Bridge Report: (4043)Tokuyama Corporation

Hiroshi Yokota The President and Executive Officer | Tokuyama Corporation(4043) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Chemicals |

The President and Executive Officer | Hiroshi Yokota |

Address | FRONT PLACE AKIHABARA, 1-7-5, Sotokanda, Chiyoda-ku, Tokyo |

Year-end | End of March |

URL |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE(Actual) | Trading Unit | |

¥2,562 | 69,934,375 shares | ¥179,171 million | 24.6% | 100 shares | |

DPS (Est.) | Dividend yield(Est.) | EPS (Est.) | PER (Est.) | BPS (Actual) | PBR (Actual) |

¥70.00 | 2.7% | ¥438.88 | 5.8 times | ¥2,199.83 | 1.1x |

*The share price is the closing price on May 24th. The number of shares issued and BPS are values for the end of previous term and ROE are values for the previous term.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2014 (results) | 287,330 | 20,270 | 14,965 | 10,218 | 29.37 | 6.00 |

Mar. 2015 (results) | 302,085 | 19,530 | 12,920 | -65,349 | -187.85 | 0.00 |

Mar. 2016 (results) | 307,115 | 23,071 | 17,725 | -100,563 | -289.10 | 0.00 |

Mar. 2017 (results) | 299,106 | 39,720 | 33,998 | 52,165 | 147.78 | 0.00 |

Mar. 2018 (results) | 308,061 | 41,268 | 36,196 | 19,698 | 259.81 | 30.00 |

Mar. 2019 (results) | 324,661 | 35,262 | 33,400 | 34,279 | 493.26 | 50.00 |

Mar. 2020 (estimates) | 343,000 | 39,000 | 39,000 | 30,500 | 438.88 | 70.00 |

*Unit: Yen, one million yen

*The forecast is from the company. Net income is profit attributable to owners of the parent. Hereinafter the same applies.

On Oct. 1, 2017, Tokuyama Corporation changed its trading lot from 1,000 shares to 100 shares, while conducting 1-for-5 reverse split. DPS is total annual dividend taking mergence in consideration. EPS as well as DPS has not been recalculated retroactively.

This report outlines the overview of Tokuyama Corporation for the end of the Fiscal Year Mar.2019, progress of medium-term management plan and interview with President Yokota, etc.

Table of Contents

Key Points

1. Company Overview

2. End of the Fiscal Year March 2019 Earnings Results

3. Fiscal Year March 2020 Earnings Estimates

4. The improvements of the Medium-Term Management Plan “Cornerstone of the Group’s Revitalization”

5. Interview with President Yokota

6. Conclusions

<Reference1: The Med-Term Management Plan “Cornerstone of the Group’s Revitalization”>

<Reference2: Regarding Corporate Governance>

Key Points

- The sales for the term ended Mar. 2019 were 324.6 billion yen, up 5.4% year on year. The correction of the selling price of caustic soda progressed, mainly semiconductor-related products sold well, and all business segments witnessed sales growth. However, due to the augmentation of costs for raw materials and fuels, such as coal and domestic naphtha, gross profit rate declined 2.4 points and gross profit decreased 2.0% year on year. As it could not offset the increase in SGA, operating income dropped 14.6% year on year to 35.2 billion yen. Both sales and profit fell below the full-year estimates, as the sales amounts of major products did not reach the estimates in the 4th quarter (Jan. to Mar.) and the increase in costs for raw materials and fuels exceeded the estimates.

- For the term ending Mar. 2020, sales are estimated to grow 5.7% year on year to 343 billion yen and operating income is projected to rise 10.6% year on year to 39 billion yen. The sales amounts of major products are forecasted to increase. Sales and profit are expected to grow in all segments. As for exchange rates, it is assumed that 1 US dollar equals 110 yen, indicating a 1-yen appreciation of the yen. Under the assumption that the price of domestic naphtha will decrease from 49,500 yen/kl in the previous term to 44,000 yen/kl, the cost for raw materials and fuels is estimated to drop about 2 billion yen. The dividend is to be 70.00 yen/share per year. The estimated payout ratio is 15.9%.

- We interviewed the president Hiroshi Yokota about the review on the financial results of the previous term, the progress of the medium-term management plan, and messages to shareholders and investors. He said, “Our reform is still halfway through, but we were definitely able to increase our earning ability and nurture many factors for growth. I would ask our shareholders and investors to continue supporting us as we take on more challenges from here on out.”

- Sales grew, but profit declined. Although failing to reach the estimate in the previous term, the 3-year medium-term management plan has progressed steadily. Although there are some negative factors, including the sluggishness of the semiconductor domain, heat-dissipating materials, dental products, etc. in the growing business field performed well, and they are starting to underpin their business. As mentioned in the interview, the coming two years is the period for preparation for full-scale growth toward the year 2025. This term, it is forecasted that depreciation will augment, but sales and profit will increase. We would like to pay attention to whether the company will be able to grow sales and profit steadily this term in the short term and the invention of new promising materials in the fields of electronics and healthcare and their efforts to create business chances while minimizing risks in the “E: Environment” field in the medium/long term.

1. Company Overview

Tokuyama Corporation is a chemical manufacturer, which produces basic chemicals used for a variety of applications, including soda ash and caustic soda; semiconductor-related products, including polycrystalline silicon; cement, whose production volume is the 4th largest in Japan; materials for eye glasses, generic medicine ingredients, etc. It was founded in 1918. Its major strengths include cutting-edge products created with a wide array of unique technologies and the competitiveness of Tokuyama Factory, which has accumulated and integrated technologies in an advanced manner.

【1-1 Corporate history】

In 1918, the founder Katsujiro Iwai established “Nippon Soda Industry Co., Ltd.” with the aim of producing soda ash (sodium carbonate), which is a raw material for glass, inside Japan. The company is still the only Japanese manufacturer that keeps manufacturing soda ash.

In 1938, it started producing cement with the wet method from the byproducts in the soda ash manufacturing.

After the Second World War, it grew the inorganic business, and during the rapid economic growth period, it expanded the petrochemical business handling vinyl chloride, polypropylene, etc.

After the two oil shocks, it entered the high added value field, including electronic materials and fine chemicals. In 1984, the company launched the polycrystalline silicon business, which is now ranked in the top 3 in the world. In 1985, it started producing aluminum nitride powder, which is used for cooling down electronic parts, with its original reduction-nitridation method.

Since then, the company has expanded its business domains, including the fields of living and medicine handling materials for eye glasses, dental apparatus, etc., and environment and energy.

The revenue of the polycrystalline silicon business of “Tokuyama Malaysia,” which is a consolidated subsidiary established in Malaysia in 2009, dropped considerably due to the market downturn. Then, significant impairment losses were posted in the term ended Mar. 2015 and the term ended Mar. 2016, and no dividends were paid.

To cope with that situation, the company procured funds by issuing class shares in May 2016, for the purpose of “reconstructing its financial base.”

Under the vision of “new foundation,” the company produced and announced the 5-year Medium-Term Management Plan “Cornerstone of the Group's Revitalization,” and is working on important projects for reforming its corporate culture, redeveloping business strategies, etc. In the term ending Mar. 2018, it paid a dividend for the first time in 4 terms.

【1-2 Corporate ethos, etc.】

Tokuyama Corporation thoroughly revised its “corporate ethos” and “course of action,” which were enacted in 1989, and set the “Tokuyama’s vision” for new foundation, composed of “mission,” “aspirations,” and “values,” when designing the Medium-Term Management Plan “Cornerstone of the Group's Revitalization” in 2016. In order for Tokuyama Corporation, which commemorated the 100th anniversary of establishment in 2018, to build the “Cornerstone of the Group’s Revitalization” and achieve sustainable growth for the coming 100 years, it is necessary to clarify its missions and aims.

Corporate activities, ranging from business strategies, are mostly linked to this vision.

Tokuyama’s vision

Mission | Centered on the field of chemistry, the Tokuyama Group will continue to create value that enhances people’s lives |

Aspirations | Shift from a focus on quantity to quality

(Fiscal 2025) Global leader in advanced materials Leader in its traditional businesses in Japan |

Values | ・Customer satisfaction is the source of profits ・A higher and broader perspective ・Personnel who consistently surpass their predecessors ・Integrity, perseverance, and a sense of fun |

【1-3 Business Description】

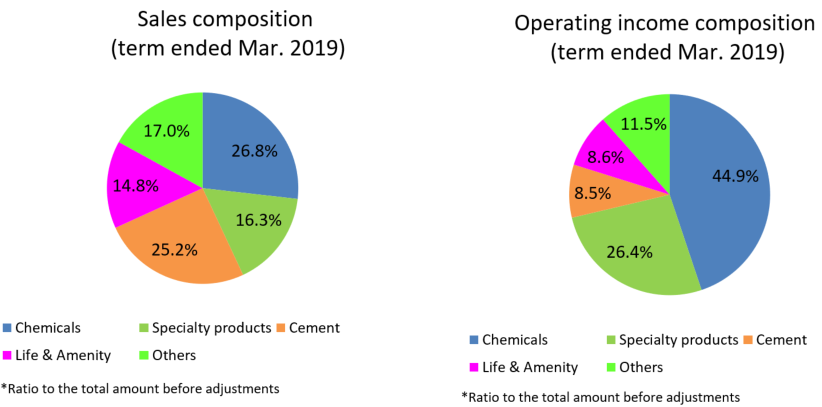

The business segments are “chemicals,” “specialty products,” “cement,” “life & amenity,” and “others.” (The first four segments are to be reported.)

◎ Chemicals

<Outline and major products>

Tokuyama Corporation handles basic chemicals that are indispensable for a broad range of applications in each industry, such as soda ash, caustic soda, and calcium chloride.

The company also operates business efficiently, for example, by using the chlorine and hydrogen produced during the process of manufacturing caustic soda for producing polycrystalline silicon.

With the goal of “becoming a company that will be chosen by customers forever,” the company strives to offer products and services that satisfy the needs of individual customers in a stable and timely manner.

Business | Characteristics | Major products |

Soda and calcium chloride | Since competition is fierce due to the sluggish domestic demand and the increase of imported products, the business environment is severe, and so Tokuyama Corporation is the only manufacturer of soda ash in Japan. Its missions and responsibility as a Japanese manufacturer are more significant than before, and it aims to maintain or enhance its competitiveness and establish a firm position in the domestic market based on its technologies and trusting relationships with customers, which have been nurtured since the establishment of the company. For silicate soda cullets, the company boasts the lion’s share in Japan, by taking advantage of the competitiveness in producing the cullets from soda ash and caustic soda and high production capacity. | Soda ash, calcium chloride, silicate soda, and sodium bicarbonate |

Chlor-alkali and vinyl chloride | The company produces 490,000 tons of caustic soda per year, which is the third largest in Japan. In addition, it manufactures a wide array of products by using chlorine, which is generated as a byproduct. This backs up its competitiveness. As another characteristic, its business performance is hardly affected by the consumption trend in a specific field, because its products are diverse. Vinyl chloride resin is derived 40% from petroleum and 60% from salt. From the viewpoint of the dependence on petroleum, vinyl chloride resin is a plastic that can save natural resources. Multilayered glass sashes made from vinyl chloride excel at keeping housing warm, and are effective for reducing the emissions of greenhouse gases by saving the energy for air-conditioning. | Caustic soda, vinyl chloride monomer, propylene oxide, methylene chloride |

New organic chemicals | The industrial isopropyl alcohol (IPA) of Tokuyama Corporation can be characterized by its pollution-free manufacturing process, which does not emit air pollutants or industrial wastes. Its original direct hydration method for propylene received the Technological Advance Award of the Japan Petroleum Institute in 1974, the Mainichi Industrial Technology Award in 1975, and the Chemical Technology Award of the Chemical Society of Japan in 1976. In addition to energy-saving and low-cost features, the company can supply high-purity products, and so the quality of its products is highly evaluated. | Industrial isopropyl alcohol (IPA) |

Major products | Purposes of use |

Soda ash | Materials for glass, glass wool, soap and detergent; brine water; water treatment agents, etc. |

Calcium chloride | Anti-freezing agents, dust control, dehumidifying agents, waste liquid treatment, food additives |

(Provided by Tokuyama Corporation)

<Basic policy and measures>

By offering basic chemical materials and services that have high quality and cost competitiveness and satisfy the needs of customers, the company aims to contribute to the business growth of each customer and the stable, continuous increase in revenue for its core business.

Business | Primary measures |

Soda and calcium chloride | ・To maintain stable supply and quality as the only manufacturer in Japan To increase the production amount of granular calcium chloride for melting snow |

Chlor-alkali and vinyl chloride | ・To enhance in-house power generation and quality of electrolysis for further reducing costs for caustic soda and chlorine ・To expand the export of vinyl chloride monomer, and keep operating plants fully ・To increase the profitability of chlorine-induced substances, such as vinyl chloride, propylene oxide, and chloromethane |

◎ Specialty products

<Outline and major products>

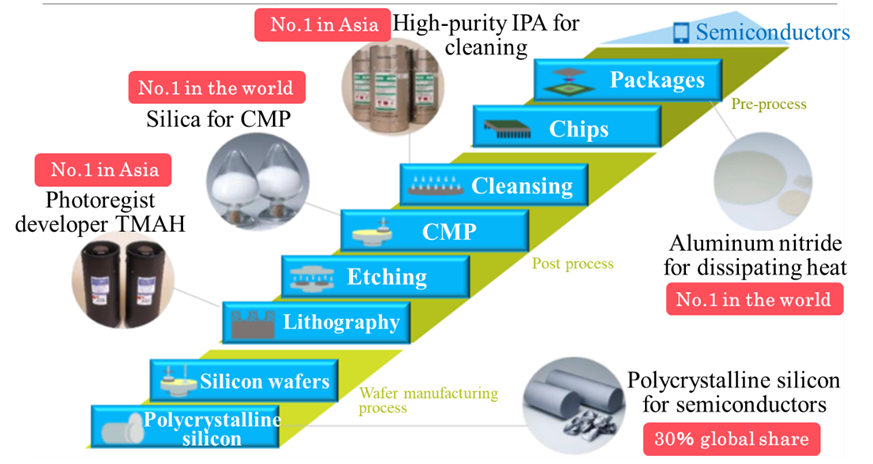

Tokuyama Corporation handles products in a broad range of fields, including energy, electronics, and the environment. For high-purity polycrystalline silicon used for semiconductors, the company has a remarkable share in the world. In addition, fumed silica, which is produced from byproducts, is used for silicone rubber, copier’s toner, etc. Aluminum nitride, which is excellent in heat release, is used for energy-saving products, such as inverters and LEDs, in addition to semiconductor manufacturing equipment, and high-purity chemicals for the electronic industry are used for producing semiconductors, liquid crystal panels, etc.

Business | Characteristics | Major products |

Electronic materials | Tokuyama Factory can produce 8,500 tons of polycrystalline silicon per year. This output is the highest in Japan. | Polycrystalline silicon |

Fumed silica | REOLOSIL, which was developed with the original technology of Tokuyama, is manufactured by hydrolyzing refined gases in oxyhydrogen flame at high temperatures under thoroughgoing management with a fully closed system for all processes from reactions to packaging. Accordingly, it is characterized by high purity, high dispersibility, and high-specific surface area, and used for various applications of use. The company has production facilities in not only Japan, but also China, strives to supply its products stably and continuously while optimizing its business, and aims to expand its business further while considering the global market. | Fumed silica |

Thermal management material | Tokuyama Corporation handles products for each purpose of use, which includes ceramics made by sintering granules and powder from aluminum nitride powder. With its original manufacturing and reduction-nitration methods, the company produces high-quality products with few impurities, and manufactures 600 tons of aluminum nitride products, the largest in the world. For aluminum nitride powder, it has a 70% global share. | Aluminum nitride |

IC chemicals/cleaning system | The company operates manufacturing and sales footholds for supplying products with higher purity to growing markets in Asia. | High-purity chemicals for the electronic industry, and positive photoresist developer |

Major products | Purposes of use |

Polycrystalline silicon | Semiconductors and wafer |

Fumed silica | Elastomers, sealants, liquid resin products, powder products |

Aluminum nitride | Heat management materials for electronic parts |

High-purity chemicals for the electronic industry | Precise cleaning and drying for wafers, electronic devices, etc. |

(Provided by the company)

<Basic policy and measures>

To expand its business and revenue by supplying products that will be chosen by customers forever and proposing newly developed products.

Business | Primary measures |

Polycrystalline silicon | ・To achieve the world’s highest quality and minimize cost by accurately grasping the most advanced products and the quality demanded by customers |

Fumed silica | ・To enrich highly functional products following those for silicone and CMP ・To reduce cost and add high value to products at Tokuyama Chemicals |

IC chemicals | ・To pursue the better quality of products for cutting-edge semiconductors, and promote sales |

Thermal management material | ・To enhance the output of aluminum nitride powder (from 480 tons/year to 600 tons/year; operation has started in Apr. 2018) ・To commercialize boron nitride and aluminum nitride fillers |

A wide array of semiconductor-related products that are indispensable for manufacturing semiconductors, such as polycrystalline silicon, for which the company has a 30% global share, and aluminum nitride for dissipating heat, are the cutting-edge materials created by combining a variety of element technologies, which have been developed and accumulated by the company for many years, and all of them are outstandingly competitive in the world.

(Taken from the reference materials of the company)

In the semiconductor manufacturing field, more minituarized and three-dimensional semiconductors are being developed rapidly, as the capacity of semiconductors is increasing and their size is shrinking.

The “high-purity polycrystalline silicon for semiconductors” and “high-purity chemicals for the electronic industry” of Tokuyama Corporation are ultrahigh-purity materials for which impurities and residues, which would worsen yield, have been reduced to the maximum degree, and highly evaluated by semiconductor manufacturers, which are developing more minituarized and three-dimensional products.

In addition, Tokuyama’s heat dissipating materials, which are indispensable for the stable operation of semiconductors, are highly evaluated.

As the power devices for in-vehicle apparatus, industrial equipment, and electric railways are having higher output and smaller size, the demand for heat-dissipating materials is growing rapidly. Tokuyama Corporation supplies heat-dissipating materials with high thermal conductivity and an extremely small amount of impurities developed with its original reduction-nitridation method, such as aluminum nitride powder and ceramics, and boron nitride.

As shown in the above figure, the company plans to create larger business opportunities and meet demand by supplying a wide array of cutting-edge products rather than only specific products, which are used in the process of manufacturing semiconductors from raw materials.

◎ Cement

<Outline and major products>

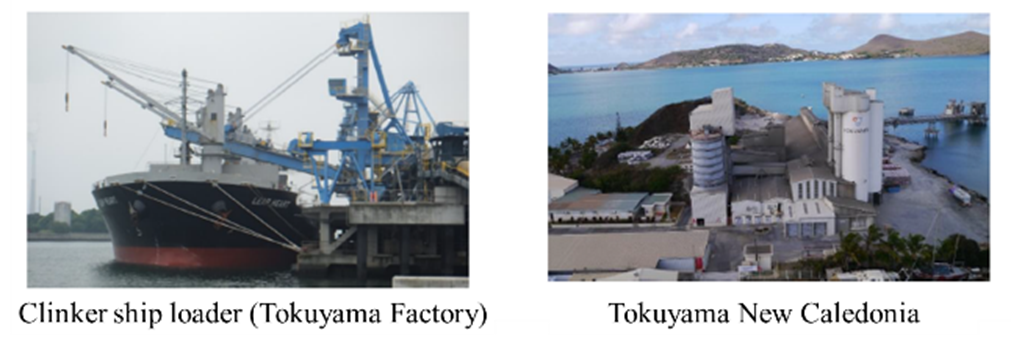

In 1938, Tokuyama Corporation started this business for the purpose of utilizing the byproducts generated at Tokuyama Factory. The cement and related products, such as cement solidifying agents, produced at Nanyo Plant of Tokuyama Factory are used as ready-mixed concrete and secondary concrete products for constructing structures, ports, bridges, roads, etc. that support housing, buildings, and lifelines for the living of people.

The company receives a large amount of wastes, including waste plastics and ash from the combustion of household garbage, from the inside and outside of the company, and uses them as raw materials and thermal energy for manufacturing cement, contributing to the development of a resources recycling society.

Business | Characteristics | Major products |

Cement | Nanyo Plant of Tokuyama Factory has the largest scale as an independent factory in Japan. The cement business is the 4th largest in Japan, and community-based sales activities are conducted mainly in Tokyo, Osaka, Hiroshima, Takamatsu, and Fukuoka. The company built a cement testing laboratory in Tokyo, Osaka, Hiroshima, and Fukuoka. For the use of cement and cement solidifying agents, the company gives meticulous support to users by conducting a blending test before work and a management test after work.

In addition, Tokuyama M Tech Corp. manufactures and sells building materials made of cement and mortar. Tokuyama Corporation offers “Shikkui Lemarge,” an interior material produced with the original technology for producing a plaster sheet, “Fresco Graph,” the latest fresco technique developed by combining the classical fresco panting technique and the three-dimensional shaping technique with plaster, and so on. The company is pursuing new business opportunities with its technologies nurtured in the cement and building material fields. | Portland cement, blast furnace slag cement, cement solidifying agents |

Recycling and environment | A variety of recycling facilities, including low and high-water-content sludge and jagged waste treatment facilities, accept a broad range of wastes, including waste plastics, sludge, and glass wastes. | Waste treatment |

<Basic policy and measures>

The company will develop optimal systems for manufacturing, selling, and distributing products while flexibly responding to the changes in the business environment. It aims to enhance its competitiveness by maximizing the revenue from waste treatment by expanding export and reducing costs.

Business | Primary measures |

Cement | ・To reduce costs by streamlining production processes, improving basic units, and increasing the capacity of receiving wastes ・To secure revenue by expanding export while taking full advantage of Kiln No.4 (used for sintering cement) ・Tokuyama M Tech will improve the infrastructure repair and reinforcement business |

Recycling and environment | ・To use the most appropriate raw materials, promote the use of combustible wastes, and optimize the fuel plant business ・To stably operate the existing business of recycling waste plasterboards, and create a new recycling business |

Tokuyama New Caledonia, which was acquired in Jun. 2013, has recorded substantial positive operating income and cash flow for 4th consecutive year. It also serves as an exporter of clinker (chunks generated during the cement manufacturing process, from which cement is produced through pulverization), contributing to the increase in the revenue of the cement section.

In the mid to long-term, domestic demand will inevitably shrink due to the decline in population. Accordingly, the company will increase sales amounts by securing stable importers, improve the operation rate of cement factories, and accept more wastes, while discussing and proceeding with the operation of overseas pulverization plants following those of Tokuyama New Caledonia.

(Taken from the reference material of the company)

◎ Life & amenity

<Outline and major products>

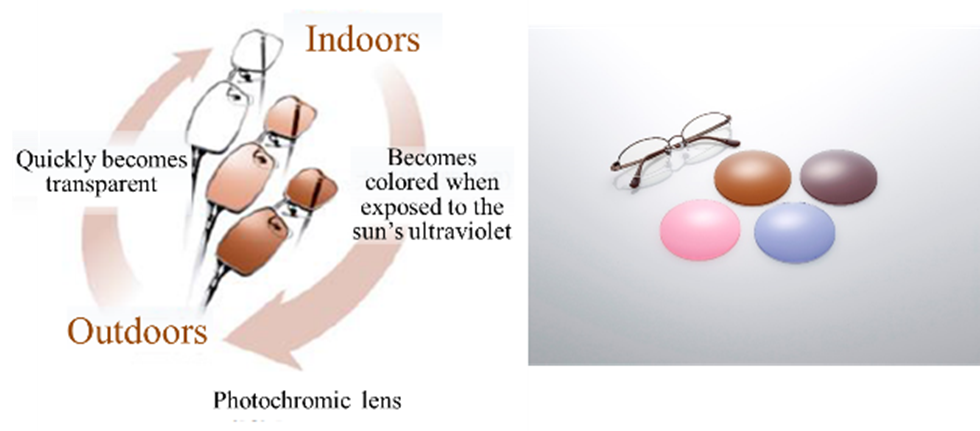

This segment is constituted by the fine chemical and NF businesses operated by Tokuyama Corporation, and ion exchange membranes, dental products, clinical testing systems, polyolefin films, resin sashes, etc. developed, manufactured, and sold by group companies.

In the fine chemical business, the company handles mainly materials for eye glasses, generic medicine ingredients and intermediates, which were developed with its organic synthesis technology. In the NF business, the company manufactures and sells films that block water, but allow air and moisture to penetrate.

Its overseas group companies include Shanghai Tokuyama Plastics, which manufactures and sells breathable films for disposable diapers, whose demand is growing rapidly in emerging countries, including China.

Business | Major products |

Fine chemicals | Medicine ingredients and intermediates (amino group protection agents and condensation agents), plastic lens-related materials (photochromic dye materials and hard coating agents) |

NF | Microporous films |

Tokuyama Dental Corporation | Manufacturing, import, export, and sale of dental products |

A&T Corporation | Development, manufacturing, and sale of clinical testing reagents, devices, and systems |

SunTox Co., Ltd. | Manufacturing and sale of polyolefin films |

ASTOM Corporation | Manufacturing and sale of ion exchange membranes for desalination and concentration and electro-dialysis |

EXCEL SHANON Corporation | Manufacturing and sale of resin sashes, related products, and building materials for housing |

Pharmaceutical products

(Provided by the company)

<Basic policy and measures>

The company will secure an advantageous position inside and outside Japan, by establishing and fortifying customer-oriented development, manufacturing, and sales systems. It aims to expand its business, to contribute to the improvement of the living and health (quality of life) of people.

Business | Primary measures |

Fine chemicals | To expand the company’s share for photochromic dye materials for eye glasses, and cultivate the applications of use |

NF | To revitalize the Chinese business |

Dental products business | To accelerate the overseas business expansion mainly for esthetic restorative filling |

Medical diagnosis system business | To fortify the production system by enlarging Esashi Factory (from Sep. 2017) |

Polyolefin film business | To improve productivity by dismantling decrepit production equipment and constructing new equipment (from Oct. 2017) |

Ion exchange membranes | To deal with large-scale projects outside Japan |

Resin sashes | To promote the sales of zero energy houses |

In this segment, the company concentrates on the development of photochromic dye materials.

Photochromic dye materials are resin materials that change colors from colorless to gray, brown, etc., when illuminated by sunlight (ultraviolet rays), and return to the colorless state when the illumination stops.

Recently, the usage for sports-wear and driving wear has spread, the awareness of harmful ultraviolet rays has grown, and the cases of eye diseases, such as glaucoma, have increased due to aging population. In these circumstances, the use of photochromic dye materials is increasing.

The products of Tokuyama Corporation are characterized by “plenty of color variation based on the three primary colors: red, blue, and yellow,” “rapid coloration and de-coloration speeds,” “sufficient coloration performance even at high temperatures in the summer,” “excellent durability,” and “the capability of blocking over 99% of ultraviolet rays.”

The company will advertise these characteristics, aim to expand its share by meticulously meeting customer needs about product specifications and enriching its product lineup, improve visibility, and cultivate new applications of use by utilizing its product features, such as the blocking of ultraviolet rays.

(Taken from the reference material of the company)

◎ Others

This is the segment other than the segments to be reported: “chemicals,” “specialty products,” “cement,” and “life & amenity,” and includes overseas distributors, transportation business, and real estate business.

【1-4 Research and development】

Under the R&D slogan of “creating helpful value for living with chemical technology,” the company engages in R&D with the aim of (1) conducting R&D for customer-oriented business, (2) creating an only-one, No.1 technology by improving unique technologies and fusing them with new technologies, and (3) creating original products while emphasizing customer needs based on its technologies.

Tokuyama Corporation aims to carry out R&D for cutting-edge materials by utilizing its unique technologies for synthesizing inorganic and organic materials, increasing purity, inducing crystallization and deposition, controlling powder, and sintering materials, which have been nurtured by the company as a chemical manufacturer while expecting the aging of society and the drastic growth and diffusion of environmentally friendly and ICT technologies, and by fusing these technologies with new technologies.

As R&D facilities in western and eastern Japan, the company has a “development center (Tsukuba Research Lab)” in Tsukuba City, Ibaraki Prefecture, and an “analysis center (Tokuyama Comprehensive Institute)” in Shunan City, Yamaguchi Prefecture.

The development center Tsukuba Research Lab is developing cutting-edge technologies from the medium to long-term viewpoint and analysis technologies as basic technologies, conducting R&D in the dental material field, which is characterized by composite materials, and the organic fine chemical field, which is targeted at high value-added products.

The analysis center (Tokuyama Comprehensive Institute) located in Tokuyama Factory is a foothold for R&D in the Tokuyama district.

There are some significant merits, such as the synergy of the development group in the Tokuyama district and various R&D teams and the easy exchange of information with the manufacturing section.

【1-5 Competitors】

Code | Corporate name | Sales | Growth rate | Operating income | Growth rate | Operating margin | ROE | ROA | Market cap | PER | PBR |

4005 | Sumitomo Chemical | 2,440,000 | 5.2 | 205,000 | 0.4 | 8.4% | 12.3 | 6.0 | 804,546 | 7.9 | 0.8 |

4042 | Tosoh | 860,000 | -0.2 | 95,000 | -10.2 | 11.0% | 15.1 | 13.1 | 456,088 | 6.8 | 0.8 |

4043 | Tokuyama | 343,000 | 5.7 | 39,000 | 10.6 | 11.4% | 24.6 | 9.0 | 179,171 | 5.8 | 1.2 |

4063 | Shin-etsu Chemical | - | - | - | - | - | 12.8 | 14.0 | 3,986,149 | - | 1.6 |

4118 | Kaneka | 650,000 | 4.7 | 40,000 | 11.0 | 6.2% | 6.7 | 4.8 | 260,440 | 10.8 | 0.1 |

4183 | Mitsui Chemicals | 1,540,000 | 3.8 | 105,000 | 12.4 | 6.8% | 14.3 | 7.0 | 491,438 | 6.2 | 0.8 |

4185 | JSR | 508,000 | 2.3 | 44,500 | 3.4 | 8.8% | 7.8 | 6.4 | 338,963 | 10.7 | 0.8 |

4205 | Zeon | 330,000 | -2.2 | 30,000 | -9.5 | 9.1% | 7.2 | 8.4 | 247,743 | 10.4 | 0.9 |

5711 | Mitsubishi Materials | 1,700,000 | 2.2 | 51,000 | 38.4 | 3.0% | 0.2 | 2.6 | 371,326 | 12.3 | 0.6 |

*Sales and operating income are the estimates for this term. The unit for them is million yen. ROE and ROA are the results for the previous term in units of %.

The market cap, PER (forecast), and PBR (results) are the closing values on May 24. The unit is in millions of yen and the unit is two-fold. Shin-etsu Chemical hasn’t announced earnings estimate yet.

Compared with competitors, sales are small, but it boasts high profitability and asset efficiency with double-digit operating margin and high ROE ranking first, and its shares are evaluated at medium level.

【1-6 Characteristics and strengths】

① Cutting-edge products created with a variety of unique technologies

By fusing new technologies with unique technologies for synthesizing organic and inorganic materials, increasing purity, controlling powder, inducing crystallization and deposition, sintering, electrolysis, refining, reprocessing resources, and so on, which have been accumulated and polished for many years, Tokuyama Corporation has developed cutting-edge products, including inorganic chemicals, cement, silica, silicon, aluminum nitride, high-purity chemicals for semiconductors, lens materials, ion exchange membranes, films, resin, sensor materials, and dental products.

For example, the company possesses an original reduction-nitridation technology for producing aluminum nitride powder, which is broadly used as a heat-dissipating agent.

Its aluminum nitride powder, which has an extremely low amount of impurities, boasts a 70% global share because of its high competitiveness.

At present, its purity is at the world’s highest level. The company started producing polycrystalline silicon for the purpose of utilizing the hydrogen and chlorine generated at its electrolysis plant, and it is now ranked in the world’s top three. It can be said that its broad, profound technological base helped realize these achievements.

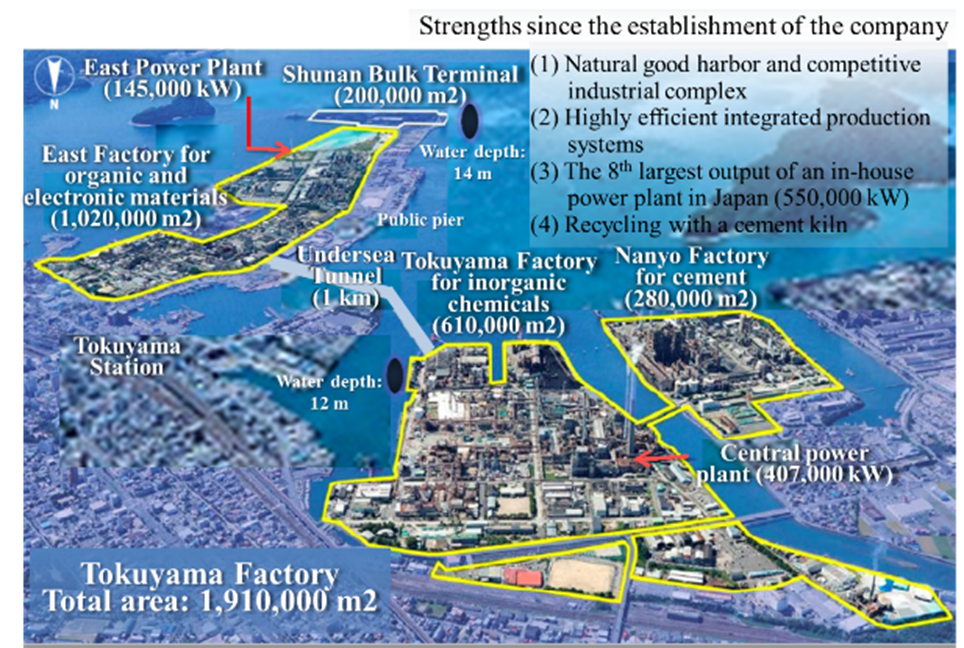

② Competitiveness of Tokuyama Factory, which has integrated and accumulated technologies in an advanced manner

Tokuyama Factory is indispensable for manufacturing products with its unique technologies at low cost and supplying them to customers around the world. It has one of the greatest port infrastructures in Japan and an in-house generation plant, with the following characteristics:

・With the in-house power generation plant, whose output is the 8th largest in Japan, it can use electric power at competitive cost.

・Factories for producing inorganic and organic chemicals, cement, electronic materials, etc. are integrated, so as to utilize raw materials, products, by-products, and wastes mutually.

・The company has achieved zero emissions by using its wastes at a cement kiln (used for sintering cement). It also receives wastes from external enterprises in the Shunan industrial complex, making a social contribution for the environment.

(Taken from the reference material of the company)

Since it has a natural harbor with a water depth of over 10 m, where large shipping vessels can be docked, it is possible to carry in and out large amounts of raw materials and products.

The highly efficient production and supply systems integrated and accumulated sophisticatedly at Tokuyama Factory boost the competitive advantage of Tokuyama Corporation.

2. End of the Fiscal Year March 2019 Earnings Results

(1) Overview of consolidated results

| FY 3/18 | Ratio to sales | FY 3/19 | Ratio to sales | YoY | Initial forecast |

Sales | 308,061 | 100.0% | 324,661 | 100.0% | +5.4% | -1.0% |

Gross profit | 100,346 | 32.6% | 97,996 | 30.2% | -2.3% | - |

SGA | 59,077 | 19.2% | 62,733 | 19.3% | +6.2% | - |

Operating income | 41,268 | 13.4% | 35,262 | 10.9% | -14.6% | -7.2% |

Ordinary profit | 36,196 | 11.7% | 33,400 | 10.3% | -7.7% | -1.8% |

Net income | 19,698 | 6.4% | 34,279 | 10.6% | +74% | +27.0% |

* Unit: million yen. Net income belonging to its parent company. The same applies hereafter.

Although sales increased thanks to the price effect, profit decreased due to the rising raw fuel costs.

Sales were 324.6 billion yen, up 5.4% year on year. The correction of the selling price of caustic soda progressed, mainly semiconductor-related products sold well, and all business segments witnessed sales growth.

However, due to the augmentation of costs for raw materials and fuels, such as coal and domestic naphtha, gross profit rate declined 2.4 points and gross profit decreased 2.0% year on year. As it could not offset the increase in SGA, operating income dropped 14.6% year on year to 35.2 billion yen.

Both sales and profit fell below the full-year estimates, as the sales amounts of major products did not reach the estimates in the 4th quarter (Jan. to Mar.) and the increase in costs for raw materials and fuels exceeded the estimates.

(2)Trend in each segment

Sales | FY3/18 | Composition ratio | FY3/19 | Composition ratio | YoY | Initial forecast ratio |

Chemicals | 935 | 30.4% | 983 | 30.3% | +5.1% | -3.6% |

Specialty products | 586 | 19.0% | 596 | 18.4% | +1.7% | -5.4% |

Cement | 873 | 28.3% | 923 | 28.4% | +5.7% | -0.8% |

Life & amenity | 515 | 16.7% | 543 | 16.7% | +5.4% | -3.0% |

Others | 545 | 17.7% | 623 | 19.2% | +14.3% | +15.4% |

Adjustment | -376 | - | -425 | - | - | - |

Total | 3,080 | 100.0% | 3,246 | 100.0% | +5.4% | -1.0% |

Operating income |

|

|

|

|

|

|

Chemicals | 161 | 17.2% | 168 | 17.1% | +4.3% | -6.7% |

Specialty products | 110 | 18.8% | 99 | 16.6% | -10.0% | -10.0% |

Cement | 45 | 5.2% | 32 | 3.5% | -28.9% | -28.9% |

Life & amenity | 37 | 7.2% | 32 | 5.9% | -13.5% | +6.7% |

Others | 62 | 11.4% | 43 | 6.9% | -30.6% | +22.9% |

Adjustment | -4 | - | -23 | - | - | - |

Total | 412 | 13.4% | 352 | 10.8% | -14.6% | -7.2% |

* Unit: 100 million yen. The composition ratio for profit means profit rate.

*Chemicals

Sales and profits increased.

Caustic soda | The effort at price adjustment in Japan was propelled. |

Vinyl chloride resin | Although the sales amounts showed a steady growth, profit decreased because manufacturing costs increased due to the rising prices of raw material, such as naphtha produced in Japan. |

Calcium chloride | Due to the abnormally warm winter, sales amounts dropped, and profit declined. |

*Specialty products

Sales increased, and profit decreased.

Polycrystalline silicon | Although the sales amounts showed a steady growth, profit decreased because manufacturing costs increased due to the rising raw fuel prices. |

High purity chemicals for electronics industry | Although the sales amounts grew for semiconductor manufacturing, profit decreased because manufacturing costs increased due to the rising prices of raw material, such as naphtha produced in Japan. |

Heat management material | The sales amounts increased mainly for semiconductor manufacturing equipment components, contributing to a favorable growth. |

*Cement

Sales increased, and profit decreased.

Cement | Profit dropped because shipment in Japan showed a downward growth and manufacturing costs increased due to the rising prices of raw material, such as coal. |

Resources and environmental business | The business performance was almost flat compared to the same period last year. |

*Life & amenity

Sales increased, and profit decreased.

Plastic lens-related materials | The shipment of photochromic materials for lenses of glasses was favorable. |

Ion-exchange membranes | Although shipment showed a steady growth, profit decreased from the same period last year, in which the company received a large-scale order. |

Active pharmaceutical ingredients, intermediates, and dental products | Sales amounts grew, and business performance was steady. |

(3) Financial standing and cash flows

◎Primary balance sheet

| End of Mar. 2018 | End of Mar. 2019 |

| End of Mar. 2018 | End of Mar. 2019 |

Current assets | 191,031 | 202,936 | Current liabilities | 93,032 | 93,248 |

Cash and deposits | 57,229 | 68,613 | Trade payables | 47,610 | 47,268 |

Trade receivables | 79,660 | 80,358 | Noncurrent liabilities | 132,325 | 122,856 |

Inventories | 39,430 | 43,474 | Total liabilities | 225,357 | 216,104 |

Noncurrent assets | 170,917 | 176,693 | Net assets | 136,591 | 163,525 |

Property, plant and equipment | 110,242 | 116,104 | Shareholders’ capital | 119,288 | 150,095 |

Intangible assets | 2,766 | 1,973 | Retained earnings | 90,752 | 121,901 |

Investments and other assets | 57,908 | 58,614 | Total liabilities and net assets | 361,949 | 379,630 |

Total assets | 361,949 | 379,630 | Balance of interest-bearing debts | 139,916 | 128,964 |

*Unit: one million yen. Interest-bearing debts include lease obligations.

Total assets grew 17.6 billion yen year on year to 379.6 billion yen, due to the increase of cash and deposits and increase of machinery, transportation equipment, and land.

Total liabilities were 216.1 billion yen, down 9.2 billion yen from the end of the previous term, due to a decrease in interest-bearing debts.

Net assets rose 26.9 billion yen to 1.635 billion yen due to an increase of retained earnings.

As a result, equity ratio rose by 5.5 points from the end of the previous term to 40.2%.

DE ratio fell from 1.11 at the end of the previous term to 0.84.

By the end of March 2021, the final year of the medium-term management plan, the company aims to have an “interest-bearing debt of 120 billion yen, an equity capital of 140 billion yen, cash and deposits of 80 billion yen, and a DE ratio of 0.9.

◎ Cash Flow

| FY3/18 | FY3/19 | Increase/decrease |

Operating CF | 61,885 | 38,531 | -23,354 |

Investing CF | -12,665 | -16,174 | -3,509 |

Free CF | 49,220 | 22,357 | -26,863 |

Financing CF | -101,209 | -21,104 | +80,105 |

Cash and equivalents | 66,807 | 67,991 | +1,184 |

*unit: million yen

The surplus of operating CF shrank because the company did not incur a loss on transfer of business like in the previous term.

The deficit of investing CF widened further because there was no longer income from sale of shares of subsidiaries, which the company earned in the same period last year.The free CF remained in surplus.

The deficit of financing CF narrowed as there was no longer expenditure due to redemption of corporate bonds.

The cash position increased.

3. Fiscal Year March 2020 Earnings Estimates

(1)Full-year earnings estimates

| FY 3/19 | Ratio to sales | FY 3/20 (Forecast) | Ratio to sales | YOY |

Sales | 324,661 | 100.0% | 343,000 | 100.0% | +5.7% |

Operating income | 35,262 | 10.9% | 39,000 | 11.4% | +10.6% |

Ordinary income | 33,400 | 10.3% | 39,000 | 11.4% | +16.8% |

Net income | 34,279 | 10.6% | 30,500 | 8.9% | -11.0% |

*unit: million yen

*The forecasts were announced by the company.

Sales and profit estimated to grow

Sales are estimated to grow 5.7% year on year to 343 billion yen and operating income is projected to rise 10.6% year on year to 39 billion yen. The sales amounts of major products are forecasted to increase.

Sales and profit are expected to grow in all segments.

As for exchange rates, it is assumed that 1 US dollar equals 110 yen, indicating a 1-yen appreciation of the yen. Under the assumption that the price of domestic naphtha will decrease from 49,500 yen/kl in the previous term to 44,000 yen/kl, the cost for raw materials and fuels is estimated to drop about 2 billion yen.

The dividend is to be 70.00 yen/share per year. The estimated payout ratio is 15.9%.

(2) Trend in each segment

Sales | FY 3/19 | Composition ratio | FY 3/20 (forecast) | Composition ratio | YOY |

Chemicals | 983 | 30.3% | 1,030 | 30.0% | +4.8% |

Specialty products | 596 | 18.4% | 670 | 19.5% | +12.4% |

Cement | 923 | 28.4% | 940 | 27.4% | +1.8% |

Life & amenity | 543 | 16.7% | 580 | 16.9% | +6.8% |

Others | 623 | 19.2% | 640 | 18.7% | +2.7% |

Adjustment | -425 | - | -430 | - | - |

Total | 3,246 | 100.0% | 3,430 | 100.0% | +5.7% |

Operating income |

|

|

|

|

|

Chemicals | 168 | 17.1% | 185 | 18.0% | +10.1% |

Specialty products | 99 | 16.6% | 110 | 16.4% | +11.1% |

Cement | 32 | 3.5% | 35 | 3.7% | +9.4% |

Life & amenity | 32 | 5.9% | 40 | 6.9% | +25.0% |

Others | 43 | 6.9% | 45 | 7.0% | +4.7% |

Adjustment | -23 | - | -25 | - | - |

Total | 352 | 10.8% | 390 | 11.4% | +10.8% |

*unit: 100million yen

Outlook for each segment

Field | Business environment | Initiatives |

Chemicals | As the demand is strong in Asia, the sales amounts of mainly caustic soda and vinyl chloride resin are estimated to be steady. | To promote sales of major products, strengthen cost competitiveness by reducing cost per product, fixed expenses, etc. and secure stable revenues. |

Specialty products | The semiconductor market is temporarily stagnant, due to the downturn of the Chinese economy, etc., but it is expected to grow in the long term. As the downsizing of semiconductors for IoT and 5G is progressing, there is growing demand for high quality and stable supply. | To pursue better quality of polycrystalline silicon for semiconductors and promote the sales of products with high added value differentiated from competitors’ products, to grow revenues. As for high-purity chemicals for the electronic industry, the company will enhance production capacity in Japan, Taiwan, and China, and establish a supply system for meeting demand in Asia. As for heat dissipating materials, the company will enhance production capacity and concentrate on development for increasing the product lineup. |

Cement | The demand from the private sector in Japan will remain steady due to the redevelopment in Tokyo, etc. The demand from the government and other public agencies is estimated to grow somewhat through the progress of the national resilience plan, and total demand is projected to rise slightly. | The company will make efforts to secure revenues by passing on the augmentation of material cost to selling prices, increasing the export amount and accepting capacity of waste, reducing the manufacturing cost thoroughly, and so on. |

Life & amenity | The domestic market is forecasted to keep recovering gently, but overseas markets are faced growing uncertainties about international affairs and the trade policy of each country. Especially, there is concern over the slowdown of the economies of China and emerging countries. | The company will concentrate on the development of new products and sales activities to meet the customer needs and market changes regarding healthcare-related products, to expand revenues. |

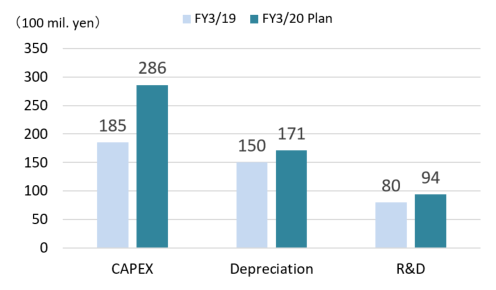

(3) Investment Record/Plan

This term, the company will conduct active investments in the growing and traditional businesses, increasing the investment amount for equipment by 10.1 billion yen and for R&D by 1.3 billion yen.

As for the investment composition, equipment enlargement and sales promotion account for 40%, maintenance and renewal 30%, infrastructure for rationalization 10%, and R&D 20%.

Major growth investment projects include the boosting of output of aluminum nitride powder and granules, the enhancement of TMAH production, the development of equipment for shipping the solution for semiconductors, and port infrastructure, etc.

4. The improvements of the Medium-Term Management Plan “Cornerstone of the Group’s Revitalization”

4-1: Numerical Targets under the management plan

| FY16/3 | FY19/3 | Targets for FY21/3 | Progress evaluation |

Sales | ¥307.1 billion | ¥324.6 billion | ¥335.0 billion | Progressing as scheduled |

Operating income | ¥23.0 billion | ¥35.2 billion | ¥36.0 billion | As the company could not offset the rise in prices of raw materials and fuels, profit declined and did not reach the estimate. |

ROA | 5.7% | 9.5% | 10% | Total asset turnover improved from the previous year, but the target value was not achieved, as operating margin dropped due to the augmentation of input cost. |

Operating margin | 7.5% | 10.9% | 10% | |

Total asset turnover | 0.77times | 0.88 times | 1.0times | |

CCC | 69days | 60 days | 55days | Progressing as scheduled |

D/E ratio | 4.7 | 0.8 | 1 | Already achieved, and maintained |

*CCC: Accounts receivable turnover (days) + Inventory turnover (days) – Trade payables turnover (days). ROA: Operating income ÷ Total assets.

In the single fiscal year, operating income declined, but over the past 3 years, operating income has grown about 12 billion yen, thanks to the transfer of Tokuyama Malaysia, the growth of sales amounts, the revision to prices, cost reduction, etc. despite the negative factor of the rise in costs for raw materials and fuels.

In order to shorten CCC by 5 days, the company will decrease inventory assets and reduce inventory.

4-2: Key challenges and countermeasures

The 4 key challenges, results in the previous term, and countermeasures in this term are as follows:

Key challenges | Results from FY 3/19 | Countermeasures for FY 3/20 |

1. Reform organizational culture | *Increase in diversity *Active recruitment of external personnel *Operation of a human resources system for senior employees | *Reform of a comprehensive human resources system *(Continued) active recruitment of external personnel *Promotion of the reform of ways of working |

2.Rebuild business strategies | *Differentiation of quality and revision to prices of polycrystalline silicon for semiconductors *Enrichment of the lineup of products of heat dissipating materials *Improvement of performance of heat dissipating materials and IC chemicals *Acceleration of overseas sale of healthcare-related products *Strengthening and streamlining of port and in-factory logistics

| *Healthcare-related business operation *Streamlining of business operation utilizing IoT and AI and plant operation *Strengthening of the environmental business (hydrogen utilization, water treatment, and CO2-related) |

3. Strengthen group management | *Improvement in profit of two Chinese companies dealing in the microporous films and EXCEL SHANON Corporation. *Start of operation of a new business evaluation system | *Logistics streamlining and cost reduction by cementing the cooperation among logistics-related group companies |

4. Improve the company’s financial position | *Refinancing of subordinated loans *Reduction of interest-bearing debts to decrease the burden of interest | *Accumulation of equity capital for return to Rank A |

The reform of the organizational culture, which is emphasized most, is still underway, but the company will keep focusing on it.

The company will strive to improve its financial standing further.

4-3: Business initiatives

① Growth business

<ICT-related products>

Raw materials for semiconductor wafers | *Maintenance of full-scale operation *Differentiation from competitors through pursuing better quality |

Photoresist developer | *Enhancement of production capacity (Operation to be started in Apr. 2020) |

Precise cleaning of semiconductors | *Strengthening of a system for supplying high-purity IPA in Asia at Tokuyama Chemicals and the 2nd factory of Taiwan *Development of new etching materials |

Raw materials for CMP | *Growth of sales amounts of fumed silica |

Heat dissipating materials | *Enhancement of production capacity (Operation to be started in Apr. 2020) *Enrichment of the product lineup |

The recent performance is stagnant, but it is certain that demand will grow in the mid/long term. Accordingly, the company will proceed with investment and development for increasing production capacity and quality.

<Healthcare-related products>

Active pharmaceutical ingredients and intermediates | *Stabilization and expansion of the pharmaceutical business *Operation of the peripheral business for pharmaceuticals (cosmetics, supplements, and animals) |

Materials for eye glasses | *Sales expansion in cooperation with customers *Application of unique technologies to other fields |

Dental products | *A new large-scale product (composite resin) will be released first in North America, and then in Europe and Japan. |

Diagnostic systems | *Increase of customers through global business expansion |

The company will develop unique products from the viewpoints of “Treatment,” “Maintenance,” “Prevention,” and “Diagnosis.”

In addition to the field of generic medicines, the company is planning to enter the field of medicine creation, and development of supplements from the viewpoint of making the human body resistant to diseases.

In addition, the company will start handling peripheral materials for veterinary services for the health of livestock.

As for dental devices, the company’s products are highly evaluated, and sales in the U.S. exceeded the estimate. The company will increase production output and promote sales also in Europe and Asia.

As for materials for eye glasses, the company is thinking of expanding the scope of business beyond the mere supply of materials.

② Traditional business

The cost reduction amount in fiscal 2018 exceeded that in fiscal 2017, and has achieved the target amount in fiscal 2020 as a whole.

This term, that is, the fiscal year 2019, the company plans to go forward by setting a new theme of cost reduction.

4-4: Dividends

As mentioned earlier, assuming the profit forecast based on the medium-term management plan, the dividend for this term is to be 70.00 yen/share per year. The estimated payout ratio is 15.9%.

5. Interview with President Yokota

We interviewed the president Hiroshi Yokota about the review on the financial results of the previous term, the progress of the medium-term management plan, and messages to shareholders and investors.

Q: “First, we would like to ask you about your thoughts on the financial results of the previous term. What was your understanding about the business environment, where do you think you performed well and where do you think you need to improve?”

A: “Unfortunately, while we did report an increase in sales for the previous term, we had lower profits and could not complete our initial plan. The stagnation of the supply and demand of semi-conductors, a loss in production due to problems with power plants and external procurement to make up for the loss in production in order to ensure a stable supply ended up slowing us down. On the other hand, some of our businesses expanded steadily as we expected at the start, such as heat dissipating materials and dental products, and reflecting on our performance in the previous term, we will further expand these new growing businesses and aim to achieve an increase in sales and profits for this term.”

Unfortunately, while we did report an increase in sales for the previous term, we had lower profits and could not complete our initial plan.

In these circumstances, the following two can be enumerated as the business environments that affect our performance.

The first is the stagnation in demand and supply for semi-conductors. Of course, in the mid/long term, the demand is expected to increase, but the momentum we saw in the second preceding term was not seen during the previous term.

The second is an increase in global awareness towards the risks of global warming and climate change.

Our company operates thermal power plants that use coal. Because we also handle cement businesses which use coal as a raw material, we need to be aware of the fact that CO2 emissions from coal combustion will have a substantial impact on our middle and long-term management.

The stagnation in demand for semi-conductors and loss in production due to problems with power plants toward the end of the year and external procurement to make up for the loss in production in order to ensure a stable supply were factors in us not being able to complete our plan. It is unfortunate since we were doing comparatively well for the first half of the fiscal year.

For this term, we would like to continue steady investment in maintenance and renewal and prepare to avoid unexpected problems.

On the other hand, some of our businesses expanded as we expected at the start.

One of those is our heat dissipating materials business.

As power devices for vehicles, industrial machinery and electric railways becoming high-power and being downsized, the demand for heat dissipating materials has sharply increased. The heat dissipating materials we supply are highly evaluated, because we offer products with an extremely small amount of impurities and high conductivity that we developed through our unique reduction-nitridation method, such as aluminum nitride powder, aluminum nitride ceramics, and boron nitride.

Although the overall circumstances regarding semi-conductors have leveled off, we certainly expanded our heat dissipating materials business.

In addition, our businesses of materials for eye glasses and dental products did well.

In particular, dental products released this year are selling well.

Traditionally, for the replacement of cavities, in order to avoid patients feeling uncomfortable due to a different colored tooth replacement, you needed to select among 20-30 different colors, mix them appropriately and then apply the color to the replacement tooth before operating, which took a lot of time and required storage of materials. However, through our repairing agent, which saves time by not requiring mixing of colors, we have significantly increased our cost performance. This point has highly evaluated and strongly recommended by a famous dentist from U.S.

Accordingly, we released this product in the U.S. in this February, and ran out stocks despite having fully prepared.

For this term, we shall strengthen our enhanced manufacturing system and start supplying this product to Europe and Asia in addition to the U.S.

Reflecting on our performance in the previous term, we will further expand these new growing businesses and aim to achieve an increase in sales and profits for this term.

Q: “Next we would like to ask you about the medium-term management plan. We believe your greatest mission is the reform of organizational culture and the development of personnel. So we would like to know about your efforts, results and changes within your company.”

A: “While continuing to strengthen the recruitment of outside personnel, we have also started initiatives to nurture business leaders within our company. However, despite it being 3 years since we started our medium-term management plan, my honest thoughts are that the awareness of our employees as a whole company has not yet changed. Although it will take time, , I strongly believe that we must continue the reform of our organizational culture and nurturing of personnel with an appropriate sense of crisis.”

We are aggressively continuing the recruitment of outside personnel. The outside personnel we employed last year have now become part of our executives. And we are appointing personnel from mid-level to leader classes, appointing people who worked in other industries, including women, as business leaders of the department head class, and through this, we are stimulating the office environment, including the ways to deal with work and their way of thinking.

In addition, the energization of company personnel is also important, which is the reason why we started a business leader nurturing program last year.

We select 10 ace level personnel who are in their mid-30s to mid-40s, from each workplace and have them study various subjects in the first year and then create their own business plan in the second year. Our aim is to make them develop a sense for management from a young age by broadening their perspective instead of just focusing on the job at hand.

Furthermore, we are planning to start full-scale nurturing of personnel for internationalization from this year.

However, despite it being 3 years since we started our medium-term management plan, my honest thoughts are that the awareness of our employees as a whole company has not yet changed.

Certainly, it is an indisputable fact that departments and divisions that showed a change in leader’s mindset also showed a significant change in working methods and their sense of speed.

In particular, the sections that handle growing businesses have a high sensitivity to change, but I feel that traditional businesses like those that have been doing the same job for 100 years have relatively low sensitivity and they are lacking speed.

We also have cases where people who only focused on domestic businesses have now started turning their attention to overseas businesses, so I believe things have started to change, but this change is still only concentrated in certain sections of our company.

From 2014 to 2017, recovering from the difficult circumstances caused by Tokuyama Malaysia was our company’s top priority. In that period, our competitors aggressively invested their management resources into structural reform, increasing productivity and the establishment of a growth strategy and I feel that their investments are showing results.

Meanwhile, our company has just started seriously taking initiatives, and though it will take time, with an appropriate sense of crisis, I strongly believe that we must continue the reform of our organizational culture and nurturing of personnel.

Q: “Moving on, which business fields are you focusing on?”

A: “Electronics will certainly show growth in the middle/long term, so even if there are a few fluctuations in the short term, we will continue investing in it without backing down. Healthcare is also a very prolonged business, so instead of giving up on it because it won’t show immediate results, we must engage in it for spans of 5, 10 or even 20 years.”

Electronics will certainly show growth in the middle/long term, so even if there are a few fluctuations in the short term, we will continue investing in it without backing down.

Healthcare is also a very prolonged business, so instead of giving up on it because it won’t show immediate results, we must engage in it for spans of 5, 10 or even 20 years.

As for electronics, we need to develop and deepen our relations with large enterprises that are on the forefront of this field on a global scale. We are finally seeing some results, so even if it might take time, by taking initiatives in the theme of 2 or 3 years in the future, we must establish a position that is vital for them.

One of the initiatives for that purpose is open innovation, but after about 2 years of engagement, the pipeline for development has greatly increased. The sense of speed of development has also gone up and I believe one can say that the effects of open innovation have actualized.

Q: “Could you tell us about your company’s initiatives and your opinions on ESG, which is becoming increasingly relevant in recent years?”

A: “Along with recognizing the fact that environmental problems are a risk to us, we want to incorporate them aggressively into our company’s business chance. Further, we believe it is important that our initiatives towards the environment involve not only our company, but the government and local communities as well. In addition, along with strengthening the corporate governance through our management system, we also want to turn this organization into one that can basically make decisions and operate on site, in other words, make decisions close to the actual locations, in order to speed up the decision-making and execution of the entire company.”

(E: Environment)

I believe our company, which suffered from a mercury problem in the past, has taken initiatives to seriously combat environmental problems, but we must also accelerate our measures against greenhouse gas, which have been rapidly increasing in demand nowadays.

In-house power generation, which has been a strength of our company, is facing great risk and we recognize that how we minimize the risk and reduce the effect on our business as much as possible will be a big challenge. It is indispensable to produce results with a sense of speed, so that our measures will be highly evaluated by society.

For that purpose, we launched a project with top level university professors and receive their advice. Mainly factories have engaged in the project so far, but the R&D department will join this project, and we will keep our eyes on technologies that show potential, including effective and promising technologies, and actively try those that can be applied.

Taking initiatives from a different perspective is also important.

Till now, our main initiatives have been increasing efficiency as much as possible, reducing electricity consumption and then controlling power generation output to decrease CO2 emissions or using biomass in some areas, Now, however, we have broadened our scope and are thinking of technologies that effectively utilize the emitted carbon dioxide.

Or, when caustic soda is produced in our electrolysis factories, hydrogen and chlorine are produced, and we can produce hydrogen as a renewable energy source in a process completely free of carbon dioxide to use it as an energy resource. It is possible to connect it to a new business.

While recognizing the fact that environmental problems are a risk to us, we want to incorporate them aggressively into our company’s business chance.

(S: Society)

We believe that it is important to consider how we shall transmit our initiatives in the future, and develop our environmental initiative not only involve our own company, but also the government and the local community.

To give a concrete example, we shall supply our excess electric power to the public facilities of municipalities in the vicinity of our company.

In addition to becoming a financial support to the local community, we can increase the total power generation efficiency of the entire community and reduce carbon dioxide emissions by using our surplus energy and take aggressive initiatives in order to contribute to society.

(G: Governance)

Along with strengthening corporate governance through our management system, we want to turn this organization into the one that can basically make decisions and operate on site, in other words, make decisions close to the actual locations, in order to speed up the decision-making and execution of the entire company.

However, in order to achieve that, the level of every employee must go up, or else we won’t be able to entrust tasks with peace of mind during management. So in that sense, nurturing of personnel will be our most important tasks. However, more than just thinking about what to do systematically and formally about our corporate governance system, we shall also make greater efforts to raise the level of the company as a whole.

Q: “Finally, do you have a message toward your shareholders and investors?”

A: “This term, we entered the fourth year of our medium-term management plan and numerically, we were able to clear our plans without any trouble. The next 2 year will be a period of preparation for our next big leap. Our reform is still halfway through, but we were definitely able to increase our earning ability and nurture many factors for growth. I would ask our shareholders and investors to continue supporting us as we take on more challenges from here on out.”

This term, we entered the fourth year of our medium-term management plan and numerically, we were able to clear our plans without any trouble.

Originally, we had divided the medium-term management plan into a first half and a second half of 5 years each, and had worked out a top strategy to achieve what we wanted our company to become by 2025. 2019 and 2020 - these 2 years, which will lead on to our next big leap, will be the most important years for us where we must build up our strength.

In the first half of the plan, the aspect of a withdrawal from Malaysia is quite strong, though we have been moving in the direction of our growth strategy since last year. 2019 and 2020 will be when we seriously implement it.

In other words, these 2 years will truly be a period of preparation for our growth, where we will be sowing seeds with a sense of speed and continuing with reform of organizational culture while incorporating new things and then reap those benefits in the next 5 years.

Conversely, if we do not reform our system in these 2 years, we will not be able to make a big leap in the next 5 years.

Thanks to the support from stakeholders, we were able to greatly expand the reach of our free hand financially, and we will continue the 30-billion-yen level investment made in this term for some time to come.

We are supporting foundational businesses, or traditional businesses, with a focus on sustainability and conducting aggressive research development and capital investment in our growing businesses.

Our reform is still halfway through, but we were definitely able to increase our earning ability and nurture many factors for growth.

I would ask our shareholders and investors to continue supporting us as we take on more challenges from here on out.

6.Conclusions

Sales grew, but profit declined. Although failing to reach the estimate in the previous term, the 3-year medium-term management plan has progressed steadily. Although there are some negative factors, including the sluggishness of the semiconductor domain, heat-dissipating materials, dental products, etc. in the growing business field performed well, and they are starting to underpin their business. As mentioned in the interview, the coming two years is the period for preparation for full-scale growth toward the year 2025. This term, it is forecasted that depreciation will augment, but sales and profit will increase.

We would like to pay attention to whether the company will be able to grow sales and profit steadily this term in the short term and the invention of new promising materials in the fields of electronics and healthcare and their efforts to create business chances while minimizing risks in the “E: Environment” field in the medium/long term.

<Reference1: the Medium-Term Management Plan “ Cornerstone of the Group’s Revitalization”>

The company was forced to pass its dividend as it recorded heavy impairment losses in the terms ended Mar. 2015 and Mar. 2016. Needing a new driver for profit growth, the company drew up the 5-year Medium-Term Management Plan entitled “Cornerstone of the Group’s Revitalization” in May 2016 under the vision of “New foundation.”

With this plan, the company is tackling various important issues such as reforming its corporate culture and reconstructing business strategies.

(1) Outline of the Medium-Term Management Plan: “Cornerstone of the Group’s Revitalization”

① Assessment of the present state

◇ | The company has its business base in nonorganic and organic chemistry. Having endured the oil crisis of the 1970s, it has since been constantly growing its businesses by expanding into the field of specialty chemicals and overseas expansion. |

◇ | While the profitability of specialty product business increased during the second half of the 2000s, its general-purpose product business centered on chemicals and cement suffered a profitability decrease due to the shrinking domestic market. |

◇ | Since its founding, the company has always enjoyed its high-efficiency factories and one of the best in-house power generation capacities in Japan. On the back of these qualities, it has built a business based on chemicals and cement, and also been nurturing new fortes in the field of specialty chemicals such as high-purification, powder control, organic and nonorganic synthesis, crystal precipitation, and sintering. |

◇ | On the other hand, the company was not able to successfully relay its technological prowess built up through the specialty chemicals business onto business expansion, apart from the polycrystalline silicon for semiconductors. Therefore, there was a blank period in its creation of new businesses. |

◇ | In 2009, its net interest-bearing debts practically decreased to the no-debt level; however, it swelled rapidly due to the fundraising for its massive investment into its Malaysian business and its financial structure deteriorated drastically, marking a D/E ratio of 4.7 in FY2015. |

Assessing its present state like this, and with the shrinking of domestic general-purpose product market for its traditional businesses and slowdown of growth rate of its electronic materials business forecast, the company believes it is essential to create a new driver for profit growth by overcoming the points listed below.

“Overconfidence and dependence on Tokuyama Factory”

“Inward and passive posture spread among employees”

“Corporate governance”

“Uncertainty surrounding the strategic direction of the Group and each department”

② Management policies

With the “Tokuyama’s vision” below, the company will place changing its business culture and a fundamental overhaul of business operations as its core business strategies, and aim to achieve these by FY 2025.

(Tokuyama’s vision)

Mission | Centered on the field of chemistry, the Tokuyama Group will continue to create value that enhances people’s lives |

Aspirations | Shift from a focus on quantity to quality

(Fiscal 2025) ・Global leader in advanced materials ・Leader in its traditional businesses in Japan |

Values | ・Customer satisfaction is the source of profits ・A higher and broader perspective ・Personnel who consistently surpass their predecessors ・Integrity, perseverance, and a sense of fun |

(Medium to Long Term Business Strategies)

Transition toward a robust business structure that is resilient against changes in the Company’s operating environment and is capable of sustainable growth |

Transition to a Group-wide low-cost structure by undertaking a comprehensive review of existing work practices |

(Restructuring business strategies)

| Aspirations | Methods | Key Indicators |

“Growth businesses” ・Specialty Products ・Life & Amenities ・New businesses | “Become a global leader in advanced materials through unique technologies” ・Thoroughly understand customers’ needs, and meet requirements through unique technologies | ・Adhere strictly to customer-oriented business activities ・Utilize open innovation ・Leverage alliances ・Review the research and development structure | EBITDA growth rate |

“Traditional businesses” ・Chemicals ・Cement | “Become a leader in Japan through strengthening competitiveness” ・Overcome competition in the general-purpose products market ・Become an entity that maintains a thirst for increased efficiency | ・Adopt a stringent approach toward maintaining and renewing investments; undertake strategic investments aimed at strengthening competitiveness ・Increase the efficiency of repairs and maintenance expenses by shortening the periods of periodic maintenance ・Strengthen cross-departmental improvement activities ・Leverage alliances | ROA, CCC |

(Drivers for growing businesses)

In the growing businesses, the company endeavors to utilize its unique technologies nurtured in the cutting-edge areas to develop products to respond to the society’s needs.

ICT and healthcare are the prospective fields.

In the ICT field, the company will expand the production line of aluminum nitride for heat-dissipating materials, put boron nitride production into operation, and increase production of polycrystalline silicon.

In the healthcare field, the dental equipment and diagnostic medicines will occupy the company’s core business, while seeking further growths and not ruling out the possible M&A.

(Cross-departmental cost reduction activities)

The company will perform non-conventional, cross-departmental approaches and strategic capital investments to reduce the costs of principal items such as raw material and fuel, repair costs and logistics costs.

The company aims to reduce company-wide cost by 4 billion yen by 2020.

(Research & development)

To achieve the expansion of existing businesses and expand into the new business fields to utilize its unique technologies, the company will change its R&D structure so it is more in line with the general customer needs.

Also it will embrace a more outward-looking R&D, involving a higher ratio of R&D personnel from operations department and group companies rather than from within.

(Capital investment plan and setting strategic investments)

The company plans to spend a cumulative total of 96 billion yen on capital investments from 2016 to 2020 (5 years). Of the total, 26% will be earmarked for new business extensions such as responding to demands for refinement of polycrystalline silicon and enhancing the heat-dissipating materials, to lay down a stronger foothold.

At the same time, the 20 billion yen strategic investment will be set aside to expand the growth businesses and strengthen the competitiveness of traditional businesses, with the breakdown of 65% towards the traditional businesses and 35% for the growing businesses.

③ Key challenges and countermeasures

The company identifies the following 4 key challenges and the measures.

Key challenges | Measures |

1. Change the Group’s organizational culture and structure | Steps will be taken to review personnel evaluation systems, actively promote the exchange of human resources between Group companies, and drastically reform structures and systems through a variety of initiatives including the vigorous introduction of outside personnel. |

2. Rebuild the Group’s business strategies | The Group will strictly adhere to a customer-oriented approach on the conduct of its business activities. At the same time, the Group will transition to a research and development structure that is in tune with customers’ needs. Through these means, energies will be channeled toward cultivating new business domains that employ unique technologies. The Group will reinforce management resources including personnel and information through alliance with other companies

|

3. Strengthen Group management | Each company of the Tokuyama Group will once again clarify its role and position. Seeking to contribute to the Group’s growth strategy as well as the reduction of costs, particular emphasis will be placed on further strengthening the management of the Group as a whole. |

4. Improve the Company’s financial position | Every effort will be made to restore the Company’s shareholders’ equity by steadily building up profits. Tokuyama will issue classified stock (preferred stock) to quickly stabilize the Company’s financial position, thereby ensuring that the Group is well positioned to flexibly pursue opportunities including M&As that are designed to accelerate the pace of growth. |

④ Targets for Final Business Year (FY2020)

Items | Targets | Themes |

Sales | 335 billion yen | Emphasize quality over quantity |

Operating income | 36 billion yen | Shift toward high-value-added products and reduce costs |

ROA* | 10% | Realize Tokuyama Factory’s potential |

Operating margin | 10% | Pursue a thirst for increased efficiency |

Total asset turnover | 1.0 | Promote improvements through various measures including efforts to shorten the periods of periodic maintenance |

CCC | 55 days | Reduce inventories, improve trading terms and conditions |

D/E ratio | 1 | Promote improvement by building up profits and utilizing external capital |