Bridge Report:(3608)TSI the second quarter of the fiscal year ending February 2023

President Tsuyoshi Shimoji | TSI HOLDINGS CO., LTD. (3608) |

|

Company Information

Market | TSE Prime Market |

Industry | Textile (Manufacturing) |

President | Tsuyoshi Shimoji |

HQ Address | 8-5-27 Akasaka Minato-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Share Outstanding | Total Market Cap. | ROE (Act.) | Trading Unit | |

¥ 429 | 95,783,293 shares | ¥41,091 million | 1.1% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥ 7.00 | 1.6% | ¥ 27.63 | 15.5x | ¥ 1,075.44 | 0.4x |

*The share price is the closing price on October 17. The values of Share Outstanding, DPS, and EPS were taken from the brief report on financial results for the second quarter of the term ending February 2023. ROE and BPS are the results for the previous term.

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Feb. 2019 Act. | 165,009 | 2,280 | 3,902 | -185 | -1.93 | 17.50 |

Feb. 2020 Act. | 170,068 | 70 | 1,851 | 2,181 | 23.42 | 17.50 |

Feb. 2021 Act. | 134,078 | -11,843 | -10,359 | 3,861 | 42.64 | 0.00 |

Feb. 2022 Act. | 140,382 | 4,440 | 5,834 | 1,022 | 11.32 | 5.00 |

Feb. 2023 Est. | 154,000 | 1,800 | 3,300 | 2,400 | 27.63 | 7.00 |

* Unit: million-yen, yen. The forecasted values are from the company.

This report provides the overview of TSI Holdings Co., Ltd.’s financial results for the second quarter of the fiscal year ending February 2023.

Table of Contents

Key Points

1. Company Overview

2. Medium-term management plan “TSI Innovation Program 2025”

3. Second quarter of the Fiscal Year ending February 2023 Earnings Results

4. Fiscal Year ending February 2023 Earnings Forecasts

5. Conclusions

<Reference1: Sustainability>

<Reference2: Regarding Corporate Governance>

Key Points

- TSI Holdings is an apparel enterprise operating 51 brands. It clearly specifies targets (gender, age, preference, etc.) for each brand, and provides a broad range of customers with its products. The mid-term management plan “TSI Innovation Program 2025 (TIP 25)” is ongoing, and they aim to create empathy and social value in the world through the power of fashion entertainment.

- In the second quarter of the term ending February 2023, sales grew 11.3% year on year to 72,087 million yen. Due to the sluggish performance of some brands, TSI Holdings failed to meet the budget target, but the performance of real shops recovered steadily, so sales increased. Operating income dropped 48.1% year on year to 588 million yen. The initial forecast called for a loss, but the company posted a profit. In response to the yen depreciation, the company raised prices for some brands from the first half, and concentrated on the development of a system for manufacturing and selling appropriate amounts of products. As a result, the ratio of sales of discounted products decreased considerably and yield rate improved, increasing gross profit margin. The curtailment of SGA, too, contributed. The expenses for relocating the headquarters amounted to 590 million yen. If this is excluded, operating income is up from the same period of the previous year. Net income increased 19.0% year on year to 2,249 million yen, hitting a record high for the first half of a term, as the company posted an exchange gain from foreign-currency assets, sold cross-shareholding, and so on.

- The full-year earnings forecast for the term ending February 2023 has been revised. The sales forecast has been revised downwardly, and sales are now projected to increase 9.7% year on year to 154 billion yen. This is because, in addition to the results in the first half, considering the effects of the global inflation and the yen depreciation in the second half, the impact of a special sale in the fourth quarter was estimated rigorously. The profit forecast has been revised upwardly. Operating income is projected to drop 59.5% year on year to 1.8 billion yen. There is no revision to the dividend forecast. The company plans to pay a dividend of 7.00 yen/share, up 2.00 yen/share from the previous term. The expected payout ratio is 25.3%.

- As TSI Holdings considers the realization of sustainability as an important management mission, it disclosed information in accordance with the recommendations from TCFD in October 2022. While following the recommendations from TCFD, the company has disclosed the 4 items: “governance,” “risk management,” “strategy,” and “indicators and goals.” While visualizing the CO2 emissions of Scopes 1 to 3, the company set goals of reducing the CO2 emissions of Scopes 1 and 2 by 48% and reducing the CO2 emissions of Scope 3 by 30% from FY 2/2020 by 2030. These are challenging reduction goals considering the certification of science-based targets (SBT).

- While the company revised the full-year earnings forecast for the term ending February 2023, the company has not revised the plans from the term ending February 2024 in “TIP25,” but if EC sales recover, mid-term growth potential will increase. In the second half of the term, all brands of all group companies are holding events in their EC channels, selling limited-time products, etc. In addition, the company prepared a filming space for live streaming via social media in the new corporate building, to improve company-wide EC sale systems and functions. We would like to keep an eye on the effects of these measures.

1. Company Overview

TSI Holdings is an apparel enterprise operating 51 brands. It clearly specifies targets (gender, age, preference, etc.) for each brand, and provides a broad range of customers with its products. They aim to proceed with transformation, evolve from an enterprise that conducts apparel business only, and become “a company creating fashion entertainment” that links social value to its corporate growth and not only provides products, but also creates original value with the fashion entertainment, from the viewpoints of “the environment and society,” “markets,” and “residents.” The mid-term management plan “TIP 25” is ongoing.

【1-1 Corporate history】

While the environment surrounding the apparel field was becoming severe, Tokyo Style Co., Ltd. and Sanei-International Co., Ltd. established TSI Holdings Co., Ltd. through the transfer of shares in June 2011, with the aim of achieving sustainable growth by utilizing their respective strengths. It was listed on Tokyo Stock Exchange (TSE). After the market restructuring, it got listed on the Prime Market of TSE in April 2022.

【1-2 Corporate philosophy】

The company upholds the corporate philosophy, vision, purpose, and code of conduct described below.

Corporate philosophy | We create value that shines the hearts of people through fashion and share the happiness of living tomorrow together with society. |

Vision | We aim to become the world’s most beloved global group through the best and a step- ahead-of-the-times creation and lifestyle proposal. |

Purpose | Nurture worldwide empathy and social value through the power of fashion entertainment. |

Group's code of conduct | 1. We value our spirit of fairness/impartiality and honesty and work with passion and responsibility. 2. We always have problem consciousness, strive for self-study, and actively challenge with flexibility. 3. We respect each person's individuality, communicate well, and contribute to the team by running own roles. 4. We deliver excitement and pleasure to our customers with sincere hospitality and strive to improve customer satisfaction. 5. We respect each stakeholder's position to realize the mutual benefit and contribute to the sustainable growth of the company. 6. We sincerely appreciate society and the natural environment and contribute to social development through our business. |

【1-3 Business description】

The TSI Group is composed of TSI Holdings, which is a holding company, 28 consolidated subsidiaries, and 1 equity-method affiliate.

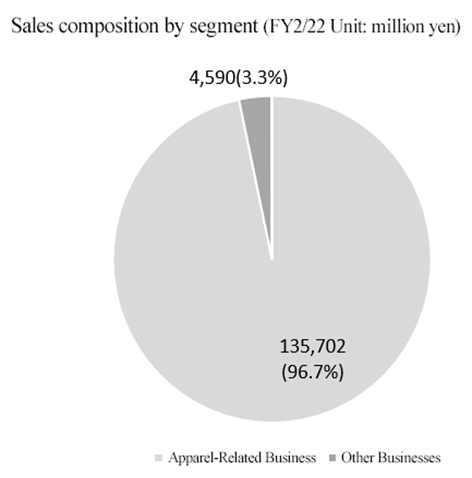

In the “apparel-related business,” they plan, manufacture, and sell mainly clothes and operate the brand licensing business and the production/distribution business. In “other business,” they serve as distributors for other companies’ products, dispatch personnel, and operate the synthetic resign-related, store design/management, and restaurant businesses, and so on.

◎ Brands

Currently, they operate 51 brands. They set clear targets (according to gender, age, preference, etc.) for each brand, and provide a broad range of customers with products. The top 10 brands in terms of sales account for about 60%. The gross profit margin is about 50-70%.

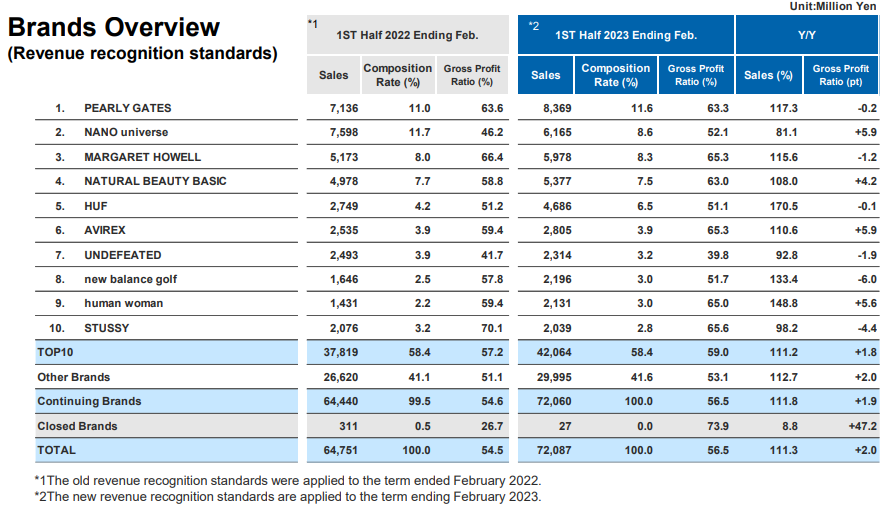

◎ Sales and gross profit margin of each brand

| FY 2/22 | |||

Sales | Ratio to total sales | Gross profit margin | ||

1 | NANO universe | 17,861 | 12.7% | 49.5% |

2 | PEARLY GATES | 15,069 | 10.7% | 61.9% |

3 | MARGARET HOWELL | 11,002 | 7.8% | 66.1% |

4 | NATURAL BEAUTY BASIC | 10,356 | 7.4% | 58.0% |

5 | HUF | 6,733 | 4.8% | 51.1% |

6 | AVIREX | 6,240 | 4.4% | 62.1% |

7 | UNDEFEATED | 4,389 | 3.1% | 41.1% |

8 | STUSSY | 4,286 | 3.1% | 69.8% |

9 | new balance golf | 3,632 | 2.6% | 57.8% |

10 | ROSE BUD | 3,455 | 2.5% | 44.5% |

TOP 10 | 83,029 | 59.1% | 57.0% | |

Total for other brands | 57,272 | 40.8% | 51.5% | |

Total for continued brands | 140,301 | 99.9% | 54.7% | |

Total for discontinued brands | 80 | 0.1% | 106.2% | |

Total | 140,382 | 100.0% | 54.7% | |

◎ Outline of major brands

Brand | Targets | Concept |

Nano Universe

| Women and men | It operates the three lines: “Japan Made Traditional,” “Modern Vintage,” and “Seasonal Wardrobe” and multi-label stores with selected brands and proposes fashion and information that are useful in daily life as wisdom. |

Pearly Gates

| Women and men | OUT ON THE WEEKEND (leaving urban areas on weekends) Under the concept: “Let’s play golf more casually and more enjoyably,” it proposes moderately fashionable golf clothing beyond the bounds of age, gender, etc. |

Margaret Howell

| Women and men | With the basic stance of keeping simple and basic features, it pursues comfort and functionality, and disseminates timeless, modern designs regardless of gender and age. |

Natural Beauty Basic

| Women | With the keyword: “Comfortable,” it proposes the enrichment of lifestyles of those who wear its clothes to a broad range of customers. |

HUF

| Men | The original brand of the shop opened by the legendary skater Keith Hufnagel in 2002 grew into the lifestyle brand “HUF,” which handles not only apparel, but also footwear. The products were developed by incorporating unique styles and artistic taste into the American classic based on the skate and street fashion, which is the background of Keith, are attracting attention in major fashionable cities, including NY, LA, SF, Tokyo, and London. |

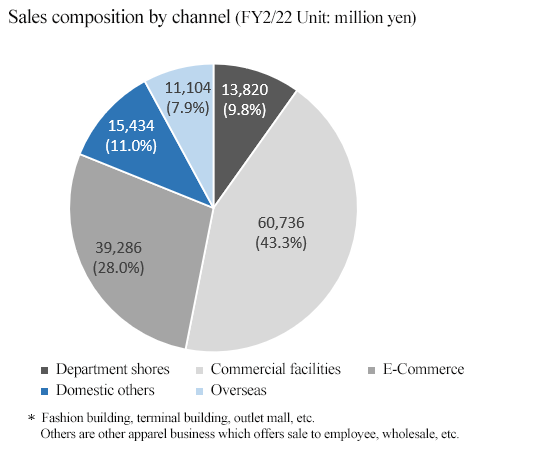

◎ Sales channels

They sell apparel via real stores and EC inside and outside Japan.

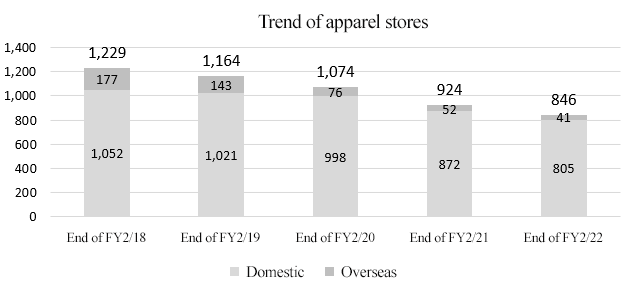

The number of real stores was 889 as of the end of FY 2/2022. Among them, 846 stores sell apparel.

Through the reform of the business structure, they have closed unprofitable stores, and completed closure for 95% of domestic stores to be closed, ending the phase of closing unprofitable stores.

As “a fashion entertainment enterprise,” they consider that real stores remain important as bases for disseminating the world view of each brand and pleasing/exciting customers and will proceed to the aggressive phase focused on the brands liked by customers.

By opening attractive shops in large-sized stores and prime locations, they will reform the revenue structure of the store business.

By FY 2/2025, they plan to open 100 shops (net increase: 35 shops).

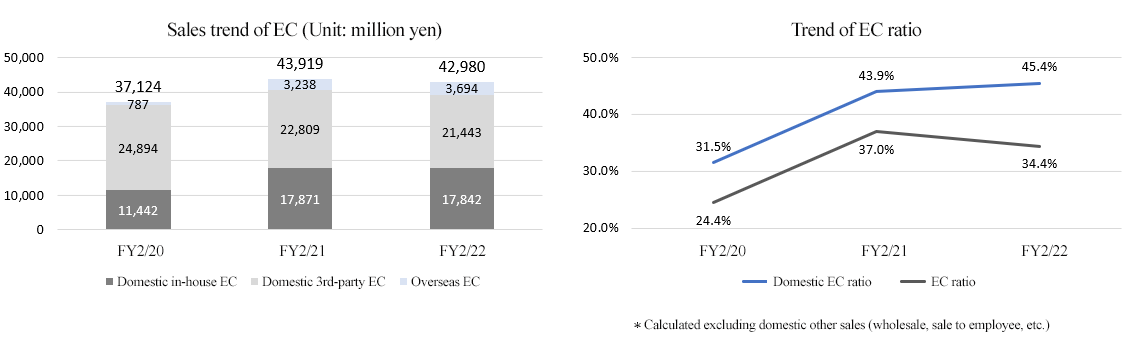

The ratio of sales from their website to domestic EC sales has been increasing steadily, and high profitability is maintained.

【1-5 Characteristics, strengths, and competitive advantages】

According to President Shimoji, the company excels at seeking, finding, and developing categories and brands in line with the trend of the times.

The domains of athleisure, wellness, outdoor, and streetwear is thriving, partially because people became interested in outdoor activities and health enhancement amid the coronavirus pandemic, and “PEARLY GATES” earns one of the largest sales as a golf brand in Japan.

The company has achievement that found such brands through the networks in the U.S. and the U.K. etc. The number of companies that introduced a new brand and made it successful in the past 10 years like TSI Holdings is small.

The company’s competitive advantages come from the base and experience of taking risks and the know-how and track record of developing brands.

【1-6 ROE analysis】

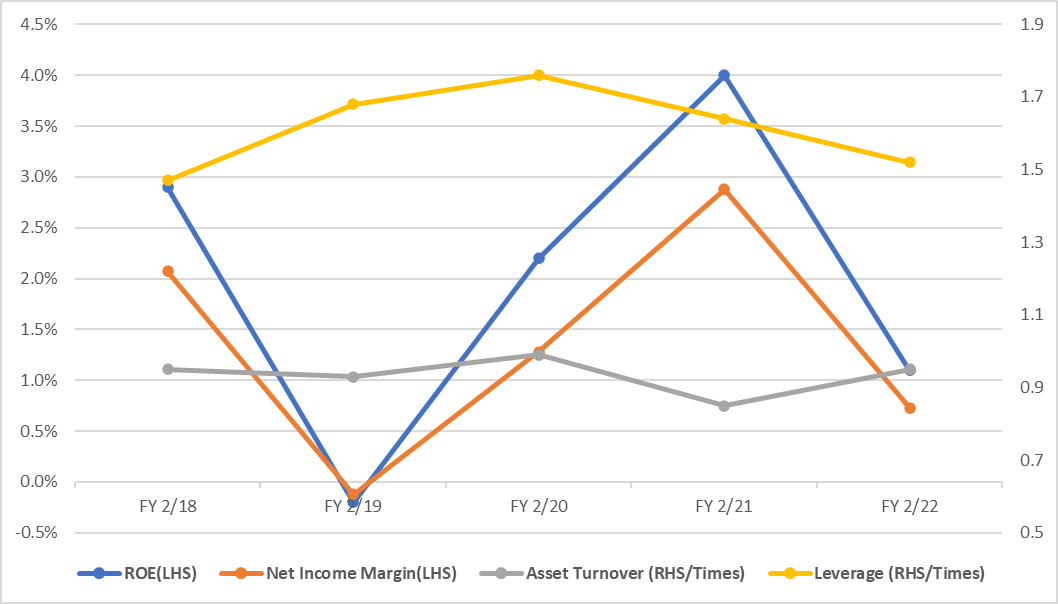

| FY 2/18 | FY 2/19 | FY 2/20 | FY 2/21 | FY 2/22 |

ROE (%) | 2.9 | -0.2 | 2.2 | 4.0 | 1.1 |

Net profit margin (%) | 2.07 | -0.12 | 1.28 | 2.88 | 0.73 |

Total asset turnover (times) | 0.95 | 0.93 | 0.99 | 0.85 | 0.95 |

Leverage (times) | 1.47 | 1.68 | 1.76 | 1.64 | 1.52 |

*Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

In the mid-term management plan “TIP 25,” the company aims to increase ROE to 5.3% or higher by the term ending February 2025. The key is how they will improve profitability.

2. Medium-term management plan “TSI Innovation Program 2025”

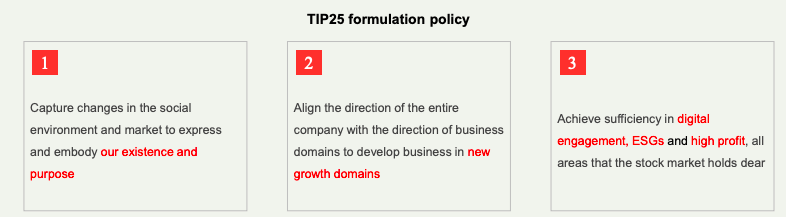

The TSI Group formulated and announced “TSI Innovation Program 2024 (TIP 24),” which set mid-term growth strategies, in FY 2/2021, but the coronavirus pandemic forced them to postpone the reform for one year.

Accordingly, in April 2022, the company updated TIP 24, formulating a new mid-term management plan “TSI Innovation Program 2025 (TIP 25)” for 2025.

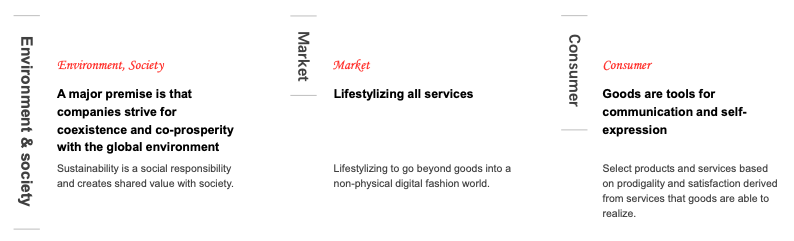

【2-1 Policies for formulating TIP 25】

TIP 25 was formulated under the following three policies.

(Taken from the reference material of the company)

【2-2 Directions and purposes of the transformation】

◎ Recognition of the business environment

The company considers that the business model of mass-producing excessive amounts of clothing, while generating environmental burdens, selling them at discounted prices, and competing with brands of the same nature, is reaching its limit, and the norms of the apparel industry disappeared.

◎ Determination

The company resolved to abandon the conventional norms and stereotypes in the apparel business, take a new step as an enterprise for offering true value for people and the environment, and be reborn as an enterprise in which everyone can have a dream.

The keyword is “Regeneration.”

◎ Directions of the transformation

The company will proceed with transformation from the viewpoints of “the environment and society,” “markets,” and “residents,” evolve from an enterprise handling apparel only, and aim to become “a company creating fashion entertainment” that not only provides products, but also create original value with fashion-based entertainment while linking social value to corporate growth.

(Taken from the reference material of the company)

◎Purpose and will

Purpose: Social meaning of existence

To win international sympathy and create social value with fashion entertainment.

WILL: Goal to be achieved

The company aims to become the world’s happiest fashion company for all stakeholders, including society, the environment, customers, shareholders, and employees.

【2-3 Business plan】

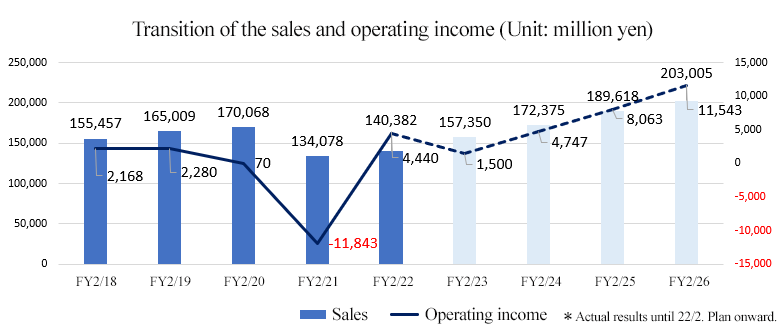

(1) Target values and measures

In FY 2/2025, the company aims to achieve sales of 189.6 billion yen, an operating income of 8 billion yen, and an operating income margin of 4.3%. In the following term ending February 2026, the company aims to increase sales to over 200 billion yen.

In addition, the company aims to achieve an EBITDA of 9% or higher, an ROE of 5.3% or higher, and an EC ratio of 40% or higher in FY 2/2025.

The following three are primary measures for attaining the goals.

1.To clearly define our growth areas and invest in them intensively

To specify business domains and actively invest in growth areas In particular, the company will increase sales from the wellness and street businesses in 3 years. To invest in digital generation while looking ahead to the future, and develop next-generation customer value |

2.To aim to increase customers by pursuing entertainment

To create fashion entertainment not limited to apparel To integrate the press rooms when integrating offices, and develop a media base To directly distribute a variety of contents to customers |

3.To reform the corporate structure for significantly expanding the e-commerce business

To prioritize EC and digitalization for all business operations To discuss large-scale investment in the development of a CRM structure and internal services, and aim to realize sales growth linked with large-scale sales promotion |

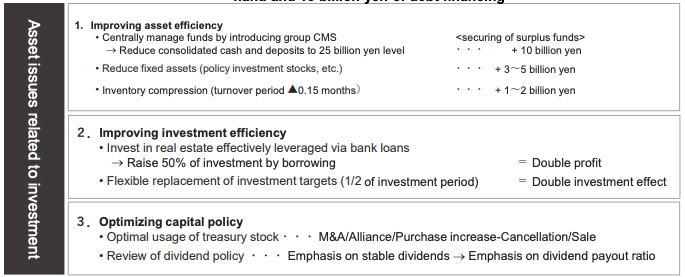

【2-4 Business investment】

The company will invest in mainly “A: Rapid growth of EC,” “B: Enhancement of earning capacity,” “C: Creation of new value of experience,” and “D: Investment in the growing business area.”

“A: Rapid growth of EC”

To make all group companies shift to strategies and business structures prioritizing EC and digitalization

To invest for evolving organizational structures for developing products, services, and communication that would exceed the expectations from the market

*To increase EC sales to 76 billion yen and the ratio of EC to 40%

To raise sales from 43 billion yen to 76 billion yen and the ratio of EC from 30% to 40%

To achieve these goals, the company will design a growth system that motivates customers to use services continuously.

As they recognize that it is imperative to improve the profitability of the brand business by reforming the resource structures of the real store business and the EC business, they will shift to strategies and business operations giving top priority to EC and digitalization from the viewpoints of productivity and profit margin.

To design products, inventory, sales promotion, and operation while considering EC from the planning stage

For less profitable stores, the company will lead customers to EC and decide whether or not to close the stores while considering the growth of EC sales.

To enrich entertainment contents quantitatively and qualitatively.

*Establishment of a platform for 15 million members

To shift from the competition among brands to the competition in each business field. To increase the population of customers dramatically in each field, while strengthening contents.

To provide not only products, but also the value of experience under the themes of “food, clothing, shelter, work, and play,” distribute information via facilities and the media, and manage communities of staff and users, etc.

The utilization of CRM, the creation of business models other than sale of products, etc. are important keys.

*Improvement of entertainment contents

To concentrate on the development of new communication methods as “a company creating fashion entertainment”

To combine contents with high engagement and the profound knowledge of users, so that many customers will access platform partners. To pursue sales promotion strategies that put importance on value rather than costs

To create a new economic zone based on tipping, NFT*, etc. by taking advantage of the enthusiasm of fans

*NFT (Non-Fungible Token)

It means digital data proven to be non-fungible or one of a kind. Digital contents are being capitalized in various fields, including fine arts, video games, music, and sports.

“B: Enhancement of earning capacity”

To re-polish the attractiveness of real stores. The company puts importance on the value of real stores as the sites for offering luxury value where customers can see the world views of brands.

To redefine ideal stores as the sites for increasing customers’ loyalty and improve the earning capacity.

*Reform of the earning structure and development of attractive stores

95% of domestic stores to be closed have been closed, and the phase of closing unprofitable stores for structural reform has ended. From now on, the company will proceed to the aggressive phase focused on the brands that have attracted many customers.

To reopen shops in large-sized stores, prime locations, etc., to demonstrate new types of shops in the post-pandemic period

To open attractive shops, and reform the revenue structure in the store business

The company plans to open 100 shops (net increase: 35 shops) by FY 2/2025.

*To improve the value of experience in large-sized stores and offer “experience available only there” so that customers will be motivated to revisit there

To make stores the sites for providing luxury value so that customers can experience the world views of brands

The company will enrich product categories and the quantity of each product in parallel with the enlargement of shops, hold events, and operate simulation facilities, to provide customers with new experience in shops. Then, the company will improve the capability of reeling in customers and have customers stay for a longer time, with the aim of increasing average spending per customer and brand loyalty.

If the area of each shop increases, sales per unit area will drop, but the cost reduction effect will increase. While reducing staff in parallel with enlargement, the company will strive to improve profit margin.

*To review and withdraw from less profitable businesses, and shift to growing areas

To review businesses and decide whether or not to withdraw from them, based on the indicators of growth potential, compatibility with fashion entertainment, profitability, meanings of existence, business scale, EC ratio, and customer loyalty.

At the same time, the company will seize growing areas with measures including M&A and keep reshuffling its business portfolio.

“C: Creation of new value of experience”

To create not only products, but also other items, to offer fashion-based entertainment as value

*To make the PR team that offers items, things, and meanings entertaining

The company will reform the press operation, which has been mainly BtoB, develop contents by itself, and develop an emotional PR team for directly approaching customers with its own media.

The press room of the new headquarters completed in September will become a new working studio for generating entertainment, experience, and sympathy.

*To design customers’ experience beyond their imagination

The company will make a contribution so that the life of each customer will become more enjoyable, healthy, safe, productive, and meaningful.

The company will establish “TSI Fashion Entertainment Lab,” grasp the trends among customers, and create opportunities for customers’ experience while understanding the relationships between “society and customers.”

*Operation of the non-apparel business and synergy between businesses

The company will become a “fashion entertainment enterprise” that will design essential lifestyles beyond non-materialistic value from the perspectives of society and customers.

To do so, the company will trigger business synergy with peripheral and different businesses based existing assets, and create a new economic zone through investment, alliance, and M&A.

As an example, the company launched the agritech business, which cultivates organic cotton, in the term ending February 2023. In addition to it, they work on the creation of carbon credits.

“D: Investment in the growing business area”

To clearly define growth areas in terms of changing and diversifying markets, values, and needs, and invest in them.

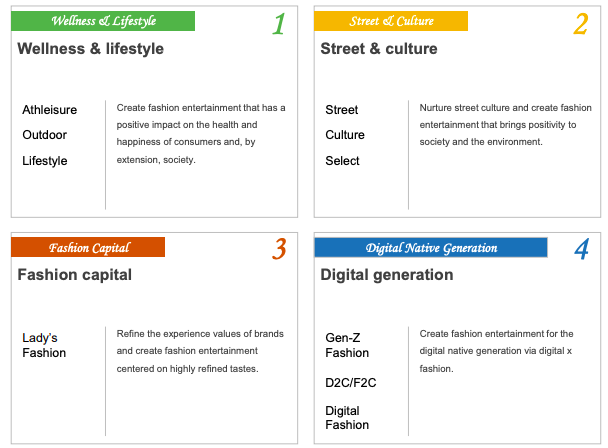

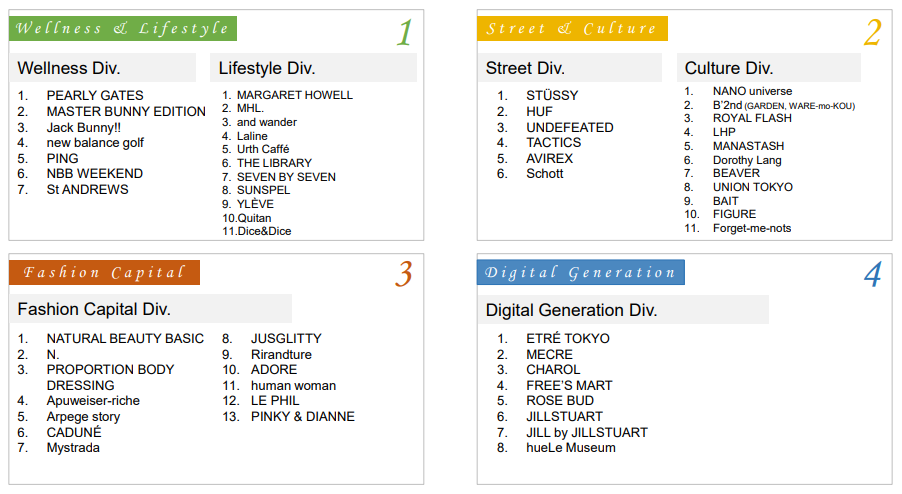

(1) Business domains

The company defined four business domains, and reformed structures in order to operate business smoothly in each domain.

(Taken from the reference material of the company)

1. Wellness & lifestyle

The company will create attractive communities.

While aiming to evolve from an apparel brand into a community brand, the company will operate entertainment business focused on lifestyles.

◎ Business division composition

“Wellness Business Division”

It is a group that operates business while forming communities in the fields of sports and fitness, not limited to the golf business.

“Lifestyle Business Division”

It is a group that creates new business designs that can offer experiences beyond conventional apparel, while maintaining the core of the established brand.

◎ Measures and activities

The company will develop communities of brands and clients, to foster enthusiasm. The company will expand economic zones by proposing new brands to communities, etc.

They are proceeding with initiatives utilizing the customer assets of their golf brand, establishing a golf community, launching a hybrid D2C brand of sports and fashion, etc.

Focusing on the fact that a new style of play based on a broad range of experiences with the elements of play and entertainment combined is a current trend, the company supports the life of each customer and proposes new value of not only apparel, but also other items from various brands of TSI.

The company started handling the gear of outdoor brands and opening cafes outside commercial facilities.

2. Street & culture

The company will establish a platform for play with the street spirit.

Based on the keyword “play,” they will diffuse their brands in peripheral lifestyles, reinvent gear, develop new experiences, etc.

◎ Business division composition

“Street & Culture Business Division”

It is a group that provides authentic wear and gears based on the culture of playing, disseminates cultures through the collaboration and combination of brands as a retailer that selects and deals in products of various brands, and creates customer value while forming communities by giving opportunities to experience events and encounter new brands.

◎ Measures and activities

The company will develop a project with global sales of 40 billion yen in the street, skating, and snowboard businesses.

With the keywords “authenticity,” “play,” and “culture,” they will diffuse their brands in peripheral lifestyles, redevelop gear, create new experiences, etc. and then operate business globally.

They will open flagship shops of mainly HUF and TACTICS in major cities around the world.

For “TACTICS,” an EC site for skateboards and snowboards, which was acquired in 2020, the company will operate a project for debuting it in Japan, to diffuse the new skating culture in the U.S. in Japan.

By opening integrated skateboard parks and taking OMO (Online Merges with Offline) initiatives, the company will offer a variety of experiences not limited to product sales and develop communities. Then, they will improve customers’ loyalty.

The company recognizes that multi-brand shops (which select and deal in products of various brands) have recently become homogeneous and less valuable, so it will develop new kinds of multi-brand shops for the next generation.

They will create multi-brand shops that would generate unprecedented value, by designing freewheeling in-store layouts beyond genders, genres, etc., installing pop-up spaces for developing communities, cafes for offering leisure time, free spaces, etc.

3. Fashion capital

The company will keep offering services to keep up with trends and changes.

They will have flexibility to keep changing swiftly, help customers to become what they hope to become, and link happiness.

◎ Business division composition

“Fashion Capital Business Division”

It is a group that focuses on highly sensitive apparel, redefines the roles of department stores, shopping centers, and e-commerce in order to promote customers’ engagement while responding to trends and changes, and maximizes the advantage of having real shops.

◎ Measures and activities

The company will an OMO system for shortening the distance between the company and customers.

To survive in the new normal age, the company will develop a selling system in which shops and sales staff can increase customers’ engagement in an unprecedented manner.

They will make efforts to enrich online contents and services and get connected with customers via social media, to promote sales and reflect the results in product development.

In addition, the company will adopt new evaluation and training systems for promoting sales staff to engage in online business. The company will evaluate and train staff while putting importance on the elements of talent, that is, guarantees and the popularity among customers in social media.

For strengthening the services for customers with the OMO system, the company will redefine the roles and functions of real stores, combine real stores and EC, and establish new store models and new methods for leading customers.

As they still consider that only real shops allow customers to feel the world views of brands with their five senses, they will pursue strategies for utilizing the forte of real shops.

They will open shops in new areas and facilities and adopt a system in which customers can determine who will attend to them.

4. Digital generation

To design contents that would attract the next generation.

To foster sympathy and enthusiasm with tangible and intangible unlimited contents

◎ Business division composition

“Digital Generation Business Division”

It is a group that creates systems and mechanisms for proposing diverse styles to and gaining support from the digital native generation (Generation Z), and flexibly adjusting to spur-of-the-moment purchase, and develops next-generation communities and trading zones.

◎ Measures and activities

Currently, we are in the spur-of-the-moment consumption age, in which consumers buy a product in a minimum amount of time after recognizing it. In this age, the company will pursue new creativity by innovating contents for directly attracting customers and promoting sales.

To establish a D2C (direct-to-consumer) conglomerate

The company will develop systems and mechanisms for creating a variety of businesses, brands, and contents based on directors and contents.

The company aims to achieve sales of 3.5 billion yen with the six brands: ETRE TOKYO, MECRE, EC Cosmetics, F2C* Brand, New Brand A, and New Brand B, by FY 2/2025.

*F2C

It means the retail style of directly delivering products from factories to customers. The size of each consumer is measured at a shop or the like, its data are sent to a factory, the factory cuts and sews cloth, and finished clothing is delivered directly from the factory to the consumer. Consumers can get tailor-made clothes in a short period of time. Makers do not have to bear the inventory risk.

The company will launch a digital business with a new kind of sensibility.

By strategically utilizing the advantages of TSI Sewing Co., Ltd., which is a consolidated subsidiary that possesses excellent sewing technologies, the company will endeavor to “sell products in a new way while combining brands, factories, and digital content” as an F2C model.

The company will create a mechanism for meticulously designing experiences before and after purchase so that customers will buy its products on the spur of the moment and sell limited-time products and collaborative products with rarity, topicality, and profitability, to make F2C more attractive.

The company will form a team for fostering the sympathy and enthusiasm of customers and improve work styles and the working environment further.

The residents of Generation Z put importance on styles rather than tastes. They do not stick to specific tastes, but choose their own styles according to with whom, where, and what they will do. In this situation, the company is recruiting and developing creators of Generation Z, so that they will create new businesses.

In addition, the company holds hybrid meetings for planning while combining 3D samples, avatars, real samples, and trial fitting. At such meetings, customers and female employees in the same age group discuss “clothing they would want” thoroughly and commercialize such clothing.

To redevelop the brand portfolio for women of Generation Z

As the first step, the company engages in a project of redefining the two brands: JILLSTUART and JILL by JILLSTUART. As “self-actualization needs,” “changes in femininity,” etc. are getting stronger, the company will grasp the values and insight of respective residents on a real-time basis and reflect them in products and experiences.

In particular, they consider that the brand portfolio needs to include some brands that can reel in young people.

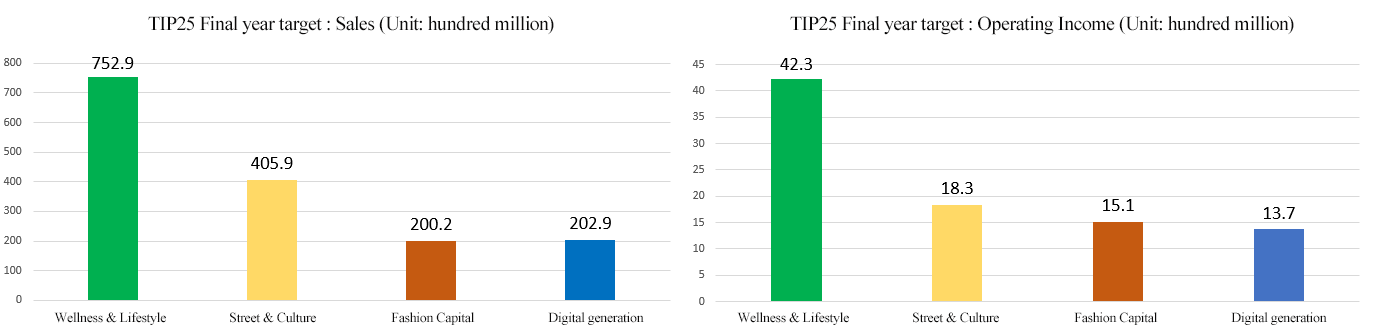

(2) Numerical goals of final fiscal year

The numerical goals in each business domain are as follows.

| Sales | CAGR | Operating income | Operating income margin | EBITDA margin | EBITDA |

Wellness & lifestyle | 752.9 | 13.2% | 42.3 | 5.6% | 8.8% | 66.5 |

Street & culture | 405.9 | 5.3% | 18.3 | 4.5% | 8.6% | 35.1 |

Fashion capital | 200.2 | 13.7% | 15.1 | 7.5% | 12.7% | 25.5 |

Digital generation | 202.9 | 10.2% | 13.7 | 6.7% | 11.9% | 24.2 |

Unit: 100 million yen. CAGR is the compound annual growth rate for the period from FY 2/2022.

【2-4 Investment plan】

They believe that in order to complete the midterm management plan, it is necessary to actively invest in mainly new businesses.

The company plans to invest up to 30 billion yen by using cash reserves amounting to 15 billion yen and borrowed money amounting to 15 billion yen.

They take into account the following points when conducting investment.

(Taken from the reference material of the company)

3. Second Quarter of the Fiscal Year ending February 2023 Earnings Results

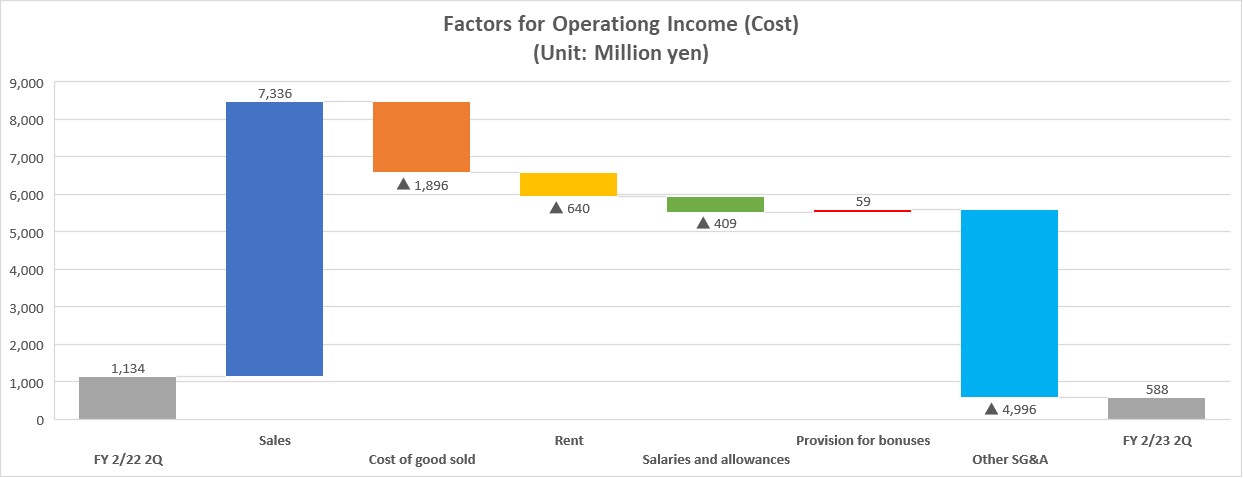

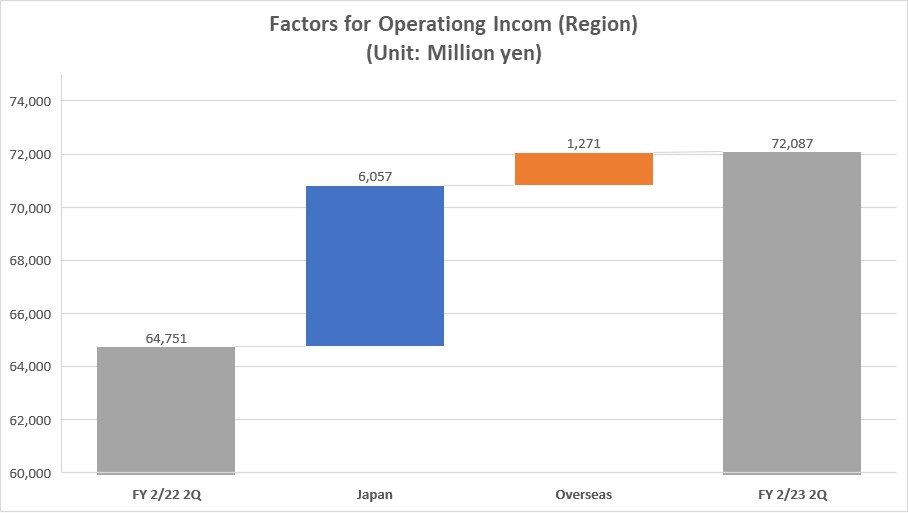

【3-1 Overview of business results】

| FY 2/22 2Q | Ratio to sales | FY 2/23 2Q | Ratio to sales | YoY (1) | Vs. Budget | YoY (2) |

Sales | 64,751 | 100.0% | 72,087 | 100.0% | +11.3% | -4,382 | +5.4% |

Gross profit | 35,294 | 54.5% | 40,735 | 56.5% | +15.4% | -2,165 | +5.3% |

SG&A | 34,160 | 52.8% | 40,146 | 55.7% | +17.5% | ‐3739 | +6.6% |

Operating income | 1,134 | 1.8% | 588 | 0.8% | -48.1% | +1,574 | -35.4% |

Ordinary income | 2,002 | 3.1% | 1,892 | 2.6% | -5.5% | +2,413 | +1.7% |

Net income | 1,890 | 2.9% | 2,249 | 3.1% | +19.0% | +2,490 | +19.0% |

*Unit: million yen. The standards for revenue recognition have been applied from the term ending February 2023. YoY (1) means the rate of increase/decrease from the results in the 2nd quarter of FY 2/2022 based on the old accounting standards to the results in the 2nd quarter of FY 2/2023 based on the new standards. YoY (2) means the rate of increase/decrease from the results in the 2nd quarter of FY 2/2022 to the results in the 2nd quarter of FY 2/2023, both based on the old standards.

*Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

Sales grew, but profit dropped year on year. Sales fell below the forecast, but profit exceeded the forecast.

(*The year-on-year increase/decrease rate is based on the new accounting standards.)

In the second quarter of the term ending February 2023, sales grew 11.3% year on year to 72,087 million yen. Due to the sluggish performance of some brands, TSI Holdings failed to meet the budget target, but the performance of real shops recovered steadily, so sales increased.

Operating income dropped 48.1% year on year to 588 million yen. The initial forecast called for a loss, but the company posted a profit. In response to the yen depreciation, the company raised prices for some brands from the first half, and concentrated on the development of a system for manufacturing and selling appropriate amounts of products. As a result, the ratio of sales of discounted products decreased considerably and yield rate improved, increasing gross profit margin. The curtailment of SGA, too, contributed. The expenses for relocating the headquarters amounted to 590 million yen. If this is excluded, operating income is up from the same period of the previous year.

Net income increased 19.0% year on year to 2,249 million yen, hitting a record high for the first half of a term, as the company posted an exchange gain from foreign-currency assets, stopped cross-shareholding, and so on.

【3-2 Trend in each channel】

| FY 2/21 2Q | FY 2/22 2Q | FY 2/23 2Q | YoY |

Department stores | 5,107 | 6,314 | 9,565 | +51.5% |

Non-department stores | 22,768 | 27,359 | 31,375 | +14.7% |

Domestic EC | 18,559 | 18,785 | 17,828 | -5.1% |

Other domestic channels | 6,218 | 7,438 | 7,185 | -3.4% |

All domestic channels | 52,653 | 59,898 | 65,955 | +10.1% |

Overseas | 3,617 | 4,852 | 6,132 | +26.4% |

Total | 56,270 | 64,751 | 72,087 | +11.3% |

*Unit: million yen. The figures in 2Q of FY 2/2021 and 2Q of FY 2/2022 are based on the old accounting standards, while the figures in 2Q of FY 2/2023 are based on the new accounting standards.

*Non-department stores: fashion buildings, station buildings, outlet stores, etc. Othe other apparel businesses, including wholesale and sale to employees, and non-apparel businesses of group companies. Efuego Corp, which operates mainly the EC site “TACTICS” in the U.S., was included in the scope of consolidation in the second quarter of 2021, and its sales have been posted as overseas sales.

*Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

| FY 2/21 2Q | FY 2/22 2Q | FY 2/23 2Q | YoY |

Domestic EC | 18,559 | 18,785 | 17,828 | -5.1% |

In‐house EC | 8,124 | 8,993 | 8,731 | -2.9% |

Other | 10,434 | 9,792 | 9,096 | -7.1% |

Overseas EC | 1,508 | 1,603 | 1,942 | +21.2% |

Total amount for EC | 20,067 | 20,388 | 19,771 | -3.0% |

*Unit: million yen. The figures in 2Q of FY 2/2021 and 2Q of FY 2/2022 are based on the old accounting standards, while the figures in 2Q of FY 2/2023 are based on the new accounting standards.

* | Among real shops, the new product lineup of Natural Beauty Basic, a flagship brand for women, performed well. |

* | Outside Japan, the business performance in the U.S. and Europe was healthy, partially thanks to the positive effects of exchange rates. |

* | Domestic EC was sluggish for both the company’s website and other ones. It was affected by the stagnation of major brands. The company was not able to sufficiently implement pricing measures targeted at EC customers, whose spending behavior differs from the customers of real shops, offer exclusive products, or plan limited services and event strategies other than pricing ones. |

* | The gross profit margin of EC sales improved considerably to 57.1%. Through the company’s own channel, they concentrated on increasing new members, and the number of new members rose 18.5% year on year. |

* | The ratio of EC sales (consolidated) dropped 5.1 points year on year to 30.5%. |

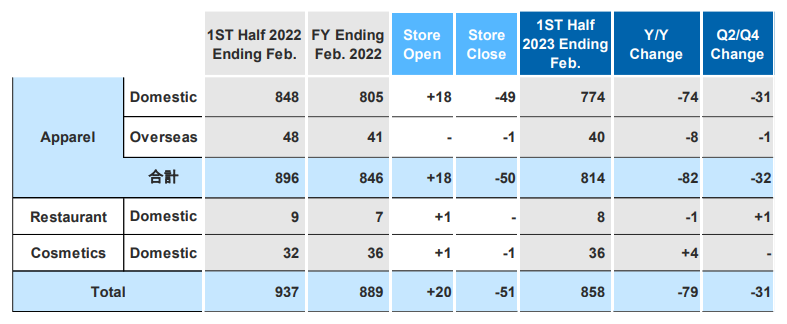

【3-3 Number of Stores and Brand Overview】

◎No. of stores

(Taken from the reference material of the company)

The company closed some apparel shops in Japan.

◎Sales and gross profit margin of each brand

(Taken from the reference material of the company)

* | The total sales of 7 thriving brands out of top 10 brands in terms of sales increased 23.0% from the previous term. This increase rate is much higher than the average of the entire corporate group. |

* | Major brands have grown healthily, while improving earnings. |

* | The golf apparel and street fashion businesses remained healthy, exceeding the forecast. |

* | In the domain of brands targeted at women, the business division evolved its selling methods through enhanced OMO and D2C, and improved yield rate, exceeding the budget target. |

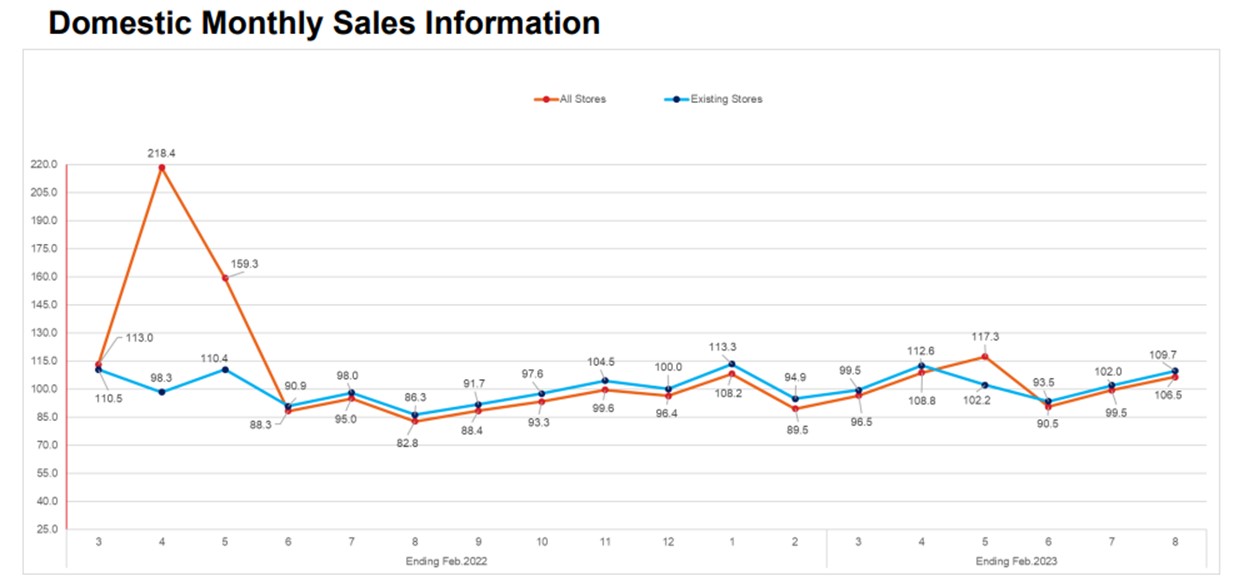

◎Domestic Sales of All Stores and Existing Stores

【3-4 Business Topics】

* | The company relocated the headquarters for the purpose of integrating the physical environments of business companies, and consolidated the 6 major business companies into a single base. Regarding the strategic activities for investment in EC, manufacturing, distribution, digital business, and value chain reform, the company pursues information sharing, high execution speed, and high operation accuracy. The company aims to enhance the cooperation among functional divisions, which have been working separately, remove the double cost structure, and reform productivity. The company will establish an integrated pressroom on the first floor of the headquarters by the end of this year, and form a strategic PR team that would contribute to BtoB revenues, etc. |

* | The company established a new division for promoting reform. As the first step for vitalizing the new business domain, the company formed an alliance with sitateru Inc. The company is strengthening the supply chain of the F2C business and developing services in the next generation business domain. |

* | The company commenced a joint project with Alibaba Cloud and JP GAMES. The company is preparing for the creation of attractive game content and innovative business models, with the aim of breaking away from the legacy supply chain and developing a next EC domain based on the three-dimensional virtual space “metaverse.” |

* | After June, the company enhanced activities with the new system “TSI INNOVATION PROGRAM 2025,” and started activities for further evolution from the second half of the term. They are considering the increase of investment in 4 growing business domains, and will fortify the foundation for actualizing accelerated growth. |

【3-5 Financial statement】

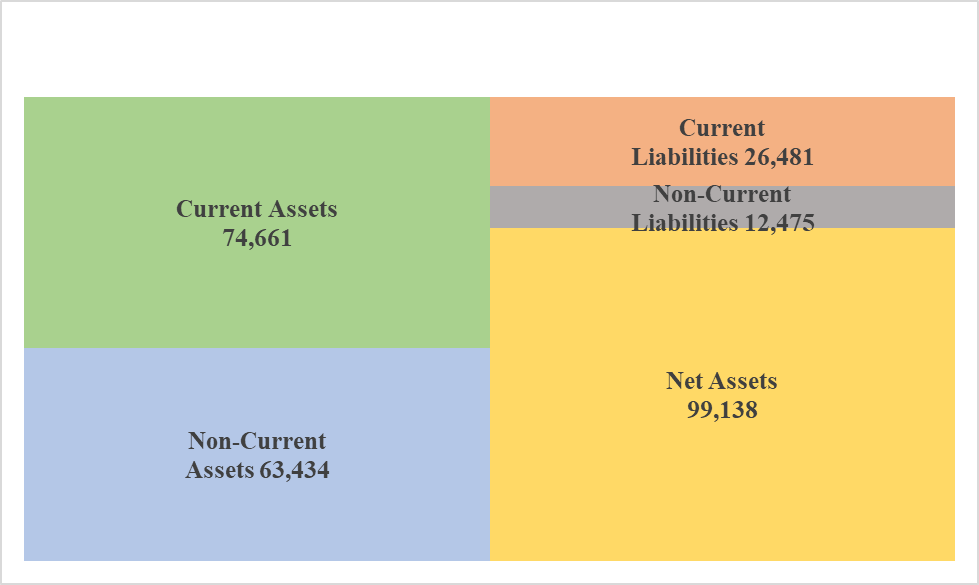

Major BS

| End of Feb. 2022 | End of Aug. 2022 | Increase/decrease |

| End of Feb. 2022 | End of Aug. 2022 | Increase/decrease |

Current assets | 75,547 | 74,661 | -886 | Current liabilities | 28,375 | 26,481 | -1,894 |

Cash and deposits | 39,258 | 37,069 | -2,189 | Trade payable | 10,595 | 11,029 | +434 |

Trade receivable | 10,378 | 11,200 | +822 | Short term interest-bearing liabilities | 6,326 | 5,383 | -954 |

Non-current assets | 64,893 | 63,434 | -1,459 | Non-current liabilities | 14,329 | 12,475 | -1,854 |

Property, plant and equipment | 6,544 | 6,296 | -248 | Long term interest-bearing liabilities | 9,803 | 7,313 | -2,490 |

Intangible assets | 9,265 | 9,612 | +347 | Total liabilities | 42,704 | 38,957 | -3,747 |

Investments and other assets | 49,083 | 47,524 | -1,559 | Net assets | 97,736 | 99,138 | +1,402 |

Total assets | 140,440 | 138,095 | -2,345 | Total liabilities and net assets | 140,440 | 138,095 | -2,345 |

*Unit: million yen.

*Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

Total assets decreased 2,345 million yen from the end of the previous term to 138 billion yen, due to the decline in cash & deposits and investments and other assets, etc.

Total liabilities dropped 3.7 billion yen to 38.9 billion yen, due to the decline in interest-bearing liabilities, etc.

Net assets grew 1.4 billion yen to 99.1 billion yen.

Capital-to-asset ratio rose 2.3 points from the end of the previous term to 71.5%.

【3-6 Progress of TIP 25】

The progress of “investment in the growing business domains” in the midterm management plan “TIP 25” is as follows.

(1) Activities in each business domain

1. Wellness & lifestyle

The company will create attractive communities.

While aiming to evolve from an apparel brand into a community brand, the company will operate an entertainment business focused on lifestyles.

In the first half of the term ending February 2023, sales increased 21.2% year on year to 22,676 million yen.

◎ Measures and activities

① Holding “Jack Bunny!!” Junior Golf Tour 2022

The company held “Jack Bunny!!” Junior Golf Tour, which was started in 2012 for the purpose of developing and supporting next-generation golfers, at a total of 14 venues this year, too, enlivening each region. Their business performance is healthy, showing double-digit or more growth amid the coronavirus pandemic.

② Developing new communities for “and wander” in North America

Regarding “and wander,” whose overseas wholesale ratio exceeds 50%, the company has shipped products to mainly the European market, but it will start cultivating the North American area with the autumn and winter collection in 2022.

Signing a contract with a showroom in NY, they plan to cultivate a new global market.

③ “Urth Caffé” providing community-based places

The company opened the seventh café in a quiet residential area of Chigasaki. In addition to the existing strategy of opening shops in large-scale commercial facilities, they aim to develop places for contributing to local communities through restaurant business.

They will enhance the cultivation of places for opening cafés to introduce new food cultures.

2. Street & culture

The company will establish a platform for play based on the street spirit.

Based on the keyword “play,” they will diffuse their brands in peripheral lifestyles, reinvent gear, develop new experiences, etc.

In the first half of the term ending February 2023, sales increased 2.8% year on year to 24,727 million yen.

◎ Measures and activities

① “AVIREX” thrived, because Top Gun made a big hit.

As the movie “Top Gun: Maverick” became a big hit, related products sold well. After watching the movie, customers visited a shop, so new customers increased. Sales grew 20.5% from the previous term.

② The company opens new shops of “ONE HUF PROJECT,” commemorating the 20th anniversary of launch.

“HUF” was established in 2002, and has commemorated the 20th anniversary this year, releasing a wide array of commemorative items and collaborative items globally, and winning support from fans inside and outside Japan.

Sales grew considerably by 137.1% from the previous term.

This fall, the company opened new shops in Kobe and Iruma, and pop-up stores in Kisarazu and Kumamoto.

3. Fashion capital

They offer services to keep up with trends and changes.

To have flexibility to keep changing swiftly, help customers become what they want to be, and link happiness

In the first half of the term ending February 2023, sales increased 18.1% year on year to 16,066 million yen.

◎ Measures and activities

① “LE PHIL” caused repercussions in the market.

The live streaming on Instagram, which is held every Thursday, has gained a foothold, attracting attention from influencers and stylists. The number of preorders at an exhibition increased about 100% from the previous term, and the evaluation of the brand has improved rapidly inside and outside the company. Then, sales grew 77.2% year on year, and the performance of both EC and real shops has been improving rapidly.

② “Arpege story” excels at OMO strategies.

The company offers services utilizing the merit of each channel, such as “presale through EC,” “preparing products that have been preordered online at shops,” and “attending to customers at shops by utilizing the inventory for EC.” These services lead customers from EC to real shops, and vice versa, increasing sales.

The sales at real shops increased 125.6% year on year, while EC sales rose 120.3% year on year, showing the favorable performance of both channels.

The company disseminates the brand value by increasing contact points with customers based on enriched content, live commerce inviting attractive guests, etc., winning support from customers.

4. Digital generation

To develop contents for attracting the next generation.

To foster sympathy and enthusiasm with tangible and intangible unlimited contents

In the first half of the term ending February 2023, sales increased 10.7% year on year to 6,112 million yen.

◎ Measures and activities

① hueLe Museum × F2C

It is a D2C business under the concept of “ART × FLOWER × FASHION.” The pop-up store in GINZA SIX sells various products and hold events related to art and flower. The company is considering new operations with a production structure based on digitalization × factories.

② Debut of the new D2C brand “CHAROL”

In the autumn/winter season of 2022, the company will launch the new D2C brand “CHAROL.” It proposes relaxing trendy styles by combining trendy styles with a relaxing taste.

The company operates this brand mainly through EC, but plans to open pop-up stores at two sites in Tokyo and Osaka this winter.

③ ETRÉ TOKYO × EDWIN

The company released collaborative items between ETRÉ TOKYO and EDWIN on August 11.

It offers three items: wide pants, high-waist suspender skirts, and all-in-one. Prepared products were sold out immediately. It will keep developing attractive products and new mechanisms, providing topics of conversation. The business remains on a rapid grow track.

(2) Results for first half of FY 2/23

The results of each business domain are as follows.

| Sales | Ratio to total sales | Y/y |

Wellness & Lifestyle | 22,676 | 32.6% | +21.2% |

Street & Culture | 24,727 | 35.5% | +2.8% |

Fashion Capital | 16,066 | 23.1% | +18.1% |

Digital Generation | 6,112 | 8.8% | +10.7% |

*Unit: million yen.

【3-7 Progress of activities for sustainability】

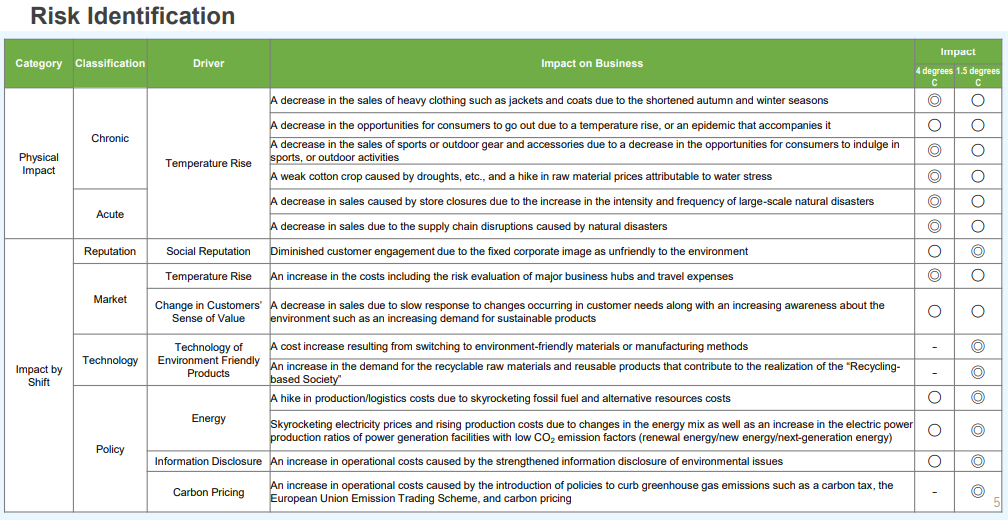

(1) Information disclosure following the recommendations from TCFD

The company considers the realization of sustainability as an important management mission, and disclosed information in accordance with the recommendations from TCFD in October 2022.

(Reference 1: See the section “Sustainability.”)

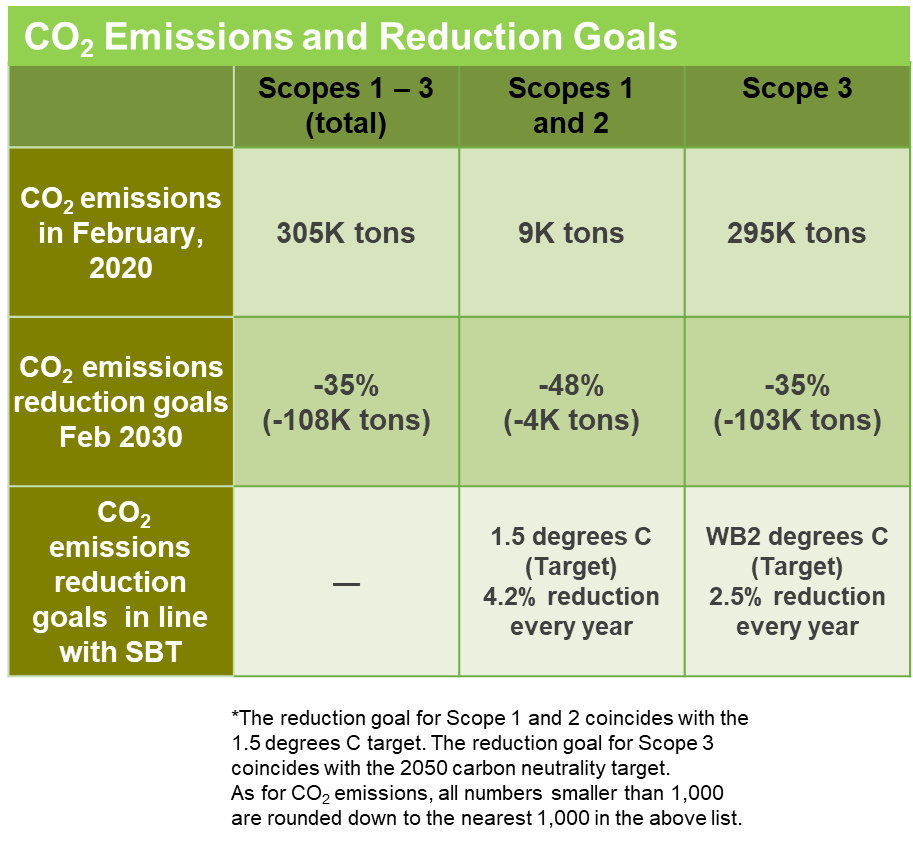

While following the recommendations from TCFD, the company has disclosed the 4 items: “governance,” “risk management,” “strategy,” and “indicators and goals.” Then, the company visualized the CO2 emissions of Scopes 1 to 3, and set reduction targets while considering the certification of science-based targets (SBTs).

①Governance

In order to improve the governance of sustainability strategies, which are linked to their measures for coping with climate change, management policy, and mid-term management plan, the company established “Sustainability Committee” as an advisory body of the representative director and president under the supervision of the board of directors.

The company will formulate a policy for sustainability, set goals for controlling and reducing greenhouse gas emissions, and develop businesses for a sustainable future, including human rights and supply chain management.

②Risk management

The Sustainability Committee analyzed serious risks that would hinder sustainable business growth, and designed scenarios in cooperation with experts.

They produced scenarios while assuming that air temperature will increase by 4 degrees Celsius and by 1.5 degrees Celsius, which are the goals set in the Paris Agreement, with reference to the scenarios announced by IPCC and IEA.

They will revise them flexibly according to actual climate change, resultant market changes, their management strategy, and mid-term plan.

The following risks have been identified.

(Taken from the reference material of the company)

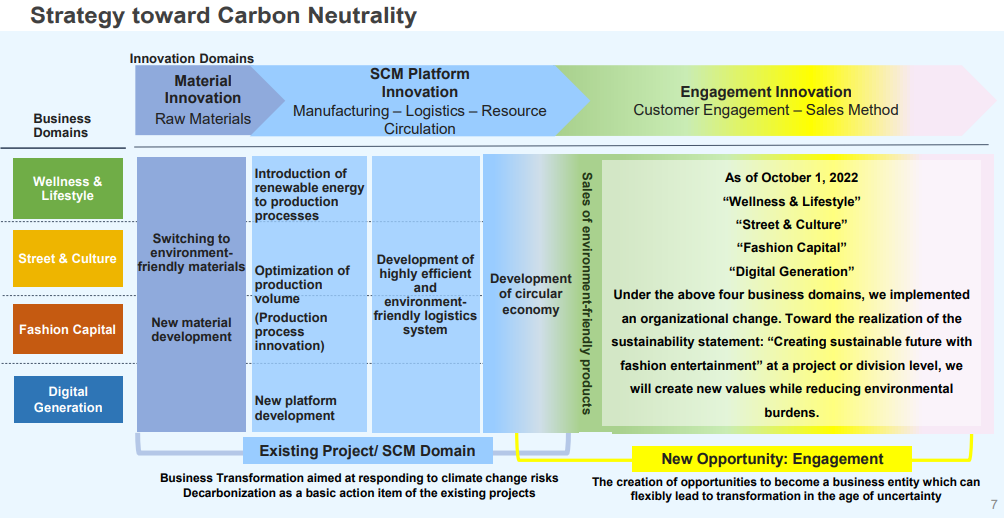

③Strategy

Considering these risks, the company specified 3 domains for innovation to create opportunities.

In order to reform the entire value chain, the company defined “Material Innovation” as initiatives regarding raw materials, “SCM Platform Innovation” as initiatives for reviewing manufacturing and distribution processes and recycling resources, and “Engagement Innovation” as the fostering of new relationships with customers.

The company will evolve each domain and create opportunities and value.

(Taken from the reference material of the company)

④Indicators and goals

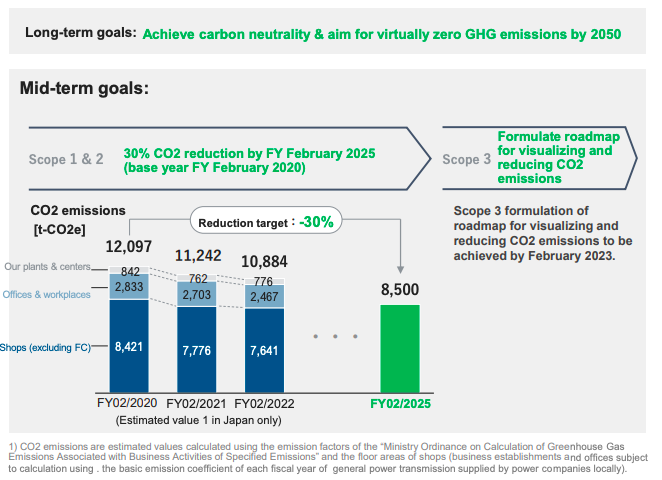

In order to reduce the environmental burden of the entire business, the company visualized the CO2 emissions of the entire value chain for realizing carbon neutrality by 2050.

The company set mid-term goals of reducing the CO2 emissions of Scopes 1 and 2 by 48% and the CO2 emissions of Scope 3 by 35% from FY 2/2020 by 2030.

By attaining these goals, the company will contribute to the earth environment.

(Taken from the reference material of the company)

(2) Other topics

① Held the first sustainable exhibition of TSI ALL GOLF BRANDS.

Under the theme of “the future of sustainable golf envisioned by golf brands,” the company held the first sustainable exhibition of golf brands of the TSI Group. Under the themes of “the earth,” “society,” and “human beings,” they announced environment-conscious initiatives.

② Use of waste materials for the interior of the new corporate building

In the new office to which the company relocated in September, recycled materials were used for the interior finishing of various places, including the library.

③ Project for developing organic cotton unique to TSI

The company concluded a contract for outsourcing with the farming venture firm “SynCom Agritech” in Ibaraki Prefecture under the theme of “development of original organic cotton and research for improving the production of cotton,” and started the cultivation of cotton in TSI’s unique way in Tamil Nadu, India.

SynCom Agritech is a venture firm established by members who encountered one another in Tsukuba University for the purpose of innovating organic farming. It excels at consulting about farming by utilizing their skills related to “methods for improving soil by utilizing the agricultural ecosystem,” “original materials for protecting plants,” and “farm management based on IoT.”

Through this alliance, the TSI Group produces raw materials, spins cotton, and sells it by utilizing organic farming techniques in a seamless manner, to reduce environmental burdens, realize the unified management of traceability, improve the working environment, and produce sustainable clothes.

In the future, the company aims to put them into practice for NANO universe, NATURAL BEAUTY BASIC, etc.

4. Fiscal Year ending February 2023 Earnings Forecasts

【4-1 Earnings forecast】

| FY 2/22 | Ratio to sales | FY 2/23 Est. | Ratio to sales | YoY | Revision ratio |

Sales | 140,382 | 100.0% | 154,000 | 100.0% | +9.7% | -2.1% |

Operating income | 4,440 | 3.2% | 1,800 | 1.2% | -59.5% | +20.0% |

Ordinary income | 5,834 | 4.2% | 3,300 | 2.1% | -43.4% | +37.5% |

Net income | 1,022 | 0.7% | 2,400 | 1.6% | +134.7% | +60.0% |

*Unit: million yen. This forecast was made by the company. The revenue recognition standards have been applied from FY 2/23.

Revised Forecasts

The full-year earnings forecast for the term ending February 2023 has been revised. The sales forecast has been revised downwardly, and sales are now projected to increase 9.7% year on year to 154 billion yen. This is because, in addition to the results in the first half, considering the effects of the global inflation and the yen depreciation in the second half, the impact of a special sale in the fourth quarter was estimated rigorously.The profit forecast has been revised upwardly. Operating income is projected to drop 59.5% year on year to 1.8 billion yen. There is no revision to the dividend forecast. The company plans to pay a dividend of 7.00 yen/share, up 2.00 yen/share from the previous term. The expected payout ratio is 25.3%.

5.Conclusions

While the company revised the full-year earnings forecast for the term ending February 2023, the company has not revised the plans from the term ending February 2024 in “TIP25,” but if EC sales recover, mid-term growth potential will increase. In the second half of the term, all brands of all group companies are holding events in their EC channels, selling limited-time products, etc. In addition, the company prepared a filming space for live streaming via social media in the new corporate building, to improve company-wide EC sale systems and functions. We would like to keep an eye on the effects of these measures.

<Reference1: Sustainability>

The company disclosed “Sustainability Storybook” in April 2022.

https://www.tsi-holdings.com/pdf/TSI_SUSTAINABILITY_20220418_FIX_ENG_REV3.pdf

The issues in the apparel field, material issues identified by the company, major initiatives, etc. are as follows.

(1) Issues in the apparel field

Major issues are the following four.

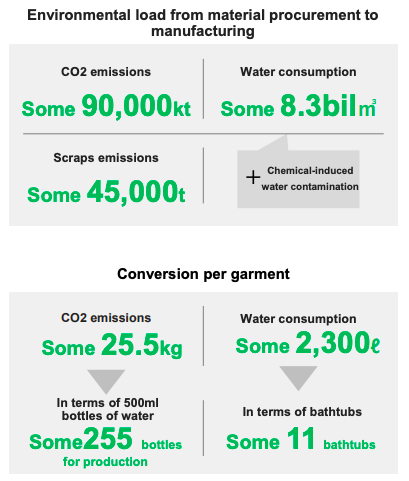

CO2 emissions | The CO2 emissions in the apparel industry are projected to augment over 60% between 2015 and 2030, reaching about 2 billion tons. This is equivalent to the annual CO2 emissions from 230 million passenger vehicles, worsening global warming. |

Mass production and disposal | The disposal amount of textiles is about 92 million tons per year, and is projected to increase 57 million tons by 2030. The ratio of 3Rs (reuse, recycle, and repair) of clothes in Japan is as low as about 26%. |

Water resources | For producing a piece of clothing, about 11 bathtubs of water is used, and also for cultivating cotton, a large volume of water is consumed. The use of chemical substances in the dyeing process accounts for 20% of freshwater pollution. It is said that clothing made of chemical textiles accounts for 60% of about 13 million tons of marine micro-plastic waste. |

Human rights | It is said that forced labor and illegal working conditions are rampant in the value chain. |

(Taken from the reference material of the company)

(2) Material issues of TSI

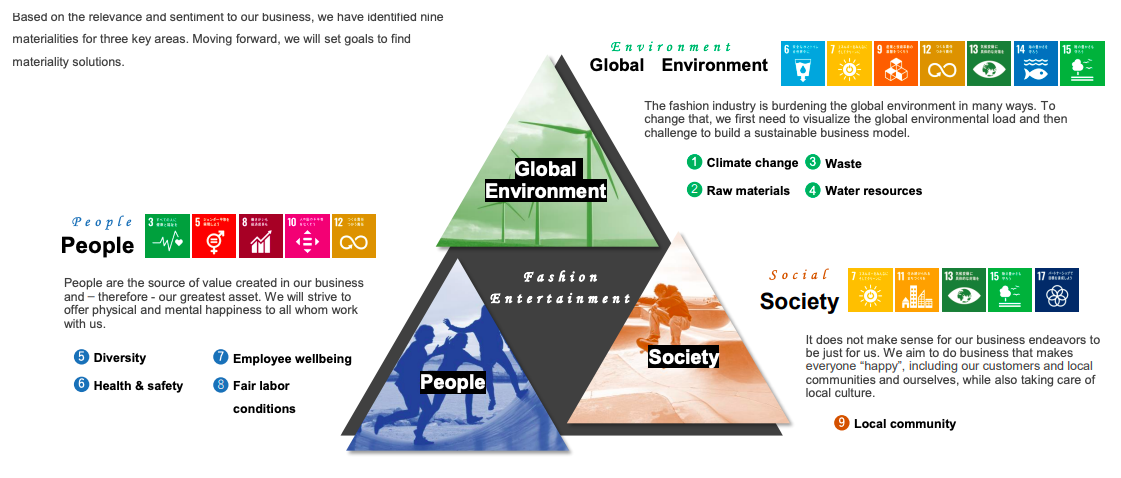

In three important fields, they have identified 9 material issues.

(Taken from the reference material of the company)

(3) Initiatives, goals, etc. for each field and each material issue

・3-1 Earth environment

Material issue | Commitment |

①Climate change | To realize carbon neutrality |

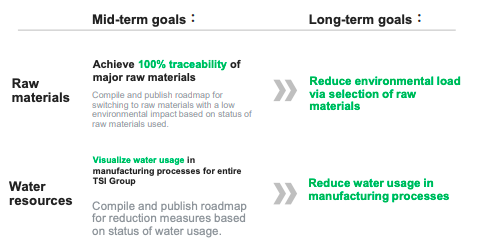

②Raw materials | To enhance the traceability of raw materials and select environmentally friendly materials |

③Waste | To develop a recycling model to minimize waste |

④Water resources | To reduce water consumption |

①Climate change

They promote “the endeavor to achieve carbon neutrality.”

The company aims to reduce CO2 emissions by 30% by FY 2/2025 and achieve carbon neutrality by 2050.

(Taken from the reference material of the company)

* Actions

Action | Outline |

Switch to renewable energy resources for electric power | For roadside stores, business establishments, offices, and factories where it is possible to choose electric power suppliers, the company will switch to electric power contracts with environmental value or zero-carbon contracts. When opening new stores, they consider it at the time of signing contracts. |

Implementation of measures for realizing zero emissions | The company will take measures for rationalizing production output, by adopting the made-to-order production system, digitalizing sample production, strengthening the D2C brands, improving digital fashion, etc. |

Development of an organizational structure for visualizing CO2 emissions in Scope 3 | The company will establish a system for estimating emissions in Scope 3 by the end of FY 2/2023. For purchased products, they will try to visualize it while considering the differences in material based on Higg Index of SAC. |

②Raw materials/④ Water resources

For curtailing water consumption while reducing CO2 emissions, they will switch to materials with low environmental burdens, such as “sustainable cotton,” and develop materials like Tag Fastener made of biodegradable plastics developed by Toska-Bano’k.

(Taken from the reference material of the company)

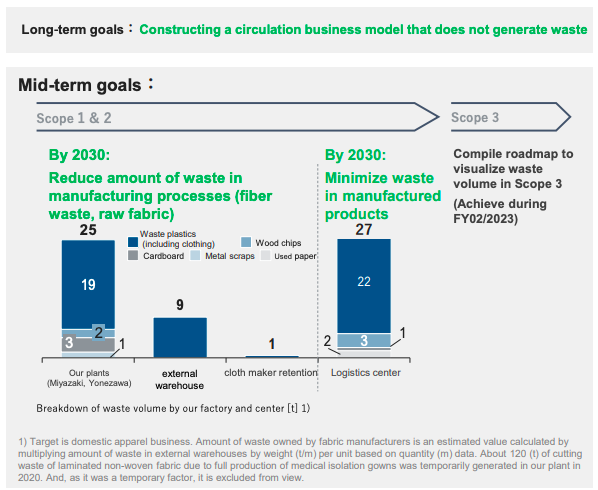

③Waste

To reduce the disposal amount of clothing to zero

(Taken from the reference material of the company)

* Actions

Action | Outline |

Rationalization of production output | The company will review the manufacturing process by utilizing digital tools and develop a system for delivering necessary amounts of products to customers at reasonable prices timely in a necessary cycle. |

Re-utilization of items that would be discarded | The company aims to increase the rates of reuse, recycling, upcycling, and sale of refurbished items. |

Currently, the company engages in feasible measures in SCM Division, including the switch to environmentally friendly secondary materials for product packages, tags, hanger covers, and shopping bags.

From now on, SCM Division plans to cooperate with the business section of each brand and implement more company-wide measures linked with the strategies for business and SDGs.

・3-2 Human resources

Material issue | Commitment |

⑤Diversity | The company will develop an environment in which all of diverse employees can flourish. |

⑥Health and safety | The company will safeguard the physical and mental health of each employee, which is the source of value. |

⑦Degree of happiness of employees | The company will create value so that employees will be financially satisfied, feel mentally fulfilled, achieve self-realization, and grow. |

⑧Fair labor | The company will respect the human rights of all people involved in the supply chain who will contribute to the creation of value. |

⑤ Diversity

The company will develop an environment for realizing a good work-life balance with diversity and flexibility.

The major KGIs and goals are as follows.

(Taken from the reference material of the company)

⑥ Health and safety

While establishing systems in accordance with laws and regulations, the company flexibly implements various measures for protecting the daily lives of employees.

They recommended telework in all offices in Japan and reduced working hours.

(Taken from the reference material of the company)

⑤Diversity/⑥ Health and safety

They are making efforts to secure mental and physical health and actualize diversity & inclusion.

(Taken from the reference material of the company)

➆ Degree of happiness of employees

The company conducts a survey on the satisfaction level of employees (eNPS), in order to develop an environment in which each employee can work on tasks flexibly by utilizing diversity.

Based on the survey results, each business section implements measures for improving the labor environment.

(Taken from the reference material of the company)

⑧Fair labor

In order to realize fair labor, the company revised the regulations for behavior of business partners in January 2022 and engages in activities for diffusing them among suppliers.

From now on, the company will increase the range of subjects, establish a system for managing and operating them, and promote activities for protecting the human rights of partners and factory staff who will keep creating value.

(Taken from the reference material of the company)

・3-3 Society

Material issue | Commitment |

⑧Local communities | The company will contribute to the preservation of local communities and the earth environment by utilizing its own technology and know-how and promote activities for the next generation. |

While collaborating and cooperating with various local partners, the company is making efforts to solve local issues, vitalize and develop each region through its business.

It concluded a comprehensive cooperation agreement with Kamikawa Town, Hokkaido, with the aim of developing a region where new value is created.

(4) CSR

Basic policy for CSR

Under the corporate philosophy: “We create value that brightens the minds of people through fashion, and share the pleasure of living tomorrow with society,” we will build a sustainable society together with all kinds of stakeholders through business activities. |

Under this basic policy, they engage in the following activities.

*The “Happiness For All” project by JILL by JILLSTUART × International NGO Plan International

This is a collaborative project with the NGO, which operates activities in over 70 countries, for the purpose of realizing a society free of poverty and discrimination. The company made a donation according to the purpose of subject products.

*Donation of clothes to the areas devastated by the heavy rain and the evacuation sites in Atami City

The company sent clothes, such as T-shirts and tank tops to the evacuation sites in the wake of the heavy rain in Atami City in July 2021.

*Humanitarian support for Ukraine

The company donated 10 million yen via “Relief for the Humanitarian Crisis in Ukraine” of Japanese Red Cross Society.

In addition, the company produces and sells mugs, and organizes a project of printed T-shirts for charity, etc. to give donations.

(5) Management system

In order to establish a business operation system suited for a global apparel company, the company is developing a structure for maintaining soundness and transparency and making decisions swiftly and strengthening the internal control system for complying with laws and regulations thoroughly and controlling risks.

Through these activities, the company enhances the corporate governance further while building good relationships with the stakeholders.

*Corporate governance system

As an organizational structure, the company adopted a company with auditors. Three out of 7 directors are outside ones, who are all independent executives. Two out of 4 auditors are outside ones, who are all independent executives.

They think that this structure is optimal as of now but will think of improving it according to the situation when necessary.

*System for attaining SDGs

The company established a division for attaining SDGs, drew up a policy for it, and is striving to make it known to related sections.

Regarding important projects, the sustainability committee, which is composed of mainly outside directors, discuss them, and the board of directors makes decisions.

<Reference2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with company auditors |

Directors | 7 directors, including 3 external ones (including 3 independent executives) |

Auditors | 4 auditors, including 2 external ones (including 2 independent executives) |

◎ Corporate Governance Report

The latest update: May 31, 2022

<Basic concept>

The Company seeks to enhance its internal control, including rigorous compliance with laws and regulations and risk management, and develop a structure that enables decision-making that is highly sound, transparent, and swift in order to build a business operation system befitting a fashion and apparel company engaged in business globally, under the corporate philosophy that “we create value that lights up people’s hearts through fashion and share the happiness of living tomorrow together with society.” Through these initiatives, we will make efforts to keep our corporate value growing, which is our basic business policy, to enhance our corporate governance further while building good relationships with our stakeholders.

<Reasons for not following the principles of the Corporate Governance Code (excerpt)>

[Principle 1-4. Strategic shareholding]

To run our operations smoothly and maintain and improve our business relationships, the Company strategically holds shares that would contribute to the enhancement of our corporate value after comprehensively considering the medium/long-term economic rationality and future prospects.

The appropriateness of strategic shareholding will be periodically examined and reported to the Board of Directors. For shares whose effects are fading, we will reduce the number of shares held after taking into consideration the situation of the target companies, such as dividends.

When exercising voting rights, the Company comprehensively decides to vote in favor or against each of the proposals based on whether it is consistent with the purpose of strategic shareholding and whether it contributes to the maintenance and improvement of the corporate value of the target company and the shareholder value.

[Principle 3-1. Enhancement of information disclosure]

[Supplementary Principle 3-1-3]

For the Company’s sustainability efforts and investments in human capital and intellectual property, please check the section titled “Disclosure Based on the Principles of the Corporate Governance Code.”

Regarding the impact of climate change-related risks and revenue earning opportunities on our business activities and earnings, the Company will reduce CO2 emissions across the value chain for achieving carbon neutrality by 2050. To this end, we will gather and analyze necessary data, and lay down a roadmap to visualize and reduce CO2 emissions in Scope 3 by the end of February 2023.

<Disclosure based on the principles of the Corporate Governance Code (excerpt)>

[Principle 2-3. Issues related to sustainability, mainly social and environmental issues]

[Supplementary Principle 2-3-1]

[Principle 3-1.-Enhancement of information disclosure]

[Supplementary Principle 3-1-3]

[Principle 4-2. Roles and responsibilities of the Board of Directors (2)]

[Supplementary Principle 4-2-2]

(1) The Company’s Sustainability Efforts

The Company released the sustainability statement, “Creating a Sustainable Future with Fashion Entertainment: Beautiful Planet Earth, Radiant Society, and Happy Life,” and set up material issues and key goal indicators (KGIs) as the foundation for generating sustainable happiness in the long term through its business activities.

We set up the SDGs Promotion Office in September 2021 to promote sustainability activities while proactively working to build in-house systems and raise the awareness of employees.

For reports on specific activities, please see SUSTAINABILITY STORY BOOK.

https://www.tsi-holdings.com/pdf/TSI_SUSTAINABILITY_20220418_FIX_ENG_REV3.pdf

(2) Investment in human capital and intellectual property, etc.

(i) Investment in human capital

People are the source of value in our business activities and our greatest asset.

By setting diversity, employee wellbeing, health and safety, and fair labor conditions as part of our essential material issues, we will strive to improve the environment to enable all staff working together to thrive happily both physically and mentally.

Furthermore, to deal with the era of change, the Company will invest in employee education, training, and development. We will establish programs through which employees acquire needed skills, by enhancing job rotations, training schemes, and self-learning systems to develop a multi-skilled workforce.

(ii) Investment in intellectual property

For the Company, which operates a brand business, intellectual property, mainly trademark rights and copyrights, is crucial for business administration. Intellectual property constitutes the foundation of creative value to be delivered to customers as we seek to achieve the goal of “Creating worldwide sympathy and social value with the power of fashion entertainment,” which was established as the purpose of the medium-term management plan “TSI Innovation Program 2025 (TIP 25).”

We will not only develop superior designs and brands, but also proactively invest in expertise, such as business models and communication design know-how, to deliver a customer experience that exceeds their expectations.

[Principle 2-4. Ensuring diversity within the Company by promoting the active participation of women, etc.]

[Supplementary Principle 2-4-1]

(1) Ensuring diversity

The TSI Group will create a diverse environment where anyone can thrive by actively promoting initiatives to realize diversity and flexibility in work and life for all in a manner that suits each one of them.

(2) Voluntary and measurable goals for ensuring diversity, and their statuses

(i) Promotion of women to managerial positions

While female employees accounted for 27.0% of the total number of managers at the Company at the end of February 2022, we have set a goal of raising the ratio to 40% by the end of February 2025.

(ii) Promotion of employees of foreign nationalities to managerial positions

Although we have yet to set any goal for promoting employees of foreign nationalities to managerial positions, we will continue to review this subject internally.

(iii) Voluntary and measurable goals for the promotion of mid-career hire employees to managerial positions and their status

There are no goals for the promotion of mid-career employees to managerial positions. Still, we have established diverse work systems (a flextime system, a reduced working hours system, and a second job system) and various training programs to accommodate individuality within the TSI Group which brings together companies with different organizational climates and cultures. We operate our personnel system appropriately while introducing internal recruitment and job rotation schemes and flexibly accepting diversity in work duties, job category, and work experience.

(3) Human resources development and in-house environment improvement policies to ensure diversity, and their statuses

(i) Human resources development policy to ensure diversity

To ensure diversity in promoting core personnel, we evaluate and promote employees solely based on their skills regardless of gender, age, and nationality.

Moreover, in addition to hiring new graduates, we actively hire highly skilled mid-career professionals, including those from other industries. As for promoting female employees to managerial positions, we will proactively work to raise further the ratio of female employees in managerial positions, which is already over 25% of all managers in the Group.

Moreover, while more than 100 foreign national employees already work for the Group as a whole, mainly at overseas subsidiaries, we intend to avidly conduct recruitment activities to further secure highly skilled professionals as we focus on expanding the overseas business in the coming years.

(ii) Improving the environment to enable diverse employees to thrive further

To allow diverse employees to exert their skills fully in accordance with their own lifestyles, the TSI Group takes measures, such as applying flexible work hours and work formats, revising pay levels, and easing the burden of shop work clothes, among other employee welfare matters, and it will continue to improve its measures in the future.

(iii) Promotion of diversity and inclusion

We aim to enable each of our employees of different backgrounds varying in gender, age, nationality, and physical and mental conditions to thrive according to their characteristics, skills, and conditions. Thus, we will work to reform awareness of all our employees to create a culture that respects diversity and an environment where diverse employees can grow, be motivated, and thrive.

(iv) Status of efforts to ensure diversity

The following efforts are in progress to ensure diversity in accordance with employees’ characteristics.

◎ Active participation of women

While female managers accounted for 27.0% of all managers at the Group at the end of February 2022, we set a goal of raising the ratio to 40% by the end of February 2025, and we will recruit and promote employees while taking into consideration raising the ratio of female managers within the highly senior positions.

◎ Further employment of workers of foreign nationalities

Employment of workers of foreign nationalities by the Group has been growing year after year, and we are now in the process of employing workers of foreign nationalities in a more planned manner.

◎ Utilization of elderly professionals equipped with experience and past achievements

The Group is working to proactively employ personnel up to age 65 and continues to recruit and promote employees irrespective of age. Thus, it has an increasing number of employees aged 65 or above.

◎ Empowerment of people with disabilities

To date, the Group, mainly its special subsidiary companies, has avidly empowered people with disabilities. Its employees with disabilities accounted for 2.39% of the total workforce at the end of February 2022. From now on, we will seek to generate work satisfaction for them in ways more directly linked to operations.

◎ Promotion of understanding of LGBT

To date, the Group has had a culture with a high level of understanding of LGBT, different surnames for married couples, and common-law marriage and is now in the process of eliminating gender-based discrimination by comprehensively reviewing and amending various packages, such as the congratulatory/condolence cash gift rules (including wedding congratulation cash gifts).

Moreover, the Group is working on the following initiatives that focus not only on employee characteristics, but also on workstyle diversity.

◎ Developing diverse workstyle systems such as reduced working hours and remote work

The Group has developed rules and systems to realize more diverse work styles than before. These include developing work systems such as reduced working hours ranging from 30 minutes to four hours, a staggered working hours system that allows employees to start working at any time from 8:00 to 13:00, a flextime system, and lifting the ban on second jobs as well as providing subsidies for telework environment maintenance. In addition, we are working on reviewing and amending these systems and establishing new ones.

◎ Creation of a work environment and systems that accommodate pregnancy, giving birth, and child-rearing