Bridge Report:(3778)Sakura internet Second quarter of fiscal year ending March 2024

President Kunihiro Tanaka | Sakura internet Inc.(3778) |

|

Company Information

Market | TSE Prime Section |

Industry | Information, Telecommunication |

President | Kunihiro Tanaka |

HQ Address | Tokyo Tatemono Umeda Building 11F Umeda, Kita-ku, Osaka-shi, Osaka |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥1,169 | 35,708,885 shares | ¥41,473 million | 8.0% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥3.50 | 0.3% | ¥23.81 | 49.1 x | ¥234.10 | 5.0 x |

*The share price is the closing price on November 15.

*The number of shares issued is obtained by subtracting the number of treasury shares and shares held by the Stock Compensation Trust (J-ESOP) from the number of shares issued as of the end of the latest quarter.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net profit attributed to parent company shareholders | EPS | DPS |

March 2019 Act. | 19,501 | 567 | 395 | 91 | 2.44 | 2.50 |

March 2020 Act. | 21,908 | 939 | 789 | 160 | 4.39 | 2.50 |

March 2021 Act. | 22,168 | 1,372 | 1,099 | 758 | 20.79 | 3.00 |

March 2022 Act. | 20,019 | 763 | 649 | 275 | 7.55 | 3.00 |

March 2023 Act. | 20,622 | 1,093 | 965 | 666 | 18.29 | 3.50 |

March 2024 Est. | 22,800 | 1,450 | 1,300 | 850 | 23.81 | 3.50 |

*Estimates are provided by the company.

*Units: million yen, yen.

This Bridge Report presents Sakura internet’s earning results for the 1st Half of the Fiscal Year ending March 2024 Earnings Results, along with estimates for the term ending March 2024.

Table of Contents

Key Points

1. Company Overview

2. First Half of the Fiscal Year ending March 2024 Earnings Results

3. Fiscal Year ending March 2024 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the 1st half of the fiscal year March 2024, sales increased 3.5% year on year and operating income shrank 42.8% year on year, which were as forecast by the company. Sales grew, because the cloud infrastructure services generated strong sales and offset the profit decline in the physical base services. On the other hand, profit dropped because the company increased investment in personnel recruitment and enhancement of marketing activities with the aim of strengthening the cloud services and expenses rose due to external factors, such as the steep increase in crude oil prices. ABEJA, Inc. got newly listed on a stock exchange, along with which the company recorded gain on sale, and net income decreased 29.1% year on year to 170 million yen, exceeding the company’s forecast.

- For the full fiscal year March 2024, it is projected that both sales and operating income will rise 10.6% and 32.7% year on year, respectively. The company continues its efforts to enhance personnel recruitment and sales and marketing activities in order to be in line with its initial forecast that is aimed at high growth. It has left the full-year forecast unrevised at the moment because it is currently carrying out a careful examination on such matters as the impact of the GPU cloud services on the business performance this term and earnings forecasts of its group companies. It is expected that sales will rise through continuous growth of the cloud business and profit will increase because sales in the highly profitable cloud services will grow while the company continues proactive investment with an eye on medium- and long-term growth. The company expects to yield revenues from one-shot orders and its group companies at the end of this fiscal year. The amount of dividends remains unrevised from the previous fiscal year, with the projected year-end dividend being 3.50 yen/share.

- Profit shrank by double digits in the 1st half of the fiscal year due principally to an increase in investment in human resources, which was aimed at business growth. The cloud services, which the company regards as the pillar of growth, are growing on a steady basis. Furthermore, the company received a greater number of inquiries for the GPU cloud services than it expected and decided to make an additional investment, meaning that the outlook is promising. Another notable point is the company’s efforts at public cloud services developed in Japan. The Japanese government has adopted government cloud services provided by four American companies for joint use by government-related organizations, indicating that Japanese companies have weak presence in the rapidly growing domestic cloud market. SAKURA internet, therefore, aims to break into the market in the next few years by cutting its way as a provider of domestically developed cloud services. We would like to continuously pay attention to their future trends.

1. Company Overview

Sakura internet operates data centers located in Tokyo (Nishi Shinjuku, Higashi Shinjuku and Daikanyama, using rented floor space), Osaka (Dojima, using rented floor space) and Hokkaido (Ishikari, owned land, and buildings) to provide cloud/internet infrastructure services. Currently, the company is shifting from physical base services, such as housing and exclusive servers, to cloud services. By owing its own infrastructure, Sakura internet pursues higher profitability and increases utilization rates and reduce fixed cost risk.

1-1Content Business

Sakura internet’s business is divided into cloud services (cloud infrastructure and cloud application), physical base services, domain and SSL acquisition (Certification for unique domain acquisition outsourcing), and others including subsidiary business. The composition ratio of sales of fiscal year ended March 2023 is cloud services are 57.4% (of which cloud infrastructure and cloud application for 38.7%, and 18.7% respectively), physical base services are 17.6%, and other services are 24.9%.

2. First Half of the Fiscal Year ending March 2024 Earnings Results

2-1 Consolidated Results for 1 H

| 1H of FY 3/23 | Ratio to sales | 1H of FY 3/24 | Ratio to sales | YoY | Company’s forecast | Difference from the forecast |

Sales | 9,989 | 100.0% | 10,343 | 100.0% | +3.5% | 10,500 | -1.5% |

Gross Profit | 2,500 | 25.0% | 2,639 | 25.5% | +5.6% | - | - |

SG&A | 2,063 | 20.7% | 2,389 | 23.1% | +15.8% | - | - |

Operating Income | 436 | 4.4% | 249 | 2.4% | -42.8% | 250 | -0.2% |

Ordinary Income | 377 | 3.8% | 172 | 1.7% | -54.3% | 180 | -4.1% |

Net Profit attributed to Parent Company Shareholders | 247 | 2.5% | 175 | 1.7% | -29.1% | 120 | +45.9% |

*Unit: million yen.

Sales increased 3.5% and operating income shrank 42.8%, with the cloud services growing steadily.

Sales stood at 10,340 million yen, up 3.5% year on year. The cloud infrastructure services performed well and offset the decline in the physical base services, resulting in the sales increase. The earnings results were as the company forecasted.

Operating income decreased 42.8% year on year to 240 million yen. The company increased investment in personnel recruitment and enhancement of marketing activities with the aim of strengthening its cloud services. In addition, profit shrank because expenses (electricity cost and domain acquisition cost) rose due to such external factors as the soaring of crude oil prices, which have been continuing since last year, and the weakening of the yen. Operating income and ordinary income were also as forecasted by the company. The company sold some of the shares that it held and SAKURA internet recorded gain on sale of investment securities as extraordinary income because ABEJA, Inc. got listed on a stock exchange, so profit attributable to owners of parent declined 29.1% year on year to 170 million yen, which exceeded the company’s forecast.

Progress on priority initiatives

Growth strategy | Received a greater number of inquiries for the GPU cloud services than expected and decided an additional investment. Applied for the government cloud project this fiscal year and focused on elevating the technological level on a continuous basis. |

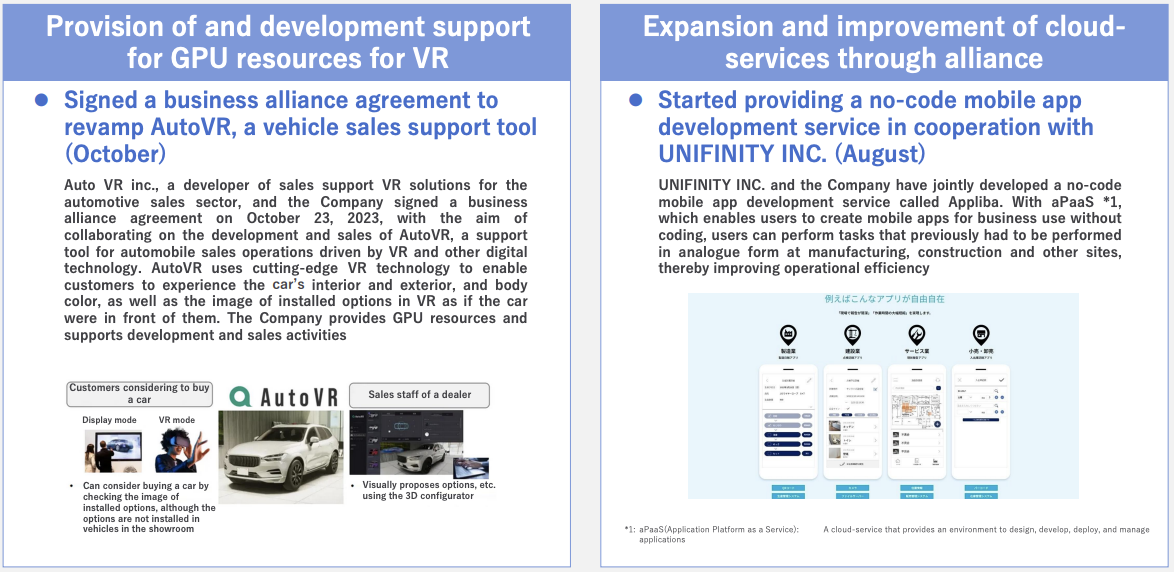

● Regarding the GPU cloud services for generative AI that are scheduled to be released in January 2024, the company has received a larger number of inquiries than initially expected, and decided to move the schedule forward and make an additional investment of 7,850 million yen in the next fiscal year. ● The company applied for the project of cloud services provision for government cloud development at the Digital Agency (submission of applications is for fiscal 2023), and aims to enter the market in the coming few years by focusing on boosting its level of cloud service technology. ● The company continues to intensify its efforts at co-creation and support of digital transformation (DX) toward medium- and long-term growth. Recently, in October, it set up an organization in charge of onboarding plans for partner companies and design of qualification systems for SAKURA internet’s cloud services in order to propel forward DX-related support. |

|

|

Concentration of management resources | Made a steady progress on recruitment activities toward realization of the growth strategy Procured equipment for GPU cloud services with an expected budget of 3.2 billion yen as planned this term |

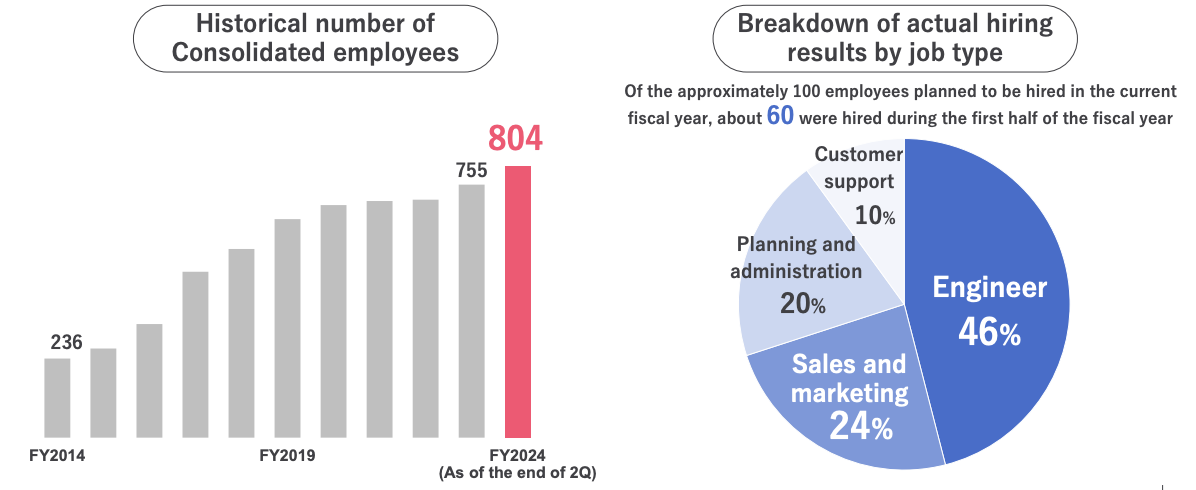

● The company plans to employ about 100 people, mainly engineers, sales staff, and marketing personnel, by the end of this fiscal year. The number is up 49 from the end of the previous fiscal year (the number of employees of the corporate group as of the end of the second quarte 804). ● The company made proactive investments in doing digital marketing, such as online advertising, and hosting events with the aim of expanding its presence in the field and acquiring new customers. ● The company procured equipment for the GPU cloud services as planned this term. It will continue investment in equipment, such as replacement of existing services. |

Sales by Service

| 1H of FY 3/23 | Ratio to sales | 1H of FY 3/24 | Ratio to sales | YoY |

Cloud services | 5,789 | 58.0% | 6,248 | 60.4% | +7.9% |

Physical base services | 1,845 | 18.5% | 1,787 | 17.3% | -3.1% |

Other services | 2,354 | 23.6% | 2,306 | 22.3% | -2.0% |

Total | 9,989 | 100.0% | 10,343 | 100.0% | +3.5% |

*Unit: million yen

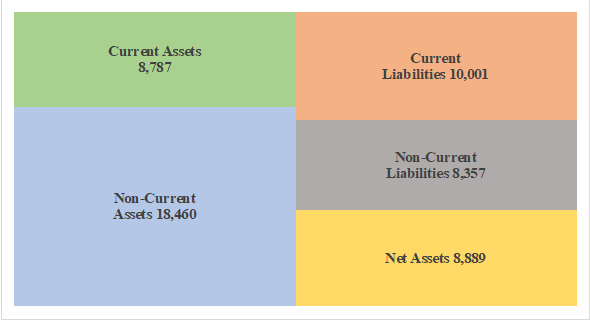

Balance Sheet Summary

| End of March 2023 | End of September 2023 |

| End of March 2023 | End of September 2023 |

Current Assets | 8,930 | 8,787 | Current Liabilities | 9,840 | 10,001 |

Tangible Assets | 14,716 | 15,468 | Noncurrent Liabilities | 7,929 | 8,357 |

Intangible Assets | 508 | 486 | Shareholder Equity | 8,337 | 8,516 |

Investments and Other Assets | 2,100 | 2,505 | Net Assets | 8,486 | 8,889 |

Noncurrent Assets | 17,325 | 18,460 | Total Liabilities and Net Assets | 26,256 | 27,248 |

*Unit: million yen

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

Total assets at the end of the 1st half of the fiscal year stood at 27,240 million yen, up 990 million yen from the end of the previous fiscal year. The increase was caused principally by the rise in property, plant and equipment resulting from the procurement of equipment for services and the growth in investment securities because a company in which SAKURA internet invests has become subject to mark-to-market valuation after it got listed on a stock exchange. Liabilities augmented 580 million yen from the end of the previous fiscal year to 18,350 million yen, due mainly to growth in lease obligations related to equipment for services. Net assets stood at 8,880 million yen, up 400 million yen from the end of the previous fiscal year, owing chiefly to a rise in valuation difference on available-for-sale securities following growth in investment securities as they became subject to mark-to-market valuation and an increase in retained earnings resulting from recording of profit attributable to owners of parent. Equity ratio was 32.0% (31.8% at the end of the previous fiscal year).

3.Fiscal Year ending March 2024 Earnings Forecasts

3-1 Earnings Forecasts

| FY 3/ 23 Act. | Ratio to sales | FY 3/ 24 Est. | Ratio to sales | YoY |

Sales | 20,622 | 100.0% | 22,800 | 100.0% | +10.6% |

Operating Income | 1,093 | 5.3% | 1,450 | 6.4% | +32.7% |

Ordinary Income | 965 | 4.7% | 1,300 | 5.7% | +34.6% |

Net profit attributed to parent company shareholders | 666 | 3.2% | 850 | 3.7% | +27.5% |

*Unit: million yen

Plans 10.6% year-on-year sales growth and 32.7% year-on-year operating income growth for FY 3/24

The full-year forecast remains unrevised. The company intends to enhance personnel recruitment and sales and marketing activities on a continuous basis in order to achieve the initial forecast that is aimed at high growth. It has left the full-year forecast as it is at the moment because it is currently carrying out a careful examination on such matters as the impact of the GPU cloud services on the business performance this term and the earnings forecasts of the group companies.

For the fiscal year ending March 2024, the company forecasts a 10.6% year-on-year increase in sales to 22.8 billion yen. The company expects sales to increase due to continued growth in the cloud business. Operating income is forecast to rise 32.7% year on year to 1.45 billion yen, ordinary income is expected to increase 34.6% year on year to 1.3 billion yen, and profit attributable to owners of parent is projected to grow 27.5% year on year to 850 million yen. Profit is expected to increase due to sales growth of highly profitable cloud services while the company will continue aggressive investment for mid- to long-term growth. At the end of the term, profit from spot projects and group companies is expected. In terms of expenses, the company expects to increase expenses for the investment in human resources, electricity, equipment, and marketing reinforcement. The amount of dividends remains unrevised from the previous fiscal year, with the projected year-end dividend being 3.50 yen/share.

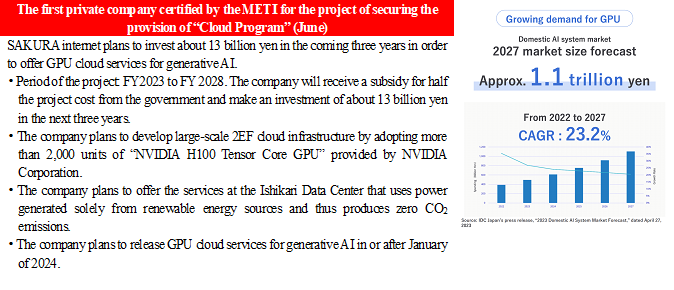

[Expansion of the new growth field] GPU cloud services for generative AI

(1) Plan to offer GPU cloud services in response to the rapidly escalating demand for advanced computational resources for AI

(Taken from the company’s explanatory material)

(2) Equipment was procured as planned this term. They decided to make an additional investment as inquires increased in number.

The company decided to move the schedule forward and make an additional investment of 7,850 million yen in the next fiscal year in order to meet the demand for computational resources that greatly exceeds the initial forecast.

It will make an additional investment of 7,850 million yen in the fiscal year March 2025 in addition to 3.2 billion yen invested this fiscal year. It aims to complete installation of 2,000 units of equipment by the end of the next fiscal year, well ahead of schedule.

3-2 Current efforts for co-creation and support for DX

(Taken from the company’s explanatory material)

The company has established an organization that propels forward digital transformation (DX) in client companies through enlightenment activities and educational support.

It will strive to grow together with customers by setting up partner and qualification systems in the future.

(Taken from the company’s explanatory material)

Personnel recruitment

The company is making a steady progress on its recruitment activities aimed at pursuing the growth strategy at an accelerated rate, with the number of employees of the corporate group at the end of the second quarter being up 49 from the end of the previous year.

(Taken from the company’s explanatory material)

4. Conclusions

Profit declined by double digits in the 1st half of this fiscal year due mainly to an increase in investment in human resources that was aimed at growth. Sales increased only slightly by 3.5%, which was chiefly because the company made transition to a cloud-focused structure in the physical base services. SAKURA internet saw steady growth in the cloud services that it regards to be the pillar of growth. Furthermore, the company has received a larger number of inquiries for the GPU cloud services that will be released next year and thus decided to make an additional investment, meaning that its future outlook is promising. Cloud services are enormously profitable, so profitability will improve dramatically once the company has done with investment. The earnings results in the 1st half of the term were in line with the company’s forecast and acceptable in general, and we would like to expect significant improvement in profitability in the second half.

One area to watch is the company's initiatives in domestic public cloud services. Japan's trade deficit is widening, with one major factor being the increase in payments for IT services. In particular, in the rapidly expanding domestic cloud market, the presence of Japanese companies is relatively weak, as the government has adopted four American companies for the government cloud that it jointly uses for cloud services. The company aims to break into the market with the next few years by cutting its way as a provider of domestically developed cloud services. We would like to continuously keep an eye on their future trends.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory |

Directors | 9 directors, including 5 outside ones (including 3 independent directors) |

Auditors | 4 directors, including 4 outside ones (including 2 independent directors) |

◎Corporate Governance Report (Updated on July 3, 2023)

Basic Policy

Our company has strived with the basic policy about corporate governance: promote the maintenance of business management organizations and enhance efficient and systematic management and internal controls of each department while expanding the company size. There is a greater social responsibility in internet industry than in other industries as communication facilities are released to a large number of invisible customers and its market is the internet users around the world. We consider that the establishment of corporate governance at our company means the management base which enables to fulfill such social responsibilities.

<Reason for Non-Compliance with the Principles of the Corporate Governance Code (Excerpts)>

Supplementary Principle 2-4-1 【Ensuring diversity in the appointment of core personnel, etc.】

<View on ensuring diversity, voluntary and measurable goals and their status>

We believe that all employees generate diversity with diverse values, and we aim to provide value to our customers and contribute to the growth of our group as a whole by taking advantage of the diversity in attributes, careers and skills. Therefore, in the recruitment and appointment of core personnel, we are committed to promoting recruitment and appointment with respect for diversity, regardless of age, gender, nationality, or other attributes.

We also believe that innovation comes from employees with diverse attributes having diverse values and co-creating with each other based on mutual recognition of each other's values. Therefore, our goal is to have the percentage of women in all management positions be equal to the percentage of women among all employees by March 2026. To achieve this goal, we will identify the causes of the low ratio of female employees in managerial positions after conducting a career awareness survey of female employees, take steps to eliminate the causes, and continue our efforts to encourage female employees to aim for managerial positions in a more positive manner, including the formulation of role models.

As most of them are mid-career hires in our company, we do not set a target for promotion of mid-career employees. For employment and promotion of foreign employees, we do not have a set target by attributes at this point, however, we will consider setting such goals when we determine it necessary in the future.

<Human resources development policy for ensuring diversity, in-house environmental improvement policy, and their status>

In our group, we have adopted “ES (Employee Success)” as our policy for talent development and creating an inclusive internal environment that fosters diversity. This approach aims to elevate the value of our human resources, who are the cornerstone of delivering value to society and our customers. We focus on realizing each employee's growth and success (ES) by fostering a cycle of learning and hands-on practice that bolsters their abilities, providing opportunities for diverse talents to gather and embark on challenges, and building a long-term, secure foundation for their continued engagement and development.

We are making various efforts to respect diversity in the way we work, based on the ideal that the company provides a "comfortable" work environment and that individual employees can pursue "job satisfaction" within that environment. In terms of the internal environment, we are working to create a corporate culture that maximizes the individuality and willingness to grow of each and every employee, and that allows them to maximize their abilities, by creating opportunities that lead to an understanding of diversity, equity and inclusion, an environment that allows diverse employees to play an active role, and a career and learning structure that allows them to feel a sense of growth.

Supplementary Principles 3-1-3 and 4-2-2 【Sustainability initiatives, formation of the basic policy for such initiatives, etc.】

<Sustainability initiatives>

In our group, we provide cloud and Internet infrastructure services utilizing our domestic data centers, recognizing the essential role of both the Internet and data centers. Given that data center operations consume a significant amount of electricity, our company is advancing efforts to address climate change and decarbonization, which are closely related to energy issues. Recognizing that the effective use of the Internet is crucial for maintaining social infrastructure and securing essential services, we place a special emphasis on our cybersecurity efforts.

(1) Initiatives for Climate Change and Decarbonization

As a social infrastructure supporting DX (Digital Transformation), the importance of data centers is increasing year by year. However, data centers inherently consume a large amount of electricity for server operation and cooling. Furthermore, with the rapid development of large-scale language models and the commercialization of VR technology in recent years, the power consumption of high-performance servers in operation has also increased. From the perspective of global environmental conservation such as preventing global warming and SDGs, we fully recognize the need to manage and reduce energy consumption and strive to contribute to a sustainable society through initiatives for carbon neutrality.

In November 2011, we opened and have been operating an environmentally friendly suburban large-scale data center (Ishikari Data Center) in Ishikari City, Hokkaido. Besides operating data centers utilizing the cool outside air at the location, we have been actively engaged in environmental conservation activities in data center operations. These include the establishment of the Ishikari Solar Power Plant in 2015 for our use of renewable energy, reduction of CO2 emissions by switching to LNG/gas-fired power generation in 2021, achieving virtually zero CO2 emissions through non-fossil certificates in 2022, and as of June 2023, achieving zero CO2 emissions by utilizing 100% renewable energy sources mainly from hydropower.

In 2021, we endorsed the “Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)” and joined the TCFD Consortium of companies and organizations that endorse these recommendations. Although our current information organization is not primarily focused on climate change, we continue to prepare for appropriate disclosure regarding the impact of climate change-related risks and revenue opportunities on our business activities and earnings.

(2) Initiatives for Cybersecurity

In recent years, as corporate activities have become increasingly digitalized, the exchange of personal and confidential corporate information over the Internet has become commonplace. At the same time, as in the real world, a variety of problems have arisen, including nuisance activities, various rights violations, and the distribution of illegal and harmful content. Therefore, ensuring and improving the safety and quality of the Internet is increasingly important. As a cloud service provider, we review our services daily and implement multifaceted measures to ensure and enhance safety and quality.

We also recognize it as our duty as a cloud and Internet infrastructure service provider to establish systems that enable us to collect a wide range of information through affiliated and sponsoring organizations about legal and administrative issues related to advancements in Internet technologies such as AI and cybersecurity, respond accurately, and express our opinions as needed. As a specific example, personnel in charge of specialized teams for responding to and taking countermeasures against nuisance activities, etc. and legal affairs staff participate in the Administrative Law Subcommittee, a subcommittee of the Japan Internet Providers Association (JAIPA), to exchange opinions with relevant ministries and agencies on the sound use of the Internet.

<Investment in Human Capital, Intellectual Properties, etc.>

Our company regards investment in intellectual properties is crucial for our business development, and actively supports creative activities within the company. As for investment in human capital, our company has been working to establish an environment that enhances and maximizes the capabilities of our employees, therefore, securing and developing human resources is one of our strengths, and is in line with our key theme of Achieving Customer Success (CS) and Employee Success (ES), which is to build a relationship of mutual growth by supporting our customers as well as our employees to succeed. At our company, we believe that each employee represents our capital and their growth and success are essential in providing value to our business and customers. In order to transform "what you want to do" into "what you can do.” and realize sustainable corporate management and Employee Success (ES), our efforts in this direction include a variety of initiatives as described below, the details of which are disclosed in our securities report.

・Cultivating a culture of talent development and collaborative learning

・Fostering mental and physical health

・Promoting the success of a diverse workforce

・Creating a culture where diverse talents and skills converge, fostering new values through leadership

・Promoting flexible work arrangements

Moreover, we consider investing in intellectual property as essential for our business growth. We actively support in-house creative activities and are committed to appropriately protecting, managing, and utilizing our intellectual property. By communicating within the company the importance of respecting third-party intellectual property rights, we diligently work to prevent any infringements. Although we are not a content creation and provision company, we are a member of the Association of Copyright for Computer Software (ACCS). We participate in various study groups organized by the ACCS to enhance our knowledge, facilitate information exchange, and engage in activities to protect copyright rights.

We continue to oversee these initiatives, which contribute to our company's sustainable growth, and are committed to proactive information disclosure.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 【Strategically held shares】

(1) Philosophy regarding strategic shareholding

Our company generally does not hold listed shares as strategically-held shares unless their significance and rationality are recognized.

We annually assess the significance and rationality for holding each stock, considering potential corporate collaboration or business synergy with the issuing company and whether the benefits and risks associated with holding these shares justify the capital cost. Shares deemed to lack sufficient significance and rationality are sold, taking into account stock prices, market trends, and other relevant factors.

(2) Regarding the exercise of voting rights

While considering the purpose of holding listed shares, we exercise voting rights based on whether it aligns with the sustainable growth and medium to long-term enhancement of corporate value for both our company and the invested entities.

Principle 5-1 [Policy regarding constructive dialogue with shareholders]

The Company has established a department for managing IR, and holds financial results briefings for shareholders and investors at least twice a year. We also create opportunities for dialogue by obliging individual interviews with persons such as the Director and Chief Financial Officer upon request. We have also created a system for sharing the opinions received during these interviews with management on an as-needed basis.

As discussions unfold, we consider the topic of the discussion and strictly control insider information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved |

To view back numbers of Bridge Reports (Sakura internet Inc.: 3778) or the contents of Bridge Salon (IR related seminars), please go to our website at the following url:

www.bridge-salon.jp/