Bridge Report:(3778)Sakura internet Fiscal Year ended March 2025

President Kunihiro Tanaka | Sakura internet Inc. (3778) |

|

Company Information

Market | TSE Prime Section |

Industry | Information, Telecommunication |

President | Kunihiro Tanaka |

HQ Address | GRAND GREEN OSAKA North, JAM BASE, 3F 6-38 Ofukacho, Kita-ku, Osaka-shi, Osaka |

Year-end | March |

Website |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥3,170 | 40,001,242 shares | ¥126,803 million | 15.0% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥5.00 | 0.2% | ¥60.00 | 52.8x | ¥751.36 | 4.2x |

*The share price is the closing price on May 22. The number of shares issued is obtained by subtracting the number of treasury shares and shares held by the Stock Compensation Trust (J-ESOP) from the number of shares issued as of the end of the latest quarter.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net profit attributed to parent company shareholders | EPS | DPS |

March 2022 Act. | 20,019 | 763 | 649 | 275 | 7.55 | 3.00 |

March 2023 Act. | 20,622 | 1,093 | 965 | 666 | 18.29 | 3.50 |

March 2024 Act. | 21,826 | 884 | 764 | 651 | 18.26 | 3.50 |

March 2025 Act. | 31,412 | 4,145 | 4,060 | 2,937 | 75.23 | 4.00 |

March 2026 Est. | 40,400 | 3,800 | 3,400 | 2,400 | 60.00 | 5.00 |

*Estimates are provided by the company. Units: million yen, yen.

This Bridge Report presents Sakura internet’s earning results for the Fiscal Year ended March 2025, along with estimates for the Fiscal Year ending March 2026.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2025 Earnings Results

3. Fiscal Year ending March 2026 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the fiscal year ended March 2025, sales increased 43.9% year on year and operating income grew 368.7% year on year. Sales saw a significant growth as GPU cloud services met the vigorous demand for a computing platform for generative AI, becoming a mainstay of revenues on par with the cloud service. In terms of profit, operating income margin considerably improved owing to the substantial increase in sales, despite extensive recruitment in step with receiving government cloud certification and proactive investments in GPU infrastructure for securing an advantageous position in advance. The forecasts for sales and all kinds of profits were upwardly revised twice during the fiscal year, and results exceeded even the revised forecasts.

- For the fiscal year ending March 2026, the company forecasts a 28.6% increase in sales and an 8.3% decline in operating income. Sales of GPU cloud services for the full fiscal year are expected to grow 149.0% year on year as new GPUs (H200 and B200) will be launched. Regarding the cloud service, they will expand sales through the enhancement of services by developing functions to fulfil the requirements for the government cloud. In terms of profit, they will proactively invest in digital infrastructure and boost recruitment in step with receiving the official government cloud certification by March 2026, and in order to prepare for raising the public cloud market share in the future. A decrease in profit is projected as the company will build an ecosystem for expanding sales channels and promote sales and marketing measures.

- GPU cloud services were launched on a full scale, leading to a significant growth in sales and profit in the fiscal year ended March 2025, following two upward revisions during the year. GPU cloud services for generative AI have been rapidly growing quarter by quarter and are projected to substantially contribute to the growth in sales in the fiscal year ending March 2026 as well. However, a decline in profit is forecast due to proactive investments and the enhancement of recruitment for satisfying the vigorous demand. The revenue from GPU cloud services is expected to temporarily decrease in the first quarter. Consequently, both sales and profit are projected to be much larger in the second half of the year. It can be surmised that the forecast for the second half of the year reflects the actual situation. Moreover, GPU cloud services are expected to keep growing in the fiscal year ending March 2027 as well, indicating a substantial potential for revenue expansion. It can be said that stock value is at a sufficiently inexpensive level, considering the forecast for the second half of the year, which shows the actual situation, and the continuity of the rapid growth.

1. Company Overview

Sakura internet operates data centers located in Tokyo (Nishi Shinjuku, Higashi Shinjuku and Daikanyama, using rented floor space), Osaka (Dojima, using rented floor space) and Hokkaido (Ishikari, owned land, and buildings) to provide cloud/internet infrastructure services. It began offering GPU cloud services in January 2024. It is also the only government cloud-certified company in Japan, although there are some conditions. By owing its own infrastructure, Sakura internet pursues higher profitability by increasing utilization rates and reducing fixed cost risk.

1-1 Business Contents

Sakura internet’s business is divided into cloud services (cloud infrastructure and cloud application), GPU cloud services, physical base services, and others including subsidiary business. Moreover, GPU cloud services were newly added in the fiscal year ended March 2025. The composition ratio of sales of fiscal year ended March 2025 is cloud services are 44.6% (of which cloud infrastructure and cloud application for 30.7%, and 13.8% respectively), GPU cloud services are 20.2, physical base services are 11.8%, and other services are 23.4%.

2. Fiscal Year ended March 2025 Earnings Results

2-1 Consolidated Results

| FY 3/24 | Ratio to sales | FY 3/25 | Ratio to sales | YoY | Company’s forecast | Difference from the forecast |

Sales | 21,826 | 100.0% | 31,412 | 100.0% | +43.9% | 31,000 | +1.3% |

Gross Profit | 5,735 | 26.3% | 11,230 | 35.8% | +95.8% | - | - |

SG&A | 4,851 | 22.2% | 7,084 | 22.6% | +46.0% | - | - |

Operating Income | 884 | 4.1% | 4,145 | 13.2% | +368.7% | 3,400 | +21.9% |

Ordinary Income | 764 | 3.5% | 4,060 | 12.9% | +431.4% | 3,250 | +24.9% |

Net Profit attributed to Parent Company Shareholders | 651 | 3.0% | 2,937 | 9.4% | +350.7% | 2,100 | +39.9% |

*Unit: million yen. The company’s forecast as of January 2025.

Sales grew 43.9%, operating income increased 368.7% and GPU cloud services have grown into a mainstay of revenues, exceeding the upwardly revised company forecast

Sales increased 43.9% year on year to 31.41 billion yen. Sales saw a significant growth as GPU cloud services, launched in January 2024, met the vigorous demand for a computing platform for generative AI, becoming a mainstay of revenues on par with cloud services.

Operating income grew 368.7% year on year to 4.14 billion yen. Operating income margin considerably improved from 4.1% in the previous fiscal year to 13.2%, owing to the substantial increase in sales and growth of cloud services, despite the extensive recruitment in step with receiving government cloud certification and proactive investments in GPU infrastructure for securing an advantageous position in advance.

The forecasts for sales and all kinds of profits were upwardly revised twice, in September and January, and the results exceeded even the revised forecast. The company paid a year-end dividend of 4.00 yen/share.

Summary of Status of Initiatives for Priority Measures

Priority measures | Actions and Results | |

Growth Strategies Promote GPU infrastructure focused on demand for AI and enhance cloud services | GPU cloud services | ● Early provision of services focused on the vigorous demand for generative AI contributed to revenue growth. ● To develop services that swiftly and flexibly address a variety of needs |

Cloud services | ● To improve the capability of responding to market needs by boosting development in anticipation of official government cloud certification by the end of March 2026. ARR maintained a double-digit growth (12.9%). ● To build an ecosystem where clients, partners and the company grow together through partnerships and cloud certification tests [Results of initiatives] ✓Companies registered in Sakura’s rental server agency system: 1,088 ✓Companies disclosed in Sakura’s partner network: 47 ✓Sakura cloud certification tests: held three times, the number of users registered for official online learning materials: over 2,000 | |

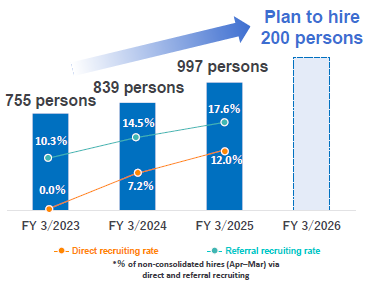

To strengthen foundations for supporting growth strategies Invest in both people and goods in anticipation of growth opportunities | Human resources | ● To focus on system arrangement and activities for talent acquisition with the aim of recruiting 200 workers 214 engineers, sales and marketing staff members (including prospective employees) have been recruited, increasing the consolidated number of employees to 997 as of the end of March 2025. |

Facility investment | ● Made the first move to address the expansion of demand by swiftly procuring GPUs and proactively investing in digital infrastructure (approx. 27.7 billion yen) in preparation for expanding GPU cloud services for generative AI. ● Also proceeding with building a containerized data center as the foundation for providing services. | |

