Bridge Report:(3778)Sakura internet 1st Half of the Fiscal Year ending March 2023

President Kunihiro Tanaka | Sakura internet Inc.(3778) |

|

Company Information

Market | TSE Prime Section |

Industry | Information, Telecommunication |

President | Kunihiro Tanaka |

HQ Address | Tokyo Tatemono Umeda Building 11F Umeda, Kita-ku, Osaka-shi, Osaka |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥519 | 36,879,056 shares | ¥19,140million | 3.4% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥3.50 | 0.7% | ¥21.77 | 23.8x | ¥228.01 | 2.3x |

*The share price is the closing price on Nov 4.

*The number of shares issued is obtained by subtracting the number of treasury shares from the number of shares issued as of the end of the latest quarter.

ROE and BPS are the results of the previous year.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net profit attributed to parent company shareholders | EPS | DPS |

March 2019 Act. | 19,501 | 567 | 395 | 91 | 2.44 | 2.50 |

March 2020 Act. | 21,908 | 939 | 789 | 160 | 4.39 | 2.50 |

March 2021 Act. | 22,168 | 1,372 | 1,099 | 758 | 20.79 | 3.00 |

March 2022 Act. | 20,019 | 763 | 649 | 275 | 7.55 | 3.00 |

March 2023 Est. | 20,350 | 1,390 | 1,230 | 800 | 21.77 | 3.50 |

*Estimates are provided by the company.

*Units: million yen, yen.

This Bridge Report presents Sakura internet’s earning results for 1st Half of the Fiscal Year ending March 2023 Earnings Results, along with estimates for the term ending March 2023.

Table of Contents

Key Points

1. Company Overview

2. 1st Half of the Fiscal Year ending March 2023 Earnings Results

3. Fiscal Year ending March 2023 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the first half of the fiscal year ending March 2023, sales increased 3.4% year on year and operating income grew 120.6% year on year. Sales rose as the cloud service continued to perform favorably, spot sales of group companies were recorded, and so on. With regard to profit, gross profit grew due to the reduction of depreciation and leasing fees brought about by shifting to a policy of investing in Cloud business, etc. Profit considerably increased, as the rise in SG&A expenses was offset. Profit attributable to owners of parent was 240 million yen (loss of 60 million yen in the previous term) .Sales and all kinds of profit exceeded the company’s forecast revised in July.

- The full-year forecast remains unchanged, calling for year-on-year growth of 1.7% in sales and 82.1% in operating income. Cloud business is projected to perform healthily. In terms of profit, while the depreciation of the yen is rapidly progressing, the impact of foreign currency exchange on the service cost will be curtailed as a significant percentage of the services is developed within the company. While the cloud business is going to perform healthily, the company kept the performance forecast for the whole term unchanged, taking into consideration unclear economic factors such as oil prices and foreign currency exchange, while considering various measures for medium-to-long term growth, such as investment in personnel and reinforcement of marketing. Dividends have not been revised either and the company plans to pay a year-end dividend of 3.50 yen/share, up 0.50 yen/share year on year.

- The company has been steadily proceeding with a shift to cloud services, and results in the first half of the term significantly exceeded the initial forecast. They considerably elevated profit margin in the first half, but it is projected to keep rising even more in the second half. The improvement trend is expected to continue. Furthermore, the company has released new services in step with the shift to cloud services. If these services fully contribute, they can expect not only the elevation of profit margin, but also the remarkable growth of sales. While the business is being steadily progressed, the share price of the company remains sluggish. The company has adopted a restricted stock compensation system and J-ESOP as an incentive for executives and employees. It can be expected that executives and employees will strive for management which takes into consideration the share price of the company.

1. Company Overview

Sakura internet operates data centers located in Tokyo (Nishi Shinjuku, Higashi Shinjuku and Daikanyama, using rented floor space), Osaka (Dojima, using rented floor space) and Hokkaido (Ishikari, owned land, and buildings) to provide cloud/internet infrastructure services. Currently, the company is shifting from physical base services, such as housing and dedicated servers, to cloud services. By owing its own infrastructure, Sakura internet pursues higher profitability and increases utilization rates and reduce fixed cost risk.

【Corporate philosophy】

The company defines the following mission, vision and value as their corporate philosophy and aims to be supported as a valuable company by all stakeholders through the realization thereof.

Corporate mission

We shall contribute to the realization of a future brimming with creativity and surprise through the Internet by providing a data center service that broadens the possibilities of people and businesses.

Corporate vision

・Service | :Providing a high-quality and low-cost IT platform and innovative and interesting Internet services |

・Infrastructure | :Realizing a highly cost-competitive IT infrastructure offering both scale economy and flexibility |

・Technology | :Pursuing advanced technologies to contribute to the realization of valuable services and the advance of the Internet |

Corporate value

・Constant innovation creating high-quality services

・Excellent operation supporting cost performance

・Quality communication as the base of all activities

Business Description

Sakura internet’s business is divided into cloud services (cloud infrastructure and cloud application), physical base services, domain and SSL acquisition (Certification for unique domain acquisition outsourcing), and others including subsidiary business. The composition ratio of sales of fiscal year ended March 2022 is cloud services are 54.8% (of which cloud infrastructure and cloud application for 36.2%, and 18.6% respectively), physical base services are 22.5%, and other services are 22.7%.

Cloud Service

The company currently concentrates its management resources on this business. They are accelerating the development of new cloud services tailored to the usage scenario and growth phase of their clients, by utilizing their technological capabilities and know-how fostered by offering an extensive service line-up.

Cloud infrastructure

Services where multiple virtual servers are built on a physical server through virtualization technologies, and each of them can be used as a dedicated server. The company offers a service where generally a single contract is made for each virtual server (“Sakura VPS”), a service that allows for the application for multiple servers and the network setting thereof within the contract and makes it possible to charge fees based on days or hours (“Sakura Cloud”), etc.

Cloud application

The company offers SaaS services developed on their own or in cooperation with partner companies, such as a service where multiple clients can jointly use the company-owned physical server and a variety of functions without requiring maintenance (“Sakura Rental Server”).

Physical base service

Data centers operated by the company offer spaces where clients can freely install their communication devices, a housing service for the rental of network and electrical circuits necessary for Internet connection as well as a dedicated server service that allows for dedicated usage of the company-owned physical server.

Other services

Other services include the revenues of the security service by Gehirn Inc., MSP (a management service provide undertaking the monitoring, operation and maintenance of servers and networks) for large corporations by ITM Inc., MSP for small and medium-scale corporations by BitStar, Inc., integration in high-performance computing by Prunus-Solutions Inc. and storage virtualization service by IzumoBASE, INC.

The company forms a group with six consolidated subsidiaries and two equity-method affiliates. Consolidated subsidiaries are Gehirn Inc., SAKURA Mobile LIMITED, ITM Inc., BitStar, Inc., Prunus-Solutions Inc. and IzumoBASE, INC. Equity-method affiliates are S2i Inc. and BBSakura Networks, Inc.

2. 1st Half of the Fiscal Year ending March 2023 Earnings Results

2-1 Consolidated Results for 1H

| 1H FY 3/22 | Ratio to sales | 1H FY 3/23 | Ratio to sales | YoY | Company’s forecast | Difference from the forecast |

Sales | 9,662 | 100.0% | 9,989 | 100.0% | +3.4% | 9,970 | +0.2% |

Gross Profit | 2,146 | 22.2% | 2,500 | 25.0% | +16.5% | - | - |

SG&A | 1,948 | 20.2% | 2,063 | 20.7% | +5.9% | - | - |

Operating Income | 197 | 2.0% | 436 | 4.4% | +120.6% | 370 | +18.0% |

Ordinary Income | 129 | 1.3% | 377 | 3.8% | +192.6% | 320 | +18.0% |

Net Profit attributed to Parent Company Shareholders | -69 | - | 247 | 2.5% | - | 220 | +12.3% |

*Unit: million yen.

* Created by Investment Bridge Co, Ltd. based on disclosed materials.

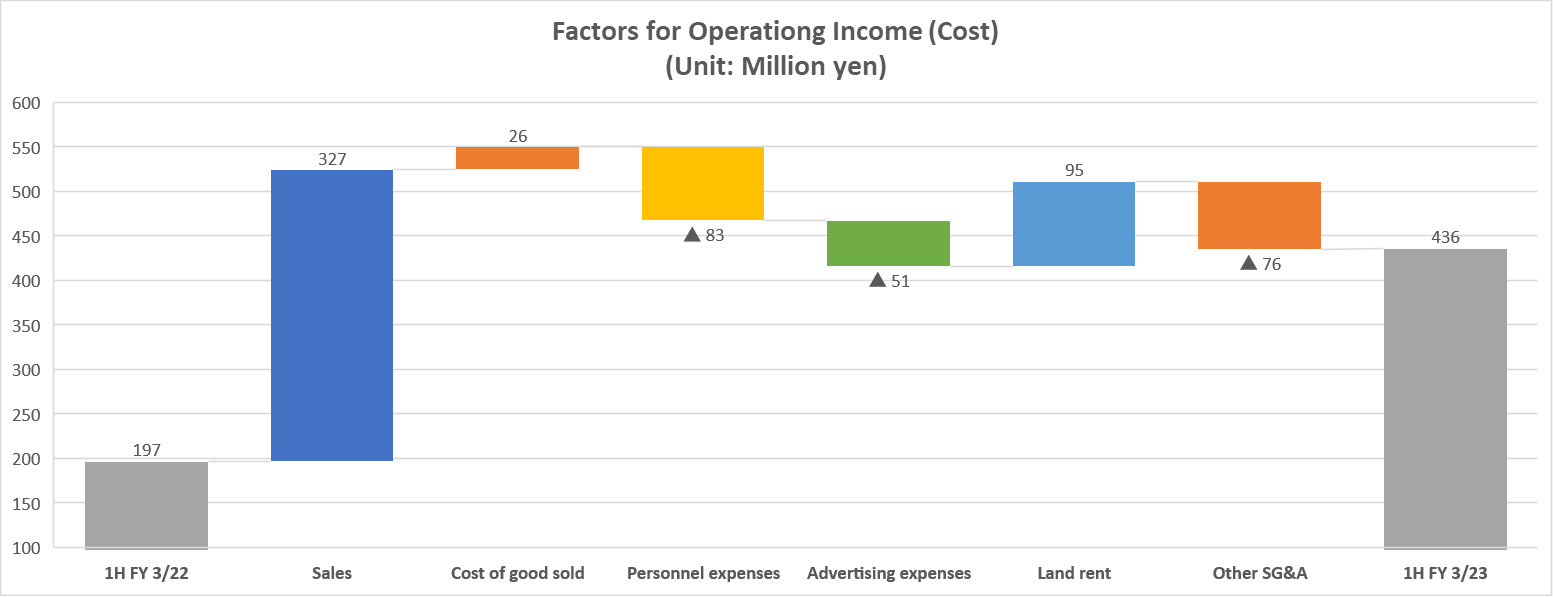

* The ▲ mark used in items regarding costs denotes an increase in costs.

3.4% increase in sales and 120.6% increase in operating income, exceeding the company’s forecast, with the progress of shift to cloud services

Sales stood at 9,980 million yen, up 3.4% year on year. Although some contracts for large projects in the physical base service have expired while they were concentrating on cloud services, sales grew as the cloud service continued to perform favorably, spot sales of group companies were recorded, etc., exceeding the company’s forecast of 9,970 million yen.

Operating income reached 430 million yen, up 120.6% year on year. Gross profit rose from 2,140 million yen in the previous term (profit margin of 22.2% in the previous term) to 2,500 million yen (profit margin of 25.0%) due to decrease in depreciation and leasing fees brought about by shifting to a policy of investing in Cloud business (positive impact of 270 million yen), reduction of rent owing to the optimization of data centers, etc. (positive impact of 60 million yen), increase in the cost of other services of group companies (negative impact of 190 million yen), etc. While SG&A expenses augmented from 1,940 million yen (SG&A expenses/sales ratio of 20.2%) in the previous term to 2,060 million yen (SG&A expenses/sales ratio of 20.7%) due to growth in personnel costs brought about by hiring more staff, etc. (80 million yen), rise in advertisement costs such as digital marketing for promoting sales, etc. (50 million yen), curtailment of rent due to relocating the company headquarters in step with new workstyles (90 million yen), operating income considerably grew, owing mainly to the increase of gross profit. Ordinary income was 370 million yen, up 192.6% year on year. Profit attributable to owners of parent was 240 million yen (loss of 60 million yen in the previous term) as a consequence of posting the loss of relocating the company headquarters as an extraordinary loss in the previous term.

Situation regarding initiatives for priority measures

Reinforcement of cloud business | Accelerating the elevation of value provided by existing services and the establishment of foundations for new growing areas based on partnerships with other companies |

●Continuous enhancement of cloud service functions and reinforcement of digital marketing such as Internet advertisement | |

●Start of cooperation between the comprehensive support service for virtual general meetings of shareholders by Coincheck, Inc. and Sakura internet’s live-broadcasting engine (August) | |

|

|

Concentration of investment in core areas | Focusing on acquiring human resources and reinforcing marketing to achieve further growth in the medium to long term |

●Favorable progress in acquiring human resources, succeeding in recruiting about 35 staff members focus on engineers in the first half of the term amid the rising demand for IT personnel in Japan | |

●Establishment of an organization with the aim of building a cycle of performing data-driven collection and analysis of clients’ challenges and opinions and linking them to products | |

|

|

Other initiatives | ●Adoption of a restricted stock compensation system and Employee Stock Ownership Plan (J-ESOP) as an incentive toward executives and employees |

●Decision to build a new base in Okinawa as part of initiatives to acquire and train DX personnel and bring about open innovation |

Sales by Service

| 1H FY 3/22 | Ratio to sales | 1H FY 3/23 | Ratio to sales | YoY |

Cloud services | 5,359 | 55.5% | 5,789 | 58.0% | +8.0% |

Physical base services | 2,298 | 23.8% | 1,845 | 18.5% | -19.7% |

Other services | 2,003 | 20.7% | 2,354 | 23.6% | +17.5% |

Total | 9,662 | 100.0% | 9,989 | 100.0% | +3.4% |

*Unit: million yen

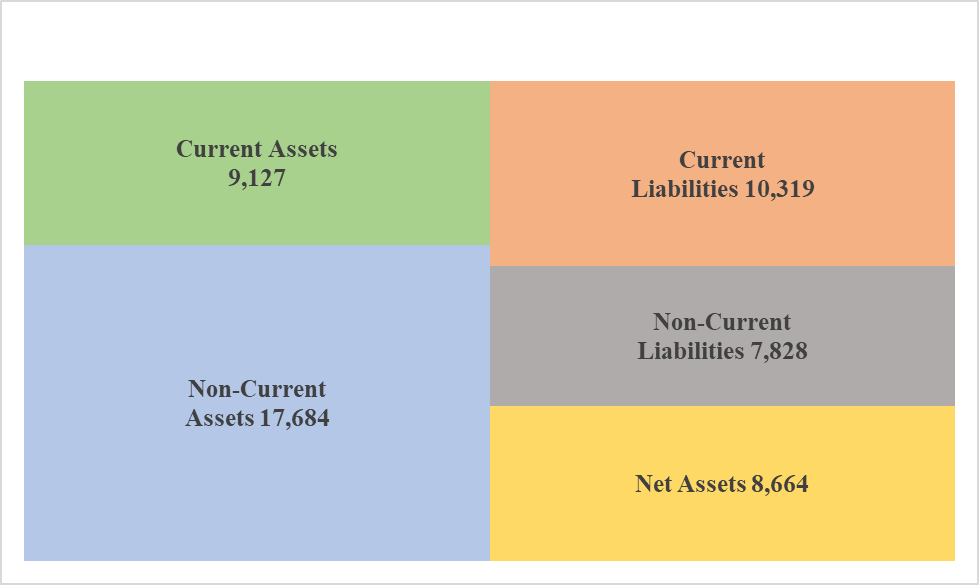

Balance Sheet Summary

| End of March 2022 | End of September 2022 |

| End of March 2022 | End of September 2022 |

Current Assets | 9,776 | 9,127 | Current Liabilities | 11,309 | 10,319 |

Tangible Assets | 15,725 | 15,005 | Noncurrent Liabilities | 8,637 | 7,828 |

Intangible Assets | 426 | 398 | Shareholder Equity | 8,313 | 8,517 |

Investments and Other Assets | 2,468 | 2,280 | Net Assets | 8,449 | 8,664 |

Noncurrent Assets | 18,620 | 17,684 | Total Liabilities and Net Assets | 28,396 | 26,812 |

*Unit: million yen

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

Total assets at the end of the first half of the term stood at 26,810 million yen, down 1,580 million yen from the end of the previous term. The decrease was caused mainly by reduction in tangible fixed assets brought about by depreciation, decrease in cash due to the payment of accounts payable and repayment of debt, decrease in accounts receivable, etc. Liabilities were 18,140 million yen, down 1,790 million yen, mainly due to the decrease in accounts payable and debt. Net assets were 8,660 million yen, up 210 million yen, mainly owing to the growth in retained earnings stemming from recording profit attributable to owners of parent, etc. Equity ratio stood at 31.8% (it was 29.3% at the end of the previous term).

3.Fiscal Year ending March 2023 Earnings Forecasts

3-1 Earnings Forecasts

| FY 3/ 22 Act. | Ratio to sales | FY 3/ 23 Est. | Ratio to sales | YoY |

Sales | 20,019 | 100.0% | 20,350 | 100.0% | +1.7% |

Operating Income | 763 | 3.8% | 1,390 | 6.8% | +82.1% |

Ordinary Income | 649 | 3.2% | 1,230 | 6.0% | +89.4% |

Net profit attributed to parent company shareholders | 275 | 1.4% | 800 | 3.9% | +190.4% |

*Unit: million yen

Plans 1.7% year-on-year sales growth and 82.1% year-on-year operating income growth for FY 3/23

The full-year forecast remains unchanged, calling for sales of 20,350 million yen, up 1.7% year on year. The cloud business is projected to perform healthily.

An operating income of 1,390 million yen, up 82.1% year on year, an ordinary income of 1,230 million yen, up 89.4% year on year, and a profit attributable to owners of parent of 800 million yen, up 190.4% year on year, are expected. Regarding profit, while the depreciation of the yen is rapidly progressing, the impact of foreign currency exchange on the service cost will be curtailed as a significant percentage of the services are developed within the company. While the cloud business is going to perform healthily, the company kept the performance forecast for the whole term unchanged, taking into consideration unclear economic factors such as oil prices and foreign currency exchange, while considering various measures for medium-to-long term growth, such as investment in personnel and reinforcement of marketing.

Investments of 2,500 million yen, mainly in servers and network devices (2,200 million yen), are planned.

Dividends have not been revised either and the company plans to pay a year-end dividend of 3.50 yen/share, up 0.50 yen/share year on year.

3-2 Business overview

Reinforcement of cloud business

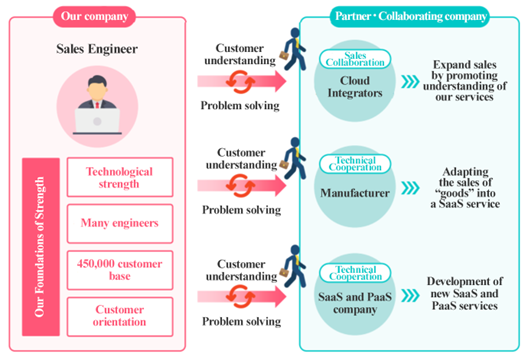

The company will become deeply intertwined with their partners and cooperating companies, and create and provide new value based on integrated support in solving issues.

|

■Recent initiatives, the latest situation ●Organizing frequent service study sessions attended by the company’s engineers for their partner companies in cloud integration (25 sessions in the first half of the term) ●Progressing projects for adapting the sales of “goods” into a SaaS service in manufacturing ●Start of cooperation between the company’s live broadcasting engine and the comprehensive support service for virtual general meetings of shareholders by Coincheck, Inc. (August) |

(from the company’s material)

Adoption of a restricted stock compensation system and Employee Stock Ownership Plan (J-ESOP)

Adoption of a restricted stock compensation system for directors and executive officers

The company decided to adopt this compensation system for allocating restricted shares to concerned directors for them to further share the advantages and risks of fluctuations in share prices with shareholders and enhance their ambitions in contributing to the rise in share prices and elevation of corporate value more than before.

Adoption of Employee Stock Ownership Plan (J-ESOP) for staff

The company decided to adopt “Employee Stock Ownership Plan (J-ESOP), an incentive plan of providing the company’s shares to employees in order to elevate the ambition, morale and motivation of the staff to drive the organization and business. The company expects that by adopting this system, the interest of employees in share price and performance improvement will rise and they will engage in their work with more zeal.

4. Conclusions

The company has been steadily proceeding with the shift to cloud services, and the results in the first half of the term significantly exceeded the initial forecast. The shift to cloud services will improve profit margin. The company considerably elevated profit margin, but it is projected to keep rising even more in the second half. The improvement trend is expected to continue. At the beginning of the fiscal year March 2022, they set targets of 22 billion yen in sales and 2.4 billion yen in operating income for the fiscal year March 2024 and it feels that the achievement thereof is gradually coming into sight. Furthermore, the company has released new services in step with the shift to cloud services. If these services fully contribute, they can expect not only the rapid elevation of profit margin, but also the remarkable growth of sales. On the other hand, profit in the second quarter (July to September) declined in comparison with the first quarter (April to June). While there was influence of strategic aspects such as growth of advertisement expenses, it appears that rising electricity costs also played a role. However, the increase in oil price, which brought about the rise in electricity costs, has already subsided and is possibly not going to have a considerable impact from now on. Securing human resources amid the growing lack of IT personnel was stated as another challenge. As the company temporarily refrained from recruiting, there was a possibility that they would struggle to acquire personnel, but it appears that their recent progress is steady. While the business is being steadily progressed, the company’s share price remains sluggish and is far from reaching the level around 800 yen before announcing financial results in the fiscal year March 2021. Amid such situation, the company adopted a restricted stock compensation system and J-ESOP as an incentive for executives and employees. It can be expected that executives and employees will strive for management which takes into consideration the share price of the company.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory |

Directors | 9 directors, including 5 outside ones (including 3 independent directors) |

Auditors | 4 directors, including 4 outside ones (including 2 independent directors) |

◎Corporate Governance Report (Updated on July 1, 2022)

Basic Policy

Our company has strived with the basic policy about corporate governance: promote the maintenance of business management organizations and enhance efficient and systematic management and internal controls of each department while expanding the company size. There is a greater social responsibility in internet industry than in other industries as communication facilities are released to a large number of invisible customers and its market is the internet users around the world. We consider that the establishment of corporate governance at our company means the management base which enables to fulfill such social responsibilities.

<Reason for Non-Compliance with the Principles of the Corporate Governance Code (Excerpts)>

Supplementary Principle 2-4-1 【Ensuring diversity in the appointment of core personnel, etc.】

<View on ensuring diversity, voluntary and measurable goals and their status>

Under our belief that “diversity helps our company grow,” we strive to promote employment and promotion of core personnel that respect diversity, regardless of age, gender, nationality, or other attributes. However, we recognize our challenges that there are few female applicants due to the high employment ratio of IT engineers in the first place, and that the ratio of female managers is lower than the ratio of female employees to all employees, and we announce our target figures for the ratio of female employees and female managers in the Action Plan for General Business Owners.

As most of them are mid-career hires in our company, we do not set a target for promotion of mid-career employees. For employment and promotion of foreign employees, we do not have a set target by attributes at this point, however, we will consider setting such goals when we determine it necessary in the future.

<Human resources development policy for ensuring diversity, in-house environmental improvement policy, and their status>

In light of the significance of Human Resources Strategies for enhancing our corporate value over the medium/long term, our company has been making various improvements in the in-house environment that respect diversity in work styles, and individual employees can pursue “job satisfaction” in the comfortable work environment the company provides, while aiming to induce co-creation by leveraging the knowledge and experience obtained from both a broad career not tied to the company and private life.

Supplementary Principles 3-1-3 and 4-2-2 【Sustainability initiatives, formation of the basic policy for such initiatives, etc.】

<Sustainability initiatives>

The significance of data centers has been increasing every year as a social infrastructure that supports DX (digital transformation), and data center operations that consume a large amount of electricity are required to contribute to a sustainable society by reducing greenhouse gas emissions, from the perspective of the SDGs. Our company adequately recognizes the significance of initiatives for sustainability as a significant factor for our management strategies.

At the Ishikari Data Center our company operates in Ishikari City, Hokkaido, we have been actively carrying out initiatives to enhance sustainability by leveraging its location since the launch of the facility in 2011. In addition to achieving the highest energy efficiency standard in the world by reducing electricity consumption by about 40% in comparison with usual urban data centers through elevating energy efficiency based on outside air-cooling systems utilizing cold outside air, etc., we realized substantial elimination of yearly carbon dioxide (CO2) emissions in the Ishikari Data Center by switching to power with a non-fossil fuel energy certificate in June 2022, and thus succeeded in reducing about 12,861 tons of CO2 emissions per year. We will go beyond this substantial elimination of CO2 emissions and aim for the operation of the Ishikari Data Center powered fully by renewable energy.

In October 2021, in addition to endorsing the Recommendations of the Task Force on Climate-Related Financial Disclosure (TCFD), we joined TCFD Consortium, a group of companies and institutions that endorse the recommendations of the TCFD. Moving forward, our company will prepare to make appropriate disclosures regarding the impact of climate change-related risks and profit opportunities on its own business activities, earnings, etc.

<Investment in Human Capital, Intellectual Properties, etc.>

Our company regards investment in intellectual properties is crucial for our business development, and actively supports creative activities within the company. As for investment in human capital, our company has been working to establish an environment that enhances and maximizes the capabilities of our employees, therefore, securing and developing human resources is one of our strengths, and is in line with our key theme of Achieving Customer Success (CS) and Employee Success (ES), which is to build a relationship of mutual growth by supporting our customers as well as our employees to succeed. We will supervise these activities to contribute to the sustainable growth of our company and actively disclose the information.

Principle 5-2, Supplementary Principle5-2-1 [Formulation and disclosure of management strategies and plans and others]

When formulating our management strategies and plans, we set goals regarding our profitability while fully taking into account capital costs. However, regarding indicators, such as capital efficiency, we do not disclose them as of now. We will keep discussing the level of indicators while considering the characteristics of our business, etc. and plan to carefully determine how to convey the information through the dialogue with shareholders at results briefing sessions, individual meetings, etc. We will continue to discuss the formulation of basic policies regarding our business portfolio.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 【Strategically held shares】

Our company does not hold any shares strategically.

Principle 5-1 [Policy regarding constructive dialogue with shareholders]

The Company has established an organization for managing IR, and holds financial results briefings for shareholders and investors at least twice a year. We also create opportunities for dialogue by obliging individual interviews with persons such as the Director and Chief Financial Officer upon request. We have also created a system for sharing the opinions received during these interviews with management on an as-needed basis.

As discussions unfold, we consider the topic of the discussion and strictly control insider information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved |

To view back numbers of Bridge Reports (Sakura internet Inc.: 3778) or the contents of Bridge Salon (IR related seminars), please go to our website at the following url:

www.bridge-salon.jp/