Bridge Report:(3300)AMBITION the Fiscal Year June 2019

President Takeshi Shimizu | AMBITION (3300) |

|

Company Information

Market | TSE Mothers |

Industry | Real estate business |

President | Takeshi Shimizu |

HQ Address | 2-34-7 Jingumae, Shibuya-ku, Tokyo |

Year-end | June |

Homepage |

Stock Information

Share price | Shares Outstanding (Excluding Treasury Shares) | Total Market Cap | ROE (Act.) | Trading Unit | |

¥869 | 6,804,396 shares | ¥5,913 million | 32.8% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥25.00 | 2.9% | ¥136.59 | 6.4 x | ¥380.39 | 2.3 x |

*The share price is the closing price on August 28 2019.

Earnings Trend

Fiscal Year | Net Sales | Operating Profit | Ordinary Profit | Net Profit | EPS | DPS |

Jun. 2016 (Act.) | 9,841 | 199 | 195 | 109 | 36.25 | 10.00 |

Jun. 2017 (Act.) | 14,578 | 291 | 268 | 148 | 49.21 | 10.00 |

Jun. 2018 (Act.) | 23,278 | 1,141 | 1,017 | 611 | 90.27 | 16.50 |

Jun. 2019 (Act) | 29,636 | 1,594 | 1,433 | 736 | 108.28 | 25.00 |

Jun. 2020 (Est) | 31,256 | 1,647 | 1,470 | 929 | 136.59 | 25.00 |

*units: million yen and yen. The estimates were from the company.

*2-for-1 stock split was conducted in April 2016 and April 2018 (EPS was revised retroactively).

This Bridge Report presents AMBITION Corporation’s earnings results for the fiscal year ended June 2019 and earnings estimates for the fiscal year ending June 2020.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year Ended June 2019 Earnings Results

3.Fiscal Year Ending June 2020 Earnings Estimates

4.Growth Strategy

5.Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the term ended June 2019, sales and operating profit grew 27.3% and 39.7%, respectively, year on year. Due to the increase of properties under management, the sales of the property management (PM) business increased 7.3% year on year stably. Thanks to the favorable sale of condominium units for investment by Veritas Investment, which is a consolidated subsidiary, the sales of the investment business rose 58.4% year on year. As for profit, the sales growth offset the upfront investment in the Real Estate Tech business, mainly RPA, and the augmentation of SGA due to the increase of reserves in response to the revision to accounting policies. The dividend amount is to be 25 yen/share, up 8.5 yen/share (payout rati 23.1%).

- For the term ending June 2020, it is estimated that sales and operating profit will increase 5.5% and 3.3%, respectively, year on year. Considering that the number of new transactions in the investment business is limited, it is forecasted that sales will grow steadily mainly in the property management business. It is projected that the sales growth will offset the upfront investment in the RPA business, which will be launched in a full-scale basis, and profit will keep hitting a record high. As for dividends, the company plans to pay a term-end dividend of 25 yen/share (estimated payout rati 18.3%).

- In the term ending June 2020, the upward trend of sale of condominiums for investment will subside and the growth of consolidated sales will become gentle, but the PM business, which can earn recurring revenue, will be healthy so that sales and profit will keep rising. When the real estate market thrives, the company stamps on the accelerator of the investment business, and there emerge uncertainties, the company steps on the brakes, and aims to grow steadily with the PM business. We would like to highly evaluate their management, which can actualize the growth in sales and profit regardless of the external environment with the effects of their business portfolio. In addition, the RPA business made a good start, as the company succeeded in forming a business alliance with Dangonet Co., Ltd., which is one of the three major companies developing Property Management systems. There are about 125,000 real estate firms in Japan, and 5,000 firms out of them are the clients of Dangonet Co., Ltd. By forming a business tie-up with Dangonet, the company expanded its sales channels considerably. The future progress of their business is noteworthy.

1.Company Overview

The main business is real estate Property Management, and the company covers development, procurement, sale, brokerage of trade and lease, private residence rental, insurance, and system development on a one-stop basis. While earning recurring revenue from Property Management and the sublease business under the “Kariage-Oh” brand name, the company accelerates its growth with one-shot revenue businesses, including the brokerage of lease and the development and sale of condominiums for investment. As characteristics, the company has fortified its competitiveness through appropriate M&A and streamlined its business operation based on IT at the early stage, while adopting the RPA technology. By expanding its existing businesses and developing new businesses based on the small-amount short-term insurance business and real estate technologies, the company aims to achieve sales of 100 billion yen and an operating profit of 10 billion yen as soon as possible.

The AMBITION group is composed of AMBITION, 7 consolidated subsidiaries, and 1 non-consolidated subsidiary. The consolidated subsidiaries are Ambition ROOMPIA, Co., Ltd. and VALOR, Co., Ltd., which broker lease, Veritas Investment Co., Ltd., which develops condominiums for investment, Not Found Co., Ltd., which mediates sale and purchase, Vision Inc., which trades real estate on behalf of clients, AMBITION VIETNAM CO. LTD., which deals with BPO and develops systems, and Hope Small Amounts and Short-Term Insurance Co., Ltd. The non-consolidated subsidiary is Room Guarantee Co., Ltd., which conducts the rent guarantee business.

【Mission “Target a dream! Target reality!”】

With the “ambition” to create a future of “housing,” the company aims to become a “real company” for bringing “dreams” to all people they have encountered. AMBITION believes that it is necessary to “differentiate” itself from other companies clearly in order to grow significantly in the present age, in which a broad range of enterprises are competing with one another.

The company was established with a vision that they want to pump fresh blood into every field related to real estate industry by challenging various real estate rental business. Behind the corporate name “AMBITION,” they endeavor to become a “real company” which provide “dreams” to all the stakeholders by creating a future of “living” with a theme of “Target a dream! Target reality!” As for the logo, “human (Driving force of the company),” “passion” and “great leap” are designed as a motif.

1-1. Business Segment

The business of AMBITION is classified into the property management business, the rental brokerage business, the investment business, and other businesses (not included in segments to be reported), including the businesses of AMBITION VIETNAM CO., LTD. and Hope Small Amounts and Short-Term Insurance Co., Ltd.

Property management business - AMBITION, VERITAS Investment Co., Ltd., VALOR Co., Ltd., Room Guarantee Co., Ltd.

This is the mainstay of the AMBITION group, and a stable business that is not affected by economic performance. The company offers agency services of Property Management, including the maintenance and management of real estate, the management of occupants, Property Management, etc. and sublease, which means that the company leases real estate from owners while guaranteeing rents and subleases them to general consumers. The company carries out marketing activities targeting VERITAS Investment Co., Ltd., a subsidiary, NISSHIN FUDOSAN Investment Advisors, Inc., in which the company invests, and “companies that sell real estate for investment” that do not have a lease brokerage business division, to increase client owners. The company sets high guaranteed rents by keeping occupancy rates high, by utilizing the lease brokerage capability of the corporate group and product competitiveness based on rent plans, including “ALL ZERO PLAN” (no security deposits, key money, or guarantee fees required) and “SUPER ZERO PLAN” (no security deposits, key money, guarantee fees, initial rents, or update fees required), which curb the initial cost for relocation. In addition, in response to the expansion of the private residence lease market due to the increase of foreign visitors to Japan, the company started operating the fashionable facilities for private residence lease “C'est joli IKEGAMI” and AMB HANEDA Bienvenue, whose minimum stay period is 2 nights and 3 days, in Ota-ku, Tokyo, which is a special area for accommodation facilities for foreign visitors. (In the investment business, the company operates 3 buildings of &AND HOSTEL as accommodation facilities.)

Rental brokerage business - Ambition ROOMPIA Co., Ltd., VALOR Co., Ltd.

This business is targeted at singles in their late 10s to 30s, including college students and those who have just started working, DINKS, and households of cohabitants. AMBITION mediates and brokers the transactions for real estate managed in the property management business (hereinafter called “own real estate”) and real estate managed by other companies (hereinafter called “outside real estate”) and introduces movers as its accompanying operation. Based on the concept that every shop is “easy to access and enter” for consumers, all shops are located within the walking distance of a terminal station in Tokyo and on the first floor of the building, and are glass-walled, so that the inside of the shop can be seen from the outside. While striving to differentiate products with its own real estate not handled by other companies, the company places a priority on offering the information on own real estate, to exert the synergy with the property management business.

Investment business - AMBITION, VERITAS Investment Co., Ltd., Vision Inc.

The investment department of AMBITION conducts the business under the brand name “Kaitori-Oh,” in which it acquires residential properties that are underrated due to various factors, such as “the age of buildings” and “the lack of occupants,” increases their value (by renovating the interior) when the units are vacant (when not vacant, increases their value after leaving), and sells them to clients with actual demand.

In addition, by utilizing the know-how nurtured through the property management business and the lease brokerage business and the data for selecting good locations and excellent properties in the urban center, the company procures used real estate for investment and improves occupancy ratio to maximize their value, and sells them as real estate for investment.

Furthermore, the company acquires newly built condominium buildings in the urban center, improves occupancy ratio under the AMBITION brand, and sells them to wealthy people and investors.

VERITAS Investment Co., Ltd. develops and sells new designer condominiums mainly in the premium areas (Meguro, Shibuya, Shinjuku, Minato, Shinagawa, and Chuo Wards) of the Tokyo Metropolitan Area and Vision Inc. takes a role as a real estate agent.

In addition, in order to meet the needs of customers who hope to own real estate other than condominiums, the company develops and sells 3 buildings of &AND HOSTEL: &AND HOSTEL KANDA (Chiyoda-ku, Tokyo), &AND HOSTEL ASAKUSA (Taito-ku, Tokyo), and &AND HOSTEL HOMMACHIEAST (Chuo-ku, Osaka-shi), which are Japan’s first IoT experience-oriented accommodation facilities produced by “and factory, Inc.” The company currently carries out the subleasing of them.

Other businesses

Other businesses include the small-amount short-term insurance business of Hope Small Amounts and Short-Term Insurance Co., Ltd., the real estate tech business of Re-Tech RaaS Co., Ltd. and RPA Retech Lab, Inc., and the BPO and system development (overseas business) of AMBITON VIETNAM CO., LTD.

The major businesses of AMBITON VIETNAM CO., LTD. are the brokerage of trade and lease of real estate for foreign people in Vietnam, BPO of inputting tasks as an offshore business, and entrusted system development for Vietnamese enterprises and Japanese venture firms.

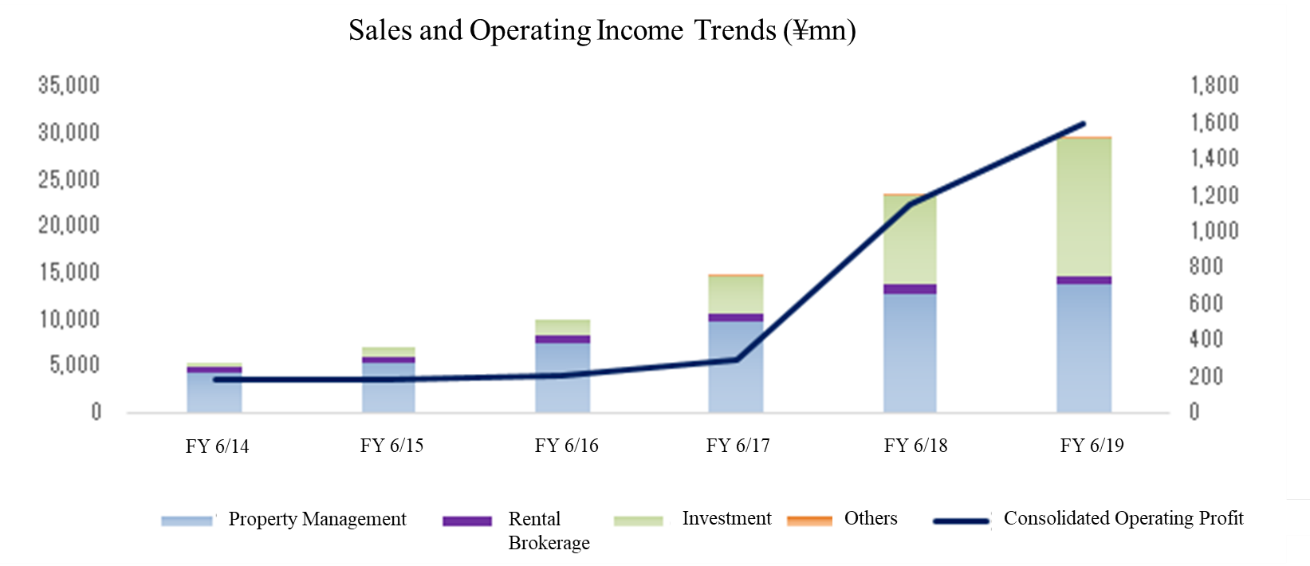

Segment Earnings

| FY 6/14 | FY 6/15 | FY 6/16 | FY 6/17 | FY 6/18 | FY 6/19 |

Property Management | 4,281 | 5,335 | 7,415 | 9,686 | 12,777 | 13,706 |

Rental Brokerage | 557 | 564 | 763 | 790 | 1,011 | 855 |

Investment | 449 | 1,053 | 1,661 | 4,090 | 9,356 | 14,825 |

Others | - | - | - | 10 | 132 | 249 |

Consolidated sales | 5,288 | 6,953 | 9,841 | 14,578 | 23,278 | 29,636 |

Property Management | 287 | 338 | 406 | 320 | 1,024 | 881 |

Rental Brokerage | 86 | 29 | 72 | 79 | 114 | 38 |

Investment | 33 | 84 | 138 | 412 | 1,143 | 2,151 |

Others | - | - | - | 2 | -19 | -88 |

Company-wide cost | -225 | -266 | -417 | -524 | -1,121 | -1,388 |

Consolidated operating profit | 182 | 185 | 199 | 291 | 1,141 | 1,594 |

*Unit: Million yen

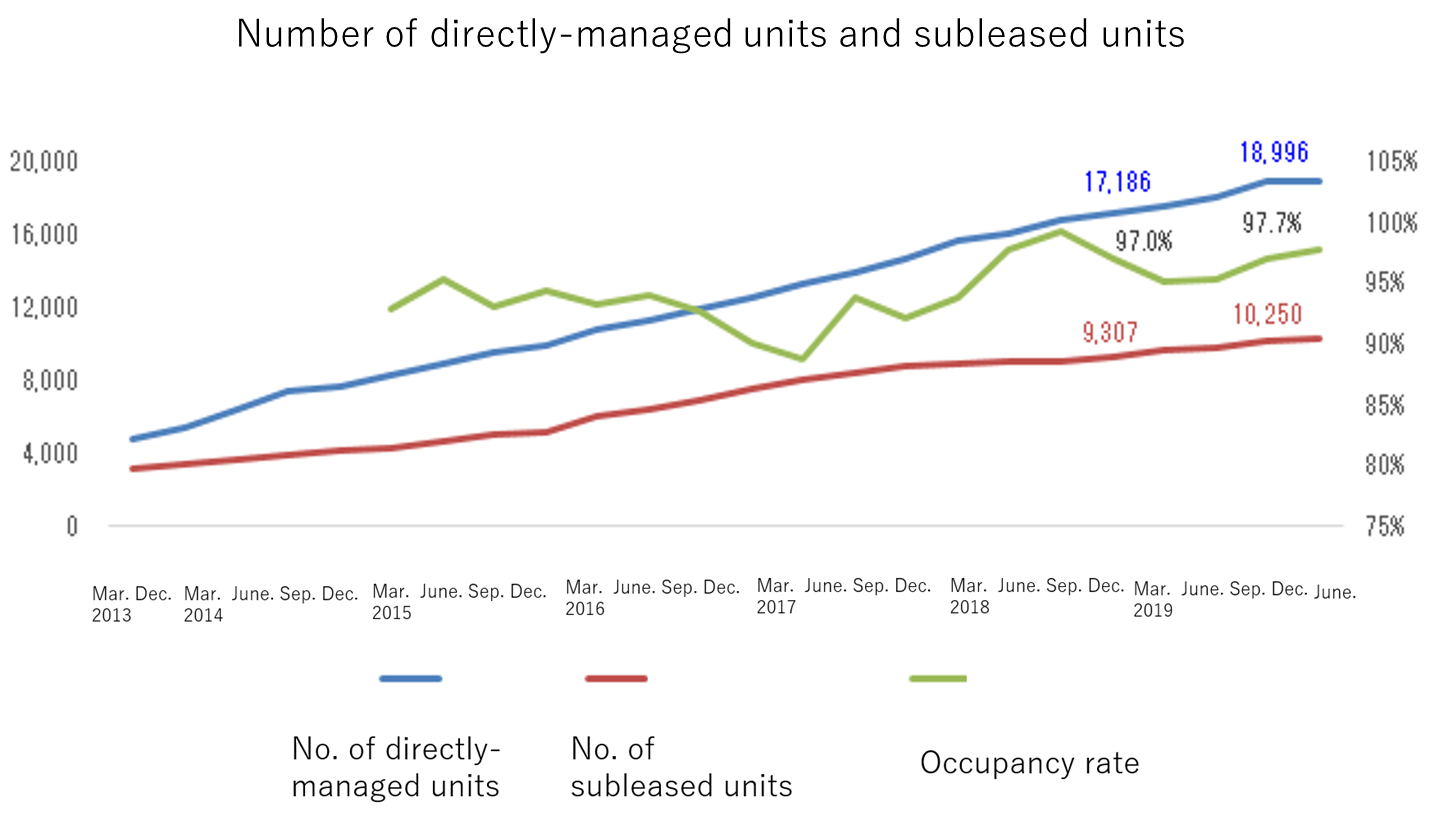

1-2. Core Business - PM business

AMBITION has been mainly conducting the PM business, which is not easily affected by economic performance and can earn stable revenue, since the start of business in Sep. 2007. Its strengths are “the scheme for acquiring properties to manage stably” and “high operational efficiency realized through the adoption of technologies.” The company has increased the number of units under management steadily while appraising real estate appropriately. The number of units under management as of the end of the term ended Jun. 2019 is 18,996, up 110.5% from the end of the same period of the previous year, and the number of subleased units is 10,250, up 110.1% from the end of the same period of the previous year.

The populations of the Nagoya and Osaka areas have declined for the 5th consecutive year, while the population of the Tokyo area has increased for the 21st consecutive year. This trend is expected to be continued, and the environment surrounding the PM business is estimated to remain favorable. Rent revision rate declined after the bankruptcy of Lehman Brothers, but started increasing in 2010, and is recovering. Especially, it recovered rapidly in the urban center, and it is increasing by around 5% per year (Normally, rent revision rate is about negative 1% one year after completion of the building, but it varies according to the balance between demand and supply). While the population of the urban center is expected to keep growing, the enforcement of the new resident status system is projected to spur the business of AMBITION.

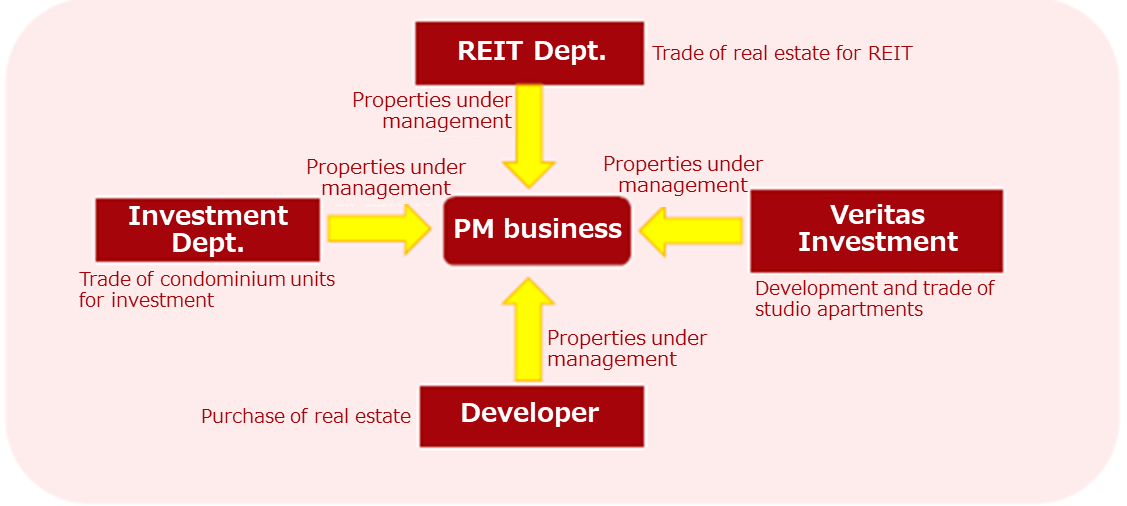

Strength 1: Scheme for stably acquiring properties to manage

AMBITION developed a scheme for acquiring properties to manage by pursuing the synergy between the investment department and the REIT department of AMBITION and Veritas Investment Co., Ltd., which is a group company, and utilizing the relations with many developers who have plenty of experience of making transactions. This has contributed to the continuous increase of properties under management.

(Source: the Company)

Strength 2: High operational efficiency achieved by adopting technologies

AMBITION has concentrated on the streamlining of business operation based on IT since its early years, and has adopted RPA technologies, including “RPA automatic processing” (automatic processing for notifications on renewal and reminders, automatic reconciliation for deposits, linkage of data between the Property Management system and the contract management system, etc.), “a system for automating contract progress management,” “24-hour services for occupants,” and “AI-based prediction of feedback about properties for rental.”

As a result, AMBITION can manage 250 units per employee, while ordinary PM companies manage about 50 units per employee. In the case where the number of units that can be managed by a single employee is 50, it is necessary to have 360 employees to manage 18,000 units (the number of units under management as of the end of the term ended June 2019 was 18,996).

Strength 3: Various services for improving convenience

In June 2019, the company started QR code-based payment settlement with PayPay and LINEPay, in order to meet the needs for payment with mobile devices. In addition, the company started offering “subsclife,” a subscription-type service for furniture and home appliances (No. of brands: 41, No. of pieces of furniture: 38,000), to occupants of real estate for rental the company handles. In August 2019, the company started the service of buying disused goods, etc. (deducting purchase amounts from relocation fees) when occupants move out.

(Source: the Company)

New business chance: Operation of the new resident status system

In order to cope with the new resident status system started in April 2019, the company is developing an environment for foreign workers. The ratio of non-Japanese occupants for 18,996 units under the management of AMBITION was 8.2% according to the latest survey, but the cumulative number of contracts with occupants with a foreign nationality is 2,418, up over 4 times from 2015 (556 contracts).

The new resident status system was established in response to the enforcement of the amended Immigration Control Law in April 2019. This enabled foreign workers in 14 fields, including restaurants and accommodation, to obtain a visa for staying in Japan for 5 years, if they satisfy some conditions, including the passing of examinations regarding their skills and Japanese proficiency. Due to the start of the new system, it is expected that more foreign workers will be accepted.

The population of foreign people in Japan was 2.731 million people, accounting for about 2.1% of the total population, as of December 2018. It increased 6.6% (169,000) year on year, making up about 2.1% of the total population.

1-3. Strategy of Veritas Investment, which is a consolidated subsidiary

The favorable sales of newly built fashionable condominiums for investment of Veritas Investment Co., Ltd. contributed to the expansion of the investment business. The most important thing in the sale of studio apartments for investment is to minimize the risk of investors. Veritas Investment Co., Ltd. achieved high yield with high occupancy rate and high rents by selling condominiums with high added value directed by famous designers in premium areas in Tokyo. (⇒ Minimization of the risk of investors) The population of Tokyo is increasing, and the value of assets does not easily decline in popular premium areas.

Condominiums with high added value designed by famous designers + Premium areas in Tokyo = high rents × high occupancy rate = high yield

1-4. Hope Small Amounts and Short-Term Insurance Co., Ltd.

A small-amount short-term insurance business is a new kind of insurance business that was started in April 2006, and handles insurance policies whose insurance benefit is small (10 million yen or less for non-life insurance) and whose insurance period is 1 to 2 years (2 years for non-life insurance [the second area]). Hope Small Amounts and Short-Term Insurance Co., Ltd. offers home contents insurance, liability insurance, etc. for occupants of rental housing to customers related to real estate managed or handled by the AMBITION Group, and has been developing new policies with insurance coverage contents for meeting needs of policyholders. As the number of insurance contracts rises as the properties managed by the AMBITION Group increase, the number of contracts is in the order of 1,000 per month.

2.Fiscal Year Ended June 2019 Earnings Results

2-1. Overview of consolidated results

| FY 6/18 | Ratio to Sales | FY 6/19 | Ratio to Sales | YoY | Revised Forecast | Difference from Forecast |

Net sales | 23,278 | 100.0% | 29,636 | 100.0% | +27.3% | 29,268 | +1.3% |

Gross profit | 4,644 | 20.0% | 6,257 | 21.1% | +34.7% | - | - |

SG&A | 3,502 | 15.0% | 4,662 | 15.7% | +33.1% | - | - |

Operating profit | 1,141 | 4.9% | 1,594 | 5.4% | +39.7% | 1,536 | +3.8% |

Ordinary profit | 1,017 | 4.4% | 1,433 | 4.8% | +40.9% | 1,346 | +6.5% |

Net profit | 611 | 2.6% | 736 | 2.5% | +20.4% | 846 | -12.9% |

*Unit: Million yen

Sales and operating profit grew 27.3% and 39.7%, respectively, year on year.

Sales were 29,636 million yen, up 27.3% year on year. While the sales of the property management (PM) business stably grew 7.3% year on year due to the increase of properties under management, the sales of the investment business rose 58.4% year on year, thanks to the favorable sale of condominium units for investment by Veritas Investment (hereinafter called “Veritas”), which is a consolidated subsidiary.

Operating profit was 1,594 million yen, up 39.7% year on year. SGA augmented 33.1% year on year, due to the increase of condominiums for investment, the upfront investment (expenses for development personnel) in the Real Estate Tech business, mainly RPA, and the rise in reserves in response to the revision to accounting policies in the PM business, but it was offset by the sales growth and the improvement in gross profit rate thanks to the rise in the ratio of the investment business, which has a high profit rate.

Net profit was only 736 million yen, because non-operating expenses augmented from 132 million yen to 174 million yen due to the increase in commission paid, etc., the company posted an extraordinary loss of 95 million yen, including a loss on valuation of investment securities of 58 million yen, and tax burden ratio rose 40.1% to 44.9%.

2-2. Segment Earnings

| FY 6/18 | Composition ratio | FY 6/19 | Composition ratio | YoY |

Property Management | 12,777 | 54.9% | 13,706 | 46.2% | +7.3% |

Rental Brokerage | 1,011 | 4.3% | 855 | 2.9% | -15.4% |

Investment | 9,356 | 40.2% | 14,825 | 50.0% | +58.4% |

Others | 132 | 0.6% | 249 | 0.8% | +87.8% |

Consolidated sales | 23,278 | 100.0% | 29,636 | 100.0% | +27.3% |

Property Management | 1,024 | 8.0% | 881 | 6.4% | -13.9% |

Rental Brokerage | 114 | 11.3% | 38 | 4.5% | -66.3% |

Investment | 1,143 | 12.2% | 2,151 | 14.5% | +88.1% |

Others | -19 | - | -88 | - | - |

Company-wide cost | -1,121 | - | -1,388 | - | +23.8% |

Consolidated operating profit | 1,141 | 4.9% | 1,594 | 5.4% | +39.7% |

*Unit: Million yen

Property management business

As the company increased the number of properties under management while evaluating real estate appropriately, the number of properties under management as of the end of the term ended June 2019 was 18,996, up 10.5% year on year, and the number of subleased properties was 10,250, up 10.1% year on year. Due to the increase of properties under management, sales grew 7.3% year on year, but due to the augmentation of reserves in response to the revision to the accounting policies, operating profit dropped 13.9% year on year. In the term ending June 2020, it is expected that profitability will improve and profit will increase thanks to the streamlining of business operation with RPA.

Rental brokerage business

The number of shops as of the end of the term was 5 in Tokyo (11 as of the end of the previous term), 7 in Kanagawa (6 as of the end of the previous term), 1 in Saitama (1 as of the end of the previous term), and 1 in Chiba (1 as of the end of the previous term) for a total of 14 (19 as of the end of the previous term). Since the company decreased shops in order to concentrate on the Real Estate Tech business, sales and profit declined. From now on, the company plans to strive to conclude contracts with corporations, etc.

Investment business

Thanks to the favorable sale of Veritas exceeding the estimate, sales and profit increased. The sales of the business of reselling used real estate, which is under development, increased steadily.

Others

The company started active upfront investment in the Real Estate Tech business, mainly RPA.

2-3. Financial Conditions and Cash Flow

Financial Conditions

| Jun. 2018 | Jun. 2019 |

| Jun. 2018 | Jun. 2019 |

Cash and deposits | 3,834 | 3,438 | Accounts payable – other and accrued expenses | 430 | 389 |

Inventories | 6,780 | 5,866 | Income taxes payable and accrued consumption taxes | 377 | 452 |

Total current assets | 11,132 | 9,807 | Advances received | 466 | 538 |

Property, plant and equipment | 1,219 | 1,382 | Operating deposit | 156 | 165 |

Intangible assets | 1,336 | 1,196 | Long-term guarantee deposited | 541 | 720 |

Investments and other assets | 889 | 1,261 | Interest-bearing liabilities | 10,479 | 7,998 |

Total non-current assets | 3,446 | 3,840 | Total liabilities | 12,688 | 11,057 |

Total assets | 14,590 | 13,659 | Total net assets | 1,902 | 2,602 |

*Unit: Million yen

Total assets decreased 931 million yen to 13,659 million yen from the end of the previous term. In the debit side, inventory assets declined about 914 million yen, due to the favorable sale of condominiums, etc. In the credit side, interest-bearing liabilities declined due to the improvement in CF. Capital-to-asset ratio was 18.9% (13.0% at the end of the previous term).

Cash Flows (CF)

| FY 6/18 | FY 6/19 | YoY | |

Operating cash flow (A) | 1,217 | 4,255 | +3,037 | +249.4% |

Investing cash flow (B) | -3,256 | -2,118 | +1,137 | - |

Free cash flow (A+B) | -2,038 | 2,136 | +4,175 | - |

Financing cash flow | 3,423 | -2,525 | -5,948 | - |

Cash, equivalents at term end | 3,696 | 3,307 | -388 | -10.5% |

*Unit: Million yen

Operating CF improved considerably, as net profit before taxes and other adjustments increased and the delivery of condominiums progressed smoothly. Investing CF improved through the acquisition of property, plant and equipment, and costs related to M&A decreased from the previous term. Financing CF decreased due to the reduction of interest-bearing liabilities.

Reference: Variation in ROE

| FY 6/15 | FY 6/16 | FY 6/17 | FY 6/18 | FY 6/19 |

ROE | 22.65% | 15.40% | 14.78% | 38.64% | 32.84% |

Net profit to sales ratio | 1.59% | 1.11% | 1.02% | 2.63% | 2.49% |

Total asset turnover ratio | 3.79 | 3.49 | 4.02 | 2.51 | 2.10 |

Leverage | 3.76 | 3.97 | 3.60 | 5.86 | 6.30 |

*Return on equity (ROE) is obtained by multiplying “net profit to sales ratio (net profit ÷ sales),” “total asset turnover ratio (sales ÷ total assets),” and “leverage (total assets ÷ equity capital or the inverse of capital-to-asset ratio).”

*The above figures were calculated based on the data of brief financial reports and securities reports, while using the average of total assets and equity capital in the current term.

3. Fiscal Year Ending June 2020 Earnings Estimates

3-1. Annual consolidated results

| FY 6/19 | Ratio to sales | FY 6/20 (Est.) | Ratio to sales | YoY |

Net sales | 29,636 | 100.0% | 31,256 | 100.0% | +5.5% |

Operating profit | 1,594 | 5.4% | 1,647 | 5.3% | +3.3% |

Ordinary profit | 1,433 | 4.8% | 1,470 | 4.7% | +2.6% |

Net profit | 736 | 2.5% | 929 | 3.0% | +26.1% |

*Unit: Million yen

The upward trend of sale of condominiums for investment will subside and operating profit is estimated to grow 3.3% from the previous term, as the upfront investment in the RPA business will be offset.

In the term ending June 2020, the company will work on various new businesses for future growth. Sales are projected to be 31,256 million yen, up 5.5% year on year, thanks to the property management business, while the number of new transactions in the investment business is limited. Operating profit is estimated to grow 3.3% year on year to 1,647 million yen, as the sales growth will offset the active upfront investment in the RPA business.

In the first half, the upfront investment in the RPA business is forecasted to affect profit, so it is estimated that operating profit will drop 41.4% year on year while sales will grow 7.1% year on year.

As for dividends, the company plans to pay a term-end dividend of 25 yen per share like in the previous term (estimated payout rati 18.3%).

Consolidated results for the first half

| FY 6/19 1H (Actual) | Ratio to sales | FY 6/20 1H (Forecast) | Ratio to sales | YoY |

Net sales | 13,436 | 100.0% | 14,389 | 100.0% | +7.1% |

Operating profit | 557 | 4.2% | 327 | 2.3% | -41.4% |

Ordinary profit | 483 | 3.6% | 248 | 1.7% | -48.6% |

Net profit | 262 | 2.0% | 143 | 1.0% | -45.1% |

*Unit: Million yen

Consolidated results for the second half

| FY 6/19 2H (Actual) | Ratio to sales | FY 6/20 2H (Forecast) | Ratio to sales | YoY |

Net sales | 16,200 | 100.0% | 16,867 | 100.0% | +4.1% |

Operating profit | 1,036 | 6.4% | 1,320 | 7.8% | +27.3% |

Ordinary profit | 949 | 5.9% | 1,222 | 7.2% | +28.8% |

Net profit | 474 | 2.9% | 786 | 4.7% | +65.6% |

*Unit: Million yen

3-2. AMBITION PROJECT 100

The company has upheld “AMBITION DREAM 1000,” which aims to achieve sales of 100 billion yen and an operating profit of 10 billion yen in the medium term, but will revise it, renaming it “AMBITION PROJECT 100,” and implement measures for prioritizing the achievement of an operating profit of 10 billion yen. While considering the term ending June 2020 as the initial fiscal year of the new project, the company will carry out active upfront investment in mainly the RPA business, which has a high profit rate, in the first half, in order to realize steep growth from the next term.

As mid-term policies, the company will operate the existing businesses, mainly the property management business, which can earn recurring revenue, as the base for stable growth, and develop new businesses, mainly the RPA business, which has a high profit rate, as drivers of profit growth, while aiming to achieve an operating profit of 10 billion yen and an operating profit rate of 10% as soon as possible.

Existing business | : | Increase of properties under management in the PM business + Expansion of the insurance business |

New business | : | Sale of systems to real estate firms + new business related to real estate |

4. Growth Strategy

The company will develop “Realty × Technology,” which supports the streamlining and improvement of business operation, and real estate solutions based on CPMA(Contract Process Management Automation), to make them new primary sources of revenue, and also put its energy into &AND HOSTEL, which subleases hotels, and cope with the new resident status system.

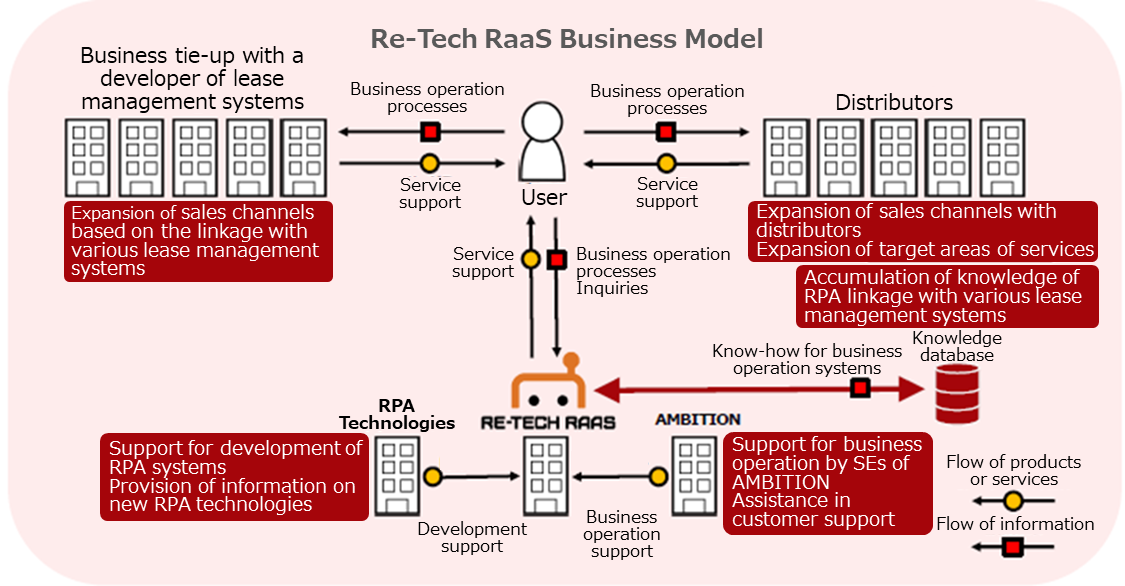

4-1. Realty × Technology

The company will conduct the RPA business, which supports the streamlining of business operation and the utilization of human resources, improve convenience for customers with the IT-based real estate disclosure statement, etc. and carry out efficient marketing, etc. by utilizing data. RPA means a system for automating PC tasks. As part of the RPA business, the company established Re-Tech RaaS Co., Ltd., which is a joint venture with RPA Technologies, Inc. (headquartered in Minato-ku, Tokyo; representative director, executive officer, and president: Nobuyuki Osumi; hereinafter referred to as “RPA Technologies”) and develops and sells RPA for real estate, in July 2019.

Automatic processing by RPA in conjunction with existing systems

After an RPA system of AMBITION is installed, RPA will conduct automatic processing in conjunction with already installed systems for Property Management, real estate management, business operation, etc. In detail, it will automatically link data of systems for notifications on renewal, reminders, reconciliation of deposits, Property Management, and contract management, which have been dealt with manually. We heard that AMBITION currently operates 30 RPA units.

Three sales channels

The number of firms handing real estate transactions in Japan is 124,430. About 95% of them are small-sized firms with 10 or less employees, and they are urged to reform ways of working, for example, by shortening working hours like large companies, and it is indispensable to improve the efficiency of business operation. Re-Tech RaaS Co., Ltd. develops PRA packages and plans to promote sales with three sales channels: direct sale, sale via distributors, and sale via Property Management system companies based on the API linkage. The Property Management system market is occupied by 3 major companies, and Re-Tech RaaS Co., Ltd. formed a business alliance with one of them, Dangonet Co., Ltd. (Kokubunji-shi, Tokyo; representative directo Tatsuya Matsukawa), in August. As there are 125,000 real estate firms in Japan, 5,000 firms out of them use “Chintai Meijin (Lease Master),” a system of Dangonet Co., Ltd. The company plans to sell RPA systems to real estate management firms around Japan, via Dangonet, which has the experience of installing systems in many real estate management firms. The company is negotiating with the other two major companies, and the negotiation with one of them is at the phase of coordinating conditions.

In addition, the company started the sales promotion of “Hankyo-baizou-kun,” an AI tool for optimizing advertisements for real estate brokerage firms, which has the functions to predict repercussions (inquiries) and automatically input ads (real estate information). “Hankyo-baizou-kun” is a robot that predicts real estate each customer would hope to rent based on AI analysis. Currently, 5 companies are using it as trials.

(Source: the Company)

4-2. Real estate solution based on CPMA

In October 2018, the company launched Contract Process Management Automation (CPMA), which is a system for automating the management of progress of each contract in websites exclusively for real estate brokers. Between brokers and the company, there emerge an enormous amount of tasks for booking the preview of real estate, confirming expenses, checking vacancy, completing application procedures, checking the situation of screening, etc. on a daily basis, but by using CPMA, it is possible to manage the tasks for checking vacancy, booking previews, managing the progress of contracts, etc. online in a unified manner. Brokers can allocate more time to attending to occupants by streamlining the brokerage process and then improve customer satisfaction level and reform their ways of working. In October 2018, the company started accepting the registration for CPMA, and 4,179 firms have been registered so far (440 firms as of Oct. 2018; 3,067 as of Jan. 2019).

4-3. Business tie-up with Uhomes, a leading rental business company targeted at Chinese people

In August 2019, the consolidated subsidiary AMBITION Rent Co., Ltd. reached an agreement for business alliance with Uhouzz Network Technology Co., Ltd. (brand name: Uhomes; hereinafter referred to as “Uhomes”), a Chinese company that introduces housing for international students. Uhomes is a leading Chinese company that introduces housing to mainly international students going abroad from China. In four years since the establishment of Uhomes, it has offered reliable, safe second houses to a total of 80,000 Chinese students studying abroad. From now on, the company will upload the information on properties under management to the websites and apps of Uhomes, to introduce them to international students coming from China to Japan and international students already staying in Japan.

5.Conclusions

In the term ending June 2020, the upward trend of sale of condominiums for investment will subside and the growth of consolidated sales will become gentle, but the PM business, which can earn recurring revenue, will be healthy, offsetting upfront investment, so that sales and profit will keep rising, marking a record-high profit.

According to a firm that surveys the real estate market, the number of condominiums for investment supplied in the Tokyo Metropolitan Area in the first half (Jan. to Jun.) of 2019 was 3,196, down 31% year on year, and the average price was 30.47 million yen, down 1% year on year. They mentioned that their business performance was affected by the fierce competition of acquiring land with hotels and offices. The number of units supplied in 2019 is estimated to fall below 7,000 for the first time in 2 years. However, it is forecasted that the performance of the group company Veritas Investment, which develops and sells condominiums for investment, will not decline significantly. They said that the procurement in the previous term was smooth, although they rigorously selected properties. Since sale progressed more rapidly than expected, the release of properties that were first scheduled to be released in the fourth quarter was carried over to the term ending June 2020.

When the real estate market thrives, the company stamps on the accelerator of the investment business, and there emerge uncertainties, the company steps on the brakes, and aims to grow steadily with the PM business. There may be some people who are unsatisfied with the company’s business results when compared to the pace of business expansion over the past few years, but we would like to highly evaluate their management, which can actualize the growth in sales and profit regardless of the external environment with the effects of their business portfolio. In addition, the RPA business made a good start, as the company succeeded in forming a business alliance with Dangonet Co., Ltd., which is one of the three major companies developing Property Management systems. There are about 125,000 real estate firms in Japan, and 5,000 firms out of them are the clients of Dangonet Co., Ltd. By forming a business tie-up with Dangonet, the company expanded its sales channels considerably. The future progress of their business is noteworthy.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 7 directors, including 4 outside ones |

◎ Corporate Governance Report (Updated on Sep. 28, 2018)

Basic Policy

Our basic policy for corporate governance is to improve the soundness of our business administration and transparency and increase our corporate value under the belief that it is indispensable to comply with laws, regulations, and corporate ethics for business administration. In order to live up to the trust of all stakeholders, including shareholders, we regard it as a management issue to take measures, including the disclosure of appropriate information, and fortify corporate governance.

<Major principles that have not been followed, and reasons>

There are no items that should be mentioned here.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved |

To view back numbers of Bridge Reports on AMBITION Corporation (3300) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/