Bridge Report:(3909)Showcase the second quarter of the fiscal year ending December 2022

Chairperson Masahiro Mori |

CEO Toyoshi Nagata | Showcase Inc. (3909) |

|

Company Information

Exchange | Standard Market of TSE |

Industry | Information and Communications |

Chairperson | Masahiro Mori |

CEO | Toyoshi Nagata |

Address | 14th Floor, Roppongi First Building, 1-9-9, Roppongi, Minato-ku, Tokyo |

Year-end | End of December |

Homepage |

Stock Information

Share Price | Number of Shares issued | Total Market Cap | ROE (Act.) | Trading Unit | |

¥377 | 8,569,100 shares | ¥3,230million | 2.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

0.00 | - | -¥49.49 | - | ¥254.51 | 1.5x |

*The share price is the closing price on September 26. Number of shares issued and DPS are taken from the financial results for the second quarter of the FY ending December 2022. EPS is from the earning forecast revision release announced on September 13, 2022. ROE and BPS are results of the previous term.

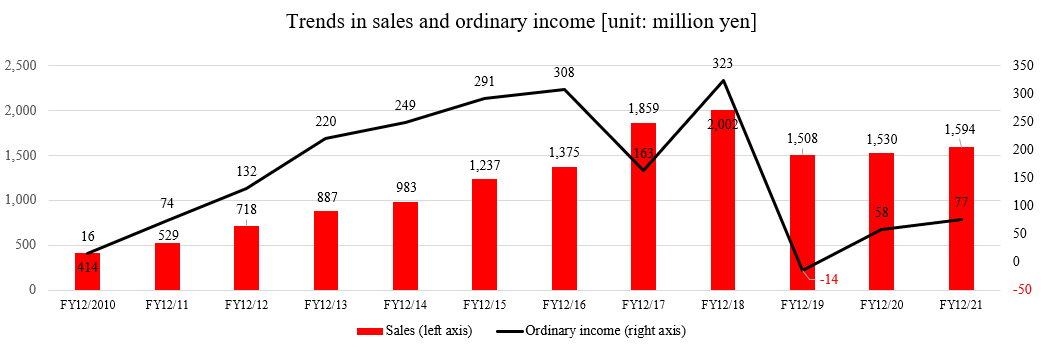

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2018 Act. | 2,002 | 352 | 323 | 16 | 2.48 | 0.00 |

December 2019 Act. | 1,508 | 92 | -14 | -183 | -27.02 | 5.50 |

December 2020 Act. | 1,530 | 45 | 58 | 25 | 3.75 | 6.00 |

December 2021 Act. | 1,594 | 12 | 77 | 59 | 6.98 | 6.50 |

December 2022 Est. | 4,624 | -510 | -520 | -424 | -49.49 | 0.00 |

*Unit: million yen, yen. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply.

This report outlines Showcase Inc.’s earnings results for the second quarter of the fiscal year ending December 2022.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of the Fiscal Year Ending December 2022 Earnings Results

3. Fiscal Year Ending December 2022 Earnings Forecasts

4. Future Medium-term Growth Strategy

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Based on their core value, “Make People Happy with Our OMOTENASHI (Hospitality) Technology,” the company operates business, with a focus on development and provision of cloud-type SaaS systems from the viewpoint of users. The company has set up the term ended Dec. 2019 as the “Second Start-up” period. It upholds their new business concept, “DX cloud service that connects companies and customers,” and supports enterprises in promoting DX. Its strengths include an excellent customer base, plenty of SaaS development technologies with operation knowledge, and high customer satisfaction level.

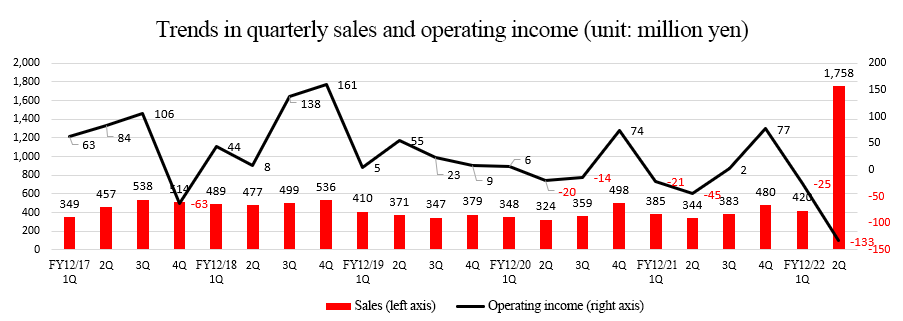

- In the second quarter of the term ended Dec. 2022, sales increased 198.2% year on year to 2,178 million yen. Nippon Telephone Inc. (Standard Market of TSE: 9425), which was acquired as a subsidiary in January 2022, boosted sales. The sales in the SaaS Business rose slightly, while the sales in the advertising and media, cloud integration, and Investment-related Businesses decreased. Operating loss was 158 million yen (a loss of 67 million yen in the same period last year). Gross profit also grew, but it could not absorb the increase in costs due to the acquisition of Nippon Telephone Inc., personnel expenses for development, new media development, advertising, and alliance-related expenses. Nippon Telephone's profit and loss statement has been included since the second quarter of 2022.

- As of February 2022, the forecast for this term was challenging to predict rationally, including the impact of the capital and business alliance with Nippon Telephone, which the company undisclosed. However, the forecast was announced in March 2022 and was revised downwardly in September 2022.

- Sales are forecasted to increase 190.0% year on year to 4,624 million yen, 1,748 million yen smaller than the previous forecast. Operating loss is expected to be 510 million yen, 94 million yen higher than the previous forecast. In the Reused Mobile Business of Nippon Telephone Inc., which has become a subsidiary, the procurement volume of devices is expected to decrease, and sales of the SaaS Business and Advertisement/Media Business are also expected to fall short of expectations. No dividend is planned, but the company aims to resume dividends in the term ending Dec. 2023. The Reused Mobile Business is on a recovery trend after reviewing the procurement method. Nippon Telephone will try to control expenses by relocating offices. Toward the end of the year, the company plans to launch multiple services jointly operated with Nippon Telephone.

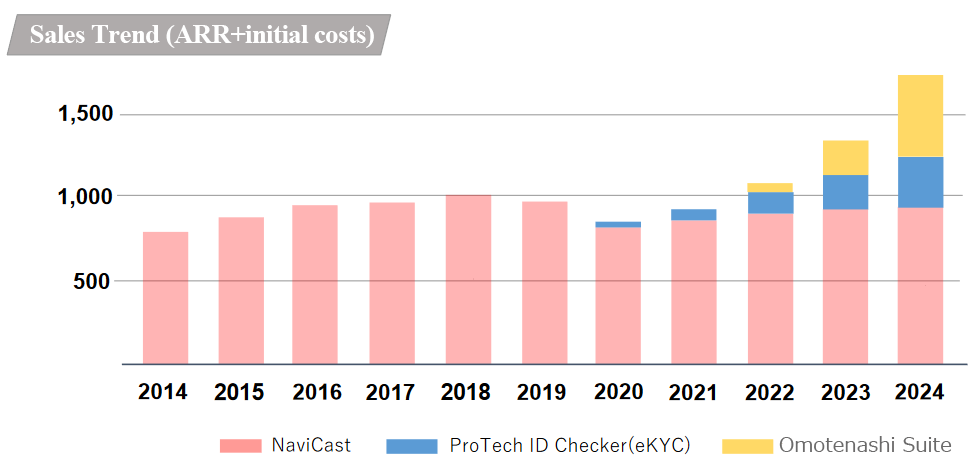

- As stated in the "Future Growth Strategy," the company believes it has changed the downward trend of the NaviCast series and achieved growth through the creation and investment of the ProTech ID Checker (eKYC) service, which is its growth engine. From 2022 to 2024, the company will promote an expansion strategy by creating services in the Omotenashi Suite (Hospitality Suite) series, where the service's target market is expanding. In 2024, the company aims to achieve approximately 50% of sales of the SaaS Business segment with ProTech ID Checker (eKYC) and new services in the Omotenashi Suite series.

- To achieve the targets of the new medium-term management plan for the term ending Dec. 2024, which are sales of 10 billion yen or more and a record-high operating income, the trend changes of the NaviCast series and the expansion ProTech ID Checker (eKYC) and Omotenashi Suite series are crucial. We would like to pay close attention to trends from the third quarter onward. As for making Nippon Telephone Inc. a subsidiary, we would like to pay attention to the progress of the PMIs as well as the creation of synergies. Due to the downward revision, the stock price has fallen to the lowest level since its listing. To restore the market's confidence, first of all, we would like to focus on how much the company can exceed the downwardly revised forecast.

1. Company Overview

Based on the core value, “Make People Happy with Our OMOTENASHI (Hospitality) Technology,” Showcase Inc. operates business, with a focus on development and provision of cloud-type SaaS systems from the viewpoint of users. The company has set up the term ended Dec. 2019 as the Second Start-up period, it upholds the new business concept, “DX cloud service that connects companies and customers,” and supports enterprises in promoting DX. Its strengths include the excellent customer base, plenty of SaaS development technologies and operation knowledge, and high customer satisfaction level.

1-1 Corporate History

In 1996, Futureworks CORP was established for the purpose of supporting sales promotion and public relations activities. In 1998, it was reorganized into a joint stock company, and in 2005, it absorbed Smart Image Inc., which engaged in promotion utilizing the Internet, Web videos, etc. with Futureworks Co., Ltd. being the surviving company, for the purpose of expanding business and improving the efficiency of use of managerial resources, and the corporate name was renamed to Showcase-TV Inc. The company changed its business model from the commissioned production of sales promotion goods for marketing to the creation of original products and services.

Meanwhile, the Web Form Optimization service, Form Assist, which is the current core service developed with reference to the clients’ opinions, was highly evaluated. At first, it was adopted mainly by EC sites, real estate firms, etc., but the number of financial institutions that consider Showcase’s high-level system for maintenance and operation as attractive increased and formed the current stable customer base. As a result, its business performance grew steadily, and it was listed in Mothers of Tokyo Stock Exchange in 2015, and then listed in the first section of TSE in 2016.

However, the policy for diversification of business through M&A, which was adopted in 2015, did not generate assumed synergetic effects, and sales dropped significantly, and impairment loss was posted in the first quarter of the term ended Dec. 2019. In this situation, that term was defined as the Second Start-up period, and Mr. Toyoshi Nagata, who had led business as vice-president since the inauguration of business, was appointed as representative director and in March 2019. It was renamed to Showcase Inc., while conducting organizational reform to shift to a new business execution system in April 2019.

In April 2022, the company got listed on the Standard Market of TSE due to market restructuring.

Since Nippon Telephone Inc. became a consolidated subsidiary, the company has had two representatives, Chairperson Masahiro Mori and Toyoshi Nagata, from April 2022, to strengthen the group management system.

1-2 Corporate Philosophy, etc.

Its core value is “Make People Happy with Our OMOTENASHI (Hospitality) Technology.”

Since its business start-up, the company has been offering business services focused on users’ happiness by using easy-to-adopt, easy-to-use, hospitality-oriented technologies, intending to solve problems and create value from the users' viewpoint.

For the “Second Start-up”, the company started upholding “DX cloud service that connects companies and customers” as a new business concept in 2020, and clearly reports its business domains to investors.

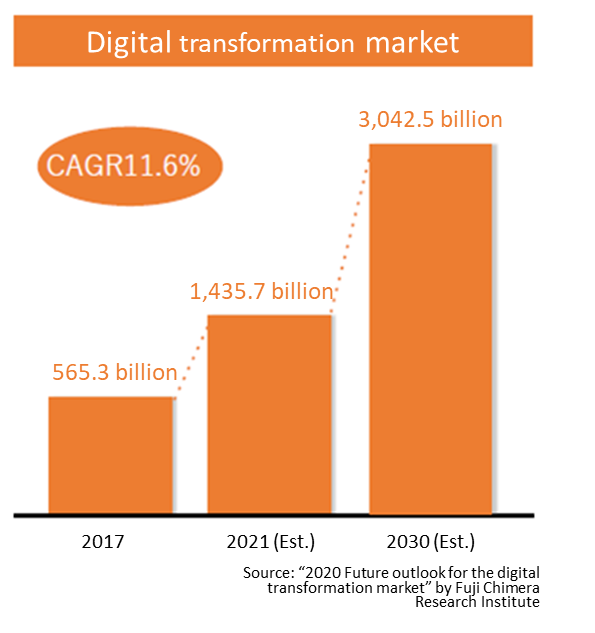

1-3 Market Environment

(1) The DX market, which is expected to grow rapidly, and the 2025 Digital Cliff

According to “Digital Transformation: Overcoming of ‘2025 Digital Cliff’ Involving IT Systems and Full-fledged Development of Efforts for Digital Transformation” (Study Group for Digital Transformation) announced by the Ministry of Economy, Trade and Industry in September 2018, in all industries, new entrants are emerging to develop unprecedented business models using new digital technologies, and become game-changers. Under these circumstances, it is necessary for all companies to proceed with digital transformation (DX) speedily to maintain and improve their competitiveness. On the other hand, the following problems have been pointed out.

☆ | Since existing IT systems are closely linked to business processes, it is necessary to renew the business processes to solve the problems with the existing systems. Accordingly, on-site workers are reluctant. |

☆ | Unless the problems with existing IT systems are solved, it is impossible to create new businesses and reform business models swiftly. Namely, it is difficult to carry out DX on a full-scale basis. |

☆ | A lot of funds and human resources are allocated to the operation and maintenance of existing systems, so it is impossible to allocate resources to IT investments for utilizing new digital technologies. |

☆ | If this problem is left unaddressed, the costs for operation and maintenance will skyrocket further, the so-called technical debt will augment, the staff who can operate and maintain existing systems will become scarce, and security risk will increase. |

Especially, if existing systems that are complicated, decrepit, and obscure remain, the economic loss due to the rise in risk caused by the resignation of IT personnel, the termination of support, etc. by 2025 is estimated to reach up to 12 trillion yen/year (about 3 times today’s loss) in 2025 or later. This is called the problems with the existing IT systems, the 2025 Digital Cliff.

If many enterprises work on DX to survive, the DX market will grow rapidly, but the growth of service vendors depends on whether they can offer services and solutions for overcoming the 2025 Digital Cliff.

(Taken from the reference material of the company)

(2) eKYC, which is expected to grow steeply

As the demand from housebound consumers grew amid the COVID-19 pandemic, we have entered the era of full-scale online procedures and non-face-to-face transactions and eKYC, which is a tool for online non-face-to-face identification, is rapidly distributed.

eKYC stands for electronic Know Your Customer, meaning online identification.

In order to prevent international money laundering and disrupt the provision of funds to criminal organizations, such as drug rings and terrorists, financial institutions, etc. are obligated to identify customers and check their purposes of transactions when their accounts are created, in accordance with the Act on Prevention of Transfer of Criminal Proceeds.

The damage due to illegal remittance amounted to about 2.5 billion yen in fiscal 2019, so financial institutions were requested to check transactions more strictly.

On the other hand, for non-face-to-face identification using conventional mails, the following problems have been pointed out:

* | Necessity to submit documents by mail for each financial institution is causing 1.7 million people to give up in the middle of creating an account every year. |

* | The identification process at financial institutions is cumbersome, and its cost amounts to about 2 trillion yen per year. |

* | Japanese financial institutions bear the cost of about 4 billion yen per year for sending personalized mails to verified customers. |

* | Even after creating accounts, customers need to log in to respective financial institution’s websites with different IDs when making transactions. |

The current identification process is not convenient for users, extremely costly for financial institutions, and many opportunities are lost. Accordingly, the identification process needs to be swifter and more efficient, thus, eKYC is rapidly expanding.

Through the amendment to the Act on Prevention of Transfer of Criminal Proceeds in November 2018, The Method for Checking Items for Identifying an Individual Online, in which each user sends identification documents and their images via the Internet, was added. Until 2023, both the conventional identification method using paper and the online one can be used, but from 2023, online identification will become mandatory.

It will become unnecessary to send identification documents by mail, so the identification process will become convenient for users and less costly for financial institutions. Accordingly, eKYC will become more common.

Since identification is not just for the financial field, but also for other various fields, online identification is expected to become common in the fields of insurance, credit cards, communications carriers, trade of antiques (recycling), etc.

The unauthorized access incident at a leading communications carrier that occurred in 2020 could have been prevented with online identification, so it is likely that online identification will be popularized rapidly before 2023.

According to the company’s reference material, the market scale of the eKYC service will expand from 480 million yen in 2019 to 4.4 billion yen by 2024. Substantial growth with an average yearly growth rate of 55.8% is anticipated.

1-4 Business Contents

(1) Business form

Utilizing the SaaS development technology with high usability, the company offers high-value services to eliminate the insufficiencies in society.

In addition, under the new business concept, “DX cloud service that connects companies and customers,” the company develops SaaS and platforms around interfaces connecting enterprises and customers and supports DX for co-creation, to offer services for overcoming the 2025 Digital Cliff.

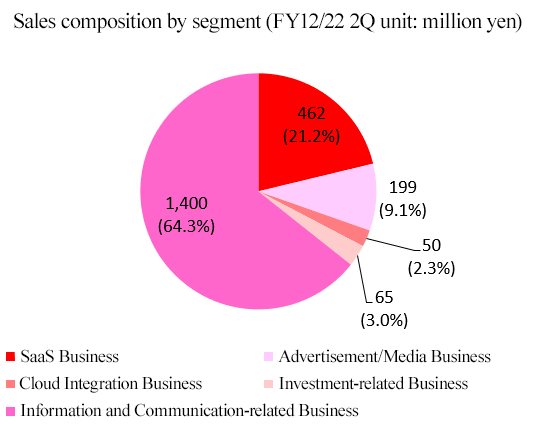

(2) Business segment

The acquisition of Nippon Telephone Inc. resulted in adding an Information and Communication-related Business to the existing four reported segments of SaaS Business, Advertisement/Media Business, Cloud Integration Business, and Investment-related Business from the first quarter of the term ending Dec. 2022. The profit and loss statement of Nippon Telephone Inc. has been included from the second quarter.

①SaaS Business

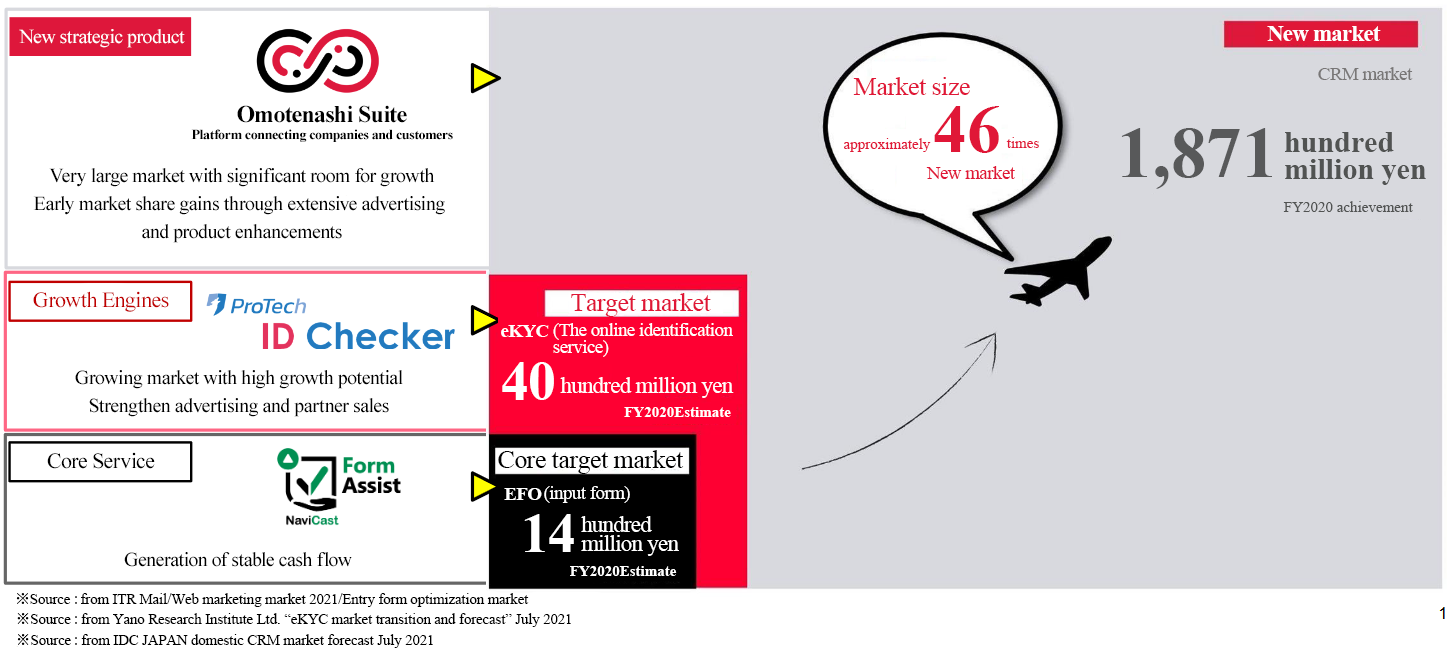

The business mainly offers "Form Assist," a cloud service that increases the conversion rate (contract rate) based on input form optimization technology, which is one of the company's core businesses. The business also provides the security-related cloud service "ProTech Series," a growth engine, as well as "Omotenashi Suite (Hospitality Suite)," a platform service that digitally connects companies and customers, which the company positions as a strategic product.

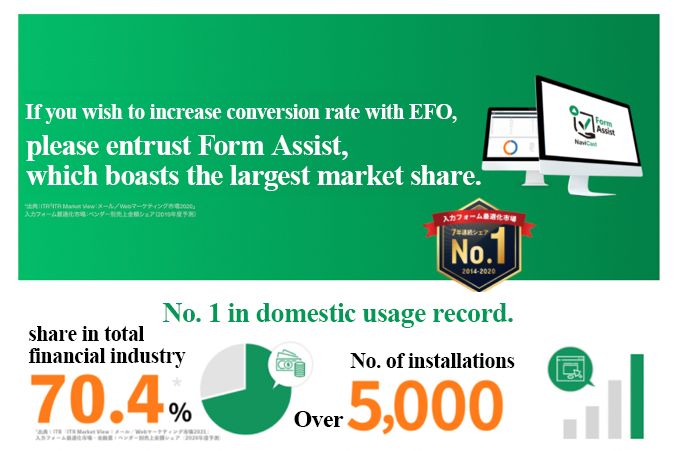

Form Assist

Administrators of websites for offering services, including EC sites, hope that visitors to their websites (potential customers) will not only browse their contents, but also input their personal information, send an inquiry, and purchase their products or services. They need to avoid a case in which a user accesses a Web form, but leaves the webpage because of the difficulty or cumbersomeness of inputting.

A measure for reducing such opportunity loss cases and increasing the ratio of customers who fill in forms for maximizing the results is called Web Form Optimization.

Form Assist is the first Web Form Optimization tool released in Japan.

It has been adopted for over 5,000 forms, meeting various needs. The company offers original knowledge based on the accumulation of experience for over 10 years.

Among financial institutions, which are their major clients, leading megabanks, local banks, non-life insurance companies, etc. have installed it. It boasts the largest share in the financial Web Form Optimization market.

Financial institutions, such as megabanks, major regional banks, and non-life insurance companies, which are the company's core customers, have installed it. As a result, the company proudly possesses the largest share in the financial industry's EFO market and has maintained the largest share in the entry form optimization market for seven consecutive years. *1

*1: From ITR "ITR Market Vie Email/Web Marketing Market 2021"

(Taken from the reference material of the company)

It has more than 40 types of assist functions that make it easier for users to input, and it does not require large-scale repairs and has a function that can optimize the input form simply only by installing tags.

In addition to the ease of use, easy installation thanks to the fact that Showcase does not need access to personal information is a major benefit for financial institutions in particular.

