Bridge Report:(3608)TSI Fiscal Year ended February 2025

President and CEO Tsuyoshi Shimoji | TSI HOLDINGS CO., LTD. (3608) |

|

Company Information

Market | TSE Prime Market |

Industry | Textile (Manufacturing) |

President | Tsuyoshi Shimoji |

HQ Address | 8-5-27 Akasaka Minato-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Share Outstanding | Total Market Cap. | ROE (Act.) | Trading Unit | |

¥1,022 | 76,941,393 shares | ¥78,634 million | 14.9% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥40.00 | 3.9% | ¥60.47 | 16.9x | ¥1553.70 | 0.7x |

*The share price is the closing price on April 21. All figures are from the financial results for the fiscal year ending February 2025.

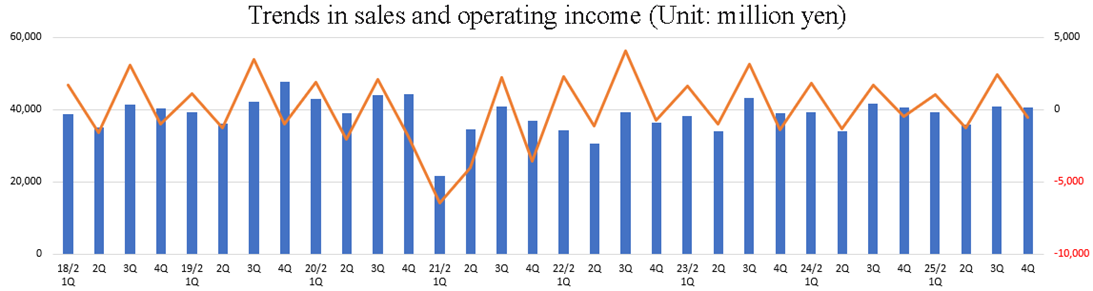

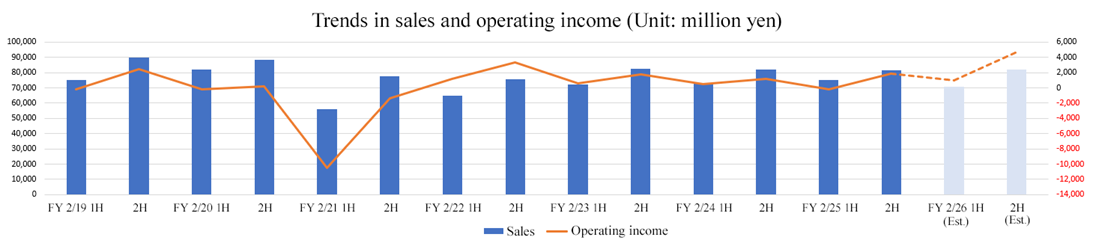

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Feb. 2022 Act. | 140,382 | 4,440 | 5,834 | 1,022 | 11.32 | 5.00 |

Feb. 2023 Act. | 154,456 | 2,329 | 3,859 | 3,063 | 35.21 | 10.00 |

Feb. 2024 Act. | 155,383 | 1,760 | 3,758 | 4,849 | 59.97 | 15.00 |

Feb. 2025 Act. | 156,606 | 1,636 | 2,076 | 15,230 | 210.02 | 65.00 |

Feb. 2026 Est. | 153,000 | 5,700 | 6,000 | 4,200 | 60.47 | 40.00 |

* Unit: million-yen, yen. The forecasted values are from the company.

This report provides the overview of TSI Holdings Co., Ltd.’s financial results for the fiscal year ended February 2025.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended February 2025 Earnings Results

3. Fiscal Year ending February 2026 Earnings Forecasts

4. Progress of the Medium-term Management Plan

5. Conclusions

<Reference1: Medium-term Management Plan “TSI Innovation Program 2027”>

<Reference2: Regarding Corporate Governance>

Key Points

- In the fiscal year ended February 2025, sales increased 0.8% year on year to 156.6 billion yen. In Japan, while physical stores performed steadily, e-commerce (EC) sales declined due to the withdrawal of some brands. Overseas, physical stores struggled, but EC remained firm owing to the success of strategic initiatives. Operating income declined 7.1% year on year to 1.6 billion yen. The company pursued revenue growth and advanced structural reform measures such as supplier consolidation, localization of payment systems, and appropriate pricing, but gross profit and gross profit margin both decreased 0.9% year on year, due to an increase in discount sales and impairment losses associated with inventory optimization for ongoing businesses and early inventory liquidation for discontinued businesses, and the skyrocketing of procurement costs due to the unfavorable exchange rates, etc. SG&A expenses were reduced through improved efficiency in promotional advertising, logistics, and outsourcing, and the establishment of a cost optimization framework to lower various expenses. However, certain costs related to the sale of fixed assets were recorded under SG&A expenses, resulting in operating income falling below the revised forecast. Excluding this one-off expense, results were generally in line with the revised forecast. As a gain of 23.9 billion yen from the sale of fixed assets was recorded as extraordinary income, net income rose 214.0% year on year to 15.2 billion yen.

- For the fiscal year ending February 2026, sales are projected to decline 2.3% year on year to 153 billion yen, while operating income is forecast to rise 248.4% to 5.7 billion yen. Although some growth is expected for the existing brands, the slight decrease in revenue is projected due to the withdrawal of some businesses for reforming the brand portfolio in the previous fiscal year. As fiscal year ending February 2026 is the second year of the current medium-term management plan and a key year in preparation for its final year, the company will continue to allocate management resources to structural reform initiatives and focus on improving profitability. In addition to the absence of one-off costs recorded in the previous fiscal year and the positive effects of the discontinued businesses, the company anticipates further profit growth driven by sales expansion and the additional impact of earnings structure reforms. Operating income is expected to exceed the previous record of 4.44 billion yen achieved in the fiscal year ended February 2022. The company plans to pay a total of 40.00 yen per share per year, comprising a regular dividend of 25.00 yen and a special dividend of 15.00 yen. The expected dividend payout ratio is 41.3% for the basic dividend and 66.1% for the total dividend.

- In the fiscal year ended February 2025, the company recorded a gain of 23.9 billion yen from the sale of fixed assets. This gain will serve as the funding source for special dividends, with the total amount expected to be approximately 5.0 billion yen over the three-year period from fiscal year ended February 2025 to fiscal year ending February 2027. These special dividends will be paid in addition to regular dividends. For the fiscal year ended February 2025, the year-end dividend forecast was revised from the originally planned 19.00 yen per share to 65.00 yen per share, including a special dividend of 46.00 yen per share. For the fiscal years ending February 2026 and 2027, the company also plans to pay a special dividend of 15.00 yen per share each year, in addition to the regular dividend, which is based on a target payout ratio of 30% or higher.

- Following the announcement of various measures for realizing a PBR of over 1 and the acquisition of additional treasury shares, the company’s stock price nearly doubled from its low in March 2024 in February 2025, temporarily exceeding a PBR of 1.0. However, due to broader market adjustments triggered by concerns over renewed U.S. tariffs under the Trump administration, PBR has once again fallen below 1.0.

- Achieving an operating margin of 6% or higher and an ROE of at least 8% is undoubtedly a challenging target. The key to reaching these goals lies in the steady execution of structural reforms and the effective use of cash generated from the sale of fixed assets. Under President Shimoji’s firm commitment to see these initiatives through with a unified corporate effort, steady progress across all measures can be expected.

1. Company Overview

TSI Holdings is an apparel enterprise operating over 50 brands. It clearly specifies targets (gender, age, preference, etc.) for each brand, and provides a broad range of customers with its products. They aim to proceed with transformation, evolve from an enterprise that conducts apparel business only, and become a “creator of fashion entertainment” that links social value to its corporate growth and not only provides products but also creates original value with the fashion entertainment, from the viewpoints of “the environment and society,” “markets,” and “residents.”

[1-1 Corporate history]

While the environment surrounding the apparel field was becoming severe, Tokyo Style Co., Ltd. and Sanei-International Co., Ltd. established TSI Holdings Co., Ltd. through the transfer of shares in June 2011, with the aim of achieving sustainable growth by utilizing their respective strengths. It was listed on the Tokyo Stock Exchange (TSE). After the market restructuring, it was listed on the Prime Market of TSE in April 2022.

[1-2 Corporate philosophy]

With the following corporate philosophy, vision, purpose, and group’s code of conduct, they aim to become a “creator of fashion entertainment.”

Corporate philosophy | We create value that shines the hearts of people through fashion and share the happiness of living tomorrow together with society. |

Vision | We aim to become the world’s most beloved global group through the best and a step-ahead-of-the-times creation and lifestyle proposal. |

Purpose | We create empathy and social value across the world through the power of fashion entertainment. |

Group's code of conduct | 1. We value our spirit of fairness/impartiality and honesty, and work with passion and responsibility. 2. We always have problem consciousness, strive for self-study, and actively challenge with flexibility. 3. We respect each person's individuality, communicate well, and contribute to the team by playing our own roles. 4. We deliver excitement and pleasure to our customers with sincere hospitality and strive to improve customer satisfaction. 5. We respect each stakeholder's position to realize mutual benefit and contribute to the sustainable growth of the company. 6. We sincerely appreciate society and the natural environment and contribute to social development through our business. |

[1-3 Business description]

The TSI Group consists of TSI Holdings, which is a holding company, 26 consolidated subsidiaries, and one equity-method affiliate.

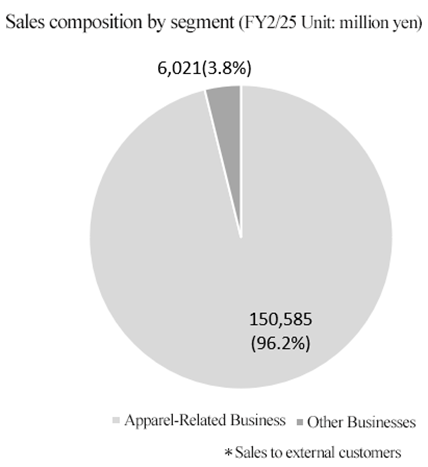

In the “apparel-related business,” the main activities include planning, manufacturing, and selling mainly clothes, as well as licensing brand operations and production/logistics businesses. The “other business” includes sales agency and staffing services, synthetic resin-related business, store design/management, and restaurant operations.

(1) Brands

Currently, they operate over 50 brands. They set clear targets (according to gender, age, preference, etc.) for each brand and provide products to a broad range of customers.

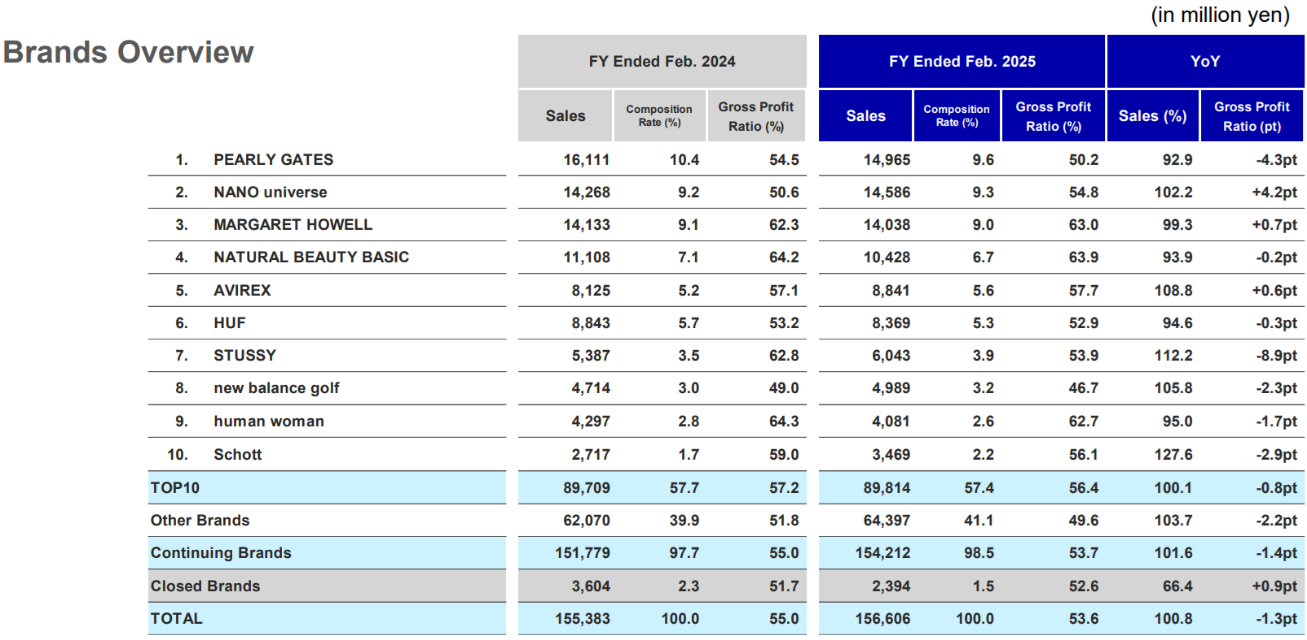

The top 10 brands account for about 60% of total sales. The gross profit margin is about 50-65%.

*Outline of major brands

Brand | Targets | Concept |

PEARLY GATES

| Women and men | OUT ON THE WEEKEND (leaving urban areas on weekends) Under the concept: “Let’s play golf more casually and more enjoyably,” it proposes new golf apparel, highlighting the intrinsic appeal of the sport.

|

NANO universe

| Women and men |

Under the concept of “glamour yourself up,” this brand brings out the attractive points of each customer and gives them confidence, with refined designs and high-quality functional materials. |

MARGARET HOWELL

| Women and men |

In 1970, the British designer MARGARET HOWELL started producing clothes at home. Clothing is not a passing fad but part of daily life, so she puts importance on materials, craftsmanship, and styles. This brand operates a broad range of businesses, including the sale of clothing and home-use products and the operation of cafes. |

NATURAL BEAUTY BASIC

| Women |

Based on the intrinsic natural beauty of each woman, this fashion store brand is for women who live each day beautifully, elegantly, and simply embracing their own unique femininity. |

AVIREX

| Men |

Established in 1975 as an official supplier to the U.S. Air Force, the brand has revived numerous flight jackets for urban wear. Drawing on decades of technical expertise, AVIREX produces military-inspired items known for their exceptional functionality and design, earning lasting popularity among consumers around the world. |

(2) Sales channels

They sell apparel via physical stores and EC inside and outside Japan.

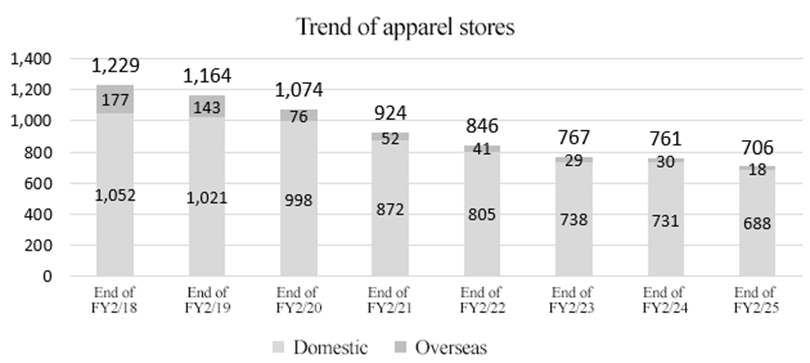

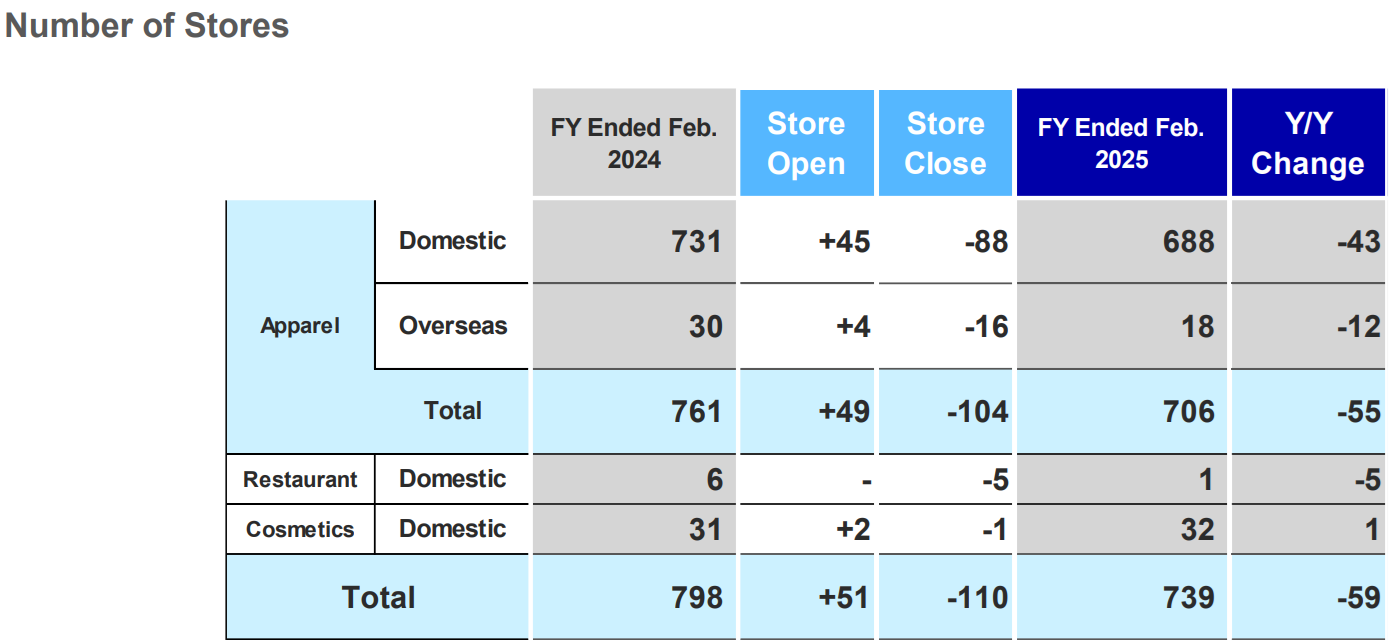

The number of physical stores was 739 (including overseas) as of the end of the fiscal year ended February 2025. Among them, 706 stores sell apparel.

While closing unprofitable stores as part of its business restructuring, the company, described as a "fashion entertainment company," believes that physical stores remain important for articulating brand narratives and providing entertainment to customers. The company will continue to develop stores focused on brands popular with customers while implementing a “scrap and build” approach to update the image. By opening stores with large floor sizes and/or in prime locations, they will reform the revenue structure of their physical store business.

The ratio of sales via their own websites to domestic EC sales had been rising but dropped consecutively in the fiscal year ended February 2024 and fiscal year ended February 2025 due to the withdrawal from some businesses. EC sales have been declining after peaking in the fiscal year ended February 2021, and reigniting growth remains a key challenge.

[1-4 Characteristics, strengths, and competitive advantages]

The company excels at seeking, finding, and developing categories and brands that are in line with the trends of the times.

In segments such as athleisure, wellness, outdoor, and streetwear, they grasped consumer preferences and reeled in foreign visitors to Japan, too. This resulted in strong performance, particularly among men's brands.

The company has successfully found brands through its networks in the U.S., U.K., and beyond. In the past decade, few companies have introduced new brands and made them successful, like TSI Holdings.

The company’s competitive advantages come from its base and experience in taking risks, as well as its know-how and track record of developing brands.

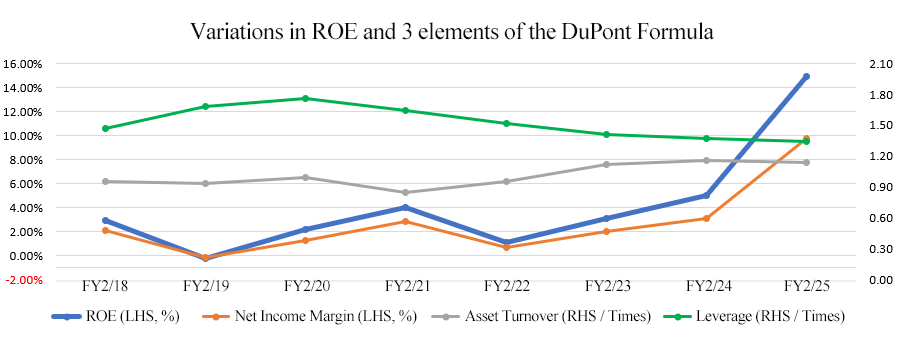

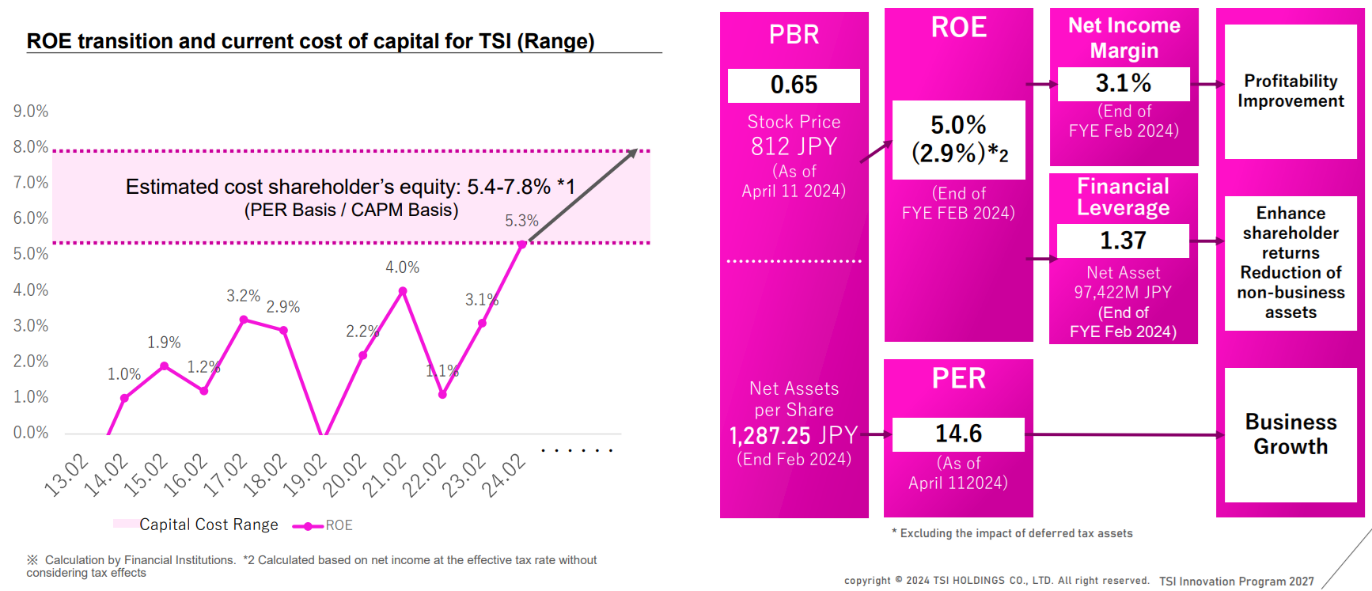

[1-5 ROE analysis]

| FY 2/18 | FY 2/19 | FY 2/20 | FY 2/21 | FY 2/22 | FY 2/23 | FY 2/24 | FY 2/25 |

ROE (%) | 2.9 | -0.2 | 2.2 | 4.0 | 1.1 | 3.1 | 5.0 | 14.9 |

Net income margin (%) | 2.07 | -0.12 | 1.28 | 2.88 | 0.73 | 1.98 | 3.12 | 9.73 |

Total asset turnover (times) | 0.95 | 0.93 | 0.99 | 0.85 | 0.95 | 1.12 | 1.16 | 1.14 |

Leverage (times) | 1.47 | 1.68 | 1.76 | 1.64 | 1.52 | 1.41 | 1.37 | 1.35 |

*Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

In the fiscal year ended February 2025, ROE rose significantly from the previous fiscal year, primarily due to a gain of 23.9 billion yen from the sale of fixed assets recorded as extraordinary income.

For the fiscal year ending February 2026, the company expects net profit margin to decline to 2.75%, falling below the amount recorded in the fiscal year ended February 2024. In order to achieve the ROE target of 8.0% or higher by the fiscal year ending February 2027, as set forth in the medium-term management plan "TIP27," continued efforts to improve profitability and asset efficiency will be essential.

2. Fiscal Year ended February 2025 Earnings Results

[2-1 Overview of business results]

| FY 2/24 | Ratio to sales | FY 2/25 | Ratio to sales | YoY | Ratio to revised forecast |

Sales | 155,383 | 100.0% | 156,606 | 100.0% | +0.8% | -0.3% |

Gross profit | 84,729 | 54.5% | 83,995 | 53.6% | -0.9% | - |

SG&A | 82,968 | 53.4% | 82,359 | 52.6% | -0.7% | - |

Operating income | 1,760 | 1.1% | 1,636 | 1.0% | -7.1% | -18.2% |

Ordinary income | 3,758 | 2.4% | 2,076 | 1.3% | -44.8% | -17.0% |

Net income | 4,849 | 3.1% | 15,230 | 9.7% | +214.1% | +1.5% |

*Unit: million yen. The revised forecast ratio is the ratio to the earnings forecast announced in January 2025.

Slight increase in sales, but decrease in profit. Sales were in line with the revised forecast, but both operating income and ordinary income fell below the forecasts.

Sales increased 0.8% year on year to 156.6 billion yen. In Japan, while physical stores performed steadily, EC sales declined due to the withdrawal of some brands. Overseas, physical stores struggled, but EC remained firm owing to the success of strategic initiatives.

Operating income declined 7.1% year on year to 1.6 billion yen. The company pursued revenue growth and advanced structural reform measures such as supplier consolidation, localization of payment systems, and appropriate pricing, but gross profit and gross profit margin both decreased 0.9% year on year, due to an increase in discount sales and impairment losses associated with inventory optimization for ongoing businesses and early inventory liquidation for discontinued businesses, and the skyrocketing of procurement costs due to the unfavorable exchange rates, etc. SG&A expenses were reduced through improved efficiency in promotional advertising, logistics, and outsourcing, and the establishment of a cost optimization framework to lower various expenses. However, certain costs related to the sale of fixed assets were recorded under SG&A expenses, resulting in operating income falling below the revised forecast. Excluding this one-off expense, results were generally in line with the revised forecast.

As a gain of 23.9 billion yen from the sale of fixed assets was recorded as extraordinary income, net income rose 214.0% year on year to 15.2 billion yen.

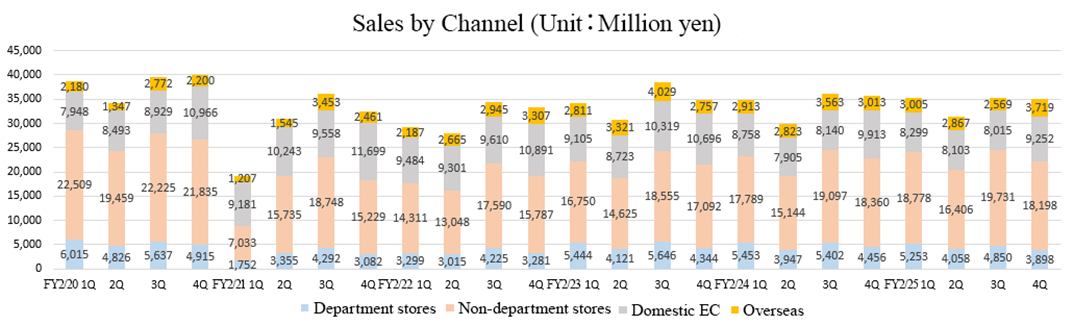

[2-2 Trend in each channel]

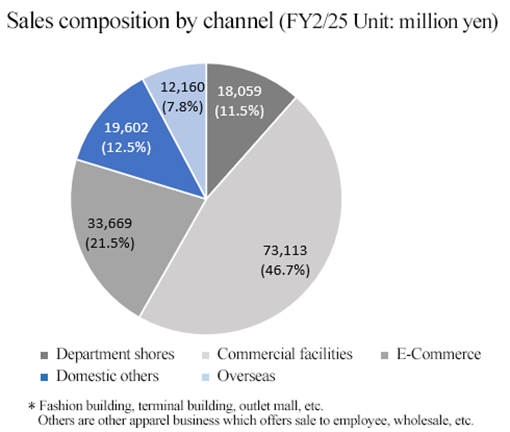

| FY 2/24 | FY 2/25 | YoY |

Department stores | 19,258 | 18,059 | -6.2% |

Non-department stores | 70,390 | 73,113 | +3.9% |

Domestic EC | 34,716 | 33,669 | -3.0% |

Other domestic channels | 18,706 | 19,602 | +4.8% |

All domestic channels | 143,071 | 144,445 | +1.0% |

Overseas | 12,312 | 12,160 | -1.2% |

Total | 155,383 | 156,606 | +0.8% |

*Unit: million yen.

*Non-department stores: fashion malls, station buildings, outlet stores, etc. Othe other apparel businesses, including wholesale and sale to employees and non-apparel businesses of group companies.

* | The sales at domestic physical stores increased 1.7% year on year. Brands that successfully met the demand from foreign visitors to Japan led growth in physical retail. The sales at department stores declined year on year, due to a net decrease of stores through structural reforms, as well as inventory clearance efforts at golf brands, which account for a large share of sales. |

* | The sales of domestic EC declined 3.0% year-on-year, due to the termination of a brand. |

* | Overseas sales declined despite the positive effects of exchange rate changes, as the wholesale business at the U.S. subsidiary continued to struggle. |

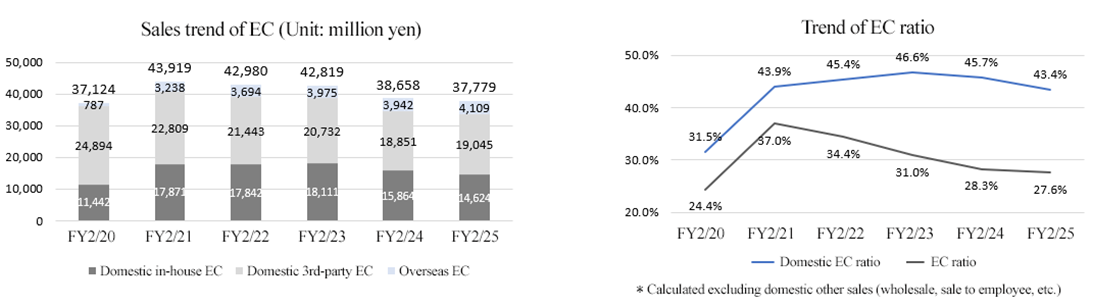

◎EC Sales Trends

| FY 2/24 | FY 2/25 | YoY |

Domestic EC | 34,716 | 33,669 | -3.0% |

In‐house EC | 15,864 | 14,624 | -7.8% |

Other | 18,851 | 19,045 | +1.0% |

Overseas EC | 3,942 | 4,109 | +4.3% |

Total amount for EC | 38,658 | 37,779 | -2.3% |

*Unit: million yen.

Domestic EC sales declined. While sales through third-party EC platforms increased due to a focus on limited-edition and collaboration items, in-house EC saw a decline. This was primarily due to restrained promotional spending as part of the pursuit of cost-effectiveness, as well as the temporary closure of the site for renovation, during which inventory was redirected to physical stores.

Overseas EC sales showed signs of recovery, with growth recorded year on year even on a local currency basis, in addition to the positive effect of the yen depreciation.

[2-3 Number of Stores and Brand Overview]

(1) No. of stores

(Taken from the reference material of the company)

The company continued efforts to improve the efficiency and productivity of store personnel through initiatives such as optimizing staff allocation across brands and regions, consolidating or closing unprofitable stores, and opening large-sized stores.

(2) Sales and gross profit margin of each brand

(Taken from the reference material of the company)

◎ Status of each major brand

* | PEARLY GATES Year-on-year growth rate: -7.1%. Sales growth was limited due to aggressive discounting carried out to optimize inventory. Recently, the collaboration with the Pokémon brand has been well received, attracting not only existing customers, but also new customers both domestically and internationally. In March 2025, new stores were opened in Shanghai and Taiwan. The brand will continue to advance its overseas strategy, including initiatives targeting foreign visitors to Japan. |

* | NANO universe Year-on-year growth rate: 2.2%. Although traffic to the official EC site temporarily declined due to the upgrade of the site, overall sales remained steady. Profitability improved through the review and revision of pricing strategies and optimization of procurement efficiency. Going forward, the focus will be on expanding sales while maintaining a strong profit structure. |

* | MARGARET HOWELL Year-on-year growth rate: -0.7%. The number of stores declined as low-performing stores were closed or consolidated to improve profitability, but existing stores achieved sales growth. Overall, physical store performance remained solid. On the other hand, EC did not achieve sufficient growth. The brand will continue to strengthen its store strategy, aiming to expand its customer base by offering lifestyle-oriented products mainly at flagship stores. |

* | AVIREX Year-on-year growth rate: 8.8%. Sales and gross profit both increased from the previous year, and the brand maintained strong performance with high profitability. As the year 2025 marks the 50th anniversary of its founding, the brand will continue working to create additional value. |

Outside of the mainstay brands, there are a number of brands that achieved double-digit or higher year-on-year growth.

“and wander” recorded a 137.5% year-on-year growth. Collaborations with ALTRA and Gramicci were well received, and its first collaboration with a Spanish fashion brand also drew attention. Collections reflecting the brand’s distinctive aesthetic attracted significant interest. In addition, the designer of “and wander” was selected for the “Hypebeast 100” for the second consecutive year. New store openings are planned for the current fiscal year, and further growth is anticipated.

Schott recorded a 127.6% year-on-year growth. In April 2024, the brand launched an official TikTok account. It also expanded its social media presence by sharing behind-the-scenes videos on YouTube featuring collaborative products with well-known celebrities whose image aligns with the brand. A collaboration with YOUNGER SONG, a label with strong support among younger consumers, also drew attention as an initiative that fused the brand’s heritage with a fresh sensibility. These efforts have contributed to expanding the brand’s fan base beyond its existing customers.

In addition, “wagona,” a new lifestyle-focused apparel brand launched by “human woman” in the autumn of 2024, held its “Living Like Traveling” pop-up event in October 2024 and again in March 2025. The March event featured not only sales of the wagona collection, but also exhibitions and sales of handcrafted works by artists, as well as a tea gathering for foretelling the year 2025 through astrology. These experiential events, designed to embody the brand’s concept, were well received. The brand’s worldview has resonated strongly with visitors, fostering a deeper connection with core fans while steadily expanding awareness.

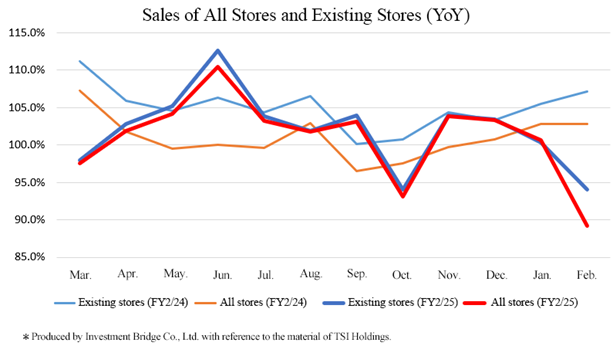

(3) Domestic Sales of All Stores and Existing Stores

For the cumulative full-year of the fiscal year ended February 2025, the sales of existing stores grew 2.0% year-on-year, while the sales of all stores rose 1.0% year-on-year.

[2-4 Financial statement and cash flow]

◎ Major BS

| End of Feb. 2024 | End of Feb. 2025 | Increase/ decrease |

| End of Feb. 2024 | End of Feb. 2025 | Increase/ decrease |

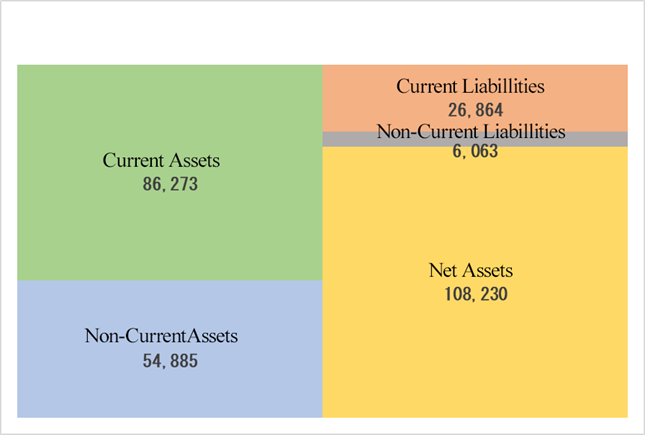

Current assets | 70,877 | 86,273 | +15,396 | Current liabilities | 28,388 | 26,864 | -1,524 |

Cash and deposits | 27,472 | 46,325 | +18,853 | Accounts payable | 9,615 | 8,005 | -1,610 |

Accounts receivable | 11,681 | 11,450 | -231 | Short-term interest-bearing liabilities | 8,322 | 1,247 | -7,078 |

Inventory assets | 28,052 | 25,909 | -2,143 | Non-current liabilities | 7,653 | 6,063 | -1,590 |

Non-current assets | 62,586 | 54,885 | -7,701 | Long-term interest-bearing liabilities | 1,630 | 407 | -1,223 |

Property, plant and equipment | 6,560 | 6,165 | -395 | Total liabilities | 36,041 | 32,928 | -3,113 |

Intangible assets | 7,159 | 6,318 | -841 | Net assets | 97,422 | 108,230 | +10,808 |

Investments and other assets | 48,866 | 42,401 | -6,465 | Retained earnings | 60,052 | 74,140 | +14,088 |

Total assets | 133,464 | 141,159 | +7,695 | Total liabilities and net assets | 133,464 | 141,159 | +7,695 |

*Unit: million yen. Interest-bearing liabilities includes lease obligations.

Total assets stood at 141.1 billion yen, up 7.6 billion yen from the end of the previous fiscal year, due to the increase in cash and deposits, etc. Total liabilities stood at 32.9 billion yen, down 3.1 billion yen from the end of the previous fiscal year, due to the decrease in interest-bearing liabilities, etc. Total net assets stood at 108.2 billion yen, up 10.8 billion yen from the end of the previous fiscal year, due to the increases in retained earnings, etc.

The equity ratio rose 3.7 points from the end of the previous fiscal year to 76.4%.

*Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

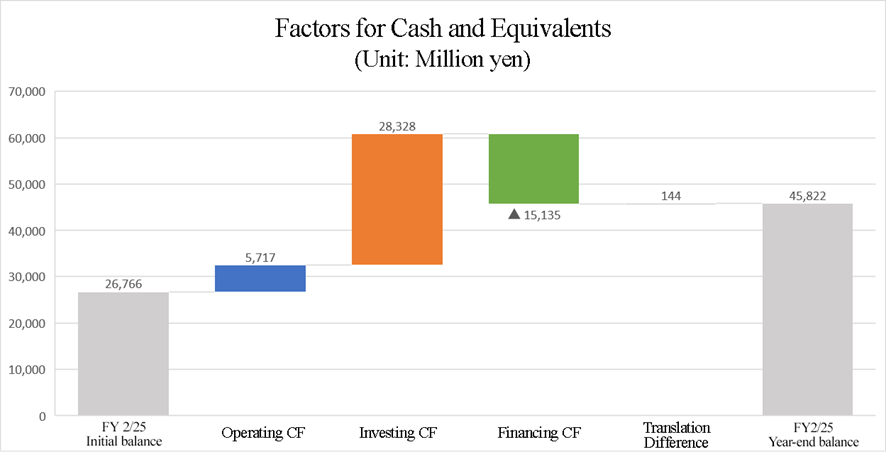

◎ Cash Flow

| FY 2/24 | FY 2/25 | Increase/ decrease |

Operating CF | -525 | 5,717 | +6,242 |

Investing CF | 3,496 | 28,328 | +24,832 |

Free CF | 2,971 | 34,045 | +31,074 |

Financing CF | -7,252 | -15,135 | -7,883 |

Cash and cash equivalents | 26,766 | 45,822 | +19,056 |

*Unit: million yen.

Operating cash flow turned positive due to an increase in net income before taxes and other adjustments, resulting in a larger positive free cash flow. Financial cash flow recorded a larger outflow as short-term borrowings shifted from a net increase to a net decrease. The company’s cash position improved.

Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

[2-5 Topics]

◎ Strengthening Shareholder Returns

The company positions the maintenance of a stable dividend while enhancing long-term corporate value as a core policy, and uses a dividend payout ratio of 30% or higher as a reference for shareholder returns.

Based on this policy and in consideration of recent business performance, the company announced a revision to its dividend forecast for the fiscal year ended February 2025, along with the payment of special dividends over the three-year period from the fiscal year ended February 2025 through fiscal year ending February 2027.

In the fiscal year ended February 2025, the company recorded a gain of 23.9 billion yen from the sale of fixed assets. This gain will serve as the funding source for special dividends totaling approximately 5.0 billion yen (planned), to be distributed over the aforementioned three years in addition to regular dividends.

Accordingly, the year-end dividend forecast for the fiscal year ended February 2025 was revised from the initially planned 19.00 yen per share to 65.00 yen per share, including a special dividend of 46.00 yen. For the fiscal years ending February 2026 and 2027, the company also plans to pay a special dividend of 15.00 yen per share each year, in addition to regular dividends, which are based on a payout ratio of 30% or higher.

3. Fiscal Year ending February 2026 Earnings Forecasts

[3-1 Earnings forecast]

| FY 2/25 | Ratio to sales | FY 2/26 Est. | Ratio to sales | YoY |

Sales | 156,606 | 100.0% | 153,000 | 100.0% | -2.3% |

Operating income | 1,636 | 1.0% | 5,700 | 3.7% | +248.4% |

Ordinary income | 2,076 | 1.3% | 6,000 | 3.9% | +188.9% |

Net income | 15,230 | 9.7% | 4,200 | 2.7% | -72.4% |

*Unit: million yen. This forecast was made by the company.

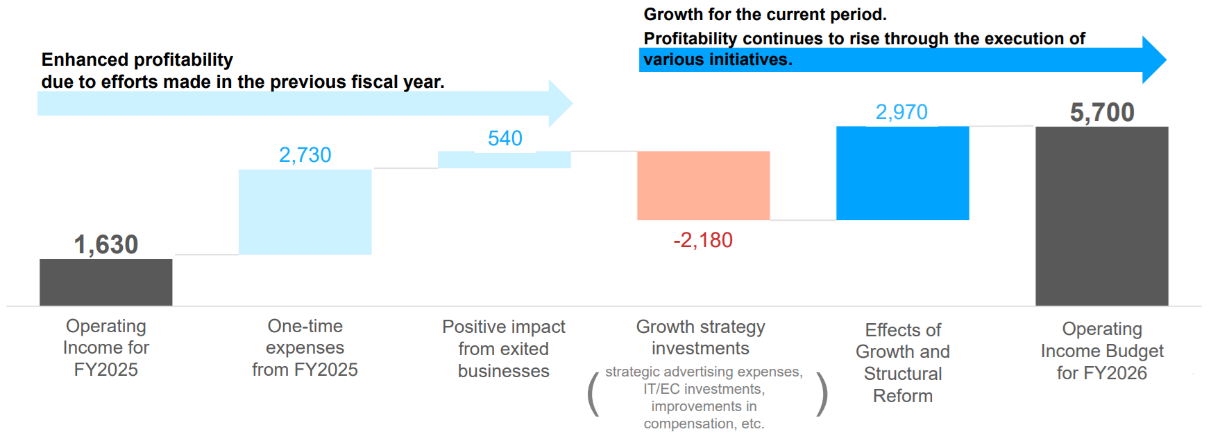

Despite a decline in sales, a significant increase in operating profit is forecasted.

Sales are projected to decline 2.3% year on year to 153 billion yen, while operating income is forecast to rise 248.4% to 5.7 billion yen.

Although some growth is expected for the existing brands, the slight decrease in revenue is projected due to the withdrawal and transfer of some businesses for reforming the brand portfolio in the previous fiscal year. As fiscal year ending February 2026 is the second year of the current medium-term management plan and a key year in preparation for its final year, the company will continue to allocate management resources to structural reform initiatives and focus on improving profitability.

In addition to the absence of one-off costs recorded in the previous fiscal year and the positive effects of the discontinued businesses, the company anticipates further profit growth driven by sales expansion and the additional impact of earnings structure reforms. Operating income is expected to exceed the previous record of 4.44 billion yen achieved in the fiscal year ended February 2022.

The company plans to pay a total of 40.00 yen per share per year, comprising a regular dividend of 25.00 yen and a special dividend of 15.00 yen. The expected dividend payout ratio is 41.3% for the basic dividend and 66.1% for the total dividend.

(Taken from the reference material of the company)

4. Progress of the Medium-term Management Plan

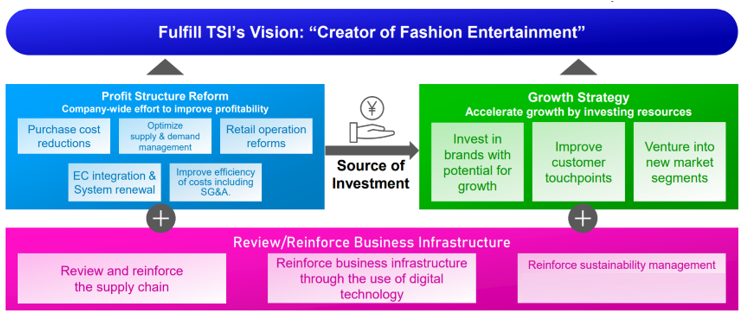

In order to improve corporate value, the company will promote the drastic reform of the revenue structure and investment for accelerating growth with the medium-term management plan “TSI Innovation Program 2027.”

(1) Structural reform

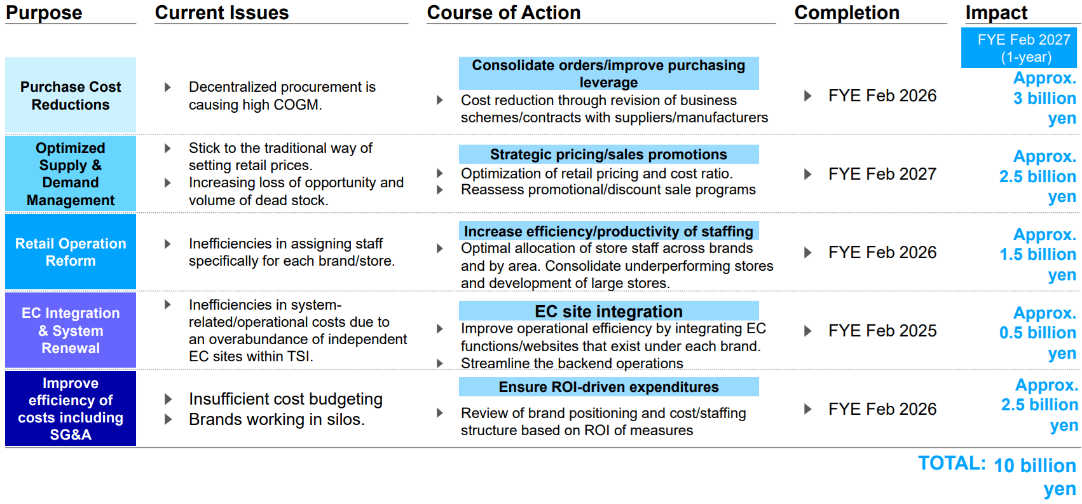

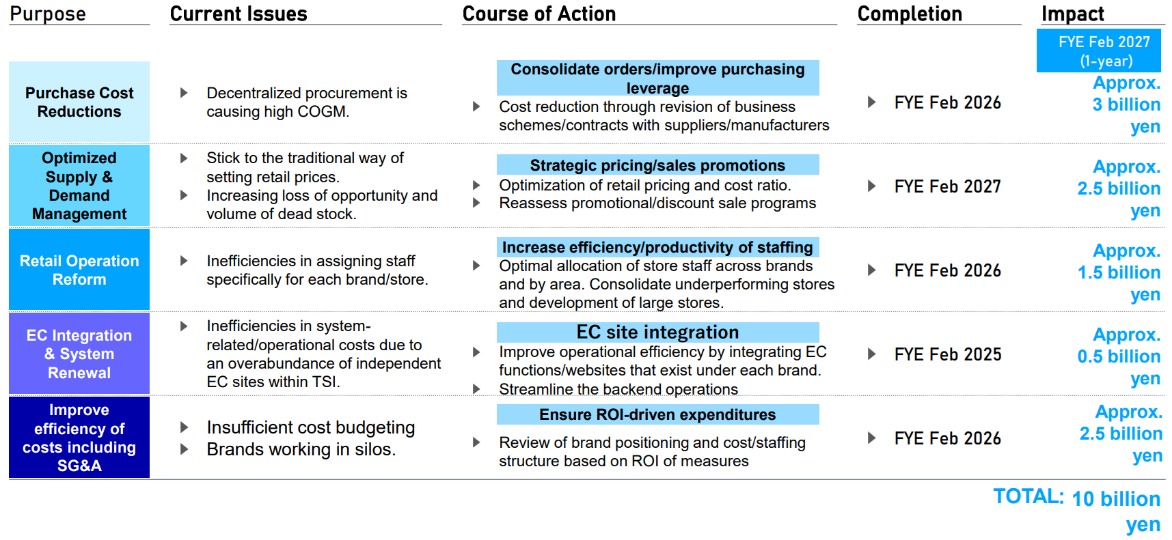

The company strives to increase revenues by approximately 10 billion yen by fiscal year ending February 2027 in five reform items: “purchase cost reduction,” “the optimization of supply-and-demand management (strategic pricing),” “store operation reform,” “EC integration and system refurbishment,” and “the rationalization of costs including selling expenses.”

The progress of and initiatives for each item and others are as follows:

(Taken from the reference material of the company)

① Purchase cost reductions

The company aims to reduce costs by establishing a strategy for production and manufacturing and implementing measures aligned with the business model.

Procurement costs will be lowered through initiatives such as consolidating suppliers, building strategic partnerships with key suppliers, consolidating factories within China, and relocating production bases to ASEAN countries, mainly for brands with shorter production lead times.

The company is expected to complete these measures by fiscal year ending February 2026, reducing costs by over 500 million yen from fiscal year ended February 2024. The company aims to reduce costs by approximately 3 billion yen in fiscal year ending February 2027 alone.

(Taken from the reference material of the company)

② Optimization of supply-and-demand management (strategic pricing)

The company will develop a model to set prices strategically and establish a process and framework to enable brand-led analysis and pricing decisions.

By conducting research and analysis from the perspectives of competitors, the company itself, and customers, the company will identify room for pricing strategically and create a “strategic pricing model.”

Next, using this model, the identified room for pricing strategically will be reflected in individual product prices.

Afterward, the company will analyze and check whether the intended increase in retail prices and improvement in gross profit are being achieved, and use the findings to improve the pricing strategy for the following period.

In fiscal year ended February 2025, this initiative was implemented across over a dozen brands, covering 24 autumn/winter items and 25 spring/summer items.

In fiscal year ending February 2026, the number of subject brands will be further expanded.

In fiscal year ending February 2027, the company also plans to begin optimizing prices from the product planning stage.

The initiative is scheduled to be completed by fiscal year ending February 2027, with expected gains of over 500 million yen in fiscal year ending February 2026 compared to that in fiscal year ended February 2024, and a targeted improvement effect of approximately 2.5 billion yen in fiscal year ending February 2027 alone.

③ Store operation reform

The company will focus on optimizing the deployment of sales staff and implementing institutional reforms.

At individual stores, the optimal number of staff members will be defined based on performance trends, traffic differences between weekdays and weekends, and the ratio of full-time employees.

With the shared sales staff system introduced, staffing will be maintained at appropriate levels through controlled hiring at individual stores. In each area, the system enables flexible responses to temporary increases in demand.

Regarding sales positions, new career paths will be developed to better utilize personnel. In addition to promotion tracks within a single brand, the company plans to offer diverse career paths that allow individuals to thrive based on their interests and strengths, such as becoming a general sales expert by honing specific skills and working across multiple brands.

These initiatives are scheduled for completion by fiscal year ending February 2026, with expected gains of over 500 million yen compared to those in fiscal year ended February 2024, and an anticipated improvement of approximately 1.5 billion yen in fiscal year ending February 2027 alone.

④ EC platform integration and system renewal

In February 2025, the company launched “mix.tokyo,” a brand mall-style online store that integrates 11 of its proprietary EC sites and membership services.

In addition to expecting cost reduction through site integration, the company has streamlined business operations and operational structures in conjunction with system integration to maximize operational efficiency. IT cost reduction is also being considered in preparation for the integration of additional brands.

These initiatives were completed by fiscal year ended February 2025. The company expects to generate over 500 million yen in fiscal year ending February 2026 compared to that in fiscal year ended February 2024 and aims to achieve approximately 500 million yen in improvement effects in fiscal year ending February 2027 alone.

⑤ Rationalization of costs including selling expenses

In addition to improving cost-effectiveness by introducing cost control across brands, the company will reduce logistics costs from a supply chain perspective.

The company will adopt a company-wide cost control framework through company-wide reviews to optimize advertising, sales promotion, and outsourcing, and take further steps to optimize logistics across the entire supply chain in collaboration with production and sales departments in addition to conventional logistics-focused initiatives.

For the former, advertising, promotion, and outsourcing projects will be reviewed by an advisory committee. The company will also set appropriate cost levels, evaluate the cost/economic rationality, and measure effectiveness to accumulate data.

For the latter, efforts are made to optimize returns, transportation between stores, warehouse staffing, and storage fees.

These initiatives are scheduled to be completed by fiscal year ending February 2026, with expected savings of over 1 billion yen compared to those in fiscal year ended February 2024, and a targeted improvement effect of approximately 2.5 billion yen in fiscal year ending February 2027 alone.

(2) Growth strategy

The company is focusing on “investment in leading brands,” “improvement of customer touch points,” and “expansion into new areas.”

① Investment in leading brands

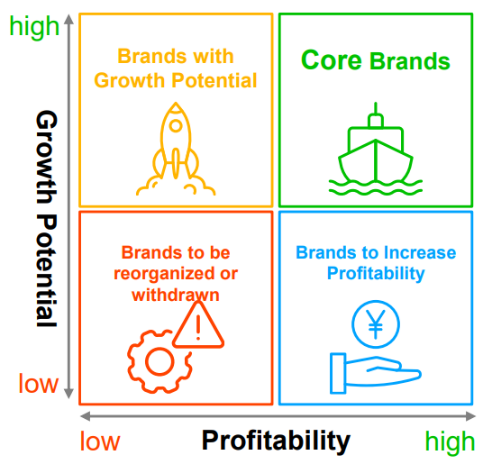

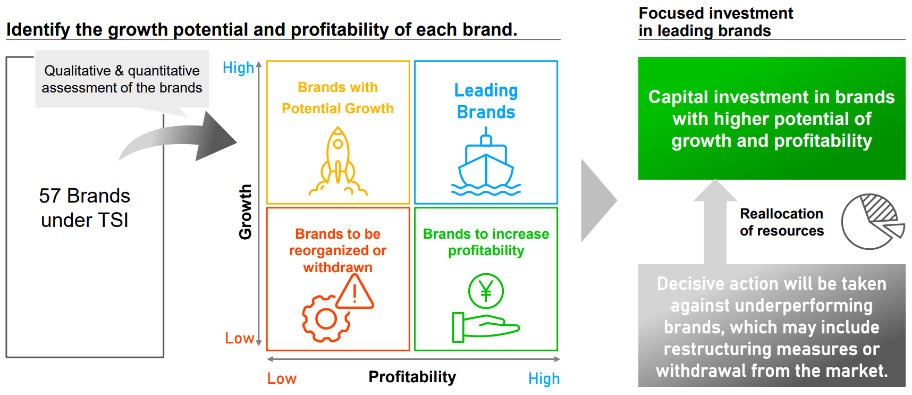

As shown in the diagram below, brands were classified into four quadrants, and strategic directions were defined for each. Among the brands under revitalization assessment, which had low growth and low profitability, several domestic and international brands were withdrawn or sold. This restructuring is expected to generate a profit of approximately 500 million yen in fiscal year ending February 2026.

Meanwhile, for flagship brands with high growth and high profitability, management resources are being reallocated, including the opening of large-scale stores and new brand stores.

With the formulation of medium-term growth plans for all brands, revenue targets and strategic directions have become clear.

Aiming to maximize overall growth and profitability, the company will begin full-scale capital investment in brands to enhance from fiscal year ending February 2026 onward.

(Taken from the reference material of the company)

② Improvement of customer touch points

Through "mix.tokyo," the official online store membership platform for its brands, the company aims to deliver new, cross-brand value tailored to each customer.

The company is expanding customer touch points from individual brand channels to the entire portfolio of TSI's brands, by centralizing membership services under "mix.tokyo." Furthermore, by doing so, it plans to offer community events and other experiences that deepen customer engagement that foster brand affinity and make new discoveries. It will also promote OMO* and aim to improve service levels and foster a loyal membership base by proposing new forms of entertainment value across brands.

*OMO (Online Merges with Offline) is a marketing concept that removes the boundaries between the online and the offline, such as physical stores.

(3) Overall management

① Review/strengthening of the management foundation: Initiatives toward sustainable management

For the second consecutive year, the company received the score "B" after answering the climate change questionnaire conducted by the environmental non-profit organization CDP. It was the first time that the company received the score "B" in water security.

The score "B" is the third highest among eight levels and indicates that the company is evaluated as "understanding the environment and the company’s environmental risks and taking action accordingly."

Other major progress is as follows:

Global environment | In order to achieve greenhouse gas reduction targets, the company is promoting the use of materials with a low environmental impact, and has adopted a fee for shopping bags to reduce plastic usage and consumption. |

Human capital | The company has established KGIs and KPIs related to human capital, which it regards as a material issue, and launched company-wide mandatory training and workshops to promote sustainability. |

Society | Universal design wear was created, led by members selected through an in-house competition. |

Governance | To ensure thorough due diligence in the supply chain, the company conducted document-based audits using Self-Assessment Questionnaires (SAQ). Going forward, on-site audits are also planned. |

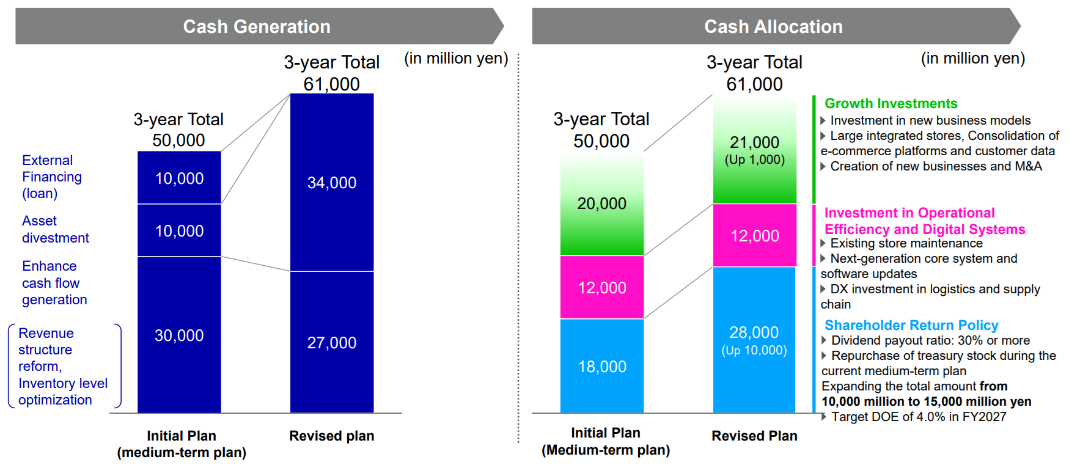

② Financial capital policy: Resource allocation policy

At the time of formulating and announcing the medium-term management plan, the total cash generation over a three-year period was set at 50 billion yen. However, due to the sale of real estate during fiscal year ended February 2025, this amount increased by 11 billion yen to 61 billion yen.

The new capital allocation plan is as follows: 21 billion yen for growth investments, 12 billion yen for foundational and efficiency-related investments, and 28 billion yen for shareholder returns. The additional resources will be allocated to growth investments and shareholder returns to further strengthen these areas.

(Taken from the reference material of the company)

(4) Outlook

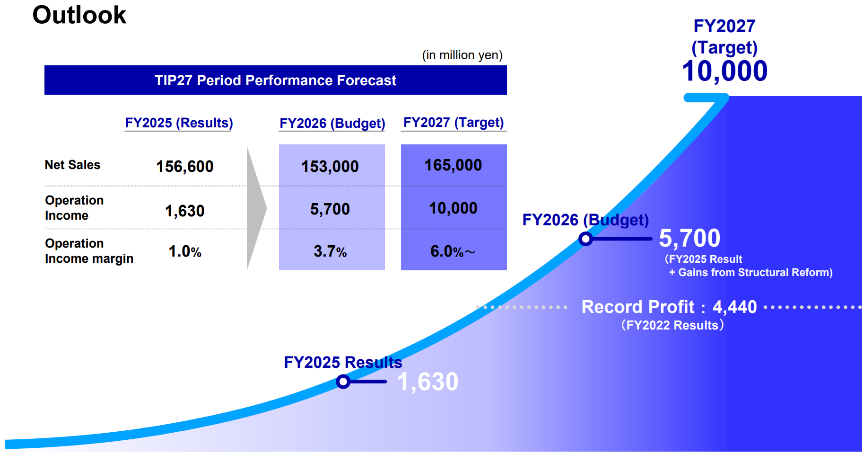

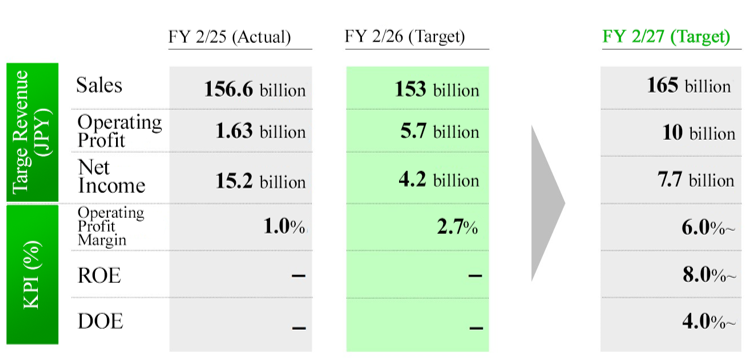

For the fiscal year ending February 2027, the company has set the following targets: net sales of 165 billion yen, an operating income of 10 billion yen, an operating income margin of 6.0% or higher, and an ROE of 8.0% or higher.

(Taken from the reference material of the company)

5. Conclusions

Following the announcement of various measures for realizing a PBR of over 1 and the acquisition of additional treasury shares, the company’s stock price nearly doubled in February 2025 from its low in March 2024, temporarily exceeding a PBR of 1.0. However, due to broader market adjustments triggered by concerns over renewed U.S. tariffs under the Trump administration, PBR has once again fallen below 1.0.

Achieving an operating margin of 6% or higher and an ROE of at least 8% is undoubtedly a challenging target. The key to reaching these goals lies in the steady execution of structural reforms and the effective use of cash generated from the sale of fixed assets.

Under President Shimoji’s firm commitment to see these initiatives through with a unified corporate effort, steady progress across all measures can be expected.

<Reference1: Medium-term Management Plan “TSI Innovation Program 2027”>

The company is currently advancing its medium-term management plan, “TSI Innovation Program 2027 (TIP27),” which began in the fiscal year ended February 2025 and marks the start of a full-scale structural reform initiative.

[1-1 Background to the formulation of TIP27, formulation policy, outline of the plan, and vision]

(1) Background to the formulation and analysis of the current situation

Following the merger and integration of Tokyo Style and Sanei International in 2011, the TSI group has grown by emphasizing the autonomy of each brand and strengthening each brand. However, while the management foundation was established, efforts to unify business operations were still underway, resulting in performance often falling significantly below goals.

Current status and challenges faced by TSI Holdings

* Sales remain flat due to delay in recovery after COVID-19

* Low profitability due to inefficiency resulting from delayed organization integration

* Capital inefficiency

(2) Formulation policy

In order to actually generate large revenues as TSI Holdings, TIP27 was designed to accelerate fundamental structural reforms aimed at optimizing company-wide business operations, focusing on “cross-brand profit structure reforms” and “growth strategies based on core brands.”

(3) Outline of the plan

In order to increase corporate value, the company will promote both fundamental reform of its profit structure and investments aimed at accelerating growth.

In addition to strengthening the management foundation, the company will allocate the cash generated by the profit structure reform to growth investments and fulfill its goal of becoming a “creator of fashion entertainment.”

(Taken from the reference material of the company)

(4) Vision

By promoting the medium-term management plan, and through “building a community,” “fashion that leads to health and happiness,” and “self-realization through beauty and individual characteristics,” the company aims to contribute to society with fashion, design, and hospitality at its core.

[1-2 Profit structure reform and growth strategies](1) Profit structure reform

Traditionally, each brand has independently sourced materials and managed production based on its unique designs, shaped by individual experiences and sensibilities. They have set prices according to their own rules, and sold products through independently operated stores and EC platforms, all in pursuit of an optimization strategy that highlights each brand's individuality. However, in the future, the company will integrate the processes for planning and designing products and sourcing materials, which have been conducted by respective organizations or systems, set prices under uniform guidelines based on structured supply and demand management, and streamline its operational bases through strategic personnel allocation and area selection while enhancing its EC operations by consolidating over 30 brands independent EC sites to achieve optimized, company-wide business operations.

Specifically, the company plans to increase revenues by approximately 10 billion yen by the fiscal year ending February 2027 through five reform initiatives: “purchase cost reductions,” “optimization of supply and demand management,” “retail operation reforms,” “EC integration and system renewal,” and “improvement of efficiency of costs, including SG&A expenses.”

(Taken from the reference material of the company)

(2) Growth strategy

① Selection of brands to strengthen: Assessment of the brand portfolio

The company has 57 brands (when this plan was formulated), which will be assessed both qualitatively and quantitatively to clarify the role of each brand based on growth potential and profitability.

In addition, the company will focus its investments on strengthening brands with high growth potential and profitability. For brands with low growth potential and profitability, the company will take decisive action, which may include restructuring measures or withdrawal from the market.

(Taken from the reference material of the company)

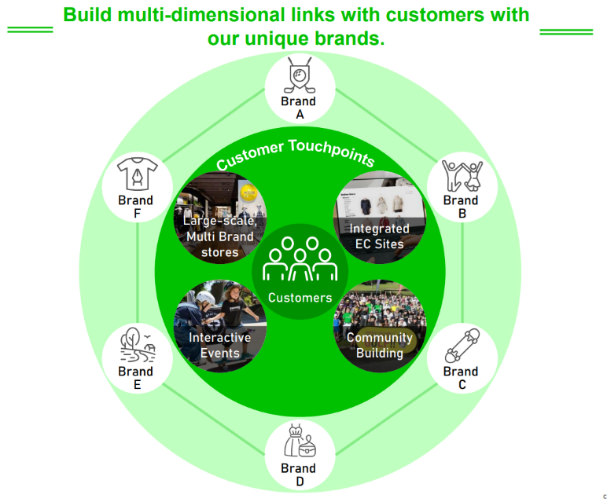

② Improvement of customer touch points: Proposing new value tailored to customers across brands

The company aims to build multi-dimensional links with customers through its unique brands.

Based on the premise of consolidating stores and EC platforms, the customer touch points that each unique and diverse brand has built will be extended to the entire TSI brand.

The company will propose new entertainment value across brands in line with customer preferences and backgrounds.

The company will offer experiences and new discoveries that will make people fall in love with the brand even more, not only through stores and EC but also through communities and interactive events.

(Taken from the reference material of the company)

③ Venturing into new fields

◎ Entering new fields based on market trends and TSI's strengths

The market is experiencing polarization of prices.

In this environment, the company will leverage its strengths, which include high fashion creativity and a large number of unique brands, to enter the high-end market with its existing “high-priced” and “basic” brands, as well as the mid- to low-priced market, which offers both fashion and affordability.

The latter is an area where the company can leverage its fashion creativity and is considering launching a new brand, including through M&A.

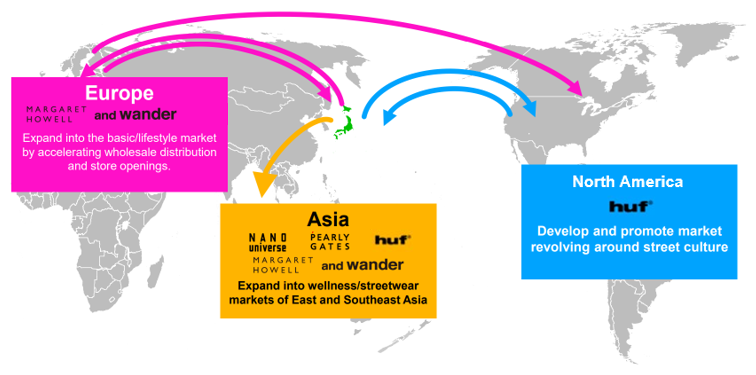

◎ Venturing into overseas markets

The company aims to increase revenues in overseas markets, including the U.S., Asian, and European markets, based on the preferences and needs of each market.

(Taken from the reference material of the company)

[1-3 Quantitative targets]

For the fiscal year ending February 2027, the company aims to achieve sales of 165 billion yen, an operating profit of 10 billion yen, an operating profit margin of at least 6.0%, and an ROE of at least 8.0%.

(Taken from the reference material of the company)

[1-4 Financial strategy and capital policy]

◎ Achieving a PBR of over 1

The company estimates the cost of shareholders’ equity to be between 5.4% and 7.8%.

By achieving an ROE that exceeds this target and expanding equity spread, they will achieve a PBR of 1.

In order to improve ROE, the company will improve profitability, enhance shareholder returns, and improve asset efficiency by reducing non-business assets.

(Taken from the reference material of the company)

The company's shareholder return policy has been to maintain a stable dividend level while enhancing corporate value over the long term. However, in order to further enhance shareholder returns by improving profitability and promoting financial and capital policies based on management that is conscious of capital costs, share price, and PBR, the company has revised its shareholder return policy, specifying that “dividend payout ratio shall be 30% or higher as an indicator of the level of shareholder returns.” The company will pay special dividends amounting to about 5.0 billion yen over the period from the fiscal year ended February 2025 to the fiscal year ending February 2027.

In addition, to improve capital efficiency and clearly demonstrate its commitment to shareholder returns, the company announced plans to acquire additional treasury shares worth 15 billion yen during the “TIP27” period and set a target to achieve a dividend-on-equity ratio (DOE) of 4% or higher by the fiscal year ending February 2027.

[1-5 Sustainability]

*The following is a summary. For details, please refer to the company's securities report (FY 2/24).

(1) Basic understanding

The corporate group operates its business with the purpose “We create empathy and social value across the world through the power of fashion entertainment” under the corporate philosophy: “We create value that shines the hearts of people through fashion and share the happiness of living tomorrow together with society.”

The challenges facing the world include serious risks of global warming, human rights violations, and war. The company believes that a healthy global environment and a society in which human rights are respected are the foundations for conducting business and that without these, sustainable corporate growth cannot be achieved. The corporate group sees the rapid changes in society as an opportunity for growth and will make sustainability-oriented management the core of its business activities, integrating both financial and non-financial aspects of the company's operations.

Based on this concept, the company announced its medium-term management plan, “TSI Innovation Program 2025 (TIP25),” in April 2022 and revised it to “TSI Innovation Program 2027 (TIP27)” in April 2024.

(Taken from the securities report of the company)

(2) Material issues

The corporate group has identified the following material issues that it will prioritize in each of the areas of “global environment,” “human,” and “society.”

Global environment | Human | Society |

Energy Raw materials Waste Water resources Biodiversity | Diversity Health and safety Employees’ happiness Fair labor | Co-creation with local communities Nurturing the next generation Supporting society |

* For a detailed description of each material issue, please refer to the following URL.

Global environment (https://sustainability.tsi-holdings.com/materiality/environment/index.html)

Human (https://sustainability.tsi-holdings.com/materiality/human/index.html)

Society (https://sustainability.tsi-holdings.com/materiality/social/index.html)

(3) Major initiatives and approaches① Governance

Toward sustainability-oriented management, the company is promoting the establishment of a business operation system suitable for a global fashion company by integrating its E (Environment), S (Society), and G (Governance) initiatives with its business activities and making material issues the backbone of all its activities. The company is working to maintain soundness and transparency, develop a system for rapid decision-making, and strengthen internal control, including thorough compliance and risk management.

In addition, indicators and targets for each material issue are set as part of the management strategy, and the status of their achievement is quantitatively reflected in the evaluation of the executive directors and executive officers of each group company, including TSI Holdings. In order to realize the purpose, the TSI group will address issues that it needs to address on its own in order to continuously promote sustainability-oriented management. By complying with social norms, laws, and regulations throughout the value chain and acting with high ethical standards, the company will live up to the “trust” of all stakeholders, including customers, business partners, shareholders, employees, and local communities.

The sustainability committee was established as an advisory body to the President and CEO to expand efforts to promote sustainability-oriented management and strengthen governance to ensure its diffusion. The committee is responsible for formulating and implementing sustainability strategies linked to management policies and the medium-term management plan and developing management systems.

② Human capital

The goal of creating value that brightens people's hearts lies at the core of the company's business operations. Therefore, people, who form the backbone of value creation, are the group's most important management resource and source of competitiveness. In order to realize its purpose of providing fashion entertainment, the group respects the diversity of all personnel involved in the business and strives to develop personnel and create an environment in which they can thrive, ensuring their mental and physical well-being and enhancing their creativity.

In order to create a working environment that promotes employees’ well-being and mental health, the company has implemented legally regulated systems, such as occupational safety and health committees and stress assessments. In addition, the company is actively working on workstyle reforms, reducing working hours, and promoting remote work as ways to achieve a work-life balance.

③ Climate change and natural capital

The apparel industry is said to account for 4-10% of the total greenhouse gas emissions of all industries, and its reduction is a top priority. Therefore, in April 2022, the company set a long-term objective to achieve carbon neutrality by 2050. In October of the same year, the company endorsed the TCFD recommendations and disclosed its CO2 emission reduction targets. In October 2023, the company obtained “SBT (Science Based Targets) Initiative” certification, which states that its greenhouse gas and other greenhouse gas reduction targets are based on scientific grounds. In addition, the company received the score “B,” for the second consecutive year in the “Climate Change” section, and the score “B,” for the first time in the “Water Security” section of the 2023 CDP questionnaire.

<Actual CO2 emissions and reduction targets>

| Sum of Scopes 1 to 3 | Scopes 1 and 2 | Scope 3 |

Actual CO2 Emissions FY 2/25 (tons) | 182,000 | 6,000 | 176,000 |

CO2 emission reduction target (tons) FY 2/31 | -35% (-108,000) | -40% (-4,000) | -35% (-103,000) |

CO2 emission reduction target setting standard in SBT | - | Annual reduction of 4.2% in line with the 1.5°C climate commitment | Annual reduction of 2.5% in line with a well-below 2°C commitment (WB2℃) |

* Reduction targets for Scopes 1 and 2 are in line with the 1.5°C target. Scope 3 is in line with the 2050 carbon neutrality target. Emissions are rounded down to the nearest thousand tons.

* Progress data on emission reduction is available at the following URL.

https://sustainability.tsi-holdings.com/materiality/environment/climate-change.html

<Reference2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with company auditors |

Directors | 5 directors, including 2 external ones (including 2 independent executives) |

Auditors | 3 auditors, including 2 external ones (including 2 independent executives) |

◎ Corporate Governance Report

The latest update: May 26, 2025

<Basic concept>

The Company seeks to enhance its internal control, including rigorous compliance with laws and regulations and risk management, and develop a structure that enables decision-making that is highly sound, transparent, and swift in order to build a business operation system befitting a fashion and apparel company engaged in business globally, under the corporate philosophy that “we create value that lights up people’s hearts through fashion and share the happiness of living tomorrow together with society.” Through these initiatives, we will make efforts to keep our corporate value growing, which is our basic business policy, to enhance our corporate governance further while building good relationships with our stakeholders.

<Reasons for not following the principles of the Corporate Governance Code (excerpt)>

[Principle 1-4. Strategic shareholding]

Our company holds shares on a strategic basis when it can be considered that we can improve its medium- to long-term corporate value, by building stable business or transactional relationships, creating business opportunities, or facilitating smooth business operations.

The appropriateness of strategic shareholding will be periodically examined and reported to the Board of Directors. For shares whose effects are fading, we will reduce the number of shares held after taking into consideration the situation of the target companies, such as dividends.

When exercising voting rights, the Company comprehensively decides to vote in favor or against each of the proposals based on whether it is consistent with the purpose of strategic shareholding and whether it contributes to the maintenance and improvement of the corporate value of the target company and the shareholder value.

<Disclosure based on the principles of the Corporate Governance Code (excerpt)>

[Principle 2-3. Issues related to sustainability, mainly social and environmental issues]

[Supplementary Principle 2-3-1]

[Principle 3-1.-Enhancement of information disclosure]

[Supplementary Principle 3-1-3]

[Principle 4-2. Roles and responsibilities of the Board of Directors (2)]

[Supplementary Principle 4-2-2]

(1) The Company’s Sustainability Efforts

Our company has declared the following sustainability statement:

“Creating a sustainable future through fashion entertainment—A beautiful planet, a brighter society, and fulfilling lives.” Based on this vision, our corporate group has established material issues and key goal indicators (KGI) that serve as the foundation for generating long-term and sustainable well-being through business activities.

In September 2021, we established the SDGs Promotion Office, which was reorganized into the SDGs Promotion Department in March 2025. With this change, our company has strengthened our sustainability initiatives while actively working to build internal structures and raise awareness among employees.

For reports on specific activities, please see TSI Holdings Sustainability Website

https://sustainability.tsi-holdings.com/index.html

Additionally, the company's response to the TCFD, as well as its sustainability, human rights, governance, environmental, and social policies, are disclosed on the company's website.

“Information Disclosure Based on the TCFD Recommendations” (https://www.tsi-holdings.com/pdf/221012_TCFD.pdf)

“Sustainability Policy” (https://sustainability.tsi-holdings.com/management.html#policy)

“Human Rights Policy” (https://sustainability.tsi-holdings.com/materiality/human/index.html#policy)

“Governance Policy” (https://sustainability.tsi-holdings.com/materiality/governance/index.html#policy)

“Environmental Policy” (https://sustainability.tsi-holdings.com/materiality/environment/index.html#policy)

“Social Policy” (https://sustainability.tsi-holdings.com/materiality/social/index.html#policy)

(2) Investment in human capital and intellectual property, etc.

(i) Investment in human capital

People are the source of value in our business activities and our greatest asset.

By setting diversity, employee wellbeing, health and safety, and fair labor conditions as part of our essential material issues, we will strive to improve the environment to enable all staff working together to thrive happily both physically and mentally.

Furthermore, to deal with the era of change, the Company will invest in employee education, training, and development. We will establish programs through which employees acquire needed skills, by enhancing job rotations, training schemes, and self-learning systems to develop a multi-skilled workforce.

(ii) Investment in intellectual property

For the Company that operates brand businesses, intellectual property, including trademark rights and copyrights, is crucial for business administration. Intellectual property constitutes the foundation of creative value to be delivered to customers as we seek to achieve the goal “We create empathy and social value across the world through the power of fashion entertainment,” which was established as the purpose of the medium-term management plan “TSI Innovation Program 2027 (TIP 27).” We will not only develop superior designs and brands but also proactively invest in expertise, such as business models and communication design know-how, to deliver a customer experience that exceeds their expectations.

[Principle 2-4. Ensuring diversity within the Company by promoting the active participation of women, etc.]

[Supplementary Principle 2-4-1]

(1) Ensuring diversity

The TSI Group will create a diverse environment where anyone can thrive by actively promoting initiatives to realize diversity and flexibility in work and life for all in a manner that suits each one of them.

(2) Voluntary and measurable goals for ensuring diversity, and their statuses

(i) Promotion of women to managerial positions

While female managers accounted for 31.2% of the total number of managers in the Group at the end of February 2025, we have set a goal of raising the ratio to 35% by the end of February 2027.

(ii) Promotion of employees of foreign nationalities to managerial positions

Although we have yet to set any goal for promoting employees of foreign nationalities to managerial positions, we will continue to review this subject internally.

(iii) Voluntary and measurable goals for the promotion of mid-career hire employees to managerial positions and their status

There are no goals for the promotion of mid-career employees to managerial positions. Still, we have established diverse work systems (a flextime system, a reduced working hours system, and a second job system) and various training programs to accommodate individuality within the TSI Group, which brings together companies with different organizational climates and cultures. We operate our personnel system appropriately while introducing internal recruitment and job rotation schemes and flexibly accepting diversity in work duties, job categories, and work experience.

(3) Human resources development and in-house environment improvement policies to ensure diversity, and their statuses

(i) Human resources development policy to ensure diversity

To ensure diversity in promoting core personnel, we evaluate and promote employees solely based on their skills regardless of gender, age, and nationality.

Moreover, in addition to hiring new graduates, we actively hire highly skilled mid-career professionals, including those from other industries. As for promoting female employees to managerial positions, we will proactively work to raise the ratio of female employees in managerial positions further, which is already over 30% of all managers in the Group.

Moreover, while more than 100 foreign national employees already work for the Group as a whole, mainly at overseas subsidiaries, we intend to actively conduct recruitment activities to further secure highly skilled professionals as we focus on expanding the overseas business in the coming years.

(ii) Improving the environment to enable diverse employees to thrive further

To allow diverse employees to exert their skills fully in accordance with their own lifestyles, the TSI Group takes measures, such as applying flexible work hours and work formats, revising pay levels, and easing the burdens related to shop work attire, among other employee welfare initiatives, and it will continue to improve its measures in the future.

(iii) Promotion of diversity and inclusion

We aim to enable each of our employees of different backgrounds varying in gender, age, nationality, and physical and mental conditions to thrive according to their characteristics, skills, and conditions. Thus, we will work to reform the awareness of all our employees to create a culture that respects diversity and an environment where diverse employees can grow, be motivated, and thrive.

(iv) Status of efforts to ensure diversity

The following efforts are in progress to ensure diversity in accordance with employees’ characteristics.

◎ Promotion of active engagement of women

While female managerial positions accounted for 31.2% of all managerial positions in the Group at the end of February 2025, we set the goal of raising the ratio to 35% by the end of February 2027 and strive to recruit and promote employees to increase the ratio of female managerial positions among highly senior positions.

◎ Further employment of workers of foreign nationalities

Employment of workers of foreign nationalities by the Group has been growing year after year, and we are now in the process of employing workers of foreign nationalities in a more planned manner.

◎ Utilization of elderly professionals with experience and past achievements

The Group is working to proactively employ personnel up to age 65 and continues to recruit and promote employees irrespective of age. Thus, the number of employees aged 65 or above actively contributing is increasing.

◎ Empowerment of people with disabilities

To date, the Group, mainly through its special subsidiaries, has avidly promoted the participation of people with disabilities. Its employees with disabilities accounted for 2.72% of the total workforce as of the end of February 2025. We will continue to work on creating opportunities for them to find fulfillment directly linked to operations.

◎ Promotion of understanding of LGBT

To date, the Group has a culture with a high level of understanding of LGBT, different surnames for married couples, and common-law marriage and is now in the process of eliminating gender-based discrimination by comprehensively reviewing and amending various packages, such as the congratulatory/condolence cash gift rules (including congratulatory allowances for marriage).

Moreover, the Group is working on the following initiatives that focus not only on employee characteristics but also on workstyle diversity.

◎ Developing diverse workstyle systems such as reduced working hours and remote work

The Group has developed rules and systems to realize more diverse work styles than before. These include developing work systems that allow working hours to be reduced by 30 minutes to up to four hours, a staggered working hours system that allows employees to start working at any time from 8:00 to 13:00, a flextime system, and lifting the ban on second jobs as well as providing subsidies for remote work environment maintenance. In addition, we are working on reviewing and amending these systems and establishing new ones.

◎ Creation of a work environment and systems that accommodate pregnancy, giving birth, and child-rearing

We achieved a 96.1% childcare leave uptake rate and a 97.6% return-to-work rate after childcare leave for women (both as of the fiscal year ended February 2025) through the above-mentioned reduced working hour system that allows employees to working hours to be reduced by 30 minutes to up to four hours, supportive measures including offering the reduced working hours system for childcare until the child graduates from elementary school, and thorough communication when employees return to work. We are constantly making improvements to maintain and enhance such an environment.

◎ Creating a system for balancing nursing care and work

We work to address anticipated increases in work restrictions due to nursing care, hospital visits, and medical treatment by extending the legally stipulated total number of caregiving days from 93 days to a maximum of 365 days and by implementing flexible policies.

[Principle 5-1. Policy for constructive dialogue with shareholders]

As a policy regarding system development and initiatives to promote a constructive dialogue with shareholders, the director overseeing investor relations, legal affairs, stock administration, and finance will be responsible for the overall dialogues with shareholders and will cooperate actively with relevant internal divisions that assist the dialogue by sharing information properly. To promote a constructive dialogue with shareholders, we will not only arrange for opportunities to have one-on-one meetings but also hold briefing meetings. Furthermore, as a means of managing important matters in dialogue with shareholders, we will work to prevent the leakage of insider information by ensuring that the internal information and insider trading management rules are widely understood and strictly enforced.

[Action to Implement Management that is Conscious of the Cost of Capital and the Stock Price]

The Company establishes its business strategy based on an understanding of its own capital cost and discloses and explains its outline at the general shareholder meetings and the financial results briefing meetings. To achieve our strategy, we regard various measures, such as capital investments, as crucial factors in the decision-making process.

The company recognizes that improving its PBR, which is currently below the level requested by the Tokyo Stock Exchange, is a critical management issue.

Regarding our shareholder return policy, our company announced a revision on April 12, 2024, and subsequently updated that policy on January 14, 2025. Under the revised policy, our company will continue to use a dividend payout ratio of 30% or higher as a reference for shareholder returns. In addition, over the period from the fiscal year ending February 2025 through the fiscal year ending February 2027, the company plans to acquire treasury shares amounting to 15.0 billion yen and aims to achieve a dividend on equity (DOE) of 4% or higher by the fiscal year ending February 2027.

In the medium-term management plan, TSI Innovation Program 2027 (TIP27), we have disclosed the entire program, including the basic policy on the business portfolio.

“Medium-Term Management Plan: TSI Innovation Program 2027”

(https://www.tsi-holdings.com/pdf/TIP27.pdf)

For an update, see the most recent financial briefing material titled “Full-Year Financial Results Briefing for the Fiscal Year Ended February 2025.”

https://www.tsi-holdings.com/pdf/250414_Result%20Briefing.pdf

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back issues of the Bridge Report (TSI HOLDINGS CO., LTD.: 3608) and the contents of the Bridge Salon (IR Seminar) can be found at: www.bridge-salon.jp/ for more information.