Bridge Report:(3909)Showcase term ended Dec. 2020

President Toyoshi Nagata | Showcase Inc. (3909) |

|

Company Information

Exchange | 1st section of Tokyo Stock Exchange |

Industry | Information and Communications |

President | Toyoshi Nagata |

Address | 14th Floor, Roppongi First Building, 1-9-9, Roppongi, Minato-ku, Tokyo |

Year-end | End of December |

Homepage |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE (Actual) | Trading Unit | |

¥965 | 8,561,900 shares | ¥8,262 million | 1.7% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥6.50 | 0.7% | ¥4.20 | 229.8 x | ¥253.56 | 3.8 x |

*The share price is the closing price on April 9. All figures are taken from the brief financial report for the term ended December 2020. EPS is the lower limit of the estimated range.

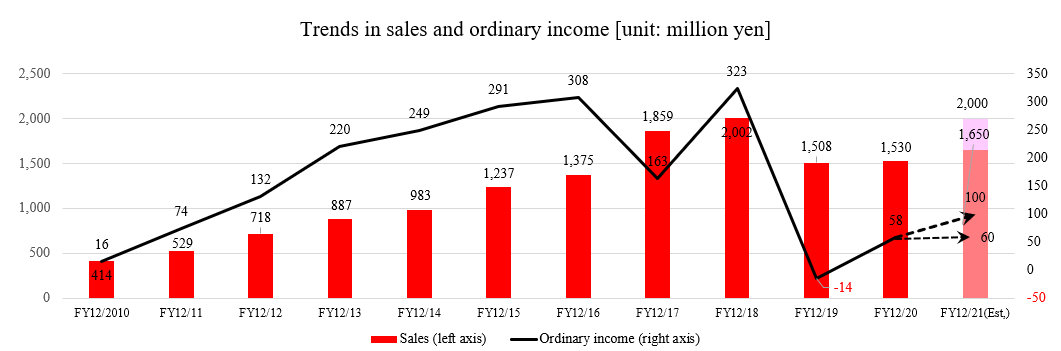

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2017 Act. | 1,859 | 191 | 163 | 12 | 1.79 | 5.50 |

December 2018 Act. | 2,002 | 352 | 323 | 16 | 2.48 | 0.00 |

December 2019 Act. | 1,508 | 92 | -14 | -183 | -27.02 | 5.50 |

December 2020 Act. | 1,530 | 45 | 58 | 25 | 3.75 | 6.00 |

December 2021 Est. | 1,650-2,000 | 60-100 | 60-100 | 36-60 | 4.20-7.01 | 6.50 |

* Unit: million yen. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This report outlines Showcase Inc., briefly describes the financial results for the term ended Dec. 2020, and includes the interview with President Nagata.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year December 2020 Earning Results

3. Fiscal Year December 2021 Earnings Forecasts

4. Mid-term Growth Strategy

5. Interview with President Nagata

<Reference: Regarding Corporate Governance>

Key Points

- Based on their core value, “Make People Happy with Our OMOTENASHI (Hospitality) Technology,” the company operates business, with a focus on development and provision of cloud-type SaaS systems from the viewpoint of users. The company has set up the term ended Dec. 2019 as the “Second Start-up” period, it upholds their new business concept, “DX cloud service that connects companies and customers,” and supports enterprises in promoting DX. Its strengths include the excellent customer base, plenty of SaaS development technologies and operation knowledge, and high customer satisfaction level.

- The sales for the term ended Dec. 2020 were 1,530 million yen, up 1.4% year on year. The sales of the Marketing/SaaS Business dropped, while the sales of the Advertisement/Media Business increased. The Cloud Integration Business, which is a new segment, also contributed to this increase. Operating income declined 51.0% year on year to 45 million yen. Despite the sales growth, gross profit declined, and SG&A augmented 4.4% year on year as the company conducted advertisement for recruiting personnel and increasing popularity. Under the stable dividend policy, the company set the dividend at 6.0 yen/share, up 0.5 yen/share from the previous term.

- For the term ending Dec. 2021, sales and profit are estimated to grow. Considering the large impact of new businesses on revenues, the estimates are indicated with ranges, but sales are estimated to grow, and operating income is projected to rise by double digits even in the most conservative forecast. Through the intensive investment in products and services for markets with a great growth potential, sales and profit are forecasted to increase considerably. Profit was estimated conservatively, because the company will enhance investment in human resources and advertisement. The dividend is to be 6.50 yen/share, up 0.5 yen/share year on year. The estimated payout ratio is 92.7 to 154.8%.

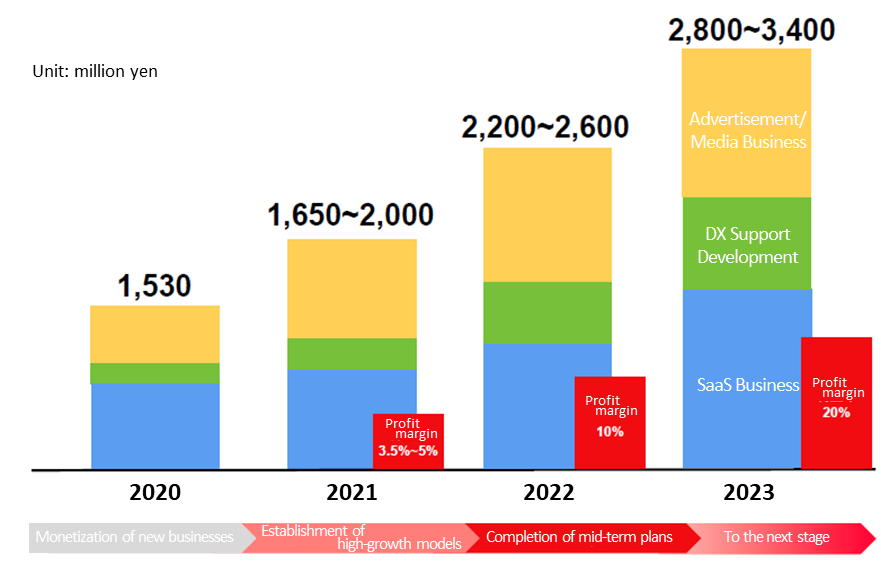

- While the performance of existing services was on a plateau, sales declined due to the COVID-19 in the term ended Dec. 2020, but from this term onward, the trend will shift thanks to the new growth engines, including eKYC, which was released in 2019. The annual recurring revenue (ARR) of new services is projected to grow 63% year on year. With the 3-year mid-term growth strategy, the company aims to achieve record-high sales and profit in 2022, and earn sales of 2.8 to 3.4 billion yen in 2023, which is the final fiscal year of the strategy, to advance to the next stage.

- We interviewed President Toyoshi Nagata about the purposes of “the Second Start-up”, the company’s competitive advantage, future issues, his message toward shareholders and investors, etc. He mentioned, “As our company has conducted the ‘Second Start-up’, we will significantly contribute to DX in Japan and improve corporate value through company-wide efforts. Accordingly, we would appreciate your support from the mid/long-term viewpoint.”

- According to “Digital Transformation: Overcoming of ‘2025 Digital Cliff’ Involving IT Systems and Full-fledged Development of Efforts for Digital Transformation” (Study Group for Digital Transformation) announced by the Ministry of Economy, Trade and Industry in 2018, a big hurdle to DX is the “problem with existing IT systems.” Especially, “the difficulty in allocating resources to IT investments for utilizing new digital technologies due to the use of a lot of funds and human resources for operating and maintaining existing systems” is a serious problem for business operators who need to conduct DX for surviving. The DX market itself is expected to grow rapidly, but the growth of respective service vendors depends on whether they can offer services or solutions for overcoming the 2025 Digital Cliff.

- Under these circumstances, high expectations have been placed on Showcase Inc., which plans to provide a system to enable IT staff of each company to easily establish an IT platform. The fact that its PER exceeds 200 implies that the market evaluates such point highly. Since PER is higher than the market average, the growth of profit is indispensable for raising its share price further. We would like to see whether the company will take measures as expected, to achieve sales of 2.8 to 3.4 billion yen and a profit margin of 20% in the term ending Dec. 2023 as set in the mid-term growth strategy and release products and services mentioned in the schedule as planned this term.

1. Company Overview

Based on the core value, “Make People Happy with Our OMOTENASHI (Hospitality) Technology,” Showcase Inc. operates business, with a focus on development and provision of cloud-type SaaS systems from the viewpoint of users. The company has set up the term ended Dec. 2019 as the Second Start-up period, it upholds the new business concept, “DX cloud service that connects companies and customers,” and supports enterprises in promoting DX. Its strengths include the excellent customer base, plenty of SaaS development technologies and operation knowledge, and high customer satisfaction level.

【1-1 Corporate History】

In 1996, Futureworks CORP was established for the purpose of supporting sales promotion and public relations activities. In 1998, it was reorganized into a joint stock company, and in 2005, it absorbed Smart Image Inc., which engaged in promotion utilizing the Internet, Web videos, etc. with Futureworks Co., Ltd. being the surviving company, for the purpose of expanding business and improving the efficiency of use of managerial resources, and the corporate name was renamed to Showcase-TV Inc. The company changed its business model from the commissioned production of sales promotion goods for marketing to the creation of original products and services.

Meanwhile, the Web Form Optimization service, Form Assist, which is the current core service developed with reference to the clients’ opinions, was highly evaluated. At first, it was adopted mainly by EC sites, real estate firms, etc., but the number of financial institutions that consider Showcase’s high-level system for maintenance and operation as attractive increased, and formed the current stable customer base. As a result, its business performance grew steadily, and it was listed in Mothers of Tokyo Stock Exchange in 2015, and then listed in the first section of TSE in 2016.

However, the policy for diversification of business through M&A, which was adopted in 2015, did not generate assumed synergetic effects, and sales dropped significantly, and impairment loss was posted in the first quarter of the term ended Dec. 2019. In this situation, that term was defined as the Second Start-up period, and Mr. Toyoshi Nagata, who had led business as vice-president since the inauguration of business, was appointed as representative director and president in March 2019. It was renamed to Showcase Inc., while conducting organizational reform to shift to a new business execution system in April 2019.

【1-2 Corporate Philosophy, etc.】

Its core value is “Make People Happy with Our OMOTENASHI (Hospitality) Technology.”

Since its business start-up, the company has been offering business services focused on users’ happiness by using easy-to-adopt, easy-to-use, hospitality-oriented technologies, with the aim of solving problems and creating value from the users’ viewpoint.

For the Second Start-up, the company started upholding “DX cloud service that connects companies and customers” as a new business concept in 2020, and clearly reports its business domains to investors.

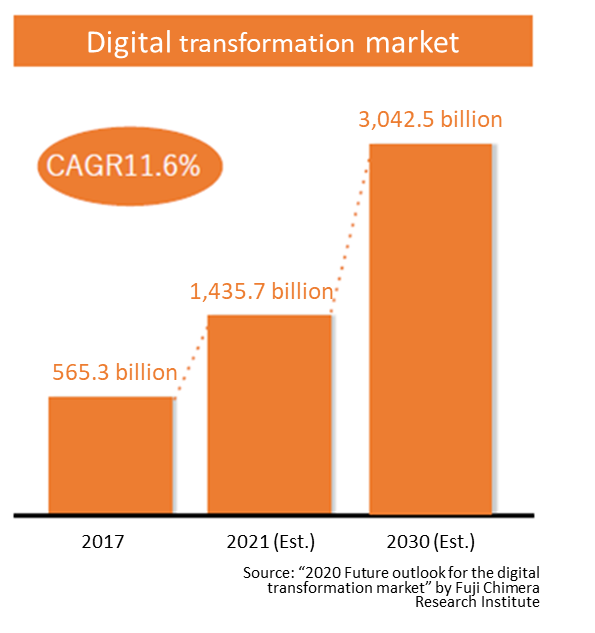

【1-3 Market Environment】

(1) The DX market, which is expected to grow rapidly, and the 2025 Digital Cliff

According to “Digital Transformation: Overcoming of ‘2025 Digital Cliff’ Involving IT Systems and Full-fledged Development of Efforts for Digital Transformation” (Study Group for Digital Transformation) announced by the Ministry of Economy, Trade and Industry in September 2018,

“There have emerged new entrants with unprecedented business models based on new digital technologies in all kinds of industries, and drastic change is upcoming. In this situation, each enterprise is required to conduct digital transformation (DX) quickly, to maintain and enhance competitiveness.” Meanwhile, the following problems have been pointed out:

☆ | Since existing IT systems are closely linked to business processes, it is necessary to renew the business processes to solve the problems with the existing systems. Accordingly, on-site workers are reluctant. |

☆ | Unless the problems with existing IT systems are solved, it is impossible to create new businesses and reform business models swiftly. Namely, it is difficult to carry out DX on a full-scale basis. |

☆ | A lot of funds and human resources are allocated to the operation and maintenance of existing systems, so it is impossible to allocate resources to IT investments for utilizing new digital technologies. |

☆ | If this problem is left unaddressed, the costs for operation and maintenance will skyrocket further, the so-called technical debt will augment, the staff who can operate and maintain existing systems will become scarce, and security risk will increase. |

Especially, if existing systems that are complicated, decrepit, and obscure remain, the economic loss due to the rise in risk caused by the resignation of IT personnel, the termination of support, etc. by 2025 is estimated to reach up to 12 trillion yen/year (about 3 times today’s loss) in 2025 or later. This is called the problems with the existing IT systems, the 2025 Digital Cliff.

If many enterprises work on DX to survive, the DX market will grow rapidly, but the growth of service vendors depends on whether they can offer services and solutions for overcoming the 2025 Digital Cliff.

(Taken from the reference material of the company)

(2) eKYC, which is expected to grow steeply

As the demand from housebound consumers grew amid the COVID-19 pandemic, we have entered the age of online cashless payment, and eKYC, which is a tool for online non-face-to-face identification, is rapidly distributed.

eKYC stands for electronic Know Your Customer, meaning online identification.

In order to prevent international money laundering and disrupt the provision of funds to criminal organizations, such as drug rings and terrorists, financial institutions, etc. are obligated to identify customers and check their purposes of transactions when their accounts are created, in accordance with the Act on Prevention of Transfer of Criminal Proceeds.

The damage due to illegal remittance amounted to about 2.5 billion yen in fiscal 2019, so financial institutions were requested to check transactions more strictly.

On the other hand, for non-face-to-face identification using conventional mails, the following problems have been pointed out:

* | Necessity to submit documents by mail for each financial institution is causing 1.7 million people per year to give up creating an account in the middle. |

* | The identification process at financial institutions is cumbersome, and its cost amounts to about 2 trillion yen per year. |

* | Japanese financial institutions bear the cost of about 4 billion yen per year for sending receiver-specified mails to identified customers. |

* | Even after creating accounts, customers need to log in to respective financial institution’s websites with different IDs when making transactions. |

The current identification process is not convenient for users, extremely costly for financial institutions, and many opportunities are lost. Accordingly, the identification process needs to be swifter and more efficient, thus, eKYC is rapidly distributed.

Through the amendment to the Act on Prevention of Transfer of Criminal Proceeds in November 2018, The Method for Checking Items for Identifying an Individual Online, in which each user sends identification documents and their images via the Internet, was added. Until 2023, both the conventional identification method using paper and the online one can be used, but from 2023, online identification will become mandatory.

It will become unnecessary to send identification documents by mail, so the identification process will become convenient for users and less costly for financial institutions. Accordingly, eKYC will become more common.

Since identification is not just for financial field, but also for other various fields, online identification is expected to become common in the fields of insurance, credit cards, communications carriers, trade of antiques (recycling), etc.

The unauthorized access incident at a leading communications carrier that occurred in 2020 could have been prevented with online identification, so it is likely that online identification will be popularized rapidly before 2023.

【1-4 Business Contents】

(1) Business form

Utilizing the SaaS development technology with high usability, the company offers high-value services to eliminate the insufficiencies in society.

In addition, under the new business concept, “DX cloud service that connects companies and customers,” the company develops SaaS and platforms around interfaces connecting enterprises and customers and supports DX for co-creation, to offer services for overcoming the 2025 Digital Cliff.

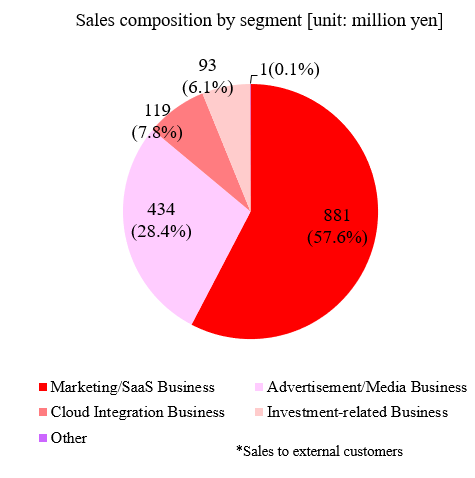

(2) Business segment

There are four segments to be reported: Marketing/SaaS Business, Advertisement/Media Business, Cloud Integration Business, and Investment-related Business.

Cloud Integration Business is a new segment established in the term ended Dec. 2020, under the new business concept.

① Marketing/SaaS Business

It offers mainly Form Assist, which is a cloud service for increasing conversion rate based on the website optimization technology, and ProTech Series, which is a cloud service related to security.

⊚ Form Assist

Administrators of websites for offering services, including EC sites, hope that visitors to their websites (potential customers) will not only browse their contents, but also input their personal information, send an inquiry, and purchase their products or services. They need to avoid a case in which a user accesses an Web form, but leaves the webpage because of the difficulty or cumbersomeness of inputting.

A measure for reducing such opportunity loss cases and increasing the ratio of customers who fill in forms for maximizing the results is called Web Form Optimization.

Form Assist is the first Web Form Optimization tool released by the company in Japan.

It has been adopted for over 5,000 forms, meeting various needs. The company offers original knowledge based on the accumulation of experience for over 10 years.

Among financial institutions, which are their major clients, leading megabanks, local banks, non-life insurance companies, etc. have installed it. It boasts the largest share in the financial Web Form Optimization market.

(Taken from the reference material of the company)

When installing over 30 kinds of assisting functions, which make inputting easier, and the function to change the appearance of the Web form, you do not need to significantly upgrade a website but just set tags.

Such user-friendliness is highly evaluated, and additionally, among financial institutions, for Showcase not needing to access personal information is lowering the hurdle to installation.

Specialized staff who possess plenty of knowledge and skills regarding web-based marketing conduct analysis for increasing conversion rate, clarify problems with websites, and offer solutions for attaining the goals of respective clients based on the accumulated cases of success and failure, which are original to the company.

Enterprises that adopted Form Assist have seen an increase in conversion rate. Especially, conversion rate rose by over 10% among the enterprises that are inexperienced in improving UI.

Most leading financial institutions own system development companies in their respective corporate groups, and Showcase sometimes competes with them when adopting Web Form Optimization, but companies that develop such systems lack the knowledge of web-based marketing. In this light, Showcase has a great competitive advantage.

(Taken from the reference material of the company)

⊚ Online identification/eKYC tool, ProTech ID Checker

ProTech Series is a cloud service for maximizing the benefits of orders from customers by specializing in the prevention of unauthorized log-in to websites, impersonation, the loss of opportunities due to typing errors and such, and the fortification of security.

The company recognizes the online identification/eKYC tool ProTech ID Checker released in 2019 as well as License Reader, which take in personal information from the image of a driver’s license taken with a smartphone with the OCR technology to an web form, as the growth drivers, and is concentrating on the expansion of its sales.

As mentioned in the Market Environment section, eKYC is expected to be adopted not only by financial institutions, but also in a wide range of business fields.

With their ProTech ID Checker, you can complete online identification just by submitting an identification document and taking a picture of yourself.

Like Web Form Optimization, all you need to do is to embed tags. This service attracted people's attention as it meets the needs for non-face-to-face transactions that grew steeply due to the spread of COVID-19. It also solves the social issue of unauthorized use of accounts, and is highly evaluated in the industry, as it won Semi Grand Prix at Nikkei × TECH EXPO AWARD 2019.

The company conducted the full-scale introduction of ProTech ID Checker in 2020, but the number of installations in 2021 has already exceeded the total number in 2020, so it is expected to contribute to sales and profit in the term ending Dec. 2021.

Currently, the company offers ProTech ID Checker, which complies with the amended Act on Prevention of Transfer of Criminal Proceeds, and ProTech ID Checker Type S, which is an ID selfie type. In March 2021, the company released ProTech AI Masking, which offers a service of automatically masking an insurance certificate at identification, and plans to enrich its service lineup.

(Taken from the reference material of the company)

② Advertisement/Media Business

The company operates its own media and offers advertisement-related services.

⊚ Operation of its own media

This business is growing, with its major content being the smartphone-related media, bitWave. In addition, the company launched Finance Lab., a financial information media for providing simple-to-understand-information on money. It distributes beneficial tips on credit cards, stock investment, asset operation, insurance, loans, etc. As of March 2021, the number of subscribers to the video media was over 15,000, and exceeded 20,000 in April.

By utilizing the customer base composed of financial institutions, which was developed through the Marketing/SaaS Business, the company is striving to increase the revenues from affiliate advertising, such as leading customers to credit-card companies. The company will actively invest in the media business, which is promising and profitable.

(Taken from the reference material of the company)

⊚ Advertisement-related service

In addition to adjustable ad-related services, such as NaviCast Ad, which has been offered since before, the company offers a video platform, SHOWCASE Ad, which is compatible with SNS ads and smartphone apps, and so on.

③ Cloud Integration Business

The company operates the DX support and development business by combining the accumulated knowledge to develop SaaS products and the business knowledge of leading companies.

It conducts the SaaS business actively in various fields, and supports enterprises in adopting cloud computing for information systems in the DX market, which is in the midst of a structural reform.

As mentioned in the Market Environment section, the DX market is expected to grow rapidly, as many enterprises will work on DX to survive, but the 2025 Digital Cliff still need to be dealt with.

By utilizing the technology and knowledge it has nurtured, the company plans to release a platform for reducing the labor of system staff in enterprises for DX considerably, and help enterprises and municipalities actualize DX.

(Taken from the reference material of the company)

(Concrete measure (1): To support DX in the fields of publicity and PR)

PR Automation, a system for automating publicity operations, which is managed by PRAP node, Inc., a joint venture with PRAP Japan, Inc. (JASDAQ market of TSE; 2449), which is a leading company in the PR field, was released in September 2020, and adopted by over 60 leading companies in one month after the release.

By developing additional functions, the company further supports DX in the fields of publicity and PR.

(Concrete measure (2): To support DX in the financial field)

By adopting cloud computing for the procedure of checking the contents of loan contracts for each purpose in the Bank of Yokohama, the company developed a cloud system for checking online processes.

④ Investment-related Business

The consolidated subsidiary Showcase Capital Inc. operates SmartPitch, a platform service for matching business companies, venture capitals, and corporate venture capitals with start-up firms. The number of registered start-up firms exceeded 170 as of March 2021.

It also joined J Startup, a METI-led program for supporting the growth of start-up firms, as a supporter enterprise, and is collaborating with municipalities that support the regional revitalization with start-ups.

In addition, it conducts venture capital investment mainly for start-up firms in the fields of Fintech, the Internet, and mobile devices.

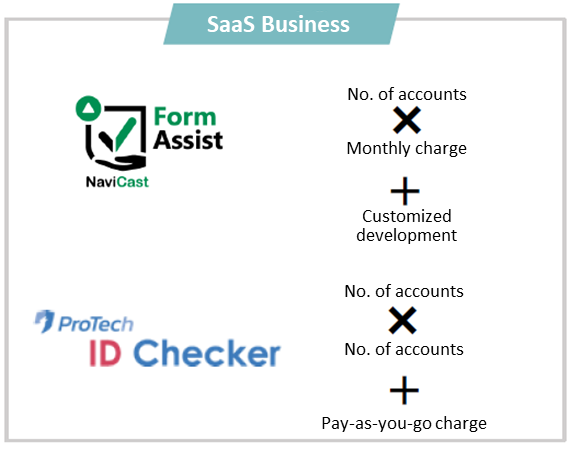

(3) Revenue model

The SaaS Business is based on a business model of earning revenues from the pay-as-you-go service in addition to monthly charges.

(Taken from the reference material of the company)

KPIs are sales per contract and the number of contracts. The following measures are taken for each KPI.

KPI | Measures |

To expand sales per contract | * To offer optional functions * To provide new services and services linked with other companies * To support DX * To expand the pay-as-you-go model |

To increase the number of contracts | * To enhance digital marketing * To increase sales via partners * To promote regional business operations * To sell products in other fields |

【1-5 Characteristics and Strengths】

(1) Excellent customer base

The excellent customer base composed of a total of over 8,000 customers, mainly financial institutions, which was developed through the Marketing/SaaS Business, has high value as an intangible asset from the viewpoint of reliability. In addition, it led to the monetization of financial media in the Advertisement/Media Business.

(2) High customer satisfaction level thanks to plenty of SaaS development technologies, operation knowledge, and customer-oriented policy

The company has accumulated plenty of SaaS development technologies and operation knowledge. As the company develops products that meet customer needs speedily and offers high-quality products at low cost under the customer-oriented policy, the company is highly evaluated by customers and has a great competitive advantage.

Based on this advantage, it supports the DX in enterprises and governments through the newly launched Cloud Integration Business.

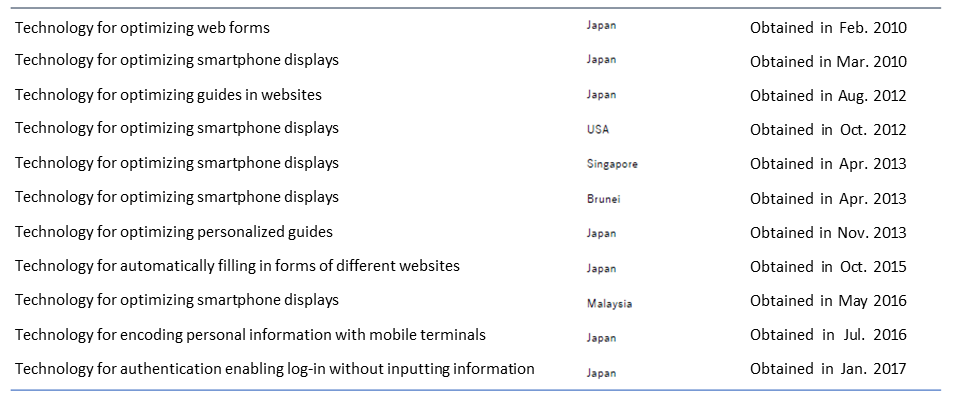

(3) Holding a lot of technological patents

Showcase holds a lot of patents in Japan, the U.S., Singapore, etc.

At present, patents for identification system programs, etc. of ProTech ID Checker are pending.

It will actively develop technologies with the aim of acquiring technological patents.

(Taken from the reference material of the company)

【1-6 Business Strategy】

With the above product lineup and competitive advantage, Showcase aims to increase sales and profit with the following three growth engines.

⊚ Growth engine I: Identification (eKYC) service

While the social situation is changing rapidly as mentioned above, the company aims to promote this service while advertising its simplicity of adoption.

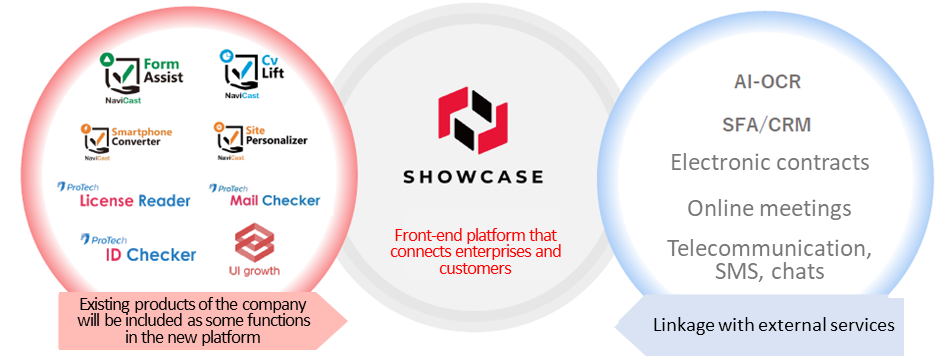

⊚ Growth engine II: New platform scheme

The company will operate a new front-end platform for offering inlet of all kinds of data.

By linking its core technologies and patented technologies, SaaS development knowledge, and identification technologies with leading enterprises and services, the company will connect users and clients, and increase corporate users.

(Taken from the reference material of the company)

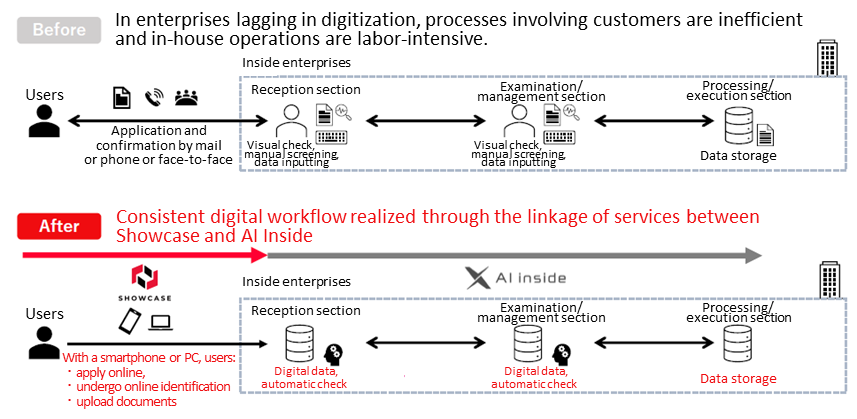

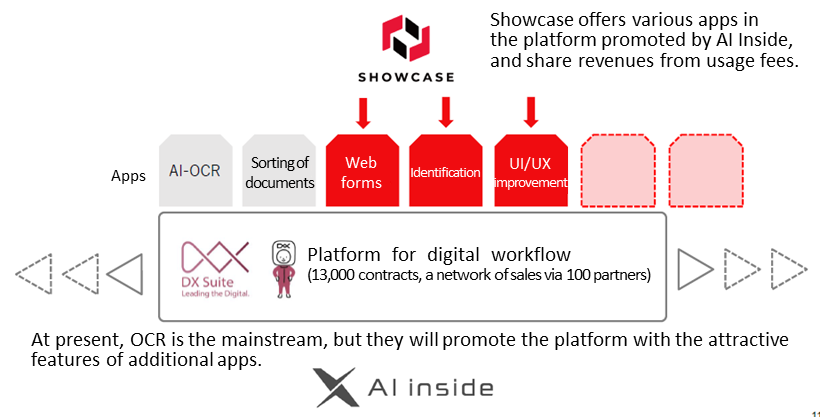

⊚ Growth engine III: Capital and business tie-ups with AI inside Inc.

(For details, please refer to (4) Topics in Section 2. Fiscal Year December 2020 Earning Results)

By utilizing the strengths of the two companies, it aims to offer new value to society and improve the corporate value of both companies, through mutual use of technological knowledge, mutual sales of services, and collaborative product development.

(Taken from the reference material of the company)

In detail, Showcase offers various apps in the platform promoted by AI inside, and shares revenues from usage fees.

(Taken from the reference material of the company)

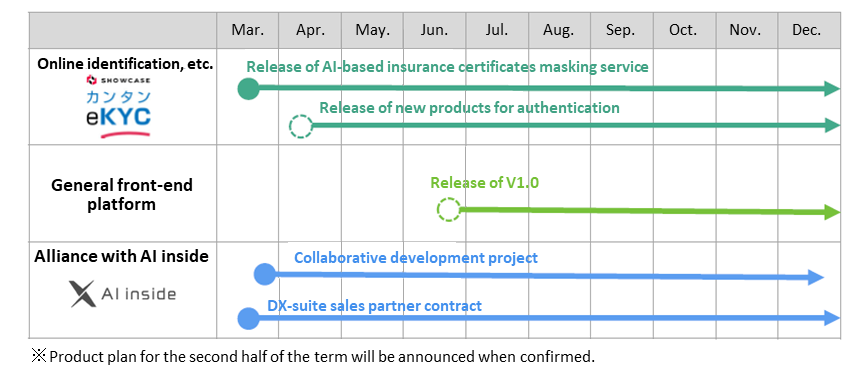

The release schedule of each growth engine is as follows:

(Taken from the reference material of the company)

【1-7 Return on Equity (ROE) Analysis】

| FY 12/16 | FY 12/17 | FY 12/18 | FY 12/19 | FY 12/20 |

ROE (%) | 14.8% | 1.0% | 1.4% | -17.2% | 1.7% |

Net income margin [%] | 12.86 | 0.65 | 0.84 | -12.14 | 1.69 |

Total asset turnover [times] | 1.02 | 0.92 | 0.78 | 0.63 | 0.59 |

Leverage [times] | 1.13 | 1.62 | 2.14 | 2.24 | 1.66 |

Although the company does not own a lot of assets, ROE has been low, because profitability and efficiency of assets are low.

In the mid-term management strategy, the company aims to achieve an operating income margin of 20% in 2023. The improvement in ROE depends on whether the company will be able to increase profitability by promoting eKYC tools and expanding the DX support business.

2. Fiscal Year December 2020 Earning Results

(1) Overview of consolidated business results

| FY 12/19 | Ratio to sales | FY 12/20 | Ratio to sales | YoY | Ratio to forecast |

Sales | 1,508 | 100.0% | 1,530 | 100.0% | +1.4% | +2.0% |

Gross profit | 1,112 | 73.7% | 1,109 | 72.5% | -0.2% | - |

SG&A | 1,019 | 67.6% | 1,064 | 69.6% | +4.4% | - |

Operating Income | 92 | 6.2% | 45 | 3.0% | -51.0% | +127.7% |

Ordinary Income | -14 | - | 58 | 3.8% | - | +17.7% |

Net Income | -183 | - | 25 | 1.7% | - | -25.9% |

*Unit: million yen. Net income means profit attributable to owners of parent. Ratio to forecast means the ratio to the forecast announced in August 2020.

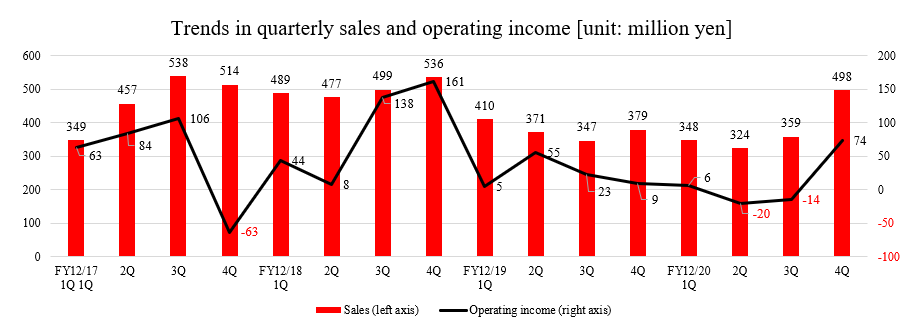

Sales grew, while operating income declined.

Sales increased 1.4% year on year to 1,530 million yen. The sales of the Marketing/SaaS Business decreased, but the sales of the Advertisement/Media Business rose. The Cloud Integration Business, which is a new segment, contributed too.

Operating income dropped 51.0% year on year to 45 million yen. Despite the sales grow, gross profit decreased, and SG&A increased 4.4% year on year, as the company conducted advertisement for improving personnel and popularity.

Ordinary income was 58 million yen (14 million yen in the previous term). The profit from an investment partnership, which is posted in non-operating revenues, increased 28 million yen year on year. In the previous term, an equity in losses of affiliates of 63 million yen and a provision of allowance for doubtful accounts of 40 million yen were posted in non-operating expenses, but such expenses were not posted this term.

Based on the stable dividend policy, the dividend is to be 6.0 yen/share, up 0.5 yen/share from the previous term.

Quarterly sales and profit recovered in the fourth quarter (Oct. to Dec.). Sales increased to the level in the term ended Dec. 2018.

(2) Trend in each segment

| FY 12/19 | Composition ratio | FY 12/20 | Composition ratio | Y/Y |

Marketing/SaaS Business | 1,041 | 69.0% | 881 | 57.6% | -15.4% |

Advertisement/Media Business | 377 | 25.0% | 434 | 28.4% | +15.4% |

HR Business | 31 | 2.1% | - | - | - |

Cloud Integration Business | - | - | 119 | 7.8% | - |

Investment-related Business | - | - | 93 | 6.1% | - |

Other | 58 | 3.9% | 1 | 0.1% | -98.0% |

Total sales | 1,508 | 100.0% | 1,530 | 100.0% | +1.4% |

Marketing/SaaS Business | 709 | 68.1% | 592 | 67.3% | -16.5% |

Advertisement/Media Business | 118 | 31.3% | 65 | 15.0% | -44.8% |

HR Business | -4 | - | - | - | - |

Cloud Integration Business | - | - | -1 | - | - |

Investment-related Business | -69 | - | 19 | - | - |

Other | 31 | 54.0% | 7 | 646.3% | -75.9% |

Adjustment | -692 | - | -637 | - | - |

Total profit | 92 | 6.2% | 45 | 3.0% | -51.0% |

*Unit: million yen. Sales mean those to external clients. The composition ratio of profit means the ratio of profit to sales. Cloud Integration Business was added as a new segment in the term ended Dec. 2020. On the other hand, the HR Business segment was deleted, as Lazer Beam Co., Ltd., which operated the HR Business, was dissolved on Dec. 31, 2019.

⊚ Marketing/SaaS Business

Sales and profit dropped.

The company keeps selling Form Assist mainly to financial institutions, but due to the spread of COVID-19, business talks for customization decreased considerably, and the volume of sales to new clients was sluggish.

As for ProTech Series, the online identification/eKYC tool, ProTech ID Checker, which was released in 2019, was adopted by clients, such as banks, credit-card companies, antique dealers, and law offices, and the number of accounts increased.

In addition, the lineup of services, including the automatic insurance certificate masking function, expanded, and the company will offer services in a variety of fields.

⊚ Advertisement/Media Business

Sales grew, but profit decreased.

As for advertisement-related services, the performance of (i) programmatic advertising services, including NaviCast Ad, (ii) the SNS ads for meeting customer needs, (iii) SHOWCASE Ad, a video ad platform compatible with smartphone apps, etc. remained healthy.

As for bitWave, the media for smartphone-related news, the revenues from affiliate advertising increased. The online sales of the new model of iPhone 12 contributed to the results. Finance Lab., the media regarding finance, and ARVO, the media regarding beauty, performed well.

Sales grew, but profit dropped due to upfront investment.

⊚ Cloud Integration Business

PRAP node, Inc. (establish in February 2020), a joint venture with PRAP Japan, Inc., which operates support business on publicity and public relations, released PR Automation, a product for promoting the digitalization of corporate PR activities, in September 2020.

In addition, it started offering a cloud system for checking the contents of loan contracts for respective purposes to the Bank of Yokohama in December 2020, with the aim of supporting financial institutions in DX.

⊚ Investment-related Business

The company released the matching platform service SmartPitch, and sold the shares of Image Magic Inc.

(3) Financial position and cash flows

⊚ Main Balance Sheet

| End of December 2019 | End of December 2020 | Increase/ decrease |

| End of December 2019 | End of December 2020 | Increase/ decrease |

Current Assets | 1,750 | 2,477 | +726 | Current Liabilities | 771 | 480 | -290 |

Cash and Deposits | 1,428 | 2,198 | +769 | Trade Payables | 28 | 25 | -2 |

Trade Receivables | 188 | 207 | +19 | ST Interest-bearing Liabilities | 569 | 328 | -240 |

Noncurrent Assets | 478 | 472 | -5 | Noncurrent Liabilities | 507 | 298 | -208 |

Tangible Assets | 92 | 85 | -6 | LT Interest-bearing Liabilities | 507 | 298 | -208 |

Intangible Assets | 97 | 125 | +27 | Total Liabilities | 1,279 | 779 | -499 |

Investment, Others | 287 | 260 | -26 | Net Assets | 949 | 2,170 | +1,220 |

Total assets | 2,228 | 2,949 | +721 | Total Liabilities and Net Assets | 2,228 | 2,949 | +721 |

|

|

|

| Balance of Interest-bearing Liabilities | 1,077 | 627 | -449 |

*Unit: million yen. Interest-bearing liabilities include lease obligations.

Through the third-party allocation of shares for AI inside Inc., cash and deposits, capital, and retailed earnings increased. Liabilities declined due to the repayment of short and long-term debts.

Capital-to-asset ratio rose 31 points from the end of the previous term to 73.6%.

⊚ Cash Flow

| FY 12/19 | FY 12/20 | Increase/decrease |

Operating Cash Flow | 239 | 96 | -142 |

Investing Cash Flow | -0 | -61 | -61 |

Free Cash Flow | 239 | 34 | -204 |

Financing Cash Flow | -218 | 735 | +953 |

Term End Cash and Equivalents | 1,428 | 2,198 | +769 |

*Unit: million yen

Due to the income from the issuance of shares, financing CF turned positive, and the cash position improved.

(4) Topics

① Capital and business tie-ups with AI inside Inc.

In November 2020, the company announced the capital and business tie-ups with AI inside Inc. (Mothers of TSE; 4488).

(Outline of AI inside Inc.)

Established in August 2015. Under the mission, “To bring AI to every being in the world and contribute to a richer future society,” AI inside Inc. aims to actualize a society in which everyone can use and receive benefits from AI behind the scene.. Its core service is DX Suite, an AI-OCR service based on the high-precision character recognition AI, which was developed in house, and the number of contracts exceeded 12,700 as of the end of September 2020. It proceeds with DX, automation, etc. in all kinds of business operations. It implements partner strategies for sales, OEM, and product linkage, has many customers, broad sales networks, customer base, and advanced AI technology which Showcase does not have.

(Background and purpose of the alliance)

Showcase utilizes AI inside’s excellent AI-OCR technology, automatic document categorization technology, etc. for developing new products and conducting the business of DX promotion.

On the other hand, Showcase offers the knowledge to improve websites for products and services of AI inside Inc. to strengthen the products and increase the added value of services of both companies. Furthermore, it is possible to improve the business results of both companies considerably, by making various services add-ons in their sales networks and customer bases.

To develop a long-term partnership as well as a smooth and steady business alliance with AI inside Inc., the company decided to form a capital tie-up in addition to the business tie-up and designated AI inside Inc. as the receiver of new shares allocated.

(Details of the alliance)

⊚ Business tie-up

① Mutual use/sale of both companies’ technologies, knowledge, and products

② Discussion on collaborative development of products and services utilizing both companies’ strengths

③ Exchange of personnel and technologies for proceeding with the above

(Details will be discussed and determined by both companies.)

⊚ Capital tie-up

In December 2020, 1,771,100 new shares were allocated to AI inside Inc. to procure about 1.2 billion yen.

The shareholding ratio of AI inside Inc. became 20.71%.

* Purposes of use of funds

Funds amounting to about 1.2 billion yen, which were procured through the third-party allocation, will be used for the following purposes.

Concrete purposes of use | Amount [million yen] | Scheduled period of spending |

Costs for R&D, SG&A, infrastructure operation, marketing, etc. for executing collaborative projects | 500 | Jan. 2021 to Dec. 2023 |

Costs for developing new products in the Marketing/SaaS Business while utilizing the technology of AI inside Inc., enhancing the functions after launching the products, and marketing | 400 | Jan. 2021 to Dec. 2022 |

Expenses for recruiting engineers and acquiring a company for staffing engineers | 300 | Jan. 2021 to Dec. 2021 |

Investment in a joint venture with other partner company for promoting DX in the Cloud Integration Business | 200 | Jan. 2021 to Dec. 2022 |

⊚ Acceptance of a director

To cement the relationship with AI inside Inc., the company appointed a person nominated by AI inside Inc. as a director of Showcase.

(This was resolved at the annual meeting of shareholders of Showcase on March 24, 2021.)

② Received the grand prix at TOKYO Telework Award hosted by the Tokyo Metropolitan Government

In March 2021, the company received the grand prix at the first TOKYO Telework Award hosted by the Tokyo Metropolitan Government.

(Outline of TOKYO Telework Award)

The Tokyo Metropolitan Government promotes the diffusion of Tokyo Rules for Telework, in order to spread and popularize telework through the collaboration between the public and private sectors. In the TOKYO Telework Award, the Tokyo Metropolitan Government solicits, examines, and commends enterprises and groups among those who have declared the compliance with the Tokyo Rules for Telework that made advanced or exemplary efforts for telework.

(Showcase’s initiatives)

In February 2020, the company started the shift to remote work and a system for working from home for the purpose of coping with COVID-19, and increased the ratio of remote work to about 95% in a short period of time.

* Under the commitment of the representative director and president, the corporate headquarters (management department) took a leading role to make the operations of business sections online swiftly.

* They support each section in realizing a working environment equivalent to that of the headquarters, by installing business operation tools (such as omitting the seal-affixing process, issuing bills online), adopting a full flextime system without core working hours, holding an online company-wide meeting for energizing in-house communication twice a month, and so on.

* They started the DX of marketing strategies, tactics, and processes, and changed general meetings of shareholders into online hybrid ones.

The company considers that a factor in success was a swift, appropriate response to such changes in social situations.

3. Fiscal Year December 2021 Earnings Forecasts

(1) Earnings forecasts

| FY 12/20 | Ratio to sales | FY 12/21 Est. | Ratio to sales | YoY |

Sales | 1,530 | 100.0% | 1,650 to 2,000 | 100.0% | +7.8% to +30.7% |

Operating Income | 45 | 3.0% | 60 to 100 | 3.6% to 5.0% | +31.7% to +119.6% |

Ordinary Income | 58 | 3.8% | 60 to 100 | 3.6% to 5.0% | +1.9% to +69.9% |

Net Income | 25 | 1.7% | 36 to 60 | 2.2% to 3.0% | +38.8% to +131.4% |

*Unit: million yen. The forecast was those released by the company.

Sales and profit are estimated to grow.

Considering the large impact of new businesses on revenues, the estimates are indicated with ranges, but sales are estimated to grow, and operating income is projected to rise by double digits even in the most conservative forecast. Through the intensive investment in products and services for markets with a great growth potential, sales and profit are forecasted to increase considerably.

Profit was estimated conservatively, because the company will enhance investment in human resources and advertisement.

The dividend is to be 6.50 yen/share, up 0.5 yen/share year on year. The estimated payout ratio is 92.7 to 154.8%.

With the following three growth strategies, the company will accelerate growth.

① Acceleration through the investment in the core business and its growth

The company will increase the investment in online identification and the development of a front platform for solving rapidly augmenting social issues.

The company will develop SaaS systems with leading companies in each field in the growing DX market.

② Acceleration through the active alliance with leading partner companies

The company will form business tie-ups and collaborate with leading enterprises related to DX, such as AI inside Inc.

In addition, it will try to expand the business scale by selling via partners, etc.

③ Acceleration through the M&A strategy for expanding business

The company plans to implement M&A for expanding the scale of the core business.

4. Mid-term Growth Strategy

As the company defined the term ended Dec. 2019 as the Second Start-up period, the term ended Dec. 2020 was the second year of the Second Start-up. From this term, the company set the following mid-term growth strategies for three years until the term ending Dec. 2023.

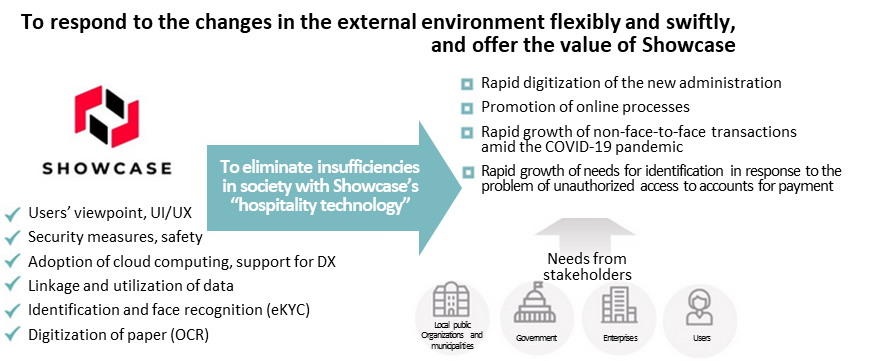

(1) Response to the changes in the external environment

The external environment has changed rapidly through the digitization led by the government, the significant increase of non-face-to-face transactions and online deals in various scenes amid the pandemic, the rapid growth of needs for identification in response to the problem of unauthorized access to accounts for payment, etc. Therefore, new needs emerged from stakeholders, including enterprises, users, governments, and municipalities.

Showcase considers that growth can be achieved by responding flexibly and swiftly to such changes in the external environment and emerging needs and solving social issues by offering its value.

(Taken from the reference material of the company)

(2) Priority strategies

The company puts importance on the following three strategies:

* Improvement in mid-term corporate value and return to shareholders

* Intensive investment in profitable, promising domains

* Active dissemination of information for popularizing the corporate brand

For the core business, the company will reform its business model and aim to expand the business in markets with a high growth rate.

For new businesses, the company will grasp changes in the business environment and establish a revenue structure that can take advantage of its forte.

(3) Envisioned mid-term growth

While the performances of existing services are on plateau, sales declined in the term ended Dec. 2020, due to the COVID-19, but from this term and beyond, the trend will change, thanks to the next growth engines, including eKYC, which was released in 2019. The ARR* of the new service is expected to rise 63% year on year.

The company aims to earn record-high sales and profit in 2022, and achieve sales of 2.8 to 3.4 billion yen in 2023, which is the final fiscal year of the plan, to proceed to the next stage.

The measures and goals for each business are as follows:

Business | Measures and goals |

SaaS Business | To expand the business of new front-end platforms, including eKYC Target operating income margin (2023): 65% |

DX Support Development | To expand development scale and apply the SaaS development knowledge multilaterally. Target operating income margin (2023): 10% |

Advertisement/Media Business | To enhance the investment in financial media, and expand business. Target operating income margin (2023): 30% |

(Taken from the reference material of the company)

*ARR (Annual Recurring Revenue)

It means stable sales earned every year and does not include initial costs, additional purchase expenses, consulting fees, or the like. It is often used in recurring, subscription, and SaaS businesses based on annual contracts. By grasping the variation in ARR, it is possible to check the outlook for the increase, retention, and loss of customers for each business.

5. Interview with President Nagata

We interviewed President Toyoshi Nagata about his thoughts on the Second Start-up, the company’s competitive advantage, future challenges, and his message to shareholders and investors, among other topics.

Q: “You have assumed the position of president in March 2019 and positioned the fiscal year ended December 2019 as the Second Start-up period. Please tell us about the situation at that time and what you had in mind for the ‘Second Start-up’.”

A: “The basic concept of our Second Start-up is to go back to our roots and pursue a business unique to Showcase.”

While the SaaS business in the marketing domain centered on Form Assist, which was the original growth engine, matured, the diversification through M&A in an effort to seek growth did not proceed as expected, and an impairment loss was recorded in the fiscal year ended December 2019.

After much reflection, I considered that it is necessary to change representatives to renew the direction and control of the company and present it in an easily understandable form both inside and outside the company, and reformed our management system.

The new direction of the company is to create the next growth engine in its original business domain and scale it up, rather than adding up sales through diversification that is difficult to create synergy. Indeed, the basic idea behind the Second Start-up is to return to the basics and pursue a business unique to Showcase.

Q: “What specific steps did you take?”

A: “We have renewed our personnel system. It took a lot of drastic measures, but now that we have embarked on a new journey with employees who share our new policy, the company is full of motivation, which is very encouraging for me.”

First of all, we have renewed our personnel system. I felt that some employees were being treated well only because of their long history with the company and that there were, unfortunately, fewer employees who were full of enthusiasm like in the growth phase before the IPO. At the beginning of 2019, I announced that I wanted only those who were enthusiastic about contributing to the company’s performance to stay and that the growth of the company would be the growth of the people. We need to create a win-win relationship, where if the company’s performance increases, it will be reflected in the compensation.

As a result, unfortunately, many employees have left the company. In addition, we took some very drastic measures such as replacing all the managers in charge of each business division. As a result, while turnover rate rose significantly in 2019, it dropped to below 10% last year in 2020. As a result, we have embarked on a new journey with employees who share the enthusiasm for the new policy, and the company is full of motivation, which is very encouraging for me.

Q: “Then, what do you think are the strengths and competitive advantages of your company?”

A: “I believe that we are a company that has always practiced turning customer issues into solutions faster than anyone else, and I would like to continue to make that one of our strengths. To this end, we are hiring engineers who can naturally think about what combination of services is the best way to stably and cheaply provide services to meet our customers’ needs.”

I believe that we are a company that has always practiced turning customer issues into solutions faster than anyone else, and I would like to continue to make that one of our strengths.

More than 90 percent of our sales are made directly with our customers, and with our client companies that are above a certain size, we have established relationships where our customer service people always provide report to them every month.

Taking advantage of these relationships, we regularly bring new issues and customer problems back to the company, and the development department creates prototype concepts to solve the problems, proposes them to the customers, and decides whether to commercialize them after seeing the response.

This market-oriented approach is firmly rooted in our company.

In addition, since almost 100% of our products are developed in house, we can develop prototypes very quickly, which we believe is a major competitive advantage.

We cannot say that our development team is much more technologically advanced than those of other companies, but we are very different from them in terms of our philosophy and approach to development.

When it comes to hiring, the most important factor we look for is the person’s mindset to solve the customers’ problems.

In general, many engineers want to polish their skills or experience new technological systems, but at our company, the old and new technologies are irrelevant to our customers, and we hire engineers who can naturally think about what combination of technologies is best for providing services that meet our customers’ needs in a stable and inexpensive manner.

This is why we can propose solutions like the ones I just mentioned on a daily basis and in a speedy manner, and this is one of our major strengths.

I mentioned earlier that the market-oriented approach is deeply rooted in our company, but at the same time, we always keep an eye on the current needs of the world and technological trends to see what we can do.

ProTech ID Checker, an online identification/eKYC tool that we have positioned as a future growth driver, is a product that was created based on such a product-out concept.

Q: “What do you think needs to be done to further refine such a competitive advantage?”

A: “Securing engineering resources is the most important thing. We have created a system that allows us to monitor more than 100 engineers at all times, so that we can always secure engineers even when the order situation changes. We are also working to strengthen our basic development capabilities for advanced technologies, which have been somewhat weak.”

Securing engineering resources is the most important thing. To achieve this, we are not only hiring people on a regular basis, but we are also working to create new systems.

We use outside engineer dispatch services to keep up with the increase and decrease in workload, but in addition to this, we hired a manager with experience in such business and started our own engineer dispatch business.

However, we did not take this initiative to develop engineer dispatching as a new business, but there are two other specific reasons for this.

For one thing, we always want to have a network of people to whom we can immediately assign new projects when they are launched.

For example, if an additional project is launched, we would normally go and get engineers from that point, but that would inevitably increase the lead time.

Therefore, we have created a system that allows us to monitor more than 100 engineers at any given time, and when we are not assigned to a project, we assign them to projects at other companies, so that we can respond to increases or decreases in projects at any time.

The other reason is to strengthen our basic development capabilities for advanced technologies. Since our basic stance has been to provide engineering solutions to our customers’ problems, we are unfortunately lagging in such basic development. However, we were aware of the issue that development without the use of AI will not be possible in the future, so we are planning to increase the number of access points to engineers with such advanced technology by monitoring a large number of engineers.

The capital and business alliance with AI inside at the end of 2020 is for the same reason. Even if we don’t do the research and development for AI ourselves, we believe that we can solve our problems by enabling the use of the engine developed by AI inside.

Q: “How do you plan to expand the sales volume of ProTech ID Checker, which is positioned as a growth driver in your mid-term growth strategy?”

A: “While maintaining our strength of dealing directly with customers for 90% of our business, we are thinking of strengthening our partnerships to increase our accounts. In addition to AI inside, we will work with other vendors that provide cloud services with deep penetration, such as telecommunications carriers and business groupware.”

As I mentioned earlier, 90% of our business is done directly with our customers, and while this is a major strength, it also makes it difficult to increase the number of other accounts.

Therefore, as we have been doing for product development, we will continue to utilize our customer base to get hints for development and provide new added values to increase the unit price per customer, while strengthening our partnerships to increase the number of accounts.

One is AI inside. However, we do not want to simply sell our products through AI inside’s channels. Rather, we intend to develop products jointly with them, develop and implement functions that cannot be provided by AI inside, and sell them as options in AI inside’s product lineup.

In addition to AI inside, we are also planning to expand our accounts by collaborating with vendors that provide cloud services with deep penetration, such as telecommunication carriers and business groupware, and we are currently negotiating such alliances with several companies.

Q: “What other issues are you aware of?”

A: “It is also important to secure personnel for the project management tier. We see an urgent need to secure core personnel who are knowledgeable about the given industry and can also provide software services.”

In addition to securing engineers, it is important to secure personnel for the project management tier.

Financial institutions account for more than half of our sales base. As I mentioned earlier, our focus is on customer-oriented development, but to support DX that is rooted in the operations of financial institutions, we needed to learn about their operations more deeply than ever before.

Therefore, we appointed a person with a banking background and a wealth of knowledge in online marketing as the executive officer in charge. As a result, DX support for regional banks and the adoption of online identification at banks proceeded smoothly.

I believe this will also be essential when we promote DX support in domains other than financial institutions, and we see an urgent need to secure core human resources with expertise in real estate, education, and other domains that we will be working on in the future, as well as the ability to provide software services.

Q: “So in closing, do you have a message for shareholders and investors?”

A: “As we started our ‘Second Start-up’, we will make a significant contribution to the promotion of DX in Japan, and we will make a concerted effort to increase our corporate value so I hope that you will support our efforts from a mid-to-long-term perspective.”

The promotion of DX is extremely important for Japan, but in reality, diffusion of IT and DX are very slow, as even the distribution of a single benefit can take months and require a lot of workforce. This is not only the case for local governments, but for all governments and corporations.

We will eliminate such situation and provide a system that makes building a platform easier than ever.

We aim to solve social issues and grow sales and profits by providing services that allow departments to easily create online procedures and non-face-to-face transaction systems as needed, rather than having to hire an outside system company when building a system for either the government or a company. We are planning to release a concrete service by the end of this fiscal year, so please look forward to it.

As we started our Second Start-up, we will make a significant contribution to the promotion of DX in Japan, and we will make a concerted effort to increase our corporate value so I hope that you will support our efforts from a mid-to-long-term perspective.

6. Conclusions

According to “Digital Transformation: Overcoming of ‘2025 Digital Cliff’ Involving IT Systems and Full-fledged Development of Efforts for Digital Transformation” (Study Group for Digital Transformation) announced by the METI in 2018, a big hurdle to DX is the “problem with existing IT systems.”

Especially, “the difficulty in allocating resources to IT investments for utilizing new digital technologies due to the use of a lot of funds and human resources for operating and maintaining existing systems” is a serious problem for business operators who need to conduct DX for surviving. The DX market itself is expected to grow rapidly, but the growth of respective service vendors depends on whether they can offer services or solutions for overcoming the 2025 Digital Cliff.

Under these circumstances, high expectations have been placed on Showcase Inc., which plans to provide a system for enabling IT staff of each company to easily establish an IT platform. The fact that its PER exceeds 200 implies that the market evaluates such point highly. Since PER is higher than the market average, the growth of profit is indispensable for raising its share price further.

We would like to see whether the company will take measures as expected, to achieve sales of 2.8 to 3.4 billion yen and a profit margin of 20% in the term ending Dec. 2023 as set in the mid-term growth strategy and release products and services mentioned in the schedule as planned this term.

<Reference: Regarding Corporate Governance>

⊚ Organization type and the composition of directors and auditors

Organization type | Company with company auditor(s) |

Directors | 6 directors, including 3 outside ones |

Auditors | 3 auditors, including 3 outside ones |

⊚ Corporate Governance Report

Last update date: April 9, 2021

<Basic Policy>

Our company considers that establishing corporate governance is one of the important managerial issues to maximize the profits of many stakeholders, including shareholders, and to improve corporate value while enhancing the efficiency and transparency of management.

In this situation, we will observe related laws and regulations and operate a management organization system while responding to the changes in the business environment swiftly and flexibly.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Principle | Reasons |

(Supplementary Principle 3-1-2) | Our company opened the English version of our website to disclose the details of our business around the world. (English website: ) As for material for briefing financial results, convocation notices for general meetings of shareholders, overviews of quarterly results, etc., we will see the trend of ratio of foreign shareholders and consider cost-effectiveness, and if the ratio of foreign shareholders exceeds a certain value, we will consider translating documents and disclosing information in English.https://www.showcase-tv.com/en/corporate/ |

(Supplementary Principle 4-1-3) | Our company recognizes that a plan for appointing successors to CEO, et al. is important for realizing sustainable growth and improving mid/long-term corporate value. As of now, there are no concrete plans, but considering that it is indispensable to train executives and managers who will support the management in order to achieve sustainable growth and improve mid/long-term corporate value, we will comprehensively discuss requirements for becoming a chief executive and other executives, the policy for training them, etc. while taking into account our business environment and climate, and if necessary, we will discuss how the board of directors should supervise business operations. |

(Principle 4-11) | We think that the board of directors should be composed of directors who possess knowledge, experience, and skills for fulfilling their roles and duties with good balance for realizing diversity and appropriate scale. Our board of directors is composed of personnel who possess technical knowledge and plenty of experience in the fields of business administration, financial affairs, marketing, systems, etc., being well-balanced. In addition, our auditors include certified public accountants and tax accountants who possess appropriate knowledge of financial accounting. However, we recognize that there are problems regarding gender diversity and internationality. From now on, we will have discussions for securing female and foreign personnel to be appointed as directors. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle | Description of disclosure |

【Principle 1-4 Strategically Held Shares】 (Supplementary Principle 1-4-1) (Supplementary Principle 1-4-2) | Our company may hold some shares of listed companies, if such shareholding is expected to improve our corporate value in the medium/long term, from the viewpoints of fostering stable, long-term transactions and concreate cooperation in business activities with business partners and alliance partners. We have the basic policy of disposing of or reducing the strategically held shares that are considered to be not worth holding as soon as possible, by considering the situation as of the end of the latest fiscal year. Hence, we will discuss the effects of shareholding from the viewpoints of mid/long-term economic rationality and the maintenance/strengthening of comprehensive relationships with business alliance partners, and the board of directors will pass a resolution. We will exercise the voting rights of the listed shares appropriately after examining the contents of bills at general meetings of shareholders and checking whether the exercise will contribute to the improvement in corporate value and benefits for shareholders. Our company does not have the so-called cross-held shares. |

(Supplementary Principle 4-11-3) | The internal audit division conducts a questionnaire survey every year to directors and auditors, on the composition and operation status of the board of directors, to evaluate the effectiveness of the operation, deliberation, etc. of the board of directors. The evaluation results indicate that the board of directors can exert its supervision function with the current composition, operation, and deliberation systems, and participants in meetings of the board of directors is able to express their opinions actively and to have unfettered discussions. On the other hand, in order to improve the effectiveness of the board of directors further, it is important to enrich information to be offered to directors and auditors. With this recognition, our company will make continuous efforts to increase the effectiveness of the board of directors. |

【Principle 5-1 Policy for Constructive Dialogue with Shareholders】 | The management planning department is in charge of IR, and promotes constructive dialogue with shareholders.The section in charge of IR is developing a system for collecting necessary information for giving explanations to shareholders on a daily basis in cooperation with the corporate headquarters, which manages general affairs, financial affairs, accounting, and legal affairs, to support the dialogue with shareholders.We will strive to enrich the contents of sessions for briefing financial results and giving explanations to investors.The information obtained through the dialogue with shareholders will be reported at the meetings of the management council, the board of directors, etc. and we will give feedback to executives, directors, and auditors.We set the regulations for preventing insider trading, and manage information appropriately and thoroughly. |

This report is intended solely for information purposes and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the company and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |