Bridge Report:(3778)Sakura Internet the fiscal year ended March 2020

President Kunihiro Tanaka | Sakura Internet Inc.(3778) |

|

Company Information

Market | TSE 1st Section |

Industry | Information, Telecommunication |

President | Kunihiro Tanaka |

HQ Address | Grand Front Osaka Tower A 35F 4-20 Ofukachou, Kita-ku, Osaka City, Japan |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥587 | 36,480,056 shares | ¥21,413 million | 2.2% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥2.50 | 0.4% | ¥9.59 | 61.2x | ¥201.10 | 2.9x |

*The share price is the closing price on April 28.

*The number of shares issued is obtained by subtracting the number of treasury shares from the number of shares issued as of the end of the latest quarter.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net profit attributed to parent company shareholders | EPS | DPS |

March 2017 Act. | 13,961 | 1,018 | 804 | 548 | 15.74 | 2.50 |

March 2018 Act. | 17,033 | 745 | 574 | 349 | 9.29 | 2.50 |

March 2019 Act. | 19,501 | 567 | 395 | 91 | 2.44 | 2.50 |

March 2020 Act. | 21,908 | 939 | 789 | 160 | 4.39 | 2.50 |

March 2021 Est. | 23,400 | 740 | 580 | 350 | 9.59 | 2.50 |

*Estimates are provided by the company.

*Units: million yen, yen

This Bridge Report presents Sakura Internet’s earning results for the fiscal year ended March 2020, along with estimates for the term ending March 2021.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2020 Earnings Results

3. Fiscal Year ending March 2021 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the fiscal year March 2020, sales and operating income increased 12.3% and 65.6%, respectively, year on year. While the sales of VPS and cloud services kept growing by double digits, the sales of dedicated servers also rose 26.4% year on year due to the contribution of Koukaryoku (high firepower) computing in national research institutes, and subsidiaries witnessed an increase in the sales of equipment. The improved sales absorbed the augmentation of the cost of equipment for sale, depreciation and leasing fees due to the increase in servers and network equipment, and operating expenses due to the increase in the number of engineers, including the development staff of the company’s system. Profit increased significantly from the fiscal year March 2019, partly because the profit level was low in that year.

- For the fiscal year March 2021, sales are estimated to increase 6.8% and operating income are projected to decline 21.2% year on year. The sales of housings and dedicated servers will decrease due to the shift of customer needs to the cloud, but this will be absorbed by the rise in sales of VPS and cloud services and subsidiaries’ equipment. The cost of equipment for sale, depreciation and leasing fees and labor costs for engineers will continue to increase, which is projected to impact profitability negatively. However, net income is expected to increase 2.2 times year on year because the impairment loss will disappear. As of now, neither the company’s business performance nor business operations have been affected by COVID-19.

- We are concerned about the effects of COVID-19 on the business. However, the pandemic has no impact on business performance or business operations, although the company made some changes and is refraining from some business activities for safety. The company has been conducting work style reforms such as remote work for several years. Thus, business operations are going smoothly even under the state of emergency. Regarding usage trends, it is necessary to pay close attention to the long-term impact. However, there is no major change at this point.

1. Company Overview

Sakura Internet operates data centers located in Tokyo (Nishi Shinjuku, Higashi Shinjuku and Daikanyama, using rented floor space), Osaka (Dojima, using rented floor space) and Hokkaido (Ishikari, owned land and buildings) to provide internet based hosting services for server environments (Computer resources), and server installation space for housing services, electrical and network circuits and other services. Sakura Internet owns its own infrastructure, allowing them to pursue higher profitability and utilization of this infrastructure for their housing services allows for reduced risk of fixed costs through the ability to increase utilization rates.

Business Description

Sakura Internet’s business is divided into housing, hosting(Dedicated servers, rental servers, VPS, and cloud), domain and SSL acquisition (Certification for unique domain acquisition outsourcing), and others including subsidiary business. The composition ratio of sales of fiscal year March 2020 is 11.0%, 65.1% (of which exclusive servers, rental servers and VPS Cloud accounting for 23.1%, 15.4% and 26.6% respectively), and 23.9%.

2. Fiscal Year ended March 2020 Earnings Results

2-1 Earnings Overview

| FY 3/19 | Ratio to sales | FY 3/20 | Ratio to sales | YoY | 3Q Revised forecasts | Difference from the forecast | |

Sales | 19,501 | 100.0% | 21,908 | 100.0% | +12.3% | 21,800 | +0.5% | |

Gross Profit | 5,345 | 27.4% | 5,831 | 26.6% | +9.1% | - | - | |

SG&A | 4,778 | 24.5% | 4,892 | 22.3% | +2.4% | - | - | |

Operating Income | 567 | 2.9% | 939 | 4.3% | +65.6% | 690 | +36.1% | |

Ordinary Income | 395 | 2.0% | 789 | 3.6% | +99.5% | 540 | +46.2% | |

Net Profit attributed to Parent Company Shareholders | 91 | 0.5% | 160 | 0.7% | +74.7% | 140 | +14.4% | |

*Unit: million yen

Sales and operating income increased 12.3% and 65.6%, respectively, year on year.

Sales increased 12.3% year on year to 21,908 million yen. While the sales of VPS and cloud services kept growing by double digits, the sales of dedicated servers also rose 26.4% year on year due to the contribution of Koukaryoku (high firepower) computing in national research institutes. Subsidiaries’ sales of equipment (others) also increased.

Operating income was 939 million yen, up 65.6% year on year. SG&A expenses augmented 2.4% because of the rise in the cost of equipment for sale (1,052 million yen), depreciation and leasing fees (723 million yen) due to the increase of servers and network equipment. Other factors contributing to the rise in SG&A expenses were the rise in labor costs (377 million yen) due to the increase of engineers that led to the rise in the cost of sales and the increase of in-house system development engineers and sales staff of subsidiaries. However, sales increase absorbed these expenses.

Non-operating income improved due to the recording of equity-method investment income and commissioned business fees. Nonetheless, the valuation loss on investment securities acquired in the previous fiscal year, and the impairment loss on the subsidiary ITM and in-house system (169 million yen and 198 million yen, respectively) resulted in an extraordinary loss of 500 million yen. Thus, net income increased 74.7% year on year to 160 million yen (in the fiscal year March 2019, an extraordinary loss of 383 million yen was recorded due to impairment loss on fixed assets).

Difference from the revised forecast

Sales forecasts were conservative because of the IoT sales downturn due to the struggling sales of conventional dedicated servers and the impact of malfunctions. However, sales and profitability of ITM Co., Ltd. and other group companies improved toward the end of the fiscal year more than expected.

Sales by services

| FY 3/19 | Ratio to sales | FY 3/20 | Ratio to sales | YoY |

Housing Services | 2,643 | 13.6% | 2,408 | 11.0% | -8.9% |

Dedicated Server Services | 3,998 | 20.5% | 5,055 | 23.1% | +26.4% |

Rental Server Services | 3,277 | 16.8% | 3,380 | 15.4% | +3.1% |

VPS and Cloud Services | 5,305 | 27.2% | 5,835 | 26.6% | +10.0% |

Others | 4,275 | 21.9% | 5,230 | 23.9% | +22.3% |

Total | 19,501 | 100.0% | 21,908 | 100.0% | +12.3% |

*Unit: million yen

Breakdown of SG&A

| FY 3/19 | Ratio to sales | FY 3/20 | Ratio to sales | YoY |

Provision of allowance for doubtful accounts | - | - | 9 | 0.0% | - |

Salaries and allowances | 1,408 | 7.2% | 1,494 | 6.8% | +6.1% |

Provision of bonus reverse | 97 | 0.5% | 117 | 0.5% | +20.6% |

Commission fee | 907 | 4.7% | 897 | 4.1% | -1.1% |

Others | 2,365 | 12.1% | 2,373 | 10.8% | +0.3% |

Total | 4,778 | 24.5% | 4,892 | 22.3% | +2.4% |

*Unit: million yen

Cash Flow

| FY 3/19 | FY 3/20 | YoY | |

Operating Cash Flow (A) | 2,231 | 4,582 | +2,350 | +105.4% |

Investing Cash Flow (B) | -2,576 | -2,973 | -397 | - |

Free Cash Flow (A+B) | -345 | 1,608 | +1,953 | -566.3% |

Financing Cash Flow | 1,237 | -2,541 | -3,779 | - |

Term End Cash and Equivalents | 5,505 | 4,572 | -933 | -16.9% |

*Unit: million yen

The company secured an operating CF of 4,582 million yen due to the receipt of money from large-scale projects and the refund of consumption tax. Investing CF was mainly attributed to the payment of equipment costs for large-scale projects. Financing CF was mainly due to the repayment of long-term debt.

2-2 Consolidated Business Results of the 4Q of FY3/20

| 1Q of FY 3/19 | 2Q | 3Q | 4Q | 1Q of FY 3/20 | 2Q | 3Q | 4Q | QoQ |

Sales | 4,399 | 4,614 | 4,928 | 5,558 | 5,122 | 5,206 | 5,555 | 6,024 | +8.4% |

Gross Profit | 1,212 | 1,332 | 1,354 | 1,446 | 1,518 | 1,285 | 1,454 | 1,573 | +8.2% |

Operating Income | 112 | 171 | 154 | 129 | 312 | 95 | 212 | 319 | +50.6% |

Ordinary Income | 63 | 144 | 97 | 89 | 273 | 52 | 185 | 277 | +49.3% |

Net Income | 39 | 69 | 37 | -53 | 159 | 17 | -49 | 32 | - |

EBITDA | 726 | 808 | 771 | 810 | 1,069 | 853 | 1,000 | 1,086 | - |

Gross profit margin | 27.6% | 28.9% | 27.5% | 26.0% | 29.6% | 24.7% | 26.2% | 26.1% | - |

Operating margin | 2.6% | 3.7% | 3.1% | 2.3% | 6.1% | 1.8% | 3.8% | 5.3% | - |

*Unit: million yen

EBITDA=Ordinary income+ Interest expense +Depreciation

Sales growth offset the augmentation of operating expenses.

Sales in the fourth quarter were 6,024 million yen, up 8.4% from the previous quarter. Sales of VPS and cloud services and rental servers remained strong, and sales of other services rose thanks to government satellite data projects and subsidiaries’ equipment sales.

As for profit, the rise in the cost of sales due to the cost of government satellite data projects (up 217 million yen) and the increase in equipment for sale (up 61 million yen) was absorbed. As a result, gross profit augmented 8.2% year on year. On the other hand, SG&A expenses increased only slightly due to a rise in shareholder benefit expenses, and operating income increased 50.6% year on year to 319 million yen.

Net loss was 49 million yen in the third quarter due to the recording of the impairment loss of ITM Co., Ltd., and profit was only 32 million yen in the fourth quarter due to the recording of the impairment loss of the in-house system.

2-3 Major BS

| March, 19 | March, 20 |

| March, 19 | March, 20 |

Cash | 5,505 | 4,572 | Short-term loans | 2,716 | 3,170 |

Trade receivables | 2,002 | 2,306 | Short-term lease debt | 1,305 | 1,352 |

Current assets | 9,452 | 8,577 | Advances received | 3,393 | 4,276 |

Tangible fixed assets | 18,928 | 17,598 | Long-term loans | 6,089 | 4,317 |

Intangible fixed assets | 1,025 | 554 | Long-term lease debt | 5,867 | 5,361 |

Fixed assets | 21,706 | 20,209 | Liabilities | 23,814 | 21,362 |

Total assets | 31,158 | 28,787 | Net assets | 7,344 | 7,424 |

*Unit: million yen

Total assets at the end of the term decreased 2,371 million yen from the end of the previous term to 28,787 million yen. This was mainly because of a decrease in cash and deposits due to payment of equipment for large-scale projects and repayment of borrowings, a decline in fixed assets due to depreciation and impairment loss, and a decrease in long-term lease obligations. Equity ratio was 25.5% (23.3% at the end of the previous fiscal year).

Reference: Transition of ROE

| FY3/16 | FY3/17 | FY3/18 | FY3/19 | FY3/20 |

ROE | 13.21% | 9.12% | 4.52% | 1.21% | 2.19% |

Net profit margin ratio | 4.58% | 3.93% | 2.05% | 0.47% | 0.73% |

Total asset turnover | 0.74 times | 0.63 times | 0.65 times | 0.68 times | 0.73 times |

Leverage | 3.90x | 3.71x | 3.37x | 3.79x | 4.11x |

* ROE = Net profit margin ratio × Total asset turnover × Leverage

3. Fiscal Year ending March 2021 Earnings Forecasts

3-1 Consolidated Business Results

| FY 3/ 20 Act. | Ratio to sales | FY 3/ 21 Est. | Ratio to sales | YoY |

Sales | 21,908 | 100.0% | 23,400 | 100.0% | +6.8% |

Gross profit | 5,831 | 26.6% | 5,700 | 24.4% | -2.3% |

SG&A | 4,892 | 22.3% | 4,960 | 21.2% | +1.4% |

Operating Income | 939 | 4.3% | 740 | 3.2% | -21.2% |

Ordinary Income | 789 | 3.6% | 580 | 2.5% | -26.5% |

Net profit attributed to parent company shareholders | 160 | 0.7% | 350 | 1.5% | +118.6% |

* Unit: million yen

It is estimated that sales will increase 6.8% and operating income will decrease 21.2% year on year.

Sales are expected to increase 6.8% year on year to 23,400 million yen. Sales of housing and dedicated servers will continue to decline due to the shift to the cloud, but sales of VPS and cloud services and others will rise by more than 10%, and the sales of rental servers are also expected to grow steadily by 1.7%.

In terms of profits, operating income is projected to be 740 million yen, down 21.2% year on year. This is attributed to the increase in cost of sales due to the augmentation of sales of equipment, including IoT-related items (723 million yen), the rise in depreciation and leasing fees (546 million yen), and the increase in personnel expenses for engineers, including those of subsidiaries hired in the previous fiscal year (431 million yen), and the rise in SGA, mainly personnel costs (up 123 million yen). However, net income is expected to increase 2.2 times to 350 million yen because the impairment loss will disappear.

Capital investment amount is to be 4,700 million yen. The main investments are for server and network equipment (3,100 million yen) for expanding cloud services and data center-related (1.3 billion yen). The subsidiaries plan to hire 14 new employees.

Sales by services

| FY 3/ 20 Act. | Ratio to Total | FY 3/ 21 Est. | Ratio to Total | YoY |

Housing Services | 2,408 | 11.0% | 2,232 | 9.5% | -7.3% |

Dedicated Server Services | 5,055 | 23.1% | 5,040 | 21.5% | -0.3% |

Rental Server Services | 3,380 | 15.4% | 3,435 | 14.7% | +1.7% |

VPS and Cloud Services | 5,835 | 26.6% | 6,522 | 27.9% | +11.8% |

Others | 5,230 | 23.9% | 6,168 | 26.4% | +17.9% |

Total | 21,908 | 100.0% | 23,400 | 100.0% | +6.8% |

* Unit: million yen

The sales of VPS and cloud services are estimated to increase 11.8% year on year due to the provision of services to achieve customer success (consulting, cloud migration services, and tuning) by strengthening cooperation with partners. Also, by providing high value-added services through collaboration with group companies and partners, other sales will increase 17.9% year on year. In addition, rental servers that enjoy the benefits of being industry survivors are projected to grow steadily 1.7% year on year. As for dedicated servers, the decrease in existing projects will almost be compensated by customization services such as integration and development (down 0.3% year on year). However, sales of housing, which is expected to witness large-scale projects’ cancellations, are expected to decrease by 7.3% year on year.

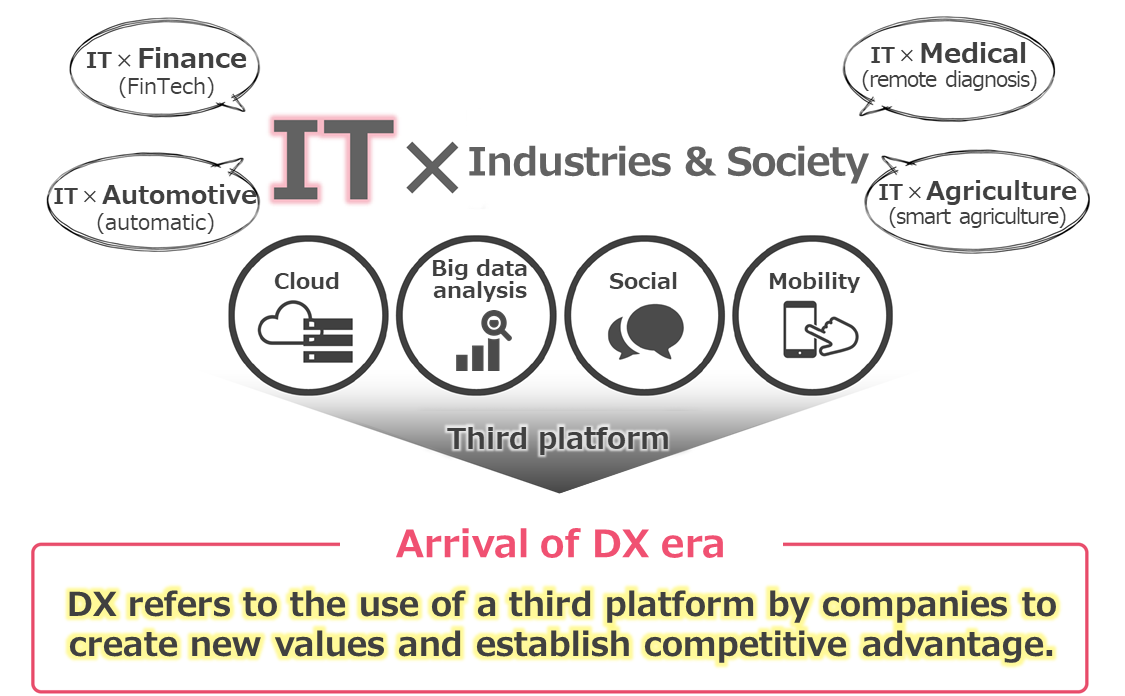

3-2 Group Goal: becoming a platformer that supports customers’ DX realization

Third platform

According to IDC Japan, the “first platform” was centered around mainframes and the “second platform” on servers, clients, and the Internet. We are now entering the age of the “third platform,” which involves cloud, social networking, big data, and mobility. This “third platform” will drive the IT market and create numerous innovations (new value creation). Creating new value and establishing a competitive advantage using the “third platform” technology by companies is defined as digital transformation (DX).

(Taken from the reference material of the company)

An explosive increase in data volume and data centers

In the DX era, the adoption of IT in everything will generate a massive amount of data, which will be stored and analyzed in the data centers (IDC Japan predicts that world digital data generated annually, which was 16 trillion GB in 2016, is going to increase to 163 trillion GB by 2025). Through data collection and analysis, data resources become information that is used in decision-making and actions. IoT is responsible for data collection, AI is responsible for data analysis, and the data center is the place where the data are stored and analyzed. Thus, the data center will play a part in the success of DX.

Process of switching to the cloud, which is necessary for achieving DX

“Third platform” technology is expected to increase new value creation upon promoting DX. Aside from its function in DX, the “third platform” can also promote work-style reforms and customer experience improvement. We can anticipate that these functions will contribute to the expansion of the third platform market. The “third platform” is not only used in new applications but can also streamline the infrastructure operations by migrating existing on-premise systems to the cloud. For this reason, the company believes that “in the future, the shift of corporate IT infrastructure from on-premise to the cloud will accelerate, and the time will come when all businesses will be using cloud-based IT” (according to IDC Japan, the third platform market is expected to grow at an annual rate of 7.2% from 2018 to 2023, and grow at 11.2% in the corporate sector).

Challenges for domestic companies

However, domestic companies are facing challenges in business transformation and the creation of new business models. There are few IT engineers in user companies, and system integrators are often asked to conduct the development process. Also, many costs and human resources are allocated to legacy systems as existing core systems become complicated, old, and obscured. As with the case overseas, DX can be realized by investing in new digital technologies. Hence, it is necessary to transform into a society that relies on cloud-based IT instead of conventional ones. Under these circumstances, the company will strongly promote the cloud business, seize market opportunities, focus on creating a company that customers and employees favor, and aim for growth.

Cloud business promotion | Achieving CS and ES |

・ Increase sales focusing on the growth of the company’s IaaS and becoming a platformer for customers (cloud service providers) ・ Build a platform to aid the company and customers’ cloud business success by refining the platform through continuous use in-house. ・ Providing new services in the DX era through collaboration with group companies and partners | ・ Achieving CS (Customer Success) Build lasting relationships with customers and create a chain of successful experiences ・ Achieving ES (Employee Success) Providing a comfortable work environment where employees can find motivation and supporting their success, and pursuing their satisfaction |

(Created based on the company’s material)

Aiming to be a platformer that supports customers’ DX realization

The company aims to become a platformer that supports the customers’ DX realization by providing added value. This is through offering speed, cost, and flexibility of proposals as a value using “the simplicity and technical capabilities of its one-layer structure” (IT infrastructure) and its wide range of services that entails collaborations with group companies and partners. As for value-added services, the company will offer various services that are not limited to the cloud to create proposals tailored to usage scenarios and growth phases. It will also collaborate with group companies and partner companies that offer Saas to provide added value such as MSP, system development, security, and mobile communications and peripheral services.

3-3 Efforts in FY 3/21

【Basic policy】

The company’s basic policies, which are “business activities in the growing environment” and “utilization of existing resources in growing fields,” remain unchanged. The company will proceed with the concrete measures shown below to speed up its progress and support customer success by linking the group’s know-how and technical capabilities.

Business activities in the growing environment

Hosting and cloud services | ・Focus on collaborative efforts to continue to increase the value of cloud services with their partners ・ VPS celebrates its 10th anniversary and is expected to reach 100,000 VMs |

IoT and AI | ・Continue to flexibly respond to the customers’ demand |

Data distribution field | ・Expanding the data distribution market, including the industrial use of satellites through public-private partnerships |

Utilization of existing resources in growing fields

Realization of customer success | ・ Help customers attain their goals, regardless of the business focus, using the group’s comprehensive capabilities + partners ・ Improving customer support by analyzing customer behavior data ・ Focus on cloud business and build a system that can flexibly respond to customers’ cloud needs |

Maximize employee performance | ・ Provide an environment and mechanisms to realize employee success and utilize human resources |

Strengthening initiatives for new technologies | ・ Promote technological research, mainly in research institutes by predicting changes in the next few years |

Initiatives in hosting and cloud services

The domestic data center market continues to expand against the backdrop of the rise in cloud usage. IDC Japan estimates that the market scale will expand from 311.1 billion yen in 2018 to 842.4 billion yen in 2023 (annual growth rate: 22%). Under these circumstances, the company will work to maintain and promote continuous usage of its services by strengthening and improving functions of VPS and cloud services and enhancing rental servers’ usability.

VPS and cloud | ・Continue to work with many partners to increase value in the cloud service business ・ VPS is celebrating its 10th anniversary, and the number of users is expected to reach 100,000 VM during the 22nd term. |

Rental servers | ・ The company will continue to implement measures to improve the satisfaction of the existing environment, such as improving the convenience of control panels and webmail and focusing on measures for WordPress. |

IoT and AI market and efforts in the company

With the spread of IoT and 5G, a massive amount of data is continuously generated, stored, and processed. Thus, it is expected that the IoT and AI applications and technologies in infrastructure such as automatic driving (AI) and IoT connection will accelerate (according to the Reiwa 1-Year White Paper on Information and Communication, the number of IoT devices in the world, which was 30.71 billion in 2018, is expected to increase to 44.79 billion in 2023). The company will promote its IoT business in collaboration with BB Sakura Networks Inc., a joint venture that provides mobile network solutions for IoT and 5G to capture demand in the IoT field. As for the AI field, the company will continue to focus on public and tech venture projects through collaborations across the group.

Efforts in the data distribution field

In February, the company officially released “Tellus Ver.2.0”, in which the UI and UX of the satellite data platform “Tellus” have been improved and new market functions were added, and the company has opened the “Tellus Market” where data and algorithms can be traded.

“Tellus” is an open and free satellite data platform from Japan that creates a new business marketplace using government satellite data. The Ministry of Economy, Trade, and Industry has entrusted the company with development and operation for three years (Ministry of Economy, Trade and Industry’s “Open and Free Government Satellite Data and Data Utilization Promotion Project). Also, the “Tellus market” is a service that allows a wide range of corporations and individuals to trade safely in various tools (algorithms for analysis, satellite and ground data, and applications created using data or algorithms on Tellus). You can search, check, and purchase various tools using a UI similar to EC sites that you use in your daily life. The purchased tools can be used in the Tellus development environment and the Tellus operating environment (Tellus OS).

Efforts to achieve customer success

The company will respond to what its customers want to achieve using the comprehensive capabilities of the entire group + partners regardless of the service focus. The company group will improve its services by collaborating with partners to provide IT platforms (cloud and hosting, big data collection and distribution, and IoT platforms) and IT solutions (system integration, server network monitoring, operation and maintenance (MSP), and mobile networks). Most recently, the company received an order from the Japan Meteorological Agency’s Meteorological Satellite Center to “provide geostationary meteorological satellite image data distribution services via the Internet” related to the meteorological satellite observation data provision services for Japan Meteorological Agency’s Himawari 8 and 9 (the company provides the infrastructure for geostationary meteorological satellite image data distribution services). The operation started on February 29, 2020, and the total scale of the project is 207 million yen (tax included).

Efforts to maximize employee performance

The company aims to achieve employee success by developing an environment and mechanisms that make the best use of human resources. To that end, the company will pursue work styles that allow employees to maximize their abilities. Specifically, the company will work on “building an environment where individuals are respected and supported and praised for taking on challenges” and “creating a culture that makes communication the foundation of understanding and trust.” In addition, Sakura Internet will pursue work styles that are not restricted by location or working hours and will establish a system to fulfill that purpose. At the same time, it will promote new work styles that utilize digital tools.

In March 2020, the unique “work style reform” created with employees was highly recognized and won the “5th White Company Award” in the work-life balance category. The company respects the diverse work styles of its employees and established a work style platform that supports the improvement of individual creativity and productivity called “Saburiko.” Since 2016, the company has focused on improving the environment and systems that allow employees to work comfortably, such as introducing a flextime system and a work from home system and encouraging parallel careers. The company received the award as it was recognized for its efforts to take on the challenge of fulfilling the new corporate standards. These new standards entail that the company creates the most needed mechanisms rather than just establishing systems that are in line with laws and national policies with the employees, who are the essence of work styles reforms. In addition, at the “5th White Company Award,” the Japan Next-Generation Enterprise Promotion Organization (White Foundation), which has developed the white company certification system, solicited entries from companies certified as white companies and gave awards to companies that are making efforts that met the selection requirements.

Strengthening efforts in new technologies

The company is engaged in forecasting changes and technical research in the next few years, centered on research institutes. As a result, the company has been engaged in research and development on data center decentralization and has published many related papers. In addition, in October 2019, the company started a joint research with Future University Hakodate on distributed OS and virtualization technology to abstract autonomously distributed computers to achieve the next-generation data center and the concept of computing, which is a super organic data center.

3-4 Impact of the novel coronavirus and the company’s countermeasures

At this moment, the company made some changes and is refraining from some business activities due to safety considerations. Yet, the pandemic has no particular impact on business performance and business operations. The company has been conducting work style reforms such as remote work for several years. Thus, business operations are going smoothly even under the state of emergency.

Remote work as the basis for the company’s working style

From March 2 to May 6, as a general rule, all offices in Osaka, Tokyo, and Fukuoka have implemented a work from home policy (the company has prohibited going to the office since April 8), and user support is provided by email or chat. The company provides an emergency commuting to work allowance of 5,000 yen per day to employees in charge of tasks that cannot be handled remotely, such as data center maintenance. In addition, the company has given a temporary special allowance of 10,000 yen and a temporary communication allowance of 3,500 yen as support for preparing a remote work environment at home. The company plans to accelerate the development of an environment where people can work regardless of their location (remote work as the basis for the company’s work style). Thus, it plans to adopt tools such as web conferencing and provide monthly communication allowances of 3,000 yen from May.

No major changes in usage trends

Some events were canceled, but in principle, the company mainly resorted to postponing events or switching to holding them online. Some face-to-face meetings were also canceled or postponed, but the company tried as much as possible to hold the meetings as video conferences. Regarding usage trends, although it is necessary to pay close attention to the long term, there are no significant changes at this point.

Providing free servers for websites on COVID-19

In addition, the company started to provide free servers for websites that summarize the latest information on COVID-19 (the first is the website JUST Michi IT that summarizes the coronavirus information in Hokkaido. (https://stopcovid19.hokkaido.dev/)). The company is also promoting the provision of free servers for similar attempts by other local governments.

4. Conclusions

For the time being, the company does not have any plans for large-scale hardware investments and will focus on improving the cloud services’ added value. Companies need to move their existing businesses to the cloud to proceed with the digital transformation (DX). Therefore, the company will capture the demand of companies promoting DX by providing infrastructure and consistent services from consulting to cloud migration and even application tuning. However, the company’s cloud service is a type of service called IaaS that provides infrastructure (virtual servers, storage, etc.). Therefore, it will provide the services necessary for the DX support in collaboration with application developers. When an application developer provides services on the cloud, the application development cost and the server cost are incurred as initial costs. This cost is a barrier to cloud entry for application developers. However, by partnering with Sakura Internet, server costs can be suppressed.

In order to improve the added value of cloud services, the company intends to pursue employee success that is directly linked to customer success and service quality.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 6 directors, including 3 outside ones |

Auditors | 4 directors, including 3 outside ones |

◎Corporate Governance Report (Updated on July 10, 2019)

Basic Policy

Our company has strived with the basic policy about corporate governance: promote the maintenance of business management organizations and enhance efficient and systematic management and internal controls of each department while expanding the company size. There is a greater social responsibility in internet industry than in other industries as communication facilities are released to a large number of invisible customers and its market is the internet users around the world. We consider that the establishment of corporate governance at our company means the management base which enables to fulfill such social responsibilities.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principle 3-1 【Improvement of information disclosure】

(4) The board of directors’ policies and procedures for appointing and dismissing executives and nominating candidates for directors and auditors

As candidate directors, we will nominate those who are strongly interested in our business, take action for following our corporate ethos, possess plenty of practical experience and technical knowledge, profound knowledge of company management, etc., and could appropriately oversee the business administration of our company based on their advanced insight. As candidate auditors, we will nominate those who are strongly interested in our business, can highly fulfill the roles and responsibilities as an auditor, audit business from a neutral, objective viewpoint, contribute to the soundness of business administration, possess plenty of experience and advanced knowledge for carrying out audit, technical knowledge, and profound knowledge of company management. As for the policy and procedure for dismissing them, we will discuss appropriate processes so as to oversee and evaluate the results of managerial plans, etc. and deliberate them sufficiently at a meeting of the board of directors.

Supplementary Principle 4-1-3 【Roles and duties of the board of directors (plan for successors)】

Our company is designing a plan for successors as CEO, etc. The board of directors will continue discussions regarding the process for nominating successors, a plan for training them, etc. based on our ethos and management strategies.

Supplementary Principle 4-2-1 【Remunerations for the management】

As for remunerations of directors, the representative director gives a proposal and the board of directors makes a decision for each director, while comprehensively considering the division of duties, the contribution to business performance, etc. From now on, we will keep discussing an objective, transpiration system for remunerations and the adoption of remunerations based on mid/long-term performance and stock options.

Principle 5-2: [Formulation and disclosure of management strategies and plans]

When formulating our business strategies and business plans, we have set our goal based on the premise of achieving the Group's goal; that is, a continuous sales growth rate of 10% or more, a gross profit margin of 30% or more, and an ordinary income-to-sales ratio of 10% or more. With regard to disclosing management plans that accurately describe the cost of capital, we will carefully consider how to best communicate information by maintaining an open dialogue with shareholders through financial results briefings and individual meetings.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 5-1 [Policy regarding constructive dialogue with shareholders]

The Company has established an organization for managing IR, and holds financial results briefings for shareholders and investors at least twice a year. We also create opportunities for dialogue by obliging individual interviews with persons such as the Director and Chief Financial Officer upon request. We have also created a system for sharing the opinions received during these interviews with management on an as-needed basis. As discussions unfold, we consider the topic of the discussion and strictly control insider information.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020, Investment Bridge Co., Ltd. All Rights Reserved |

To view back numbers of Bridge Reports (Sakura Internet Inc.: 3778) or the contents of Bridge Salon (IR related seminars), please go to our website at the following url: