| INTERTRADE Co., Ltd. (3747) |

|

||||||||

Company |

INTERTRADE Co., Ltd. |

||

Code No. |

3747 |

||

Exchange |

TSE, Second Section |

||

Industry |

Information, Communications |

||

President |

Takahiro Ozaki |

||

HQ Address |

Kayabacho First Building, 1-17-21 Shinkawa, Chuo-ku, Tokyo |

||

Year End |

September |

||

URL |

|||

* Share price as of closing on December 12, 2016. Number of shares outstanding as of most recent quarter end, excluding treasury shares. ROE and BPS are the values for the previous term.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. From the fiscal year ended September 2016, the definition for net profit has been changed to net profit attributable to parent company shareholders (Abbreviated as parent net profit).

|

| Key Points |

|

| Company Overview |

|

The INTERTRADE Group consists of the Company itself and its four consolidated subsidiaries: 1) BSJ Co., Ltd. (66.7% ownership) which develops and maintains business management packaged software called "GroupMAN@IT e2", 2) Laboag Co., Ltd., (100% ownership) which manufactures and processes sparassis crispa, 3) Kenko Plaza Pal Co. Ltd. (100% ownership), which works on sales of sparassis crispa related products via Internet/catalog mail order, and 4) TRADEX Co., Ltd. (100% ownership), which operates proprietary fund management. The Company started as a consulting company for front systems and expanded its business to sell packaged software for dealing/trading. In September 2000, it began sales of "Trade Office-SX", a packaged dealing system software for securities companies. At that time, the technology for e-trading was still under development, and there were only a handful of vendors that were specialized in the front systems for stock trading for financial instructions. Because of its affordable front system with excellent operability and functionality, "Trade Office-SX" was sought after by many security companies' equity department. The "Information distribution service" (distributing trade information of major stock exchanges such as Tokyo Stock Exchange), commenced in March 2003, grew steadily. In September 2004, the Company was listed on the Mothers Section of the Tokyo Stock Exchange. Its market share further increased by the sales of "TIGER Trading System", the successor of "Trade Office-SX" launched in August 2007. Aiming to offer comprehensive solutions for securities companies, the Company also achieved strong business results in the realm of back office systems for securities companies (Client information and account reserves management systems) and middle office systems (Risk management systems to measure risks of contract positions). In January 2005, it launched "ITMonster", the world's only auction-style private trading system (PTS). From 2012 onwards, the Company diversified its businesses. The management solutions development company BSJ Co., Ltd. was turned into a subsidiary in October 2012. In order to grow the healthcare business (previously known as the food service business), the company renamed and restructured its subsidiary INTERTRADE Asset Management Co., Ltd. to Laboag Co., Ltd. In 2013, Pal Co., Ltd. (Currently known as Kenko Plaza Pal Co., Ltd.) was turned into a subsidiary to secure sales channels for the healthcare business,  Financial Solutions Business

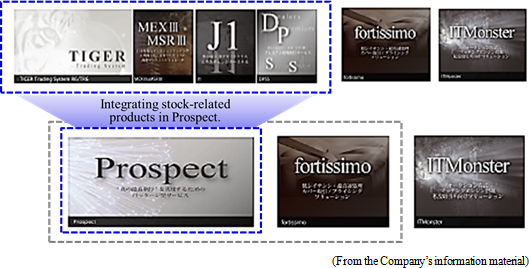

Under this business, efforts have been made to realize the MIOP concept, which was launched in 2010. The MIOP concept aims to achieve the "one stop" transactions of various financial products such as "stocks", "interest rates", "foreign exchange", "commodities" on a common platform called "Prospect". By utilizing the company's high speed processing servers and high capacity communication lines, the integration of the Company's products with "Prospect" will allow transactions at domestic stock exchanges or with proprietary trading systems (PTS). Furthermore, through business partnerships with major domestic/foreign securities companies and FX business operators, the integration will enable transactions with major foreign stock exchange and commodity exchange. In addition, with a highly refined algorithm, "Prospect" instantly selects the most favorable price and place orders, which minimizes the transaction costs. Furthermore, the Company is adding functions (added values) such as the big data organization and data analysis function by AI. With a view to expand the business, targeting major securities companies and hedge funds, the Company plans to expand its business targets. Business Solution Business

The business solution business provides general corporate services, and its three pillars are: 1) the Company's in-house packaged products including "GroupMAN@IT e2" (hereafter "e2") and "Gadics MAN@IT" (hereafter "Gadics"), 2) engineer dispatch service (SES) which mainly provides maintenance and operation, and integrated support service which is characterized by multi-vendors, multi-products and multi-businesses, and 3) support center services, which provide support for accounting system transition, operated by SuperStream Co., Ltd. Through these businesses, the Company is aiming at securing stable earnings. Consolidated subsidiary, BSJ Co., Ltd. is working on development and maintenance of "e2".

Integrated business management platform "GroupMAN@IT e2" (hereafter "e2")

The "e2" integrated business management platform can manage any types of operating systems in an integrated manner. In addition to this multi-vender compatibility, it also offers "virtual business planning" function, in which business grasp to business forecast can be undertaken at a go. With these unique features, there is no competitive product in the market. The potential clients are about 200,000 companies with annual sales of over 500 million yen across the country (among which, the business partners with friendly partnerships are over 40,000). Companies often use multiple operational systems for accounting, human resources, payroll, facilities, and materials, and, in many instances, each system is sold by different vendors. Furthermore, parent company and subsidiaries often use different systems for similar tasks, which is making it difficult to control management information (business analysis of the entire group via data sharing of each system) within a company or corporate group in an integrated manner. This is why many companies invest a great amount in constructing a separate system for coordination (major system companies are very negative about connecting their system with other companies' systems). However, with "e2", it is possible to connect various data of different vendors or systems because of its "FLEX I/O", a highly flexible interface (The Company's "FLEX I/O" technology uses the protocol "FIX" technology that is designed to exchange securities trade information). IT asset management tool, Gadics MAN@IT (hereafter, "Gadics")

"Gadics" targets medium to small scale companies and the range of potential targets is large. Only in Japan, the number of potential targets exceeds 4,500. The Company is a pioneer of this type of products in Japan, and there is currently no competitor. "Gadics" is not offered as a function. Instead, as a "virtual engineer", it supports management of personal computers, etc. at low cost on a cloud basis from four aspects, namely, "collection", "decision making", "implementation" and "confirmation." Following the introduction of "My Number" system (a Social Security and Tax Number System) in 2016, "Gadics" can also be used as a technological security measure to protect "My Number" information.

Healthcare Business

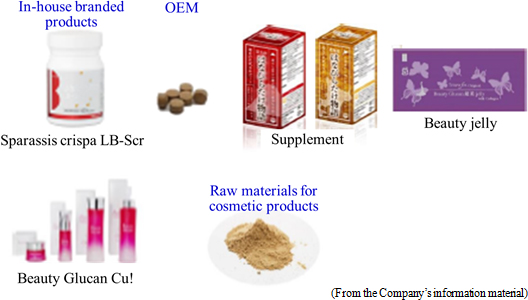

The health care business includes cultivation of sparassis crispa and sales of sparassis crispa related in-house branded products (i.e. supplement, health food products, cosmetic products), OEM supply and sales of cosmetic product raw materials using ingredients originated from sparassis crispa within Japan and overseas. INTERTRADE manages the overall healthcare business including marketing. Laboag Co., Ltd. manufactures and processes sparassis crispa, and Kenko Plaza Pal Co. Ltd. works on sales of sparassis crispa related products via Internet/catalog mail order. Furthermore, the Company is currently trying to acquire scientific evidence for immune-stimulating function of sparassis crispa through joint research with academia (to be described later in this report).

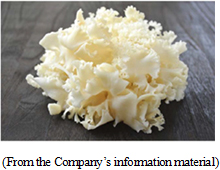

Sparassis crispa

Sparassis crispa grows in Japan, Europe and Americas. In the natural environment, edible mushroom typically does not grow. It grows in coniferous forests at a level of 1,000 meters. Because it is very rare to see naturally grown sparassis crispa, it is called "rare mushroom". It has over 35% of β-gulcan contents, which play a particularly important role to maintain good health. It is also rich in various useful components such as amino acids and trehalose. Many mushroom is in brown, but sparassis crispa is in beautiful white to pale yellow, as if a white flower is gently blooming. It can be edible.

IT Sparassis Crispa Project (Joint Research conducted by National Institute of Advanced Industrial Science and Technology (AIST) and Tokyo Women's Medical University (TWMU))

In cooperation with TWMU and AIST, as part of the industry-academia-government collaborative research, the "IT Sparassis Crispa Project" is being promoted to search for the active ingredient of sparassis crispa at the cellular and molecular level to discover the mechanism that makes this ingredient effective. For this joint research, TWMU takes charge of clinical trials to assess safety and functionality using research materials, AIST shares the role of search and component analysis on the cellular and genetic level using gene chips, and the INTERTRADE Group is responsible for commercialization of sparassis crispa as well as data collection and analysis. Collaboratively, 3 agents are making efforts to prove the hypothesis and obtain an international patent together. The research includes (a) safety tests of sparassis crispa extract, (b) activity test of sparassis crispa extract, (c) molecular analysis of sparassis crispa, (d) exploration of effective components of sparassis crispa, and (e) genome analysis of sparassis crispa. From the clinical trials in humans, the effectiveness of "LB-Scr", a sparassis crispa-derived component, for type-II diabetes, allergy, and liver function indicators (γ-GTP, GOT, GPT) is already confirmed. Furthermore, from validation of adverse events, it is already confirmed that sparassis crispa is safe and causes no side effects.  |

| Fiscal Year September 2016 Earnings Results |

Sales declined by 4.1% YoY, but operating loss turned to profit (-¥165 million →¥11 million)

Overall sales declined by 4.1% YoY to ¥2,358 million. While sales of the healthcare business increased by 30.0% YoY, contributed by favorable OEM and sales of sparassis crispa related products, sales of the financial solutions business decreased by 4.4% YoY due to the delay in development of new products. Sales of the business solution business also decreased by 24.9% YoY as a reaction to increasing sales in the previous term by a large-scale project. As for operating loss/profit, operating loss of 165 million yen turned to operating profit of 11 million yen. Sales cost declined by 8.2% YoY due to a decrease in subcontracting cost and human resource cost contributed by in-house development of systems and streamlining of businesses. SG&A expenses also decreased by 14.3% YoY, mainly from the reduction in research and development cost (from 324 million yen to 189 million yen) and advertisement cost (from 59 million yen to 30 million yen). The Company reached the cost reduction goal of 10 million yen per month and successfully turned the operating profit to black. By segments, profit of the financial solutions business increased by 11.8% YoY as a result of improved profitability. Loss of the healthcare business also decreased by half as a result of reduction in advertisement cost and peaking out of research and development cost. Meanwhile, the business solution business posted a loss due to sales reduction. No dividend payment

The Company continues to pay no dividend as it prioritizes investment for future re-growth. It will "respond to the expectation of shareholders by improving the business performance". The Company considered profit return to the shareholders as one of the highest priorities. Its basic policy is "To continue paying dividend in a consistent manner in accordance with the business performance, while ensuring sound financial foundation and internal reserve for future business expansion." As a shareholder incentive, the Company offers discounts for their healthcare products from March 2015 to their shareholders.    Financial Solutions Business

Sales of the financial solutions business decreased by 4.4% YoY to ¥1,911 million, but profit for this segment increased by 11.8% YoY to ¥568 million. Sales from licensing business of products such as that of "Prospect" increased by 4.6% YoY, but it was insufficient to compensate the decrease in sales of packaged programs and system integration partially due to a delay in the development of new products (the delay was caused by prioritizing the adaptation to a new system of the Osaka Stock Exchange). Meanwhile, as for the profit/loss, the continuous in-house development of systems and streamlining of businesses contributed to the reduction in subcontracting expenses. For research and development, the Company made efforts to integrate various products that are offered under the financial solutions business into "Prospect" and expand its innovative functions.

Business Solutions Business

Sales of the business solutions business decreased by 24.9% to ¥206 million, and loss for this segment was ¥44 million (it was an operating profit of ¥10 million in the previous term). To stabilize income, the Company made efforts to expand sales of the packaged system with a focus on "e2". Consequently, they successfully obtained orders from a major restaurant chain and major manufacturer and attained a certain level of success. However, sales decreased drastically and the segment reported a loss due to reaction to increased sales and profit from a large-scale project for the support center during the previous FY and a delay in acceptance inspection timing for some projects during this FY.

Healthcare Business

Sales of the healthcare business increased by 30.0% YoY to ¥240 million, and loss for this segment was ¥185 million (it was an operating loss of ¥354 million in the previous term). Product sales via mail order increased and the effects of sparassis crispa gained recognition. As a result, OEM of sparassis crispa related products and sales of sparassis crispa-originated cosmetic ingredients began from the fourth quarter. As for the profit/loss, the Company reduced advertisement cost by focusing on the effective advertising. It also reduced research and development cost for the joint research with AIST and TWMU as initially planned. Recording devaluation of inventory assets has also completed the first round. All these factors contributed to improving the loss.The proprietary fund management business recorded a loss of ¥15 million (it was a loss of ¥1 million in the previous term). From the fourth quarter, the Company started an investment education business, under which the Company hosts investment seminars for individual investors and runs a program on Tokyo MX.    |

| Fiscal Year September 2017 Earnings Estimates |

It is expected that the sales increase by 10.3% YoY and operating profit is ¥50 million, mainly due to doubled sales growth of healthcare business.

Sales are estimated to be ¥2,600 million, up 10.3% YoY. Sales of cosmetic products overseas, OEM business in Japan and full-fledged sales of raw materials for cosmetic products will contribute to doubling the sales for the healthcare business. Furthermore, sales for the business solutions business will increase, mainly from the Company's integrated business management platform "GroupMAN@IT e2" and support center services. Sales activities for the financial solutions business will be strengthened with a focus on "Prospect" in order to breakaway from decreasing revenue trend.Operating profit is expected to increase from ¥11 million in the previous fiscal year to ¥50 million. Investment for integrating various products into "Prospect" will be a financial burden on the financial solutions business. The healthcare business will also continue investing in research and development activities. However, the losses from investments will be recovered by increasing sales for the healthcare business and business solutions business. The financial solutions business is also expected to improve its profitability by growing licensing business sales and promoting in-house development. (2) Future activities

Since its establishment, the Company has provided the systems for the stock and foreign exchange professionals. About 4 years ago, it also started the business solutions business and healthcare business. Since then, it has been working on the development of new businesses using the profits gained from the financial solutions business as resources. However, the new businesses have not produced profits yet as of the end of FY September 2016. Aiming at turning the figures to black in the FY September 2018, the Company will accelerate the activities to produce profits from those businesses in the FY September 2017.

Financial Solutions Business

For the financial solutions business, the Company has been working on connecting various markets under the MIOP concept (providing one-stop services) which was announced in 2010. The Company has already connected the stocks and index of Tokyo Stock Exchange and Osaka Stock Exchange, PTS of alternative markets, dark pool, and even commodity markets. The Company's system is now allowing the users to access various markets at one stop. However, the Company's system requires the users to install different application (product) for each field. For example, the users need to install a stock exchange terminal called "J1" for stocks, "TIGER" for dealing, "MEXIII/MSRIII", etc. for sales/purchase simulation, and "fortissimo" for foreign currency /FX. This is causing inconvenience and low efficiency for maintenance to the users.To resolve the issues, in the FY September 2017, the Company will integrate stock-related products such as "J1" and "TIGER" in "Prospect" to enable the users to use various applications on "Prospect".  Business Solutions Business

The business solutions business provides general corporate services, and its three pillars are: 1) the Company's own in-house packaged products including "e2" and "Gadics", 2) engineer dispatch service (SES) which mainly provides maintenance and operation, and integrated support service which is characterized by multi-vendors, multi-products and multi-businesses, and 3) support center services, which provide support for accounting system transition, operated by SuperStream Co., Ltd.The support center services fell substantially below the planned figures during the FY September 2016, and it became the main cause for segmental loss. The sales of support center services, however, are expected to increase during the FY September 2017 as a result of expanding the service line-ups. Furthermore, for packaged services, the Company won 2 new contracts with customers (i.e. a major restaurant chain and major manufacturer) by introducing "e2". The Company is planning to have 6 additional new customers for the FY September 2017. The SES services are producing a stable profit. In the future, the Company is planning to establish a system in which 3 businesses will equally contribute to the profit. Healthcare Business

Sparassis crispa related products are directly sold to Uny Co., Ltd, major department stores, beauty salons, retailers, pharmacies and animal clinics within Japan and overseas in addition to sales via Internet/catalog mail order. Currently, the sales are highly dependent on purchased products and the challenge lies in raising the sales ratio of sparassis crispa related in-house branded products. Within Japan, the OEM supply (to 3 companies) of supplements and beauty jelly product began last summer and sales of cosmetic raw materials using ingredient extracted from sparassis crispa to a major cosmetic manufacturer is expected to begin. Therefore, the business will be full-fledged in the FY September 2017. In the overseas market, through RegMed Prof (a distributor) in Russia, business relationships with the largest retailer of medical and beauty products "36.6", a retailer of medical and beauty products "SUPRAMED", a major Internet business company "Beauty Health" and a major television mail order company "Studio Moderna" will begin in the FY September 2017. Furthermore, necessary documents have been submitted for the sales of supplements in Dubai, and their sales will begin by the end of 2017. (In addition to these, several business negotiations are going on for the overseas market). Because of these factors, it is expected that sales of the healthcare business will double in the FY September 2017.  Joint Research (Project name: IT Sparassis Crispa Project)

The joint research (Project name: IT-Sparassis Crispa Project) that began on October 1, 2014 is making a steady progress and the medium-term report was released on August 12, 2016. The IT- Sparassis Crispa Project identified a new (never reported before) physiological active substance that might be effective for circulatory diseases and isolated the substance from sparassis crispa. According to the medium-term report, some studies reported their research results on sparassis crispa in the past, but none of them have reported the physiological active substance that was successfully isolated from sparassis crispa. It is said that this substance is effective for humans. The results will be presented at academic conferences and published in journals around March 2017. The group is also planning to jointly apply for a patent concerning the structure and usage of this new component of sparassis crispa.

|

| Conclusions |

|

|

| <Reference: Regarding Corporate Governance> |

◎ Corporate Governance Report Updated on Dec. 26, 2016

The basic goal of the Company's corporate governance is to maximize the Company Group's corporate value. The Company will achieve the basic goal from the perspectives of "Management transparency", "Legal compliance", and "Efficient management". Basic concept The management team, led by the President, plays a role to maintain good relationships with the Company Group's stakeholders (e.g. shareholders, customers, business partners, employees). To fulfil this role, it is important to establish and operate a system to understand management situation and disclose information in a timely and appropriate manner in compliance with laws, ordinances, and regulations. <Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The top management of the Company is the President, and board members and executive members are the candidates to succeed the position. The successor shall be determined based on the business performance and organizational management capacity. The desirable qualities of the successor will depend on the management environment, etc. of that time. Thus, the Company does not have a pre-fixed standard for selection. The actual selection of the President will be based on exhaustive deliberation based on management environment and qualities of the candidates at the board of directors.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

When the Company holds shares of other listed companies as strategically held shares, the shares should contribute to the growth of the Company through business partnership, etc. with the share-issuing companies. The board of directors regularly monitors the business performance of the share-issuing companies and their partnership status with the Company. The voting rights concerning strategically held shares are determined case by case because there are many items to take into consideration such as the management team's background, business performance, and external environment. In principle, the Company does not own strategically held shares.

Once a year, the Company hosts a financial results briefing and shares a video of the briefing on the Company's website. It also hosts meetings for individual investors and organizes individual meetings as needed. Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2017 Investment Bridge Co., Ltd. All Rights Reserved. |