Bridge Report:(3778)Sakura internet Fiscal year ended March 2021

President Kunihiro Tanaka | Sakura internet Inc.(3778) |

|

Company Information

Market | TSE 1st Section |

Industry | Information, Telecommunication |

President | Kunihiro Tanaka |

HQ Address | Grand Front Osaka Tower A 35F 4-20 Ofukachou, Kita-ku, Osaka City, Japan |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥650 | 36,480,056 shares | ¥23,712 million | 9.9% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥3.00 | 0.5% | ¥3.84 | 169.3x | ¥219.41 | 3.0x |

*The share price is the closing price on May 7.

*The number of shares issued is obtained by subtracting the number of treasury shares from the number of shares issued as of the end of the latest quarter.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net profit attributed to parent company shareholders | EPS | DPS |

March 2017 Act. | 13,961 | 1,018 | 804 | 548 | 15.74 | 2.50 |

March 2018 Act. | 17,033 | 745 | 574 | 349 | 9.29 | 2.50 |

March 2019 Act. | 19,501 | 567 | 395 | 91 | 2.44 | 2.50 |

March 2020 Act. | 21,908 | 939 | 789 | 160 | 4.39 | 2.50 |

March 2021 Act. | 22,168 | 1,372 | 1,099 | 758 | 20.79 | 3.00 |

March 2022 Est. | 19,500 | 400 | 250 | 140 | 3.84 | 3.00 |

*Estimates are provided by the company.

*Units: million yen, yen.

This Bridge Report presents Sakura internet’s earning results for the fiscal year ended March 2021, along with estimates for the term ending March 2022.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2021 Earnings Results

3. Fiscal Year ending March 2022 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- For the fiscal year March 2021, sales grew 1.2% year on year and operating income rose 46.1% year on year. While the sales of housing services and dedicated server services declined, the sales of VPS and cloud services grew by double digits thanks to the continuous improvement of new functions and cementing the cooperation with business partners. Gross profit dropped due to the augmentation of labor costs through the employment of engineers, etc., but SG&A was significantly reduced, through the decrease of travel and transportation expenses caused by the revision of workstyles for realizing remote work. All kinds of incomes significantly exceeded the company’s forecast, which was revised in January. The company paid a term-end dividend of 3.0 yen/share.

- For the fiscal year March 2022, sales are projected to decrease 12.0% year on year and operating income is forecasted to drop 70.9% year on year. Sales are estimated to decline, due to the transfer of the physical infrastructure service and the expiration of contracts for large-scale transactions. Profit is projected to decrease temporarily, due to the drop in sales and the delayed onset of effects of the concentration of resources to cloud services and their optimization. From the next fiscal year, profit is expected to rise, thanks to the sales growth of cloud services and the optimization of costs. The company plans to pay a term-end dividend of 3.0 yen/share.

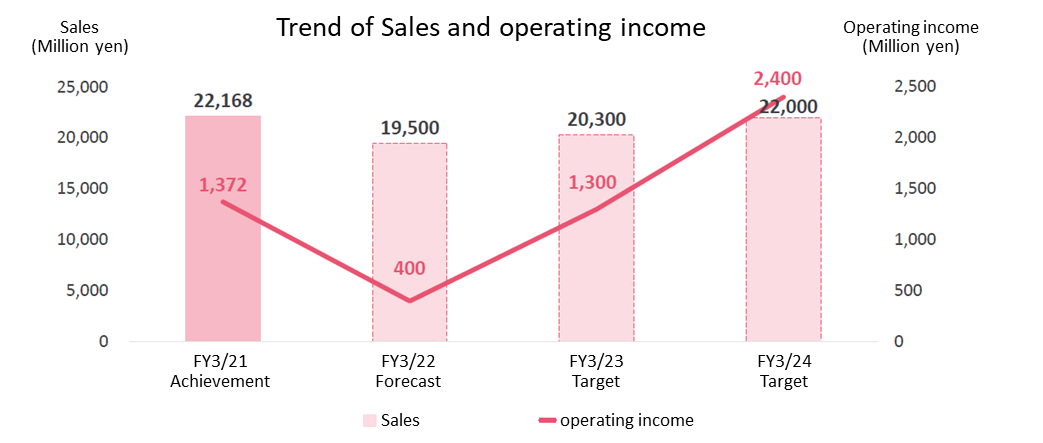

- As the company is concentrating its managerial resources to cloud services, its business is at a major turning point. The earnings forecasts for the fiscal year March 2022 call for double-digit declines in sales and profit, but this can be considered as birth pangs for digital transformation (DX) and the shift to cloud services. From the fiscal year March 2023, sales are expected to grow steadily, and profit is estimated to increase considerably, thanks to the reduction of costs, including rental expenses. As sales and profit are forecasted to decline, its share price nosedived, but profit is expected to recover to the level of the fiscal year March 2021 in the fiscal year March 2023 and exceed it considerably in the fiscal year March 2024. Considering the mid/long-term prospect for business performance, the company’s share seems to be undervalued. We would like to pay attention to the progress of the shift to cloud services and their business.

1. Company Overview

Sakura internet operates data centers located in Tokyo (Nishi Shinjuku, Higashi Shinjuku and Daikanyama, using rented floor space), Osaka (Dojima, using rented floor space) and Hokkaido (Ishikari, owned land, and buildings) to provide internet based hosting services for server environments (Computer resources), and server installation space for housing services, electrical and network circuits, and other services. Sakura internet owns its own infrastructure, allowing them to pursue higher profitability and utilization of this infrastructure for their housing services allows for reduced risk of fixed costs through the ability to increase utilization rates.

Business Description

Sakura internet’s business is divided into housing, hosting(Dedicated servers, rental servers, VPS, and cloud), domain and SSL acquisition (Certification for unique domain acquisition outsourcing), and others including subsidiary business. The composition ratio of sales of fiscal year March 2021 is 9.1%, 65.6% (of which exclusive servers, rental servers, and VPS Cloud accounting for 20.4%, 15.8% and 29.4% respectively), and 25.3%.

2. Fiscal Year ended March 2021 Earnings Results

Full Year Consolidated Results

| FY 3/20 | Ratio to sales | FY 3/21 | Ratio to sales | YoY | Forecast in January | Difference from the forecast |

Sales | 21,908 | 100.0% | 22,168 | 100.0% | +1.2% | 22,000 | +0.8% |

Gross Profit | 5,831 | 26.6% | 5,689 | 25.7% | -2.4% | - | - |

SG&A | 4,892 | 22.3% | 4,317 | 19.5% | -11.8% | - | - |

Operating Income | 939 | 4.3% | 1,372 | 6.2% | +46.1% | 1,060 | +29.5% |

Ordinary Income | 789 | 3.6% | 1,099 | 5.0% | +39.3% | 850 | +29.4% |

Net Profit attributed to Parent Company Shareholders | 160 | 0.7% | 758 | 3.4% | +373.7% | 550 | +37.9% |

*Unit: million yen.

Sales and profit grew 1.2% and 46.1%, respectively, while the shift to cloud services progressed.

Sales were 22.16 billion yen, up 1.2% year on year. The company has provided the Internet infrastructure with a diverse lineup of services, and made efforts to enrich its services and improve functions for bringing success to customers. In the cloud service market, the shift from physical infrastructure services to cloud services has been progressing, so the sales of housing and dedicated server services dropped, as clients cancelled their subscriptions to them. Meanwhile, the sales of VPS and cloud services increased 11.7% year on year, as the company strived to increase new clients and promote existing clients to use more services by continuously adding new functions and cementing the cooperation with business partners. Sales of other businesses also increased 7.5% year on year, thanks to the rise in sales of devices, etc.

Operating income was 1.37 billion yen, up 46.1% year on year. Gross profit decreased 2.4% to 5.68 billion yen, as the cost of sales augmented due to the rise in labor costs caused by the increase of engineers and the transfer of cost of sales, SG&A expenses, etc. through the transfer of personnel to the customer support section (up 460 million yen), the growth of depreciation and lease charges caused by the increase of servers and network equipment (up 280 million yen), etc. On the other hand, SG&A declined 11.8% year on year, due to the decrease in travel and transportation expenses caused by the revision of workstyles for realizing remote work (down 140 million yen), the decrease in personnel expenses caused by the transfer of cost of sales, SG&A expenses, etc. through the transfer of personnel to the customer support section (down 130 million yen), the decrease in depreciation (down 130 million yen), etc.

The total assets as of the end of the fiscal year March 2021 stood at 27.97 billion yen, down 810 million yen from the end of the previous fiscal year. Major factors include the decrease of cash and deposits through the repayment of debts and the drop through the depreciation of servers, network devices, and data center equipment. Liabilities amounted to 19.86 billion yen, down 1.5 billion yen. A major factor is the repayment of debts. Net assets stood at 8.11 billion yen, up 680 million yen. A major factor is the rise in retained earnings through the posting of net income attributable to the shareholders of the parent company. Capital-to-asset ratio was 28.6% (25.5% at the end of the previous fiscal year).

3. Fiscal Year ending March 2022 Earnings Forecasts

3-1 Consolidated Business Results

| FY 3/ 21 Act. | Ratio to sales | FY 3/ 22 Est. | Ratio to sales | YoY |

Sales | 22,168 | 100.0% | 19,500 | 100.0% | -12.0% |

Operating Income | 1,372 | 6.2% | 400 | 2.1% | -70.9% |

Ordinary Income | 1,099 | 5.0% | 250 | 1.3% | -77.3% |

Net profit attributed to parent company shareholders | 758 | 3.4% | 140 | 0.7% | -81.5% |

*Unit: million yen

For the fiscal year March 2022, sales are projected to drop 12.0% year on year, and operating income is forecasted to decrease 70.9% year on year.

Sales are estimated to decline 12.0% year on year to 19.5 billion yen. Sales are projected to decline temporarily, due to the transfer of physical infrastructure services at a certain size, which became evident in the fourth quarter of the previous fiscal year, and the expiration of contracts for large-scale transactions related to the government. The factors in the drop in sales are the 630-million-yen decrease in sales from dedicated servers, excluding those for large-scale contracts, the 420-million-yen decrease in sales from housing services, and the 940-million-yen decrease in sales from large-scale contracts. In addition, the decline in product sales and the posting of the net amount of agency transactions are projected to decrease sales by 1.2 billion yen, and the transfer of government-related transactions from commissioned business to in-house business is estimated to decrease sales by 680 million yen. Meanwhile, the adoption of cloud computing for in-company systems will accelerate the sales growth of cloud services. It is expected to boost the sales of VPS and cloud services by 750 million yen and the sales of rental server services by 170 million yen.

Profit is projected to decline temporarily, due to the drop in sales and the delayed onset of the effects of concentration of resources to cloud services and their optimization. It is forecasted that the sales drop will decrease profit by 1 billion yen, the augmentation of personnel expenses will decrease profit by 170 million yen, and the rise in depreciation and lease charges will decrease profit by 130 million yen. The company will continue the discussion on the acquisition of new assets related to data centers and dedicated servers and the streamlining and optimization of existing resources, which have been conducted since the previous fiscal year. It is expected that the decrease in the rent for data centers will increase profit by 220 million yen, the drop in commissions due to the discontinuation of outsourcing customer support will increase profit by 120 million yen, and the decline in rents for branches, etc. will increase profit by 120 million yen. From the next fiscal year, profit is expected to rise, thanks to the sales growth of cloud services and the optimization of costs.

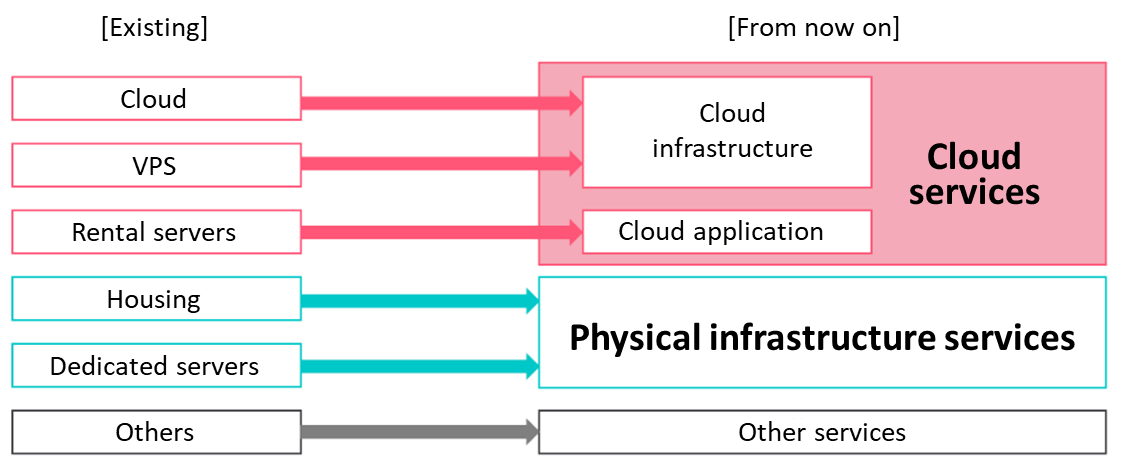

From the fiscal year March 2022, the company plans to offer its services mainly in the cloud business domain, which has a great potential for growth, to correct the course of business for further growth. Through the change of the priority area, the company will revise sales categories as shown in the following figure.

(From the company's presentation materials)

The forecast in the new category is as shown in the table below

| FY 3/ 21 Act. | FY 3/ 22 Est. | YoY |

Cloud Services | 10,131 | 11,010 | +8.7% |

Cloud Infrastructure | 6,495 | 7,200 | +10.8% |

Cloud Application | 3,635 | 3,810 | +4.8% |

Physical Infrastructure Services | 6,524 | 4,520 | -30.7% |

Other Services | 5,511 | 3,970 | -28.0% |

Total | 22,168 | 19,500 | -12.0% |

*Unit: million yen.

The company plans to invest a total of 2.3 billion yen in mainly servers and network equipment (1.7 billion yen) and increase the number of employees by five.

3-2 Future Direction

Changes in the Business Environment Surrounding the Company (Arrival of the DX Age)

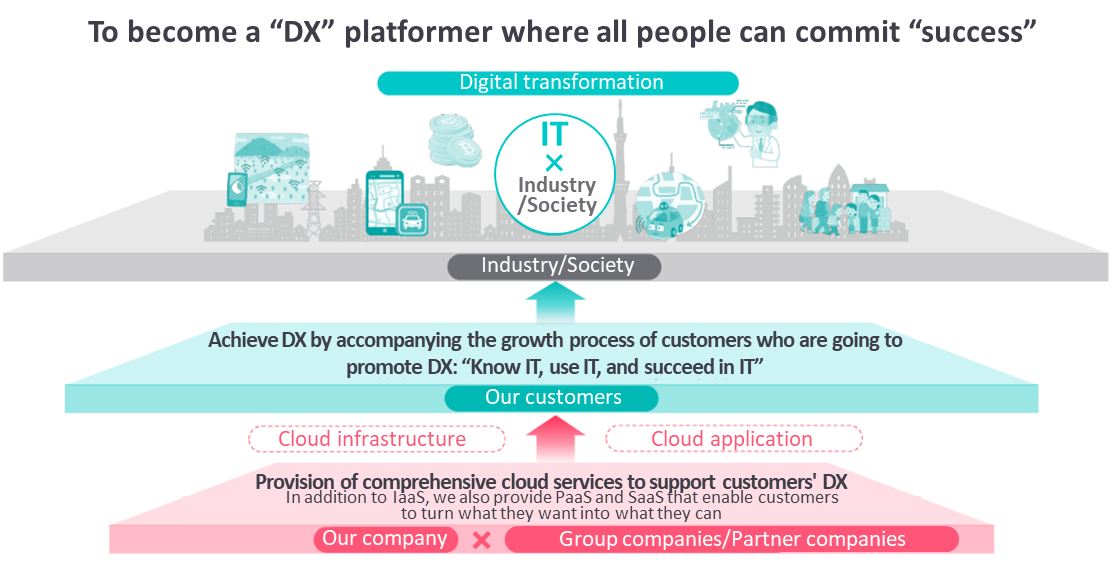

The company recognizes that the business environment regarding computers is changing considerably. The period until 1996 was the “manufacturing age,” in which only a limited number of people could use computers; the period until 2007 was the “portal site age,” in which the browsers for PCs and cellphones served as portal sites; the period until 2018 was the “app age,” in which users accessed browsers via apps; and in the current period, we are seeing a new world based on the third platform. The company recognizes the current period as the “digital transformation (DX) age,” in which all kinds of enterprises will become IT ones. According to the definition by IDC, a research company specializing in IT, DX means enterprises creating value and securing competitive advantages by changing customers’ online and real experiences with new products, services, and business models by utilizing the third platform (cloud, mobility, big data/analytics, and social technologies) while responding to the destructive changes in external ecosystems (customers and markets) and leading the innovation of internal ecosystems (organizations, culture, and employees). The company aims to become a DX platform provider for helping all people win success.

(From the company's presentation materials)

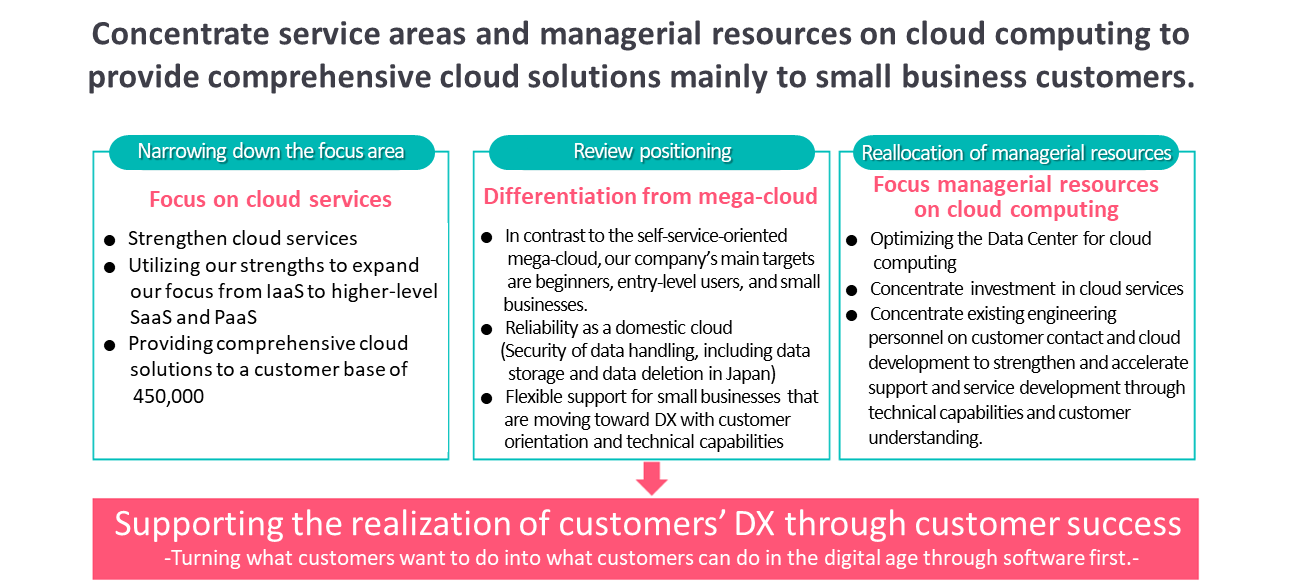

Changes in the Business Environment Surrounding the Company (Shift to the System Focused on the Cloud)

In addition to the continued trend of DX, the COVID-19 pandemic caused a significant change, accelerating the shift to digital technologies. For data center services, the shift from physical services to cloud services is progressing rapidly. The annual average growth rate between 2019 and 2024 is as high as 9.1%. The market scale in 2024 is estimated to be 2,182.8 billion yen. As most domestic enterprises are adopting cloud services for IT infrastructure, including servers and storage devices, the conventional services of data centers are changing to cloud ones.

Under these circumstances, the growth of the data center market is led by IaaS (Infrastructure as a Service), PaaS (Platform as a Service), and SaaS (Software as a Service). The central players for data centers are changing from conventional data center business operators, which offer housing services, etc., to mega-cloud service providers, which conduct global, large-scale IaaS/PaaS business.

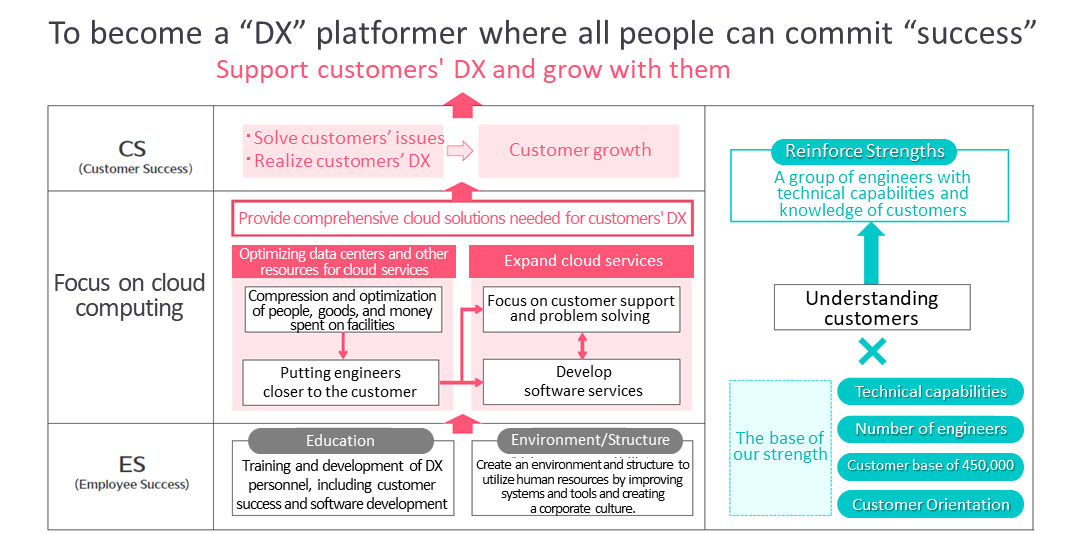

The company considered these changes in the business environment as marketing opportunities, and set the policy of helping clients make what they want to do mainly through the cloud business. The company revised the policies for business and allocation of managerial resources. Shifting from a broad lineup, the company will concentrate its managerial resources to cloud services.

(From the company's presentation materials)

Utilizing its strengths, the company plans to expand its priority domains from IaaS to include SaaS and PaaS. Targeting mainly beginners and small business operators who are going to work on DX from now on, the company plans to support and escort them according to their growth phase, to actualize their DX. The company will also emphasize the reliability and safety of its cloud services developed in Japan for domestic users.

Ideal State

(From the company's presentation materials)

Profit Trend from Now On

As the sales of physical infrastructure services, including housing and dedicated server services, will decline, the company aims to recover and grow sales while changing the sales composition through the continuous growth of cloud services. Profit is projected to decline temporarily due to the drop in sales, but it is expected to rise through the concentration of resources to cloud services and the optimization of them and the sales from the next fiscal year are to recover.

Through the concentration to the cloud service business, costs will also change. The company will optimize the existing data centers, actualize operation that does not require stationed staff, and reduce rents. In addition, the augmentations of depreciation and lease charges are expected to become gentle.

(From the company's presentation materials)

4. Conclusions

As the company is concentrating its managerial resources to cloud services, its business is at a major turning point. The earnings forecasts for the fiscal year March 2022 call for double-digit declines in sales and profit, but this can be considered as birth pangs for digital transformation (DX) and the shift to cloud services. Like the results in the fiscal year March 2021 exceeded the initial forecasts and the forecasts revised in January considerably, the forecasts for the fiscal year March 2022 seem to be conservative. From the fiscal year March 2023, sales are expected to grow steadily, and sales and profit are estimated to increase considerably, thanks to the reduction of costs, including rental expenses. After the announcement of financial results (the earnings forecasts for the fiscal year March 2022), its share price nosedived, but profit is expected to recover to the level of the fiscal year March 2021 in the fiscal year March 2023 and exceed it considerably in the fiscal year March 2024. Considering the mid/long-term prospect of business performance, the company’s share seems to be undervalued. We would like to pay attention to the progress of the shift to cloud services and their business.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 9 directors, including 5 outside ones |

Auditors | 4 directors, including 3 outside ones |

◎Corporate Governance Report (Updated on July 10, 2020)

Basic Policy

Our company has strived with the basic policy about corporate governance: promote the maintenance of business management organizations and enhance efficient and systematic management and internal controls of each department while expanding the company size. There is a greater social responsibility in internet industry than in other industries as communication facilities are released to a large number of invisible customers and its market is the internet users around the world. We consider that the establishment of corporate governance at our company means the management base which enables to fulfill such social responsibilities.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principle 3-1 【Improvement of information disclosure】

(1) Corporate Philosophy, Management Strategy and Management Plan

They are disclosed on the Company's website and at financial results briefings.

Website https://www.sakura.ad.jp/ir/managerial_policy.html

Financial Results Briefing https://www.sakura.ad.jp/ir/library.html

(2) Basic Policy on Corporate Governance

It is described in "Basic Policy" of I.1 of this report.

(3) Policies and Procedures for the Board of Directors in Determining the Remuneration of Senior Management and Directors

The total amount of remuneration for Directors is set at the General Meeting of Shareholders, and the Board of Directors determines the individual allocation.

(4) The board of directors’ policies and procedures for appointing and dismissing executives and nominating candidates for directors and auditors

As candidate directors, we will nominate those who are strongly interested in our business, take action for following our corporate ethos, possess plenty of practical experience and technical knowledge, profound knowledge of company management, etc., and could appropriately oversee the business administration of our company based on their advanced insight. As candidate auditors, we will nominate those who are strongly interested in our business, can highly fulfill the roles and responsibilities as an auditor, audit business from a neutral, objective viewpoint, contribute to the soundness of business administration, possess plenty of experience and advanced knowledge for carrying out audit, technical knowledge, and profound knowledge of company management. As for the policy and procedure for dismissing them, we will discuss appropriate processes so as to oversee and evaluate the results of managerial plans, etc. and deliberate them sufficiently at a meeting of the board of directors.

(5) Election and Dismissal of Senior Management and Individual Election, Dismissal, and Nomination of Candidates for Directors and Corporate Auditors

The reasons for the individual election of candidates for Directors and Corporate Auditors are stated in the Notice of Convocation of the General Meeting of Shareholders.

Principle 5-2: [Formulation and disclosure of management strategies and plans]

When formulating our business strategies and business plans, we have set our goal based on the premise of achieving the Group's goal; that is, a continuous sales growth rate of 10% or more, a gross profit margin of 30% or more, and an ordinary income-to-sales ratio of 10% or more. With regard to disclosing management plans that accurately describe the cost of capital, we will carefully consider how to best communicate information by maintaining an open dialogue with shareholders through financial results briefings and individual meetings.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 5-1 [Policy regarding constructive dialogue with shareholders]

The Company has established an organization for managing IR, and holds financial results briefings for shareholders and investors at least twice a year. We also create opportunities for dialogue by obliging individual interviews with persons such as the Director and Chief Financial Officer upon request. We have also created a system for sharing the opinions received during these interviews with management on an as-needed basis. As discussions unfold, we consider the topic of the discussion and strictly control insider information.

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved |

To view back numbers of Bridge Reports (Sakura internet Inc.: 3778) or the contents of Bridge Salon (IR related seminars), please go to our website at the following url: