Bridge Report:(3497)LEGAL the Fiscal Year July 2019

President Tetsuji Hirano | LEGAL CORPORATION (3497) |

|

Corporate Information

Market | TSE Mothers |

Industry | Real estate |

President | Tetsuji Hirano |

HQ Address | 10F Nihon Seimei Umeda Building, 3-3 Doyamacho, Kita-ku, Osaka |

Year-end | July |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE Act. | Trading Unit | |

¥1,199 | 2,885,200 shares | ¥3,459 million | 25.4% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR (x) |

TBD | - | ¥264.96 | 4.5 x | ¥1,265.07 | 0.9 x |

* Share Price is the closing price on November 13, 2019. Shares Outstanding, ROE, DPS, EPS and BPS are cited from the Company’s

“Financial Results of Fiscal Year ended July 2019.” Figures for Total Market Cap, PER, and PBR are rounded down.

Earnings Trend

Fiscal Year | Net sales | Operating Profit | Ordinary Profit | Net Profit | EPS | DPS |

July 2016 Act. | 11,085 | 967 | 536 | 399 | 199.93 | 0.00 |

July 2017 Act. | 14,846 | 1,392 | 704 | 475 | 237.76 | 0.00 |

July 2018 Act. | 19,263 | 1,885 | 861 | 584 | 292.03 | 0.00 |

July 2019 Act. | 23,727 | 2,318 | 1,118 | 694 | 259.74 | 5.00 |

July 2020 Est. | 34,163 | 2,504 | 1,152 | 766 | 264.96 | TBD |

*Unit: million yen. The estimated values are based on the forecasts made by the Company.

This Bridge Report provides the company overview, business results, and an interview with the president Hirano.

Table of Contents

Key Points

1.Company Overview

2.Business Results

3.Medium-term Management Plan

4.Growth Strategy

5.Interview with the president Hirano

6.Conclusions

<Reference: Corporate Governance>

Note: Hereinafter amounts cited from the Company’s disclosed information and those calculated by Investment Bridge Co., Ltd. based on the information are rounded down.

Key Points

- LEGAL CORPORATION is an all-around real estate developer that provides optimal solutions for utilizing lands in a broad range of services from brokerage and consulting to purchase and development of real estate. With its strengths and specialties, such as “ability to make original proposals from a viewpoint of an all-around real estate developer,” “flexibility to adapt to changing business environments” and “sincerity, meticulousness and speediness it has cultivated as an intermediate agent,” the Company is actively developing its businesses in Osaka and Tokyo areas respectively. Based on its Three-year Medium-term Management Plan, the Company is going to improve its balance sheet and aims for further expansion of its business.

- In the fiscal year ending July 2020, the first year of the Three-year Medium-term Management Plan, it is expected that Net sales will increase 43.9% to 34.1 billion yen compared to the previous year and Operating profit will increase 8.0% to 2.5 billion yen year-on-year. Each of its businesses is expected to grow steadily. Setting Equity Ratio as an important management indicator in the Plan, the Company will consider any possible approach to improve it more than 10% as soon as possible.

- In "Osaka area" and "Tokyo area" it will promote business strategies which are most suitable to the areas according to their characteristics while launching Real Estate Tech to create a future market. In addition, it aims to reinforce its management base and become a company that can achieve a sustainable growth.

- We had an interview with Mr. Tetsuji Hirano, the President, about the Company's competitive advantages, its future growth strategy and challenges, and his message to shareholders and investors. “The experience, knowledge, and know-how that our company has accumulated through its career as an intermediate agent are now our real strength and competitive advantages for us to keep on growing as an all-around real estate developer," he said. “We will aggressively capture business opportunities in the real estate market in Osaka, which is expected to become even more active. Also, in Tokyo area while we will respond to needs of measures for inheritance, we have started Real Estate Tech which combines real estate and IT to create a new market for the future,” he added. He concluded, “Over the next 3 years, we will dedicate ourselves to enhancement of our management base and improvement of our balance sheet, a weak point I would say, and then our key stage will start in 4 years. We will meet your expectations with tangible results, so I hope you would support our company from a medium to long-term perspective.”

- At present, the sales from short sale occupies a very small ratio of the whole sales, but it should be noted that the career as an intermediate agent of short sale is the strength of the Company as well as the base of its competitive advantages. Also, the Company has transformed itself from an intermediate agent to a developer, which Mr. Hirano describes as “a result of necessity posed by the business environments rather than a business strategy.” This flexible administration, including his unique career in real estate business, is an exquisite feature of the Company, as he says, “It is not the strongest that survives, but the only one who can change will survive.”

- In the next three years, the Company will focus on securing profits and profitability more than increasing Net sales in order to strengthen its balance sheet. It remains to be seen how and what it will carry out for a big leap in 4 years, including development projects in the Osaka area and Real Estate Tech.

1. Company Overview

LEGAL CORPORATION is an all-around real estate developer that provides optimal solutions for utilizing lands in a broad range of services from brokerage and consulting to purchase and development of real estate. With its strengths and specialties, such as “ability to make original proposals from a viewpoint of an all-around real estate developer in order to maximize and optimize the values of real estate regardless of areas, use and scale,” “flexibility to adapt itself to changing business environments” and “sincerity, meticulousness and speediness it has cultivated as an intermediate agent,” the Company is actively developing its businesses in Osaka and Tokyo areas respectively. Based on its Three-year Medium-term Management Plan, the Company is going to improve its balance sheet and aims for further expansion of its business.

[1-1 History]

After graduating from university, Mr. Tetsuji Hirano (the President of LEGAL CORPORATION) joined Tokyo Electron Limited. and Sumitomo Metal Industries, Ltd. where he was engaged in the sales of semiconductor manufacturing equipment, refining his business skills such as marketing technology. Because he had a set of values different from the one the company has, he decided to start his own business and launched an advertising agency.

It was in the midst of the bubble burst when he had a hard time with his business and decided to engage in real estate brokerage business on referral from his friend.

Although he was a complete amateur, Mr. Hirano was attracted by the real estate industry which, different from sales of semiconductor manufacturing equipment, enabled him to handle all the procedures of business by himself from customer development to concluding business talks, including explanation of products, and he steadily built his career in the industry.

Under these circumstances, he started to handle a brokerage of a property for short sale (*).

It is necessary for a real estate company to have legal knowledge and experiences in order to mediate short sale successfully, but he made it with advices of a lawyer.

As there were few intermediate agents who dealt with a brokerage of properties for short sale in Osaka then, he took it as a big opportunity to further develop the business and proactively engaged in it with the more enhanced network with lawyers.

Backed up by the lawyers, he expanded his business by accumulating legal knowledge that other real estate agents do not have as his own unique know-how and established LEGAL CORPORATION in September 2000. The Company has established its firm position as an intermediate agent for short sale in Osaka.

The company was named “LEGAL” with an aim to be “a company that can propose “solutions” to its clients by correctly understanding laws, adjusting the interests related to real estate, and distributing real estate.”

In the wake of the Lehman shock in 2008, it was expected that bankruptcies of real estate companies would increase and the market for short sale would expand further. However, the SME Financing Facilitation Act, which allows for a moratorium under certain conditions, caused a rapid decline in bankruptcies, commercial failures, and properties for short sale, and consequently the Company’s performance was affected adversely.

In response to these surroundings, the Company, an intermediate agent, entered the development business by taking advantage of the fact that its balance sheet didn’t so worsen to receive loans from financial institutions.

Making use of its "ability to judge" and the ability of risk management based on the legal knowledge and know-how it has cultivated as an intermediate agent, the Company purchased, developed and sold excellent properties. Benefited by the bear market, the Company increased the number of handling properties and its business performance developed steadily. In addition to the brokerage business, the Company has successfully transformed itself into an all-around real estate developer that develops, sells and leases real estate in addition to brokerage.

In middle of expanding its business based in the Kansai steadily, the Company was listed on the Tokyo Stock Exchange Mothers in October 2018 in order to build a foundation for its sustainable growth.

* Short sale

Short sale is a method to sell a real-estate property with an unpaid mortgage after its sale under an agreement with a financial institution if the owner of the property becomes insolvent and cannot pay borrowings including mortgage. In the case that a debtor cannot pay off the outstanding, a financial institution usually sells a collateral through "an auction" mandatorily and collects the loan out of the proceeds of the sale. However, since auctions have various disadvantages, some owners want to avoid auctions and short sale is one of methods to satisfy such needs by the owners.

Short sale has such advantages that “the property sells at prices close to market prices,” “the owner can sell it secretly,” and “the outstanding can be paid in installments.” But, it requires the cooperation of owners and creditors (financial institution) as well as the real estate company that has abundant knowledge and experience of the sale.

[1-2 Corporate Philosophy]

1 | Infuse our real estate business with intelligence |

2 | Establish a product brand that customers will choose |

3 | Implement a totally results-based approach that respects employees’ drive to take on any challenge |

4 | Continue to have mutually beneficial relationships with our partners, and maintain our high creditworthiness |

As mentioned in the history, the Company, which started its business as an intermediate agent, maximally takes advantage of its unique career to understand and judge each of real estate properties accurately and respond to diversifying needs precisely by providing solutions to improve the value of each property.

Also, it aims to be "a company that gives equal opportunities to motivated employees" by excluding seniority-based personnel evaluations, and to achieve a sustainable growth oriented by the win-win relationship with its business partners through their strong mutual trust.

[1-3 Business Environments]

An overview of the surrounding environments for the Company, which is pursuing a further growth as an all-around real estate developer is as follows.

(1)A buoyant real estate market in Kansai

The real estate market in Kansai area, including Osaka where the Company is based is expected to continue being active due to the following factors:

➀Growing Inbound Demand

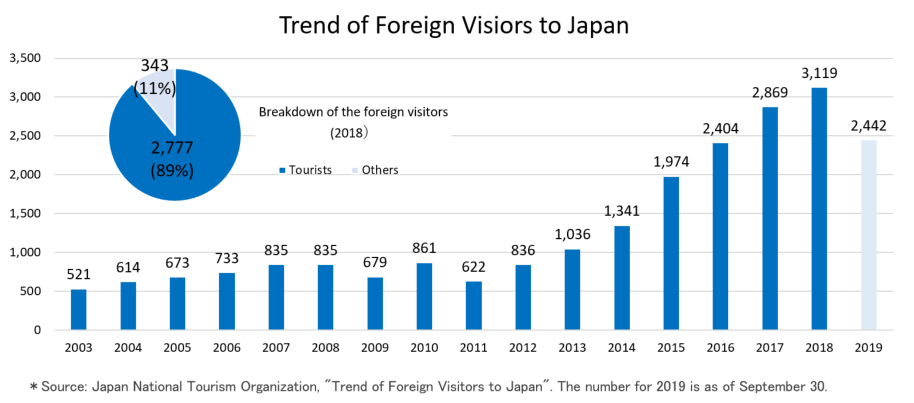

The total number of foreign visitors to Japan increased by 5% from the previous year despite the decrease of visitors from South Korea affected by the Japan-South Korea relation and others (the number of South Korean visitors in September 2019 decreased 58.1% year-on-year. Source: Japan National Tourism Organization). The number of foreign visitors excluding those from South Korea increased 23% year-on-year, showing a continuous increasing trend.

The number of foreign visitors to Japan in 2019 is 24.42 million in total as of September, and it is likely to exceed the number of 2018 for the whole year.

The government has set a target of 40 million visitors in 2020 and 60 million in 2030, and the number of foreign visitors to Japan is expected to increase steadily in the future, supported by the national policies.

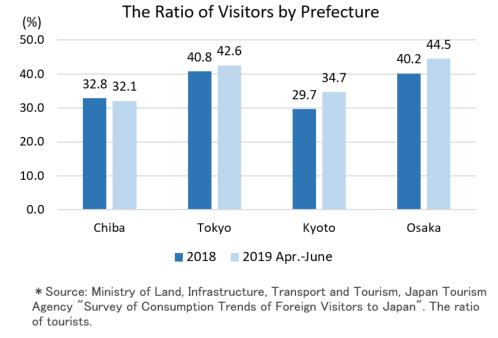

According to the Japan Tourism Agency’s “Survey of Consumption Trends of Foreign Visitors to Japan,” the ratio of visitors by prefecture shows that the ratio of visitors to Osaka is almost the same as that of Tokyo.

Considering their difference in economic scale between Tokyo and Osaka, it can be said that the impact of Inbound demand on the economy in Osaka is extremely large.

②Attracting Integrated Resorts (IR)

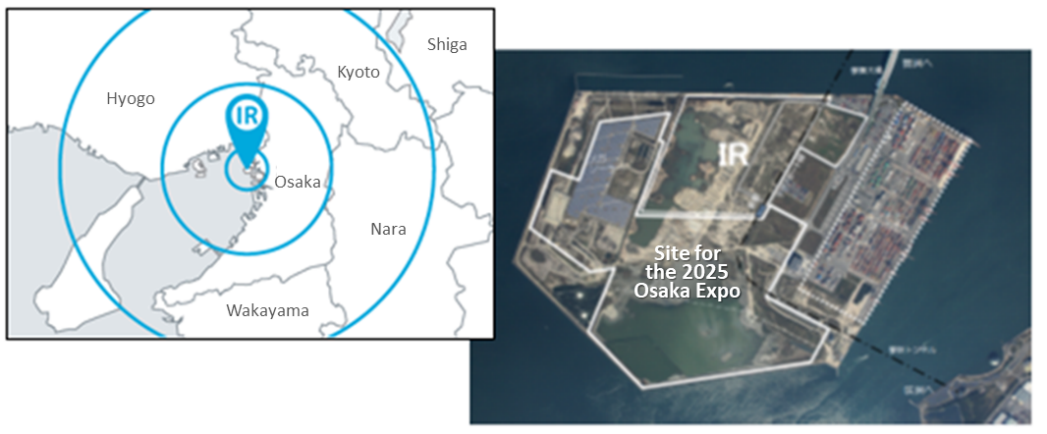

In light of the "Act on Promotion of Development of Specified Complex Tourist Facilities Areas" (IR Promotion Act) voted and come into effect in December 2016, Osaka Prefecture and Osaka City established the IR Promotion Bureau as a joint internal organization in April 2017 in order to carry out matters related to attracting IR to Yumeshima (an artificial island in Konohana-ku, Osaka City) together, and in February 2019 the Osaka IR Basic Plan (Draft) was formulated.

The basic concept of the project is “the growth-oriented IR of the world's highest-level that will drive a sustainable economic growth in Osaka and Kansai area.”

In addition to attracting people, goods and investments from all over the world and serving as an engine for an economic growth, they aim to build “a growth-oriented IR of the world's highest level” that is constantly changing itself not only by the initial investment but also by the constant renewals to furnish itself with the cutting-edge facilities, functions and services, looking ahead 50 or 100 years.

(Source: "Osaka IR Basic Plan (Draft)" of Osaka Prefecture and Osaka City)

Yumeshima, the planned site of the project, is a large reclaimed site of about 390 ha located in the bay area of Osaka Port in the middle of Osaka Bay. Most of the land is unused and its southern part is the planned site for the 2025 World Exposition, Japan (the Osaka and Kansai Expo).

The IR project is scheduled to open in the fiscal year 2024 and expected to attract 15 million visitors and sales of 480 billion yen annually.

③The 2025 Osaka Expo

The “2025 World Exposition, Japan (Osaka Expo)” will be held from May to November 2025.

With the theme, “Designing Future Society for Our Lives,” the Expo has its concept to be an “Experimental Site of Future Society” and aims to be a platform to achieve the United Nations’ “SDGs (Sustainable Development Goals)” by 2030.

Its venue is also Yumeshima and the Japan Association for the 2025 World Exposition has announced that “the estimated number of visitors will be approximately 28 million” and “the pro forma amount of its economic ripple effect will be approximately 2 trillion yen.”

(Source: the Company’s materials)

Stated in “4. Growth Strategy” below, the Company will go forward the development of condominiums and hotels for minpaku (short-term stays in residences) to directly capture a market of Inbound demands while focusing on the construction and redevelopment of office buildings and condominiums as an all-around real estate developer based on its forecast that Kansai real estate market will continue to be active in general.

(2) Advent of the age of the great inheritance

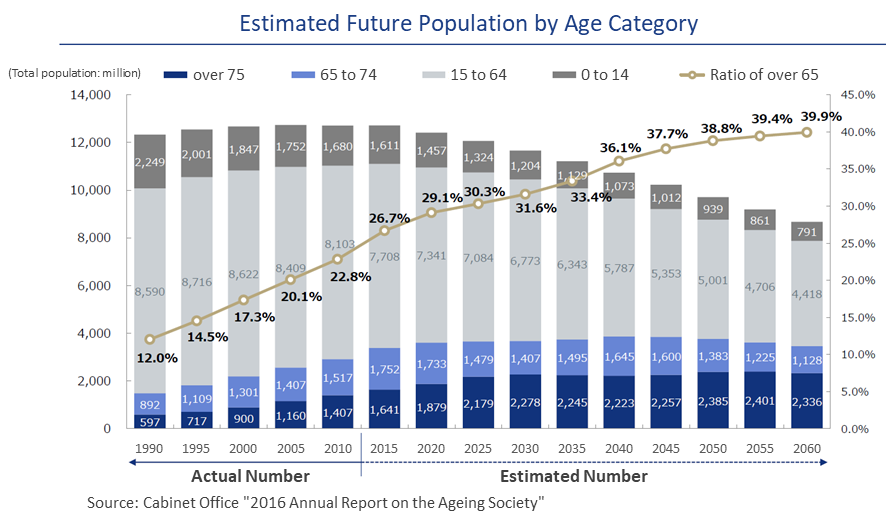

Against the backdrop of the declining birthrate, the ratio of people aged 65 and over is expected to rise to nearly 40% by 2060.

Over the next 10 years when the baby-boom generation turns 80 years old, there will be increasing needs to utilize real estate as a measure for inheritance. Particularly in Tokyo, where there are 2.05 million households with family members aged 65 or older and the percentage of owner-occupied houses is about 70% or more which exceeds the national average, the Company forecasts that the needs for measures for inheritance will become more apparent.

(Source: the Company’s materials)

For assessment of inheritance tax, roadside land prices or assessments of fixed assets tax are used for lands while assessments of fixed assets tax are used for buildings. As for lands where a rent house is built (Land with Rent House), its assessment value can be deducted by 20% for the land and by 30% for the building respectively.

Under this system, when a rental condominium is purchased together with its land and, the assessment value of inheritance tax will be much lower than the purchase price, thus it will be possible for the owner to reduce the inheritance tax compared with the case when he inherits cash and deposits and pays the inheritance tax for them.

The Company is actively developing a brand of low-rise rental condominiums, “LEGALAND” as a powerful solution for inheritance problems mainly in Tokyo area for the coming era of the great inheritance.

[1-4 Business Profile]

The Company’s business consists of 3 segments; "Real Estate Solution Business," "Real Estate Leasing Business" and "Other Business."

(1) Real Estate Solution Business

The Company purchases real estate properties based on a variety of sources, gets the properties to be the most suitable measures, depending on the contracts to improve their values such as “improvement of buildings management conditions,” “change of use,” “replacement of tenants” and “major repairs” and then sells them mainly to wealthy individuals and corporations which seek to own assets, meeting their respective needs.

It handles properties with a wide range of objectives, including housing development, commercial development, effective utilization of lands, hotels and minpaku, and improvement of values of pre-owned properties, regardless of their genres.

(Source: the Company’s materials)

In Osaka area, the Company engages in housing development, commercial development, condominiums for minpaku and hotels.

"LEGALAND" is a brand of compact low-rise rental condominiums for single persons and small families developed mainly in Tokyo area. Their land area is about 30 to 200 tsubo and their sales price varies 300 to 500 million yen. Sales yields (actual) are 4 to 6%. The brand features a high-class appearance that is favored by wealthy individuals to definitely meets their needs as a product to solve inheritance problems.

(Source: the Company’s materials)

(2) Real Estate Leasing Business

The Company actively owns high-profit properties regardless of areas or type of properties to secure profit gain.

It also engages in a facility management business to connect real estate management companies and tenants in better approaches and support their building management. In the business the Company specializes in repairs and restorations of condominium buildings. Under the theme of increasing rents and improving occupancy rates, it carries out such work as attending a relocation when a tenant leaves the property, restoration work, renovation work, repair work and others.

(Portfolio of Holdings)

| End of July 2018 | End of July 2019 |

Office buildings | 29 | 18 |

Condominiums | 18 | 16 |

Hotels | 1 | 3 |

Warehouses | - | 1 |

Total | 48 | 38 |

(Number of buildings)

(Source: the Company’s materials)

(3) Other Business

①Real Estate Consulting Business

This is the original business of the Company. Since its foundation, the Company has proposed such solutions as brokering and consulting on short sale for civil suits and extending loans from financial institutions.

As a real estate expert, it provides services tailored to the needs of its clients, ranging from brokering buyers to debtors, negotiating with relevant parties, contacting holders of rights of separate satisfaction, preparing distribution plans, investigating real estate, assessing prices, transferring rights, leasing, bidding to purchasing the properties by itself and others.

Utilizing its know-how on the real estate consulting it has accumulated, the Company proposes its clients’ solutions for various situations other than legal case resolution.

②Nursing Care Business

The Company engages in Nursing Care Business by providing, operating and managing fee-based homes for the elderly, housings with services for the elderly and group homes, providing supports for prevention of the long-term care according to the Long-term Care Insurance Act, as well as providing nursing care dealing with the in-home and long-term care insurance services.

As of the end of September 2019, it operates 5 fee-based residential nursing homes and 1 group home.

(Source: the Company’s materials)

[1-5 Features and Strengths]

(1) An ability to make original proposals from a viewpoint of an all-around real estate developer in order to maximize and optimize the value of real estate regardless of its region, use, or size.

It has a wide lineup of products and services including condominiums, effective use of lands, increase of values of pre-owned properties, office buildings, condominiums for minpaku, hotels, etc., and its strength lies in the ability to make original proposals to maximize and optimize the value of real estate according to needs of the parties involved, regardless of the area, use or size of the properties.

The ability is based on its flexible and quick planning and development capabilities, utilizing its problem-solving competencies based on legal knowledge it has cultivated through the business of short sale. It also has a unique and competitive advantage coming from the company, which has grown from a real estate company specializing in brokerage to an all-around real estate developer.

(2) Flexibility to adapt itself to changing business environments

The Company has evolved from a real estate company specializing in brokerage to a real estate developer despite the unfavorable circumstances of the decreasing number of bankruptcies and properties for short sale. It is never satisfied with the status quo and believes that it is essential for it to go ahead of the changing business environments and flexibly change itself to create a new market for its sustainable growth.

The Company focuses on flexible management, looking ahead 5 to 10 years while forging solid footing in various fields such as business strategies, organizational operation and personnel affairs.

(3) Sincerity, meticulousness and speediness the Company has cultivated as an intermediate agent

The Company emphasizes sincerity, meticulousness and speediness it has cultivated as an intermediate agent for short sale that requires the cooperation of owners of properties and creditors (financial institutions), and the financial institutions, business partners and other related parties evaluate this attitude highly.Its career and history as an intermediate agent together with its ability to make original proposals mentioned in (1) are a source of its competitive advantage against other real estate agencies.

(4) Hybrid business strategies corresponding to the business environments in Osaka and Tokyo respectively

The market trend and the stances of consumers and investors are very different between Tokyo and Osaka. It is unlikely that the strategy that worked well in Osaka will also work well in Tokyo.

The Company believes that it is necessary to formulate and implement different business strategies in accordance with the respective business environments of Tokyo and Osaka, which has steadily brought it good results in both areas.

2. Business Results

(1) Financial Summary for Fiscal Year Ended July 2019

①Business Results

| FY 7/18 | Ratio to Net sales | FY 7/19 | Ratio to Net sales | YoY | Compared with the initial plan |

Net sales | 19,263 | 100.0% | 23,727 | 100.0% | + 23.1% | -6.1% |

Gross profit | 4,399 | 22.8% | 5,428 | 22.8% | + 23.3% | -1.0% |

SG&A | 2,514 | 13.0% | 3,109 | 13.1% | + 23.6% | + 8.0% |

Operating Profit | 1,885 | 9.7% | 2,318 | 9.7% | + 22.9% | + 10.2% |

Ordinary Profit | 861 | 4.4% | 1,118 | 4.7% | + 29.8% | + 18.5% |

Net Profit | 584 | 3.0% | 694 | 2.9% | + 18.9% | + 5.9% |

*Unit: million yen.

Both sales and profits increased. Profits exceeded expectations.

Net sales increased 23.1% to 23.7 billion yen. The Real Estate Solutions Business contributed to this figure.

Operating Profit increased 22.9% to 2.3 billion yen while Ordinary Profit increased 29.8% to 1.1 billion yen, which absorbed increases in financial expenses due to increases in SG&A expenses and interest-bearing debt. Although Net sales and Gross profit fell short of the initial plan, each of the profits exceeded the plan.

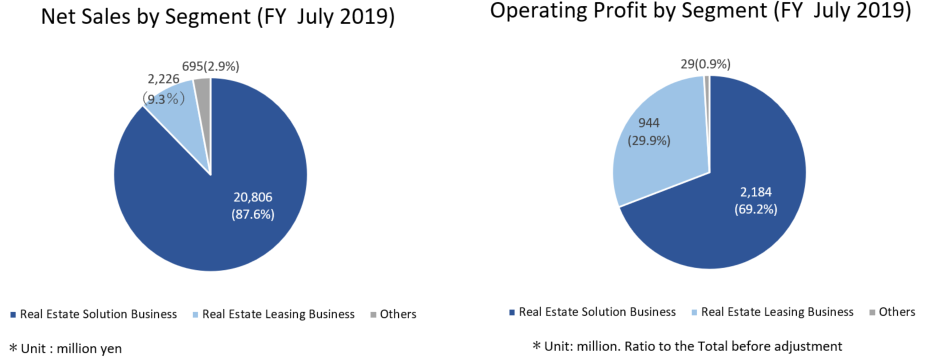

②Earnings by Segment

| FY 7/18 | Composition ratio | FY 7/19 | Composition ratio | YoY |

Real Estate Solution Business | 16,322 | 84.7% | 20,806 | 87.6% | + 27.4% |

Real Estate Leasing Business | 2,263 | 11.7% | 2,226 | 9.3% | -1.7% |

Other | 678 | 3.5% | 695 | 2.9% | + 2.5% |

Net sales Total | 19,263 | 100.0% | 23,727 | 100.0% | + 23.1% |

Real Estate Solution Business | 1,411 | 8.6% | 2,184 | 10.5% | + 54.8% |

Real Estate Leasing Business | 1,041 | 46.0% | 944 | 42.4% | -9.3% |

Other | 136 | 20.0% | 29 | 4.2% | -78.2% |

Adjustment | -702 | - | -839 | - | - |

Segment profit Total | 1,885 | 9.7% | 2,318 | 9.7% | + 22.9% |

*Unit: million yen. Ratio of Operating Profit comprises is Net sales’ operating profit margin.

◎Real Estate Solution Business

Sales and profits increased.

The Company actively engaged in purchasing and sales activities of properties for sale. Now that the prices of real estate are on an upward trend, the Company took maximum advantage of its ability to judge and know-how to select and buy rare properties, such as those near train stations when it purchased properties for sale.

On the sales side, although there were some properties whose sales were delayed to the next fiscal year, the sales increased due to strong inquiries, and high-profit properties whose sales prices exceeded expectations contributed to the positive results.

◎Real Estate Leasing Business

Sales and profits decreased.

Although the high occupancy rate continued, the Company sold some properties after considering their long-term earnings and inquiries on them and the sale resulted in the decreased sales and profits. It will further strengthen its business foundation by maintaining the high occupancy rate and increasing its real estate stock.

◎Other Business

Sales increased and profits decreased.

A newly opened facility in the Nursing Care Business performed well and other facilities kept their high occupancy rate. But, in the Real Estate Consulting Business the sales increased but profits decreased because large-scale spot brokerage transactions with high profit margins were included in the previous fiscal year.

③ Financial Conditions and Cash Flows

◎Main BS

| FY 7/18 | FY 7/19 |

| FY 7/18 | FY 7/19 |

Current assets | 37,918 | 39,646 | Current liabilities | 15,395 | 12,781 |

Cash and deposits | 1,198 | 1,054 | Short-term interest-bearing liabilities | 13,062 | 11,149 |

Real estate for sale | 25,753 | 18,486 | Non-current liabilities | 29,386 | 31,985 |

Real estate for sale in process | 10,556 | 19,511 | Long-term interest-bearing liabilities | 28,310 | 31,395 |

Non-current assets | 8,681 | 8,770 | Total Liabilities | 44,782 | 44,766 |

Property, plant and equipment | 8,177 | 8,252 | Net assets | 1,817 | 3,649 |

Investments and other assets | 498 | 475 | Total Liabilities and Net assets | 46,599 | 48,416 |

Total Assets | 46,599 | 48,416 | Total Interest-bearing liabilities | 41,373 | 42,544 |

*Unit: million yen. Interest-bearing liabilities includes Lease obligations.

Total Assets increased by ¥1.8 billion from the end of the previous fiscal year due to the increase of Real estate for sale in process.

Although Interest-bearing liabilities increased, Total Liabilities remained almost the same.

Net assets saw an increase of 1.8 billion yen year-on-year mainly due to the public offering for the listing.

Equity Ratio rose 3.6% year-on-year to 7.5%.

◎Cash Flow

| FY 7/18 | FY 7/19 | Increase/decrease |

Operating Cash Flow | -7,798 | -1,999 | + 5,799 |

Investing Cash Flow | -5,285 | -282 | + 5,002 |

Free Cash Flow | -13,084 | -2,282 | + 10,802 |

Financing Cash Flow | 12,826 | 2,296 | -10,530 |

Cash and equivalents | 476 | 489 | + 13 |

*Unit: million yen.

The minus range of Operating Cash Flow and Free Cash Flow decreased due to an increase of Net profit before income taxes.

The cash position remained almost unchanged.

(2) Outlook for Fiscal Year Ending July 2020

➀Earnings forecasts

| FY 7/19 | Ratio to Net sales | FY 7/20(Est.) | Ratio to Net sales | YoY |

Net sales | 23,727 | 100.0% | 34,163 | 100.0% | + 43.9% |

Operating profit | 2,318 | 9.7% | 2,504 | 7.3% | + 8.0% |

Ordinary profit | 1,118 | 4.7% | 1,152 | 3.3% | + 3.0% |

Net Profit | 694 | 2.9% | 766 | 2.2% | + 10.3% |

*Unit: million yen.

Both sales and profits will increase.

In the fiscal year ending July 2020, the first year of the 3-year Medium-term Management Plan described below, Net sales is expected to post a 43.9% increase year-on-year to 34.1 billion yen and Operating profit to 2.5 billion yen, an 8.0% increase year-on-year. Net sales is expected to rise sharply due to projects of large properties, but profits will remain in a single-digit growth as their profitability is not so high.

➁Topics

◎“YANUSY,” a web media for owners of real estate released its English version

The English version of “YANUSY,” a web media for owners of real estate which is jointly managed with ZUU Co., Ltd. (4387, TSE Mothers) was released.

(For more information on YANUSY, please see “4. Growth Strategy” below.)

(Background of the release of the English version of “YANUSY”)

Inbound demands increase in the Japanese real estate market particularly from Southeast Asia, but it is difficult for overseas investors to obtain information on Japanese business practices and laws and regulations on real estate transactions in the market and this unclear situation should be solved.

By combining a wealth of knowledge and data of LEGAL CORPORATION with the editorial ability and the know-how on digital media management of ZUU, which operates an Asian version, “ZUU online Singapore” and has a growing number of its users in Southeast Asia, the Company aims to contribute to the improvement of transparency of information about the real estate market in Japan as well as to the enhancement of Inbound demand.

(Contents for overseas investors)

From a professional viewpoint, the Company plans to offer a variety of contents, including the outlook of the Tokyo market which attracts overseas real estate investors and the fact that the hurdles for foreign investors to enter the Japanese real estate market have been lowered.

(Source: the Company’s materials)

◎Establishment of the shareholders' association made up of directors

In October 2019, the shareholders' association made up of directors was established.

(Objectives of the establishment)

It is established with the aim of preventing insider-trading concerns when its directors purchase shares of the Company as well as of further improving its value through the constant acquirement and holding of the shares by the directors to share the shareholder value with other shareholders.

The association also aims to improve the volume and liquidity of the shares by securing a stable demand for purchase.

Members of the board of directors and corporate auditors of the Company are eligible for membership discretionally. A contribution is 10,000 yen and they can make 99 donations per month at a maximum.

The members can withdraw from the association discretionally or when they resign as a director.

3. Medium-term Management Plan

We, LEGAL CORPORATION, formulated a “3-year Medium-term Management Plan (from FY ending July 2020 to FY ending July 2022)” in September 2019.

(Basic Policy)

We aim to grow as an all-around real estate company by constructing the best suited portfolio which assesses the growth, safety and risks of Real Estate Solutions Business, Real Estate Leasing Business, Real Estate Consulting Business, Facility Management Business and Nursing Care Business respectively.

(Basic Strategy)

Based on the analysis of the macro market environments, the following three basic strategic themes are defined.

➀Shrink and change | The decline in population due to the declining birthrate and aging population has a major impact directly on the shrinking of the present living area and consumption, causing changes in the living environments and the values. We see these changes as a major turning point and are going to re-create real estate values. |

➁Multipolarization | While basing in Osaka and Tokyo, we will constantly monitor market trends in other areas as well and develop strategies for the real estate business in each of the areas. |

③Promotion of diversification | In order to effectively utilize our management resources and know-how and to diversify risks, we will actively participate not only in the real estate business but also in other business including the nursing care business and hotel business. |

(Policies)

For these 3 basic strategic themes, we will build a solid management base by implementing “Measures to expand the business scale” and “Measures to strengthen the management base” and strive to expand our business.

Measures to expand the business scale | * | We will expand markets by increasing values of real estate regardless of genres of properties by utilizing our problem-solving ability based on the deep legal knowledge we have cultivated through the business of short sale. |

* | We will develop our brand “LEGALAND,” a product to solve inheritance problems as a market leader. | |

* | While focusing on the 2 largest cities of Osaka and Tokyo, we will not limit our markets to them but will monitor the market trends. such as population fluctuations as well as real estate supply and demand in other urban areas to purchase excellent properties there and expand our business scale. | |

* | Taking advantage of the strong Inbound economy in Osaka, we will further promote our hotel development business including our own hotel brand “LEGASTA” and our minpaku business such as our minpaku condominium brand “LEGALIE.” | |

* | We will promote a set-up office business to lend a tenant a whole building in response to office demands in our two bases in Osaka and Tokyo. | |

Measures to strengthen the management base | * | We will build sustainable opportunities to make profits by launching new services for real estate management and operation. |

* | By providing the operational service to nursing-care facilities, we will aim for a synergy effect with the real estate business. | |

* | In addition to real estate transactions, leasing, and brokerage, we will start a new business which has a synergy effect with our existing real estate business to build a stable management base. We will further push forward the diversification of our existing business including Nursing Care Business and Property Management Business to expand and stabilize the business. | |

* | By promoting a legal partner system to share business interests with information providers, we will keep information holders of real estate on our side to acquire the information continuously and preferentially. |

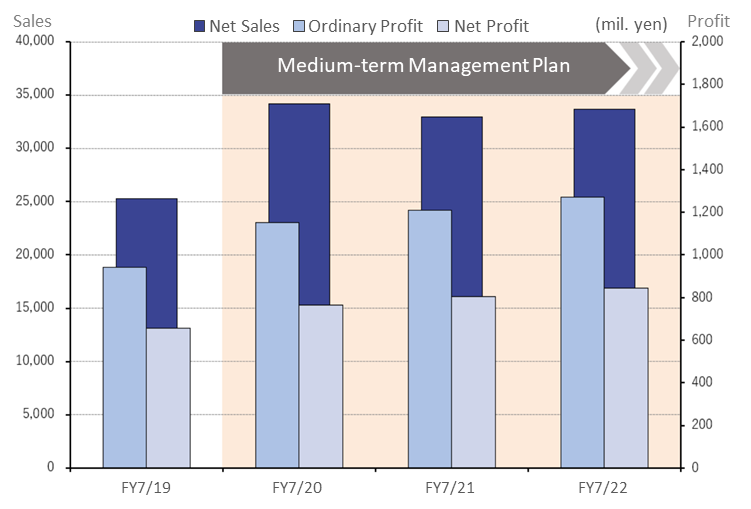

(Business objectives and numerical targets)

As an objective index to judge the state of achievement of management policies, management strategies, and management goals we will use Ordinary profit which indicates the overall profitability of a company, including financial activities and others in order to emphasize the stable and continuous growth and to increase our corporate value.

Furthermore, from the viewpoint of strengthening our financial base, we regard Equity Ratio as another important management indicator and will improve it to more than 10% as soon as possible.

(Numerical targets)

| FY 7/19 | FY 7/20 forecast | FY 7/21 forecast | FY 7/22 forecast |

Net sales | 23,727 | 34,163 | 32,963 | 33,700 |

Operating profit | 2,318 | 2,504 | 2,526 | 2,751 |

Ordinary profit | 1,118 | 1,152 | 1,210 | 1,270 |

Net Profit | 694 | 766 | 804 | 844 |

Equity Ratio | 7.5% | 9.4% | 10.3% | 10.4% |

(Source: the Company’s materials)

4. Growth strategy

Based in Osaka, the Company will promote its business strategies that capture the characteristics of “Osaka area” and “Tokyo area” respectively and launch the Real Estate Tech with the aim of creating a future market.

In addition, it is working to strengthen its management base which enables its sustainable growth.

(1) Osaka area

①Business environments

Jumping on the bandwagon led by the increasing number of “Inbound (visitors to Japan)”, the invitation of integrated resorts to Yumeshima (an artificial island in Konohana-ku, Osaka City) by Osaka Prefecture and Osaka City, and the decision to hold the 2025 Osaka Expo, the area enjoys the rising needs for hotels, minpaku, offices, and residences. The Company recognizes that Namba and the bay area especially have the highest growth potential in Japan.

➁Business strategies

◎Acceleration its minpaku business and hotel development

In response to the strong demands of Inbound, the Company will further promote its minpaku business and hotel development.

In October 2019, it opened a condominium exclusively for minpaku called “LEGALIE Nippombashi Higashi” in Naniwa-ku Osaka City.

The 9-story condominium (of 15 rooms in total) has a concept of “a facility where foreign visitors to Japan can experience a traditional Japanese culture” and has a Ninja house with hidden doors and passages in the common space on the second floor which its guests can enjoy with a rental ninja outfits for free. The Company expects that the information on the condominium and the service will spread among Inbound users through SNS and others.

All the 15 rooms are a 2LDK with an area of 50㎡, supposed to be a family-oriented use. This is the first condominium whose rooms are all exclusively for minpaku in Osaka and it is also the first case in Osaka that it is not a studio apartment. The Company expects to earn 1.8 times more than regular rental apartments if its occupancy rate exceeds 90%. The second and third condominiums are under planning in Namba area.

In April 2019, a guest house called “LEGASTA Gion Shirakawa” opened in Kyoto.

It attracts foreign tourists with its modern Japanese exterior and interior.

(Source: the Company’s materials)

◎Development of condominiums and office buildings

Land prices are rising in major cities across the country.

According to the data of the Company, the prices of the lands which are highly utilized in major cities increased at 97% of the observation points quarterly and among them 29 districts showed a relatively high increase of more than 3%, and 10 out of the districts were in Osaka Prefecture.

The Inbound demands in Kansai region has encompass not only hotels and minpaku, but also commercial facilities and residential areas, and more and more high-impact plans are coming, including the redevelopment of the area around Umeda Station and the development of the bay area for the Osaka-Kansai Japan EXPO 2025.

LEGAL CORPORATION, the Osaka-based all-around real estate developer believes it is in a position to take full advantage of the benefits and will focus on the development of condominiums of the “LEGALAND” brand and office buildings.

(2) Tokyo area

①Business environments

As the aging society progresses, “the epoch of the great inheritance” will arrive in the near future. Central market will be Tokyo.

In terms of the amount of assets held by households and the ratio of inheritance taxes (a ratio of the number of inheritances that actually require payment of inheritance tax among all inheritances), the figures in Tokyo are much higher than the national average. The Company also believes that the inheritance market in Tokyo is much larger than in Osaka and Hyogo prefectures.

Demands for office buildings in Tokyo expected to grow further as well.

②Business strategies

◎ Promotion of development of "LEGALAND" to meet the needs of wealthy individuals for their measures for inheritance

“LEGALAND” is a brand of compact low-rise rental condominiums for single persons and small families. It is characterized by its luxurious appearance favored by wealthy individuals.

In addition, it can be developed in areas with a building height restriction (such as Category 1 and Category 2 exclusively for low-rise residential areas, etc.) and in small land which pose difficulties including “a narrow road and a narrow frontage,” “a too strict city plan” and others, and where it would be competitive with apartments or residences.

In addition, it has its unique design of installing underground floors and eliminating elevators, beams and pillars to reduce maintenance costs and secure the maximum number of rooms and floor space in order to maximize rent profit.

Currently the Company has about 80 condominiums in Tokyo area, including those it has already purchased. There are 5 condominiums in Osaka and Hyogo, but it plans to concentrate its management resources on the business development in Tokyo for the time being under the circumstances mentioned above.

In anticipation of the arrival of “the epoch of great inheritance,” the Company will keep the concept and work to refine it, aiming to provide more comfortable rooms as well as to increase rental profit.

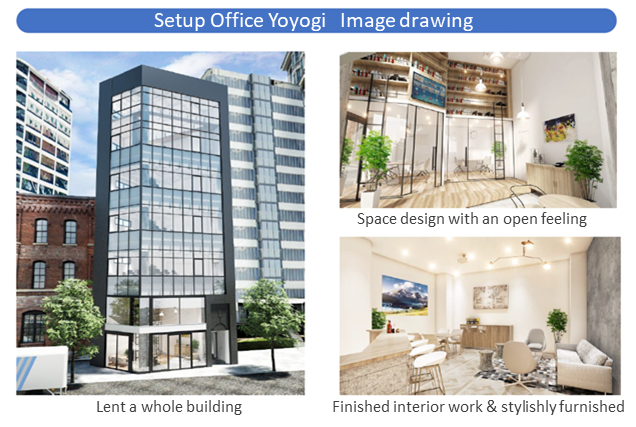

◎Development of a setup office business with superior design and convenience

The Company aims to create a market by offering its unique solutions to the tight office supply situation in Tokyo.

“Setup office” is a concrete solution to it.

A “setup office” is an office building which can be leased to a tenant as a whole so that the tenant can use it as if it were its own building to accelerate its business.

The tenant can use each floor for any purpose, such as for an office, a conference room, a lounge and so on. Although each floor is not so large, the tenant can secure enough floor space in total, which makes it easy for the tenant to use the building from a security point of view.

(Source: the Company’s materials)

As the first project, the Company purchased a small building along the Meiji-dori Street and completed the conversion to “Setup Office Yoyogi.”

The Company has already acquired properties for the second and third projects to accelerate the full-scale development of the projects in near future.

(3) Promotion of strategic alliances

The Company recognizes that strategic alliances are essential for its continuing growth in the increasingly diverse and complex society and real estate industry, and is actively developing these alliances.

➀Joint development with Osaka Metro

As the first project with Osaka Metro (Osaka Metro Co., Ltd.), a rental apartment “Metrosa Asashiobashi” was completed by fully renovating the Asashiobashi Official House (Minato-ku, Osaka City) for subleasing.

Since it became a joint-stock corporation in 2018, Osaka Metro has been active in making effective use of its assets. Many projects are expected to be carried out along the Midosuji or Chuo lines as well as in Yumeshima and Morinomiya. The Company will take the opportunity of the first project to strengthen its alliance with Osaka Metro.

In addition, the Company develops a condominium in Ibaraki City jointly with Kanden Realty & Development Co., Ltd. and a rental condominium in Osaka City with Osaka Gas Urban Development Co., Ltd. Moreover, it develops a condominium in Nishinomiya jointly with JR West Real Estate & Development Company and another condominium in Osaka City and other areas with ITOCHU Property Development, Ltd. to expand business opportunities and accumulate its know-how.

②Real Estate Tech initiatives

In July 2019 the Company launched a joint venture with ZUU Co., Ltd. (4387, TSE Mothers) in the real estate technology field with an aim to explore a future market by combining real estate and IT.

It aims to provide new values by combining its capabilities to develop new products in the real estate industry and its know-how in providing services to owners with ZUU’s know-how on data marketing which it has acquired through its WEB service operations, including "ZUU online" that has 4 million monthly users.

Through the joint business development and joint research in the field of Real Estate Tech and the utilization of highly specialized information and know-how on real estate as valuable online contents to offer, the Company aims to build a brand-new real estate platform.

As their first joint venture, they released a WEB media "YANUSY" for real estate owners.

“YANUSY” is a web media that provides useful information to real estate owners throughout Japan and supports them to create “rich real estate (a new type of real estate assets that secures them revenue).”

The web media sets 5 categories of theme “Assets Management,” “Real Estate Investment,” “Leasing Management,” “Taxes,” and “Trends” and utilizes the information as its unique contents from its original editorial viewpoint to provide them to readers as valuable information.

(Source: the YANUSY website)

The web media has readers who are mainly in their 30s to 60s and has reached 100 thousand PV (page views) per month in the first two months since its launch by providing its original content such as “eBooks” for download by its members.

In October 2019, they released an English version of “YANUSY” with the aim of improving the transparency of information on the Japanese real estate market and contributing to promotion of the Inbound demand.

They set a goal to achieve 400 thousand PV in a year.

They will develop its concrete monetization methods including a membership fee by watching the future trend.

(4) Other Initiatives

Besides, as for the initiatives for its sustainable growth, the Company points out “the redevelopment of the former site of Dotonbori, Sauna New Japan,” “the development of shared offices in Osaka,” “the operation of licensed nursery schools in Tokyo,” “the continued and stable expansion of nursing care facilities” and so on.

(5) Strengthening the Management Base

In order to realize the growth strategy, the Company believes it is necessary for it to strengthen the following infrastructure construction of management bases:

* | To move up to the First Section of the Tokyo Stock Exchange |

* | To secure and develop excellent human resources |

* | To further strengthen its internal management systems |

* | To further strengthen its compliance system |

* | To strengthen its purchase and sales capabilities |

* | To increase its stable earnings by focusing on stocks |

* | To expand and stabilize its business through diversification of services (i.e. improvement of lineups of real estate products) |

* | To improve its balance sheet |

As for the improvement of its balance sheet particularly, as is mentioned in the Medium-term Management Plan, the Company has set Equity Ratio as an important management index and will examine and carry out any possible measures to improve it to reach more than 10% as soon as possible.

5. Interview with the president Hirano

We asked Mr. Tetsuji Hirano, the president, about the Company's competitive advantages, its future growth strategy and challenges, and his message to shareholders and investors.

Bridge Report (BR): Could you tell us again about strengths and competitive advantages of your company?

Mr. Hirano (H): Our experience, knowledge, and know-how that we have cultivated through the career as an intermediate agent. These are the only skills that the company that has developed from an intermediate agent to a developer can possess, and they constitute powerful strengths and competitive advantages of our company which even keeps on growing as an all-around real estate developer.

We have achieved the phase 1 growth in the brokerage business of short sale since the foundation, then we have evolved into an all-around real estate developer to reach the phase 2 growth, and we were able to be listed in 2018.

There are many real estate companies in Japan, both listed and unlisted, but probably we are the only company that has changed its business category from an intermediate agent to a developer.

I would like all our investors to know that this uniqueness is in fact the source of our strong competitive advantages.

Short sale is a method to sell a real-estate property with an unpaid mortgage after its sale under an agreement with a financial institution. It could not be successful without the cooperation of the owner who is the debtor, and the financial institution who is the creditor, and the thorough consent of both parties.

It is our role as an intermediate agent to proceed with their negotiation smoothly, and to be successful we need to work out carefully, taking their conditions and ideas into consideration in order to reach their mutually agreeable conditions.

To do so, a wealth of legal knowledge and experience regarding real estate is essential, but “honesty” is equally important for our business.

Short sale makes a less amount repaid than the amount of loaned money. In this situation when both the owner and the financial institution make a loss, the negotiation never goes through if the intermediate agent alone insists on a fixed commission of 3%.

“Good for the three parties (i.e. good for a seller, good for a buyer and good for the society)” is said to be the base of good business, but this is not enough for our business. I think that an idea of “altruism” such as the stance that “we will take the balance after both of you, the owner and the financial institution recoup enough” is an ideal attitude for an intermediate agent to conduct the business, and this kind of spirit of “sincerity” and “altruism” is very important for a developer.

For example, talking about purchasing, each of our salespersons has a business policy that he should get information on properties as soon as possible and always treat it in an honest way and make a quick response.

Developers start their work by getting information from intermediate agents, and we can understand their feelings, guessing “what they really want to do is this” as we have a lot of experience as an intermediate agent by ourselves.

Because we can understand their feelings, they will be pleased if we meet their needs and they will give us even better information next time, which creates a positive spiral for our business.

Contrarily, based on my experience as an intermediate agent I know that it makes them feel bad if a developer enters negotiations with an idea that “we will buy it for you.” Also, the developers who have this kind of attitude often ask for a cut from the 3% commissions, but this never leads to the next business opportunity and the intermediate agent will never introduce you good properties.

As we understand feelings of intermediate agents, we never ask for a discount. We always have the attitude that “we will humbly buy it.” But this is easy to say and hard to do.

If we had conducted our business as a buyer, we would not understand how intermediate agents feel. But, as we have a wealth of experiences as an intermediate agent, we can make various decisions in a moment, which leads to faster response, better relationships and better information.

I also believe that it is necessary to have a win-win relationship with people involved in all processes.

It is essential to have a cooperation not only with intermediate agents who give us information on purchase but also with all the people involved including sellers, sales brokers, buyers, interior decorators, judicial scriveners, surveyors, etc. in order to complete tasks and projects smoothly. To this end, the spirit of “sincerity” and “altruism” is critical. Thus, our experience, knowledge, and know-how that we have cultivated through the career as an intermediate agent are the only skills that the company that has developed itself from an intermediate agent to a developer can possess, and they constitute powerful strengths and competitive advantages of our company.

BR: In order for your company to grow even further in the future, we think it is essential for each individual employee to grow as well. What kind of message do you usually convey to your employees, especially to you sales staff?

H: I send a message to our employees that I want them to behave as if they were a business proprietor themselves. Also, they should inherit the spirits of “sincerity” and “altruism” we have cultivated as an intermediate agent as the DNA of our company. I take every chance to insist its importance to them.

We have more than 40 salespersons together in Tokyo, Osaka and Kobe.

What I expect them and keep telling them is “I want you to have a sense and skills to carry out projects from the beginning to the end by yourself. In other words, although you are an employee of LEGAL CORPORATION, I want you to be a person who can behave as if you were a business proprietor yourself.”

In such business as the real estate industry, it is absolutely possible for each employee to behave as a representative of the company or as a key person who leads the business. When they work with such a mindset, it would lead to their personal growth as well as to the growth of our company as a result.

We have an evaluation system completely based on a performance of our employees to judge their achievements against our expectation. By visualizing the evaluation through a simple performance-based system that eliminates the seniority system, it is possible to keep the motivation of our employees at a high level.

Also, as for the spirits of “sincerity” and “altruism” which I mentioned we have cultivated as an intermediate agent, we believe that they should be inherited as the DNA of our company and I take every chance to insist its importance to our employees.

BR: Now, I would like to ask about your growth strategy. What are its important points?

H: We will aggressively capture business opportunities in the real estate market in Osaka, which is expected to see further revitalization. Also, in Tokyo, in addition to meeting needs for inheritance measures, we believe that our initiatives for "Real Estate Tech" which creates a future market by combining real estate with IT are extremely important measures in pursuing our future growth.

As we move forward with our growth strategy, I would like to emphasize the key words, “Cheer up Osaka!”

I would like to emphasize that we are a developer based in Osaka even more than ever.

We hope to grow as a company through our role to cheer up Osaka by utilizing the experience and personal connections we have cultivated there.

While various preparations are underway for the 2025 Osaka Expo and IR (Integrated Resort), which Osaka Prefecture and the City plan to open in 2024, real estate in Osaka is expected to be even more activated than now, and we are willing to seize business opportunities.

Among others, the most significant project is the alliance with Osaka Metro.

In addition to joining the Osaka Metro development project by participating in its urban development project in Minato-ku, Osaka City as our first project, we will promote strategic alliances with companies such as Kanden Real Estate Development Co., Ltd., Osaka Gas Urban Development Co., Ltd., JR West Real Estate & Development Company, and ITOCHU Property Development, Ltd.

In Tokyo area, while we will continue to promote the development of the low-rise rental condominiums “LEGALAND” to grasp needs of measures for inheritance, we will also expand the number of “setup office” buildings which are leased to a tenant as a whole so that the tenant can use them as its own building to accelerate its business.

In addition, our initiative for "Real Estate Tech" is also extremely important measures for pursuing our future growth.

In order to create a future market by fusing real estate and IT, we launched the WEB Media “YANUSY” jointly with ZUU Co., Ltd. who has extensive know-how in the development and operation of Internet services as well as of data marketing.

I think that the real estate industry is one of the last industries to catch up with the times of digitization, and we would not be able to expect our growth when we see the increasingly diverse and complex society and market if we remain the same.

Although our company is still a small company, we want to change the status quo in such an old-fashioned industry and make a revolutionary change to it even though we are small, which is the idea behind the launch of “YANUSY.”

As a developer, we believe that the role we should play is not only to develop condominiums “LEGALAND,” for example, but also to provide services for comfortable living experiences by improving the living environment through “LEGALAND.”

In other words, “by owning a LEGALAND condominium and enjoying various services the owners can feel the increasing value of their asset and they are more satisfied as owners.” This kind of satisfaction is the greatest added value that our company can offer to our clients and we want to deliver the satisfaction to them.

In order to do so, it is necessary for us to digitize information on real estate through “YANUSY,” visualize its accumulated data, improve the accuracy of fair distribution of information and to spread the information to readers.

However, it is also true that we cannot get the results so easily, so we are determined to continue making our efforts with conviction and tenacity from the viewpoint of the medium to long-term, and we will carry out our challenges without failure.

“YANUSY” is our first joint venture with ZUU Co., Ltd. who is very good at data marketing, and we are going to launch the second and third projects, including the development of services utilizing AI and IoT in order to achieve success in “Real Estate Tech.”

BR: Your company announced the Medium-term Management Plan in September 2019. What message do you want to deliver to your investors?

H: Our biggest challenge is to strengthen our management base and to improve our balance sheet. So, to build the firm and stable management base and balance sheet is our top priority.

Thanks to supports and cooperation extended to us, we were able to get listed and now we can secure good human resources, and what I think is the most important issue right now is to strengthen our management base and to improve our balance sheet.

Our Equity Ratio at the end of the previous fiscal was 7.5%. It is necessary to improve it to more than 10% as soon as possible and then to more than 20%, and we will take any possible measure for it.

For this reason, we will not increase our liabilities largely during the plan but execute our top priority to build the firm and stable management base and balance sheet, and then we will manage the company with our strong faith that we will make a big leap in the next medium-term management plan.

As a result, I’m afraid the plan may look not enough for our shareholders and investors, showing almost unchanged Net sales and slightly increased profits over the next 3 years. I hope that they would understand it.

BR: Could you please conclude the interview with your message to your shareholders and investors?

H: Our key stage will start in 4 years. We will devote ourselves to meet your expectation with the tangible results and so please support us from a medium to long-term perspective.

Again, we will focus on strengthening our management base and improving our balance sheet which may be our weak point. Our key stage will start in 4 years. We will show successful results, including improved Equity Ratio, increases of sales and profits, a steady improvement of market capitalization to meet your expectation. We look forward to your support for our company from a medium to long-term perspective.

6. Conclusions

At present, the sales from short sale occupies a very small ratio of the whole sales, but it should be noted that the career as an intermediate agent of short sale is the strength of the Company as well as the base of its competitive advantages. Also, the Company has transformed itself from an intermediate agent to a developer, which Mr. Hirano describes is “a result of necessity posed by the business environments rather than a business strategy.” This flexible administration, including his unique career in real estate business as a newcomer is an exquisite feature of the Company, as he says, “It is not the strongest that survives, but the only one who can change will survive.”

In the next 3 years, the Company will devote itself not to make a topline growth but to secure profits and profit margins in order to improve its balance sheet as its top priority. So, we should pay attention to what kind of projects it will implement for its significant growth in 4 years’ time, including the development projects in the Osaka area and “YANUSY.”

<Reference: Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with corporate auditors |

Directors | 6, including 2 outside directors |

Auditors | 4, including 4 outside directors |

◎ Corporate Governance Report

Updated: November 1, 2019

<Basic Concept>

Our Company has a basic policy on corporate governance which consist of the basic idea that we aim to maximize the profits for our shareholders and our corporate while contributing to the local community through our professional services in the real estate industry, and of the importance of compliance. Specifically, in order to ensure our thorough awareness of compliance, we have opened several arms in the company under the Companies Act while constructing an internal control and disclosure system that can respond flexibly to changes in the business environment and has a power to control the company, and we operate them appropriately. We are working to strengthen our corporate governance based on the idea that it is important to respect our shareholders’ rights, respond to the social trust, and achieve our sustainable growth and development.

<Key principles and reasons for not implementing them>

Its Corporate Governance Report states, “We have implemented all of the basic principles of the Corporate Governance Code as a company listed on the TSE Mothers.”

The purpose of this report is to provide information only and not for soliciting or promoting you to make investments. The information and opinions contained in this report are provided by our company based on data which are publicly available. The information in this report is based on the sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. We do not guarantee the accuracy, completeness or validity of the information and opinions, nor do we bear any responsibility for the same. All rights relating to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions shall be made by the responsibility of individuals with thorough consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |