| Tokuyama Corporation (4043) |

|

||||||||

Company |

Tokuyama Corporation |

||

Code No. |

4043 |

||

Exchange |

TSE 1st Section |

||

Industry |

Chemicals |

||

President and Executive Officer |

Hiroshi Yokota |

||

Address |

FRONT PLACE AKIHABARA, 1-7-5, Sotokanda, Chiyoda-ku, Tokyo |

||

Year-end |

End of March |

||

URL |

|||

* The share price is the closing price on June 16. The number of shares issued and BPS were taken from the latest brief financial report.

ROE is the values for the previous term. |

||||||||||||||||||||||||

|

|

*The forecast is from the company. Net income is profit attributable to owners of the parent. Hereinafter the same applies.

On Oct. 1, 2017, Tokuyama Corporation plans to change its trading lot from 1,000 shares to 100 shares, while conducting 1-for-5 reverse split. This report outlines the financial results of Tokuyama Corporation for the term ended Mar. 2017 and its Medium-Term Management Plan, and includes the interview with the president Yokota, and so on. |

| Key Points |

|

| Company Overview |

|

In 1938, it started producing cement from the byproducts in the soda ash manufacturing with the wet method. After the Second World War, it grew the inorganic business, and during the rapid economic growth period, it expanded the petrochemical business handling vinyl chloride, polypropylene, etc. After the two oil shocks, it entered the high added value field, including electronic materials and fine chemicals. In 1984, the company launched the polycrystalline silicon business, which is now ranked in the top 3 in the world. In 1985, it started producing aluminum nitride powder, which is used for cooling down electronic parts, with its original reduction-nitridation method. Since then, the company has expanded its business domains, including the fields of living and medicine handling materials for eye glasses, dental apparatus, etc., and environment and energy. The revenue of the polycrystalline silicon business of "Tokuyama Malaysia," which is a consolidated subsidiary established in Malaysia in 2009, dropped considerably due to the market downturn. Then, significant impairment losses were posted in the term ended Mar. 2015 and the term ended Mar. 2016, and no dividends were paid. To cope with that situation, the company procured funds by issuing class shares in May 2016, for the purpose of "reconstructing its financial base." Under the vision of "new foundation," the company produced and announced the 5-year Medium-Term Management Plan "Cornerstone of the Group's Revitalization," and is working on important projects for reforming its corporate culture, redeveloping business strategies, etc. In the term ending Mar. 2018, it plans to pay a dividend for the first time in 4 terms. Corporate activities, including business strategies, are mostly linked to this vision.   ◎ Chemicals

<Outline and major products>

Tokuyama Corporation handles basic chemicals that are indispensable for a broad range of purposes in each industry, such as soda ash, caustic soda, and calcium chloride. The company also operates business efficiently, for example, by using the chlorine and hydrogen produced during the process of manufacturing caustic soda for producing polycrystalline silicon. With the goal of "becoming a company that will be chosen by customers forever," the company strives to offer products and services that satisfy the needs of individual clients in a stable and timely manner.   <Basic policy and measures>

By offering basic chemical materials and services that have high quality and cost competitiveness and satisfy the needs of clients, the company aims to contribute to the business growth of each client and the stable, continuous increase in revenue for its core business.

◎ Specialty products

<Outline and major products>

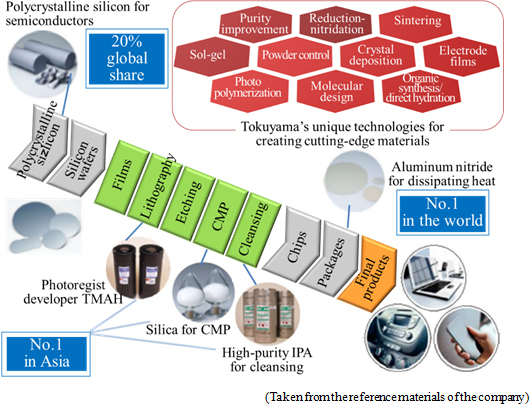

Tokuyama Corporation handles products in a broad range of fields, including energy, electronics, and the environment. For high-purity polycrystalline silicon used for semiconductors, the company has a remarkable share in the world. In addition, fumed silica, which is produced from byproducts, is used for silicone rubber, copier's toner, etc. Aluminum nitride, which is excellent in heat release, is used for energy-saving products, such as inverters and LEDs, in addition to semiconductor manufacturing equipment, and high-purity chemicals for the electronic industry are used for producing semiconductors, liquid crystal panels, etc.

<Basic policy and measures>

To expand its business and revenue by supplying products that will be chosen by clients forever and proposing newly developed products.

The "high-purity polycrystalline silicon for semiconductors" and "high-purity chemicals for the electronic industry" of Tokuyama Corporation are ultrahigh-purity materials for which impurities and residues, which would worsen yield, have been reduced to the maximum degree, and highly evaluated by semiconductor manufacturers, which are developing more minituarized and three-dimensional products. In addition, Tokuyama's heat dissipating materials, which are indispensable for the stable operation of semiconductors, are highly evaluated. As the power devices for in-vehicle apparatus, industrial equipment, and electric railways are having higher output and smaller size, the demand for heat-dissipating materials is growing rapidly. Tokuyama Corporation supplies heat-dissipating materials with high thermal conductivity and an extremely small amount of impurities developed with its original reduction-nitridation method, such as aluminum nitride powder and ceramics, and boron nitride. As shown in the above figure, the company plans to create larger business opportunities and meet demand by supplying a wide array of cutting-edge products rather than only specific products, which are used in the process of manufacturing semiconductors from raw materials. ◎ Cement

<Outline and major products>

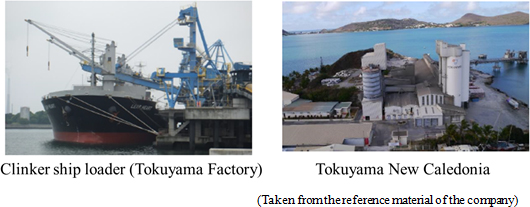

In 1938, Tokuyama Corporation started this business for the purpose of utilizing the byproducts generated at Tokuyama Factory. The cement and related products, such as cement solidifying agents, produced at Nanyo Plant of Tokuyama Factory are used as ready-mixed concrete and secondary concrete products for constructing structures, ports, bridges, roads, etc. that support housing, buildings, and lifelines for the living of people. The company receives a large amount of wastes, including waste plastics and ash from the combustion of household garbage, from the inside and outside of the company, and uses them as raw materials and thermal energy for manufacturing cement, contributing to the development of a resources recycling society.  <Basic policy and measures>

The company will develop optimal systems for manufacturing, selling, and distributing products while flexibly responding to the changes in the business environment. It aims to enhance its competitiveness by maximizing the revenue from waste treatment by expanding export and reducing costs.

In the mid to long term, domestic demand will inevitably shrink due to the decline in population. Accordingly, the company will increase quantity sold by securing stable importers, improve the operation rate of cement factories, and accept more wastes, while discussing and proceeding with the operation of overseas pulverization plants following those of Tokuyama New Caledonia.  ◎ Life & amenity

<Outline and major products>

This segment is constituted by the fine chemical and NF businesses operated by Tokuyama Corporation, and ion exchange membranes, dental materials, clinical testing systems, polyolefin films, resin sashes, etc. developed, manufactured, and sold by group companies. In the fine chemical business, the company handles mainly materials for eye glasses, generic medicine ingredients and intermediates, which were developed with its organic synthesis technology. In the NF business, the company manufactures and sells films that block water, but allow air and moisture to penetrate. Its overseas group companies include Shanghai Tokuyama Plastics, which manufactures and sells breathable films for disposable diapers, whose demand is growing rapidly in emerging countries, including China.   <Basic policy and measures>

The company will secure an advantageous position inside and outside Japan, by establishing and fortifying customer-oriented development, manufacturing, and sales systems. It aims to expand its business, to contribute to the improvement of the living and health (quality of life) of people.

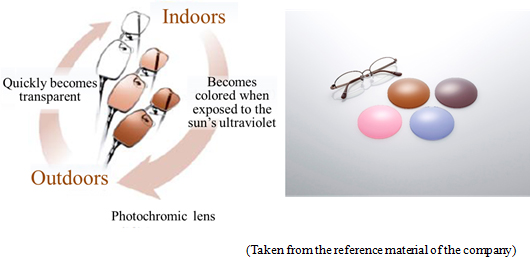

Photochromic dye materials are resin materials that change colors from colorless to gray, brown, etc., when illuminated by sunlight (ultraviolet rays), and return to the colorless state when the illumination stops. Recently, the usage for sports-wear and driving wear has spread, the awareness of harmful ultraviolet rays has grown, and the cases of eye diseases, such as glaucoma, have increased due to aging population. In these circumstances, the use of photochromic dye materials is increasing. The products of Tokuyama Corporation are characterized by "plenty of color variation based on the three primary colors: red, blue, and yellow," "rapid coloration and de-coloration speeds," "sufficient coloration performance even at high temperatures in the summer," "excellent durability," and "the capability of blocking over 99% of ultraviolet rays." The company will advertise these characteristics, aim to expand its share by meticulously meeting customer needs about product specifications and enriching its product lineup, improve visibility, and cultivate new purposes of use by utilizing its product features, such as the blocking of ultraviolet rays.  ◎ Others

This is the segment other than the segments to be reported: "chemicals," "specialty products," "cement," and "life & amenity," and includes overseas distributors, transportation business, and real estate business.

Tokuyama Corporation aims to carry out R&D for cutting-edge materials by utilizing its unique technologies for synthesizing inorganic and organic materials, increasing purity, inducing crystallization and deposition, controlling powder, and sintering materials, which have been nurtured by the company as a chemical manufacturer while expecting the aging of society and the drastic growth and diffusion of environmentally friendly and ICT technologies, and by fusing these technologies with new technologies. As R&D facilities in western and eastern Japan, the company has a "development center (Tsukuba Research Lab)" in Tsukuba City, Ibaraki Prefecture, and an "analysis center (Tokuyama Comprehensive Institute)" in Shunan City, Yamaguchi Prefecture. The development center Tsukuba Research Lab is developing cutting-edge technologies from the medium to long-term viewpoint and analysis technologies as fundamental technologies, conducting R&D in the dental material field, which is characterized by composite materials, and the organic fine chemical field, which is targeted at high value-added products. The analysis center (Tokuyama Comprehensive Institute) located in Tokuyama Factory is a foothold for R&D in the Tokuyama district. There are some significant merits, such as the synergy of the development group in the Tokuyama district and various R&D teams and the easy exchange of information with the manufacturing section.  From now on, we would like to pay attention to the variations in ROA and ROE after the disposal of Tokuyama Malaysia. ① Cutting-edge products created with a variety of unique technologies

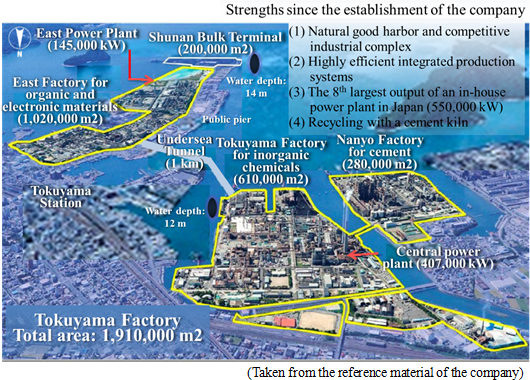

By fusing new technologies with unique technologies for synthesizing organic and inorganic materials, increasing purity, controlling powder, inducing crystallization and deposition, sintering, electrolysis, refining, reprocessing resources, and so on, which have been accumulated and polished for many years, Tokuyama Corporation has developed cutting-edge products, including inorganic chemicals, cement, silica, silicon, aluminum nitride, high-purity chemicals for semiconductors, lens materials, ion exchange membranes, films, resin, sensor materials, and dental materials.For example, the company possesses an original reduction-nitridation technology for producing aluminum nitride powder, which is broadly used as a heat-dissipating agent. Its aluminum nitride powder, which has an extremely low amount of impurities, boasts a 70% global share because of its high competitiveness. At present, its purity is at the world's highest level. The company started producing polycrystalline silicon for the purpose of utilizing the hydrogen and chlorine generated at its electrolysis plant, and it is now ranked in the world's top three. It can be said that its broad, profound technological base helped realize these achievements. ② Competitiveness of Tokuyama Factory, which has integrated and accumulated technologies in an advanced manner

Tokuyama Factory is indispensable for manufacturing products with its unique technologies at low cost and supplying them to clients around the world. It has one of the greatest port infrastructures in Japan and an in-house generation plant, with the following characteristics:

The highly efficient production and supply systems integrated and accumulated sophisticatedly at Tokuyama Factory boost the competitive advantage of Tokuyama Corporation. |

| Fiscal Year March 2017 Earnings Results |

Sales dropped, but operation rate improved. Profit increased considerably due to the decrease in manufacturing cost, etc.

Sales were 299,106 million yen, down 2.6% year on year. As the sold quantities of polycrystalline silicon, etc. grew, the performance of specialty products was healthy, but the selling prices of petrochemicals were sluggish and the domestic performance of cement was weak, decreasing sales. Gross profit rate improved considerably, as the operation rate of Tokuyama Malaysia increased and the prices of fuel and materials dropped. Operating income rose 72.2% year on year to 39,720 million yen, due to the decline in depreciation, etc.       Due to the decrease in short and long-term interest-bearing debts, total liabilities dropped 52.6 billion yen to 288.4 billion yen. Net assets grew 75.7 billion yen from the end of the previous term, due to the increase in retained earnings, the issuance of type-A shares, etc. As a result, equity ratio rose by 17.1% from 12.8% at the end of the previous term to 29.9%.  As purchase of property, plant and equipment augmented and gain on sale of investment securities dropped, investing CF became negative, and the surplus of free CF decreased. The deficit of financing CF shrank as repayment of long-term loans payable declined. The cash position degraded. (4) Topics

Japanese Stock Exchanges Conference aims to unify the share unit number of every listed company in Japan into 100 in accordance with "the action plan for unifying the share unit number" by Oct. 1, 2018.◎ Change in the share unit number and the reverse stock split Considering this goal as a company listed in Tokyo Stock Exchange, the company has decided to change the share unit number of common shares from 1,000 to 100. The scheduled date for the change is Oct. 1, 2017. As the share unit number is changed, the company has decided to conduct 1-for-5 reverse split, for the purpose of adjusting the investment unit to an appropriate level. On Oct. 1, 2017, the company will carry out 1-for-5 reverse split for the shares owned by shareholders registered in the latest list of shareholders as of Sep. 30, 2017 (virtually Sep. 29). |

| Fiscal Year March 2018 Earnings Estimates |

Sales are estimated to grow, while profit is forecasted to decline.

Sales are estimated to be 300 billion yen, up 0.3% year on year. The sold quantities of vinyl chloride monomer, cement, etc. are forecasted to increase, and the selling prices of petrochemicals will be revised. Operating income is projected to be 36 billion yen, down 9.4% year on year. It is forecasted that the growth of quantity sold will increase profit by 4 billion yen, but the costs for materials, fuel, and repair will augment 8 billion yen. Net income is estimated to be 13 billion yen, down 75.1% year on year. Extraordinary loss will be posted through the transfer of Tokuyama Malaysia. Dividend distribution will be resumed, paying 4.00 yen/share. Payout ratio is projected to be 10.9%.   |

| The Medium-Term Management Plan: "Cornerstone of the Group's Revitalization" |

|

With this plan, the company is tackling various important issues such as reforming its corporate culture and reconstructing business strategies. (1) Outline of the Medium-Term Management Plan: "Cornerstone of the Group's Revitalization"

① Assessment of the present state

"Overconfidence and dependence on Tokuyama Factory"

With the "Tokuyama's vision" below, the company will place changing its business culture and a fundamental overhaul of business operations as its core business strategies, and aim to achieve these by FY 2025.

"Inward and passive posture spread among employees" "Corporate governance" "Uncertainty surrounding the strategic direction of the Group and each department" ② Management policies   In the growing businesses, the company endeavors to utilize its unique technologies nurtured in the cutting-edge areas to develop products to respond to the society's needs. ICT and healthcare are the prospective fields. In the ICT field, the company will expand the production line of aluminum nitride for heat-dissipating materials, put boron nitride production into operation, and increase production of polycrystalline silicon. In the healthcare field, the dental equipment and diagnostic medicines will occupy the company's core business, while seeking further growths and not ruling out the possible M&A. (Cross-departmental cost reduction activities) The company will perform non-conventional, cross-departmental approaches and strategic capital investments to reduce the costs of principal items such as raw material and fuel, repair costs and logistics costs. The company aims to reduce company-wide cost by 4 billion yen by 2020. (Research & development) To achieve the expansion of existing businesses and expand into the new business fields to utilize its unique technologies, the company will change its R&D structure so it is more in line with the general customer needs. Also it will embrace a more outward-looking R&D, involving a higher ratio of R&D personnel from operations department and group companies rather than from within. (Capital investment plan and setting strategic investments) The company plans to spend a cumulative total of 96 billion yen on capital investments from 2016 to 2020 (5 years). Of the total, 26% will be earmarked for new business extensions such as responding to demands for refinement of polycrystalline silicon and enhancing the heat-dissipating materials, to lay down a stronger foothold. At the same time, the 20 billion yen strategic investment will be set aside to expand the growth businesses and strengthen the competitiveness of traditional businesses, with the breakdown of 65% towards the traditional businesses and 35% for the growing businesses. ③ Key challenges and countermeasures

The company identifies the following 4 key challenges and the measures.

(2) Progress of the Medium-Term Management Plan: "Cornerstone of the Group's Revitalization"

① Outcome of works on key challenges and future measures

The company regards this as the most important point of its resurgence.<1. Change the Group's organizational culture and structure> During the term ended Mar. 2017, the company engaged itself in activities such as the in-house dialogues initiated by the president, revision of the core personnel management system, and human resources development through the lectures given by external experts. In the future, it will continue with its activities to further realize its visions, while at the same time endeavor to perform the revision of its regular personnel management system, reform the human resources development system, and hire external talents actively. <2. Rebuild the Group's business strategies>

The company aspires to become the world leader in its growing business field and the Japan's leader in its traditional business field. During the term ended Mar. 2017, the company worked to a) improve profit by resuming operations of the plants for polycrystalline silicon for semiconductors, increasing the production of aluminum nitride, transferring equity of its businesses in polycrystalline silicon for solar panels and gas sensor business, rationalizing soda ash and PVC businesses, and operating full-capacity for electrolysis, b) improve operation rate by increasing cement export, c) commence the cross-departmental cost reduction activities "BRIGHT II" at Tokuyama Factory, and d) further the PDCA management regarding its financial indicators and key challenges. In the future, it will attempt to achieve quality differentiation and increased production by responding to the miniaturization of polycrystalline silicon for semiconductors, and increase the capacity for producing its high-purity chemicals for electronics industry (IPA, developing solution). The company can exert its competitive advantage sufficiently when responding to the miniaturization, and it will put a further effort to expand this domain. Additionally, it will strive to expand its business domains with speed by restructuring the R&D system and open innovations. <3. Strengthen Group management>

In the past, the positioning of its group companies was somewhat unclear within the group. The group is now poised to clarify the contributions required of its operational subsidiaries in the group's growth strategies firmly assisted by the mother company in the personnel front, and the contributions, positioning and roles required of its functional subsidiaries through the cost reduction activities carried out in collaboration with Tokuyama Factory.During the term ended Mar. 2017, the company made significant progresses including the re-examination of its business positions and raisons d'être, transferring some shares of FIGARO Engineering Inc. (subsidiary), making the decision to transfer Tokuyama Malaysia, the renewal of SunTox Co., Ltd. (subsidiary), and the factory extension of A&T Corporation (subsidiary). In the future, the group will endeavor to unify the operations of its mother company and the subsidiaries in both capital and personnel, and improve profits at two Chinese companies dealing in the microporous films and EXCEL SHANON Corporation. The transfer of Tokuyama Malaysia was completed on May 31st, 2017. <4. Improve the Company's financial position>

The company will work towards the recovery of own capital through building up profits and the early stabilization of its financial base.During the term ended Mar. 2017, the company was able to achieve strengthening of its financial base through issuance of type-A shares, reduction of interest-bearing debts by 30.1 billion yen, and a 3.06% reduction (improvement) of the D/E ratio. In the future, the company will work towards a further reduction of interest-bearing debts, relief of an interest burden, and capital maintenance by building up operational profits. On June 14th 2017, the acquisition and repayment of the type-A shares were completed. ② Capital investment

During the term ending Mar. 2018, 20.7 billion yen is appropriated, in contrast to 17.3 billion yen of the term ended Mar. 2017, of which 7.8 billion yen is earmarked for the extension and sales promotion investments in the current term, while during the previous term this was 6.2 billion yen.The company will continue investing in projects such as the quality improvement of semiconductor related materials, the increased production of aluminum nitride powder, the introduction of the cutting-edge facility for polyolefin films at one of its subsidiaries SunTox Co., Ltd., and the extension of Esashi factory at another subsidiary A&T Corporation. ③ Research and development

The high-level of R&D activities will be maintained at 7.5 billion yen (previous term) and 9.0 billion yen (current term).

|

| Interview with the President of Tokuyama Corporation |

|

Mr. Yokota is 55 years old (born in October 1961). After working at various posts such as the labor management and working overseas, he became the president and executive officer in March 2015, then the president and executive officer with the representation right in June of the same year. He is driving the resurgence of the company with his strong leadership with the "Tokuyama's vision" to realize the "New foundation" under the Medium-Term Management Plan entitled "Cornerstone of the Group's Revitalization". Q: After becoming the president in March 2015, you launched the new management structure. What do you consider as your mission?"

A: "Building human resources, through and through. Changing the employees' ways of thinking towards "customer oriented" and "outward-looking attitude" through the organizational climate reform is to create the talents who will carry our company forward in the future."

One of the key challenges listed under the ongoing Medium-Term Management Plan is "organizational climate reform" and it is nothing but about building human resources for Tokuyama's resurgence.  Because we have our varied and fantastic unique technologies nurtured over the years and the highly competitive business base, namely Tokuyama Factory, our thinking had become infested with the product-out concept and we had lost the keenness towards the markets and the customer needs. I think it is very telling that we haven't been able to create any product that would become the core profit maker in the last 20 years, apart from polycrystalline silicon. Based on such reflections, I believe that changing employee awareness to "customer-oriented" and "outward attitude" through organizational culture change creates the talents who will be responsible for the Company's future. Q: "As the top of the management, what kind of things are you doing specifically?"

A: "I have explained the meaning of the vision to all the employees directly and I have initiated the opportunities for opinion exchanges and training in the form of discussion meetings for manager class employees as the changes in their ways of thinking was essential to achieve the organizational climate reform. I will continue with these activities."

For this reason, in the first half of FY 2016, which was the first year of our Medium-Term Management Plan, I made an effort to explain the meaning of "Tokuyama's vision" directly to our employees so that the vision is fully understood by every single employee of the Tokuyama Group. From the second half onwards, we initiated the opportunities for opinion exchanges and in-situ trainings in the form of discussion meetings for the manager level employees to discuss the business reform, operational reform and awareness reform, and additionally we revised the core personnel management system. Without the change in the ways of thinking of the core employees of an organization, especially at the manager level who are directly tasked with training the members, there would be no suffusion of the vision and the climate reform would not succeed. I hope to continue these activities every year in conjunction with the progress management. Q: "What do you practically tell your employees normally?"

A: "I tell them to work with the question "are we responding to the customers' expectations?" always in their mind."

What is important in doing so is to question yourself if you are responding to the customers' expectations. The work you are doing in a conventional manner as usual may in fact be not giving satisfaction to customers, or you don't notice that it is not up to the standards of other businesses in the industry: this is precisely what I mean by "inward-looking attitude." To change this, I keep asking employees to always keep in mind the following 5 questions when working: (1) "What is the value of your work?" (2) "Who are you offering that value to?", (3) "Is the recipient of that value satisfied?", (4) "Did you check that directly", and (5) "So how was the result?". With these 5 points clarified, and thinking about what needs to be improved and reformed daily, the change in work will happen without fail. Although the level of the change depends on the departments and the occupational categories, I feel the employees' ways of thinking have changed considerably already. Especially at the departments that have started new businesses and the have been receiving good customer responses, the members are starting to act much more vividly. Of course, the organizational climate reform still has a long way to go, I am really happy that the changes are being felt. I would like to press on further in this direction and including the active promotion of young employees. Q: "It has been one year since the Medium-Term Management Plan has commenced. What is your view on this?"

A: "We were able to carry out the clearance of the past earlier than we initially thought. The profit has increased significantly and with the company-wide efforts, we have been able to utilize the favorable conditions."

With the help of favorable conditions including the lower cost of raw materials and fuel, the operating income was much higher than the initial forecast. This was a result that was better than our real capacity, but I believe we were able to place ourselves in those favorable conditions because we put a company-wide, hard effort daily. As for the dividend, we are expecting to achieve the profit plan for this term as set down in the Medium-Term Management Plan as well, so accordingly we are planning to resume dividends for the first time in 4 years at 2 yen/stock for interim dividends and the same for term-end dividends, i.e. a total of 4 yen/stock for the term ending Mar. 2018. Of course, it is not nearly at the satisfactory level yet - say about 60% on the school report, just scraped through "adequate"! Q: "How about the R&D work which is almost a lifeline for your company?"

A: "We are going to make it clear again that R&D is one of our important business strategies, and from there, we will find the themes and directions that respond well to the market's needs and that our strengths as a company are fully utilized."

Also at the scenes of development themselves, the narratives for the objectives of the developments were not drawn up because of the inward-looking attitude that prevented them from facing the markets' needs. My analysis is that these were the contributing factors that made our R&D to come to a standstill and that we were not able to come up with new products in time. So, after making clear that R&D is indeed one of our important business strategies, we at the board of directors discussed how to make the best of our company's strengths by investing how much business resources and pressing on with R&D in what kind of themes and directions. At the same time, in the actual scenes of R&D, newly appointed development department chiefs are leading the groups of volunteers in the frequent discussions about questions such as "what are the elemental technologies that are our company's strengths?" and "how best can we push on with the R&D and in which directions so to respond to the markets' and customers' needs?" by clarifying the strengths a product may contain. If the narratives and the directions that are born of heated discussion from the staff at the scenes, I think we can expect the ways of thinking within the company will also change greatly. As the management, I feel it is our essential responsibility to secure the resource if it is deemed lacking to actually process the R&D activities that were decided based on the views from the scenes. Whether it is personnel, money or technologies, we will process these speedily collaborating with the outside world, including potential M&A. Strengthening the R&D structure is as important as changing the employees' way of thinking for the Tokuyama resurgence, so we at the management will lead this strongly too. Q: "Finally, do you have any messages to stockholders and investors?"

A: "We will continue to work hard as a company as a whole towards achieving the goal of our Medium-Term Management Plan and realization of the company's vision. We would like our stockholders and investors to keep supporting our company's future."

On the other hand, in the growing industry the key is how much growth we can achieve in the ICT related areas. We will continue the development and research of products that can respond to the needs of the cutting-edge devices utilizing the high-purification technology in which our company has an advantage. With these strategies, we will continue with the effort to turn our investments "into numbers" with a great speed. We will continue to work hard as a company as a whole towards achieving the goal of our Medium-Term Management Plan and realization of the company's vision. We would like our stockholders and investors to keep supporting our company's future. |

| Conclusions |

|

From now on, we would like to pay attention to the steady progress of the Medium-Term Management Plan, financial performance, and the outcomes of the ongoing reform of corporate culture, which is recognized by the President Yokota as the most important.  |

| <Reference: Regarding Corporate Governance> |

◎ Corporate Governance Report

Last update date: Jun. 27, 2016

|

|

Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2017 Investment Bridge Co., Ltd. All Rights Reserved. |