Bridge Report:(3633)GMO Pepabo the first half of Fiscal Year December 2019

Kentaro Sato, President | GMO Pepabo, Inc. (3633) |

|

Company Information

Market | JASDAQ |

Industry | Information and communications |

President | Kentaro Sato |

HQ Address | Cerulean Tower, 26-1 Sakuragaoka-cho, Shibuya-ku, Tokyo |

Year-end | End of December |

HP |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

2,304 | 5,434,600 shares | 12,521 million | 33.3% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

65.00 | 2.8% | 129.71 | 17.8 x | 624.89 | 7.4 x |

The share price is the closing price on August 15, 2019. Shares Outstanding is the end of June 2019. ROE and BPS are actual results at the end of the previous term. The company implemented 1:2 stock split on April 1, 2019.

For PBR, the stock split is taken into consideration.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2015 Act. | 5,697 | -621 | -597 | -797 | -149.97 | 0.00 |

December 2016 Act. | 6,890 | 108 | 135 | 153 | 29.12 | 15.00 |

December 2017 Act. | 7,365 | 143 | 172 | 119 | 22.75 | 12.50 |

December 2018 Act. | 8,200 | 467 | 524 | 467 | 88.65 | 52.50 |

December 2019 Est. | 9,200 | 950 | 962 | 684 | 129.71 | 65.00 |

* Unit:million yen .Non-consolidated values have been used from the term ended December 2017. Consolidated values have been used from the term ending December 2019.

The company implemented 1:2 stock split on April 1, 2019. EPS and DPS are adjusted retrospectively. DPS for the term ended December. 2018 includes the commemorative dividend of 5.00 yen.

We introduce GMO Pepabo's first half of the fiscal year ending December 2019 earnings results etc.

Table of Contents

Key Points

1.Company Overview

2.First Half of Fiscal Year ending December 2019 Earnings Results

3.Fiscal Year ending December 2019 Earnings Forecasts

4.Growth Strategy – Promoting the development of platforms

5.Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales for the second quarter of the term ending December 2019 (cumulative total) were 4.4 billion yen, up 10.1% year on year. All three business segments saw a rise in their sales. Operating income was 506 million yen, up 75.5% year on year. Sales grew, and SG&A expenses declined 1.5% year on year due to the decreased promotion costs of the Handmade business. Both sales and profit marked record highs.

- The earnings forecast for the full fiscal year remained unchanged. The sales for the term ending December 2019 are projected to be 9.2 billion yen, up 12.2% year on year, and operating income is expected to be 950 million yen, up 103.1% year on year. Sales are expected to grow in all the segments. The Handmade business, in which promotion costs will decline, will turn profitable on a full-year basis, resulting in a large increase in operating income. Sales and profit are expected to mark record highs again for this term. The dividend forecast is 65.00 yen per share, and the expected payout ratio is 50.1%.

- The company has accumulated overwhelming achievements by supporting expressers, and it aims to become the dominant No.1 company supporting expressive activities in the future, through the expansion of the fields of support, such as security, education and finance, in addition to “production”, where the company provides assistance in expressive activities and increasing the amount of what one can make.

- Profit augmented largely as the e-commerce (EC) business was healthy and the promotion costs were reduced in the Handmade business. However, as for the Handmade business, as the distribution amount in the first half was 6.15 billion yen against the estimated annual distribution amount of 13 billion yen and the distribution amount in the second quarter (April to June) also fell short of the amount at the same period of the previous term, the company plans to strengthen the promotion while maintaining profitability in the second half. The progress rate of operating income has exceeded 50%, but the company aims to achieve the same result as estimated at the beginning of the term.

- The company once again indicated its growth strategy as “promoting the development of platforms” and measures for that purpose. While the platform volume cannot be simply compared with overseas cases such as “Shopify” and “Etsy”, as they target English-speaking countries while the company targets Japanese-speaking countries, it is clear that there is room for significant growth for the company, which has an overwhelming track record in Japan.

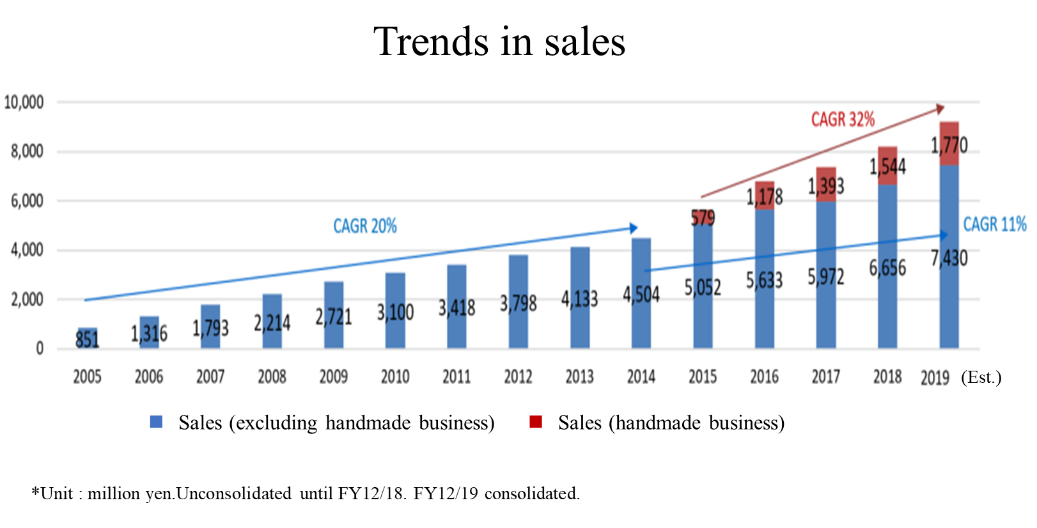

- The CAGR (compound annual growth rate) of the sales of the businesses excluding the Handmade business was 17% between 2005 and 2019. The annual growth rate of the Handmade business was 32% between 2015 and 2019. Based on the infrastructure services that have entered a stable growth period, we would like to pay attention to the medium-term perspective to see how far the company can increase their growth potential by promoting platform development centered on the handmade business.

1.Company Overview

GMO Pepabo provides individual users who want to express themselves through the Internet with several services, including rental servers, domain acquisition agency, online shop development ASP. Its characteristics and strengths include the diversity of services based on internal production and unique corporate culture.

In addition to the stable revenue from the existing stock-type business (business with moderate yet stable income), the company aims to grow further based on Handmade crafts market service “minne”, a handmade market launched in 2012 for handmade products.

【1-1 Corporate history & profile of the president】

In January 2003, the founder Kazuma Ieiri established the limited company “paperboy & co.” for operating personal hosting business.

Around that time, the Internet environment had already advanced from the early period to the spread period, but it was still necessary to install your own server to distribute information through your website. Most services were targeted at corporations, and too expensive for individuals to use.

In that circumstance, the company launched a hosting service while setting a monthly charge at several hundred yen, to offer Internet infrastructure for “individuals who want to express themselves” at affordable prices. One year later, it started the service of obtaining a domain on behalf of each customer. The company grew its business steadily, by grasping the multifaceted needs of individual users who want to distribute information and express themselves through the Internet.

The company's far-sightedness both in recognizing the commercial potential of blogs, which had already been showing a sign of spread in the U.S., and in developing the environment for using blogs in Japanese, was a significant growth driver.

In March 2004, the company conducted the allocation of new shares to a third party, which was GMO Internet, Inc. (named Global Media Online Co., Ltd. at that time), and became a member of the GMO Internet group.

Around that time, several leading Internet firms had strong interests in paperboy & co., and requested capital participation. Among these firms, the GMO Internet group, which operated services with a main focus on corporations, was judged as the most appropriate collaborator for exerting synergetic effects, creating new services, etc.

After that, the company launched a succession of new services, including online shop development and creation service and rental servers for creators, achieving steady business expansion. In December 2008, it was listed on the JASDAQ market. In April 2014, the company was renamed as GMO Pepabo, Inc.

President Kentaro Sato was born in January 1981. He created websites, etc. on his own, and was invited by Mr. Ieiri to offer help to the predecessor of the company while he was still a student. In January 2003, he participated in the establishment of the company. After serving as Executive Secretary, and Representative Director, Vice President, and Head of the Management Planning Section, he was appointed as Representative Director and President in March 2009.

【1-2 Corporate ethos, etc.】

Under the following corporate ethos and missions, GMO Pepabo aims to offer an Internet environment that is attractive and easy to use for individual users.

Management Philosophy | We can make it more fun. |

In 2008 we set this phrase as our corporate ethos. As users’ activities for expressing themselves were undergoing diversification and our company was gradually growing, we upheld this ethos, while believing in our potential of “challenging ourselves to make things more enjoyable”. Countless things can be made more enjoyable regardless of one’s occupation and age, such as the creation of enjoyable services, the design of plans that would be considered as fun, and enjoying your work more. The company Pepabo is composed of staff members who are glad to hear “I like it!” and delighted to hear “It is fun!” (Taken from the website of GMO Pepabo) | |

Mission | To connect and expand possibilities through the Internet |

As we have been assisting individuals in expressing themselves with Internet services, we set the above mission in 2013, that is, the 11thyear after the establishment of Pepabo, with the hope of “pursuing the potential of the Internet and expression and then providing everyone with a chance to flourish”. When the possibilities of those who want to initiate something by utilizing the Internet encounter the services provided by Pepabo, we hope that new potentials such as−“An online shop I opened in the form of a hobby became my business”, and “Uploading my music to my website led to my debut from a label” will emerge. We operate our services while pursuing the potential of the Internet and expression, create something new for expanding the talents and possibilities of individuals, and develop an environment in which the Internet would bring out the capabilities of a broad range of people and allow them to flourish. (Taken from the website of GMO Pepabo) | |

【1-3 Business contents】

Under the above corporate ethos and mission, the company provides individual users who want to “initiate something through the Internet” with a wide array of Internet services at affordable prices, and supports individual expression activities with the Internet.

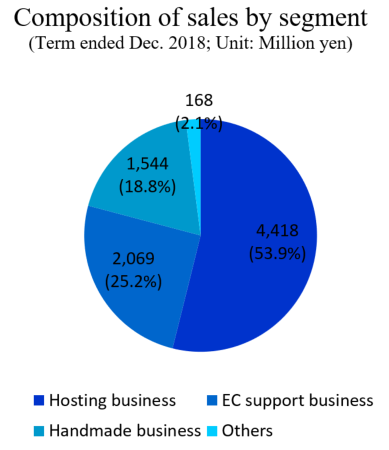

Reported segments are “Hosting business”, “EC support business”, and “Handmade business”. The company also has “Other business” segment, including the rental blog service “JUGEM”.

<Hosting business>

GMO Pepabo offers servers, functions, domains, etc. for establishing websites. Sales is derived mainly from the usage fee of such services.

(Major services)

Service name | Content | Brief description |

Lolipop! | Rental server service | Rental servers targeting a wide range of people ranging from Internet beginners to corporations. The company launched a hosting service at prices that can be paid with “pocket money” so that anyone can use this service at ease. With this, it enabled individuals to use rental servers. The company offers multiple plans to meet various needs of customers from individuals to corporations. It offers plentiful manuals for producing and operating a website easily, responsive customer services, and software for designing a website. The number of contracts is about 400,000. |

Muu Muu Domain | Domain acquisition agency service | Low-cost domain acquisition agency service. The company introduced a system for acquiring a domain easily online at the start of this service, dispelling the conventional recognition that “registering a domain is complicated, because it requires a lot of paperwork” and making obtaining a domain easier. The number of contracts is about 1,220,000. |

heteml | Rental servers for creators | Rental servers for creators. The company offers an environment for enabling advanced website operation with “original SSL”, which makes it possible to develop a safe website, the multi-domain function to operate more than one website, and a backup option for storing data in a server regularly. The company uses SSD for storage and customers can upload images and videos smoothly due to its large capacity. |

Petit Homepage Service | Design-oriented website production service | A website production service with the concept of “paper websites”, which is favored by mainly photo enthusiasts and housewives. This service emphasizes design and enables you to produce a website as if it was a diary or sketchbook. |

30days Album | Online photo album service | Service for sharing, storing, and disclosing photo and video data online. In addition to the basic functions of an online album for sharing photos safely and photo storage with unlimited capacity, the company offers apps that are compatible with various devices, including smartphones and tablets. With this service, you can enjoy photos in your house, office, and any other places. |

<EC support business>

GMO Pepabo offers services for developing online shops, operating online shopping malls, and establishing websites of stores for supporting e-commerce (EC) at low rates. The sales of this business are mainly from usage charges and commissions.

(Major services)

Service name | Content | Brief description |

Color Me Shop | online shop development and creation service | The company offers a system for enabling even inexperienced owners to open online shops easily at low cost. Over 350 functions and rich design templates are offered regardless of the scale of their shops, so that all the owners can feel satisfied. Also, the company holds seminars for shop owners at real places and offers assistance actively for them. The number of contracts is about 43,000. |

Goope | ASP service creating websites | Website creation service for shops and companies. From the individual to the official site of the shop and company, this service prepares the design and contents which can create various websites in advance and can create homepages with high designability even for novice users who do not have web designing experience. |

SUZURI | Service for producing and selling original goods | This service enables you to produce and sell T-shirts, mugs, etc. with your original illustrations or photos easily. There are no risks of initial investment cost, inventory management, etc. and “SUZURI” supports the entire processes from production to delivery. Accordingly, even beginners can use this service with peace of mind. The annual distribution amount is 260 million yen. The number of users as of the end of December 2018 is about 230,000. |

Canvath | On-demand original goods development service | Service that enables you to produce your original goods, such as T-shirts, accessories, and mugs, just by uploading an illustration you have drawn or a photo you have taken with your smartphone. |

<Handmade business>

At present, the company is committing most of its efforts towards developing “minne”.

Aiming for further growth, the company aims to evolve from the traditional “CtoC handmade market” to a “monozukuri platform”.

(For details, see “4. Growth Strategy”)

(Taken from the website of minne)

<Overview>

Launched in 2012, “minne” is a C-to-C online market for connecting artists, who want to exhibit and sell their handmade products, and consumers, who want to purchase one-of-a-kind items or characteristic works.

As of the end of June 2019, the number of registered artists is 540,000 and the number of products on display is 9.98 million. These numbers indicate that “minne” is the largest C-to-C handmade product market in Japan. Pepabo aims to further accelerate its growth and make it overwhelming No.1.

The development of this service was started because it turned out to be consistent with the corporate policy of “supporting those who want to express themselves” when the company discussed various plans for increasing its growth rate further.

This service is provided through the website and app, and most of the users use the app. As of the end of June 2019, the number of app downloads is 10,730,000.

<Market scale and background of growth>

The “C-to-C” business, which means the trade of products and services among customers through the Internet, is growing rapidly.

Products and services offered on the Internet are diverse, which include auctions, flea markets, ticket sale, and accommodation in private houses, but the company estimates that distribution amounts of the C-to-C market and handmade product websites in the domestic hobby market are approximately 100 billion yen and 20 billion yen, respectively, and both are experiencing double-digit growth continuously.

The distribution amount of “minne” for the year 2018 was 12.07 billion yen, up 17.3% year on year.

*Background of the growth of the C-to-C market

It is suggested that the following three factors exist behind the growth of the C-to-C market:

(1) Spread of smartphones

When an artist puts his/her artwork on display by using a PC, he/she needs to take pictures, import images into a PC, input and upload the description of his/her work. At present, however, anyone can put his/her products on display just by taking pictures of the products with a smartphone and inputting necessary text in a form. Namely, the hurdle for presenting artworks to the market has been significantly lowered.

(2) Change in awareness from ownership to sharing

As the age of mass production and consumption ended and the way of thinking for valuing materials, including the environment and sustainability, has spread, “sharing economy”, in which items you own but do not use are shared with others, is growing. Auctions, flea markets, etc. are typical of this trend.

(3) Place where individuals can demonstrate their abilities

Many cases substantiate the fact that since the Internet can connect you with people around the world, you can flourish by yourself as long as you are competent, like celebrities, leading companies, etc., even if you are not famous. Stimulated by this trend, an increasing number of individuals aim to express themselves and flourish in the C-to-C market. The artists who exhibit their artworks in “minne” are the very examples of such individuals.

<System of minne>

*Merits for artists and purchasers

Artists | Just by registering product information and images, artists can have their own gallery pages. A user’s page, which can manage the sale and order receipt for products, is simple and highly operable. Therefore, it can be easily used by even beginners who don’t know how to create or operate a website. Registration is free of charge. |

Purchasers | “minne” displays many unique items, including one-of-a-kind accessories, bags, and characteristic sundries. In addition, visitors can check the products picked up by minne staff, and the items bookmarked by other users, to enjoy shopping. |

*minne’s business model and payment settlement method

When a product is sold, the company pays the amount calculated by subtracting 10% from the selling price to the seller (artist).

As for the transfer of proceeds from sale, the company adopted the escrow service for satisfying the needs of both buyers: “I want to pay the price after receiving the product” and sellers: “I want to ship the product after receiving the price”.

<Progress of minne>

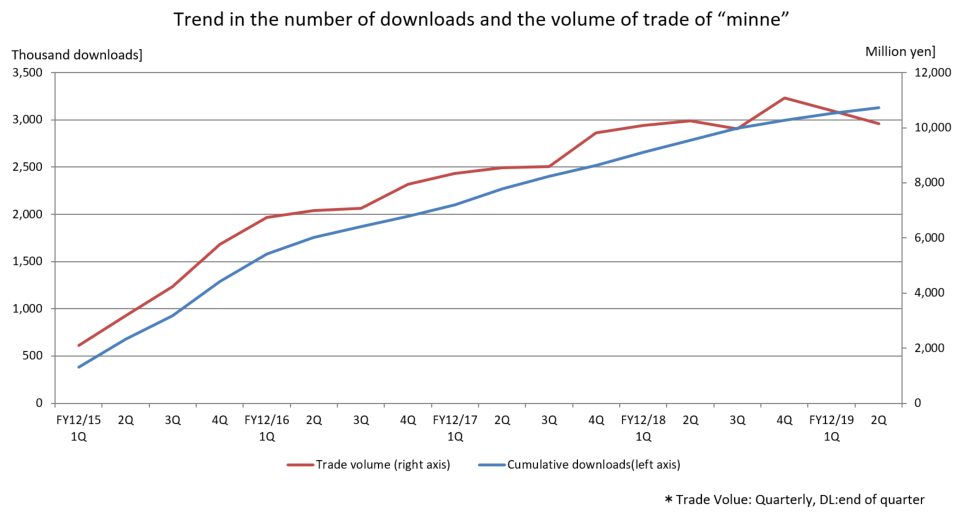

The trends of the distribution amount and the number of app downloads, which are the key performance indicators of “minne”, are as follows.

To further grow and expand as the largest handmade craft market in Japan, the company believes that it is important to improve services by conducting diversified businesses including the distribution amount to be acquired online, hosting various offline events and strengthening efforts with companies that will support artists’ activities. Therefore, in January 2019, the company ended the monthly disclosure of “minne” distribution amount.

【1-4 Characteristics and strengths】

1.Provision of a variety of services based on internal production

As mentioned in the section 【1-3 Business contents】, the company offers a wide array of services, differentiating it considerably from competitors.

According to President Sato, such diversity of services can be achieved only because the company possesses a system capable of not only development, but also the ability to design and market services by itself. This leads to excellent speed and quality, and is essential for making the Internet business successful.

2. Unique corporate culture

The mission of the company is to root for “individuals who want to express themselves”. To do so, the company itself needs to express itself, and the active outputting through the Internet is now its established homegrown corporate culture.

【1-5 ROE analysis】

| FY 12/ 12 | FY 12/ 13 | FY 12/ 14 | FY 12/ 15 | FY 12/ 16 | FY 12/ 17 | FY 12/ 18 |

ROE(%) | 26.4 | 23.3 | 20.5 | -51.6 | 14.6 | 10.5 | 33.3 |

Net income margin(%) | 10.40 | 9.80 | 9.04 | -13.99 | 2.22 | 1.63 | 5.70 |

Total asset turnover | 2.26 | 1.16 | 1.10 | 1.34 | 1.56 | 1.46 | 1.43 |

Leverage [times] | 2.09 | 2.04 | 2.05 | 2.74 | 4.20 | 4.45 | 4.08 |

In the term ended December 2018, ROE also increased due to a significant improvement in margin.

The estimated net income margin for the term ended December 2018 is 7.4%. Its basic ROE is estimated to be at a high level.

【1-6 Shareholder return】

The target payout ratio is 50% or more. The company has a basic policy to stably and appropriately return profits to shareholders while improving profitability and strengthening the financial structure.

2.First Half of Fiscal Year ending December 2019 Earnings Results

(1)Consolidated Business Results

| 2Q of FY 12/18 | Ratio to sales | 2Q of FY 12/19 | Ratio to sales | YoY |

Sales | 4,015 | 100.0% | 4,419 | 100.0% | +10.1% |

Gross profit | 2,442 | 60.8% | 2,627 | 59.4% | +7.6% |

SG&A | 2,153 | 53.6% | 2,121 | 48.0% | -1.5% |

Operating Income | 288 | 7.2% | 506 | 11.5% | +75.5% |

Ordinary Income | 306 | 7.6% | 521 | 11.8% | +70.5% |

Quarterly Net Income | 269 | 6.7% | 401 | 9.1% | +48.8% |

* Unit:million yen

*2Q of FY 12/18 is unconsolidated. YoY is the reference value.

Sales and profits increase, reaching record highs.

Sales were 4.4 billion yen, up 10.1% year on year. All the three business segments saw a rise in their sales.

Operating income was 506 million yen, up 75.5% year on year. Sales grew, and SG&A expenses declined 1.5% year on year due to the decreased promotion costs of the Handmade business.

Both sales and profit marked record highs.

Quarterly Trends

| FY 12/17 | FY 12/18 | FY 12/19 | |||||||||

1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | 1Q | 2Q | 3Q | 4Q | |

Sales | 1,805 | 1,863 | 1,816 | 1,880 | 1,897 | 2,117 | 2,073 | 2,111 | 2,185 | 2,234 | - | - |

Operating Income | 117 | -26 | 131 | -79 | 151 | 136 | 109 | 69 | 300 | 205 | - | - |

* Unit:million yen

*Consolidated from 1Q FY12 / 19.

(2) Trends of each segment

| 2Q of FY 12/18 | Ratio to sales | 2Q of FY 12/19 | Ratio to sales | YoY |

Sales |

|

|

|

|

|

Hosting | 2,190 | 54.5% | 2,271 | 51.4% | +3.7% |

EC support | 941 | 23.5% | 1,183 | 26.8% | +25.6% |

Handmade | 793 | 19.8% | 836 | 18.9% | +5.4% |

Others | 89 | 2.2% | 128 | 2.9% | +44.0% |

Total | 4,015 | 100.0% | 4,419 | 100.0% | +10.1% |

Operating Income |

|

|

|

|

|

Hosting | 720 | 32.9% | 698 | 30.7% | -3.1% |

EC support | 427 | 45.4% | 452 | 38.2% | +5.7% |

Handmade | -336 | - | 60 | 7.3% | - |

Others | 17 | 19.6% | -14 | - | - |

Adjustment | -541 | - | -690 | - | - |

Total | 288 | 7.2% | 506 | 11.5% | +75.5% |

* Unit:million yen

*2Q of FY 12/ 18 is unconsolidated. YoY comparison is a reference value. The composition ratio of operating income means profit rate on sales.

① Hosting

Sales rose, but profit declined due to the enhancement of promotion.

The number of subscriptions to the rental server service decreased by 1,469 from the end of the same period last year to 438,271, but increased by 1,995 from the end of December 2018 due to enhanced promotion of the “Lolipop!”. The customer unit price rose 5.2% from the same period last year to 366 yen as a result of the enhanced promotion of the superior plans and option function.

However, the growth of the number of subscriptions slowed down in the second quarter (April-June) in comparison to the first quarter (January-March) due to the increase in cancellation. The company will implement the new measures based on the cause analysis in September.

As for “Muu Domain”, the number of registered domains dropped 13,710 from the end of the same period last year to 1,229,674 due to the low renewal rate of the domains acquired during the discount campaign of the new domains conducted in 2018.

② EC support

Sales increased and profit grew.

As for “Color Me Shop”, the number of subscriptions declined by 2,033 from the end of the same period last year to 42,175, but average spending per customer rose 10.1% year on year to 2,529 yen.

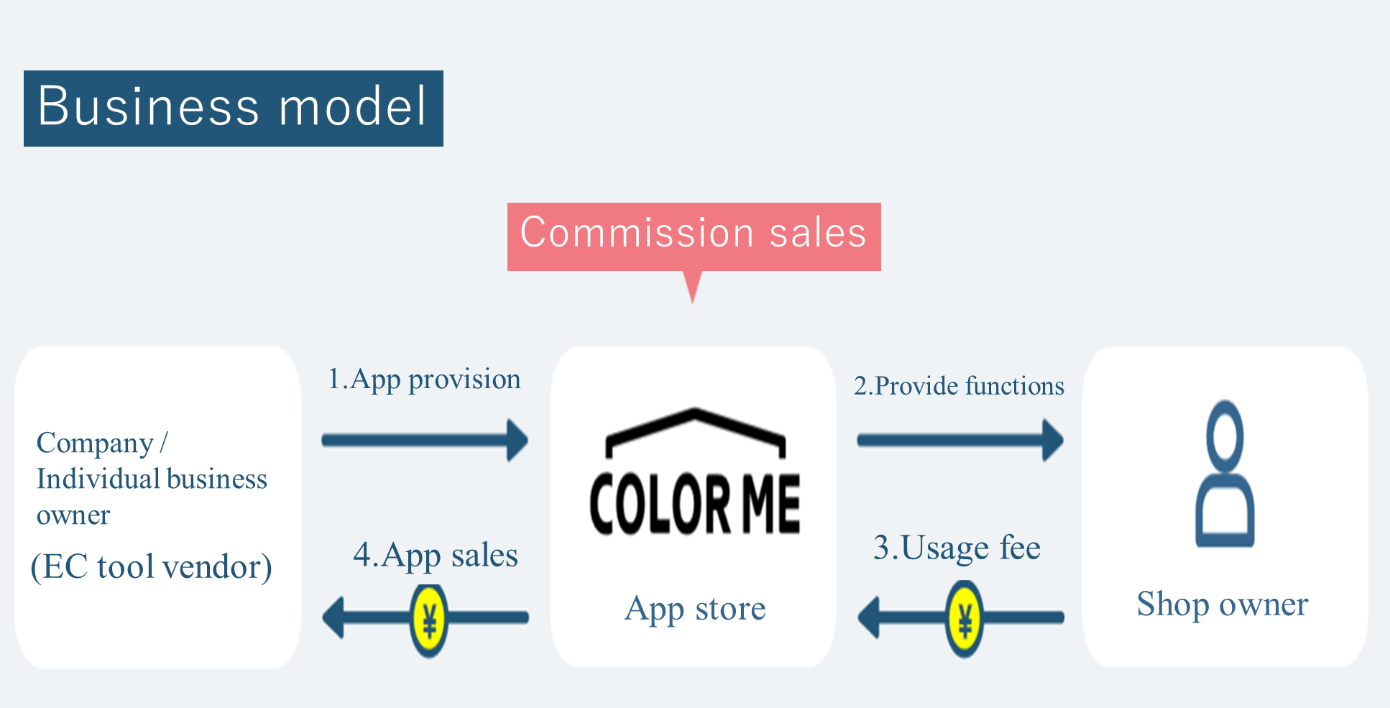

In May 2019, the company released “Color Me Shop App Store”, which offers systems or functions developed by third parties to shop owners. This is a platform where a third party (vendor) can provide applications supporting the running of shops by sales support or bringing efficiency in work to 40,000 shop owners using “Color Me Shop”.

In this business model, some parts of the income earned by vendors from shop owners are acquired as fee income, and the company aims to establish a one-shot revenue-type business with expansion of the “App Store”, in addition to a recurring revenue-type business based on the usual service charges of “Color Me Shop”.

As for the original goods production and sale service “SUZURI”, the T-shirt sale conducted in June 2019 succeeded and the monthly distribution amount exceeded 100 million yen, marking a record high. The number of members grew steadily, and the cumulative number of members reached 290,000.

③ Handmade

Sales grew, and income turned positive.

Based on the service infrastructure such as the number of authors, works, downloads, etc. built by the large-scale promotion that has been implemented since 2015, the company aims to create multiple layers of revenue. As for the segment income, the company reduced the promotion costs by 70.1% year on year to 137 million yen as it plans to make profit for the full fiscal year.

The distribution amount grew 3.7% year on year to 6.1 billion yen, the cumulative number of smartphone app downloads rose 12.6% year on year to 10.73 million and the number of artists and works augmented 21.8% each, year on year, to 540,000 and 9,980,000, respectively.

(3)Financial standing and cash flows

◎Main BS

| End of December 2018 | End of June 2019 |

| End of December 2018 | End of June 2019 |

Current Assets | 4,853 | 4,482 | Current liabilities | 4,294 | 4,239 |

Cash | 1,802 | 1,761 | Trade payables | 147 | 194 |

Trade receivables | 900 | 600 | Other accounts payables | 1,568 | 1,383 |

Securities | 1,886 | 1,866 | Advances received | 1,729 | 1,758 |

Noncurrent Assets | 1,224 | 1,404 | Total Liabilities | 4,370 | 4,272 |

Tangible Assets | 266 | 268 | Net Assets | 1,706 | 1,614 |

Intangible Assets | 335 | 448 | retained earnings | 1,457 | 1,581 |

Investment, Others | 622 | 688 | Total Liabilities and Net Assets | 6,077 | 5,887 |

Total assets | 6,077 | 5,887 | Capital Adequacy Ratio | 27.1% | 25.9% |

* Unit:million yen

*Unconsolidated at the end of December 2018. The increase or decrease in the text is the reference value.

Total assets declined 190 million yen from the end of the previous term to 5,887 million yen due to a decrease in deposits paid in subsidiaries and affiliates, and an increase in intangible assets.

Total liabilities dropped 98 million yen from the end of the previous term to 4,272 million yen.

Net assets decreased 92 million yen to 1,614 million yen. As a result, the equity ratio declined 1.2% from the end of the previous term to 25.9%.

◎Cash Flow

| 2Q of FY 12/18 | 2Q of FY 12/19 | Increase/decrease |

Operating Cash Flow | 144 | 396 | +251 |

Investing Cash Flow | -170 | -211 | -41 |

Free Cash Flow | -26 | 184 | +210 |

Financing Cash Flow | -65 | -525 | -459 |

Term End Cash and Equivalents | 2,299 | 2,361 | +62 |

* Unit:million yen

*FY12/18 is unconsolidated, and Consolidated financial results for the fiscal year ending December 2019.

*The increase or decrease in the text is the reference value.

The free CF turned positive and cash positions improved.

(4)Topics

◎ Status of the Factoring business

The status of a freelance factoring service “FREENANCE” handled by GMO Creators Network, Inc., which was reorganized into a subsidiary in February 2019, is as below.

*Sales in the second quarter (April-June) were up 72.8% from the first quarter (January-March). It is important to attract new customers as the purchase rate of repeat customers occupies approx. 80% of the total amount. The rate is on a downward trend with the increase of repeat customers.

*The company tied up with freee K.K., a company which provides “Cloud Accounting Software freee”, which enables a user to do account processing easily on the cloud without having any knowledge about accounting.

The company started offering a function that allows a user to apply for purchase using “FREENANCE” easily with an invoice he/she made using the accounting software “freee” through API integration in August 2019.

As the accounting software “freee” has many users including sole proprietors, freelancers and approx. 1 million offices, the company expects a synergetic effect.

Also, since freee K.K also provides services to improve cash flow for small businesses through a tie-up with a financial institution, the company will extend the support for users of “minne” and “FREENANCE” by providing freelancers opportunities to learn about tax and accounting by conducting seminars related to tax returns/taxes and distributing guidebooks.

The company plans to extend the partnership with the companies like freee K.K., to expand the number of users coming in from the partner company and raise the invoice purchase rate by offering favorable conditions to users.

◎ Entered into a comprehensive collaboration agreement with the Central Federation of Societies of Commerce and Industry

The company entered into a comprehensive collaboration agreement with the Central Federation of Societies of Commerce and Industry (CFSCIJ) on May 2019.

The CFSCIJ is a national organization with over 800,000 member companies, and it takes initiatives for the dissemination of management improvements and the development of regional commerce and industry for small and medium-sized enterprises and small-scale firms including its members. With the spread of the Internet, the member companies are increasingly utilizing IT for their business growth, for example, by creating a website to provide information about the business and products, and starting e-commerce (EC) transactions.

In addition, as it is a must for small and medium-sized enterprises and small-scale firms to make efforts in labor saving and bringing efficiency in operation with the help of internet in order to tackle the problem of labor shortage, the CFSCIJ has been receiving many requests from its members to “do business utilizing the Internet and not restricted by regional commerce and industry”.

In response to the above situation, the company and the CFSCIJ concluded a comprehensive collaboration agreement to support the growth of business and improvement in management efficiency using the Internet for the members.

Specifically, the company plans to “offer a special plan for a website creation service ‘Goope’ to the member companies”, “make a proposal for running an online shop using 'Color Me Shop’, an online shop development and creation service” and “make a proposal to support solving cash flow-related issues using a financial support service ‘FREENANCE’”.

3.Fiscal Year ending December 2019 Earnings Forecasts

(1) Full-year earnings forecast

| FY 12/18 | Ratio to sales | FY 12/19 Est. | Ratio to sales | YoY | Progress rate |

Sales | 8,200 | 100.0% | 9,200 | 100.0% | +12.2% | 48.0% |

Operating Income | 467 | 5.7% | 950 | 10.3% | +103.1% | 53.3% |

Ordinary Income | 524 | 6.4% | 962 | 10.5% | +83.6% | 54.3% |

Net Income | 467 | 5.7% | 684 | 7.4% | +46.5% | 58.6% |

*Unit:million yen

*The estimated values were announced by the company.

*Unconsolidated from FY12/18. and Consolidated financial results for the fiscal year ending December 2019.

Earnings forecast remains unchanged. Sales and profits increase, marking record highs for this fiscal year.

There is no change to the earnings forecast. Sales are estimated to be 9,200 million yen, up 12.2% year on year. Operating income is estimated to be 950 million yen, up 103.1% year on year.

Sales are estimated to grow for all segments. The Handmade business, for which promotion costs will decline, will turn profitable on a full year basis, resulting in a large increase in operating income.

Sales and profit will mark the record highs again for the current fiscal year.

The dividend forecast is 65.00 yen per share, and the expected dividend payout ratio is 50.1%.

(2)Trends by segment

| FY 12/18 | FY 12/19 Est. | YoY | Progress rate |

Sales |

|

|

|

|

Hosting | 4,418 | 4,596 | +4.0% | 49.4% |

EC support | 2,069 | 2,426 | +17.3% | 48.8% |

Handmade | 1,544 | 1,770 | +14.6% | 47.3% |

Operating Income |

|

|

|

|

Hosting | 1,415 | 1,300 | -8.1% | 53.7% |

EC support | 831 | 948 | +14.1% | 47.7% |

Handmade | -682 | 77 | - | 78.8% |

*Unit : million yen

*Unconsolidated from FY12 / 18. and Consolidated financial results for the fiscal year ending December 2019.

4.Growth Strategy – Promoting the development of platforms

(1) Outline

(Background)

While the way of performing one’s expressive activities has shifted to online with the rise and spread of the Internet, the environment around the expressive activities also changed greatly with the spread of smartphones and social networking sites, expanding one’s areas of activity.

Meanwhile, advancement in technology is giving rise to many new economic areas yielding income, such as influencer marketing and e-sports.

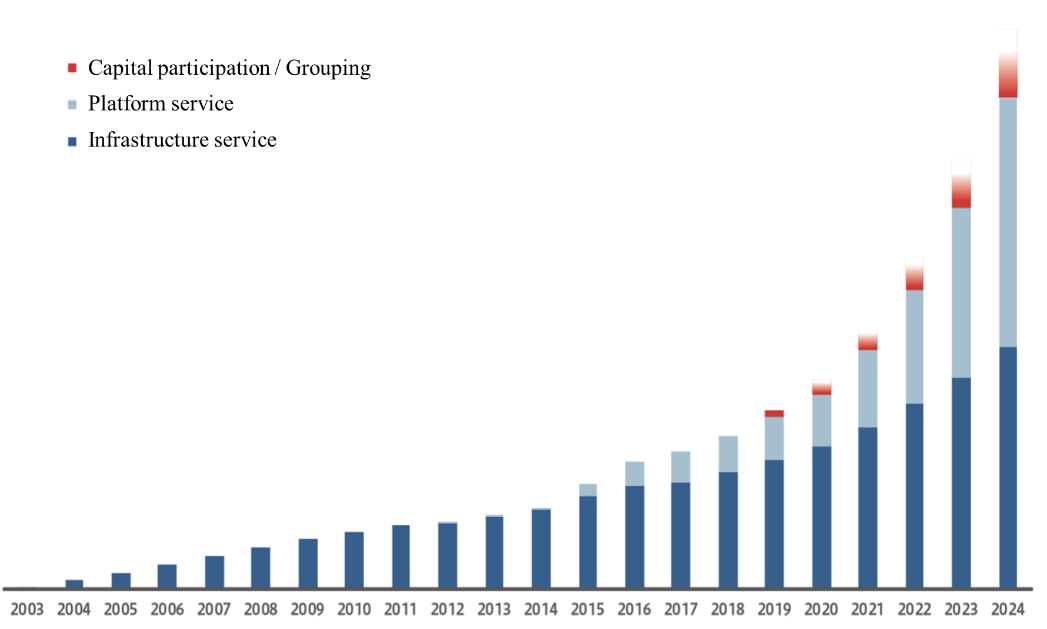

GMO Pepabo, which has expanded by providing multifaceted services starting from a rental server service “Lolipop!” under the mission “to connect and expand possibilities through the Internet”, provides a platform service connecting users in addition to an infrastructure service supporting online expressive activities, and it has been favored by people engaged in expressive activities online since its foundation in 2003. The number of expressors using the company’s services is the largest in Japan, exceeding 6 million as of the end of 2018.

(Vision)

The company has accumulated overwhelming achievements, and it aims to become the No.1 dominant company supporting expressive activities in the future, through the expansion of the fields of support, such as security, education and finance, in addition to “production”, where the company provides assistance in increasing the value of expressive activities and the amount of what one can make.

(2) Specific initiatives

The company will take efforts in “promoting the development of platforms”, in which it will pursue the possibilities of the Internet and expression in each service and create opportunities for everyone to play an active role to achieve the above vision.

① Color Me Shop

(Efforts)

The number of shops using “Color Me Shop” is approx. 40,000 and the total distribution amounts to 131.6 billion yen in 2018.

Along with the diversification of handling commodities, such as fashion-related, food and beverage and convenience goods, the company launched “Color Me App Store”, which is a platform to provide systems and functions developed by third parties to shop owners, in May 2019 to respond to various needs.

(Source: the company)

The major feature of this platform is that it grows and strengthens its functions on its own through the expansion of the numbers of shops and applications installed, utilizing the company’s advantage of possessing over 40,000 shops.

The number of installations of cross-border EC apps and order creation apps increased steadily, and the company will take efforts in growing the number of apps further.

Canadian EC shop creation service “Shopify App Store” is one of the examples of App Store succeeding overseas.

This service, which was launched in 2009, is used by 700,000 stores out of 800,000 active stores (87%), and the distribution amount and sales in 2018 were as high as 4.4 trillion yen and 115.8 billion yen, respectively.

② minne

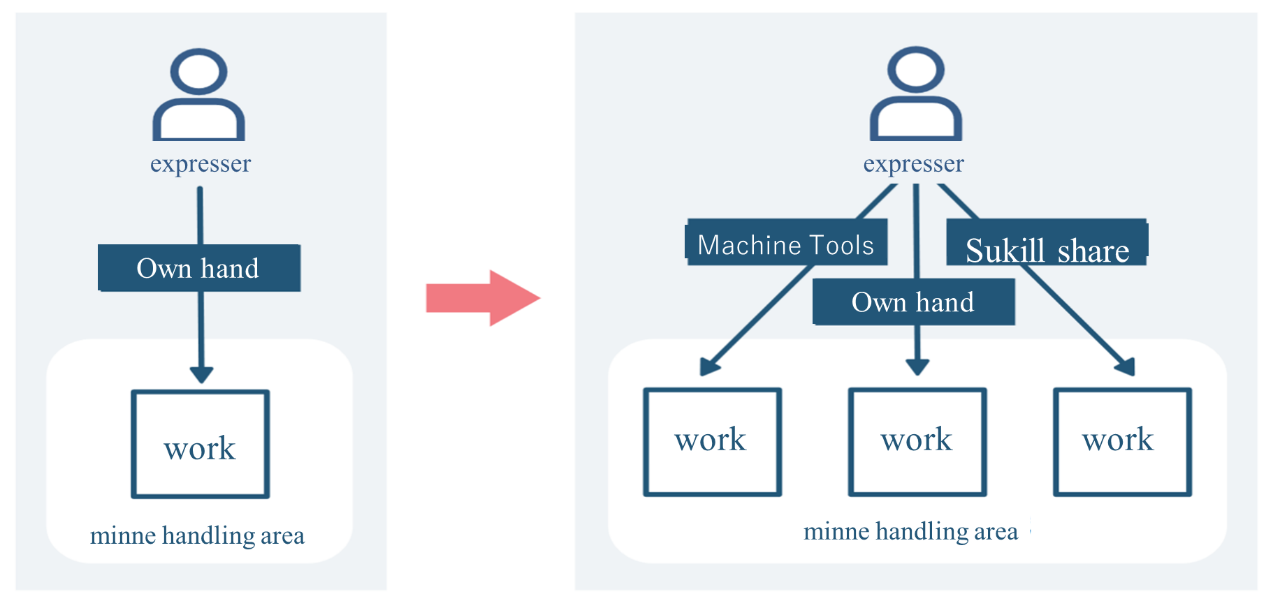

The company aims to evolve “minne” from “the CtoC handmade market” into “the integrated craftsmanship platform”.

(Transition of minne: expansion in each area)

Handmade craft, which was one of the expressive activities, and the company’s mission merged and gave rise to “minne”, a new platform. The recognition of handmade craft improved as the business grew, and the number of expressors (artists) at the end of December 2018 was as high as 500,000.

*Expansion of target areas

On the other hand, the environment surrounding craftsmanship changed greatly due to the innovation of creation methods, such as the rise of 3D printers, and the expansion of sharing economy, which further diversified the expressive activities. The target areas of “minne” are expanding as putting the works made by third parties for sale in addition to the usual handmade products became possible through the utilization of machine tools and sharing of skills.

(Source: the company)

*Expansion of the definition of “expressor”

While the word “expressor” has focused on “an individual” until now, “companies” are making expressive activities more active by developing the brands of Japanese traditional crafts and selling artworks of handicapped people, because of which the BtoC area is rapidly expanding in addition to CtoC area.

*Expansion of areas to express

Besides, the company made a business tie-up with Makers’ Co., Ltd. in July 2019, as it thinks that providing opportunities to expressors to take part in workshops and creating a new area of activity as “lecturer” to deliver the charm of craftsmanship to the participants is an important support for expressors.

Makers’, which was founded in 2013, runs “Makers’ Base”, the largest membership shared workshops in Japan, and also conducts workshops in Japan and overseas for sole proprietors (creators, etc.).

The company will create more opportunities for workshops where artists become lecturers through this tie-up. The company is also considering holding workshops jointly with Makers’ overseas to expand the areas of activity for individual artists.

(Vision for minne)

The company will proceed with “expansion of target areas” and “expansion of the definition of ‘expressor’”, and “expansion of areas to express”, and evolve “minne” from “the CtoC handmade market” into “the integrated craftsmanship platform”.

③ Other services

The company will evolve “Goope”, which is a SaaS, from website creation service into business support platform, and “SUZURI”, which is a market place, from an original goods creation and sales service into an activity support platform for expressors.

(3) Growth image

The company will promote the development of platforms based on the growth of the infrastructure service, and improve the growth rate through M&A, capital participation and consolidation.

(Source: the company)

5.Conclusions

Profit augmented largely as the e-commerce (EC) business was healthy and the promotion costs were reduced in the Handmade business. However, as for the Handmade business, as the distribution amount in the first half was 6.15 billion yen against the estimated annual distribution amount of 13 billion yen and the distribution amount in the second quarter (April to June) also fell short of the amount at the same period of the previous term, the company plans to strengthen the promotion while maintaining profitability in the second half. The progress rate of operating income has exceeded 50%, but the company aims to achieve the same result as estimated at the beginning of the term.

The company once again indicated its growth strategy as “promoting the development of platforms” and measures for it this time. While the platform volume cannot be simply compared with overseas cases such as “Shopify” and “Etsy” as they target English-speaking countries while the company targets Japanese-speaking countries, it is clear that there is room for significant growth for the company, which has an overwhelming track record in Japan.

The CAGR (compound annual growth rate) of the sales of the businesses excluding the Handmade business was 17% between 2005 and 2019. The annual growth rate of the Handmade business was 32% between 2015 and 2019. Based on the infrastructure services that have entered a stable growth period, we would like to pay attention to the medium-term perspective to see how far the company can increase their growth potential by promoting platform development centered on the handmade business.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory committee |

Directors | 12 directors, including 2 outside ones |

◎ Corporate Governance Report

Last update date: March 18, 2019

<Basic Policy>

Basic Policy

The company takes efforts in protecting a fair and impartial profit for stakeholders including shareholders and customers, and ensuring thorough compliance and strengthening corporate governance for continued improvement in corporate value.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

The Company has implemented all the basic principles of the Corporate Governance Code.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |