Bridge Report: (3921) NEOJAPAN, Inc.

President Akinori Saito | NEOJAPAN Inc. (3921) |

|

Company Information

Market | TSE 1st Section |

Industry | Information and communications technology |

President | Akinori Saito |

HQ Address | Yokohama Landmark Tower, 2-2-1 Minatomirai, Nishi-ku, Yokohama-shi |

Year-end | End of January |

Homepage |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

915 | 14,815,200 shares | 13,555 million | 11.7% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

6.50 | 0.7% | 27.02 | 33.9 x | 231.48 | 4.0 x |

*The share price is the closing price on March 22. The number of shares issued, ROE and BPS are based on previous term's results.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Jan. 2015 Act. | 1,724 | 251 | 265 | 172 | 14.33 | 1.42 |

Jan. 2016 Act. | 1,904 | 366 | 386 | 246 | 19.95 | 2.00 |

Jan. 2017 Act. | 2,116 | 391 | 428 | 296 | 20.64 | 2.13 |

Jan. 2018 Act. | 2,312 | 432 | 451 | 324 | 22.05 | 5.50 |

Jan. 2019 Act. | 2,661 | 528 | 547 | 382 | 25.81 | 6.00 |

Jan. 2020 Est. | 2,939 | 561 | 576 | 400 | 27.02 | 6.50 |

*The forecasted values were provided by NEOJAPAN Inc. The Company split shares at ratios of 200 for 1 as of Sep. 8, 2015, 3 for 1 as of Feb. 1, 2016, 2 for 1 as of July 1, 2017, and 2 for 1 as of Nov. 16, 2017. EPS as well as DPS has been recalculated retroactively. The commemorative dividends of 1.00 yen per share were included in the dividends paid in the term ended Jan. 2018.

We present this Bridge Report reviewing the Fiscal Year ended January 2019 Earnings Results and other information about NEOJAPAN Inc.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended January 2019 Earnings Results

3. Fiscal Year ending January 2020 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

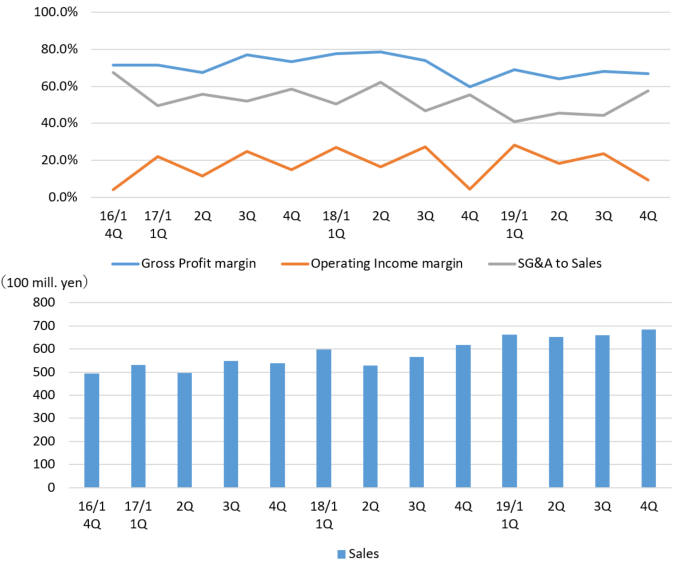

- The sales for the term ended January 2019 were 2,661 million yen, up 15.1% year on year. Sales increased in all segments, mainly cloud services. Gross profit margin declined due to the rise in the software amortization incurred by the release of “desknet’s NEO V5.0”, the increase in the usage fee for such as data centers and license fees to cope with the increased cloud services, and the increase of personnel cost for operation. However, gross profit increased by 6.9% year on year to 1,785 million yen. Although recruiting, personnel, and business outsourcing costs increased, the augmentation of SG&A expenses was slight owing to the reduction of advertising and R&D costs, and operating income was 528 million yen, up 22.1% year on year. Sales and profit exceeded the initial forecasts, and dividends were revised upwardly from the initially estimated 5.00 yen per share to 6.00 yen per share.

- The sales for the term ending January 2020 are estimated to be 2.9 billion yen, up 10.4% year on year. Cloud services will continue to be the main driver. Operating income is estimated to increase by 6.2% year on year and reach 561 million yen. Sales and profit are estimated to hit a record high and maintain an increase in sales and profit for 8 consecutive terms. Dividends are estimated to increase 0.50 yen per share to 6.50 yen per share in the next term. Payout ratio is estimated at 24.1%.

- The company forecasts that cloud services will continue to be the main driver this term and that sales and profit will hit a record high and maintain an increase in sales and profit for 8 consecutive terms. Its robust business results, which are based on a recurring-revenue business model, will again attract attention as the company’s main distinctive feature. On the other hand, the quarterly change in profit ratios indicates that gross profit margin and operating income margin remained flat. The growth strategy mentions “To first expand the company’s share in the groupware market.” It seems as though it’s aiming to achieve top-line expansion by increasing the company’s market share, but we would like to pay attention to their concrete measures for improving profitability and their progress.

1. Company Overview

With the managerial philosophy: “Contribute to the formation of an abundant society through real IT communications,” NEOJAPAN Inc. is assisting companies in improving operational efficiency and cutting down on costs through development and sale of “groupware (*),” an online technology-based business communication tool, and provision of cloud services. The cumulative total number of users of its major “desknet’s” product stands at 3.9 million (as of the end of January 2019). A multitude of aspects of “desknet’s,” such as the price, functions, reliability, and support system, have been well reputed, gaining the greatest satisfaction rating from customers and sales partners for 4 years in a row (in the groupware category; according to the magazine Nikkei Computer). The Company has embarked on entering overseas markets, aiming at further growth.

(What is groupware?)

Groupware is software developed for information sharing using the network of a company.

On the server of the network set by an administrator, the members of a group can share information, manage schedules, and share document information databases.

For example, when a schedule for a meeting needs to be arranged, groupware enables its users to grasp the schedules of group members at a glance, easily register dates when each of them is available in a timetable, send and receive e-mails about various matters and decisions, and share documents.

The number of companies and organizations that are propelling introduction of groupware keeps going up these days because of its useful aspects, including improvement of operational efficiency, cost reduction, speed-up of decision-making, and cross-departmental information sharing.

1-1 Corporate history

Mr. Akinori Saito (current Representative Director and President of NEOJAPAN Inc.), who engaged in research into optical communication systems with extensive know-how of communication technology for which he was highly acclaimed at Nippon Telegraph and Telephone Public Corporation (Current NIPPON TELEGRAPH AND TELEPHONE CORPORATION), transferred to a medium-sized software company in Japan, and then participated in a communications and infrastructure project led by Tokyo Electric Power Company Holdings, Inc. (TEPCO) and served as chief technology officer.

At that time, Mr. Saito, who was among the first to take interest in the Internet that was barely understood and wholly new, was attracted to the possibility that he might be able to make a massive change in the society with the Internet. In 1992, therefore, after the abovementioned project was completed, he founded NEOJAPAN Inc. at the age of 29.

At the beginning, NEOJAPAN conducted development entrusted by TEPCO and other electric power companies. Then, President Saito by himself developed a calendar system, which is one of the functions of groupware, in order to manage schedules of outsourced work. The calendar was very practical, and he received requests from outside companies for permission to use the calendar system.

In those days, although groupware had already been developed, it was designed only for large companies and available at a high price; however, thinking that it was possible to develop groupware at the cost of one-tenth of such expensive software and, more than anything else, that groupware was truly convenient and, therefore, a number of small- and medium-sized companies would be willing to use groupware if one was offered at a low price, President Saito started to sell NEOJAPAN’s original groupware “iOffice2000” in 1999 and, in 2002, released its successor model, “desknet’s.”

Issuance of the license and downloading of the software were conducted via the Internet, which is taken for granted today but was an epoch-making sales method around that time.

The Company successfully took in the needs of companies that were reluctant to adopt the software as expected, and its business expanded rapidly. NEOJAPAN began offering “desknet’s NEO,” its current major product, in 2012 and released the cloud version in 2013.

The cumulative number of users has exceeded 3 million. Considering that it is necessary to strive for corporate management that is healthier than ever before in order to fulfill the social responsibility towards numerous users, NEOJAPAN got listed on TSE Mothers in 2015.

1-2 Managerial and Corporate philosophy

Management Philosophy | Contribute to the formation of an abundant society through real IT communications |

NEOJAPAN Inc. engages in business with the aim of supporting all workers and contributing to social prosperity through development and sale of online technology-based business communication tools.

With ideas that overthrow the established theories and attentiveness unique to Japanese companies, the Company is endeavoring to continuously provide high-quality products and services to society.

(Origin of the Company’s name)

The Company has been named “NEOJAPAN (which means a new Japan)” in hopes of bringing advantages of superior information technology (IT) not only to some advanced companies but also to all companies, and changing communication between Japanese companies and the society using the power of computers.

1-3 Market environment

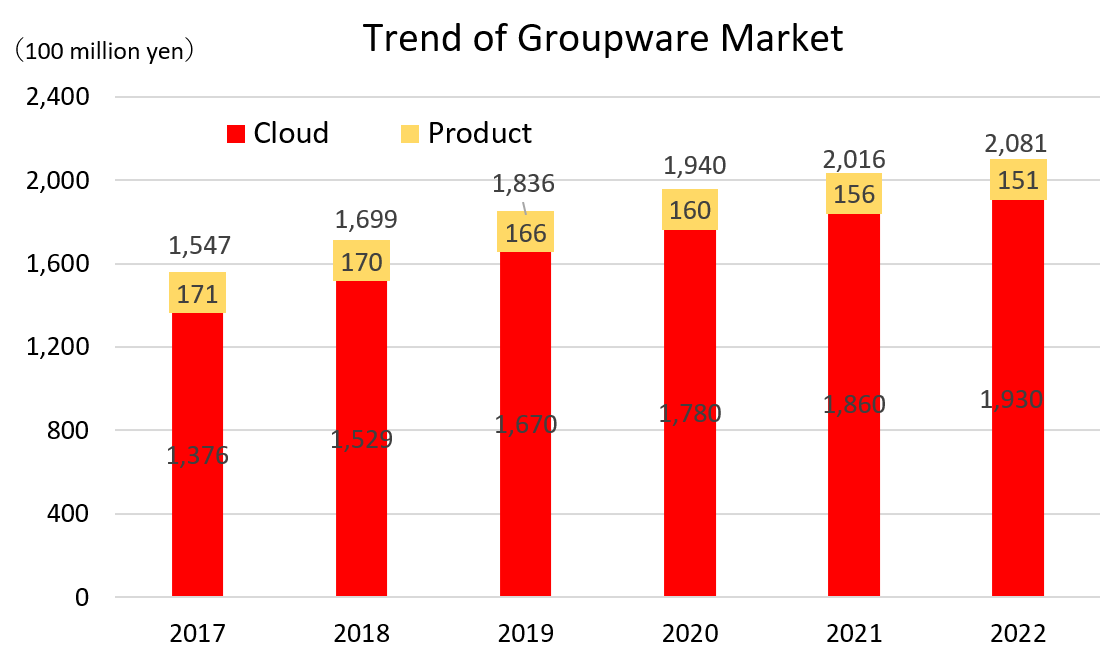

Trend in the groupware market

The groupware market in Japan was worth 154.7 billion yen, accounting for about 10% of the Japanese software market worth around 1.3 trillion yen in the fiscal 2017 and creating a relatively large market.

The groupware market will grow to 208.1 billion yen by fiscal 2022, with an annual growth rate estimated at 6.1%. While it is projected that sales of the product version that requires an installation of a server by each company will decrease, sales of the cloud version which does not require any initial costs and is easy to install are expected to grow at an annual rate of 7.0%.

(Produced by Investment Bridge Co., Ltd. based on the reference material of NEOJAPAN)

1-4 Business content

With a focus on its major groupware product, “desknet’s NEO,” NEOJAPAN develops and sells various products and services, including business chat, online databases, online e-mail systems for companies, systems for sending and receiving large-capacity files, sales management systems, and customer information management systems.

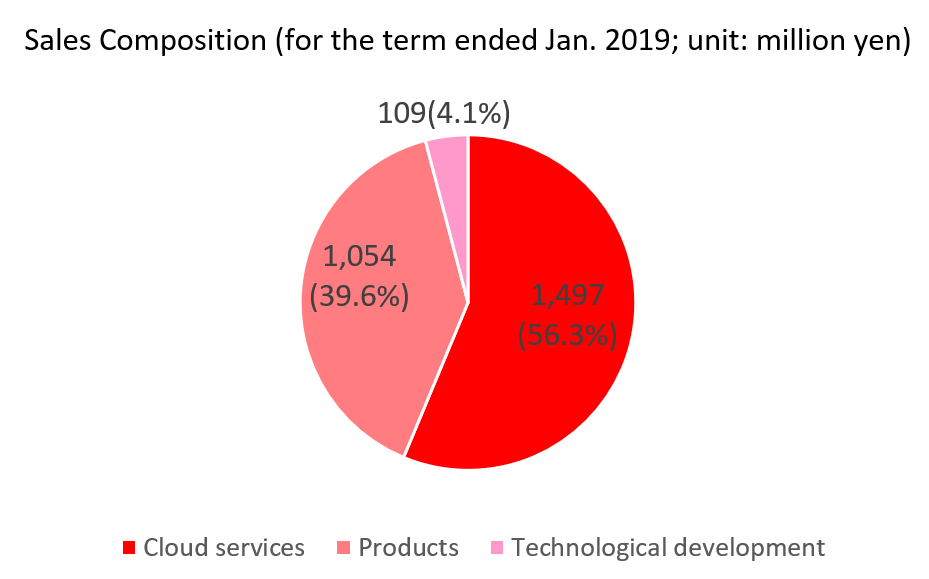

Sales are made up by the following 3 segments; the “cloud services” that provides groupware and related products via the Internet, the “products” that sells the license for the groupware and related products, and the “technological development” that develops software as commissioned by other companies.

1-4-1 “desknet’s NEO,” the major product

As mentioned in 1-1 Corporate History, NEOJAPAN has thrived by developing and selling groupware, and what will grow its business further is the groupware product, “desknet’s NEO.”

“desknet’s NEO” is one of the groupware developed independently by NEOJAPAN that consistently follows a thorough “hands-on approach.” The software has incorporated design features suited to the work styles and commercial practices in Japan, aiming to contribute to the revitalization of companies as well as boosting daily operational efficiency, and possesses the following characteristics:

(Characteristics)

*Usability

The simple and consistent screen design has established an interface that is easy to see and use by anyone, including those who are new to the groupware.

The “user-friendliness” and “simplicity” of “desknet’s NEO” improve the situations of the working sites and supports work.

Users can use the groupware without stress on multiple kinds of devices, such as smartphones and tablets.

*High performance

In addition to basic functions, including schedules, information, and online e-mail, 25 full-fledged applications which are capable of dealing with workflow, internal SNS, and global design have been installed by default. The applications are coordinated with each other.

“desknet’s NEO” not only possesses various functions, such as schedules, booking of meeting rooms, and e-mails but also, outside the scope of groupware, offers solutions to issues confronted in working sites.

*25 applications installed by default

Furthermore, use of “AppSuite,” a tool with which custom-made business apps can be created, enables users to build apps in 4 steps based on a wide range of on-site operations. Apps so developed can be used as one of the functions of “desknet’s NEO,” and therefore, on-site business processing can be further streamlined according to the situations of each company’s work sites.

(Source: the company)

*Adoption cases

A multitude of companies and organizations, including over 920 public agencies and local governments in 47 prefectures in Japan, have installed the groupware, regardless of industries, business types, and scales. The cumulative total number of users (accounts) have reached about 3.9 million (as of the end of January 2019).

(Form of providing the groupware)

The groupware has been offered in 2 forms: the cloud version and the package version. Lately, however, the cloud version of the software is showing a significant growth, following the soring needs by companies, such as “unwillingness to spend time and effort in installing groupware,” “unavailability of dedicated administrators due to a lack of staff who have extensive knowledge and experience regarding IT,” “desire to operate in a reliable security environment,” and “desire to cut down on initial expenses and operational costs as much as possible.”

(Sales structure)

NEOJAPAN itself sells its products and services; however, the Company specializes, in principle, in development and its products have been sold mainly via a total of about 600 agencies and Application Software Providers (ASPs) (*), who are referred to as partners.

(*) Application Software Providers (ASPs)

An Application Software Provider (ASP) is an operator that engages in the business of providing functions of application software as services to customers via networks.

1-4-2 Sales segment

1) Cloud services

NEOJAPAN offers the groupware products and services developed by itself, with “desknet’s NEO” deemed its major product, and related products on demand at a low price and in a highly reliable cloud environment.

As long as an Internet environment is available, users can use the services without any special investment in systems, such as servers, or knowledge about systems.

Customers are required only to pay a monthly fee or an annual fee for the number of users who will use the services, and they need not pay any initial expenses. The minimum number of users for subscription is 5, and no upper limit has been set.

The monthly fee per user is 400 yen, which is the lowest in the cloud services industry.

2) Products

The Company sells the licenses for its groupware products and services, including the major product “desknet’s NEO,” and related products. It also provides incidental services, such as customization, labor services, and support services.

Customers purchase the licenses and then install the groupware products and services in relevant internal servers, virtual environment, rental servers, and cloud environment.

The “Small License” and the “Enterprise License” are available to small- and medium-sized customers with 5 – 300 users and large-sized customers with over 300 users, respectively.

| Small License | Enterprise License |

Outline | The Small License is targeted at small- and medium-sized customers and available at a low price. | The Enterprise License is designed for large-sized customers and can deal with large-scale and highly available configurations. |

Price | ¥39,800 for 5 users to ¥998,000 for 300 users | ¥410,000 for 100 users to ¥13,000,000 for the unlimited number of users |

No. of users | 5 – 300 users | Over 100 users |

Annual support services | Support services are available for free for the first year, and it is optional to purchase support services from the second year onwards. ¥10,000 for 5 users to ¥150,000 for 300 users | Support services must be purchased for the first and subsequent years (mandatory). ¥90,000 for 100 users to ¥2,340,000 for the unlimited number of users |

3) Technological development

The Company engages in development of individual business applications related to the Internet and Intranet as outsourced by other companies, comprehensively offering a variety of system-related services, ranging from consulting to planning, designing, development, and network infrastructure establishment regarding application systems.

With the aim of cultivating techniques, the Company accepts orders mainly for development projects that are expected to lead to development of products and services for the “cloud services” and “products” segments.

1-5 Growth strategy

NEOJAPAN has cited the following 3 points as its future growth strategy:

1-5-1 Further expansion of share in the groupware market

The Company aims to expand its market share by enhancing its sales capabilities and improving added value through higher performance.

(Future market environment)

With regard to medium-sized and larger offices, it is projected that Japanese leading vendors will not give focus to groupware services, and therefore, the Company will strive proactively to get the market share currently held by other companies, including foreign ones.

With regard to small- and medium-scale offices which are expected to adopt groupware in the future, accelerating installation of cloud-based systems that are less expensive and easier to install is anticipated. The Company, thus, will broaden the appeal of its competitive edge with its products in terms of localization, security, and cost performance in order to secure market share.

(Specific policies)

“Improvement of market awareness”

As the Company has focused its management resources on technological development, the “desknet’s” products have held a relatively weak presence in the market. Following the realization of transfer to the first section of TSE from the Mothers market, NEOJAPAN will endeavor not only to increase its corporate creditworthiness but also to boost market awareness of its brand.

“Enhancement of sales structure/organization of local business bases”

Using funds raised through the stock listing, the Company will strengthen its sales structure. It will open offices in various major cities in an effort to attract local partners.

“Systemization of services”

The Company will move ahead with systemization of its services in order to simplify the installation and management processes, as well as achieve greater efficiency.

“Securing human resources”

The Company will address a challenge of securing and developing “human capital” that will display a positive attitude toward creation of strong products and new approaches.

1-5-2 Improvement of added value through expansion of product lineup

Besides the existing 25 default applications, the Company will add functions through incorporation of the latest communication tools and middleware, aiming to differentiate its products and services from those of other companies.

- Means of business communication are undergoing rapid evolution and change from the conventional e-mail to a multitude of means, such as SNSs and real-time communication of chat.

The Company will in earnest enter the field of real-time communication based on Web Real-Time Communication (WebRTC) and opportunely strengthen functions in order to provide products and services in anticipation of user needs.

-Based on its advanced technological development capabilities, the Company will establish a secure position as a leading company in the industry by continuously proposing and providing new services, ahead of any other competitor.

- In addition to the existing 25 functions and update of additional functions, the Company has added a business chat function, “ChatLuck.” Furthermore, it is considering adding a broad range of other functions, besides provision of the 26th function, “AppSuite,” a tool for creating operational applications enable customers to easily build necessary operational applications on their own.

- The Company will offer system administrators a portal function that can be customized. By allowing existing internal systems to have a portal function, the Company aims to realize the further unity of systems and improvement of user-friendliness.

It will strive to take in customer demand for services associated with peripheral functions by taking advantage of the experience of the introduction of “desknet’s NEO.”

1-5-3 Overseas business expansion

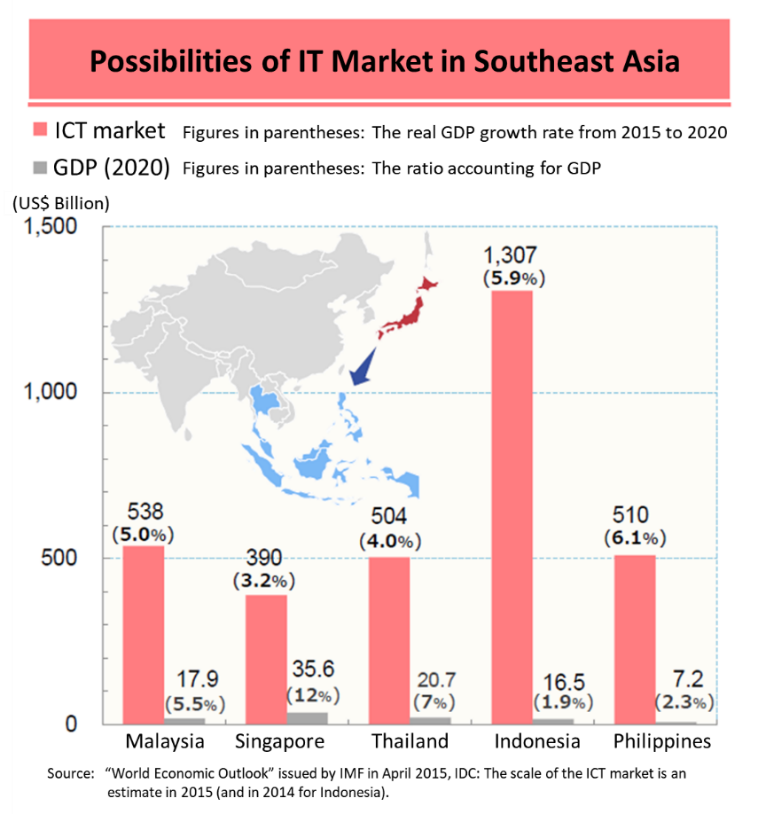

Starting off with Malaysia, the Company plans to break into the groupware market in Southeast Asia.

- It is expected that the real GDP of various Southeast Asian countries will grow at a rate of 3 to 6% toward 2020 and the ICT-related markets will boom greatly.

- The Company has considered that there is room for entering the groupware market in Southeast Asia because of the similarity between the business practices in Japan and those in Southeast Asia (such as the ring decision-making system (requests circulated for approval) and methods for information sharing).

- The Company has already forged ahead with language localization and plans to sell its products and services in Southeast Asia, starting off with Malaysia.

(Taken from the reference material of NEOJAPAN)

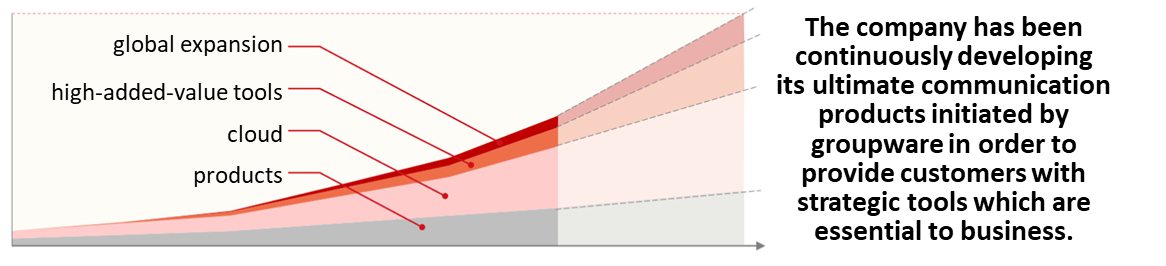

Furthermore, from a medium- and long-term perspective, with a focus on the existing groupware, the Company aims to develop communication tools essential for business and continue to provide products and services that lead the industry at all times.

Strengthening of the sale of groupware, and business expansion overseas | Continue to upgrade the existing groupware products and enhance their functions, and in the cloud field, differentiate the products and services from those of other companies in terms of security which is ensured based on the high technological capabilities Further expand market share and gain a secure position in the industry by strengthening sales and marketing capabilities Start to enter the market in Southeast Asia, which has followed business practices similar to those of Japan, by offering products and services in multiple languages and prospecting for overseas partners |

Development and proposal of communication tools that are strategic for companies in an effort to further differentiate NEOJAPAN from competitors | Evolve the existing groupware products as a core so that they become a tool developed in anticipation of the future society, forms of companies, and business trends with higher added value Move ahead further with differentiation from other companies not only by realizing improved efficiency for companies but also by providing IT communication tools essential for business strategies Accelerate business expansion overseas, and aim at a de facto standard in the immature groupware market in Southeast Asia |

(Source: the company)

1-6 Characteristics and strengths

1-6-1 Great customers’ and sales partners’ satisfaction

According to the survey presented in 2018 by Nikkei Computer, NEOJAPAN Inc. won the highest rating in the item “cost” in the groupware section. Also, the Company received high scores in other items, i.e., “reliability” and “serviceability”, and was judged that it gained the highest overall satisfaction for 4 years in a row.

In addition, the Company was ranked No.1 in the groupware section of “Nikkei BP Government Technology: IT System Satisfaction Survey targeted at Municipalities 2018-2019”.

The Company was also highly regarded by its sales partners, obtaining the top scores in 6 items, including “price competitiveness,” “profitability,” “technical support,” “point of contact,” “flexibility,” and “delivery date,” and taking the greatest partner satisfaction.

The high evaluation from both customers and sales partners has become a strong competitive advantage of the Company’s products.

The Company has taken a considerable lead in the industry with not only its outstanding technological abilities realized by the fact that about 60% of its employees are working in development-related departments, but also its comprehensive capabilities, including the user-friendliness and support structure.

1-6-2 Competitive edge with services and costs

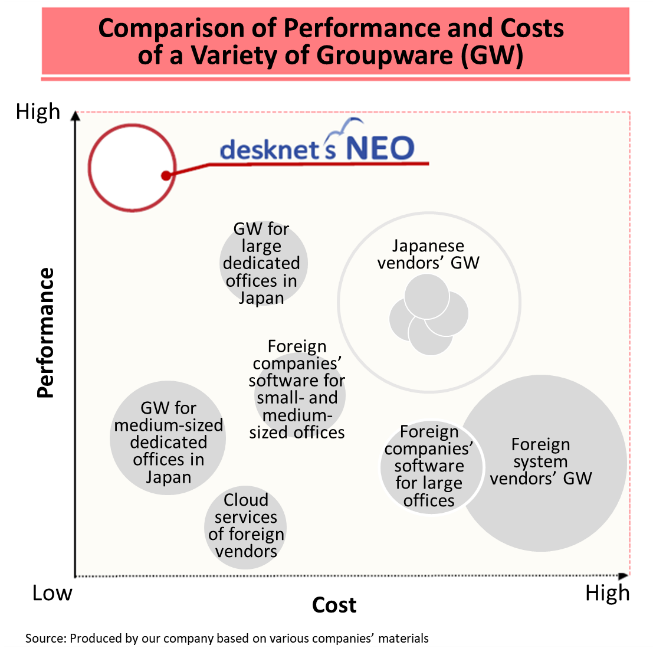

Considering the main players in the groupware market, leading vendors, including foreign companies, have held a large market share; however, NEOJAPAN has a competitive edge with services and costs, which has led to the abovementioned satisfaction rating.

- As for functions, products of Japanese vendors have garnered higher reputation than those of foreign companies because support provided by foreign companies, such as localization (systems supporting Japanese, and commercial and business practices in Japan), is not satisfactory.

- Twenty-five basic applications have been installed in the systems of NEOJAPAN by default, which has topped the number of functions in services offered by other Japanese vendors.

- Installation cost and cost per unit of foreign vendors’ products and services tend to be expensive because they are targeted chiefly at large companies.

The introduction and operating costs of NEOJAPAN’s systems are the lowest in the industry, with the monthly fee for the cloud services being about one-half and that for the products (installation basis, including on-site hardware services) also being approximately one-half of other Japanese vendors’ systems.

(Source: the company)

1-6-3 Business model that realizes stable earnings

Fixed costs are kept at a low level as the Company’s products are sold mainly via partners.

Furthermore, in addition to the fact that, once the Company’s products have been adopted, multifarious customers continue to use them because of the user-friendliness and low cost, another characteristic of NEOJAPAN is a recurring-revenue business in which sales rise every month on a cumulative basis mainly through monthly billing, a business model that realizes stable earnings.

The ratio of recurring-revenue business in the term ended January 2019 is 77%.

1-6-4 Increased efforts in health management

NEOJAPAN Inc. offers groupware as its main product that contributes to “Work Style Reform” of the companies that have installed that groupware, for example, by improving their work efficiency and productivity. This company itself is increasing awareness of health management.

“Health management” means to think about employees’ healthcare from a management perspective and practice it strategically. Based on the corporate philosophy, it is expected that investing in employees’ health will lead to revitalization of the organization including better vitality of employees and productivity, resulting in improvement in business performance as well as stock price (taken from the Ministry of Economy, Trade and Industry’s website).

President Saito, who likes sports, has always spoken to staff members about “the importance of exercise and meals”, “balance between work and dream (personal life)”, etc., but as mentioned in the top message on the Company’s website for stockholders and investors, he has made a commitment to practice and promote health management in the future.

“In order to practice the management philosophy and realize operations considering global expansion of the Company, we will improve the work environment, where everyone is sound in mind and body and is able to demonstrate his or her ability to the fullest, and promote health management.” (Taken from the Company’s website. Some parts have been modified by the writer.)

To be more specific, the Company strives to obtain the certification of “Corporation that is excellent in health management”, which is designed by the Ministry of Economy, Trade and Industry (METI) and recognized by Nippon Kenko Kaigi, and to be accepted as the “Health management brand”, which is selected and announced jointly by METI and Tokyo Stock Exchange.

1-7 Shareholder return

NEOJAPAN has deemed shareholder return as an important business challenge and raised the rough indication of the dividend payout ratio to over 20%.

In addition, the Company carries out a shareholder benefit program, in which it presents quo cards worth 500 yen to shareholders holding100 shares or more but less than 200 shares, and 1,000 yen’s worth of quo cards to shareholders who hold over 200 shares as of the end of an interim period and the end of each term, respectively.

1-8 ROE analysis

| FY Jan. 16 | FY Jan. 17 | FY Jan. 18 | FY Jan. 19 |

ROE (%) | 11.2 | 11.1 | 10.9 | 11.7 |

Net income margin (%) | 12.93 | 14.01 | 14.02 | 14.36 |

Total asset turnover [times] | 0.63 | 0.59 | 0.59 | 0.62 |

Leverage [times] | 1.38 | 1.33 | 1.31 | 1.32 |

ROE has been double-digit. Further improvements can be expected if asset efficiency is raised.

2. Fiscal Year ended January 2019 Earnings Results

2-1 Earnings Results

| FY Jan. 18 | Ratio to sales | FY Jan. 19 | Ratio to sales | YoY | Compared with the initial forecast |

Sales | 2,312 | 100.0% | 2,661 | 100.0% | +15.1% | +2.4% |

Gross profit | 1,669 | 72.2% | 1,785 | 67.1% | +6.9% | - |

SG&A | 1,237 | 53.5% | 1,256 | 47.2% | +1.6% | - |

Operating Income | 432 | 18.7% | 528 | 19.8% | +22.1% | +7.6% |

Ordinary Income | 451 | 19.5% | 547 | 20.6% | +21.3% | +8.0% |

Net Income | 324 | 14.0% | 382 | 14.4% | +17.9% | +12.4% |

(Unit: million yen)

Double-digit increase in sales and profit, exceeding estimates.

The sales were 2,661 million yen, up 15.1% year on year. Sales increased in all segments, mainly cloud services. Gross profit margin declined due to the rise in the software amortization incurred by the release of “desknet’s NEO V5.0”, the increase in the usage fee for such as data centers and license fees to cope with the increased cloud services, and the increase of personnel cost for operation. However, gross profit increased by 6.9% year on year to 1,785 million yen. Although recruiting, personnel, and business outsourcing costs increased, the augmentation of SG&A expenses was slight owing to the reduction of advertising and R&D costs, and operating income was 528 million yen, up 22.1% year on year. Sales and profit exceeded the initial forecasts, and dividends were revised upwardly from the initially estimated 5.00 yen per share to 6.00 yen per share.

2-2 Sales trend by segment

| FY Jan. 18 | FY Jan. 19 | YoY | Compared with the initial forecasts |

Cloud services | 1,259 | 1,497 | +19.0% | +0.4% |

Products | 991 | 1,054 | +6.3% | +4.6% |

Technological development | 61 | 109 | +78.4% | +9.7% |

Total Sales | 2,312 | 2,661 | +15.1% | +2.4% |

(Unit: million yen)

*Cloud services

1,497 million yen, up 19.0% year on year, almost as planned

The number of users of “desknet’s NEO could version” exhibited a steady increase, exceeding 240,000 as of the end of January 2019.

The sales from the service reached 1,169 million yen, up 25.6% year on year. From the term ended January 2015 and on, the average annual growth rate has been 16.5%.

Sales for ASPs declined by 1.3% from the previous term to 123 million yen. The number of users was over 150,000.

*Products

1,054 million yen, up 6.3% year on year, exceeding initial forecasts

The sales of the Small License for the products targeted at small and medium-sized users shrank by 3.4% from the previous term to 75 million yen as the customers of cloud services increased. The sales of the Enterprise License targeted for large-scale users increased by 4.3% from the previous term to 195 million yen, almost as initially forecasted.

The sales of AppSuite, which was released in October 2017, were 39 million yen.

Affected by factors such as the fact that there were customization projects for relatively large financial institutions in the previous term, the sales of customization decreased 29.3% from the previous term to 62 million yen.

The sales of the support services of “desknet's NEO” (including old products) grew steadily to 540 million yen, up 5.4% from the previous term.

*Technological development

109 million yen, up 78.4% year on year, exceeding the initial estimate.

Sales increased largely through development projects related to electronic commerce site, etc., and maintenance of the system entrusted in past fiscal years.

2-3 Financial standing and cash flows

Main BS

| End of Jan. 18 | End of Jan. 19 |

| End of Jan. 18 | End of Jan. 19 |

Current Assets | 2,909 | 2,954 | Current liabilities | 719 | 846 |

Cash | 2,551 | 2,599 | Payables | 20 | 23 |

Receivables | 289 | 285 | Unearned revenue | 401 | 469 |

Noncurrent Assets | 1,183 | 1,587 | Noncurrent liabilities | 251 | 265 |

Tangible Assets | 53 | 51 | Total Liabilities | 971 | 1,112 |

Intangible Assets | 105 | 91 | Net Assets | 3,121 | 3,429 |

Investment, Others | 1,024 | 1,443 | retained earnings | 2,492 | 2,792 |

Total assets | 4,092 | 4,541 | Total liabilities and net assets | 4,092 | 4,541 |

(Unit: million yen)

Current assets went up by 45 million yen from the end of the previous term due to several factors, such as the increase in cash and deposits. Increase in investment securities (acquisition of corporate bonds and unlisted shares), etc. boosted noncurrent assets by 403 million and total assets went up to 4,541 million, up 448 million from the end of the previous term.

The increase in unearned revenue etc. grew total liabilities to 1,112 million yen by 140 million yen from the end of the previous term.

Retained earnings grew net assets to 3,429 million yen by 307 million from the end of the previous term.

As a result, a capital-to- asset ratio was 75.5%, down by 0.8% from 76.3% at the end of the previous term.

Cash Flow

| FY Jan. 18 | FY Jan. 19 | Increase/decrease |

Operating Cash Flow | 423 | 696 | +272 |

Investing Cash Flow | -227 | -566 | -339 |

Free Cash Flow | 196 | 129 | -66 |

Financing Cash Flow | -16 | -79 | -62 |

Term End Cash and Equivalents | 2,557 | 2,606 | +49 |

Unit: million yen

Operating CF grew further due to the profit increase.

Increase in the purchase of investment securities, etc., expanded the deficit of investing CF, but free CF remained in surplus.

The deficit of financing CF expanded as the payment amounts of dividends rose. The cash position is nearly unchanged from the end of the previous term.

2-4 Topics

2-4-1 Announcing the evaluation results about the board of directors’ effectiveness

In accordance with the disclosure of the corporate governance report, the answers to the questionnaire survey targeted at all directors were analyzed and evaluated, and then the outline of the results was announced in January 2019.

The questionnaire was consisted of 4 main sections, (1) The roles and duties of the Board of Directors, (2) The Board of Directors’ structure, (3) Operation and deliberation of the Board of Directors, and (4) Communication with outside executives.

From the survey results, it was concluded that the Board of Directors is functioning and performing properly and that it ensures effectiveness overall. At the same time, the board members realized that it would be necessary to “establish a remuneration system that functions as a sound incentive towards achieving sustainable growth,” “enhance the discussion in the Board of Directors regarding the plan of training new successors in the medium to long term,” “improve communication among the company’s executives and outside ones,” and “secure training opportunities for executives continuously.”

Based on the results of evaluation and analysis of the effectiveness of our company’s Board of Directors, the company will continuously identify the problems that need to be addressed, in order to further improve the effectiveness of the Board. The company plans to discuss and implement countermeasures, improve the functions of the Board of Directors, and further strengthen the supervisory function as well as corporate governance.

2-4-2 Holding talk sessions under the theme of “workstyle reforms”

The company’s mainstay product, groupware, contributes to “workstyle reforms” by enhancing operation efficiency and productivity, which are issues for Japanese corporations. Like last year, the company held a talk session themed on “workstyle reforms,” entitled “desknet’s WORK SHIFT SESSION 2018” in November 2018, where about 700 people attended.

In the session held in Tokyo and Osaka, the company invited “workstyle” specialists to discussions about the Japanese workstyle. Also, it introduced workstyle-reform approaches of enterprises that succeeded in utilizing IT tools to improve their operation, introduced concrete measures, utilization techniques of IT tools, etc. Also, it built booths to experience desknet's NEO, AppSuite, and ChatLuck.

The company plans to hold more events for contributing to “workstyle reforms” and enhancing “brand recognition” as mentioned in its growth strategy.

3. Fiscal Year ending January 2020 Earnings Forecasts

3-1 Business Results

| FY Jan. 19 | Ratio to sales | FY Jan. 20 Est. | Ratio to sales | YoY |

Sales | 2,661 | 100.0% | 2,939 | 100.0% | +10.4% |

Operating Income | 528 | 19.8% | 561 | 19.1% | +6.3% |

Ordinary Income | 547 | 20.6% | 576 | 19.6% | +5.2% |

Net Income | z382 | 14.4% | 400 | 13.6% | +4.7% |

* Estimates are those of the Company. Unit: million yen

Sales and revenue are estimated to increase for 8 consecutive terms, hitting a record high.

Sales is expected to be 2.9 billion, up 10.4% from the previous term. Each of three fields are planned to rise.

Operating income will grow to 561 million, up 6.3%, year on year, and sales and profit are expected to rise for the 8th consecutive term.

The amounts of dividends are scheduled to be 6.50 yen per share, up 0.50 yen per share. The payout ratio is to be 24.1%

3-2 Sales trend by segment

| FY Jan. 19 | FY Jan. 20 Est. | YoY |

Cloud services | 1,497 | 1,679 | +12.2% |

Products | 1,054 | 1,178 | +11.7% |

Technological development | 109 | 81 | -25.6% |

Total Sales | 2,661 | 2,939 | +10.4% |

Unit: million yen

*Cloud services

Along with the expansion of sales of “desknet’s NEO,” it is projected that sales of AppSuite and ChatLuck will grow through cross-selling. Orders for large-scale projects are expected as well.

*Products

Sales from public agencies and local governments will exhibit a healthy growth. It is also anticipated that sales of AppSuite will increase through cross-selling.

*Technological development

The Company predicts sales from outsourced projects for which the Company has already received orders and maintenance projects for existing systems.

3-3 Management policies and measures

*The company will continue to reinforce the development of its mainstay products, "AppSuite” and “ChatLuck,” while enriching the functions of existing products.

*The company will steadily grow a stable profitability model by expanding its market share of its specialty, products for enterprise uses, and the recurring-revenue business model of cloud services and support services. Particularly, it is going to develop and reinforce an operation structure that enables stable service provision as cloud services grow.

*The company will make strategic investments in products and alliances that are expected to enhance its integration capability, achieve system integration with a focus on its products, and make synergy with its products, and aim to establish a new revenue model.

*It will strive to secure and train human assets who have robust product development capability and are ready to work on the new profitability model as a core theme, while especially focusing on training engineers and strengthening its marketing capabilities.

4. Conclusions

The company forecasts that cloud services will continue to be the main driver this term and that sales and profit will hit a record high and maintain an increase in sales and profit for 8 consecutive terms. Its robust business results, which are based on a recurring-revenue business model, will again attract attention as the company’s main distinctive feature. On the other hand, the quarterly change in profit ratios indicates that gross profit margin and operating income margin remained flat. The growth strategy mentions “To first expand the company’s share in the groupware market.” It seems as though it’s aiming to achieve top-line expansion by increasing the company’s market share, but we would like to pay attention to their concrete measures for improving profitability and their progress.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with an audit and supervisory board |

Directors | 7directors, including 3 to outside ones |

Auditors | 3directors, including 3 to outside ones |

Corporate Governance Report

Last update date: December 21, 2018

<Basic Concept>

NEOJAPAN's managerial philosophy is to "contribute to the formation of an abundant society through real IT communications."

Under the managerial philosophy, all the directors and employees of NEOJAPAN will comply with laws and articles of incorporation, fulfill their respective duties based on healthy social norms, and engage in corporate activities.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

“Supplementary Principle 3-1-2 Disclosure and provision of information in English”

| Currently, the ratio of foreign shareholders is as low as 2%, therefore, considering costs, etc., we don’t disclose information in English. In the future, we will reconsider disclosing information in English according to the increase in the ratio of foreign shareholders. |

“Supplementary Principle 4-1-2 Disclosure of mid-term managerial plan” | Although our company draws a mid-term managerial plan each term, we have not disclosed any plans for the ICT-related and groupware markets in which our company has engaged in business because the business environment and technology change rapidly and, thus, there is a great possibility that plans and forecasts diverge; provided, however, that, every month, the board of directors analyzes divergence between forecasts and actual results for the relevant fiscal year and, if forecasts for the fiscal year have not been achieved, the board performs thorough analysis and detailed discussion regarding causes and measures to take. We do not analyze divergence between forecasts and results for the following and subsequent years, but the Corporate Planning Office will take a leading role in summarizing numerical values and holding discussion, including report to the board of directors. Furthermore, taking into consideration the results of analysis of forecasts for the fiscal year as mentioned above, we conduct rolling planning every term in order to produce mid-term managerial plans. In the present circumstances, we have not scheduled to disclose any mid-term managerial plan so created; however, we would like to consider disclosing managerial plans in response to requests from shareholders. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

“Principle 1-4 Explaining the purpose of strategic shareholding and establishment of standards for exercising voting rights”

| Our company doesn’t own any cross-held stocks, however, in case the Board of Directors determines that it will contribute to increasing the corporate value in the medium to long term, and leads to strengthening the management strategy and establishing relationships with our clients, there will be a possibility of strategically holding other companies’ stocks. The Board of Directors will annually examine the rationality of the continuous holding of listed shares that were decided to be cross-held, in light of the purpose for which it was held, while considering its risks and return for the medium to long term. Regarding exercising voting rights, we are yet to establish a uniform standard, since a qualitative and a comprehensive judgment based on the relationship with the issuing corporate of each share is required. |

“Supplementary Principle 4-11-3: Ensuring the effectiveness of the Board of Directors and the Board of Auditors”

| Since the term ended January 2018, we’ve been distributing questionnaires to each Board Member, collecting answers, and evaluating and analyzing the results to survey the effectiveness of the Board of Directors overall. Additionally, we will disclose the outline of the results in a timely and appropriate manner.

|

“Principle 5-1 Policy on constructive dialogue with shareholders” | Our company takes a positive action toward requests by shareholders for dialogue. In our company, the Corporate Planning Office has been designated as a department in charge of dealing with dialogue (interview) with shareholders and will organically coordinate with personnel in charge of accounting and marketing. Individual meetings with major institutional investors and investors who have submitted requests for dialogue will be held mainly by the Corporate Planning Office after disclosing the business performance. In addition, in view of the shareholder composition, we currently have not hosted any regular individual meetings with overseas institutional investors, but the Corporate Planning Office holds telephone conferences with overseas institutional investors who have made requests for dialogue, in an effort to foster understanding of our company and our products. Furthermore, we are paying heed to insider information management by holding dialogue with shareholders based on disclosed contents. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2019 Investment Bridge Co., Ltd.All Rights Reserved. |