Bridge Report:(3912)Mobile Factory the first half of Fiscal Year December 2019

Yuji Miyajima , President | Mobile Factory, Inc. (3912) |

|

Company Overview

Exchange | TSE 1st Section |

Industry | Information, Communication |

President | Yuji Miyajima |

HQ Address | 1-24-2 Higashi-gotanda, Shinagawa-ku, Tokyo |

Year-end | December |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE (Actual) | Trading Unit | |

¥1,389 | 8,822,737 shares | 12,255 million | 26.2% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

- | - | ¥65.85 | 21.1x | ¥245.46 | 5.7x |

*The share price is the closing price on July 24.

*ROE and BPS are the values as of the end of the previous term.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

December 2015 (Actual) | 1,751 | 314 | 305 | 185 | 20.01 | 20.00 |

December 2016 (Actual) | 2,072 | 611 | 611 | 411 | 43.64 | 27.00 |

December 2017 (Actual) | 2,437 | 736 | 722 | 511 | 54.18 | 17.00 |

December 2018 (Actual) | 2,978 | 849 | 848 | 585 | 63.37 | - |

December 2019 (Forecast) | 3,137 | 900 | 899 | 588 | 65.85 | - |

*The forecasted values were not provided by the company.

*In October 2016, it implemented a 2-to-1 stock split. In July 2017, it implemented a 2-to-1 stock split. EPS in FY ended December 2016 are retroactively adjusted.

*Unit: ¥mn

This report outlines Mobile Factory’s financial results for first half of the fiscal year ended December 2019 and its earnings forecasts.

Table of Contents

Key Points

1. Company Overview

2. First half of the Fiscal Year December 2019 Earnings Results

3. Fiscal Year December 2019 Earnings Forecast

4. Conclusions

<Reference: Regarding Corporate Governance>

Key points

- In the first half of the Fiscal Year ending December 2019, sales and operating income jumped 21.5% and 46.0%, respectively, year on year. Sales marked a record high for the first half of past fiscal years thanks to the DAU of “Station Memories!” that reached an all-time high. Also, operating income hit a record high for the first half of any fiscal year with an increase in cost of goods sold being offset, including system usage fees. Mobile Factory, Inc. released a mobile signature management system, “Quragé Link,” in May 2019 and moved ahead with development of a tool for developing decentralized applications, “Uniqys Kit,” aiming to release an official version of it by the end of this fiscal year.

- Sales and operating income are expected to increase 5.3% and 6.0%, respectively, year on year for the full fiscal year. It is anticipated that location-based games, including “Station Memories!,” will continue to grow on a steady basis in the second half of the current fiscal year. Regarding profits, effective operation of promotional expenses will improve profitability. The Company acquired treasury shares (339,200 shares for 499,893,500 yen), resulting in an estimated total return ratio of 86% for the Fiscal Year ending December 2019. Furthermore, it will retire 882,305 shares (9.1% of the total number of outstanding shares before the retirement) on July 31, 2019, including the treasury shares that it has already held.

- It was confirmed that not only the existing businesses, but also the new business grew steadily based on the financial statements for the first half of the current fiscal year. While it has been five years since the release of “Station Memories!,” which is the revenue pillar, the life cycle of the game seems to be different from the cycle of other games because of its feature as a life log service. In addition, sales of the Contents Service were on the gradual decline, but it made no small contributions to earnings, meaning that the revenue base has been made sound for developing the new Blockchain Business. We would like to keep an eye on the progress that Mobile Factory, Inc. will make.

1. Company Overview

The Company’s two main pillars are the Social Apps Service led by location-based games and the Contents Service that provides contents such as ringtones. “A shift to decentralized economy through the blockchain technology is highly likely to bring about a considerable change in the social infrastructure, with the entertainment industry being no exception. This is a promising business field.” Based on this idea, in 2018, Mobile Factory, Inc. initiated a project, “Uniqys Project,” which aims to spread Decentralized Applications (DApps) that utilize the blockchain technology for which expectations are growing as the next-generation Internet. The Company plans to contribute to promoting DApps and secure an influential position in the field by providing users with an environment for getting familiar with DApps that use the blockchain technology while offering developers an environment for easily developing DApps. The Group consists of Mobile Factory and two 100% subsidiaries: G1 Dash, Inc., which carries out the broadcasting of “Station Memories!” and "Eki Dash" series, and Bit Factory, Inc. which manages blockchain business.

1-1.Corporate Philosophy

The corporate philosophy is “To make the people of the world happy through the things we create,” with a brand message of “Take your experiences with you.” The phrase “your experiences” here indicates the quality of media and receptiveness of users, and “take” refers to the portability and activeness. The Company runs business based on the following views: as a provider of services, our employees must take initiative and bring new experiences to our users; share moving experiences with each other and polish our sensibilities; and our experiences spread to our stakeholders.

1-2.Business Description

Business contents are the Social Apps Service led by location-based games and the Contents Service that provides contents such as ringtones. While the Social Apps Service offers free-to-play games but charges money for in-game items, the Contents Service charges a monthly flat-rate fee (there are some exceptions). As for the sales composition in the Fiscal Year ended December 2018, social application services made up 75.4% and content services accounted for 24.6%.

Social Apps Service

The Company operates its business with a focus on “Station Memories!” and the "Eki Dash" series, which are location-based games, (the Company terminated the service of Rekishito Connect in September 2018) and distributes games through SNS platforms (GREE, Mobage, and Colopl, etc.) and through application markets (App Store, Google Play, etc.).

The "Eki Dash" series, which was released in March 2011, has 3 elements: a competition element in which the players compete to seize nearby stations, a life-log element in which the locations that the players actually visited are logged, and a collection element in which the players collect seized stations, train lines and titles. “Station Memories!” released in June 2014 still has the fun of capturing and collecting stations from the “Eki Dash” series and also has the enjoyment of raising original characters.

Contents Service

For the Contents Service, the Company mainly offers contents such as stamp images and ringtones through services operated by communication carriers. For ringtones provision, it has “Newest Songs Unlimited Downloads” as own-company model and “RecoChoku Melody” in partnership with RecoChoku Co., Ltd. as OEM model targeting smartphones and feature phones. Users can download unlimited ringtones from 100 yen (excluding tax) to 300 yen (excluding tax) per month. Although the number of fee-paying members is on the decrease, the profitability is still high, because products are, in principle, developed internally and the profit of the remaining players is high.

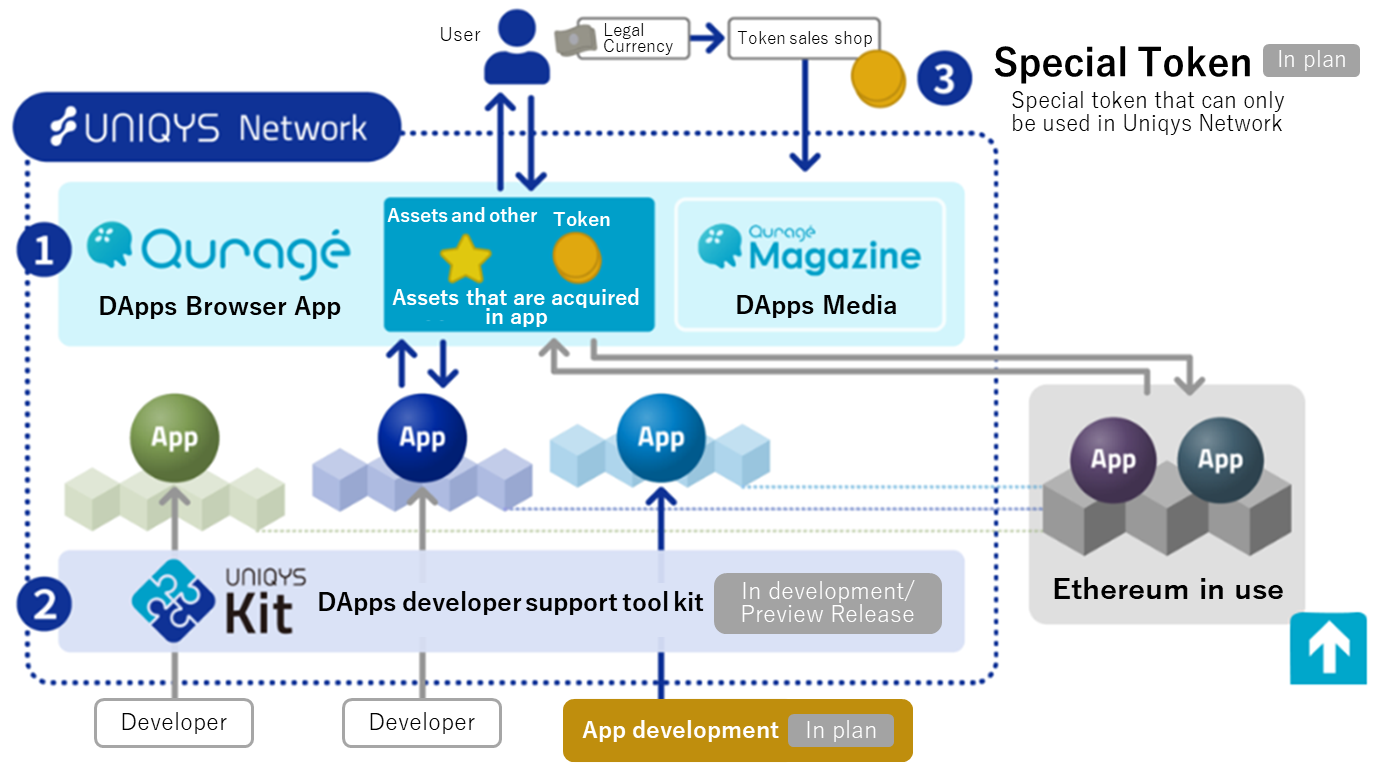

Blockchain Business

Aiming to spread Decentralized Applications (DApps), Mobile Factory, Inc. is promoting “Uniqys Project.” The Company plans to contribute to promoting DApps and secure an influential position in the field by providing users with an environment for getting familiar with DApps that use the blockchain technology while offering developers an environment where they can easily develop DApps. It aims to establish “Uniqys Network” that comprehensively covers “Quragé” that is designed for mobile users to easily play games on DApps (a new-generation mobile browser exclusively for DApps that deals with the blockchain technology) and “Uniqys Kit,” a service for developers that supports development of DApps

.

(source: the company)

2. First Half of the Fiscal Year December 2019 Earnings Results

2-1 First half of Consolidated Business Results

| 1H of FY 12/18 | Ratio to sales | 1H of FY 12/19 | Ratio to sales | YoY | Initial Estimates | Rate compared to estimates |

Sales | 1,369 | 100.0% | 1,663 | 100.0% | +21.5% | 1,558 | +6.7% |

Gross profit | 803 | 58.7% | 921 | 55.4% | +14.7% | - | - |

SG&A expenses | 430 | 31.5% | 377 | 22.7% | -12.4% | - | - |

Operating income | 372 | 27.2% | 543 | 32.7% | +46.0% | 405 | +34.1% |

Ordinary income | 371 | 27.1% | 543 | 32.7% | +46.2% | 405 | +34.0% |

Net income | 256 | 18.7% | 342 | 20.6% | +33.3% | 280 | +22.0% |

*Unit: ¥mn

Both sales and operating income hit a record high for the first half.

Sales were 1,663 million yen, up 21.5% from the same period of the previous year. Although sales by the Contents Service dropped 17.7% year on year to 318 million yen, sales from the DAU (described later) of “Station Memories!” that was released five years ago on COLOPL platform marked an all-time high, contributing to sales from location-based games rising 38.2% year on year to 1,338 million yen.

Operating income soared 46.0% year on year to 543 million yen. Due to the impact of the change of the distributor of Station Memories! (iOS/Android) from an OEM (released under the name of another company) to the Company itself (released under the name of Mobile Factory, Inc.) in April 2018, system usage fees, which are variable costs, were on the rise, which in turn raised cost of goods sold; however, gross profit increased 14.7% year on year. Meanwhile, selling, general and administrative (SG&A) expenses declined 12.4% year on year due to a decrease in advertising expenses achieved through careful examination of effects of promotional activities.

Here, DAU stands for Daily Active Users, which indicates the number of users who used the Company’s services per day. The Company started offering “Station Memories!” in June 2014.

Sales by service

| 1H of FY 12/18 | Ratio to sales | 1H of FY 12/19 | Ratio to sales | YoY |

Location-based game | 968 | 70.7% | 1,338 | 80.5% | +38.2% |

Others | 13 | 1.0% | 6 | 0.4% | -53.4% |

Social Apps Service Total | 981 | 71.7% | 1,344 | 80.8% | +36.9% |

Contents Service | 387 | 28.3% | 318 | 19.2% | -17.7% |

Consolidated sales | 1,369 | 100.0% | 1,663 | 100.0% | +21.5% |

*Unit: ¥mn

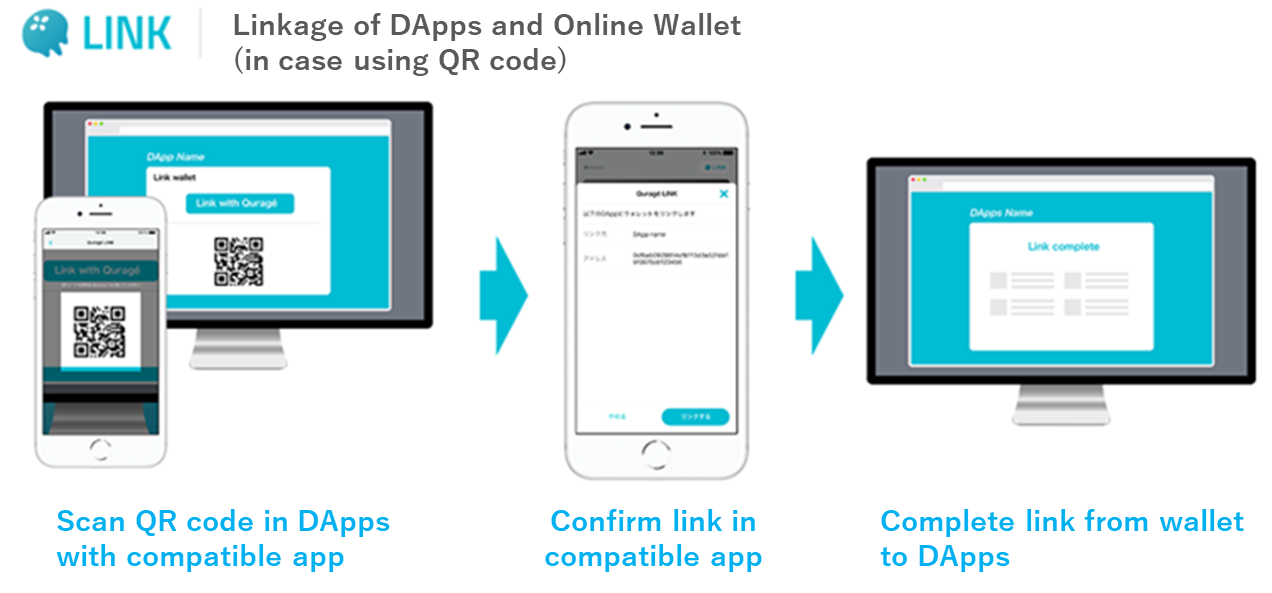

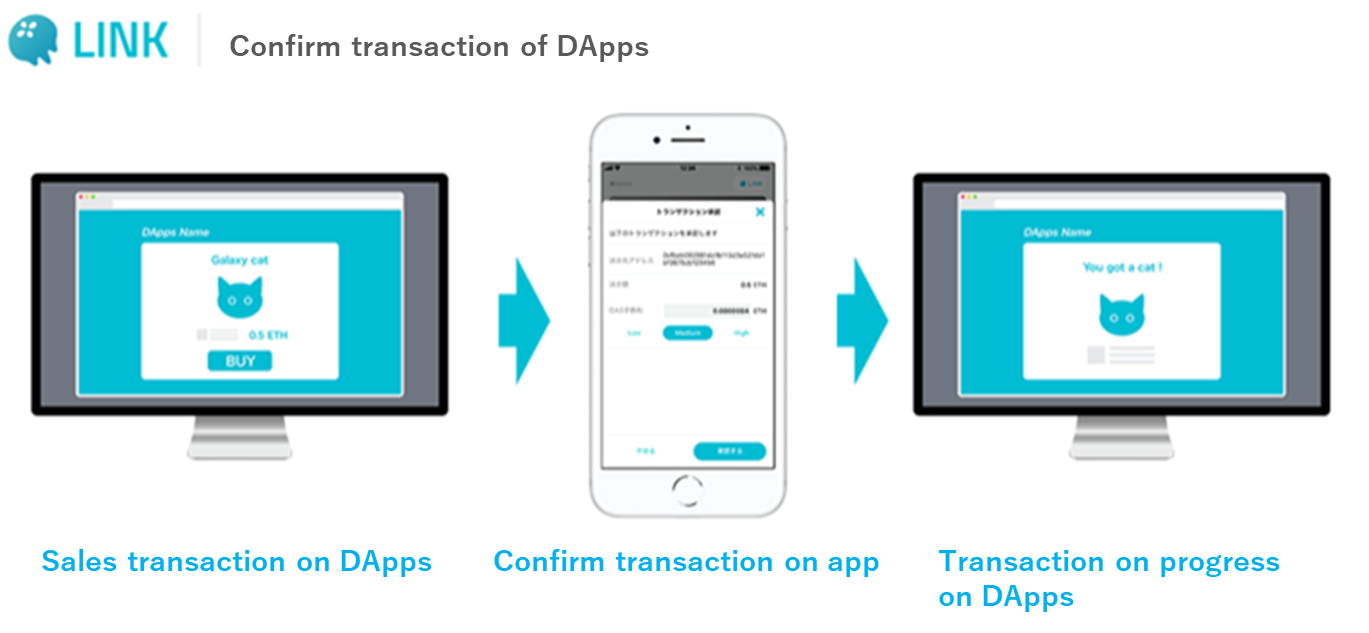

Mobile Factory released “Quragé Link,” a mobile signature management service, in the Blockchain Business.

Users are required to enter a secret key every time they use “DApps” on any generally available browser, such as Google Chrome, Safari, Firefox, and Microsoft Edge, which is troublesome and has raised security-related issues; however, introduction of “Quragé Link” will enable users to use DApps without entering the secret key regardless of which browser a user uses (this solves the issue arising when DApps are used). Mobile Factory, Inc. applied for a patent for “Quragé Link.”

In addition, the Company is developing “Uniqys Kit,” a kit that makes it easier to develop DApps, with the aim of releasing an official version of it by the end of 2019.

(Source: the company)

2-2.Consolidated Business Results for 2Q(April to June)

| December 2018-1Q | 2Q | 3Q | 4Q | December 2019-1Q | 2Q |

Sales | 576 | 793 | 766 | 842 | 761 | 901 |

Gross profit | 375 | 428 | 401 | 460 | 418 | 502 |

SG&A expenses | 239 | 191 | 189 | 194 | 180 | 196 |

Operating income | 135 | 236 | 211 | 265 | 238 | 305 |

Ordinary income | 135 | 236 | 211 | 265 | 238 | 304 |

Net income | 93 | 163 | 146 | 182 | 165 | 176 |

Cost rate | 65.1% | 54.0% | 52.3% | 54.6% | 55.0% | 55.7% |

SG&A expense ratio | 41.5% | 24.2% | 24.7% | 23.1% | 23.7% | 21.8% |

*Unit: ¥mn

Sales and operating income rose 13.7% and 29.2%, respectively, year on year.

Sales and operating income also hit a record high in the second quarter of the current fiscal year on a quarterly basis. Mobile Factory organized events to commemorate the anniversary of “Station Memories!” in the second and fourth quarters, and the event held in the second quarter went down well.

Although system usage fees increased due to a change of the distributor of Stations Memories! (iOS/Android) from an OEM to the Company itself in April 2018, SG&A expenses grew only slightly thanks to decreased advertising costs.

Trend of sales by service

| December 2018-1Q | 2Q | 3Q | 4Q | December 2019-1Q | 2Q |

Location-based games | 362 | 605 | 589 | 667 | 592 | 745 |

Others | 8 | 4 | 4 | 2 | 3 | 2 |

Social Apps Service | 371 | 610 | 593 | 670 | 596 | 748 |

Contents Service | 204 | 182 | 172 | 172 | 164 | 153 |

Consolidated sales | 576 | 793 | 766 | 842 | 761 | 901 |

*Unit: ¥mn

Trend of cost of sales

| December 2018-1Q | 2Q | 3Q | 4Q | December 2019-1Q | 2Q |

System usage fee | 37 | 190 | 185 | 208 | 186 | 232 |

Network server usage fee | 15 | 19 | 22 | 18 | 20 | 19 |

Others | 147 | 154 | 157 | 155 | 134 | 147 |

Total | 200 | 365 | 365 | 382 | 342 | 399 |

*Unit: ¥mn

Trend of SG&A

| December 2018-1Q | 2Q | 3Q | 4Q | December 2019-1Q | 2Q |

Advertisement cost | 139 | 97 | 100 | 92 | 77 | 79 |

Collection agency commission | 15 | 15 | 14 | 14 | 13 | 13 |

Others | 83 | 78 | 74 | 88 | 88 | 103 |

Total SG&A | 239 | 191 | 189 | 195 | 180 | 196 |

*Unit: ¥mn

2-3 Financial Condition and Cash Flow

Financial Condition

| December 2018 | June 2019 |

| December 2018 | June 2019 |

Cash and deposits | 2,142 | 1,923 | Accounts payable | 143 | 205 |

Trade receivables | 361 | 540 | Income and consumption taxes payables | 192 | 250 |

Current assets | 2,547 | 2,500 | Provision for bonuses | 59 | 42 |

Property | 27 | 30 | Liabilities | 424 | 531 |

Intangible asset | 7 | 8 | Net Assets | 2,247 | 2,093 |

Investment and other assets | 88 | 85 | Total Liabilities, Net Assets | 2,671 | 2,624 |

Noncurrent assets | 123 | 123 | Total of interest-bearing liabilities | - | - |

*Unit: ¥mn

Total assets at the end of the first half of the current term stood at 2,624 million yen, down 46 million yen from the end of the previous term. The acquisition of treasury shares reduced cash and deposits, and net assets. Capital-to-asset ratio was 79.7% (which was 84.1% at the end of the previous fiscal year).

Acquisition and retirement of treasury shares

Mobile Factory, Inc. acquired treasury shares over the period from January 28, 2019 to June 3, 2019 (on a trade basis), obtaining 339,200 common shares for 499,893,500 yen. While the Company has cited a total return ratio of 30% as its shareholder return policy, the total return ratio for the Fiscal Year ending December 2019 is estimated to be 86%, which significantly exceeds the target. Furthermore, it will retire 882,305 shares (9.1% of the total number of outstanding shares before the retirement) on July 31, 2019, including the treasury shares that the Company has already possessed.

Cash Flow (CF)

| 1H of FY 12/18 | 1H of FY 12/19 | YoY | |

Operating Cash Flow (A) | 406 | 288 | -117 | -29.0% |

Investing Cash Flow (B) | -3 | -9 | -6 | - |

Free Cash Flow (A+B) | 402 | 278 | -124 | -30.8% |

Financing Cash Flow | -560 | -497 | +62 | - |

Cash and Equivalents at Term End | 1,615 | 1,923 | +307 | +19.0% |

*Unit: ¥mn

Mobile Factory secured an Operating CF of 288 million yen owing to an income before taxes of 543 million yen (371 million yen in the same period of the previous term), a depreciation cost of 6 million yen (8 million yen in the same period of the previous term), increased trade receivables of 179 million yen (which was a deficit of 70 million yen in the same period of the previous term), and tax expenses of 137 million yen in deficit (which was a deficit of 84 million yen in the same period of the previous term). Financing CF remained in deficit because the Company acquired treasury shares.

2-4.Business Summary

“Station Memories!” celebrated the fifth anniversary of the release (it has been five years since the game was released on COLOPL), and Mobile Factory, Inc. opened a Station Memories! 5th Birthday Café in the Harajuku district for a limited time only as an event commemorating the anniversary. In addition, it placed transportation advertisements of “Station Memories!” at all of the stations on the Yamanote Line. The Company is also organizing a collaborative campaign, “Onsen Musume x Station Memories!,” and a collaborative event, “Frame Arms Girl x Station Memories!”

(Source: from the company)

Special Café commemorating the fifth anniversary of the release of “Station Memories!

(Source from the company)

The Company opened “Station Memories! Café,” that goes down well every year, at AREA-Q ANNEX in Harajuku this year as well (for the third consecutive year) for a limited time only (from June 19, 2019 to July 7, 2019). A chronological table of the on-site events that the Company had hosted in the past, the train name plates that had been used in the on-site events, and rare autographs of related illustrators were exhibited, collaborative menus were offered, and originally designed goods were sold, all of which led the events to success. Fans proactively communicated with each other by talking about their memories and exchanging goods while enjoying the exhibits that could be seen only at “Station Memories! Café.”

Posters of Station Memories! at all 29 stations on the JR Yamanote Line

(Source from the company)

Honoring the fifth anniversary of the release of “Station Memories!,” Mobile Factory put up posters of Station Memories! at all 29 stations on the JR Yamanote Line for a week starting on June 17, 2019. The design of the posters represented the “distinctive characteristics” of each station, such as memories associated with “Station Memories!,” and features and bits of knowledge of the stations. Furthermore, “people talked about the posters a lot on such social media as Twitter” (according to Operating Officer Sato).

Not only fans of “Station Memories!,” but also those who were not familiar with “Station Memories!” enjoyed the event.

Onsen Musume ×Station Memories!

(Source from the company)

Mobile Factory has been hosting the collaborative event with “Onsen Musume” (Starting on May 24, 2019 to May 24, 2020). The Company offers some programs such as the project in which participants collect a series of digital stamps at stations which include “Onsen (hot spring)” in the station name all over Japan. Furthermore, it also organized the event where visitors of specific stations who register their location get special Denko by collaborating of “Onsen Musume” and “Denko” in the game of “Station Memories! ”. Some users actually traveled all targeting stations and posted pictures of them. The collaborative events triggered fans of “Station Memories!” to enjoy hot spring tour all over Japan.

Frame Arms Girl x Station Memories!

(Source from the company)

Mobile Factory has been hosting a collaborative event of “Frame Arms Girl Movie: Kyakkya Ufufu na Wonderland,” an animation film that has its origin in a plastic model developed by Kotobukiya Co., LTD., and “Station Memories!” (starting at 3:00 p.m. on June 29, 2019, and ending at 3:00 p.m. on August 31, 2019). In the game “Station Memories!”, the Company offers a program in which participants collect a series of digital stamps at the theaters where the movie is screened and a special gacha event, through which players may be able to get any of the characters of “Frame Arms Girl” appearing as Denko during the event.

3. Fiscal Year December 2019 Earnings Forecast

3-1.Consolidated Business Forecast

| FY 12/18 Actual | Ratio to sales | FY 12/19 Est. | Ratio to sales | YoY |

Sales | 2,978 | 100.0% | 3,137 | 100.0% | +5.3% |

Operating income | 849 | 28.5% | 900 | 28.7% | +6.0% |

Ordinary income | 848 | 28.5% | 899 | 28.7% | +6.0% |

Net income | 585 | 19.6% | 588 | 18.7% | +0.6% |

Sales and operating income are expected to grow 5.3% and 6.0%, respectively, year on year.

Mobile Factory, Inc. expects that “Station Memories!” will grow on a steady and continuous basis in the second half of the current term, with sales forecasted to rise 5.3% year on year to 3,137 million yen. Regarding profits, it is projected that operating income will stand at 900 million yen, up 6.0% year on year, through increasing sales and effective use of promotional expenses based on continuous detailed examination.

3-2.Future Vision

“Number-one company of location-based games made in Japan”

As a “number-one company of location-based games made in Japan,” Mobile Factory, Inc. will work on strengthening its foundation for stable operation of services and continue hosting myriad collaborative campaigns and events. Five years have passed since “Station Memories!” was released, and the Company continuously plans to enhance the system base for stable operation of the game starting in the second half of this term with an eye toward operating the game in the longer term. It will propel forward this plan in parallel with an effort to raise its appealing power to users through collaborative campaigns and events.

Blockchain Business

Following a mobile signature management tool, “Quragé Link,” Mobile Factory, Inc. is scheduled to release an official version of a tool for supporting development of DApps, “Uniqys Kit,” by the end of this fiscal year. The Company plans to propel forward the Blockchain Business while discussing with Japan’s regulatory authority with its responsibility as a listed company kept in mind. This means that the Company will have to be careful in not a few cases, but Mobile Factory will strive to commercialize its related services as early as possible with the aim of becoming a leading company of the service supporting DApps.

(Source from the company)

Mobile Factory would like to realize medium- and long-term business growth based on its three revenue pillars, which are location-based games, the Blockchain Business that is a service supporting DApps, and mobile contents.

4. Conclusions

Mobile Factory said that sales from “Station Memories!” were more than expected in the first half of the current term thanks to the effects of advertising. Conducting rigorous examination while making the most of its service characteristic that is the high user retention rate, the Company appears to be strictly managing advertisement placement, including advertising media and ways to make them appealing enough to reach each target customer, by clearly identifying targets, such as new users and repeat users.

Meanwhile, the Company has made conservative full-year earnings forecasts. It says that “Station Memories!” is a game that strongly tends to serve as a life log service, and there is no wonder that some people continue using it for the next ten years. Therefore, it will not just focus on growth of the DAU, but make timely and proper investments with the long-term service operation in mind. The access disturbance that occurred this June may force the Company to make upfront investment in the second half of this term, and this is the reason why the Company’s full-year forecasts are conservative.

As for the Blockchain Business, some firms attach weight to speediness and go through gray areas; however, Mobile Factory, Inc. will forge ahead with the business carefully but swiftly under discussion with the regulatory authorities. This does not mean that Mobile Factory is behind schedule because it endeavors to be cautious. The Company is actually striving to release “Uniqys Kit” by the end of the current fiscal year as planned. “Quragé Link” that was released in the first half has brought advantages for both users and developers of DApps because it is a unique item that lowers the bar for spreading DApps.

It was confirmed that not only the existing businesses but also the new business grew steadily based on the financial statements for the first half of the current fiscal year. The life cycle of “Station Memories!,” which is the revenue pillar, seems to be different from the cycle of other games because of its feature as a life log service. In addition, sales were on the gradual decline, but the Contents Service made no small contributions to earnings, meaning that the revenue base has been made sound for developing the new Blockchain Business. We would like to keep an eye on the progress that Mobile Factory, Inc. will make.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 4 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎ Corporate Governance Report

Updated on March 29, 2019

The Group companies recognize that establishing the corporate ethics based on legal compliance is the highest priority in order to respond to trust and expectations from the customers, shareholders and entire society and maximize the corporate value. To achieve it, the Company will strengthen risk management and supervision functions and elevate soundness and transparency of the management to contribute to development of the economic society.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 4-1-②】

Our mobile content industry is seeing rapid technological innovations, the evolution of services, etc. In this business environment, the announcement of a mid/long-term plan could degrade the flexibility to respond to environmental changes, and hinder the growth of our company. Therefore, we have not announced a mid/long-term business plan.

【Supplementary Principle 4-1-③】

At the present time, with the age of CEO Yuji Miyajima and other related factors taken into account, our company does not specifically formulate plans or hold discussion regarding a successor to the senior management, including CEO, as a dire issue at the Board of Directors; however, we have considered development of officers and workers in administrative positions who support the senior management to be essential for realizing sustainable business growth and medium- and long-term improvement of corporate value. Thus, we are providing educational and training programs for our mid-level employees with the aim of developing and selecting candidates for the next management who will assume the responsibility as a leading force for our company’s sustainable organizational growth and prosperity.

【Supplementary Principle 4-10-①】

In our company, independent outside directors account for 50% of directors, so that we can receive their appropriate involvement and advice when discussing important matters, but we have no plans to establish an advisory committee. We will discuss this issue in the near future.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】

The Company may hold shares of other listed companies as strategic shareholdings, if it determines that they will contribute to maintaining or improving their corporate value such as strengthening partnerships. At this point, the Company does not hold any shares of other listed companies.

【Principle 1-7】

The Company examines if the transactions are rational or not, before it engages in transaction with related parties. Furthermore, with a focus on the appropriateness of the transaction conditions compared with the other transactions, the Company makes it a requirement to obtain an approval for the transaction at a Board of Directors meeting.

【Principle 5-1】

Our company has a system for proactively communicating with institutional and personal investors, in order to achieve sustainable growth and improve mid/long-term corporate value.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Report on LIKE Co., Ltd (2462) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/