Bridge Report:(3921)NEOJAPAN second quarter of fiscal year ending January 2022

President Akinori Saito | NEOJAPAN Inc. (3921) |

|

Company Information

Market | TSE 1st Section |

Industry | Information and communications technology |

President | Akinori Saito |

HQ Address | Yokohama Landmark Tower, 10th Floor, 2-2-1 Minatomirai, Nishi-ku, Yokohama-shi |

Year-end | End of January |

Homepage | https://www.neo.co.jp/en/ |

Stock Information

Share Price | Shares Outstanding | Total Market Cap | ROE Act. | Trading Unit | |

¥1,328 | 14,895,600 shares | ¥19,781 million | 16.4% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥12.00 | 0.7% | ¥45.62 | 29.1x | ¥296.83 | 4.8x |

*The share price is the closing price on October 14. Shares outstanding, DPS, and EPS are from the earning results of the second quarter for FY 1/22.

ROE and BPS are the results of the previous term.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Jan. 2018 Act. | 2,312 | 432 | 451 | 324 | 22.05 | 5.50 |

Jan. 2019 Act. | 2,661 | 528 | 547 | 382 | 25.81 | 6.00 |

Jan. 2020 Act. | 3,742 | 699 | 717 | 495 | 33.38 | 7.50 |

Jan. 2021 Act. | 5,325 | 920 | 948 | 677 | 45.58 | 11.00 |

Jan. 2022 Est. | 5,717 | 948 | 980 | 679 | 45.62 | 12.00 |

*The forecasted values were provided by NEOJAPAN Inc. Consolidated accounting started in the term ended January 2020, so the net income from the term ended January 2020 means the profit attributable to owners of parent. The Company split shares at ratios of 2 for 1 as of July 1, 2017, and 2 for 1 as of Nov. 16, 2017. EPS as well as DPS has been recalculated retroactively. The commemorative dividends of 1.00 yen per share were included in the dividends paid in the term ended Jan. 2018.

We present this Bridge Report reviewing the second quarter of fiscal year ending January 2022 Earnings Results and other information about NEOJAPAN Inc.

Table of Contents

Key Points

1. Company Overview

2. Second quarter of Fiscal Year ending January 2022 Earnings Results

3. Fiscal Year ending January 2022 Earnings Forecasts

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the second quarter of the term ending January 2022, sales grew 8.4% year on year to 2,842 million yen. The cloud services showed growth. Operating income stood at 641 million yen, up 12.6% year on year. The increase in sales offset the rises in the costs for cloud services, labor, and advertising. The number of users of desknet’s NEO cloud, whose sales account for slightly over 80% of the sales of the cloud service business, steadily increased, exceeding 420,000 as of the end of July 2021. On the other hand, churn rate stayed low at 0.36% as of July 2021.

- The full-year earnings forecasts remain unchanged. For the term ending January 2022, sales are expected to increase 7.4% year on year to 5,717 million yen, and operating income is projected to rise 3.0% to 948 million yen. In the software business, the number of cloud service users is forecasted to remain stable, and overall cloud service sales are expected to increase about 15%. In the products business, sales of enterprise licenses are expected to increase, but the rise in overall sales is estimated to be slight due to a decrease in the sales of small licenses. The sales of the system development service business are projected to augment slightly. Operating income margin is expected to decrease 0.7 points from the previous fiscal year to 16.6% because of the rise in personnel expenses due to an increase in personnel and R&D expenses. The dividend is to be 12.00 yen/share, up 1.00 yen/share from the previous year's dividend. The expected payout ratio is 26.3%.

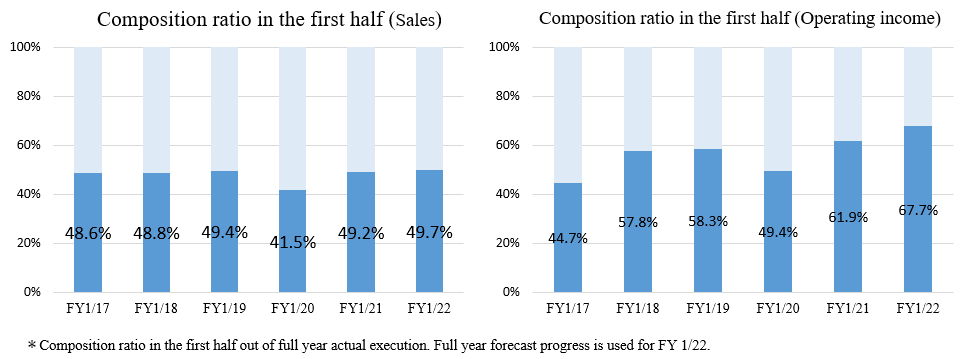

- The company reached 49.7% and 67.7% of the sales and operating income targets, respectively, in the first half of the term. These rates are higher than those of the past few years, and the company may be able to make an upturn if it successfully boosts sales from desknet’s NEO cloud, on which the company intends to concentrate continuously from the third quarter onward.

- Meanwhile, the financial report issue did not contain any mention of policies or measures toward 2030 by which the company aims to become the top domestic brand of groupware and achieve the goals of taking the largest market share, selling services to a cumulative number of 10 million users, and yielding annual sales of 10 billion yen for the group as a whole. Investors must be curious about a clearer and more concrete roadmap.

1. Company Overview

With the corporate philosophy: “Contributing to the formation of a flourishing information society through real IT communication tools,” NEOJAPAN Inc. is assisting companies in improving operational efficiency and cutting down on costs through development and sale of “groupware (*),” a collaboration software provided as both on-premise license and cloud service. The number of users of its major product “desknet’s NEO” (the sum of the cumulative number of users who have purchased the licenses and the number of users using the cloud service) stands at 4.34 million (as of the end of July 2021). The Company has embarked on entering overseas markets, aiming at further growth.

(What is groupware?)

Groupware is synonymous with collaboration software and collaborative software.

The members of a group can share information, manage schedules, and share document information databases.

For example, when a schedule for a meeting needs to be arranged, groupware enables its users to grasp the schedules of group members at a glance, easily register dates when each of them is available in a timetable, send and receive e-mails about various matters and decisions, and share documents.

The number of companies and organizations that are propelling introduction of groupware keeps going up these days because of its useful aspects, including improvement of operational efficiency, cost reduction, speed-up of decision-making, and cross-departmental information sharing.

1-1 Corporate history

Mr. Akinori Saito (current Representative Director and President of NEOJAPAN Inc.), who engaged in research into optical communication systems with extensive know-how of communication technology for which he was highly acclaimed at Nippon Telegraph and Telephone Public Corporation (Current NIPPON TELEGRAPH AND TELEPHONE CORPORATION), transferred to a medium-sized software company in Japan, and then participated in a communications and infrastructure project led by Tokyo Electric Power Company Holdings, Inc. (TEPCO) and served as chief technology officer.

At that time, Mr. Saito, who was among the first to take interest in the Internet that was barely understood and wholly new, was attracted to the possibility that he might be able to make a massive change in the society with the Internet. In 1992, therefore, after the abovementioned project was completed, he founded NEOJAPAN Inc. at the age of 29.

At the beginning, NEOJAPAN conducted development entrusted by TEPCO and other electric power companies. Then, President Saito by himself developed a calendar system, which is one of the functions of groupware, in order to manage schedules of outsourced work. The calendar was very practical, and he received requests from outside companies for permission to use the calendar system.

In those days, although groupware had already been developed, it was designed only for large companies and available at a high price; however, thinking that it was possible to develop groupware at the cost of one-tenth of such expensive software and, more than anything else, that groupware was truly convenient and, therefore, a number of small- and medium-sized companies would be willing to use groupware if one was offered at a low price, President Saito started to sell NEOJAPAN’s original groupware “iOffice2000” in 1999 and, in 2002, released its successor model, “desknet’s.”

Issuance of the license and downloading of the software were conducted via the Internet, which is taken for granted today but was an epoch-making sales method around that time.

The Company successfully took in the needs of companies that were reluctant to adopt the software as expected, and its business expanded rapidly. NEOJAPAN began offering “desknet’s NEO,” its current major product, in 2012 and released the cloud version in 2013.

The cumulative number of users has exceeded 3 million. Considering that it is necessary to strive for corporate management that is healthier than ever before in order to fulfill the social responsibility towards numerous users, NEOJAPAN got listed on TSE Mothers in 2015. In 2018, the company was listed in the first section of Tokyo Stock Exchange.

1-2 Corporate philosophy

Corporate Philosophy | Contributing to the formation of a flourishing information society through real IT communication tools |

NEOJAPAN Inc. engages in business with the aim of supporting all workers and contributing to social prosperity through development and sale of online technology-based business communication tools.

With ideas that overthrow the established theories and attentiveness unique to Japanese companies, the Company is endeavoring to continuously provide high-quality products and services to society.

(Origin of the Company’s name)

The Company has been named “NEOJAPAN (which means a new Japan)” in hopes of bringing advantages of superior information technology (IT) not only to some advanced companies but also to all companies and changing communication between Japanese companies and the society using the power of computers.

1-3 Market environment

(1) Trend in the groupware market

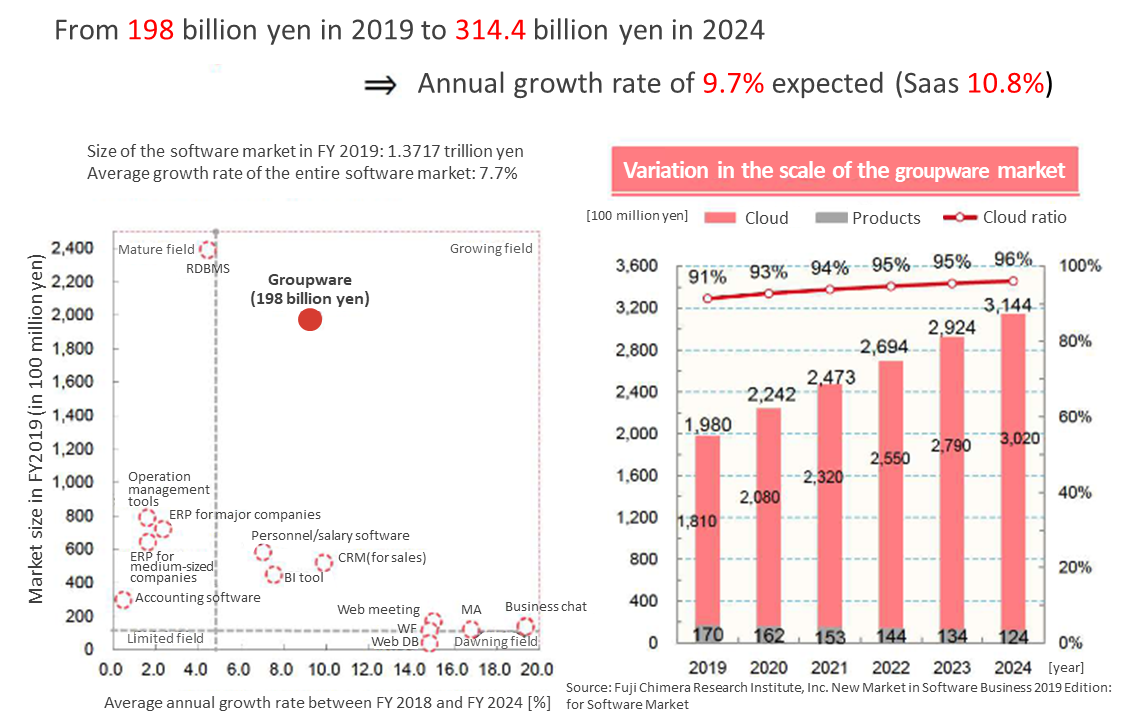

The groupware market in Japan was worth 198 billion-yen, accounting for 14% of the Japanese software market worth around 1.4 trillion yen in the fiscal 2019 and creating a relatively large market.

The groupware market will grow to 314.4 billion yen by fiscal 2024, with an annual growth rate estimated at 9.7%.

While it is projected that sales of the on-premise version, which requires the installation of a server by each company, will decrease, sales of the cloud version, which does not require any initial costs and is easy to install, are expected to grow.

(Source: the company)

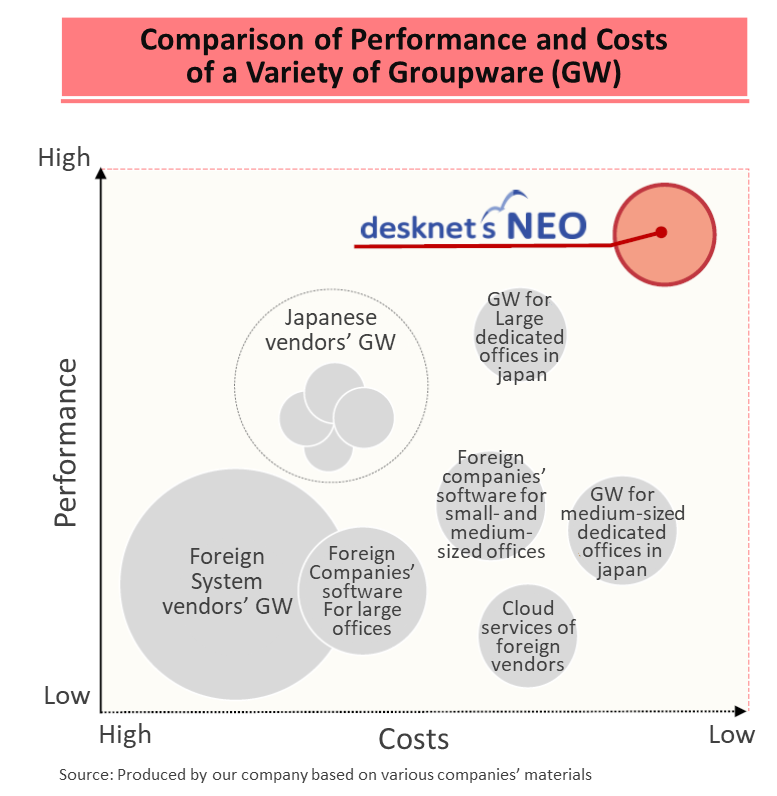

(2) The Company’s positioning

While leading vendors including foreign ones have a higher share in the groupware market, NEOJAPAN considers that it has its competitive edge with “desknet’s NEO” in terms of functions, costs, etc., including localization.

The Company plans to use these advantages to increase its share in both on-premise and cloud markets.

(The following is the comment by Fuji Chimera Research Institute, Inc. stated in the NEOJAPAN’s reference material).

①Cloud market

Other companies are ending the provision of free groupware services and turning to fee-charging cloud services.

NEOJAPAN steadily expanded SaaS sales in fiscal 2019 through installations in major companies by highlighting the services' multifunctionality and low cost. The company aims to increase sales further in fiscal 2020 by continuing to focus on new installations in major companies.

(Excerpt from NEOJAPAN’s reference material; Source: Fuji Chimera Research Institute, Inc.)

②On-premise market

The Company has been holding the largest share since 2017 in terms of the number of new IDs in the market of on-premise version for large-scale organizations.

Sales grew steadily in fiscal 2019 through installations in major companies by emphasizing the services' good cost performance. The company aspires to expand sales further in fiscal 2020 by focusing on new installations in major companies that are seeking services with good cost performance.

(Excerpt from NEOJAPAN’s reference material; Source: Fuji Chimera Research Institute, Inc.)

1-4 Business content

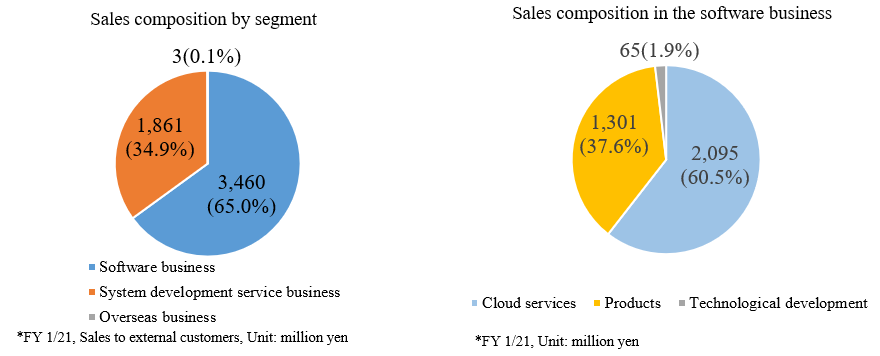

The business segments to be reported are the software business, the system development service business, and overseas business.

(1) Software business

This business is operated by NEOJAPAN. In this business, the company mainly develops and sells AppSuite, which can produce business apps without a code, business chat systems “ChatLuck”, online databases, web mail systems for enterprises, heavy file transmission systems, marketing management systems, customer information management systems, etc. while handling its mainstay groupware “desknet's NEO. The business can be divided into three sections: “cloud services” for offering groupware and related products through the Internet, “products” for selling licenses regarding groupware and related products, and “technological development” for undertaking software development.

①The major product “desknet’s NEO”

As mentioned in 1-1 Corporate History, NEOJAPAN has thrived by developing and selling groupware, and what will grow its business further is the groupware product, “desknet’s NEO.”

“desknet’s NEO” is one of the groupware developed independently by NEOJAPAN that consistently follows a thorough “hands-on approach.” The software has incorporated design features suited to the work styles and commercial practices in Japan, aiming to contribute to the revitalization of companies as well as boosting daily operational efficiency, and possesses the following characteristics:

(Characteristics)

*Usability

The simple and consistent screen design has established an interface that is easy to see and use by anyone, including those who are new to the groupware.

The “user-friendliness” and “simplicity” of “desknet’s NEO” improve the situations of the working sites and supports work.

Users can use the groupware without stress on multiple kinds of devices, such as smartphones and tablets.

*High performance

In addition to basic functions, including schedules, information, and online e-mail, 27 full-fledged applications which are capable of dealing with workflow, internal SNS, and global design have been installed by default. The applications are coordinated with each other.

“desknet’s NEO” not only possesses various functions, such as schedules, booking of meeting rooms, and e-mails but also, outside the scope of groupware, offers solutions to issues confronted in working sites.

*27 applications installed by default

Furthermore, use of “AppSuite,” a tool with which custom-made business apps can be created, enables users to build apps in 4 steps based on a wide range of on-site operations. Apps so developed can be used as one of the functions of “desknet’s NEO,” and therefore, on-site business processing can be further streamlined according to the situations of each company’s work sites.

In addition, in September 2021, the company released Version 6.1, which comes by default with Smart Viewer, which helps to achieve a paperless meeting system by allowing users to share document contents with multiple members in real time, and assists user companies with their efforts for attaining the SDGs.

(Source: the company)

*Equipped with the function to link up with Amazon Business

Its version was upgraded to link up with “Amazon Business” in July 2019, and a purchase management function was incorporated.

The linkage between the groupware and “Amazon Business,” which is targeted at corporations, is taking place for the first time in Japan. (Source: NEOJAPAN Inc.)

Users can considerably cut down on man-hours and costs incurred for internal procedures for business purchases, through automation of all the processes involved in product selection, sending of an internal decision request and placement of orders.

From now on, the Company will take initiatives in telemarketing and holding events jointly with Amazon Business in order to expand sales.

*Adoption cases

A multitude of companies and organizations, including over 1,000 public agencies and local governments in 47 prefectures in Japan, have installed the groupware, regardless of industries, business types, and scales. Total number of users (the sum of the cumulative number of users who have purchased the licenses and the number of users using the cloud service) have reached about 4.34 million (as of the end of July 2021).

(Form of providing the groupware)

The groupware has been offered in 2 forms: the cloud version and the on-premise version. Lately, however, the cloud version of the software is showing a significant growth, following the soring needs by companies, such as “unwillingness to spend time and effort in installing groupware,” “unavailability of dedicated administrators due to a lack of staff who have extensive knowledge and experience regarding IT,” “desire to operate in a reliable security environment,” and “desire to cut down on initial expenses and operational costs as much as possible.”

(Sales structure)

NEOJAPAN itself sells its products and services; however, the Company specializes, in principle, in development and its products have been sold mainly via a total of about 600 agencies and Application Software Providers (ASPs) (*), who are referred to as partners.

(*) Application Software Providers (ASPs)

An Application Software Provider (ASP) is an operator that engages in the business of providing functions of application software as services to customers via networks.

②Sales segment

1) Cloud services business

NEOJAPAN offers the groupware “desknet’s NEO” and related products at a low price and in a highly reliable cloud environment.

As long as an Internet environment is available, users can use the services without any special investment in systems, such as servers, or knowledge about systems.

It is based on a “subscription model,” where customers are required only to pay a monthly fee or an annual fee for the number of users who will use the services, and they need not pay any initial expenses.

The minimum number of users for subscription is 5, and no upper limit has been set.

The monthly fee per user is 440 yen(tax included), which is the lowest in the cloud services industry.

2) Products business

The Company sells the licenses for its groupware “desknet’s NEO,” and related products. It also provides customization, labor services, and support services related to the products.

Customers purchase the licenses and then install the groupware products and services in relevant internal servers, virtual environment, rental servers, and cloud environment.

The “Small License” and the “Enterprise License” are available to small- and medium-sized customers with 5 – 300 users and large-sized customers with over 300 users, respectively.

| Small License | Enterprise License |

Outline | The Small License is targeted at small- and medium-sized customers and available at a low price. | The Enterprise License is designed for large-sized customers and can deal with large-scale and highly available configurations. |

Price | (desknet’s NEO licenses) ¥43,780 for 5 users to ¥1,097,800 for 300 users

(AppSuite licenses) ¥34,100 for 5 users to ¥877,800 for 300 users | (desknet’s NEO licenses) ¥451,000 for 100 users to ¥14,300,000 for the unlimited number of users

(AppSuite licenses) ¥360,800 for 100 users to ¥11,440,000 for the unlimited number of users |

No. of users | 5 to 300 users | Over 100 users |

Annual support services | Support services are available for free for the first year, and it is optional to purchase support services from the second year onwards. (desknet’s NEO licenses) ¥11,000 for 5 users to ¥165,000 for 300 users

(AppSuite licenses) ¥8,800 for 5 users to ¥132,000 for 300 users | Support services must be purchased for the first and subsequent years (mandatory). (desknet’s NEO licenses) ¥99,000 for 100 users to ¥2,574,000 for the unlimited number of users

(AppSuite licenses) ¥79,200 for 100 users to ¥2,059,200 for the unlimited number of users |

*All price indicates the gross price (tax included).

3) Technological development business

The Company engages in development of individual business applications related to the Internet and Intranet as outsourced by other companies, comprehensively offering a variety of system-related services, ranging from consulting to planning, designing, development, and network infrastructure establishment regarding application systems.

With the aim of cultivating techniques, the Company accepts orders mainly for development projects that are expected to lead to development of products and services for the “cloud services” and “products” segments.

(2) System development service business

This business is operated by the subsidiary Pro-SPIRE. Based on the accumulated know-how for cloud integration and system integration, they develop engineers, and provide mainly system engineering services for meeting customer needs by utilizing cutting-edge technologies.

(3) Overseas business

The overseas business includes businesses run by the company’s consolidated subsidiaries outside Japan, with the subsidiaries in Thailand and Malaysia engaging chiefly in selling NEOJAPAN’s products and services while the main business of the subsidiary in the United States is to conduct local marketing research.

1-5 Medium- to Long-Term Outlook

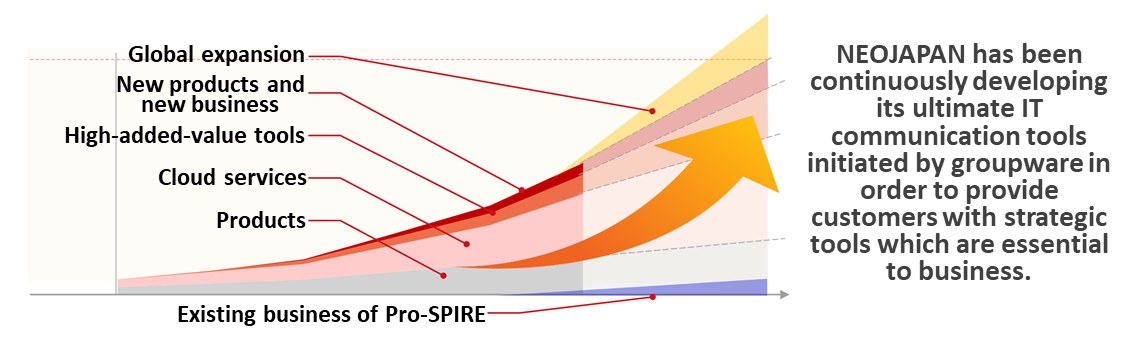

(1) Growth Image

With a focus on the existing groupware, the Company aims to develop communication tools essential for business and continue to provide products and services that lead the industry at all times.

The concrete measures are as follows.

High added value and product cooperation | * Evolve into higher value-added tools centered on groupware. |

Cloud service products | * Continue to upgrade existing groupware and enhance its functions.

* The company will expand marketing bases and improve sales and marketing capabilities and become No.1 in the groupware market. |

New products and new businesses | * The company will offer new IT communication tools that are indispensable for business strategies and develop businesses. |

Existing Pro-SPIRE business | * Steady operation of SES business, monetization through rationalization within the group, and participation of engineers in product development. |

Overseas operations | * Expanding to the Southeast Asian markets starting with Malaysia and Thailand and launching sales through alliances with overseas partners. |

(Source: the company)

(2) The management vision in the medium- to long-term plans

①Market position and external evaluation (Part 1)

The company aims to become "the top domestic brand of groupware," "hold the largest market share, and achieve cumulative sales of 10 million users and annual group sales of 10 billion yen" by 2030.

As for external evaluation, the company aspires to be No.1 in each fiscal year based on customer satisfaction surveys and partner satisfaction surveys as an index of external assessment.

To that goal, the company will take rapid steps to put reliable high technology and advanced IT into practical use to become the company that possesses Japan's leading software technologies.

②Market position and external evaluation (Part 2)

Furthermore, upon the reorganization of the TSE, the company aims to further improve corporate value through selecting the prime market to attract investments from domestic and foreign investors.

1-6 Characteristics and strengths

①Great customers’ and sales partners’ satisfaction

"desknet's NEO" received the "ITreview Grid Award 2021 Summer" for ten consecutive terms in the groupware and workflow categories. Also, "ChatLuck" won the same award for four successive terms in the business chat category. "ITreview Grid Award" is an award that recognizes products that have been endorsed by users once each fiscal quarter based on reviews posted on "IT review," a review platform for BtoB IT products and cloud services.

The Company has taken a lead in the industry with not only its outstanding technological abilities realized by the fact that about 60% of its employees are working in development-related departments, but also its comprehensive capabilities, including the user-friendliness and support structure.

②Competitive edge with services and costs

Considering the main players in the groupware market, leading vendors, including foreign companies, have held a large market share; however, NEOJAPAN has a competitive edge with services and costs, which has led to the abovementioned satisfaction rating.

- As for functions, products of Japanese vendors have garnered higher reputation than those of foreign companies because support provided by foreign companies, such as localization (systems supporting Japanese, and commercial and business practices in Japan), is not satisfactory.

- 27 basic applications have been installed in the systems of NEOJAPAN by default, which has topped the number of functions in services offered by other Japanese vendors.

- Installation cost and cost per unit of foreign vendors’ products and services tend to be expensive because they are targeted chiefly at large companies.

The introduction and operating costs of NEOJAPAN’s systems are the lowest in the industry, with the monthly fee for the cloud services being about one-half and that for the products (installation basis, including on-site hardware services) also being approximately one-half of other Japanese vendors’ systems.

(Source: the company)

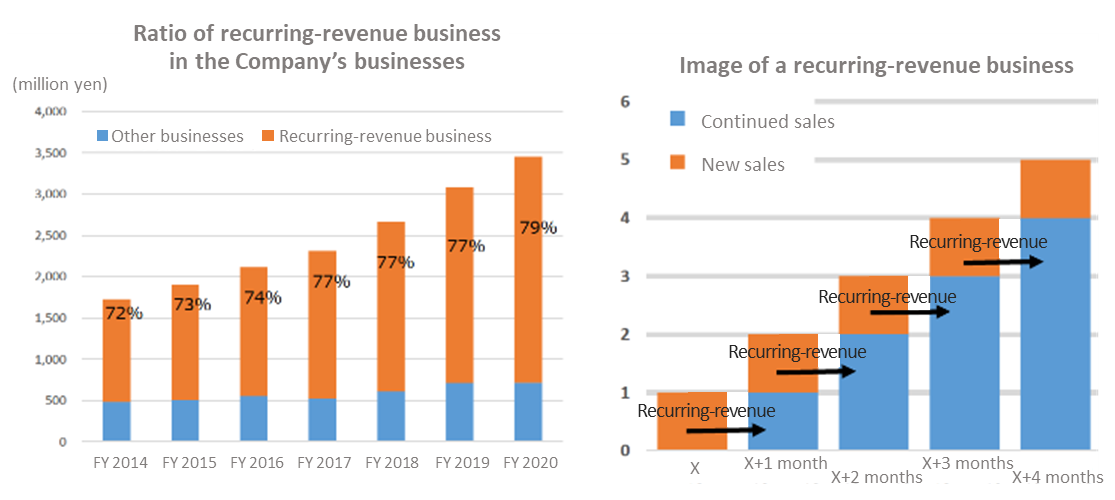

③Business model that realizes stable earnings

The Company’s main services, i.e., cloud services adopted a “subscription model” in which sales rise every month on a cumulative basis through monthly billing.

In addition, it is possible to upgrade the version of products for free on a continuous basis by providing support services after the purchase of on-premise version, so the Company recognizes these two as a “recurring-revenue business.”

Another notable characteristic of NEOJAPAN is that it established a business model that realizes stable earnings as it sells its products through its partners because of which the fixed costs are low, and also through the fact that once the Company’s products have been adopted, multifarious customers continue to use them because of the user-friendliness and low cost.

The ratio of recurring-revenue business is increasing each year, and it is expected to reach over 80% in the term ending January 2022.

(Source: the company)

④Pursuit of a continuous growth through synergies among each business

The Company pursues growth through a cycle of acquiring new, innovative technology in the technological development business utilizing the feedback from the market of cloud services, commodifying or upgrading the new technology in the product business, and enhancing its earning capacity, while expanding the market by adopting a subscription model for its core cloud services.

The company plans to improve its system engineering service by reorganizing Pro-SPIRE into a subsidiary and accelerate growth rate.

⑤Increased efforts in health management

NEOJAPAN Inc. offers groupware as its main product that contributes to “Work Style Reform” of the companies that have installed that groupware, for example, by improving their work efficiency and productivity. This company itself is increasing awareness of health management.

“Health management” means to think about employees’ healthcare from a management perspective and practice it strategically. Based on the corporate philosophy, it is expected that investing in employees’ health will lead to revitalization of the organization including better vitality of employees and productivity, resulting in improvement in business performance as well as stock price (taken from the Ministry of Economy, Trade and Industry’s website).

President Saito, who likes sports, has always spoken to staff members about “the importance of exercise and meals”, “balance between work and dream (personal life)”, etc., but as mentioned in the top message on the Company’s website for stockholders and investors, he has made a commitment to practice and promote health management in the future.

“In order to practice the management philosophy and realize operations considering global expansion of the Company, we will improve the work environment, where everyone is sound in mind and body and is able to demonstrate his or her ability to the fullest and promote health management.” (Taken from the Company’s website. Some parts have been modified by the writer.)

To be more specific, the Company strives to obtain the certification of “Corporation that is excellent in health management”, which is designed by the Ministry of Economy, Trade and Industry (METI) and recognized by Nippon Kenko Kaigi, and to be accepted as the “Health management brand”, which is selected and announced jointly by METI and Tokyo Stock Exchange.

As a result of these efforts, the company was certified as one of “Excellent Corporations for Health-oriented Management 2021 (section of large corporations),” for which the Ministry of Economy, Trade and Industry designed systems and Nippon Kenko Kaigi certifies excellent corporations for two consecutive years. From now on, the company will aim to be listed in “Stocks of companies that conduct health-oriented management,” which will be selected and announced jointly by the Ministry of Economy, Trade and Industry and Tokyo Stock Exchange.

1-7 Shareholder return

NEOJAPAN has deemed shareholder return as an important business challenge and raised the rough indication of the dividend payout ratio to over 20%.

In addition, the Company carries out a shareholder benefit program, in which it presents quo cards worth 500 yen to shareholders holding100 shares or more but less than 200 shares, and 1,000 yen’s worth of quo cards to shareholders who hold over 200 shares as of the end of an interim period and the end of each term, respectively.

1-8 ROE analysis

| FY Jan. 16 | FY Jan. 17 | FY Jan. 18 | FY Jan. 19 | FY Jan 20 | FY Jan 21 |

ROE (%) | 11.2 | 11.1 | 10.9 | 11.7 | 12.8 | 16.4 |

Net income margin (%) | 12.93 | 14.01 | 14.02 | 14.36 | 13.23 | 12.72 |

Total asset turnover [times] | 0.63 | 0.59 | 0.59 | 0.62 | 0.65 | 0.85 |

Leverage [times] | 1.38 | 1.33 | 1.31 | 1.32 | 1.50 | 1.51 |

ROE increased due to improved asset efficiency.

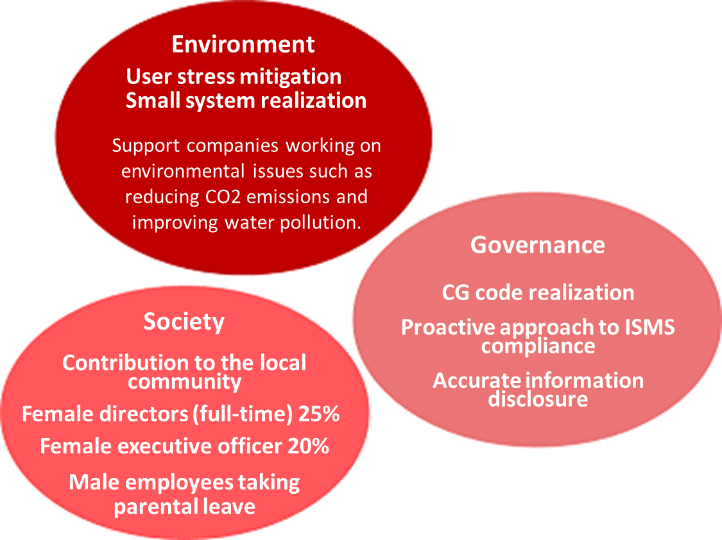

1-9 ESG/SDGs

ESG  | NEOJAPAN Inc. focuses on developing collaboration tools that not only communicate information, but also facilitate mutual understanding and synergy.

By expanding its own business in this manner, the company would like to contribute to creating an enriched society as follows:

A society in which individuals become independent and grow, make choices from a variety of options on their own responsibility, are treated with respect for their personalities, and demonstrate their capabilities. A society in which independent individuals cooperate with each other through connection with other people and join while playing different roles. A society in which achievements of the economic strengths are reflected in the life of each and every citizen. A society in which people coexist with the global society and cherish the blessings of nature and culture. |

SDGs

The company has formulated nine materiality items (management issues) to solve social issues and increase corporate value over the long term through business.

Materiality items | SDGs |

①Promoting a healthy and productive work style | Social issues that the company is focusing on

|

②Empowerment of customers and local economy through digital transformation | |

③Continuity risk mitigation of customer | |

④Response to climate change risk | |

⑤Business development through open innovation utilizing digital technology | Business creation as a solution to problems

|

⑥Fostering and diversifying digital human resources unique to our company | Sustainable supply chain

|

⑦Pursuit of a healthy and productive work style | |

⑧Providing safe and secure products | |

⑨Building a sustainable management base | Sustainable management base

|

2. Second quarter of Fiscal Year ending January 2022 Earnings Results

2-1 Earnings Results

| FY 1/21 2Q | Ratio to sales | FY 1/22 2Q | Ratio to sales | YoY |

Sales | 2,621 | 100.0% | 2,842 | 100.0% | +8.4% |

Gross profit | 1,366 | 52.1% | 1,473 | 51.8% | +7.8% |

SG&A | 797 | 30.4% | 832 | 29.3% | +4.4% |

Operating Income | 569 | 21.7% | 641 | 22.5% | +12.6% |

Ordinary Income | 585 | 22.3% | 723 | 25.4% | +23.5% |

Quarterly Net Income | 397 | 15.2% | 493 | 17.3% | +24.1% |

*Unit: million yen.

*Quarterly net income is net income attributable to shareholders of the parent company.

Sales and profit increased.

The sales were 28,42 million yen, up 8.4% year on year. The cloud services showed growth.

Operating income stood at 641 million yen, up 12.6% year on year. The increase in sales offset the rises in the costs for cloud services, labor, and advertising.

2-2 Sales trend by segment

| FY 1/21 2Q | Ratio to sales | FY 1/22 2Q | Ratio to sales | YoY |

Sales |

|

|

|

|

|

Software business | 1,699 | 64.8% | 1,860 | 65.4% | +9.4% |

System development service business | 933 | 35.6% | 997 | 35.1% | +6.9% |

Overseas business | - | - | 14 | 0.5% | - |

Adjustment | -11 | - | -28 | - | - |

Total Sales | 2,621 | 100.0% | 2,842 | 100.0% | +8.4% |

Operating income |

|

|

|

|

|

Software business | 472 | 27.8% | 614 | 33.0% | +30.0% |

System development service business | 96 | 10.3% | 49 | 5.0% | -48.7% |

Overseas business | - | - | -22 | - | - |

Adjustment | - | - | -0 | - | - |

Total Operating income | 569 | 21.7% | 641 | 22.6% | +12.6% |

*Unit: million yen

*Ratio to sales for operating income is operating income to sales. From the third quarter of FY 1/21, NEOREKA ASIA Sdn. Bhd. was included in the scope of consolidation, and "Overseas business" was added to the reportable segments.

①Software business

Sales increased 9.4% year on year due to the expansion of cloud services sales. Operating income rose 30% year on year.

◎Sales trends by segment

| FY 1/21 2Q | FY 1/22 2Q | YoY |

Cloud service business | 1,015 | 1,162 | +14.4% |

Product business | 650 | 666 | +2.5% |

Technological development business | 33 | 31 | -5.9% |

Software Business Total Sales | 1,699 | 1,860 | +9.4% |

*Unit: million yen

*Cloud service business

Sales increased 14.4% year on year.

The number of users of desknet’s NEO cloud, whose sales account for slightly over 80% of the cloud service business, steadily increased, exceeding 420,000 as of the end of July 2021. On the other hand, churn rate stayed low at 0.36% as of July 2021.

Although sales from AppSuite cloud make up only a small percentage of the total sales of the cloud services, the number of users grew on a steady basis.

Other monthly sales shrank due primarily to the declining number of individual orders for services other than the mainstay services but were almost as initially forecasted.

Total monthly sales increased 16.8% year on year.

Sales from other service operations were also as initially projected, although sales mainly from the customization service for application service providers decreased.

Sales of major services

| FY 1/21 2Q | FY 1/22 2Q | YoY |

desknet's NEO cloud | 818 | 976 | +19.2% |

AppSuite cloud | 23 | 40 | +69.6% |

ChatLuck cloud | 28 | 29 | +4.8% |

Other monthly sales | 108 | 98 | -9.7% |

Monthly Total Sales | 979 | 1,144 | +16.8% |

Other service work, etc. | 36 | 18 | -50.6% |

Cloud Service Total | 1,015 | 1,162 | 14.4% |

*Unit: million yen

*Product business

Sales increased 2.5% year on year.

Although sales from desknet’s NEO Enterprise License targeting large-scale users showed a significant drop as of the end of the first quarter, they were almost unchanged year on year at the end of the second quarter. Sales slightly exceeded the initial forecast and are expected to increase for the year as initially projected.

A number of large-scale user companies have an environment suitable for desknet’s NEO Enterprise License, including personnel in charge of operation, and the larger the users’ business scale is, the greater the benefits will be than when using the cloud version of the service in terms of the average spending per user; therefore, the company does not expect that demand for desknet’s NEO Enterprise License will fall considerably for the time being, but rather will focus on it along with desknet’s NEO cloud because it is a field in which the company’s products can make a strong showing.

Sales from desknet’s NEO Small License for medium- and small-sized users went down because a growing number of customers choose the cloud version of it. Its sales are on a downward trend because the use of the cloud version is becoming common.

Sales from AppSuite and ChatLuck Licenses fell into significant declines as of the end of the first quarter; however, customers tend to purchase them together with desknet’s NEO Enterprise License, because of which their sales increased as sales from desknet’s NEO Enterprise License grew, allowing the sales of the two licenses to be almost the same as those of the previous year.

The volume of orders for relatively large customization projects shrank.

Sales from the support services were greater than those of the last year owing mainly to a rise in sales from the support service for desknet’s NEO (including old products).

| FY 1/21 2Q | FY 1/22 2Q | YoY |

desknet's NEO Enterprise License | 99 | 97 | -1.2% |

desknet's NEO Small License | 36 | 28 | -22.8% |

AppSuite | 28 | 28 | -3.0% |

ChatLuck | 22 | 21 | -5.1% |

Other license sales | 3 | 0 | -99.3% |

Total License Sales | 190 | 175 | -7.8% |

Support service | 333 | 350 | +5.3% |

Customize | 55 | 43 | -22.0% |

Other service work, etc. | 72 | 97 | +35.4% |

Product Total | 650 | 666 | +2.5% |

*Technological development business

As the company has no policy of actively undertaking development, sales decreased 5.9% year on year to 31 million yen.

②System development service business

Although the impact of the COVID-19 infection has brought about environmental changes, including continuous diffusion of remote working, sales exceeded the initial forecast because the company flexibly fulfilled customer needs. On the other hand, profit shrank due to an increase in provision for bonuses in the first half of the term resulting mainly from a change in the rate of summer and winter bonuses allocated.

③Overseas business

The amount of investment is expected to be larger than sales to be generated for the time being.

*ASEAN region

While selling chiefly desknet’s NEO and AppSuite, the company cannot carry out sales activities as planned mainly in Malaysia because of the restrictions imposed on economic activities due to the spread of COVID-19. Sales from external customers fell below the initial forecast.

In its far-sighted marketing activities, however, the company conducts intense sales activities in pursuit of an objective of cost reduction by appealing customers to use its products and propelling forward commercialization of its products including services. Inquiries and orders are increasing, too.

The company is also planning collaboration projects with governments, government offices, and financial cliques of various countries aiming to expand its business.

*United States

The company collects market information through proactive meetings with local corporations and research.

The company also began considering new products and services that would help create NEOJAPAN’s new value by analyzing information on the local IT trends, and new technologies and markets expected to emerge in the future.

2-3 Financial standing and cash flows

◎Main BS

| End of Jan. 21 | End of Jul. 21 |

| End of Jan. 21 | End of Jul. 21 |

Current Assets | 4,457 | 4,516 | Current liabilities | 1,721 | 1,561 |

Cash | 3,385 | 3,525 | Payables | 152 | 155 |

Receivables | 723 | 691 | Unearned revenue | 570 | 679 |

Noncurrent Assets | 2,285 | 2,371 | Noncurrent liabilities | 590 | 548 |

Tangible Assets | 56 | 67 | Total Liabilities | 2,311 | 2,109 |

Intangible Assets | 369 | 443 | Net Assets | 4,431 | 4,778 |

Investment, Others | 1,860 | 1,860 | Total liabilities and net assets | 6,742 | 6,888 |

Total assets | 6,742 | 6,888 |

|

|

|

*Unit: million yen

Total assets stood at 6,888 million yen, up 145 million yen from the end of the year before, due in part of an increase in cash. Total liabilities went down by 201 million yen from the end of the previous year to 2,109 million yen. Capital-to-asset ratio grew 3.5 points from the end of the previous year to 69.1%.

◎Cash Flow

| FY 1/21 2Q | FY 1/22 2Q | Increase/decrease |

Operating Cash Flow | 456 | 443 | -13 |

Investing Cash Flow | -129 | -239 | -109 |

Free Cash Flow | 326 | 203 | -122 |

Financing Cash Flow | -137 | -244 | -107 |

Term End Cash and Equivalents | 2,993 | 3,474 | +481 |

*Unit: million yen

The surpluses of operating CF and free CF decreased. The cash position improved.

2-4 Topics

①NEOJAPAN chose the Prime Market

On July 9, 2021, NEOJAPAN Inc. received the result of a primary judgment from the Tokyo Stock Exchange (TSE) regarding the status of compliance with the criteria for maintaining the listing status for the new market segments and was confirmed that it satisfies all the following criteria for maintaining the listing status for the Prime Market: the number of outstanding shares, the market capitalization of outstanding shares, the ratio of outstanding shares, and the trading value.

Consequently, on September 14, 2021, the company resolved to choose to be listed on the Prime Market, one of the three new market segments into which the TSE plans to restructure its stock market on April 4, 2022, and to apply to the TSE.

②Develop a web marketing strategy & PR

The company hosted a greater number of online seminars and proactively exhibited at online events corresponding to the difficulty in holding in-person events due to the COVID-19 pandemic.

In addition, the company carried out public relations activities using the Internet and magazines with the aim of further fostering its public awareness.

3. Fiscal Year ending January 2022 Earnings Forecasts

3-1 Forecasts of Consolidated Business Results

| FY Jan. 21 | Ratio to sales | FY Jan. 22 Est. | Ratio to sales | YoY | Progress Rate |

Sales | 5,325 | 100.0% | 5,717 | 100.0% | +7.4% | 49.7% |

Operating Income | 920 | 17.3% | 948 | 16.6% | +3.0% | 67.7% |

Ordinary Income | 948 | 17.8% | 980 | 17.1% | +3.3% | 73.8% |

Net Income | 677 | 12.7% | 679 | 11.9% | +0.3% | 72.7% |

*Unit: million yen

*Estimates are those of the Company.

No change in earnings forecast. Sales and profit are expected to increase.

The full-year earnings forecasts remain unchanged. The estimate of sales is projected to grow 7.4% year on year to 5,717 million yen and operating income by 3.0% year on year to 948 million yen.

(Sales)

*Software business

The number of cloud service users is expected to remain stable, and overall cloud service sales are estimated to rise about 15%. As for products, sales of enterprise licenses are forecasted to rise because a certain amount of demand is expected, mainly from government offices and large users. Nonetheless, sales of products as a whole will only increase slightly due to a decrease in the sales of small licenses.

*System development service business

Although sales were smaller than the initial estimate in the previous fiscal year, the impact of the spread of the novel coronavirus infection is limited, so sales are expected to increase this fiscal year slightly.

*Oversea business

The company strives to cut down costs on streamlines business operations because the situation surrounding restrictions on marketing activities due to COVID-19 continues to be uncertain, as seen from the restrictions on activities that Malaysia imposed again in its country in February 2021.

(Costs)

R&D expenses are projected to augment, and also personnel expenses are forecasted to rise due to the increase of personnel. Advertising expenses are planned to be at the same level as the previous fiscal year.

Assuming that the activities of overseas subsidiaries go into full swing, SG&A expenses are expected to increase by approximately 80 million yen in relation to overseas businesses.

As a result, operating income margin will fall 0.7 points from the previous fiscal year to 16.6%.

The dividend is to be 12.00 yen/share, up 1.00 yen/share from the previous year's dividend. The expected payout ratio is 26.3%.

4. Conclusions

The company reached 49.7% and 67.7% of the sales and operating income targets, respectively, in the first half of the term. These rates are higher than those of the past few years, and the company may be able to make an upturn if it successfully boosts sales from desknet’s NEO cloud, on which the company intends to concentrate continuously from the third quarter onward.

Meanwhile, the financial report issue did not contain any mention of policies or measures toward 2030 by which the company aims to become the top domestic brand of groupware and achieve the goals of taking the largest market share, selling services to a cumulative number of 10 million users, and yielding annual sales of 10 billion yen for the group as a whole. Investors must be curious about a clearer and more concrete roadmap.

<Reference: Regarding Corporate Governance>

◎Organization type, and the composition of directors and auditors

Organization type | Company with board of company auditors |

Directors | 6 directors, including 2 to outside ones |

Auditors | 3 directors, including 3 to outside ones |

As of October 1, 2021, the Nomination and Compensation Committee was established as a voluntary advisory institution to the Board of Directors in order to strengthen the supervisory function of the Board of Directors and enhance the corporate governance system by increasing the transparency and objectivity of procedures related to the nomination and compensation of directors.

In response to the Board of Directors' consultation, the Committee mainly deliberates and reports on "matters related to the election and dismissal of directors," "matters related to policies and procedures for directors' compensation," "matters related to directors' compensation," and "other important management matters that are considered necessary by the Board of Directors.

The Committee consists of three or more directors appointed by resolution of the Board of Directors, the majority of whom are independent outside directors. The committee is chaired by an outside director by resolution of the Board of Directors.

Corporate Governance Report

Last update date: April 27, 2021

<Basic Concept>

NEOJAPAN's corporate philosophy is to "contributing to the formation of a flourishing information society through real IT communication tools."

Under the managerial philosophy, all the directors and employees of NEOJAPAN will comply with laws and articles of incorporation, fulfill their respective duties based on healthy social norms, and engage in corporate activities.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

“Supplementary Principle 3-1-2 Disclosure and provision of information in English”

| Currently, the ratio of non-Japanese shareholders is as low as 5%. Considering costs, etc., we do not disclose information in English. From now on, considering the increase in the shareholding ratios of non-Japanese shareholders, we will discuss the disclosure of information in English. |

“Supplementary Principle 4-1-2 Disclosure of mid-term managerial plan” | Although our company draws a mid-term managerial plan each term, we have not disclosed any plans for the ICT-related and groupware markets in which our company has engaged in business because the business environment and technology change rapidly and, thus, there is a great possibility that plans and forecasts diverge; provided, however, that, every month, the board of directors analyzes divergence between forecasts and actual results for the relevant fiscal year and, if forecasts for the fiscal year have not been achieved, the board performs thorough analysis and detailed discussion regarding causes and measures to take. Furthermore, taking into consideration the results of analysis of forecasts for the fiscal year as mentioned above, we conduct rolling planning every term in order to produce mid-term managerial plans. In the present circumstances, we have not scheduled to disclose any mid-term managerial plan so created; however, through IR activities and other means, we will strive to promote understanding of our medium- to long-term management strategies among shareholders and investors. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

“Principle 1-4 Explaining the purpose of strategic shareholding and establishment of standards for exercising voting rights”

| Our company doesn’t own any shares of listed companies as cross-held stocks, however, in case the Board of Directors determines that it will contribute to increasing the corporate value in the medium to long term, and leads to strengthening the management strategy and establishing relationships with our clients, there will be a possibility of strategically holding listed companies’ stocks. The Board of Directors will annually examine the rationality of the continuous holding of listed shares that were decided to be cross-held, in light of the purpose for which it was held, while considering its risks and return for the medium to long term. Regarding exercising voting rights, we are yet to establish a uniform standard, since a qualitative and a comprehensive judgment based on the relationship with the issuing corporate of each share is required. |

“Supplementary Principle 4-11-3: Ensuring the effectiveness of the Board of Directors and the Board of Auditors”

| Since the term ended January 2018, we’ve been distributing questionnaires to each Board Member, collecting answers, and evaluating and analyzing the results to survey the effectiveness of the Board of Directors overall. Additionally, we will disclose the outline of the results in a timely and appropriate manner. |

“Principle 5-1 Policy on constructive dialogue with shareholders” | Our company's policy on the development of systems and initiatives to promote constructive dialogue with our shareholders is as follows. (1) Our company will designate an officer in charge of overall dialogue with shareholders, who will be responsible for IR, and the department in charge of IR will promote dialogue with shareholders in cooperation with accounting, finance, and management planning. (2) Our company will make feedbacks of the opinions and other information obtained through dialogue with shareholders to directors other than those in charge of IR and other related internal persons in order to share information. (3) As a dialogue other than individual meetings, we hold financial results briefings for institutional investors and analysts (twice a year), and also hold briefings for individual investors when necessary. In addition, we improve our IR website and respond to inquiries from shareholders to the rational extent possible. (4) When engaging in dialogue with shareholders, we take care to manage insider information by conducting dialogue based on the disclosed information. In addition, a certain period of time prior to the announcement of financial results is designated as a quiet period, and dialogue regarding financial results information is restricted during this period. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |