Bridge Report:(3497)LeTech Second quarter of Fiscal Year July 2021

President Tetsuji Hirano | LeTech Corporation (3497) |

|

Corporate Information

Market | TSE Mothers |

Industry | Real estate |

President | Tetsuji Hirano |

HQ Address | 10F Nihon Seimei Umeda Building, 3-3 Doyamacho, Kita-ku, Osaka |

Year-end | July |

Homepage | https://letech-corp.net/ |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE Act. | Trading Unit | |

¥1,162 | 3,153,478 shares | ¥3,664 million | 2.6% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR (x) |

TBD | - | ¥45.54 | 25.5 x | ¥1,273.45 | 0.9 x |

* Share Price is the closing price on April 19,2021. Shares Outstanding, DPS and EPS are cited from the Company’s Financial Results for the second quarter of Fiscal Year ending July2021. ROE and BPS are the result of the previous fiscal year. Figures for Total Market Cap, PER, and PBR are rounded down.

Earnings Trend

Fiscal Year | Net sales | Operating Profit | Ordinary Profit | Net Profit | EPS | DPS |

July 2017 Act. | 14,846 | 1,392 | 704 | 475 | 237.76 | 0.00 |

July 2018 Act. | 19,263 | 1,885 | 861 | 584 | 292.03 | 0.00 |

July 2019 Act. | 23,727 | 2,318 | 1,118 | 694 | 259.74 | 5.00 |

July 2020 Act. | 26,703 | 1,780 | 624 | 100 | 33.07 | 6.00 |

July 2021 Est. | 26,643 | 1,209 | 290 | 141 | 45.54 | TBD |

*Unit: million yen. The estimated values are based on the forecasts made by the Company.

This Bridge Report outlines The Second quarter of Fiscal Year July 2021 earnings results and other information about LeTech Corporation.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of Fiscal Year July 2021 Earnings Results

3. Fiscal Year July 2021 Earnings Forecast

4. Future business strategy

5. Conclusions

<Reference: Corporate Governance>

Note: Hereinafter amounts cited from the Company’s disclosed information and those calculated by Investment Bridge Co., Ltd. based on the information are rounded down.

Key Points

- LeTech Corporation is an all-around real estate developer that provides optimal solutions for utilizing lands in a broad range of services from brokerage and consulting to purchase and development of real estate. With its strengths and specialties, such as “ability to make original proposals from a viewpoint of an all-around real estate developer” and “flexibility to adapt to changing business environments,” the Company is actively developing its businesses. In February 2021, the company was renamed “LeTech Corporation” with the aim of evolving into an OMO enterprise that fuses online and offline information based on its business foundation.

- The net sales for the second quarter of the term ending July 2021 were 11.9 billion yen, down 21.9% year on year. Sales dropped in both the real estate solution business and the real estate leasing business, which are the mainstays. Operating profit declined 21.4% year on year to 996 million yen, and ordinary profit decreased 20.7% year on year to 510 million yen. Gross profit margin rose 2.0 points thanks to the sale of profitable real estate, but gross profit decreased in the two businesses. SGA was reduced, but could not offset the drop in gross profit due to the drop in net sales. Quarterly net profit grew 535.5% year on year to 290 million yen. The company posted a cancellation penalty of 410 million yen as an extraordinary loss in the same period of the previous year, but not in the first half of this year.

- There is no revision to the earnings forecast for the term ending July 2021. It is estimated that net sales will be 26.6 billion yen, down 0.2% year on year, and operating profit will be 1.2 billion yen, down 32.1% year on year. As of the end of the first half, the results are reportedly almost in line with the forecast. The dividend is still to be determined.

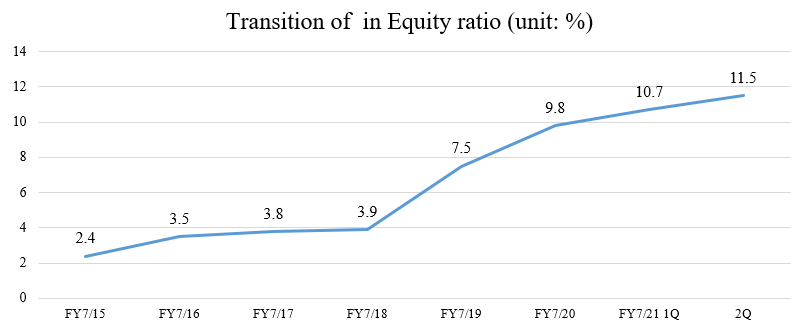

- As the company has concentrated on the fortification of its financial standing through mainly the sale of inventory assets (real estate for sale and real estate for sale in process), capital-to-asset ratio was 11.5% in the second quarter of the term ending July 2021, hitting a record high on a quarterly basis. As the company will pursue a good balance between procurement and capital-to-asset ratio, we would like to pay attention to how their efforts will be reflected in business results. In addition, we would like to keep an eye on the speed of their business expansion and how the company will concentrate on Real Estate Tech and evolve into an OMO enterprise, as indicated in the visions set when renaming the company.

1. Company Overview

LeTech Corporation is an all-around real estate developer that provides optimal solutions for utilizing lands in a broad range of services from brokerage and consulting to purchase and development of real estate. With its strengths and specialties, such as “ability to make original proposals from a viewpoint of an all-around real estate developer,” “hybrid business strategies suited for the respective business environments in Osaka and Tokyo,” “flexibility to adapt to changing business environments,” and “sincerity, meticulousness and speediness it has cultivated as an intermediate agent,” the Company is actively developing its businesses. The company was renamed “LeTech Corporation” with the aim of evolving into an OMO enterprise that fuses online and offline information based on its business foundation.

[1-1 History]

After graduating from university, Mr. Tetsuji Hirano (the President of LeTech Corporation) joined Tokyo Electron Limited. and Sumitomo Metal Industries, Ltd. where he was engaged in the sales of semiconductor manufacturing equipment, refining his business skills such as marketing technology. After that, he launched an advertising agency.

It was in the midst of the bubble burst when he had a hard time with his business and decided to engage in real estate brokerage business on referral from his friend.

Although he was a complete amateur, Mr. Hirano was attracted by the real estate industry which, different from sales of semiconductor manufacturing equipment, enabled him to handle all the procedures of business by himself from customer development to concluding business talks, including explanation of products, and he steadily built his career in the industry.

Under these circumstances, he started to handle a brokerage of a property for short sale (*).

It is necessary for a real estate company to have legal knowledge and experiences in order to mediate short sale successfully, but he made it with advices of a lawyer.

As there were few intermediate agents who dealt with a brokerage of properties for short sale in Osaka then, he took it as a big opportunity to further develop the business and proactively engaged in it with the more enhanced network with lawyers.

Backed up by the lawyers, he expanded his business by accumulating legal knowledge that other real estate agents do not have as his own unique know-how and established LEGAL CORPORATION in September 2000. The Company has established its firm position as an intermediate agent for short sale in Osaka.

The company was named “LEGAL” with an aim to be “a company that can propose “solutions” to its clients by correctly understanding laws, adjusting the interests related to real estate, and distributing real estate.”

In the wake of the Lehman shock in 2008, it was expected that bankruptcies of real estate companies would increase and the market for short sale would expand further. However, the SME Financing Facilitation Act, which allows for a moratorium under certain conditions, caused a rapid decline in bankruptcies, commercial failures, and properties for short sale, and consequently the Company’s performance was affected adversely.

In response to these surroundings, the Company, an intermediate agent, entered the development business by taking advantage of the fact that its balance sheet didn’t so worsen to receive loans from financial institutions.

Making use of its "ability to judge" and the ability of risk management based on the legal knowledge and know-how it has cultivated as an intermediate agent, the Company purchased, developed and sold excellent properties. Benefited by the bear market, the Company increased the number of handling properties and its business performance developed steadily. In addition to the brokerage business, the Company has successfully transformed itself into an all-around real estate developer that develops, sells and leases real estate in addition to brokerage.

In middle of expanding its business based in the Kansai steadily, the Company was listed on the Tokyo Stock Exchange Mothers in October 2018 in order to build a foundation for its sustainable growth.

In February 2021, the company was renamed “LeTech Corporation” with the aim of evolving into an OMO enterprise that fuses online and offline information based on its business foundation.

* Short sale

Short sale is a method to sell a real-estate property with an unpaid mortgage after its sale under an agreement with a financial institution if the owner of the property becomes insolvent and cannot pay borrowings including mortgage. In the case that a debtor cannot pay off the outstanding, a financial institution usually sells a collateral through "an auction" mandatorily and collects the loan out of the proceeds of the sale. However, since auctions have various disadvantages, some owners want to avoid auctions and short sale is one of methods to satisfy such needs by the owners.

Short sale has such advantages that “the property sells at prices close to market prices,” “the owner can sell it secretly,” and “the outstanding can be paid in installments.” But it requires the cooperation of owners and creditors (financial institution) as well as the real estate company that has abundant knowledge and experience of the sale.

[1-2 Corporate Philosophy]

As mentioned in the section of corporate history, the company started its business with brokerage and has responded to diversifying needs appropriately by taking full advantage of its characteristics, accurately grasping and evaluating each piece of real estate, and offering solutions for improving the value of each piece of real estate.

Meanwhile, ICT advanced rapidly, and the company changed its name with the hope of “determing which path to take and creating unique corporate activities under the founding ethos as LEGAL CORPORATION” and “diffusing the belief that the fusion of real estate and technology will cultivate future markets,” and decided to expand its business scale and improve its corporate value further.

In addition, the company will keep fostering win-win relationships with business partners and making efforts to become “an enterprise which provides those who have motivation with chances evenly,” and renewed its founding ethos, in order to clarify its social responsibility for actualizing a sustainable society.

(Old founding ethos)

1 | Infuse our real estate business with intelligence |

2 | Establish a product brand that customers will choose |

3 | Implement a totally results-based approach that respects employees’ drive to take on any challenge |

4 | Continue to have mutually beneficial relationships with our partners, and maintain our high creditworthiness |

(New founding ethos)

1 | To apply intelligence to real estate business by utilizing IT |

2 | To establish a product brand that will be selected by customers |

3 | To maintain win-win relationships with partners, and keep reliability high |

4 | To produce personnel who can endeavor to solve problems valiantly and voluntarily |

5 | To contribute to the realization of a sustainable society as a member of a local community |

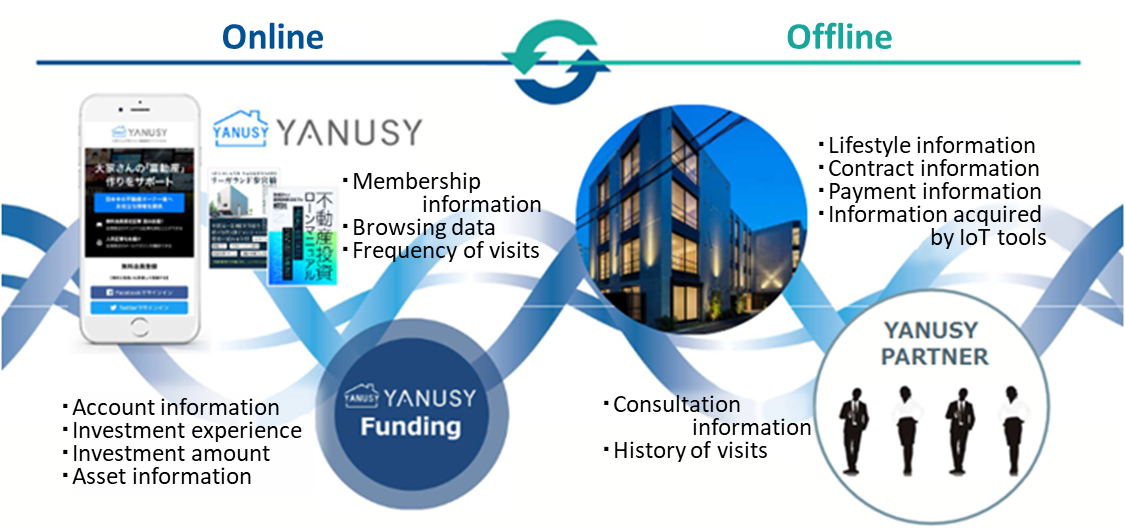

The company aims to become an OMO* enterprise by fusing the digital and the real and combining online and offline information.

*OMO

It stands for “Online Merges with Offline.” It is an idea of offering better experiences to customers by fusing online and offline channels from the viewpoint of customers rather than separating online and offline channels from the viewpoint of enterprises.

It differs considerably from O2O (Online to Offline), which is a measure of considering online and offline channels separately and then combining them for encouraging customers to purchase products from the viewpoint of enterprises, and omni-channels, as OMO fuses channels from the viewpoint of customers.

[1-3 Business Environments]

An overview of the surrounding environments for the Company, which is pursuing a further growth as an all-around real estate developer is as follows.

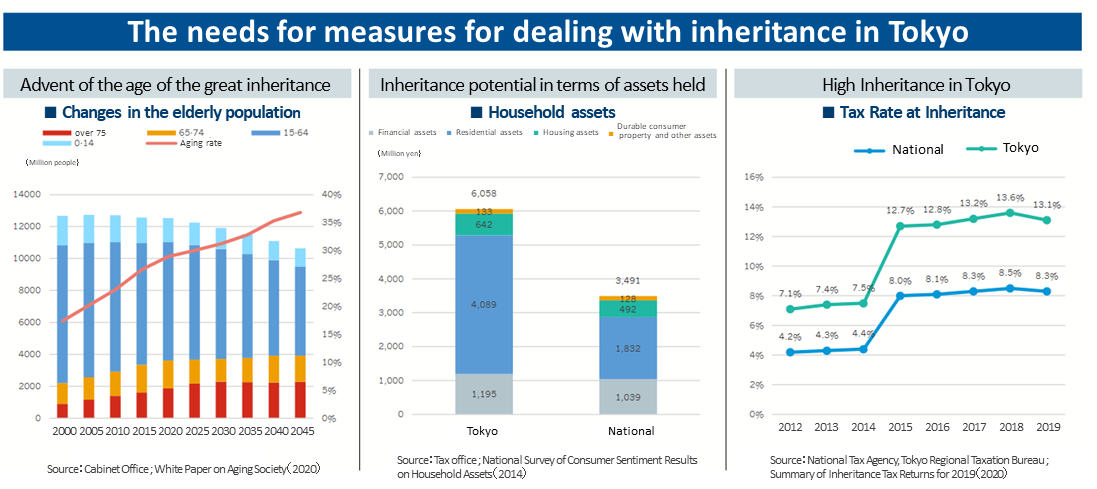

(1) Advent of the age of the great inheritance

Against the backdrop of the declining birthrate, the ratio of people aged 65 and over is expected to rise to over 35% by 2045.Also, over the next 10 years when the baby-boom generation turns 80 years old, there will be increasing needs to utilize real estate as a measure for inheritance. Particularly in Tokyo, where there are 2.05 million households with family members aged 65 or older, the percentage of owner-occupied houses is about 70% which exceeds the national average of about 50%.

In addition, the national average ratio of cases in which inheritance tax is actually imposed was 8.3% as of 2019, but that in Tokyo was 13.1%, much higher than the national average. Accordingly, the company expects that the needs for measures for dealing with inheritance will become more evident.

(Taken from the reference material of the company)

For assessment of inheritance tax, roadside land prices or assessments of fixed assets tax are used for lands while assessments of fixed assets tax are used for buildings. As for lands where a rent house is built (Land with Rent House), its assessment value can be deducted by 20% for the land and by 30% for the building respectively.

Under this system, when a rental condominium is purchased together with its land and, the assessment value of inheritance tax will be much lower than the purchase price, thus it will be possible for the owner to reduce the inheritance tax compared with the case when he inherits cash and deposits and pays the inheritance tax for them.

The Company is actively developing a brand of low-rise rental condominiums, “LEGALAND” as a powerful solution for inheritance problems mainly in Tokyo area for the coming era of the great inheritance.

(2) Real estate market in the Kansai region

Due to the novel coronavirus, the demand from foreign visitors to Japan nearly disappeared. As of now, it is impossible to predict when the pandemic will subside, but the number of foreign visitors to Japan is estimated to start increasing again in the medium/long term, as Japan will promote investment in integrated resort (IR) facilities and the Osaka-Kansai Japan Expo 2025 will be held.

The company will develop condominiums exclusively for private residence lease and hotels to meet the demand from foreign visitors to Japan, while monitoring the situation.

(3) Emergence of new needs

Through the diffusion of remote work in response to the novel coronavirus pandemic, the needs for housing are changing, shifting from urban areas to suburban areas and from condominiums to detached houses with gardens.

The advance of ICT, including AI, has affected the real estate industry to a significant degree, and increased the possibility of offering new added value to clients and users.

The company is strengthening the Real Estate Tech domain, while developing various styles of real estate as a general real estate developer.

[1-4 Business Profile]

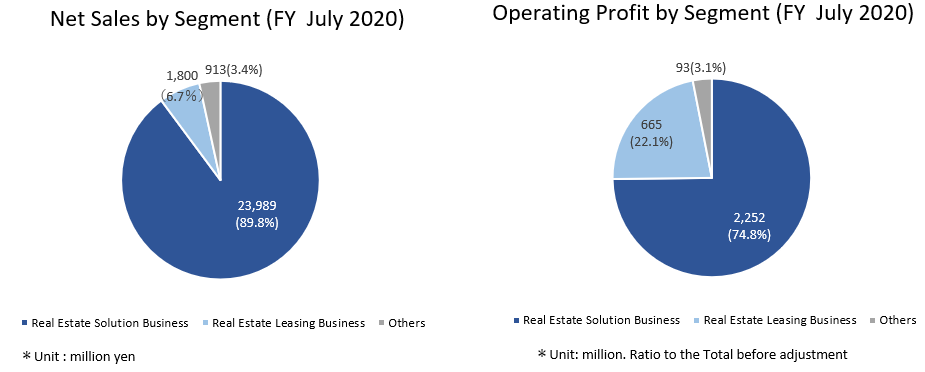

The Company’s business consists of 3 segments; "Real Estate Solution Business," "Real Estate Leasing Business" and "Other Business."

(1) Real Estate Solution Business

The Company purchases real estate properties based on a variety of sources, gets the properties to be the most suitable measures, depending on the contracts to improve their values such as “improvement of buildings management conditions,” “change of use,” “replacement of tenants” and “major repairs” and then sells them mainly to wealthy individuals and corporations which seek to own assets, meeting their respective needs.

It handles properties with a wide range of objectives, including housing development, commercial development, effective utilization of lands, hotels and minpaku, and improvement of values of pre-owned properties, regardless of their genres.

(Taken from the reference material of the company)

◎ The core product “LEGALAND”

"LEGALAND" is a brand of compact low-rise rental condominiums for single persons and small families developed mainly in Tokyo area. Their land area is about 30 to 200 tsubo and their sales price varies 300 to 500 million yen. Sales yields (actual) are 4 to 6%. The company sells apartment buildings to wealthy people and asset management companies.

The designs and structures of the apartments are based on the company’s know-how of planning and development, so they can be built in areas where there exist height limits for nearby apartments and detached houses (areas exclusively for type-1 and type-2 low-rise housing) and narrow land. In addition, the company strives to maximize revenues from rents by constructing underground floors, doing away with elevators, beams, pillars, etc. to reduce maintenance costs, and maximizing the number of rooms and floor areas.

The brand features a high-class appearance that is favored by wealthy individuals to definitely meets their needs as a product to solve inheritance problems.

(Taken from the reference material of the company)

(2) Real Estate Leasing Business

The Company actively owns high-profit properties regardless of areas or type of properties to secure profit gain.

It also engages in a facility management business to connect real estate management companies and tenants in better approaches and support their building management. In the business the Company specializes in repairs and restorations of condominium buildings. Under the theme of increasing rents and improving occupancy rates, it carries out such work as attending a relocation when a tenant leaves the property, restoration work, renovation work, repair work and others.

(Taken from the reference material of the company)

(3) Other Business

①Real Estate Consulting Business

This is the original business of the Company. Since its foundation, the Company has proposed such solutions as brokering and consulting on short sale for civil suits and extending loans from financial institutions.

As a real estate expert, it provides services tailored to the needs of its clients, ranging from brokering buyers to debtors, negotiating with relevant parties, contacting holders of rights of separate satisfaction, preparing distribution plans, investigating real estate, assessing prices, transferring rights, leasing, bidding to purchasing the properties by itself and others.

Utilizing its know-how on the real estate consulting it has accumulated, the Company proposes its clients’ solutions for various situations other than legal case resolution.

②Nursing Care Business

The Company engages in Nursing Care Business by providing, operating and managing fee-based homes for the elderly, housings with services for the elderly and group homes, providing supports for prevention of the long-term care according to the Long-term Care Insurance Act, as well as providing nursing care dealing with the in-home and long-term care support services.

(Taken from the reference material of the company)

[1-5 Features and Strengths]

(1) An ability to make original proposals from a viewpoint of an all-around real estate developer in order to maximize and optimize the value of real estate regardless of its region, use, or size.

It has a wide lineup of products and services including condominiums, effective use of lands, increase of values of pre-owned properties, office buildings, condominiums for minpaku, hotels, etc., and its strength lies in the ability to make original proposals to maximize and optimize the value of real estate according to needs of the parties involved, regardless of the area, use or size of the properties.

The ability is based on its flexible and quick planning and development capabilities, utilizing its problem-solving competencies based on legal knowledge it has cultivated through the business of short sale. It also has a unique and competitive advantage coming from the company, which has grown from a real estate company specializing in brokerage to an all-around real estate developer.

(2) Hybrid business strategies corresponding to the business environments in Osaka and Tokyo respectively

The market trend and the stances of consumers and investors are very different between Tokyo and Osaka. It is unlikely that the strategy that worked well in Osaka will also work well in Tokyo. Considering that it is necessary to design and execute different business strategies for the business environments in Tokyo and Osaka, the company has produced good results steadily in both areas.

(3) Flexibility to adapt itself to changing business environments

The Company has evolved from a real estate company specializing in brokerage to a real estate developer despite the unfavorable circumstances of the decreasing number of bankruptcies and properties for short sale. It is never satisfied with the status quo and believes that it is essential for it to go ahead of the changing business environments and flexibly change itself to create a new market for its sustainable growth.

The Company focuses on flexible management, looking ahead 5 to 10 years while forging solid footing in various fields such as business strategies, organizational operation and personnel affairs.

(4) Sincerity, meticulousness and speediness the Company has cultivated as an intermediate agent

The Company emphasizes sincerity, meticulousness and speediness it has cultivated as an intermediate agent for short sale that requires the cooperation of owners of properties and creditors (financial institutions), and the financial institutions, business partners and other related parties evaluate this attitude highly.Its career and history as an intermediate agent together with its ability to make original proposals mentioned in (1) are a source of its competitive advantage against other real estate agencies.

【1-6 System for shareholder benefits】

For the purpose of making the shares of the company more attractive, the company adopted “LeTech Premium Benefit Club.”

The company gives points to receive shareholder benefits to shareholders who hold 2 lots (200 shares) or more according to the number of shares they hold. With the given points, shareholders can choose any products from over 2000 items posted on the special website, including rice, brand beef, beverages, prestigious alcoholic beverages, and home appliances. The company also holds events for shareholders, etc.

For details, please see the website of the company.

https://legal-corp.premium-yutaiclub.jp/program/

2. Second quarter of Fiscal Year July 2021 Earnings Results

①Business Results

| FY 7/20 2Q | Ratio to Net sales | FY 7/21 2Q | Ratio to Net sales | YoY |

Net sales | 15,298 | 100.0% | 11,943 | 100.0% | -21.9% |

Gross profit | 2,948 | 19.3% | 2,542 | 21.3% | -13.7% |

SG&A | 1,680 | 11.0% | 1,546 | 12.9% | -8.0% |

Operating Profit | 1,267 | 8.3% | 996 | 8.3% | -21.4% |

Ordinary Profit | 643 | 4.2% | 510 | 4.3% | -20.7% |

Net Profit | 45 | 0.3% | 290 | 2.4% | + 535.5% |

*Unit: million yen.

Both sales and profits decreased.

Net sales decreased 21.9% to 11.9 billion yen year on year. Sales dropped in both the real estate solution business and the real estate leasing business, which are the mainstays. Operating profit declined 21.4% year on year to 996 million yen, and ordinary profit decreased 20.7% year on year to 510 million yen. Gross profit margin rose 2.0 points thanks to the sale of profitable real estate, but gross profit decreased in the two businesses. SGA was reduced, but could not offset the drop in gross profit due to the drop in net sales. Quarterly net profit grew 535.5% year on year to 290 million yen. The company posted a cancellation penalty of 410 million yen as an extraordinary loss in the same period of the previous year, but not in the first half of this year.

②Earnings by Segment

| FY 7/20 2Q | Composition ratio | FY 7/21 2Q | Composition ratio | YoY |

Real Estate Solution Business | 13,903 | 90.9% | 10,755 | 90.1% | -22.6% |

Real Estate Leasing Business | 956 | 6.3% | 676 | 5.7% | -29.2% |

Other | 439 | 2.9% | 510 | 4.3% | + 16.3% |

Net sales Total | 15,298 | 100.0% | 11,943 | 100.0% | -21.9% |

Real Estate Solution Business | 1,455 | 10.5% | 1,466 | 13.6% | + 0.7% |

Real Estate Leasing Business | 379 | 39.7% | 150 | 22.2% | -60.5% |

Other | 53 | 12.2% | 39 | 7.8% | -25.8% |

Adjustment | -620 | - | -659 | - | - |

Segment profit Total | 1,267 | 8.3% | 996 | 8.3% | -21.4% |

*Unit: million yen. Ratio of Operating Profit comprises is Net sales’ operating profit margin.

◎Real Estate Solution Business

Sales dropped, but profit was unchanged from the previous year.

Sales declined due to the recoil from large-scale sale transactions in the previous term, but the company secured profit by selling profitable real estate.

◎Real Estate Leasing Business

Sales and profit decreased.

Occupancy rate remains stable, but the company sold real estate for sale while considering the balance with long-term revenues, decreasing the sales and profit from this business. It was also affected by the shrinkage of demand for private residence lease caused by the decrease of foreign visitors in the novel coronavirus pandemic.

◎Other Business

Sales grew, but profit declined.

The occupancy rate in the nursing care business remained high, but the real estate consulting business saw decreases in short sale transactions and brokerage commissions.

③ Financial Conditions and Cash Flows

◎Main BS

| End of July 2020 | End of Jan. 2021 |

| End of July 2020 | End of Jan. 2021 |

Current assets | 33,795 | 31,079 | Current liabilities | 20,839 | 20,392 |

Cash and deposits | 1,982 | 1,758 | Short-term interest-bearing liabilities | 19,182 | 17,041 |

Real estate for sale | 10,939 | 16,948 | Non-current liabilities | 16,130 | 12,687 |

Real estate for sale in process | 20,006 | 10,882 | Long-term interest-bearing liabilities | 15,816 | 12,475 |

Non-current assets | 7,186 | 6,284 | Total Liabilities | 36,969 | 33,080 |

Property, plant and equipment | 6,417 | 5,439 | Net assets | 4,012 | 4,284 |

Investments and other assets | 733 | 811 | Total Liabilities and Net assets | 40,981 | 37,364 |

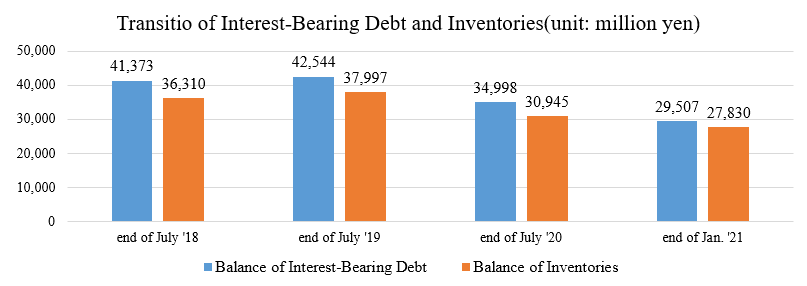

Total Assets | 40,981 | 37,364 | Total Interest-bearing liabilities | 34,998 | 29,516 |

*Unit: million yen. Interest-bearing liabilities includes Lease obligations.

Total assets shrank 3.6 billion yen from the end of the previous term, due to the decrease of inventory (real estate for sale and real estate for sale in process).

As interest-bearing liabilities decreased 5.4 billion yen, total liabilities declined 3.8 billion yen from the end of the previous term. Net assets increased 200 million yen, due to the rise in retained earnings, etc.

Capital-to-asset ratio rose 1.7% from the end of the previous term to 11.5%.

◎Cash Flow

| FY 7/20 2Q | FY 7/21 2Q | Increase/decrease |

Operating Cash Flow | 6,916 | 5,386 | -1,529 |

Investing Cash Flow | -1,280 | -88 | +1,191 |

Free Cash Flow | 5,636 | 5,297 | -338 |

Financing Cash Flow | -4,510 | -5,495 | -984 |

Cash and equivalents | 1,615 | 1,442 | -173 |

*Unit: million yen.

Pretax net profit grew, but the surpluses of operating CF and free CF shrank. The cash position declined.

3. Fiscal Year July 2021 Earnings Forecast

➀Earnings forecasts

| FY 7/20 | Ratio to Net sales | FY 7/21(Est.) | Ratio to Net sales | YoY |

Net sales | 26,703 | 100.0% | 26,643 | 100.0% | -0.2% |

Operating profit | 1,780 | 6.7% | 1,209 | 4.5% | -32.1% |

Ordinary profit | 624 | 2.3% | 290 | 1.1% | -53.5% |

Net Profit | 100 | 0.4% | 141 | 0.5% | +40.9% |

*Unit: million yen.

There is no revision to the earnings forecast. Net sales are on a par with the previous fiscal year, and operation profit will decrease.

It is estimated that net sales will be 26.6 billion yen, down 0.2% year on year, and operating profit will be 1.2 billion yen, down 32.1% year on year. As of the end of the first half, the results are reportedly almost in line with the forecast. The dividend is still to be determined.

4. Future business strategy

The future business strategies as “LeTech Corporation” are as follows.

(1) Recognition of the business environment

The novel coronavirus pandemic is considered to have affected the Japanese economy and the lives of people as follows in respective time spans.

(Short-term effects)

* Nationwide self-restraint in a state of emergency

* Stagnation of economic activities around Japan

* Popularization of telework

* Changes in ways of living and working

(Mid/long-term effects)

* Commencement of new businesses and services

* The Japanese real estate market attracting attention

* Change in housing needs (a shift from urban areas to suburban areas and a shift from condominiums to detached houses with gardens)

* Spread of Real Estate Tech (DX of real estate transactions [trade and lease])

In the medium/long term, the real estate industry is estimated to change considerably, so the company will meet new demand without fail and create business opportunities.

(2) Business domain

The company operates the “legal solution business,” which is a real estate consulting business utilizing legal knowledge, the “YANUSY business,” which is a real estate tech business fusing realty and technology, and “other business.”

(3) Business strategy

The future strategies for sustainable growth are as follows.

* To foster relationships with investment firms inside and outside Japan, which will become stable large-scale buyers of real estate for sale, including LEGALAND

* To actualize a variety of real estate transactions with “YANUSY,” a platform fusing realty and IT

* To increase real estate transactions inside and outside Japan through global business expansion

(Concrete initiatives)

◎ “LEGALAND,” a low-rise apartment series

As mentioned above, the company will actively build apartment buildings as products for dealing with inheritance mainly in Tokyo.

Also in Osaka, the company is developing apartments in land whose value will be maintained.

As of January 2021, the company had 80 pieces of real estate in Tokyo, 4 pieces of real estate in Hyogo, and 2 pieces of real estate in Osaka, including those under development.

◎ Stable sales of owned real estate

The company will continuously sell multiple pieces of real estate, mainly LEGALAND, to investment firms inside and outside Japan.

The company will seek new large-scale buyers, targeting investment firms inside and outside Japan.

The company is also thinking of selling owned real estate other than LEGALAND.

◎ Real Estate Tech initiatives

In July 2019 the Company launched a joint venture with ZUU Co., Ltd. (4387, TSE Mothers) in the real estate technology field with an aim to explore a future market by combining real estate and IT.

It is aiming to provide new values by combining its capabilities to develop new products in the real estate industry and its know-how in providing services to owners with ZUU’s know-how on data marketing which it has acquired through its WEB service operations, including "ZUU online" that has 4 million monthly users.

Through the joint business development and joint research in the field of Real Estate Tech and the utilization of highly specialized information and know-how on real estate as valuable online contents to offer, the Company aims to build a brand-new real estate platform.

As their first joint venture, they released a WEB media "YANUSY" for real estate owners.

“YANUSY” is a web media that provides useful information to real estate owners throughout Japan and supports them to create “rich real estate (a new type of real estate assets that secures them revenue).”

It has grown to Japan’s largest platform for real estate owners with 500,000 pageviews per month, about 350,000 visitors per month, and 5,000 member owners as of December 2020.

The web media sets 5 categories of theme “Assets Management,” “Real Estate Investment,” “Leasing Management,” “Taxes,” and “Trends” and utilizes the information as its unique contents from its original editorial viewpoint to provide them to readers as valuable information.

(Taken from the reference material of the company)

The web media has readers who are mainly in their 30s to 60s since its launch by providing its original content such as “eBooks” for download by its members.

With the aim of improving the transparency of Japanese real estate market information and stirring the demand from foreign clients, the company released the English version in October 2019 and adopted an AI-based content production system in March 2020.

They will develop its concrete monetization methods including a membership fee by watching the future trend.

(4) Ideal state

As mentioned above, the company aims to become an OMO enterprise fusing online and offline information with YANUSY being a platform.

(Taken from the reference material of the company)

(5) Strengthening the Management Base

In order to realize the growth strategy, the Company believes it is necessary for it to strengthen the following infrastructure construction of management bases:

* | To move up to the First Section of the Tokyo Stock Exchange |

* | To secure and develop excellent human resources |

* | To further strengthen its internal management systems |

* | To further strengthen its compliance system |

* | To strengthen its purchase and sales capabilities |

* | To increase its stable earnings by focusing on stocks |

* | To expand and stabilize its business through diversification of services (i.e. improvement of lineups of real estate products) |

* | To improve its balance sheet |

As for the improvement of its balance sheet particularly, the Company has set Equity Ratio as an important management index and will examine and carry out any possible measures to improve it to reach more than 20% as soon as possible.

5. Conclusions

As the company has concentrated on the fortification of its financial standing through mainly the sale of inventory assets (real estate for sale and real estate for sale in process), capital-to-asset ratio was 11.5% in the second quarter of the term ending July 2021, hitting a record high on a quarterly basis. As the company will pursue a good balance between procurement and capital-to-asset ratio, we would like to pay attention to how their efforts will be reflected in business results. In addition, we would like to keep an eye on the speed of their business expansion and how the company will concentrate on Real Estate Tech and evolve into an OMO enterprise, as indicated in the visions set when renaming the company.

<Reference: Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with corporate auditors |

Directors | 6, including 2 outside directors |

Auditors | 4, including 4 outside directors |

◎ Corporate Governance Report

Updated: November 6, 2020

<Basic Concept>

Our Company has a basic policy on corporate governance which consist of the basic idea that we aim to maximize the profits for our shareholders and our corporate while contributing to the local community through our professional services in the real estate industry, and of the importance of compliance. Specifically, in order to ensure our thorough awareness of compliance, we have opened several arms in the company under the Companies Act while constructing an internal control and disclosure system that can respond flexibly to changes in the business environment and has a power to control the company, and we operate them appropriately. We are working to strengthen our corporate governance based on the idea that it is important to respect our shareholders’ rights, respond to the social trust, and achieve our sustainable growth and development.

<Key principles and reasons for not implementing them>

Its Corporate Governance Report states, “We have implemented all of the basic principles of the Corporate Governance Code as a company listed on the TSE Mothers.”

The purpose of this report is to provide information only and not for soliciting or promoting you to make investments. The information and opinions contained in this report are provided by our company based on data which are publicly available. The information in this report is based on the sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. We do not guarantee the accuracy, completeness or validity of the information and opinions, nor do we bear any responsibility for the same. All rights relating to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions shall be made by the responsibility of individuals with thorough consideration. Copyright (C) Investment Bridge Co., Ltd. All Rights Reserved. |