Bridge Report:(3853)Asteria the third quarter of the term ended March 2022

Yoichiro Hirano Chief Executive Officer | Asteria Corporation (3853) |

|

Company Information

Marketing | TSE 1st Section |

Industry | Information and telecommunications |

President & CEO | Yoichiro Hirano |

HQ Address | 19F Ebisu Prime Square Tower, 1-1-39 Hiroo, Shibuya-ku, Tokyo 150-0012, Japan |

Year-end | March |

Homepage | https://www.asteria.com/jp/en |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥851 | 17,491,265 shares | ¥14,885 million | 15.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

NYD | - | ¥121.44 | 7.0x | ¥330.25 | 2.6x |

*The share price is the closing price on February 14. Share outstanding and DPS and EPS are based on the results in the third quarter of the term ended March 2022. ROE is the profit margin of equity attributable to the owners of the parent company, and BPS is equity attributable to owners of parent per share. The values of ROE and BPS are the results of the previous term.

Earnings Trends

Fiscal Year | Sales | Operating Income | Pretax Profit | Net Income | EPS | DPS |

Mar. 2018 (Act.) | 3,110 | 577 | 444 | 197 | 11.90 | 6.00 |

Mar. 2019 (Act.) | 3,478 | 389 | 463 | 271 | 16.39 | 4.00 |

Mar. 2020 (Act.) | 2,677 | -262 | -159 | -176 | -10.66 | 4.00 |

Mar. 2021 (Act.) | 2,688 | 820 | 1,026 | 807 | 49.02 | 4.50 |

Mar. 2022 (Est.) | 2,900 | 3,400 | 3,400 | 2,000 | 121.44 | NYD |

*Unit: million yen, yen. The forecast is from the company. IFRS is applied. Net income is net income attributable to owners of parent.

This report includes the outline of Asteria Corporation, summary of Financial Results and Earning Forecast for the Third Quarter of the Fiscal Year Ending March 31, 2022.

Table of Contents

Key Points

1. Company Overview

2. The Third Quarter of the Fiscal Year Ending March 2022 Earnings Results

3. Fiscal Year Ending March 2022 Earnings Forecasts

4. Conclusions

<Reference1: Mid-Term Management Plan “STAR”>

<Reference2: Regarding Corporate Governance>

Key Points

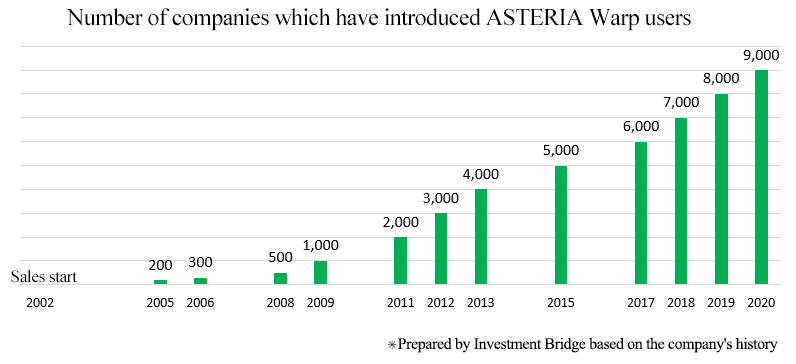

- Under the concept of “connecting the world with software,” the company develops software to meet various needs for “connection” based on its software and Internet technologies. The number of enterprises that have adopted its core product “ASTERIA Warp” exceeded 9,000 in 2020. The company has been occupying the largest market share for 15 years until 2021. The characteristics and strengths of the company include the capability of developing products based on the excellent “foresight,” competent human capital developed by diffusing its unique corporate culture, the large market share, new technologies, and active measures for developing solutions.

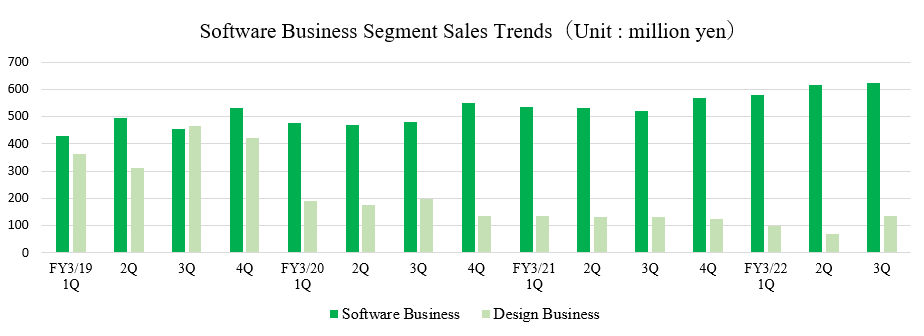

- The sales in the third quarter of the term ended March 2022 were 2,127 million yen, up 6.7% year on year. As Western countries, especially the U.S. and the U.K., were affected by the spread of COVID-19, the sales of the Design Business declined year on year, but the Software Business, whose core product is “ASTERIA Warp,” grew. Operating income was 973 million yen, up110.9% year on year. As the company increased employees and implemented marketing measures in accordance with the mid-term plan “STAR,” SG&A increased, but it was offset by the sales growth of the Software Business and the revenues from the Investment Business (primarily gains on the valuation of Gorilla Technology Inc.). The company recorded its highest profit in the third quarter (accumulated). Gross and operating profit margins increased by 2.6% and 22.6%, respectively, over the same period last year. The company recorded its highest operating income, pre-tax income, and net income in the cumulative third quarter. Gross and operating income margins increased 2.6% and 22.6%, respectively, year on year.

- There is no change to the earnings forecast that were revised upwardly on January 13, 2022. As of February 14, 2022, when the company announced its results for the third quarter, Gorilla was scheduled to be listed in the second quarter of 2022 (April-June 2022), but the revised forecasts incorporate a certain degree of anticipated risks, including a delay in this company's listing date. There is no change to the dividend forecast, too. The interim dividend will be 0.00 yen/share. The year-end dividend is still to be determined.

- The main reason for the upward earnings forecast revision announced on January 13, 2022, is a valuation gain of 3.8 billion yen associated with Gorilla's listing on the NASDAQ market. As stated in the earnings report for the third quarter, the company said that the valuation gain is a conservative figure that incorporates a certain degree of expected risks, including a delay in the timing of the listing, and that even if there were a delay, it is unlikely that it would lead to a revision of the forecast.

- On the other hand, the mainstay software business continues to perform well for all products, and the design business is showing signs of recovery after bottoming out in the second quarter (July-September) of the fiscal year ending March 2022. Eyes are on how much sales and income the three businesses, including the investment business, will accumulate in the fourth quarter (January-March). The company usually announces its dividend forecast in mid-March. The EPS forecast for the current term is 121.44 yen, much higher than the 49.02 yen in the previous term. The announcement of this forecast is also noteworthy.

- From a medium-term perspective, we will continue to closely monitor the progress of the business activity plans in the “Medium-Term Management Plan STAR”, with a focus on the targets for each product.

1. Company Overview

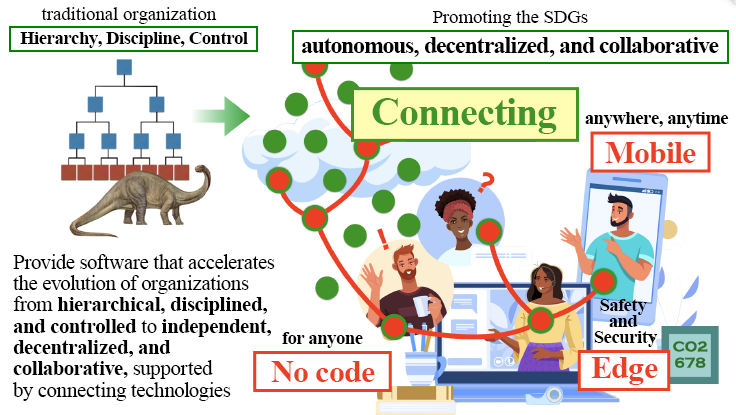

Embracing the concept of “connecting the world with software,” Asteria Corporation develops software products that meet the needs for “connectivity” using mainly the software technology and the Internet technology. The number of companies that have adopted its mainstay product, ASTERIA Warp, reached 9,000 in 2020. The company had the largest share in the Japanese data integration software market for the 15th consecutive year through 2021. With the vision: “To provide services to create an autonomous, decentralized, and collaborative society worldwide,” the company aims to achieve net sales of 4.5 billion yen and an adjusted EBITDA of 1 billion yen, the targets for fiscal year March 2024, in its Mid-Term Management Plan “STAR”.

1-1. Corporate History Leading up to Listing

Mr. Yoichiro Hirano (current president and chief executive officer of Asteria Corporation), who began to take an interest in computers even when he was a junior high school student and has been devoted to software development, entered a university with an aspiration to learn more about the world of computers. However, he left the university because of his high ambition and set up a software company with one of his friends. He worked as an engineer and developed software for word processors which proved popular, and later joined Lotus Software, which is a global software manufacturer.

While the Internet was spreading rapidly in the mid-1990s, Mr. Hirano foretold the future in which systems and software would certainly be required to be connected even when they were manufactured by different manufacturers, and he suggested that it was essential to make the data formats and communication protocols of Lotus Notes, the major groupware product of Lotus Software, open to the public so that the software could be connected with other manufacturers’ groupware products; however, Lotus rejected his suggestion because it had already occupied a large market share.

Mr. Hirano deeply felt the need and importance of data integration and believed that, by using the common language of computers, XML, a future in which systems would be connected with each other regardless of whether they were used inside or outside companies and myriad business operations were executed would surely follow, and thus, he established Infoteria Corporation (currently Asteria Corporation) in September 1998 with one of his co-workers, Mr. Yoshiyuki Kitahara.

Thinking that it was necessary to firmly focus on product development, President Hirano raised a fund of about 2.7 billion yen, which was an unusually large amount raised by Japanese startup companies at that time, and was engaged in development soon after the establishment of his company.

In 2002, he released ASTERIA R2 (current ASTERIA Warp), which is software for data integration.

ASTERIA Warp is a product that integrates data without the need for coding (no-code) even when companies that have adopted the software are not fully capable of programming, which was innovative at that time, and has been growing as the company’s mainstay product that has taken the largest market share for many years.

Data integration using the common language of computers, XML, created a new trend firstly in the field of electric commerce and garnered attention of several leading companies, such as Sony Corporation and KYOCERA Corporation, which adopted it. Then, companies that understood the significance of data integration steadily grew in number, and over 200 companies adopted ASTERIA Warp in 2005, three years after the release of the software. In 2006, the company gained the largest share with the software in the Japanese market of Enterprise Application Integration (EAI) software (it had held the top share for 15 years in a row up to 2021 since then).

The growth trend of the company began as just described, and the company further expanded its business and got listed on the Market of the High-Growth and Emerging Stocks (Mothers) of the Tokyo Stock Exchange (TSE) in June 2007.

Since then, the company has released products and services one after another that enhance the value of “connectivity”, including Handbook, a management system for mobile content launched in June 2009, Platio, a mobile application creation tool released in October 2016, and Gravio, an AI-based IoT integrated edgeware made available in June 2017, by predicting the trend of the times.

The company changed its listing market from the Mothers to the first section of the TSE in March 2018 and renamed it Asteria Corporation in October of the same year (The word “asteria” means constellations in the Greek language. The company has adopted the corporate name in the hope that it can create new forms and new values by connecting a myriad of shining things that exist all over the world like constellations).

1-2. Management Philosophy

Asteria continues to take on new challenges in order to provide value worldwide with the following three core management principles:

Challenge for Ideas | We value freedom of ideas and the spirit to challenge. New ideas give birth to innovation that leads the future. For its realization, we take risks to challenge and to explore new possibilities. |

Global Perspective | We always eye the global market. We provide products and services that have unique and special meaning of existence in the world. |

Chain of Happiness | We lead a chain of happiness. We perform the activities that we feel happy about and proud of in order to contribute to the happiness of our customers and then to the happiness of society. |

1-3. Business Description

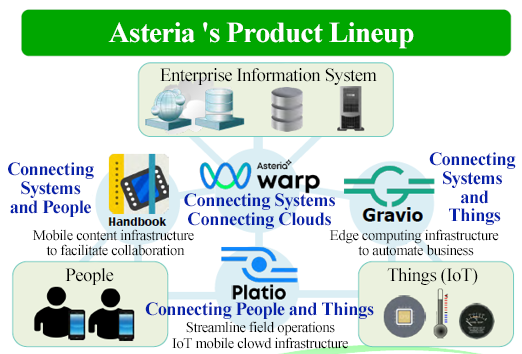

The company develops and sells software that satisfies various “connectivity” needs mainly with the software technology and the Internet technology, and conducts related businesses by embracing the concept of “connecting the world with software.” The segments to be reported are the Software Business and the Investment Business.

1-3-1. Software Business Segment

This business segment consists of the Software Business and the Design Business.

(1) Software Business

The Software Business is the leading business of Asteria Corporation.

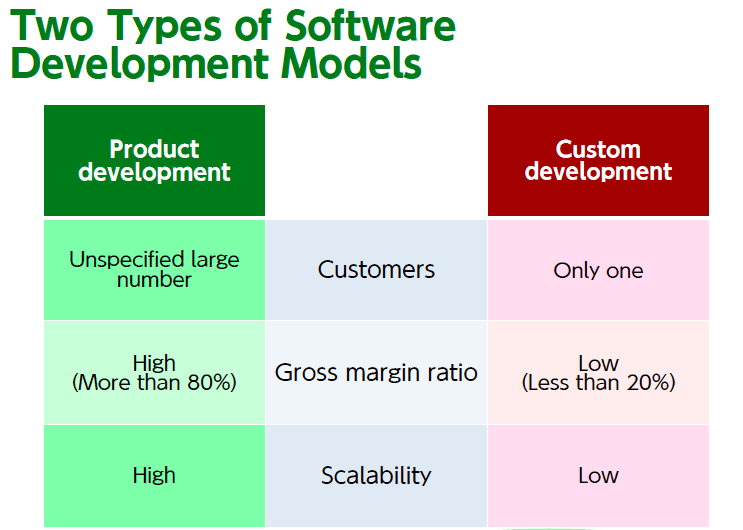

This business is specialized in product development that offers packaged services and cloud services for an unspecified and large number of people, not in custom development of software for individual companies. The company develops software for “connecting” corporate information systems, cloud services, hardware devices, and other relevant items and provides products to the market.

Asteria’s leading products are ASTERIA Warp, Handbook, Platio, and Gravio.

(Data integration)

The fundamental concept of Asteria Corporation is “connectivity.” It is to offer easy, efficient, and safe data integration and system coordination within a company or between companies, and enhance the value of data.

*Necessity of data integration

Systems and software, in principle, are developed by different vendors and based on different programming languages and protocols (standards, procedures, and rules).

This makes it difficult to coordinate data used in, for instance, the sales department and the product planning or marketing department if the departments use different systems and tools even within a company, which means that data obtained from other departments cannot be used unless it is processed by a relevant department itself. Furthermore, it requires time and effort in the same manner for sending data to other companies.

It is data integration technology that settles these issues.

Data integration will prevent the loss of business opportunities because necessary data will be readily available in a timely manner, while business productivity will significantly improve because data integration will cut down on the time and cost that a relevant department or company has been required to spend for processing data, which has conventionally been treated in different formats in different departments or companies, in order to treat it with its own system.

(Taken from the reference material of the company)

(Main software products)

① Data integration middleware, ASTERIA Warp

It is ASTERIA Warp that President Hirano released as the first product with the aim of further raising the value of data through easy data integration.

The number of companies that have adopted ASTERIA Warp reached 9,000 in 2020. Asteria took the largest share in the Japanese data integration software market with the product for 15 straight years up to 2021. The product’s market share is about 1.5 times larger than that of the product with the second largest share, indicating that ASTERIA Warp enjoys overwhelmingly stronger support than other products in the field.

ASTERIA Warp is a data integration middleware product for companies, which was designed and developed originally by Asteria Corporation, and is aimed at easily and swiftly coordinating systems used inside and outside companies through provision of general-purpose data integration functions as a package.

As described in Corporate History above, the noteworthy feature of ASTERIA Warp is that it helps companies that adopt it with no-code data integration, that is, even if companies are not fully capable of programming, all they need to do is to complete data integration by arranging icons without the coding process.

(Forms of data integration)

*Data integration inside companies

When coordinating systems within a company, ASTERIA Warp does not connects one system to another system individually, but plays a central role in connecting multiple systems to other systems. Systems can be swiftly and efficiently coordinated in a highly extensible and flexible manner with a minimum number of connections through use of multifarious data formats, communication procedure formats, and operational systems that have been made available in advance in ASTERIA Warp.

*Data integration between companies

ASTERIA Warp has such functions as communication protocols and authentications required for communicating various pieces of information between multiple companies that employ different system specifications and operational flows, enabling smooth system cooperation in order processing between companies.

A media organization (news agency), one of the users of ASTERIA Warp, can deliver news throughout Japan without any need for individual settings for the systems adopted by its relevant organizations, such as local newspaper companies.

*Connecting with cloud services

ASTERIA Warp can be connected with various types of cloud services that are gaining popularity lately. Data integration is possible with not only the fundamental cloud services provided by Amazon Web Service (AWS) and Microsoft Azure, but such application services available on cloud as Salesforce and kintone.

While the company has integrated data with a host of Enterprise Resource Planning (ERP) and operational systems, ASTERIA Warp is a product that the company continues to evolve by predicting changes in the future so that it can connect corporate systems with cloud services and new technologies, such as blockchains, IoT, AI, Robot, and Fintech, through the API without the need for coding.

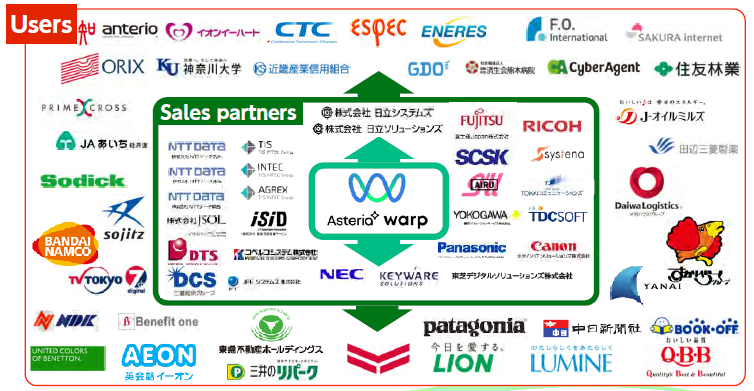

(Marketing method)

ASTERIA Warp is sold by Asteria Corporation’s sales partners (agencies) called ASTERIA Master Partners, which are mainly system integrators. There were 28 sales partners as of February 13, 2022.

The ASTERIA Master Partners sell ASTERIA Warp to end users primarily by incorporating the software into their own systems.

(Taken from the reference material of the company)

Regarding ASTERIA Warp Core, which is a subscription version of the software available at monthly usage charges and was released in 2016, ASTERIA Subscription Partners (ASPs) sell it as the company’s partners, A s of February 13, 2022, there were 62 ASPs.

Technological support (responses to inquiries) and other support services that help operate the products, such as product updates (dealing with new operating systems, expanding functions, and fixing bugs) are also provided to companies that have adopted the product. The price of the support services is 15% of the license fee. Revenues from the support services increase on a recurring basis every year as with the license, and this is one of the factors behind the stable sales growth of ASTERIA Warp.

The support services are offered, in principle, via the sales partners.

② Handbook X (including Handbook)

On February 28, 2022, the company launched “Handbook X”, a business negotiation support application that responds to diversifying work styles and changes in the sales field.

The use of a various sales promotional content, such as presentation data, PDF files of product catalogs, YouTube videos, and webpages, has become indispensable in business negotiations. At the same time, there are more and more opportunities to be tested for skills to use such a variety of information and smoothly give proposals to customers. However, there remain many issues. For example, it takes time to switch to dedicated applications when presenting PDF files, videos, etc., and it is impossible to immediately show promotional content as intended, as a result of utilizing so many different types of content.

To address these issues, “Handbook X” allows users to register, view, and share sales promotion content necessary for business meetings on the application, and to easily create their own customized proposal stories.

In addition, “Handbook X” provides one-stop access to PDF files such as product catalogs, product photos, instructional videos, and external content such as YouTube and websites, without having to switch to a dedicated application each time.

These functions enable the smooth storytelling of a wide variety of content, both in face-to-face sales using tablets and in online meetings, to realize successful business negotiations.

The company offers a wide range of monthly subscription plans, including a free version, for a wide range of users, from individuals to companies.

Prior to the release of Handbook X, the company has been offering the following Handbook, the product description of which is as follows.

Handbook is a service that enables users to register, distribute, and share various items of information arising within organizations via smart devices (such as smartphones and tablet devices) while ensuring security.

It is composed of an application that is available to download on smart devices and an editing and management tool provided on cloud.

Users can use the product right after they have concluded contracts because it is offered for subscription available at monthly usage charges. Over 1,600 users, including companies and educational institutions, have adopted the product, and it brings about significant effects for smoothly conducting online meetings, remote learning or training during the COVID-19 pandemic using smartphones and tablet devices.

According to ITR Market Vie SFA/Integrated Marketing Support Market 2021, which is a market survey report prepared by ITR Corporation, a market survey and consulting company, Handbook took the largest share with Handbook in two categories (the sales amount share and the cumulative number of companies adopting the product) of the sales enablement tool market.

In the future, Asteria plans to expand sales centered on the newly released Handbook X.

(Reference material from company: Major users of Handbook)

③ Platio

Platio is an application creation tool that helps everyone easily create and utilize mobile applications which fit in with their business operations.

The no-code concept is its distinctive feature like ASTERIA Warp.

The product has a function of inputting manually entered information, as well as location information and camera and video information all together obtained through mobile devices Information entered via the applications will be shared immediately on the mobile devices of business team members. Other functions include outputting shared data in the CSV format and connecting with other systems through the API.

The product comes equipped with over 100 types of templates. It has a flexible customization function, allowing users to create mobile applications suited for on-site operations with no code required.

The iOS version (for iPhones and iPads) and the Android version of the product is offered for subscription at monthly usage charges through a partner program.

It is employed in a wide range of industries, including not only companies but also local municipalities.

(Taken from the reference material of the company)

In December 2021, the company began offering “Platio Connect” (four types), a product with data linkage functions.

“Platio Connect” enables automatic, no-code linkage between business applications created with Platio and more than 100 business tools, including kintone, Box, business chat tools, BI tools, and office-related tools. The addition of the data linkage function to “Platio” will greatly enhance the functionality of the Platio application as an input interface for corporate systems, further contributing to the digitization of on-site operations and the promotion of DX through mobile devices.

④ Gravio

Gravio is AI-based middleware for edge computing developed for simply realizing effective data collection and usage in IoT solutions at offices, buildings, and shops.

The product can easily realize edge integrated AI/IoT systems that use camera and AI-based image recognition and various sensor data without the need for coding while making the most of the knowhow and information resources cultivated through operation of existing computers because it works on Windows and MacOS, which are operating systems widely used throughout the world.

Six features

1: Sensor data processing. Data obtained through IoT devices can be processed and coordinated uniformly at the edge.

2: Capability to control various devices. Operations can be controlled (commands are issued) to IoT devices.

3: Equipped with AI (machine learning). Cameras can be used as sensors for such purposes as face recognition and weather identification.

4: No-code. High operability is offered through the intuitive and flowing interface.

5: Layout view. The condition of the IoT devices installed in areas can be checked on the screen.

6: Capability to work on Windows, MacOS, and Linux. Operation, management, and maintenance are easy, and tight security is ensured.

The Windows version, the MacOS version, and the Linux version of the product are offered for subscription (at monthly or annual usage charges). The company plans to continue adding both hardware and software functions.

There are a growing number of cases in which Gravio is adopted for automation and remote control.

(Taken from the reference material of the company)

(2) Design Business

The Design Business was started in 2017 after Asteria Corporation acquired U.K.-based This Place.

The company believes that design of software for companies comes before anything else, that is, not just functions but design with emphasis on usability and ease of understanding will become important, and this business is aimed at helping companies with digital transformation (DX). The Design Business provides such services as consulting for developing clients’ digital branding strategies, formulation of DX strategies and support for implementing the strategies for customer companies, consulting related to design of websites and mobile applications, and development support.

This Place is mainly based for major companies in the United Kingdom, the United States, and Hong Kong. It plans to start providing services by establishing a business base in Japan by the end of the period of the current Mid-Term Management Plan.

1-3-2. Investment Business Segment

This business segment is a corporate investment business run by Asteria Vision Fund Inc., a wholly owned subsidiary set up in 2019 in the United States.

The company believes that 4D is the key driver of IT growth, which is not affected by changes in trends.

Area | Concept | Specific products and services |

Data | Only data will be corporate IT assets. | AI, big data, etc. |

Device | Devices will constitute an essential infrastructure. | IoT, Smart devices, etc. |

Decentralized | An era centered on individuals where they are dispersed but can collaborate future of individuality with decentralization and harmony will come. | Blockchains, DApps, etc. |

Design | The design-first era will come. | Design Thinking, DX, etc. |

As of January 2022, it invests in a total of five companies-- a company in Japan, Australia, and Taiwan, respectively, and two companies in the United States. The fund’s assets under management stands at 220,000 US dollars in total.

Investment target | Country/Region | Year of investment | Overview/Characteristics |

Gorilla | Taiwan | October 2019 | The largest AI software company in Taiwan. It applies AI for image recognition and cyber security |

Imagine | Australia | February 2020 | Technology for liquifying the new carbon material Graphene to use it for IoT sensors |

Workspot | United States | February 2021 | The remote PC operation was made possible through the cloud and has expanded its application amid the novel coronavirus pandemic |

JPYC | Japan | March 2021 | Blockchain-based stablecoin issuance and NFT technology |

SpaceX | United States | January 2022 | Distributed satellite internet, “Starlink” |

1-4. Characteristics, Strengths, and Competitiveness

(1) Product development capabilities based on superior foresight

The company operates in the "IT industry," primarily focusing on software product development.

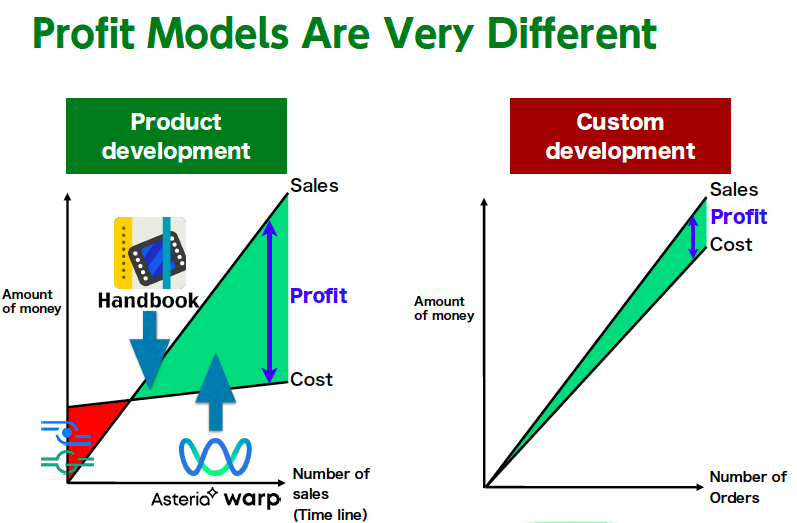

Product development for an unspecific number of users makes it easier to expand sales, unlike custom development, which involves developing systems that meet the needs of individual clients. In addition, once the initial development cost is covered by selling a certain volume of products and the break-even point is reached, sales and profits become nearly equal. Hence gross margin ratio is very high compared to custom development.

The gross margin ratio of ASTERIA Warp is 80-90%, and Handbook has already exceeded the break-even point. The two new products, Platio and Gravio, have yet to contribute to profits, but the company expects them to expand sales and contribute to profits in the future.

Of course, there is a great risk if the sales volume of a developed product does not expand as expected, so foresight and design concepts in product development are important. However, the company has been providing highly competitive products to the world one after another with its excellent ability to forecast forward to the future, as in the case of ASTERIA Warp, which is the company's main product and was developed by quickly predicting the importance of "connecting" data inside and outside the company.

|

|

(Taken from the reference material of the company)

(2) Strong human capital built through the spread of a unique corporate culture

The company's unique corporate culture, represented by the aforementioned management philosophy, has been instilled throughout the company and has become the basis for its actions.

In particular, instead of following precedents like Japanese companies often do, the company has adopted the slogan "Challenge for Ideas: Respecting free and open-minded ideas and challenges. Innovation that leads the times is born from new ideas. To achieve this, the company is willing to take risks and constantly endeavor to find new possibilities" as the most important evaluation item.

This is related to the above section (1), but at the time of the company's founding, President Hirano "foresaw" a world in which everything would be "connected" via the Internet, and with the vision of "producing world-class software from Japan," he worked on product development for about 20 years, nurturing the software development capability up to the point of being able to develop products without coding.

By sharing this philosophy and vision with all employees, the company has been introducing new products with new ideas one after another even after the launch of ASTERIA Warp, and the strong human capital centering on engineers built through the promotion of its unique corporate culture is the source of the company's competitive advantage.

(3) Significant market share

The company's products, developed based on (1) and (2) above, have been highly evaluated by users for their usefulness and ease of use, and have become the No. 1 products.

As of 2021, ASTERIA Warp has held the largest share of the domestic market for EAI/ESB products (based on shipment volume) for 15 consecutive years. Handbook also has the largest share in two categories of the sales enablement tools market.

(4) Proactive measures for new technologies and solutions

The company, which has "Ideas and Challenges" at the top of its management philosophy, is actively working to promote, commercialize, and offer services based on new technologies and solutions.

President Hirano served as vice-chairman of the XML Consortium, an organization for the promotion and awareness of XML, a common computer language (activities ended in March 2010). In 2015, the company became the first listed company to start working on a blockchain, which is its current focus. In April 2016, President Hirano led the establishment of the Blockchain Collaborative Consortium (BCCC), an organization that promotes the widespread use of the blockchain technology, for which he serves as CEO.

Regarding the blockchain technology, which the company is currently focusing on, the "Attendance-based Virtual Shareholders Meeting Solution" developed by Asteria while leveraging the blockchain technology was adopted by Meiji Yasuda Life Insurance Company for its "General Meeting of Shareholders" held on December 1, 2020.

The key points that led Meiji Yasuda Life Insurance to adopt the "Attendance-type Virtual Shareholders Meeting Solution" were: "Avoiding the three Cs (closed spaces with poor ventilation, crowded and close-contact settings) at the general meeting to be held on December 1 was essential due to the rapid increase in COVID-19 cases," "the blockchain technology was brought to attention to ensure the fairness of vote counting and questions even when the meeting is held virtually," and "the interface is easy to operate despite the use of the latest technology, even for elderly people."

In addition, at Asteria's 23rd Annual Shareholders Meeting held on Saturday, June 26, 2021, a "Hybrid Attendance-type Virtual Shareholders Meeting" was held as a measure to prevent the spread of COVID-19.

For this general meeting of shareholders, Quorum*, which is attracting attention as a blockchain for corporations, was applied as the infrastructure technology to realize the motion handling required for a virtual-only general meeting of shareholders in a virtual environment. This completes the virtual handling of all actions (votes, questions, and motions) by shareholders entitled to vote at the meeting.

Shareholders can easily vote from the browsers of their PCs, smartphones, etc. by following the instructions on the voting form, and companies can also accept voting or questions even during the shareholders' meeting, and the votes are instantly counted in real time. In addition, the voting results are recorded in a blockchain so that even the organizer cannot falsify the votes, making this an unprecedented and revolutionary shareholders' meeting.

※Quorum

An Ethereum-based smart contract platform developed by JP Morgan Chase & Co. in the U.S. and currently owned by ConsenSys, Inc. in the U.S. It is developed as a blockchain for enterprises in the financial sector.

In the future, the company plans to develop this service for companies, mainly those listed on the stock exchange, as well as to expand it into a system that can ensure fairness in the way votes are counted and the results in the government and even entertainment fields.

(5) Governance and management system that emphasizes diversity

Based on the idea that diversity is extremely important in the pursuit of world-class manufacturing, outside directors were appointed with an emphasis on diversity (gender and nationality).

Since the company's founding in 1998, when the term "corporate governance" was not still widely known, the company has continuously appointed at least two outside directors, and currently, three of the five directors are outside directors.

In addition, the company has adopted a system that separates management from execution, with only President Hirano and Vice President Kitahara serving concurrently. The company has established a global management structure with two of its eight executive officers, who have strengths in a variety of fields, being non-Japanese.

1-5. ESG/SDGs

In order to meet the trust and expectations of society, the company aims to contribute to the sustainable development of society by conducting the business activities while actively communicating with all stakeholders, including customers, shareholders, employees, business partners, and local communities.

The following basic policies have been established.

Asteria endeavors to constantly maintain a customer-oriented perspective and create value through "connectivity." |

Asteria will meet shareholders’ expectations and provide justifiable reasons for all of its judgements. |

Asteria will respect diversity, rights, and individuality, while valuing the pride and sense of purpose of employees. |

Asteria will strive toward its goal of "connecting the world," while making positive progress alongside our business partners. |

Asteria will contribute to society by generating utility and value for all. |

The company views the Sustainable Development Goals (SDGs), adopted by the United Nations General Assembly in 2015, as an important issue required by society.

With the SDGs as a common global goal, the direction in which companies should work has become clearer, and many companies have begun to take the initiative, and the company is also working on business activities with an awareness of the SDGs. The company has already covered 11 of the 17 goals and will continue promoting them further. The main ideas and initiatives are as follows.

Environment

| Initiatives for the Environment In addition to building a good "eco-system" with business partners and end-users, we will also focus on developing an "eco-system" to realize "coexistence and co-prosperity" in the natural environment, thereby contributing to the construction of a sustainable society. Through these activities, we will develop various measures to build an "eco-system" between "the global environment/nature" and "society/industry" from a medium- to long-term perspective, aiming to realize a sustainable society.

-Promoting paperless operations -Asteria Green Activity*

|

Social | Initiatives for Social Contribution Asteria is engaged in social contribution activities that work to support the next generation of young citizens and that seek to realize the richness, health, and sustainable development of society.

-Supporting the Kamonohashi Project -Participation in a charity marathon -Pangaea (startup support)

|

Response to Diverse Needs Asteria actively promotes the creation of a workplace environment that supports diverse styles of work, so that people from a variety of backgrounds can continue to be actively productive.

-Promoting diversity -Telework -Sabbatical leave and birthday leave -Supporting childrearing

| |

Governance | -Corporate governance -Internal control systems -Exclusion of anti-social forces

|

(*) What is Asteria Green Activity?

An activity to contribute to the creation of a sustainable social and natural environment that was launched in 2015 to commemorate the fact that more than 5,000 companies had installed ASTERIA Warp, the company's main product (the name at the time of the launch was "Infoteria Green Activity").

To date, the following achievements have been made:

◎Regional Revitalization Plan with Oguni Town, Kumamoto Prefecture

Since 2015, the company has been conducting forest conservation activities for the Oguni cedar, a brand-name timber in Oguni Town, Kumamoto Prefecture, promoting the use of thinned wood and revitalizing the forestry and forestry industry.

In addition to producing toys and novelties made from Oguni cedar and providing them to employees and user companies, Oguni cedar is also used in the company's office to create a warm space where people can feel the warmth of wood.

◎Regional Revitalization Plan with Semboku City, Akita Prefecture

Since 2016, the company has been collaborating with Senboku City in Akita Prefecture to promote the introduction of ICT for industrial promotion, and has made video content captured by drones available for viewing at each tourist site using the company's product "Handbook," as well as conducting demonstration experiments to enhance tourism services using tablets.

◎The corporate version of hometown tax payment to Oguni Town in Kumamoto Prefecture and Senboku City in Akita Prefecture

The business plan for the town of Oguni, named "Make more use of Oguni cedar for a long time " and the business plan for the city of Senboku, cherry blossom conservation and tourism promotion activities, both of which are funded from Asteria by 1 million yen per year each, have been approved by the Cabinet Office as projects eligible for the "taxation system for supporting regional development (corporate version of hometown taxation).

The company has been making donations to the corporate version of hometown taxation for the past five years, and has used the donations as an opportunity to build new partnerships through dialogues and study sessions on public relations with the local governments to which the company donates. In 2022, the company received the "2021 minister's award for the taxation system for supporting regional development (corporate version of hometown taxation)" from the Cabinet Office in recognition of its efforts to contribute to the local community, including the development and free provision of an application for managing the body temperature of city employees by utilizing the company's strengths.

◎Holding an Annual Shareholders Meeting Using Carbon Offsetting

At the company's annual meeting of shareholders held in June 2021 in a virtual hybrid format, CO2 offsetting was used.

In addition to the venue of the meeting, the CO2 emitted by the electricity consumption at the homes of the 14 executives who participated in the meeting from a telework environment has been reduced to virtually zero.

This offset is in accordance with the J-credit system* operated by the Japanese government, and was implemented by purchasing 1 ton of forest absorption credits generated from CO2 absorption in Oguni Town, Kumamoto Prefecture, and other areas from more trees, a general incorporated association (Tokyo). Since 2015, Asteria has been conducting forest conservation activities under an agreement with the town of Oguni, Kumamoto Prefecture, and has selected the general incorporated association more trees, which includes the town's forest as a CO2 offset destination.

J-credit system (*): A system under which the government certifies the amount of reduction or absorption of greenhouse gas emissions such as CO2 as "credits" through initiatives such as the introduction of energy-saving equipment and forest management. It is jointly managed by the Ministry of Economy, Trade and Industry, the Ministry of the Environment, and the Ministry of Agriculture, Forestry and Fisheries.

2. The Third Quarter of the Fiscal Year Ending March 2022 Earnings Results

2-1 Business Results

| 3Q FY3/21 (Cumulative) | Ratio to Sales | 3Q FY3/22 (Cumulative) | Ratio to Sales | YoY |

Net Sales | 1,994 | 100.0% | 2,127 | 100.0% | +6.7% |

Gross Income | 1,620 | 81.3% | 1,785 | 83.9% | +10.2% |

SG&A | 1,206 | 60.5% | 1,539 | 72.4% | +27.6% |

Operating Income | 461 | 23.1% | 973 | 45.7% | +110.9% |

Pretax Income | 419 | 21.0% | 1,067 | 50.2% | +154.9% |

Net Income | 294 | 14.7% | 680 | 32.0% | +131.6% |

*Unit: million yen. Net income is net income attributable to owners of parent. The same applies below.

Net sales grew, and profit rose significantly, hitting a record high after listing.

Net sales grew 6.7% year on year to 2,127 million yen.

As Western countries, especially the U.S. and the U.K., were affected by the spread of COVID-19, the sales of the Design Business declined year on year, but the Software Business, whose core product is “ASTERIA Warp,” grew.

Operating income was 973 million yen, up 110.9% year on year.

As the company increased employees and implemented marketing measures in accordance with the mid-term plan “STAR,” SG&A increased, but it was offset by the sales growth of the Software Business and the revenues from the Investment Business. (Primarily gains on the valuation of Gorilla Technology Inc.). The company recorded its highest income in the third quarter (accumulated). Gross and operating income margins increased by 2.6% and 22.6%, respectively, over the same period last year.

2-2 Trend by Segments

| 3Q FY 3/21 (Cumulative) | 3Q FY 3/22 (Cumulative) | YoY |

Software Business | 1,994 | 2,127 | +6.7% |

Investment Business | - | - | - |

Consolidated Sales | 1,994 | 2,127 | +6.7% |

Software Business | 426 | 267 | -37.4% |

Investment Business | -13 | 673 | - |

Adjustment | 0 | 0 | - |

Consolidated profit | 414 | 940 | +127.4% |

Investment Business: Change in valuation | - | 695 | - |

*Unit: million yen. “Sales” means the sales to external customers. Segment income is calculated by subtracting cost of goods sold and SG&A expenses from net sales, but gain or loss on valuation related to financial assets held by held in Asteria Vision Fund I, L.P that are measured at fair value through profit or loss in other revenues and expenses is reclassified into income of the investment business.

(1) Software Business Segment

| 3Q FY 3/21 (Cumulative) | 3Q FY 3/22 (Cumulative) | YoY |

Software Business | 1,593 | 1,821 | +14.4% |

Design Business | 401 | 306 | -23.7% |

Total | 1,994 | 2,127 | +6.7% |

① Software Business

The sales of each product grew steadily. Monthly recurring revenue (MRR) increased 5.7 times in 24 months for “Platio” and 24 times in 24 months for “Gravio.” On the other hand, cancellation rate is low for every product.

The performance of “Handbook” remained flat but is expected to expand with the launch of new products in the fourth quarter.

On the other hand, the churn rate remained low at 0.5% for “ASTERIA Warp Core”, 0.6% for “Handbook”, and 0.6% for “Gravio”, although it was slightly higher for “Platio” at 2.9%.

The company has conducted one of the largest promotional campaigns in its history with “Platio”, and plans to conduct such aggressive promotions for “ASTERIA Warp” and “Handbook”, too.

* ASTERIA Warp

Sales exceeded 1.5 billion yen, marking a record high.

The strong performance was supported by the continued expansion of needs for the construction of internal systems to support telework and new data linkage needs in line with the implementation of the revised electronic books preservation act. In particular, sales of the licensed version, which is the flagship product, grew 33.4% year on year, driving the overall software business.

The subscription version “ASTERIA Warp Core” also saw a 30% increase in sales.

A new version of the software is now available with enhanced convenience of the development environment, greatly improving developers’ work efficiency, and new SAP and Ethereum-compatible adapters have been released.

* Gravio

Sales almost doubled year on year due to continued strong demand for visualization of CO2 and avoidance of 3Cs, as well as new business opportunities through collaboration with sales partners.

* Platio

To further raise awareness of this no-code development tool for promoting on-site DX and in-house production of business applications, the company conducted aggressive promotional activities, including TV ads, transit advertising, and large-scale dialogues using no-code as a keyword. As a result, the company has received many inquiries from a wide range of industries, including local governments. In December 2021, the company also announced the addition of the “Platio Connect” lineup with data linkage functionality and implemented functionality enhancements to expand its applications.

* Handbook

In response to the growing needs for paperless internal operations, the use of the system has been expanding, including its introduction for online training at Matsuya Ginza, and sales were solid for online meetings and other applications.

② Design Business

The impact of the global spread of the novel coronavirus has led to a decline in project orders from client companies. Although the company was able to win additional orders from some existing clients and strengthened efforts to acquire new clients, sales still declined year on year. However, on a quarterly basis, sales increased both quarter on quarter and year on year, and there are signs of bottoming out.

(2) Investment Business Segment

Results remained favorable, with a valuation gain of 695 million yen recorded. Among AVF-1's portfolio companies, in addition to the valuation increase in Gorilla and valuation decrease in Imagine Intelligent Material (hereinafter called "Imagine") that occurred during the second quarter (July-September), a valuation increase occurred in JPYC (Japan) during the third quarter (October-December). The investment business recorded a full write-down for Imagine, which entered into civil rehabilitation proceedings due to difficulties in continuing its business, in the second quarter.

Furthermore, the valuation of Gorilla's planned listing on NASDAQ, which was announced during the third quarter, is not included at this time.

At the end of January 2022, the company made a new investment of USD 2 million (about 230 million yen) in SpaceX (USA).

The company led by Elon Musk is best known for its rocket launch business, but Asteria decided to invest in the company because of the growth potential of “Starlink”, a distributed satellite Internet service.

Valuation gains will not be reflected until the next term or later.

“Starlink”, SpaceX's distributed satellite Internet, aims to leverage a global network of satellites orbiting in low Earth orbit to make high-speed broadband Internet available in places where access is unstable or expensive.

Currently, 12,000 satellites have been approved by the International Telecommunications Union (ITU), with another 30,000 satellites pending approval.

SpaceX has a track record of more than 1,700 satellites already launched and 100,000 Starlink terminals shipped.

The service is currently in beta in more than 12 countries around the world, including the U.S., U.K., Germany, Canada, Australia, France, and the Netherlands. 600,000 people have already made deposits after making reservations as potential users, and future growth is expected.

2-3 Financial Position and Cash Flows

◎ Balance Sheet Summary

| End of March 2021 | End of December 2021 | Increase/Decrease |

| End of March 2021 | End of December 2021 | Increase/Decrease |

Current Assets | 2,787 | 3,278 | +490 | Current Liabilities | 1,213 | 1,480 | +267 |

Cash and cash equivalents | 2,451 | 2,486 | +35 | Accounts payables | 182 | 399 | +216 |

Operating Receivable | 256 | 307 | +51 | Non-current Liabilities | 973 | 1,256 | +284 |

Non-current Assets | 5,120 | 6,011 | +891 | Deferred Tax Liabilities | 101 | 316 | +215 |

Tangible fixed assets | 180 | 505 | +324 | Long-term Borrowings (noncurrent) | 886 | 536 | -107 |

Goodwill | 1,015 | 1,035 | +21 | Total liabilities | 2,186 | 2,737 | +550 |

Intangible assets | 69 | 82 | +13 | Total capital | 5,721 | 6,553 | +832 |

Investments and others | 3,855 | 4,389 | +534 | Retained Earnings | 1,487 | 2,073 | +586 |

Total assets | 7,907 | 9,290 | +1,382 | Total Liabilities and Net Assets | 7,907 | 9,290 | +1,382 |

*Unit: million yen. “Operating receivable” is composed of “operating and other receivables.” “Investments and others” is the sum of “investments posted with the equity method,” “other financial assets,” and “other non-current assets.” “Operating payables” is composed of “operating and other payables.” “Shareholders’ equity” is “total equity attributable to owners of parent.”

Total assets increased 1,382 million yen from the end of the previous term to 9,290 million yen, due to the decline in cash & equivalents and the increases in tangible assets and investments & other assets. Total liabilities augmented 550 million yen to 2,737 million yen, due to the increase in accounts payable and deferred tax liabilities, etc. Total net assets grew 832 million yen to 6,553 million yen, due to the rise in retained earnings, etc.

The ratio of equity attributable to owners of parent decreased 2.7 points from the end of the previous term to 67.4%.

◎ Cash Flow

| 3Q FY 3/21 | 3Q FY 3/22 | Increase/Decrease |

Operating CF | 591 | 304 | -287 |

Investing CF | -431 | -47 | +384 |

Free CF | 160 | 257 | +97 |

Financing CF | -295 | -234 | +61 |

Cash and Equivalents | 2,387 | 2,486 | +99 |

*Unit: million yen.

The cash inflow from operating activities decreased, as income before taxes increased, but other revenues declined and accounts receivable rose. The cash outflow from investment redemption activities shrunk due to the expenditure for lending, and free CF remained virtually unchanged.

The cash position declined, but the company’s cash is as ample at 2.5 billion yen.

2-4 Topics

① Received Minister's Award for the Taxation System for Supporting Regional Development (Corporate Version of Hometown Taxation)

In January 2022, the company received the “minister's award for the taxation system supporting regional development (corporate version of hometown tax payment)” from the Cabinet Office” for the fiscal year 2021.

With the aim of promoting the use of the tax system for supporting regional development (corporate version of hometown taxation), the Cabinet Office has awarded companies and local governments that have made particularly outstanding achievements in the use of the system and whose activities are recognized as a model for others every year since the fiscal year 2018 by the minister of state for regional revitalization.

Asteria has been making donations to Semboku City in Akita Prefecture and Oguni Town in Kumamoto Prefecture for the corporate version of furusato (hometown) taxation continuously, for five years. In addition, the company was recognized for its efforts to contribute to the community that goes beyond donations, for example, by building new partnerships through dialogues and public relations workshops with local governments to which it donated funds, and developing and providing a charge-free application to manage the body temperature of local government employees by leveraging the strengths of the company.

② Launched Handbook X, an application to support business negotiations

In February 2022, the company began offering “Handbook X”, an application for supporting business negotiations, in response to diversified work styles and changes in the sales field.

For more information, see “Company Profile: Major Software Products.”

3. Fiscal Year Ending March 2022 Earnings Forecasts

3-1 Earnings Forecasts

| FY 3/21 | Ratio to Sales | FY 3/22 (Est.) | Ratio to Sales | YoY |

Net Sales | 2,688 | 100.0% | 2,900 | 100.0% | +7.9% |

Operating Income | 820 | 30.5% | 3,400 | 117.2% | +314.8% |

Pretax Income | 1,026 | 38.2% | 3,400 | 117.2% | +231.5% |

Net Income | 807 | 30.0% | 2,000 | 69.0% | +147.7% |

*Unit: million yen. The forecasted values were provided by the company.

No change in earnings forecast

There is no change to the upwardly revised forecast as of January 13, 2010.

As of February 14, 2022, when the Q3 results were announced, Gorilla was scheduled to be listed in the second quarter of 2022 (April-June 2022), but the revised forecast incorporates a certain degree of assumed risk, including the delay in the company's listing date. The estimated dividend is also unchanged. The interim dividend will be 0.00 yen/share, and the term-end dividend is still to be determined.

4. Conclusions

The company plans to record a valuation gain of 3.8 billion yen from the listing of Gorilla on NASDAQ, which is the main reason for the upward revision on January 13, 2010.

As stated in the Q3 earnings report, the valuation gain is a firm figure that takes into account a certain degree of expected risks, including a delay in the timing of the listing, and even if there is a delay, it is unlikely to lead to a revision in the forecast.

On the other hand, the mainstay software business continues to perform well for all products, and the design business is showing signs of recovery after bottoming out in the second quarter (July-September) of FY03/10. It will be interesting to see how much sales and profit the three businesses can accumulate in the fourth quarter (January-March). The company usually announces its dividend forecast in mid-March. The company's EPS forecast for this fiscal year is 121.44 yen, which is much higher than the 49.02 yen forecast for the previous fiscal year. We will also pay attention to this announcement.

From a medium-term perspective, we will continue to monitor the progress of the business activity plans in the "Medium-Term Management Plan STAR," with a focus on the targets for each product.

<Reference1: Mid- Term Management Plan “STAR”>

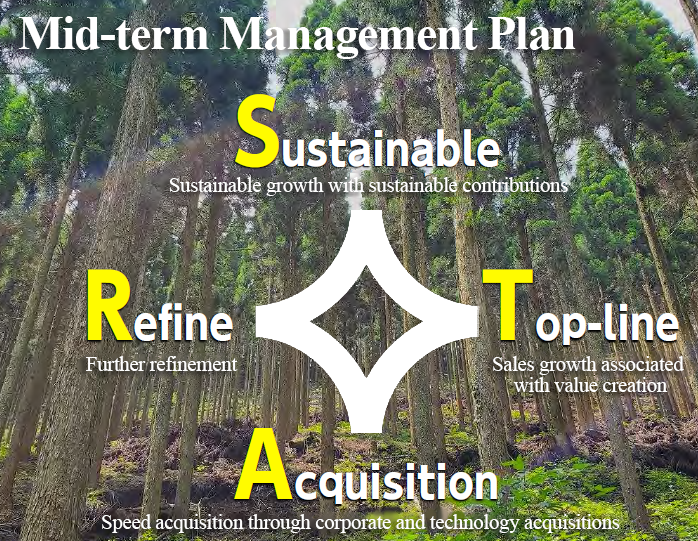

In June 2021, the company announced the Mid-Term Management Plan “STAR” for three years from April 2021 to March 2024.

(1) Vision

Based on the founding vision: “to develop software for realizing computing beyond the boundaries of organizations and supply it globally,” the company set a medium-term management vision: “To offer services of creating a new autonomous, decentralized, collaborative society globally.”

(Regarding the Mid-Term Management Plan “STAR”)

This plan was named STAR, by taking the initials of the following priority items.

Sustainable | To ensure our businesses are conducive to building a sustainable society To conduct business that would contribute to the development of a sustainable society |

Top-line | To aim for sales expansion through the creation and provision of value To increase sales by creating and offering value |

Acquisition | To increase growth rate via business and technology acquisitions To accelerate growth by acquiring enterprises and businesses |

Refine | To improve existing products and services and keep ahead of the new era To refine existing products and services, to usher in a new era |

The basic ideas for the vision are as follows.

☆ | Asteria launched its business with products using XML technologies and has provided products which have advanced “connectivity” for more than 20 years. |

☆ | Since we began supplying ASTERIA R2 in 2002, all Asteria products work without any coding under the concept of “Graphical Language.” While the term “no-code” is gaining wider recognition, this trend will likely continue to grow for decades onwards. |

☆ | Due to the COVID-19 pandemic, the global momentum toward an “autonomous, decentralized and collaborative” type of society, which Asteria has pursued since its founding, is becoming increasingly relevant. |

☆ | In this decentralized environment, mobile devices that can be used whenever and wherever have become commonplace. Moreover, the performance of chips and parts will be enhanced as IPv6 -- the next generation of Internet Protocol -- prevails, while “edge computing” spreads more rapidly so as to prevent cloud security threats. |

(Taken from the reference material of the company)

(Taken from the reference material of the company)

(2) Action plans for each business

① Software Business

◎ Core products

Two core products as of FY2020 are as follows:

* Warp

Raise the ratio of a recurring revenue model to 70% by increasing the ratio of subscriptions.

* Handbook

Begin shipping new products in the latter half of FY2021.

◎ New products

The aim is to build four pillars with the two products remaining as core pillars:

* Platio

To carry out active marketing activities.

To establish a product category and win the No.1 market share.

* Gravio

To commence a global operation in Japan, the U.S., the U.K., and Singapore by March 2022; China by March 2023.

To establish a product category and win the No.1 market share.

◎ R&D and consulting

The aim is to promote research and development of technologies that form the basis of

long-life products. The subjects of R&D are as follows:

*Blockchain: Offer in-house developed blockchain externally

*AI: Middleware for robotics handled by Asteria ART

*To promote joint ventures with infrastructure service providers as a means of

monetization that can expect a high level of growth.

◎ M&A

The aim is to reinforce domestic M&A in view of the pandemic.

*To launch a unit for domestic M&A (Completed).

*To target cloud services which receive a majority of its sales from licenses.

② Design Business

◎ Existing market

To continue with the diverse client strategy.

To acquire projects from clients in the U.S. and Europe after they recover from

the pandemic.

◎ Japanese market

To set up an operation in Japan as early as possible.

③ Investment Business

◎ Asteria Vision Fund(AVF)-1

Constantly recognize unrealized gains through growth of invested companies

to achieve an Internal Rate of Return (IRR) target of 10%.

◎ AVF-2

Start considering an establishment of AVF-2 depending on the performance of

the AVF.

④ Hiring plan

Grow workforce by 50% by March 2024 (124 employees as of end-March 2021).

Continue to focus on diversity in gender and nationality.

Continue to recruit new graduates and expand hiring through internships and other means.

Attract talent from around the world with the benefit of different ways of working, including teleworking and super-flex time.

(3) Numerical plans and goals

The following numerical plans have been set.

| FY 3/21 (Act.) | FY 3/24 (Est.) | CAGR |

Net Sales | 2,688 | 4,500 | +18.7% |

Adjusted EBITDA | 615 | 1,000 | +17.6% |

Adjusted EBITDA Margin | 22.9% | 22.2% | - |

Operating Income | 820 | - | - |

Operating Income Margin | 30.5% | - | - |

Unit: million yen. Adjusted EBITDA = operating income + depreciation ± other adjustments. Other adjustments include impairment of goodwill, unrealized earn-out cost, and unrealized valuation loss/gain. CAGR was estimated by Investment Bridge with reference to the plan of Asteria.

<Reference2: Regarding Corporate Governance>

◎Organization Type and the Composition of Directors and Auditors

Organization type | Company with auditors |

Directors | 5 directors, including 3 outside ones |

Auditors | 3 directors, including 3 outside ones |

◎Corporate Governance Report

Updated on December 10, 2021.

<Basic Policy>

The management goal of our company is to widely contribute to our stakeholders, including our shareholders, customers, and employees, and society through continuous business growth. In order to achieve this goal, we aim to implement highly transparent and sound business management, while committing to strengthening corporate governance by inviting outside directors since the foundation of the corporation. We strictly observe applicable laws and regulations, and practice fair and equitable corporate activities without ethical misconduct, positioning thorough compliance among our executives and employees as our basic principle of management.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

We have followed all of the principles of the Corporate Governance Code.

<Disclosure Based on the Principles of the Corporate Governance Code>

Principles | Disclosure contents |

【Principle 1-4. Strategically held shares】 | Our corporate policy is to hold shares strategically if we determine that such shareholding would contribute to improving the medium- and long-term corporate value of our company from the perspective of maintaining and strengthening stable and long-term relationships with our business partners, and we may reduce such strategically held shares if we determine that contemplated effects cannot be expected. With respect to the shares held by our company strategically, the board of directors shall meet regularly to examine whether our strategic shareholding contributes to improving medium- and long-term corporate value of our company, taking the above perspectives, return and risk into account. For voting rights related to strategically held shares, we evaluate the exercise of such rights from the standpoint of improving medium- and long-term corporate value of our investees, and from the viewpoint of whether it meets social demand. |

【Supplementary Principle 3-1-3 Disclosure regarding sustainability】 | For our initiatives on sustainability, please visit our website. https://www.asteria.com/jp/en/company/csr/ |

【Supplementary Principle 4-11-1 Views on the balance of knowledge, experience, and capability of the board of directors, as well as its diversity, and size】 | Our company’s Articles of Incorporation stipulates that the board of directors shall consist of up to 8 members, and we adopt a policy to select those who are considered to be the best fit for the director’s position as candidates for directors, regardless of their nationality, sex, and age. At present, 5 members with rich knowledge and experience in Information Technology, Corporate Management, Corporate Investment and Finance serve on the board. We developed a skills matrix of directors and executive officers, which is attached to the convening notice for general shareholder meetings as a reference for a proposal to appoint board members. Out of the five directors, one is female, one is a foreign national, and three of them meet requirements to assume as independent outside directors stipulated by the Tokyo Stock Exchange, who can make vibrant debates at meetings of the board of directors. |

【Principle 5-1 Policy for constructive dialogue with shareholders】 | We recognize that it is important for us to hold positive dialogues with shareholders in order to achieve sustainable growth and to improve medium- and long-term corporate value. Therefore, we developed an IR system, and our president attends presentation meetings for individual investors, for constructive dialogue with shareholders, to provide clear explanations, in order to obtain their understanding of our management strategy and business conditions. PR and IR departments handle dialogues with shareholders, and if a shareholder submits a request individually, the representative director(s) and the executive officer(s) will hold a dialogue to a reasonable extent. Shareholders’ opinions identified through the dialogue are conveyed to the board of directors to assist their management decisions. As a measure to manage insider information when engaging in dialogues, we implement “Regulations for Prevention of Insider Trading” and manage insider information, to enforce information management to prevent insider information from being conveyed to certain shareholders. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |