Bridge Report:(4205)ZEON fiscal year ended March 2023

Kimiaki Tanaka President | ZEON CORPORATION(4205) |

|

Company Information

Market | TSE Prime Market |

Industry | Chemicals |

President | Kimiaki Tanaka |

HQ Address | Marunouchi 1-6-2, Chiyoda-ku, Tokyo Shin-Marunouchi Centre Building |

Year-end | March |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding (including treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥1,419 | 229,513,656 shares | ¥325,679 million | 3.2% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥40.00 | 2.8% | ¥89.93 | 15.7 x | ¥1,591.79 | 0.8 x |

* Share price as of closing on May 9. Each number is from the financial results for the fiscal year ended March 2023.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2019 | 337,499 | 33,147 | 36,319 | 18,458 | 84.06 | 19.00 |

Mar. 2020 | 321,966 | 26,104 | 28,744 | 20,201 | 92.44 | 21.00 |

Mar. 2021 | 301,961 | 33,408 | 38,668 | 27,716 | 126.74 | 22.00 |

Mar. 2022 | 361,730 | 44,432 | 49,468 | 33,413 | 153.22 | 28.00 |

Mar. 2023 | 388,614 | 27,179 | 31,393 | 10,569 | 49.94 | 36.00 |

Mar. 2024 Est. | 399,000 | 24,000 | 26,000 | 19,000 | 89.93 | 40.00 |

*Unit: million yen, yen. Estimates are those of the company. Effective from the beginning of March 2022, the "Accounting Standard for Revenue Recognition" (ASBJ Statement No. 29) and others are applied. Net income is net income attributable to owners of the parent company. The same applies hereinafter.

This Bridge Report presents ZEON CORPORATION’s earnings results for the fiscal year ended March 2023.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2023 Earnings Results

3. Fiscal Year ending March 2024 Earnings Forecasts

4. Conclusions

<Reference 1: Medium-term Management Plan>

<Reference 2:Regarding Corporate Governance>

<Appendix:Fact Sheet>

Key Points

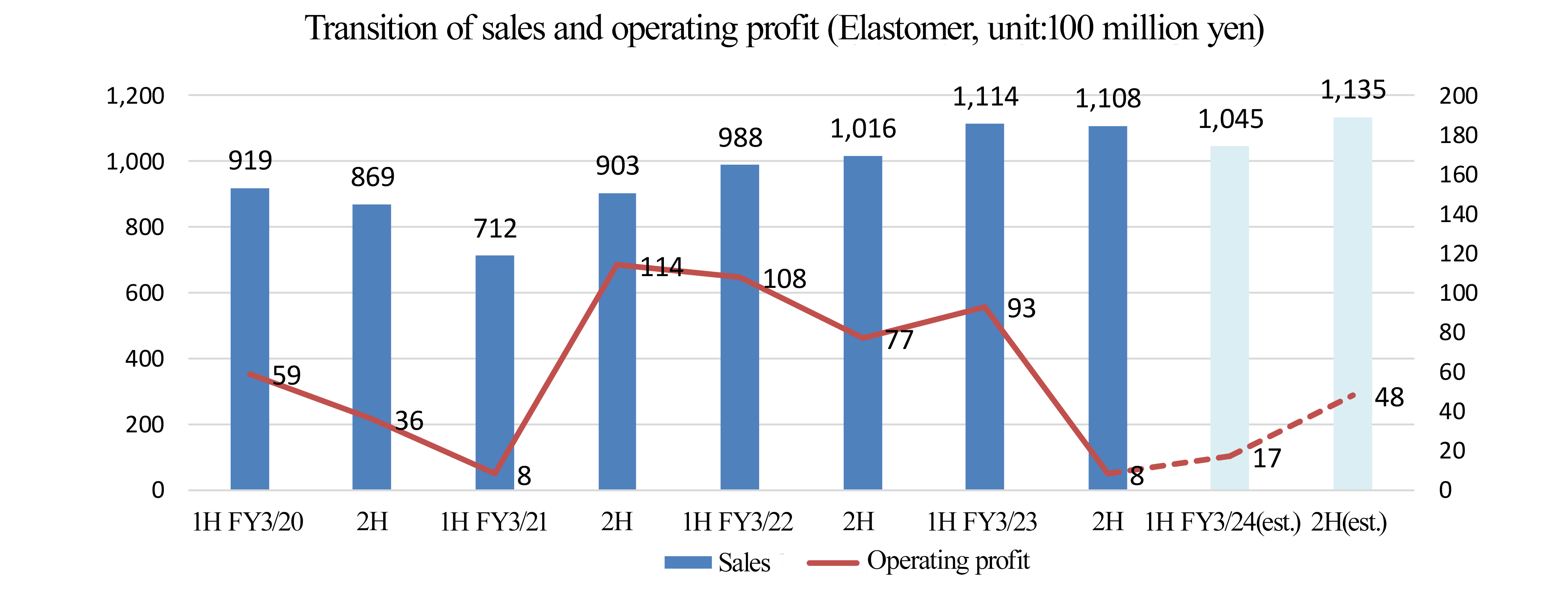

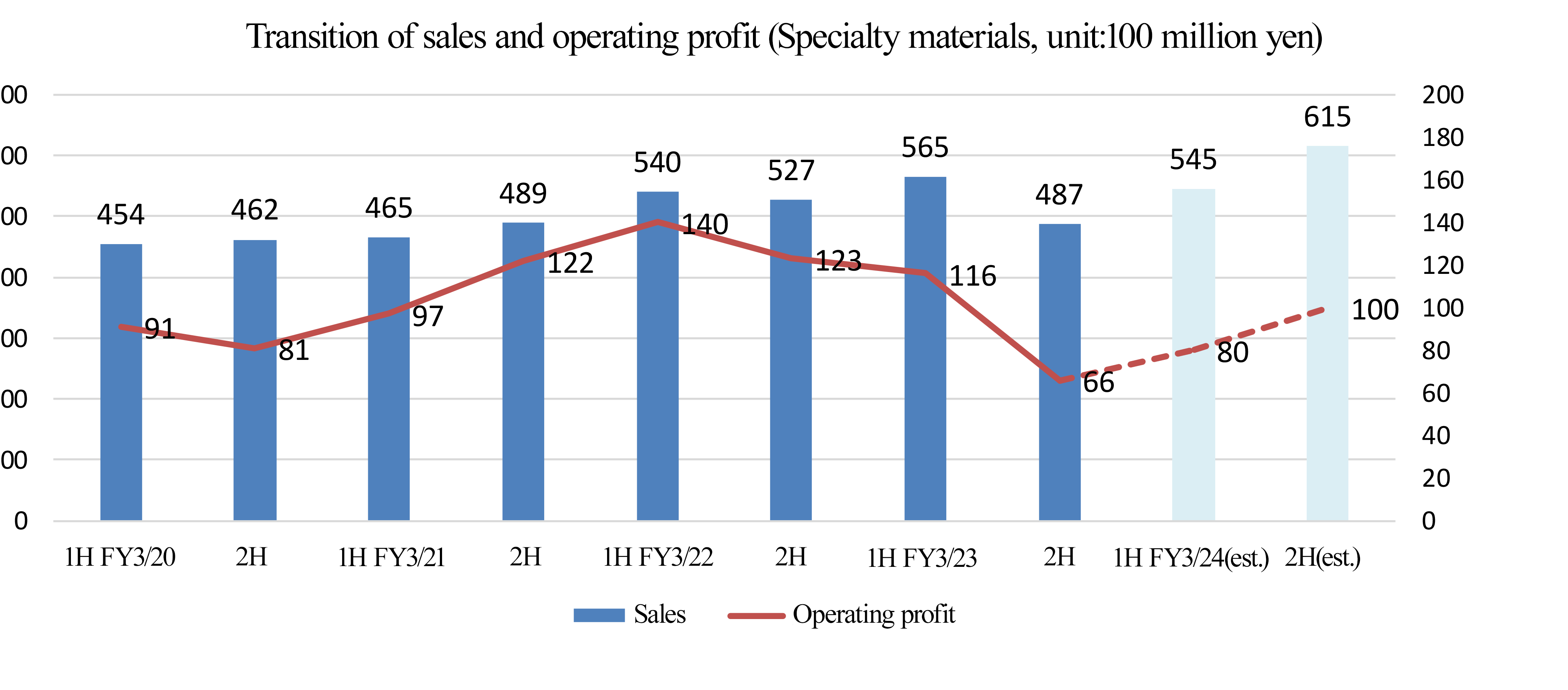

- In the fiscal year ended March 2023, sales increased 7.4% year on year to 388.6 billion yen, while operating income decreased 38.8% year on year to 27.1 billion yen. The Elastomer Business saw the growth of sales and the decline in profit. Sales increased due to sales price revisions for synthetic rubber and chemical products, but profit decreased due to decreased shipment volume, soaring raw material and energy prices, and rising sea freight rates. Sales and profit dropped in the Specialty Materials Business. Sales increased mainly for battery materials and optical resins, but the sales of optical films were affected by production adjustments by customers. The company paid a term-end dividend of 18 yen/share. The annual dividend will be 36 yen/share, up 8 yen/share from the previous term.

- In the fiscal year ending March 2024, sales are expected to increase 2.7% year on year to 399 billion yen, while operating income is projected to decrease 11.7% year on year to 24 billion yen. In the Elastomer Business, the company expects that demand will recover from the second half and sales and profit will decrease slightly. In the Specialty Materials Business, sales are expected to increase 10.1%, but operating income is forecast to decrease 1.6% due to periodic repairs at main plants and prolonged production adjustments by customers. Dividends are forecasted to be 20 yen/share for the interim period and 20 yen/share for the end of the term. Thus, the annual dividend is expected to be 40 yen/share, up 4 yen/share from the previous term, and the dividends are forecast to increase for the 14th consecutive term from the fiscal year 2010. The expected dividend payout ratio is 44.5%.

- In the fiscal year ended March 2023, the company was affected by soaring raw material prices, their reflection in selling prices, and production adjustments by customers. As a result of being greatly affected by the external environment, the company was forced to revise its earnings forecasts three times during the term. However, raw material prices have already stabilized in the fiscal year ending March 2024. Demand is expected to recover in the second half, and we would like to pay attention to this recovery. Regarding lithium-ion batteries for electric vehicles, production adjustments by customers have been prolonged in the short term, but recovery is expected from the second quarter onward, which will result in significant growth. In addition, cycloolefin polymer (COP), which has wide applications mainly in optics and medicine, is steadily accumulating results, primarily in the medical and other fields. Thus, its outlook is bright. Despite short-term economic and market deterioration, medium/long-term growth is likely to continue. Dividends have increased for 14 consecutive terms. Thus, aggressive shareholder returns have also been highly recognized. The medium-term management plan is expected to be announced in June, so we would like to keep an eye on it.

1. Company Overview

ZEON CORPORATION is a petrochemical manufacturer that maintains numerous products with a large share of the global markets including synthetic rubber used in automobile parts and tires, synthetic latex used in surgery-use gloves, and other products. The Company’s strengths include its creative technology development function, R&D structure, and high earnings generation capability. Many of the products and materials manufactured by Zeon are used in a wide variety of products including automobile parts and tires, rubber gloves, disposable diapers, cell phones, LCD televisions, perfumes and other products commonly used in everyday life. The Zeon Group is comprised of the parent company, 59 subsidiaries and 7 affiliated companies. Zeon also has manufacturing and marketing facilities in 16 countries around the world.

(Annual Securities Report for the fiscal year March 2022)

|

|

(Source: the company)

1-1 Company Name and Management Vision

The company name “Zeon” is derived from the Greek word for earth “geo” (phonetically pronounced “zeo” in Japanese) and the English word reflecting eternity “eon,” and reflects the Company’s principle of “deriving raw materials from the earth and perpetually contributing to human prosperity” through the development and application of creative technologies.

(Zeon’s original name “Geon,” used at the time of its establishment, was derived from the trademark acquired for the vinyl chloride plastics “Geon” from B.F. Goodrich chemical Company in the United States, with which it had capital and collaborative technological agreements. The company name was changed to “Zeon” when the capital agreement was dissolved in 1970.)

1-2 Corporate History

Zeon was established as a joint venture company formed by the Furukawa Group of companies: Nippon Light Metal Co., Ltd., Furukawa Electric Co., Ltd., and Yokohama Rubber Co., Ltd. in April 1950 to acquire and use the vinyl chloride resins technology from B.F. Goodrich Chemicals Co.

In 1951, Goodrich acquired 35% of the shares of Zeon for full-scale technological and capital partnership, and in 1952 mass production of vinyl chloride resins began in Japan for the first time.

In 1959, Goodrich transferred synthetic rubber manufacturing technologies to Zeon, which, in turn, started Japan’s first mass production of synthetic rubber. Manufacturing facilities were also expanded to match the growing demand for automobile parts.

In 1965, use of the Company’s unique technology called Geon Process of Butadiene (GPB) for the efficient manufacture of butadiene (main raw material of synthetic rubber) from C4 fraction was operational.

Goodrich transferred its specialty synthetic rubber business to Zeon along with the shift in its main business focus toward vinyl chloride resins. Capital ties were dissolved in 1970. Along with these changes, the Company name was changed from Geon to Zeon in 1971.

Also, in 1971, Zeon developed a unique technology called Geon Process of Isoprene (GPI) and began using it to manufacture raw materials including high-purity isoprene, Petroleum plastics, and synthetic perfume ingredients from C5 fraction.

After entering the 1980s, Zeon aggressively launched new businesses in various fields including photoresists and other information materials, synthetic fragrance, and medical-related applications in addition to its main synthetic rubber business.

In 1984, production of hydrogenated nitrile rubber Zetpol®, which currently has top share of the worldwide market, began at the Takaoka Plant.

In 1990, manufacture of cyclo olefin polymer (COP) ZEONEX®, which is the main product of the specialty materials business using the GPI method to extract and synthesize products, was started at the Mizushima Plant.

In 1993, Zeon entered China with its electronics materials business.

In 1999, Zeon Chemicals L.P. (Consolidated subsidiary in the United States) acquired the specialty rubber business of Goodyear Tire & Rubber Company of the United States to become the world’s top manufacturer of specialty rubber.

In 2000, Zeon discontinued production of vinyl chloride resins at the Mizushima Plant, and thus withdrew from the Company’s founding business.

Since the 21st century came, the company has been operating business actively. For example, by releasing ZeonorFilm®, an optical film for LCD, strengthening global production and sales systems, starting the commercial operation of solution-polymerized styrene-butadiene rubber(S-SBR) in Singapore, upgrading the equipment for optical films for LCD in Himi-shi, Toyama Prefecture, starting the operation of the world’s first mass-production factory for super-growth carbon nanotubes, and establishing a joint venture for manufacturing and selling S-SBR in cooperation with Sumitomo Chemical.

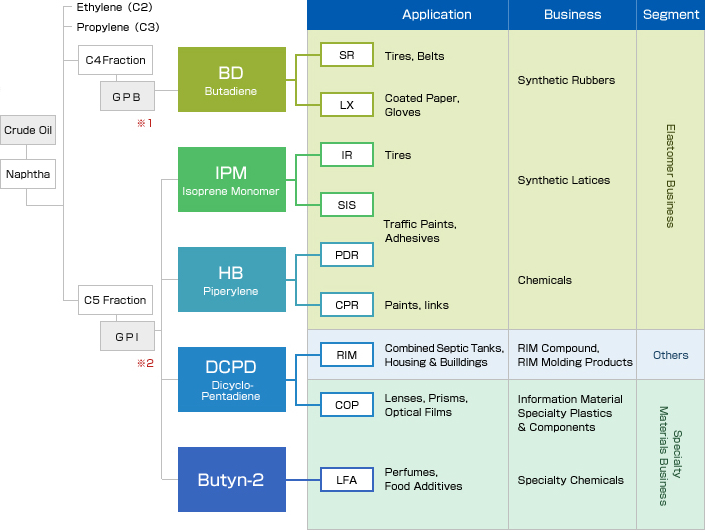

1-3 Business Description

Zeon’s main products use various extracted from naphtha, which is extracted by distillation of crude oil.

When the naphtha is heated, carbon monoxide gas (C1), ethylene (C2), and propylene (C3) are extracted in sequence.

Zeon uses butadiene extracted in the GPB method developed in-house from C4 fraction, isoprene monomer, piperylene, dicyclopentadiene, and 2-butyne extracted from C5 fraction using the GPI method, as raw materials to be processed into synthetic rubber, synthetic latex and various other materials.

(Source: the company)

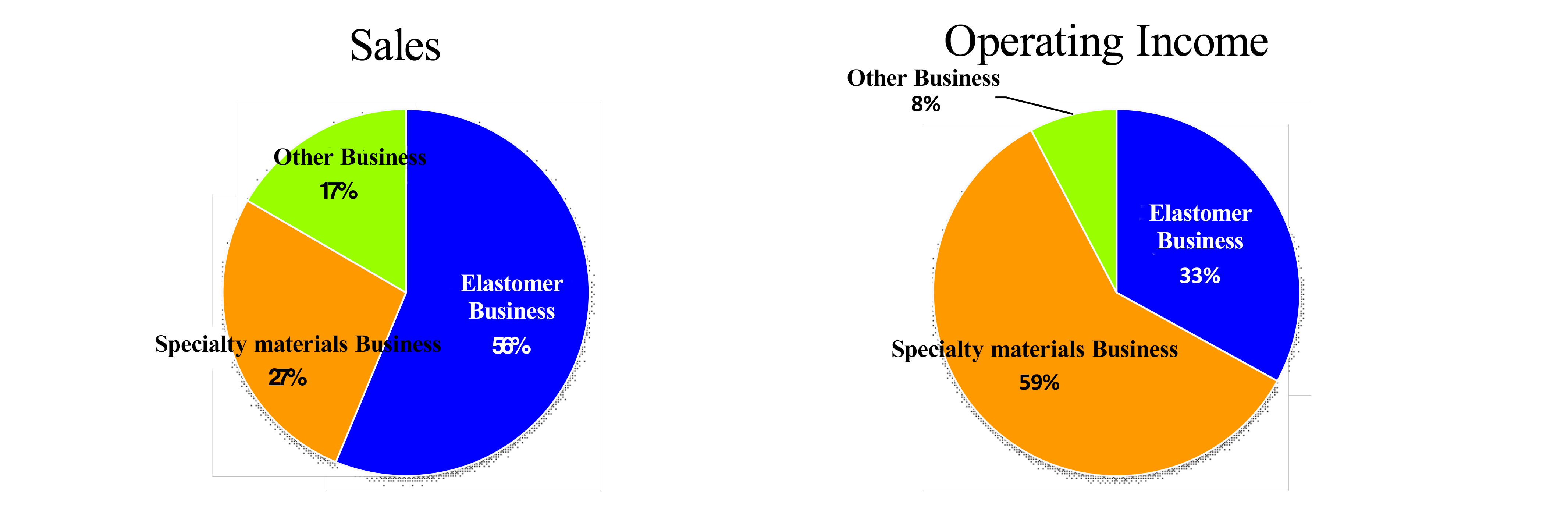

Zeon has three business segments: 1) the elastomer business, where manufactured basic materials are sold to customers; 2) the specialty materials business, where basic materials are submitted to primary processing for sale to customers as processed materials, and 3) the other business.

*Both are results for the fiscal year ended March 2023. Composition ratio is before elimination and company-wide.

Elastomer Business

Elastomers are “high molecular compounds that have rubber-like elastic properties,” an example of which is synthetic rubber. As described in the corporate history section of this report, in 1959 Zeon became the first company in Japan to mass-produce synthetic rubber, which became the foundation underlying all of Zeon’s businesses. This business includes the segments of synthetic rubbers, synthetic latices, and chemicals products (Petroleum resins, thermoplastic elastomers) businesses.

1) Synthetic Rubbers Business

Example of final product: Tires

Zeon provides the world’s leading tire manufacturers with the world’s highest-quality synthetic rubber for use in tires. Among the various types of synthetic rubber manufactured are styrene butadiene rubber (SBR), which promotes superior abrasion resistance, aging resistance and mechanical strength properties, butadiene rubber (BR), which includes a superior balance between elasticity, wear and low-temperature properties, and isoprene rubber (IR), which features similar properties as natural rubber but with higher quality stability. It is expected that the demand for S-SBR for fuel-efficient tires, which was developed by improving the characteristics of SBR, will grow rapidly. In order to increase the supplying capacity for coping with it, the first line of Singapore Factory started operation in September 2013, and the second line in April 2016. The supplying capacity of Singapore Factory is now 70,000 tons.

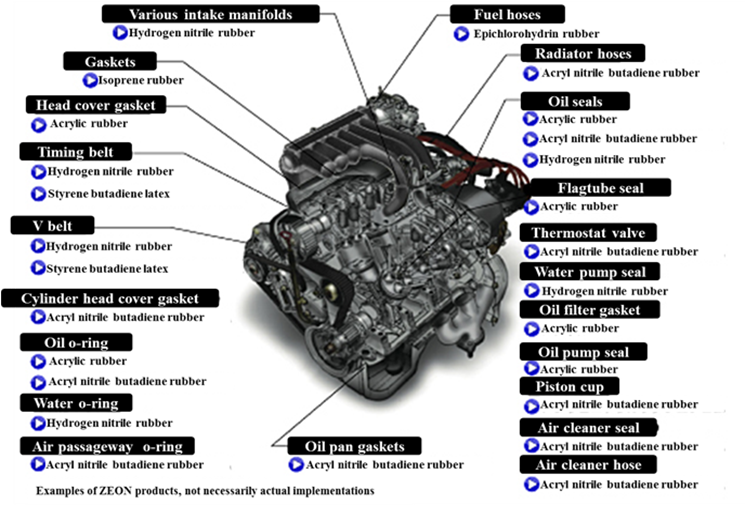

Example of product: Automobile Parts

(Source: the company)

Radiator hoses, fuel hoses, fan belts, oil seals, and various other car engine parts use specialty synthetic rubber that has superior oil resistance and heat deterioration-resistant qualities.

Zeon is the world’s number one manufacturer of specialty synthetic rubber and features high quality levels and high market share of specialty synthetic rubber automobile parts. In particular, Zeon’s Zetpol® hydrogenated nitrile rubber, used for timing belts, displays superior heat and oil resistance and mechanical strength characteristic and claims high share of the worldwide market.

Furthermore, a new grade of Zetpol® has vastly improved the performance of products using the original versions of Zetpol®.

Products using the new grade of Zetpol® are heat resistant at temperatures that exceed the limits for the original version of Zetpol® by 10 degrees centigrade, thereby extending the life of seals and gaskets, and are in strong demand for use in next generation bio-fuel engines. The new grade of Zetpol® is well suited to extrusion processing which is being leveraged to expand its usage in various hoses. Products using Zetpol® have also been well received by customers and are being used increasingly as a replacement material for more expensive competitive rubber in Japan, Asia, Europe, and North America.

2) Synthetic Latices Business

Synthetic latex is liquid rubber that synthetic rubber dispersed in water. It is used to manufacture gloves, paper coating, textile processing, adhesives, paints, and cosmetic puffs, etc. Zeon has high share of NBR latex used in cosmetic puffs in the world.

3) Chemicals Business

Zeon produces C5 fraction by its unique in-house GPI method, and turn it into materials for adhesive tapes and hot melt adhesive traffic paint binder and a wide variety of other products.

Specialty Materials Business

Zeon deals in high value-added materials and parts that are created using its unique technologies including polymer design and processing technologies.

This is composed of the specialty plastics business, including optical plastics and optical films, the specialty chemicals business, including specialty chemicals, battery materials, electronic materials and polymerized toners, and the medical devices business.

1) Specialty materials Business

◎ Optical plastics and optical films

Cyclo olefin polymer is thermoplastic polymer developed using raw material extracted from C5 fraction using GPI methods and synthesized with Zeon’s own unique technologies. The commercial products are ZEONEX® and ZEONOR®.

ZEONEX® leverages its high transparency, low water absorption, low absorptive and chemical resistance properties for use in camera and projector lenses and other optical applications and in medical use containers including syringes and vials.

ZEONOR® leverages its high transparency, transferability, and heat resistance properties for use as transparent general use engineering plastics used in light guide plates, automobile parts, semiconductor containers and a wide range of other product applications.

ZeonorFilm® is the world's first optical film by the melt extrusion method from the cyclo olefin polymer. It is excellent in optical properties, low water absorption / low moisture permeability, high heat resistance, low outgassing, and dimensional stability. It is used in a wide range of applications such as displays for LCD TV, smartphones, tablets, and OLED displays.

(Source: the company)

“Diagonally-stretched optical film” is also Zeon’s world first development.

The OELD application as anti-reflection film is progressing, and demand for small- to medium-sized flat panel display applications is growing. The company’s optical films are produced in 3 bases: Takaoka city, Toyama prefecture, Himi city, Toyama prefecture, and Tsuruga city, Fukui prefecture.

ZEOCOAT® is organic insulation material used in electronic devices such as cellphones, smartphones, and LCD televisions.

ZEOCOAT® was successful in improving both the picture quality and reliability of displays because of its high transparency, extremely low water absorption and low gas generation properties. Zeon will aggressively expand its marketing efforts for OELDs, which will be thinner displays than LCD, thin-film transistors using new semiconductors, and flexible displays.

2) High Performance Chemicals Business

◎ Battery Materials

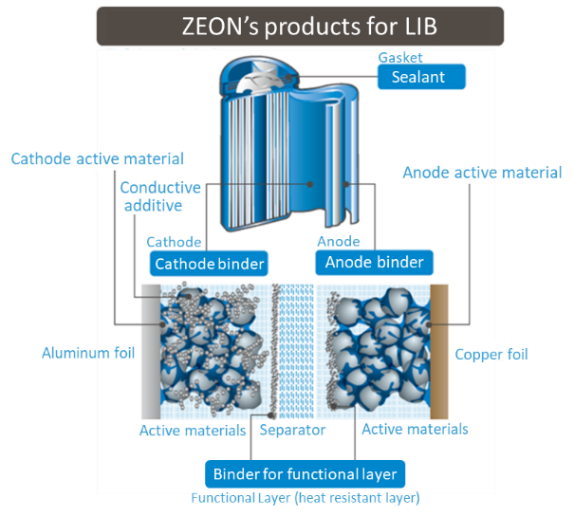

Zeon provides materials for Li-ion battery in this segment; anode / cathode binders, binder for functional layer (heat resistant separator), and sealant. Currently, Li-ion batteries are widely used as a power source for mobile devices such as smartphone and notebook computers and there is a strong demand for batteries with higher capacity.

Adoption for electric vehicles, including hybrid and plug-in hybrid cars, and industrial power sources (such as smart grids, etc.) is expanding, since it is lightweight and compact and can store a lot of energy. On the other hand, there was a problem that lifetime tends to decrease under high temperature usage. The company has advanced the function of Li-ion battery binder and succeeded in developing an aqueous cathode binder, which greatly contributes to longer battery life. In addition, Zeon succeeded in commercializing anode binder, which can raise the storage capacity of Li-ion battery by 5% to 15%.

The company believes that its binders and sealants for the cathode, anode, and functional layer (heat-resistant separator) will contribute to the improvement of the five major performance parameters of lithium-ion batteries: durability, capacity, productivity, safety, and quick charge, and thus contribute to the popularization of electric vehicles.

The company focused on the promising future of Li-ion batteries and worked on it for a long time. Zeon seeks to keep its top share in the Li-ion battery binder market, aims to expand the diffusion of new material functions that meet the needs of the application and propose functional materials to realize the next generation of new batteries.

(Source: the company)

◎ Specialty Chemicals

Zeon deals in specialty chemicals that use derivatives from C5 fraction, such as synthesized fragrances for cosmetics and flavor used in foods, characteristic solvents, and plant growth regulator.

The Company holds the world’s top share of the synthesized fragrances in green note. They provide a wide range of specialty products including ingredients for intermediary bodies used in medical and agricultural chemicals, alternative solvents to CFCs, cleaning agents, urethane expanding agent, and functional ether agents.

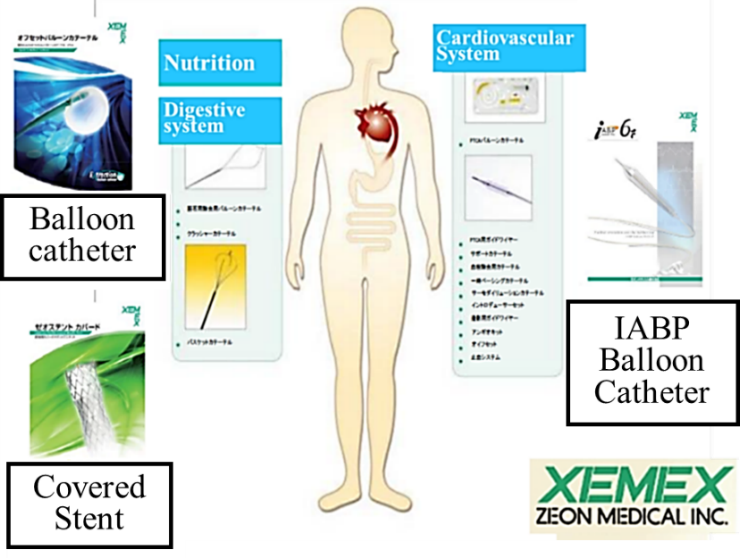

3) Medical Devices Business

The medical device market is relatively well insulated from fluctuations in the economy and is anticipated to grow with the aging society in Japan and expansion in developing countries. Furthermore, medical device companies are subject to strict laws and regulations, and they need to submit approval applications to regulatory bodies. In addition, the need to develop relationships with healthcare professionals is critical and the subsequent high barriers to entry makes this a highly attractive market.Along with the start of development of artificial kidneys in 1974, Zeon aggressively promoted its medical device business. In 1989, a subsidiary Zeon Medical Inc. was established to conduct development, manufacturing, sales, and all other functions of the medical field for the Zeon Group. Zeon has shown bountiful development track record both in gastroenterology and cardiovascular area.

“The Offset Balloon Catheter” as a means of differentiation in the gallstone removal process and with Japan’s first biliary covered stent “Zeostent Covered in the area of gastroenterology products, and the world’s smallest diameter “XEMEX IABP Balloon PLUS” as a device to aid the heartbeat at times of acute myocardial infarction in the area of cardiovascular products.

(Source: the company)

Currently Zeon is focusing efforts in the development of the biliary stone removal devices that eliminate pain. Zeon has a lineup of products for extracting biliary stones ranging from extremely large stones to sludge and sand with products such as XEMEX Crusher Catheter, XEMEX Basket Catheter NT, Extraction Balloon Catheter, and is aiming at a 50% share of the gallstone removal market.In March 2016, the Company launched the world’s first optical sensor FFR device as a type of guide wire. Because it uses an optical fiber sensor, mistaken readings of blood pressure measurements rarely occur. The operability as a guide wire has also gained a high evaluation.

* FFR: fractional flow reserve ratio for quantitatively evaluating the severity of lesions and determining treatment strategies in diagnosing and treating coronary arteries.

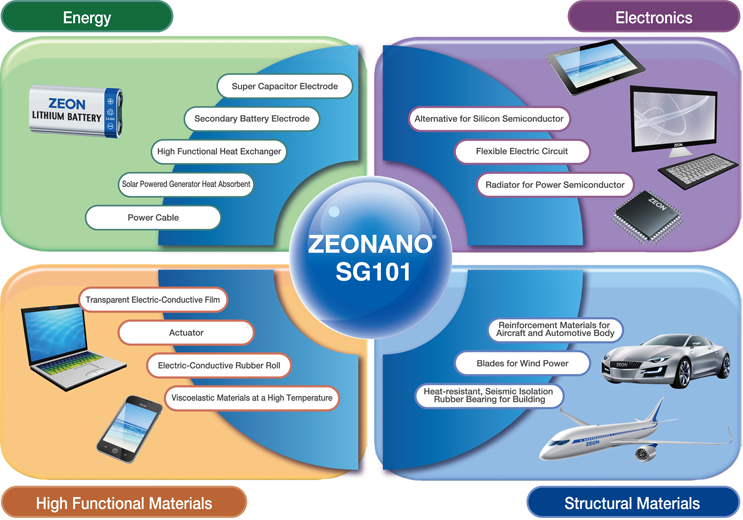

【New Specialty Materials Development: ~Carbon Nano Tube (CNT)~ 】

Aggressive R&D activities have allowed Zeon to launch various new materials into the market, and particularly high expectation is in the development of “single-wall carbon nanotubes (CNT)”.

1) What is Single-Walled CNT?

Carbon Nanotubes (CNTs) are cylindrical nanostructure formed by hexagonal lattice of carbon atoms. In 1993, Sumio Iijima, Ph.D., head of the Applied Nanotube Research Center of the National Institute of Advanced Industrial Science and Technology (AIST), discovered this structure for the first time in the world and named Carbon Nanotubes (CNTs). CNTs are categorized into single-walled and multiple-walled CNTs. Multiple-walled CNT is relatively easy to manufacture and the developments for commercial applications already started.

At the same time, single-walled CNT exhibits the following properties and is superior to multiple-walled CNT:- 20 times stronger than steel- 10 times more heat conductive than copper- Half as dense as aluminum- 10 times the electron mobility of silicon- lightweight but highly flexible- has extremely high electric-and heat-conductivity properties

Possible CNT applications are electrical conductivity assistance agent in Li-ion batteries, transparent conductive film used in electronic paper and ultra-thin touch panel because of its high elasticity and strength, and as a thermal interface material. Because of its ability to absorb a wide spectrum of light, practical applications of single-walled CNT are being promoted in the area of electromagnetic wave absorbing materials for use in a wide range of fields including energy, electronics, structural materials, and other specialty materials.

(Source: Homepage of Zeon Nano Technology Co., Ltd.)

Conventional single-walled CNT has several major issues including high levels of impurities, low levels of productivity and high manufacturing costs, which are about several tens of thousands to hundreds of thousands of yen per gram.

2) Zeon’s Efforts and Position

Against this backdrop, the company aims at establishing technologies that are necessary for the commercialization of new products using single-walled CNT developed in Japan with its numerous superior qualities in response to the worldwide social demands to realize a low-carbon society.

3) Future Endeavors

Having established the mass production technology based on the super growth method, Zeon completed the CNT production facility and started mass production, the first in the world in November 2015 in its Tokuyama plant at Shunan-city, Yamaguchi Prefecture.

Zeon is the only company in the world that has established mass production technologies for single-wall CNT. Companies around the world request for its product samples. Consequently, shipments of samples have already begun. Zeon has also begun to propose practical applications of this product.

Developing a technology for suppressing lithium dendrites with the sheets based on carbon nanotubes is expected to contribute to significant improvement in the life of lithium metal electrodes (negative electrodes) and to accelerating the practical application of high energy density and large capacity lithium metal electrodes (negative electrodes) (from the company's press release on January 25, 2022).

At the same time, single-wall CNT is a type of nanomaterial that is extremely small and fiber shape. Therefore, there is a concern that it may have some impact upon biological processes depending upon its size and shape. Currently, the AIST is conducting standardization of the evaluation process, and activities for the OECD endpoint measurement are being conducted, with global standardization and legal and regulatory aspects being considered.

Other Business

The combination liquid for Reaction Injection Molding (RIM) using the ingredient dicyclopentadiene (DCPD) as a raw material.

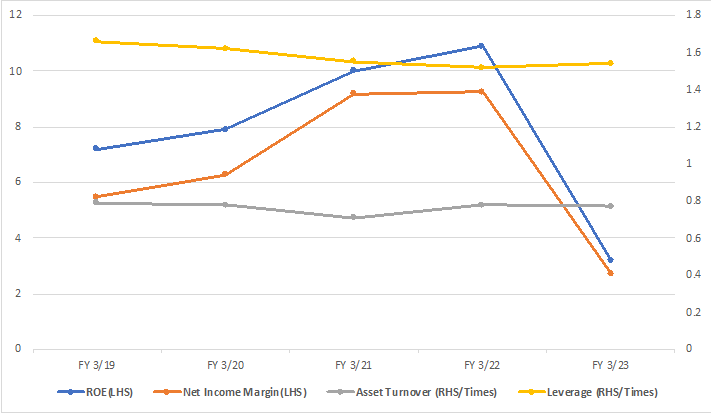

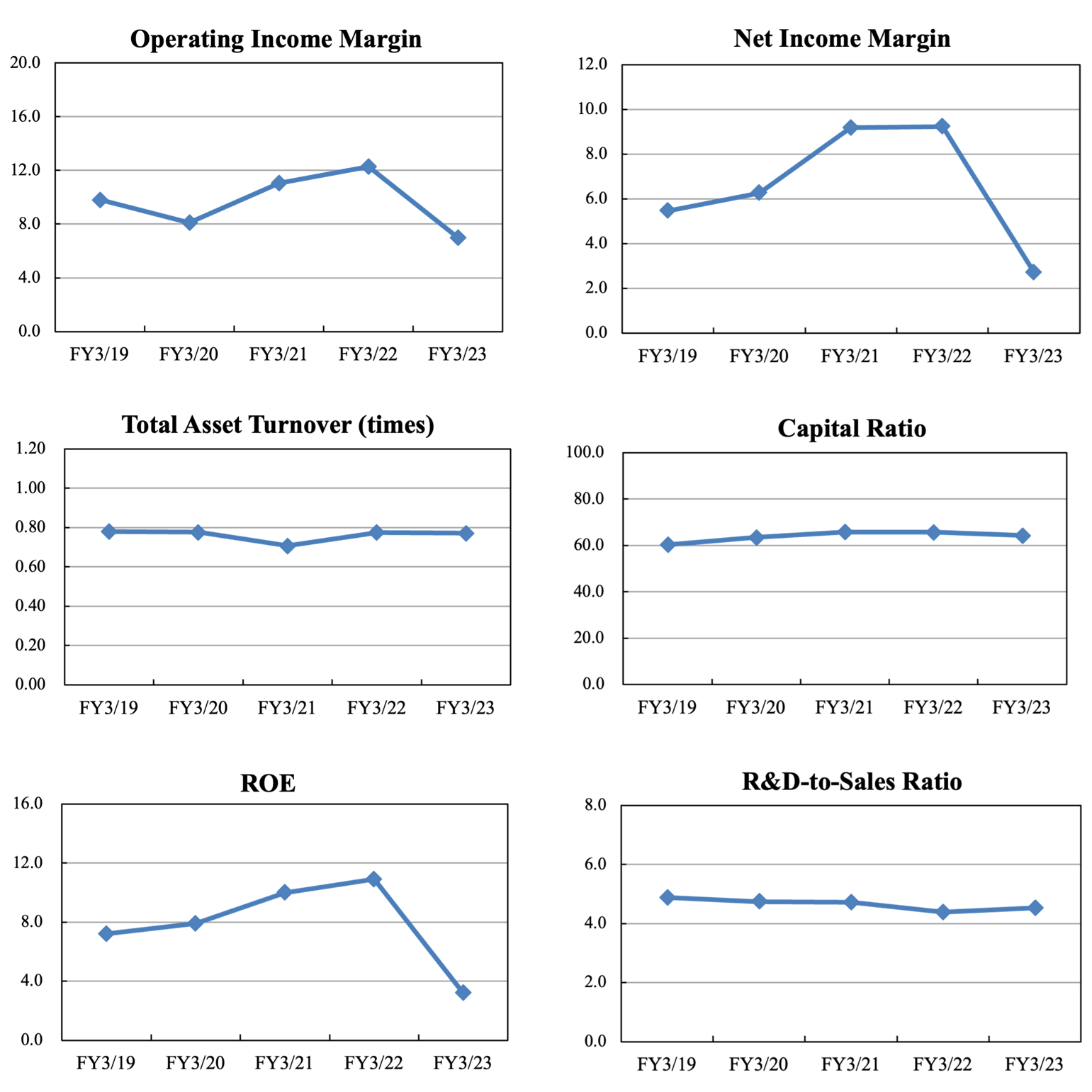

1-4 ROE Analysis

| FY Mar. 16 | FY Mar. 17 | FY Mar. 18 | FY Mar. 19 | FY Mar. 20 | FY Mar. 21 | FY Mar. 22 | FY Mar. 23 |

ROE (%) | 8.6 | 10.3 | 5.3 | 7.2 | 7.9 | 10.0 | 10.9 | 3.2 |

Net income margin (%) | 6.12 | 8.05 | 3.92 | 5.47 | 6.27 | 9.18 | 9.24 | 2.72 |

Total asset turnover (times) | 0.75 | 0.72 | 0.78 | 0.79 | 0.78 | 0.71 | 0.78 | 0.77 |

Leverage (x) | 1.86 | 1.77 | 1.71 | 1.66 | 1.62 | 1.55 | 1.52 | 1.54 |

ROE exceeded 10% in the fiscal years ended March 2021 and March 2022. However, ROE remained low in the fiscal year ended March 2023 due to a decline in the net income margin. We look forward to improved profitability mainly due to the recovery of economic and market conditions and the growth of the Specialty Materials segment.

*Prepared by Investment Bridge Co., Ltd. based on the disclosed material.

1-5 Characteristics and Strengths

1. World’s Leading Creative Technology Development Capability

The GPB method used to manufacture butadiene from C4 fraction is the most important development in Japan’s postwar history of chemicals and is licensed to 49 plants in 19 countries around the world.

In addition, the Mizushima Plant is the world’s only plant with GPI method to extract high-purity isoprene and other effective substances from C5 fraction. This Zeon’s GPI method is a completely unique technology, which is not provided to other companies.

These two technologies represent the creative technological capabilities that are among the strengths of Zeon. They also are highly regarded and have received numerous awards in the global markets. Regarding technologies, Zeon has received 48 awards since 1960 including the GPB and GPI methods, in addition to 26 awards since 1982 for its environment conservation and safety efforts.

2. High Worldwide Share

Zetpol®, ZEONEX®, and ZEONOR® are representative of the products born from Zeon’s highly creative technologies, which have allowed it to acquire high shares of worldwide markets. In addition, their Leaf alcohol for in cosmetics and food flavorings and NBR latex for cosmetic puffs have the world’s top share.

3. R&D Structure that Continues to Yield Creative Technologies

Zeon seeks to conduct R&D activities based upon its basic corporate philosophy of "contributing to society by continuously creating the world's No.1 products and businesses based on innovative and original technologies that are unique to ZEON, even in niche markets, in fields in which ZEON excels, and that no one else can imitate, and that are friendly to the earth."

The Company’s main R&D center is in Kawasaki City, Kanagawa Prefecture. Zeon has also established the Precision Optics Laboratory and Medical Laboratory at the Takaoka Plant, the Specialty Chemical Product Research Facility at the Yonezawa Plant, the Toner Research Facility at the Tokuyama Plant and C5 Chemicals Laboratory at the Mizushima Plant for more efficient R&D activities to be conducted closer to the manufacturing sites. The technical support bases are in the U.S., Germany, Singapore, and China.

New research and development initiatives have also been launched, including the establishment of the Emergence Promotion Center, which specializes in new businesses and technologies, and is taking on the challenge of sustainable research and development, including efforts to address the SDGs, which are to be attained by 2030.

2. Fiscal Year ended March 2023 Earnings Results

2-1 Consolidated Earnings

| FY 3/22 | Ratio to sales | FY 3/23 | Ratio to sales | YoY | Compared with forecast |

Sales | 361,730 | 100.0% | 388,614 | 100.0% | +7.4% | +0.4% |

Gross Profit | 120,358 | 33.3% | 109,643 | 28.2% | -8.9% | - |

SG&A | 75,927 | 21.0% | 82,464 | 21.2% | +8.6% | - |

Operating Income | 44,432 | 12.3% | 27,179 | 7.0% | -38.8% | -2.9% |

Ordinary Income | 49,468 | 13.7% | 31,393 | 8.1% | -36.5% | -0.3% |

Net Income | 33,413 | 9.2% | 10,569 | 2.7% | -68.4% | -42.9% |

*Unit: million yen. Forecast ratio is compared with the revised forecast of 1/31.

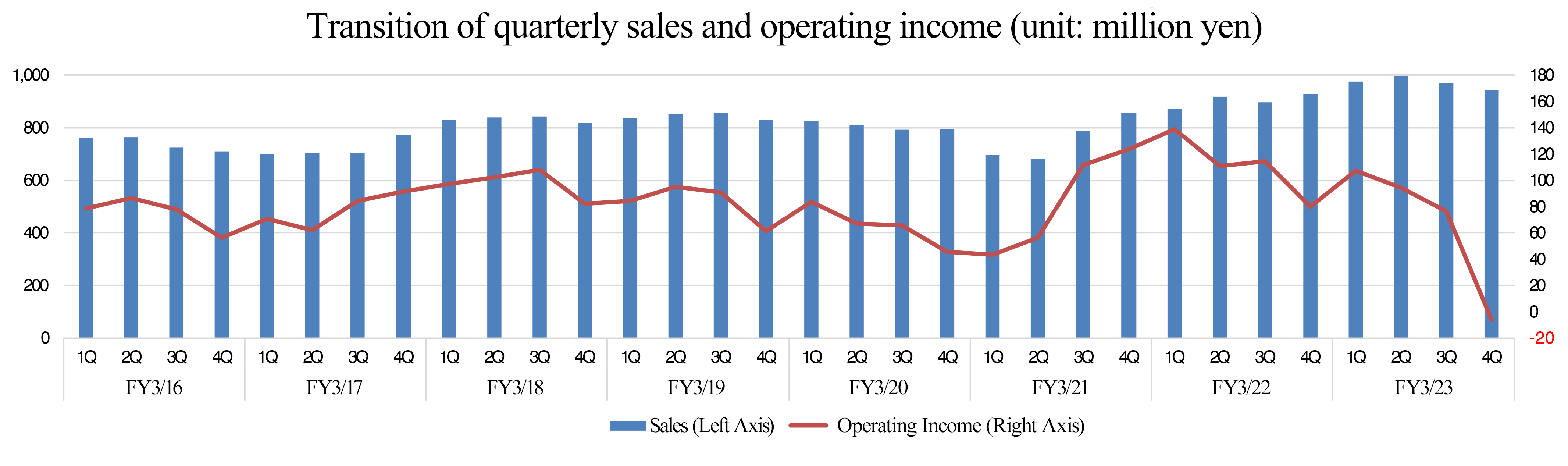

◎Quarterly Earnings

| 1Q FY 3/22 | 2Q | 3Q | 4Q | 1Q FY 3/23 | 2Q | 3Q | 4Q |

Sales | 87,171 | 91,904 | 89,681 | 92,974 | 97,576 | 99,841 | 96,788 | 94,409 |

Operating Income | 13,865 | 11,086 | 11,454 | 8,027 | 10,726 | 9,458 | 7,651 | -656 |

Sales increased, and profit decreased.

Sales were 388.6 billion yen, up 7.4% year on year, and operating income was 27.1 billion yen, down 38.8% year on year.

The Elastomer Business saw the growth of sales and the drop in profit. Sales increased due to sales price revisions in synthetic rubber and chemical products, but profit dropped due to a decrease in shipment volume, soaring raw material and energy prices, and rising sea freight rates.

Sales and profit decreased in the Specialty Materials Business. The sales of battery materials and optical resins increased, but optical films were affected by production adjustments by customers. Sales price revisions continued due to soaring raw material prices, but profit decreased due to rising sea freight rates and decreased shipments of optical films.

Net income declined 68.4% year on year to 10.5 billion yen. Regarding the carbon nanotube business, the company posted an impairment loss of 19.3 billion yen as an extraordinary loss. This was mainly due to the delay in the business plan for some applications and the book value being reduced to a recoverable amount, because the company did not expect the investment amount to be recovered due to the decline in profitability of the production equipment at Tokuyama Plant.

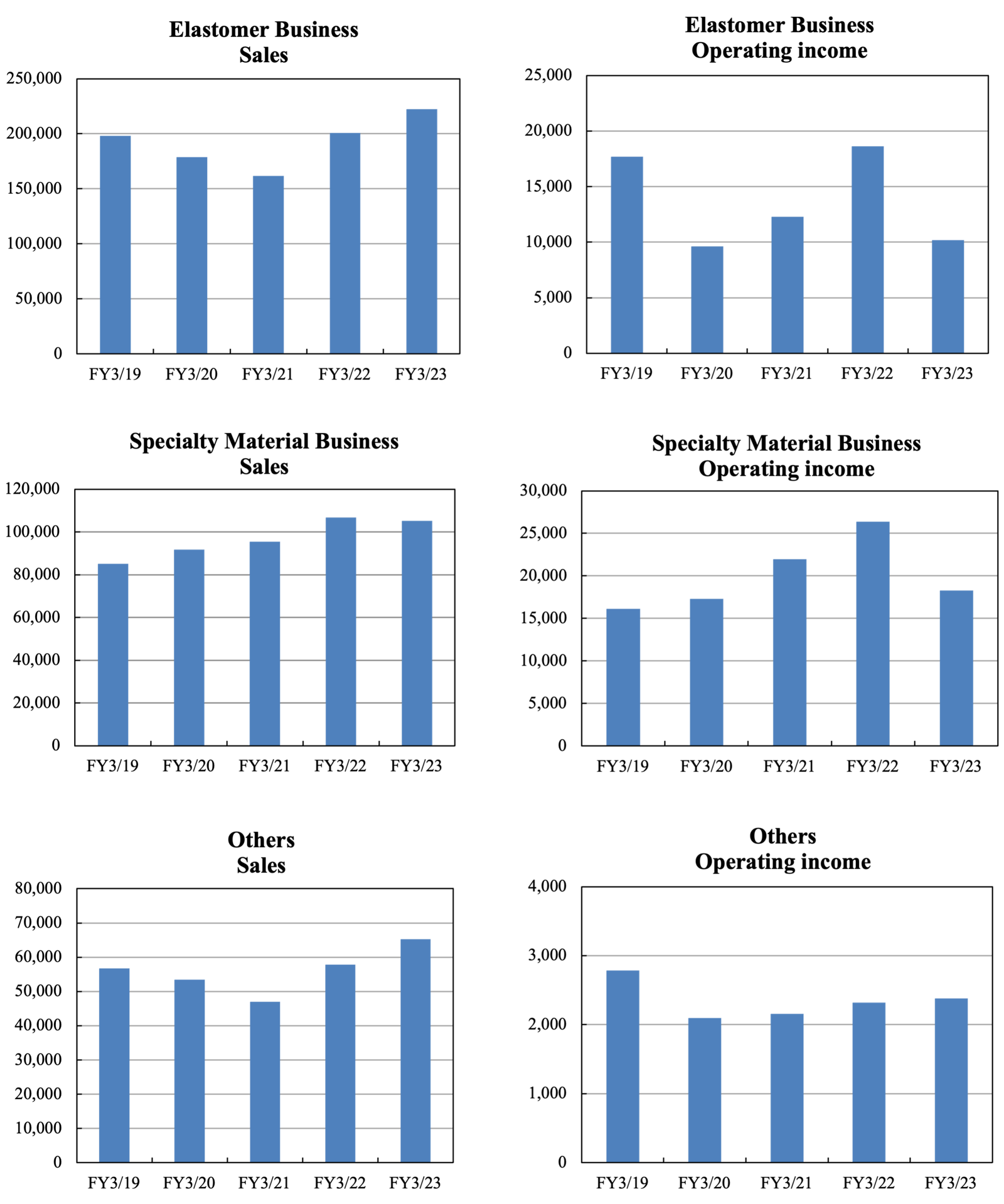

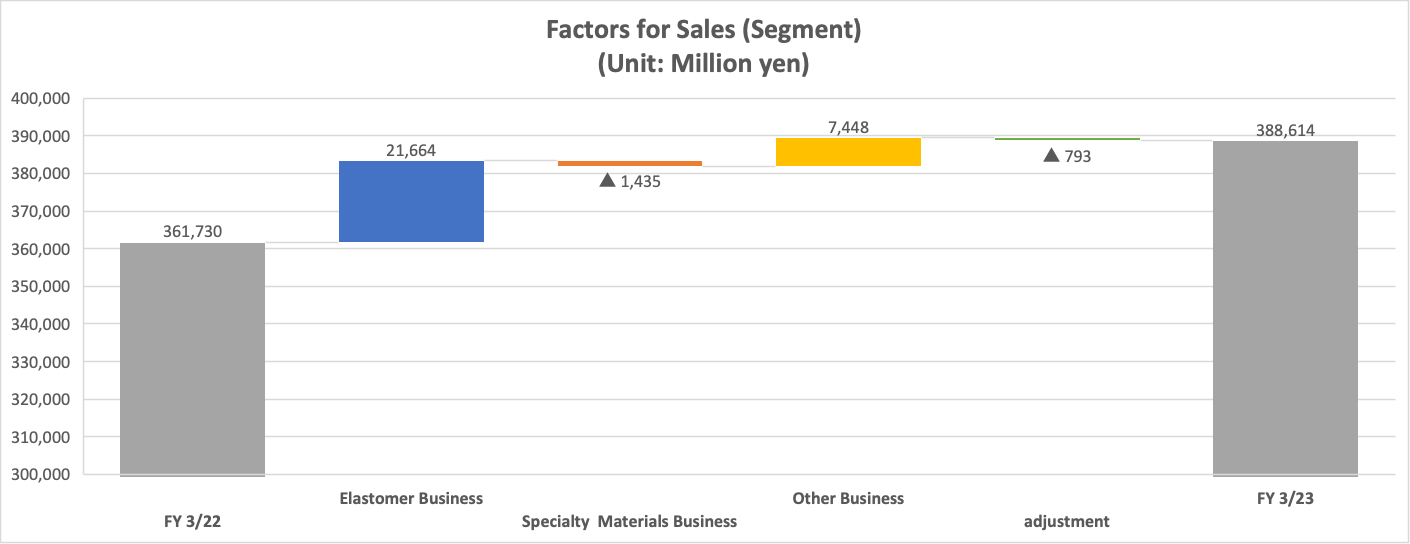

2-2 Trends by Business Segments

◎Total Earnings

| FY 3/22 | Ratio to sales | FY 3/23 | Ratio to sales | YoY |

Sales |

|

|

|

|

|

Elastomer Business | 200,566 | 55.4% | 222,230 | 57.2% | +10.8% |

Specialty Materials Business | 106,791 | 29.5% | 105,356 | 27.1% | -1.3% |

Other Business | 57,822 | 16.0% | 65,270 | 16.8% | +12.9% |

adjustment | -3,449 | - | -4,242 | - | - |

Total | 361,730 | 100.0% | 388,614 | 100.0% | +7.4% |

Operating Income |

|

|

|

|

|

Elastomer Business | 18,623 | 9.3% | 10,184 | 4.6% | -45.3% |

Specialty materials Business | 26,360 | 24.7% | 18,296 | 17.4% | -30.6% |

Other Business | 2,318 | 4.0% | 2,381 | 3.6% | +2.7% |

adjustment | -2,868 | - | -3,682 | - | - |

Total | 44,432 | 12.3% | 27,179 | 7.0% | -38.8% |

*Unit: million Yen. Composition of operating income is the ratio of operating income to net sales.

*Prepared based on disclosed materials by Investment Bridge Co., Ltd.

*▲ in the cost item indicates an increase in cost.

◎Quarterly Earnings

| 1Q FY 3/22 | 2Q | 3Q | 4Q | 1Q FY 3/23 | 2Q | 3Q | 4Q |

Sales |

|

|

|

|

|

|

|

|

Elastomer Business | 48,718 | 50,178 | 49,030 | 52,640 | 53,547 | 57,865 | 55,921 | 54,897 |

Specialty materials Business | 25,159 | 28,923 | 26,232 | 26,477 | 30,076 | 26,486 | 24,941 | 23,853 |

Other Business | 13,990 | 13,616 | 15,251 | 14,965 | 15,099 | 16,512 | 16,853 | 16,806 |

Operating Income |

|

|

|

|

|

|

|

|

Elastomer Business | 6,069 | 4,773 | 5,088 | 2,693 | 4,058 | 5,273 | 2,878 | -2,025 |

Specialty materials Business | 7,761 | 6,258 | 6,377 | 5,964 | 6,981 | 4,655 | 4,905 | 1,755 |

Other Business | 581 | 715 | 635 | 387 | 422 | 297 | 686 | 976 |

*Unit: million Yen

【Elastomers】

◎ Quarter-on-quarter increase in sales, but decrease in profit

Sales increased due to price revisions. Profit decreased due to a decline in shipment volume, soaring costs of raw materials and energy prices, and an increase in ocean freight rates, etc.

◎Increase in sales and decrease in profit from the previous period

*Synthetic Rubber

Domestic sales remained strong, thanks to firm demand amid sluggish automobile production due to the shortage of semiconductors. However, as a result of adjusting the shipping volume due to regular repairs at the main synthetic rubber production plant, export sales volume decreased from the previous term. Still, sales and profit increased as higher raw material and fuel costs were reflected in product prices.

*Latex

Sales and profit decreased due to the supply exceeding the demand because of the continued excess in distributors’ inventories of medical and sanitary gloves throughout the term.

*Chemical Products

Sales increased due to the depreciation of the yen and the reflection of rising raw material and distribution costs in prices. Profit declined due to excess in the distributors’ inventories of adhesive tape, which is the main purpose of use of this business’ product, in the second half of the fiscal year and the recording of inventory-related expenses.

【Specialty Materials】

◎Sales and Income Decreased QoQ

Sales and income decreased due to lower shipment volume mainly of battery materials and higher new development costs, despite progress in sales price revisions in optical resins and chemicals.

◎Revenues and income decreased from the previous quarter

*Specialty Resins Related

The demand for medical applications was firm, but sales and profit decreased due to excess in distributors’ inventories of optical film panels for large-screen TVs.

*Battery Materials Related

Sales improved due to increased shipments for the EV industry, despite the drop in demand due to the economic slowdown in China. On the other hand, profit decreased due to the soaring raw material and fuel prices and an increase in new product development costs.

*Chemical Products Related

Demand for applications of synthetic perfume and special solvent remained strong. Both sales and profit increased due to the impact of yen depreciation as well as price revisions for passing on the soaring costs of both raw materials and logistics.

*Electronic Materials Related

In the second half of the fiscal year, the operating rate of semiconductor manufacturers declined significantly, resulting in lower sales and profit.

*Toner Related

Sales and profit decreased due to excess in distributors’ inventories after special teleworking demand subsided.

(Trends in shipment volume by item)

* Battery materials

Shipment volume decreased 1% from the previous term, and it declined in the fourth quarter (January-March) by 37% year on year and by 39% quarter on quarter.

Shipments for the EV field increased 10% from the previous term and decreased in the fourth quarter by 31% year on year and by 32% quarter on quarter. Shipments were affected by customers’ inventory adjustments. Demand is expected to recover from the second quarter of the fiscal year ending March 2024 after the completion of inventory adjustments.

Shipments for the consumer product industry decreased 37% from the previous term, and they fell in the fourth quarter by 62% year on year and 65% quarter on quarter. Demand was sluggish, especially by the mobile terminal industry, due to the economic recession, and there was a reactionary decline from earlier shipments due to the Spring Festival in China.

* Optical plastics

Shipment volume grew 4% from the previous term, decreased in the fourth quarter by 12% year on year, and increased by 25% quarter on quarter.

Shipment for the field of optical applications decreased 30% from the previous term, and it declined in the fourth quarter by 43% year on year and by 19% quarter on quarter. Demand remained slow due to the economic recession, and shipments were sluggish.

Shipments for medical and other industries increased 22% from the previous term, and they grew in the fourth quarter by 1% year on year and by 42% quarter on quarter. Demand was strong, mainly in Europe and the United States, and shipment volume increased due to a reactionary increase from the off-season for shipping in the third quarter.

* Optical films

Shipment volume decreased 28% from the previous term, and it declined in the fourth quarter by 21% year on year and by 35% quarter on quarter.

Shipments for the small and medium-sized product industries decreased 16% from the previous term, and they fell in the fourth quarter by 40% year on year and by 32% quarter on quarter. Demand remained sluggish due to the off-season in shipments and the economic recession.

Shipment for large-size product industries decreased 31% from the previous term, and it declined in the fourth quarter by 17% year on year and increased by 60% quarter on quarter. Since TV manufacturers stopped procuring components in the second quarter, shipments have been gradually recovering, and despite a decrease in shipments for the year, current demand is firm. A full-fledged recovery in demand is expected from the fiscal year ending March 2024.

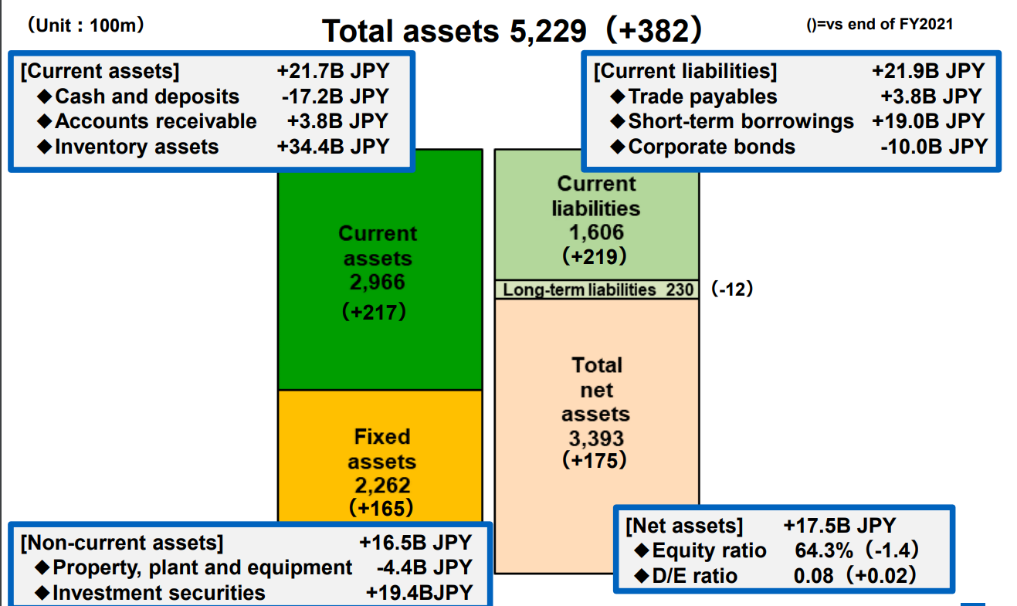

2-3 Financial standing and cash flows

◎Main Balance Sheet

| End of 3/22 | End of 3/23 | Increase/decrease |

| End of 3/22 | End of 3/23 | Increase/decrease |

Current Assets | 274,947 | 296,631 | +21,684 | Current liabilities | 138,653 | 160,587 | +21,934 |

Cash | 47,271 | 30,082 | -17,189 | Payables | 82,994 | 86,781 | +3,787 |

Receivables | 82,498 | 83,594 | +1,096 | ST Interest-Bearing Liabilities | 18,960 | 27,960 | +9,000 |

Inventories | 93,076 | 127,452 | +34,376 | Non-current liabilities | 24,172 | 22,973 | -1,199 |

Non-current Assets | 209,713 | 226,237 | +16,524 | LT Interest-Bearing Liabilities | - | - | - |

Tangible Assets | 118,299 | 113,924 | -4,375 | Total Liabilities | 162,824 | 183,560 | +20,736 |

Intangible Assets | 3,249 | 4,442 | +1,193 | Net Asset | 321,836 | 339,308 | +17,472 |

Investment, Others | 88,166 | 107,871 | +19,705 | Capital | 318,623 | 336,310 | +17,687 |

Total assets | 484,660 | 522,868 | +38,208 | Total Liabilities and Net Assets | 484,660 | 522,868 | +38,208 |

*Unit: million yen. Receivables include electronically booked receivables; likewise, payables include electronically booked payables.

Total assets increased 38.2 billion yen from the end of the previous term due to increases in inventories, investments, and other assets.

Total liabilities increased 20.7 billion yen from the end of the previous term due to increases in commercial paper (part of the short-term interest-bearing debt) and accounts payable.

Net assets increased 17.5 billion yen from the end of the previous term due to increases in valuation difference on available-for-sale securities and foreign currency translation adjustments.

As a result, the equity ratio decreased by 1.4 percentage points from the end of the previous fiscal year to 64.3 %, and the D/E ratio 0.02 to 0.08.

3. Fiscal Year ending March 2024 Earnings Forecasts

3-1 Earnings Forecast

| FY 3/23 | Ratio to Sales | FY3/24(Est) | Ratio to Sales | YoY |

Sales | 388,614 | 100.0% | 399,000 | 100.0% | +2.7% |

Operating Income | 27,179 | 7.0% | 24,000 | 6.0% | -11.7% |

Ordinary Income | 31,393 | 8.1% | 26,000 | 6.5% | -17.2% |

Net Income | 10,569 | 2.7% | 19,000 | 4.8% | +79.8% |

*Unit: million yen.

Sales will increase, and operating income will decrease.

For the fiscal year ending March 2024, sales are expected to increase 2.7% year on year to 399 billion yen, while operating income is expected to decrease 11.7% year on year to 24 billion yen.

In the Elastomer Business, demand is forecast to recover from the second half, and sales and profit will slightly decline. In the Specialty Materials Business, sales are expected to increase 10.1%, but operating income is projected to decrease 1.6%.

Assumed exchange rates and market conditions are 1 US dollar = 130 yen, 1 euro = 140 yen, Domestic naphtha = 64,000 yen, and Asian butadiene = 1,000 US dollars.

Dividends are expected to be 20 yen/share for the interim dividend and 20 yen/share for the term-end dividend, increasing the annual dividend by 4 yen to 40 yen/share. The dividends are expected to increase for the 14th consecutive year from the fiscal year 2010. The expected dividend payout ratio is 44.5%.

3-2 Trends by Business Segments

| FY3/23 | FY3/24(Est) | YoY |

Sales |

|

|

|

Elastomer Business | 222,230 | 218,000 | -1.9% |

Specialty materials Business | 105,356 | 116,000 | +10.1% |

Sales Total | 388,614 | 399,000 | +2.7% |

Operating Income |

|

|

|

Elastomer Business | 10,184 | 6,500 | -36.2% |

Specialty materials Business | 18,296 | 18,000 | -1.6% |

Operating Income Total | 27,179 | 24,000 | -11.7% |

*Unit: million yen.

<Business Environment in the Second Half>

(1) Elastomer Business

The performance in the first half of the fiscal year ending March 2024 is expected to be on par with the performance in the second half of the fiscal year ended March 2023, and demand is expected to recover from the second half.

* Synthetic rubber

The automobile market is expected to be unchanged from the fiscal year ended March 2023, but profit is projected to decline due to increased costs associated with an increase in the number of employees.

* LaticesDemand for gloves will be on par with that in the fiscal year ending 2023, and operating income is expected to improve due to enhancing the business structure.

* Chemicals

The adhesive tape market is unlikely to recover until the second half of the year, and annual sales and profit are expected to decline from the previous term.

(2) Specialty materials

Demand is expected to recover steadily, and sales are projected to expand.

* Optical plastics

Sales for optical applications will recover from the second half, and sales for medical and other industries will be firm. In the first half of the year, the company plans to adjust shipments due to the periodic maintenance at its main factory.

* Optical films

The large-size product market is expected to be unchanged from the term ended March 2022. Annual profit is expected to decrease in the short term due to an increase in depreciation expenses for the new large-scale production line.

* Battery materials

An increase in shipments is expected mainly for the electric vehicle market.

4. Conclusions

In the fiscal year ended March 2023, sales were affected by soaring raw material prices, their reflection in selling prices, and production adjustments by customers. As a result of being greatly affected by the external environment, the company was forced to revise its earnings forecasts three times during the term. However, raw material prices have already stabilized in the fiscal year ending March 2024. Demand is expected to recover from the second half, and we would like to pay attention to this recovery.

Lithium-ion batteries for electric vehicles, which the company handles materials for, are expected to recover significantly from the second quarter onward, despite the prolonged short-term production adjustments by customers. In addition, cycloolefin polymer (COP), which has wide applications especially in optics and medicine, is steadily accumulating results, mainly in medical and other segments. Thus, its prospects are bright. Despite short-term economic and market deterioration, medium/long-term growth is likely to continue. Dividends have increased for 14 consecutive years, and aggressive shareholder returns have also been highly recognized. We are looking forward to the stock price stabilizing above the BPS (1,591.79 yen).

The medium-term management plan is scheduled to be announced in June, so we would like to keep an eye on that.

<Reference 1: Medium-term Management Plan>

The company is currently promoting a medium-term management plan with the fiscal year ending March 31, 2022 as its first year.

1-1 Summary of the Previous Medium-term Management Plan

In the previous medium-term management plan, SZ-20 Phase III, the company set goals of achieving record-high sales in the first year (fiscal year March 2019) and consolidated sales of 500 billion yen or more in the final year, fiscal year March 2021. However, the company did not achieve this goal.

The sales of the Elastomer Business were impacted by the global economic stagnation caused by the US-China trade conflict and the spread of the novel coronavirus. As for the Specialty Materials Business, the sales of optical plastics, optical films, and battery materials were strong.

1-2 Overview of the New Medium-term Management Plan

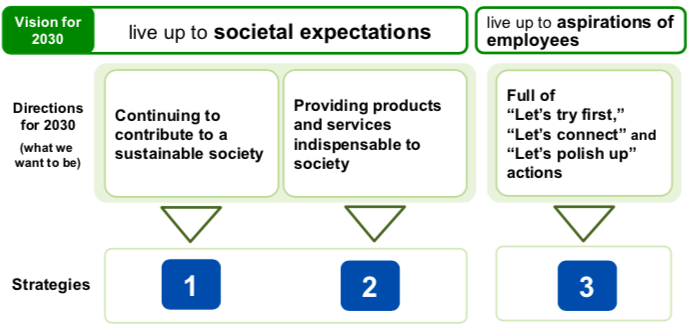

The corporate philosophy is to contribute to the preservation of the earth and the prosperity of human race.

Zeon’s mission befits the company name’s origin, which is acquiring raw materials from the earth and prospering for eternity. The company’s mission is to contribute to a sustainable planet and a safe and comfortable life for people by providing unique technologies, products, and services.

Based on this mission, the company set its vision for 2030 to be a company that meets the expectations of society and the aspirations of employees.

Furthermore, the company has listed three specific action guidelines for all employees to focus on: “Let’s try first,” “Let’s connect,” and “Let’s polish up.”

Zeon will focus on achieving nine of the SDGs’ target to be a company that meets society’s expectations.

The company views the period of this new medium-term management plan as two years to build a foundation for realizing the vision for 2030.

1-3 2030 Vision and Company-wide Strategies

The company has formulated three company-wide strategies to realize its vision for 2030.

1-4 Outline of the Company-wide Strategy

(1) Promote the shift to manufacturing that realizes carbon neutrality and a circular economy

The company will formulate a carbon-neutral master plan leading up to 2050 and persistently implement R & D and technological innovation necessary to shift to long-term manufacturing.

The company will reduce total CO2 emissions (emissions associated with Scopes 1 and 2 of the manufacturing) from 722,000 tons in 2013 to 389,000 tons in 2030.

Specifically, the company will work on the production of butadiene, a raw material, from biomass.

(2) “Polish up” existing businesses, “explore” new businesses, and developing digital infrastructure to create value for customers

The targets for 2030 are a sales ratio of products contributing to the SDGs of 50%, a ROIC of the existing businesses of 9.0%, and an increase in new business sales of 60 billion yen from the fiscal year March 2020.

1) “Polish up” existing businesses

Regarding enhancing specialty plastics, the company will focus on timely capacity-building investments that drive growth markets and improving resilience.

As for the former, the company will increase the production capacity of the Mizushima Plant from 37,000 tons to 41,600 tons per year. The construction is to be completed in July 2021.

As for the latter, the company will proceed with the study of new production bases to reduce the dependence on the Mizushima Plant.

Regarding enhancing battery materials, the company will introduce a new product group that contributes to improving the five major performances required for lithium-ion batteries; durability, capacity, productivity, safety, and charge and discharge rate.

One of them, AFL®, an adhesive for separators, possesses a long lifespan and high productivity, and its sales are expected to grow at a high rate.

Regarding the survival of existing SBUs (Strategic Business Units), Zeon will improve resource and equipment utilization efficiency to pursue sustainability.

For elastomers businesses, the company will work on enhancing differentiated products and improving the efficiency of all production lines. As for specialty materials, the company will work on product development and capacity enhancement to further improve its strengths.

2) “Explore” new businesses

Regarding determining priority fields and concentrating resources, the company has set CASE and MaaS, healthcare and life sciences, information technology, and energy-saving as the priority fields.

Priority fields | Specific materials and products |

Healthcare and life sciences | Inspection and analysis components and microfluidic chips using COP (Cyclo olefin Polymer) |

CASE and MaaS | Multi-material adhesive for vehicles (newly developed material that adheres substances that do not stick to each other) |

Telecommunications | Film substrates and semiconductor containers using newly developed heat-resistant COP |

Energy-Conservation | Sheet-type thermal interface materials (TIM) and solar cards |

3) Developing a digital infrastructure for customer value creation

The promotion of digital transformation is indispensable for creating value for customers and achieving goals of both existing businesses and new businesses.

The company will go through the following stages to promote the reforms leading to 2030.

Build a digital infrastructure: human resource development (such as power user development), advanced simulation of existing businesses, and promotion of smart plants

↓

Transformation of corporate management and business management: understanding global markets and businesses in real-time

↓

Creation of customer value: Transformation of the business model by MI* and AI

* MI stands for Materials informatics, which works on improving the efficiency of material development by using informatics methods that utilize statistical analysis.

(3) Create ”Stages” where everyone can demonstrate their individual strengths

The targets for 2030 are an employee engagement rate of 75% and a foreigner and female executive ratio of 30% (adding both internal and external company directors and audit & supervisory board members).

The company will create an environment that provides more lifestyle options to achieve employees’ well-being, such as work style reforms, childcare and nursing care support, career design, recurrent education, workplace dialogues, and club support to achieve the above goals.

1-5 Financial Targets for 2030 and Shareholder Returns

The company aims to achieve both business expansion through new investments and the improvement of capital efficiency.

The company plans to allocate a total of 350 billion yen for new investments by the fiscal year 2030 to achieve the targets, a ROIC of existing businesses of 9.0% and an increase in new business sales of 60 billion yen from the fiscal year March 2020.

Moreover, the company has continued to increase dividends from the fiscal year 2010 to the fiscal year 2020 and intends to provide continuous and stable shareholder returns.

<Reference 2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 9 directors, including 3 external ones |

Auditors | 5 auditors, including 3 external ones |

Through the press release on April 26, 2023, they announced the addition of two candidates for new outside directors.

◎ Corporate Governance Report

Last update date: :July, 5, 2022

Basic policy

Our company respects the interests of a broad range of stakeholders, including shareholders, and aims to earn revenue and continuously improve our corporate value while adjusting the relations of interests. To do so, we will make continuous efforts to establish a system for realizing efficient, sound business administration through corporate governance.

In addition, we will make decisions and execute business operations swiftly after clarifying the functions and roles of each institution and each in-company organization by developing internal control systems. We will properly monitor and disclose its progress and results and strive to improve the transparency of our business administration.

Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)

(All principles are based on the Code revised in June 2021, including the content for the prime market)

Our company follows the principles of the corporate governance code.

Disclosure Based on the Principles of the Corporate Governance Code (Excerpt)

Principles | Disclosure content |

【Principle 1-4 The so-called strategically held shares】 | ・Before strategically holding shares of any other companies, we consider carefully if the strategically held shares of a company strengthen the relationship between us and our business partners, the society and other stakeholders and will eventually enhance our corporate value in a medium- to long-term perspective. ・As for shares held based on these considerations, the company will annually verify the appropriateness of holding shares of each company by considering the appropriateness of its holding purpose and whether the benefits, risks, etc. that come along are commensurate with the capital cost. Most recently, the Board of Directors made the verification in their meeting, which was held on October 29, 2021, and decided that it would be appropriate to hold all of the stocks. We will continue to examine the possibility of reducing the number of stocks that are deemed to have lost their significance in the future. ・We will determine when to exercise our voting right of strategically held shares based on a medium- to long-term viewpoint on enhancement of the corporate value of the company that we invest in. |

[Supplementary Principle 4-11-1 Concept of Balance, Diversity, and Scale of the Board of Directors] | -The Board of Directors shall consist of diverse directors with different backgrounds such as knowledge, experience, and expertise. As the scale of the board should be appropriate for sufficient deliberation and prompt and rational decision-making, the number of directors shall be limited to 15 or less based on the provisions of the Articles of Incorporation.

-In order to appropriately reflect the opinions of personnel with abundant experience and insight, such as outside corporate managers and those who possess experience in public administration, in the company’s management policy and to ensure the effectiveness of independent and objective management supervision by the Board of Directors, we will appoint multiple independent outside directors who will not be involved in business execution. -For a list of the skills that the Board of Directors should possess in light of the Company's management strategy and the combination of skills that each Director possesses and that the Company specifically expects him/her to demonstrate (so-called skills matrix), please refer to Reference documents for the General Meeting of Shareholders in the “Notice of Convocation of the Ordinary General Meeting of Shareholders” ().https://www.zeon.co.jp/ir/stock/meeting/ |

Principle 5-1 Policy on constructive dialogue with shareholders | ・In our company, the IR and SR Department is in charge of interacting with our shareholders, and the Director of Administration manages the office. ・The IR and SR Dept. appropriately exchanges information with the related departments within our company and provides precise and unbiased information to our shareholders. ・Our company will continuously strive to enrich methods of dialogue other than individual interviews, such as holding information sessions for investors on a quarterly basis, improving explanatory materials for our financial results disclosed on our website and participating in company information sessions for individual investors. ・The IR and SR Dept. collates and analyzes opinions obtained through interaction with our shareholders when necessary and report them to the Representative Director. ・Our company thoroughly manages unreleased important facts in accordance with the “Insider Trading and Timely Disclosure Management Rules”, and communicates with our shareholders to prevent information leak. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgement. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on ZEON CORPORATION(4205)and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp

<Appendix:Fact Sheet>

<Major Shareholders>

Shareholder | Number of Holding Shares(thousand) | Rate (%) |

The Master Trust Bank of Japan, Ltd. (Trust Account) | 22,923 | 10.58 |

Yokohama Rubber Co., Ltd. | 18,757 | 8.88 |

SSBTC CLIENT OMNIBUS ACCOUNT | 15,325 | 7.25 |

Japan Custody Bank, Ltd. (Trust Account) | 11,796 | 5.58 |

Mizuho Bank, Ltd | 9,600 | 4.54 |

Asahi Mutual Life Insurance Company | 7,679 | 3.63 |

Asahi Kasei Corporation | 5,579 | 2.64 |

National Mutual Insurance Federation of Agricultural | 4,765 | 2.26 |

The Norinchukin Bank | 4,000 | 1.89 |

ZEON Business Partners Shareholding Association | 3,676 | 1.74 |

| 104,100 | 48.99 |

*Total number of shares issued at the end of the term common stock 229,513,656 shares

As of Mar 31, 2023

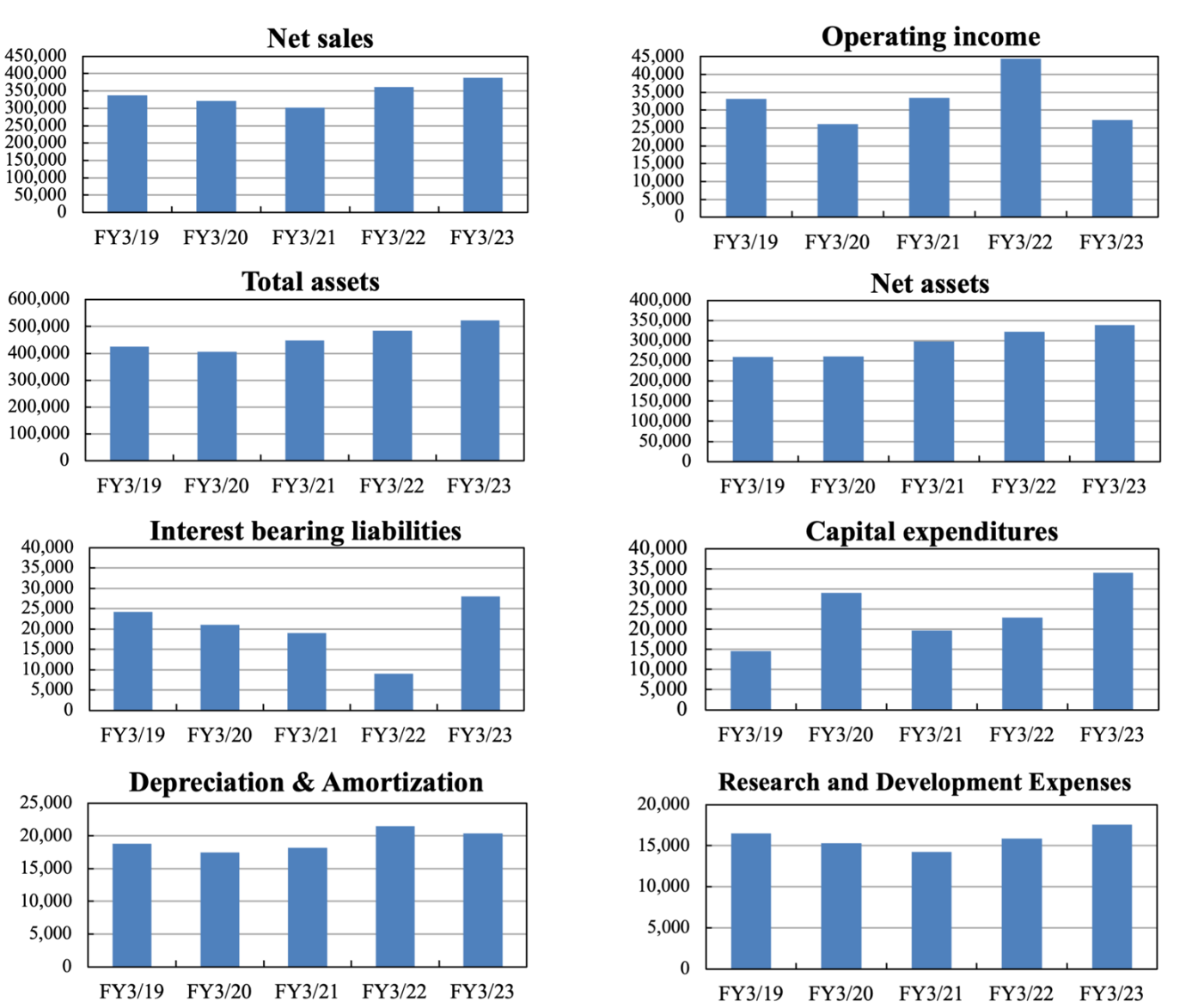

<Selected Financial Data>

| FY3/19 | FY3/20 | FY3/21 | FY3/22 | FY3/23 |

Net sales | 337,499 | 321,966 | 301,961 | 361,730 | 388,614 |

Gross profit | 96,742 | 91,911 | 97,552 | 120,358 | 109,643 |

Operating income | 33,147 | 26,104 | 33,408 | 44,432 | 27,179 |

Ordinary income | 36,319 | 28,744 | 38,668 | 49,468 | 31,393 |

Net income | 18,458 | 20,201 | 27,716 | 33,413 | 10,569 |

EPS (JPY) | 84.1 | 92.4 | 126.7 | 153.2 | 49.9 |

DPS (JPY) | 19.00 | 21.00 | 22.00 | 28.00 | 36.00 |

Total assets | 424,937 | 405,131 | 448,821 | 484,660 | 522,868 |

Net assets | 259,156 | 260,358 | 298,246 | 321,836 | 339,308 |

Interest bearing liabilities | 24,125 | 20,960 | 18,960 | 8,960 | 27,960 |

Capital expenditures | 14,640 | 29,088 | 19,645 | 22,902 | 34,045 |

Depreciation &Amortization | 18,780 | 17,448 | 18,154 | 21,469 | 20,382 |

R&D Expenses | 16,480 | 15,274 | 14,258 | 15,869 | 17,580 |

(Units: Million Yen)

<Financial Summary>

| FY3/19 | FY3/20 | FY3/21 | FY3/22 | FY3/23 |

Operating Income Margin | 9.8 | 8.1 | 11.1 | 12.3 | 7.0 |

Net Income Margin | 5.5 | 6.3 | 9.2 | 9.2 | 2.7 |

Total Asset Turnover (times) | 0.78 | 0.78 | 0.71 | 0.78 | 0.77 |

Capital Ratio | 60.3 | 63.5 | 65.8 | 65.7 | 64.3 |

ROE | 7.2 | 7.9 | 10.0 | 10.9 | 3.2 |

R&D-to-Sales Ratio | 4.9 | 4.7 | 4.7 | 4.4 | 4.5 |

(Unit: %)

<Segment Information>

| FY3/19 | FY3/20 | FY3/21 | FY3/22 | FY3/23 |

Sales |

|

|

|

|

|

Elastomer Business | 198,087 | 178,847 | 161,626 | 200,566 | 222,230 |

Specialty Materials Business | 85,142 | 91,749 | 95,465 | 106,791 | 105,356 |

Others | 56,733 | 53,473 | 46,977 | 57,822 | 65,270 |

Eliminations and corporate assets | -2,463 | -2,103 | -2,107 | -3,449 | -4,242 |

Consolidated | 337,499 | 321,966 | 301,961 | 361,730 | 388,614 |

Operating income |

|

|

|

|

|

Elastomer Business | 17,691 | 9,642 | 12,283 | 18,623 | 10,184 |

Specialty Materials Business | 16,115 | 17,311 | 21,960 | 26,360 | 18,296 |

Others | 2,786 | 2,098 | 2,156 | 2,318 | 2,381 |

Eliminations and corporate assets | -3,446 | -2,948 | -2,991 | -2,868 | -3,682 |

Consolidated | 33,147 | 26,104 | 33,408 | 44,432 | 27,179 |

Total assets |

|

|

|

|

|

Elastomer Business | 209,089 | 189,618 | 195,856 | 223,375 | 234,261 |

Specialty Materials Business | 89,402 | 101,425 | 118,840 | 118,724 | 134,490 |

Others | 32,907 | 31,193 | 30,006 | 42,008 | 41,778 |

Eliminations and corporate assets | 93,539 | 82,895 | 104,119 | 100,553 | 112,339 |

Consolidated | 424,937 | 405,131 | 448,821 | 484,660 | 522,868 |

Depreciation & Amortization |

|

|

|

|

|

Elastomer Business | 8,864 | 8,432 | 8,211 | 8,846 | 8,475 |

Specialty Materials Business | 6,793 | 6,089 | 7,362 | 10,208 | 9,574 |

Others | 302 | 312 | 263 | 243 | 268 |

Eliminations and corporate assets | 2,822 | 2,616 | 2,318 | 2,170 | 2,065 |

Consolidated | 18,780 | 17,448 | 18,154 | 21,469 | 20,382 |

Capital Expenditure |

|

|

|

|

|

Elastomer Business | 5,744 | 7,792 | 7,440 | 9,493 | 8,527 |

Specialty Materials Business | 6,234 | 17,965 | 10,111 | 10,596 | 18,220 |

Others | 359 | 95 | 47 | 291 | 764 |

Eliminations and corporate assets | 2,303 | 3,236 | 2,047 | 2,521 | 6,534 |

Consolidated | 14,640 | 29,088 | 19,645 | 22,902 | 34,045 |

(Units: Million Yen)