In addition, dedicated staff that possesses a wealth of web marketing knowledge and skills, including a WACA-certified Web Analyst certification, conducts analyses for better conversions and clarify website's issues. The company also provides measures suitable for each customer's goals based on accumulated success cases and failure cases that other companies do not have.

The conversions rates of the companies that have implemented this service have improved steadily on average, and especially for companies that are not familiar with UI betterment, it has led to a 10% improvement and even more in some cases.

Many major financial institutions have their own development companies, and although these development companies may compete with each other in the adoption of Web form optimization, they lack the know-how in web marketing which gives a great competitive advantage to Showcase.

◎Online identification/eKYC service, ProTech ID Checker

ProTech Series is a cloud service for maximizing the benefits of orders from customers. It specializes in the prevention of unauthorized logins to websites, impersonations, losses of leads due to typing errors and such, fortification of security in general.

In addition to License Reader, which allows users to take a picture of their driver's license with their smartphone and automatically insert their personal information in form inputs using OCR technology, the company is focusing on expanding sales of ProTech ID Checker, an online identity verification/eKYC service released in 2019, as a future growth driver.

As mentioned in the Market Environment section, eKYC is expected to be adopted not only by financial institutions but also by a wide range of industries and business categories.

The company's "ProTech ID Checker" also allows users to complete online identity verification by simply taking a photo of themselves and their identification documents. Like the web form optimization service, it is easy to install, requiring only the embedding of a tag, attracting attention as a solution to the rapidly growing need for non-face-to-face transactions due to the spread of the new Coronavirus infection and the social problem of identity fraud. It has received industry acclaim, including the Nikkei x TECH EXPO AWARD 2019 Semi-Grand Prix Security Award.

In addition, in a survey comparing the perceptions of websites conducted by General Research Inc. in 2021, it came in first in the three categories: "eKYC solution that you think is easy to use," "usability of the identification service that consumers choose," and "eKYC solution price satisfaction."

Since 2020, the number of companies using the service has increased in a wide range of industries due to the increase in demand for remote and online transactions. Thus, it has diverse clients in industries such as professional practices (doctors, lawyers, etc..), secondhand goods dealers, and rental shops.

In addition to ProTech ID Checker, which complies with the revised Act on Prevention of Transfer of Criminal Proceeds, in March 2021, the company released ProTech AI Masking, which provides an automatic masking service for health insurance cards at the time of identification. ProTech AI Masking responds to the restrictions on notification requests for the medically insured person's codes and numbers. In May 2021, the company also released the multi-factor authentication service, ProTech MFA by SMS, using SMS. The company plans to continue to increase its service lineup in line with social trends such as law revisions and fraud prevention.

In July 2022, the company acquired a patent for the personal identification system program for "ProTech ID Checker."

(Taken from the reference material of the company)

◎Omotenashi Suite (Hospitality) Series

Omotenashi Suite is a platform that enables the creation of all kinds of user interfaces and data linkages of business systems between companies and customers, all in a single integrated manner. In November 2021, as a multi-channel contact tool a chat function was released, and in January 2022, an input form function as a low-code online tool was released as well.

On May 11, 2022, the company announced its decision to acquire the AI and high-performance chatbot "Sugres" from ALBERT Inc. (Securities Code: 3906, Growth Market of TSE) and signed a business transfer agreement. "Sugres" was scheduled to be added to the "Omotenashi Suite (Hospitality Suite)" lineup in July 2022. Sales of the transferred business for the term ended Dec. 2021 were 126 million yen, and it will be included in the company's sales in the future.

Chat Function

A service that lets companies and their customers perform smooth text communication via a browser chat, LINE, and +Message. The service has a full range of functions, from AI chat-bot, auto-response to manned chat. Initial setup is simply done by pasting a tag.

Input From Function

Form creation service that allows users to immediately start linking data from online forms to existing systems. It’s also a low-code editor that enables form creation with intuitive operations, even without specialized knowledge of programming or Web production. In the future, the company plans to provide more extensive linkage with other external systems such as SFA and CRM tools, as well as add-on functions such as eKYC and OCR.

The company has started broadcasting TV commercials and taxi advertisement distribution for "Omotenashi Suite (Hospitality)" and is carrying out activities to improve recognition by investing a large amount in advertising expenses this year.

(Expansion of the target market)

The main markets that the company has targeted so far are the Web form optimization market (about 1.4 billion yen) and the eKYC market (about 4 billion yen). The Omotenashi Suite targets the high-growth CRM market, which manages customers in the cloud and is estimated to be about 190 billion yen. Thus, it aims to grow in a unique position that leverages its strengths. The company aims to make it a platform that can provide all the required functions for all situations to connect companies and customers by gradually adding new functions.

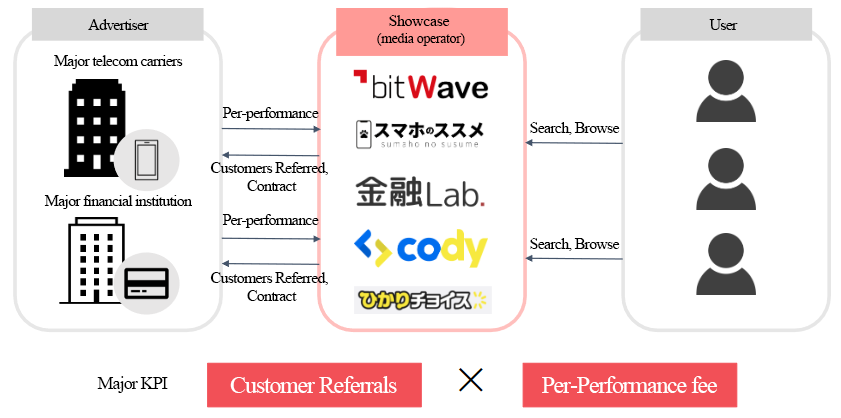

② Advertisement/Media Business

In addition to the conventional operational advertising-related services provided so far, the company provides SNS advertising operation services that meet customers' needs.

◎Operation of its own media

The business is growing with smartphone-related media, bitWave, as its primary content. Showcase is one of the prominent companies in Japan for leading customers to online contracts of major domestic carriers such as Docomo and Au. By making Nippon Telephone a consolidated subsidiary, we can expect to see the impact of this synergy with the company's reused mobile business.

In addition, by utilizing the customer base composed of financial institutions, which was developed through the SaaS business, the company is striving to increase the revenues from affiliate advertising, such as leading customers to credit-card companies. The company launched Finance Lab., a financial information media for providing simple-to-understand-information regarding money. It shares information about credit cards, stock investment, asset operation, insurance, loans, etc.

In addition, the company manages "Hikari Choice," which compares optical lines, cheap SIMs, Wi-Fi, and home routers and suggests recommendations, and "MoneyPitch," which carefully explains information necessary for asset management such as virtual currency (crypto assets), FX, and online securities.

As of August 2022, the number of video media channel subscribers exceeds 66,000 people.

The company plans to continue to invest actively in smartphone-related and financial products fields.

◎Advertisement-related service

In addition to the conventional operational advertising-related services provided so far, the company provides SNS advertising operation services that meet customers' needs.

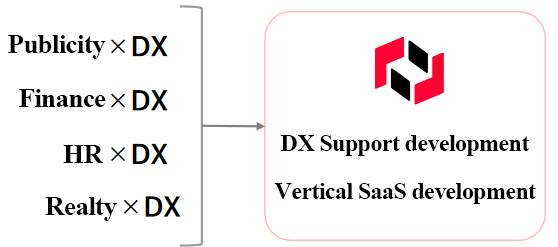

③ Cloud Integration Business

The company operates the industry-specific DX support and development business by combining the accumulated knowledge to develop SaaS products and the business knowledge of leading companies.

It conducts the SaaS business actively in various fields, and supports enterprises in adopting cloud computing for information systems in the DX market, which is in the midst of a structural reform.

As mentioned in the Market Environment section, the DX market is expected to grow rapidly, as many companies will work on DX to survive. But the “2025 Digital Cliff “still needs to be dealt with.

The company plans to use the technology and know-how it has cultivated to date to release a platform that will greatly reduce the time and efforts required by corporate system staff involved in DX, thereby contributing to the promotion of DX by corporations and local governments.

(Taken from the reference material of the company)

(Concrete measure (1): To support DX in the fields of publicity and PR)

The advertising and PR support cloud tool “PR Automation” operated by PRAP node Inc., which is a joint venture with PRAP Japan Inc. (TSE Standard: 2449), a major public relations firm, continues to grow with regard to the number of companies using the service and its recognition. The service has been adopted by more than 300 companies in one year from its start in September 2020 and received an incentive award at the PR Award Grand Prix 2021 organized by the Public Relation Society of Japan. The company is expanding its support for DX in the advertising/PR industry by developing additional functions.

(Concrete measure (2): To support DX in the financial field)

The Bank of Yokohama has developed a cloud-based system for confirming the contractual details of its loans, allowing customers to check the details online.

④ Investment-related Business

Consolidated subsidiary Showcase Capital Inc. operates SmartPitch, a matching platform service that introduces startups to operating companies, venture capital firms, and corporate venture capital firms online. As of August, 2022, there are more than 390 registered startups and more than 160 investors, including operating companies.

The company provides funding support, such as supporting the business growth of startup companies and listed companies. For example, in December 2021, the company signed an agreement of stock acquisition rights allotment to support the financing of ANAP Inc. (TSE Standard: 3189) and undertook it in January 2022.

⑤ Information and Communication-related Business

The consolidated subsidiary Nippon Telephone Inc. operates two businesses: a Reuse-related Business centered on sales of used smartphones and a Mobile Communication-related Business centered on carrier shops.

In the Reuse-related Business, the company is focusing on the BtoB market. In the Mobile Communication-related Business, it is concentrating management resources on profitable DoCoMo shops and au shops.

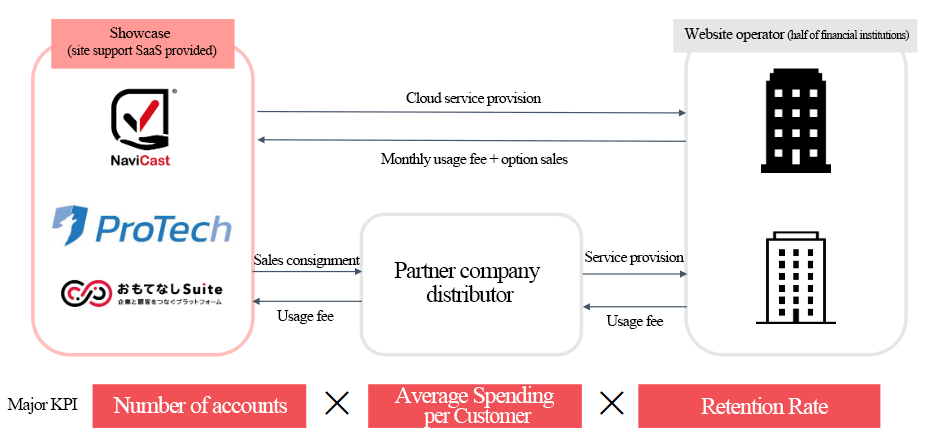

(3) Revenue model

①SaaS Business

It is a subscription-type model that offers website support for website operators on a monthly basis.

KPIs are the number of accounts, average spending per customer, and retention rate.

The company is promoting measures to increase the number of accounts by strengthening marketing and to improve average spending per customer by ensuring customer success. The company also aims to expand the number of accounts in the future by enhancing the partner sales network.

(Taken from the reference material of the company)

②Advertisement-related service

The company operates a performance-based advertising service with major carriers and financial institutions as advertisers by referring customers from its own media.

The KPIs are the number of customers referred and the unit price of pay for performance.

Following the smartphone news media, which boasts one of the strongest customer traffic in Japan, the company is developing financial product comparison media. The company plans to double the number of media it operates in order to increase the number of visitors and achieve growth.

(Taken from the reference material of the company)

1-5 Characteristics and Strengths

(1) Excellent customer base

The excellent customer base composed of a total of over 8,000 customers, mainly financial institutions, which was developed through the SaaS Business, has high value as an intangible asset from the viewpoint of reliability. In addition, it led to the monetization of financial media in the Advertisement/Media Business.

(2) High customer satisfaction level thanks to plenty of SaaS development technologies, operation knowledge, and customer-oriented policy

The company has accumulated plenty of SaaS development technologies and operation knowledge. As the company develops products that meet customer needs speedily and offers high-quality products at low cost under the customer-oriented policy, the company is highly evaluated by customers and has a great competitive advantage.

Based on this advantage, it supports the DX in enterprises and governments through the newly launched Cloud Integration Business.

(3) Holding a lot of technological patents

Showcase holds a lot of patents in Japan, the U.S., Singapore, etc.

In July 2022, we acquired a patent for identification system programs for “ProTech ID Checker”.

It will actively develop technologies with the aim of acquiring technological patents.

(Taken from the reference material of the company)

1-6 Business Strategy

With the above product lineup and competitive advantage, Showcase aims to increase sales and profit with the following growth engines.

◎Growth engine I Identification/eKYC service

While the social situation is changing rapidly as mentioned above, the company aims to promote this service while advertising its simplicity of adoption.

◎Growth engine II New platform scheme

In November 2021, the company released the Omotenashi Suite Series, a platform that creates all sort of user interfaces connecting companies and customers as SaaS. It is also a new front-end platform that provides a gateway to all types of data. By linking its core technologies and patented technologies, SaaS development knowledge, and identification technologies with leading enterprises and services, the company will connect users and clients and increase corporate users. The company has positioned it as a strategic product that could determine its fate and has strengthened sales personnel and advertising to improve sales of the Omotenashi Suite Series. In June 2022, the company started broadcasting TV commercials to increase recognition.

(Taken from the reference material of the company)

1-7 Return on Equity (ROE) Analysis

| FY 12/16 | FY 12/17 | FY 12/18 | FY 12/19 | FY 12/20 | FY 12/21 |

ROE (%) | 14.8% | 1.0% | 1.4% | -17.2% | 1.7% | 2.7% |

Net income margin [%] | 12.86 | 0.65 | 0.84 | -12.14 | 1.69 | 3.75 |

Total asset turnover [times] | 1.02 | 0.92 | 0.78 | 0.63 | 0.59 | 0.57 |

Leverage [times] | 1.13 | 1.62 | 2.14 | 2.24 | 1.66 | 1.29 |

Although the company does not own a lot of assets, ROE has been low, because profitability and efficiency of assets are low.

In the medium-term management strategy, the company aims to achieve an operating income margin of 20% in 2023. Improving profitability by further developing the eKYC tool "ProTech ID Checker" and expanding the strategic product "Omotenashi Suite (Hospitality) is the key to improving ROE.

2. Second Quarter of the Fiscal Year Ending December 2022 Earning Results

(1) Overview of Consolidated Business Results

| 2Q of FY 12/21 | Ratio to sales | 2Q of FY 12/22 | Ratio to sales | YoY |

Sales | 730 | 100.0% | 2,178 | 100.0% | +198.2% |

Gross profit | 544 | 74.5% | 765 | 35.2% | +40.7% |

SG&A | 611 | 83.7% | 924 | 42.4% | +51.1% |

Operating Income | -67 | - | -158 | - | - |

Ordinary Income | -34 | - | -168 | - | - |

Quarterly Net Income | -36 | - | -140 | - | - |

*Unit: million yen. Quarterly net income means profit attributable to owners of parent.

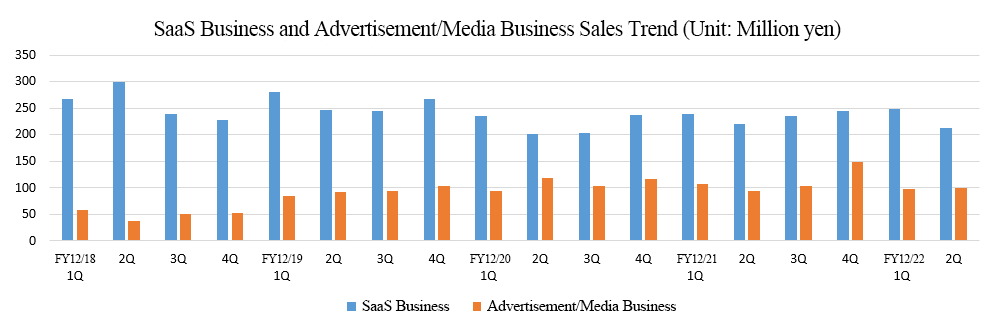

Sales grew, posting a loss

Sales increased 198.2% year on year to 2,178 million yen. Nippon Telephone Inc. (Standard Market of TSE: 9425), which was acquired as a subsidiary in January 2022, boosted sales. The sales in the SaaS Business rose slightly, while the sales in the Advertisement/Media Business, Cloud Integration Business, and Investment-related Businesses decreased.

Operating income lost 158 million yen (a loss of 67 million yen in the same period last year). Gross profit also grew but it could not absorb the increase in costs due to the acquisition of Nippon Telephone Inc., personnel expenses for development, new media development, advertising, and alliance-related expenses.

Nippon Telephone's profit and loss statement has been included since the second quarter of 2022

(2) Trend in each segment

| 2Q of FY 12/21 | 2Q of FY 12/22 | YoY |

SaaS Business | 460 | 462 | +0.4% |

Advertisement/Media Business | 202 | 199 | -1.4% |

Cloud Integration Business | 60 | 50 | -17.0% |

Investment-related Business | 5 | 65 | +1026.3% |

Information and Communication-related Business | - | 1,400 | - |

Other | 0 | 0 | -18.9% |

Total sales | 730 | 2,178 | +198.2% |

SaaS Business | 296 | 202 | -31.7% |

Advertisement/Media Business | 18 | 23 | +28.2% |

Cloud Integration Business | -15 | -1 | - |

Investment-related Business | -8 | 0 |

|

Information and Communication-related Business | - | -35 | - |

Other | 9 | 5 | -43.8% |

Adjustment | -368 | -354 | - |

Total profit | -67 | -158 | - |

*Unit: million yen. Sales mean those to external clients.

◎SaaS Business

Sales were unchanged from the same period of the previous year and profits decreased.

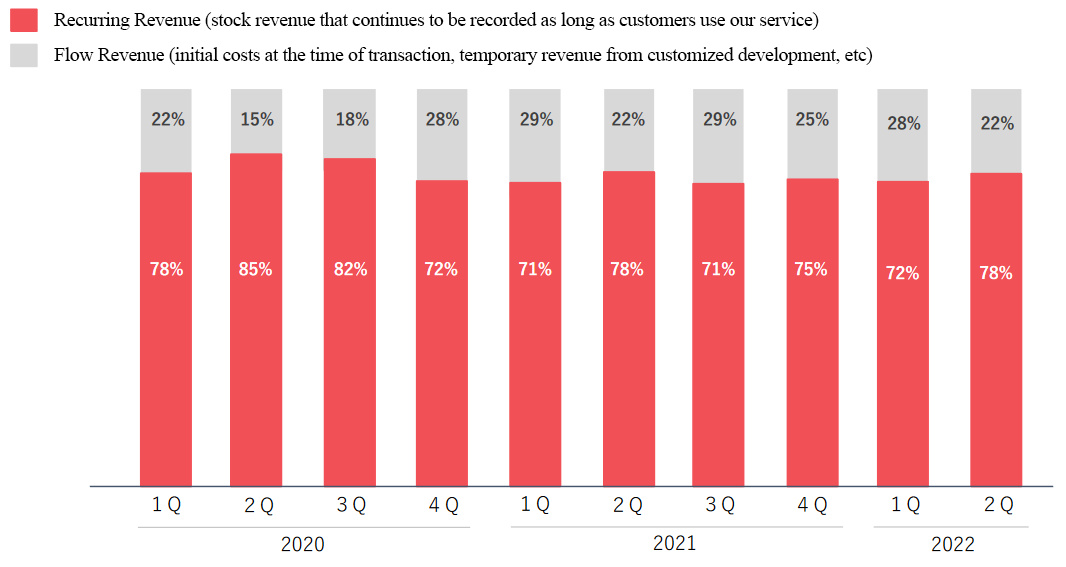

The recurring revenue ratio, which is set as a KPI, continues to hover at around 75%, ensuring a stable earning base.

(Taken from the reference material of the company)

* Omotenashi (Hospitality) Suite Series

The series was released in November 2021 and is steadily expanding sales. In June 2022, the company started broadcasting TV commercials, which was the company's first attempt to grow sales.

The company acquired the AI and high-performance chatbot "Sugres" from ALBERT Inc. (Code: 3906, Growth Market of TSE) in July 2022, and it has been added to the lineup of its strategic product, the Omotenashi Suite. The chat function of the existing Omotenashi Suite has been expanded, making it possible to achieve communication optimized for each user.

* Navicast Series

The input form optimization service "Form Assist" demonstrates a steady performance. Thanks to detailed proposals by consultants, the churn rate remains below 1%.

* Online identity verification and eKYC service "ProTech ID Checker"

The number of companies using the service has increased by 155% year on year. MRR (Monthly Recurring Revenue) also increased by 168% year on year and continues to grow, resulting in expanding the company's market share. In addition to financial institutions, the service has various sales destinations, such as professional practices (doctors, lawyers, etc.), secondhand goods dealers, and rental shops.

In July 2022, the face recognition technology was patented.

◎Advertisement/Media Business

Sales decreased, and profit increased.

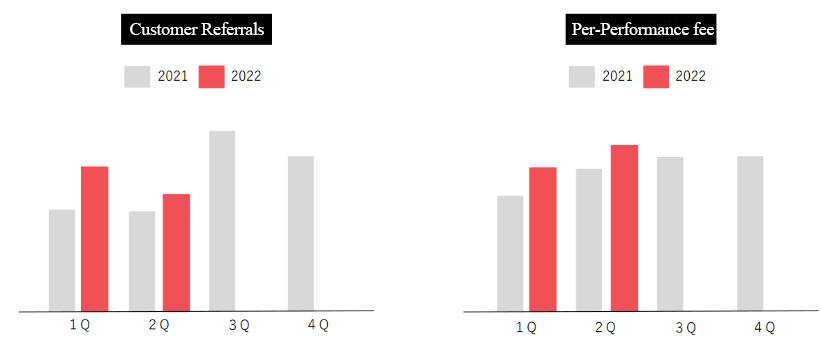

Customer referrals and per-performance fees, which are the business' KPIs, exceeded the results in the same period of the previous year. The company aims for growth by horizontally deploying the media management know-how it has cultivated so far to develop multiple media with high customer-attracting power.

(Taken from the reference material of the company)

(Advertising related services)

In addition to the operational advertising-related services that the company has provided so far, it is recording stable sales by providing SNS advertising operation services that meet the needs of its customers.

(Owned media)

The mainstay smartphone-related news media "bitWave" and "Sumaho no Susume (Smartphone Recommendations)" and the new media "cody," which introduces programming schools, are performing well.

Speaking of new media, the company has also established other multiple media, such as virtual currency-related media, "Money Pitch."

As the first step of a joint business with Nippon Telephone Inc., the company started "Hikari Choice," a comprehensive media service about fiber-optic lines, cheap SIM cards, Wi-Fi, and home routers. By compiling reviews, evaluations, and comparative recommended information, the company aims to eliminate any hidden problems or trouble between companies and customers to create a convenient information society. Being the focus business, increasing the number of media and expanding channels will increase the number of customer referrals and contribute to earnings.

⊚ Cloud Integration Business

Sales decreased and loss shrank.

It has contributed to the business performance by conducting stable additional development in the PR support SaaS "PR Automation" owned by PRAP node Inc., a joint venture with PRAP Japan Inc.

Sales decreased despite the delivery of other consigned development projects. The company will continue to actively promote DX with leading companies in various fields.

⊚ Investment-related Business

Sales increased and profit was recorded.

As of the end of August 2022, the number of registrations for SmartPitch, a platform for online matching business companies and VC/CVCs with startup companies, is over 390 on the startup company side and over 160 on the investor side, such as business companies.

In December 2021, the company signed a stock acquisition rights allotment agreement to support the financing of ANAP Inc. and undertook it in January 2022.

Like in the first quarter, the sale of some stock acquisition rights was completed in the second quarter, contributing to earnings.

⊚Information and Communication-related Business

The company incorporated Nippon Telephone Inc.'s profit and loss statement.

(3) Financial position and cash flows

⊚ Main Balance Sheet

| End of December 2021 | End of June 2022 | Increase/Decrease |

| End of December 2021 | End of June 2022 | Increase/Decrease |

Current Assets | 2,179 | 3,683 | +1,503 | Current Liabilities | 374 | 822 | +448 |

Cash and Deposits | 1,875 | 2,627 | +751 | Trade Payables | 25 | 120 | +95 |

Trade Receivables | 223 | 462 | +238 | ST Borrowings | 210 | 341 | +131 |

Noncurrent Assets | 504 | 764 | +260 | Noncurrent Liabilities | 129 | 857 | +728 |

Tangible Assets | 80 | 107 | +26 | LT Borrowings | 84 | 748 | +664 |

Intangible Assets | 163 | 442 | +279 | Total Liabilities | 504 | 1,680 | +1,176 |

Investment, Others | 259 | 214 | -45 | Net Assets | 2,180 | 2,768 | +588 |

Total assets | 2,684 | 4,448 | +1,764 | Total Liabilities and Net Assets | 2,684 | 4,448 | +1,764 |

|

|

|

| Balance of Interest-bearing Liabilities | 294 | 1,090 | +795 |

*Unit: million yen.

Due to the increase in cash and deposits , total assets increased 1,764 million yen year on year to 4,448 million yen. Due to an increase in borrowings, total liabilities increased by 1,176 million yen to 1,680 million yen. While retained earnings decreased, non-controlling interests increased, and net assets grew by 588 million yen from the end of the previous term to 2,768 million yen.

Capital-to-asset ratio fell 36.6 points from the end of the previous term to 44.6%.

⊚ Cash Flow

| 2Q of FY 12/21 | 2Q of FY 12/22 | Increase/Decrease |

Operating Cash Flow | 14 | -92 | -107 |

Investing Cash Flow | -9 | 641 | +650 |

Free Cash Flow | 4 | 548 | +543 |

Financing Cash Flow | -87 | 203 | +290 |

Term End Cash and Equivalents | 2,115 | 2,627 | +511 |

*Unit: million yen.

Investing CF recorded a surplus due to proceeds from purchase of shares of subsidiaries resulting in change in scope of consolidation. Financing CF also recorded a surplus due to proceeds from long-term borrowings. The cash position has rose.

3. Fiscal Year Ending December 2022 Earnings Forecasts

(1) Consolidated Earning Forecast

| FY 12/21 | Ratio to Sales | FY 12/22 Est. | Ratio to Sales | YoY | Adjustments |

Net Sales | 1,594 | 100.0% | 4,624 | 100.0% | +190.0% | -1,748 |

Operating Profit | 12 | 0.8% | -510 | - | - | -94 |

Ordinary Profit | 77 | 4.9% | -520 | - | - | -104 |

Quarterly Net Profit | 59 | 3.7% | -424 | - | - | -8 |

*Unit: million yen. Quarterly net income means profit attributable to owners of parent.

Earning Forecast Revised Downwards

As of February 2022, the forecast for this term was challenging to predict rationally, including the impact of the capital and business alliance with Nippon Telephone, which the company undisclosed. However, the forecast was announced in March 2022 and was revised downwardly in September 2022.

Sales are forecasted to increase 190.0% year on year to 4,624 million yen, 1,748 million yen smaller than the previous forecast.

Operating loss is expected to be 510 million yen, 94 million yen higher than the previous forecast.

Regarding the operating loss, in the previous forecast, in addition to personnel expenses of 420 million yen for Nippon Telephone, the increase in sales and development personnel for the strategic product "Omotenashi Suite" and financial product comparison media in the Advertisement/Media Business. In addition to an increase in expenses of 495 million yen, advertising expenses were expected to increase by 330 million yen, but the following factors will widen the range of losses.

(Factors Behind the Downward Revision)

☆ | In Nippon Telephone’s primary business area, the Reuse Mobile Business, the procurement volume of their core products, which are high-quality reusable mobile devices, is expected to decrease due to the global shortage of semiconductors and a rapid depreciation of the yen, and net sales of this business are expected to decrease by 1,588 million yen from the previous forecast. |

☆ | In the SaaS Business, the number of customization projects that incur initial costs is expected to fall below the forecast. |

☆ | In the Advertising and Media Business, cost-effectiveness of investment in some financial media started this period is expected to fall below the forecast. |

The company plans to pay no dividends. The company aims to resume dividend payments in FY 12/23.

(Current Status and Future Actions)

The Reuse Mobile Business is on a recovery trend after the company’s review of the procurement methods.

Nippon Telephone is working to control costs by relocating its office.

Toward the end of the year, Showcase and Nippon Telephone plan to launch several joint business services.

4. Future Medium-term Growth Strategy

(1) Growth Strategies

The following three points will be the priority strategies for improving corporate value and returning profits to shareholders over the medium term.

① Business growth by aggressively investing in core business's strategic products

◎SaaS Business

In 2020 and 2021, the company achieved a trend conversion in the NaviCast series which had been trending downward, and in addition, the company achieved growth through creation of and investment in the ProTech ID Checker (eKYC) service, which is their growth engine.

During the coronavirus pandemic, the company strengthened their digital marketing by converting the sales and marketing channels.

Moving forward (from 2022 to 2024), the company will promote its expansion strategy through creation of the Omotenashi Suite series that can expand the target market.

By 2024, the company plans to generate approximately 50% of sales from new services of the ProTech ID Checker (eKYC) and the Omotenashi Suite series.

(Taken from the reference material of the company “2022.03.23 Notice Regarding out Management Strategy”)

◎Advertisement/Media Business

The company will operate new media with a focus on highly profitable smartphone-related news media.

The company aims to achieve growth by leveraging the media management know-how they have built, and through creating media with high customer attractiveness.

Specific growth strategies include spending on advertising to improve the capability of reeling in customers and achieve sales growth.

In 2022, profitability will be low because the company invests in building and growing new media, however, the company expects that profitability will increase along with sales growth from 2023 onward.

◎ Shift from the In-House Sales Policy: To accelerate growth by increasing the number of sales channels

The company will actively utilize alliances with influential partners to accelerate expansion of sales channels and DX support.

Nexway Co., Ltd. of TIS INTEC Group became a sales partner for the eKYC tool “ProTech ID Checker”; KDDI Evolva, Inc. became a sales partner for “Omotenashi Suite” and eKYC Tool “ProTech ID Checker”; and the Hokuto Bank became a DX support partner.

◎ The Capital and Business Alliances, and Joint Venture: Joint development projects and joint project management

Joint development projects for the digital input portion are ongoing with AI Inside, Inc. (TSE Growth: 4488). The company has concluded a sales partnership agreement for AI Inside’s leading product, “DX Suite” for AI OCR.

The company aims to generate good results by strengthening the sales structure.

PRAP Japan, Inc. (Standard Market of TSE: 2449) established PRAP node, Inc., and launched a PR support SaaS “PR Automation,” and the number of companies using the service exceeded 350.

The company received the Encouragement Award in the “PR Award Grand Prix 2021” hosted by the Japan PR Association.

(Taken from the reference material of the company)

③ M&A for Discontinuous Business Growth

The company made Nippon Telephone, Inc. (TSE Standard: 9425) its subsidiary.

With Showcase’s strengths such as SaaS (software) know-how, media that reel in customers, and marketing know-how, combined with Nippon Telephone, Inc.’s strength in procurement and its sales of over 100,000 hardware units per year, the company will promote the following initiatives.

☆ | To establish and release an online purchasing service for smartphones utilizing online identity verification (eKYC), and an automated assessment and purchasing system utilizing AI |

☆ | To support clients in marketing and attracting customers, linked with smartphone news media |

☆ | New smartphone rental business with added value using software for corporate clients |

☆ | To promote DX in the Reuse Mobile Business |

(2) Target Value

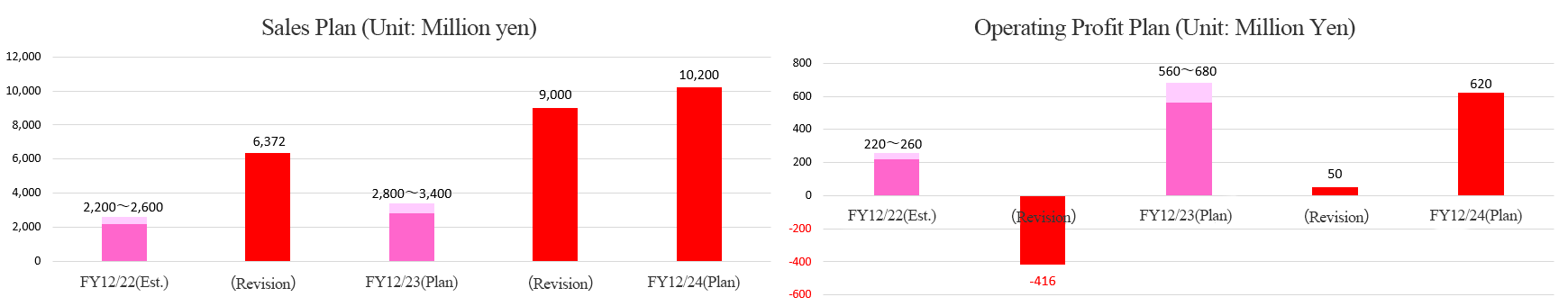

The medium-term management plan announced in March 2021 has been revised.

In FY 12/2022, Nippon Telephone will become a consolidated subsidiary through growth of the core business and M&A, and sales are expected to increase rapidly.

The company aims to achieve higher growth by leveraging the growth of new business, however, the short-term loss is forecasted because of growth investment.

A new goal in the medium-term management plan is to achieve “sales of 10 billion yen or more and a record-high operating income” by FY 12/24, by investing in the growth of the company’s core SaaS Business and the Advertising/Media Business, as well as by achieving business growth through the business synergies with Nippon Telephone, Inc.

5. Conclusions

Although sales will increase significantly in this term due to the acquisition of Nippon Telephone Co., Ltd., a loss of 500 million yen is expected to be recorded due to additional costs such as personnel expenses and growth investment. On the other hand, net sales excluding Nippon Telephone Co., Ltd. increased only 6.5% year on year. Due to the downward revision, the stock price has fallen to near the lowest price since listing, and we would like to pay attention to how much the company can increase the forecast after the downward revision in order to regain the trust of the market.

As mentioned in "Future Growth Strategy," the company said, "In addition to realizing a trend change in the NaviCast series, which was in a downtrend, we also achieved growth through the creation and investment of the ProTech ID Checker (eKYC) service, which is a growth engine. "From 2022 to 2024, we will promote an expansion strategy by creating the Omotenashi Suite series to expand the target market. We are aiming for about 50% of sales.”

In order to achieve the target of the new medium-term management plan for the fiscal year ending December 2024, "sales of over 10 billion yen and record-high operating income," we will expand the NaviCast series trend change, ProTech ID Checker (eKYC) and Omotenashi Suite series.” will be a big key. We would like to keep an eye on trends from the third quarter onwards.

Also, regarding the acquisition of Nippon Telephone Co., Ltd., we would like to pay attention to the progress of PMI as well as the creation of synergies.

<Reference: Regarding Corporate Governance>

⊚ Organization type and the composition of directors and auditors

Organization type | Company with company auditor(s) |

Directors |

|

Auditors |

|

⊚ Corporate Governance Report

Last update date: April 4, 2022

<Basic Policy>

Our company considers that establishing corporate governance is one of the important managerial issues to maximize the profits of many stakeholders, including shareholders, and to improve corporate value while enhancing the efficiency and transparency of management.

In this situation, we will observe related laws and regulations and operate a management organization system while responding to the changes in the business environment swiftly and flexibly.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principle | Reasons |

(Supplementary Principle 3-1-2) | Our company opened the English version of our website to disclose the details of our business around the world. English website: https://www.showcase-tv.com/en/corporate/ As for material for briefing financial results, convocation notices for general meetings of shareholders, overviews of quarterly results, etc., we will see the trend of ratio of foreign shareholders and consider cost-effectiveness, and if the ratio of foreign shareholders exceeds a certain value, we will consider translating documents and disclosing information in English. |

(Supplementary Principle 3-1-3) | We recognize the need to address sustainability issues as an essential element of our management strategy. Thus, in order to enhance our efforts to tackle social issues such as investing in human capital and intellectual property, we will review the existing system and take measures such as managing the progress of goals and deliberating on measures. We will also enhance the effectiveness of the supervision of the Board of Directors by appropriately reporting the evaluation of specific achievements to the Board of Directors. |

(Supplementary Principle 4-1-3) | The board of directors of our company is not voluntarily involved in the formulation and operation of a successor plan, but when selecting executives, such as directors and executive officers, the board of directors makes a decision. Through this process, we check whether a successor plan is appropriately formulated and operated by the representative director. |

(Principle 4-11) | We think that the board of directors should be composed of directors who possess knowledge, experience, and skills for fulfilling their roles and duties with good balance for realizing diversity and appropriate scale. Our board of directors is composed of personnel who possess technical knowledge and plenty of experience in the fields of business administration, financial affairs, marketing, systems, etc., being well-balanced. In addition, our auditors include certified public accountants and tax accountants who possess appropriate knowledge of financial accounting. However, we recognize that there remains a problem with diversity of gender, internationality, work experience, age, etc. From now on, we will have discussions for securing diverse personnel to be appointed as directors. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principle | Description of disclosure |

(Supplementary Principle 1-4-1) (Supplementary Principle 1-4-2) | We do not currently possess strategically held shares. Our company may hold some shares of listed companies, if the cost of capital of shareholding is reasonable, from the viewpoints of fostering stable, long-term transactions and concreate cooperation in business activities with business partners and alliance partners. We have the basic policy of disposing of or reducing the strategically held shares that are considered to be not worth holding as soon as possible, by considering the situation as of the end of the latest fiscal year. Hence, we will discuss the effects of shareholding from the viewpoints of mid/long-term economic rationality and the maintenance/strengthening of comprehensive relationships with business alliance partners, and the board of directors will pass a resolution. We will exercise the voting rights of the listed shares appropriately after examining the contents of bills at general meetings of shareholders and checking whether the exercise will contribute to the improvement in corporate value and benefits for shareholders. |

(Supplementary Principle 2-4-1) | Since the current number of staff members in the group is relatively small and the population is limited, we have not set a target value for ensuring diversity in recruiting core human resources. However, as of December 2021, female managers account for 13%, and mid-career managers account for 73% of the total personnel. Thus, we already have a track record in this matter. As of now, we have not promoted foreigners to managerial positions yet, but our basic policy is to conduct personnel evaluations according to their abilities and achievements regardless of nationality and gender. Moreover, as we expand our business domains and the scale of our company in the future, we will aim to operate an organization that has secured and improved diversity. We also recognize the importance of human resources strategies for improving corporate value over the medium to long term. Hence, we will consider developing human resources and improving the internal environment so that the ratio of female, foreign, and mid-career hires to managerial positions will increase as our core human resources. |

(Supplementary Principle 4-11-3) | The internal audit division conducted a questionnaire survey to all directors and auditors, on the composition and operation status of the board of directors, to evaluate the effectiveness of the operation, deliberation, etc. of the board of directors. The evaluation results indicate that the board of directors can exert its supervision function with the current composition, operation, and deliberation systems, and participants in meetings of the board of directors is able to express their opinions actively and to have unfettered discussions. On the other hand, in order to improve the effectiveness of the board of directors further, it is important to enrich information to be offered to directors and auditors. With this recognition, our company will make continuous efforts to increase the effectiveness of the board of directors. |

[Principle 5-1] | To continuously grow our company and improve corporate value over the medium to long term, we have set up a dial-in for shareholders and a contact point by email to respond to the shareholders' inquiries as a way to promote constructive dialogue with shareholders. The contact point is disclosed on our website. https://www.showcase-tv.com/ir/inquiry/

|

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |