| GMO Pepabo, Inc. (3633) |

|

||||||||

Company |

GMO Pepabo, Inc. |

||

Code No. |

3633 |

||

Exchange |

JASDAQ |

||

Business category |

Information and communications |

||

President |

Kentaro Sato |

||

Address |

Cerulean Tower, 26-1 Sakuragaoka-cho, Shibuya-ku, Tokyo |

||

Year-end |

Last day of December |

||

HP |

|||

* The share price is the closing price on Aug 15, 2016. The number of shares issued, ROE, and BPS were taken from the latest brief financial report.

|

||||||||||||||||||||||||

|

|

* The forecasted values are from the Company. Consolidated values have been used from the term ended Dec. 2012.

* From the term ending Dec. 2016, net income means the profit attributable to owners of the parent. The same applies to the rest of this report. This report introduces GMO Pepabo's the first half of fiscal year December 2016 earnings results and so on. |

| Key Points |

|

| Company Overview |

|

Around that time, the Internet environment had already advanced from the early period to the spread period, but it was still necessary to install your own server in order to distribute information through your website. Most services were targeted at corporations, and too expensive for individuals to use. In that circumstance, the company launched a hosting service while setting a monthly charge at several hundred yen, with the aim of offering Internet infrastructure for "individuals who want to express themselves" at affordable prices. One year later, it started the service of obtaining a domain on behalf of each customer. The company grew its business steadily, by grasping the multifaceted needs of individual users who want to distribute information and express themselves through the Internet. The company's far-sightedness both in recognizing the commercial potential of blogs, which had already been showing a sign of spread in the U.S., and in developing the environment for using blogs in Japanese, was a significant growth driver. In March 2004, the company conducted the allocation of new shares to a third party, which was GMO Internet, Inc. (named Global Media Online Co., Ltd. at that time), and became a member of the GMO group. Around that time, several leading Internet firms had strong interests in paperboy & co., and requested capital participation. Among these firms, the GMO group, which operated services with a main focus on corporations, was judged as the most appropriate collaborator for exerting synergetic effects, creating new services, etc. After that, the company launched a succession of new services, including online shop development ASP and rental servers for creators, achieving steady business expansion. In December 2008, it was listed in the JASDAQ market. In April 2014, the company was renamed GMO Pepabo, Inc., the current name. President Kentaro Sato was born in January1981. He created websites, etc. on his own, and was invited by Mr. Ieiri to offer help to the predecessor of the company while he was still a student. In January 2003, he participated in the establishment of the company. After serving as Executive Secretary, and Representative Director, Vice President, and Head of the Management Planning Section, he was appointed as Representative Director and President in March 2009. He also serves as Director of GMO Internet.  Its business is composed of the 4 major segments: "hosting business," "EC support business," "handmade business," and "community business." (In January 2016, the C-to-C handmade product market "minne," which had belonged to the EC support business segment, was redefined as an independent segment called "handmade business.")  <Hosting business>

GMO Pepabo offers servers, functions, domains, etc. for establishing websites. Its sales are mainly from the charges for such services.

<EC support business>

GMO Pepabo offers the services for developing online shops, operating online shopping malls, and establishing the websites of stores for supporting e-commerce (EC) at lowrates. The sales of this business are mainly from charges for use and commissions.

<Handmade business>

At present, the company is committing most of its efforts towards developing the customer to customer handmade crafts market "minne," and as its quantitative importance has increased, from this period onwards, the company has decided to place it in a segment of the report separate and independent to the EC support business.

<Overview>

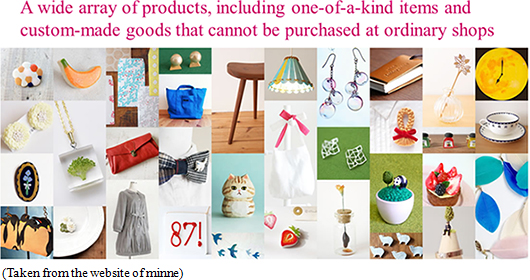

Launched in 2012, "minne" is a C-to-C online market for connecting artists, who want to exhibit and sell their handmade products, and consumers, who want to purchase one-of-a-kind items or characteristic works. As of the end of June 2016, the number of registered artists is 252,000 and the number of products on display is 3.27 million. These numbers indicates that "" is the largest C-to-C handmade product market in Japan. Pepabo aims to further accelerate its growth and make it overwhelming No.1. The development of this service was started because it turned out to be consistent with the corporate policy of "supporting those who want to express themselves" when the company discussed various plans for increasing its growth rate further. <Market scale and background of growth>

The "C-to-C" business, which means the trade of products and services among consumers through the Internet, is growing rapidly. Products and services sold on the Internet are diverse, which include auctions, flea markets, ticket sale, and accommodation in private houses. The company estimates the market scale and trend of Japanese handmade products that are handled by "minne" as tabulated below:  (1) Spread of smartphones When an artist puts his/her artwork on display by using a PC, he/she needs to take pictures, import images into a PC, input and upload the description of his/her work.At present, however, anyone can put his/her products on display just by taking pictures of the products with a smartphone and inputting necessary text in a form. Namely, the hurdle for presenting artworks to the market has been significantly lowered. (2) Change in awareness from ownership to sharing As the age of mass production and consumption ended and the way of thinking for valuing materials, including the environment and sustainability, has spread, "sharing economy," in which items you own but do not use are shared with others, is growing. Auctions, flea markets, etc. are typical of this trend. (3) Place where individuals can exert their abilities Many cases substantiate the fact that since the Internet can connect you with people around the world, you can flourish by yourself as long as you are competent, like celebrities, leading companies, etc., even if you are not famous. Stimulated by this trend, an increasing number of individuals aim to express themselves and flourish in the C-to-C market. The artists who exhibit their artworks in "minne" are the very examples of such individuals. *Overseas handmade product market

The outline of Etsy, Inc. (listed in NASADQ, ETSY), the world's largest handmade product market operator, would be helpful for forecasting the future of minne.

On the other hand, the trade volume of minne, which was started in 2012, reached 4.46 billion yen in the term ended December 2015, or the first half of the 4th year. In the term ending December 2016, or the 5th year, the company aims to achieve a trade volume of 10 billion yen. The trend of the trade volume of minne so far is very similar to that of Etsy. The simple comparison with Etsy, which is targeted at the global market, is difficult, but it can be said that there is potential for dramatic growth of the trade volume of minne in parallel with the growth of the C-to-C market. <System of minne>

When a product is sold, the company pays the amount calculated by subtracting 10% from the selling price to the seller (artist). As for the transfer of proceeds from sale, the company adopted the escrow service for satisfying the needs of both buyers: "I want to pay the price after receiving the product" and sellers: "I want to ship the product after receiving the price." <Progress of minne>

In October 2015, the company started disclosing the number of app downloads and the volume of trade on a monthly basis. The trade volume in January 2016 dropped due to decreased orders during year-end and new-year holidays, but it increased by 286.9% year on year.  <Community business>

The company offers services based on communication through the Internet, such as blogs. The sales of this business are mainly from ad fees for charge-free services, and charges for use and commissions for paid services.

1. Provision of a variety of services based on internal production

As mentioned in the section "Business contents," the company offers a wide array of services, differentiating it considerably from competitors. According to President Sato, such diversity of services can be achieved only because the company possesses a system capable of not only development, but also the ability to design and market services by itself. This leads to excellent speed and quality, and is essential for making the Internet business successful. 2. Unique corporate culture

The mission of the company is to root for "individuals who want to express themselves." To do so, the company itself needs to express itself, and the active outputting through the Internet is now its established homegrown corporate culture. (For details, see "4. Interview with President Sato.")  |

| 1H of Fiscal Year December 2016 Earnings Results |

Sales increased, operating loss shrank

Compared with the same period last year, sales increased by 28.6% to 3,424 million yen. In the existing stock-type business, the number of contracts also increased steadily.Gross profit also increased by 35.7%. As a result of positive investment in "minne" through TV commercials and web promotion, SG&A expenses increased by 27.5%, and operating income made a loss of 119 million yen. Total advertising and publicity expenses for "minne" as of the first half are 700 million yen.   (1) Hosting business

Sales and profit grew.The company carried out a three-month free campaign etc. targeting new contracts for the rental server service, and as a result the number of contracts did well, finishing at 429,474. This was an increase of 13,597 contracts, 3.3% up from the end of the same period last year. Furthermore, for the domain acquisition agent service "Muu Muu Domain," the company carried out periodic discount campaigns for various domains, and planned increases in the replacement rate.As a result the number of registered domains was 1,133,611. This was an increase of 137,220 domains, 13.8% up from the end of the same period last year. The customer unit cost is also rising. (2) EC support business

Sales and profit increased.As a result of continuously making efforts towards the promotion of up-selling and cross-selling, the number of "Color Me Shop" contracts is healthy. The number increased by 1,359 to 44,615, 3.1% up from the end of the same period last year. Average customer spend, too, increased. In addition, for the original goods creation and sales service "SUZURI," the company has pursued active development through plans for collaboration with renowned creators, etc. As a result the membership is continuing well, and in June 2016 it exceeded 100,000 people. Sales too have expanded three times from the same period last year, although it is still at a low level. (3) Handmade crafts business

There was a large increase in sales. The margin of loss shrunk somewhat.In addition to the active operation of web advertisements, as a new effort to raise the popularity of "minne," in April 2016 the company held its largest ever sales event at Tokyo Big Sight, the "minne handmade market." As a result of this and other efforts, at the end of June 2016 the number of artists was 252,000 and the number of works for sale was 3,270,000. Furthermore, by the end of June 2016 the app had been downloaded 6,020,000 times. However, the circulation amount in the first half was 2,040 million yen, an increase of only 3.7% compared to the first quarter. The primary factors were the fact that the company curbed promotion costs compared to the first quarter, and limited the push from the company to match the decreased consumption tendency resulting from the Kumamoto earthquake, and also the influence of golden week causing the number of purchases to decrease. (4) Community business

Sales decreased, and profit increased.Because of the continued decreasing trend in the number of paid memberships and page views of the blog service "JUGEM," the company focused on securing profits through cost control. In addition, Booklog, Inc. has been removed as a consolidated subsidiary through the transfer of stocks on January 18th, 2016.  Because of the augmentation of other accounts payables, etc., current liabilities increased 332 million yen to 3,370 million yen, and total liabilities rose 374 million yen to 3,424 million yen. As legal retained earnings decreased, net assets shrank 56 million yen to 955 million yen. Consequently, equity ratio dropped 3.5% from the end of the previous term to 20.7%.  As the revenues due to the redemption of last period's securities and the silent partnership capital repayment have been exhausted, investing CF turned to the negative. Free CF remained in the positive. The dividend payment amount decreased and the negative margin of financing CF was reduced. The cash position dropped 340 million yen. |

| Fiscal Year December 2016 Earnings Estimates |

There is no change to the earnings forecast. In this period, too, positive investment in "minne" will continue.

There are no changes to the earnings forecast. Sales are expected to increase to 6,850 million yen, up 20.2% from the previous period. The existing stock-type business will remain strong, and the circulation amount of "minne" will increase. The sales progress rate in the first half is 50%, and the company judges that it is progressing steadily.While carrying out positive investment in "minne," the company will also proceed with cost control and achieve income and expenditure balance of profit accounts following the operating income. No dividends are planned for this period. (2) Future measures

The company will concentrate on two subjects: "paid contract increase x increase in average spending per customer" in the continued primary stock-type business, and "positive investment in minne."

① Efforts in the primary business

In the stock-type business the company will further a "paid contract increase x increase in average spending per customer" through improvements in the customer satisfaction level, and the company plans a solid expansion of sales and profit. The company believes that the results are beginning to show.

*Hosting service "Lollipop! Rental Server"

The standard plan, where the rental server can be used for a reasonable price (500 yen a month for 120GB capacity) despite it providing a major function, is gathering popularity.Its provided capacity has greatly improved compared to the previous version of the plan, and despite being a shared server it can be used with the convenient speed of a private server. In addition, as a result of increasing the level of user satisfaction by providing telephone support etc., while standard plan contracts accounted for 9.3% of new Lollipop! contracts in January 2014, they increased to 37.5% by June 2016. This is linked to an increase in average spending per customer. *EC support business "Color Me Shop"

The company is working on raising popularity, with things like theawards ceremony for the "Color Me Shop" Grand Prize 2016,a contest to find stores whose online shops show ingenuity and originality in their construction and management, in May 2016.Meanwhile, of the plans the company is providing, the regular plan is expanding. This plan targets mid to small scale shops and provides high functionality, offering "a maximum of 10,000 free pages and 50 photographs per product for 3,240 yen per month." In January 2014 the regular plan accounted for 11.5% of new contracts, but by June 2016 this had increased to 35.1%. "Color Me Shop" also assembles an abundance of optional services (access analysis, various payment functions, packaging, payment, and shipping agent services, coupon functions, etc.). Compared to the shops not making use of these services, the shops using them have a 4.4 times larger circulation amount per shop (as of the results from the first half). With this performance as a foundation, the company endorsed the use of the optional services focused on access analysis, and as a result the use of options has expanded and average spending per customer is showing an increase of more than 10% from last year. *Other

<Background to the cooperation agreement>◎Entering into a cooperation agreement with Amami City aimed at regional regeneration Despite its abundant natural resources, Amami City is facing problems characteristic to outlying islands, including the lack of large scale industries and difficulty securing employment. Because of these problems, in 2015 they began the "plan to make the island the best place for freelance work," focusing attention on IT-related enterprises that can overcome the restrictions of place and time. Based on this plan, Amami City is doing things like supporting the maintenance of fiber optic broadband through private communications operators, in order to actively construct an "information (ICT)" environment. Alongside this, while linking up with private businesses, Amami City is also working on generating opportunities for ICT work, encouraging permanent residency, and supporting child raising (supporting work from home). Meanwhile, with the mission of "connecting and expanding possibilities with the internet," the company is putting its efforts into things like holding events related to using the internet, and supporting the cultivation of creators. The company entered into the cooperation agreement in order to encourage regional regeneration, by proposing new ways of working using the internet, and supporting the creation of a suitable environment, and cultivation of human resources. <Future developments> The company will actively carry out seminars and study groups about the services in Amami City, and will also propose new ways of working using the internet, and support the cultivation of human resources. The company has already carried out study groups etc. aimed at craftspeople in Amami Oshima. With the alliance with Amami City as a successful precedent, the company plans to go on to create more ties with various regional municipalities. ◎ Establishment of Pepabo Research Institute

With the concept of realizing a " Dimensionless Autonomous System" and in order to conduct the creation and application of new technologies, on Friday, July 1, 2016, the company established the research and development organization Pepabo Research and Development Institute (PRDI).A "Dimensionless Autonomous System" is a new system structure that applies the life preservation function of the cells of living things to internet services, an arrangement whereby the system itself controls the services through AI (artificial intelligence), and automatically reconstructs before abnormalities occur. PRDIwill go on to consistently carry out research and development of new technology and information transmission, and even implementation in services, aimed at the realization of this "Dimensionless Autonomous System" ② Active investment in "minne"

In addition to the expansion of the domestic craftsperson customer to customer market, the company will expand the circulation of "minne" on the theme of "maximizing the shopping experience," by carrying out various types of promotions and feature developments aimed at both artists and buyers. The company is aiming for a circulation this term of 10 billion yen.In the first half, the accumulated total was 4 billion yen. As the circulation of "minne" is mainly composed of "DAU x purchase rate x unit purchase price," these are the three key progress indicators for the present term. DAU (Daily Active Users: the number of users who launch the app at least once in a given day) is expanding, but the purchase rate and unit purchase price remain static. In order to solve this problem and to realize a circulation of 10 billion yen, the company will implement the following measures. *Increasing purchase rate

The company will proceed with developing an environment where it is "easy to find" and "easy to shop."For an environment where it is "easy to find," the company is carrying out improvements day by day along with UI and UX* specialists. *UI (User Interface): this is the OS, app screen etc. that assists with smooth communication between the user and the digital device. UX (User Experience): this means the experience or satisfaction gained by a user upon using a particular service. Furthermore, for an "easy to shop" environment, the company plans to release carrier settlements etc. sequentially from August. The company will improve and expand the functions so that people can experience a stress free shopping experience, from searching for a product to completing the purchase. *Raising unit purchase price

The company aims to do away with the image that "handmade = cheap".The company has started the web magazine "minne mag." In addition to this, the company will continuously focus on enhancing the content, with special articles, popular products etc., and make improvements to the search function and algorithms (recommendation function based on big data). The company will also make it so that products with a good balance between quality and cost stand out. The company believes that realizing a suitable price without causing price competition is important. In terms of achieving a circulation of 10 billion yen this term, it is important to consider the year-end sales battle stimulated by the EC market as a whole. The company is thinking that the third quarter onward is the period in which to carry out preparations for the above measures, aimed at the maximization of circulation in the year-end sales battle, and the company needs to think about the entire income and expenditure, and when the company will step on the accelerator. |

| Conclusions |

|

According to the president Sato, the 10 billion yen for this period is just a tenth of the way to the summit of the mountain, and the company needs to aim to get to the very top of the handmade goods market while continuing to expand the categories. However, in addition to external factors such as the Kumamoto earthquake, issues include the slowing down of the circulation rate increase, and accumulated total as of July was 4.7 billion yen. It will be a significant challenge to accumulate 5.3 billion yen in the remaining five months. Although the company will continue to watch the monthly circulation amount in the short term, in the mid to long term the company would like to focus on expanding the categories and strengthening the number of artists and the number of works, as the company aims for the top of the mountain. |

| <Reference : Regarding Corporate Governance> |

◎ Corporate Governance Report

The company submitted a latest corporate governance report on Jun. 30, 2016.As a JASDAQ company, the company fully follows the basic principles of the corporate governance code. |

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2016 Investment Bridge Co., Ltd. All Rights Reserved. |