Bridge Report:(3538)WILLPLUS Fiscal Year ended June 2022

President Takaaki Naruse | WILLPLUS Holdings Corporation (3538) |

|

Company Information

Market | TSE Prime |

Industry | Retail (Commercial) |

President | Takaaki Naruse |

HQ Address | 5-13-15, Shiba, Minato-ku, Tokyo |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

¥1,109 | 9,951,200 shares | ¥11,035 million | 19.0% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥41.17 | 3.7% | ¥183.00 | 6.1 x | 923.02 yen | 1.2 x |

* The share price is the closing price on September 22. All figures were taken from the brief financial report for FY 6/22.

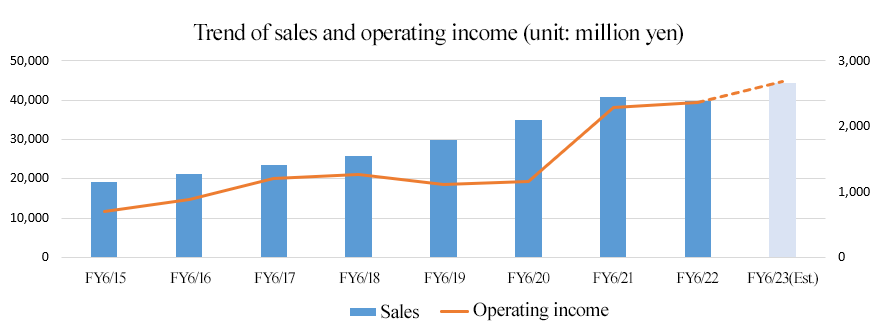

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

June 2019 Act. | 29,860 | 1,118 | 1,115 | 730 | 78.36 | 13.80 |

June 2020 Act. | 35,068 | 1,160 | 1,196 | 802 | 85.32 | 14.00 |

June 2021 Act. | 40,776 | 2,290 | 2,301 | 1,533 | 161.47 | 28.26 |

June 2022 Act. | 39,696 | 2,366 | 2,377 | 1,550 | 162.84 | 34.90 |

June 2023 Est. | 44,363 | 2,687 | 2,686 | 1,750 | 183.00 | 41.17 |

*Unit: million yen or yen. Estimates are those of the company.

This report includes Willplus Holdings Corporation's company profile, medium- to long-term strategies, performance trends, and an interview with President Naruse.

Table of Contents

Key Points

1. Company Overview

2. Mid- to Long-Term Strategy

3. Growth Strategy

4. Fiscal Year ended June 2022 Earnings Results

5. Fiscal Year ending June 2023 Earnings Forecasts

6. Interview with President Naruse

7. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

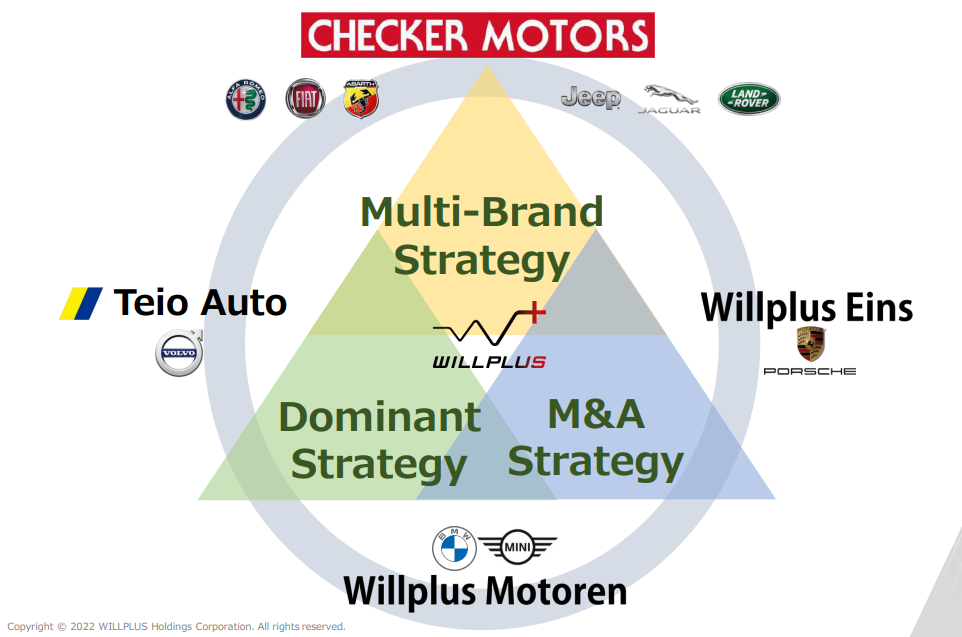

- Willplus Holdings Corporation is a holding company with four consolidated subsidiaries that operate dealers handling ten brands of imported cars, including Jeep, BMW, Mini, and Volvo. It focuses on improving customer satisfaction and pursues growth through a multi-brand strategy, a dominant strategy, and an M&A strategy. It has a significant advantage in business revitalization capabilities in the M&A field. The company aims for further growth, taking the major environmental changes surrounding automobiles, including the shift to EVs, as an opportunity.

- The company formulated and announced a new medium- to long-term strategy, while companies are currently required to enhance their social significance and efforts to improve their corporate value to solve social issues. It aims to achieve both the enhancement of social value and corporate value. In other words, the company aspires to realize solutions to social issues and corporate growth simultaneously. Specifically, the company views solving climate change issues as an opportunity and M&A as a way to acquire new areas and new brands to expand the business actively. Furthermore, the company is committed to the maximization of business, making shops environmentally friendly, and continuing to pursue the ultimate reduction of GHG emissions.

- The company launched a new proactive shareholder return policy. The company aims for an ROE of 15% or higher over the medium to long term. Thus, it will gradually raise the dividend payout ratio to 30% by the fiscal year 2026 to maintain appropriate capital and further expand shareholder returns. From fiscal 2027 onward, the company will strive to maintain and improve stable and continuous profit returns, with a dividend payout ratio of 30% as its dividend policy and a lower limit of DOE of 4.5%.

- For the term ending June 2023, sales are expected to increase 11.8% year on year to 44,363 million yen, and operating income is projected to rise 13.6% year on year to 2,687 million yen. Due to the recovery of new car sales, sales and profit are expected to grow by double digits. Also, sales are forecast to reach a record high for the first time in two terms, and operating income is expected to hit a record high for three consecutive terms.

- We asked President Takaaki Naruse about the social significance of Willplus Holdings, his own mission, M&A strategy, and message to shareholders and investors. He expressed during the interview that "we want to create a company that customers, manufacturers, and society choose in the medium and long term, and where employees are happy. We will also contribute by returning profits to our shareholders, who are our important stakeholders. We will steadily implement the medium- to long-term strategy announced this time, achieve our goals, and work to maximize both our social value and corporate value. Please stay tuned to our company's achievements."

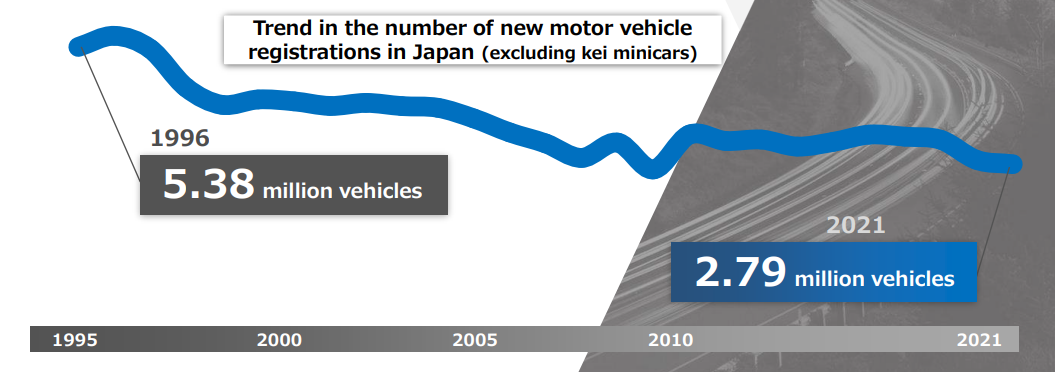

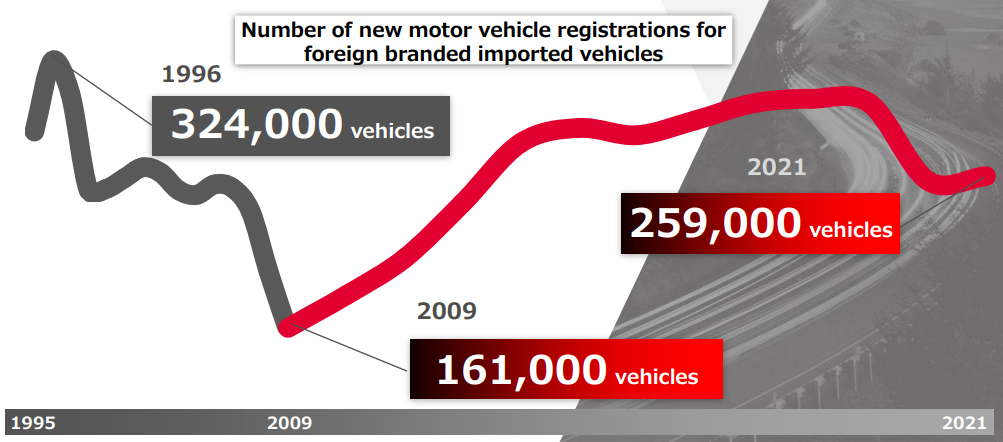

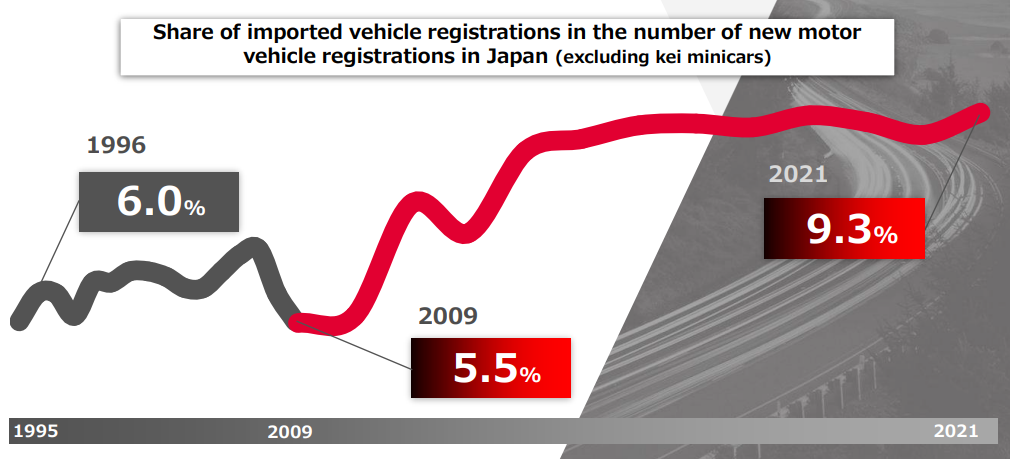

- The number of new car registrations in Japan has been declining for a long period of time. The reasons behind this decline include the declining birthrate, the aging population, the longer car ownership period due to improved performance, young people's disinterest in cars, and the expansion of sharing services. However, regarding imported cars, the number of new car registrations has been on the rise since the global financial crisis in 2008 (due to the bankruptcy of Lehman Brothers), and the market is by no means shrinking. For the same reason, vehicle maintenance will inevitably shrink in Japan as a whole. Yet, imported cars have plenty of room for growth. Thus, it can be viewed as a business where stable growth can be expected, especially for the company, which is further expanding its market share through M&A.

- Exhaust gas from automobiles is one of the leading causes of environmental problems. Thus, we would like to pay attention to the progress of all of the company's measures to create environmentally friendly shops to solve environmental issues through automobile sales and also improve corporate value.

1. Company Overview

Willplus Holdings Corporation is a holding company with four consolidated subsidiaries that operate dealers handling ten brands of imported cars, including Jeep, BMW, Mini, and Volvo. It focuses on improving customer satisfaction and pursues growth through a multi-brand strategy, a dominant strategy, and an M&A strategy. It has a significant advantage in business revitalization capabilities in the M&A field. The company aims for further growth, taking the major environmental changes surrounding automobiles, including the shift to EVs, as an opportunity.

[1-1 Corporate History]

In January 1997, the father of President Takaaki Naruse established Sunflower CJ Co., Ltd., an imported car sales company, in Kitakyushu City, Fukuoka Prefecture. The company was the first official Chrysler dealer in western Japan.

In October 2004, President Naruse acquired all of the company's shares and started business activities as the Willplus Group.

Although it was a small dealer with a few staff members, including President Naruse, it achieved excellent results nationwide in sales of Chrysler cars and received high acclaim, which led him in 2005 to take over Chrysler's directly managed store in Ohta-ku, Tokyo, and advance to Tokyo. In 2006, the company opened a store in Kurume City, Fukuoka Prefecture. It also started a dominant strategy in Tokyo and Fukuoka.

Willplus Holdings Corporation was established in October 2007 to flexibly acquire dealers through optimal allocation of management resources and prompt management decision-making.

Under the holding company structure, the company actively expanded its business scope and was listed on the JASDAQ of the Tokyo Stock Exchange in March 2016. In September 2017, as the market changed, it shifted to the Second Section of the Tokyo Stock Exchange, and then it was listed on the First Section of the Tokyo Stock Exchange in February 2018.

In April 2022, it got listed on the Prime Market of the Tokyo Stock Exchange due to market restructuring.

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

[1-2 Corporate Philosophy]

In this section, we state the company's significance and core values.

Our Significance (MISSION STATEMENT)

We propose a life with imported cars, share affluence, fun, and joy with more people, and continue to take on the challenge of drawing warm smiles on the face of everyone involved. |

Core Values ・Love our cars, love our colleagues, and work with pride. ・Always take on challenges and break through our limits. ・Achieve great results through teamwork. ・Make sure we reach our goal on time. ・Never give up until the end, and do our best. ・Provide richness, enjoyment, and joy. ・Never forget to be sincere and grateful. |

[1-3 Business Environment]

The business environment, which is essential in understanding the company, is as follows.

Regarding the business environment related to the M&A strategy, which is the company's growth driver, see “2. Medium- to long-term strategy”.

◎ The share of imported cars in the domestic passenger car market continues to increase, and the number of imported cars owned in Japan is growing steadily.

The domestic automobile market is shrinking due to factors such as the declining birthrate, the aging population, the longer vehicle ownership due to improved performance, and changes in consumption styles and preferences (= so-called "disinterest in cars" among young people).

(From the reference material of the company)

Under such circumstances, the number of new imported car registrations has increased since the financial crisis in 2008 (due to the Lehman Brothers' bankruptcy), and the imported car market in Japan continues to expand. The share of imported cars in the domestic passenger car market (excluding minicars) is in the 9% range, and the six-year average growth rate of domestic ownership (as of 2021) is 0.35% for passenger cars (including minicars). On the other hand, the ownership of imported cars (passenger cars) increased steadily by 3.54%.

|

|

(From the reference material of the company)

Imported car manufacturers are releasing a large number of attractive products such as hybrid vehicles, EVs (electric vehicles), PHVs (plug-in hybrid vehicles), diesel vehicles, and various other eco-friendly technologies, as well as unique and excellent designs.

In addition, in this shrinking market, domestic manufacturers have concentrated their energy for development and sales on popular models such as minivans and wagons, resulting in a biased lineup. On the other hand, imported car manufacturers have a diverse lineup with a wide range of prices, sizes, models, and types. Thus, they have won the support of users who seek diversity and more attractive cars. Moreover, active investment in Japan, such as establishing and expanding sales networks, has also increased the imported car manufacturers' market share.

◎ Comparison with other companies in the same industry

Code | Company | Sales | Sales growth rate | Operating income | Profit growth rate | Operating income margin | ROE | Market Capitalization | PER | PBR |

3184 | ICDA HLD | 28,100 | -1.2 | 1,173 | -23.9 | 4.2% | 13.9 | 5,166 | 6.6 | 0.7 |

3538 | Willplus HLD | 44,363 | +11.8 | 2,687 | +13.6 | 6.1% | 19.0 | 11,035 | 6.1 | 1.2 |

7593 | VT HLD | 253,000 | +6.3 | 11,000 | +7.9 | 4.3% | 25.5 | 59,451 | 8.8 | 1.1 |

8291 | Nissan Tokyo Sales HLD | 140,000 | +1.2 | 4,500 | +2.1 | 3.2% | 4.6 | 18,657 | 8.4 | 0.4 |

9856 | KU HLD | 125,000 | -4.7 | 7,800 | -6.0 | 6.2% | 11.4 | 51,406 | 7.4 | 0.7 |

* Units: million yen and %. Sales and operating income are company forecasts for this term. ROE is the result of the previous term. Market capitalization is the number of shares at the end of the most recent quarter × the closing price on September 22, 2022. PER (forecasted figures) and PBR (actual figures) are based on the closing price on September 22, 2022.

The company is the only company that expects double-digit sales and profit growth. If the market highly evaluates the company's high business revitalization capabilities through M&A, raising its dividend payout ratio to 30%, and an aggressive shareholder return policy aiming for dividend growth that exceeds profit growth, the valuation level will likely change.

[1-4 Business Description]

◎Overview

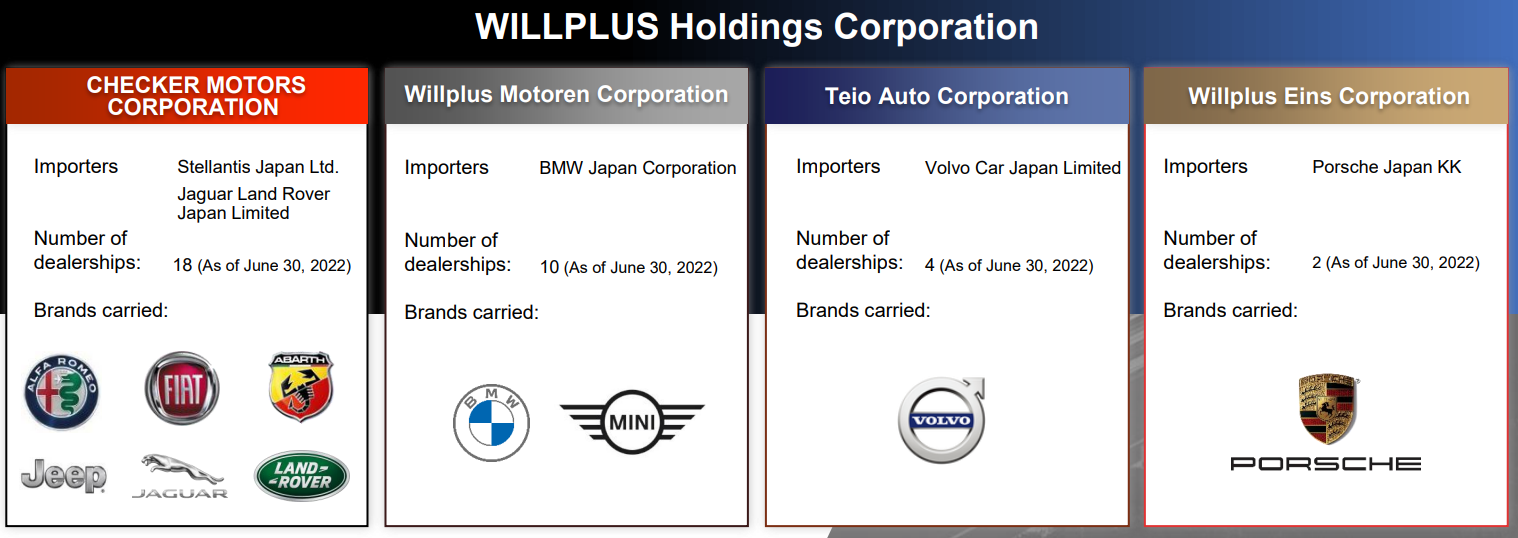

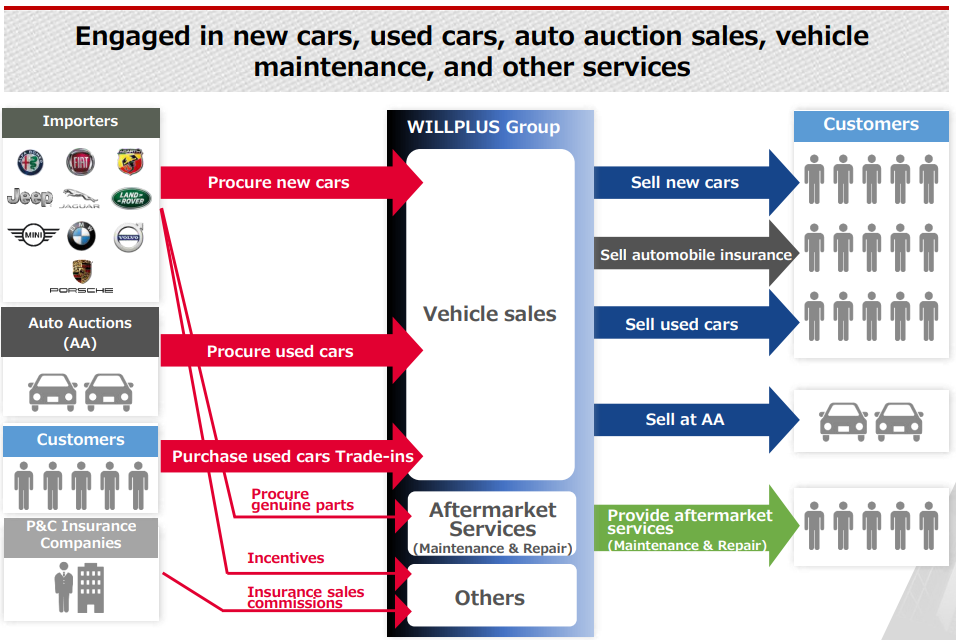

Under the holding company Willplus Holdings Corporation, four consolidated subsidiaries engage in sales of imported new and used cars, vehicle maintenance, and non-life insurance agency business. The company handles ten brands. The company has an official dealer contract with an importer (a company that handles imported cars in Japan) for each brand it handles.

(From the reference material of the company)

◎ Products and services (business description)

In addition to selling new and used cars, the company handles vehicle maintenance and non-life insurance sales.

(From the reference material of the company)

Products and Services | Description |

|

New cars | As authorized dealers, the companies sell all new car brands procured from each importer. | |

Used cars | It mainly sells certified used cars of recent models of each brand with a short travel distance. Products are purchased through trade-ins at the time of selling new cars, purchases, and automobile auctions. | |

Sales | It sells trade-in used cars of other brands at automobile auctions. In addition, at the request of dealers of other companies, it may sell new and used vehicles owned by the corporate group. | |

Vehicle maintenance | The main services are maintenance, repair, and inspection of the sold vehicles. With the exception of some stores, service centers are set up alongside showrooms. | |

Others | It sells compulsory automobile liability insurance and voluntary insurance as an agent for non-life insurance companies. Incentive income related to new car sales from importers is also included. |

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

Although the sale of new cars is the main business, the company is focusing on the sale of used cars and strengthening customer relationships by providing services that customers need after purchasing a car, such as vehicle maintenance and car insurance sales.

Regarding vehicle maintenance, maintenance packages are provided to ensure maintenance after sale. As for insurance sales, the provision of detailed information on insurance products has been highly evaluated, and the enrollment and retention rates are higher than the industry average.

In this way, “the increase in sales quantity = expansion of retailer business model earnings” leads to the expansion of recurring revenues through the increase in the number of vehicle maintenance and insurance purchases.

◎ Number of stores

As of the end of June 2022, the number of stores is 15 in Fukuoka, 15 in Tokyo and Kanagawa, 2 in Yamaguchi, 1 in Miyagi, and 1 in Fukushima, for a total of 34 stores.

[1-5 Characteristics, Strengths, and Competitive Advantages]

(1) Ability to revitalize business through M&A

From the perspective of "purchasing time," many companies currently use M&A strategies as a pillar of their growth strategies. It goes without saying that finding excellent deals and executing them at appropriate prices are essential for a successful M&A. However, the post-M&A process called PMI (Post Merger Integration) to create the expected synergy effect is seen as more important.

There are countless cases of M&A failing due to a lack of prior assessment of factors that impede integration and the inability to manage differences in corporate culture.

Under such circumstances, investors should pay attention to the company's business revitalization ability.

Since the establishment of Willplus Holdings in October 2007, the company has carried out nine M&A deals to date. At the time of acquisition, the companies were in the red or had extremely low profits, but Willplus Holdings achieved profitability in all projects.

The key to a successful M&A is sharing philosophies, such as pursuing the improvement of customer satisfaction and clarifying the evaluation criteria, which includes respecting challenges to the maximum extent possible. The company believes these key factors can drastically change companies and has great confidence in its ability to revitalize its business.

(2) The only listed company whose main business is being an authorized dealer of imported cars

While there are many companies that are authorized dealers of imported cars while mainly relying on selling used cars, the company is the only listed company that mainly sells new cars.

The number of new imported car registrations has been on the rise since the financial crisis in 2008 (due to the Lehman Brothers' bankruptcy), and the imported car market in Japan continues to expand. The share of imported cars in the domestic passenger car market (excluding minicars) is in the 9% range, and the six-year average growth rate (as of 2021) of passenger car ownership (including minicars) in Japan is 0.35%. On the other hand, the ownership of imported cars (passenger cars) increased steadily by 3.54%.

As the market itself continues to grow, further expansion of earnings is expected by expanding the market share through M&A strategies.

2. Mid- to Long-Term Strategy

While today’s companies are required to improve their social significance and corporate value to solve social issues, the company formulated and announced a new mid- to long-term strategy based on its basic growth strategies (multi-brand strategy, dominant strategy, M&A strategy).

[2-1 Willplus Group Policy]

The company aims to enhance social value and corporate value. In other words, the company aspires to solve social issues and achieve corporate growth.

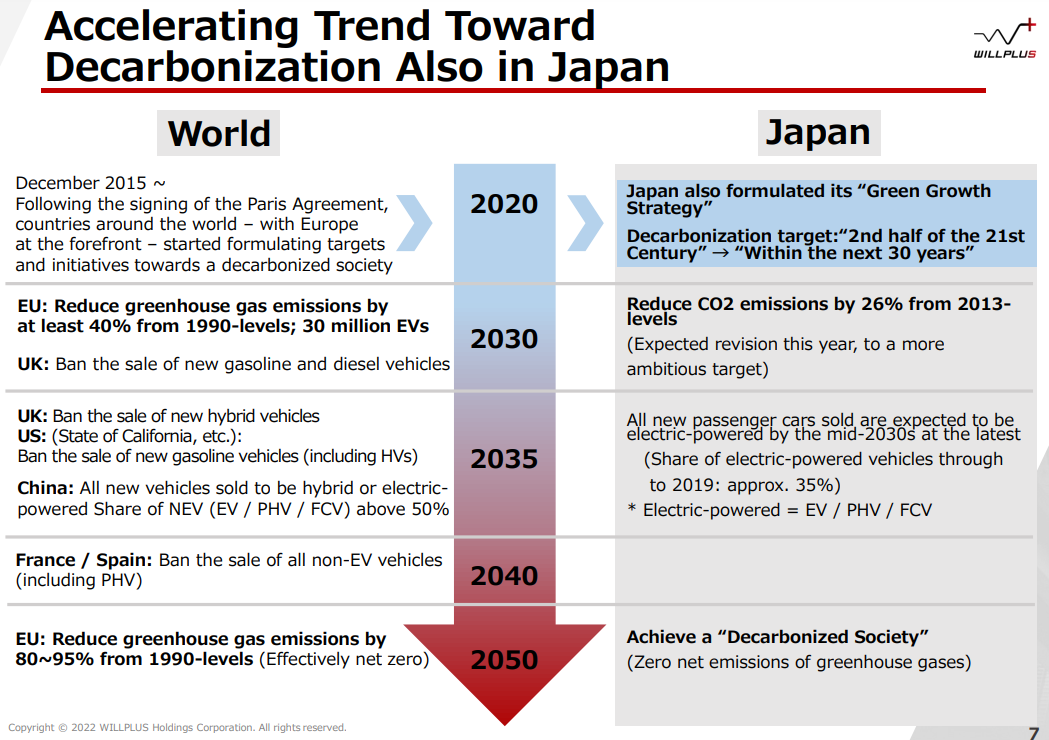

Improving social value means realizing a decarbonized society in the Japanese automobile industry.

Specifically, the company has the following three goals as what it aspires to be as an authorized import car dealer.

☆ A leading company in solving climate change issues: Reduction of GHG (greenhouse gas) emissions

☆ To become a dealer chosen by brand car manufacturers: Acceleration of M&A, expansion of store areas and brands

☆ To become a dealer trusted by customers: To increase store profitability and enhance store revitalization

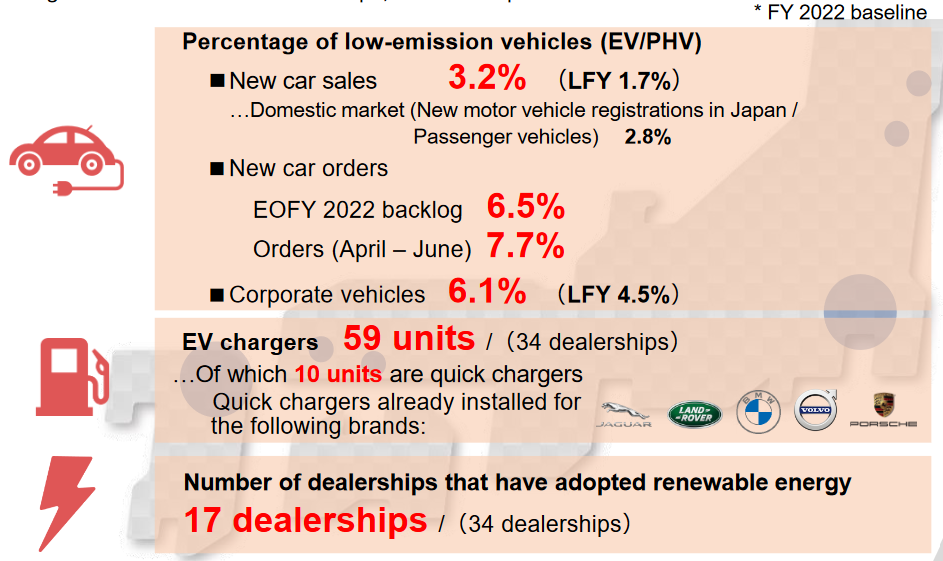

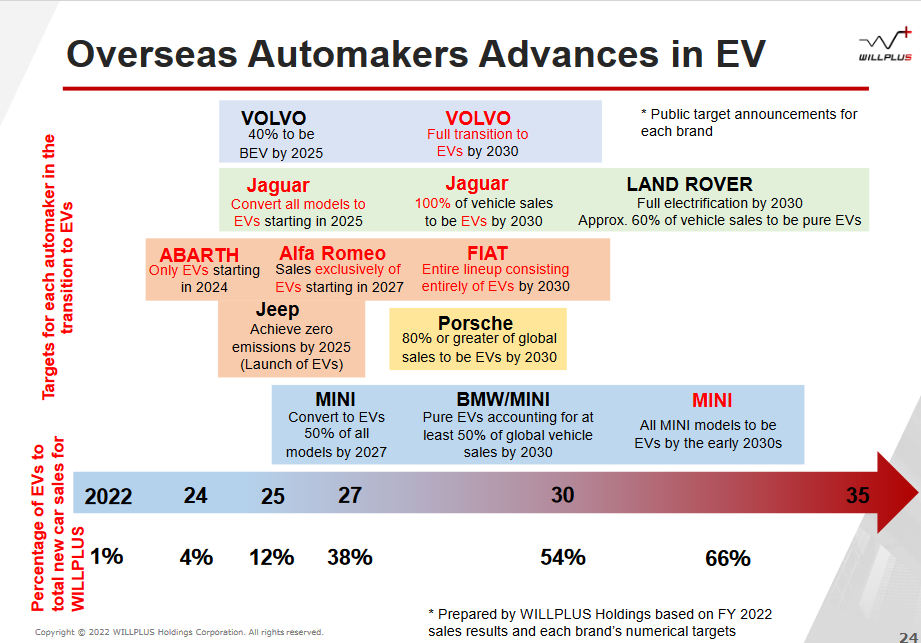

Recognizing “addressing the climate change issue” as an “opportunity,” the company will actively work on business expansion with the aim of occupying “new areas” and acquiring “new brands” through “M&A.” At the same time, the company is committed to “maximizing the reduction of GHG emissions” by “making its shops green” while “expanding its business as much as possible.”

[2-2 Goal]

The company, which aims to be a leading company in solving climate change issues, has set the following GHG emission reduction targets.

To reduce Scope 1 + Scope 2 GHG emissions by 50% in FY 2030 compared to FY 2021.

*Ratio of low-carbon vehicles among company vehicles (including test vehicles): 80% or higher in FY 2030

*Target for the introduction of renewable energy sources: All stores in FY 2025

[2-3 Initiatives of the Willplus Group]

The Willplus Group's initiatives to solve social issues and achieve corporate growth at the same time are as follows.

(1) Contribute to the realization of a decarbonized society by promoting green store operations

As brand car manufacturers promote the reduction of GHG emissions in their own supply chains, etc., they have been asking authorized dealers to accurately gauge GHG emissions in their store operations, set reduction targets, and implement measures to achieve specific targets (Ratio of EVs to demo vehicles, ratio of renewable energy, and recycling rate of waste).

In addition to setting the above reduction targets, the company intends to make capital investments to promote the spread of EVs in its store areas as an imported car dealer striving to be one of the first to promote green store operations, thereby contributing to the decarbonization of its store areas and the domestic automobile industry. The company has shown the following results until the end of FY 6/2022.

(From the reference material of the company)

(2) "Enhancement of social value" and "enhancement of corporate value" through promotion of M&A

M&A is an important measure for quickly entering new areas, acquiring new brands, and expanding the market shares of existing brands. In the saturated domestic automobile market, the company believes that M&A is the most appropriate and priority strategy from the perspectives of customer acquisition, early return on investment, and securing profits.

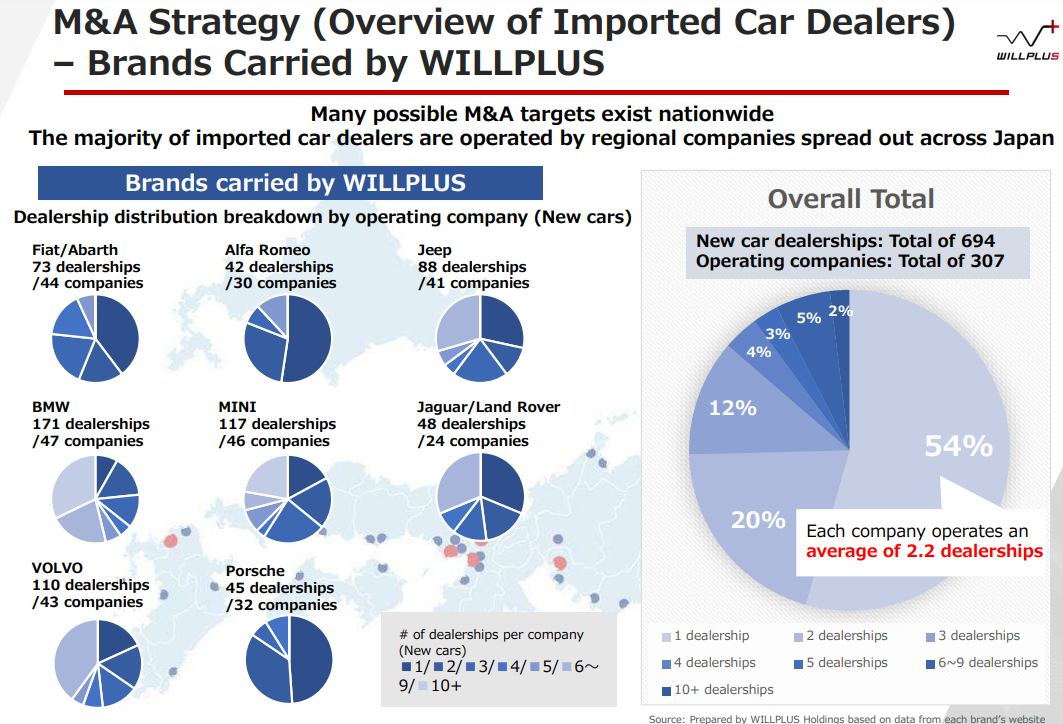

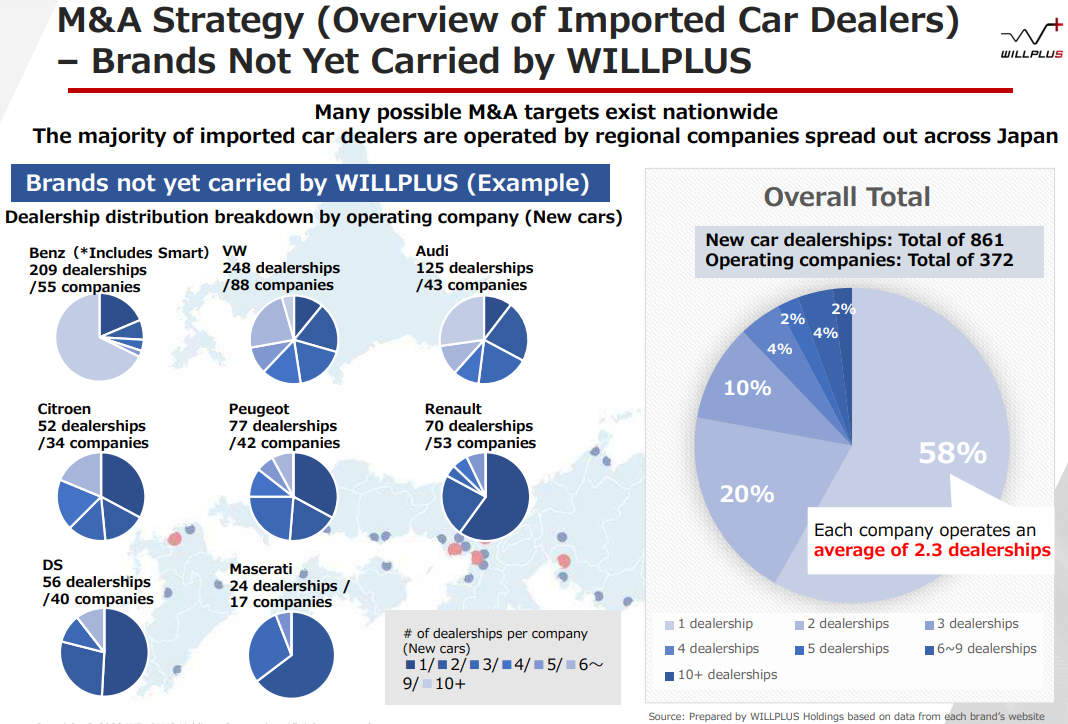

1) Business Environment for M&A Promotion

According to the company's assessment, there will be 679 imported automobile dealers operating throughout Japan by the end of 2021, with a total of 1,555 new car sales offices. Each company had an average of 2.3 shops, while small and medium-sized businesses with three or fewer shops accounted for over 90% of the total number of dealers.

In addition, many dealers are struggling with the difficulty in finding successors, a common problem for small and medium-sized companies in Japan.

|

|

(From the reference material of the company)

For these imported car dealers, the "CASE" of automobiles, of which "Electric Vehicle" and "Connected" are the most important management issues for the future.

"CASE" stands for Connected, Autonomous, Shared & Services (which may refer to car sharing and services/sharing only), and Electric. They are drastically changing the conventional concept of a "car" and creating new demand and markets in each of these areas.

◎ Enhanced Environmental Awareness and the Progress of the Shift to EVs

With heightened awareness of the global warming crisis, efforts to reduce greenhouse gas emissions and realize a decarbonized society are progressing rapidly.

One of the most significant concerns is reducing automotive emissions, and as governments try to attain carbon neutrality by 2050, automobile manufacturers are shifting from traditional gasoline and diesel engine cars to electric vehicles (EVs) in order to survive.

Manufacturers headquartered in Europe, which has long had a high degree of environmental awareness, have been particularly engaged in the transition to EVs.

As previously stated, brand car manufacturers must commit to developing a firm understanding of emissions throughout their supply chains and to reducing them, so they are increasingly urging dealers to not only understand their current emissions, but also to make appropriate capital investments and responses to climate change issues, such as increasing EV purchases, installing quick chargers, and disclosing emission reduction targets.

Many dealers, however, face financial and human resource limits that make it difficult for them to respond adequately, and some analysts predict that brand car manufacturers may take the lead in combining and restructuring vendors who can respond appropriately to such demand.

|

|

(From the reference material of the company)

◎ Complication of car maintenance through the spread of connected systems and EVs

The term "connected" refers to the usage of communication equipment in automobiles to enable continuous external contact. Data about the status of the automobile, road conditions, and information transferred between cars and other cars, as well as between cars and infrastructure, are all gathered and analyzed for use in services.

The connected automobile will evolve into smartphone-like devices, improving convenience while potentially complicating maintenance work in the case of a breakdown or vehicle inspection.

Furthermore, the previously noted shift to EVs will have a significant influence on car maintenance. Through the distribution of EVs, high-voltage battery and generator failures will increase, and vehicle maintenance will need to manage high-voltage systems, prompting substantial investment in high-voltage equipment and special training for safety reasons. Because the shift to connected systems and electric cars will need greater investment in both hardware and software, maintenance work for imported vehicles is likely to be concentrated in the hands of authorized dealers and large capital organizations with substantial investment capacity.

2) The company's policy on M&A

While responding to EVs and connected automobile is an urgent task for imported car dealers, the company intends to differentiate itself by building stores that are preferred by brand car manufacturers and by acquiring dealers who find it challenging to address these issues through M&A. By doing so, it hopes to expand into new areas and pick up new brands in order to grow and boost its corporate value. Additionally, the company wants to help with social issues by creating new brands and working to make its stores greener.

The company will not only decarbonize the neighboring area and turn the stores green, but it will also reinvigorate the social capital that already exists by repurposing resources and assets including stores, retraining personnel, and enhancing productivity by streamlining processes using DX.

As imported vehicle dealers confront succession concerns and increase their attention to tackling climate change issues, it is anticipated that the company's primary strategy, M&A, will accelerate in the future.

3) To strengthen the foundation for stable growth through recurring-revenue business

As stated in section 1-3, "Business Environment," the number of passenger vehicles owned in Japan, including mini cars, has been virtually stable, while the number of passenger cars imported has been steadily rising. Additionally, the average number of years a vehicle is used is increasing as a result of the change in economic conditions and the growth of environmental awareness, which unavoidably highlights the significance of maintenance. Furthermore, with the advancement of CASE, maintenance work is anticipated to grow more complex and will concentrate on authorized dealers for imported automobiles.

The company plans to strengthen the foundation of this business by adding maintenance packages and extended warranties for new vehicles to increase the percentage of vehicles that undergo maintenance services because it believes that the vehicle maintenance industry will offer more opportunities for profit-making in the future.

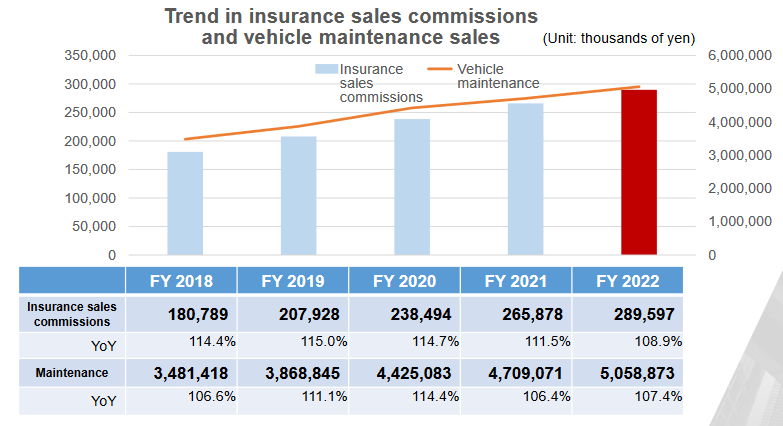

The company will also keep its staff up to date on insurance matters to further enhance customer satisfaction with regard to insurance commission income, which has been increasing at double-digit rates every fiscal year, to further strengthen the foundation for steady growth in the recurring-revenue business of insurance sales and vehicle maintenance.

(From the reference material of the company)

[2-4 Medium- to Long-term Shareholder Return Strategy]

The company, which has increased dividends consecutively since its listing, has newly established the following policy.

☆ | To target a medium- to long-term ROE of 15% or higher (19.0% in the prior year). |

☆ | The company will gradually raise its dividend payment ratio to 30% by FY 2026 in order to "keep sufficient capital" and "further boost shareholder return" at the same time. |

☆ | In order to sustain and increase consistent and ongoing returns to shareholders, the company will continue to pay out dividends at a payout ratio of 30% from FY 2027, with a DOE of 4.5% or higher. |

The company kept the dividend at 34.90 yen per share as forecasted for FY 6/2022, increasing the payout ratio to 21.4%, and achieving dividend growth that outpaced profit growth for the second consecutive fiscal year.

With a planned dividend of 41.14 yen per share for the current FY 6/2023, the company has further increased its payout ratio to 22.5%.

In order to demonstrate its extremely aggressive profit growth policy and shareholder return stance, the company aims to achieve ROE that significantly exceeds the cost of shareholders' equity, increase the dividend payout ratio gradually, and increase dividends in excess of profit growth over the next four years.

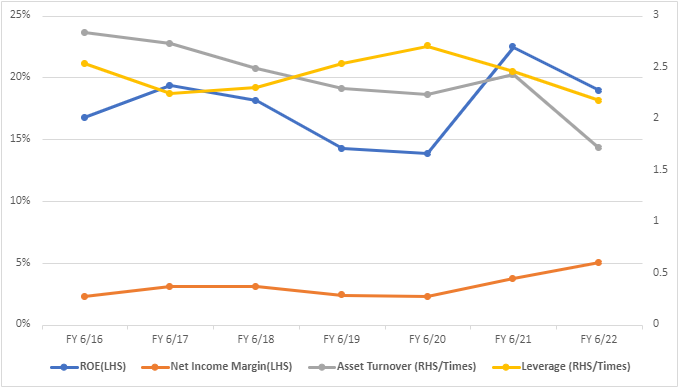

(ROE Analysis)

| FY 6/16 | FY 6/17 | FY 6/18 | FY 6/19 | FY 6/20 | FY 6/21 | FY 6/22 |

ROE (%) | 16.8 | 19.4 | 18.2 | 14.3 | 13.9 | 22.5 | 19.0 |

Net income margin (%) | 2.34 | 3.16 | 3.16 | 2.44 | 2.29 | 3.76 | 5.05 |

Total asset turnover (times) | 2.84 | 2.73 | 2.49 | 2.30 | 2.24 | 2.43 | 1.72 |

Leverage (x) | 2.54 | 2.25 | 2.31 | 2.54 | 2.71 | 2.46 | 2.18 |

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

While total asset turnover and leverage are on a downward trend, ROE is on an upward trend due to improved profitability.

3. Growth Strategy

Three strategies promote the company's growth: "multi-brand strategy," "dominant strategy," and "M&A strategy."

(From the reference material of the company)

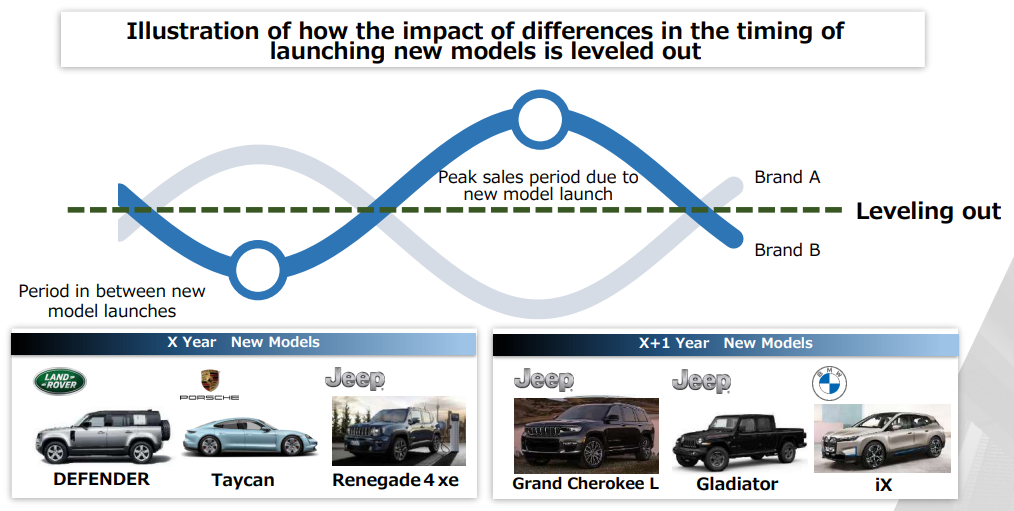

[3-1 Multi-brand strategy: Expansion of earnings and leveling of the sales cycle]

By handling multiple brands without relying on a specific brand, the company aims to even out the impact of the sales cycle caused by differences in the timing of new model launches among brands.

The company currently handles ten brands and aims to expand the number of brands through M&A strategies.

(From the reference material of the company)

[3-2 Dominant strategy: Increase the market share and maximize profit in the same trade area]

The company is opening new stores in cities with a population of 1 million and surrounding cities as specified areas in order to increase its market share by attracting customers in the same trade area, improve productivity through efficient personnel allocation among stores, and maximize profit.

Currently, the company focuses on Tokyo, Kanagawa, and Fukuoka, which are Japan's top markets in terms of new car registrations and ownership of imported cars (passenger cars), but it is also aiming to expand into other areas through the M&A strategy.

[3-3 M&A Strategy: Speed Up]

M&A is an important measure for quickly entering new areas, acquiring new brands, and expanding the market share of existing brands.

WILPLUS HOLDINGS has executed nine M&A since its establishment in October 2007. Following the acquisition of a huge number of stores, trade areas, and new brands via M&A, the company has been extending its business by building additional stores in neighboring regions to complement its trade areas.

The company targets more than ten brands, including Mercedes-Benz, Volkswagen, and Audi, and there is a tremendous opportunity for growth through the M&A acquisition of additional brands.

Aside from direct approaches from the company to the target companies and direct contact from the target companies back to the company, the company searches out deals through introductions from importers, financial institutions, and M&A brokerage firms.

The company will carry out due diligence and only engage in negotiations with those agreements that satisfy the company's investment recovery requirements following internal discussions that focus on prospects for future development and synergies.

4. Fiscal Year ended June 2022 Earnings Results

[4-1 Overview of Financial Results]

| FY 6/21 | Ratio to sales | FY 6/22 | Ratio to sales | YoY | Compared with initial forecast | Compared with revised forecast |

Sales | 40,776 | 100.0% | 39,696 | 100.0% | -2.6% | -3.3% | -3.3% |

Gross Profit | 8,255 | 20.2% | 8,441 | 21.3% | +2.3% | - | - |

SG&A | 5,965 | 14.6% | 6,075 | 15.3% | +1.8% | - | - |

Operating Income | 2,290 | 5.6% | 2,366 | 6.0% | +3.3% | +10.1% | -3.7% |

Ordinary Income | 2,301 | 5.6% | 2,377 | 6.0% | +3.3% | +11.5% | -3.4% |

Net Income | 1,533 | 3.8% | 1,550 | 3.9% | +1.1% | +11.9% | -3.6% |

*Unit: million yen. The accounting standards for revenue recognition have been applied since the term ended June 2022. “Compared with revised forecast” means the difference from the earnings forecast announced in May 2022.

Sales declined, but operating income hit a record high for two consecutive terms.

Sales dropped 2.6% year on year to 39,696 million yen. The sales calculated with the conventional standard before the application of the accounting standards for revenue recognition were 41,345 million yen, up 1.4% year on year.

The sales of new cars declined, as procurement was unstable due to the shortage of semiconductors, logistics disruption, etc., but by utilizing the relationships with importers based on its track record, the company focused on the procurement of products.

On the other hand, the company steadily sold used cars, which are in high demand due to the unstable supply of new cars, by striving to procure products through the enhanced trade-in, etc.

Recurring-revenue business, such as car maintenance and insurance, was healthy, as the number of car shops increased and continuous transactions were accumulated.

Operating income rose 3.3% year on year to 2,366 million yen.

The ratio of sales of high-priced vehicles increased and the efforts to improve profit margin by selling automobiles at a reasonable price contributed, offsetting the augmentation of expenses for expanding its business. The growth of recurring-revenue business with a high profit margin, too, contributed, and operating income margin rose 0.4 points year on year to 6.0%, hitting a record high. EBITDA margin increased 0.5 points year on year to 9.0%, hitting a record high.

The results exceeded the initial forecast, but fell below the revised forecast announced in May 2022. This is mainly because the delivery of automobiles to customers was delayed longer than expected, due to the delays in the manufacturing of automobiles caused by the global shortage of semiconductors and the supply of products amid logistics disruption, and the sales of new cars did not reach the forecast amount.

The problem of the delay in supply of products is being solved.

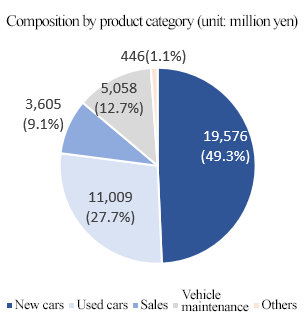

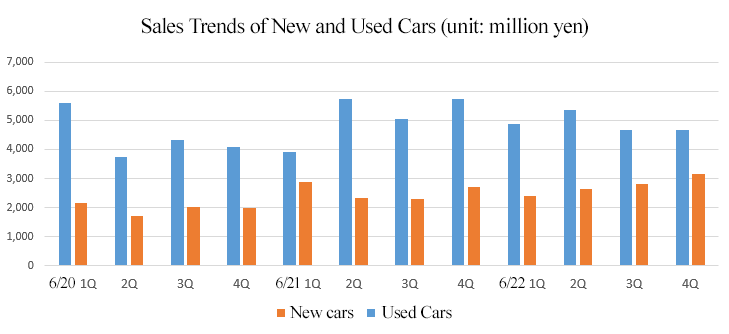

[4-2 Trend of each business]

| FY 6/21 | Composition ratio | FY 6/22 | Composition ratio | YoY | YoY 2 |

New cars | 20,477 | 50.2% | 19,576 | 49.3% | -4.4% | -2.5% |

Used cars | 10,238 | 25.1% | 11,009 | 27.1% | +7.5% | +9.5% |

Sale by distributors | 3,662 | 9.0% | 3,605 | 9.1% | -1.6% | -1.6% |

Subtotal of sales of cars | 34,378 | 84.3% | 34,190 | 86.1% | -0.5% | +1.2% |

Car maintenance | 4,709 | 11.5% | 5,058 | 12.7% | +7.4% | +7.4% |

Other | 1,688 | 4.1% | 446 | 1.1% | -73.6% | -10.9% |

Total | 40,776 | 100.0% | 39,696 | 100.0% | -2.6% | +1.4% |

*Unit: million yen. The accounting standards for revenue recognition have been applied since the term ended June 2022. “YoY 2” means the difference from the amount in the previous term before the application of the new accounting standards, which was calculated by Investment Bridge for reference.

*Sale of new cars

The company took measures for minimizing the impact of the stagnation of supply of new cars, by selling new models that can be procured stably and mainly high-priced vehicles at a reasonable price, by taking advantage of the multi-brand strategy.

*Sale of used cars

As the supply of new cars was stagnant, demand for used cars grew, so the market prices of used cars increased. The company considers the sale of used cars as a priority strategy like the sale of new cars. This time, it enhanced the efforts to increase the trade-in rate, strived to secure products, and increased profit steadily.

* Recurring-revenue business

This business performed well, as the number of shops grew and the number of customers who make continuous transactions with the company increased steadily. In the non-life insurance agency business, they conducted group-wide initiatives, including the training for improving the quality of insurance solicitors, and then the revenues from insurance commissions increased 8.9% year on year to 289 million yen.

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

[4-4 Financial Standing and Cash Flows]

◎Main Balance Sheet

| End of June 2021 | End of June 2022 | Increase/ Decrease |

| End of June 2021 | End of June 2022 | Increase/ Decrease |

Current Assets | 9,488 | 11,374 | +1,886 | Current Liabilities | 8,510 | 8,254 | -255 |

Cash and Deposits | 3,376 | 5,538 | +2,161 | Payables | 1,958 | 1,793 | -165 |

Inventories | 5,141 | 4,882 | -259 | ST Borrowings | 3,428 | 3,549 | +121 |

Noncurrent Assets | 7,483 | 7,255 | -228 | Noncurrent Liabilities | 930 | 1,545 | +614 |

Tangible Assets | 6,389 | 6,274 | -115 | LT Borrowings | 466 | 1,066 | +600 |

Buildings and Structures | 3,759 | 3,664 | -95 | Total Liabilities | 9,441 | 9,800 | +359 |

Intangible Assets | 259 | 174 | -85 | Net Assets | 7,530 | 8,829 | +1,298 |

Investment, Others | 834 | 806 | -27 | Retained Earnings | 6,286 | 7,566 | +1,279 |

Total Assets | 16,972 | 18,630 | +1,657 | Total Liabilities and Net Assets | 16,972 | 18,630 | +1,657 |

*Unit: million yen.

Total assets grew 1,657 million yen from the end of the previous term to 18,630 million yen, as cash and deposits increased while inventories declined due to the unstable supply of new cars and the thriving market of used cars.

Total liabilities augmented 359 million yen to 9.8 billion yen, due to the rise in debt, etc.

Net assets increased 1,298 million yen to 8,829 million yen, due to the rise in retained earnings, etc.

Capital-to-asset ratio rose 3.0 points from the end of the previous term to 47.4%.

◎CF

| FY 6/21 | FY 6/22 | Increase/decrease |

Operating Cash Flow | 2,890 | 1,910 | -980 |

Investing Cash Flow | -676 | -217 | +458 |

Free Cash Flow | 2,214 | 1,692 | -521 |

Financing Cash Flow | -1,359 | 469 | +1,829 |

Cash and Equivalents | 3,376 | 5,538 | +2,161 |

The surpluses of operating CF and free CF shrank.

The cash position improved.

[4-5 Topics]

(1) Launch of new models

The supply of new cars is still unstable, but considering the recurring-revenue business in the future, they continued the sales promotion of new cars, mainly new models.

In the term ended June 2022, the company launched the following three models, etc. from the brands they handle.

(Taken from the reference material of the company)

(2) Switch to renewable energy

As the company concentrates on activities for sustainability, it will switch the electric power used at stores to that generated from renewable energy as mentioned above. In the term ended June 2022, the company changed the electric power used in 17 existing stores in the Kyushu and Chugoku areas to that generated from renewable energy.

5. Fiscal Year ending June 2023 Earnings Forecasts

[5-1 Earnings Forecast]

| FY 6/22 | Ratio to Sales | FY6/23(Est) | Ratio to Sales | YoY |

Sales | 39,696 | 100.0% | 44,363 | 100.0% | +11.8% |

Operating Income | 2,366 | 6.0% | 2,687 | 6.1% | +13.6% |

Ordinary Income | 2,377 | 6.0% | 2,686 | 6.1% | +13.0% |

Net Income | 1,550 | 3.9% | 1,750 | 3.9% | +12.9% |

*Unit: million yen. Estimates are those of the company.

Sales and profit are expected to grow by double digits, and both sales and operating income are projected to hit a record high.

It is forecast that sales will increase 11.8% year on year to 44,363 million yen and operating income will grow 13.6% year on year to 2,687 million yen.

The double-digit growth in sales and profit is expected thanks to the recovery of sale of new cars, and it is projected that sales will hit a record high for the first time in 2 terms and operating income will hit a record high for 3 consecutive terms.

(Sale of new cars)

Demand remains strong, so the company is expected to receive orders steadily. Sales are expected to recover significantly from the second half (Jan. to Jun. 2023), although there is concern over the shortage of semiconductors, and gross profit is projected to grow considerably if new cars are sold at a reasonable price.

(Sale of used cars)

Thanks to the rise in market prices of used cars and the stagnation of supply of new cars, it is expected that the revenue earning environment will remain favorable, but it will be difficult to secure products. Accordingly, it is forecast that the momentum will weaken, and annual sales and profit will decline slightly.

(Recurring-revenue business)

In the car maintenance and non-life insurance agency businesses, profit will be healthy and gross profit is expected to grow.

[5-2 Initiatives for the current term]

◎Active investment in stores

The company will continue active investment in stores, with the aim of increasing repeat customers and revenues by improving the customer satisfaction level.

At existing stores, the company will follow the latest CI, offer various retail experiences for each brand, and provide high-quality services with the latest equipment, etc. In addition, the company will relocate some stores to more noticeable and convenient locations, to improve management efficiency.

The company will open new stores for expanding its trade area, complementing the existing area, and diversifying the business of the existing brands.

In August 2022, the company opened “Jeep Ohta,” following the latest CI.

6. Interview with President Naruse

We interviewed President Takaaki Naruse about the social significance of WILLPLUS Holdings, his own mission, M&A strategy, message toward the shareholders and investors, etc.

Q: While announcing the latest financial results, you launched a “medium-to-long term strategy.” First of all, please tell us about the social significance of your company and what kind of company you are aiming for.

Ever since the listing of our company in 2016, we have poured our efforts into maximizing the customer satisfaction and expanding our sales and profit. From the viewpoint of our company’s social significance and value, I used to view the realization of stable employment as part of our social value, but as the business environment has been rapidly changing in recent years, I am now strongly aware of the fact that as an enterprise, we need to engage in solving social challenges, including issues related to climate change, in a broader way.

Amid such situation, we continued to discuss and consider concrete initiatives for building a trusting relationship with all stakeholders, aiming for the elevation of both the social value and corporate value, and announced this “medium-to-long term strategy.”

We shall view “solving issues related to climate change” as an “opportunity” and proactively engage in the expansion of our business, aiming to acquire “new areas” and “new brands” through “M&A,” which is our important growth strategy with overwhelming advantages.

At the same time, we will progress with “the maximization of the business scale” while “making our dealers green” and “reducing GHG emissions as much as possible.”

Moreover, while we have been successively increasing dividends since our listing, we decided to commit to an even more proactive policy for the return to shareholders.

With the target of keeping ROE at 15% or higher in the medium-to-long term, we shall gradually raise payout ratio to 30% by fiscal year 2026 in order to “maintain capital adequacy” and “further expand the return to shareholders.”

From fiscal year 2027 on, we will keep payout ratio at 30% as our dividend policy and endeavor to maintain and elevate stable and continuous return of profit with a DOE of 4.5% as a minimum dividend.

We will aim for dividend growth exceeding profit growth under this kind of policy while making proactive investments and expanding profit.

The adequate balance of social value and corporate value, and proactive return to shareholders – I view the realization of these two as my mission.

Q:We would like to ask about the “M&A strategy” that you have just mentioned. First of all, you indicate that there are plenty of targets.

As for the number of imported car dealers in Japan, there are currently about 300 companies and about 700 shops selling the ten brands that we deal with, and about 400 companies and about 900 shops selling brands that we do not deal with yet. We grasp the scale of sales, capital-related matters and the existence of successors for all of these companies.

Based on this list, we shall progress with the conclusion of M&A contracts through various routes, such as importers, financial institutions or mediating companies and proposals from the owners in addition to the approach by our company. As for the acquisition price, it is possible to make an offer at the price we consider appropriate in almost all cases.

We generally take the dominant strategy, but even in the case where M&A is for a detached location at first, if we conclude one or two more contracts afterward, it will eventually be dominant, so we currently continue to sow seeds across Japan.

Like this, M&A targets are extremely abundant.

Q: Please tell us about the business environment which accelerates your M&A strategy.

There are as many as about 700 dealers in Japan, but many of them operate two or three shops in their respective hometowns.

Furthermore, it is a fact that an extremely large number of enterprises are currently facing the “difficulty in finding a successor.”

The reliability of our company as a listed company is a notable advantage when it comes to protecting the employment of staff while succeeding the business.

Moreover, significant changes in the environment surrounding cars are also a considerable tailwind for pushing our M&A strategy.

One of these changes is “the climate change issue.”

Brand manufacturers are rapidly shifting to EV. Through the shift to EV, brand manufacturers will require dealers to arrange the infrastructure, for example, by setting up quick chargers. Furthermore, new maintenance skills including the knowledge on electrical machinery will be required for vehicle maintenance. Therefore, dealers will not be able to meet the requirements of the brand manufactures if they do not ensure sufficient funds and human resources.

In addition, brand manufacturers need to understand their GHG emissions as well as announce and commit to targets for the reduction thereof to achieve decarbonization, and will seek this kind of information from dealers which are part of their supply chain as well. However, dealers who are faced with issues such as profitability, capital and finding a successor may not be able to respond in some cases.

With regard to this matter, we have already begun with “making our dealers green” and as a listed company we disclose information related to climate change and set targets for reducing emissions.

We assume that brand manufacturers will get even more strongly motivated to focus on dealers who can meet their requirements.

The second is the progress of “CASE” for automobiles.

In step with the shift to EV and connection, it is not too much to say that an automobile will not be a conventional machine, but a cluster of electronic components, an electronic device. As sufficient knowledge and skills for vehicle maintenance will be sought in this light, we assume that many dealers will not be able to keep up.

As mentioned above, we believe that our “M&A strategy” will powerfully drive our company’s growth from now on, based on abundant opportunities and spurred on by the business environment which will accelerate the conclusion of contracts.

Q: As you have succeeded in achieving profitability and significant improvement of revenues at all companies you have acquired so far, we recognize that the ability to revitalize the business after M&A is your notable forte.

Experience cultivated through business revitalization after M&A we have implemented so far has accumulated, allowing us to build know-how for creating a solution for achieving PMI. We assume that the accuracy of this solution is linked to high reproducibility.

For example, many dealers are not involved in recurring-revenue business, which is the forte of our company, or it tends to be weak, so it is possible to considerably elevate the profitability just by reinforcing this part. Furthermore, there are also many cases of missing precious business opportunities, for example, by entirely outsourcing sales (wholesaling such as auctions) to companies specialized in dealing used cars as it requires time and labor for the company to do it themselves. We analyze the acquired company from this viewpoint, too, and inject the essence such as human resources and know-how in order to revitalize the business.

Q: While you also faced difficulty in selling new cars in the previous term due to the lack of semiconductors and global disruption of logistics, you succeeded in exceeding the average in this industry in delivering cars to new owners. Please tell us about the background and factors in your success.

We were able to exceed the industry average, although just subtly, in delivering cars as a result of our past sales accomplishments exceeding the average of the overall market, client satisfaction, close communication with brand manufacturers, etc.

Nonetheless, we faced a harsh situation in the previous term. The lack of semiconductors is quite on the way to be resolved, so we suppose that we can expect some positive results during this term and assume that it will lead to the growth of sales and profit.

Q: You consider your vehicle maintenance business as promising. Please tell us about its background.

As mentioned above, expanding our shops through the progress of M&A is one factor. In addition, we assume that as vehicle maintenance itself will become more complex and advanced due to the shift to EV and connection and it will be difficult for the so-called local garages and volume retailers to take care of it, the importance of official dealers will grow.

Accordingly, we expect that customers who used to bring their cars to a competing shop will bring them to our company.

As for connection, we believe that grasping the state of each customer’s vehicle, the timing of maintenance, etc. and providing a suitable service will also lead to the increase in customer satisfaction.

Q: Your other business with recurring revenues, insurance marketing, is also steadily growing. Please tell us more, including the background of the high rate of enrollment in insurance.

The primary factor in expansion of the insurance sales lies in the thorough education of our employees. Insurance is treated as an essential and vital part of the sales training and we think that making sufficient investments (money and time) in it leads to differentiation.

As the system and contents of car insurance change almost every year, we organize training so that our staff properly update their information and are able to analyze the current situation of each customer and provide immediate and accurate advice, such as “this option will give you more benefits.”

The ability to properly manage this greatly affects the trust and satisfaction of customers. Seeing how important this is, I definitely take part in the training every time as well.

Professional agents currently hold 70-80% of the car insurance market shares and dealers account for about 30%.

We are steadily boosting our insurance sales, but as there are still considerable shares of the professional agents possible to acquire, we will continue to proactively invest in education and expand our market share.

Q: Thank you very much. Lastly, we would like to ask you for a message toward the shareholders and investors.

We would like to create an enterprise chosen by customers, chosen by manufacturers and chosen also by the society, where employees will be happy, in both the medium and long terms.

Furthermore, we shall contribute by properly returning profit to our shareholders, who are important stakeholders.

We shall achieve our targets by surely implementing the medium/long-term strategy that we announced this time and engage in maximizing both our social value and corporate value, so please do keep your expectations for our company high.

7. Conclusions

As mentioned in the section of “the market environment,” the number of registered new cars in Japan has been decreasing for a long period of time. This is attributable to the “the decrease of young people who own automobiles,” “the expansion of sharing services,” etc. in addition to the “declining birthrate and aging population” and “customers owning a car for a longer period of time due to the improvement in performance.” However, the number of registered imported new cars has been increasing since the bankruptcy of Lehman Brothers, so this market is not shrinking.

For the same reason, the car maintenance business will shrink unavoidably in Japan, but there is great room for growth regarding imported cars. As the company will expand its market share through M&A, this business can be expected to grow stably.

The exhaust gas from automobiles is one of the factors in polluting the environment. We would like to pay attention to the progress of measures of the company, which tackles environmental issues by “making stores environmentally friendly” and selling automobiles there, and aims to improve its corporate value.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 10 directors, including 4 outside directors (4 of which are independent executives) |

Audit committee members | 5 members, including 4 outside directors (4 of which are independent executives) |

◎ Corporate Governance Report

Last update date: September, 29, 2022

<Basic Policy>

Our company’s basic approach on corporate governance is to establish a sound management system that can respond to rapid changes in society and is efficient and compliant with laws and regulations, for maximizing our corporate value. To achieve this, we continue to strive to ensure transparent management and appropriate and prompt disclosure, by strengthening our relationships with stakeholders and further enhancing management governance functions.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

■ Supplementary Principle 3-1 ③ and Supplementary Principle 4-2 ② 【Issues related to Sustainability】

Our company has formulated basic sustainability policies, and established a Sustainability Committee and a Risk Management Committee to strengthen our corporate group’s sustainability initiatives and proactive risk management platform, and to focus on expanding our business scope by promoting growth strategies, responding to technological innovations including EVs in the automotive industry, and promoting DX, in order to achieve a sustainable society and enhance corporate value through our corporate activities. Specific initiatives led by these committees are disclosed in documents including the financial results presentation materials.

https://contents.xj-storage.jp/xcontents/AS01236/078770bd/f7ea/4bc2/872b/e27b99a6bb7b/140120220824523428.pdf

In addition, our efforts to address climate change issues are disclosed through CDP.

The investment in human capital and intellectual property for enhancing medium/long-term corporate value is currently under discussion by our Executive Board, for which the Board of Directors will formulate and disclose basic policies in the future.

■ Supplementary Principle 2-4 ① 【Ensuring Diversity in Appointment of Core Personnel, etc.】

<Our view on ensuring diversity>

Our company aims to provide an environment where each and every employee can maximize their abilities and continue to work for a long period of time, and follows its basic policy to appoint personnel based on their abilities and performance, regardless of gender, internationality, or whether they are mid-career hires or not.

<Proactive and measurable goals for ensuring diversity>

Our company has not set measurable goals for ensuring diversity in our core human resources, however, we will consider setting such goals along with our human resources strategies for enhancing medium-term corporate value.

<Status of ensuring diversity>

Ratio of female employees: 18.2% in FY6/22

Employment of foreign nationals in professional positions: 0.71% in FY6/22

Ratio of mid-career hires in management positions: 93.2% as of the end of June 2022

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

■ Principle 1-4 【Strategic Shareholding】

(1) Policies concerning strategic shareholding

Our company does not hold shares strategically. Unless such shareholding is necessary to maintain and strengthen relationships for capital tie-ups and collaboration with our business partners and it is determined that their business benefits are worth the risk and cost of capital from the medium/long-term perspective, we shall adhere to our company’s policy of not holding shares strategically.

(2) Review process concerning strategic shareholding, and criteria for exercising voting rights related to strategically held shares

If it is considered appropriate to hold shares strategically, we will establish a method to review the reasonableness of continued holding of such shares as well as specific criteria for the exercise of voting rights on such shareholding.

■ Principle 5-1 【Policies concerning the establishment of a system to promote constructive dialogue with shareholders and the initiatives for it】

Our company believes that clearly explaining our management policies and growth strategies to shareholders and institutional investors and deepening their understanding through active and constructive dialogue (interviews) with them will contribute to enhancing our company’s medium/long-term corporate value.

Dialogue with shareholders and institutional investors is conducted reasonably through visits, office visits, telephone calls, etc. by representative directors and IR staff, with the IR Office of the Corporate Strategy Division as a point of contact. In addition to individual interviews, in order to provide opportunities for direct dialogue with many investors, our company holds financial results briefings for investors and analysts as well as briefings for individual investors at which representatives themselves give explanations, and uses such opportunities to promote mutual understanding between our company and investors. Furthermore, we broadly disseminate information by video streaming of the meetings or posting material on our website.

When engaging in dialogue, we take all necessary precautions to ensure that there is no leakage of unpublished important information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |