Bridge Report:(4169)ENECHANGE First Quarter of Fiscal Year December 2021

Yohei Kiguchi CEO | ENECHANGE Ltd. (4169) |

|

Company Information

Market | TSE Mothers |

Industry | Information and Communications |

CEO | Yohei Kiguchi |

HQ Address | 3F Nihon Building, 2-6-2 Otemachi, Chiyoda-ku, Tokyo |

Year-end | End of December |

Homepage |

Stock Information

Share Price | Shares Outstanding (Term-end) | Total Market Cap | ROE Act. | Trading Unit | |

¥2,116 | 11,904,916 shares | ¥25,190 million | -2.9% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

TBD | - | Undisclosed | - | ¥144.98 | 29.2 x |

*The share price is the closing price on June 8. The number of shares issued, DPS, and EPS were taken from the brief financial report for the Q1 of FY2021. ROE and BPS were the values for the previous term.

PBR was calculated while taking into account the 2-for-1 stock split conducted on April 1, 2021.

Earnings Trend

Fiscal Year | Sales | Operating Profit | Ordinary Profit | Net Profit | EPS | DPS |

December 2018 Act. | 1,140 | 93 | 104 | 91 | 17.35 | 0.00 |

December 2019 Act. | 1,268 | -322 | -304 | -238 | -45.40 | 0.00 |

December 2020 Act. | 1,713 | 53 | 6 | -16 | -3.10 | 0.00 |

December 2021 Est. | 2,600 | - | - | - | - | TBD |

*Unit: yen, million yen. Net profit is profit attributable to owners of parent. The same applies below. The estimated values are based on the forecasts made by the Company. Operating profit and other profits are estimated to be more than 0, but the company plans to refrain from disclosing the exact estimates of operating, ordinary, and net profits, from the viewpoint of making swift investment decisions.

This report includes a brief description of ENECHANGE Ltd., its growth strategy, an interview with CEO Kiguchi, etc.

Table of Contents

Key Points

1. Company Overview

2. First Quarter of Fiscal Year December 2021 Earnings Results

3. Fiscal Year December 2021 Earnings Forecasts

4.Growth Strategy

5.Interview with CEO Kiguchi

6.Conclusions

<Reference: Corporate Governance>

Key Points

- ENECHANGE Ltd. is an energy tech enterprise that does not generate or sell electric power, but facilitates innovation in the energy field with a neutral stance. The company’s mission is to support the transformation of the entire energy industry by offering cutting-edge technology services to energy enterprises that are required to change rapidly in order to build a decarbonized society.

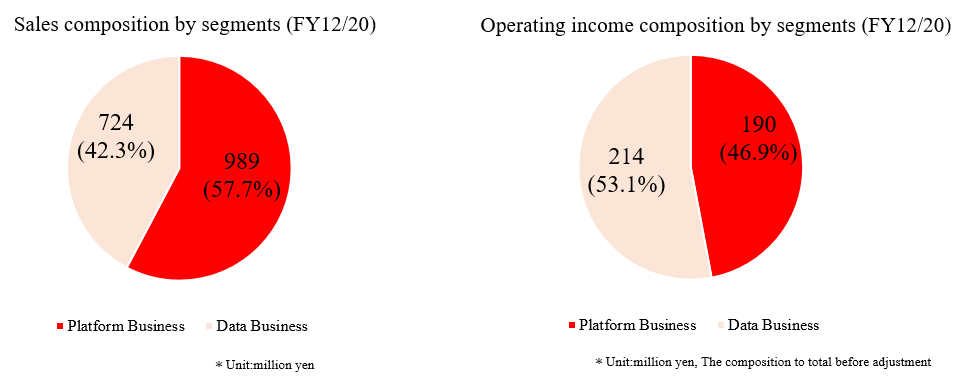

- There are two business segments: one is the Platform business, and the other is the Data business. In the Platform business, they offer an online platform for comparing and evaluating electricity and gas companies, and applying for changing suppliers, to choose the best ones. In the Data business, they provide energy companies with new cloud-based IT systems that are increasingly becoming necessary to respond to the “4Ds of Energy”. These IT systems enable a variety of next-generation capabilities including the analysis of smart meter data and the streamlining of power plant operations using renewable energy.

- The company has three characteristics/strengths: “the only company that offers a SaaS system specializing in the electric power industry,” “a robust business base which comes from recurring revenues,” and “a management team comprised of personnel with industry-specific knowledge.”

- For the first quarter of the term ending December 2021, sales were 657 million yen, up 56% year on year. Gross profit significantly rose 78% year on year, and gross profit margin increased 10.1 points, largely thanks to the growth of sales of the Platform business. Operating profit declined 22% to 33 million yen. In the Platform business, the company actively invested in increasing the number of users by augmenting advertisement costs and sales commissions. The initial forecast called for a loss, but sales and profits both grew faster than expected. In addition, adjusted operating profit, which was calculated by subtracting expenses for increasing users from operating profit/loss, was 321 million yen, an increase of 163% year on year.

- The estimated sales for the term ending December 2021 were revised upward to 2.6 billion yen (initial estimate: 2.3 billion yen), up 51.8% from the previous term, on May 24, 2021 after the announcement of the results for the first quarter. The company plans to keep operating profit and other profits positive, while conducting investment to increase users (advertisement costs and sales commissions). The company has refrained from disclosing the exact estimates from the viewpoint of making swift investment decisions.

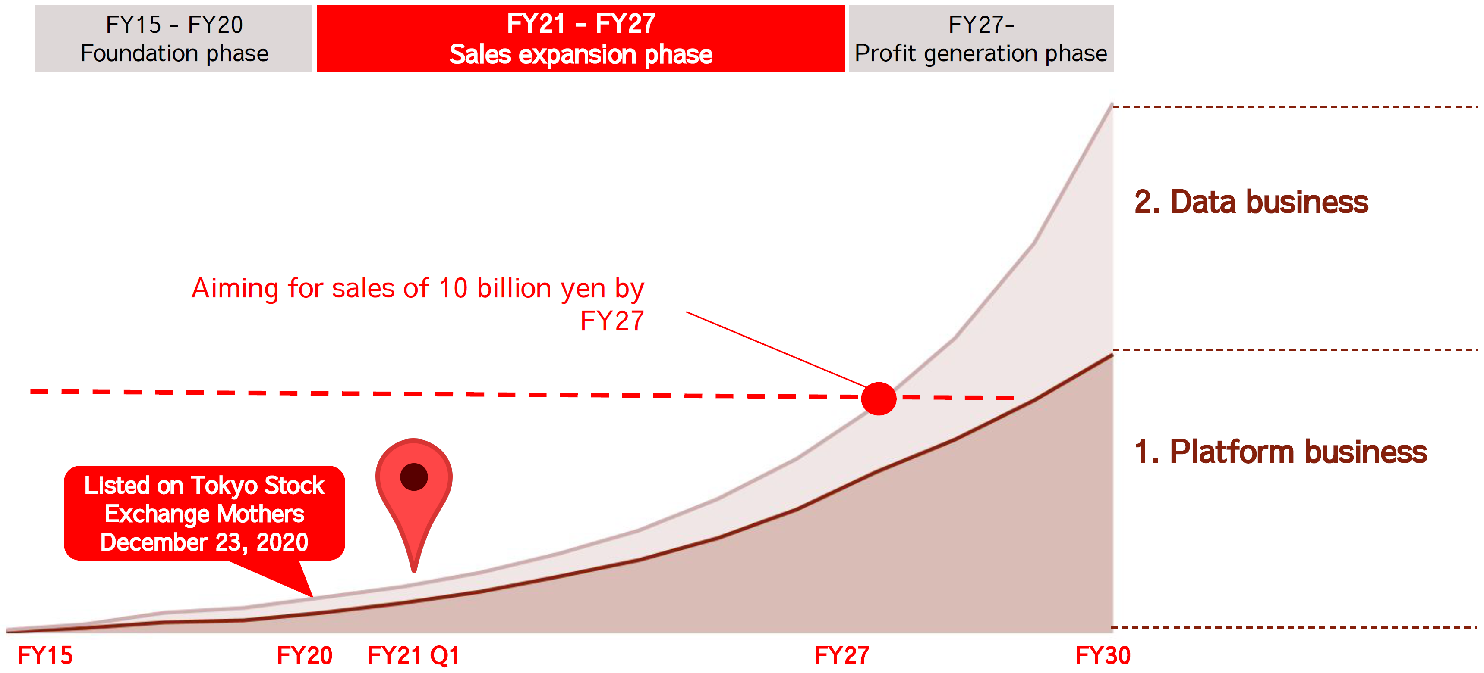

- For the mid/long-term growth vision, the company aims to keep increasing sales by 30% or more every year and achieve sales of 10 billion yen by the term ending December 2027. The company aims to be listed in the prime market when they achieve the goal of 10 billion yen in sales, in order to gain further trust of stakeholders.

- We asked CEO Yohei Kiguchi to give his message to shareholders and investors. He said, “We hope that you will recognize the social significance and business potential of our company, and we would like to build a decarbonized society with you. We would appreciate your support for accelerating our growth.”

1. Company Overview

【1-1 History】

After the Great East Japan Earthquake, which occurred in 2011, CEO Yohei Kiguchi became increasingly interested in issues related to energy. Hence, he enrolled in the University of Cambridge, the most prestigious university in the field of science in the UK, a nation leading with many innovation initiatives in the field of energy and electricity systems. He obtained a master’s degree/doctorate in engineering, focusing on AI-based analysis of power data.

While at Cambridge in 2013, he founded Cambridge Energy Data Lab, Limited, an industry-academia partnership organization to launch businesses and to engage in R&D of smart meter data in the Japanese market.

In April 2014, at Cambridge Energy Data Lab Limited, he developed a prototype service named “enechange,” a site for comparing electricity and gas for households in advance of electricity liberalization in Japan.

In April 2015, he founded “enechange Ltd.” in Sumida-ku, Tokyo, and in June of the same year, he started the current business on a full-scale basis, after the business transfer from Cambridge Energy Data Lab Limited. In May 2018, the company was renamed “ENECHANGE Ltd.”

As the service grew, new functions were added such as electricity charges simulation (ASP) service for power companies, revamped as the “EMAP” service (August 2018); and “JEF,” a fund operation and administration service using power data analysis technologies to streamline the operation of renewable energy power plants. Sales have been growing positively and the company was listed on the Mothers section of Tokyo Stock Exchange in December 2020.

【1-2 Corporate Philosophy】

The company’s mission is “CHANGING ENERGY FOR A BETTER WORLD.”

The corporate name ENECHANGE encompasses the hope of many people who desire to devote their lives to energy issues. The company aims to contribute to society through the creation of innovative services that build the future of energy in all areas of the 4Ds of Energy (explained below), which are vital for realizing a decarbonized society.

【1-3 Business Environments】

There are two parts to the company: the Platform Business, which offers services for switching electricity and gas; and the Data Business, which offers cloud-based DX services for electricity and gas companies. The business context for these is as follows.

(Note some parts were taken from the company’s annual securities report, etc.)

(1) Revolution in the Energy Industry

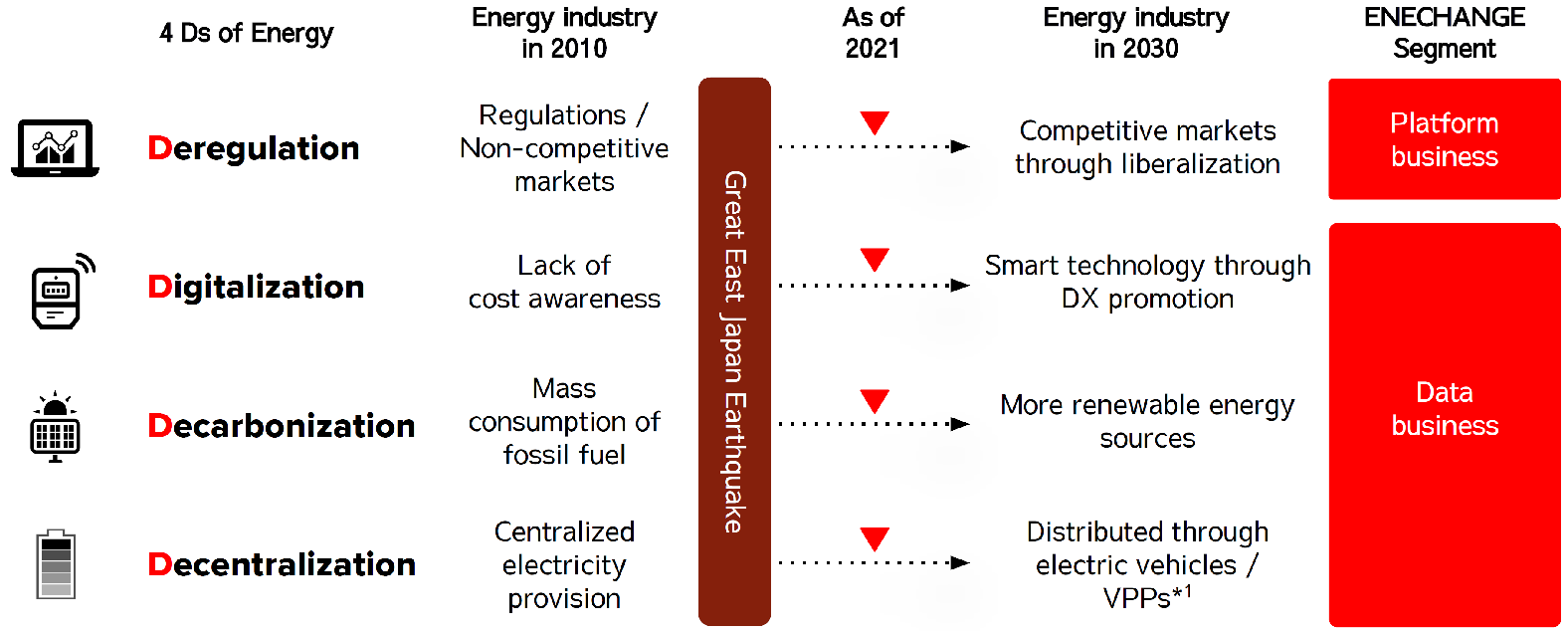

◎Steps toward building a decarbonized society and “The 4Ds of Energy”

The global energy industry is facing a period of dramatic transitions. Following European countries consenting to decarbonization by 2050, Japan declared its “Green Growth Strategy”, aiming for carbon neutrality in 2050, and the U.S. rejoined the Paris Agreement.

It is this future that we must consider, where the popularization of EVs (electric vehicles) and the expansion of electricity demand in emerging Asian countries, amongst others, are considered a fact. To enable this, innovation through the 4Ds of Energy is vital in order to supply electricity in a stable and efficient way while taking environmental issues into consideration.

*The 4Ds of Energy

Deregulation | Introducing competition and utilization of market mechanisms |

Digitalization | Stable and efficient electricity supply based on DX |

Decarbonization | Initiatives for climate changes, expansion of renewable energy |

Decentralization | Shift from a large-scale centralized system to a distributed system |

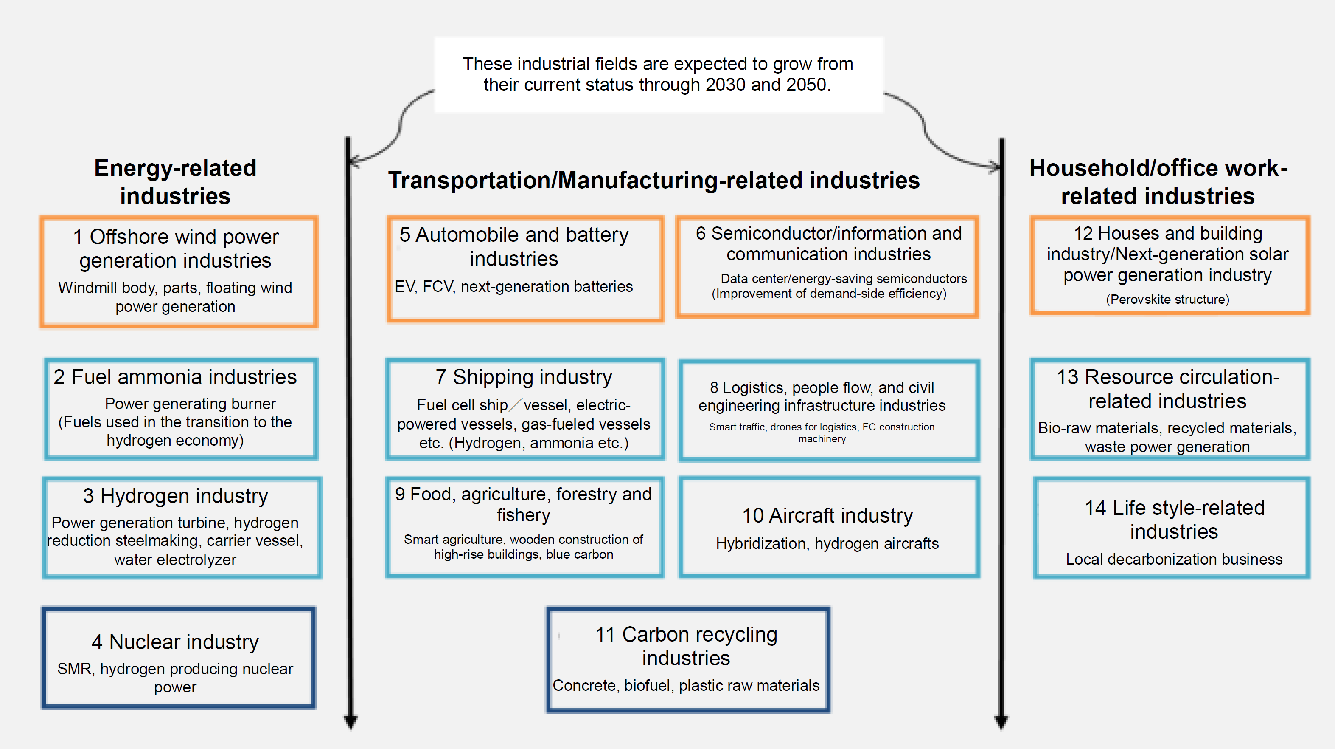

◎Japanese government’s actions toward the realization of a decarbonized society-Green Growth Strategy

The road map towards a decarbonized society in Japan was announced through the declaration of the “Green Growth Strategy in line with Carbon Neutrality in 2050” (December 25th, 2020).

Prime Minister Suga mentioned the Green Growth Strategy during the administrative policy speech at the 204th Ordinary Diet Session held in January 2021. He stated that by realizing the Green Growth Strategy, a positive economic effect of 190 trillion yen per year and large-scale employment creation are expected in 2050.

(Framework)

The endeavors toward carbon neutrality in 2050 will lead to large-scale growth through reform of the industrial structure and economic system. In addition to supporting private investment and encouraging the utilization of 240 trillion yen in cash and deposits, the Japanese government expects that environment-related investment funds from across the globe, which are said to be worth a combined 3,000 trillion yen, will be brought to Japan, bringing about employment and growth.

A plan of action is to be formulated for every priority field vital for achieving carbon neutrality by 2050, incorporating (1) objectives with a clearly stated term, (2) R&D and verification, (3) system development through regulatory reform, standardization, etc., (4) international cooperation etc.

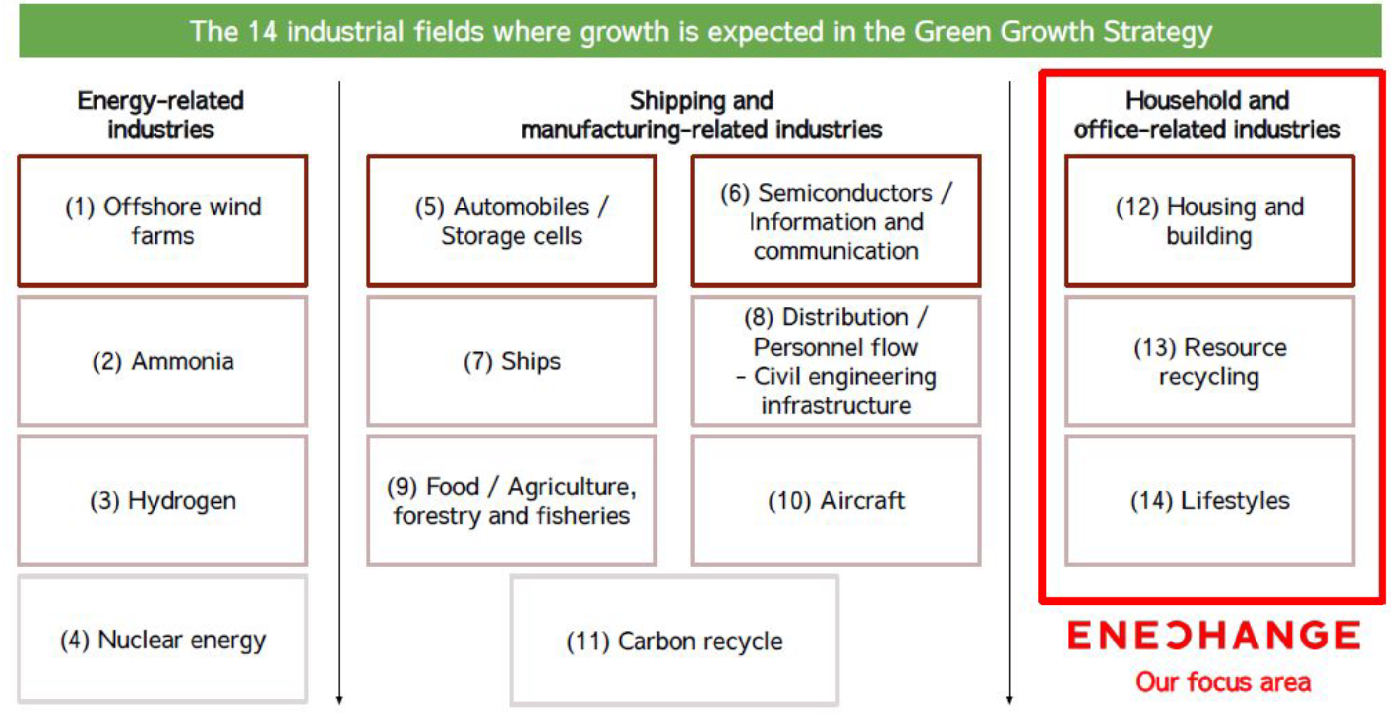

(Important fields)

A plan of action is set to be formulated for fields which require innovation to reach carbon neutrality by 2050, by focusing on reducing greenhouse gas emissions in these fields while maintaining a growth mindset. Fourteen fields with different time spans for achieving growth are covered, ranging from fields where the market will mature by 2030 to fields where it will take until 2050 to launch the market.

(“Green Growth Strategy Through Achieving Carbon Neutrality in 2050,” by the Ministry of Economy, Trade and Industry)

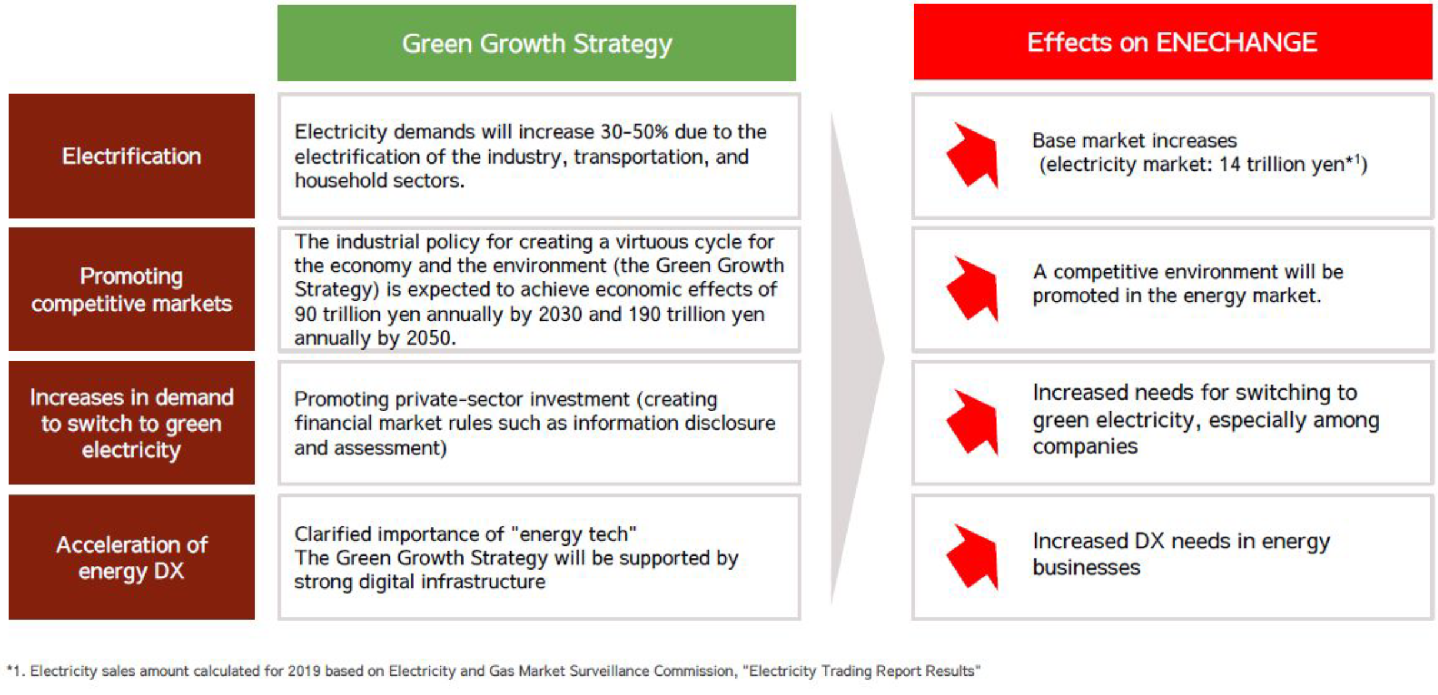

(Energy industry in which further progress of reforms is expected)

Electricity is one of the pivotal themes of the Green Growth Strategy, as the reference values for 2050 for the Green Growth Strategy indicate that electricity demand will increase by 30-50% from the current state due to electrification in the fields of industry, transport and households.

While deregulation is already in progress in the energy industry, further policy reforms, investments, promotion of competition, etc. are expected.

◎ Electricity market that is expanding rapidly due to electrification

The company assumes that, following the trend of decarbonization, the electricity market will grow by up to about 50% from the current 13 trillion yen to a scale of 20 trillion yen due to the distribution of all-electric homes and electric vehicles. The market will take in the 7-trillion-yen city gas/LP gas market and the 9-trillion-yen gasoline market.

(2) Business Environment of the Platform Business

(Outline of electricity liberalization)

Electricity liberalization in Japan began with the extra high voltage category for corporations in 2000 and the high voltage category in 2004.

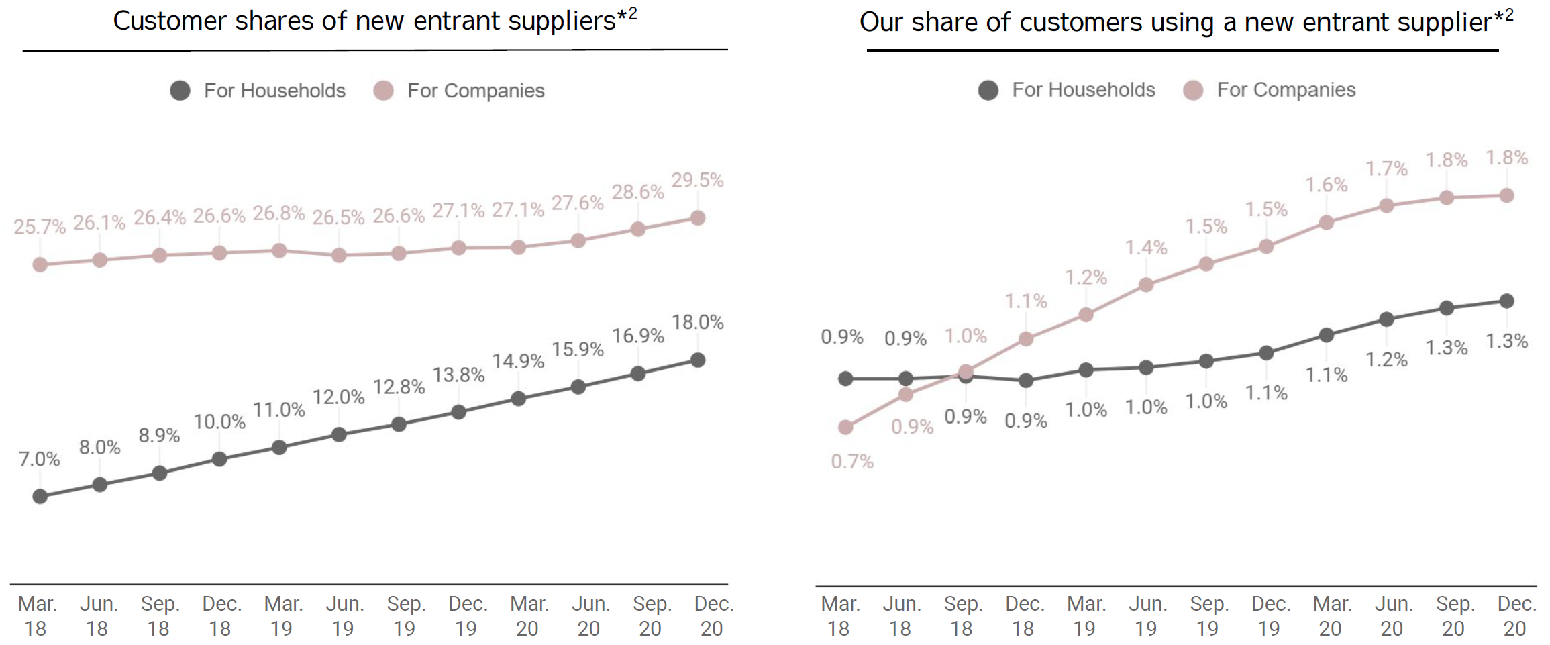

Following the start of the deregulation of the retail market for households (low voltage lighting and low voltage power) in April 2016, the market shares of new entrants for both households and corporations are expanding due to the increase in competition caused by the uptick in new companies entering the market, and a rise in awareness of the switching of electricity and gas utilities.

While the market shares of new PPSs for corporations and households (based on the number of contracts) were 25.7% and 7.0% respectively in March 2018, they rose to as high as 29.5% and 18.0% by the end of 2020.

(Regarding electricity switching)

In regard to the retail market for low voltage lighting, which is the main market for households, the switching of contracts for electricity keeps progressing after the full liberalization in 2016.

*Variation in the number of the cases of switching contracts for electricity over years

| 2017 | 2018 | 2019 | 2020 |

Number of cases of switching from leading energy companies | 3,171,284 | 3,476,507 | 3,365,446 | 3,415,391 |

Number of cases of switching from new entrants | 72,561 | 320,975 | 846,613 | 839,484 |

Number of new contracts with new entrants | 426,232 | 648,271 | 1,164,921 | 1,781,378 |

Total | 3,670,077 | 4,445,753 | 5,376,980 | 6,036,253 |

The company assumes that the demand for switching from leading energy companies will be stable due to the enhanced awareness of the switching of electricity and gas suppliers.

The demand for switching from new entrants is brought about mainly by users who have already switched to a new entrant and then looked for a better pricing plan, etc. It can be assumed that users who have experienced switching once tend to keep looking for better electricity and gas utilities, as they feel more at ease with switching electricity and gas suppliers and also recognize advantages related to switching.

It is thought that especially in regard to the first switch, a large number of users passively decide to switch as a result of a direct approach by electricity and gas utilities, and it is presumed that in case these users switch for the second time or more, they will actively compare and consider electricity and gas utilities, leading to an increase in demand for switching services such as those offered by the company.

Furthermore, the company assumes that the demand for new contracts with new entrants is brought about by users who choose a new entrant instead of a leading company when entering into a new contract for electricity and gas at the time of relocation. The company presumes that the demand for e.g. a better tariff will keep increasing due to higher awareness of electricity and gas switching options.

(3) Environment of the Data Business

(Outline of the IT system market in the energy industry)

According to the report co-authored by the World Economic Forum and Accenture, it is estimated that the value from which the whole world can benefit from the digital initiative (value brought about by the progress of digitalization) in the electricity market will reach 1.3 trillion USD between 2016 and 2025.

ENECHANGE believes that electricity and gas utilities in Japan also have a soaring demand for data analysis, due to the need for the operation of an elastic and flexible electric power system, etc., against a backdrop of intensifying competition between electricity and gas utilities, the increase in the amount of energy data due to the rising implementation of smart meters, and the evolution of technologies such as AI and large-scale introduction of renewable energy power plants. These are all linked to the process of deregulation.

Fields related to the utilization of energy data are therefore not limited only to digitalized areas, but can be also found cross-sectionally in the above-mentioned fields of the 4 Ds of energy.

In recent years, the amount of IT investment in the energy industry, on which the services developed by the company in the Data Business are focused, has expanded due to the development of the competitive environment. The ratio of the IT budget to net sales of enterprises in the Japanese energy industry increased from 0.82% in fiscal 2015 to 1.05% in fiscal 2019.

It is presumed that this stems from the demand for the renovation of IT systems in step with industry policy reforms such the full retail liberalization of electricity and gas, the separation of electrical power production from power distribution and transmission, and the distribution of smart meters and the increase in renewable energies. It is thought that IT investments in the energy industry will continue to expand.

【1-4 What is ENECHANGE?】

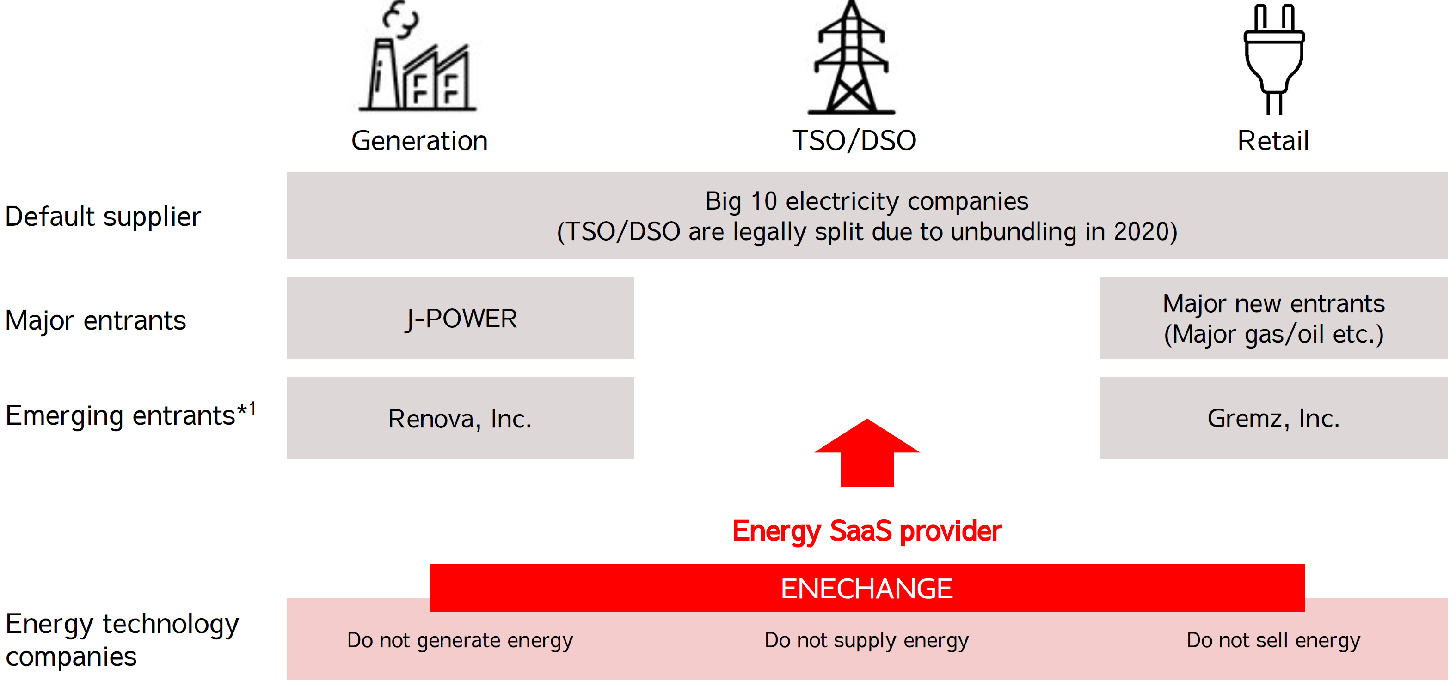

ENECHANGE is an energy tech enterprise promoting innovation in the energy industry from a neutral position, as it is not involved in power generation or retail.

Its mission is to support energy industry reform by providing cutting-edge technology services to energy enterprises, which require rapid changes to help realize a net-zero society. It is developing an energy SaaS business specialized in the 4Ds of Energy.

(Taken from the reference material of the company)

【1-5 Details of the Business】

(1) Business segments

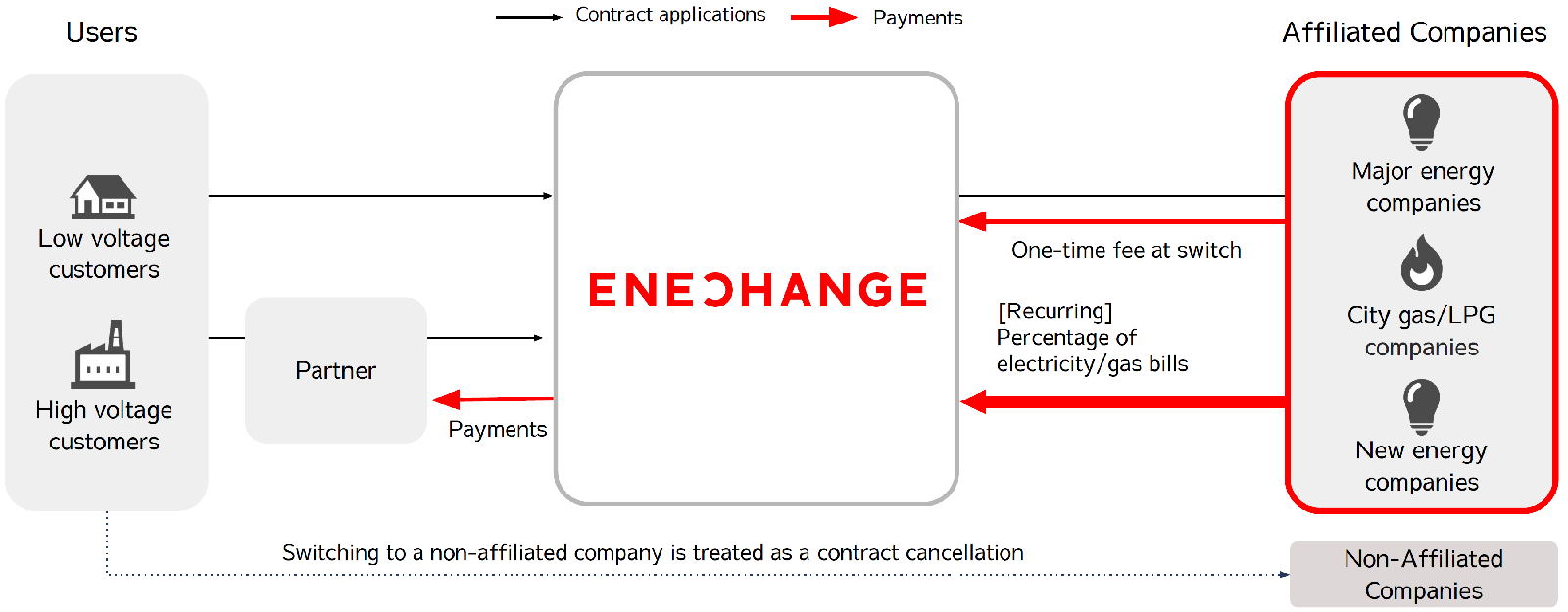

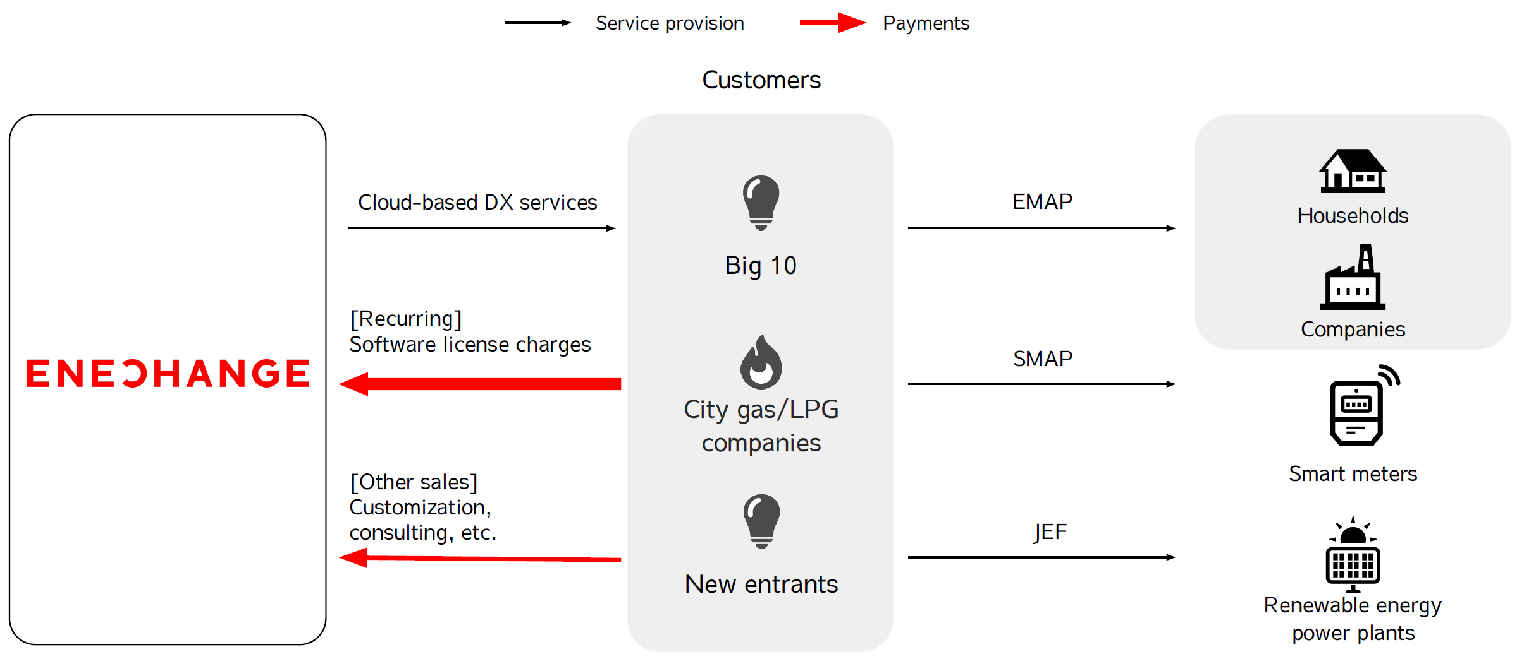

There are two business segments, the Platform Business, which offers services for switching electricity and gas suppliers, and the Energy Data Business, which offers cloud-based DX services for electricity and gas utilities. Both businesses are based on a SaaS model for B2B2C transactions.

(Produced by Investment Bridge Co., Ltd. based on the reference material of the company)

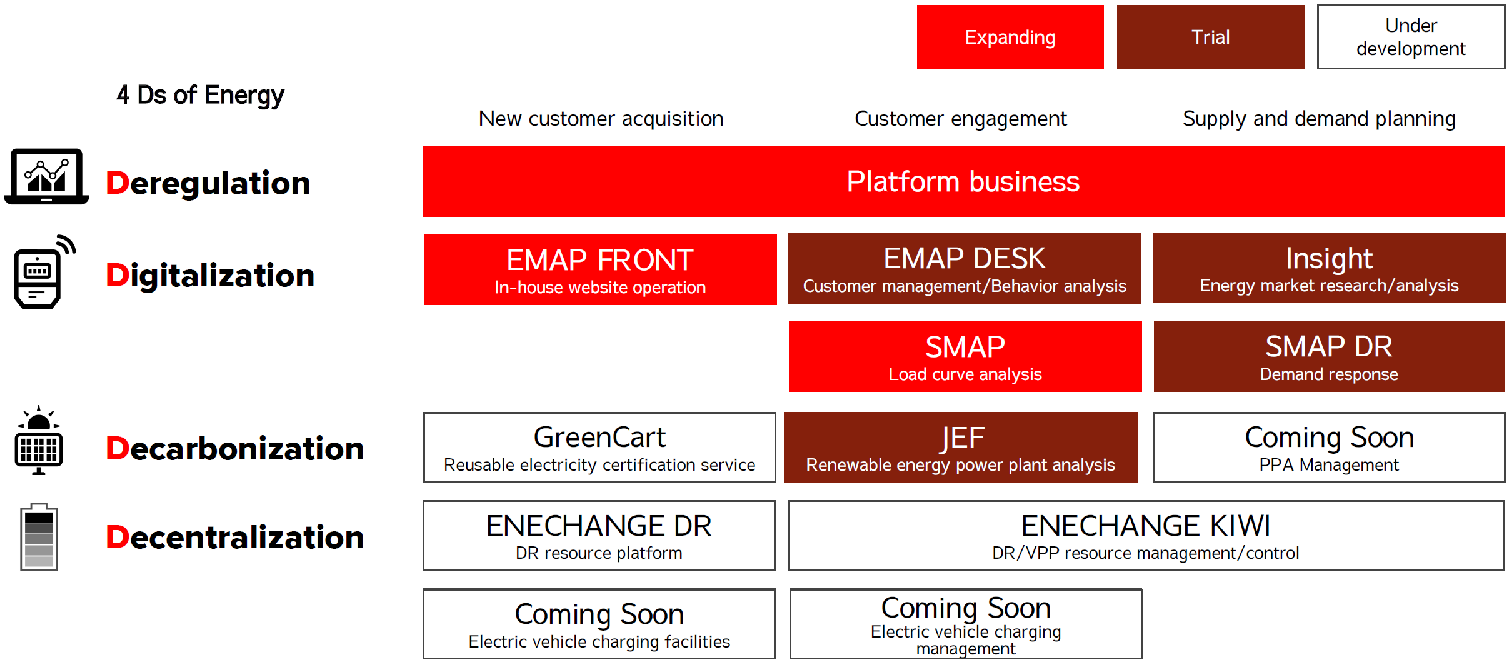

Regarding the 4Ds of Energy, the Deregulation domain is covered by the Platform Business, while the domain of the other 3Ds are covered by the Data Business.

(Taken from the reference material of the company)

(1) Platform Business

Based on the idea that choosing your energy should be common, the company provides a one-stop online platform which allows comparison, diagnosis and application for switching to select the optimal electricity/gas utility.

Users are individuals (households) and companies, with ENECHANGE being for households, and ENECHANGE BIZ for companies. Users can use the service free of charge.

As of the end of December 2020, ENECHANGE and ENECHANGE BIZ are affiliated with 52 electricity/gas utilities (excluding duplicate entries).

Based on this strong network with electricity and gas utilities, the company not only attracts customers from the aspect of costs, but has also begun to provide both electricity and gas services and offer an electricity plan using only renewable energy, and is thus developing a service that meets a wide range of user needs.

This service was launched in step with the electricity liberalization in 2016 and gas liberalization in 2017, and since November 2019 the company has been providing services in line with the Feed-In Tariff (FIT) system for purchase of electricity, and for introducing storage batteries.

(Outline of the service)

*ENECHANGE

The average number of unique users per month in 2020 was 2.2 million.

By simply entering information, such as the postal code of the area of residence, the number of household members, how much time they spent at home or the amount of used electricity, online, users can acquire information comparing optimal electricity/gas utilities in the form of various rankings based on the results of a diagnosis utilizing an algorithm that takes into consideration climate conditions or the load curve (electricity load curve: used for grasping changes in the demand for electricity) for each area. Furthermore, besides diagnosis and comparison, it is possible to proceed with the procedures for switching electricity/gas utilities online within one platform.

*ENECHANGE BIZ

The company is affiliated with electricity and gas utilities, predominantly large new entrants, to offer a service of obtaining estimates and proceeding with application formalities free of charge to corporate users nationwide.

As of December 2020, the service receives over 300 inquiries per month.

Following a free diagnostic registration, corporate users can commission the company to take care of all formalities, from getting quotes for new electricity tariffs from multiple electricity/gas utilities to proceedings for switching electricity utilities, by submitting a record of the amount of used electricity in the past 12 months. The service is favorably received among corporate users as it leads to cost reduction without requiring initial cost or great efforts.

(Taken from the reference material of the company)

(Revenue model of the Platform Business)

When users finish switching the contract for electricity/gas on ENECHANGE, the company receives a fixed remuneration from the electricity/gas utility to which the user switched.

There are two types of remunerations, as outlined below.

Recurring remuneration (based on recurring fees) for switching | As a general rule, the company receives the amount calculated by multiplying the electricity/gas fees, which users who finished switching in the platform service pay to electricity/gas utilities every month, by a rate agreed in advance, every month after the switching as long as the contract for the retail supply of electricity/gas is valid. This is a recurring remuneration where remuneration increases proportionally to the number of contracts when an application is made and switching is finished via the platform service. |

Other remunerations | One-time remunerations received additionally from electricity/gas utilities at the time of switching the contract for electricity/gas besides the recurring remuneration for switching, or advertising revenue based on the requests to insert an advertisement or broadcasting activities from electricity/gas utilities who anticipate positive effects of promotion on ENECHANGE and ENECHANGE BIZ as media, etc. The net sales fluctuate depending on the number of applications and advertisements. |

(Taken from the reference material of the company)

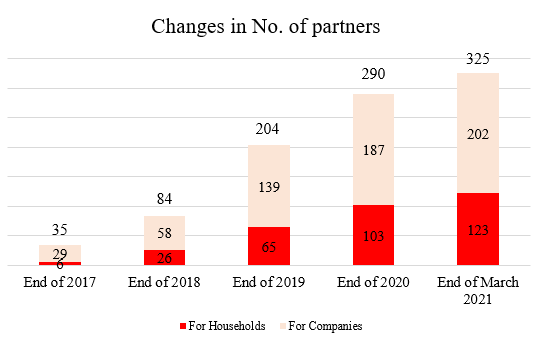

(How to attract customers)

The company reels in a broad range of customers, including households and corporations, through online and offline marketing activities.

For online marketing, the company operates its own media and systems in sites for comparing prices, etc.

For offline promotion of switching energy companies, the amount users can save is limited due to marketing personnel costs, etc., but the company increases applications and ARPU by implementing cashback campaigns exclusively for ENECHANGE, utilizing the merits of online systems in cooperation with various affiliated enterprises.

For offline marketing, the company offers the option to real estate brokers, etc. for households and to financial institutions, etc. for corporations, to receive applications for switching of power companies via business partners.

The company strives to increase business partners that significantly contribute to the increase of switching, and the number of business partners was 325 as of March 2021. In parallel with the increase of business partners, the number of cases of switching of energy companies via business partners is rising.

(Produced by Investment Bridge with reference to the material of the company)

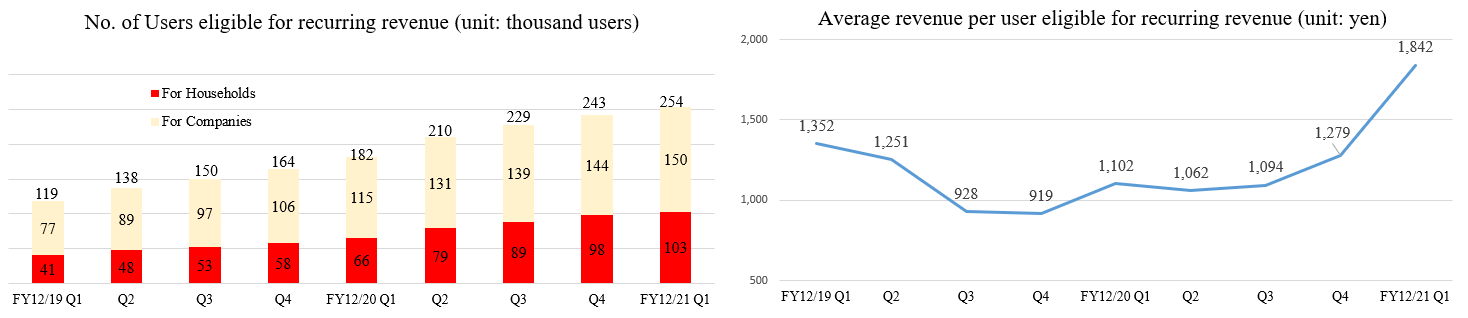

The number of users subject to the continuous remunerations as of the end of March 2021 was 100,000 for households and 150,000 for corporations (*converted value).

*Converted value

The average power capacity of households is considered to be 4 kW, so the value was converted to that for general households based on the total capacity for corporations.

(Policy for expenses for increasing users)

The cost for increasing users, including advertisement expenses and sales commissions paid to business partners, accounted for about 60% of sales in this segment in the first quarter of the term ending December 2021.

Recently, the company has invested preferably for sales commissions, which represent cost effectiveness (cashback in its original channel and payment of incentives to business partners).

The company actively invested in increasing users, and the number of users is growing steadily, so LTV/CAC rose from 3.4 at the end of the previous term to 5.3.

LTV/CAC is the ratio of life time value (LTV) to customer acquisition cost (CAC). In general, this value is used as an indicator of the soundness level of CAC in SaaS companies. If it exceeds 3, the soundness level is considered to be sufficient.

The company defines LTV as “(One-shot remuneration・Cross-selling – Sales commissions) + Lifetime continuous remuneration × Gross profit margin.”

The primary measures for increasing LTV are the following tw

*To increase one-shot remuneration + cross-selling: Expansion of cross-selling of energy-saving products for corporations

*To increase the lifetime continuous remunerations: Development and adoption of measures for retaining users for improving the rate of cancellation by households

As for customer acquisition cost (CAC), the company plans to conduct advertisements, etc. actively while monitoring their effects, because there is significant room for investment, considering the current levels of LTV and CAC.

(For increasing the market share)

After the electricity liberalization, the cases of switching to new power companies have been increasing year by year. The ratio of contracts for new electric power increased to 18.0% for households and 29.5% for corporations at the end of 2020.

The ratio of users of the company’s switching service among users of new electric power steadily increased to 1.3% for households and 1.8% for corporations at the end of 2020.

(Taken from the reference material of the company; The shares were calculated from the number of contracts in the report on electric power transactions by the Electricity and Gas Market Surveillance Commission. The company’s shares were calculated by the company by converting the number of contracts to KW.)

In this situation, the company considers that there is plenty of room to increase its market share, and engages in various measures.

* “Switching from a new energy company to another energy company”

After the electricity liberalization, an increasing number of users are switching to another energy company for the second time or more.

However, the effect of the second or more switching is difficult to gauge compared with the first switching, and the procedures for switching are complex.

To deal with such problems, the company supports the “switching from a new energy company to another energy company” by managing and updating the database for over 600 new power companies and over 1,600 plans on a daily basis, estimating prices, and providing a flowchart for switching.

* “New contracts with a new energy company at the time of relocation or the like”

Post-liberalization, unless residents sign a contract for electricity with an energy company at the time of relocation in advance, they cannot use electricity upon moving into a new house. Accordingly, there have been several cases in which residents forget to complete the procedures for use of electricity and cannot use electricity upon moving into a new house.

In cooperation with real estate firms, the company offers the ENECHANGE service of applying for electricity on behalf of customers, so that customers can use electricity immediately after relocation.

At present, the company is signing more partnership contracts with real estate management and brokerage companies, and its market share is estimated to have reached about 4.7%. This field is still underexplored, so it is considered that there is great room for growth.

(Overseas cases)

In the UK, which pioneered electricity liberalization and has a similar system to the Japanese one, the switching of energy companies via an online comparison site accounted for 60% of total switches in fiscal 2019.

Moneysupermarket.com Group PLC, which operates a leading price comparison site that has the second largest share in the switching market, entered the market of switching of electric power and gas suppliers in 2006, actively conducted investment (accounting for about 60% of sales), formed more alliances with partners, and carried out M&A, growing sales with a CAGR of about 37%. For fiscal 2020, it is estimated that their sales from energy switching will be 7.7 billion yen, operating profit margin will be 30%, and the share in the switching market will be 15.9%.

Liberalization in Japan is still at an early stage, and the market share of ENECHANGE is only 1%, but the company considers that it is possible to grow significantly by implementing various measures like this British company.

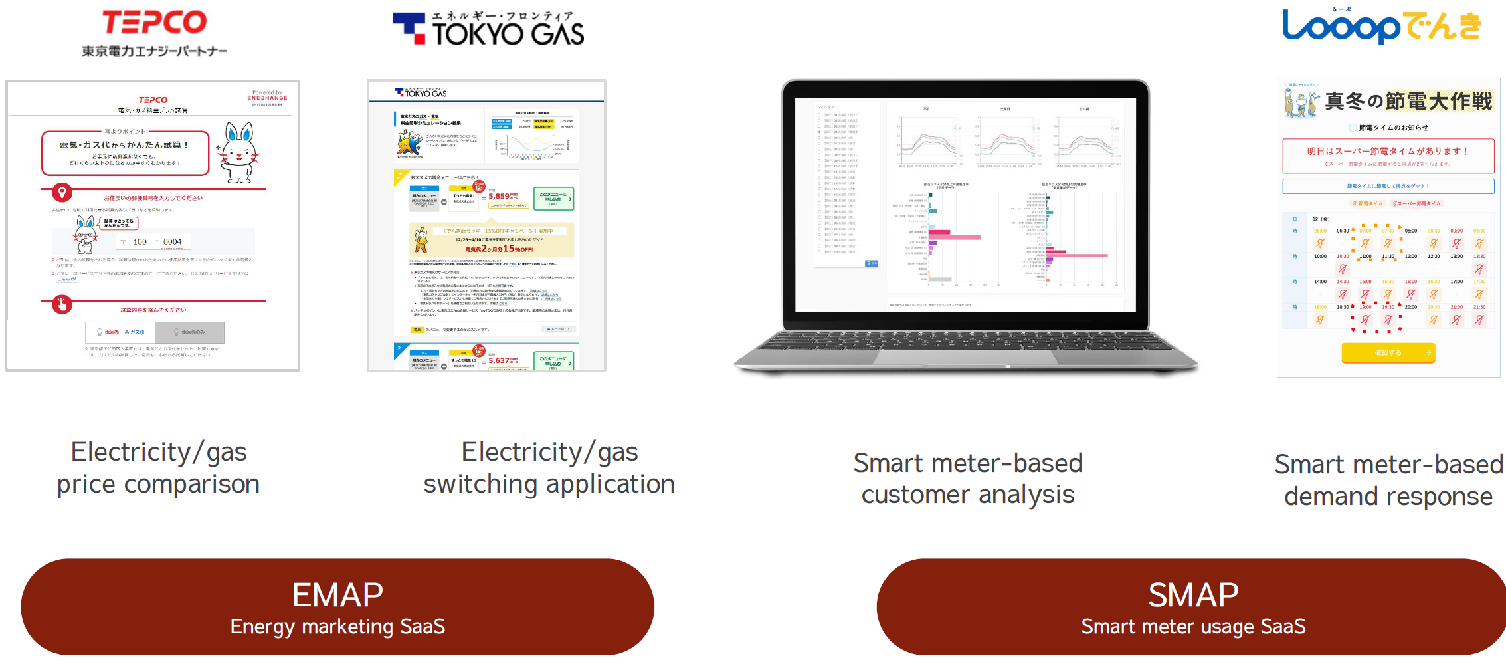

(2) Data Business

Under the banner of "making energy more efficient through digitalization," the company provides energy companies with new cloud-based IT systems that are required as the 4Ds of energy progress, such as the analysis of smart meter data and operational efficiency improvement of renewable energy power plants.

Currently, the company provides services, mainly "EMAP" and "SMAP," all of which are unique in that they are general purpose systems for the electricity and gas industries that utilize proprietary data.

The company offers these services to domestic and overseas power and gas companies, through strategic business alliances with domestic power and gas companies, etc. Since all of these services are cloud-based, it is possible to accumulate a variety of data through the provision of the services, and the analysis and utilization of the accumulated data will lead to further enhancement of service quality and functions. This enables the company to increase its competitiveness. As of the end of December 2020, there were 32 companies using their service.

(Taken from the reference material of the company)

(Overview of the Services)

*EMAP (Energy Marketing Acceleration Platform)

Digital marketing support SaaS for energy businesses.

Based on the knowledge, information, and technological assets acquired through the operation of the electricity and gas switching platform ENECHANGE, the company provides SaaS-based digitalization and efficiency improvement services to the electricity and gas retailing field.

As of the end of December 2020, the company was providing services to electricity and gas companies including TEPCO Energy Partner Inc., Tokyo Gas Co, Ltd., and Hokuriku Electric Power Company.

Hokuriku Electric Power Company, which adopted the system in 2020, is promoting DX for various procedures for relocation, changing contracts, etc. By providing SaaS options based on the experience gained through the operation of ENECHANGE, the company is helping to improve user satisfaction and reduce costs.

As of the end of December 2020, more than one million contracts for electricity and gas switching have been accumulated through EMAP.

Standard packages are available, allowing companies to set up the system quickly. Even after commencing operation, the company provides one-stop services such as system life and death monitoring, regular maintenance, and even regular updates of fuel cost adjustments.

The two main functions are as follows.

(1) EMAP Front Series (Marketing)

The company offers a number of functions that are effective in acquiring new customers and deepening user relationships online, including an application form that achieves a high CVR (conversion rate, subscription rate). It was developed by using a database on user behavior and other data accumulated by ENECHANGE. It includes a rate simulation that supports the tariffs of electricity and gas companies nationwide, and a personal user page that features graphs of billing amounts and electricity usage. The system can be set up in a minimum of one month, because it has been redesigned for electric and gas company sites based on functions optimized through the experience of running ENECHANGE.

(2) EMAP Desk Series (customer and sales management, back-office functions, data analysis)

The company offers a customer management system based on ENECHANGE’s know-how, which has managed the customers of many electric and gas companies as an agent, and on software assets such as user management functions. It features functions such as the ability to manage all customer information (area, tariff, application status, etc.) to meet the needs of agencies for flexible management of acquisition results and sales, as well as access user behavior analysis.

In addition, starting from EMAP Desk, the company is also providing BPO services for switching operations, assuming that the main target will be electricity and gas companies in the start-up phase of their business, such as new energy companies. BPO enables business development with fewer human resources and flexible service design construction that cannot be handled by existing customer management systems, by efficiency improvement through the sharing and automation of required functions.

*SMAP (Smart Meter Analytics Platform)

Smart meter data analysis SaaS for energy providers.

SMAP Energy Limited, which is a ENECHANGE subsidiary, develops and operates its business in Japan and overseas.

The company provides a SaaS-based service that analyzes and predicts the 30-minute data of users' electricity usage (in kWh) sent via smart meters from various perspectives.

Currently, the service is being provided to major new energy companies and other electricity and gas companies. In particular, with the distribution of smart meters, the need for data utilization is increasing among new electric power companies.

As of the end of December 2020, there were over 2.5 billion smart meter electricity usage data points to be managed and analyzed.

The two main functions are as follows.

(1) Customer profitability improvement function

Power companies can use APIs and other means to link their own electricity procurement cost data with data on retail supply prices to existing customers, enabling them to analyze profitability in various ways, from their own company as a whole to the status of income and expenditure by industry and by individual customer. This makes it possible to formulate and implement effective strategies for acquiring and retaining customers in light of their own power supply situation.

In addition, it provides the results of data analysis to reduce the consignment fees paid by electric power companies to general transmission and distribution companies. Based on the results of this analysis, electric power companies can also improve their profitability by changing their consignment fees to match the power usage of their existing customers.

(2) Demand response function

Since some of the electricity tariffs offered by energy companies are set by time zone, and as some electricity procurement prices also fluctuate according to time zone, the revenue and expenditure of power companies fluctuate according to time zone.

Demand response is a technology to control electricity on the demand side in order to balance the demand (consumption) and supply (generation) of electricity, a technology that will become important in the future as the amount of electricity generated fluctuates due to the spread of renewable energy.

SMAP provides a function for predicting the amount of electricity demand, which is important for implementing demand response.

(Revenue model for data business)

In both services, the company receives a certain amount of compensation from clients, mainly electricity and gas companies, for providing the service.

As the service is optimized for the energy industry, direct customers are mainly electric power and gas companies, but by adopting a pay-as-you-go billing system based on the number of users, it is a B2B2C-type service in which end users of electric power and gas are indirect customers of the service.

There are two types of payment:

Recurring revenue-based licensing fees | Monthly payment received on an ongoing basis for services offered. It is based on a recurring revenue model where products are provided to power and gas companies in the form of SaaS-based license fees, and pay-as-you-go fees are linked to end-users (consumers, the number of smart meters, etc.). EMAP and SMAP payments are linked primarily to the number of users (consumers, smart meters, etc.). |

Other fees | For EMAP and SMAP, there is a one-time fee for development and consulting for installation and customization. |

(Taken from the reference material of the company)

(Management policy in the data business)

The 4Ds of energy are a global trend, with Europe and the United States leading the way. The company believes that there is a need for what it calls "time machine management," in which the company grasps the overseas situation and then develops its business in line with the Japanese market environment.

While the UK is ahead in electricity liberalization, the situation in digitalization, decarbonization, and decentralization differs from country to country, so a more detailed analysis is needed.

The company, which was founded in the UK and has a strong overseas network, will use its strengths to implement this method.

(New movement: development of new products)

As mentioned above, the data business is responsible for decarbonization, digitalization, and decentralization, three of the 4Ds of energy.

The company's policy is to develop products that meet various needs of electric power companies (new customer acquisition, customer engagement, supply and demand planning), and in addition to its current main products, EMAP and SMAP, it is currently developing and evaluating about 10 other products.

(Taken from the reference material of the company)

Of these new products, the company has released the following services.

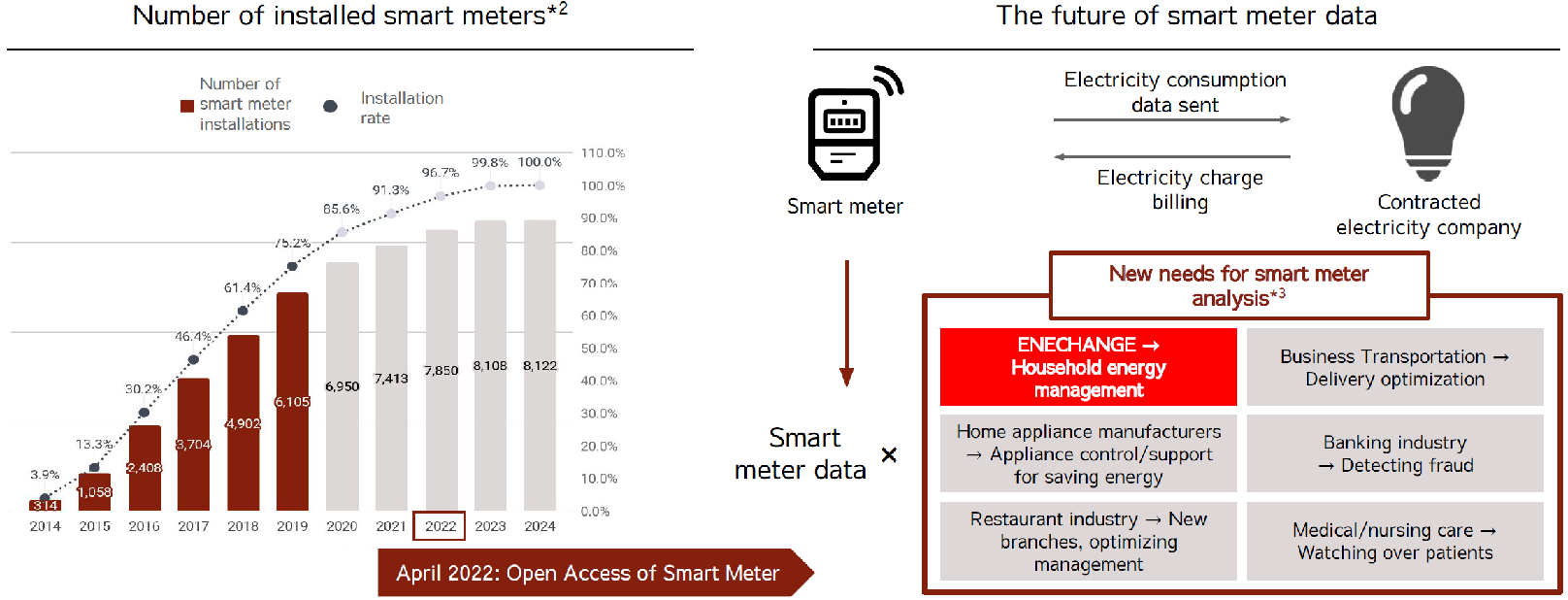

*Electricity data utilization service

Electricity data liberalization is scheduled for April 2022, and access to electricity data obtained from over 78 million smart meters will be released to third parties (other than electricity retailers).

The company has not been able to access users' data until now, but this liberalization will expand its business opportunities.

Since it will be possible to manage and analyze data before and after the switchover, in addition to developing new services for members of ENECHANGE (e.g., electricity household account book), and since new needs related to electricity data analysis will be created, the company will strengthen its approach to different industries. The company is actively working on commercialization and forming alliances.

(Taken from the reference material of the company)

*Full-scale entry into the VPP market

In February 2021, the company announced its full-scale entry into the VPP (Virtual Power Plant) market.

(What is VPP?)

VPP refers to the collective control of small-scale renewable energy power generation, storage batteries, fuel cells, and other facilities that are scattered throughout the city, making them function together as if they were a single power plant. This is an example of one of the 4D's of energy, decentralization: the shift from a large centralized system to a decentralized system.

(The role of VPP and the VPP market in Japan)

As set out in the Green Growth Strategy, electricity demand is expected to increase by 30-50% from the current level by 2050. In response to this increase in demand, the supply and demand adjustment market (to be launched in phases from 2021) and the capacity market (to be launched in 2024) will enable electric power companies to adjust supply and demand to achieve the same amount of supply and demand and to secure supply capacity over a medium-term span more efficiently than before under market principles.

Renewable energies such as solar power and wind power are being promoted to build a decarbonized society, but it is extremely important to achieve a stable supply and demand balance through both markets to compensate for the disadvantage that the amount of energy generated is not constant.

In both markets, the sellers (supply side) are power generators and retail electricity providers, but VPPs are also expected to play a major role.

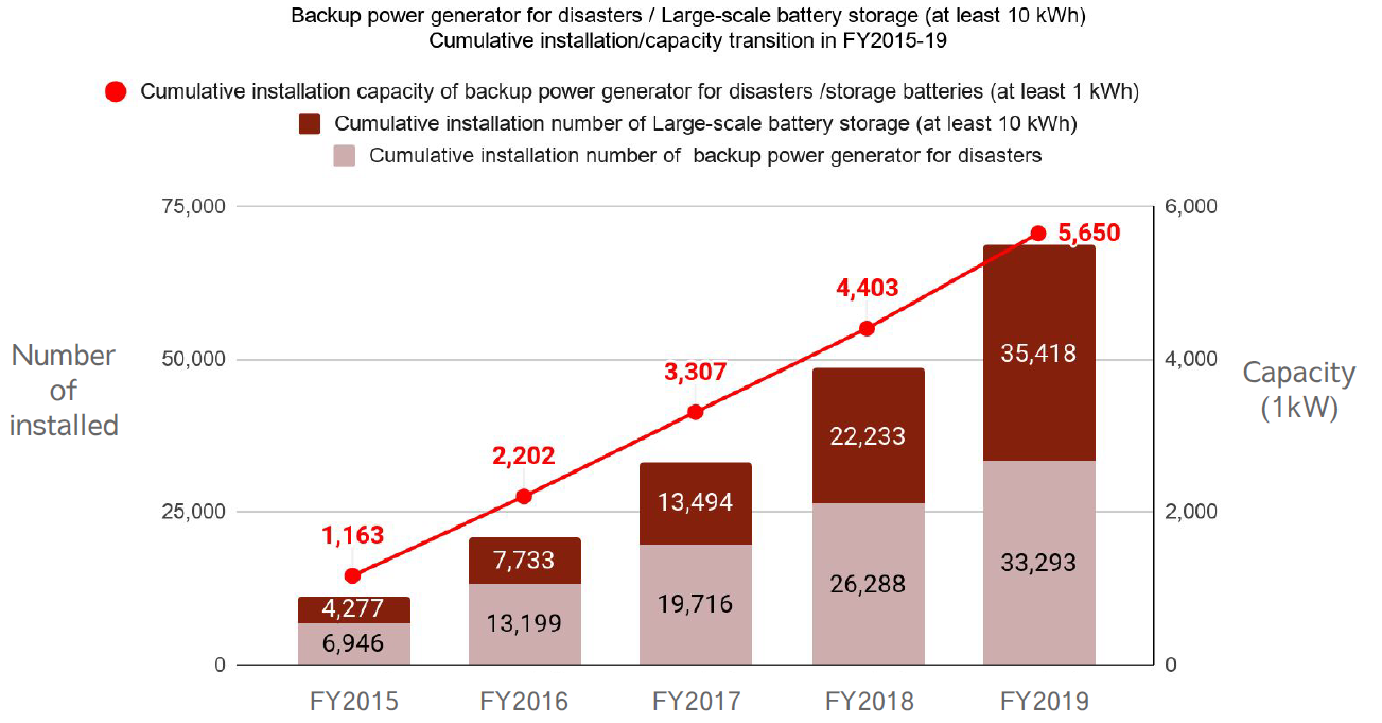

In Japan, the number of large storage batteries, private power generators, and other power sources installed in buildings, hospitals, and other facilities since 2015 for disaster prevention purposes and not yet used during normal times is estimated at 70,000, or a cumulative total of 5.6 million kW, which is equivalent to about six nuclear power plants.

In leading European countries, VPP markets with a scale of 79 billion yen in the UK and 85 billion yen in Germany have already been formed, and it is said that the market in Japan will grow to 100 billion yen through the flexible operation of these unused power sources during normal times, along with the gradual expansion of the supply and demand adjustment market and the capacity market.

(Taken from the reference material of the company)

(Launch of the ENECHANGE DR service)

With an eye on the growth potential of the VPP market, the company will leverage its data utilization technology and Japan's largest energy-related customer base to enter the VPP market on a full scale.

As the first step, the company announced ENECHANGE DR as a service to collect unused power sources during normal times.

The ENECHANGE DR service will be offered to owners of resources such as permanent private generators, emergency private generators, and storage batteries, which have limited use, as well as corporate resource owners who can respond to demand* by shifting factory production schedules and controlling air conditioners and refrigerators.

Resource owners can reduce their electricity bills and earn compensation by reducing or shifting their electricity demand in accordance with requests from aggregators*. In addition, although a capacity of 1,000 kW or more is required for demand response market transactions, resource owners with a capacity of less than 1,000 kW can still engage in demand response transactions by bundling their resources and introducing them to the aggregator, so that resource owners with smaller capacities can also earn revenue through transactions.

ENECHANGE will also select the best aggregator for the resource owner's facilities.

VPP is all about discovering the market value of a single private power generator and storage battery in the ever-changing supply and demand environment, so having the ability to analyze data is a major key. The company has a large amount of data and a strong analytical capability, which is a big advantage.

(*) Demand response

When a supply shortage is predicted, consumers who have signed a DR (Demand Response) contract in advance work to resolve the shortage by saving electricity or shifting the time of use.

(*) Aggregator

An entity that stands between power companies and consumers to control the balance in demand response (DR), which maintains the balance between supply and demand of electricity by controlling the amount of demand from consumers.

(Full-scale entry into VPP SaaS through an exclusive alliance with Kiwi Power)

In May 2021, the company signed a business alliance agreement with Kiwi Power Limited (UK) to provide VPP software for resource aggregators that bundle distributed energy resources that can adjust the supply and demand of electricity such as private generators and storage batteries.

Overview of Kiwi Power

The company has been providing services in more than 10 countries for over 10 years and has experience in connecting a wide range of resources, from small 5kW resources such as private generators and storage batteries to large stationary storage batteries of 80MW scale. This has resulted in more than 1 GW of distributed power assets to date, connected to a platform called Kiwi Core. In addition, by providing customers with stable connectivity through Kiwi Fruit, a device developed by the company, it is expected to increase the reliability of resource control in the supply and demand adjustment market, which requires detailed output control.

Purpose and details of the business alliance

ENECHANGE believes that by utilizing Kiwi Power's resource control technology, it will be able to provide stable operations to address the issues of VPP projects in Japan.

Based on this alliance, the company plans to offer the ENECHANGE Kiwi Platform, which specializes in resource management for resource aggregators that bundle resources such as private power generators and storage batteries.

The platform is characterized by its strength in control technology for distributed power assets, as well as its ability to link APIs with market trading systems. Additionally, they plan to pursue synergetic effects through the business alliance.

* Launch of GreenCart, a Platform for Issuing Green Power Certificates

In May 2021, the company began the joint operation of GreenCart, an online issuing platform for green power certificates, with Japan Natural Energy Corporation, the largest company handling green power certificates domestically.

Background and Objectives

On March 26, 2021, the Ministry of the Environment began accepting applications for the Clean Energy Vehicle Introduction Project Subsidy, which provides subsidies for the purchase of EVs and other clean energy vehicles on the condition that homes and businesses procure 100% of their electricity from renewable energy sources.

The methods of procuring 100% renewable electricity include on-site power generation, purchase of a renewable electricity plan, and purchase of renewable electricity certificates.

GreenCart, which is jointly operated by ENECHANGE and Japan Natural Energy Corporation, is an online issuing platform for the purchase of Green Power Certificates that fall under the category of Purchase of Renewable Energy Power Certificates.

ENECHANGE believes that this platform will promote the widespread use of Green Power Certificates and contribute to the early realization of a decarbonized society.

Overview of the Service

GreenCart is an online issuing platform for green electricity certificates equipped with a credit card payment system.

The flow from application to issuance of the certificate used to take about a month, but now it is possible to issue the certificate immediately online.

In addition, the system can display the calculation method and guidelines for the number of green power certificates purchased and annual power consumption for at least four years (which is required to receive subsidies) and automatically calculates the purchase amount.

* Overseas cases

Similar overseas companies that provide SaaS for power companies include Oracle Utilities Opower (US) and Uplight (US).

Oracle Utilities Opower went public on the New York Stock Exchange in 2014 and was subsequently acquired by Oracle Corporation for approximately 58.5 billion yen. Its sales are 16.3 billion yen, and it has 100 client companies.

Uplight is a unicorn company with 11 billion yen in sales, 80 customers, and an estimated market value of 165 billion yen despite not being listed.

ENECHANGE will continue to research these companies while aiming to dominate and grow the Japanese market.

(The above figures were taken from ENECHANGE data.)

【1-6 Characteristics and Strengths】

(1) The only enterprise that offers a SaaS system specializing in the electric power sector

It is the only energy tech enterprise that has already established its position in the electric power field, where there is a high entry barrier, and is highly evaluated by electric power companies. Based on that position, it plans to respond to the changes in the industry, further strengthening its competitive advantage.

(2) Firm business base based on recurring revenues

The competition in the electric power market is a zero-sum game where the total number of consumers cannot be expected to grow, so it is important for power companies to not only increase customers, but also retain their customers.

The company has established a business model of not only increasing new customers, but also receiving continuous remunerations by offering continuous support, so cancellation rate is low.

As electricity and gas supply systems are infrastructure to be used continuously and all of the contracts from fiscal 2019 are for continuous remunerations, their business base will certainly get stronger.

(3) Management team composed of personnel with plenty of knowledge

At the previous general meeting of shareholders, Mr. Kenichi Fujita, who is the former representative director, president, and chairman of Siemens Japan, was appointed as an outside director. In addition, the management team includes Mr. Minoru Takeda, who is the former president of Royal Dutch Shell Japan, Mr. Akihiko Mori, who is the former CFO of RENOVA, Inc., and Mr. Shinichiro Yoshihara, who is the representative director and CFO of EPCO., Ltd. (which established a joint venture with Tokyo Electric Power Company). These board members are well-versed in the energy situations inside and outside Japan, and possess a strong foundation of knowledge.

【1-7 Policy for improving corporate value】

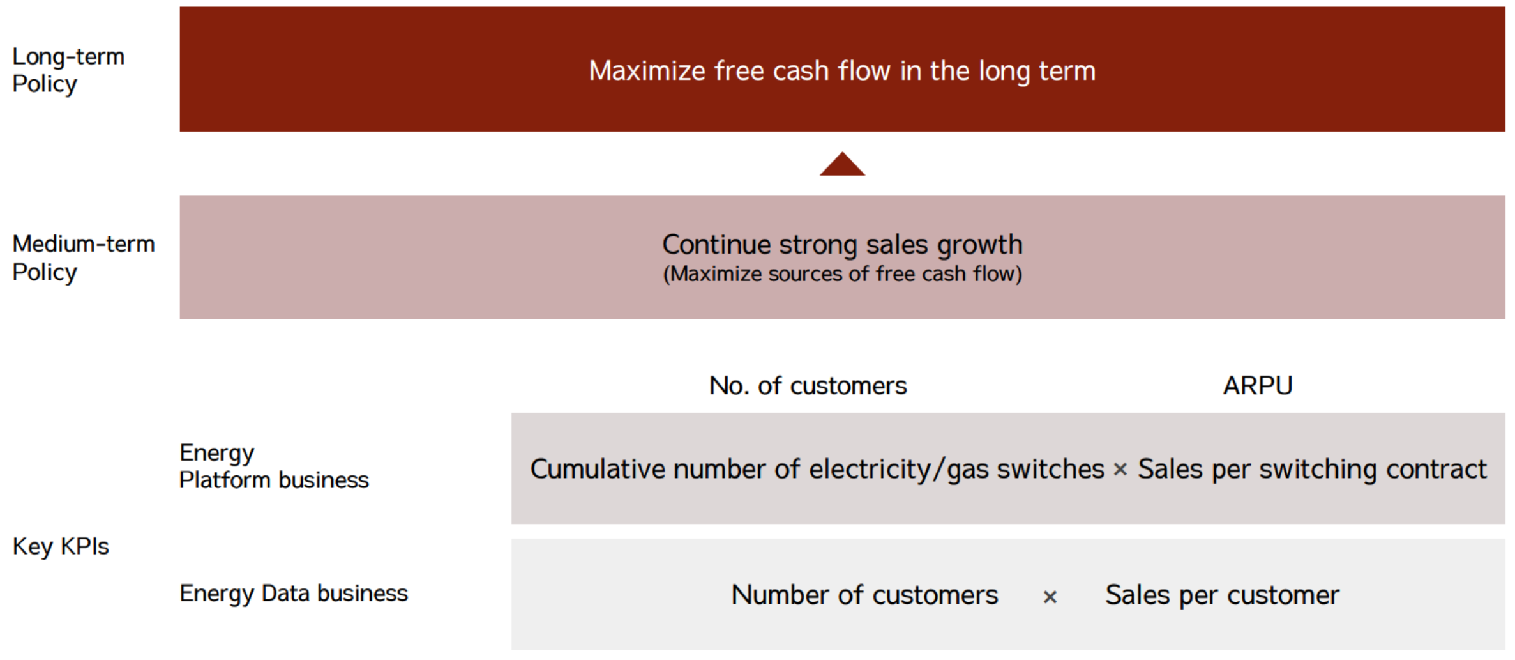

Their management policy is to maximize long-term free cash flow, and they place importance on sales growth rate in the medium term.

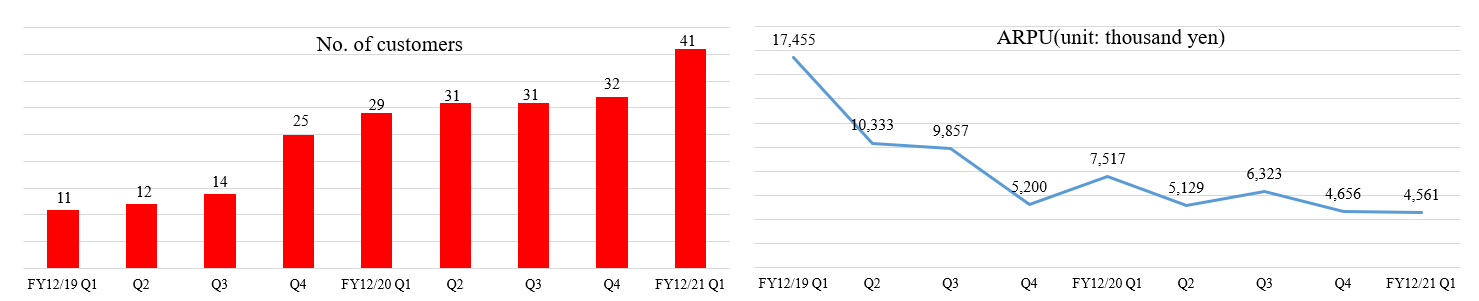

To do so, the company defined the number of customers/users and average revenue per user (ARPU) as KPIs, and will conduct investment for growth to maximize the two KPIs.

In the Platform business, the rise in ARPU due to the one-time revenues, such as cashback from power companies, is expected, but the company will increase recurring revenues in the medium term.

More precisely, they aim to increase the usage fees of users by promoting the purchase of electricity and gas and Green Power Certificates for the use of renewable energy.

In the Data business, the company will advocate SMAP, as well as EMAP, for cross-selling.

(Taken from the reference material of the company)

2. First Quarter of Fiscal Year December 2021 Earnings Results

(1) Consolidated Business Results

| Q1 FY 12/20 | Ratio to Sales | Q1 FY 12/21 | Ratio to Sales | YoY |

Sales | 420 | 100.0% | 657 | 100.0% | +56% |

Gross Profit | 315 | 75.2% | 560 | 85.3% | +78% |

SG&A | 273 | 65.0% | 527 | 80.3% | +93% |

Operating Profit | 42 | 10.0% | 33 | 5.0% | -22% |

Ordinary Profit | 42 | 10.0% | 43 | 6.7% | +3% |

Net Profit | 40 | 9.5% | 14 | 2.1% | -65% |

*Unit: million yen. Net profit means profit attributable to owners of parent.

Sales grew, hitting a record high, while operating profit declined

Sales increased 56% year on year to 657 million yen.

Gross profit rose 78% year on year, and gross profit margin increased by 10.1 points, thanks to the growth of sales of the Platform business, the gross profit margin of which is high.

Operating profit declined 22% to 33 million yen. In the Platform business, the company actively invested in increasing users (augmenting advertisement costs and sales commissions). The initial forecast called for a loss, but sales grew, earning the company profits. In addition, adjusted operating profit, which was calculated by subtracting expenses for increasing users from operating profit/loss, was 321 million yen, up 163% year on year.

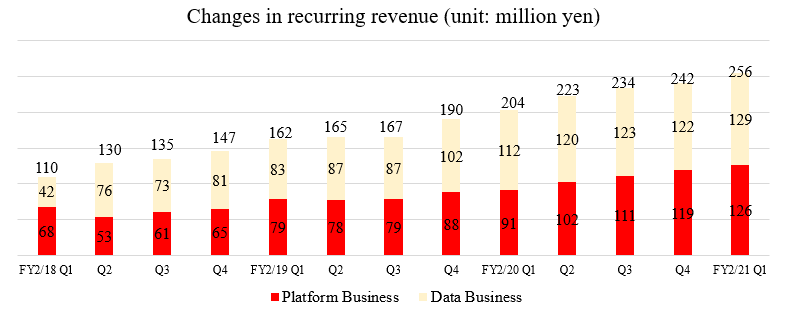

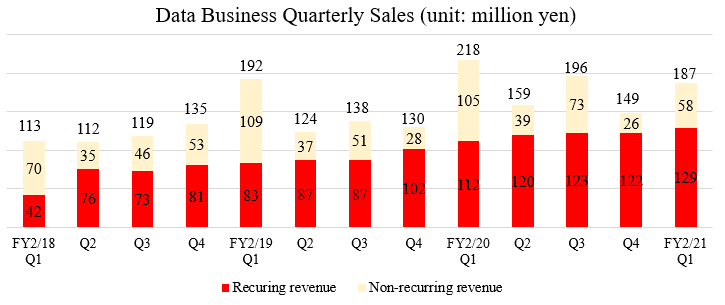

◎ Recurring revenue

Recurring revenue, including continuous remunerations and software license fees that are posted constantly and repeatedly every term, increased 26% year on year to 256 million yen, hitting a record high. The ratio of recurring revenues is 26.9% for the Platform business, 69.0% for the Data business, and 39.0% for the entire company.

Net revenue retention (NRR), which is an indicator of how much the sales from existing customers have been maintained from the previous year, was 129% for the term ending December 2020. This is attributable to the steady growth of recurring revenues from existing clients through the cross-selling of multiple services to affiliated enterprises (including power and gas companies); such recurring revenues are increasing further this term.

The ratio of recurring revenues in the Platform business is now 2%.

The recurring revenues in the term ended December 2020 were 426 million yen. As of the end of December 2020, the number of users that pay fees continuously is about 240,000, and recurring revenue per user is about 1,700 yen. The average electricity charge per person in Japan is about 80,000 yen per year, which is consistent with (1,700 yen ÷ 80,000 yen × 100 = 2.12%) as a whole.

(2) Trend of each business segment

|

| Q1 of FY 12/20 | Q1 of FY 12/21 | YoY |

Sales | Platform business | 201 | 469 | +133% |

Data business | 218 | 187 | -14% | |

Profit | Platform business | 28 | 75 | +168% |

Data business | 89 | 60 | -33% |

*Unit: million yen. Profit in each segment without taking into account company-wide expenses

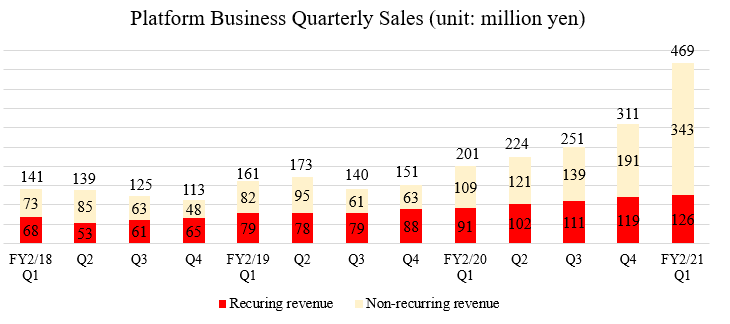

① Platform business

Sales and profit grew.

Sales rose 133% year on year to 469 million yen, due to the growth of demand for change of energy companies and the rise in average one-time remuneration.

Recurring revenues increased 38% year on year to 126 million yen.

*Variations in KPIs

*The number of users eligible for recurring revenue refers to the current number of contracts considering cancellations. The number of cancellations is calculated by the equation: “No. of contracts in the previous month + No. of cases of start of supply in this month – No. of contracts this month,” for households and corporations. Cancellation rate is calculated from the ratio of the number of cancellations to the number of contracts for continuous fees to be imposed on households and corporations (monthly average in the past 12 months). The conversion of values for corporations to values for households is conducted by assuming that the capacity for general households is 4 kW, dividing by the total capacity. The average revenue per user eligible for recurring revenue is calculated by dividing the quarterly sales in the segment by the number of users subject to continuous remunerations as of the end of the quarter.

The number of users subject to continuous remunerations grew 40% year on year to 254,000. For households, it increased 56%, while for corporations, it rose 30%. Monthly cancellation rate was as low as 1.1%.

The number of applications for switching was healthier than initially assumed, due to the emergence of demand for switching caused by the skyrocketing of JEPX prices and the increase in use of online channels.

The sales per user subject to continuous remunerations (ARPU) increased 67% to 1,842 yen. The rise in average one-shot remuneration due to intensified competition contributed.

② Data business

Sales and profit dropped.

Sales declined 14% year on year to 187 million yen. Recurring revenues were 129 million yen, up 15% year on year. Non-recurring revenues decreased 45% year on year, as estimated, because large-scale development projects were recorded in the same period of the previous year and the company concentrated on the increase of recurring revenues this term.

* Variations in KPIs

*Cancellation rate = No. of cancellations (including cancellations during the term) / No. of continuous products as of the end of the previous fiscal year + No. of new products (including cancellations during the term). The number of customers means that as of the end of the term. ARPU was obtained by dividing quarterly sales in the segment by the number of customers as of the end of the quarter.

The number of client companies rose 41% year on year to 41, thanks to the release of new products, including EMAP. Monthly cancellation rate was about 1%. Sales per customer (ARPU) decreased 39% year on year, due to the drop in non-recurring revenue as planned.

The business is estimated to grow, as new demand will emerge after the revision to the systems from 2024 (including the liberalization of the VPP market and electric power data).

(3) Financial Condition and Cash Flow

◎Balance Sheet Status

| End of Dec. 2020 | End of Mar. 2021 | Increase/ decrease |

| End of Dec. 2020 | End of Mar. 2021 | Increase/ decrease |

Current assets | 1,626 | 1,638 | +11 | Current liabilities | 364 | 534 | +170 |

Cash and deposit | 1,334 | 1,265 | -68 | Trade payables | 7 | 11 | +4 |

Trade receivables | 254 | 339 | +84 | ST Interest-bearing debts | 9 | 9 | +0 |

Noncurrent assets | 340 | 434 | +93 | Noncurrent liabilities | 750 | 750 | +0 |

Tangible fixed assets | 27 | 24 | -2 | LT Interest-bearing debts | 750 | 750 | +0 |

Intangible fixed assets | 120 | 136 | +15 | Total liabilities | 1,114 | 1,285 | +170 |

Investments and other assets | 192 | 273 | +80 | Net assets | 852 | 787 | -65 |

Total Assets | 1,967 | 2,072 | +105 | Total Liabilities and Net assets | 1,967 | 2,072 | +105 |

|

|

|

| Total Interest-bearing liabilities | 759 | 759 | +0 |

*Unit: million yen.

The capital-to-asset ratio as of the end of December 2020 was 37.3%, down 5.3% from the end of the previous term.

Since operating cash flow is positive, the company plans to actively invest in its businesses as long as operating profit is positive. In addition, they will utilize interest-bearing liabilities while considering capital cost.

(4) Topics

◎ Appointment of a new director

At the annual meeting of shareholders held in March 2021, Mr. Kenichi Fujita, who is the former representative director, president, and chairman of Siemens Japan, was appointed as an independent outside director.

Mr. Fujita has been in charge of the energy sector in the Siemens Group (Japanese corporation with Japan HQ). He possesses plenty of experience, as he served as a board member of Japan Association of Corporate Executives (the environmental resources/energy committee). He is expected to contribute to the Data business, by utilizing his international knowledge of the field of digitalization of energy.

3. Fiscal Year December 2021 Earnings Forecasts

(1) Earnings Forecast

| FY 12/20 | FY 12/21 (Est.) | YoY | Ratio of the revised amount |

Sales | 1,713 | 2,600 | +51.8% | +13.0% |

Operating Profit | 53 | Positive | - | - |

Ordinary Profit | 6 | Positive | - | - |

Net Profit | -16 | Positive | - | - |

*Unit: million yen. The forecast was announced by the company.

Upward revision to the earnings forecast

On May 24, 2021, after the announcement of the results for the first quarter, the estimated sales were revised upwardly to 2.6 billion yen, up 51.8% from the previous term.

In the Platform business, the number of cases of switching of energy companies and ARPU are healthier than initially estimated, and in the Data business, too, they are healthier than initially estimated.

As for operating profit and other profits, the company plans to keep them positive while conducting investments for increasing users (advertisement costs and sales commissions). From the viewpoint of swift investment decisions, the company refrained from disclosing exact estimates.

The assumptions for the earnings forecast as of February 2021 and the updates at the time of announcement of the results for the first quarter are as follows.

Platform business | (Assumptions as of Feb. 12, 2021, when the earnings forecast was announced) *The company aims to grow sales by 40% or more. *No. of customers: It is expected to increase to some degree from the same month of the previous year. *ARPU: It will increase mainly thanks to the rise in average one-time remuneration. *Expenses in this segment: While maintaining the LTV/CAC discipline, the company will increase advertisement costs and sales commissions. As for other common expenses in this segment, mainly personnel costs will change. |

(Updates at the time of announcement of the results for Q1) *As for the number of customers, the company has acquired more users than initially expected, thanks to the increase of applications caused by the cold weather and JEPX. *ARPU was better than initially estimated, thanks to the rise in average one-shot remuneration. *The expenses in this segment changed in parallel with the rise in one-time remunerations (sales). The discipline of LTV/CAC was maintained. | |

Data business | (Assumptions as of Feb. 12, 2021, on which the earnings forecast was announced) *The company aims to grow sales by 10-20%. *No. of customers: It is expected to increase to some degree from the same month of the previous year. *ARPU: It is estimated to be unchanged, as they will upsell products to existing customers and adopt low-priced products. *Expenses in this segment: Mainly personnel costs augmented, due to mid-term development investment. |

(Updates at the time of announcement of the results for Q1) *The number of customers increased thanks to new orders as initially assumed. *ARPU was at the same level as the fourth quarter of 2020, as initially assumed. *The expenses in this segment augmented, due to recruitment as initially assumed. | |

Common expenses in the entire company | (Assumptions as of Feb. 12, 2021, on which the earnings forecast was announced) *Augmented due to the recruitment for growth, etc. |

(Updates at the time of announcement of the results for Q1) *Personnel costs augmented about 5%, due to the progress of recruitment as initially assumed. *Expenses were smaller than initially assumed, due to the postponement of events in response to the declaration of a state of emergency, etc. | |

Operating profit | (Assumptions as of Feb. 12, 2021, on which the earnings forecast was announced) *The company will keep positive profit while investing mainly in the Platform business to increase users (ad costs and sales commissions) for growing sales. *As the company will conduct measures for increasing users actively in the first half of 2021, operating profit is projected to be negative in the first and second quarters. |

(Updates at the time of announcement of the results for Q1) *Operating loss was assumed, but the number of users in the Platform business increased healthily, increasing one-shot remunerations more than expected, and operating profit was posted. *For the second quarter, operating loss is assumed. | |

Other | (Assumptions as of Feb. 12, 2021, on which the earnings forecast was announced) *The effects of COVID-19, the declaration of a state of emergency, etc. were considered conservatively. *The profit/loss from new businesses that are still to be determined and uncertain events, such as M&A, were not taken into account. |

(Updates at the time of announcement of the results for Q1) *In March, the consolidated subsidiary (SMAP Energy Limited) became a 100% subsidiary (whose effect on business performance is minor). |

Recurring revenues are estimated to increase 30% or more from the previous term. The company will reduce the receipt of one-shot orders for customization, consulting, etc. and allocate saved resources to the development of new products, and increase recurring revenues and the income from license fees.

4.Growth Strategy

【4-1 Response to the macro-trend】

(1) Basic strategy

As mentioned in Section 1-3 Market environment, 14 growing fields are highlighted in the Green Growth Strategy set out by the Japanese government. In order to realize a decarbonized society, it is necessary to trigger technological innovation in the power generation field, including offshore wind power generation, and innovation in the entire value chain for electric power. The company plans to contribute to the realization of a decarbonized society with demand-side technological services utilizing the contact points with consumers in the industries related to households and offices.

(Taken from the reference material of the company)

(2) Effects of the Green Growth Strategy on the company

It is considered that there are positive factors in various aspects, such as the expansion of the electric power market, the intensification of competition, the growth of demand for switching to green electric power, and the promotion of digital transformation.

(Taken from the reference material of the company)

(3) Initiatives in line with the Green Growth Strategy

Utilizing the contact points with consumers, they will engage with the Green Growth Strategy. As of now, they have announced the following two initiatives.

◎ Growing field 12. Housing, buildings, and next-generation solar power generation

In collaboration with Looop Inc., the company started offering an emergency demand response program to 22,370 households nationwide, in case of a power shortage. From now on, the company plans to develop an AI-based automatic control network for home appliances, storage batteries, electric vehicles, etc., and to establish a demand response platform.

◎ Growing field 14. Lifestyle

The company formed an alliance with Right Stuff Co., Ltd., which operates the hair salon mod’s hair, and commenced supporting the selection of green electric power at 370,000 barber shops/beauty parlors. From now on, the company plans to support decarbonization by encouraging enterprises and individuals that aim to achieve decarbonization to use environmentally friendly plans, and developing new services.

【4-2 Initiatives in the two businesses】

The Japanese energy sector is in the middle of great 9-year reforms from the electricity liberalization in 2016 to the start of the capacity market in 2024.

The policy reform related to the Platform business had been completed by 2020, in the first half of the reform period, so the Platform business is currently at the sales expansion phase.

On the other hand, the policy reform related to the Data business will span from 2021 to 2024, and the liberalization of electric power data and the start of the demand-supply adjustment market (third adjustment capacity 2) (start of the VPP market) are scheduled for 2022. Accordingly, the company is putting importance on upfront investment for developing and demonstrating services for the foreseeable future.

Under these circumstances, the management policies and target sales growth rates for the two businesses are as follows.

① Platform business

(Management policy)

The related policy reform has been completed as a whole by fiscal 2020, so the business environment has been prepared.

By increasing advertisement costs while keeping LTV and CAC sound, the company aims to maximize sales growth.

(Target sales growth)

To keep growing sales by 30% or higher.

② Data business

(Management policy)

In anticipation of the important policy reforms in 2022, the company puts importance on upfront investment for developing and demonstrating services in 2021. The company will launch new businesses step by step from 2022, and is expected to start full-scale growth from 2024.

(Target sales growth)

The company aims to achieve a growth rate of 10-20% between 2021 and 2023, and a growth rate of 30% or higher after 2024.

【4-3 Envisioned mid/long-term growth】

The company aims to achieve sales of 10 billion yen by the term ending December 2027, by growing sales by 30% or more every year.

At the timing of achieving sales of 10 billion yen, the company aims to get listed in the prime market, in order to win more trust of stakeholders.

(Taken from the reference material of the company)

5.Interview with CEO Kiguchi

Representative Director and CEO Yohei Kiguchi has delivered speeches and received several awards overseas. He is the first Japanese person to be featured in the Forbes 30 Under 30 Europe Edition, with his greatest strength being his deep knowledge about the latest circumstances regarding energy in the world. As CEO of ENECHANGE Ltd. and its subsidiary SMAP Energy Limited, he is in charge of the management strategy of the Group as well as its overseas coordination.

We interviewed Mr. Kiguchi regarding his company’s competitive advantage, future growth strategies, challenges, and his message to stockholders and investors.

Q: Firstly, we would like to ask about your company’s founding. You took a deep interest in the energy problem following the Great East Japan Earthquake of 2011 and got enrolled at Cambridge University, which is the pinnacle of the United Kingdom’s scientific institutions at the forefront of energy and power systems, after which you founded Cambridge Energy Data Lab Limited which would be the predecessor of your company, and conducted research. Could you tell us how you perceived Japan’s electric power and energy industries from the United Kingdom at the time?

Back when I was deepening my understanding of the energy problem, I saw the news about the electricity liberalization that started in Japan in 2016 and understood that an energy revolution was about to begin in Japan, too.

The United Kingdom had already undergone its electricity liberalization in 1999 and other European countries had liberalized their electricity roughly between 2008 and 2009, and because what was happening in Europe would happen in Japan as well, I strongly felt that being able to choose the electrical power company one wanted to use was a very natural and necessary action, which is why I founded this company.

The necessary action means two things.

The first is the necessity of improving the soundness of the Japanese energy industry and promoting innovation.

This is the case with all industries, but an appropriately competitive environment promotes innovation, eliminates waste, and leads to the creation of new venture businesses. On the contrary, industries without such competition do not produce such rejuvenation and are unable to provide merits to their users, with no prospects of development within the industry itself. Japan’s energy industry is in that very situation and is facing a multitude of problems, which is why we must reform it by letting in the wisdom and expertise from outside through liberalization.

The second point is the importance of providing consumers with the freedom of choosing their own electric power company.

After witnessing the disastrous scenes of the Fukushima Daiichi Nuclear Power Station Accident caused by the Great East Japan Earthquake, many citizens voiced their objection to nuclear power, but other than demonstrating publicly, they did not have any other method to carry out their protest.

On the other hand, the United Kingdom also had its share of people believing in the promotion of green energy, and they could express those views by choosing their own electric power company.

In other words, if you are against nuclear energy and want to promote the usage of green energy, you can just enter a contract with an electric power company which supplies said green energy. However, in Japan, even if you are against nuclear energy, you have no choice but to buy electricity from electric power companies like Tokyo Electric Power Company (TEPCO) Holdings which operates on nuclear energy. Reforming a situation like this and allowing consumers to choose their electric power companies on their own is not only relevant for the nuclear energy issue, but also of paramount societal significance.

My belief in the importance of these two points was a huge factor in the founding of this company.

Q: According to your company’s security report, the sales for the first year were around 5 million yen, but grew rapidly afterwards. What do you think were the factors that led to this growth?

As you said, the sales for our first year, which was the term ended December 2015, was 5 million yen, but we rapidly increased our sales to 180 million yen in the second term and 520 million yen in the third term.

The reason behind this growth might surprise you, but it is because TEPCO Holdings and Tokyo Gas, which are the two largest companies in Japan’s energy industry, became our customers at the onset and helped us grow together.

When the other electric power and gas companies saw these two companies proactively utilizing our company’s services, they started trusting us which led to an increase in business.

Why did TEPCO Holdings and Tokyo Gas decide to use our services? Taking up initiatives with a venture business that has only recently been founded seems to be a very rare case, but these companies were extremely passionate about their beliefs regarding the need to reform the energy industry after electricity liberalization. Because of that, they praised our company’s management team for their deep knowledge in Europe, which is leading the world in electricity liberalization, and fully supported us from the initial stages.

Q: Where do you think your company’s special characteristics, strengths, and competitive advantage come from?

I think there are three factors.

The first is the fact that we are the only company that offers the SaaS System specializing in the trends of the electric power industry.

Like the healthcare industry, the electric power industry has very high barriers to entry. In an industry with high barriers to entry like that, we are the only energy tech company, among both listed and unlisted companies, where professionals in this industry can gather, already has established a steady position, and is trusted by many electric power and gas companies.

With that position as our baseline, we plan to deeply commit ourselves to the reform of this industry by not just coping with liberalization but diving further into newer businesses, through which I believe our competitive advantage will be further solidified.

The second is a strong earnings foundation supported by a recurring revenue model.

The gross profit margin for the term ended December 2020 was 77%, but with the accumulation of recurring revenues, there is still huge room for increase.

We are still only in our sixth year since foundation and only recently got listed on the stock exchange, but with the establishment of a strong foundation like this for our earnings, we are moving from the foundation phase to the sales expansion phase.

The third is a management team comprised of personnel with an abundance of expertise.

We welcomed Mr. Kenichi Fujita, the former Representative Director, President and Chairman of Siemens K.K., as our new Outside Director in our previous General Meeting of Stockholders.

In addition, we have board members with deep knowledge regarding the circumstances of Japan and the world along with abundant expertise, including Mr. Minoru Takeda, who is the former President of Shell Japan Ltd., Mr. Akihiko Mori, who is the former CFO of RENOVA Inc., and Mr. Shinichiro Yoshihara, who is the Representative Director and CFO of EPCO Ltd.

Further, we have gathered members, including executive officers, who want to promote the reform of Japan’s energy industry and want to make it their life’s mission to resolve the energy problem.

The utilization of international expertise through the cooperation with our team in the United Kingdom is also one of our strengths.

Q: Could you tell us about your growth strategy?

The growth potential of the Platform business regarding the change of electricity and gas suppliers is still massive and the reform of the related legal systems is already complete. Accordingly, we will continue to grow steadily by attracting more customers online as well as offline through our partner channels.

Regarding the Data business, the period from 2021 to 2024 will be packed with major policy reforms and we are planning to use these reforms as a business opportunity to achieve rapid growth.

Even with a slightly conservative estimate, we believe we can achieve 10 billion yen in sales over five to six years through an annual sales growth rate of nearly 30% after which we will switch to the prime market using the profits gained, but until then we will be thoroughly focusing on our topline growth.

Q: I believe there are significant challenges in pursuing such a growth strategy. Could you please tell us how you are planning on dealing with these challenges and a shortage of resources?

I think there are two challenges.

The first is a weak financial base.

In our income statement, we have created a model with high profitability, but we are facing challenges in our balance sheet.

Our company was listed on the stock exchange in December 2020, but we had to narrow down the amount of money we procured for the balance with the public offering price. Our cash and deposits amount to over 1.3 billion yen but our interest-bearing debts is 760 million yen, which means our net cash is under 600 million yen, which is extremely insufficient compared to other growing IPO venture companies.

Having a limit on expendable capital for M&A and other advertising activities in the future will be a challenge for us as we pursue discontinuous growth.

The second challenge is our low visibility.

As I mentioned during the talk about our company’s founding, we are a company with an enormous social significance, which offers services that citizens all over Japan can utilize with a great deal of interest, but because we spend little for commercials and advertising expenses, our visibility remains extremely low.

Over half of the customers using services from ENECHANGE came through price comparison websites, which means they are not aware that they are using services from our company, and even for customers who accessed our company website first, the electric company website that was the top search result for them just happened to be ENECHANGE.

To take initiatives to increase our ARPU in the future, we need to establish customer value as an asset, which is why improving our brand visibility is essential.