Ltd.

AMBITION mediates and brokers the transactions for real estate managed in the property management business (hereinafter called “own real estate”) and real estate managed by other companies (hereinafter called “outside real estate”) and introduces movers as its accompanying operation. Based on the concept that every shop is “easy to access and enter” for consumers, all shops are located within the walking distance of a terminal station in Tokyo and on the first floor of the building, and are glass-walled, so that the inside of the shop can be seen from the outside. While striving to differentiate products with its own real estate not handled by other companies, the company places a priority on offering the information on own real estate, to exert the synergy with the property management business.

Investment business AMBITION, VERITAS Investment Co., Ltd., Not Found Co., Ltd., Vision Inc.

VERITAS Investment Co., Ltd. develops and sells new designer condominiums mainly in the premium areas (Meguro, Shibuya, Shinjuku, Minato, Shinagawa, and Chuo Wards) of the Tokyo Metropolitan Area. Not Found Co., Ltd. brokers the trade of real estate, and Vision Inc. carries out the agency business for trading real estate. In addition, the company acquires residential real estate that has not been evaluated appropriately because it is old, not occupied, or the like, upgrades it (improving interiors and finding tenants), and sells it to general consumers under the brand name “Kaitori-King.”

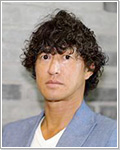

Segment Earnings

| FY Jun. 14 | FY Jun. 15 | FY Jun. 16 | FY Jun. 17 | FY Jun. 18 |

Property Management | 4,281 | 5,335 | 7,415 | 9,686 | 12,777 |

Rental Brokerage | 557 | 564 | 763 | 790 | 1,011 |

Investment | 449 | 1,053 | 1,661 | 4,090 | 9,356 |

Others | - | - | - | 10 | 132 |

Consolidated sales | 5,288 | 6,953 | 9,841 | 14,578 | 23,278 |

Property Management | 287 | 338 | 406 | 320 | 1,024 |

Rental Brokerage | 86 | 29 | 72 | 79 | 114 |

Investment | 33 | 84 | 138 | 412 | 1,143 |

Others | - | - | - | 2 | -19 |

Company-wide cost | -225 | -266 | -417 | -524 | -1,121 |

Consolidated operating profit | 182 | 185 | 199 | 291 | 1,141 |

(Unit: Million yen)

2. First Half of Fiscal Year June 2019 Earnings Results

2-1 Consolidated results for the first half

| 1H FY Jun. 18 | Ratio to sales | 1H FY Jun. 19 | Ratio to sales | YoY | Initial forecast | Difference from forecast |

Net sales | 9,055 | 100.0% | 13,436 | 100.0% | +48.4% | 12,221 | +9.9% |

Gross profit | 1,481 | 16.4% | 2,671 | 19.9% | +80.3% | - | - |

SG&A | 1,472 | 16.3% | 2,113 | 15.7% | +43.6% | - | - |

Operating profit | 9 | 0.1% | 557 | 4.2% | - | 311 | +79.1% |

Ordinary profit | -35 | - | 483 | 3.6% | - | 224 | +116.1% |

Net profit | -48 | - | 262 | 2.0% | - | 108 | +142.6% |

* Figures include reference figures calculated by Investment Bridge Co., Ltd. Actual results may differ (applies to all tables in this report).

*(Unit: Million yen)

As lease management progressed steadily as the company managed more real estate and kept occupancy rate high, the sales of condominiums for investment exceeded the forcast.

Sales were 13,436 million yen, up 48.4% year on year. As the number of units managed by the company increased and occupancy rate was kept high, the sales of the property management (lease management) business, which is its mainstay, rose 8.2% year on year, and the sales of the investment business grew 154.9% year on year, thanks to the contribution of VERITAS Investment Co., Ltd., a consolidated subsidiary that develops and sells new designer condominiums for investment.

As for profit, operating profit expanded year on year from 9 million yen to 557 million yen. Gross profit rose 80.3% year on year to 2,671 million yen, as profit rate improved due to sales growth and the rise in the ratio of sales of the investment business. Operating profit increased considerably, as the company offset the augmentation of SG&A caused by the active recruitment of IT engineers and the inclusion of VERITAS Investment Co., Ltd., which became a subsidiary in October 2017, in the scope of consolidation at the beginning of the term.

The results differ from the initial forecast, because new designer condominiums for investment were sold out earlier than planned in the investment business, and the property management business kept increasing real estate they manage while keeping occupancy rates high, partly thanks to the synergy effect with investment business.

*The revenue of the AMBITION group varies from season to season. Sales tend to be concentrated in the third quarter (particularly in March), in which college graduates join a company, employees are relocated, and students advance to higher education and relocate at the end of March or the beginning of April.

2-2 Business Trends by Segment

Sublease business

Sales were 6,622 million yen, up 8.2% year on year, and profit was 396 million yen, up 15.1% year on year. The number of subleased units as of the end of the first half was 9,776, up 8.6% (774 units) from the end of the same period of the previous year (9,002). The total number of units managed by the company was 18,094, up 13.0% (2,082) from the end of the same period of the previous year. The occupancy rate as of the end of the first half was as high as 95.3%. Since the company procured vacant real estate before the busy season (Jane to March), the condition nearly full occupation improved. Therefore, the occupancy rate fell below 97.7% at the end of the same period of the previous year, but it is still higher than the average at the end of the months in the past 3 years (from December 2015): 94.1%.

Rental brokerage business

Sales were 400 million yen, down 4.6% year on year, and loss was 10 million yen (profit: 7 million yen in the same period of the previous year). As VERITAS Investment Co., Ltd. sold condominiums for investment well, the company concentrated on the securing of occupants for real estate managed by the company. External sales declined year on year, but total sales, including internal sales, were nearly unchanged (up 0.4%) year on year. This business earns the most at the end of each fiscal year.

As of the end of the first half, the company operates 11 shops in Tokyo, 6 shops in Kanagawa Prefecture, 1 shop in Saitama Prefecture, and 1 shop in Chiba Prefecture, that is, a total of 19 shops. In January 2019, it opened 1 new shop in Kanagawa Prefecture.

Investment business

Sales were 6,320 million yen, up 154.9% year on year, and profit was 855 million yen, up 327.1% year on year. Most of the sales were from the sale of condominiums for investment by VERITAS Investment Co., Ltd. In the first half, another building developed by the company was sold. VERITAS Investment Co., Ltd. sold “PREMIUM CUBE Oimachi #mo” (to be completed in late February 2019, and to be occupied in early March 2019) out early after “PREMIUM CUBE G Kita-Shinjuku,” “PREMIUM CUBE G Higashi-Shinjuku,” and “PREMIUM CUBE G Ichigaya Kouracho.” It started selling “THE PREMIUM CUBE G Shiomi (Koto-ku, Tokyo; the total number of units: 159)” in November. The number of units sold was 186, up 88 year on year.

(Taken from the reference material of the company)

Segment Earnings

| 1H FY Jun. 18 | Composition ratio | 1H Jun. 19 | Composition ratio | YoY |

Property Management | 6,119 | 67.6% | 6,622 | 49.3% | +8.2% |

Rental Brokerage | 419 | 4.6% | 400 | 3.0% | -4.6% |

|

|

|

|

|

|

Investment | 2,479 | 27.4% | 6,320 | 47.0% | +154.9% |

Others | 37 | 0.4% | 92 | 0.7% | +149.9% |

Consolidated sales | 9,055 | 100.0% | 13,436 | 100.0% | +48.4% |

Property Management | 344 | 5.6% | 396 | 6.0% | +15.1% |

Rental Brokerage | 7 | 1.9% | -10 | - | - |

Investment | 200 | 8.1% | 855 | 13.5% | +327.1% |

Others | -14 | - | -13 | - | - |

Company-wide cost | -529 | - | -670 | - | +26.5% |

Consolidated operating profit | 9 | 0.1% | 557 | 4.2% | +5970.6% |

(Unit: Million yen)

2-3 Financial Conditions and Cash Flow

Financial Conditions

| Jun. 2018 | Dec. 2018 |

| Jun. 2018 | Dec. 2018 |

Cash and deposits | 3,834 | 3,607 | Accounts payable - other and accrued expenses | 430 | 281 |

Inventories | 6,780 | 6,288 | Income taxes payable and accrued consumption taxes | 377 | 275 |

Total current assets | 11,132 | 10,264 | Advances received | 466 | 542 |

Property, plant and equipment | 1,219 | 1,168 | Operating deposit | 156 | 162 |

Intangible assets | 1,336 | 1,273 | Long-term guarantee deposited | 541 | 540 |

Investments and other assets | 889 | 906 | Interest-bearing liabilities | 10,479 | 9,396 |

Total non-current assets | 3,446 | 3,347 | Total liabilities | 12,688 | 11,573 |

Total assets | 14,590 | 13,622 | Total net assets | 1,902 | 2,049 |

(Unit: Million yen)

The total assets as of the end of the first half were 13,622 million yen, down 968 million yen from the end of the previous term. The sale of real estate for sale progressed steadily, and inventory assets declined. The collected funds were allocated to debt repayment. Capital-to-asset ratio was 15.0% (13.0% as of the end of the previous term).

Cash Flows (CF)

| 1H FY Jun. 18 | 1H FY Jun. 19 | YoY | |

Operating cash flow (A) | -719 | 1,583 | +2,302 | - |

Investing cash flow (B) | -2,432 | -598 | +1,834 | - |

Free cash flow (A+B) | -3,152 | 985 | +4,137 | - |

Financing cash flow | 3,526 | -1,198 | -4,725 | - |

Cash, equivalents at term end | 2,684 | 3,482 | +798 | +29.7% |

(Unit: Million yen)

As the sale of real estate for sale progressed smoothly, the company secured an operating CF of 1,583 million yen. Investing CF is attributable to mainly purchase of property, plant and equipment, and financing CF is attributable to repayments of loans payable and the payment of dividends.

Reference: Variation in ROE

| FY Jun. 14 | FY Jun. 15 | FY Jun. 16 | FY Jun. 17 | FY Jun. 18 |

ROE | 44.25% | 22.65% | 15.40% | 14.78% | 38.64% |

Net profit to sales ratio | 2.09% | 1.59% | 1.11% | 1.02% | 2.63% |

Total asset turnover ratio | 4.77 | 3.79 | 3.49 | 4.02 | 2.51 |

Leverage | 4.43 | 3.76 | 3.97 | 3.60 | 5.86 |

*Return on equity (ROE) is obtained by multiplying “net profit to sales ratio (net profit ÷ sales),” “total asset turnover ratio (sales ÷ total assets),” and “leverage (total assets ÷ equity capital or the inverse of capital-to-asset ratio).” ROE = Net profit to sales ratio × Total asset turnover ratio × Leverage.

*The above figures were calculated based on the data of brief financial reports and securities reports, while using the average of total assets and equity capital in the current term (average balance at the end of the previous term and the end of the current term) (Since the capital-to-asset ratio posted in brief financial reports and securities reports is calculated from term-end figures, its inverse is not always equal to the above leverage).

3.Third Quarter of Fiscal Year June 2019 Earnings Results

3-1 Consolidated results for the first half

| 3Q FY Jun. 18 | Ratio to sales | 3Q FY Jun. 19 | Ratio to sales | YoY |

Net sales | 16,558 | 100.0% | 23,607 | 100.0% | 42.6% |

Gross profit | 2,971 | 17.9% | 5,285 | 22.4% | 77.9% |

SG&A | 2,423 | 14.6% | 3,477 | 14.7% | 43.5% |

Operating profit | 548 | 3.3% | 1,808 | 7.7% | 229.9% |

Ordinary profit | 465 | 2.8% | 1,683 | 7.1% | 261.6% |

Net profit | 268 | 1.6% | 1,028 | 4.4% | 282.7% |

* Figures include reference figures calculated by Investment Bridge Co., Ltd. Actual results may differ (applies to all tables in this report).

*(Unit: Million yen)

4. Fiscal Year June 2019 Earnings Estimates

4-1 Annual consolidated results

| FY Jun. 18 | Ratio to sales | FY Jun. 19 (Est.) | Ratio to sales | YoY | Initial forecast | Difference from forecast |

Net sales | 23,278 | 100.0% | 29,268 | 100.0% | +25.7% | 28,085 | +4.2% |

Operating profit | 1,141 | 4.9% | 1,536 | 5.2% | +34.6% | 1,300 | +18.2% |

Ordinary profit | 1,017 | 4.4% | 1,346 | 4.6% | +32.4% | 1,088 | +23.7% |

Net profit | 611 | 2.6% | 846 | 2.9% | +38.4% | 648 | +30.6% |

(Unit: Million yen)

According to the full-year forecast, sales are estimated to grow 25.7% year on year, while operating profit is projected to increase 34.6% year on year.

The full-year earnings forecast has been revised upwardly. This is because new designer condominiums developed by VERITAS Investment Co., Ltd. were sold out earlier than the initial estimate, its sales plan was revised, and the sale of used condominiums is forecasted to exceed the estimated number of sold units.

The dividend has also been revised upwardly. The company plans to pay a term-end dividend of 25 yen/share, up 8.5 yen/share.

4-2 Growth Strategy

In order to establish new primary sources of revenue, the company will focus on external sales of RPA (Robotic Process Automation), which is operated by the company, and development of “Real Estate Tech x Solutions,” while preparing real estate for foreign workers in view of new residence qualifications due to the revised Immigration Control Act. In addition, the company finished handing over “&AND HOSTEL ASAKUSA,” the second step of the “&AND HOSTEL” business, and concluded a sublease agreement.

External sales of RPA operated by the company

RPA is a system that automatically performs PC operations on behalf of people. The company partnered up with RPA Technologies, Inc. (Minato-ku, Tokyo; President and Representative Director Nobuyuki Osumi) in May 2018, linked the on-site know-how of real estate with abundant knowledge and experience in the field of RPA that RPA Technologies, Inc. has, and promoted the streamlining and improvement of business operation by combining manpower and robots in order to realize “work style reform.” As a result, 50 RPAs are already in operation in the company, and they process tasks of synchronizing data of various business systems and the core system, reflects payment data from financial institutions in the core system, etc. With RPA introduced, business systems can be optimized, and effective use of human resources can be achieved by leaving simple tasks to robots. The company plans to provide business solutions that combine manpower and robots.

In addition, RPA Technologies Inc. is a leading company of RPA in Japan. It has developed robot business for white-collar work for about 10 years, and has provided a large number of robots to a wide range of industries such as banking, insurance, distribution, retail, and information and communication industries.

Real Estate Tech x Solutions

In October 2018, the company started providing “CPMA” (Contract Process Management Automation), a system on the exclusive website for brokers to automate contract process management and increase efficiency by reducing workload of process management and telephone and fax communication. As a huge volume of work such as reservation for preview, confirmation of expenses, vacancy, examination status, or applying method emerges on a daily basis between brokers and the company, “CPMA” can integrally manage confirmation of vacancy, preview, contract process, etc. on the website. Brokers can increase time to deal with occupants and customer satisfaction by improving efficiency for brokerage tasks, and it also leads to the work style reform. The registration of “CPMA” started in October 2018, and 3,067 companies have been registered.

Preparing real estate for foreign workers in view of new residence qualifications

The revised Immigration Control Act will be enforced in April 2019. The company will work on environmental improvement for foreign workers who are expected to increase due to new residence qualifications that follow the enforcement. The company has made over 1,900 contracts with foreign citizens, and the number has tripled since 2015 (Foreign citizens occupy 7% of the approximately 18,000 units owned by the company).

The second step of “&AND HOSTEL” business

The company is engaged in business of the smart hostel brand “&AND HOSTEL” in cooperation with “and factory, inc. (Meguro-ku, Tokyo, Representative director and CEO Takamasa Ohara).” “& AND HOSTEL” is a smart hostel brand that is the first IoT-equipped accommodation facility in Japan produced by “and factory, inc.,” and has already been expanded to Hakata in Fukuoka, and Asakusa Kita and Ueno in Tokyo. AMBITION developed and sold the first property, “&AND HOSTEL KANDA” (Chiyoda-ku, Tokyo) under the supervision of “and factory, inc.” in order to meet diverse needs of customers, and concluded a sublease agreement in March 2018. Furthermore, the sale and hand-over of the second property “&AND HOSTEL ASAKUSA” (Taito-ku, Tokyo), which was developed by the company, were completed, and the sublease agreement was concluded.

“& AND HOSTEL KANDA” is used as a “smart hotel connected to the world” across boundaries of culture, nationality and value.

5. Interview with the President Shimizu

AMBITION has established a recurring-revenue business for lease property management and subleasing, and is accelerating growth through the development and sale of condominiums for investment. Over the past four years (FY JUN./15-FY JUN./18), sales increased rapidly from 6.95 billion yen to 23.27 billion yen, and operating profit grew from 180 million yen to 1.14 billion yen. We spoke with President Shimizu about the company's strengths and the strategies behind this rapid growth.

President Shimizu was born in May 14, 1971. He established AMBITION in September 2007 after working for a major rental real estate company. By focusing on lease management and subleasing, he was able to build a recurring-revenue business model valued at 10 billion yen in just 10 years.

【AMBITION’s Characteristics and Strengths】

Both sales and profit continue to reach record highs. Because of the particularly high sales and profit growth in the term ended June 2018, there was concern that they might drop in the following term, but both sales and profit remain strong. Despite the recession following the bankruptcy of Lehman Brothers, your company has established a strong business foundation, and the scale of the recurring-revenue business has already grown to over 10 billion yen. “Recurring-revenue business in real estate industry” is somewhat typical of “major real estate companies.” My image of successful real estate venture companies is that they are one-off revenue businesses. Could you give us a brief overview of your company?

President Shimizu: As a real estate technology company, we are focusing on IT and real estate. Of course, we have to keep pace with current practices in the real estate industry, but in view of the future of real estate industry in the next 10 to 20 years, the same stance will become ineffective. My desire is to build a company that can take control and be a dominant presence in the industry 10 years from now. We believe that the driving force behind this will be integration with technology. Therefore, we have been focusing on IT investment, and will continue to do so. That is our company’s stance.

As for the current business, the first thing I should explain is lease management. Our company has positioned this segment as a “property management business,” and it has been our foundation for profit since the company’s establishment. Lease management is a recurring-revenue business that is not influenced by the economy. One-off revenue businesses such as real estate brokerage and the purchase and sale of real estate are highly profitable, but are influenced by the economy and real estate market conditions. The worse economy does not mean people lose their places to live. In recession, they just avoid moving, and remain in their current housing. So, when the economy gets worse, we still receive stable income from rent. In other words, the business is not influenced by the economy, and the housing we provide is a basic necessity of life.

Our company was established in September 2007. Just one year later the Lehman Brothers went bankrupt, and the subsequent recession was considered to be the worst one of the century. Many companies, including listed companies, went bankrupt. However, during this time, our company’s performance continued to improve. Because we haven’t been influenced by the real estate market conditions, it’s as if this period has been our time to really shine and make a profit. We currently hold nearly 20,000 directly-managed units and nearly 10,000 subleased units, and this number continues to increase. We believe that this is our foundation of profit and also our strength.

As you said, the number of directly-managed units and the number of subleased units are steadily increasing. Besides AMBITION’s subsidiary Veritas Investment and your investee company NISSHIN FUDOSAN Investment Advisors, Inc., do you have any other business partners that develop condominiums for investment?

President Shimizu: We have a close relationship with Veritas and NISSHIN FUDOSAN Investment Advisors, Inc., but we also have connections with a number of other developers. In total, I think that we have around 50 to 60 business partners. Of the approximately 20,000 directly-managed units and 10,000 subleased units, I guess that Veritas and NISSHIN together account for around 10 to 20 percent. This means that we aren’t dependent on those two companies.

For subleased units, there is a risk that the rent received from the tenants won’t be able to cover the amount owed to the property owner. Could you explain how the contracts are handled?

President Shimizu: In the subleasing business, we lease the properties from the owner for 80,000 yen and rent them out for 90,000 yen, but the content of the contract varies because the assessed value depends on each area and property. While some companies sign long-term contracts for 20 to 30 year subleases, the subleasing contracts we make with property owners are for 5 years. This means that after 5 years have passed, we have a chance to review circumstances with the owners, and they appreciate us doing so. When the old contract expires and a new contract is made, it is possible to raise or lower the rent paid to the owner depending on the market prices of neighboring real estate, but in practice, that amount usually doesn’t change. Fortunately, we are maintaining a high occupancy rate.

There have been cases where some companies with long-term subleasing contracts were brought to court about lowering the rent amount that was guaranteed by the contract, but our company resolves to never cause trouble with owners. We keep to the terms for five years, then talk with owners again and make a new contract with their consent. So, a property owner making a contract with us will never be dissatisfied by the sudden reduction of rent.

So, in other words, you’re aiming to maximize performance while maintaining a mutual understanding with owners and limiting risks. Are contracts usually renewed?

President Shimizu: It would be risky for owners to change the company that has been managing a condominium for the last five years, though there is not any specific problem. There is no substitute for a five-year relationship of trust. Although the contracts are only for five years, most owners decide to renew the contract with us. That's why the number of units managed is increasing.

I see. Earlier, you mentioned occupancy rate. The occupancy rate for properties that AMBITION manages is almost always above 90%. What is the occupancy rate of residential rental properties in general? Is it about 85%? How has AMBITION achieved such a high occupancy rate?

President Shimizu: I think 85% is sufficient. Our occupancy rate was 99.3% at the end of the third quarter last term, which surprised me. One of our strengths is having two real estate brokerage subsidiaries that run shops: Ambition ROOMPIA and VALOR. Another is that we focus on Tokyo and Kanagawa (particularly Yokohama). Tokyo has a population of just under 14 million, and Kanagawa has a population of just over 9 million. This means that about 20% of Japan's population is concentrated in just these areas alone. As many listed companies in the same industry operate mainly in other areas, we may be the only company that is specifically focused on Tokyo and Kanagawa, the two highest-population prefectures in Japan.

In February 1, the VALOR Tsurumi store opened in Yokohama, Kanagawa Prefecture. AMBITION currently has 20 stores operated by two subsidiaries. Please tell us your thoughts on future store development.

President Shimizu: As a result of installation of IT at our stores, productivity per employee has been noticeably rising. There are no plans to raise the number of stores from 20 stores to 40 or 100, but the increase in productivity will reduce the number of employees needed at any one store, so in terms of manpower, we have the ability to open up new stores. Since the number of units managed is also growing, we would like to increase the number of places where we can assist customers. We hope to utilize the productivity improvements when opening new stores.

Because the number of directly-managed units is increasing, expanding your store network will lead to further improvements in service quality. As for tenants, do you get many corporate contracts for company housing? Also, is the “SUPER ZERO PLAN” with no deposit, key money, guarantee, initial rent, or renewal fees, applied to all subleased units?

President Shimizu: We also get many corporate contracts. A corporate division was established at the company headquarters in April 2015. There is a strong need for corporation-oriented services, and we are increasing the pace of expansion of those services. Companies recognize us for having an abundance of well-managed properties in Tokyo and Yokohama, where many corporate offices are located.

The “SUPER ZERO PLAN” doesn’t apply to all subleases. Some properties collect deposit and key money. It really depends on on-site staff. We leave product packages to on-site staff that know their surrounding area well. We also consider each area’s unique characteristics and observe the market response. Still, the number of cases where we don’t ask for key money is increasing. As for the deposit, many of our directly-managed properties are “pet-friendly” properties, and we do take a deposit for those.

I see. Next, I’d like to ask you about the investment business. Veritas Investment Co., Ltd., which plays a central role in this business, contributed significantly to consolidated performance in FY Jun. 18. What sort of characteristics does Veritas have as a real estate company?

President Shimizu: Veritas develops and sells condominiums for investment. Most of those have a total of 30 to 50 units with 1K-size. Veritas provides 200 to 300 units each year. They also have the ability to develop large-scale properties, such as “The Premium Cube G Shiomi” (4 minutes’ walk from JR Keiyo Line “Shiomi” station, 159 units in total), which went up for sale in November of last year. All developed properties are sold by Veritas, and AMBITION manages the properties after they are sold. Our group is promoting a strategy called “real estate SPA” to meet the diverse needs of customers, dealing with development, planning, procurement, lease management, brokerage of lease and sales, sales, private residence lease, and insurance on a one-stop basis.

We recently hear people say that the real estate market has peaked out. Is there any risk in bringing developers into the company group? Has the current demand for condominiums for investment changed? Does it not always match the trend of actual demand?

President Shimizu: It doesn’t necessarily match the trend of actual demand. This is especially true in the nicer areas of Tokyo. People who have experienced the real estate bubble or the bankruptcy of Lehman Brothers tend to think that real estate prices are certain to fall, but the value of the assets is unlikely to fall in nice areas in Tokyo apart from the suburbs, let alone nice areas in Tokyo. The population is increasing, and the demand for rental is also strong. Land prices and construction costs are rising, but not quite as high as overseas. Many people also seek to purchase properties in rural areas where the rate of yield is higher, but it is actually difficult to maintain high occupancy rates in such areas.

Local banks have been cautious about lending due to problems with apartment loans. Because of this, some people are concerned about financing for condominiums for investment, but both Veritas and our company have been praised by property owners and partnered financial institutions. Customers seeking to make a purchase usually use mortgage loans of non-bank with which Veritas cooperates. Based on the feedback we receive regarding Veritas and us as its parent company, we believe we are providing visible benefits in the form of interest rates, etc. Veritas has also partnered with a non-bank financial institution, which is normally difficult for companies involved in condominiums for investment to affiliate with. Rather than simply being recognized because our company is listed, Veritas is recognized for its strong management and customer service. I can’t say what the world will be like in the future, but even if a move to stop end loans spreads across all financial institutions, I think our group is very unlikely to be affected. Even when Lehman Brothers went bankrupt, partnered financial institutions did not change their stance toward Veritas regarding financing.

There are a lot of different opinions regarding condominiums for investment. Because they are real estate, they aren’t completely risk-free, but they don’t have the same issue regarding loans that is currently hitting the apartment industry hard. Investors tend to think that we are in a similar situation, but our company group has not been affected.

You mean that it’s different from the apartment market, which is stagnant. Are you securing land for development smoothly? VERITAS conducts business mainly in the what is called premium areas in 23 wards of Tokyo. I think it is difficult to secure land in such an excellent area.

President Shimizu: Competition is fierce, but we will keep developing residential lots in the premium area, by taking advantage of our connections we have nurtured so far. As productive green areas will be transformed into residential ones, there will emerge business chances, and if there are opportunities, we would like to develop and rebuild condominiums for investment by integrating old real estate, including old folk houses, in the excellent area. We hope to develop good property in good places.

Needless to say, we will examine each piece of real estate. In order to increase units to be supplied, it is necessary to buy them; accordingly, some developers often buy real estate no matter how expensive they are or because they have no choice. However, our company fortunately possesses the revenue base called “management.” I advised VERITAS not only to buy good real estate actively, but also not to force itself. Our corporate group can do without the excessive effort of VERITAS. The style of VERITAS is to “create genuine property.” It is important to keep growing as an enterprise, but it does not mean that we only pursue the number of units supplied. We are careful not to cause inconvenience or humiliate to owners who would purchase real estate we would buy at expensive.

As mentioned at the beginning of this report, we carry out business while predicting the situation 10 years from now. We do not think that the current business model will work 10 years from now. While improving the performance of our existing businesses, we are researching services utilizing the Internet and IT.

Segment Earnings

(Unit: Million yen)

You mean that you advise VERITAS not to force itself, because your company should not cause inconvenience to owners who would purchase real estate from your group. You can say that, because your company has established a revenue base that can cover almost all fixed costs with the profit from recurring-revenue business.

President Shimizu: Fortunately, customers recognize and highly evaluate the attitude of VERITAS, which has been developing and selling genuine real estate without any compromise. Most of them select VERITAS through introduction or word of mouth. We make efforts so that customers will be satisfied with our selling methods as well as the quality and value of our property.

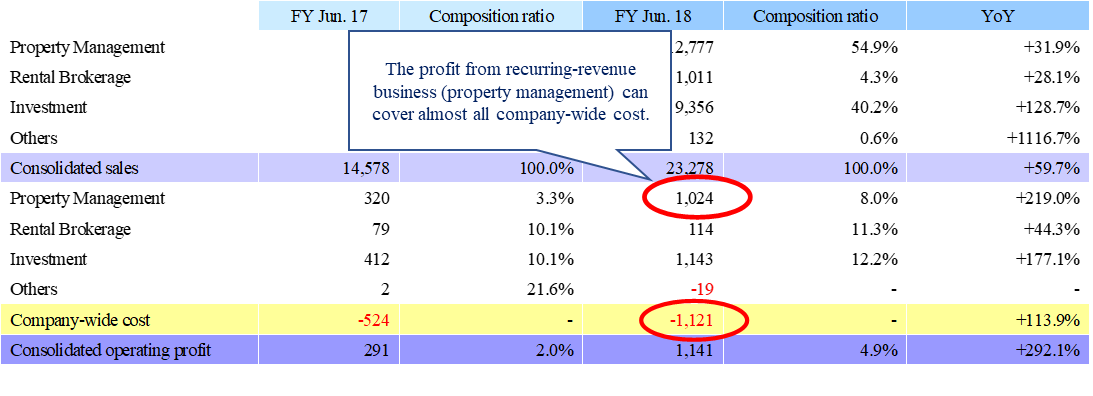

I see. By the way, in the consolidated term ended June 2018, the sales and profit of the investment business skyrocketed due to the effects of M&A of VERITAS, while the sales and profit of the property management and rental brokerage businesses, too, increased. Are there any special factors other than the effects of M&A?

President Shimizu: There was the synergy after VERITAS became a subsidiary. The performance of VERITAS itself grew steeply after the acquisition. The previous term of VERITAS was only 10 months due to the change in the accounting period, but its profit marked a record high. This term, too, it is expected to hit a record high. Synergetic effects can be seen in all business segments, including property management and rental brokerage. For example, after VERITAS joined our corporate group, we became able to obtain the information on real estate to be sold and release dates, so we can start looking for tenants before release. It is now possible to make all units occupied before handover. There is a significant difference in revenue between the case where marketing is conducted after handover and the case where all units are occupied from the beginning. In the case of sublease, it is necessary to bear some costs until occupancy rate reaches a certain level, but with the above method, it is possible to earn rents from the beginning. As VERITAS joined the group of a listed company, it increased reliability and popularity, broadening the range of customers.

When conducting M&A with VERITAS, we explained to investors and financial institutions that “this M&A does not mean 1 + 1 = 2, but 3 or 4.” We produced good results, without disappointing them. Sorry for praising ourselves, but our company carried out M&A actively, and produced results indicating “1 + 1 = over 2.” This can be said also for Ambition ROOMPIA and VALOR.

M&A strategy, which has been all successful

(Unit: Million yen)

Growth strategy

You mentioned the AMBITION DREAM 1000 "REACH THE TOP!" as a growth strategy, with which you plan to achieve 100 billion yen in sales and 10 billion yen in operating profit. As for the sales, do you plan to focus on the property management business to achieve 50 billion yen in existing businesses' sales and an additional 50 billion yen in new businesses?

President Shimizu: That’s right. I want to achieve this quickly. I think that the existing business can achieve this by simply accumulating their stock of units. The number of units of condominiums in the Tokyo metropolitan area is continuously increasing. We will make efforts to accumulate properties under management including the expansion of the number of units under management by management replacement.

As for the additional revenue from new businesses, Real Estate Tech will be the main driver. We aim to establish a new business model, in which we apply IT technologies to real estate. We have been pursuing various initiatives such as collaborating with RPA Technologies, Inc. (Minato-ku, Tokyo, President and Representative Director, Nobuyuki Osumi) to automate work processes with robots, ACCEL LAB Ltd. (Shibuya-ku, Tokyo, Representative Director Manabu Kogure) for IoT-based Smart home devices, and Nabiq, Inc. (Chiyoda-ku, Tokyo, Representative Director Tomohito Takatsu) for Wi-Fi security services. As a part of our growth strategy, we plan to start external sales of the RPA technology that we've been utilizing to improve our operation efficiency. We are a BtoB business that aims to achieve growth for our company by contributing to IT adoption in the real estate industry. In December last year, we made PC-DOCTORS (Shinjuku-ku, Tokyo, Representative Director Takashi Kon), which is involved in the system development for the real estate industry, a wholly-owned subsidiary.

So, it's a solution to streamline real estate companies’ operations. The real estate business requires a lot of paperwork, which seems to give it a lot of room for improving efficiency and digitization. The government plans to unify the administrative procedures to digital applications as a general principle for individuals and enterprises, and the National Diet deliberation for the 'Digital First' bill will start soon.

President Shimizu: This industry is a labor-intensive business model. That's why all companies are suffering from labor shortage. Adopting IT technologies will help achieve more efficient operations, which leads to resolving the problem, but the industry is slow to adopt it. As I just mentioned, we've gained room to open new branches thanks to digitizing the operations. At this stage, I'd like to refrain from disclosing the details, but the RPA technology does not only take in consideration reducing burdens of data entry work but also serving customers and such; this technology has already started operation in-house and it's producing good results. I hope that by using the RPA technology we can create a stir in the industry. It's a recurring-revenue business with a high-profit margin. It is said that Japan has 100,000 real estate companies, many of which have multiple branches making the number of branches several folds of that figure, and they all face the common problem of labor shortage. I estimate that we can achieve our goals if we can take, for example, a 10% share.

So, you have digitized the technical experience and know-how that you’ve been nurturing from daily operations. Naturally, it’s easy to introduce the system for large-scale companies, but is it easy for even small-scale companies that have a few employees?

President Shimizu: Considering the expenses and risks of employing one person, I think that they will feel the benefits from the service. The service operates 24 hours a day and eliminates the risk of a sudden resignation. It also does not make mistakes. It will support companies that are run by 1 or 2 people and are suffering from labor shortage; it can also improve productivity in companies with many employees. Moreover, it opens the door to utilizing data with AI.

Additionally, as a new recurring-revenue business, we will put efforts into the insurance industry as well. The Small-amount Short-term Insurance Company ("Hope") we established in November 2016 was approved by the Financial Services Agency in 2017 and started operation. The small-amount short-term insurance company is a new style of insurance business that started in April 2006; it's the third insurance company launched after the life and general insurance companies. The services it offers are, as implied by its name, limited to insurance with "small-sum" insurance and for a short period of time. It enables the development of a wide variety of services such as reasonable and simple warranties and unique warranties. Currently, the subsidiary takes advantage of the characteristics of the small-amount short-term insurance business to offer contents insurance and liability insurance for tenants, insurance for tenants on leased offices and eating or drinking establishment, etc., aimed at customers related to the AMBITION group's properties under management and real estate brokerage.

The real estate industry has established a strong image of generating revenue on a one-off basis by moving lands, and of course, I do not mean to deny the one-off revenue business process of our company's profit base, but we are focusing our efforts on services that utilize technology, and plan to achieve growth by accumulating stock. As we are not an IT company, but a real estate company, there might be some people who question the external sale of IT technologies by real estate companies. However, our strength is that we have been polishing up our technologies and the system through practical daily operations; it has already been in operation and gives good results. In terms of sales, we can utilize the operation team of IT subsidiaries, the sales channels, etc.

I see that as the system has been actually used and the results were good, it makes you quite confident. I look forward to seeing what kind of business model you will construct and how you will achieve profitability. Hamee (3134) is listed on the First Section of the Tokyo Stock Exchange; this business is achieving annual sales of more than 8 billion yen from EC and wholesale of mobile accessories. It sells the back-office system (efficiency-enhancing system) that it developed for expanding its EC operations and it is No.1 domestic company for such system. Its strength comes from its know-how and technology for streamlining operations, which have been polished up throughout daily business. The software companies, etc. have the technical skills to develop software. However, there seems to be a gap in business experience, and the sales of the system are still expanding. I am also interested in your company's real estate technology.

President Shimizu: Thank you. In any case, I mentioned in the beginning that our plan is for 10 years, but actually, we hope to proceed at a higher speed. China is focusing on education in the IT field as a national policy, and we also exchange information with Chinese companies. However, presently, many people are still skeptical about Real Estate Tech. Normally I should explain more in detail, but, at this stage, I am not in the position to disclose all the information to the public. Please wait just a little longer for the details. Also, it would be easier to understand the explanation after some good results are achieved.

Indeed. It is hard to associate real estate companies with the IT business. Thus, it might be easier to understand if you achieve some good results first and then explain it while revealing these results. Thinking about what you have told us today, if people only understand the strategies and strengths of existing businesses, it'd be enough to have some effect on the re-evaluation of stock prices.

【Message to investors】

It seems that your time is going to be up soon. Thank you for sharing interesting stories. Finally, could you give a message to investors?

President Shimizu: The company’s stock price reached the highest since it was listed, 1,986 yen (Intraday), in June 21, 2018 after the earnings forecast for the previous fiscal year was revised upward. This fiscal year the company predicts a 13.9% increase in operating profit from the previous fiscal year, and expects to continue to mark record highs. Due to characteristics of the business, the company’s revenue varies from season to season, making it difficult to generate profits in the first quarter, but we were able to record profits that far exceeded our record high in the first half of the current term. It started off well, but the stock price continued to decline and fell to 712 yen on December 25. However, I accept that this is the market evaluation.

We plan to do what we can do until investors fully understand our company. We will improve business performance and increase corporate value. We would like to create genuine products and services so that investors will think “This is a good company,” “I can expect a lot from this company,” “This company has the future,” “Let’s invest,” and “Let’s invest more.” We acknowledge that the reason why investors don’t fully understand the company is that we do not have sufficient business performance, appeal, or hopeful elements. We intend to work honestly and sincerely on IR and improvement of corporate value until we get noticed, and after we get noticed as well. We would appreciate your continued support.

Thank you for the careful explanation for many hours. Actually, I misunderstood your company at first, but the impression changed when I saw the financial statements, and I completely changed my understanding of your company after listening to your talk today. I would like many investors to understand your company’s greatness, such as the strength of existing business, the potential of new services refined through actual operations, and a humble management attitude. I wish you and your company, AMBITION Corporation, further success and growth.

6. Conclusions

The AMBITION group aims to grow further with “real estate SPA.” In detail, they develop and sell newly-built condominiums for investment (development business) in the investment business, encourage condominium owners to use the property management business, to increase the number of units they manage, and then broker them in the rental brokerage business, to keep occupancy rates high. In addition, the company offers small-amount short-term insurance to occupants, to meet their needs and increase profitability. For the investment business, the company also resells used real estate, etc. to meet owners’ needs for selling their condominiums.

As part of “real estate SPA,” the company established Hope Small Amounts and Short-Term Insurance Co., Ltd. in September 2017 and reorganized VERITAS Investment Co., Ltd. into a subsidiary in October 2017. The small-amount short-term insurance business is still to be developed, but the company formed a capital alliance with Adval Co., Ltd. (Shibuya-ku, Tokyo; representative directo Kunihito Nakano), which aims to become the No.1 enterprise in the space sharing business field, in February 2019, for the purpose of promoting small-amount short-term insurance. Adval Co., Ltd. conducts the space management business, in which they develop, manage, and operate “rental spaces” for parties, meetings, filming, events, accommodation, etc., which are rented by the hour, the sublease business for shops (174 shops in December 2018), and the Bukenabi business, in which they operate “Bukenabi,” a website for searching for real estate exclusively for restaurants and secondhand restaurants, etc. Based on the capital and business alliances, the company will cooperate with online search services, such as “Bukenabi,” introduce customers to shops managed directly or indirectly via “Restaurant Purchase JP,” etc., and promote general insurance for restaurants of the AMBITION group. It can be also expected that the vacant real estate owned or managed by the AMBITION group will be repurposed for rental spaces and accommodation facilities of Adval Co., Ltd. to make efficient use of space.

On the other hand, there already emerged synergy with the development business operated by VERITAS Investment Co., Ltd. Thanks to this synergy, the performances in the term ended June 2018 and in the first half of the following term were favorable and the full-year earnings forecast has been revised upwardly. The estimated dividend was revised upwardly from 16.5 yen/share to 25 yen/share, because the “real estate SPA” strategy made a good start.

In addition, the solution for the real estate industry “Real Estate Tech × Solutions” was launched in October last year. In December, the company reorganized PC-DOCTORS Co., Ltd., which develops systems for real estate, into a consolidated subsidiary. From now on, the company plans to proceed with “Real Estate Tech × Solutions” while selling RPA, by taking advantage of the customers and sales channels of PC-DOCTORS Co., Ltd.

The performance of the development business fluctuates significantly, but the business administration of VERITAS Investment Co., Ltd. is healthy. When sales are favorable, developers tend to increase inventory assets (real estate for sale and real estate in process for sale) and interest-bearing liabilities in the compensating balance. As the market is thriving and funds are revolving, developers become more active, but the balance sheet of the company as of the end of the first half shows the decline in inventory assets and interest-bearing liabilities, as they sold out real estate early and have just started selling large-scale property. This indicates that they did not get carried away by their healthy performance. After the apartment loan issue became apparent, financial institutions became reluctant to give loans, but the selling prices of real estate handled by VERITAS Investment Co., Ltd. are determined with reference to the evaluations of loan companies, and so they are in tandem with loan companies in a good sense, despite that social issue. There is concern that land prices remaining high and costs for building materials and personnel skyrocketing will increase the prices of condominiums and weaken demand, and they will become more careful when procuring real estate.

However, the market is not aware of the above facts. This term, the development business contributed to the business performance, and the company has developers as subsidiaries, but it itself is not a developer. It aims for “real estate SPA” and “a provider of solutions in the real estate field.” The company needs to make these policies understood accurately, while increasing revenue.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 7 directors, including 4 outside ones |

◎ Corporate Governance Report: Updated on Sep. 28, 2018

Basic Policy

Our basic policy for corporate governance is to improve the soundness of our business administration and transparency and increase our corporate value under the belief that it is indispensable to comply with laws, regulations, and corporate ethics for business administration. In order to live up to the trust of all stakeholders, including shareholders, we regard it as a management issue to take measures, including the disclosure of appropriate information, and fortify corporate governance.

<Major principles that have not been followed, and reasons>

There are no items that should be mentioned here.

Guidelines for protecting minority shareholders when making transactions with majority shareholders, etc.

The representative director Takeshi Shimizu of our company is a majority shareholder who holds a majority of voting rights. Any transactions between our company and a majority shareholder have not been conducted as of the reporting date. If there is any transaction with the majority shareholder, we will basically apply the same kind of appropriate conditions as those for general transactions, make the details and appropriateness of said transaction examined at the meeting of the board of directors, involving 4 outside directors, who are members of the audit committee, leave a decision up to the board of directors regardless of the amount for said transaction, and protect minority shareholders. The audit and supervisory committee examines the appropriateness of transactions in cooperation with comptrollers, so that directors fulfill their duties while caring for minority shareholders.

TSE Corporate Governance Information Service: | http://www2.tse.or.jp/tseHpFront/CGK010010Action.do?Show=Show |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved.