Bridge Report:(3538)WILLPLUS financial results for the ended June 2023

President Takaaki Naruse | WILLPLUS Holdings Corporation (3538) |

|

Company Information

Market | TSE Prime |

Industry | Retail (Commercial) |

President | Takaaki Naruse |

HQ Address | 5-13-15, Shiba, Minato-ku, Tokyo, Shiba Mita Mori Building 8th Floor |

Year-end | June |

Homepage |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

¥1,197 | 10,078,400 shares | ¥12,063 million | 14.0% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥43.51 | 3.6% | ¥174.04 | 6.9 x | ¥1,005.48 | 1.2 x |

* The share price is the closing price on September 5. Each figure is based on the financial results for the FY6/23.

Earnings Trend

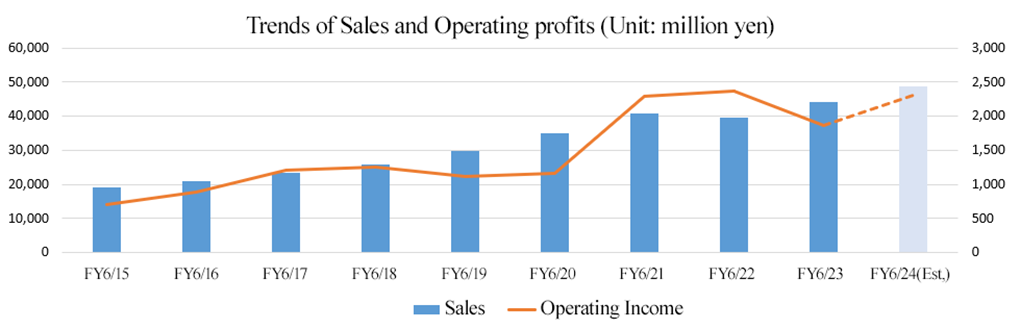

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

June 2020 Act. | 35,068 | 1,160 | 1,196 | 802 | 85.32 | 14.00 |

June 2021 Act. | 40,776 | 2,290 | 2,301 | 1,533 | 161.47 | 28.26 |

June 2022 Act. | 39,696 | 2,366 | 2,377 | 1,550 | 162.84 | 34.90 |

June 2023 Act. | 44,115 | 1,867 | 1,943 | 1,302 | 135.45 | 41.17 |

June 2024 Est. | 48,821 | 2,312 | 2,303 | 1,692 | 174.04 | 43.51 |

*Unit: million yen or yen. Estimates are those of the company.

This report includes Willplus Holdings Corporation's financial results for the ended June 2023 and other information.

Table of Contents

Key Points

1. Company Overview

2. Mid- to Long-Term Strategy

3. Growth Strategy

4. Fiscal Year ended June 2023 Earnings Results

5. Fiscal Year ending June 2024 Earnings Forecasts

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

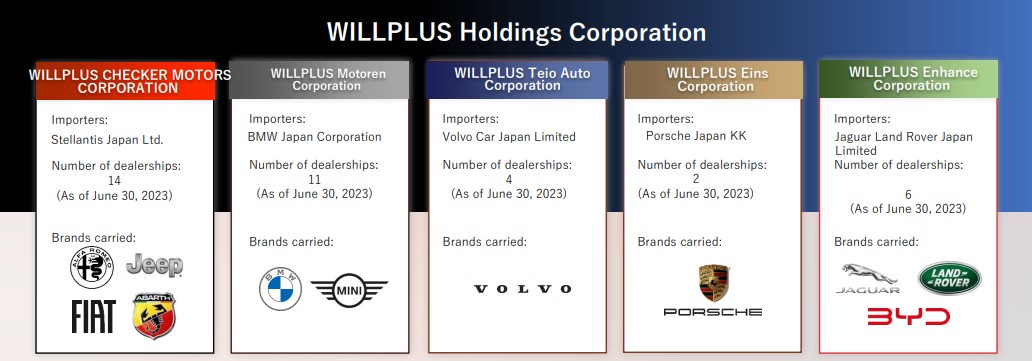

- Willplus Holdings Corporation is a holding company with five consolidated subsidiaries that operate dealers handling 11 brands of imported cars, including Jeep, BMW, Mini, and Volvo. It focuses on improving customer satisfaction and pursues growth through a multi-brand strategy, a dominant strategy, and an M&A strategy. It has a significant advantage in business revitalization capabilities in the M&A field. The company aims for further growth, taking the major environmental changes surrounding automobiles, including the shift to EVs, as an opportunity.

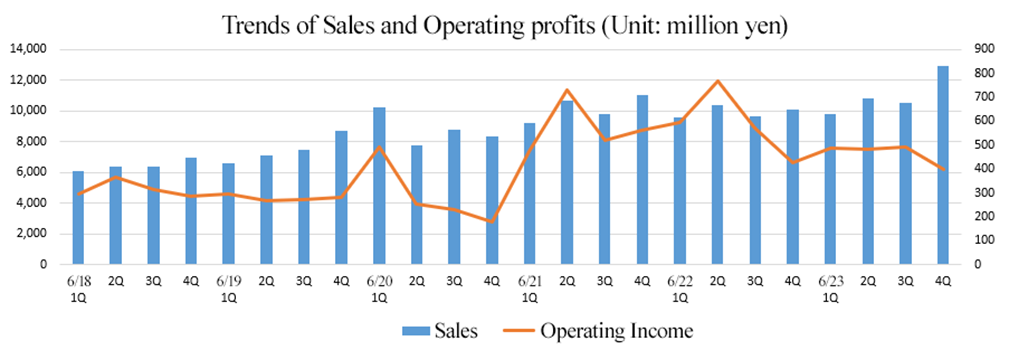

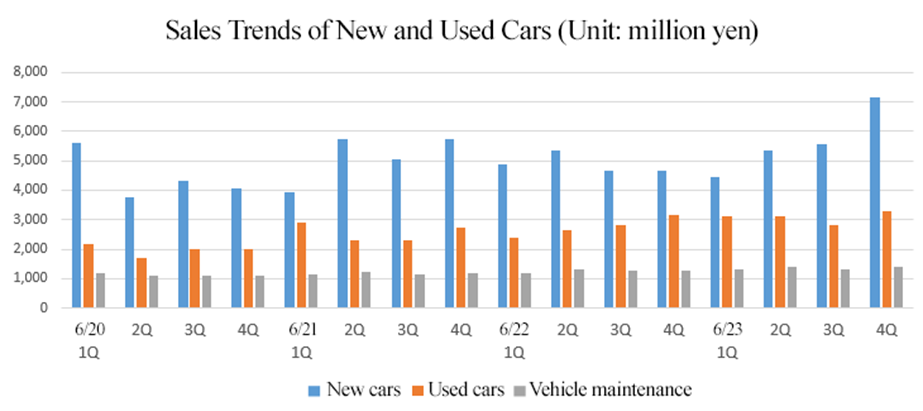

- The sales in the term ended June 2023 were 44,115 million yen, up 11.1% year on year. New car, used car and recurring revenue-type business sales have all increased, reaching a record high. Operating income was 1,867 million yen, down 21.1%. Although sales grew, the gross profit margin of new car sales declined due to a drop in sales commissions, which depend on the number of cars sold, and rising procurement costs for vehicles. The gross profit margin of used car sales dropped as well due to a year-end loss on valuation of inventories. On the other hand, various costs and expenses related to medium/long-term strategies augmented.

- The sales forecast for the term ending June 2024 is 48,821 million yen, up 10.7% year on year, while the forecast for operating income is 2,312 million yen, up 23.8% year on year. Sales are projected to hit a record high, just like in the previous term. The company expects to steadily receive orders for existing brands owing to stable demand from clients.

- The company expects a growth in new car sales despite the expected impact of rising sale prices on marketing activities as they are going to steadily deliver new cars that were ordered by the end of the previous term. Used car sales are forecast to reach the same level as those in the previous term, expecting that fluctuations on the used car market during the previous term will return to normal in this term. With regard to the recurring revenue-type business such as car maintenance and insurance agency business, the company will further enhance the connection with each customer and aim to build an even more solid revenue foundation.

- Regarding selling, general and administrative (SG&A) expenses, personnel costs, costs related to sale and costs related to store maintenance are projected to increase in step with the expansion of business. Moreover, the company plans to continue investments in human capital such as the improvement of working conditions, reduction of menial work through DX and training for reskilling to allow all employees to fully utilize their abilities.

- Seeing that sales in the fourth quarter of the term ended June 2023 reached a record high in terms of quarterly performance, new car sales seem to be on the way to full recovery as the number of cars sold picked up and average spending per customer rose, and annual sales are projected to mark a record high in this fiscal year. On the other hand, a double-digit growth is expected for profit in step with the increase of sales, but the company forecasts an augmentation of costs, mainly for strategic investments, and it is unlikely that operating income will reach a record high. We would like to pay attention to how much profit will grow as sales further accumulate, as well as the extent to which the new brand BYD will contribute.

- On the other hand, demand for automobiles, which rapidly grew due to special factors, has started shrinking as the COVID-19 pandemic subsided, and expenses for enhancing governance and addressing environmental issues have increased. Therefore, the company is expecting more projects targeting mainly small and medium-sized dealers with weak management foundations from now on. They assume that their M&A strategy, which was on hold for the past three years, will gain significant momentum, and we hold expectations for its progress, too.

1. Company Overview

Willplus Holdings Corporation is a holding company with five consolidated subsidiaries that operate dealers handling 11 brands of imported cars, including Jeep, BMW, Mini, and Volvo. It focuses on improving customer satisfaction and pursues growth through a multi-brand strategy, a dominant strategy, and an M&A strategy. It has a significant advantage in business revitalization capabilities in the M&A field. The company aims for further growth, taking the major environmental changes surrounding automobiles, including the shift to EVs, as an opportunity.

[1-1 Corporate History]

In January 1997, the father of President Takaaki Naruse established Sunflower CJ Co., Ltd., an imported car sales company, in Kitakyushu City, Fukuoka Prefecture. The company was the first official Chrysler dealer in western Japan.

In October 2004, President Naruse acquired all of the company's shares and started business activities as the Willplus Group.

Although it was a small dealer with a few staff members, including President Naruse, it achieved excellent results nationwide in sales of Chrysler cars and received high acclaim, which led him in 2005 to take over Chrysler's directly managed store in Ohta-ku, Tokyo, and advance to Tokyo. In 2006, the company opened a store in Kurume City, Fukuoka Prefecture. It also started a dominant strategy in Tokyo and Fukuoka.

Willplus Holdings Corporation was established in October 2007 to flexibly acquire dealers through optimal allocation of management resources and prompt management decision-making.

Under the holding company structure, the company actively expanded its business scope and was listed on the JASDAQ of the Tokyo Stock Exchange in March 2016. In September 2017, as the market changed, it shifted to the Second Section of the Tokyo Stock Exchange, and then it was listed on the First Section of the Tokyo Stock Exchange in February 2018.

In April 2022, it got listed on the Prime Market of the Tokyo Stock Exchange due to market restructuring.

Scheduled to be listed on the Standard Market in October 2023.

[1-2 Corporate Philosophy]

In this section, we state the company's significance and core values.

Our Significance (MISSION STATEMENT)

We propose a life with imported cars, share affluence, fun, and joy with more people, and continue to take on the challenge of drawing warm smiles on the face of everyone involved. |

Core Values ・Love our cars, love our colleagues, and work with pride. ・Always take on challenges and break through our limits. ・Achieve great results through teamwork. ・Make sure we reach our goal on time. ・Never give up until the end, and do our best. ・Provide richness, enjoyment, and joy. ・Never forget to be sincere and grateful. |

[1-3 Business Environment]

The business environment, which is essential in understanding the company, is as follows.

Regarding the business environment related to the M&A strategy, which is the company's growth driver, see

“2. Medium- to long-term strategy”.

◎ The share of imported cars in the domestic passenger car market continues to increase, and the number of imported cars owned in Japan is growing steadily.

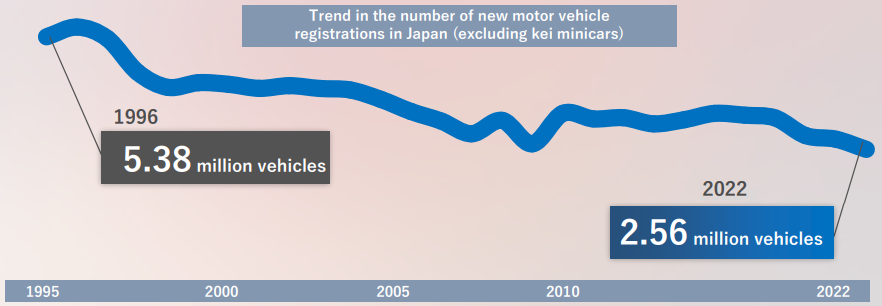

The number of new cars registered in Japan shows a decreasing trend due to the declining birth rates and aging population, the prolongation of the period of owning a car due to the elevation of functionality, changes in consumption styles and preferences (decrease of young people who own automobiles), etc.

(From the reference material of the company)

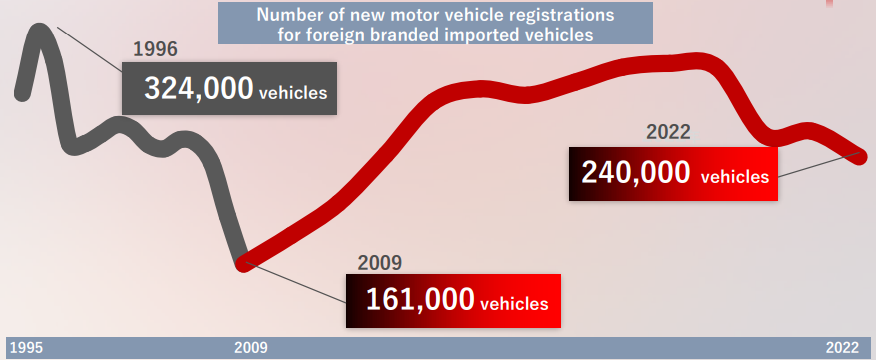

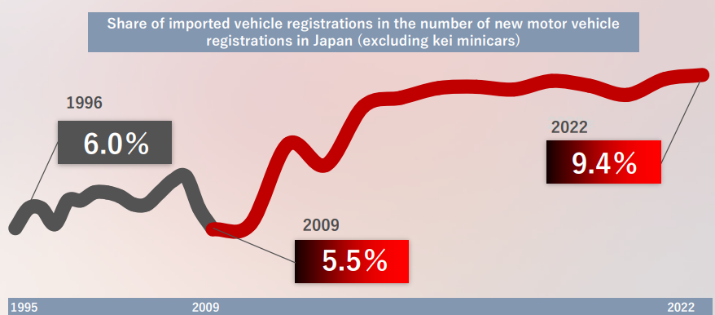

Against this backdrop, as seen in the graph below, registrations of new imported cars have been on the rise since the bankruptcy of Lehman Brothers, and the domestic market for imported cars continues to expand. With this, the share of imported cars in the domestic passenger car market (excluding mini cars) is on an upward trend.

|

|

(From the reference material of the company)

Imported car manufacturers are releasing a large number of attractive products such as hybrid vehicles, EVs (electric vehicles), PHVs (plug-in hybrid vehicles), diesel vehicles, and various other eco-friendly technologies, as well as unique and excellent designs.

In addition, in this shrinking market, domestic manufacturers have concentrated their energy for development and sales on popular models such as minivans and wagons, resulting in a biased lineup. On the other hand, imported car manufacturers have a diverse lineup with a wide range of prices, sizes, models, and types. Thus, they have won the support of users who seek diversity and more attractive cars. Moreover, active investment in Japan, such as establishing and expanding sales networks, has also increased the imported car manufacturers' market share.

◎ Comparison with other companies in the same industry

Code | Company | Sales | Sales growth rate | Operating income | Profit growth rate | Operating income margin | ROE | Market Capitalization | PER | PBR |

3184 | ICDA HLD | 31,000 | +1.7 | 1,383 | +0.8 | 4.5% | 11.2 | 5,590 | 6.1 | 0.7 |

3538 | Willplus HLD | 48,821 | +10.7 | 2,312 | +23.8 | 4.7% | 14.0 | 12,063 | 6.9 | 1.2 |

7593 | VT HLD | 290,000 | +8.9 | 12,000 | -6.7 | 4.1% | 12.4 | 62,794 | 8.2 | 0.9 |

8291 | Nissan Tokyo Sales HLD | 150,000 | +9.0 | 6,000 | -6.2 | 4.0% | 6.8 | 31,385 | 9.5 | 0.6 |

9856 | KU HLD | 142,000 | -7.4 | 8,200 | -15.3 | 5.8% | 12.1 | 55,201 | 7.2 | 0.7 |

* Units: million yen and %. Sales and operating income are company forecasts for this term. ROE is the result of the previous term. Market capitalization is the number of shares at the end of the most recent quarter × the closing price on September 5, 2023. PER (forecasted figures) and PBR (actual figures) are based on the closing price on September 5, 2023. (3184 ICDAHLD is based on the closing price September 4)

The company is the only company that expects double-digit sales and profit growth and a P/B ratio over 1x. If the market highly evaluates the company's high business revitalization capabilities through M&A, raising its dividend payout ratio to 30%, and an aggressive shareholder return policy aiming for dividend growth that exceeds profit growth, the valuation level will likely change.

[1-4 Business Description]

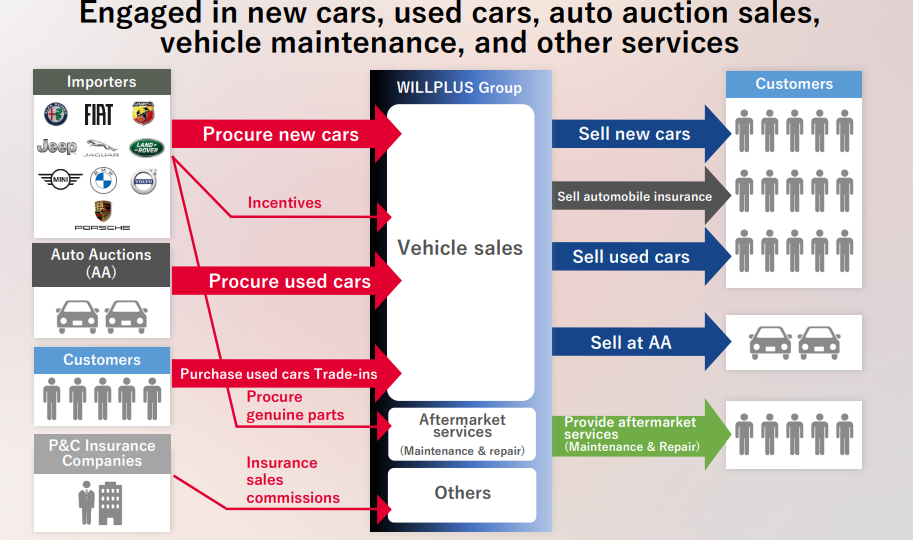

◎Overview

Under the holding company Willplus Holdings Corporation, five consolidated subsidiaries engage in sales of imported new and used cars, vehicle maintenance, and non-life insurance agency business. The company handles 11 brands. The company has an official dealer contract with an importer (a company that handles imported cars in Japan) for each brand it handles.

(From the reference material of the company)

◎ Products and services (business description)

In addition to selling new and used cars, the company handles vehicle maintenance and non-life insurance sales.

(From the reference material of the company)

Products and Services | Description |

|

New cars | As authorized dealers, the companies sell all new car brands procured from each importer. | |

Used cars | It mainly sells certified used cars of recent models of each brand with a short travel distance. Products are purchased through trade-ins at the time of selling new cars, purchases, and automobile auctions. | |

Sales | It sells trade-in used cars of other brands at automobile auctions. In addition, at the request of dealers of other companies, it may sell new and used vehicles owned by the corporate group. | |

Vehicle maintenance | The main services are maintenance, repair, and inspection of the sold vehicles. With the exception of some stores, service centers are set up alongside showrooms. | |

Others | It sells compulsory automobile liability insurance and voluntary insurance as an agent for non-life insurance companies. Incentive income related to new car sales from importers is also included. |

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

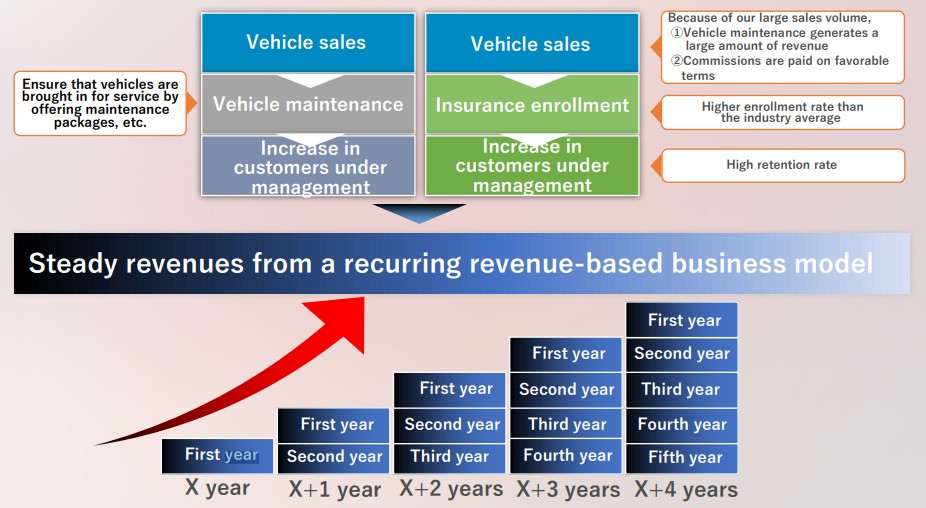

Although the sale of new cars is the main business, the company is focusing on the sale of used cars and strengthening customer relationships by providing services that customers need after purchasing a car, such as vehicle maintenance and car insurance sales.

Regarding vehicle maintenance, maintenance packages are provided to ensure maintenance after sale. As for insurance sales, the provision of detailed information on insurance products has been highly evaluated, and the enrollment and retention rates are higher than the industry average.

In this way, “the increase in sales quantity = expansion of retailer business model earnings” leads to the expansion of recurring revenues through the increase in the number of vehicle maintenance and insurance purchases.

◎ Number of stores

As of the end of June 2023, the number of stores is 16 in Fukuoka, 16 in Tokyo and Kanagawa, 2 in Yamaguchi, 1 in Miyagi, and 1 in Fukushima, for a total of 36 stores.

[1-5 Characteristics, Strengths, and Competitive Advantages]

(1) Ability to revitalize business through M&A

From the perspective of "purchasing time," many companies currently use M&A strategies as a pillar of their growth strategies. It goes without saying that finding excellent deals and executing them at appropriate prices are essential for a successful M&A. However, the post-M&A process called PMI (Post Merger Integration) to create the expected synergy effect is seen as more important.

There are countless cases of M&A failing due to a lack of prior assessment of factors that impede integration and the inability to manage differences in corporate culture.

Under such circumstances, investors should pay attention to the company's business revitalization ability.

Since the establishment of Willplus Holdings in October 2007, the company has carried out 9 M&A deals to date. With the exception of the most recent M&A in February 2023, all of nine deals, which were either in the red or extremely low-profit status at the time of acquisition, have turned profitable.

The key to a successful M&A is sharing philosophies, such as pursuing the improvement of customer satisfaction and clarifying the evaluation criteria, which includes respecting challenges to the maximum extent possible. The company believes these key factors can drastically change companies and has great confidence in its ability to revitalize its business.

(2) The only listed company whose main business is being an authorized dealer of imported cars

While there are many companies that are authorized dealers of imported cars while mainly relying on selling used cars, the company is the only listed company that mainly sells new cars.

The number of new imported car registrations has been on the rise since the financial crisis in 2008 (due to the Lehman Brothers' bankruptcy), and the imported car market in Japan continues to expand. The share of imported cars in the domestic passenger car market (excluding minicars) is in the 9% range, and the six-year average growth rate (as of 2021) of passenger car ownership (including minicars) in Japan is 0.35%. On the other hand, the ownership of imported cars (passenger cars) increased steadily by 3.54%.

As the market itself continues to grow, further expansion of earnings is expected by expanding the market share through M&A strategies.

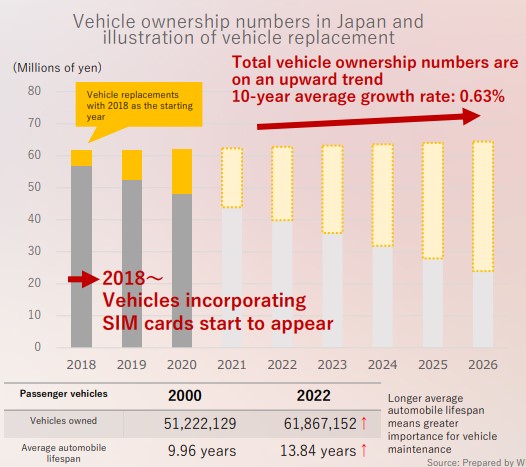

(3) Stable revenue structure based on the recurring revenue-type business

The stable revenue structure based on car maintenance and insurance sales, which are recognized as recurring revenue-type businesses, represents another significant characteristic and forte of the company.

The average growth rate of the number of owned cars in Japan in seven years is about 0.3% showing an increasing trend (up 3.5% for imported cars). Furthermore, a rising trend can be seen in the average number of years of using a car due to the changes in the economic situation, elevation of awareness concerning the environment, etc., inevitably making maintenance more important.

In addition, with the development of ” CASE “, maintenance work is expected to become more complex, and maintenance work for imported vehicles is expected to be concentrated at authorized dealers.

Given these factors, the company believes that opportunities for earnings in the vehicle maintenance business will continue to increase, and it will seek to strengthen the foundation of this business by increasing the percentage of vehicles that come in for maintenance by adding maintenance packages and extended warranties for new vehicles.

In addition, the company will continue to brush up its staff's insurance knowledge to further improve customer satisfaction with regard to insurance commission income, which has been growing at double-digit rates every fiscal year, and further strengthen the foundation for stable growth in the stock-type business of insurance sales and vehicle maintenance.

|

|

(From the reference material of the company)

2. Mid- to Long-Term Strategy

While today’s companies are required to improve their social significance and corporate value to solve social issues, the company formulated and implemented a mid- to long-term strategy based on its basic growth strategies (multi-brand strategy, dominant strategy, M&A strategy).

[2-1 Willplus Group Policy]

The company aims to enhance social value and corporate value. In other words, the company aspires to solve social issues and achieve corporate growth.

The company will strive to “contribute to the realization of a sustainable society” and “create social value” as a step toward the elevation of their social value.

Concretely, they will forge ahead with making their stores greener and decarbonizing the store areas, aiming for an enterprise that is needed by society.

They aim for “sustainable growth” and “elevation of corporate value in the medium term” as a step toward the elevation of their corporate value.

Concretely, they will promote their growth strategy, centered on M&A, and engage in solving issues through corporate revitalization in the car sales industry, where many small and medium-sized enterprises exist, by resolving the challenge of finding a successor, reusing assets (resources), improving profitability, and reeducating and stimulating human resources (human capital) while aiming for the maximization of sales and profit, as described below.

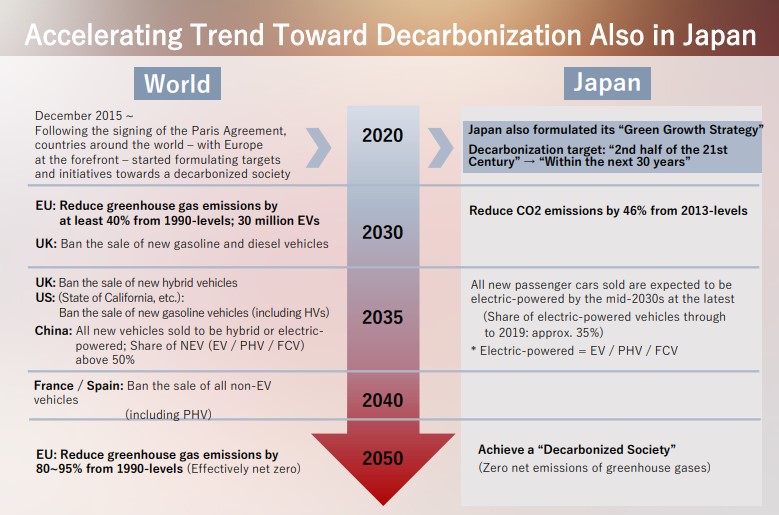

They view “the solving of issues concerning climate change” as an “opportunity,” aim for acquiring “new areas” and “new brands,” make proactive efforts to expand their business through “M&A” and work toward the “maximization of market capitalization” through the elevation of their social value and corporate value.

[2-2 Goal]

As the commitment to issues concerning climate change including the supply chain is sought, brand manufacturers are starting to demand the accurate grasping of GHG emissions from store operation, setting of goals for the reduction of GHG emissions and concrete initiatives to achieve these goals (ratio of EVs among demo cars, ratio of renewable energy use, ratio of recycled waste, etc.) from official dealers.

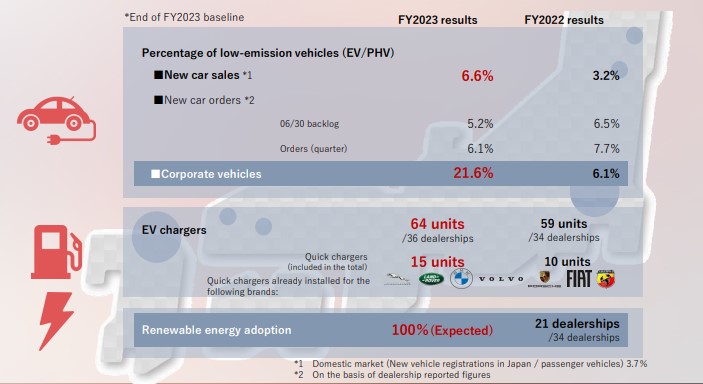

The company, which aims to be a leading company in solving climate change issues, has set the following GHG emission reduction targets.

To reduce Scope 1 + Scope 2 GHG emissions by 50% in FY 2030 compared to FY 2021.

*Ratio of low-carbon vehicles among company vehicles (including test vehicles): 80% or higher in FY 2030

*Target for the introduction of renewable energy sources: All stores in FY 2025

[2-3 Initiatives of the Willplus Group]

The company’s initiatives for realizing “the elevation of social value” and “elevation of corporate value” at the same time are outlined below.

(1)Social Value Enhancement

①Contribute to the realization of a decarbonized society by promoting green store operations

In addition to setting the above reduction targets, the company intends to make capital investments to promote the spread of EVs in its store areas as an imported car dealer striving to be one of the first to promote green store operations, thereby contributing to the decarbonization of its store areas and the domestic automobile industry.

The achievements in fiscal 2023 are as follows.

(From the reference material of the company)

The ratio of low-carbon cars has significantly risen with regard to both new car sales and company-owned cars.

As for EV charging facilities, the company added five more quick chargers. They have already installed quick chargers for seven brands.

There are now 22 stores that use renewable energy. The company plans to purchase tradable green certificates for the power used at other stores, and expects that all power the group uses will originate from 100% renewable energy in fiscal 2023.

②Other Initiatives Responses

◎Obtained the score B in the 2022 CDP Climate Change Questionnaire

The company obtained the score B in the Climate Change Questionnaire conducted by the international organization CDP (Carbon Disclosure Project) in response to requests from institutional investors and purchasing companies around the world to promote environmental information disclosure of companies.

The CDP questionnaire evaluates the disclosure of an organization's environmental information with A to F as a global standard for "E" in ESG information. As of 2022, more than 20,000 organizations, including over 18,700 companies and over 1,100 municipalities, equivalent to half of the world's market capitalization, have disclosed environmental information through CDP, which is used by institutional investors and purchasing companies for decision making. In Japan, over 1,700 companies and organizations, including more than 1,000 companies listed on the Prime Market, responded.

They have already responded in regard to 2023 and the announcement of results is scheduled for the beginning of 2024.

The company aims to obtain an "A" or "A-" rating, which corresponds to the top 0.08% of companies worldwide, by 2026.

◎Acquisition of the Eco Mark certification at 10 BMW and MINI operational bases

In December 2022, all operational bases of Willplus Motoren dealing with the BMW and MINI brands (excluding MINI Kurume) acquired the Eco Mark certification for their store operation.

The Eco Mark is an environmental label of third-party certification based on “ISO14024,” certifying products that fulfil certain criteria in the Eco Mark Program organized by The Japan Environment Association.

The “Retail Stores” certification, which was acquired by the company, certifies stores that offer a wide variety of environment-friendly products and work with consumers to promote environment-conscious activities, such as thinking about the environment while operating stores and visualizing ecological activities joined by consumers.

The company is going to organize test drives and exhibitions of next-generation vehicles such as EVs, use environment-friendly products (BMW water-based paint, wooden stir sticks, soy ink, etc.), introduce energy-saving devices, and measure and manage waste.

(2) "Enhancement of social value" and "enhancement of corporate value" through promotion of M&A

M&A is an important measure for quickly entering new areas, acquiring new brands, and expanding the market shares of existing brands. In the saturated domestic automobile market, the company believes that M&A is the most appropriate and priority strategy from the perspectives of customer acquisition, early return on investment, and securing profits.

◎Business Environment for M&A Promotion

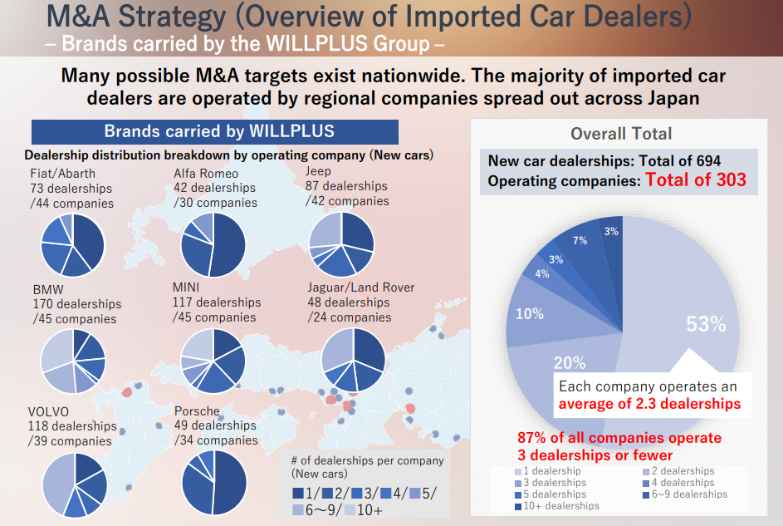

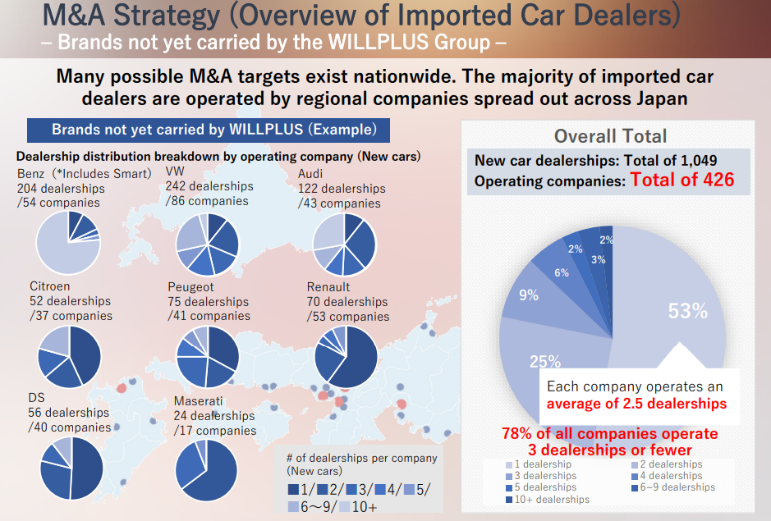

According to the company's assessment, there will be 729 imported automobile dealers operating throughout Japan by the end of 2022, with a total of 1,743 new car sales offices. Each company had an average of 2.4 shops, while small and medium-sized businesses with three or fewer shops accounted for over 90% of the total number of dealers.

Store operation varies from brand to brand, and some brands are consolidating capital.

In addition, many dealers are struggling with the difficulty in finding successors, a common problem for small and medium-sized companies in Japan.

|

|

(From the reference material of the company)

For these imported car dealers, the "CASE" of automobiles, of which "Electric Vehicle" and "Connected" are the most important management issues for the future.

"CASE" stands for Connected, Autonomous, Shared & Services (which may refer to car sharing and services/sharing only), and Electric. They are drastically changing the conventional concept of a "car" and creating new demand and markets in each of these areas.

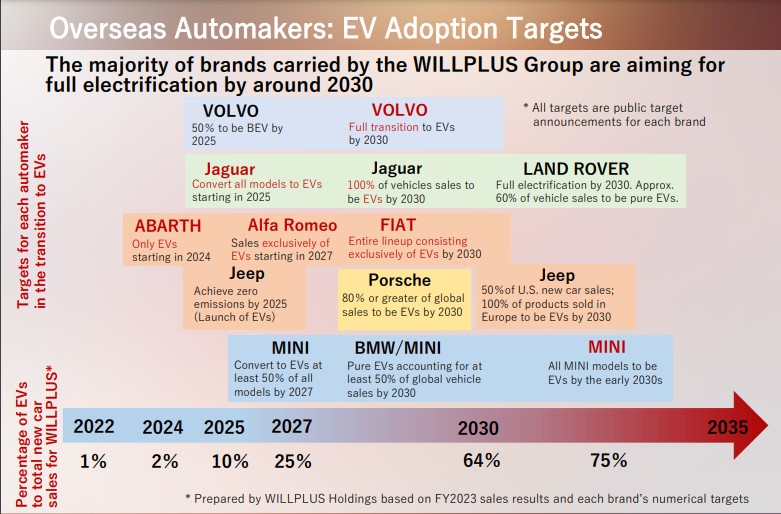

◎ Enhanced Environmental Awareness and the Progress of the Shift to EVs

With heightened awareness of the global warming crisis, efforts to reduce greenhouse gas emissions and realize a decarbonized society are progressing rapidly.

One of the most significant concerns is reducing automotive emissions, and as governments try to attain carbon neutrality by 2050, automobile manufacturers are shifting from traditional gasoline and diesel engine cars to electric vehicles (EVs) in order to survive.

Manufacturers headquartered in Europe, which has long had a high degree of environmental awareness, have been particularly engaged in the transition to EVs.

On the other hand, while Japanese manufacturers set targets for the number and ratio of sold EVs, the expansion pace is sluggish in comparison with overseas competitors and there is a high possibility that the shares of imported cars will continue growing in regard to the sale of EVs in Japan.

|

|

(From the reference material of the company)

As previously stated, brand car manufacturers must commit to developing a firm understanding of emissions throughout their supply chains and to reducing them, so they are increasingly urging dealers to not only understand their current emissions, but also to make appropriate capital investments and responses to climate change issues, such as increasing EV purchases, installing quick chargers, and disclosing emission reduction targets.

Many dealers, however, face financial and human resource limits that make it difficult for them to respond adequately, and some analysts predict that brand car manufacturers may take the lead in combining and restructuring vendors who can respond appropriately to such demand.

◎ Complication of car maintenance through the spread of connected systems and EVs

The term "connected" refers to the usage of communication equipment in automobiles to enable continuous external contact. Equipping vehicles with a SIM card will allow for grasping the state of a car and the situation on a road, exchange of information between cars and between a car and infrastructure, remote control, etc.

The connected automobile will evolve into smartphone-like devices, improving convenience while potentially complicating maintenance work in the case of a breakdown or vehicle inspection.

Furthermore, the previously noted shift to EVs will have a significant influence on car maintenance. Through the distribution of EVs, high-voltage battery and generator failures will increase, and vehicle maintenance will need to manage high-voltage systems, prompting substantial investment in high-voltage equipment and special training for safety reasons. Because the shift to connected systems and electric cars will need greater investment in both hardware and software, maintenance work for imported vehicles is likely to be concentrated in the hands of authorized dealers and large capital organizations with substantial investment capacity.

◎ The company's policy on M&A

While responding to EVs and connected automobile is an urgent task for imported car dealers, the company intends to differentiate itself by building stores that are preferred by brand car manufacturers and by acquiring dealers who find it challenging to address these issues through M&A. By doing so, it hopes to expand into new areas and pick up new brands in order to grow and boost its corporate value. Additionally, the company wants to help with social issues by creating new brands and working to make its stores greener.

The company will not only decarbonize the neighboring area and turn the stores green, but it will also reinvigorate the social capital that already exists by repurposing resources and assets including stores, retraining personnel, and enhancing productivity by streamlining processes using DX.

As imported vehicle dealers confront succession concerns and increase their attention to tackling climate change issues, it is anticipated that the company's primary strategy, M&A, will accelerate in the future.

(3) Financial Strategy for Solving Social Issues and Driving Corporate Growth

The company's business strategy centers on greening its stores and executing M&A proactively, while advancing its green initiatives through its financial strategy by increasing the proportion of funds raised through sustainable finance.

These funds will be used for M&A focused on making stores green, working capital for adopting EVs and PHVs and for investment in facilities such as the installation of quick chargers.

The company is actively utilizing the Sustainability Linked Loan (SLL) scheme. The SLL sets Sustainability Performance Targets (SPTs) aligned with the borrower's sustainability strategy and links loan conditions with SPT progress to promote environmentally and socially sustainable economic growth.

By taking measures to achieve the set SPTs, the company aims to promote sustainable management.

In this regard, the company has developed a "Sustainability Framework" based on group goals for implementing SLLs and has obtained a second opinion from Rating and Investment Information, Inc. (R&I) regarding its suitability.

In the FY6/23, the company made the following three SLLs totaling 4.0billion yen.

Implementation Date | Sustainability Coordinator | Contract Term | Loan amount | KPI | SPT |

November 30, 2022 | Sumitomo Mitsui Banking Corporation | 5 years | 1 billion yen | (1) Reduce GHG emissions (Scope 1 + Scope 2) (2) Adoption of renewable energy for electricity used by stores | (1) Reduce GHG emissions per store by 22% between FY 2021 and FY 2025 (2) Switch to renewable energy sources for electricity purchased by all stores by the end of FY 2025 |

January 30, 2023 | Mizuho Bank | 10 years | 2 billion yen | CDP Climate Change Score | Earning "A-" or higher during the financing period. |

February 28, 2023 | Fukuoka Bank | 5 years | 1 billion yen | (1) Reduce GHG emissions (Scope 1 + Scope 2) (2) Adoption of renewable energy for electricity used by stores | (1) Reduce total GHG emissions per store by 27.5% from FY 2021 by the end of FY 6/2026 (2) Switch to renewable energy sources for electricity purchased at all stores by the end of FY 6/2025. |

Through the implementation of SLL, the ratio of sustainable finance was 58.6%.

To prepare for the increase in operating funds associated with future M&A, the company plans to increase the proportion of long-term interest-bearing debt, which stood at 59.3% as of the end of June 2023.

[2-4 Medium- to Long-term Shareholder Return Strategy]

The company, which has increased dividends consecutively since its listing, has newly established the following policy.

☆ | To target a medium- to long-term ROE of 15% or higher (14.0% in the FY6/23). |

☆ | The company will gradually raise its dividend payment ratio to 30% by FY 2026 in order to "keep sufficient capital" and "further boost shareholder return" at the same time. |

☆ | In order to sustain and increase consistent and ongoing returns to shareholders, the company will continue to pay out dividends at a payout ratio of 30% from FY 2027, with a DOE of 4.5% or higher. |

In the term ended June 2023, the dividend remained 41.17 yen/share as forecast, while the company raised payout ratio to 22.5% and achieved a dividend growth exceeding profit growth for the third consecutive term.

In this term ending June 2024, they will further raise payout ratio to 25.0%, with the dividend forecast being 43.51 yen/share.

In order to demonstrate its extremely aggressive profit growth policy and shareholder return stance, the company aims to achieve ROE that significantly exceeds the cost of shareholders' equity, increase the dividend payout ratio gradually, and increase dividends in excess of profit growth over the next four years.

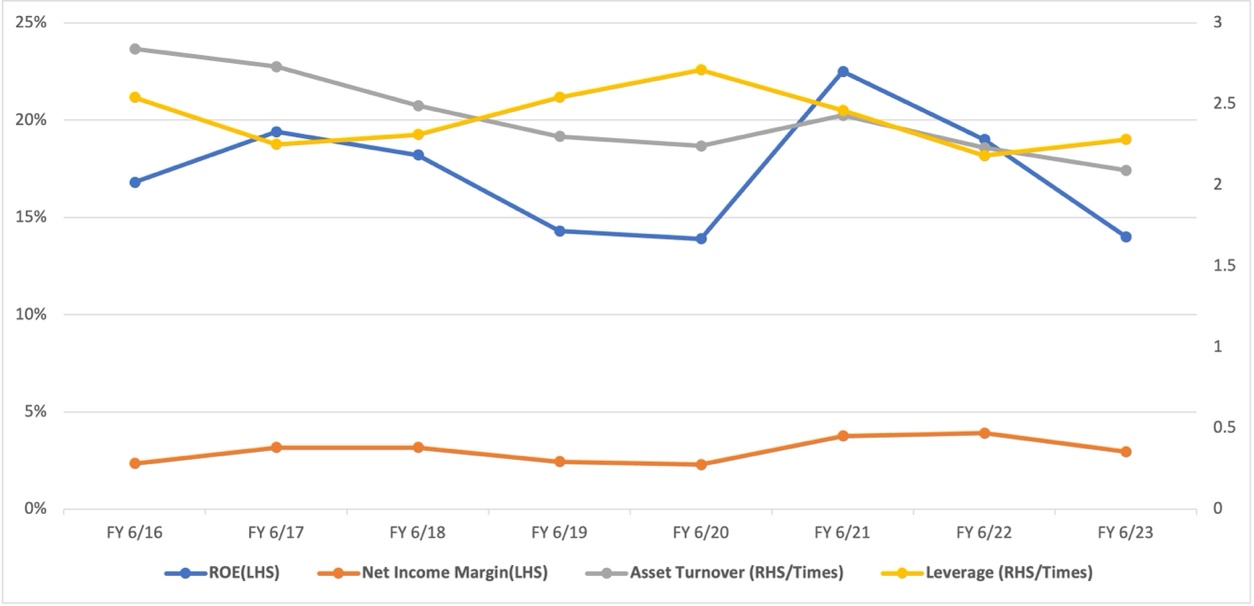

(ROE Analysis)

| FY 6/16 | FY 6/17 | FY 6/18 | FY 6/19 | FY 6/20 | FY 6/21 | FY 6/22 | FY 6/23 |

ROE (%) | 16.8 | 19.4 | 18.2 | 14.3 | 13.9 | 22.5 | 19.0 | 14.0 |

Net income margin (%) | 2.34 | 3.16 | 3.16 | 2.44 | 2.29 | 3.76 | 3.91 | 2.95 |

Total asset turnover (times) | 2.84 | 2.73 | 2.49 | 2.30 | 2.24 | 2.43 | 2.23 | 2.09 |

Leverage (x) | 2.54 | 2.25 | 2.31 | 2.54 | 2.71 | 2.46 | 2.18 | 2.28 |

Although ROE has been on a decline in the past two years, it is above 8%, which is said to be the general target for Japanese enterprises.

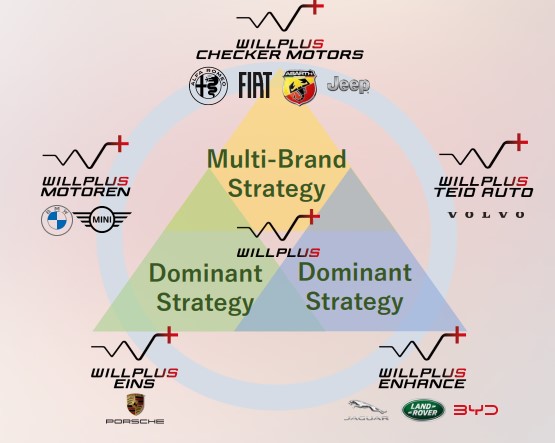

3. Growth Strategy

Three strategies promote the company's growth: "multi-brand strategy," "dominant strategy," and "M&A strategy."

(From the reference material of the company)

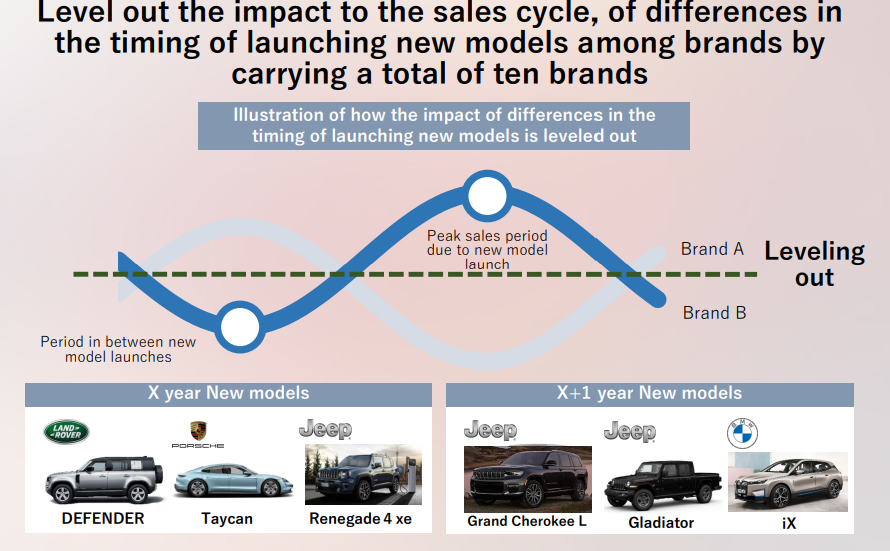

[3-1 Multi-brand strategy: Expansion of earnings and leveling of the sales cycle]

By handling multiple brands without relying on a specific brand, the company aims to even out the impact of the sales cycle caused by differences in the timing of new model launches among brands.

The company currently handles 11 brands and aims to expand the number of brands through M&A strategies.

(From the reference material of the company)

[3-2 Dominant strategy: Increase the market share and maximize profit in the same trade area]

The company is opening new stores in cities with a population of 1 million and surrounding cities as specified areas in order to increase its market share by attracting customers in the same trade area, improve productivity through efficient personnel allocation among stores, and maximize profit.

Currently, the company focuses on Tokyo, Kanagawa, and Fukuoka, which are Japan's top markets in terms of new car registrations and ownership of imported cars (passenger cars), but it is also aiming to expand into other areas through the M&A strategy.

[3-3 M&A Strategy: Speed Up]

M&A is an important measure for quickly entering new areas, acquiring new brands(multi-brand strategy), and expanding the market share of existing brands.

WILPLUS HOLDINGS has executed ten M&A since its establishment in October 2007. Following the acquisition of a huge number of stores, trade areas, and new brands via M&A, the company has been extending its business by building additional stores in neighboring regions to complement its trade areas.

The company targets more than ten brands, including Mercedes-Benz, Volkswagen, and Audi, and there is a tremendous opportunity for growth through the M&A acquisition of additional brands.

Aside from direct approaches from the company to the target companies and direct contact from the target companies back to the company, the company searches out deals through introductions from importers, financial institutions, and M&A brokerage firms.

The company will carry out due diligence and only engage in negotiations with those agreements that satisfy the company's investment recovery requirements following internal discussions that focus on prospects for future development and synergies.

Since their founding in October 2007, WILLPLUS Holdings has implemented nine projects of M&A. They have achieved profitability in all these projects by injecting their know-how, etc. in addition to opening new stores and making investments in stores, including relocation and renovation, and the high level of their PMI capability is attracting attention.

4. Fiscal Year ended June 2023 Earnings Results

[4-1 Overview of Financial Results]

| FY 6/22 | Ratio to sales | FY 6/23 | Ratio to sales | YoY | Forecast ratio |

Sales | 39,696 | 100.0% | 44,115 | 100.0% | +11.1% | -0.6% |

Gross Profit | 8,441 | 21.3% | 8,622 | 19.5% | +2.1% | - |

SG&A | 6,075 | 15.3% | 6,754 | 15.3% | +11.2% | - |

Operating Income | 2,366 | 6.0% | 1,867 | 4.2% | -21.1% | -30.5% |

Ordinary Income | 2,377 | 6.0% | 1,943 | 4.4% | -18.2% | -27.6% |

Net Income | 1,550 | 3.9% | 1,302 | 3.0% | -16.0% | -25.6% |

*Unit: million yen. Forecast ratio is the ratio to the performance forecast announced in August 2022.

Increase in sales, but decrease in income

The company reported a 11.1% YoY increase in net sales to 44,115 million yen.

New car, used car and recurring revenue-type business sales grew.

Operating income declined 21.1% YoY to 1,867 million yen.

Although sales grew, the gross profit margin of new car sales declined due to a drop in sales commissions, which depend on the number of sold cars, and rising procurement costs for vehicles. The gross profit margin of used car sales dropped due to a year-end loss on valuation of inventories.

Moreover, expenses related to medium/long-term strategies, such as costs for addressing environmental issues and costs related to human capital management, augmented in addition to the increase in depreciation for each company car caused by the rise in the average spending for new cars, growth of depreciation brought about by an increase in the number of company cars, augmentation of SG&A expenses, recruitment expenses, water, power and heating costs, and payment of special inflation compensation allowances to staff.

The sales in the fourth quarter (April to June) marked a record high in terms of quarterly performance.

*Market Environment

Imported cars showed signs of recovery later than Japanese automobiles, but their recovery pace is still slow. The company was even slower to recover than imported cars overall. They finally seem to be fully recovering from the fourth quarter (April to June).

Regarding the performance of each brand, especially the brand Stellantis is sluggish in recovery, while Jagger and Land Rover performed favorably.

[4-2 Trend of each business]

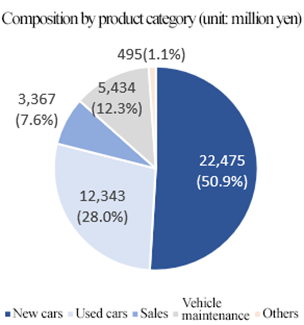

| FY 6/22 | Composition ratio | FY 6/23 | Composition ratio | YoY |

New cars | 19,576 | 49.3% | 22,475 | 50.9% | +14.8% |

Used cars | 11,009 | 27.7% | 12,343 | 28.0% | +12.1% |

Sale by distributors | 3,605 | 9.1% | 3,367 | 7.6% | -6.6% |

Subtotal of sales of cars | 34,190 | 86.1% | 38,186 | 86.6% | +11.7% |

Car maintenance | 5,058 | 12.7% | 5,434 | 12.3% | +7.4% |

Other | 446 | 1.1% | 495 | 1.1% | +10.8% |

Total | 39,696 | 100.0% | 44,115 | 100.0% | +11.1% |

*Unit: million yen.

*Sale of new cars

Despite lingering instability in product arrival and its impact on some brands, new car sales of especially high-end automobiles were stable thanks to the contribution to sales made by “JEEP Ota” newly opened in August 2022 and “MINI Kurume,” which launched its business activities in April 2023 after business transfer.

*Sale of used cars

Sales grew as a result of efforts for securing products through measures such as encouraging customers to trade in their old cars when selling new cars, especially in regard to offered brands where the supply of new cars was insufficient in the first half of the term.

* Recurring-revenue business

Even when new car sales were sluggish, sales of car maintenance grew due to a steady increase of customers who continuously have their cars serviced in addition to a rise in the number of stores.

While the company has kept forging ahead with acquiring new contracts in the agency business of insurance, they further enhanced the connection with their clients and worked toward contract period extensions. As a result, sales increased even while new car sales showed little progress.

[4-3 Financial Standing and Cash Flows]

◎Main Balance Sheet

| End of June 2022 | End of June 2023 | Increase/ Decrease |

| End of June 2022 | End of June 2023 | Increase/ Decrease |

Current Assets | 11,374 | 15,620 | +4,245 | Current Liabilities | 8,254 | 9,533 | +1,278 |

Cash and Deposits | 5,538 | 4,290 | -1,247 | Payables | 1,793 | 3,829 | +2,036 |

Inventories | 4,882 | 9,551 | +4,669 | ST Borrowings | 3,549 | 2,615 | -934 |

Noncurrent Assets | 7,255 | 8,024 | +768 | Noncurrent Liabilities | 1,545 | 4,364 | +2,819 |

Tangible Assets | 6,274 | 7,038 | +764 | LT Borrowings | 1,066 | 3,818 | +2,751 |

Buildings and Structures | 3,664 | 3,757 | +93 | Total Liabilities | 9,800 | 13,898 | +4,098 |

Intangible Assets | 174 | 97 | -76 | Net Assets | 8,829 | 9,746 | +916 |

Investment, Others | 806 | 887 | +80 | Retained Earnings | 7,566 | 8,435 | +868 |

Total Assets | 18,630 | 23,644 | +5,014 | Total Liabilities and Net Assets | 18,630 | 23,644 | +5,014 |

*Unit: million yen.

While product inventory almost doubled from the end of the previous term as the supply of new cars returned to normal, cash and deposits decreased, and total assets at the end of the term amounted to 23.6 billion yen, up 5 billion yen from the end of the previous term. Total liabilities grew 4 billion yen from the end of the previous term to 13.8 billion yen due to the augmentation of trade payables due to increased product procurement and an increase in long-term loans payable through a sustainability linked loan, etc.

Net assets increased 900million yen from the end of the previous term to 9.7 billion yen due to an increase in retained earnings.

Capital-to-asset ratio fell 6.2 points from the end of the previous term to 41.2%.

◎CF

| FY 6/22 | FY 6/23 | Increase/decrease |

Operating Cash Flow | 1,910 | -2,185 | -4,096 |

Investing Cash Flow | -217 | -492 | -274 |

Free Cash Flow | 1,692 | -2,678 | -4,370 |

Financing Cash Flow | 469 | 1,430 | +960 |

Cash and Equivalents | 5,538 | 4,290 | -1,247 |

*Unit: million yen.

Operating cash flow and free cash flow turned negative due to a decrease in net income before taxes and other adjustments.

The company's cash position decreased.

[4-4 Topics]

(1) The company chose the Standard Market.

At the time of market restructuring at TSE in April 2022, the company chose “the Prime Market” and strove to fulfill the criteria for remaining listed, but as of the end of June 2023, the market capitalization of tradable shares was still not enough to satisfy the criteria for remaining listed.

In this situation, the company considered that concentrating managerial resources onto “M&A, which is essential for corporate growth,” “business administration based on human capital,” etc. from the medium/long-term viewpoint would contribute to “sustainable growth” and “improvement in corporate value,” and conducted discussions while keeping in mind its management policy and recent business environment. As a result, the company decided to choose the Standard Market, considering that it is important to concentrate managerial resources onto initiatives for improving corporate value in the medium/long term and secure an environment where shareholders can hold or sell the company’s shares.

The company will be listed on the Standard Market from October 20, 2023, and keep aiming to achieve “sustainable growth” and “improvement in corporate value.”

(2) Establishment of a new subsidiary and renaming of a subsidiary

On July 1, 2023, the company transferred the business of dealing in Jaguar and Land Rover, which are core brands, to “Willplus Enhance Co., Ltd.,” which was established in January 2023. With the new structure, they aim to expand their business further.

In July 2023, Checker Motors was renamed “Willplus Checker Motors” and Teio Auto was renamed “Willplus Teio Auto.”

All of the names of 5 group companies start with “Willplus” and the corporate logo has been unified, to diffuse the Willplus brand further.

(3) The company started dealing in the new brand “BYD.”

In May 2023, the company concluded a dealership contract with BYD Auto Japan Co., Ltd., which is a Japanese corporation of BYD, which is the world’s leading EV maker in China.

Willplus Enhance Co., Ltd. opened “BYD AUTO Fukuoka-Nishi” on July 1, 2023. It started dealing in the new brand “BYD” in Fukuoka City.

(4) Initiatives for HR strategy

◎ Adoption of employee stock ownership plan (ESOP) trust and tax-qualified stock options

In August 2023, the company announced that it would adopt an ESOP for offering shares of the company to employees as one of employees’ incentives.

The company aims to improve its medium/long-term corporate value by giving employees a sense of belonging, motivating employees to be involved with business administration, and raising their awareness of the improvement in medium/long-term business performance and the rise in share price.

In addition, the company issued share acquisition rights for issuing tax-qualified stock options, for the purpose of enhancing employees’ resolution and motivation to maximize corporate value. They will strive to motivate employees to get involved with business administration, improve the retention rate of employees, and enhance their recruitment capability.

Regarding the “trust-type stock option” disclosed in December 2022, the company acquired and retired them in June 2023, and switched to the tax-qualified stock option.

5. Fiscal Year ending June 2024 Earnings Forecasts

[5-1Earnings Forecast]

| FY 6/23 | Ratio to Sales | FY6/24(Est) | Ratio to Sales | YoY |

Sales | 44,115 | 100.0% | 48,821 | 100.0% | +10.7% |

Operating Income | 1,867 | 4.2% | 2,312 | 4.7% | +23.8% |

Ordinary Income | 1,943 | 4.4% | 2,303 | 4.7% | +18.5% |

Net Income | 1,302 | 3.0% | 1,692 | 3.5% | +29.9% |

*Unit: million yen. Estimates are those of the company.

Sales and profit are expected to grow by double digits, and sales are projected to hit a record high.

It is forecast that sales will increase 10.7% year on year to 48,821 million yen and operating income will grow 23.8% year on year to 2,312 million yen. Sales are expected to reach a record high following the previous year.

The company expects to steadily receive orders for existing brands owing to stable demand from clients.

They expect a growth in new car sales despite the expected impact of rising sale prices on business activities as they are going to steadily deliver new cars which were ordered by the end of the previous term.

Used car sales are forecast to reach the same level as those in the previous term, expecting that fluctuations on the used car market during the previous term will return to normal in this term.

As the company expects that many new cars will be delivered in this term, they will keep encouraging customers to trade in their old cars when selling new cars as a step toward a more efficient management.

With regard to the recurring revenue-type business such as car maintenance and agency business of insurance, the company will further enhance the connection with each customer and aim to build an even more solid revenue foundation.

Selling, general and administrative (SG&A) expenses, such as personnel costs, costs related to sale and costs related to store maintenance are projected to increase in step with the expansion of business operations. Moreover, the company plans to continue with investments in human capital, such as the improvement of working conditions, reduction of menial work through DX and training for reskilling to allow all employees to fully utilize their abilities.

The company plans to pay a dividend of 43.51 yen/share, up 2.34 yen/share. The expected payout ratio is 25.0%.

【5-2 Change in the environment surrounding the M&A strategy-Subsiding of COVID-19 and acceleration of M&A】

The company considers that a tail wind has begun to blow around the company’s M&A strategy, as COVID-19 has subsided.

(1) 2020-2022: Business environment in which M&A (sale of business) is unlikely to be conducted

In the wake of the outbreak and spread of COVID-19, the demand for automobiles as a safe transportation means or for domestic travel as an alternative to overseas travel grew rapidly from 2020 to 2021.

In 2022, the prices of new automobiles skyrocketed due to the shortage of supply caused by the global shortage of semiconductors and the rise in material prices, and the shortage of new automobiles led to the growth of demand for used automobiles, and the prices of used automobiles rose significantly.

In such business environment, the sale and order receipt of automobile dealers were healthy. Inventory declined, working capital shrank, and order backlog increased steeply, so even dealers with weak marketing capabilities and small capital stock were able to operate business without trouble.

On the other hand, dealers thinking of selling their businesses decreased in that situation. It was unfavorable for the M&A strategy of the company, but the company’s growth and operating income margin exceeded the average in the industry, and the company concentrated managerial resources onto M&A in the next phase.

(2) 2023: Acceleration of M&A in parallel with the recovery of supply of new automobiles

In 2023, the business environment is changing.

While COVID-19 has subsided, the demand for automobiles, which grew rapidly due to special factors, started shrinking, and the prices of new cars have been high since they were raised considerably in 2022. Meanwhile, the recovery of supply of new cars due to the elimination of shortage of semiconductors led to the drop in prices of used cars.

Due to the hovering prices of new cars, costs augmented through the increases in investment in company-owned cars and depreciation, and inventory and working capital increased, making cash management difficult and squeezing small and medium-sized dealers.

The profitability of automobile dealers is declining, due to the change in the business environment after the subsiding of COVID-19 and the augmentation of costs for enhancing corporate governance and tackling environmental issues.

From now on, it is expected that M&A projects for mainly small and medium-sized dealers with a weak management foundation will increase, and the company believes that its M&A strategy, which has been suspended in the past 3 years, will be accelerated considerably.

6. Conclusions

Seeing that sales in the fourth quarter of the term ended June 2023 reached a record high in terms of quarterly performance, new car sales seem to be on the way to full recovery as the number of cars sold picked up and average spending per customer rose, and annual sales are projected to mark a record high in this fiscal year. On the other hand, a double-digit growth is expected for profit in step with the increase of sales, but the company forecasts an augmentation of costs, mainly for strategic investments, and it is unlikely that operating income will reach a record high. We would like to pay attention to how much profit will grow as sales further accumulate, as well as the extent to which the new brand BYD will contribute.

On the other hand, demand for automobiles, which rapidly grew due to special factors, has started shrinking as the COVID-19 pandemic subsided, and expenses for enhancing governance and addressing environmental issues have increased. Therefore, the company is expecting more projects targeting mainly small and medium-sized dealers with weak management foundations from now on. They assume that their M&A strategy, which was on hold for the past three years, will gain significant momentum, and we hold expectations for its progress, too.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 10 directors, including 4 outside directors (4 of which are independent executives) |

Audit committee members | 5 members, including 4 outside directors (4 of which are independent executives) |

◎ Corporate Governance Report

Last update date: September, 29, 2022

<Basic Policy>

Our company’s basic approach on corporate governance is to establish a sound management system that can respond to rapid changes in society and is efficient and compliant with laws and regulations, for maximizing our corporate value. To achieve this, we continue to strive to ensure transparent management and appropriate and prompt disclosure, by strengthening our relationships with stakeholders and further enhancing management governance functions.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

■ Supplementary Principle 3-1 ③ and Supplementary Principle 4-2 ② 【Issues related to Sustainability】

Our company has formulated basic sustainability policies, and established a Sustainability Committee and a Risk Management Committee to strengthen our corporate group’s sustainability initiatives and proactive risk management platform, and to focus on expanding our business scope by promoting growth strategies, responding to technological innovations including EVs in the automotive industry, and promoting DX, in order to achieve a sustainable society and enhance corporate value through our corporate activities. Specific initiatives led by these committees are disclosed in documents including the financial results presentation materials.

https://contents.xj-storage.jp/xcontents/AS01236/078770bd/f7ea/4bc2/872b/e27b99a6bb7b/140120220824523428.pdf

In addition, our efforts to address climate change issues are disclosed through CDP.

The investment in human capital and intellectual property for enhancing medium/long-term corporate value is currently under discussion by our Executive Board, for which the Board of Directors will formulate and disclose basic policies in the future.

■ Supplementary Principle 2-4 ① 【Ensuring Diversity in Appointment of Core Personnel, etc.】

<Our view on ensuring diversity>

Our company aims to provide an environment where each and every employee can maximize their abilities and continue to work for a long period of time, and follows its basic policy to appoint personnel based on their abilities and performance, regardless of gender, internationality, or whether they are mid-career hires or not.

<Proactive and measurable goals for ensuring diversity>

Our company has not set measurable goals for ensuring diversity in our core human resources, however, we will consider setting such goals along with our human resources strategies for enhancing medium-term corporate value.

<Status of ensuring diversity>

Ratio of female employees: 18.2% in FY6/22

Employment of foreign nationals in professional positions: 0.8% in FY6/22

Ratio of mid-career hires in management positions: 93.2% as of the end of June 2022

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

■ Principle 1-4 【Strategic Shareholding】

(1) Policies concerning strategic shareholding

Our company does not hold shares strategically. Unless such shareholding is necessary to maintain and strengthen relationships for capital tie-ups and collaboration with our business partners and it is determined that their business benefits are worth the risk and cost of capital from the medium/long-term perspective, we shall adhere to our company’s policy of not holding shares strategically.

(2) Review process concerning strategic shareholding, and criteria for exercising voting rights related to strategically held shares

If it is considered appropriate to hold shares strategically, we will establish a method to review the reasonableness of continued holding of such shares as well as specific criteria for the exercise of voting rights on such shareholding.

■ Principle 5-1 【Policies concerning the establishment of a system to promote constructive dialogue with shareholders and the initiatives for it】

Our company believes that clearly explaining our management policies and growth strategies to shareholders and institutional investors and deepening their understanding through active and constructive dialogue (interviews) with them will contribute to enhancing our company’s medium/long-term corporate value.

Dialogue with shareholders and institutional investors is conducted reasonably through visits, office visits, telephone calls, etc. by representative directors and IR staff, with the IR Office of the Corporate Strategy Division as a point of contact. In addition to individual interviews, in order to provide opportunities for direct dialogue with many investors, our company holds financial results briefings for investors and analysts as well as briefings for individual investors at which representatives themselves give explanations, and uses such opportunities to promote mutual understanding between our company and investors. Furthermore, we broadly disseminate information by video streaming of the meetings or posting material on our website.

When engaging in dialogue, we take all necessary precautions to ensure that there is no leakage of unpublished important information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |