| INTERTRADE Co., Ltd. (3747) |

|

||||||||

Company |

INTERTRADE Co., Ltd. |

||

Code No. |

3747 |

||

Exchange |

Mothers Section, TSE |

||

Industry |

Information, Communications |

||

President |

Takahiro Ozaki |

||

HQ Address |

Tokyo, Chuo-ku, Shinkawa 1-17-21, Kayabacho First Building |

||

Year-end |

September |

||

URL |

|||

* Share price as of closing on November 22, 2013. Number of shares outstanding as of most recent quarter end, excluding treasury shares.

ROE and BPS are based on actual results of the previous term end. |

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. A 100 for 1 stock split was performed in April 2013.

|

|

| Key Points |

|

| Company Overview |

|

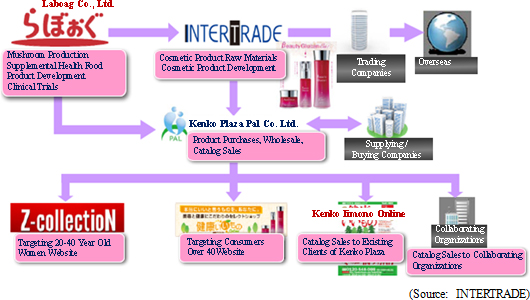

The INTERTRADE Group is comprised of five consolidated subsidiaries. The Group includes BSJ Co., Ltd. (66.7% ownership) which provides management solutions primarily through its package called "GROUP CATS." Laboag Co., Ltd., (100% ownership) manufactures and processes sparassis crispa and Kenko Plaza Pal Co. Ltd. (100% ownership) conducts sales of sparassis crispa related products over television shop channels and catalog sales. Z-Collection Co., Ltd. provides operations for websites targeting 20 year old cosmetic product customers, and TRADEX Co., Ltd. (100% ownership) conducts operations for proprietary fund management. <Corporate History>

INTERTRADE was established in January 1999 by the first President Kazuya Nishomoto, the current President Takahiro Ozaki and the former President Yukio Araki, all of whom worked at Nihon Kangyo Kakumaru Securities (Currently Mizuho Investors Securities Co., Ltd.). The three founding members, Kazuya Nishimoto, Takahiro Ozaki and Yukio Araki, leveraged experiences gained at Nihon Kangyou Kakumaru Securities working in systems, dealing, and sales to provide consulting services and to later expand into the development of packaged software for dealing and trading operations.INTERTRADE became a pioneer in the dealing system packaged software business with the start of sales of "TradeOffice-SX" packaged software system for securities company dealing operations in September 2000. The Company has recorded rapid earnings growth due to the popularity of its packaged software, which are sought after by various securities companies seeking to bolster the deterioration in their earnings resulting from the deregulation of commissions accompanying the elimination of the trading floor operations and floor traders at the Tokyo Stock Exchange (TSE) in end April 1999. In March 2003, INTERTRADE leveraged its network technologies to widen its service menu and began providing an "information distribution service" (Distribution of market information for the TSE and other major exchanges), and in September 2004 INTERTRADE listed on the Mothers Section of the TSE. Thereafter, the Company has achieved strong business results in the realm of back office systems for securities companies (Client information and account reserves management systems) and middle office systems (Risk management systems to measure risks of contract positions) as securities companies have grown to increasingly favor total comprehensive solutions. INTERTRADE fortified its packaged software lineup with the sales launch of the proprietary trading system "ITMonster" in January 2005, and the release of a foreign exchange margin trading system in August 2007. In April 2007, INTERTRADE acquired Bradea Co. Ltd., originally one of its competitors and the creator of a high performance and highly reliable trading system called "TIGER," as a consolidated subsidiary (Merged into INTERTADE in October 2008) to expand its share of the front office systems market. In August of 2008, a next generation securities dealing and trading system fusing the strengths of both INTERTRADE and Bradea called "TIGER Trading System" was released. From 2012 onwards, efforts to diversify the Company's overall business have been implemented with the management solutions development company BSJ Co., Ltd. being turned into a subsidiary in October 2012, and the change of the subsidiary INTERTRADE Asset Management Co., Ltd. into Laboag Co., Ltd. for the development of the healthcare business (Previously known as the food service business). With the goal of securing sales channels for the healthcare business in 2013, Pal Co., Ltd. (Currently known as Kenko Plaza Pal Co., Ltd.) was turned into a subsidiary to provide catalog sales in February, and Z-Collection Co., Ltd. was established in August to provide Internet sales. |

| Growth Strategy |

|

(1) Financial Solutions Business

Improvements in investor mentality and earnings of the securities firms are being seen on the back of the rise in the stock markets and increases in trading volumes. Therefore, an improvement in the difficult business conditions resulting from the securities companies' restraint in investments and withdrawal from dealing activities is anticipated. INTERTRADE will endeavor to cultivate new categories of customers by leveraging its strengths in high speed processing technologies while at the same time capturing business in the recovery in demand for existing service realms. While the image of the Company's strengths lying in "equities" dealing systems is strong, it also has a bountiful track record of providing various market side services including trading systems for the Doujima Rice Trading Exchange, exchange simulation systems leveraging ATS technologies (Alternative Trading System, an acronym used for proprietary trading system PTS), automated governance systems for foreign exchange margin trading operation companies, and the reporting systems for the Japan Securities Dealers Association (JSDA). Needless to say, these system applications require high speed processing capabilities and Investment Bridge believes that the delivery of the above systems are proof of INTERTRADE's ability to provide stable and high performance systems. Boundless Need for High Speed Processing

In 2010, the Tokyo Stock Exchange introduced the high speed trading system "Arrowhead", and implemented improvements that increased the processing speed by double in July 2013. The introduction of the "Arrowhead" system allows for order receipt reporting in less time than is required to blink an eye of 1 millisecond and distribution of share price and pricing indication information reporting in 2.5 milliseconds. The high processing speed of this new system allows for ultra-high speed automated trading known as high frequency trading (HFT) to take advantage of even small spreads in pricing using automated ordering function of computers which has become the main form of trading operations. Furthermore, the Tokyo Stock Exchange will begin offering "more detailed price quotes" on roughly 100 stocks from January 2014, and the implementation of this system is expected to lead to a rapid shift from "appropriate pricing" to "superior pricing" (Allows for quicker discovery of superior pricing) in the price discovery process.The value of PTS has already exceeded 7% of the total value of trading of all stock exchanges within Japan, and has reached nearly 20% when dark pool (Trade orders that are not submitted to the stock exchange and are processed within securities companies) is included. This represents a favorable trend for the formation of superior pricing on trades, and this trend of "more detailed price quotation" is expected to continue to grow stronger given the trends observed in overseas markets. Of course, this is not only true for the high speed needs of dealing systems. High speed processing is crucial for the selection of markets where optimum pricing is available to process trading orders in "smart order routing" (SOR), and competition over "pricing superiority" has already begun to appear in the realm of OTC trading of foreign exchange where there are no specific markets. Because there are no specific markets in OTC foreign exchange, SOR technologies allow for multiple counterparties (Banks and other financial institutions dealing in foreign exchange) to connect to form multiple pricing and are critical in the selection of the optimum pricing (rates). INTERTRADE's foreign exchange related systems are introduced in situations that require processing of large volumes of transactions that occur outside of markets (OTC) as mentioned above, and have received high regards from customers. Efforts to Capture Customer Needs for Top Class High Speed Processing Technologies

INTERTRADE boasts of strong familiarity with securities operations and has received high regard for its operational support from the start of the Company. Furthermore, Bradea Co. Ltd., which boasts of top class technologies in high speed processing, was turned into a subsidiary in April 2007 (Absorbed in October 2008) and its high speed processing technologies were further improved. Based on this "high speed processing capability", the Company will cultivate demand in a wide range of various customers, asset classes and currencies.As part of this strategy, the first (Securities systems) and second (Trading, foreign exchange margin trading systems) business divisions were merged in October 2013 to become the new financial solutions business. The knowhow and technologies cultivated in both of these divisions have been consolidated to strengthen relationships with existing customers and to cultivate new customers. BtoC front and middle office operating system development is being conducted as an "effort to broaden the breadth of the customer base" with an eye to cultivating new customers, including buy side business applications. INTERTRADE is also conducting efforts to develop new consolidated platforms that include the functions of PTS connectivity, SOR, automated execution, algorithm, and system trade functions. The consolidation of system architecture and operations not only leads to improvements in usability and functionality, but also offers merits to customers in terms of system costs. (2) IT Solutions Business

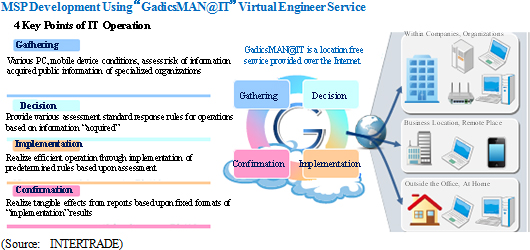

The IT solutions business of INTERTRADE provides the group management system for medium sized companies called "GroupMAN@IT" (GMAN) and IT operation management system called "GadicsMAN`IT" (Gadics), which will be used to cultivate new customers. The consolidated subsidiary BSJ Co., Ltd. will continue to cultivate development demand from large corporations and strengthening relationships with existing clients by focusing upon the group management system "GROUP CATS."

Group Management Solution Using "GMAN"

"GMAN" is a group management system that targets medium sized corporations with multiple consolidated subsidiaries and sales of less than ¥50.0 billion, and is sold as an add on product (Product with system expansion functionality) for the consolidated ERP packaged system called "Dream21" sold by BSJ (Tokyo Stock Exchange Second Section, 9629), which boasts of a customer base of approximately 1,000 companies. "GROUP CATS" group management system is also sold by the consolidated subsidiary BSJ and targets large sized companies with sales of about ¥100.0 billion. This is a large scale system that enables a short implementation time for "GMAN" for negotiations and development. The system can be implemented within one day if no customization work required. In addition, because various management benchmarks can be presented visually, this system is a very effective management tool.The partnership with PCA Corporation formed for the sales of "Dream21" will be strengthened. In addition to creation of responses for the impending hike in consumption tax, replacement demand for Windows XP equipped personal computers along with the termination of support by Microsoft from spring 2014 and other factors are expected to contribute to favorable trends for not only existing users of "Dream21" but also for new users considering "Dream21" as a replacement for their existing system. INTERTRADE will target implementations at 20 companies in fiscal year September 2014. IT Operation Management Solution Using "Gadics"

At the same time, "Gadics" is a support service for IT operation management that offers not only "functionality" but also provides "virtual engineering" at a low cost. This system utilizes IT automation technologies to provide "cloud service" support in the four realms of IT operation management of "gathering," "decision," "implementation," and "confirmation." In examples of operating systems and security software, this system allows for surveillance of updates and responds by gaining the permission of administrators to automatically perform updates. In addition, the introduction of "Gadics" allows for automatic responses to the issue of data and setting information transfer arising from the replacement of personal computers accompanying the termination of support for Windows XP applications from spring 2014. Because IT service companies are providing similar services manually, the introduction of "Gadics" can lead to a large reduction in costs. INTERTRADE successfully recorded orders for 600 units during the first year in fiscal year September 2013, and it has targeted orders of between 2,000 to 3,000 units in fiscal year September 2014.

BSJ Seeks to Establish Specialized Knowhow and Technology in "GROUP CATS"

As explained previously, the consolidated subsidiary BSJ is expected to cultivate additional demand for development work from existing large customers for its group management system "GROUP CATS". On the back of lessons learned from the unprofitable projects booked during fiscal year September 2013, the system engineering services (SES) structure will be fortified to reduce risks while accumulating knowhow and technologies related to customization.

(3) Healthcare Business

Efforts of the healthcare business will be focused upon sparassis crispa related products (Supplements and cosmetic products) that offer high profitability and for which there is strong demand. Currently, catalog sales of a wide range of products including health foods and cosmetic products, and preparations for web based sales channels are being promoted. The Doctors' Supplement brand is being promoted along with preparations for exports of raw materials for cosmetic products.

What is Sparassis Crispa?

Sparassis crispa belongs to the family of large white edible mushrooms. This mushroom has attracted widespread attention in Europe and North America because it contains large amounts of β1.3D beta glucans. The consolidated subsidiary Laboag Co., Ltd. manufactures high quality sparassis crispa in Minobucho, Komagun in Yamanashi Prefecture, and has successfully extracted high purity β1.3D glucans.Glucan is a type of polysaccharide, with different molecular chains being represented in α and β formats, with the main chains, molecular structure and combinations being the main differentiating factors. However, the 1.3D combination of β1.3D glucan has been confirmed to be the variant with the highest functionality and boast of the most research and dissertations. β1.3D glucan is found in various types of mushrooms, and bread and black yeasts. In mushroom forms, sparassis crispa has been found to contain the largest quantities of β1.3D glucans equal to triple the amount found in agaricus.  The flavor and nutritional value of sparassis crispa declines in the event it is over abundant at the time when spores begin forming. Therefore, the growth conditions must be constantly monitored in order to find the appropriate time for cultivation, and the timing and conditions of the cultivation become the knowhow of the Company.

(Source: INTERTRADE Website) Doctors Studying the Effectiveness of β1.3D Glucan

With regards to the effect of β1.3D glucan, clinical trials (In compliance with Ministry regulations governing clinical trials of medical products) for type 2 diabetes and type 1 allergies (Atopy and others) treatments are being conducted, with completion of clinical tests upon patients in finished in September 2013. During December, results of the clinical trials are expected to be announced, with an announcement also expected to be made at an academic conference to be held in March 2014. If the effectiveness can be confirmed in clinical tests, doctors can provide the product as prescribed supplements in addition to providing advice on nutrition and foods, and will give it a much stronger product appeal than the certified health foods. Health related industries have been identified as a key part of the new Abe Administration's growth strategy, and the Administration is expected to take aggressive steps toward deregulation of the health food industry (Product effectiveness labeling is expected to be relaxed to similar levels as the United States). Because clinical trials being conducted by INTERTRADE are expected to become the subject of potential deregulation, realization of deregulation will act as a tailwind for the Company.

Preparations for Web Based Sales Channel

The two subsidiaries Kenko Plaza Pal Co. Ltd., which sells over 1,000 products including health foods to approximately 20,000 individual customers over the course of one year, and Z-Collection Co., Ltd., which operates the beauty product sales site "Z-collectioN" catering to younger consumers, will be responsible for sales. Kenko Plaza Pal Co. Ltd. has received high regard for its specialization in health foods that use natural ingredients and its sales website "Kenko Iimono Online" (Previously known as "Maido Net"), which caters to consumers ranging from the 30s to senior citizens, was launched in June 2013. In addition, INTERTRADE is also promoting efforts to develop B2B2C sales channels.

Kenko Iimono Online:

Z-collectioN: Cosmetic Products, Raw Materials for Cosmetic Products Provided Externally

The cosmetics business is being promoted by leveraging essences extracted from sparassis crispa (Containing high levels ofβ1.3D glucans) for sales as cosmetic products within Japan and raw materials used in cosmetic products outside of Japan. The high molecular structure of β glucans has been found to have similar moisture retaining properties as hyaluronic acid, but it boasts of even better texture qualities of being less sticky. INTERTRADE will conduct efforts to launch sales within fiscal year September 2014, and safety and efficacy testing are currently being conducted. Because there are no other cosmetic products that use essences extracted from sparassis crispa, the Company must promote the superior moisture retaining functionality of the product to increase its recognition amongst consumers. Therefore, INTERTRADE is expected to promote aggressive advertising activities during fiscal year September 2014. At the same time, research and development is being conducted at three facilities in the Asia region where trading firms are expected to begin selling products after the start of 2014. The beauty effect of sparassis crispa has been confirmed, and the function process is expected to be jointly researched by specialized institutions.

Promote Improvements in Productivity

Reviews of the production process for sparassis crispa are being conducted to reduce materials costs. Stability of sparassis crispa at the start of production was prioritized, at the expense of costs. But given that production has been stabilized, the Company is now focused upon reducing production costs. Cost reductions will be promoted along with efforts to develop and sell unique and high value added products.

Location:

Ono 952-1, Minobucho, Minami Komagun, Yamanashi Prefecture Size: Roughly 1,700 square meters (Source: INTERTRADE) Roles of Group Companies in the Healthcare Business

|

| Fiscal Year September 2013 Earnings Results |

Sales Decline 3.0% Year-Over-Year, Operating Loss of ¥98 Million (Loss of ¥129 Million in Previous Term)

Sales declined by 3.0% year-over-year to ¥2.725 billion. While sales of the financial solutions business segment fell due to the conclusion of contracts at the end of the previous term, the contribution from new businesses of IT solutions and healthcare started during the previous term allowed overall sales to remain basically in line with the previous term.Looking at the three divisions of the introduction of new systems and restructuring accompanying development related work, delivered system maintenance booked every month (Flow based sales), and healthcare related business sales, sales of initial portions of foreign exchange related products rose by 24.0% year-over-year in to ¥645 million (23.7% of overall sales), with flow based sales declining by 13.3% year-over-year to ¥1.983 billion (72.8% of total sales) due to the completion of contracts. At the same time, the contribution from M&A contributed to an increase in healthcare related sales to ¥97 million (3.6% of total sales) from ¥2 million in the previous term. With regards to profits, IT solutions business and the healthcare business saw operating losses of over ¥300 million (Compared with operating loss of ¥71 million during FY9/12). At the same time, declines in amortization of goodwill (Amortization completed in first half of FY9/12) and improvements in profitability of the financial solutions business due to optimization of management resources contributed to a contraction in the loss to ¥129 million in the previous term to ¥98 million in the current term. While operating losses were incurred, a net cash inflow of ¥42 million was recorded in operating activities. A net cash inflow of ¥210 was recorded in free cash flow due to the repayment of time deposits.  Financial Solutions Business (Changed from the Securities Solutions Business in FY9/13)

Sales declined by 13.2% year-over-year to ¥2,419 million and operating profit rose by 66.5% year-over-year to ¥564 million. The increase in sales arising from repeat orders for system integration (SI) for foreign exchange margin trading systems could not offset declines in sales of securities dealing systems (Customized support sales) and transactions systems (Packaged sales). In addition to the completion of securities dealing system contracts, declines in pricing arising from a switch to ASP services was a major factor in the lower sales (Costs also decline along with the switch to ASP service model). At the same time, exchange related systems have been sold to a number of strong clients and are operating stably, but the rebound from the introduction of a new system at the Osaka Dojima Commodities Exchange contributed to a decline in sales.

IT Solutions Business

Sales rose by ¥209 million from ¥16 million in the previous term and operating loss expanded to ¥131 million from ¥31 million over the same period. The business performance of the consolidated subsidiary BSJ suffered from problems in the customization work for the group management system "GROUP CATS". Subsequent increases in costs above expectations and thinly stretched management resources negatively affected orders and development work. At the same time, development work for the medium sized company management system "GroupMAN@IT" and IT operation management service "GadicsMAN@IT" were completed and sales were launched. However, anticipatory costs of these services booked in fiscal year September 2013 were left uncovered because full scale contribution from sales of these systems is expected to begin being seen from fiscal year September 2014.

Healthcare Business

Sales rose from ¥2 million in the previous term to ¥97 million in the current term, and operating losses expanded from ¥40 million to ¥186 million over the same period. Sales rose by a large margin due to the securing of a sales channel through the acquisition of Pal Co., Ltd. to become the subsidiary Kenko Plaza Pal Co. Ltd. in February 2013. However, research and development expenses for clinical trials conducted by Laboag Co., Ltd. and expenses associated with sales promotion by Pal led to increases in anticipatory investments and contributed to an expansion in the loss. Kenko Plaza Pal Co. Ltd. sold over 1,000 products including primarily health foods though catalog sales to approximately 20,000 individual customers during fiscal year march 2012. In addition, the sales website "Z-collectioN" was purchased from S-Line Co., Ltd. (Chiba City, Chiba Prefecture) in September 2013, and the sales function was transferred from Laboag Co., Ltd. to Kenko Plaza Pal Co. Ltd. allowing Laboag to concentrate its efforts upon manufacturing and processing. Z-Collection Co., Ltd. was established as a 100% owned subsidiary for the operation of the "Z-collectioN" website. Other Business

The retreat from the asset management business, which was booked as asset management and proprietary fund management earnings, in the previous term led to a large decline in the proprietary fund management business. Currently the proprietary fund management business is undertaken primarily to validate development of trading systems in the securities solutions business, and no sales were booked during fiscal year September 2013.

|

| Fiscal Year September 2014 Earnings Estimates |

INTERTRADE Expects Sales to Rise 10.1%, Operating Profit of ¥205 Million

INTERTRADE earnings estimates call for sales to rise by 10.1% year-over-year to ¥3.0 billion. Outstanding orders for initial sales work at the term start amounted to ¥1.939 billion (¥1.913 billion in financial solutions and ¥26 million in IT solutions), and represent 64.7% of full year sales estimates. Initial sales (¥645 million in FY9/13) and healthcare sales (¥97 million in FY9/13) are expected to grow to account for the remaining amount of ¥1.061 billion.By business segment, INTERTRADE has established targets of acquiring 10 new customers by capturing the strong demand for high speed systems in the financial solutions business, and in the IT solutions business 20 new customers have been targeted to implement "GroupMAN@IT" and 3,000 units of operation of "GadicsMAN@IT." In addition, efforts will be promoted to facilitate sales channels over the Internet to double the number of active customers, and to launch sales of cosmetic products using β glucan both within and outside of Japan. With regards to profits, development of an integrated platform will begin in the financial solutions business, but the disappearance of unprofitable projects in the IT solutions business and improvements in profitability of the healthcare business are expected to allow INTERTRADE to see a recovery to profits at the operating level. On the back of the anticipated recovery in earnings, INTETRADE is expected to reinstate dividend payments, with expectations of a ¥3 per share payment term end dividend.. (2) Business Segment Strategies

Financial Solutions Business

The realm of services provided is being expanded from primarily "equities" to include "bonds", "interest rates", "foreign exchange" and "commodities" on the back of efforts to capture widespread demand for high speed systems. In addition to providing a wide range of business opportunities ranging from multi asset, multi currency, individual investor users, and interfaces, measures will be taken to develop integrated platforms that contribute to fortification of the Company's competitive strength (Architecture system operation integration that realizes high levels of cost effectiveness).In the realm of trading technologies, INTERTRADE has formed a collaborative agreement with TORA Trading Services (United States), a globally recognized system vendor that develops and provides electronic transaction systems. TORA electronic transaction systems are designed for a wide range of other products including cash equities, equity futures, options, convertible bonds, warrant bonds, swaps and other products. The first point of the collaboration with TORA will be measures to expand the volume of information of the "TIGER Trading System" and the second point will be integration of both companies' technological expertise in SOR and algorithms to realize reductions in execution costs and the ability to handle large transaction volumes. In addition to increasing the volume of information, a transaction system that is able to process this information at high speeds will be developed to capture the growing needs of PTS and dark pool applications within the Japanese financial markets. Dark pool refers to orders collected that allow securities companies to avoid having to go through the Tokyo Stock Exchange and to form transaction contracts via PTS internally. SOR is a system where information is gathered from multiple markets allowing for the execution of orders in markets that provide the optimal conditions (Contract price, lot, and other factors). Algorithms are programs that allow computers to automatically calculate and execute orders matching the optimized conditions to maximize profits. In addition, "TIGER Trading System", which boasts of a strong track record in proprietary trading divisions of securities companies, will begin being provided to proprietary trading firms. "TIGER Trading System" can be customized for buy-side applications to provide dealing terminals, and is expected to be a driving force behind the Company's efforts to capture 10 new customers in fiscal year September 2014. Proprietary trading firms are investment companies that specialize in high frequency trading using their own capital. IT Solutions Business

The "GROUP CATS" group management system undertaken by the consolidated subsidiary BSJ accounts for over half of sales of the IT solution business, but problems in some projects contributed to issues with profitability. At the same time, near term demand for additional development from users remains strong, and the potential for continued growth is high. Therefore, INTERTRADE has implemented changes in the contract format designed to ensure that their work is adequately covered and that prices are strengthened to secure profitability.At the same time, INTERTRADE will leverage its Group's knowhow in group management solutions acquired through the "GroupMAN@IT" group management systems sold to medium sized companies in the IT solutions business and its partnership with PCA Corporation to achieve new implementations at 20 companies during fiscal year September 2014. In addition, the Company will seek to achieve 3,000 units of "GadicsMAN@IT" in operation during fiscal year September 2014 (Orders for 600 units booked during FY9/13), including the booking of orders for between 2,000 to 3,000 units during fiscal year September 2014. Moreover, engineer dispatch is also conducted in addition to the packaged systems mentioned above and has become a key element in the foundation of the IT solutions earnings. Healthcare Business

Strengthen Sales Channels

Efforts to conduct more effective marketing and renewal of the sales websites (Renewed sites have been launched from November 22, 2013) designed to improve usability targeting the some 150,000 registered members of Kenko Plaza Pal Co. Ltd. and Z-Collection Co., Ltd. will be undertaken. Moreover, the frequency of catalog mailings will be increased along with reviews of operating hours.INTETRADE is considering forming partnerships with corporations that have large numbers of members and has formed a collaborative arrangement with Nanoha Senior Support on November 8. Nanoha Senior Support is a public interest incorporated foundation that boasts of 125,331 members as of September 2013 and provides its members monthly informational services called "Smile Partner" business service. INTERTRADE will begin providing its sparassis crispa related products and other healthcare products to the registered members through the "Smile Partner" service of Nanoha Senior Support. Fortification of Promotions for Sparassis Crispa Products

INTERTRADE expects to conduct effective promotions based upon the pending results of human clinical tests for its health products using the base iingredient "LB-Scr" extracted from the essence of sparassis crispa by Laboag Co., Ltd. Moreover, development and promotion of new products based upon β1.3D will be implemented on the back of successful extraction of highly pure levels of β1.3D glucan from sparassis crispa. The first product is expected to be raw materials for use in cosmetics exported to overseas markets in Asia and cosmetic products within Japan.

|

| Conclusions |

|

Another important factor will be INTERTRADE's ability to achieve its sales and profit estimates during the second half of fiscal year September 2014. In addition, anticipatory investments are expected to continue during the first half and may contribute to volatility in earnings in both the first half and full year. However, the achievement of second half earnings estimates can be viewed as a positive sign that the Company's strategy is successful and as an indication that potential for positive surprises in earnings during fiscal year September 2015 exists. Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2014 Investment Bridge Co., Ltd. All Rights Reserved. |