Bridge Report:(3998)SuRaLa Net the second quarter of the fiscal year ending December 2023

President Takahiko Yunokawa | SuRaLa Net Co., Ltd. (3998) |

|

Company Information

Market | TSE Growth Market |

Industry | Information and communication |

President | Takahiko Yunokawa |

HQ Address | 7F, PMO Uchikanda, 1-14-10, Uchikanda, Chiyoda-ku,Tokyo |

Year-end | December |

Homepage |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

¥622 | 6,694,764 shares | ¥4,164 million | 17.5% | 100 shares | |

DPS Est. | Dividend Yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

0.00 | - | ¥39.83 | 15.6x | ¥303.29 | 2.1x |

* Share price as of closing on August 24. Number of outstanding shares, DPS and EPS were taken from the financial statements for the second quarter of FY 12/23. ROE and BPS were taken from the financial results for the previous term.

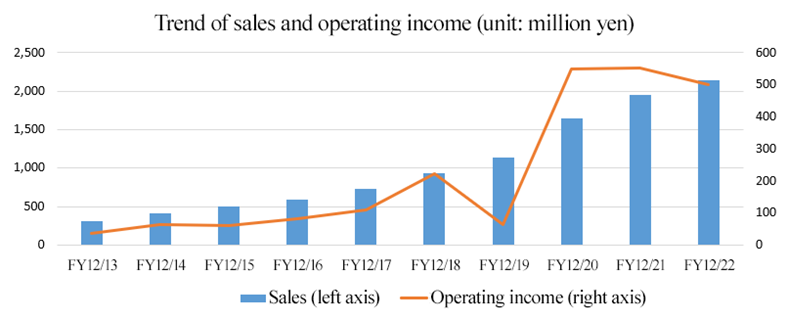

Earnings Trend

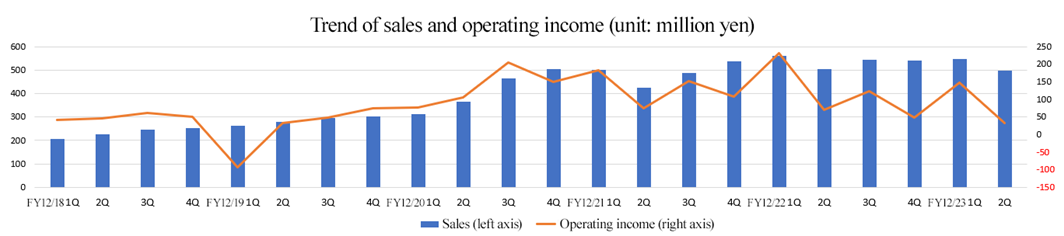

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

December 2019 Act. | 1,141 | 64 | 65 | 43 | 6.94 | 0.00 |

December 2020 Act. | 1,649 | 540 | 548 | 379 | 59.67 | 0.00 |

December 2021 Act. | 1,952 | 521 | 552 | 399 | 60.09 | 0.00 |

December 2022 Act. | 2,147 | 475 | 501 | 355 | 53.10 | 0.00 |

December 2023 Est. | 2,322 | 391 | 392 | 266 | 39.83 | 0.00 |

* Estimates are those of the company. Unit: million yen, yen. The company adopted consolidated accounting from FY 12/22

This report includes the corporate profile and the earning results for the second quarter of the fiscal year ending December 2023 and other information of SuRaLa Net Co., Ltd.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of the Fiscal Year ending December 2023 Earnings Results

3. Fiscal Year ending December 2023 Earnings Forecasts

4. Future Priority Measures

5.Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Under the corporate ethos: “Bringing transformation to education and empowerment to children,” SuRaLa Net supplies “Surala” and “Surala Drill,” which are adaptive teaching tools based on AI and information & communication technology (ICT), to over 300,000 pupils and students of schools, cram schools, etc. The company also gives learning opportunities to children with developmental disabilities, truant children, and underprivileged pupils and students. The company is pursuing growth by entering overseas markets, too, and solving more educational issues.

- “Surala” is an adaptive e-learning tool that helps pupils and students learn 5 major subjects (the Japanese language, arithmetic/mathematics, the English language, science, and social studies) from elementary to high school together with animated characters serving as their teachers according to the comprehension level of each child. With its unique systematic curricula, “Surala” aims to facilitate the “understanding of the fundamentals” and the “acquisition of basic academic skills.”

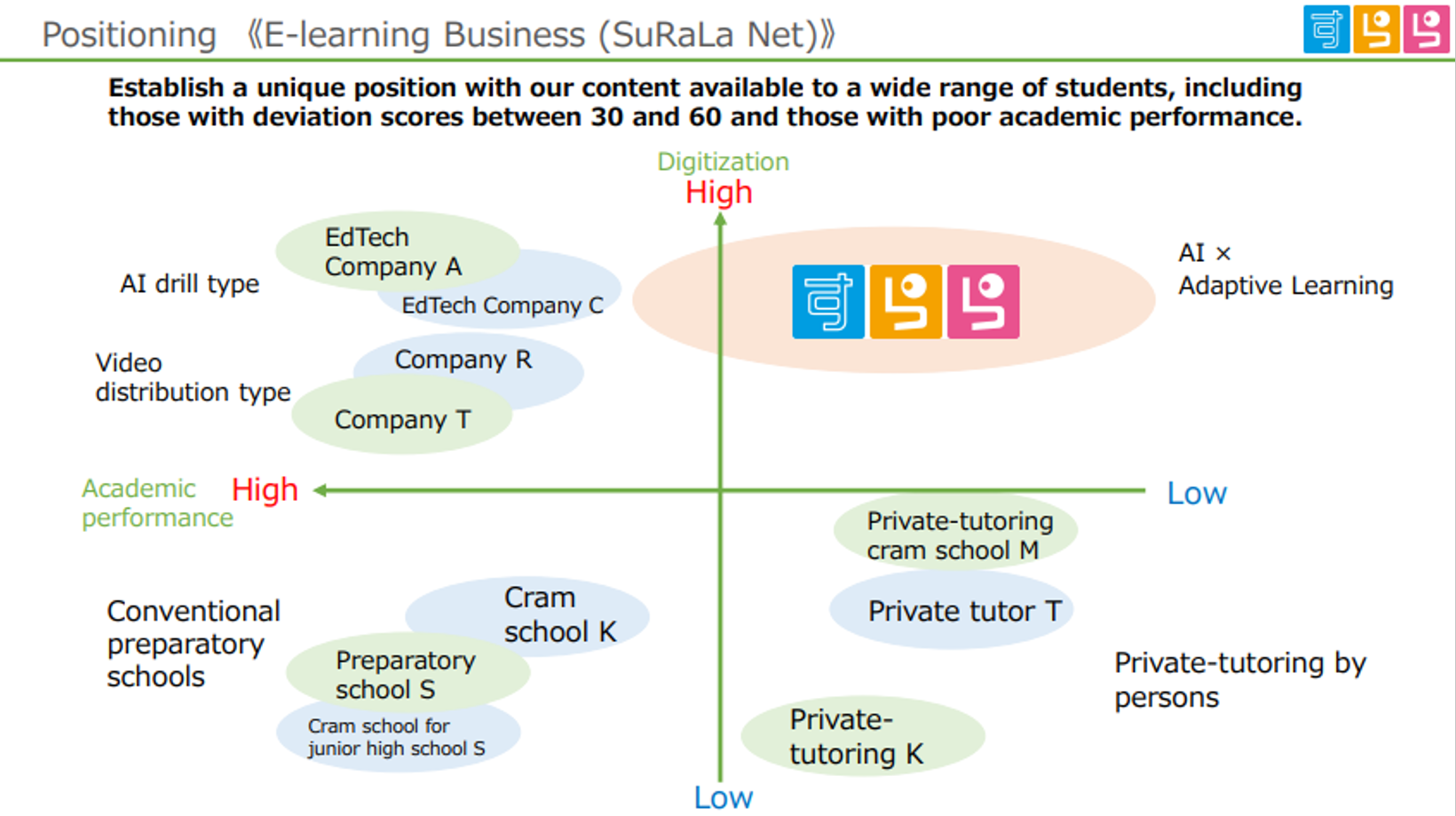

- SuRaLa Net has established an unrivaled unique position with “Surala,” an advanced digital teaching tool, targeted at a broad range of children with a deviation value of 30-60. In addition to the development and provision of “Surala,” the company possesses consultation skills to propose solutions to the problems with the management and affairs of cram and ordinary schools and support them in adopting the solutions. This is their primary characteristic that cannot be imitated by competitors. The company’s competitiveness is derived also from the adoption of cutting-edge technologies, including the installation of AI functions of leading-edge enterprises, the utilization of big data on learning activities, and so on.

- The sales in the second quarter of the term ending December 2023 were 1,043 million yen, down 1.8% from the previous term. The sales in the BtoC market grew, but the sales in the cram school market declined due to the decrease in the number of students in the private school market, the diversification of EdTech teaching materials, etc. and the sales in the school market, too, dropped, due to the termination of the subsidy for adopting EdTech. Operating income decreased 39.2% year on year to 183 million yen. Gross profit dropped 7.3% year on year, due to the augmentation of cost of sales, including the increase of development staff and depreciation after investment in development. SGA rose 12.7% year on year, due to the increase of employees.

- There is no change in the earnings forecast. For the term ending December 2023, sales are expected to grow 8.1% year on year to 2,322 million yen and operating income is projected to decline 17.7% year on year to 391 million yen. The sales of the e-learning business are forecast to rise 7.1% year on year to 2,212 million yen. The sales in the school and BtoC businesses are expected to increase, while the sales in the cram school market are forecast to decline. Despite the sales growth, profit is projected to decrease, due to the investment in development for differentiating the company from competitors, the increase of contents and system development staff, the increase of support staff for dealing with the problems with on-site use, etc. for enhancing its competitiveness, as well as the augmentation of costs for operation and maintenance due to the release of new functions.

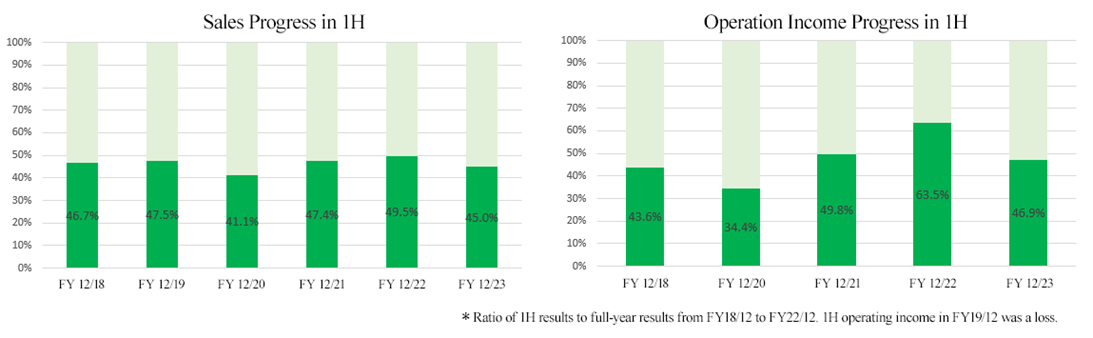

- The progress rate in the first half of the term is 45.0% for sales and 46.9% for operating income. Sales are smaller than usual. In the school market, annual sales are expected to grow by double digits, but sales dropped in the first half of the term due to the termination of the subsidy for adopting EdTech. The noteworthy point from the third quarter is whether they can respond to the assumed problems with use in school after the GIGA School Scheme is put into practice, while the number of user IDs is increasing.

1. Company Overview

Under the corporate ethos: “Bringing transformation to education and empowerment to children,” SuRaLa Net supplies “Surala” and “Surala Drill,” which are adaptive teaching tools based on AI and information & communication technology (ICT), to over 300,000 pupils and students of about 2,500 schools, cram schools, etc. While these tools are increasingly used in public schools, famous private middle and high schools, and leading cram schools around Japan, the company gives learning opportunities to children with developmental disabilities, truant children, and underprivileged pupils and students. The company is pursuing growth by entering overseas markets, too, and solving more educational issues.

*This figure is created by Investment Bridge Co., Ltd. based on disclosed materials.

【1-1 History】

When Mr. Takahiko Yunokawa (the current representative director and president of SuRaLa Net Co., Ltd.) was supporting the franchise business and direct management of tutoring schools in CatchOn Co., Ltd., which is a group company of C&I Holdings Co., Ltd. (the former Venture Link Co., Ltd.) in 2004, he was struggling to improve the academic skills of low-performing students although the marketing for attracting students progressed well. In 2005, the company started developing ideal e-learning tools.

During the development, he noticed that there were no effective solutions to improve the academic skills of low-performing students in the world, and started business operation on a full-scale basis, while believing that it is socially meaningful to improve the academic skills of such students and the market is a blue ocean where large companies had not yet started business.

In 2007, the “Surala” for junior high school students was released, targeting the cram and ordinary school markets. In 2008, SuRaLa Net Co., Ltd. was established mainly for the purposes of offering educational services with e-learning systems, supporting the operation of e-learning systems, marketing, promotion, and managing websites.

In the same year, the “Surala” for high school students was released, and in 2010, the number of students using “Surala” exceeded 10,000.

In the same year 2010, SuRaLa Net Co., Ltd. took over the e-learning business “Surala” for cram and ordinary schools throughout Japan from C&I Holdings Co., Ltd. through an absorption-type split contract, and all shares of SuRaLa Net Co., Ltd. were transferred from FC Education Co., Ltd., which is a subsidiary of C&I Holdings Co., Ltd., to Mr. Takahiko Yunokawa, as a management buyout (MBO). Then, the company released “Surala” for entrepreneurs and home-learners (2011 and 2012), and obtained a patent with the “adaptive learning” function in 2013.

The company brushed up “Surala,” increased sales, and expanded its business domains, including the support for the opening and independence of cram schools. These activities accelerated its growth, raising sales and profit steadily. In 2017, the company got listed on Mothers of TSE. In 2022, it was listed on the Growth Market of TSE through stock market structuring.

【1-2 Corporate Philosophy】

Under the corporate ethos of “Bringing transformation to education and empowerment to children,” the company aims to offer optimal “educational opportunities” to all kinds of children without being swayed by the environment.

The mission and strategy of “SuRaLa Net” are to solve the global social problem of educational inequality for children suffering from poverty and disabilities and low-performing students with cutting-edge technologies and then eliminate the educational inequality.

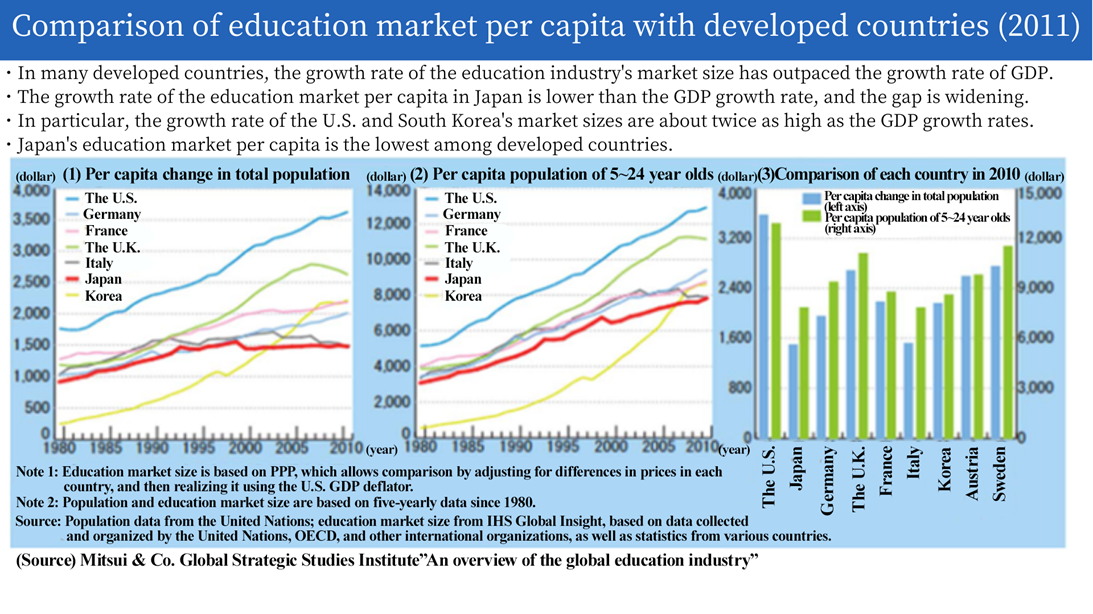

【1-3 Market Environment】

According to the reference material of the Ministry of Economy, Trade and Industry (Jan. 2018), “the scale of the Japanese educational industry in the private sector is around 2.5 trillion yen per year. As a whole, the market is shrinking due to the decline in birthrate.” “The difference in growth rate of the educational market between Japan and other advanced countries is increasing.” “In many advanced countries, the growth rate of the scale of the educational industry exceeds that of GDP. In particular, those in the U.S. and South Korea are about two times the GDP growth rate.” “Meanwhile, the educational market scale per capita is the lowest among advanced countries, and the market growth rate per capita is lower than that of GDP in Japan, and this gap is expanding.”

(Taken from the reference material of the Ministry of Economy, Trade and Industry)

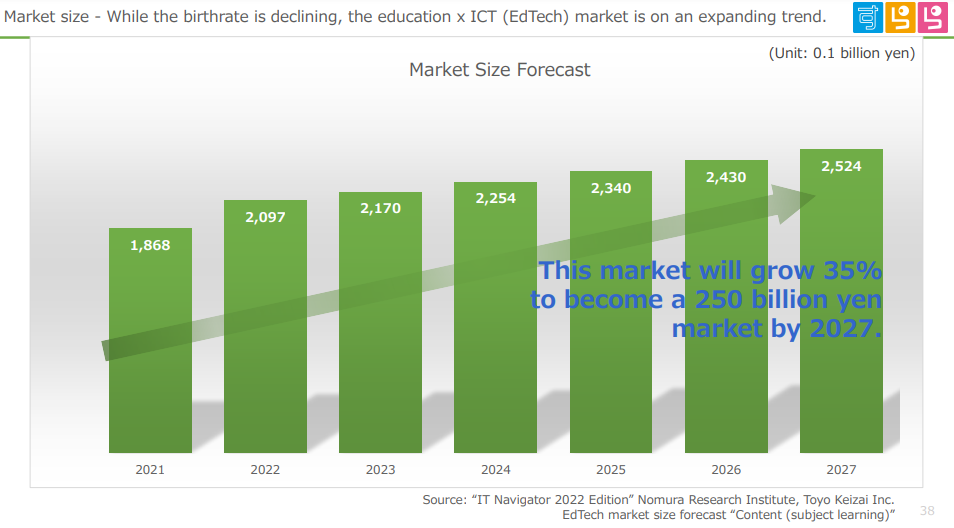

That reference material also mentions the growth potential of EdTech (Education × Technology), which is a business field aimed at innovating conventional educational scenes with technology, and introduces pioneering cases in Japan.

The company enumerated the following three concrete points to revise educational guidelines, etc., with the aim of “realizing educational curricula open to society” so that students can share the goal of creating a better society through better school education and acquire necessary qualities and skills for leading the future, while recognizing the problems with education in Japan that need to be dealt with for enhancing competitiveness and cooperating with society.

*What students will become able to d To nurture necessary qualities and skills for the new age and enrich learning assessment

*What students will learn: To establish new subjects, courses, etc. for acquiring necessary qualities and skills for the new age, and revise goals and contents

*How students will learn: To improve learning processes from the viewpoint of “active learning” (proactive, interactive, profound learning).

Recognizing this status quo, the Ministry of Education, Culture, Sports, Science and Technology issued the new educational guidelines for “elementary schools” in 2020, those for “junior high schools” in 2021, and those for “high schools” in 2022.

In accordance with the “GIGA School Scheme,” a five-year plan for adopting ICT in education, terminals and WiFi were installed in elementary and junior high schools throughout Japan by the end of fiscal 2020, and are scheduled to be installed in high schools throughout Japan from FY 2022.

Furthermore, the Ministry of Economy, Trade and Industry partially subsidizes the costs for adopting EdTech tools for “EdTech providers,” so that schools can try ICT-based educational services through the “subsidy for installing EdTech,” and they are conducting a demonstration experiment of a “Future Classroom” in which students design their learning processes by themselves.

Like this, Japan hopes to reform and grow its educational environment and market by proactively adopting ICT.

In particular, it is expected that ICT will fulfill a significant role in the above-mentioned item “How students will learn: To improve learning processes from the viewpoint of active learning (proactive, interactive, profound learning),” and it is forecast that the Japanese EdTech market will keep growing amid the declining birthrate.

(Taken from the reference material of the company)

【1-4 Business Description】

(1)Outline

The company’s business segments are the e-learning business, the commissioned development business, and the app development business.

In the e-learning business, the company offers services, including the online learning tools “Surala” and “Surala Drill,” etc. to mainly elementary school pupils and middle and high school students. In addition, the company gives proposals for educational curricula utilizing its services to clients adopting the services, supports the clients in starting business, and regularly holds charge-free study sessions, to support business administration, and also provides contents in collaboration with other companies.

In the commissioned development business, the company undertakes the entrusted development of educational contents and offers maintenance services.

In the app development business, the company develops learning contents based on gamification by itself, and provides intellectual training apps, which can be downloaded from Apple Store, etc.

*The e-learning business accounts for over 90% of total sales and profit, while the commissioned development and app development businesses make up only small percentages, so they are not significant as information to be disclosed. Accordingly, the company omits the results of each segment in disclosed material, etc.

(2)e-learning business

①AI × adaptive learning tool “Surala”

The following section describes the outline, strengths, and features of the AI × adaptive learning* tool “Surala,” which is the mainstay of the e-learning business.

*Adaptive learning

This is a method of providing individuals with optimal learning contents for more efficient learning. It enables meticulous teaching and guidance, and leads to the enrichment of learning activities based on the comprehension level, interest, etc. of each learner.

◎Outline

The AI × adaptive learning* tool “Surala” is an adaptive e-learning tool that helps pupils and students learn 5 major subjects (the Japanese language, arithmetic/mathematics, the English language, science, and social studies) from elementary to high school together with animated characters serving as their teachers according to the comprehension level of each child. With its unique systematic curricula, “Surala” aims to facilitate the “understanding of the fundamentals” and the “acquisition of basic academic skills.”

(Taken from the reference material of the company)

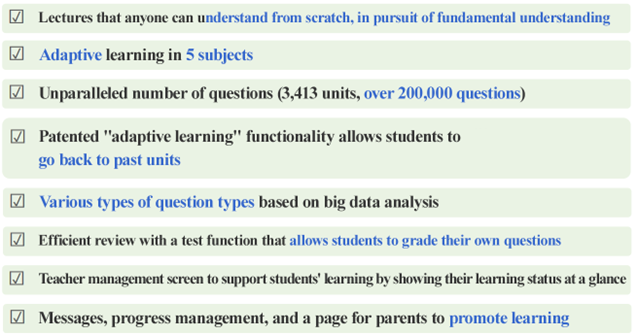

“Surala” is composed of the following five functions, which are reflected in its features and merits as an adaptive learning tool.

01 | Understandable! | Lectures with interactive animation understandable to even novice learners

*Unique systematic learning system designed without considering academic years while assigning top priority to understandability so that any subject can be understood by novice learners. *Lectures with animation and famous voice actors stir the interest of learners. *As teachers give questions in the form of a quiz, students can concentrate without becoming bored. *Students can play, pause, rewind, and fast-forward lecture videos freely, so they can learn according to their respective comprehension levels. *Each unit is finished in about 15 minutes, so students can learn in small steps without cramming contents into their heads too much. *During exercises in arithmetic/mathematics, it is possible to immediately check whether equations used for solving a problem are correct by intermediate formula judgement system. |

02 | Attainable! | The patented AI-based exercise program that automatically returns to subjects at which students are not good, enabling the students to relearn them

*The difficulty level control function automatically adjusts the difficulty level of questions according to the comprehension level of each student. *The patented mistake analysis function automatically clarifies subjects at which respective students are not good, and returns to once-completed units for relearning. |

03 | Motivating! | Gamification function for motivating students

*Achieve Egg function According to the learning status of each student, it suggests units the student should learn and assigns missions to learn to an appropriate degree, and gives points according the mission achievement level.

*My Page function By using the points obtained through the Achieve Egg function, students can conduct some activities, such as the setting of an avatar, the selection of partners, the development of partners, the change of clothes, and the exchange among students via avatars. |

04 | Usable! | Academic achievement tests for immediately checking how much each student has learned

*Automatic production of questions for tests, automatic scoring, and prior review registration With just one click, students can access lectures and exercises that are considered necessary from test results. *With the test function, it is possible to give questions for overcoming the weaknesses of each student. |

05 | Track-keeping! | Learning management function for supporting each student

*Setting of learning goals It suggests the period and range of learning, and each student selects the range of learning from the textbook schedule. *Learning progress management It manages the learning status of each student in a unified manner, and examines the questions students could not solve and how they made a mistake. *Communication function It can receive questions from pupils and students, and send encouraging messages to respective pupils and students. *Real-time monitor It grasps the learning statuses of pupils and students on a real-time basis. *Administrative window for guardians Guardians, too, can check the learning statuses of their respective children. |

With the lecture, exercise, and test functions, the cycle of “comprehension → memorization → utilization” is repeated according to the proficiency of each student, so that students can master learning contents on one-stop basis.

As even novice learners can proceed with learning by themselves, the system is increasingly utilized in elementary, middle, and high schools, cram schools, afterschool day-care centers, etc.

Based on “Surala,” the company also offers “Surala Drill,” “Pitadori,” and “Surala Ninja!”

“Surala Drill” “Pitadori” | They are composed of adaptive drills and tests with the functions to automatically produce questions and score students’ performance. As the twin versions of “Surala,” the company offers “Surala Drill” to mainly public elementary and junior high schools, and “Pitadori” to leading cram schools. |

Surala Ninja! | It was developed as the overseas version of “Surala” for elementary school pupils. It is an e-learning tool that allows pupils to enjoyably learn arithmetic, mainly the four basic arithmetic operations (addition, subtraction, multiplication, and division), through interactive animation. It is used at schools and other institutions in Sri Lanka, Indonesia, Egypt, and the Philippines. |

◎ Strengths and features

As SuRaLa Net pioneered in utilizing ICT for teaching materials in this industry, “Surala” has many strengths and features. In particular, it has the adaptive learning function, and have a significant lead over competitors’ products as a teaching tool that can optimize contents according to each learner’s status.

(Taken from the reference material of the company)

②Business model

◎ Clients/users of the company’s products

“Surala” are supplied to mainly cram schools, ordinary schools, and consumers (BtoC) (individual learners).

Users | Outline |

Cram School | The company offers services in various ways according to the scale, style, etc. of each cram school.

<Entrepreneurs> The company provides clients who aim to open cram schools with “support for procurement of real estate and funds, interior finishing, and promotion of enrollment,” “successful cases and the know-how to operate cram schools through regular charge-free study sessions,” “charge-free promotional flyers,” proposals for cram school management, including the opening of a cram school and the promotion of enrollment, and also supports the entry to the educational business market from other industries.

<Local medium-sized cram schools> The company offers plans for transforming the existing business models and proposals for new cram schools.

<Afterschool day-care centers> The company offers learning opportunities to welfare facilities for children with developmental disabilities.

<Support for the entry to the educational business market from other industries > The company supports house builders and others in non-educational fields in entering the educational industry. |

School (corporate clients and municipalities)

| The company proposes solutions utilizing “Surala” and “Surala Drill” to the challenges of improving academic skills and attracting students and goals of improving academic scores, etc. The company also supports school management by proposing educational curricula used in “Surala” and offering successful cases and know-how, and educates and enlightens teachers about ICT. |

BtoC | The company provides students learning at home with “Surala.”

Learners include truant students and children with developmental and learning disabilities. As many of their families are deeply worried about such children, the company aims to give comprehensive support to their guardians, and offers coaching for guardians via “Surala Coach,” training for guardians, and mental and educational assessment services. In addition, the company gives comprehensive support to distressed families, to solve their trouble by holding seminars and giving advice for utilizing the system in which truant students can be deemed to have attended classes by using ICT-based teaching materials. |

The company is also operating overseas business. At present, the company offers “Surala Ninja!,” the overseas version of “Surala,” to elementary schools in Indonesia, Sri Lanka, and Egypt.

◎ Revenues

The company collects service usage fees from schools, cram schools, and individual learners.

(Taken from the reference material of the company)

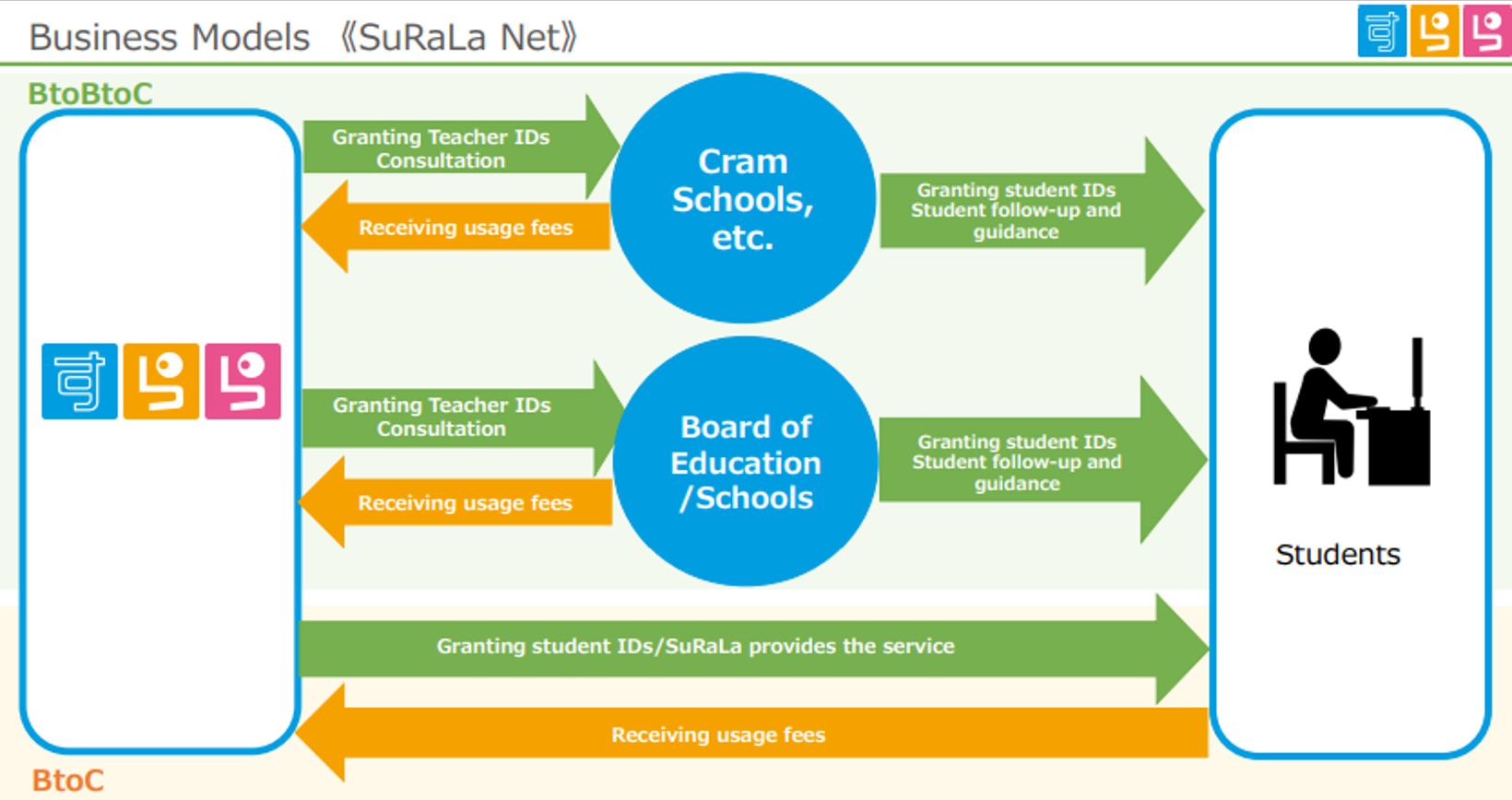

*Business model targeted at cram and ordinary schools (BtoBtoC)

The company issues administrative IDs (teachers’ IDs) for using “Surala” at schools that have adopted it, and students’ IDs for students of the schools. Students use “Surala” via their schools.

The schools give follow-up lectures to students by using the functions of “Surala,” which curtails personnel expenses and management costs.

<Cram School>

The company earns revenues mainly from a monthly “serve usage fee” charged for each building of schools using this service and a monthly “ID usage fee” charged for each student’s ID registered in the Surala system.

<School>

The company earns revenues mainly from the “initial installation fee” at the time of conclusion of a contract and a monthly “ID usage fee” charged for each student’s ID registered in the Surala system.

*(BtoC) business model targeted at individual learners

The company issues students’ IDs for “Surala” to individual learners. The teachers of cram schools that have adopted “Surala” (Surala coaches), which have cooperative relationships with the company, “set monthly goals” for learning and conduct “follow-up activities, such as the check of progress by contacting students by telephone or email about once a week,” for students who have IDs.

The company earns revenues mainly from a monthly “ID usage fee” charged for each student’s ID. In addition, the company pays the remuneration for follow-up lectures to school teachers so that the revenues of cram schools will grow in parallel with the increase of end users. Like this, the company has established a business model based on win-win relationships with schools.

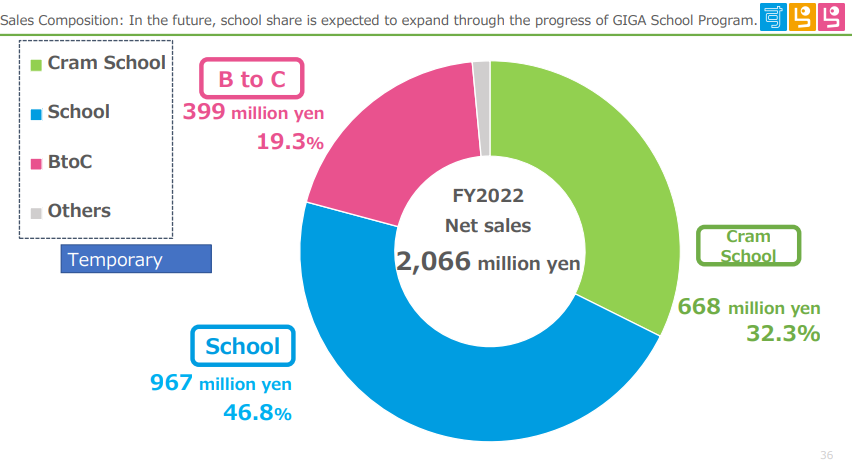

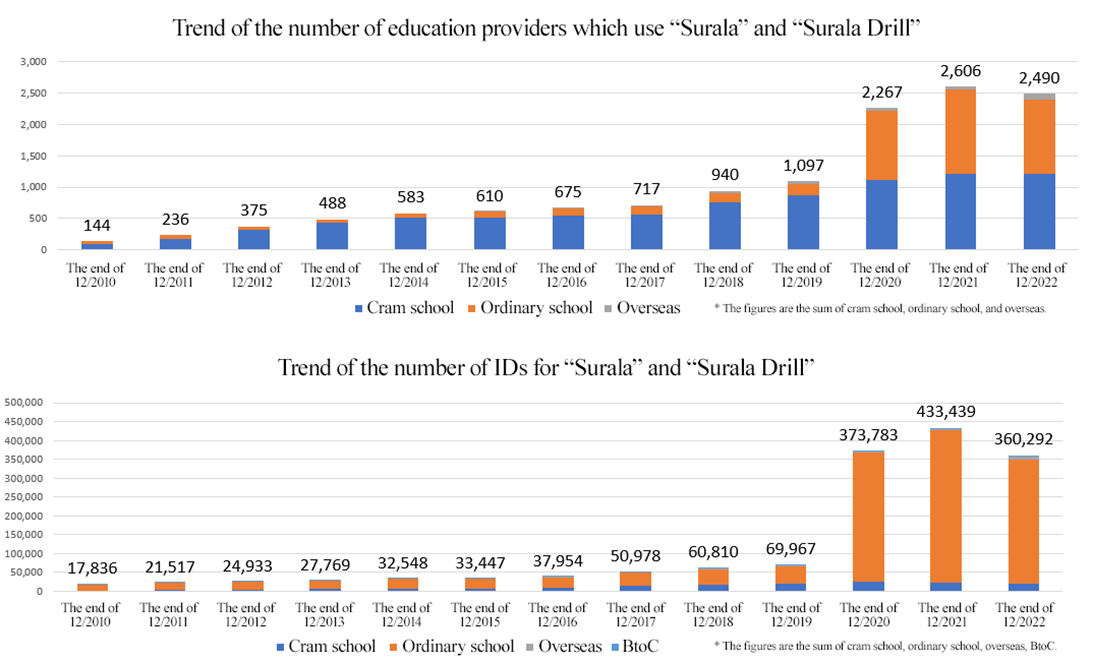

The number of clients, the number of IDs, and the sales composition in the term ended Dec. 2022 are as follows. The company considers that the ratio of sales from schools will increase through the progress of the GIGA School scheme.

| No. of clients | No. of IDs |

Cram School | 1,204 | 19,430 |

School | 1,191 | 328,882 |

Overseas | 95 | 7,819 |

BtoC | - | 4,161 |

Total | 2,490 | 360,292 |

*As of the end of Dec. 2022

(Taken from the reference material of the company)

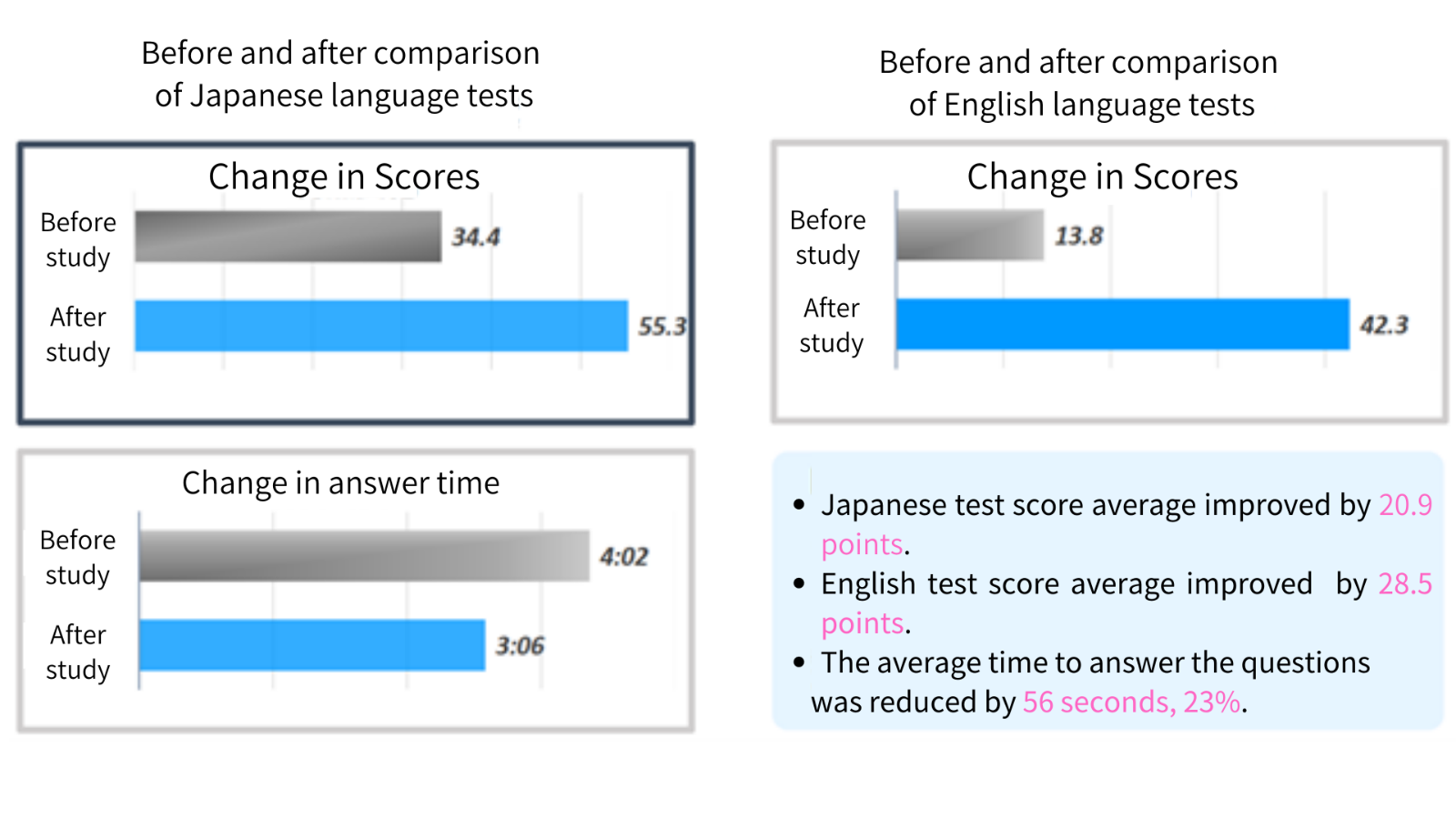

③Effects of adoption of “Surala”

As a “demonstrative project for future classrooms” in local public standard schools, “Surala” was adopted in three major subjects (the English and Japanese languages, and mathematics) in Sakaki High School in Nagano Prefecture, and the effectiveness of learning improved remarkably as mentioned below.

(Taken from the reference material of the company)

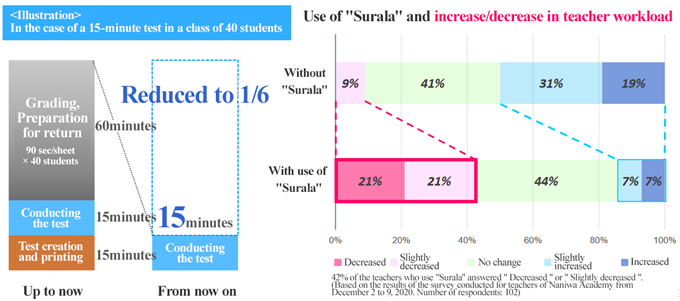

In recent years, the reform of workstyles of teachers has been a significant issue. According to the questionnaire survey targeted at teachers of Naniwa School in Osaka Prefecture in December 2020, the time required for a test was shortened to one sixth, and 42% of teachers using “Surala” replied that “their workloads have decreased somewhat/slightly.”

“Surala” helps reform the workstyles of teachers by streamlining the process of acquiring fundamental academic skills and realize an environment in which teachers can concentrate on the nurturing of students’ capabilities of thinking, judging, expressing, and learning things, and humanity.

(Taken from the reference material of the company)

④Growth potential and future developments of “Surala”

As mentioned in the section “1-3 Market Environment,” the Japanese EdTech market is expected to keep growing despite the declining birthrate. As of the end of December 2022, the market penetration rates of “Surala” and “Pitadori” are 2.3% for cram schools (1,204 schools) and 3.5% for ordinary schools (1,191 schools). The company is also actively cultivating overseas markets, so there is significant room for growth. The number of schools that have adopted “Surala” and “Surala Drill” and the number of IDs, which are key performance indicators (KPIs), have increased year on year, so it is possible to expect their growth.

⑤Active formation of alliances

The company is striving to improve contents by actively forming alliances with external enterprises.

Alliance partners | Purpose of alliance | Outline |

AIed, Inc. | Development of new contents of pronunciation tests | By incorporating the speaking AI “CHIVOX” of AIed, Inc., which checks the speaking skill and give feedback about improvement points into “Surala” English, which has helped students obtain “reading,” “listening,” and “writing” skills with its lecture, exercise, and test functions, they will develop and offer “Surala” for improving the “speaking” skill in addition to the above three skills, and then contribute to the English education in Japan. |

NEC Space Technologies, Ltd. | Joint development of “Surala Satellyzer”, profound learning tools focused on space, targeted at high school students | “Surala Satellyzer” is for discussing solutions to attain SDGs by utilizing space technology. Students will discuss social issues they want to solve in groups, and seek solutions utilizing artificial satellites. In this joint development, they will combine the knowledge of space technology, including the satellites owned by NEC Space Technologies, and the know-how to design effective learning contents and technology for developing teaching software of SuRaLa Net, which have been accumulated through “Surala” and “Surala Active Learning.” |

NTT DOCOMO, INC. | Implementation of joint demonstrative experiments utilizing emotion recognition technology | They found that when students’ emotions of “excitement,” “curiosity,” and “joy” are stirred up before learning, they can memorize things more efficiently during learning. By helping students memorize more contents by taking advantage of this effect, it is possible to improve the efficiency of learning. Accordingly, they aim to realize services for improving academic skills through guidance and follow-up activities for learning while considering students’ emotions. |

Fantamstick, Ltd. | To acquire Fantamstick, which develops intellectual training apps and learning contents for children, as a subsidiary (holding 52.2% of voting rights as of Jan. 2022) | The track record and technologies in the field of commissioned development for educational institutions and the knowledge in the design field are expected to lead to the further improvement and growth of services of SuRaLa Net. In addition, they are expected to generate synergetic effects, such as the increase of overseas users and the expansion of the customer base. |

SuRaLa Net plans to cooperate with Fantamstick in developing new services, and aims to increase personnel for strengthening the system for commissioned development, whose transactions are increasing, increase users of existing app services by enhancing marketing and brand development activities, and release new services utilizing gamification.

【1-5 Features and Strengths】

(1)Positioning

The company has established an unrivaled unique position with “Surala,” an advanced digital teaching tool, targeted at a broad range of children with a deviation value of 30-60.

(Taken from the reference material of the company)

(2)Source of competitiveness

The competitive advantage of the company is attributable to mainly the development and provision of “Surala,” which is based on AI and adaptive learning and has significant advantages over competing products. In addition to them, the company possesses consultation skills to propose solutions to the problems with the management and affairs of cram and ordinary schools and support them in adopting the solutions. This is their primary characteristic that cannot be imitated by competitors.

The company’s competitiveness is derived also from the adoption of cutting-edge technologies, including the installation of AI functions developed by leading-edge enterprises, such as AI chatbots and AI speaking functions, in “Surala” with patented functions, the utilization of big data on learning activities to evolve and upgrade teaching materials, and so on.

【1-6 ROE Analysis】

| FY 12/17 | FY 12/18 | FY 12/19 | FY 12/20 | FY 12/21 | FY 12/22 |

ROE (%) | 14.8 | 17.8 | 5.1 | 34.9 | 26.7 | 17.5 |

Net income margin (%) | 10.68 | 14.72 | 3.85 | 23.04 | 20.47 | 16.55 |

Total asset turnover [times] | 1.10 | 1.00 | 1.11 | 1.17 | 1.00 | 0.80 |

Leverage [times] | 1.26 | 1.21 | 1.19 | 1.29 | 1.30 | 1.32 |

*ROE was taken from the brief financial report. The figures until FY 12/21 are nonconsolidated, while the figures in FY 12/22 are consolidated. Until FY 12/21, total asset turnover and leverage were calculated from the average of values of total assets and equity capital at the beginning and end of each term. In FY 12/22, the values at the end of the term were used, as consolidated accounting was adopted.

The ROE of SuRaLa Net, which is an ICT enterprise, has been high, but it is considered that there remain room for further improvement in profitability, asset efficiency, and leverage.

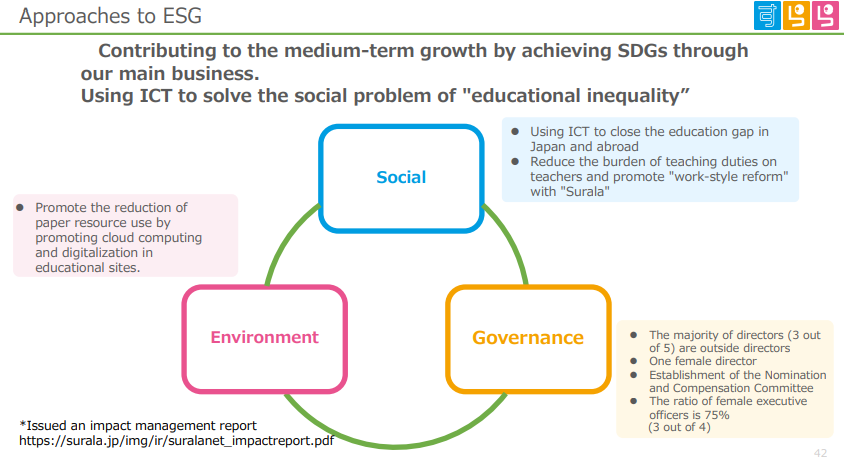

【1-7 Sustainability】

As mentioned in the section “1-2 Corporate Philosophy,” the company recognizes that its existence will become socially meaningful if it solves the social issue of “educational inequality” with ICT, and considers it as a business opportunity, to achieve mid/long-term growth.

(Taken from the reference material of the company)

Society: in Japan | The company offers learning opportunities to a broad range of children with ICT “Surala,” which enables learning suited for the comprehension level of each student.

*To provide truant children with opportunities to learn at home and advance to higher education, so that they will be deemed to have “attended classes” in accordance with the rules of the Ministry of Education, Culture, Sports, Science and Technology *To offer optimized learning contents to children with developmental and learning disabilities *To offer voluntary learning optimized for combined classes in remote islands and mountain areas *To offer learning opportunities to relatively poor children in cooperation with NPOs |

Society: outside Japan | The company offers the arithmetic e-learning program “Surala Ninja!” for elementary school pupils in developing countries, including Sri Lanka and Indonesia.

*To operate “Surala JUKU” for giving lectures on arithmetic to children of low-income families in cooperation with the microfinancing institution for women. *To offer charge-free IDs to “SOS Children’s Villages,” an NGO that accepts orphans and children who have suffered from domestic violence. *To create employment opportunities by proactively hiring local women as facilitators (lecturers) |

Environment | *To reduce the consumption of resources, such as paper, by utilizing ICT-based teaching materials *To streamline business operations, and reduce costs for printing and resources through DX |

Governance | *One out of five directors (including 3 outside directors) is female *Three out of four executive officers are female *To hold company-wide training regularly, to enrich systems for having an audit committee and complying with laws and regulations |

The company started issuing “impact management reports,” including impact assessment, to logically visualize the social issues they want to solve through their business and the outcomes they hope to achieve.

These reports cover the four social issues: “truancy,” “developmental and learning abilities,” “poverty,” and “low academic skills,” and try to qualitatively and quantitatively evaluate the impact of the company’s business on them.

The company considers that its endeavor to assess the impact is quite unique and new among IT venture firms.

Impact Management Report 2022 https://surala.jp/img/ir/suralanet_impactreport2022.pdf

2. Second Quarter of the Fiscal Year ending December 2023 Earnings Results

【2-1 Consolidated Business Results】

| FY 12/22 2Q | Ratio to sales | FY 12/23 2Q | Ratio to sales | YoY |

Sales | 1,062 | 100.0% | 1,043 | 100.0% | -1.8% |

Gross Profit | 782 | 73.6% | 724 | 69.4% | -7.3% |

SG&A | 480 | 45.2% | 541 | 51.9% | +12.7% |

Operating Income | 301 | 28.4% | 183 | 17.6% | -39.2% |

Ordinary Income | 311 | 29.3% | 186 | 17.9% | -40.1% |

Net Income | 206 | 19.4% | 135 | 13.0% | -34.3% |

*Unit: million yen. Net income is the net profit attributable to shareholders of the parent company.

Sales and profit dropped.

The sales in the second quarter of the term ending December 2023 were 1,043 million yen, down 1.8% from the previous term. The sales in the BtoC market grew, but the sales in the cram school market declined due to the decrease in the number of students in the private school market, the diversification of EdTech teaching materials, etc. and the sales in the school market, too, dropped, due to the termination of the subsidy for adopting EdTech. Operating income decreased 39.2% year on year to 183 million yen. Gross profit dropped 7.3% year on year, due to the augmentation of cost of sales, including the increase of development staff and depreciation after investment in development. SGA rose 12.7% year on year, due to the increase of employees.

【2-2 Trend of the e-learning business in each market】

(Profit and loss of the e-learning business)

| FY 12/22 2Q | Ratio to sales | FY 12/23 2Q | Ratio to sales | YoY |

Sales | 1,022 | 100.0% | 1,006 | 100.0% | -1.6% |

Gross Profit | 768 | 75.1% | 716 | 71.2% | -6.7% |

SG&A | 463 | 45.3% | 505 | 50.2% | +9.2% |

Operating Income | 305 | 29.8% | 211 | 21.0% | -30.8% |

Ordinary Income | 314 | 30.8% | 214 | 21.3% | -31.9% |

Quarterly Net Income | 214 | 21.0% | 148 | 14.7% | -30.9% |

*Unit: million yen.

(Sales in each market)

| FY 12/22 2Q | FY 12/23 2Q | YoY |

Cram school market | 339 | 307 | -9.5% |

School market | 479 | 464 | -3.2% |

BtoC market | 194 | 219 | +12.9% |

*Unit: million yen. *Number of schools and IDs of Surala Net public schools

(Trends of KPIs)

Number of clients

| FY 12/22 2Q | FY 12/23 2Q | YoY |

Cram School | 1,229 | 1,182 | -3.8% |

School | 784 | 944 | +20.4% |

Overseas | 55 | 95 | +72.7% |

Total | 2,068 | 2,221 | +7.4% |

Number of IDs

| FY 12/22 2Q | FY 12/23 2Q | YoY |

Cram School | 20,277 | 19,564 | -3.5% |

School | 224,808 | 237,827 | +5.8% |

Overseas | 2,276 | 8,128 | +257.1% |

BtoC | 3,864 | 4,349 | +12.6% |

Total | 251,225 | 269,868 | +7.4% |

*Number of schools and IDs of Surala Net public schools

| FY 12/22 2Q | FY 12/23 2Q | YoY |

Public schools |

|

|

|

client schools | 589 | 702 | +19.2% |

IDs | 167,031 | 186,298 | +11.5% |

|

|

|

|

Subsidy for adopting EdTech |

|

|

|

client schools | 28 | - | - |

IDs | 4,892 | - | - |

(1)Cram school market

Due to the diversification of EdTech-based teaching materials, the number of students of existing cram schools that have adopted the company’s product is decreasing, but the number of business inquiries is increasing due to the popularization of online education and the improvement in online marketing. The distribution of the products to afterschool day-care centers for kids is increasing steadily.

(2)School market

Sales decreased due to the termination of the subsidy for adopting EdTech.

On the other hand, their teaching tools were increasingly used in new regions, including public high schools and municipalities, so the number of user IDs grew.

Based on the track record of practical application in institutions for higher education, such as vocational schools, sales channels are expected to expand.

(3)BtoC market

Learning at home by using online systems has been increasing.

The company responded to the growth of the truancy market and proactively made efforts to diffuse the system in which truant students can be deemed to have attended classes, establishing its unique position.

There are an increasing number of pupils who use the product to study subjects for higher grades in advance, and an increasing number of children living abroad who use the product.

(4)Overseas market

The company participated in the learning support project targeted at middle and high school students of low-income families in the Philippines for 3 consecutive years.

The joint large-scale pilot project with Asian Development Bank Institute (ADBI) is steadily ongoing in Indonesia.

In Sri Lanka, which is suffering from an economic crisis, the company provided 800 children with learning opportunities via an international NGO.

【2-3 Financial Condition and Cash Flow】

◎Financial Condition (Consolidated)

| End of December 2022 | End of June 2023 | Increase/ Decrease |

| End of December 2022 | End of June 2023 | Increase/ Decrease |

Current assets | 1,738 | 1,573 | -164 | Current liabilities | 499 | 494 | -4 |

Cash and deposits | 1,333 | 1,300 | -32 | Accounts payable | 195 | 129 | -66 |

Trade receivables | 366 | 243 | -122 | Fixed liabilities | 101 | - | -101 |

Noncurrent assets | 931 | 1,004 | +72 | Total labilities | 600 | 494 | -106 |

Intangible assets | 816 | 878 | +62 | Net assets | 2,068 | 2,083 | +14 |

Investments and other assets | 84 | 96 | +11 | Retained earnings | 1,475 | 1,611 | +135 |

Total assets | 2,669 | 2,577 | -91 | Total liabilities, net assets | 2,669 | 2,577 | -91 |

*Unit: million yen.

The capital-to-asset ratio as of the end of June 2023 was 79.6%.

Cash Flow (Consolidated)

| FY 12/22 2Q | FY 12/23 2Q | Increase/Decrease |

Operating Cash Flow | 448 | 388 | -59 |

Investing Cash Flow | -295 | -203 | +91 |

Free Cash Flow | 152 | 184 | +32 |

Financing Cash Flow | 98 | -217 | -316 |

Cash, Equivalents | 1,496 | 1,300 | -195 |

*Unit: million yen.

The cash position declined.

【2-4 Topics】

(1) The company developed “SuRaLa NIHONGO” and released it in April.

The company developed and started to offer a new ICT-based learning tool, “SuRaLa NIHONGO (Japanese Language),” which helps people who have roots in overseas countries and live inside and outside Japan reach the levels of Japanese language proficiency required for working, studying, and living in Japan while enjoying learning the Japanese language in April 2023.

(Background of the development of SuRaLa NIHONGO)

Today, approximately 2,960,000 foreign nationals reside in Japan, with the number of foreign workers hitting a record high of about 1,730,000. A new status of residence, “specified skilled worker,” was established, creating a greater number of job opportunities in Japan. In addition, as a result of the enforcement of the Act on the Promotion of Japanese Language Education, it is expected that the environment surrounding Japanese language education will be improved in Japan.

Meanwhile, in overseas countries, the number of people learning the Japanese language is growing, and their motives are becoming widely diverse, ranging from their interest in Japanese anime movies and culture to necessity for business and work.

Under these circumstances, Japanese language education inside and outside Japan faces such issues as a shortage of Japanese-language teachers, differences in teachers’ teaching ability, and lack of satisfying learning tools and educational opportunities.

There are over 50,000 pupils and students of foreign nationality who live in Japan and need Japanese language education because they have trouble in making everyday conversation in Japanese or have difficulty with learning activities, and 52.6% of the municipalities in Japan have systems in place for teaching those children the Japanese language. The reality is, however, that only 30% of the municipalities ready to teach foreign children in need use ICT in teaching the Japanese language and the remaining 70% have not adopt ICT.

In this situation, taking advantage of its know-how of learning tools development, the company developed an ICT-based learning tool, “SuRaLa NIHONGO,” which allows everyone to learn correct Japanese systematically and enjoyably wherever they want. With “SuRaLa NIHONGO,” learners can learn the Japanese language at their own pace and will master Japanese at the levels required for working, studying, and living in Japan. SuRaLa Net started to provide its first service for N5, the most basic level of the Japanese Language Proficiency Test (JLPT).

With regard to development, SuRaLa Net cooperated with JQC (Chuo-ku, Tokyo) and Alpha Japanese School, which was established in 1987, and has been teaching Japanese for many years (Chiyoda-ku, Tokyo), enabling Japanese language learning using ICT learning tools that are based on professional knowledge.

(Features of “SuRaLa NIHONGO”)

(1)Users can learn all the elements of the Japanese language, ranging from the basics to advanced use of characters, vocabulary, and grammar, even if they are complete novices in Japanese.

“SuRaLa NIHONGO” offers courses designed to prepare for the JLPT and helps users systematically link prior knowledge to newly acquired knowledge. Users can learn both Japanese words and grammar through natural conversations without stress, which helps them broaden their vocabulary while learning how to use them naturally. In addition, as they can practice writing Japanese characters. “SuRaLa NIHONGO” enables users to learn all the elements of the Japanese language.

(2)Users follow small steps and deepen their understanding.

“SuRaLa NIHONGO” helps users fully acquire knowledge of the Japanese language by letting them go through a small-step learning process repeatedly, which is “to output what they have learned as soon as they have acquired a new piece of knowledge.” Furthermore, in addition to a great volume and a wide variety of exercises given following the lectures, users can proceed with their learning whenever they want according to their level of understanding. “SuRaLa NIHONGO” allows users to learn Japanese at their own pace based on their understanding level, preventing them from entering the next stage before they gain full understanding of the subject they are studying.

(3)“SuRaLa NIHONGO” offers lectures in correct Japanese by animated characters.

The lectures of “SuRaLa NIHONGO” are delivered by animated characters for whom famous Japanese voice actors provide voice-overs. Therefore, they are easy to listen to and users can expose themselves to the correct pronunciation of the Japanese language.

(4)The translation function is available in three languages and users’ mother tongues are displayed on the screen.

At the moment, “SuRaLa NIHONGO” is available in three languages, which are English, Indonesian, and Cambodian Khmer.

Users can proceed with their learning free from anxiety because some of the explanations for the exercises are given in their mother tongues while the lectures are translated into their mother tongues and displayed on the screen.

The company plans to increase the number of languages available for translation as circumstances demand.

(5)Users’ efforts and levels of attainment are visualized, and users are kept motivated with game elements.

“SuRaLa NIHONGO” has the gamification function for keeping Japanese language learners motivated, with which users are ranked by their study hours and results and are granted Japanese digital goods according to the attainment level of their learning. This function allows users to continue to learn Japanese while having fun.

In addition, “SuRaLa NIHONGO” has a learning management screen that shows the user’s progress and attainment level in an understandable manner. This function enables teachers to give advice tailored for each student.

(Future developments)

With “SuRaLa NIHONGO” it has developed, the company intends to enter the Japanese language learning market and open up new business channels, including secondary educational institutions and sending organizations in overseas countries and elementary and junior high schools, Japanese-language schools, and companies that accept foreign nationals with the residency status of a specified skilled worker in Japan.

As the demand for opportunities for learning the Japanese language is rising not only overseas, but also in Japan, a shortage of Japanese-language teachers and the quality of education have been identified as social issues. While endeavoring to settle such issues through its business with an aim of reducing the educational inequality due to various reasons, such as income inequality and regional disparities, the company strives to contribute to resolving the social issues by getting “SuRaLa NIHONGO” on the right track.

(2) Release of “Surala Satellyzer,” a teaching tool for inquiry-based learning based on ICT

In April 2023, the company released “Surala Satellyzer,” a teaching tool for inquiry-based learning based on ICT, targeting high school students, who are expected to acquire basic skills required for inquiry-based learning without fail through practice.

For “Surala Satellyzer,” the company has engaged in collaborative development with NEC Space Technologies, Ltd. (Fuchū City, Tokyo) since about 2 years ago. Under the theme of space, the company provides students with opportunities to obtain a broad perspective for understanding connections between a distant world and real life, etc.

(Background of development)

Regarding the class of “Comprehensive Learning,” which became compulsory in high school in fiscal 2022 due to the revision to the curriculum guidelines, the school team of SuRaLa Net has received many questions about the issues with inquiry-based learning in school. In the process of development of inquiry-based learning tools, they conducted test marketing at schools, and concluded that students lack “the basic skills for proactive research” and “teachers’ workload” is significant in inquiry-based learning classes.

As students’ basic skills for proactive research in inquiry-based learning, the company focused on the following three items:

・“Basic knowledge of the theme (interest in issues)”

・“Verbalizing one’s own thoughts (logical thinking and vocabulary)”

・“Having discussions with members to delve into the contents (communication skills and the framework for thinking)”

and developed the program of “Surala Satellyzer” so that students can acquire the basic skills for proactive research in the ordinary course of learning activities.

From the viewpoint of teachers, they can save the labor for preparing for their classes, unify the yardsticks and methods for evaluation, and confirm the skills to be acquired by students through inquiry-based learning, by utilizing “Surala Satellyzer.”

(Features of “Surala Satellyzer”)

【Feature 1】 Contents that can be enjoyed like a game while following a story

Students form a team to learn with “Surala Satellyzer.” A learning program is composed of several 50-min units.

The contents of the program are “acquisition of basic knowledge,” “selection of a mission (choosing an issue to be solved and deepening knowledge),” “aiming to solve issues,” and “review.” Through them, students can obtain the basic skills for proactive research. Learners choose social issues that pique their interest, and discuss solutions utilizing artificial satellites and space development technology.

【Feature 2】 Each unit is composed of “a lecture,” “group work,” and “self/mutual evaluation.”

During a lecture, basic knowledge is explained and instructions are given for group work by using animation and voice. Each lecture is interactive so that students can deepen their understanding and stay focused in learning.

For group work, tools for streamlining the processes of thinking and coming up with ideas and summarizing the ideas are prepared, so that students can learn by researching and have discussions. Through this, students can learn how group work progresses.

In self/mutual evaluation, students input data while following instructions displayed in the evaluation window, review their performance, and receive feedback from classmates, to obtain the ability to notice and improve problems (metacognitive ability).

【Feature 3】 All kinds of tools for leading a class, evaluating and grading students, etc. are used for reducing the workload of teachers.

“Surala Satellyzer” also helps reduce the workload of teachers in the operation of inquiry-based learning classes.

Teachers can leave class management to “Surala Satellyzer,” so they can concentrate on facilitating students’ learning activities. With the manual for managing classes, teachers can deal with questions from students and reduce the workload of preparation.

By preparing a variety of class operation tools, such as an evaluation system and the list of skills to be acquired, it is possible to enable every teacher to hold a class of inquiry-based learning in a unified way.

(3) Commencement of development of “Neo Surala,” a next-generation learning platform with an individual optimization function

The company started the development of “Neo Surala,” a significantly updated version of the currently available “Surala,” in cooperation with Fantamstick, Ltd., a group company.

The company will advance individual optimization by adopting new technologies, develop new contents, and install cutting-edge functions, with the aim of releasing it in 2025.

The company plans to develop a next-generation learning platform with an individual optimization function and offer learning opportunities to people with every nationality in every field and every generation.

3. Fiscal Year ending December 2023 Earnings Forecasts

【3-1 Earnings Forecast】

| FY 12/22 | Ratio to sales | FY 12/23 Est | Ratio to sales | YoY | Rate of Progress |

Sales | 2,147 | 100.0% | 2,322 | 100.0% | +8.1% | 45.0% |

Sales from the e-learning business | 2,066 | 96.2% | 2,212 | 95.3% | +7.1% | 45.5% |

Operating Income | 475 | 22.1% | 391 | 16.8% | -17.7% | 46.9% |

Operating Income from the e-learning business | 498 | 23.2% | 430 | 18.5% | -13.7% | 49.1% |

Ordinary Income | 501 | 23.3% | 392 | 16.9% | -21.7% | 47.6% |

Net Income | 355 | 16.5% | 266 | 11.5% | -25.0% | 51.0% |

*Unit: million yen. Estimates are those of the company.

No change in the earnings forecast, Sales are expected to grow, but profit is projected to drop.

There is no change in the earnings forecast. For the term ending December 2023, sales are expected to grow 8.1% year on year to 2,322 million yen and operating income is projected to decline 17.7% year on year to 391 million yen. The sales of the e-learning business are forecast to rise 7.1% year on year to 2,212 million yen. The sales in the school and BtoC businesses are expected to increase, while the sales in the cram school market are forecast to decline. Despite the sales growth, profit is projected to decrease, due to the investment in development for differentiating the company from competitors, the increase of contents and system development staff, the increase of support staff for dealing with the problems with on-site use, etc. for enhancing its competitiveness, as well as the augmentation of costs for operation and maintenance due to the release of new functions.

【3-2 Initiatives】

The trends of the e-learning business, etc. are as follows.

(Sales in each field)

| FY 12/22 | FY 12/23 Est | YoY | Rate of Progress |

Cram School | 668 | 655 | -1.9% | 46.9% |

School | 967 | 1,079 | +11.6% | 43.0% |

BtoC | 399 | 438 | +9.8% | 50.1% |

E-learning Business | 2,066 | 2,212 | +7.1% | 45.5% |

*Unit: million yen.

(KPI)

| FY 12/22 | FY 12/23 Est | YoY | Rate of Progress |

No. of client schools | 2,490 | 2,323 | -6.7% | 95.6% |

No. of IDs | 360,292 | 299,928 | -16.8% | 90.0% |

Due to the termination of the subsidy for adopting EdTech, the numbers of school buildings and students in the school market will decrease, but in order to deal with the emergence of problems with use in school under the GIGA School scheme, the company will increase marketing staff for enhancing support, with the aim of increasing sales by 10% or more in the school market. The performance in the cram school, BtoC, and overseas markets is expected to be healthy.

4. Future Priority Measures

The basic policies of the business plan are “response to the acceleration of adoption of ICT in educational scenes,” “utilization of big data and adoption of cutting-edge technologies,” and “initiatives for sustainability.” Under these basic policies, the company will implement the following priority measures in each market.

【4-1 Cram School】

Despite the declining birthrate, the market scale has been stable. However, the cram school market is becoming “mature,” so the company considers that cram schools will undergo the full-scale “competition to survive.”

Under these circumstances, the company will strive to expand business in multiple fields, based on “AI,” “adaptive tools,” and “online systems.”

For entrepreneurs who hope to expand business with new business models, which solved the problems with conventional franchised tutoring schools, the company will support their low-cost management by setting initial fees and loyalties at zero and doing without part-time lecturers. The company will support a broad range of cram schools, including private small-sized ones, afterschool childcare centers, English conversation schools, and facilities for truant pupils.

Leading cram schools, too, have been merged or integrated, indicating fierce competition. For local medium-sized and leading cram schools, which face difficulty in differentiation and promotion of enrollment, the company will propose original exercises with E-Te Editor and strategies for attracting students in the post-pandemic era amid the declining population. The company will also support clients in transforming into an organization that can use EdTech.

As offices and users are increasing year by year and competition is intensifying, the company will support afterschool day-care centers, which need to differentiate their services, in transforming into facilities where school subjects can be learned, while giving operation consultation services by proposing the use of ICT and educational plans to make students employed.

In April 2023, the company revised the area management system, to introduce its services to more cram schools.

【4-2 School】

Regarding the GIGA School scheme for elementary and junior high schools, schools face the difficulty in actually using the installed equipment and software, so the company will give proposals for solutions, and strengthen its support system.

On the other hand, the company aims to increase client public high schools and create a new pillar of revenues, by utilizing the GIGA School scheme for high schools.

In detail, they will concentrate on the development of contents and marketing, and aim to achieve the linkage and connection with e-portal sites for utilizing learning data, accumulate experiences in growing fields, including vocational schools and high schools offering correspondence courses, and conduct marketing. The company will focus on the improvement in the know-how to fully utilize them in schools, academic skills, and non-cognitive abilities. In addition to “learning programs for students with low academic results,” the company will enhance its capability of dealing with each of new educational values.

【4-3 BtoC】

It is said that there are about 600,000 children with developmental disabilities, including learning disabilities, and about 24 truant students. In addition, the company aims to grow its business by grasping the characteristics of the BtoC market, in which the demand for learning at home has grown due to the coronavirus pandemic and the product is increasingly used by Japanese children living abroad, and solving social issues.

The company will strengthen its unique position of offering the only one service that enables children with developmental and learning disabilities and truant children to learn systematically from scratch.

The company will offer comprehensive support to customers facing trouble in learning, including “Surala Coach” to coach guardians, “Homebility” to train guardians, and mental and educational assessment services.

【4-4 Overseas】

The company will promote the adoption of ICT in education in developing and emerging countries, where populations have grown and the ratio of young people is high, but educational infrastructure has not been developed and there are significant problems with the number and quality of teachers, with the aim of achieving mid/long-term growth.

In detail, the company will enrich content and target junior high schools as well as elementary schools.

In Indonesia, the company will make efforts to introduce ICT to 100 public middle schools and produce good results.

In Sri Lanka, the company will strive to expand the BtoC business and cement the cooperation with international NGOs.

In Egypt, full-scale commercialization targeted at private schools started.

【4-5 Other/company-wide】

*Alliance

As mentioned in the section “1. Company Overview,” the company is proactively forming alliances with external enterprises, and multiple projects are ongoing.

The company aims to generate synergetic effects with Fantamstick as soon as possible including the development of “Neo Surala”.

*Development

As mentioned in the section “2-4 topics”, the company is working on developing content and platforms for new educational issues and values, such as inquiry-based learning and Japanese-language content.

The company will continue active investment, for further optimizing learning programs for respective students.

5. Conclusions

The progress rate in the first half of the term is 45.0% for sales and 46.9% for operating income. Sales are smaller than usual. In the school market, annual sales are expected to grow by double digits, but sales dropped in the first half of the term due to the termination of the subsidy for adopting EdTech. The noteworthy point from the third quarter is whether they can respond to the assumed problems with use in school after the GIGA School Scheme is put into practice, while the number of user IDs is increasing.

<Reference: Regarding Corporate Governance>

◎Organizational structure and composition of directors and auditors

Organizational structure | Company with an audit and supervisory committee |

Directors | 5 including 3 outside directors (including 3 independent officers) |

Audit committee members | 3 including 3 outside directors (including 3 independent officers) |

In order to further enrich the corporate governance structure by improving the objectivity and transparency of procedures for nominating directors and determining their remuneration amounts, the company established a nomination and remuneration committee as a discretionary advisory body of the board of directors. The committee is composed of 3 or more members selected through a resolution of the board of directors, and no less than half of them shall be independent outside directors.

◎Corporate Governance Report (Update date: March 28, 2023)

Basic policy

The company believes that in order for an enterprise to keep growing and advancing amid the rapidly changing business environment, it is indispensable to enhance the efficiency and effectiveness of business administration and develop a fair, transparent management structure, and considers thoroughgoing corporate governance as an important mission. In addition, the company plans to enhance risk control and supervision function to realize more effective corporate governance, in response to the changes in the social environment, the enforcement of laws, regulations, and so on.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

The company follows all of the basic principles of the Corporate Governance Code.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |