Bridge Report: (3937) Ubicom Holdings, Inc.

President Masayuki Aoki | Ubicom Holdings, Inc. (3937) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Information and communications |

President | Masayuki Aoki |

HQ Address | Joko Bldg., 9F, 2-23-11, Koishikawa, Bunkyo-Ku, Tokyo |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥1,254 | 11,483,360 shares | ¥14,400 million | 24.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

TBD | - | ¥38.60 | 32.5 x | ¥147.18 | 8.5x |

*The share price is the closing price on May 15. The number of shares issued was taken from the latest brief financial report. ROE and BPS are the values of the pervious term.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2016 | 2,926 | 193 | 232 | -4 | -0.49 | 0.00 |

March 2017 | 2,992 | 237 | 289 | 112 | 10.60 | 0.00 |

March 2018 | 3,208 | 322 | 355 | 212 | 19.08 | 0.00 |

March 2019 | 3,555 | 564 | 591 | 368 | 32.57 | 5.00 |

March 2020 (E) | 4,021 | 671 | 710 | 443 | 38.60 | TBD |

*Forecasts are those of the company. Net income is profit attributable to owners of the parent. Hereinafter the same will apply.

This report introduces the company overview of Ubicom Holdings, Inc., its future growth strategies, earnings outline, and the interview with the president Aoki, etc.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2019 Earnings Results

3. Fiscal Year ending March 2020 Earnings Forecasts

4. Future Growth Strategy

5. Interview with President Aoki

6. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Ubicom Holdings, Inc. is the one and only global innovation company, which pursues achieving growth by providing solutions that conform with national policies. It carries out the global business for offering IT solution services in a broad range of markets and medical solutions, including medical claims validity inspection software.

- The company offers its original solutions to social issues, including “the worsening shortage of IT personnel,” “the rationalization of augmenting national healthcare expenditure,” and “the utilization of medical big data,” to meet demand without fail, and is growing.

- Its major characteristics and strengths are “the group of 900 top-class engineers at the development foothold in the Philippines,” “the robust customer base,” and “camaraderie inside and outside the corporate group.”

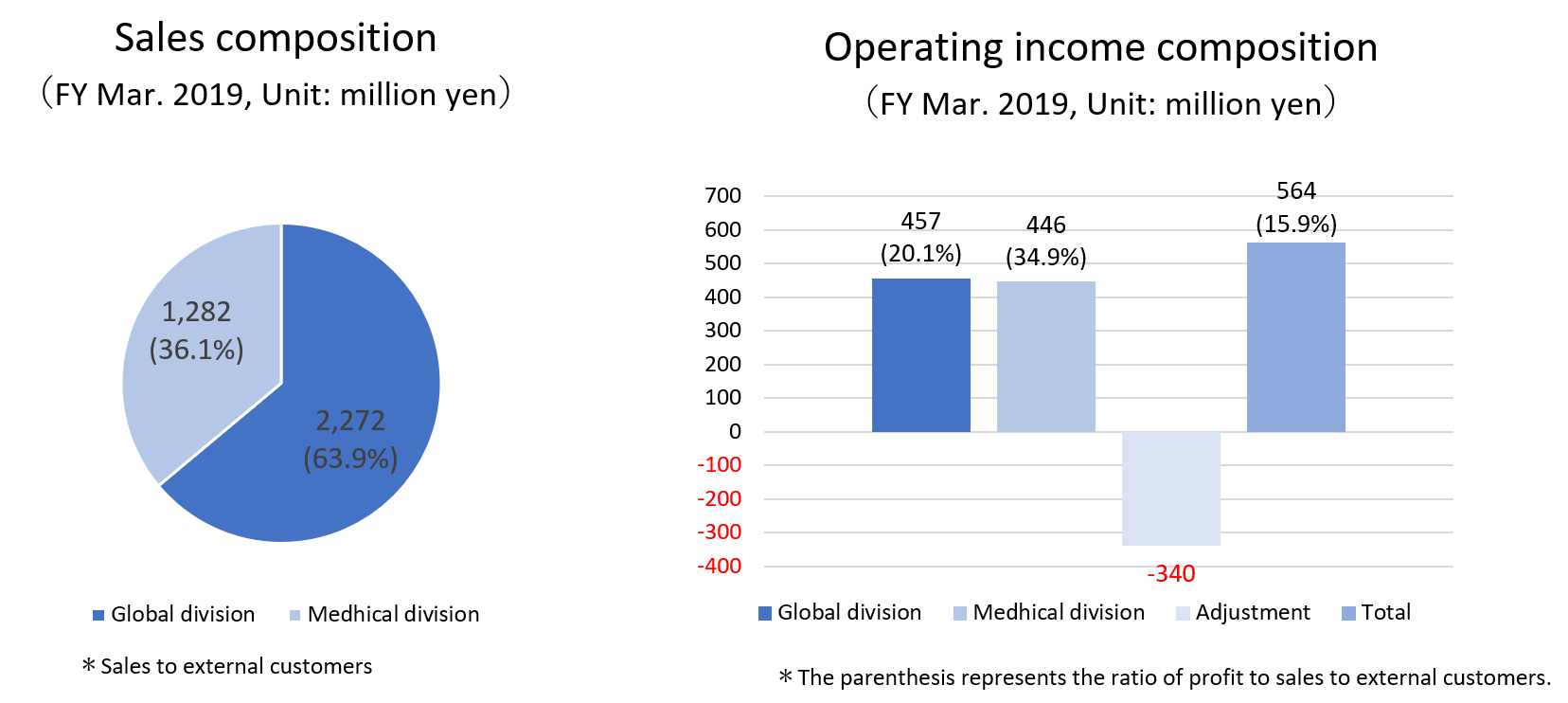

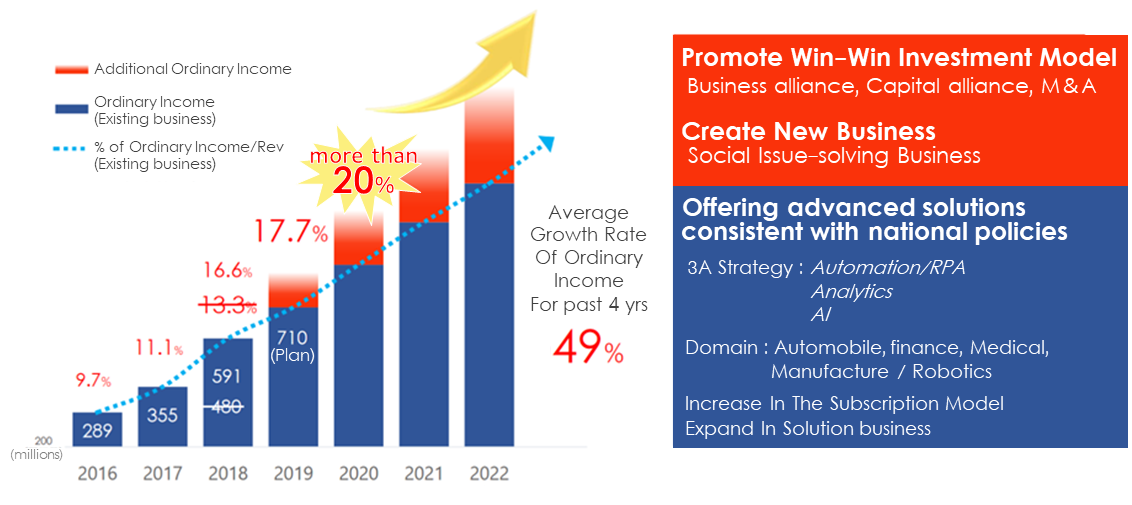

- The sales for the term ended March 2019 were 3,555 million yen, up 10.8% year on year. In the global business, the number of orders from new customers increased. In the medical business, sales grew for existing products, and the launch of new products contributed to market expansion. Operating income rose 75.1% year on year to 564 million yen. Both businesses have established a highly profitable business model, which offset the company’s aggressive strategic investment into human resources, resulting in a significant increase in profit. Both operating income and ordinary income reached record highs for the 5th consecutive term.

- The sales for the term ending March 2020 are estimated to rise 13.1% year on year to 4,021 million yen. Operating income is forecast to grow 19.0% to 671 million yen, and ordinary income will increase 20.1% year on year to 710 million yen. Both businesses will continue to perform well. Ubicom will conduct strategic investment with the intention of further boosting profits from the term ending 2020 onward, but the company will be able to offset investment costs, resulting in a double-digit increase in profit. Both operating income and ordinary income are expected to reach record highs for the 6th consecutive term. Although the dividend has not yet been decided, the company plans to return profits to shareholders appropriately, as they did in the previous term, in which they paid dividends for the first time.

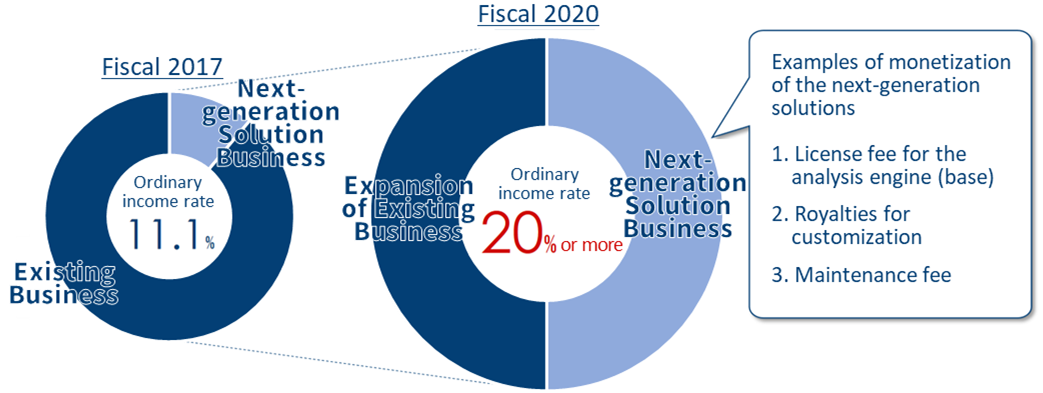

- For the term ending March 2021, the company aims to achieve an ordinary income rate of 20% or higher by considerably growing highly profitable next-generation solution businesses while expanding the existing businesses continuously, and earning half of ordinary income from next-generation solutions.

- We interviewed the president Aoki. Toward shareholders and investors, he gave the following message: “In the term ended March 2019, we decided to pay dividends for the first time. We hope to increase dividends and payout ratio in the future. After this, too, we will conduct investments, but will meet the expectations from shareholders and investors by improving our performance so that it can exceed the investment cost. We would appreciate your support from the mid or long-term viewpoint.”

- The profit margin of the company is skyrocketing. In the term ended March 2019, operating income margin (to sales toward external customers) increased 3.2% and 6.8% year on year for the global business and the medical business, respectively. The operating income rate for the entire company rose 5.9%. As mentioned in this report, this is mainly because the horizontal expansion of core solution services was accelerated for the global business and for the medical business, in addition to the existing business that is performing strongly, the highly profitable recurring-revenue model was established by releasing the next-generation medical claims validity inspection system “Mighty Checker® EX”. For the current term, ordinary income rate is estimated to be 17.7%. The company aims to achieve an ordinary income rate of 20% or higher in the term ending March 2021. To achieve it, both businesses need to establish a subscription model as soon as possible. We would like to expect the progress of cross-sectored expansion of “3A,” that is, “Automation/RPA,” “Analytics,” and “AI,” and the development of new markets.

1. Company Overview

Ubicom Holdings, Inc. is the one and only global innovation company, which pursues achieving growth by providing solutions that conform with national policies.

The company conducts a global business that offers IT solutions to diverse markets such as automotive, financial, medical, manufacturing, and robotics markets, and a medical business that deals with medical solutions, such as medical claims validity inspection software. The source of the company’s competitive advantage lies in the development base of the subsidiary in the Philippines, which has a top-class engineering group composed of about 900 engineers.

The company aims to achieve ordinary income margin to sales of 20% or higher in FY 2020 by making even more growth through strategic alliances, collaborations based on a win-win investment model, and the expansion of a high profitability recurring-revenue business.

1-1 Corporate History

Mr. Masayuki Aoki, who had entrepreneurial ambition all along, took the position of President and CEO at WCL Co., which was a new business subsidiary of WORLD CO., LTD. in March 2005, and then found out that there are many young talented engineers who work vigorously in the Philippines when he visited there during his domestic and international search for seeds of various new businesses. As the adoption of IT on internal operations of companies progressed in Japanese companies, he thought that conducting the system development in the Philippines will open the possibilities to offer a wide array of system solutions globally at a low cost and capture the demand, and decided to commercialize the idea. In December 2005, He founded Advanced World Solutions, Ltd. (currently: Ubicom Holdings, Inc.)

Following the trend of ICT adoption, the increase of new customers progressed well and the business expanded thanks to the competitive advantage of having a development base in the Philippines, which possesses many capable top-class engineers. In June 2016, the company was listed on Mothers of Tokyo Stock Exchange. After it changed its name to Ubicom Holdings, Inc. In July 2017, it was listed on the First Section of the Tokyo Stock Exchange in December of the same year.

1-2 Corporate Ethos and Vision

The company advocates the following 3 management visions as the one and only global innovation company.

1. To achieve innovation and create new markets ahead of competitors |

2. To achieve global development |

3. To remain the one and only company in providing solutions in a niche field. |

The company pursues achieving growth by providing national policy-consistent solutions, including the alleviation of labor shortage and the rationalization of medical expenses. At the same time, the company sees this as its social responsibility and raison d'être.

1-3 Business Description

1-3-1 Overview

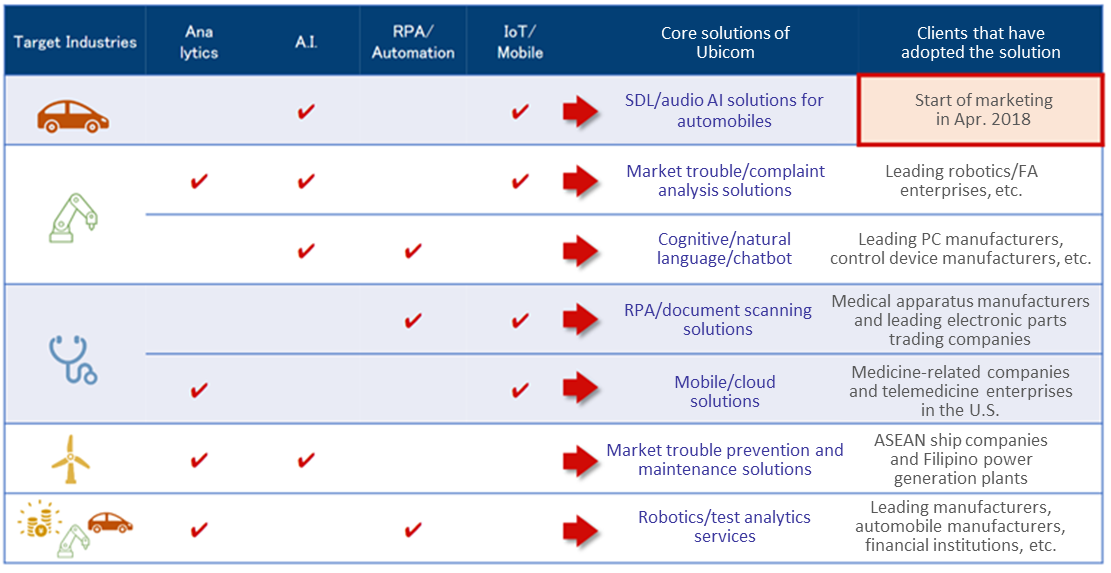

The company perceives social structure changes such as globalization and the decreasing birthrate and aging population, as well as technological advances in the field of Medical Life Sciences, Cybernetics, and Robotics, as an opportunity to develop new businesses. It develops its own core solutions mainly in the “3As” fields (Automation/RPA (Automation of software testing and inspection process of the production line), Analytics, AI (Artificial intelligence)) for the strategic business domains: automobile, financial, medical, manufacturing, and robotics ones, and provides services for many client companies.

1-3-2 The business environment surrounding the company

1) Worsening labor shortage in the IT field

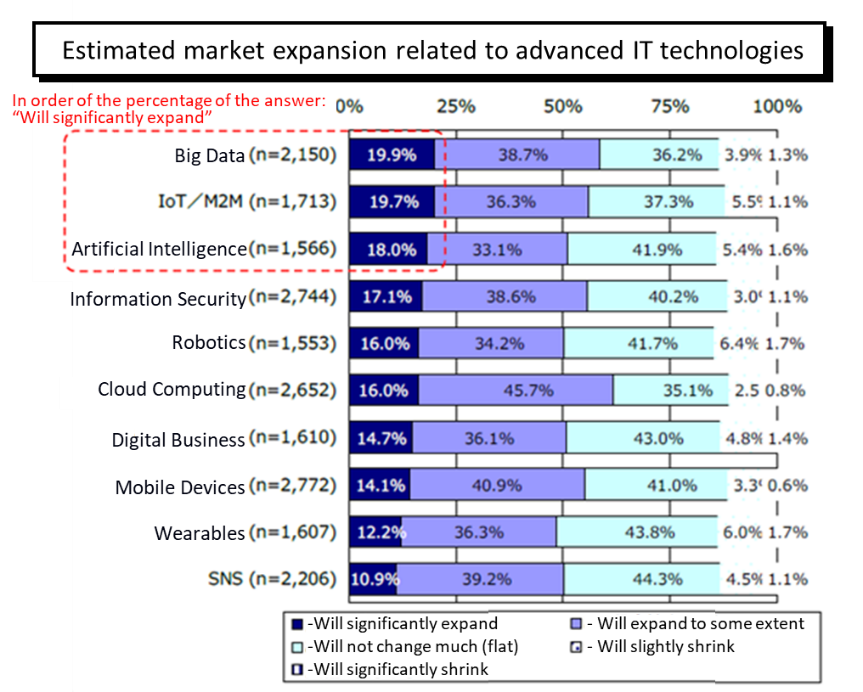

The “results of a survey on the latest trend and future forecast of IT personnel” (published on June 10, 2016) conducted by the Ministry of Economy, Trade and Industry states that the IT demand is expected to continue to further grow in the medium to long term while the workforce (especially the youth population) will decrease due to the decreasing population; This will make it even more difficult to employ IT personnel, and it's highly possible that the shortage of IT personnel issue will become severer.

While a labor shortage in 2015 was about 170,000 people, the labor shortage is estimated to reach about 790,000 people in 2030 under a negative scenario, and about 590,000 people under a neutral scenario.

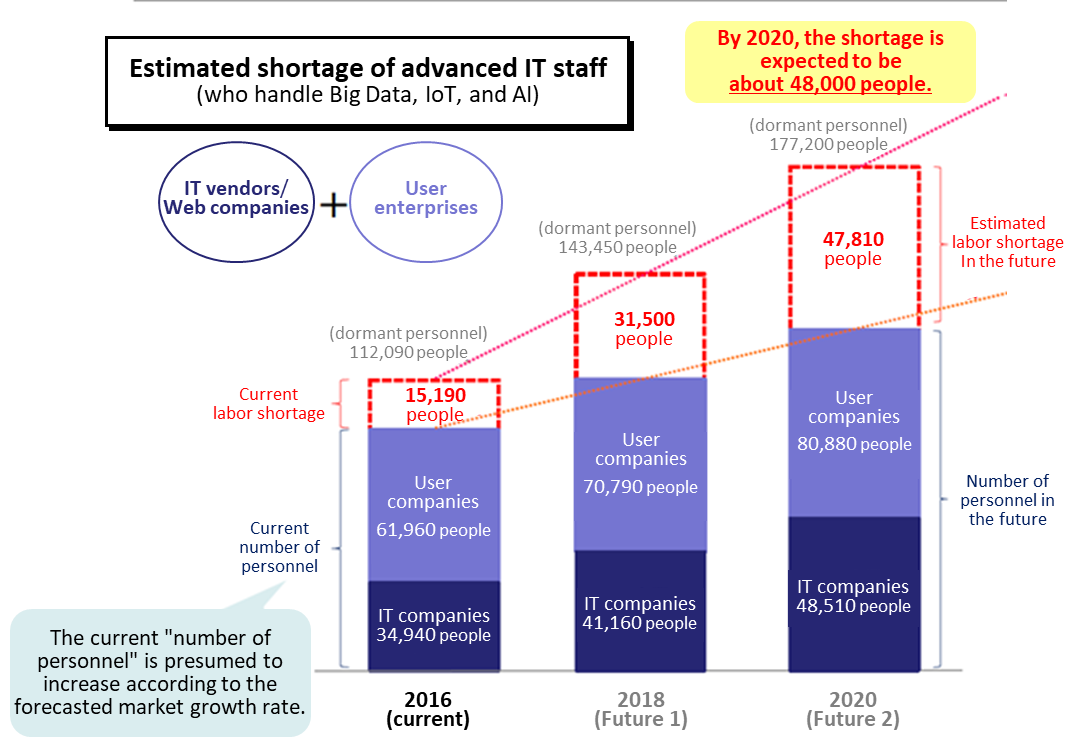

Particularly, the labor shortage in the growing markets of advanced IT technologies, such as big data, IoT, and AI, is estimated to expand from about 15,000 people in 2015 to about 48,000 people by 2020.

In addition, in Japan, the English language barrier limits the access to the most advanced technologies of Europe and the US, which makes the problem of labor shortage extremely severe in Japan.

(Taken from the “Results of a survey on the latest trend and forecast of IT personnel" conducted by the Ministry of Economy, Trade and Industry, and published on June 10, 2016)

2) The augmenting national medical care expenditure and the reinforcement of medical claims validity inspection

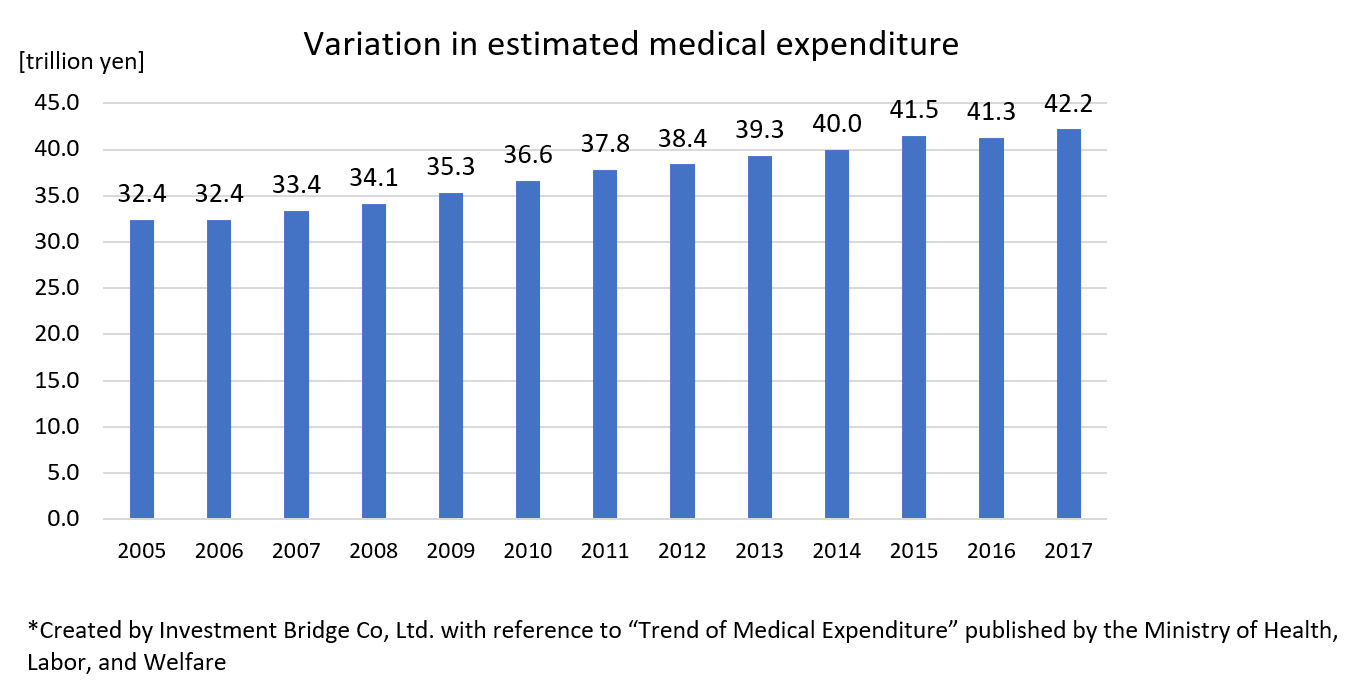

The estimated medical expenditure (excluding expenses such as workers’ accident compensation insurance and payments when the full payment is covered with own expenses. It accounts for about 98% of the national medical care expenditure, which is the overall estimate of all expenses required for treating injuries or diseases after examinations by doctors in medical institutions) has marked a record high in FY 2017 at 42.2 trillion yen, which came higher than the 41.5 trillion yen in FY 2015.

As medical expenses are in an increasing trend due to the progression of the aging population, the financial situation of medical insurances keeps getting worse. In order to reduce insurance costs, each medical insurance is proceeding with the rationalization of medical expenses by reinforcing the inspection of medical claims validity.

(What is the medical claims?)

Under the current system of health care services provided by health insurance, medical institutions receive up to 30% from patients and the other 70% or more from the health insurance association, mutual aid associations, city or ward offices, etc.

Medical institutions define the detailed statement of diagnosis and treatment, which is required to claim the amount covered by insurance from these public institutions, a Medical Claim; and the tasks performed to issue the Medical Claim are a very important procedure, which makes up most of the revenue of medical institutions.

The submitted Medical Claims are meticulously scrutinized by the Examination and Payment institutions. In case there is a mistake in its content, the Medical Claim may be sent back (returned) by the Examination and Payment institution, or the scores of medical fees may be reduced. In case the Medical Claim is returned, it must be carefully examined, revised, and resubmitted. Submitting appropriate Medical Claims is an extremely important task for the efficient management of medical institutions.

In May 2009, medical institutions were obligated to make online requests for Medical Claims, as a general principle.

Amid the trend of reinforcing inspection at examination and payment institutions, it is now important for medical institutions to adapt to online systems and improve the accuracy and efficiency of the Medical Claims inspection.

3) The medical big data market, which is expected to grow rapidly

As the social insurance system is being reconsidered due to the progression of the aging population, it is required to reduce medical expenses by streamlining medical services while maintaining and improving its quality.

The key to achieving that is the utilization of data based on medical practices, such as the data of medical claims, digital diagnostic records, health checkups, etc. and it is expected to solve regional medical issues, improve the efficiency of R&D and the management of medical institutions, and so on.

The “Next-generation Medial Base Act,” which was enforced in May 2018, was established as a system that paves the road to allow medical institutions to use personal information smoothly while considering the protection of personal information.

This act mentions “providing patients with optimum medical treatments through large-scale research on the effects, efficiency, etc. of medical treatments utilizing technological advancement of ICT,” which is expected to be achieved in the future. Also, the utilization of medical big data is expected to contribute to cutting-edge research and development in the fields of medicine manufacturing, insurance, and medical equipment, as well as creating new industries.

According to a private-sector survey, the domestic market of medical big data business in FY 2025 will be represented by diagnosis and treatment systems and its scale will be about 830 billion yen; and it is expected to steadily expand in the future.

The company, which pursues achieving growth by providing national policy-consistent solutions, offers its own solutions for the above-mentioned social issues, such as “the growing shortage of IT personnel,” “the rationalization of the expanding national medical expenditure,” and “the utilization of medical big data,” to meet demand and grow steadily.

1-3-3 Mainstay business domains

The company focuses its efforts to expand its business based on the strategic business domains of the “3As” fields, which will usher in the new age.

Field | Current situation and future plans |

Automation/RPA | The company has established a software automation engine and promoted Robotics/RPA (automation of work processes with robots). It aims to reach the major Robotics and FA (factory automation) companies to expand the market. |

Analytics | The company finished the development phase of Japan’s number one Medical Claims Inspection Software, the Mighty series, and analysis tools, and will proceed to a phase of achieving a new monetization model by building an engine that analyzes big data of medical-related fields to improve the quantity and quality of the data. In addition, the company provides solutions for predictive maintenance for factories and shipping companies. |

AI | The company has finished the development of Voice AI, ChatBot (Automatic conversation program), Voice AI for automatic vending machines, etc. with major partners. In the future, it will focus on developing solutions with in-vehicle AI devices by using voice AI with automobiles' SDL (The smart device link that connects car audio with smartphones). In addition, it also plans to support devices installed in self-driving cars and aims to build a recurring-revenue business that will sustainably generate significant profit by the time self-driving cars become popular. |

1-3-4 Segments

The company has 2 business segments; one is a global business that provides IT solutions to diverse markets such as Automotive, Finance, Medical, Manufacturing, and Robotics, and the other one is a medical business that deals with medical solutions, such as the Medical Claims Inspection Software.

1) Global business

- Overview

Its wholly-owned subsidiaries, Advanced World Systems, Inc. and Advanced World Solutions, Inc. are the major development bases in the Philippines, where it focuses on Automotive, Finance, Medical, Manufacturing, and Robotics fields and develops embedded software, device drivers, middleware, Windows/Linux applications, IoT applications, etc.

The company defines “3As” (Automation/RPA, Analytics, and AI) as a strategic business domain, and develops its own core solutions. The advanced capability of developing solutions is derived from its development bases in the Philippines, which has a top-class engineering group composed of about 900 engineers. This gives it a strong competitive advantage. (Refer to 【1-4 Characteristics and Strengths】 for more details.)

- Customers

Its client companies range broadly from automotive, manufacturing, medicine, to finance-related ones.

As mentioned above, in addition to the worsening IT personnel shortage, there have been strong needs for the reduction of costs for development and operation, but the company, which has 900 competent engineers who are native in English and proficient in Japanese, is steadily meeting such needs.

On top of that, the rich experience of development for numerous big domestic clients over many years has further earned their trust and built its reputation.

2) Medical business

- Overview

Its wholly-owned subsidiary, AIS Co., Ltd., develops and sells software products for medical information systems of medical institutions, etc.; it also offers contracted development, medical big data analysis engine, and consultation services.

The “Mighty Series,” which improves the management quality and increases the work efficiency in medical fields, is well-received thanks to its rich and useful features. Because of this, the series holds one of the top market shares. As of the end of March 2019, the Mighty series are top-share products, which have been introduced in approximately 58% of national university hospitals (26 facilities), 35% of hospitals with 20 or more beds (3,009 facilities), and 12% of clinics with 19 or less beds (12,000 facilities), totally about 15,000 facilities.

- Mainstay products

The Medical Claims Inspection Software (Mighty Checker®)

As medical claims were required to be efficient and strict, the company was ahead of competitors in releasing Medical Claims Inspection Software (Mighty Checker®) in 1999; it was well-received for its usability and it managed to establish its position as a leading maker of “Medical Claims Inspection Software.” In FY 2019, it released “Mighty Checker® EX,” an AI-based new-generation Medical Claim check system, and reaffirmed its market position.

Mainly, the company strongly supports the Medical Claim issuing process with the following features:

Product name | Features |

Mighty Checker® PRO Advance | - A standard version of Medical Claims inspection software. - Validates the disease name, medicines, and medical care of the indication. - Inspects the measures for assessment and return (cross-check inspection, general inspection, calculation day check, etc.) - Validation by the calculation support feature (checks items that can be calculated with consultation fees, etc.) |

Mighty Checker® PRO Analyze | -An advanced version of Medical Claims inspection software -Analyzes inspection results, and suggests an efficient inspection process. - In addition to the assessment and return measures, it can use inspection results more efficiently by utilizing the result of checking medical claims. - It makes it easier to modify a database by capturing the assessment and return data; thus, it helps curb assessments and returns. |

Mighty Checker® EX | -A new product of the Mighty Checker series that was released in December 2018 -An AI-based new-generation Medical Claim check system that focuses on usability |

Ordering check software, “Mighty QUBE® PRO”

It's a system that utilizes the Mighty Checker® database, and inspects the compatibility of the medical practices and medications with patients, and checks usage, dosage, etc. at the time of prescription; in case there is incompatibility or omission of the disease name, the system notifies users of an error. By restraining incorrect human input and inappropriate operation at the time of issuing a prescription, it can prevent medical accidents (close calls) and assessment (reduction).

Also, this product was highly acclaimed for its contribution to the improvement of management quality and is being adopted by many medical institutions.

1-4 Characteristics and Strengths

1-4-1 A top-class engineering group composed of about 900 engineers at the development base in the Philippines

As was touched upon in the corporate history section, the president Aoki had inspected the site several times, and considered the Philippines as an optimum location for developing a development base. It not only is the source of the company's competitive advantage, but also plays an extremely important role for driving the future growth strategy.

The development base in the Philippines and its predecessor have over 20 years of development experience, and their main characteristics are as follows:

1) The optimum location for global development: the Philippines

The Philippines enjoys the demographic dividend period, where a long-term population growth, especially for young citizens, continues. It maintains an economic growth rate of roughly 6% on average. Moreover, young citizens are full of vigor and strive for upward mobility.

In addition, the fact that English is the official language plant the seeds for engagement in global activities, the fact that IT literacy is high, and its easily accessible location at the center of ASEAN countries, etc. make it an optimum location as a global base for IT development.

2) Employing elite staff

The development base in the Philippines currently has as many as about 900 engineers enrolled, but it does not only boast of the quantity (number of people), but also the quality (their aptitude), which is unrivaled.

Backed by a long track record, the engineers who seek employment at the company highly value the development base in the Philippines, and the number of applicants reaches about 4000 every year. However, the company only hires about 160 engineers, which makes it a strait gate with a ratio of successful applicants of about 4%.

Moreover, it successfully acquired elite personnel, about 70% of whom have graduated from the University of the Philippines or one of the other top 3 universities in the Philippines.

3) Human resources development with original education and training

Building a top-class engineering group cannot be achieved just by hiring elite personnel.

One of the differentiating factors that make it hard for competitors to catch up with the company is, in fact, its educational system and training, which turn staff into capable top engineers.

In April 2003, 16 years ago, the corporate group established its own training center ACTION in the Philippines and started its operation.

The training programs offered at “ACTION” were developed by the company. It is constituted by 4 categories: basic concept for IT, advanced technologies, interpersonal skills, and the Japanese language. The training is conducted for 5 months and it aims employees will pass the PhilNITS (The Filipino National Information Technology Standards exam) and the Japanese Language Proficiency Test level 4.

After completing the training, the trainees present their achievements to a board member, and after going through interview assessments, they are finally assigned to projects. Even for elite students, the journey up to the point of being able to handle job assignments is not an easy one. The program graduates who overcome such hurdles acquire the skills needed for fulfilling their duties in an advanced technical field and a Japanese-speaking environment, hence they are overwhelmingly superior in the Japanese IT market, and they are the engine driving the company’s growth.

Furthermore, the company is always handling numerous challenging cutting-edge projects, giving highly motivated staff chances to shine. This is also one of the reasons why the corporate group is so popular as an employer in the Philippines.

4) Further upgrading and reinforcing of solution development capabilities

The company is already outshining competitors with its advanced solution development capabilities, but as it aspires to make robust use of this advantage, the company established the “Advanced Technologies Development Center” in 2017.

About 60 of the center’s advanced engineers specialize in AI and big data analysis. By taking advantage of their native English to connect with top-class researchers globally, the company established a system that gives access to the latest cutting-edge technologies.

This allowed them to mass-produce prototypes with high added value in a short period of time at low cost, and deliver them to big clients in Japan. Consequently, its proposal capabilities have tremendously improved.

5) Receiving external acclaim

The work of its top engineers, who had overcome high hurdles and managed to participate in projects, has received high external acclaim, which led to the winning of numerous awards.

* In 2016, two of its engineers were placed among the top 3 of Asia’s common standardized version exam of the Japanese Information-Technology Engineers Examination.

* In 2017, its Philippine subsidiary, AWS, Inc. was awarded as the best software company across the Philippines in the “International ICT Award.”

* Its training program “ACTION” has been consecutively awarded the Outstanding Company Program award at the "e-Services Philippines Award” for 6 years.

1-4-2 A robust customer base

Armed with a strong competitive advantage of having both a global division and a medical division, the company has established a robust customer base.

The robust client assets are considered to play a big role for the expansion of the recurring-revenue business, which is based on subscriptions, and the win-win investment model that matches growing corporations with customer enterprises, etc.

1-4-3 Feeling of partnership inside and outside the Group

The president Aoki considers all the employees, including those who work overseas, and their family members as "fellows." He thinks that one of the Group's strengths is that it achieves leaping growth thanks to all the employees who positively work with a cheerful never-fading smile, yet are never satisfied with status quo; each and everyone has a sense of ownership and thus pioneer the new times.

This feeling of partnership that values harmonious relationships extends to even outside the Group.

The win-win investment model, one of the company’s important growth strategies, offers support from various perspectives, such as capital, marketing, and the development environment, to venture companies that are expected to rapidly grow. The company embraces a sense of “fellowship” for growing together beyond differences in corporate size and relationships between shareholders and portfolio companies. This is expected to help motive venture firms grow. This is probably the big difference from general VC (venture capital) and CVC (corporate venture capital).

1-5 ROE Analysis

| FY 3/2015 | FY 3/2016 | FY 3/2017 | FY 3/2018 | FY 3/2019 |

ROE (%) | 4.9 | - | 12.2 | 17.7 | 24.7 |

Net Income to Sales Ratio (%) | 1.24 | -0.16 | 3.76 | 6.63 | 10.37 |

Asset Turnover Ratio (x) | 1.33 | 1.46 | 1.44 | 1.36 | 1.27 |

Leverage (x) | 2.97 | 2.62 | 2.25 | 1.96 | 1.87 |

*The asset turnover ratio and leverage are calculated with the average amount between the beginning and the end of the term. Calculated by Investment Bridge Co, Ltd. based on annual securities reports and brief financial statements.

For the three most recent fiscal years, profitability recovered, and ROE substantially increased.

The net income to sales ratio in the term ending 2020 is forecasted to significantly rise to 11.0%, and ROE is expected to further rise.

1-6 Shareholder Return

While the company recognizes returning profits to shareholders as one of the most important issues for management, it has been prioritizing expansion of its internal reserves for future business development and reinforcing the management quality. However, the company decided to pay dividends for the first time in FY 2019, while considering the recent increase of orders received, robust business performance, and the establishment of the foundation for a profitable recurring-revenue business model. The dividend is to be 5 yen per share, and payout ratio is expected to be 15.4%.

Going forward, Ubicom will aim for a dividend payout ratio of 30% or more, and focus on expanding shareholder returns. At the same time, they will create a stable cash flow by switching to a subscription-based business model, and will pursue active investment in human resources, R&D, and the development of new businesses.

2. Fiscal Year ended March 2019 Earnings Results

2-1 Earnings Trends

| FY Mar. 18 | Ratio to sales | FY Mar. 19 | Ratio to sales | YoY | Compared with Initial estimate | Compared with Revised estimate |

Sales | 3,208 | 100.0% | 3,555 | 100.0% | +10.8% | -1.8% | +0.9% |

Gross profit | 1,289 | 40.2% | 1,555 | 43.7% | +20.6% | - | - |

SG&A | 966 | 30.1% | 991 | 27.9% | +2.6% | - | - |

Operating Income | 322 | 10.0% | 564 | 15.9% | +75.1% | +24.3% | +15.2% |

Ordinary Income | 355 | 11.1% | 591 | 16.6% | +66.4% | +23.1% | +15.5% |

Net Income | 212 | 6.6% | 368 | 10.4% | +73.2% | +30.8% | +12.4% |

*The estimates were provided by the company. The Actual to Revised estimate figures are based on the revised forecast made in November 2018.

*Unit: million yen

Sales increased, and profit rose substantially. Both reached record highs for the 5th consecutive term.

Sales were 3,555 million yen, up 10.8% year on year. In the global business, the number of orders from new customers increased. In the medical business, sales grew for existing products, and the launch of new products contributed to market expansion.

Operating income rose 75.1% year on year to 564 million yen. Both businesses have established a highly profitable business model, which offset the company’s aggressive strategic investment into human resources, resulting in a significant increase in profit. Both operating income and ordinary income reached record highs for the 5th consecutive term.

2-2 Trend of Segments

| FY Mar. 18 | Ratio to sales | FY Mar. 19 | Ratio to sales | YoY |

Global Business | 2,038 | 63.5% | 2,272 | 63.9% | +11.5% |

Medical Business | 1,169 | 36.5% | 1,282 | 36.1% | +9.6% |

Consolidated Sales | 3,208 | 100.0% | 3,555 | 100.0% | +10.8% |

Global Business | 271 | 13.3% | 457 | 20.1% | +68.8% |

Medical Business | 371 | 31.7% | 446 | 34.9% | +20.4% |

Adjustment | -319 | - | -340 | - | - |

Consolidated Operating Income | 322 | 10.0% | 564 | 15.9% | +75.1% |

*Unit: million yen. Sales is the sales to toward external customers. Ratio to sales in Operating Income is profit margin.

(Global business)

Ubicom began using in-house engines equipped with their own core technologies such as the automation and analysis of software testing and production line inspection processes. This led to the accumulation of highly profitable projects.

The company was also highly evaluated for their ability to develop advanced solutions, and they acquired new projects from 15 major companies, including large foreign automobile manufacturers and major computer game developers.

The amount of projects doubled for medical, automotive, manufacturing, and electronics-related work in the Global business division, as well as for financial and FinTech-related work in the Enterprise business division.

In addition, the company established a system for the efficient operation of human resources. By avoiding opportunity loss, operational availability in the Enterprise division increased by more than 10 percent points.

(Medical business)

The next-generation medical claims validity inspection system “Mighty Checker® EX” was launched successfully, with confirmed purchases by some of the highest-revenue hospitals, and inquiries from many other hospitals, including major hospital groups. In the future, Ubicom plans to expand sales to include all groups.

Ubicom believes that by capturing new demand, such as improvements to medical efficiency and hospital management, they can build a solid revenue base as a leading company in the medical claims validity inspection software market.

In addition, Mighty Checker and Mighty Qube both experienced a further increase in operating income rate, and a subscription model was established. Based on this, the company made strategic investments in anticipation of the term ending 2020, but investment costs were offset and profit increased.

2-3 Financial position and cash flow

Main Balance Sheet

| Mar. 18 | Mar. 19 |

| Mar. 18 | Mar. 19 |

Current Assets | 2,048 | 2,532 | Current liabilities | 1,031 | 1,210 |

Cash and Deposits | 1,210 | 1,637 | LT Interest Bearing Liabilities | 69 | 120 |

Receivables | 504 | 553 | Advances received | 496 | 645 |

Noncurrent Assets | 438 | 561 | Noncurrent liabilities | 162 | 192 |

Tangible Assets | 79 | 72 | ST Interest Bearing Liabilities | 35 | 15 |

Intangible Assets | 122 | 79 | Liabilities | 1,193 | 1,403 |

Investment, Others | 236 | 409 | Net Assets | 1,293 | 1,690 |

Total assets | 2,487 | 3,093 | Total Liabilities and Net Assets | 2,487 | 3,093 |

*Unit: million yen

Total assets rose 606 million yen from the end of the previous term to 3,093 million yen due to an increase in cash and deposits.

Total liabilities augmented 209 million yen from the end of the previous term to 1,403 million due to an increase in advances received.

Thanks to the rise in retained earnings, net assets grew 396 million yen from the end of the previous term to 1,690 million yen.

As a result, equity ratio increased 2.6 points from the end of the previous term to 54.6%.

| FY Mar. 18 | FY Mar. 19 | Increase/decrease |

Operating CF | 294 | 567 | +273 |

Investing CF | -80 | -206 | -125 |

Free CF | 214 | 361 | +147 |

Financing CF | -51 | 58 | +109 |

Cash and equivalents | 1,175 | 1,602 | +426 |

*Unit: million yen

The deficit of investing CF increased, but it was still within the bounds of operating CF, and the surplus of free CF grew.

Financing CF turned positive due to the implementation of short-term loans.

The cash position improved.

3. Fiscal Year ending March 2020 Earnings Forecasts

Earnings Forecasts

| FY Mar. 19 | Ratio to sales | FY Mar. 20 Est. | Ratio to sales | YoY |

Sales | 3,555 | 100.0% | 4,021 | 100.0% | +13.1% |

Operating Income | 564 | 15.9% | 671 | 16.7% | +19.0% |

Ordinary Income | 591 | 16.6% | 710 | 17.7% | +20.1% |

Net Income | 368 | 10.4% | 443 | 11.0% | +20.3% |

*Unit: million yen. The forecasted values were provided by the company.

Sales and profit to increase by double digits. Profit will reach a new record high.

Sales are estimated to rise 13.1% year on year to 4,021 million yen. Operating income is forecast to grow 19.0% to 671 million yen, and ordinary income will increase 20.1% year on year to 710 million yen.

Both businesses will continue to perform well. Ubicom will conduct strategic investment with the intention of further boosting profits from the term ending 2020 onward, but the company will be able to offset investment costs, resulting in a double-digit increase in profit.

Both operating income and ordinary income are expected to reach record highs for the 6th consecutive term.

Although the dividend has not yet been decided, the company plans to return profits to shareholders appropriately, as they did in the previous term, in which they paid dividends for the first time.

4. Future Growth Strategy

4-1 Growth strategy in each business segment

The company, which has grown by offering its original core solutions, is enhancing the following activities in both the global business and the medical business, in order to establish a more profitable model.

The company will also work towards launching new businesses, in order to create another pillar of revenue.

4-1-1 Global business―Enhancement of profitability through “cross-sectoral” expansion and next-generation solutions

The company defined the “cross-sectoral” expansion as the application or provision of the technology developed in each of the fields of “3As” to prioritized business domains of automobiles, manufacturing, robots, medicine, finance, etc. It aims to improve profitability by applying and utilizing a single development resource for multiple core solutions.

It also aims to further increase profitability by developing and offering next-generation recurring revenue solutions based on a subscription model. The target gross profit rate is 60% or greater.

(Source: Ubicom HD)

4-1-2 Medical business―to become a leading enterprise specializing in medical optimization solutions

The gross profit rate of the packaged software of the company exceeded 70% for both “Mighty Checker®” and “Mighty QUBE®.” Profitability remains extremely high, but the company will keep profitability high by offering high added value.

From the term ending March 2020, the company progresses to increase the share of next-generation medical claims inspection system “Mighty Checker® EX,” which launched at the previous term.

By using the company’s strength: voices from 15,000 medical institutions, data and technical capabilities accumulated for over 30 years and Group’s management resource, “Mighty Checker® EX” improved its functions and usability significantly, resulting from that the company has an overwhelming advantage towards other company’s products.

The company also holds an advantage of management resource: a stable revenue structure by establishing a subscription model, active investment toward sales and development, further innovation of cloud engine and analysis engine by utilizing Group’s technological strength. Using these two advantages, the company advances direct deal with major medical institutions and academic filed.

In addition, the company will utilize the accumulated know-how to handle medical data and design, develop, and install medical systems, and offer IT solutions through the analysis of medical big data as a new business.

The growth strategy or vision for the medical business is to work on the creation of new recurring-revenue businesses and evolve into a leading enterprise in the domestic medical big data analysis market.

The company considers that the important elements as differentiation strategies in the medical big data analysis business are 1) the establishment of an engine platform, 2) the improvement in the quality, quantity, and value of data, and 3) intellectual property strategies for the data analysis business, and proceeds with the following collaboration and alliance to strengthen the business.

1) Establishment of an engine platform In May 2017, the company joined “Salesforce 1 IoT Jump Start Program,” which is operated by salesforce.com, Inc., and started offering medical big data analysis services as a technology partner. By combining the medical big data solution of the Ubicom Group, the business application and AI offered by salesforce.com, it became possible to offer analysis solutions utilizing Salesforce App Cloud to medical institutions and life science enterprises. From now on, the company will offer some solutions, including the monitoring of medical data and the prediction based on data fluctuations, as a partner of salesforce.com, which boasts the largest share in the world. While enabling the linkage with various devices through the network, the company aims to expand the profit from the businesses related to IoT, AI, and big data analysis in the medical field, based on the strategies of 3As: “Automation/RPA,” Analytics, and AI. |

2) Improvement in the quality, quantity, and value of data In December 2017, the company signed a memorandum for the business alliance with EM Systems Company (4820; the first section of Tokyo Stock Exchange). EM Systems develops, sells, and maintains systems for clinics, doctor’s offices, pharmacies, and nursing-care facilities, based on the system technologies and data management know-how they accumulated in Japan. By developing a network among them, it provides an environment for connecting information about medicine and nursing care in a seamless manner.

The company aims to enrich IT solution services for improving the quality and safety of medical care with the cutting-edge IT technology, while taking advantage of their managerial resources, including about 20,000 clients of EM Systems and about 15,000 clients of the Ubicom Group, development technologies, and overseas footholds. In addition, the company started collaboration with the enterprise that handles the largest amount of medical data in the world. |

3) Intellectual property strategies for the data analysis business In February 2018, the company invented “a system for rationalizing the dosage of a pharmaceutical product” in cooperation with a medical doctor of the University of Tokyo Hospital, and jointly acquired a patent with the University of Tokyo. The Ubicom Group has established a firm position as a leading maker of medical claims validity inspection software, but is proceeding with research for utilizing intellectual property strategies based on the cutting-edge technology for future business strategies, and acquired the patent as part of efforts for creating intellectual property from the mid/long-term viewpoint.

This system was developed by utilizing the know-how for medical claims data check and medical big data analysis, which has been accumulated by the corporate group for many years. By displaying the statistical figures that represent the actual situation (amounts) of the dosages of pharmaceutical products when statistically processing the prescription data owned by medical institutions and inputting the dosage and number of days of administration of each pharmaceutical product, it is possible to refer to the appropriate dosage and number of days of administration according to the status of disease and patients. From now on, by analyzing the relations between prescription data obtained from this system and diseases, it will be possible to support medical doctors in making a decision about prescription for each disease, and the analysis of these medical big data is expected to not only support the management of medical institutions and medical doctors, but also contribute to the safety and reliability of the entire medical society, including patients. The company plans to fortify its intellectual property strategy from the mid/long-term viewpoint, based on the cooperation and collaboration with academia, including national and college hospitals. |

4-1-3 Launch of new business

Aiming to further increase profitability, the company will launch a new business based on a “high unit price” model, which will target social issues such as the aforementioned “Medical big data analysis business.”

In order to achieve this, the utilization of skilled labor is the most critical point, so the company will make aggressive investment into human resources.

4-1-4 Creation of profits from the next-generation solution business―to achieve an ordinary income rate of over 20%

Through the above - mentioned activities for the two businesses, the company aims to significantly grow the next-generation solution business, which is highly profitable, and earn half of ordinary income from the next-generation solution business, while continuously expanding the existing businesses looking ahead to the fiscal year 2020.

(Source: Ubicom HD)

The monetization of the next-generation solution business is based on a subscription model with the charges for the analysis engine license, customization royalties, and maintenance fees.

The company plans to increase ordinary income margin to sales from 16.6% in the term ending March 2019 to over 20% in the term ending March 2021, by developing a business portfolio combining the firm existing business, including the development of apps and packaged software with an ordinary income rate of 10-20%, and the next-generation solution business, which earns recurring revenue stably with enhanced cross-sectoral functions, for which the company aims to achieve a profit margin of 30-40%.

4-2 Execution of strategic investment

Ubicom believes that strategic investment of unprecedented scope and scale is essential for realizing a profit from the next-generation solution business. From the term ending 2020 onward, they will actively invest into areas such as:

- R&D for advanced technology in the Philippines, such as software automation, anomaly detection using AI, and AI chatbots

- Recruitment of personnel capable of leading large-scale projects following a rapid increase of clients

- Requesting support from top Asian executives for business expansion in Asia

- Increasing the number of skilled personnel who can offer consulting services for AI and RPA, which are essential for creating a new business with a “high unit price” model

- Acquisition of staff versed in specific fields, such as medicine, finance, and automotive

4-3 Ideal state of the Ubicom Group

4-3-1 Promotion of the original alliance strategy titled “Win-Win Investment Model”

“Win-Win Investment Model” is one of the original strategies for accelerating the growth of both the global business and the medical business by taking advantage of the core competence of the company.

In this model, the company forms business and capital tie-ups and conducts M&A targeting venture firms that have the cutting-edge technologies, such as robotics ventures, AI ventures, and telemedicine firms, and supports the target ventures from various aspects, including financing, IT solution and technical support based on the development foothold in the Philippines, and business matchmaking with leading companies, which are the clients of the company. The company is expected to improve its corporate value by exerting business synergy, entering efficient new markets, increasing earning opportunities, and so on.

The company has so far achieved the following two alliances.

Date | Project | Outline |

June 2018 | Capital and business alliance with Unirobot Corporation | (Outline of Unirobot Corporation) Venture firm that develops “unibo,” a partner robot that recognizes the feelings of human beings by learning the traits, hobbies, and preferences of users through conversation, and conducts R&D for personal AI.

(Purpose and outline of the alliance) This is the first project of the Win-Win Model conducted via the investment in the cooperative firm, while expecting a lot of merits, such as the affinity with the medical domain and solutions for services, on which Ubicom concentrates, and the creation of new businesses utilizing the knowledge of the cutting-edge technology. |

September 2018 | Capital and business alliance with Liquid, Inc. | (Outline of Liquid, Inc.) It developed an original authentication algorithm that enables high-speed processing by utilizing the image analysis technology focused on biological information and the big data analysis technology utilizing machine learning. It created technologies that will support the next-generation social infrastructure, while succeeding in commercialization of identification and settlement services with biometric authentication for the first time in the world.

(Purpose and outline of the alliance) By fusing the know-how for advanced solutions, laboratory-type offshore development, and business development in the Philippines, at which Ubicom is good, the company will cultivate the Asian market as a solution provider, create new businesses in the medical field, and develop a new business pillar in the market of biometric authentication technologies. Testing for future lab development was completed in the 4th quarter of the term ended March 2019. Hereafter, the company will enter the working phase. |

Since the company changed stock markets from Mothers to the first section of Tokyo Stock Exchange in December 2017, it increased credibility and fund procurement capability further, making it easier to take a strategic approach. It will keep using the same model actively.

The company is now discussing or negotiating for multiple projects. It will actualize several projects as soon as possible, and concentrate on the advance into the Asian market in cooperation with leading conglomerates in Asia.

4-3-2 Further global expansion as a solution provider

Under the corporate ethos, the company aims to expand its business globally as a solution provider, by offering solutions to social issues around the Asia-Pacific region, while contributing to national interest.

4-3-3 Ideal state-To increase profits based on the existing business

While expanding the established existing business for offering advanced solutions consistent with national policies, the company will drive the Win-Win Investment Model and new businesses, including the social issue-solving business, to increase profits.

(Source: Ubicom HD)

5. Interview with President Aoki

We asked the President Masayuki Aoki about the company’s strengths, future endeavors, and a message for shareholders and investors.

Q: “What do you think is the source of the strength and growth of Ubicom Holdings, Inc.?”A: “I think the company’s best core competency boils down to our education for engineers in the Philippines. We are proud that this training know-how, which we have refined independently, cannot be easily imitated by other companies.”

The company’s subsidiary in the Philippines has 900 top engineers, and its ability to develop solutions is one of our greatest strengths, but I believe that the best core competency comes down to the education for engineers in the Philippines.

160 candidates (only about 4%) are recruited from 4,000 recruit entries among graduates from top class graduate schools each year. Their IQ is extremely high, but of course they cannot speak Japanese. However, in order to be successful as a truly top notch engineer in our company, it is essential to acquire the ability to communicate with Japanese client companies and to perform business in a Japanese-speaking environment.For this, we have the know-how to reach level 4 of the Japanese Language Examination in an extremely short period of time. We are proud that this training know-how, which has been refined independently at “ACTION,” the company’s training center established in 2003, as well as training programs such as basic IT concepts, advanced technologies, and interpersonal software skills, are not something that can be imitated easily.

Mr. Tan Peter, the executive officer in charge of innovation strategy in Ubicom’s headquarters of global business, is a member who was promoted from a proper employee to an executive officer. It is very reassuring that the company has developed not only engineers, but also management members.

We will continue to further brush up our know-how and develop high quality personnel more efficiently.

Q: “Could you tell us about your thoughts on the win-win investment model that you will focus on as one of the pillars of the company’s growth strategy?”A: “I would like our company to grow as the one that will contribute to Japan and the world, providing resources unique to our company as a partner that works together.”

So far, we have trained young Filipino staff and helped major Japanese companies. We will continue and expand the support, and in addition to that, we would like to develop a venture firm next.

Our company will provide resources unique to ours that are not only funds, but also business matchmaking service with our major client companies, as well as IT solution support and technical support utilizing the subsidiary in the Philippines, etc. If it helps venture companies grow, the world will change and we will be able to increase our corporate value.

We would like our company to grow as the one that will contribute to Japan and the world as a “partner” that works on tasks together without distinguishing enterprises according to the size of company, etc.

Q: “Could you also tell us about your future growth strategy, vision, issues and solutions?”

A: “We would like to significantly expand our highly profitable next-generation solution business, earn half of our ordinary income with the business, and raise ordinary income margin to over 20%, while we continue to expand our existing businesses for the term ending March 2021.

We would also like to work on collaborating with companies in Asia to promote business partnerships with major companies and expand our fields for success.”

While continuing to expand existing businesses for the term ending March 2021, we will significantly expand the highly profitable next-generation solution business, earn half of our ordinary income with the business, and raise ordinary income margin to over 20%.

Next-generation solution business is a so-called subscription model in which sales go up in a stable manner regardless of employees and months. We are working on creating the system in both global businesses and medical businesses.

As the win-win investment model I mentioned earlier is a collaborative model with a venture company, recently there have been cases where major companies propose full-scale business partnerships with us. We appreciate that our ability is acknowledged.Although I cannot talk specifically, as I thought the need to effectively use our development base in the Philippines has been increasing over time.

On the other hand, we recognize that our current challenge is to expand our capacity to firmly accept those partnerships, and we will further strengthen the system in the Philippines.

In addition, we would like to work on collaborating with companies in Asia to expand our fields for success.

Q: “Finally, please give shareholders and investors a message.”A: “We decided to pay dividends for the first time in the term ended March 2019. From now on we plan to increase payout ratio by increasing dividends. We would appreciate your support from a medium-to-long term perspective, as we will meet the expectations of our shareholders and investors by making investments this fiscal term and the next, and producing results that exceed our investments.”

So far, we have given priority to expanding our internal reserves for the future business development and strengthening our business structure. For the term ended March 2019, which is the third fiscal term since the listing on the TSE Mothers in June 2016, we decided to pay dividends for the first time.

The estimated payout ratio is 15%, but we would like to raise payout ratio by expanding our earnings and paying increased dividend. At the same time, we will firmly make investments this fiscal term and the next to establish the next-generation solution business. As we will meet the expectations of our shareholders and investors by producing results that surpass our investments, we would appreciate your support from a medium-to-long term perspective.

6. Conclusions

The profit rate of the company is skyrocketing. In the term ended March 2019, operating income rate (to sales toward external customers) increased 6.8% and 3.2% year on year for the global business and the medical business, respectively. The operating income margin for the entire company rose 5.9%.

As mentioned in this report, this is mainly because the horizontal expansion of core solution services was accelerated for the global business and for the medical business, in addition to the existing business, the highly profitable recurring-revenue model was established by releasing the next-generation medical claims validity inspection system “Mighty Checker® EX”.

For the current term, ordinary income rate is estimated to be 17.7%. The company aims to achieve an ordinary income rate of 20% or higher in the term ending March 2021, two terms later. To achieve it, both businesses need to establish a subscription model as soon as possible.

We would like to expect the progress of horizontal expansion of “3As” and the development of new markets.

<Reference: Concerning Corporate Governance>

◎ Organizational structure and composition of directors and corporate auditors

Organizational structure | Company with audit and supervisory board |

Directors | 6, out of which 2 are outside directors. |

Corporate auditors | 3, out of which 2 are outside auditors. |

◎ Corporate Governance Report

Last updated: December 20, 2018

*Basic Policy

Our corporate ethos is “to be an enterprise that offers indispensable solutions for society,” “remain professional,” and “be global.” We recognize that in order to enhance our corporate value and maintain our global competitiveness under this corporate ethos, it is important to enrich and tighten our corporate governance. In detail, our basic policy is “to aim to enhance our profitability and maximize the profits for shareholders by conducting more efficient, sound business activities” and put importance on compliance. Under this policy, we strive to strengthen our corporate governance, while considering that it is essential to fulfill our social responsibilities toward all kinds of stakeholders, including shareholders, employees, business partners, and local communities, and achieve sustainable growth and expansion.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

【Supplementary principle 1-2-(4) Electronic exercise of voting rights, and translation of convocation notices into English】 | Considering the current composition of our shareholders, we have not adopted the electronic exercise of voting rights and the translation of convocation notices for general meetings of shareholders into English. Seeing the ratio of exercised voting rights so far, we think that the exercise of voting rights in Japanese has not caused any significant troubles. From now on, we will discuss their necessity, while taking into account the situation of exercise of voting rights by overseas investors, the trend of the ratio of foreign shareholders, etc. |

【Supplementary principle 4-2-(1) Remunerations and incentives for executives】 | Since the term of each director of our company is one year, their remunerations are revised every year according to the performance in the previous fiscal year, but we have not adopted remunerations that vary with mid/long-term performance or remunerations paid with treasury shares. As for the remunerations for executives, we recognize the necessity to reflect mid/long-term corporate performance and potential risks in them and give incentives for stirring entrepreneurship soundly, and will keep discussing appropriate methods. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

Principle 1-4 【The so-called strategically held shares】 | Our company may hold shares strategically, if they are considered to contribute to the enhancement of the value of our corporate group from the mid/long-term viewpoint. Our policy is to hold such shares, as long as we can secure the rationality of shareholding purposes, such as the maintenance and cementing of transaction relations through business alliance, collaboration, etc. For exercising the voting rights of the shares, we discuss whether or not a bill is consistent with our shareholding policy. |

【Supplementary principle 4-11-(3) Analysis and evaluation of the effectiveness of the entire board of directors】 | In our company, 2 out of 6 directors are outside ones, accounting for one third. In addition, the representative director makes efforts as chairperson so that outside directors and auditors can express their candid opinions, and lively discussions contribute to the enhancement of the functions of the board of directors. Furthermore, outside the meetings of the board of directors, the representative director, outside directors, and outside auditors gather information and exchange opinions about the efficiency and operation methods of the board of directors, and they serve as an evaluator. |

Principle 5-1 【Policy for constructive dialogue with shareholders】 | We positively respond to shareholders’ application for dialogue. The finance and accounting department and the strategic planning department are in charge of our IR activities, and have developed an IR system based on their daily close cooperation, so that they can accept the phone interviews from investors, small meetings, etc. In addition, we hold a result briefing session involving the representative director and distribute a results briefing video twice or more times every year. |

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright (C) 2019 Investment Bridge Co., Ltd. All Rights Reserved. |