Bridge Report:(3778)Sakura internet fiscal year ended March 2022

President Kunihiro Tanaka | Sakura internet Inc.(3778) |

|

Company Information

Market | TSE Prime Section |

Industry | Information, Telecommunication |

President | Kunihiro Tanaka |

HQ Address | Tokyo Tatemono Umeda Building 11F Umeda, Kita-ku, Osaka-shi, Osaka |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥557 | 36,480,056 shares | ¥20,319 million | 3.4% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥3.50 | 0.6% | ¥21.93 | 25.4x | ¥228.01 | 2.4x |

*The share price is the closing price on May 27.

*The number of shares issued is obtained by subtracting the number of treasury shares from the number of shares issued as of the end of the latest quarter.

ROE and BPS are the results of the previous year.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net profit attributed to parent company shareholders | EPS | DPS |

March 2018 Act. | 17,033 | 745 | 574 | 349 | 9.29 | 2.50 |

March 2019 Act. | 19,501 | 567 | 395 | 91 | 2.44 | 2.50 |

March 2020 Act. | 21,908 | 939 | 789 | 160 | 4.39 | 2.50 |

March 2021 Act. | 22,168 | 1,372 | 1,099 | 758 | 20.79 | 3.00 |

March 2022 Act. | 20,019 | 763 | 649 | 275 | 7.55 | 3.00 |

March 2023 Est. | 20,350 | 1,390 | 1,230 | 800 | 21.93 | 3.50 |

*Estimates are provided by the company.

*Units: million yen, yen.

This Bridge Report presents Sakura internet’s earning results for the fiscal year ended March 2022, along with estimates for the term ending March 2023.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2022 Earnings Results

3. Fiscal Year ending March 2023 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2022, sales declined 9.7% year on year, and operating income dropped 44.4% year on year. The sales of cloud services remained steadily, but net sales decreased, due to the expiration of the contract period of a large-scale governmental project, the shift from physical base services in a certain scale, etc. However, all of them are within the company’s assumption. In terms of profit, gross profit declined, and despite the reduction of SG&A, profit declined mainly due to the drop in sales. However, sales and all kinds of profits significantly exceeded the forecasts revised upwardly at the time of announcement of financial results for the first half. The company has paid a term-end dividend of 3.00 yen/share like in the previous term.

- For the fiscal year ending March 2023, it is expected that sales and operating income will rise 1.7% and 82.1%, respectively, year on year. Sales are projected to grow, as the growth of cloud services will absorb the decline in sales of physical base services. In terms of profit, profit margin is forecast to rise considerably thanks to the rise in the ratio of sales of highly profitable cloud services and the optimization of costs, which has been continued from the previous term, and operating income is expected to grow considerably. The company will also enhance the investment in human resources and marketing for further growth. The increases in personnel expenses and advertisement costs are forecast to decrease profit by 360 million yen and 200 million yen, respectively. The company plans to invest 2.5 billion yen in mainly servers and network equipment (which will cost 2.2 billion yen). For dividends, the company plans to pay a term-end dividend of 3.50 yen/share, up 0.50 yen/share from the previous term.

- For the fiscal year ended March 2022, which was considered as the period of “labor pains,” the forecast was upwardly revised, and the results exceeded the revised forecast. The company will shift to cloud services, and the effects of measures it has implemented are expected to be reflected in profit in the fiscal year ending March 2023. However, the recovery of its share price is sluggish. At the beginning of the fiscal year ended March 2022, the company set targets for the fiscal year ending March 2024, and EPS is expected to be over 40 yen. We consider that these have not been reflected in share price to a sufficient degree. In addition, the company aims to create new services in parallel with the shift to cloud services. If these contribute, sales growth can be expected. They hope to take advantage of the growth of the cloud market in the public and private sectors.

1. Company Overview

Sakura internet operates data centers located in Tokyo (Nishi Shinjuku, Higashi Shinjuku and Daikanyama, using rented floor space), Osaka (Dojima, using rented floor space) and Hokkaido (Ishikari, owned land, and buildings) to provide cloud/internet infrastructure services. Currently, the company is shifting from physical base services, such as housing and dedicated servers, to cloud services. By owing its own infrastructure, Sakura internet pursues higher profitability and increases utilization rates and reduce fixed cost risk.

Business Description

Sakura internet’s business is divided into cloud services (cloud infrastructure and cloud application), physical base services, domain and SSL acquisition (Certification for unique domain acquisition outsourcing), and others including subsidiary business. The composition ratio of sales of fiscal year ended March 2022 is cloud services are 54.8% (of which cloud infrastructure and cloud application for 36.2%, and 18.6% respectively), physical base services are 22.5%, and other services are 22.7%.

2. Fiscal Year ended March 2022 Earnings Results

2-1 Full Year Consolidated Results

| FY 3/21 | Ratio to sales | FY 3/22 | Ratio to sales | YoY | Company’s forecast | Difference from the forecast |

Sales | 22,168 | 100.0% | 20,019 | 100.0% | -9.7% | 19,700 | +1.6% |

Gross Profit | 5,689 | 25.7% | 4,708 | 23.5% | -17.3% | - | - |

SG&A | 4,317 | 19.5% | 3,944 | 19.7% | -8.6% | - | - |

Operating Income | 1,372 | 6.2% | 763 | 3.8% | -44.4% | 640 | +19.2% |

Ordinary Income | 1,099 | 5.0% | 649 | 3.2% | -40.9% | 530 | +22.5% |

Net Profit attributed to Parent Company Shareholders | 758 | 3.4% | 275 | 1.4% | -63.7% | 190 | +45.0% |

*Unit: million yen.

Sales decreased 9.7% and operating income dropped 44.4%. The company proceeded with the shift to cloud services, and sales exceeded the forecast significantly.

Sales declined 9.7% year on year to 20.01 billion yen. The sales of cloud services remained healthy, but net sales decreased, due to the expiration of the contract period of a large-scale governmental project, the shift from physical base services in a certain scale, etc. The application of the standards for revenue recognition is another factor in decreasing sales. However, all of them are within the company’s assumption. Sales exceeded the company’s forecast: 19.7 billion yen.

Operating income dropped 44.4% year on year to 760 million yen. Gross profit decreased from 5.68 billion yen (gross profit margin: 25.7%) in the previous term to 4.7 billion yen (gross profit margin: 23.5%), due to the decline in cost of goods for sale (effect: 800 million yen) after posting the net amount of product sales through the application of the standards for revenue recognition, the decrease in the cost for governmental satellite data projects (effect: 540 million yen), the drop in rents caused by the optimization of data centers (effect: 290 million yen), etc. SG&A decreased from 4.31 billion yen (SG&A rati 19.5%) in the previous term to 3.94 billion yen (SG&

A rati 19.7%), due to the reduction of rents (effect: 150 million yen) caused by the relocation of the headquarters and the downsizing of Tokyo Branch for new workstyles based on remote work, the drop in outsourcing costs (100 million yen) through in-house customer support, etc., but operating income declined, mainly due to the drop in sales. Ordinary income decreased 40.9% year on year to 640 million yen, due to the posting of gain on sale of crypto-assets, etc. Profit attributable to owners of parent dropped 63.7% year on year to 270 million yen, as the loss due to the relocation of the headquarters was posted as extraordinary loss and impairment loss augmented.

The company plans to pay a term-end dividend of 3.00 yen/share like in the previous term.

Sales by Service

| FY 3/21 | Ratio to sales | FY 3/22 | Ratio to sales | YoY |

Cloud services | 9,995 | 45.1% | 10,963 | 54.8% | +9.7% |

Physical base services | 6,198 | 28.0% | 4,497 | 22.5% | -27.4% |

Other services | 5,974 | 26.9% | 4,557 | 22.7% | -23.7% |

Total | 22,168 | 100.0% | 20,019 | 100.0% | -9.7% |

*Unit: million yen

Factors in the difference from the earnings forecast

Operating income and ordinary income exceeded the forecast, thanks to the health sales of cloud services, on which the company concentrates, and the optimization of costs. The loss attributable to owners of parent exceeds the forecast, even when extraordinary losses, including the loss due to the relocation of the headquarters, are taken into account.

3. Fiscal Year ending March 2023 Earnings Forecasts

3-1 Consolidated Business Results

| FY 3/ 22 Act. | Ratio to sales | FY 3/ 23 Est. | Ratio to sales | YoY |

Sales | 20,019 | 100.0% | 20,350 | 100.0% | +1.7% |

Operating Income | 763 | 3.8% | 1,390 | 6.8% | +82.1% |

Ordinary Income | 649 | 3.2% | 1,230 | 6.0% | +89.4% |

Net profit attributed to parent company shareholders | 275 | 1.4% | 800 | 3.9% | +190.4% |

*Unit: million yen

In the fiscal year ending March 2023, it is expected that sales and operating income will grow 1.7% and 82.1%, respectively, year on year.

Sales are projected to increase 1.7% year on year to 20.35 billion yen. Sales growth is expected, as the growth of cloud services will absorb the drop in sales of physical base services. It is forecast that the growth of cloud services will increase sales by 950 million yen and the commissioned projects related to governmental satellite data, etc. will increase sales by 400 million yen. On the other hand, it is projected that the sales of physical base services will drop 510 million yen, the expiration of the period for dedicated servers in the public sector will decrease sales by 420 million yen, and the spot sales of group companies will decline 90 million yen.

Regarding profit, profit margin is expected to rise considerably and operating income is forecast to grow 82.1% year on year to 1.39 billion yen, thanks to the improvement in the ratio of sales from highly profitable cloud services and the optimization of costs, which has been continued since the previous term. The growth of sales is projected to increase profit by 330 million yen. Regarding the optimization of costs, it is forecast that the costs for servers and network equipment will decrease 480 million yen and procurement cost will drop 240 million yen. The company will enhance the investment in human resources and marketing for further growth. It is forecast that the augmentation of personnel expenses will decrease profit by 360 million yen and the increase in advertisement costs will reduce profit by 200 million yen.

The company plans to invest 2.5 billion yen in mainly servers and network equipment (which will cost 2.2 billion yen).

The company plans to pay a term-end dividend of 3.50 yen/share, up 0.50 yen/share from the previous term.

3-2 Future Direction

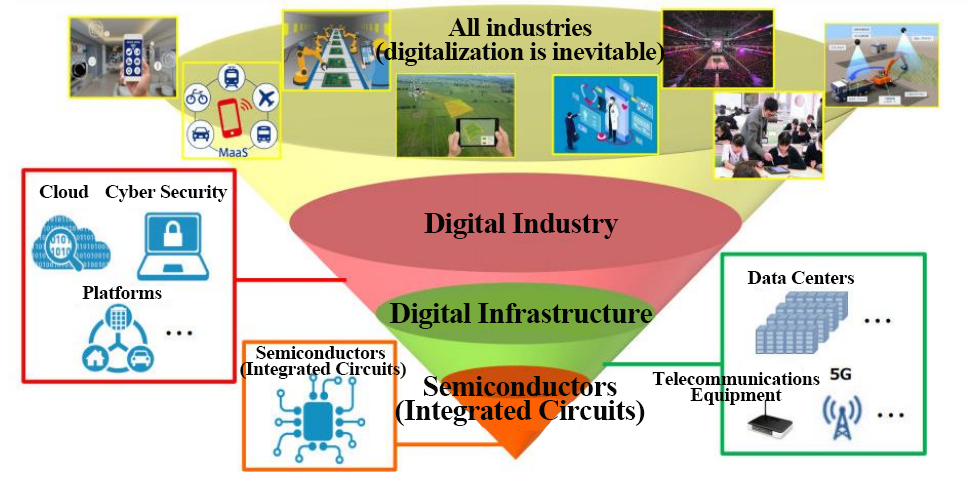

Arrival of the DX Age

All kinds of enterprises will become IT enterprises!

(From the company's presentation materials)

According to the definition by IDC, a research company specializing in IT, DX means enterprises creating value and securing competitive advantages by changing customers’ online and real experiences with new products, services, and business models by utilizing the third platform (cloud, mobility, big data/analytics, and social technologies) while responding to the destructive changes in external ecosystems (customers and markets) and leading the innovation of internal ecosystems (organizations, culture, and employees).

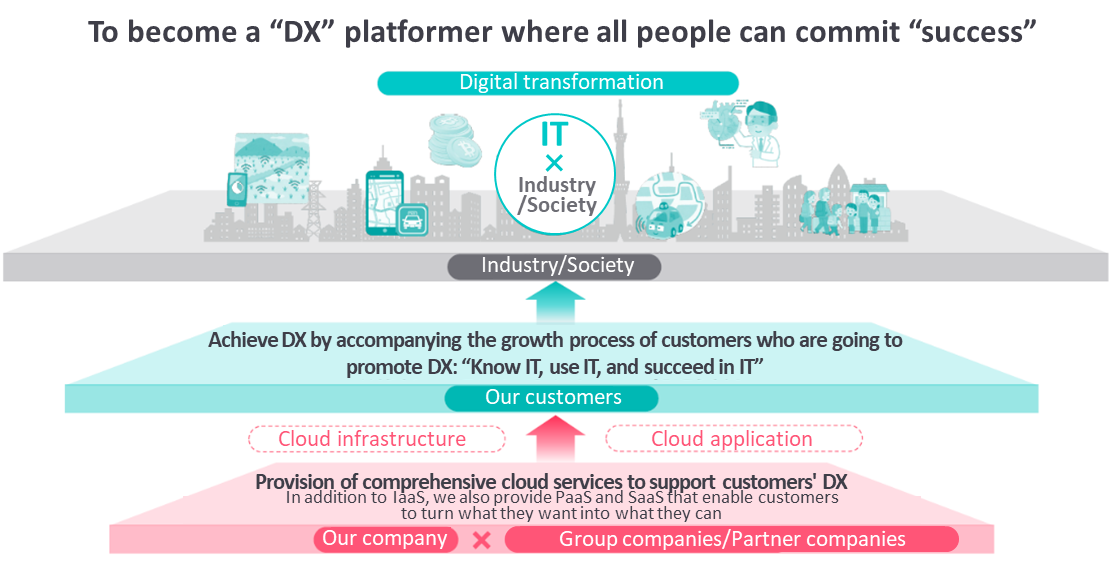

On the other hand, user clients’ insufficient IT skills are obstacles to DX. A partner that can support user clients in DX and grow together is indispensable. In this situation, the company aims to become a DX platform provider that will make all people “successful.”

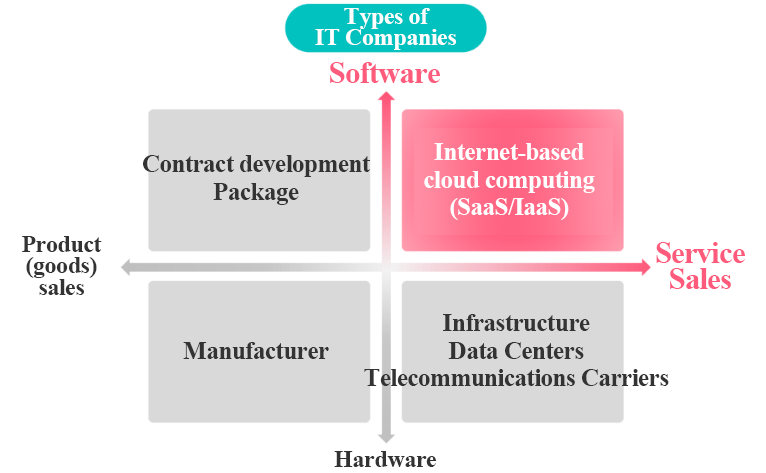

Changes in the IT industry in terms of DX

The center of the IT industry is changing from the sale of goods to the provision of software services.

(From the company's presentation materials)

The main players in the IT industry have been makers of hardware, etc. (the lower left in the above chart). However, the industry is shifting to software services, as exemplified by the fact that a leading IT company decided to withdraw from the main frame (large general computer) business. Sakura Internet, too, is switching from physical base services (lower right in the above chart), which have been the mainstay, to cloud services (the upper right in the above chart).

The staple of the Japanese industry was iron and steel in the 1970s to 1980s, semiconductors in the 1980s to 1990s, and is changing to Internet cloud resources.

(From the company's presentation materials)

3-3 For the fiscal year ending March 2023

Enhancement of the cloud business

The company will implement some measures for offering comprehensive cloud services for supporting DX.

(From the company's presentation materials)

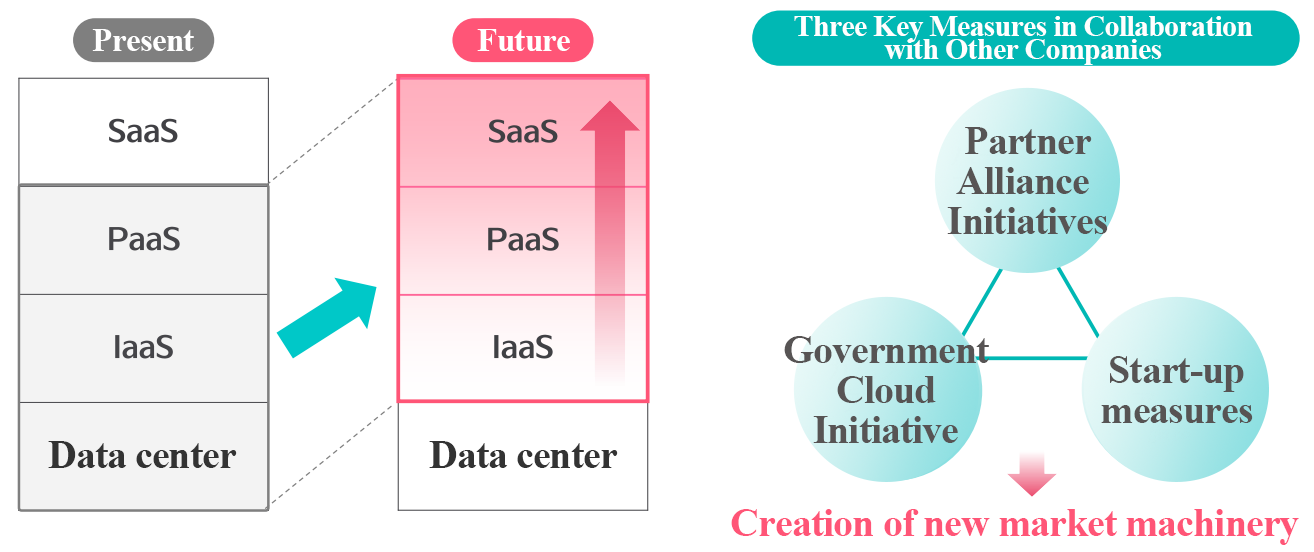

To meet various needs for cloud services for DX, the company plans to expand services, including SaaS (Software as a Service) and PaaS (Platform as a Service), and create more opportunities in the market.

In addition, the company will make efforts to earn stable profit from VPS, cloud, and rental server services through the improvement of functions and the enhancement of marketing while understanding customers.

Creation of new opportunities in the market

①Partner and alliance measures

To create new value in cooperation with other companies

To continue marketplace measures | To offer commercial software and middleware, which were developed by business partners, as PaaS and SaaS products in the cloud of the company |

To support enterprises in providing SaaS | In response to enterprises’ needs for shift from the sale of goods to the provision of software services, the company will help them produce SaaS with the infrastructure and technologies of the corporate group |

Expansion of sales channles based on the partnerships with cloud integrators | In response to the needs for operating multiple clouds with a single system, the company will form partnerships with more multi-cloud integrators. |

(Produced by Investment Bridge with reference to the company’s briefing material)

②Governmental cloud measures

The scale of the market of cloud services targeted at governments and municipalities is expected to increase over two times from FY 2021 to 566.6 billion yen in FY 2025, thanks to the increase of use of SaaS, etc. and the ratio of cloud services is projected to rise to 43.8%.

Recent measures and situation

✓To enter the governmental cloud market, the company obtained the ISMAP (Information System, Security Management, and Assessment Program) certificate for “Sakura Cloud” in December 2021.

✓Business inquiries about governmental projects have been increasing. In the future, the company will approach large companies whose clients include local governments, based on the track record of installing systems in governments.

✓The company established an internal organization for marketing and support exclusively for government ministries and agencies and local governments.

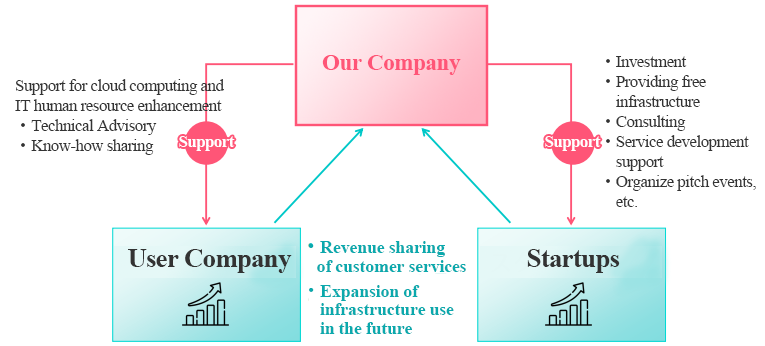

Measures for companies that have just started DX and start-up firms

●To invest in start-up firms and support development

●Sakura Internet engineers support companies that have just started DX in a meticulous way

(From the company's presentation materials)

Recent measures and situation

✓As the latest case in which engineers support clients in DX, the company concluded an advisory contract with Sketchbook, Inc., which offers lunch support services for nursery schools. Then, they supported the development of services and the establishment of an engineering organization.

✓The company invested in neton, Inc., which operates “Saiyo Kacho,” a cloud-based tool for supporting recruitment.

✓Held a large-scale pitch contest at the start-up support facility* jointly operated by the public and private sectors, including Sakura Internet.

(*) “Fukuoka Growth Next,” which is jointly managed by Sakura Internet, Fukuoka City, Fukuoka Jisho, and GMO Pepabo. It continuously support start-up firms and SMEs in creating another business, for the purpose of creating future unicorn companies while contributing to the creation of jobs in Fukuoka City and the growth of local economies.

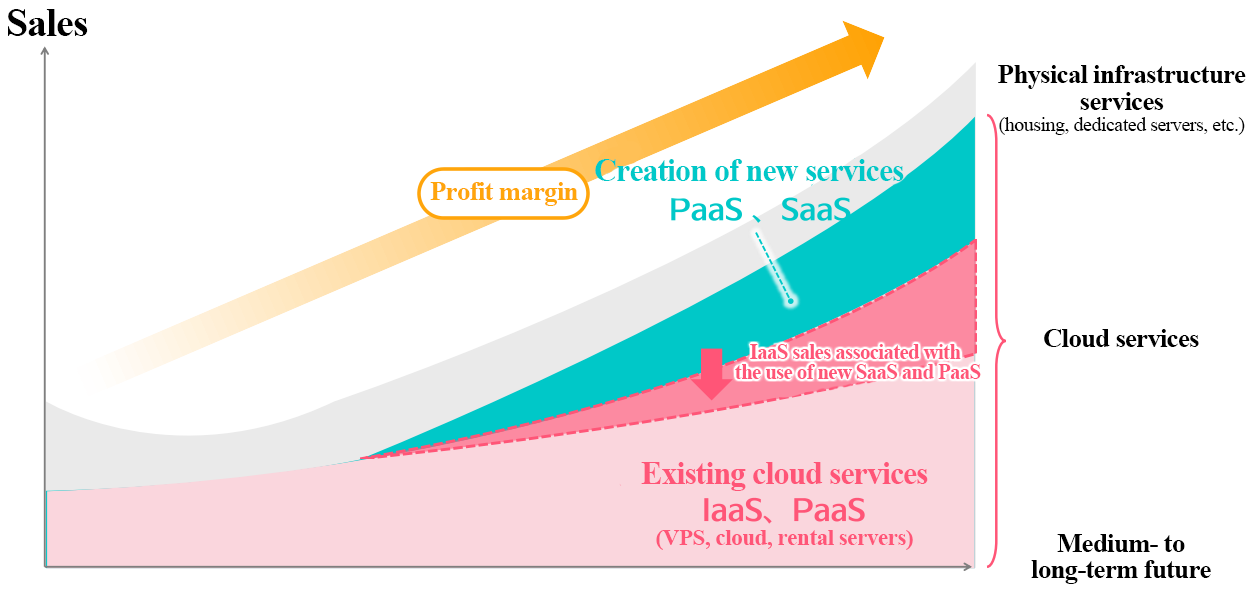

Envisioned growth

The company has focused on IaaS but will also focus on SaaS and PaaS services.

The company aims to realize discontinuous growth and maximize profit, by seizing business opportunities in growing fields without fail.

(From the company's presentation materials)

4. Conclusions

For the fiscal year ended March 2022, which was considered as the period of “labor pains,” the forecast was upwardly revised at the time of announcement of financial results for the first half, and the results exceeded the revised forecast. While the shift to cloud services is steadily progressing, the effects of their initiatives so far are expected to be first reflected in profit in the fiscal year ending March 2023. However, its impact on share price is still weak, and the share price is still much lower than around 800 yen before the announcement of financial results for the fiscal year ended March 2021. At the beginning of the fiscal year ended March 2022, the company aimed to achieve sales of 22 billion yen and an operating income of 2.4 billion yen in the fiscal year ending March 2024. EPS is expected to be over 40 yen. We consider that the share price of the company does not reflect the profit level in the fiscal year March 2024 or the forecast that profit will grow considerably for two consecutive terms. The share price is expected to be reevaluated, because the impact of the recent yen depreciation and skyrocketing commodity prices on the company is minor. In addition, the company aims to create new services in parallel with the shift to cloud services. If these contribute, sales growth can be expected. They hope to take advantage of the growth of the cloud market in the public and private sectors.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory |

Directors | 9 directors, including 5 outside ones (including 3 independent directors) |

Auditors | 4 directors, including 4 outside ones (including 2 independent directors) |

◎Corporate Governance Report (Updated on December 1, 2021)

Basic Policy

Our company has strived with the basic policy about corporate governance: promote the maintenance of business management organizations and enhance efficient and systematic management and internal controls of each department while expanding the company size. There is a greater social responsibility in internet industry than in other industries as communication facilities are released to a large number of invisible customers and its market is the internet users around the world. We consider that the establishment of corporate governance at our company means the management base which enables to fulfill such social responsibilities.

<Reason for Non-Compliance with the Principles of the Corporate Governance Code (Excerpts)>

The following description includes some contents for the Prime Market, based on the Corporate Governance Code revised in June 2021.

Supplementary Principle 2-4-1 【Ensuring diversity in the appointment of core personnel, etc.】

<View on ensuring diversity, voluntary and measurable goals and their status>

Under our belief that “diversity helps our company grow,” we strive to promote employment and promotion of core personnel that respect diversity, regardless of age, gender, nationality, or other attributes. However, we recognize our challenges that there are few female applicants due to the high employment ratio of IT engineers in the first place, and that the ratio of female managers is lower than the ratio of female employees to all employees, and we announce our target figures for the ratio of female employees and female managers in the Action Plan for General Business Owners.

As most of them are mid-career hires in our company, we do not set a target for promotion of mid-career employees. For employment and promotion of foreign employees, we do not have a set target by attributes at this point, however, we will consider setting such goals when we determine it necessary in the future.

<Human resources development policy for ensuring diversity, in-house environmental improvement policy, and their status>

In light of the significance of Human Resources Strategies for enhancing our corporate value over the medium/long term, our company has been making various improvements in the in-house environment that respect diversity in work styles, and individual employees can pursue “job satisfaction” in the comfortable work environment the company provides, while aiming to induce co-creation by leveraging the knowledge and experience obtained from both a broad career not tied to the company and private life.

Supplementary Principles 3-1-3 and 4-2-2 【Sustainability initiatives, formation of the basic policy for such initiatives, etc.】

<Sustainability initiatives>

The significance of data centers has been increasing every year as a social infrastructure that supports DX (digital transformation), and data center operations that consume a large amount of electricity are required to contribute to a sustainable society by reducing greenhouse gas emissions, from the perspective of the SDGs. Our company adequately recognizes the significance of initiatives for sustainability as a significant factor for our management strategies.

At the Ishikari Data Center our company operates in Ishikari City, Hokkaido, we have been actively carrying out initiatives to enhance sustainability by leveraging its location since the launch of the facility in 2011. We have been improving energy-efficiency by using cool air from outside to cooldown servers, and utilizing exhaust heat from servers for road heating and office heating, and also reduced the electric power consumption to approximately 60% compared with urban data centers. Furthermore, in June 2021, we changed our power procurement to power companies that mainly use LNG- and gas-fired power generation that are environmentally friendly, which enabled the Ishikari Data Center to reduce annual carbon dioxide (CO2) emissions by approximately 24%. We are continuing our effort to become an environmentally friendly data center that can operate at optimum energy efficiency with minimal environmental impact.

In October 2021, in addition to endorsing the Recommendations of the Task Force on Climate-Related Financial Disclosure (TCFD), we joined TCFD Consortium, a group of companies and institutions that endorse the recommendations of the TCFD. Moving forward, our company will prepare to make appropriate disclosures regarding the impact of climate change-related risks and profit opportunities on its own business activities, earnings, etc.

<Investment in Human Capital, Intellectual Properties, etc.>

Our company regards investment in intellectual properties is crucial for our business development, and actively supports creative activities within the company. As for investment in human capital, our company has been working to establish an environment that enhances and maximizes the capabilities of our employees, therefore, securing and developing human resources is one of our strengths, and is in line with our key theme of Achieving Customer Success (CS) and Employee Success (ES), which is to build a relationship of mutual growth by supporting our customers as well as our employees to succeed. We will supervise these activities to contribute to the sustainable growth of our company and actively disclose the information.

Principle 5-2, Supplementary Principle5-2-1 [Formulation and disclosure of management strategies and plans and others]

When formulating our management strategies and plans, we set goals regarding our profitability while fully taking into account capital costs. However, regarding indicators, such as capital efficiency, we do not disclose them as of now. We will keep discussing the level of indicators while considering the characteristics of our business, etc. and plan to carefully determine how to convey the information through the dialogue with shareholders at results briefing sessions, individual meetings, etc. We will continue to discuss the formulation of basic policies regarding our business portfolio.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

The following description includes some contents for the Prime Market, based on the Corporate Governance Code revised in June 2021.

Principle 1-4 【Strategically held shares】

Our company does not hold any shares strategically.

Principle 5-1 [Policy regarding constructive dialogue with shareholders]

The Company has established an organization for managing IR, and holds financial results briefings for shareholders and investors at least twice a year. We also create opportunities for dialogue by obliging individual interviews with persons such as the Director and Chief Financial Officer upon request. We have also created a system for sharing the opinions received during these interviews with management on an as-needed basis.

As discussions unfold, we consider the topic of the discussion and strictly control insider information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved |

To view back numbers of Bridge Reports (Sakura internet Inc.: 3778) or the contents of Bridge Salon (IR related seminars), please go to our website at the following url: www.bridge-salon.jp/