Bridge Report:(3608)TSI the First Half of Fiscal Year ending February 2026

President and CEO Tsuyoshi Shimoji | TSI HOLDINGS CO., LTD. (3608) |

|

Company Information

Market | TSE Prime Market |

Industry | Textile (Manufacturing) |

President | Tsuyoshi Shimoji |

HQ Address | 8-5-27 Akasaka Minato-ku, Tokyo |

Year-end | February |

Homepage |

Stock Information

Share Price | Share Outstanding | Total Market Cap. | ROE (Act.) | Trading Unit | |

¥994 | 74,105,793 shares | ¥73,661 million | 14.9% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥40.00 | 4.0% | ¥62.56 | 15.9x | ¥1553.70 | 0.6x |

*The share price is the closing price on October 14. All figures are from the financial results for the second quarter of the fiscal year ending February 2026. ROE and BPS are the actual figures in the previous fiscal year.

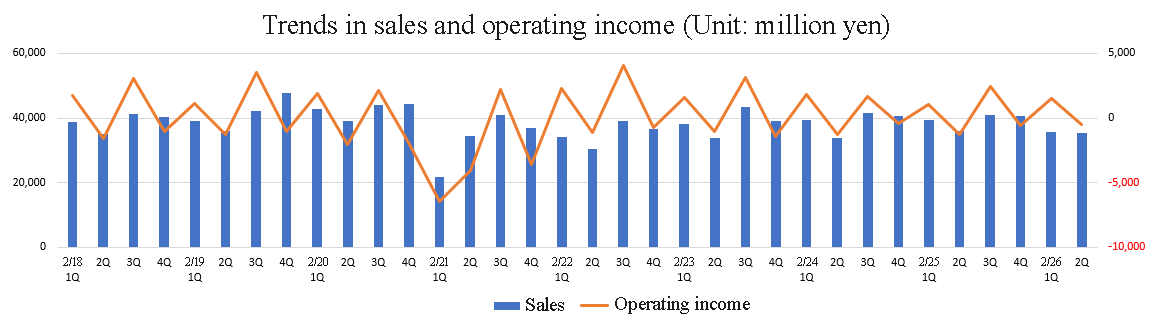

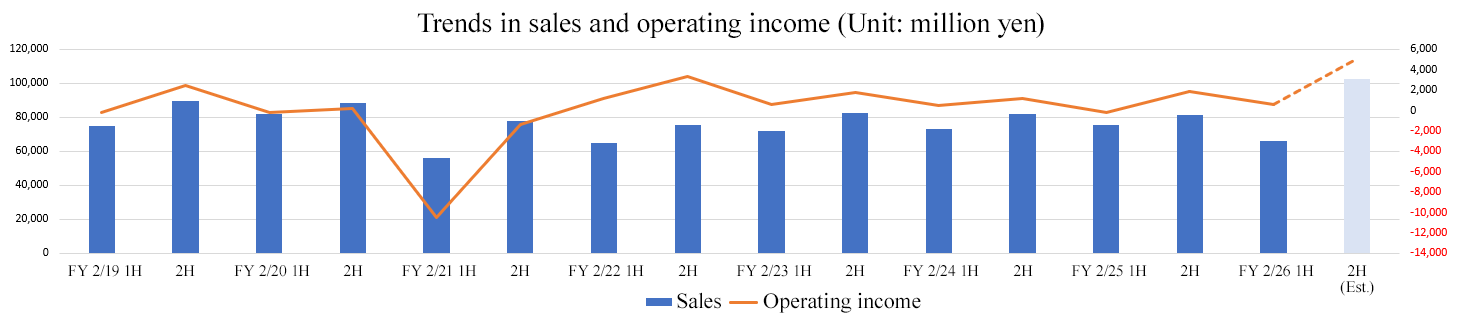

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Feb. 2022 Act. | 140,382 | 4,440 | 5,834 | 1,022 | 11.32 | 5.00 |

Feb. 2023 Act. | 154,456 | 2,329 | 3,859 | 3,063 | 35.21 | 10.00 |

Feb. 2024 Act. | 155,383 | 1,760 | 3,758 | 4,849 | 59.97 | 15.00 |

Feb. 2025 Act. | 156,606 | 1,636 | 2,076 | 15,230 | 210.02 | 65.00 |

Feb. 2026 Est. | 169,000 | 5,700 | 6,000 | 4,200 | 62.56 | 40.00 |

* Unit: million-yen, yen. The forecasted values are from the company.

This report provides the overview of TSI Holdings Co., Ltd.’s financial results for the first half of the fiscal year ending February 2026.

Table of Contents

Key Points

1. Company Overview

2. 1H of Fiscal Year ending February 2026 Earnings Results

3. Fiscal Year ending February 2026 Earnings Forecasts

4. Progress of Structural Reform in the Medium-Term Management Plan “TSI Innovation Program 2027”

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Although sales declined in the first half of the fiscal year ending February 2026, structural reform proved effective, achieving profitability as a result. Sales decreased 12.0% year on year to 66.1 billion yen, impacted by delay in the transition of the company’s e-commerce (hereinafter, “EC”)site users, in addition to the withdrawal from and sale of some businesses in the previous fiscal year and the struggle to acquire new customers for core brands. Sales dropped in all sales channels. Operating income reached 640 million yen (an operating loss of 221 million yen was posted in the first half of the previous fiscal year) and gross profit fell 9.2% year on year due to the decline in sales. However, procurement cost ratio improved owing to pricing and reduction of procurement costs, and reserves for the negative effects of inventory evaluation decreased as the disposal of stock from the past fiscal years was completed. As a result, gross profit margin improved 1.8 points year on year. SGA dropped 11.3% year on year due to the curtailment of advertising and promotional expenses and personal costs, as well as decrease in expenses linked to sales. Both sales and operating income fell below the initial forecast.

- In September 2025, the OMO platform provider Daytona International Co., Ltd. was acquired as a wholly-owned subsidiary. Seeing the high affinity in the fields of street, casual and outdoor fashion where TSI has built up business foundations and know-how, the company expects that it will be possible to acquire new customers in addition to strategically complementing the TSI Group business portfolio. Moreover, the utilization of the OMO platform, which is the forte of Daytona International, will broaden revenue-earning opportunities through the sale of related products in addition to the acquisition of new customers through the measure of mutually promoting customers to visit the physical stores and EC site of TSI Holdings’ existing brands. Consequently, effects on growth can be anticipated from multiple aspects. As Daytona International operates approximately 60 stores, such as the directly-managed “FREAK’S STORE” chain, and their sales reach the scale of about 40 billion yen, TSI also projects that turning this company into a wholly-owned subsidiary will allow for generating synergy by utilizing the economy of scale.

- Sales from the second half of the year are projected to fall short of the initial forecast, taking into consideration the sluggish performance of core brands and the company’s EC site “mix.tokyo.” However, an upward revision was made to sales, taking into account the effects of acquiring Daytona International as a subsidiary. Sales are forecast to increase 7.9% year on year to 169 billion yen, and operating income to grow 248.4% year on year to 5.7 billion yen. An approximate calculation of the impact of goodwill amortization stemming from the acquisition of Daytona International as a wholly-owned subsidiary has been incorporated, and considering the results in the first half of the year and the fact that sales of existing businesses are projected to fall short of the initial forecast in the second half as well, the forecast for operating income was left unchanged from the initial forecast. Although the company will work on the reduction of cross-shareholding, etc., the forecast for non-operating income and subsequent items concerning profit remained unchanged as there are no business opportunities except those stated in the plan at this point. They plan to pay a dividend of 40.00 yen/share, comprising a basic dividend of 25.00 yen/share and a special dividend of 15.00 yen/share. The estimated payout ratio is 40.0% for the basic dividend and 63.9% for the total dividend.

- Despite a decline in sales, the profit margin in the first half of the fiscal year ending February 2026 improved 1.8 points year on year owing to the effects of pricing and reduction of procurement costs, as well as the decrease in reserves for the negative effects of inventory evaluation due to the completion of the disposal of stock from the past fiscal years. While structural reform seems to prove effective to a certain extent, it appears that the market is still not convinced whether these effects will last, seeing that the stock price dropped to a low level after reaching a high level in the fiscal year ended February 2025. Although the acquisition of Daytona International, which boasts sales of about 40 billion yen, is a positive factor, we would like to keep an eye on whether it will lead to further profit growth, not only sales.

1. Company Overview

TSI Holdings is an apparel enterprise operating over 50 brands. It clearly specifies targets (gender, age, preferences, etc.) for each brand, and provides a broad range of customers with its products. They aim to proceed with transformation, evolve from an enterprise that conducts apparel business only, and become a “creator of fashion entertainment” that links social value to its corporate growth and not only provides products but also creates original value with the fashion entertainment, from the perspectives of “the environment and society,” “markets,” and “consumers.”

[1-1 Corporate history]

As the environment surrounding the apparel industry was becoming severe, Tokyo Style Co., Ltd. and Sanei-International Co., Ltd. established TSI Holdings Co., Ltd. through the transfer of shares in June 2011, with the aim of achieving sustainable growth by utilizing their respective strengths. It was listed on the Tokyo Stock Exchange (TSE). After the market restructuring, it was listed on the Prime Market of TSE in April 2022.

[1-2 Corporate philosophy]

With the following corporate philosophy, vision, purpose, and group’s code of conduct, they aim to become a “creator of fashion entertainment.”

Corporate philosophy | We create value that shines the hearts of people through fashion and share the happiness of living tomorrow together with society. |

Vision | We aim to become the world’s most beloved global group through the best and a step-ahead-of-the-times creation and lifestyle proposal. |

Purpose | We create empathy and social value across the world through the power of fashion entertainment. |

Group's code of conduct | 1. We value our spirit of fairness/impartiality and honesty, and work with passion and responsibility. 2. We remain mindful of challenges, continuously develop our skills, and proactively embrace new ideas with flexibility. 3. We respect each person's individuality, communicate well, and contribute to the team by playing our own roles. 4. We deliver excitement and pleasure to our customers with sincere hospitality and strive to improve customer satisfaction. 5. We respect each stakeholder's position to realize mutual benefit and contribute to the sustainable growth of the company. 6. We sincerely appreciate society and the natural environment and contribute to social development through our business. |

[1-3 Business description]

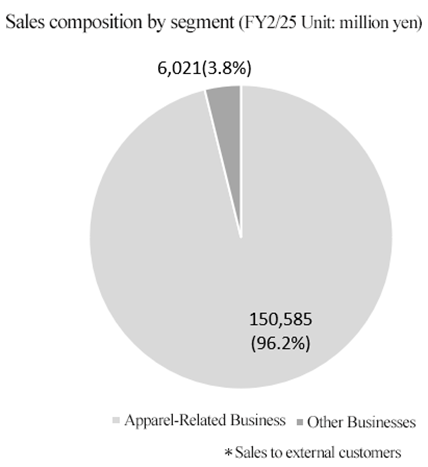

The TSI Group consists of TSI Holdings, which is a holding company, 26 consolidated subsidiaries, and one equity-method affiliate.

In the “apparel-related business,” the mainly includes planning, manufacturing, and sale of apparel products, as well as licensed brand operations and production/logistics functions. The “other business” includes sales agency and staffing services, synthetic resin-related business, store design and management, and food and beverage operations.

(1) Brands

Currently, they operate over 50 brands. They set clear targets (by gender, age, preferences, etc.) for each brand and provide products to a broad range of customers.

The top 10 brands account for about 60% of total sales. The gross profit margin is about 50-65%.

*Outline of major brands

Brand | Targets | Concept |

PEARLY GATES

| Women and men | OUT ON THE WEEKEND (leaving urban areas on weekends) Under the concept: “Let’s play golf more casually and more enjoyably,” it proposes new golf apparel, highlighting the intrinsic appeal of the sport.

|

NANO universe

| Women and men | Under the concept of “glamour yourself up,” this brand brings out the attractive points of each customer and gives them confidence, with refined designs and high-quality functional materials. |

MARGARET HOWELL

| Women and men | In 1970, the British designer MARGARET HOWELL started producing clothes at home. Clothing is not a passing fad but part of daily life, so she puts importance on materials, craftsmanship, and styles. This brand operates a broad range of businesses, including the sale of clothing and home-use products and the operation of cafes. |

NATURAL BEAUTY BASIC

| Women | Based on the intrinsic natural beauty of each woman, this fashion store brand is for women who live each day beautifully, elegantly, and simply embracing their own unique femininity. |

AVIREX

| Men | Established in 1975 as an official supplier to the U.S. Air Force, the brand has revived numerous flight jackets for urban wear. Drawing on decades of technical expertise, AVIREX produces military-inspired items known for their exceptional functionality and design, earning lasting popularity among consumers around the world. |

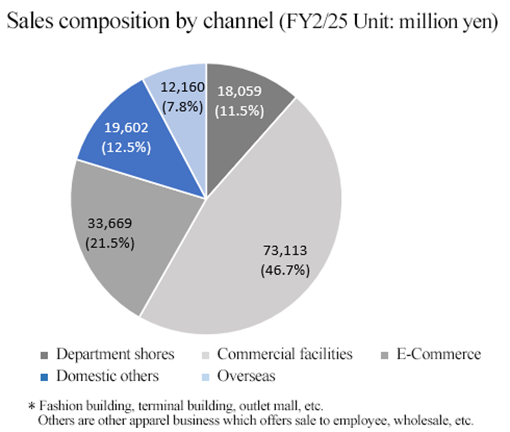

(2) Sales channels

They sell apparel via physical stores and EC inside and outside Japan.

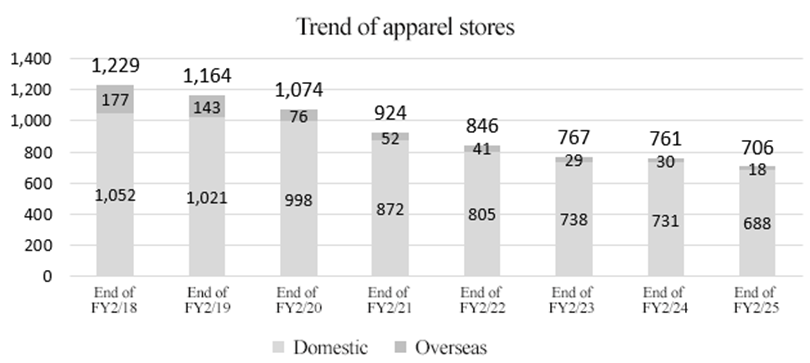

The number of physical stores was 739 (including overseas) as of the end of the fiscal year ended February 2025. Among them, 706 stores sell apparel.

While closing unprofitable stores as part of its business restructuring, the company, described as a "creator of fashion entertainment," believes that physical stores remain important for articulating brand narratives and providing entertainment to customers. The company will continue to develop stores focused on brands popular with customers while implementing a “scrap and build” approach to update the image. By opening stores with large floor sizes and/or in prime locations, they will reform the revenue structure of their physical store business.

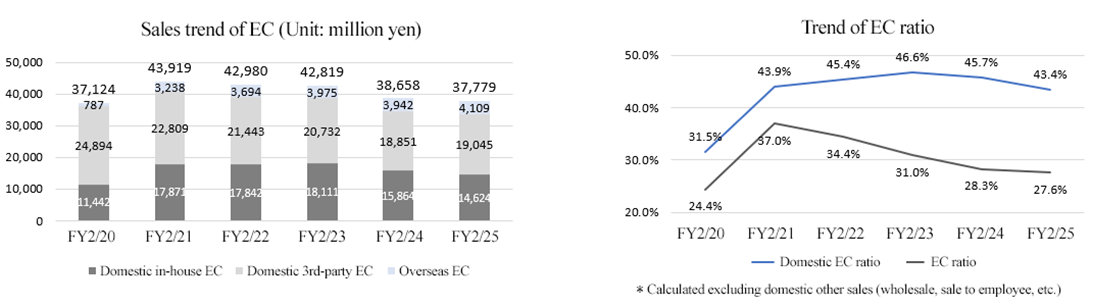

The ratio of sales via their own websites to domestic EC sales had been rising, but dropped consecutively in the fiscal years ended February 2024 and February 2025 due to the withdrawal from some businesses. EC sales have been declining after peaking in the fiscal year ended February 2021, and reigniting growth remains a key challenge.

[1-4 Characteristics, strengths, and competitive advantages]

The company excels at seeking, finding, and developing categories and brands that are in line with the trends of the times.

In segments such as athleisure, wellness, outdoor, and streetwear, they grasped consumer preferences and reeled in foreign visitors to Japan, too. This resulted in strong performance, particularly among men's brands.

The company has successfully found brands through its networks in the U.S., U.K., and beyond. In the past decade, few companies have introduced new brands and made them successful, like TSI Holdings.

The company’s competitive advantages come from its base and experience in taking risks, as well as its know-how and track record of developing brands.

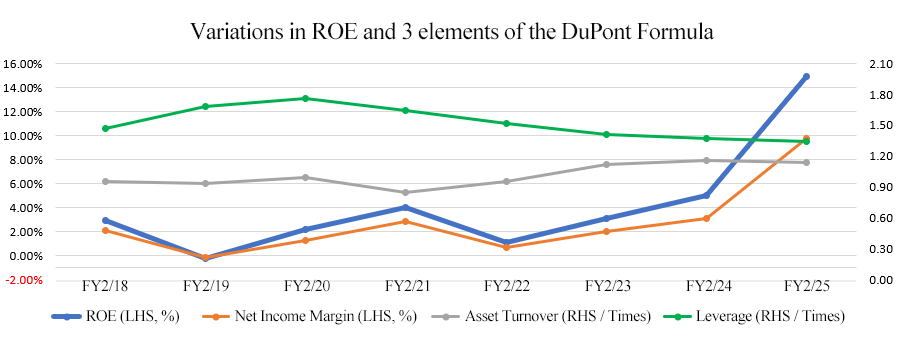

[1-5 ROE analysis]

| FY 2/18 | FY 2/19 | FY 2/20 | FY 2/21 | FY 2/22 | FY 2/23 | FY 2/24 | FY 2/25 |

ROE (%) | 2.9 | -0.2 | 2.2 | 4.0 | 1.1 | 3.1 | 5.0 | 14.9 |

Net income margin (%) | 2.07 | -0.12 | 1.28 | 2.88 | 0.73 | 1.98 | 3.12 | 9.73 |

Total asset turnover (times) | 0.95 | 0.93 | 0.99 | 0.85 | 0.95 | 1.12 | 1.16 | 1.14 |

Leverage (times) | 1.47 | 1.68 | 1.76 | 1.64 | 1.52 | 1.41 | 1.37 | 1.35 |

*Produced by Investment Bridge Co., Ltd. with reference to the material of TSI Holdings.

In the fiscal year ended February 2025, ROE rose significantly from the previous fiscal year, primarily due to a gain of 23.9 billion yen from the sale of fixed assets recorded as extraordinary income.

For the fiscal year ending February 2026, the company expects net profit margin to decline to 2.49%, falling below the amount recorded in the fiscal year ended February 2024. In order to achieve the ROE target of 8.0% or higher by the fiscal year ending February 2027, as set forth in the medium-term management plan "TIP27," continued efforts to improve profitability and asset efficiency will be essential.

2. 1H of Fiscal Year ending February 2026 Earnings Results

[2-1 Overview of business results]

| FY 2/25 1H | Ratio to sales | FY 2/26 1H | Ratio to sales | YoY | Ratio to forecast |

Sales | 75,230 | 100.0% | 66,167 | 100.0% | -12.0% | -6.8% |

Gross profit | 40,554 | 53.9% | 36,827 | 55.7% | -9.2% | - |

SG&A | 40,776 | 54.2% | 36,187 | 54.7% | -11.3% | - |

Operating income | -221 | - | 640 | 1.0% | - | -36.0% |

Ordinary income | -167 | - | 1,333 | 2.0% | - | +15.9% |

Net income | -791 | - | 1,313 | 2.0% | - | +64.1% |

*Unit: million yen.

Although sales declined, structural reform proved effective, achieving profitability as a result.

Sales decreased 12.0% year on year to 66.1 billion yen, impacted by delay in the transition of the company’s EC site users, in addition to the business withdrawals and divestitures in the previous fiscal year and the struggle to acquire new customers for core brands. Sales dropped in all sales channels.

Operating income reached 640 million yen (an operating loss of 221 million yen was posted in the first half of the previous fiscal year) and gross profit fell 9.2% year on year due to the decline in sales. However, procurement cost ratio improved owing to pricing and reduction of procurement costs, and reserves for the negative effects of inventory evaluation decreased as the disposal of stock from the past fiscal years was completed. As a result, gross profit margin improved 1.8 points year on year. SGA dropped 11.3% year on year due to the curtailment of advertising and promotional expenses and personal costs, as well as decrease in expenses linked to sales.

Both sales and operating income fell below the initial forecast.

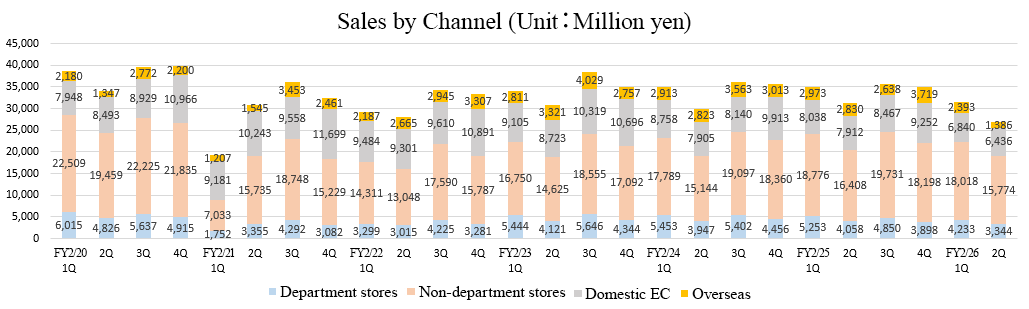

[2-2 Trend in each channel]

| FY 2/25 1H | FY 2/26 1H | YoY |

Department stores | 9,311 | 7,577 | -18.6% |

Non-department stores | 35,184 | 33,792 | -4.0% |

Domestic EC | 15,950 | 13,276 | -16.8% |

Other domestic channels | 8,980 | 7,742 | -13.8% |

All domestic channels | 69,426 | 62,388 | -10.1% |

Overseas | 5,803 | 3,779 | -34.9% |

Total | 75,230 | 66,167 | -12.0% |

*Unit: million yen.

*Non-department stores: fashion malls, station buildings, outlet stores, etc. Othe other apparel businesses, including wholesale and sale to employees and non-apparel businesses of group companies.

Sales declined in all sales channels.

* | The sales in department stores dropped as core brands struggled. The sales in non-department stores remained unchanged from the previous year, excluding the impact of withdrawal from some businesses. |

* | Despite the steady performance of business in the UK, overseas sales decreased 34.9% year on year due to the transfer of some businesses and restructuring in the U.S. |

◎EC Sales Trends

| FY 2/25 1H | FY 2/26 1H | YoY |

Domestic EC | 15,950 | 13,276 | -16.8% |

In‐house EC | 7,159 | 5,492 | -23.3% |

Other | 8,790 | 7,784 | -11.4% |

Overseas EC | 1,968 | 1,061 | -46.1% |

Total amount for EC | 17,919 | 14,337 | -20.0% |

*Unit: million yen.

Regarding domestic EC, “mix.tokyo,” a brand mall-type online store, which integrated 11 EC sites of the company and user services, entered the first summer sale season. The company continuously implemented two types of measures involving all brands and measures tailored for specific brands. A “mix.tokyo pop-up event” is to be held this winter, and the company is planning to prepare content that will allow customers to enjoy all brands across the board. While sales declined in the first half, they seem to show signs of improvementon a monthly basis.

Although mainly promotional measures were launched on third-party EC sites and favorable businesses drove performance, sales dropped 7.2% year on year, excluding the impact of withdrawal from some businesses.

The sales in overseas EC decreased significantly, impacted by the same factors that caused the decline in sales of the U.S. business.

[2-3 Number of Stores and Brand Overview]

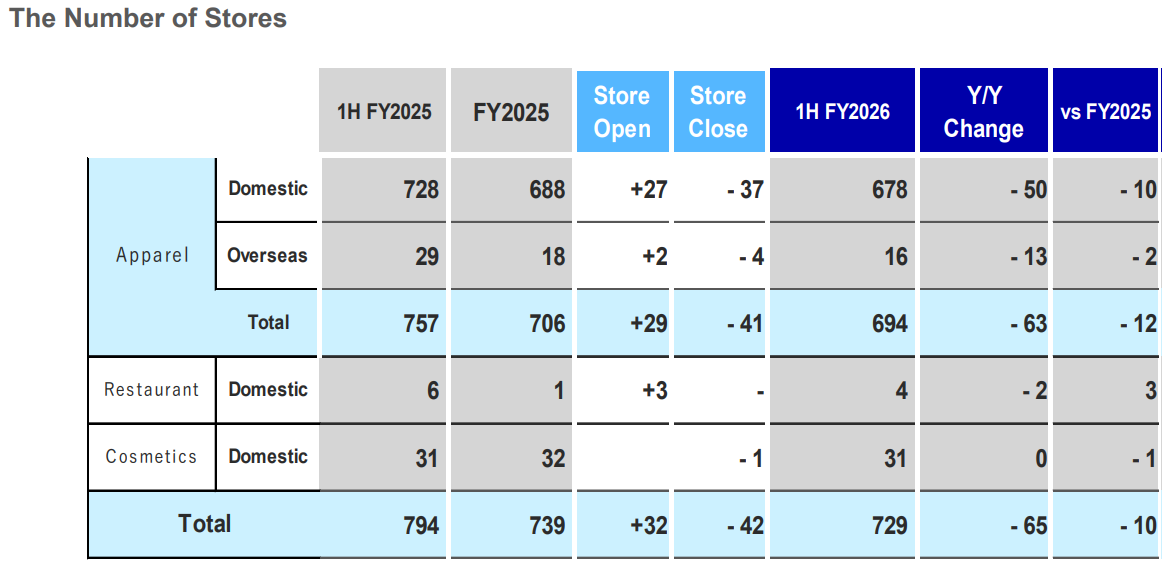

(1) No. of stores

(Taken from the reference material of the company)

The company continues efforts to improve the efficiency and productivity of store personnel through initiatives such as optimizing staff allocation across brands and regions, consolidating or closing unprofitable stores, and opening large-sized stores.

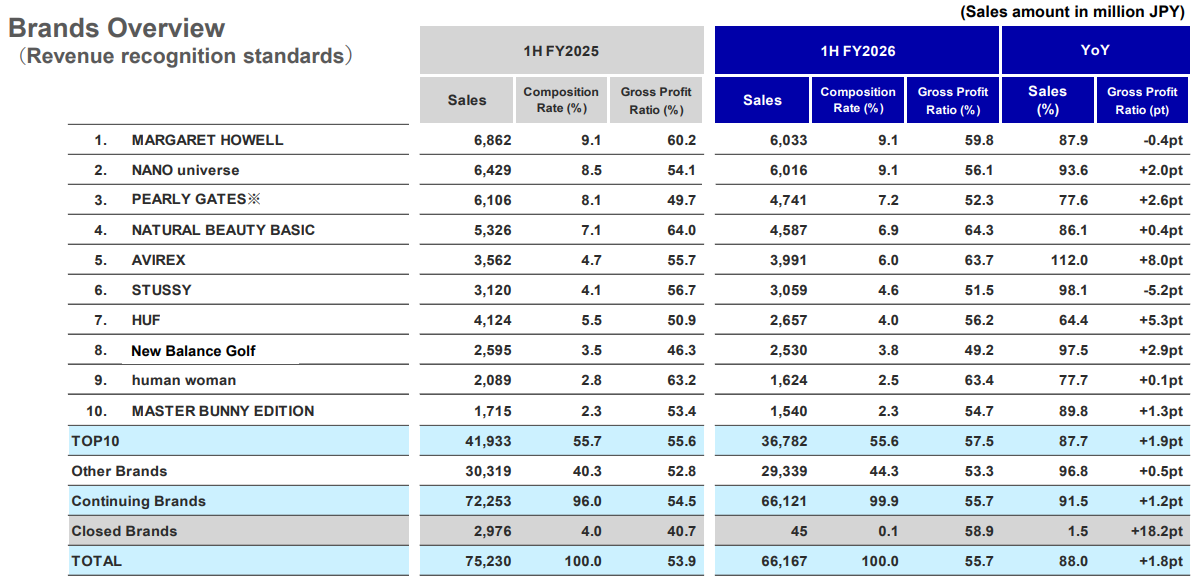

(2) Sales and gross profit margin of each brand

(Taken from the reference material of the company)

◎ Status of each major brand

* | PEARLY GATES YOY: 77.6% Inventory turnover ratio improved as a result of giving the highest priority to initiatives for inventory optimization. While sales remain sluggish due to clearance sales in the previous fiscal year, the company will work on approaching new customers in autumn and winter. On the other hand, “New Balance Golf” and “PING” are performing steadily, underpinning the golf business. |

* | NANO universe YOY:93.6% Products failed to capture the interest of customers at the beginning of the season, leading to a drop in average spending per customer in the first half of the year as a result of an early clearance sales. Launching a new brand for women “STEVELOUR,” which proposes a nonchalant effortless style based on the concept of a fusion between “sensuality (intellectual sex appeal) and casual fashion” in September, the company aims to foster a new image and increase customers. |

* | MARGARET HOWELL YOY: 87.9% In addition to the lasting impact of store closings, the appeal of products fell short of the expectation during the period when they were sold at a regular price, attracting few customers. As a store strategy for enhancing the power of the brand to convey information, the company opened a new store accompanied by Japan’s largest café in Takanawa Gateway in September 2025. |

* | AVIREX YOY: 112.0% Sales of the standard products of “DAILY WEAR” grew over two times year on year, owing to their appeal on the social media. In autumn and winter, the company will accelerate promotion for celebrating the 50th anniversary, such as collaborating with artists, aiming for further increase iin customers and sales. |

* | NATURAL BEAUTY BASIC YOY: 86.1% Weaker performance of key focus items and delays in promotional activities resulted in a decline in customer traffic, while inteisified sales promotions negatively affected profitability in the first half. On the other hand, the number of customers is recovering month by month. The company is developing new product measures, such as the new series “Chodo, Ii Fuku (Just the Perfect Clothes)” and the new line “NAVYNAVY.” |

Regarding brands other than those mentioned above, tthose where collaboration measures and subsequent promotion strategies succeeded, such as ETRE (up 8.2% year on year) and UNION (up 44.3% year on year) performed favorably both in men and women categories. Furthermore, tie-ups with companies in different fields boosted recognition among new fan bases. Profit margin improved in most brands.

On the other hand, the delay in prompting users to subscribe to mix.tokyo and the struggle to acquire new customers significantly impacted core brands throughout the first half of the year.

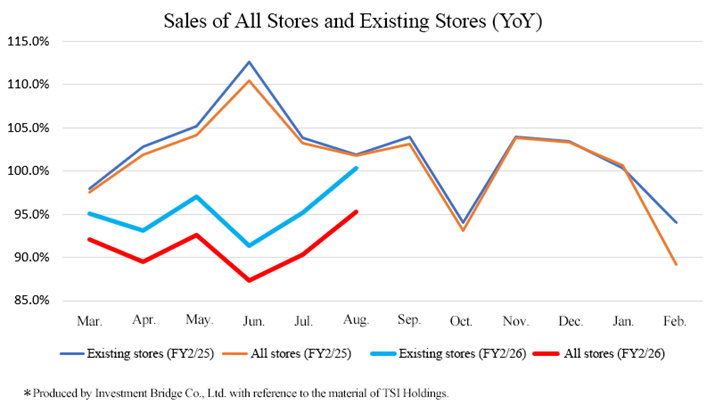

(3) Domestic Sales of All Stores and Existing Stores

In the first half of the fiscal year ending February 2026, the sales of existing stores were 95.2% of those in the same period of the previous year and the sales of all stores were 91.1% of those in the same period of the previous year, declining 8.7 points and 11.9 points, respectively, year on year. However, sales show signs of recovery after bottoming out in June, and the sales of existing stores in August 2025 exceeded 100% for the first time in 7 months, reaching 100.3%.

[2-4 Financial statement and cash flow]

◎ Key Balance Sheet Items

| End of Feb. 2025 | End of Aug. 2025 | Increase/ decrease |

| End of Feb. 2025 | End of Aug. 2025 | Increase/ decrease |

Current assets | 86,273 | 67,882 | -18,391 | Current liabilities | 26,864 | 24,213 | -2,651 |

Cash and deposits | 46,325 | 28,896 | -17,429 | Accounts payable | 8,005 | 7,376 | -629 |

Accounts receivable | 11,450 | 10,791 | -659 | Short-term interest-bearing liabilities | 1,247 | 8,654 | +7,407 |

Inventory assets | 25,909 | 25,405 | -504 | Non-current liabilities | 6,063 | 5,728 | -335 |

Non-current assets | 54,885 | 54,818 | -67 | Long-term interest-bearing liabilities | 407 | 428 | +21 |

Property, plant and equipment | 6,165 | 6,523 | +358 | Total liabilities | 32,928 | 29,942 | -2,986 |

Intangible assets | 6,318 | 6,160 | -158 | Net assets | 108,230 | 92,759 | -15,471 |

Investments and other assets | 42,401 | 42,135 | -266 | Retained earnings | 74,140 | 71,015 | -3,125 |

Total assets | 141,159 | 122,701 | -18,458 | Total liabilities and net assets | 141,159 | 122,701 | -18,458 |

*Unit: million yen. Interest-bearing liabilities includes lease obligations.

Total assets stood at 122.7 billion yen, down 18.4 billion yen from the end of the previous fiscal year, due to the decrease in cash and deposits, etc. Total liabilities stood at 29.9 billion yen, down 2.9 billion yen from the end of the previous fiscal year, due to the decrease in income taxes payable, etc. Total net assets stood at 92.7 billion yen, down 15.4 billion yen from the end of the previous fiscal year, due to the increases in treasury stock, etc.

The equity ratio dropped 1.0 points from the end of the previous fiscal year to 75.4%.

◎ Cash Flow

| FY 2/25 1H | FY 2/26 1H | Increase/ decrease |

Operating CF | 1,452 | -7,017 | -8,469 |

Investing CF | -1,408 | 78 | +1,486 |

Free CF | 44 | -6,939 | -6,983 |

Financing CF | -5,918 | -10,382 | -4,464 |

Cash and cash equivalents | 20,989 | 28,397 | +7,408 |

*Unit: million yen.

The amount of corporate tax to be paid, etc., increased, resulting in a cash outflow from operating activities and a negative free cash flow.

The cash outflow from financial activities increased due to an increase in expenditure for treasury stock acquisition.

The company’s cash position improved.

[2-5 Topics]

①Acquisition of Daytona International Co., Ltd., an OMO platform provider, as a Wholly Owned Subsidiary

(Outline of Daytona International Co., Ltd.)

Founded in March 2021. In addition to achievements as a retailer over many years under the vision of “LIFE TO BE FREAK – bringing the richness of living side by side with passion to the world,” the company offers “exciting and thrilling” customer experience through their physical stores such as “FREAK’S STORE,” their own EC site “DAYTONA PARK,” and various social media platforms as an OMO provider, which is a cutting-edge business model. They have gained a sstrong support as a fashion retailer from a wide rrange of generations, mainly people in their 20s and 40s, through products and services covering a broad range of scenarios, including casual, sport and outdoor fashion, as well as the creation of communities connected with local societies. They also operate a SaaS business providing various solutions and services to help external enterprises solve challenges in retail through Innovation Studio Co., Ltd., their subsidiary specializing in digital transformation.

*Major indicators for the fiscal year ended February 2025

Sales of 39,339 million yen, an operating income of 539 million yen, a net loss attributable to owners of parent of 70 million yen, total assets of 2.13 billion yen, and net assets of 6.6 billion yen

(Background of the acquisition as a subsidiary)

As the business content of Daytona International has high affinity with the fields of street, casual and outdoor fashion where TSI has built up business foundations and know-how, the company expects that it will be possible to acquire new customers in addition to strategically complementing the TSI Group business portfolio. Moreover, the utilization of the OMO platform, which is the forte of Daytona International, will broaden revenue earning opportunities through the sale of related products in addition to the acquisition of new customers through the effort of mutually promoting customers to visit the physical stores and EC of TSI Holdings’ existing brands. Consequently, effects on growth can be anticipated from multiple aspects. As Daytona International operates approximately 60 stores, such as the directly-managed “FREAK’S STORE,” and their sales reach the scale of about 40 billion yen, TSI also projects that turning this company into a wholly-owned subsidiary will allow them to generate synergy by utilizing the economy of scale.

(Outline of the acquisition as a subsidiary)

On September 2, 2025, TSI Holdings received 70.0% of shares in total from Unison Capital Partners V, LPS and Unison Capital Partners V(J), L.P., the shareholders of Daytona International. On the same day, Daytona International acquired treasury stock, namely 30.0% of Daytona International shares held by K Asset Management Co., Ltd.

The acquisition price by TSI Holdings was 28.3 billion yen.

②Sustainability Management

The company promotes sustainability management to work toward sustainable improvement of corporate value.

In addition to publishing the “ESG Databook,” which conveys the corporate group’s major initiatives in the ESG domain to a broad variety of stakeholders, the company newly formulated seven comprehensive policies for promoting ESG-oriented management as a step toward the achievement of their purpose as well as the sustainable management of the corporate group.

Under these policies, they will strive to improve stakeholders’ engagement, involving all group companies.

People | Customer-Initiated Harassment Policy |

Society | Quality Policy Procurement Policy |

Governance | Information Security Policy AI Utilization Policy Anti-Corruption Policy Tax Policy |

3. Fiscal Year ending February 2026 Earnings Forecasts

[Earnings forecast]

| FY 2/25 | Ratio to sales | FY 2/26 Est. | Ratio to sales | YoY | Revision rate | Progress rate |

Sales | 156,606 | 100.0% | 169,000 | 100.0% | +7.9% | +10.5% | 39.2% |

Operating income | 1,636 | 1.0% | 5,700 | 3.4% | +248.4% | 0.0% | 11.2% |

Ordinary income | 2,076 | 1.3% | 6,000 | 3.6% | +189.0% | 0.0% | 22.2% |

Net income | 15,230 | 9.7% | 4,200 | 2.5% | -72.4% | 0.0% | 31.3% |

*Unit: million yen. This forecast was made by the company.

An upward revision was made to sales, taking into account the effects of M&A. Operating income is expected to increase significantly.

Sales from the second half of the year are projected to fall short of the initial forecast, taking into consideration the sluggish performance of core brands and the company’s EC site “mix.tokyo.” However, an upward revision was made to sales, taking into account the effects of acquiring Daytona International as a subsidiary.

An approximate calculation of the impact of goodwill amortization stemming from the acquisition of Daytona International as a wholly-owned subsidiary has been incorporated, and considering the results in the first half of the year and the fact that sales of existing businesses are projected to fall short of the initial forecast in the second half as well, the forecast for operating income was left unchanged from the initial forecast. Although the company will work on the reduction of cross-shareholding, etc., the forecast for non-operating income and subsequent items concerning profit remained unchanged as there are no business opportunities except those stated in the plan at this point.

Sales are forecast to increase 7.9% year on year to 169 billion yen, and operating income to grow 248.4% year on year to 5.7 billion yen.

While the structural reform is smoothly progressing, the company believes that the recovery of the capability to sell holds the key for future growth. In the second half of the year, they will create new impulses for facilitating growth, such as organizing the first “mix-tokyo” pop-up event and launching new brands – “Alpha Industries” and “NAVYNAVY.” They are actively pushing forward with the PMI of Daytona International, aiming to solidify synergy into a tangible form. Their intention lies in the enhancement of existing businesses, growth investments, and shareholder return all at once in order to work toward the improvement of corporate value.

In addition to the absence of one-off costs recorded in the previous fiscal year and the positive effects of the discontinued businesses, the company anticipates further profit growth driven by sales expansion and the additional impact of earnings structure reforms. Operating income is expected to exceed the previous record of 4.44 billion yen achieved in the fiscal year ended February 2022.

They plan to pay a dividend of 40.00 yen/share, comprising a basic dividend of 25.00 yen/share and a special dividend of 15.00 yen/share. The estimated payout ratio is 40.0% for the basic dividend and 63.9% for the total dividend.

4. Progress of Structural Reform in the Medium-Term Management Plan “TSI Innovation Program 2027”

The progress of the structural reform in the medium-term management plan “TSI Innovation Program 2027” is outlined below.

[4-1 Overview of structural reforms]

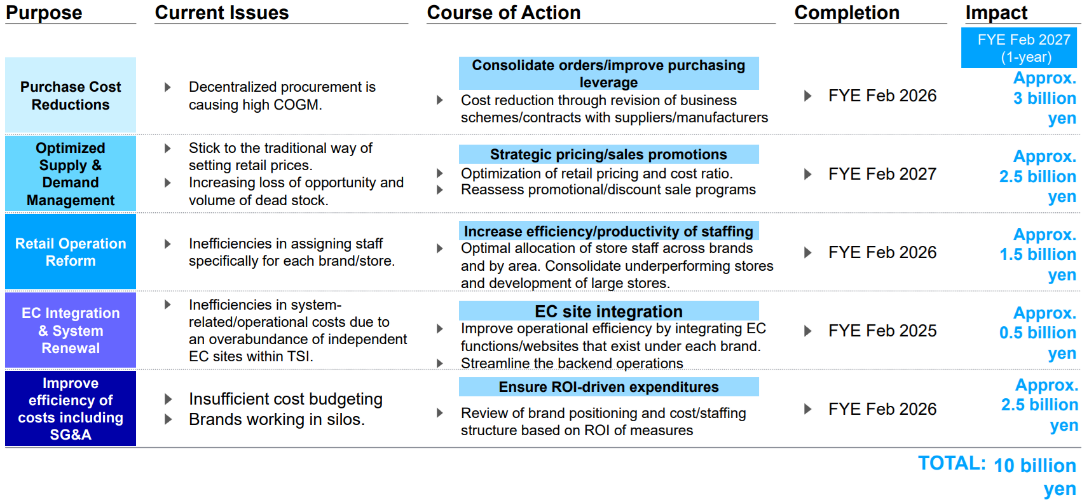

The company strives to increase revenues by approximately 10 billion yen by the fiscal year ending February 2027 in five reform items: “purchase cost reduction,” “the optimization of supply-and-demand management (strategic pricing),” “store operation reform,” “EC integration and system refurbishment,” and “the rationalization of costs, including selling expenses.”

The progress of and initiatives for each item and others are as follows:

(Taken from the reference material of the company)

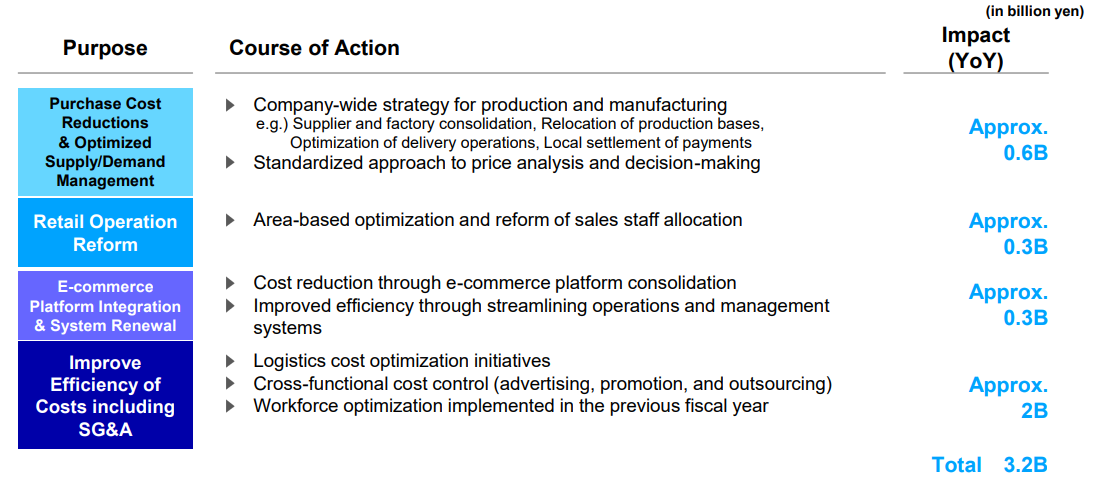

[4-2 Progress until the first half of the fiscal year ending February 2026]

Improvements are becoming evident across all domains of the structural reform, resulting in total effects of 3.2 billion yen on operating income in the first half of the year. The company will further advance the reform from the second half of the year through discussions and revisions.

(Taken from the reference material of the company)

◎EC platform integration

In February 2025, the company launched “mix.tokyo,” a brand mall-style online store that integrates 11 of its proprietary EC sites and membership services.

In addition to expecting cost reduction through site integration, the company has streamlined business operations and operational structures in conjunction with system integration to maximize operational efficiency. IT cost reduction is also being considered in preparation for the integration of additional brands.

The number of registered users of “mix.tokyo” as of the end of August 2025 is approximately 600,000. New users account for 60%, while 40% are users who signed up for the previous sites. Sales of “mix.tokyo” significantly declined in the first quarter due to a delay in transition of former members, but show signs of recovery after the start of the second quarter. More than 85% of high-ranking members of former sites have switched to “mix.tokyo,” and the company is increasing its efforts to approach to users with a middle or lower rank.

Therepurchase rate among “mix.tokyo” members is 55.1%, meaning that one in two people make a repeated purchase. There are more core fans when compared with the ratio of 36.2% for store users, and royalties are high. The company will enhance the effort of mutually promoting customers to visit online and real stores while focusing on the acquisition of new users to expand the scale of sales.

They are aiming to achieve improvement of about 500 million in the single fiscal year ending February 2027 through the consolidation of EC.

5. Conclusions

Despite a decline in sales, the profit margin improved 1.8 points year on year, owing to the effects of pricing and reductions of procurement costs, as well as the decrease in reserves for the negative effects of inventory evaluation due to the completion of the clearance of the inventories from past fiscal years. While structural reform seems to prove effective to a certain extent, it appears that the market remains unsure whether these effects will last, eespecially since the stock price dropped to a low after reaching high in the fiscal year ended February 2025.

Although the acquisition of Daytona International, which boasts sales of about 40 billion yen, is a positive factor, we would like to keep an eye on whether it will lead to further profit growth, not just increased sales.

<Reference: Regarding Corporate Governance>

◎ Corporate Governance Structure and the Composition of Directors and Audit & Supervisory Board Members

Organization type | Company with an Audit & Supervisory Board |

Directors | 5 (including 2 Outside Directors, all of whom are Independent Officers) |

Audit & Supervisory Board Members | 3 (including 2 Outside Audit & Supervisory Board Members, both of whom are Independent Officers) |

◎ Corporate Governance Report

The latest update: May 26, 2025

<Basic concept>

The Company seeks to enhance its internal control, including rigorous compliance with laws and regulations and risk management, and develop a structure that enables decision-making that is highly sound, transparent, and swift in order to build a business operation system befitting a fashion and apparel company engaged in business globally, under the corporate philosophy that “we create value that lights up people’s hearts through fashion and share the happiness of living tomorrow together with society.” Through these initiatives, we will make efforts to keep our corporate value growing, which is our basic business policy, to enhance our corporate governance further while building good relationships with our stakeholders.

<Reasons for not following the principles of the Corporate Governance Code (excerpt)>

[Principle 1-4. Cross-shareholdings]

Our company holds shares on a strategic basis when it can be considered that we can improve its medium- to long-term corporate value, by building stable business or transactional relationships, creating business opportunities, or facilitating smooth business operations.

The appropriateness of strategic shareholding will be periodically examined and reported to the Board of Directors. For shares whose effects are fading, we will reduce the number of shares held after taking into consideration the situation of the target companies, such as dividends.

In exercising voting rights, the Company comprehensively decides to vote in favor or against each of the proposals based on whether it is consistent with the purpose of strategic shareholding and whether it contributes to the maintenance and improvement of the corporate value of the target company and the shareholder value.

<Disclosure based on the principles of the Corporate Governance Code (excerpt)>

[Principle 2-3. Issues related to sustainability, mainly social and environmental matters]

[Supplementary Principle 2-3-1]

[Principle 3-1.Full disclosure]

[Supplementary Principle 3-1-3]

[Principle 4-2. Roles and responsibilities of the Board of Directors (2)]

[Supplementary Principle 4-2-2]

(1) The Company’s Sustainability Efforts

The Company released a sustainability statement:

“Creating a sustainable future with fashion entertainment—A beautiful planet, radiant society, happy life,” laying down materialities and key goal indicators (KGI) that would be the foundation for generating long-term and sustainable well-being through business activities.

In September 2021, we established the SDGs Promotion Office, which was reorganized into the SDGs Promotion Department in March 2025. With this change, our company has strengthened our sustainability initiatives while actively working to build internal structures and raise awareness among employees.

For reports on specific activities, please see TSI Holdings Sustainability Website

https://sustainability.tsi-holdings.com/index.html

Additionally, the company's response to the TCFD, as well as its sustainability, human rights, governance, environmental, and social policies, are disclosed on the company's website.

“Information Disclosure Based on the TCFD Recommendations”

https://www.tsi-holdings.com/pdf/221012_TCFD.pdf

“Sustainability Policy”

https://sustainability.tsi-holdings.com/management.html#policy

“Human Rights Policy”

https://sustainability.tsi-holdings.com/materiality/human/index.html#policy

“Governance Policy”

https://sustainability.tsi-holdings.com/materiality/governance/index.html#policy

“Environmental Policy”

https://sustainability.tsi-holdings.com/materiality/environment/index.html#policy

“Social Policy”

https://sustainability.tsi-holdings.com/materiality/social/index.html#policy

(2) Investment in human capital and intellectual property, etc.

(i) Investment in human capital

People are the source of value in our business activities and our greatest asset.

By setting diversity, employee wellbeing, health and safety, and fair labor conditions as part of our essential material issues, we will strive to improve the environment to enable all staff working together to thrive happily both physically and mentally.

Furthermore, to deal with the era of change, the Company will invest in employee education, training, and development. We will establish programs through which employees acquire needed skills by enhancing job rotations, training schemes, and self-learning systems to develop a multi-skilled workforce.

(ii) Investment in intellectual property

For the Company that operates brand businesses, intellectual property, including trademark rights and copyrights, is crucial for business administration. Intellectual property constitutes the foundation of creative value to be delivered to customers as we seek to achieve the goal “We create empathy and social value across the world through the power of fashion entertainment,” which was established as the purpose of the medium-term management plan “TSI Innovation Program 2027 (TIP 27).” We will not only develop superior designs and brands but also proactively invest in expertise, such as business models and communication design know-how, to deliver a customer experience that exceeds their expectations.

[Principle 2-4. Ensuring diversity within the Company by promoting the active participation of women, etc.]

[Supplementary Principle 2-4-1]

(1) Ensuring diversity

The TSI Group will create a diverse environment where anyone can thrive by actively promoting initiatives to realize diversity and flexibility in work and life for all in a manner that suits each one of them.

(2) Voluntary and measurable goals for ensuring diversity, and their statuses

(i) Promotion of women to managerial positions

While female managers accounted for 31.2% of the total number of managers in the Group at the end of February 2025, we have set a goal of raising the ratio to 35% by the end of February 2027.

(ii) Promotion of employees of foreign nationalities to managerial positions

Although we have yet to set any goal for promoting employees of foreign nationalities to managerial positions, we will continue to review this subject internally.

(iii) Voluntary and measurable goals for the promotion of mid-career hire employees to managerial positions and their status

There are no goals for the promotion of mid-career employees to managerial positions. Still, we have established diverse work systems (a flextime system, a reduced working hours system, and a second job system) and various training programs to accommodate individuality within the TSI Group, which brings together companies with different organizational climates and cultures. We operate our personnel system appropriately while introducing internal recruitment and job rotation schemes and flexibly accepting diversity in work duties, job categories, and work experience.

(3) Human resources development and in-house environment improvement policies to ensure diversity, and their statuses

(i) Human resources development policy to ensure diversity

To ensure diversity in promoting core personnel, we evaluate and promote employees solely based on their skills, regardless of gender, age, or nationality.

Moreover, in addition to hiring new graduates, we actively hire highly skilled mid-career professionals, including those from other industries. As for promoting female employees to managerial positions, we will proactively work to raise the ratio of female employees in managerial positions further, which is already over 30% of all managers in the Group.

Moreover, while more than 100 foreign national employees already work for the Group as a whole, mainly at overseas subsidiaries, we intend to actively conduct recruitment activities to further secure highly skilled professionals as we focus on expanding the overseas business in the coming years.

(ii) Improving the environment to enable diverse employees to thrive further

To allow diverse employees to exert their skills fully in accordance with their own lifestyles, the TSI Group takes measures, such as applying flexible work hours and work formats, revising pay levels, and easing the burdens related to shop work attire, among other employee welfare initiatives, and it will continue to improve its measures in the future.

(iii) Promotion of diversity and inclusion

We aim to enable each of our employees of different backgrounds, varying in gender, age, nationality, and physical and mental conditions to thrive according to their characteristics, skills, and conditions. Thus, we will work to raise awareness among all our employees to create a culture that respects diversity and an environment where diverse employees can grow, be motivated, and thrive.

(iv) Status of efforts to ensure diversity

The following efforts are in progress to ensure diversity in accordance with employees’ characteristics.

◎ Promotion of active engagement of women

While female managerial positions accounted for 31.2% of all managerial positions in the Group at the end of February 2025, we set the goal of raising the ratio to 35% by the end of February 2027 and strive to recruit and promote employees to increase the ratio of female managerial positions among highly senior positions.

◎ Further employment of workers of foreign nationalities

Employment of workers of foreign nationalities by the Group has been growing year after year, and we are now in the process of employing workers of foreign nationalities in a more planned manner.

◎ Utilization of elderly professionals with experience and past achievements

The Group is working to proactively employ personnel up to age 65 and continues to recruit and promote employees irrespective of age. Thus, the number of employees aged 65 or above actively contributing is increasing.

◎ Empowerment of people with disabilities

To date, the Group, mainly through its special subsidiaries, has avidly promoted the participation of people with disabilities. Its employees with disabilities accounted for 2.72% of the total workforce as of the end of February 2025. We will continue to work on creating opportunities for them to find fulfillment directly linked to operations.

◎ Promotion of understanding of LGBT

To date, the Group has a culture with a high level of understanding of LGBT, different surnames for married couples, and common-law marriage, and is now in the process of eliminating gender-based discrimination by comprehensively reviewing and amending various packages, such as the congratulatory/condolence cash gift rules (including congratulatory allowances for marriage).

Moreover, the Group is working on the following initiatives that focus not only on employee characteristics but also on workstyle diversity.

◎ Developing diverse workstyle systems, such as reduced working hours and remote work

The Group has developed rules and systems to realize more diverse work styles than before. These include developing work systems that allow working hours to be reduced by 30 minutes to up to four hours, a staggered working hours system that allows employees to start working at any time from 8:00 to 13:00, a flextime system, and lifting the ban on second jobs as well as providing subsidies for remote work environment maintenance. In addition, we are working on reviewing and amending these systems and establishing new ones.

◎ Creation of a work environment and systems that accommodate pregnancy, giving birth, and child-rearing

We achieved a 96.1% childcare leave uptake rate and a 97.6% return-to-work rate after childcare leave for women (both as of the fiscal year ended February 2025) through the above-mentioned reduced working hour system that allows employees to working hours to be reduced by 30 minutes to up to four hours, supportive measures including offering the reduced working hours system for childcare until the child graduates from elementary school, and thorough communication when employees return to work. We are constantly making improvements to maintain and enhance such an environment.

◎ Creating a system for balancing nursing care and work

We work to address anticipated increases in work restrictions due to nursing care, hospital visits, and medical treatment by extending the legally stipulated total number of caregiving days from 93 days to a maximum of 365 days and by implementing flexible policies.

[Principle 5-1. Policy for constructive dialogue with shareholders]

As a policy regarding system development and initiatives to promote a constructive dialogue with shareholders, the director overseeing investor relations, legal affairs, stock administration, and finance will be responsible for the overall dialogue with shareholders and will cooperate actively with relevant internal divisions that assist the dialogue by sharing information properly. To promote a constructive dialogue with shareholders, we will not only arrange for opportunities to have one-on-one meetings but also hold briefing meetings. Furthermore, as a means of managing important matters in dialogue with shareholders, we will work to prevent the leakage of insider information by ensuring that the internal information and insider trading management rules are widely understood and strictly enforced.

[Action to Implement Management that is Conscious of the Cost of Capital and the Stock Price]

The Company establishes its business strategy based on an understanding of its own capital cost and discloses and explains its outline at the general shareholder meetings and the financial results briefing meetings. To achieve our strategy, we regard various measures, such as capital investments, as crucial factors in the decision-making process.

The company recognizes that improving its PBR, which is currently below the level requested by the Tokyo Stock Exchange, is a critical management issue.

Regarding our shareholder return policy, our company announced a revision on April 12, 2024, and subsequently updated that policy on January 14, 2025. Under the revised policy, our company will continue to use a dividend payout ratio of 30% or higher as a reference for shareholder returns. In addition, over the period from the fiscal year ending February 2025 through the fiscal year ending February 2027, the company plans to acquire treasury shares amounting to 15.0 billion yen and aims to achieve a dividend on equity (DOE) of 4% or higher by the fiscal year ending February 2027.

In the medium-term management plan, TSI Innovation Program 2027 (TIP27), we have disclosed the entire program, including the basic policy on the business portfolio.

“Medium-Term Management Plan: TSI Innovation Program 2027”

https://www.tsi-holdings.com/pdf/TIP27.pdf

For an update, see the most recent financial briefing material titled “Full-Year Financial Results Briefing for the Fiscal Year Ended February 2025.”

https://www.tsi-holdings.com/pdf/250414_Result%20Briefing.pdf

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

The back issues of the Bridge Report (TSI HOLDINGS CO., LTD.: 3608) and the contents of the Bridge Salon (IR Seminar) can be found at: www.bridge-salon.jp/ for more information.