Sales by Service Category

| FY 3/24 | Composition ratio | FY 3/25 | Composition ratio | YoY | |

Cloud services | 12,772 | 58.5% | 14,006 | 44.6% | +9.7% | |

Breakdown | Cloud infrastructure | 8,823 | 40.4% | 9,659 | 30.7% | +9.5% |

Cloud application | 3,949 | 18.1% | 4,347 | 13.8% | +10.1% | |

GPU cloud services | 201 | 0.9% | 6,344 | 20.2% | +3,054.8% | |

Physical base services | 3,589 | 16.4% | 3,721 | 11.8% | +3.7% | |

Other services | 5,262 | 24.1% | 7,339 | 23.4% | +39.5% | |

Total | 21,826 | 100.0% | 31,412 | 100.0% | +43.9% | |

*Unit: million yen

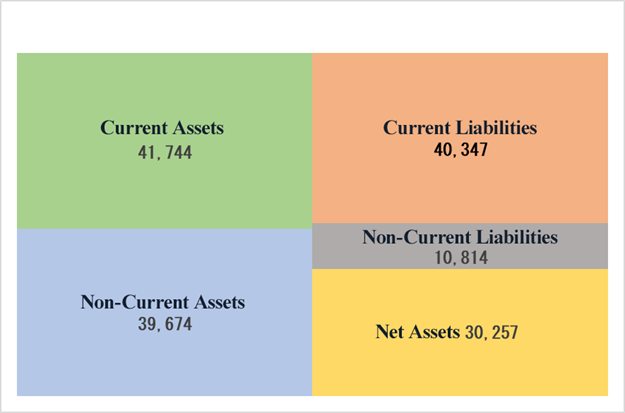

Balance Sheet Summary

| End of March 2024 | End of March 2025 |

| End of March 2024 | End of March 2025 |

Current Assets | 10,574 | 41,744 | Current Liabilities | 10,598 | 40,347 |

Tangible Assets | 16,656 | 33,469 | Noncurrent Liabilities | 10,304 | 10,814 |

Intangible Assets | 505 | 1,259 | Shareholder Equity | 8,989 | 29,931 |

Investments and Other Assets | 2,488 | 4,945 | Net Assets | 9,321 | 30,257 |

Noncurrent Assets | 19,650 | 39,674 | Total Liabilities and Net Assets | 30,224 | 81,419 |

*Unit: million yen

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

The total assets as of the end of the fiscal year ended March 2025 stood at 81.41 billion yen, up 51.19 billion yen from the end of the previous fiscal year, mainly due to the increase in cash and deposits caused by the issuance of new shares through a public offering and the increase of tangible fixed assets through the procurement of equipment for GPU cloud services. Liabilities augmented 30.25 billion yen from the end of the previous fiscal year to 51.16 billion yen, due to growth in lease obligations related to equipment for services. Net assets stood at 30.25 billion yen, up 20.93 billion yen from the end of the previous fiscal year. This is mainly because of the increases in capital and capital surplus caused by the issuance of new shares for a public offering. Capital-to-asset stood at 36.9% (30.2% as of the end of the previous fiscal year).

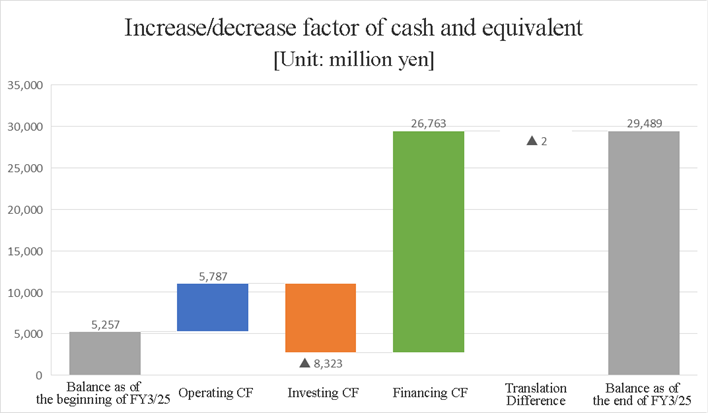

Cash Flow

| FY 3/24 | FY 3/25 | YoY | |

Operating CF (A) | 2,884 | 5,787 | +2,903 | +100.7% |

Investing CF (B) | -2,025 | -8,323 | -6,297 | - |

Free CF (A+B) | 858 | -2,535 | -3,394 | - |

Financing CF | -410 | 26,763 | +27,174 | - |

Cash and equivalent | 5,257 | 29,489 | +24,231 | +460.9% |

*Unit: million yen

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

The cash and cash equivalents as of the end of the fiscal year ended March 2025 stood at 29.48 billion yen, up 24.23 billion yen from the end of the same period of the previous year.

The cash inflow from operating activities decreased due to an increase in net income before taxes and depreciation expenses.

The cash outflow from investing activities increased due to the acquisition of tangible fixed assets, such as equipment for GPU cloud services.

The cash inflow from financial activities considerably increased due to the income from the issuance of shares, borrowing, etc.

3. Fiscal Year ending March 2026 Earnings Forecasts

3-1 Consolidated Earnings Forecasts

| FY 3/25 Act. | Ratio to sales | FY 3/26 Est. | Ratio to sales | YoY |

Sales | 31,412 | 100.0% | 40,400 | 100.0% | +28.6% |

Operating Income | 4,145 | 13.2% | 3,800 | 9.4% | -8.3% |

Ordinary Income | 4,060 | 12.9% | 3,400 | 8.4% | -16.3% |

Net profit attributed to parent company shareholders | 2,937 | 9.4% | 2,400 | 5.9% | -18.3% |

*Unit: million yen

Expecting sales to grow 28.6% year on year and operating income to decline 8.3% year on year for the fiscal year ending March 2026

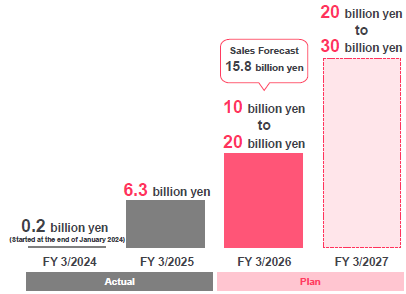

For the fiscal year ending March 2026, sales are projected to increase 28.6% year on year to 40.4 billion yen and operating income to drop 8.3% year on year to 3.8 billion yen. Regarding GPU cloud services, the revenue in the first quarter will decrease in step with a temporary fluctuation in sales caused by the expiration of large governmental contracts. However, segment sales are expected to grow 149.0% year on year to 15.8 billion yen in the full fiscal year owing to the launch of new GPUs (H200 and B200). Regarding the cloud service, the company will boost sales by enhancing services by developing functions to fulfil the requirements for the government cloud. Also focusing on measures for sales expansion, including the development of new markets based on cooperation with partners, they expect segment sales to increase 13.5% year on year to 15.9 billion yen. In terms of profit, the company will make proactive investments in digital infrastructure to firmly establish their position as a de facto standard on the generative AI infrastructure market. Moreover, they will boost recruitment in step with receiving the official government cloud certification by March 2026, and in order to prepare for raising the public cloud market share in the future. A decrease in profit is projected as the company will build an ecosystem for expanding sales channels, and promote sales and marketing measures.

With regard to dividends, they plan to pay a year-end dividend of 5.00 yen/share, up 1.00 yen/share from the previous fiscal year.

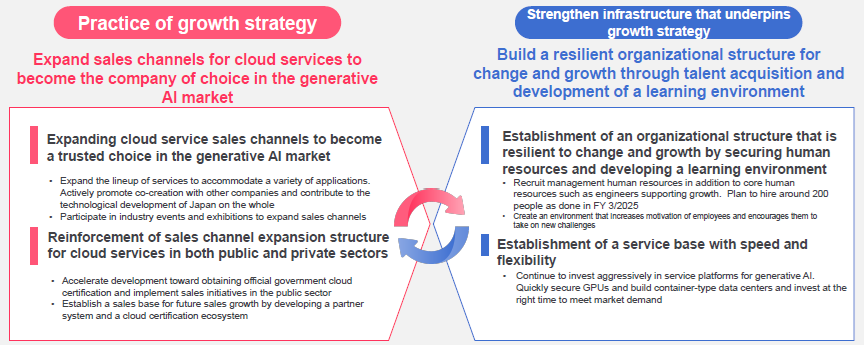

3-2 Priority Measures

The company’s policy lies in further accelerating market development centered on the government cloud by growing together with their partners, while further enhancing services for generative AI.

(Taken from the company’s explanatory material)

Practice of growth strategy

① GPU cloud services

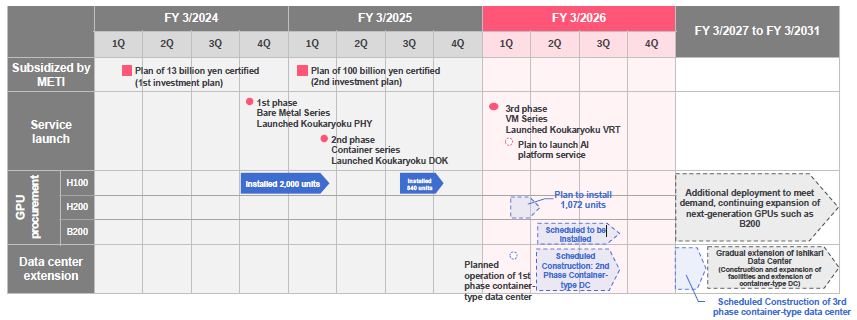

Overall Schedule

The company will continue efforts to procure GPUs and develop data centers as early as possible. Going forward, the company will also focus on expanding sales channels.

(Taken from the company’s explanatory material)

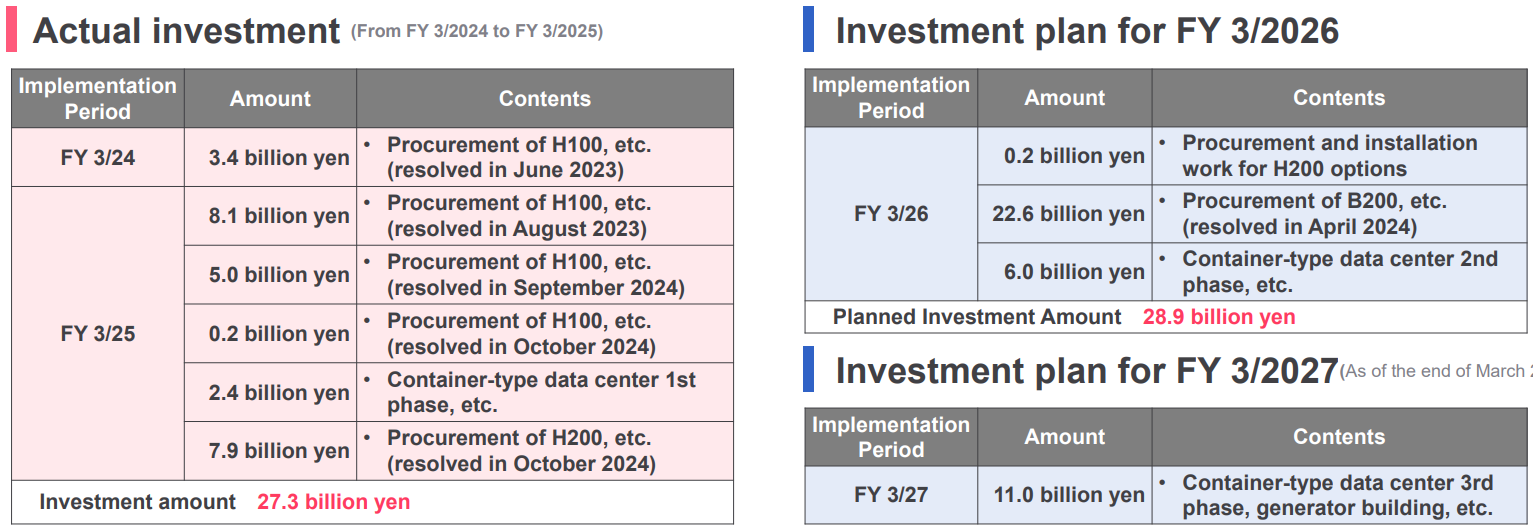

They plan to invest a total of 113 billion yen in GPU infrastructure for generative AI, etc. from the fiscal year ended March 2024. They received subsidies of approx. 56.5 billion yen in total from the Ministry of Economy, Trade and Industry.

Sales Plan

The company will expand sales channels by leveraging our leading position in the domestic AI infrastructure market and our know-how and trust cultivated through GPU cloud services.

Future sales measures

● Expansion of service line-up

Launched the third phase Koukaryoku Series “Koukaryoku VRT” (April 2025). The company plans to provide “platform services for generative AI” to respond quickly and powerfully to diverse needs.

● Increased adoption of GPU cloud services

Selected for NEDO (New Energy and Industrial Technology Development Organization)’s “Validation of Medical-Specialized LLM*” (April 2025), and also created application examples in the field of autonomous driving. The company will continue to expand our sales channels through active participation in exhibitions and events targeting new markets.

*“Verification and Validation of Safety Toward Social Implementation of Japanese Medical-Specialized LLM”

Future sales measures of GPU cloud services

(Taken from the company’s explanatory material)

Platform services for generative AI

The company plans to provide a platform that supports the expansion of AI utilization through the combination of “domestic cloud × high-performance GPUs”

Details of initiatives

● Integrating multi-vendor foundation models into SAKURA internet’s GPU cloud services for generative AI and build a layer that supports application development and operation. Realizing easier app development and domestically complete data management

● Collaboration to provide platform services for generative AI based on NEC Corporation’s generative AI model “cotomi”

● Continue to expand our base model options through collaboration with companies in Japan and overseas to meet diverse needs for generative AI applications

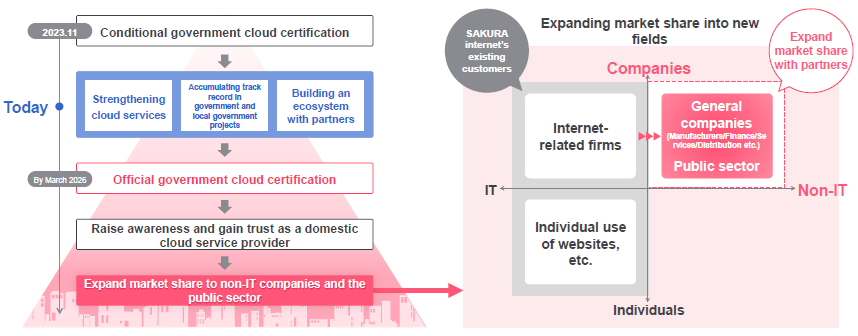

② Government cloud services

Leverage the government cloud certification to attract a greater market

(Taken from the company’s explanatory material)

Development schedule

Make steady progress in development toward being officially certified as a government cloud service provider by the end of March 2026

Grow to become a long-term competitive cloud service provider

To strengthen foundations for supporting growth

① Proactive Investments in Digital Infrastructure

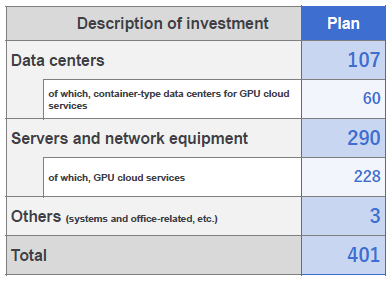

Investment plan

Investment plan for the fiscal year ending March 2026

Unit: 100 million yen, amounts are rounded down to the nearest 100 million yen (Taken from the company’s explanatory material) | Details of initiatives ● Ensure the company take an opportunity for growth on the back of huge demand, and actively invest in digital infrastructure to pave a path toward new growth ● In addition to investments in GPU cloud services, the company plan to invest in servers and network equipment to accommodate the growing demand for our cloud services, and expand the Ishikari Data Center

Capital Financing and Equity Capital Ratio ● Funding will be secured through operating cash flow, borrowings from financial institutions, and leasing, while also utilizing proceeds from the public offering in June 2024 and subsidies from cloud-related government programs ● Equity ratio of 36.9% as of the end of March 2025. The company will continue to pursue both growth investments and financial soundness |

Details of investments in the GPU cloud

Of the 100 billion yen investment plan for GPU infrastructure for generative AI, 28.9 billion yen is scheduled to be invested in fiscal year ending March 2026

● In the fiscal year ended March 2025, the company made an additional investment of 23.8 billion yen for the investment plan of 21.4 billion yen, given the demand for computational resources that was significantly higher than initially projected

● In the fiscal year ending March 2026, the company will continue to strengthen the structure and build a solid operating base to realize prompt service provision

Amounts are rounded down to the nearest 100 million yen (Taken from the company’s explanatory material)

② Securing and Training Talent to Accelerate Change and Growth

Changes in the consolidated number of personnel

(Taken from the company’s explanatory material) |

Details of initiatives ●The company hired 214 people (Non-consolidated, including prospective employees) in fiscal year ended March 2025. Referral recruiting was favorable mainly for engineers. Direct recruiting rate increased and our in-house recruitment capability improved ● The company plans to recruit around 200 people in fiscal year ending March 2026 as done in fiscal year ended March 2025, focusing on recruitment of human resources for accelerating the execution of sales strategies such as product enhancement and market development in order to build a revenue base going forward

|

4. Conclusions

GPU cloud services were launched on a full scale, leading to a significant growth in sales and profit in the fiscal year ended March 2025, following two upward revisions during the year. GPU cloud services for generative AI have been rapidly growing quarter by quarter and are projected to substantially contribute to the growth in sales in the fiscal year ending March 2026 as well. However, a decline in profit is forecast due to proactive investments and the enhancement of recruitment for satisfying the vigorous demand. The revenue from GPU cloud services is expected to temporarily decrease in the first quarter. Consequently, both sales and profit are projected to are much larger in the second half of the year, with sales of 17.6 billion yen and an operating income of 700 million yen in the first half in contrast with sales of 22.8 billion yen and an operating income of 3.1 billion yen in the second half. It can be surmised that the forecast for the second half of the year reflects the actual situation. Moreover, GPU cloud services are expected to keep growing in the fiscal year ending March 2027 as well. The company also plans to provide platform services for generative AI, indicating a substantial potential for revenue expansion. It can be said that while stock value shows little growth, it is at a sufficiently inexpensive level, considering the forecast for the second half of the year, which shows the actual situation, and the continuity of the rapid growth.

We will keep an eye on initiatives for ESG management as well. Ishikari Data Center is now fully powered by renewable energy, and talent acquisition, which is becoming extremely difficult, is likely to progress smoothly through human capital management. It can be assumed that these aspects also demonstrate the company’s significant potential for growth.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory |

Directors | 9 directors, including 5 outside ones (including 3 independent executives) |

Auditors | 4 directors, including 4 outside ones (including 2 independent executives) |

◎ Corporate Governance Report (Updated on July 3, 2024)

Basic Policy

Our company has strived with the basic policy about corporate governance: promote the maintenance of business management organizations and enhance efficient and systematic management and internal controls of each department while expanding the company size.

There is a greater social responsibility in internet industry than in other industries as communication facilities are released to a large number of invisible customers and its market is the internet users around the world. We consider that the establishment of corporate governance at our company means the management base which enables to fulfill such social responsibilities.

<Reason for Non-Compliance with the Principles of the Corporate Governance Code (Excerpts)>

Supplementary Principle 2-4-1 [Ensuring diversity in the appointment of core personnel, etc.]

<View on ensuring diversity, voluntary and measurable goals and their status>

We believe that all employees generate diversity with diverse values, and we aim to provide value to our customers and contribute to the growth of our group as a whole by taking advantage of the diversity in attributes, careers and skills. Therefore, in the recruitment and appointment of core personnel, we are committed to promoting recruitment and appointment with respect for diversity, regardless of age, gender, nationality, or other attributes.

We also believe that innovation comes from employees with diverse attributes having diverse values and co-creating with each other based on mutual recognition of each other's values. Therefore, our goal is to have the percentage of women in all management positions be equal to the percentage of women among all employees by March 2026. To achieve this goal, we will identify the causes of the low ratio of female employees in managerial positions after conducting a career awareness survey of female employees, take steps to eliminate the causes, and continue our efforts to encourage female employees to aim for managerial positions in a more positive manner, including the formulation of role models.

As most of them are mid-career hires in our company, we do not set a target for promotion of mid-career employees. For employment and promotion of foreign employees, we do not have a set target by attributes at this point, however, we will consider setting such goals when we determine it necessary in the future.

<Human resources development policy for ensuring diversity, in-house environmental improvement policy, and their status>

In our group, we have adopted “ES (Employee Success)” as our policy for talent development and creating an inclusive internal environment that fosters diversity. This approach aims to elevate the value of our human resources, who are the cornerstone of delivering value to society and our customers. We focus on realizing each employee's growth and success (ES) by fostering a cycle of learning and hands-on practice that bolsters their abilities, providing opportunities for diverse talents to gather and embark on challenges, and building a long-term, secure foundation for their continued engagement and development.

We are making various efforts to respect diversity in the way we work, based on the ideal that the company provides a "comfortable" work environment and that individual employees can pursue "job satisfaction" within that environment. In terms of the internal environment, we are working to create a corporate culture that maximizes the individuality and willingness to grow of each and every employee, and that allows them to maximize their abilities, by creating opportunities that lead to an understanding of diversity, equity and inclusion, an environment that allows diverse employees to play an active role, and a career and learning structure that allows them to feel a sense of growth.

Supplementary Principles 3-1-3 and 4-2-2 [Sustainability initiatives, formation of the basic policy for such initiatives, etc.]

<Sustainability initiatives>

In our group, we provide cloud and Internet infrastructure services utilizing our domestic data centers, recognizing the essential role of both the Internet and data centers. Given that data center operations consume a significant amount of electricity, our company is advancing efforts to address climate change and decarbonization, which are closely related to energy issues. Recognizing that the effective use of the Internet is crucial for maintaining social infrastructure and securing essential services, we place a special emphasis on our cybersecurity efforts.

(1) Initiatives for Climate Change and Decarbonization

As the digitalization of our society and industries has progressed, data-based businesses and solutions to social issues are expected in all kinds of fields, so the importance of data centers, which are components of digital infrastructure, is increasing year by year. Furthermore, with the rapid development of generative AI utilization and the commercialization of VR technology in recent years, the power consumption of high-performance servers in operation has also increased. From the perspective of global environmental conservation such as preventing global warming and SDGs, we fully recognize the need to manage and reduce energy consumption and strive to contribute to a sustainable society through initiatives to achieve decarbonization.

In November 2011, we opened and have been operating an environmentally friendly suburban large-scale data center (Ishikari Data Center) in Ishikari City, Hokkaido.

Besides operating data centers utilizing the cool outside air at the location, we established the Ishikari Solar Power Plant for the purpose of harnessing renewable energy in house in 2015, achieved virtually zero CO2 emissions through the use of non-fossil certificates in 2022, and replaced all power sources with those derived from renewable energy in 2023. Like this, we actively implement the initiatives for conserving the global environment in the operation of data centers.

In 2021, we endorsed the “Recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)” and joined the TCFD Consortium of companies and organizations that endorse these recommendations. Although our current information organization is not primarily focused on climate change, we continue to prepare for appropriate disclosure regarding the impact of climate change-related risks and revenue opportunities on our business activities and earnings. Our corporate governance and risk control are disclosed in our securities report.

(2) Initiatives for Cybersecurity

In recent years, as corporate activities have become increasingly digitalized, the exchange of personal and confidential corporate information over the Internet has become commonplace. At the same time, as in the real world, a variety of problems have arisen, including nuisance activities, various rights violations, and the distribution of illegal and harmful content. Therefore, ensuring and improving the safety and quality of the Internet is increasingly important. As a cloud service provider, we review our services daily and implement multifaceted measures to ensure and enhance safety and quality.

On the other hand, we recognize the importance of “personal information,” “freedom of expression,” and “privacy of communications,” so when responding to requests from investigative organizations or the like, we make efforts to protect them by following related laws and guidelines, including the Act on the Protection of Personal Information, the Telecommunications Business Act, and the Provider Liability Limitation Act. As part of efforts to improve the safety and quality of the Internet, we started disclosing the number of requests and the overview of our response as a “Transparency Report” in August 2023, to secure the transparency of information handling.

We also recognize it as our duty as a cloud and Internet infrastructure service provider to establish systems that enable us to collect a wide range of information through affiliated and sponsoring organizations about legal and administrative issues related to advancements in Internet technologies such as generative AI and cybersecurity, respond accurately, and express our opinions as needed. As a specific example, personnel in charge of specialized teams for responding to and taking countermeasures against nuisance activities, etc. and legal affairs staff participate in the Administrative Law Subcommittee, a subcommittee of the Japan Internet Providers Association (JAIPA), to exchange opinions with relevant ministries and agencies on the sound use of the Internet.

<Investment in Human Capital, Intellectual Properties, etc.>

Our company regards investment in intellectual properties is crucial for our business development, and actively supports creative activities within the company. As for investment in human capital, our company has been working to establish an environment that enhances and maximizes the capabilities of our employees, therefore, securing and developing human resources is one of our strengths, and is in line with our key theme of Achieving Customer Success (CS) and Employee Success (ES), which is to build a relationship of mutual growth by supporting our customers as well as our employees to succeed. At our company, we believe that each employee represents our capital and their growth and success are essential in providing value to our business and customers. In order to transform "what you want to do" into "what you can do.” and realize sustainable corporate management and Employee Success (ES), our efforts in this direction include a variety of initiatives as described below, the details of which are disclosed in our securities report.

・Cultivating a culture of talent development and collaborative learning

・Fostering mental and physical health

・Promoting the success of a diverse workforce

・Creating a culture where diverse talents and skills converge, fostering new values through leadership

・Promoting flexible work arrangements

Moreover, we consider investing in intellectual property as essential for our business growth. We actively support in-house creative activities and are committed to appropriately protecting, managing, and utilizing our intellectual property. By communicating within the company, the importance of respecting third-party intellectual property rights, we diligently work to prevent any infringements. Although we are not a content creation and provision company, we are a member of the Association of Copyright for Computer Software (ACCS). We participate in various study groups organized by the ACCS to enhance our knowledge, facilitate information exchange, and engage in activities to protect copyright rights.

We continue to oversee these initiatives, which contribute to our company's sustainable growth, and are committed to proactive information disclosure.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle 1-4 [Strategically held shares]

(1) Philosophy regarding strategic shareholding

Our company generally does not hold listed shares as strategically-held shares unless their significance and rationality are recognized.

We annually assess the significance and rationality for holding each stock, considering potential corporate collaboration or business synergy with the issuing company and whether the benefits and risks associated with holding these shares justify the capital cost. Shares deemed to lack sufficient significance and rationality are sold, taking into account stock prices, market trends, and other relevant factors.

(2) Regarding the exercise of voting rights

While considering the purpose of holding listed shares, we exercise voting rights based on whether it aligns with the sustainable growth and medium to long-term enhancement of corporate value for both our company and the invested entities.

Principle 5-1 [Policy regarding constructive dialogue with shareholders]

The Company has established a department for managing IR, and holds financial results briefings for shareholders and investors at least twice a year. We also create opportunities for dialogue by obliging individual interviews with persons such as the Director and Chief Financial Officer upon request. We have also created a system for sharing the opinions received during these interviews with management on an as-needed basis.

As discussions unfold, we consider the topic of the discussion and strictly control insider information.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved |

To view back numbers of Bridge Reports (Sakura internet Inc.: 3778) or the contents of Bridge Salon (IR related seminars), please go to our website at the following url: