Bridge Report:(3778)Sakura Internet the second quarter of fiscal year ending March 2021

President Kunihiro Tanaka | Sakura Internet Inc.(3778) |

|

Company Information

Market | TSE 1st Section |

Industry | Information, Telecommunication |

President | Kunihiro Tanaka |

HQ Address | Grand Front Osaka Tower A 35F 4-20 Ofukachou, Kita-ku, Osaka City, Japan |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥751 | 36,480,056 shares | ¥27,396 million | 2.2% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥2.50 | 0.3% | ¥9.59 | 78.3x | ¥201.10 | 3.7x |

*The share price is the closing price on October 30, 2020. The number of shares issued is obtained by subtracting the number of treasury shares from the number of shares issued as of the end of the latest quarter. ROE and BPS are the values as of the end of the previous term.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net profit attributed to parent company shareholders | EPS | DPS |

March 2017 Act. | 13,961 | 1,018 | 804 | 548 | 15.74 | 2.50 |

March 2018 Act. | 17,033 | 745 | 574 | 349 | 9.29 | 2.50 |

March 2019 Act. | 19,501 | 567 | 395 | 91 | 2.44 | 2.50 |

March 2020 Act. | 21,908 | 939 | 789 | 160 | 4.39 | 2.50 |

March 2021 Est. | 23,400 | 740 | 580 | 350 | 9.59 | 2.50 |

*Estimates are provided by the company. Units: million yen, yen

This Bridge Report presents Sakura Internet’s earning results for the second quarter of fiscal year ending March 2021, along with estimates for the term ending March 2021.

Table of Contents

Key Points

1. Company Overview

2.Second Quarter of Fiscal Year ending March 2021 Earning Results

3.Fiscal Year ending March 2021 Earning Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the first half of the fiscal year March 2021, sales and operating income grew 3.5% and 47.5%, respectively, year on year. On the sales front, the growth of high-margin cloud-based services thanks to the increase of remote work and online business offset the decline of physical infrastructure services, including services of housing and dedicated servers. On the profit front, operating income margin improved thanks to boosts from determining the right timing of investment in service equipment and continuously adjusting working styles, etc.

- The company’s forecasts for the fiscal year March 2021 are unchanged, calling for sales to grow 6.8% year on year but operating income to fall 21.2% year on year. In the first half of the term, profit exceeded the company’s estimates by a wide margin, but the company left its full-year estimates unchanged due to the fact that contract cancellations for physical infrastructure services have been on the rise recently and there are still uncertainties regarding cost management in the second half of the term. Meanwhile, the sales trends in the first half are expected to continue in the second half. The company plans to pay a term-end dividend of 2.5 yen per share.

- The sales of physical server services were projected to decrease over the medium/long term, but the decline that had been anticipated over a span of about five years occurred in the span of six months to a year. Sakura Internet needs to swiftly reduce fixed costs in response to this decline, and is currently reviewing operations of the data center in Nishi-Shinjuku (Shinjuku-ku, Tokyo). It plans to reduce fixed costs by reducing the number of racks, cutting rent costs, and taking other measures, and thus needs to accelerate depreciation. Due to this, profit for the current term will decline, but from the following term depreciation burdens should lighten. Also, as the company intends to step up the shift to cloud-based services with higher profitability, we expect profitability to improve in terms of both cost reduction and improvement of the sales mix.

1. Company Overview

Sakura Internet operates data centers located in Tokyo (Nishi Shinjuku, Higashi Shinjuku and Daikanyama, using rented floor space), Osaka (Dojima, using rented floor space) and Hokkaido (Ishikari, owned land and buildings) to provide internet based hosting services for server environments (Computer resources), and server installation space for housing services, electrical and network circuits and other services. Sakura Internet owns its own infrastructure, allowing them to pursue higher profitability and utilization of this infrastructure for their housing services allows for reduced risk of fixed costs through the ability to increase utilization rates.

1-1 Business Description

Sakura Internet’s business is divided into housing, hosting(Dedicated servers, rental servers, VPS, and cloud), domain and SSL acquisition (Certification for unique domain acquisition outsourcing), and others including subsidiary business. The composition ratio of sales of fiscal year March 2020 is 11.0%, 65.1% (of which exclusive servers, rental servers and VPS Cloud accounting for 23.1%, 15.4% and 26.6% respectively), and 23.9%.

2.Second Quarter of Fiscal Year ending March 2021 Earnings Results

2-1 Earnings Overview of first half

| 1H FY 3/20 | Ratio to sales | 1H FY 3/21 | Ratio to sales | YoY | Initial forecasts | Difference from the forecast |

Sales | 10,329 | 100.0% | 10,695 | 100.0% | +3.5% | 10,900 | -1.9% |

Gross profit | 2,803 | 27.1% | 2,802 | 26.2% | -0.0% | - | - |

SG&A | 2,396 | 23.2% | 2,201 | 20.6% | -8.1% | - | - |

Operating Income | 407 | 3.9% | 601 | 5.6% | +47.5% | 260 | +131.3% |

Ordinary Income | 326 | 3.2% | 516 | 4.8% | +58.3% | 180 | +186.8% |

Net profit attributed to parent company shareholders | 177 | 1.7% | 326 | 3.1% | +84.5% | 90 | +263.3% |

*Unit: million yen

Sales for cloud services grew on the back of an increase in remote work and online business

Sales grew 3.5% year on year to 10.69 billion yen. While sales of housing services and dedicated server services declined amid a shift in demand to cloud services, sales of VPS/cloud services rose 11.3% year on year due to an increase in remote work and online business triggered by measures to cope with the COVID-19 pandemic, and other sales jumped 19.1% year on year, centered on government satellite data projects and sales of equipment at subsidiaries that handle SI/consulting. Sales also rose 3.1% for rental server services.

Operating income came to 0.6 billion yen, up 47.5% (0.19 billion yen) year on year. Although cost of sales increased 4.9% (0.36 billion yen) due to increases in equipment for sale, etc. (up 0.24 billion yen), the number of engineers (up 0.22 billion yen), and depreciation and leasing fees (up 0.12 billion yen) stemming from an increase in servers and network equipment, the company secured gross profit in line with year-earlier levels thanks to a boost from an increase in sales. Meanwhile, SG&A expenses decreased 8.1% year on year (0.19 billion yen) thanks to lower travel expenses (down 70 million yen) owing to the adjustment of working styles based on remote work, lower advertising expenses owing partly to refrained events (down 30 million yen), and lower depreciation costs (down 40 million yen).

Sales by segments

| 1H FY 3/20 | Ratio to sales | 1H FY 3/21 | Ratio to sales | YoY |

Housing | 1,190 | 11.5% | 1,093 | 10.2% | -8.1% |

Dedicated Servers | 2,625 | 25.4% | 2,335 | 21.8% | -11.0% |

Rental Servers | 1,680 | 16.3% | 1,732 | 16.2% | +3.1% |

VPS and Cloud | 2,841 | 27.5% | 3,163 | 29.6% | +11.3% |

Other | 1,991 | 19.3% | 2,370 | 22.2% | +19.1% |

Total | 10,329 | 100.0% | 10,695 | 100.0% | +3.5% |

*Unit: million yen

Reasons for differences from the company’s earnings estimates

Although sales were in line with the company’s initial estimates, profit exceeded the estimate by a wide margin, boosted by figuring out the right timing to invest in service equipment, a decrease in transportation costs and lower advertising expenses owing to the self-restraint of events due to changed working styles based on remote work, and profit for the company’s subsidiary beating expectations thanks partly to new projects.

Main BS

| March 2020 | September 2020 |

| March 2020 | September 2020 |

Current Assets | 8,577 | 8,379 | Current Liabilities | 11,459 | 11,363 |

Tangible Fixed Assets | 17,598 | 18,362 | Fixed Liabilities | 9,903 | 10,552 |

Intangible Fixed Assets | 554 | 490 | Shareholders’ Equity | 7,335 | 7,571 |

Investment, Others | 2,056 | 2,318 | Net Assets | 7,424 | 7,664 |

Fixed Assets | 20,209 | 21,170 | Total | 28,787 | 29,550 |

*Unit: million yen

Total assets at the end of the second quarter totaled 29.55 billion yen, up 760 million yen year on year. On the credit side, server/network equipment and data center equipment increased, and on the debit side, long-term lease obligations for these assets increased. Equity ratio was 25.6% (25.5% at the end of the previous term).

Capital investment/personnel

With the company suffering continued contract cancellations for physical infrastructure services (housing services and dedicated server services) amid the shift to cloud systems, how to manage corresponding rent, depreciation, and leasing fees has become an issue. At present, the strong performance of cloud services and benefits from work-style reforms are neutralizing drags on this front, but fixed cost burdens are weighing on profits due to a decrease in physical infrastructure service sales. Due to this, the company is making capital investments in cloud systems while curbing investments in housing services and dedicated server services as much as possible.

In the first half of the current fiscal year, the company made capital investments of 2.1 billion yen (data center investments of 1.1 billion yen, cyber/network equipment investments of 1 billion yen). Of the 1 billion yen in server/network investments, 0.8 billion yen was for cloud services, and only 0.1 billion yen was for physical infrastructure services (0.1 billion yen spent for other investments).

As for personnel, the number of group employees at the end of the second quarter was 711, up 17 from the end of the previous term. While the company had previously been actively hiring new employees, it is still hiring to a certain extent, but also curbing the increase of employees by reallocating (from physical infrastructure to cloud/new businesses) and relocating personnel between groups as its business changes. Recently there has been a shortage of engineers, partly because of digital transformation (DX) initiatives, but the company has enough engineers due to having aggressively hired engineers over the last four years.

Cash Flow

| 3/20-1Q | 2Q | 3Q | 4Q | 3/21-1Q | 2Q |

Operating Cash Flow(A) | 1,374 | 1,290 | 566 | 1,350 | 31 | 1,044 |

Investing Cash Flow(B) | -2,005 | -494 | -261 | -210 | -39 | -1,051 |

Free Cash Flow(A+B) | -631 | 795 | 305 | 1,139 | -7 | -7 |

Financing Cash Flow | -732 | -635 | 21 | -1,194 | -592 | 189 |

Cash and Cash Equivalents | 4,141 | 4,301 | 4,627 | 4,572 | 3,971 | 4,154 |

*Unit: million yen

Operating CF recovered from the low levels seen in the first quarter, when the company paid consumption tax, corporate tax, etc., and bonuses, etc. Investing CF was mainly for investments in data center equipment, etc., but this was mostly covered by operating CF. Financing CF was due to leaseback payments for data center equipment, etc.

3.Fiscal Year ending March 2021 Earnings Forecasts

3-1 Consolidated Earnings Estimates

| FY 3/20 Act | Ratio to sales | FY 3/21 Est | Ratio to sales | YoY |

Sales | 21,908 | 100.0% | 23,400 | 100.0% | +6.8% |

Gross profit | 5,831 | 26.6% | 5,700 | 24.4% | -2.2% |

SG&A | 4,892 | 22.3% | 4,960 | 21.2% | +1.4% |

Operating Income | 939 | 4.3% | 740 | 3.2% | -21.2% |

Ordinary Income | 789 | 3.6% | 580 | 2.5% | -26.5% |

Net profit attributed to parent company shareholders | 160 | 0.7% | 350 | 1.5% | +118.6% |

*Unit: million yen

Earnings forecasts unchanged, calling for sales to grow 6.8% year on year but for operating income to fall 21.2% year on year

Sales are estimated to grow 6.8% year on year to 23.4 billion yen. The sales trends in the first half are expected to continue in the second half. Although sales of physical infrastructure services such as housing services and dedicated server services are projected to decrease due to contract cancellations, cloud-based services such as cloud services and server rental services are expected to grow on the back of the expansion in remote work and online business, triggered by measures to cope with the COVID-19 pandemic.

In the first half of the term, profit topped the company’s initial estimates by a wide margin, but the company kept its full-year estimates unchanged due to the fact that contract cancellations for physical infrastructure services have been on the rise recently and there are still uncertainties regarding cost management in the second half of the term. By the end of January 2021, the company is to reduce the office space in the Tokyo branch from 4 floors (3.5 floors to be exact) to 2 floors (1.5 floors) and review data center investments to reduce fixed costs for physical infrastructure services.

In the second half of the term, capital investments were made to respond to the accelerated shift in demand from physical infrastructure services to cloud-based services, triggered by the COVID-19 pandemic. It also carried out measures such as streamlining data center facilities and concentrating investments on cloud-based services. For the full year, the company plans to make capital investments of 4.7 billion yen. This mainly breaks down to spending of 3.1 billion yen on servers and network facilities aimed at expanding cloud services and 1.3 billion yen on data center-related operations.

3-2 Initiatives for the Fiscal Year March 2021

To achieve customer success

In order to achieve customer success, the company is working on continuous service updates and building operation systems. For VPS/cloud services, in collaboration with the group company BB Sakura Networks, the company started to provide a short message service (SMS) with a two-factor authentication that can be used for personal authentication of applications and one-time passwords at the time of transfer. For rental server services, it has started to provide a "content boost" function that can display websites stably at high speed. It renewed its dedicated server service in July, allowing for flexible coordination with cloud services, and started to provide a high-quality physical exclusive hosting service.

Also, Sakura Internet has built a new call center system that enables it to respond to inquiries smoothly without long waiting times. Specifically, it has set up a customer inquiry service that will serve as a comprehensive customer inquiry site using visual IVR on the screen of the smartphone, and established a system that can suggest optimal solutions via the shortest route. It has also started a “callback reservation” service in which call center staff call up customers at their designated reservation time.

Initiatives for the data distribution field

The number of registrations for satellite data platform “Tellus” has been steadily increasing, reaching 17,034 people as of September 15, 2020. The company is engaged in educational activities such as program development for the practical application of satellite data and large-scale online events in a bid to further increase the number of registrations. In program development, together with Ridge-i (President: Naofumi Yanagihara), which carries out consulting for and development of AI/deep learning technology, as well as the parking lot app operator akippa (President/CEO: Genki Kanaya), Sakura Internet has started research and development for an initial program designed to automatically detect spaces in parking lots via satellite data and AI image authentication, with the aim of putting satellite data platform “Tellus” to practical use.

Also, in educational activities, such as online events, the company started to provide learning content for programming and machine learning free of charge in May 2020, and also held “Tellus SPACE xDataFes. -Online Weeks 2020-" and "Tellus Satellite Challenge,” its 4th satellite data analysis contest. The learning content for programming and machine learning involves the re-provision of “Tellus Trainer” and the “Tellus learning course for Tellus x TechAcademy beginners” with an eye to “new lifestyles” amid the COVID-19 pandemic, which it provides free of charge. “Tellus SPACE xDataFes. -Online Weeks 2020-“ was held for 50 days from July to September, offering a total of 20 topics. It was the first major online event for the company, with about 2,200 live viewers and a total of about 15,000 views. Meanwhile, the 4th “Tellus Satellite Challenge” data analysis contest was held with the aim of developing an algorithm for extracting coastlines from satellite data with extreme accuracy, and was accepted submissions over the four months from August to November.

Promotion of the cloud business

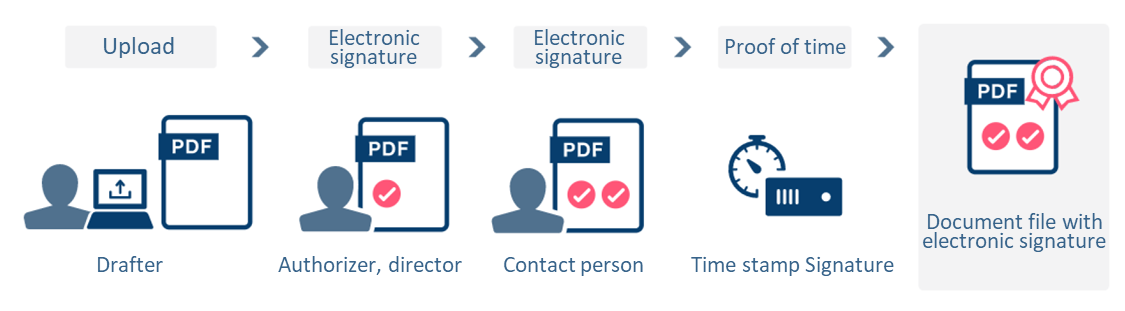

In June, the company started offering “Electronic Contract Platform β,” which enables the signing (stamping) process to be completed online, as a service to solve problems that arise during remote work (β version is provided free of charge). This service digitalizes the contract process by electronically signing documents when connected to the Internet, enabling a more secure contract signing process regardless of location.

(Taken from the reference material of the company)

The platform creates a PDF file that contains an electronic signature. Anyone can verify the integrity of the document by using Adobe Acrobat Reader, as this PDF file uses the AATL (Adobe Approved Trust List Program) certificate. Also, as the PDF file is saved on the cloud, it can be uploaded/downloaded at any time.

Initiatives for new ways of working

Amid the shift to a new way of working based on remote work, the company is working to improve its work environment by reducing the number of offices and changing how such space is used. Specifically, in light of the current percentage of employees going into the office, the company plans to reduce the office space in the branch in Shinjuku, Tokyo from 4 floors to 2 floors. As such, fixed costs for the Tokyo branch office will decrease from the next fiscal year. Sakura Internet intends to continue optimizing its offices to make them a more valuable place for employees and visitors.

The percentage of employees going into the office was: 82.8% in February 2020, 23.6% in March, 7.2% in April, 8.6% in May, 10.8% in June, 12.6% in July, 12.7% in August, 16.4% in September, and 8.8% in October (as of 22nd). From March 2020, in principle, employees were ordered to work from home to prevent the spread of COVID-19 and banned from going to the office based on the government’s declaration of a state of emergency. In addition, the company conducted a questionnaire to employees about new ways of working once a week. In its most recent questionnaire, 67% of those that answered selected “satisfied/somewhat satisfied” in regard to working styles premised on remote work.

4.Conclusions

The sales of physical server service were estimated to decrease over the medium/long term, but the decline that had been anticipated over a span of about five years occurred in six months to a year. While the decline is not that high in terms of project numbers, it is pronounced on a rack basis. The company needs to swiftly reduce fixed costs in response to this decline, and is currently reviewing the data center in Nishi-Shinjuku (Shinjuku-ku, Tokyo). It plans to lower fixed costs by reducing the number of racks, cutting rent costs, and taking other measures. If the company reduces the number of racks, it will need to accelerate depreciation. Due to this, earnings performance for the current term will decline, but from the following term depreciation burdens should lighten. Also, as the physical server service business, which requires heavy upfront investments, is shrinking, and cloud services, which carry higher profit margins, are growing, we expect profitability to improve on these fronts. We think profitability will continue to improve going forward.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 9 directors, including 5 outside ones |

Auditors | 4 directors, including 3 outside ones |

◎Corporate Governance Report (Updated on July 10, 2020)

Basic Policy

Our company has strived with the basic policy about corporate governance: promote the maintenance of business management organizations and enhance efficient and systematic management and internal controls of each department while expanding the company size. There is a greater social responsibility in internet industry than in other industries as communication facilities are released to a large number of invisible customers and its market is the internet users around the world. We consider that the establishment of corporate governance at our company means the management base which enables to fulfill such social responsibilities.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principle 3-1 【Improvement of information disclosure】

(1) Corporate Philosophy, Management Strategy and Management Plan

Corporate philosophy, management strategies and management plans are disclosed on the Company's website and at financial results briefings.

Website https://www.sakura.ad.jp/ir/managerial_policy.html

Financial results briefing materials https://www.sakura.ad.jp/ir/library.html

(2) Basic Stance on Corporate Governance

Basic policy on corporate governance is described in "Basic Policy" in I.1 of this report.

(3) Policies and Procedures for the Board of Directors in Determining the Remuneration of Senior Management and Directors

The total amount of remuneration for Directors is set at the General Meeting of Shareholders, and the Board of Directors determines the individual allocation.

(4) The board of directors’ policies and procedures for appointing and dismissing executives and nominating candidates for directors and auditors. As candidate directors, we will nominate those who are strongly interested in our business, take action for following our corporate ethos, possess plenty of practical experience and technical knowledge, profound knowledge of company management, etc., and could appropriately oversee the business administration of our company based on their advanced insight. As candidate auditors, we will nominate those who are strongly interested in our business, can highly fulfill the roles and responsibilities as an auditor, audit business from a neutral, objective viewpoint, contribute to the soundness of business administration, possess plenty of experience and advanced knowledge for carrying out audit, technical knowledge, and profound knowledge of company management. As for the policy and procedure for dismissing them, we will discuss appropriate processes so as to oversee and evaluate the results of managerial plans, etc. and deliberate them sufficiently at a meeting of the board of directors.

(5) Explanation of the appointment/dismissal of executives and the appointment/dismissal/nomination of individual candidates for director and corporate auditor positions

The reasons for the appointment of candidates for director and corporate auditor positions are stated in the notice of convocation for the general meeting of shareholders.

Principle 5-2: [Formulation and disclosure of management strategies and plans]

In formulating its management strategy and management plan, the company thoroughly considers the cost of capital when setting its profitability targets, but we do not announce performance indicators such as capital efficiency. We will continue to consider these levels based on factors such as business characteristics, and hold dialogue with shareholders through financial results briefings and individual meetings while carefully considering how to communicate with them.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 5-1 [Policy regarding constructive dialogue with shareholders]

The Company has established an organization for managing IR, and holds financial results briefings for shareholders and investors at least twice a year. We also create opportunities for dialogue by obliging individual interviews with persons such as the Director and Chief Financial Officer upon request. We have also created a system for sharing the opinions received during these interviews with management on an as-needed basis. As discussions unfold, we consider the topic of the discussion and strictly control insider information.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020, Investment Bridge Co., Ltd. All Rights Reserved |

To view back numbers of Bridge Reports (Sakura Internet Inc.: 3778) or the contents of Bridge Salon (IR related seminars), please go to our website at the following url: