Bridge Report:(3912)Mobile Factory the fiscal year December 2019

Yuji Miyajima , President | Mobile Factory, Inc. (3912) |

|

Company Overview

Exchange | TSE 1st Section |

Industry | Information, Communication |

President | Yuji Miyajima |

HQ Address | 1-24-2 Higashi-gotanda, Shinagawa-ku, Tokyo |

Year-end | December |

Homepage |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE (Actual) | Trading Unit | |

¥1,670 | 8,832,295 shares | ¥14,749 million | 32.4% | 100 shares | |

DPS (Est.) | Dividend yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

- | - | ¥78.44~101.81 | 16.4~21.3x | ¥286.20 | 5.8x |

*The share price is the closing price on February 3.

Consolidated Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

December 2016 (Actual) | 2,072 | 611 | 611 | 411 | 43.64 | 27.00 |

December 2017 (Actual) | 2,437 | 736 | 722 | 511 | 54.18 | 17.00 |

December 2018 (Actual) | 2,978 | 849 | 848 | 585 | 63.37 | - |

December 2019 (Actual) | 3,109 | 1,109 | 1,109 | 773 | 86.53 | - |

December 2020 (Forecast) | 3,295~ 3,546 | 1,004~ 1,303 | 1,002~ 1,300 | 692~ 899 | 78.44~ 101.81 | - |

* The forecasted values were provided by the company.

*In July 2017, it implemented a 2-to-1 stock split. EPS in FY ended December 2016 are retroactively adjusted.

*Unit: million yen, yen

This report outlines Mobile Factory’s financial results for the fiscal year ended December 2019 and its earnings forecasts for the fiscal year ending December 2020.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended December 2019 Earnings Results

3. Fiscal Year ending December 2020 Earnings Forecast

4. Conclusions

<Reference: Regarding Corporate Governance>

Key points

- In the Fiscal Year ended December 2019, sales and operating income increased 7.1% and 30.7%, respectively, year on year, and both marked a record high. While the sales of the Contents Service declined, the sales of the Social Apps Service, mainly the location-based game “Station Memories!,” rose 15.2% year on year. Operating margin improved as selling, general and administrative expenses, mainly advertising expenses, dropped. The Company will acquire treasury shares up to a ceiling of 1 million shares worth 1.2 billion yen as returns to shareholders (between Feb 3, 2020 and June 30, 2020).

- In the Fiscal Year ending December 2020, sales are expected to be between 3,295 million yen and 3,546 million yen (up between 3.3% and 11.2% year on year), and operating income is expected to be between 1,004 million and 1,303 million yen (between down 9.5% and up 17.4% year on year). The Company plans to release a new location-based game involving tokens (using the blockchain technology) and “Uniqys Token Marketplace (described later)” by this summer. As the performance of the new game is difficult to forecast, earnings are estimated in ranges.

- In the past two years, the Company used its management resources mainly for blockchain-related development, but these efforts were not sufficiently evaluated as the progress was hard to grasp and other reasons. However, it plans to release a new game using the blockchain technology in the current term. We believe that the evaluation on the Company will change completely if the new game successfully contributes to earnings and the performance of “Uniqys Token Marketplace,” which is cross-linked to the game, performs well. We would like to pay attention to how the Company is able to make users aware of how interesting the token based on the blockchain technology is through the new game.

1. Company Overview

The Company’s two main pillars are the Social Apps Service led by location-based games and the Contents Service that provides contents such as ringtones. “A shift to decentralized economy through the blockchain technology is highly likely to bring about a considerable change in the social infrastructure, with the entertainment industry being no exception. This is a promising business field.” Based on this idea, in 2018, Mobile Factory, Inc. initiated a project, “Uniqys Project,” which aims to spread Decentralized Applications (DApps) that utilize the blockchain technology for which expectations are growing as the next-generation Internet. By providing users with an environment for getting familiar with DApps that uses the blockchain technology while offering developers an environment for easily developing DApps, the Company aims to secure an influential position in the field as a leader in the token economy.

The Group consists of Mobile Factory and two 100% subsidiaries: G1 Dash, Inc., which carries out the broadcasting of “Station Memories!” and "Eki Dash" series, and Bit Factory, Inc. which manages blockchain business.

1-1.Corporate Philosophy

The corporate philosophy is “To make the people of the world happy through the things we create,” with a brand message of “Take your experiences with you.” The phrase “your experiences” here indicates the quality of media and receptiveness of users, and “take” refers to the portability and activeness. The Company runs business based on the following views: as a provider of services, our employees must take initiative and bring new experiences to our users; share moving experiences with each other and polish our sensibilities; and our experiences spread to our stakeholders.

1-2.Business Description

Business contents are the Social Apps Service led by location-based games and the Contents Service that provides contents such as ringtones. While the Social Apps Service offers free-to-play games but charges money for in-game items, the Contents Service charges a monthly flat-rate fee (there are some exceptions). As for the sales composition in the Fiscal Year ended December 2019, social application services made up 81.1% and content services accounted for 18.9%.

Social Apps Service

The Company operates its business with a focus on “Station Memories!” and the "Eki Dash" series, which are location-based games, (the Company terminated the service of Rekishito Connect in September 2018) and distributes games through SNS platforms (GREE, Mobage, and Colopl, etc.) and through application markets (App Store, Google Play, etc.).

The "Eki Dash" series, which was released in March 2011, has 3 elements: a competition element in which the players compete to seize nearby stations, a life-log element in which the locations that the players actually visited are logged, and a collection element in which the players collect seized stations, train lines and titles. “Station Memories!” released in June 2014 still has the fun of capturing and collecting stations from the “Eki Dash” series and also has the enjoyment of raising original characters.

Contents Service

For the Contents Service, the Company mainly offers contents such as stamp images and ringtones through services operated by communication carriers. For ringtones provision, it has “Newest Songs Unlimited Downloads” as own-company model and “RecoChoku Melody” in partnership with RecoChoku Co., Ltd. as OEM model targeting smartphones and feature phones. Users can download unlimited ringtones from 100 yen (excluding tax) to 300 yen (excluding tax) per month. Although the number of fee-paying members is on the decrease, the profitability is still high, because products are, in principle, developed internally and the profit of the remaining players is high.

1-3 Blockchain Business (service under development)

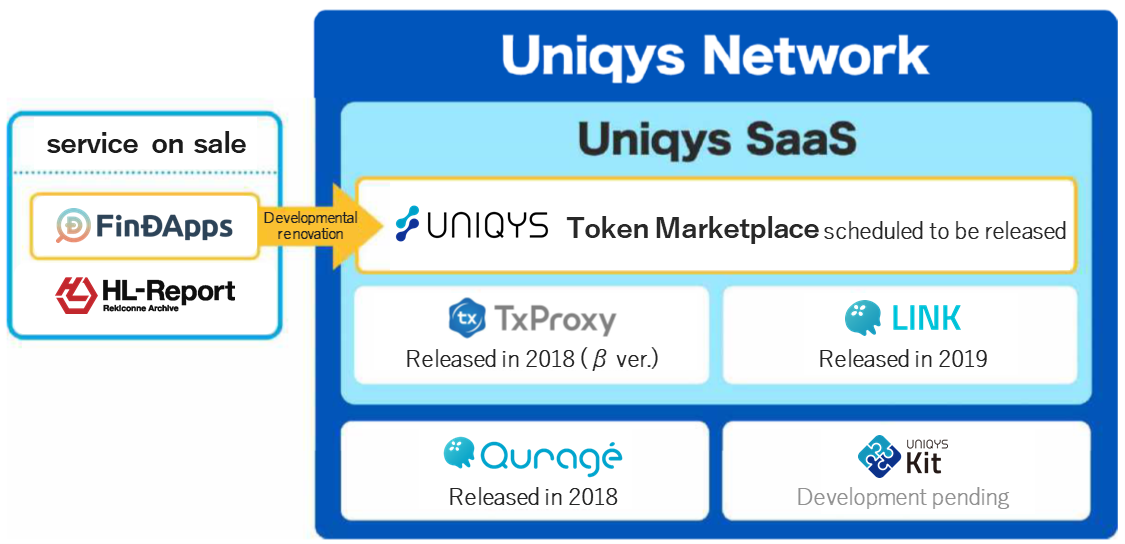

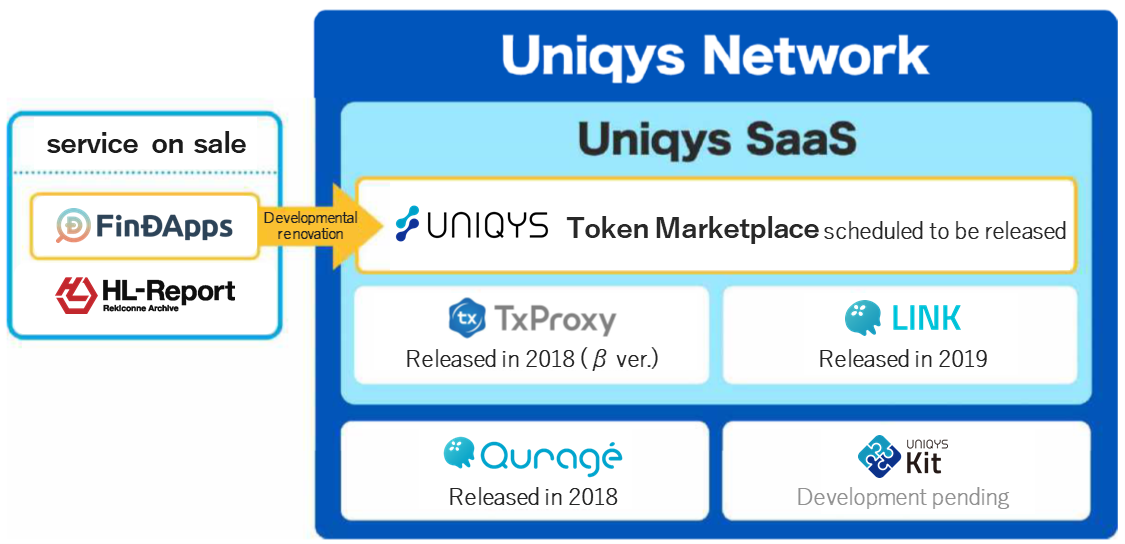

The Company is promoting “Uniqys Project” in order to become a leader in the token economy, which is expected to expand markets in medium-to-long term. It has already started offering some services of Uniqys Network, a general term for all the provided services that comprehensively cover “Quragé,” a mobile browser exclusively for DApps that is compatible with Uniqys SaaS and the blockchain technology, and “Uniqys Kit,” a service supporting the development of DApps. Some of those services are being provided as beta version.

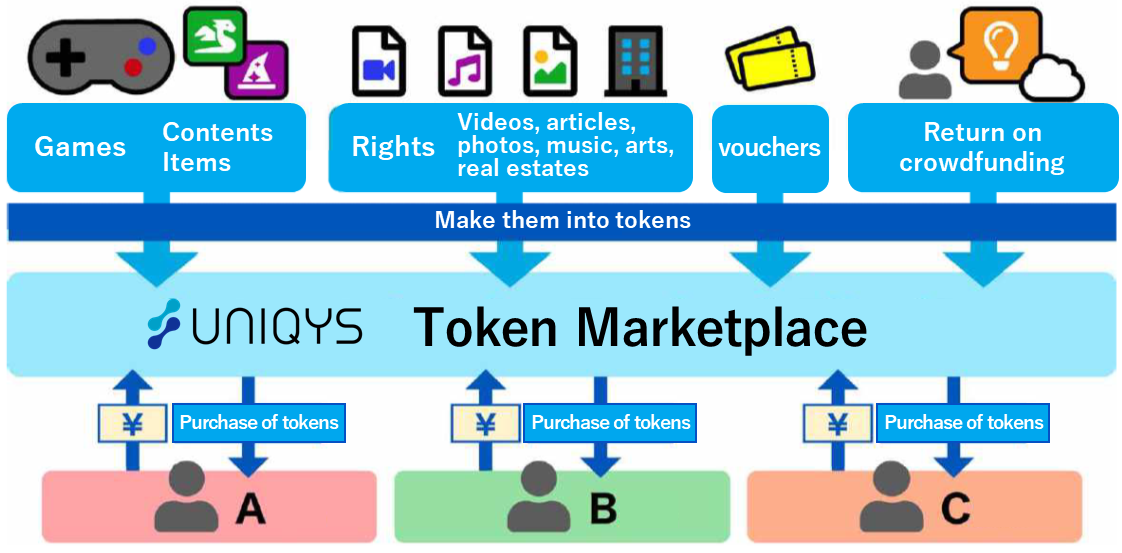

In Uniqys SaaS, there are “Uniqys Token Marketplace,” “Uniqys Transaction Proxy (TxProxy),” which allows the usage of DApps even without virtual currency, and “Quragé Link,” a mobile signature management service (which allows the use of DApps without depending on a certain browser), and the Company plans to introduce monthly charges, etc. for them. In “Uniqys Token Marketplace,” for example, some items or characters from the game can be converted into tokens, which will then be sold to users. The Company will start with converting game items, etc. into tokens, and gradually start converting rights in the fields unrelated to games, such as videos, articles, photographs, songs, and art works into tokens and sell them in the medium-to-long term.

Incidentally, a token is an electronic voucher issued using the blockchain technology as a proof of ownership. By using a token, one’s ownership is given to digital data. Digital data include, for example, items and characters from games, etc., and whoever buys or obtains such items or characters with ownership can trade them online, even outside the game.

(Source from the company)

2. Fiscal Year ended December 2019 Earnings Results

2-1 Consolidated Business Results

| FY 12/18 | Ratio to sales | FY 12/19 | Ratio to sales | YoY | Initial Estimates | Compared to estimates |

Sales | 2,978 | 100.0% | 3,190 | 100.0% | +7.1% | 3,137 | +1.7% |

Gross profit | 1,664 | 55.9% | 1,742 | 54.6% | +4.7% | - | - |

SG&A expenses | 815 | 27.4% | 633 | 19.8% | -22.4% | - | - |

Operating income | 849 | 28.5% | 1,109 | 34.8% | +30.7% | 900 | +23.2% |

Ordinary income | 848 | 28.5% | 1,109 | 34.8% | +30.7% | 899 | +23.4% |

Net income | 585 | 19.6% | 773 | 24.2% | +32.2% | 588 | +31.5% |

*Unit: million yen

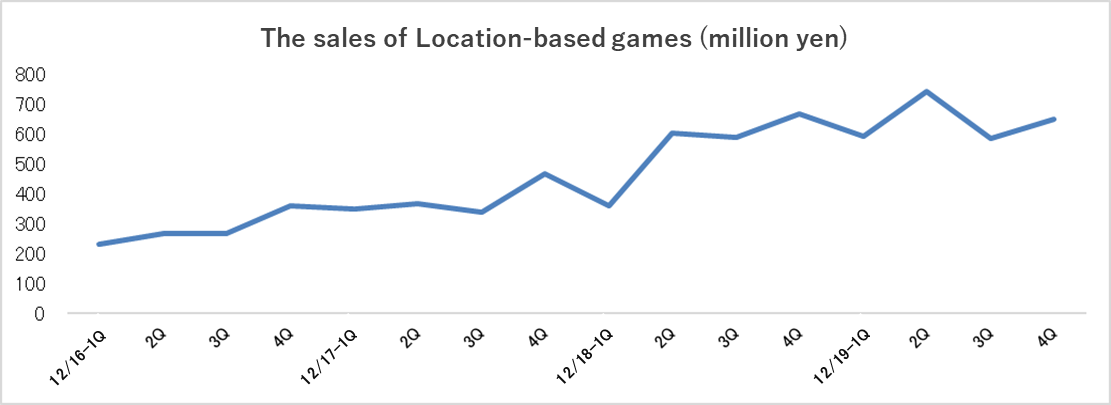

Sales and operating income increased 7.1% and 30.7%, respectively, year on year.

Sales were 3,190 million yen, up 7.1% year on year. The sales of the Social Apps Service, mainly the location-based game “Station Memories!,” rose 15.2% year on year. The drop in sales of the Contents Service by 17.7% year on year was within the expected range.

Operating income was 1,109 million yen, up 30.7% year on year. The cost of goods sold augmented due to the increase in system usage fees and development costs of Uniqys Token Marketplace and a new game, etc., which caused gross profit to grow by only 4.7% year on year. However, operating margin improved as selling, general and administrative expenses declined 22.4% year on year due to a decrease in advertising expenses.

The Company revised the earnings estimate for the full fiscal year upward at the time of announcement of financial statements of the third quarter, and both sales and profit exceeded the revised estimates. The revised estimates stated 3,169 million yen for sales, 1,070 million yen for operating income, 1,069 million yen for ordinary income, and 686 million yen for net income.

Trend of sales by service

| FY 12/18 | Ratio to sales | FY 12/19 | Ratio to sales | YoY |

Location-based games | 2,225 | 74.7% | 2,578 | 80.8% | +15.8% |

Others | 20 | 0.7% | 9 | 0.3% | -53.9% |

Social Apps Service | 2,246 | 75.4% | 2,587 | 81.1% | +15.2% |

Contents Service | 732 | 24.6% | 602 | 18.9% | -17.7% |

Consolidated sales | 2,978 | 100.0% | 3,190 | 100.0% | +7.1% |

*Unit: million yen

In the Social Apps Service, the Company held an event for commemorating the 5th anniversary of “Station Memories!” (June 2019), carried out the 5th anniversary campaign for the application version (November 2019), a collaborative campaign with Izu Express (Shizuoka Prefecture), etc., while contributing to the society through regional revitalization and activation by holding events together with the local governments, etc., such as “Eki Dash.” As a result, the Company organized 11 events in total in the term ended December 2019, in which around 360,000 people participated (which is estimated to have had an economic impact of around 1.5 billion yen.)

In the Contents Service, on the other hand, the number of paid subscribers to ringtone services operated by the Company saw a gradual decrease, but within the expected range. Profitability was maintained by reducing resources.

Shareholder return

The Company will acquire treasury shares up to a ceiling of 1 million shares (accounting for 11.3% of the total number of outstanding shares excluding treasury shares) worth 1.2 billion yen, between Feb 3, 2020 and June 30, 2020. The shares will be acquired through ToSTNeT-3 (Off-auction Own Share Repurchase) and market buying at Tokyo Stock Exchange.

2-2 Consolidated Business Results for 4Q(October to December)

| 12/18-1Q | 2Q | 3Q | 4Q | 12/19-1Q | 2Q | 3Q | 4Q | YoY | Compared to 3Q |

Sales | 576 | 793 | 766 | 842 | 761 | 901 | 735 | 791 | -6.1% | +7.6% |

Gross profit | 375 | 428 | 401 | 460 | 418 | 502 | 389 | 432 | -5.9% | +11.2% |

SG&A expenses | 239 | 191 | 189 | 194 | 180 | 196 | 114 | 140 | -27.7% | +22.6% |

Operating income | 135 | 236 | 211 | 265 | 238 | 305 | 274 | 291 | +10.0% | +6.4% |

Ordinary income | 135 | 236 | 211 | 265 | 238 | 304 | 274 | 291 | +10.0% | +6.4% |

Net income | 93 | 163 | 146 | 182 | 165 | 176 | 170 | 260 | +43.2% | +53.0% |

Gross profit margin | 65.1% | 54.0% | 52.3% | 54.6% | 55.0% | 55.7% | 52.9% | 54.7% | - | - |

SG&A expense ratio | 41.5% | 24.2% | 24.7% | 23.1% | 23.7% | 21.8% | 15.6% | 17.8% | - | - |

*Unit: ¥million yen

Sales and operating income increased 7.6% and 6.4%, respectively, from the previous quarter as a result of organizing a campaign for commemorating the 5th anniversary of “Station Memories!” app, etc. and year-end events.

Sales decreased 6.1% year on year, while operating income increased 10.0%. In addition to the sales drop of the Contents Service, the sales of the Social Apps Service declined slightly as advertising expenses were curtailed. However, as for profit, operating income grew as selling, general and administrative expenses were reduced by controlling advertising expenses strategically from the third quarter. Advertising expenses were curbed as a result of temporarily prioritizing foundation reinforcement (revision of systems and the operational structure) over increasing of DAU for a short-term gain, in view of operating services in the medium-to-long term.

In comparison to the previous quarter, sales and operating income grew 7.6% and 6.4%, respectively. The organization of the campaign for commemorating the 5th anniversary of the “Station Memories!” app, collaborative campaigns, etc. facilitated the rise in sales of the Social Apps Service, which made up for the drop in sales of the Contents Service. As for profit, increases in system usage fees, which are variable costs, advertising expenses, etc. were absorbed by the increased sales. With the progress in foundation reinforcement, the Company is gradually getting ready to raise advertising expenses.

Trend of sales by service

| 12/18-1Q | 2Q | 3Q | 4Q | 12/19-1Q | 2Q | 3Q | 4Q | YoY | Compared to 3Q |

Location-based games | 362 | 605 | 589 | 667 | 592 | 745 | 587 | 652 | -2.3% | +11.1% |

Others | 8 | 4 | 4 | 2 | 3 | 2 | 2 | 1 | -58.4% | -44.1% |

Social Apps Service | 371 | 610 | 593 | 670 | 596 | 748 | 589 | 653 | -2.5% | +10.9% |

Contents Service | 204 | 182 | 172 | 172 | 164 | 153 | 146 | 137 | -20.0% | -5.7% |

Consolidated sales | 576 | 793 | 766 | 842 | 761 | 901 | 735 | 791 | -6.1% | +7.6% |

*Unit: million yen

Trend of cost of sales

| 12/18-1Q | 2Q | 3Q | 4Q | 12/19-1Q | 2Q | 3Q | 4Q |

System usage fee | 37 | 190 | 185 | 208 | 186 | 232 | 194 | 205 |

Network server usage fee | 15 | 19 | 22 | 18 | 20 | 19 | 21 | 19 |

Others | 147 | 154 | 157 | 155 | 134 | 147 | 131 | 133 |

Total | 200 | 365 | 365 | 382 | 342 | 399 | 346 | 358 |

*Unit: million yen

Trend of SG&A

| 12/18-1Q | 2Q | 3Q | 4Q | 12/19-1Q | 2Q | 3Q | 4Q |

Advertisement cost | 139 | 97 | 100 | 92 | 77 | 79 | 18 | 33 |

Collection agency commission | 15 | 15 | 14 | 14 | 13 | 13 | 12 | 12 |

Others | 83 | 78 | 74 | 88 | 88 | 103 | 83 | 94 |

Total SG&A | 239 | 191 | 189 | 194 | 180 | 196 | 114 | 140 |

*Unit: million yen

2-3 Financial Condition and Cash Flow

Financial Condition

| December 2018 | December 2019 |

| December 2018 | December 2019 |

Cash and deposits | 2,142 | 2,478 | Accounts payable | 192 | 316 |

Trade receivables | 2,547 | 2,921 | Income and consumption taxes payables | 59 | 69 |

Current assets | 27 | 23 | Provision for bonuses | - | - |

Property | 7 | 59 | Liabilities | 424 | 613 |

Intangible asset | 88 | 136 | Net Assets | 2,247 | 2,528 |

Investment and other assets | 123 | 220 | Total Liabilities, Net Assets | 2,671 | 3,141 |

*Unit: million yen

Total assets at the end of the term stood at 3,141 million yen, up 469 million yen from the end of the previous term. The acquisition of free CF, etc. of 830 million yen increased cash and deposits on the debit side, while net assets grew as a result of the healthy performance on the credit side. Capital-to-asset ratio was 80.5% (84.1% at the end of the previous term).

Cash Flow (CF)

| FY 12/18 | FY 12/19 | YoY | |

Operating Cash Flow (A) | 940 | 924 | -15 | -1.7% |

Investing Cash Flow (B) | -11 | -94 | -82 | - |

Free Cash Flow (A+B) | 928 | 830 | -97 | -10.6% |

Financing Cash Flow | -559 | -494 | +64 | - |

Cash and Equivalents at Term End | 2,142 | 2,478 | +336 | +15.7% |

*Unit: million yen

Thanks to pretax profit of 1,109 million yen (848 million yen in the previous term) and payment of corporate tax, etc. of 251 million yen (175 million yen in the previous term), an operating CF of 924 million yen was secured. Investing CF was influenced by the acquisition of intangible asset, etc. and financing CF was affected by the acquisition of treasury shares.

Reference: the changes of ROE

| FY 12/15 | FY 12/16 | FY 12/17 | FY 12/18 | FY 12/19 |

ROE (%) | 15.61 | 24.92 | 25.19 | 26.17 | 32.39 |

Net income margin (%) | 10.58 | 19.86 | 20.97 | 19.64 | 24.24 |

Total asset turnover (times) | 1.18 | 1.03 | 1.02 | 1.14 | 1.01 |

Leverage (times) | 1.26 | 1.22 | 1.18 | 1.17 | 1.32 |

* ROE = Net income margin × Total asset turnover × Leverage

* Average balance of total assets and owned capital during the term was used for calculation.

3. Fiscal Year ending December 2020 Earnings Forecast

3-1 Consolidated Business Forecast

| FY 12/19 Act. | Ratio to sales | FY 12/20 Est. | Ratio to sales | YoY |

Sales | 3,190 | 100.0% | 3,295~3,546 | 100.0% | +3.3~+11.2% |

Operating income | 1,109 | 34.8% | 1,004~1,303 | 30.5~36.7% | -9.5~+17.4% |

Ordinary income | 1,109 | 34.8% | 1,002~1,300 | 30.4~36.7% | -9.7~+17.2% |

Net income | 773 | 24.2% | 692~899 | 21.0~25.4% | -10.4~+16.3% |

*Unit: million yen

The Company plans to release a new game involving tokens, and earnings are estimated in ranges

The Company will continue to take efforts in expanding sales of location-based games, mainly “Station Memories!,” through the organization of collaborative events with other IP and events with each local government. It also plans to release a new location-based game involving tokens and “Uniqys Token Marketplace (described later)” by this summer. As advertising expenses will rise with the release of the new location-based game, selling, general and administrative expenses are expected to increase from the third quarter onward (the conventional standard will be applied to advertising expenses, which had been curtailed recently).

The upper limit of the earnings forecast is based on the healthy growth of “Station Memories!” and satisfactory start of the new game, and the lower limit is set assuming that sales of “Station Memories!” declines and the new game performs poorly while the Company increases advertising expenses from the third quarter onward.

Development of a new service using the blockchain technology

Mobile Factory’s Blockchain Business is based on offering services on Ethereum, but as Ethereum will be updated from 1.0 to 2.0 in 2020, the Company decided to stop the development of related services and wait for the update to be completed in order to confirm the compatibility with the new version. The Company did not develop any new game for around two years and used resources for blockchain-related development instead. However, since the update created waiting time, the Company used this opportunity to use the resources for Token Marketplace and the location-based game in place of blockchain-related development.

It seems that the development of the location-based game aims to maintain the system for dividing risks by releasing a new title.

3-2 Future Direction

In the short term, the Company aims to achieve stable growth of the existing services, provide new experiences to users, and make its products “No.1 location-based games” made in Japan by releasing a new game involving tokens. In addition, it will release “Uniqys Token Marketplace” and expand the number of the Uniqys token market users.

In the medium-to-long term, the Company aims to increase the number of users of DApps and monetize DApps-related services, and strives to become a leader supporting the token economy by growing the number of users of Uniqys SaaS. Furthermore, it will make efforts in maintaining stable growth of location-based games and the Contents Service by maintaining and improving the operational structure in view of long-term operation and continuously offering new experiences to users.

Establishment of a token economy by packaging Uniqys SaaS and monetization of related services

The direction of “Uniqys Project” aimed at popularizing DApps (Decentralized Applications), which are expected to become the mainstream in long-term, remains unchanged, but the Company revised the roadmap in consideration of the scheduled update of Ethereum to version 2.0 in 2020. Specifically, the Company released the beta version in the term ended December 2018 in preparation of releasing the official version of “Uniqys Kit,” a tool for developers to support the development of DApps, but it temporarily suspended the release of the official version and prioritized the development of “Uniqys Token Marketplace,” a platform to create and sell “tokens,” an electronic voucher issued using the blockchain technology as a proof of ownership, and made efforts for its release in a short period of time instead.

The Company plans to offer the web service “Uniqys Token Marketplace” as Uniqys SaaS based on monthly subscription from now on, along with “Uniqys Transaction Proxy (TxProxy),” which allows usage of DApps even without virtual currency, and “Quragé Link,” a mobile signature management service (which allows usage of DApps without depending on a certain browser), for which the development already started in the term ended December 2019.

As explained earlier, the Company is scheduled to release a new game involving tokens and also “Uniqys Token Marketplace” by the summer of the term ending December 2020. By providing Uniqys SaaS, it aims for early acquisition of a larger number of stakeholders.

(Source from the company)

* “Uniqys Token Marketplace” is the developmentally-refurbished version of the service “FinDApps,” which allows users to search for DApps. It comprehensively covers the existing services “FinDApps” and “HL-Report.” The performance of “FinDApps” was sluggish as it was popularized late due to the inadequate number of DApps. Also, “HL-Report” is a service which allows users to view their character and costumes from Rekishito Connect (a game for which the service has ended) on Ethereum.

* “Quragé” is a mobile browser exclusively for DApps compatible with the blockchain technology, and “Uniqys Kit” is a tool for developers for supporting development of DApps.

“Uniqys Token Marketplace”

(Source from the company)

In “Uniqys Token Marketplace,” for example, some items or characters from the game are converted into tokens, which will then be sold to users. The Company will start with converting game items into tokens, and gradually start converting various rights in the fields unrelated to game, such as videos, articles, photographs, songs, and art works, etc. into tokens and sell them in the medium-to-long term (the Company is also thinking about converting returns of cloud funding into tokens and selling them). The Company aims to establish a position as the de facto standard for creation and sale of tokens.

Definition of Tokens

According to the Company’s materials, a token is an electronic voucher issued using the blockchain technology as a proof of ownership. It is officially termed as “Non-Fungible token (NFT),” and can be treated as assets. The Company calls “Non-Fungible token” as simply “token” to facilitate easier understanding.

A token is the largest characteristic of the blockchain technology and the Company anticipates that “it will bring the greatest breakthrough to the Internet world.” Everything on the Internet is subject to being copied, which is the advantage as well as the disadvantage of the online world, but tokens will allow one to give ownership to digital data itself (which will make copying of data impossible). In other words, whoever buys or obtains the digital data with ownership can trade it later.

Token Market

Several games using tokens have been already released and there are even tokens which are traded for more than 10 million yen, all of which are increasing the number and amount of transactions steadily. However, it is not possible to trade real estate or physical assets such as mobile contents and art objects, etc. freely as digital data under present circumstances. It is because there is already another market existing separate from the digital one, but they can be made into digital data and given ownership using the blockchain technology. By converting the ownership into tokens, it will be possible to trade them online.

In other words, the technology of blockchain and tokens enables the trading of commodities that existing E-commerce could not deal with. Moreover, as tokens can belong to an individual, the Company believes that “using tokens makes the Internet world even more fun” and “becoming the pioneer of providing the platform to sell tokens will earn them great benefits.” If the Company is able to establish its position as the pioneer for enabling creation and trading of tokens at an early point, it will be possible to improve its recognition as a platform where users interested in tokens gather, which will allow the Company to take the leading role of offering marketing opportunities for such users.

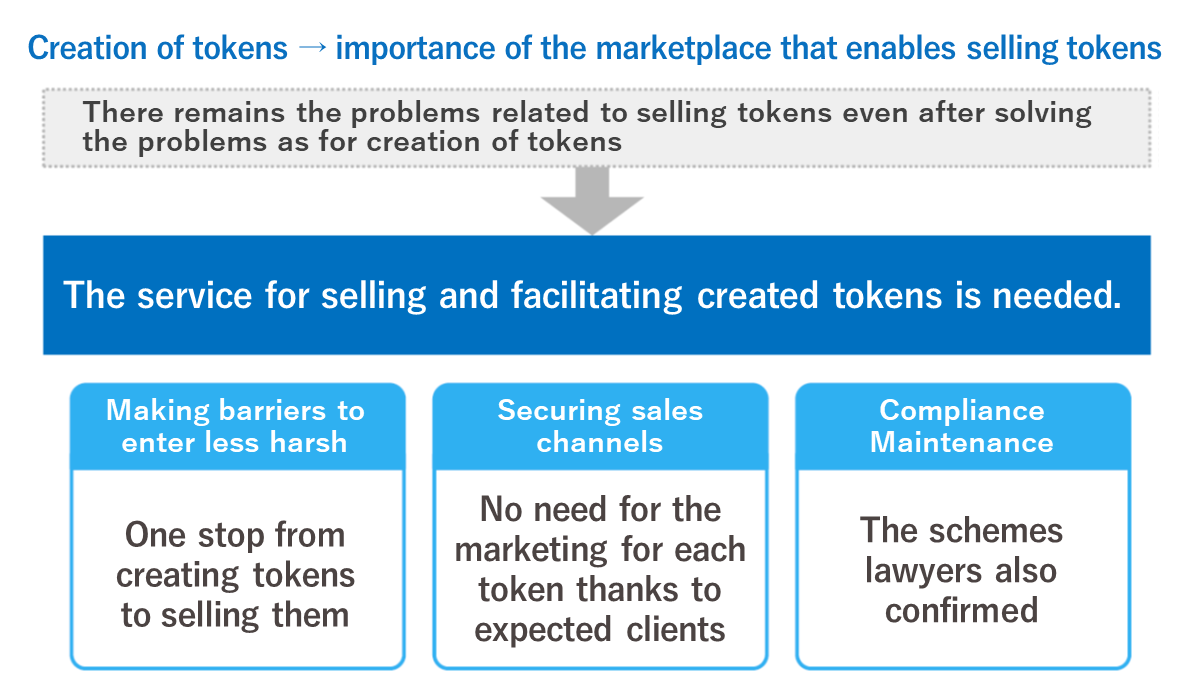

(Source from the company)

Even if one is interested in trading tokens, not everyone can create tokens as creating tokens requires special technology. However, by undertaking the role of creating tokens, the Company can lower the hurdle for it. Also, while trading of tokens is still not completely mature in terms of law and accounting, the Company will deal with rules and regulations related to laws and accounting under the coordination of lawyers and related authorities to ensure that both corporations and individuals can use the service without worry. “Uniqys Token Marketplace” will play the above two roles for creation and expansion of the token market.

4. Conclusions

Over the past two years, the Company had focused on blockchain-related development, but the efforts were not evaluated sufficiently since the business progress was difficult to grasp and there were only a few examples in which the blockchain-related business contributed to earnings except for the Company. However, we believe that the Company’s evaluation will change completely if the new game involving tokens with the blockchain technology successfully contributes to earnings and the performance of “Uniqys Token Marketplace,” which is cross-linked to the game, improves. In addition to the Company, the blockchain-related business will be evaluated differently. We would like to pay attention to how the Company is able to make users aware of how interesting the token based on the blockchain technology is through the new game.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 4 directors, including 2 outside ones |

Auditors | 3 auditors, including 3 outside ones |

◎ Corporate Governance ReportUpdated on August 14, 2019

Basic Policy

The Group companies recognize that establishing the corporate ethics based on legal compliance is the highest priority in order to respond to trust and expectations from the customers, shareholders and entire society and maximize the corporate value. To achieve it, the Company will strengthen risk management and supervision functions and elevate soundness and transparency of the management to contribute to development of the economic society.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

【Supplementary Principle 4-1-②】

Our mobile content industry is seeing rapid technological innovations, the evolution of services, etc. In this business environment, the announcement of a mid/long-term plan could degrade the flexibility to respond to environmental changes, and hinder the growth of our company. Therefore, we have not announced a mid/long-term business plan.

【Supplementary Principle 4-1-③】

At the present time, with the age of CEO Yuji Miyajima and other related factors taken into account, our company does not specifically formulate plans or hold discussion regarding a successor to the senior management, including CEO, as a dire issue at the Board of Directors; however, we have considered development of officers and workers in administrative positions who support the senior management to be essential for realizing sustainable business growth and medium- and long-term improvement of corporate value. Thus, we are providing educational and training programs for our mid-level employees with the aim of developing and selecting candidates for the next management who will assume the responsibility as a leading force for our company’s sustainable organizational growth and prosperity.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

【Principle 1-4】

The Company may hold shares of other listed companies as strategic shareholdings, if it determines that they will contribute to maintaining or improving their corporate value such as strengthening partnerships. At this point, the Company does not hold any shares of other listed companies.

【Principle 1-7】

The Company examines if the transactions are rational or not, before it engages in transaction with related parties. Furthermore, with a focus on the appropriateness of the transaction conditions compared with the other transactions, the Company makes it a requirement to obtain an approval for the transaction at a Board of Directors meeting.

【Supplementary Principle 4-11-③】

In our company, the Board of Directors periodically analyses and evaluates its effectiveness. Most recently, a practical example was that effectiveness was evaluated by deliberating the contents of materials based on the survey answered by directors and auditors at the Board of Directors. The overview of analysis results of the survey and evaluation based on deliberations are as below.

(1) At present, deliberations at the Board of Directors are reasonable and there are no special excesses or deficiencies in its operation.

(2) There is room for further consideration to deepen the discussion regarding the medium-to-long-term management plan.

【Supplementary Principle 4-14-②】

Our company invites external experts and holds seminars, compliance trainings, etc. according to the changes in our business environment for each director and auditor, and provides them appropriate support.

【Principle 5-1】

Our company has a system for proactively communicating with institutional and personal investors, in order to achieve sustainable growth and improve mid/long-term corporate value.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Report on Mobile Factory, Inc. (3912) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/