Bridge Report:(4205)ZEON First Half of the Fiscal Year ending March 2024

Tetsuya Toyoshima President and CEO | ZEON CORPORATION(4205) |

|

Company Information

Market | TSE Prime Market |

Industry | Chemicals |

President and CEO | Tetsuya Toyoshima |

HQ Address | Marunouchi 1-6-2, Chiyoda-ku, Tokyo Shin-Marunouchi Centre Building |

Year-end | March |

HOMEPAGE |

Stock Information

Share Price | Shares Outstanding (including treasury shares) | Total market cap | ROE Act. | Trading Unit | |

¥1,336.5 | 229,513,656 shares | ¥306,745 million | 3.2% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

¥40.00 | 3.0% | ¥130.15 | 10.3x | ¥1,591.79 | 0.8x |

* Share price as of closing on November 13. Shares outstanding and EPS are from the second quarter of the fiscal year ending March 2024. ROE and BPS are from the financial results of the previous year.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2019 | 337,499 | 33,147 | 36,319 | 18,458 | 84.06 | 19.00 |

Mar. 2020 | 321,966 | 26,104 | 28,744 | 20,201 | 92.44 | 21.00 |

Mar. 2021 | 301,961 | 33,408 | 38,668 | 27,716 | 126.74 | 22.00 |

Mar. 2022 | 361,730 | 44,432 | 49,468 | 33,413 | 153.22 | 28.00 |

Mar. 2023 | 388,614 | 27,179 | 31,393 | 10,569 | 49.94 | 36.00 |

Mar. 2024 Est. | 380,000 | 20,500 | 25,000 | 27,500 | 130.15 | 40.00 |

*Unit: million yen, yen. Estimates are those of the company. Effective from the beginning of March 2022, the "Accounting Standard for Revenue Recognition" (ASBJ Statement No. 29) and others are applied. Net income is net income attributable to owners of the parent company. The same applies hereinafter.

This Bridge Report presents ZEON CORPORATION’s earnings results for the first half of the fiscal year ending March 2024.

Table of Contents

Key Points

1. Company Overview

2. First Half of the Fiscal Year ending March 2024 Earnings Results

3. Fiscal Year ending March 2024 Earnings Forecasts

4. Conclusions

<Reference 1: Medium-term Management Plan>

<Reference 2:Regarding Corporate Governance>

<Appendix:Fact Sheet>

Key Points

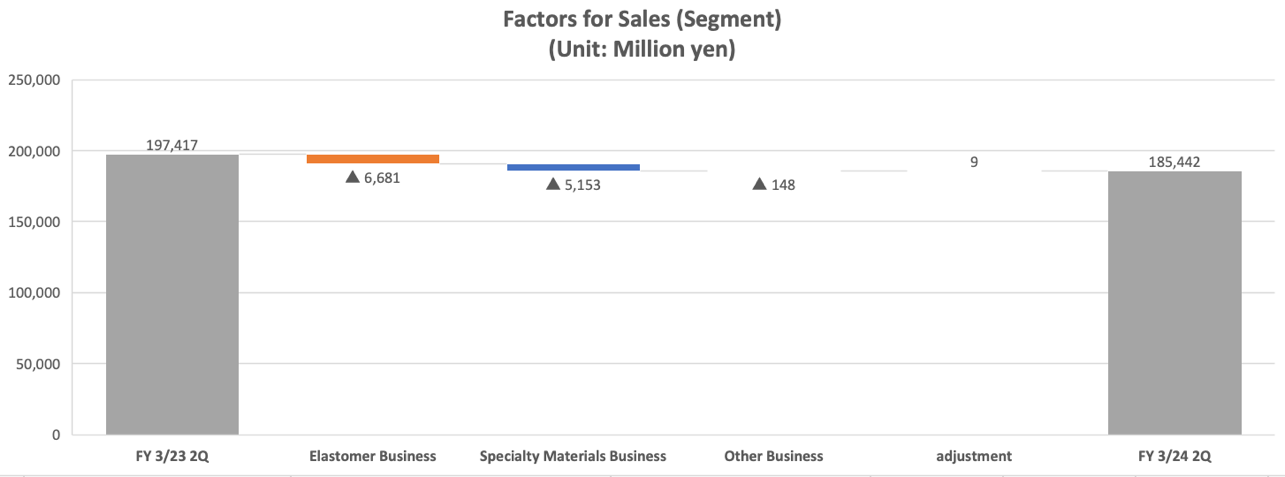

- Sales were 185.4 billion yen, down 6.1% year on year, and operating income went down 53.1% year on year to 9.4 billion yen. The Elastomer Business saw declines in both sales and profit. The synthetic rubber segment was affected by the economic slowdown in China, and demand for adhesive tapes in the segment of chemical products recovered only slowly. The demand for gloves subsided, affecting the synthetic latex segment. Both sales and profit shrank in the Specialty Materials Business. Regarding specialty plastics, while shipments of large-sized films and resins for optical applications were on an increasing trend, the volume of shipments of small- and medium-sized films and resins for medical and other applications was low. The performance of specialty chemicals was affected by the delayed posting for battery materials at some overseas affiliates.

- In the fiscal year March 2024, it is projected that sales will decline 2.2% year on year to 380 billion yen and operating income will stand at 20.5 billion yen, down 24.6% year on year. The forecasts for both sales and profit have been revised downwardly from the previous forecasts because the deteriorating market conditions caused by uncertainties about such matters as the trend of the Chinese economy have resulted in slow recovery of demand for the mainstay products in the Elastomer Business and the Specialty Materials Business and it is expected that sales quantities will make a downturn. An extraordinary income that is to be recorded will allow net income to exceed the previous forecast. Dividends remain unchanged, with the expected year-end dividend being 20 yen/share and the expected annual dividend going up by 4 yen to 40 yen/share. The amount of dividends is forecast to increase for the 14th consecutive term from fiscal 2010. Payout ratio is projected to be 30.7%.

- While the company made a considerable quarter-on-quarter improvement in the first quarter owing partly to the reversal of loss on valuation of inventory based on the lower-of-cost-or-market rule, sales increased and profit decreased quarter on quarter in the second quarter because there was no transient factor in this period like in the first quarter. The company has taken the worsening outlook in the second half of the term into account and revised the full-year forecast downwardly. The slowdown in the Chinese economy impeded recovery in the Elastomer Business, and the Specialty Materials Business stalled due in part to the reduction of production by customers regarding small- and medium-sized films for laptop computers and tablet devices; however, these factors will not have a significant impact on ZEON’s medium- and long-term business development and outlook. Demand for lithium-ion batteries for electric vehicles for which ZEON provides materials is forecast to recover owing to inventory adjustment by customers in the second quarter, and the market is expected to continue strong growth. The medium-term management plan with which the company is forging ahead remains unchanged. If the company attains the profit level that it aims to reach by the end of the fiscal year March 2027, the Earnings per Share (EPS) will be around 200 yen. While the economy and the market are on a downward trend in the short term, it is expected that the company continues to grow over the medium- and long-term run. ZEON’s share price is currently low, falling far below the Book-value Per Share (BPS). Given medium- and long-term business development and the profit target as set in the medium-term management plan, there is seemingly ample room for reconsideration.

1. Company Overview

ZEON CORPORATION is a petrochemical manufacturer that maintains numerous products with a large share of the global markets including synthetic rubber used in automobile parts and tires, synthetic latex used in surgery-use gloves, and other products. The Company’s strengths include its creative technology development function, R&D structure, and high earnings generation capability. Many of the products and materials manufactured by Zeon are used in a wide variety of products including automobile parts and tires, rubber gloves, disposable diapers, cell phones, LCD televisions, perfumes and other products commonly used in everyday life.

The Zeon Group is comprised of the parent company, 60 subsidiaries and 7 affiliated companies. Zeon also has manufacturing and marketing facilities in 16 countries around the world.

(Annual Securities Report for the fiscal year March 2023)

|

|

(Source: the company)

[1-1 Company Name and Management Vision]

The company name “Zeon” is derived from the Greek word for earth “geo” (phonetically pronounced “zeo” in Japanese) and the English word reflecting eternity “eon,” and reflects the Company’s principle of “deriving raw materials from the earth and perpetually contributing to human prosperity” through the development and application of creative technologies.

(Zeon’s original name “Geon,” used at the time of its establishment, was derived from the trademark acquired for the vinyl chloride plastics “Geon” from B.F. Goodrich chemical Company in the United States, with which it had capital and collaborative technological agreements. The company name was changed to “Zeon” when the capital agreement was dissolved in 1970.)

[1-2 Corporate History]

Zeon was established as a joint venture company formed by the Furukawa Group of companies: Nippon Light Metal Co., Ltd., Furukawa Electric Co., Ltd., and Yokohama Rubber Co., Ltd. in April 1950 to acquire and use the vinyl chloride resins technology from B.F. Goodrich Chemicals Co.

In 1951, Goodrich acquired 35% of the shares of Zeon for full-scale technological and capital partnership, and in 1952 mass production of vinyl chloride resins began in Japan for the first time.

In 1959, Goodrich transferred synthetic rubber manufacturing technologies to Zeon, which, in turn, started Japan’s first mass production of synthetic rubber. Manufacturing facilities were also expanded to match the growing demand for automobile parts.

In 1965, use of the Company’s unique technology called Geon Process of Butadiene (GPB) for the efficient manufacture of butadiene (main raw material of synthetic rubber) from C4 fraction was operational.

Goodrich transferred its specialty synthetic rubber business to Zeon along with the shift in its main business focus toward vinyl chloride resins. Capital ties were dissolved in 1970. Along with these changes, the Company name was changed from Geon to Zeon in 1971.

Also, in 1971, Zeon developed a unique technology called Geon Process of Isoprene (GPI) and began using it to manufacture raw materials including high-purity isoprene, Petroleum plastics, and synthetic perfume ingredients from C5 fraction.

After entering the 1980s, Zeon aggressively launched new businesses in various fields including photoresists and other information materials, synthetic fragrance, and medical-related applications in addition to its main synthetic rubber business.

In 1984, production of hydrogenated nitrile rubber Zetpol®, which currently has top share of the worldwide market, began at the Takaoka Plant.

In 1990, manufacture of cyclo olefin polymer (COP) ZEONEX®, which is the main product of the specialty materials business using the GPI method to extract and synthesize products, was started at the Mizushima Plant.

In 1993, Zeon entered China with its electronics materials business.

In 1999, Zeon Chemicals L.P. (Consolidated subsidiary in the United States) acquired the specialty rubber business of Goodyear Tire & Rubber Company of the United States to become the world’s top manufacturer of specialty rubber.

In 2000, Zeon discontinued production of vinyl chloride resins at the Mizushima Plant, and thus withdrew from the Company’s founding business.

Since the 21st century came, the company has been operating business actively. For example, by releasing ZeonorFilm®, an optical film for LCD, strengthening global production and sales systems, starting the commercial operation of solution-polymerized styrene-butadiene rubber(S-SBR) in Singapore, upgrading the equipment for optical films for LCD in Himi-shi, Toyama Prefecture, starting the operation of the world’s first mass-production factory for super-growth carbon nanotubes, and establishing a joint venture for manufacturing and selling S-SBR in cooperation with Sumitomo Chemical.

[1-3 Business Description]

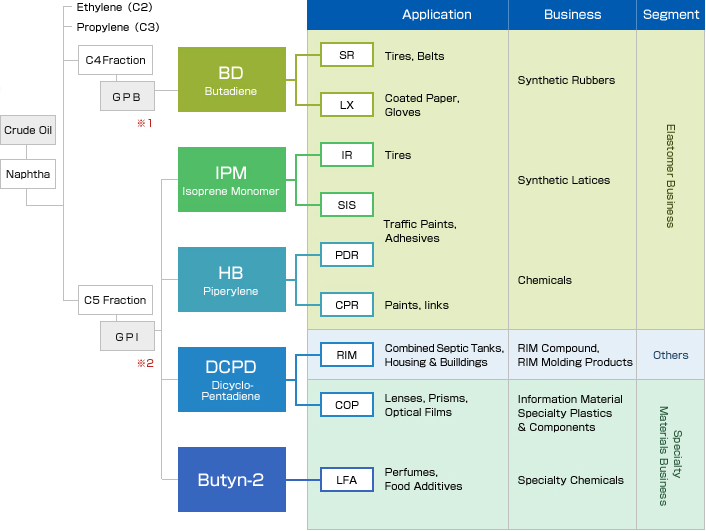

Zeon’s main products use various extracted from naphtha, which is extracted by distillation of crude oil.

When the naphtha is heated, carbon monoxide gas (C1), ethylene (C2), and propylene (C3) are extracted in sequence.

Zeon uses butadiene extracted in the GPB method developed in-house from C4 fraction, isoprene monomer, piperylene, dicyclopentadiene, and 2-butyne extracted from C5 fraction using the GPI method, as raw materials to be processed into synthetic rubber, synthetic latex and various other materials.

(Source: the company)

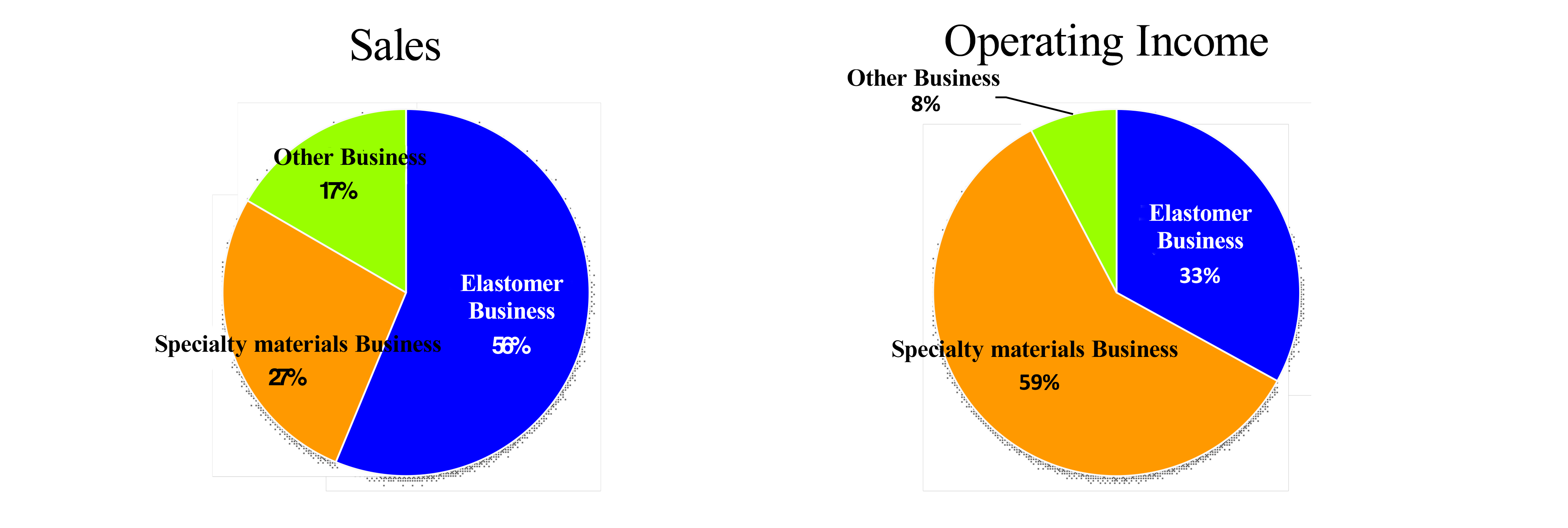

Zeon has three business segments: 1) the elastomer business, where manufactured basic materials are sold to customers; 2) the specialty materials business, where basic materials are submitted to primary processing for sale to customers as processed materials, and 3) the other business.

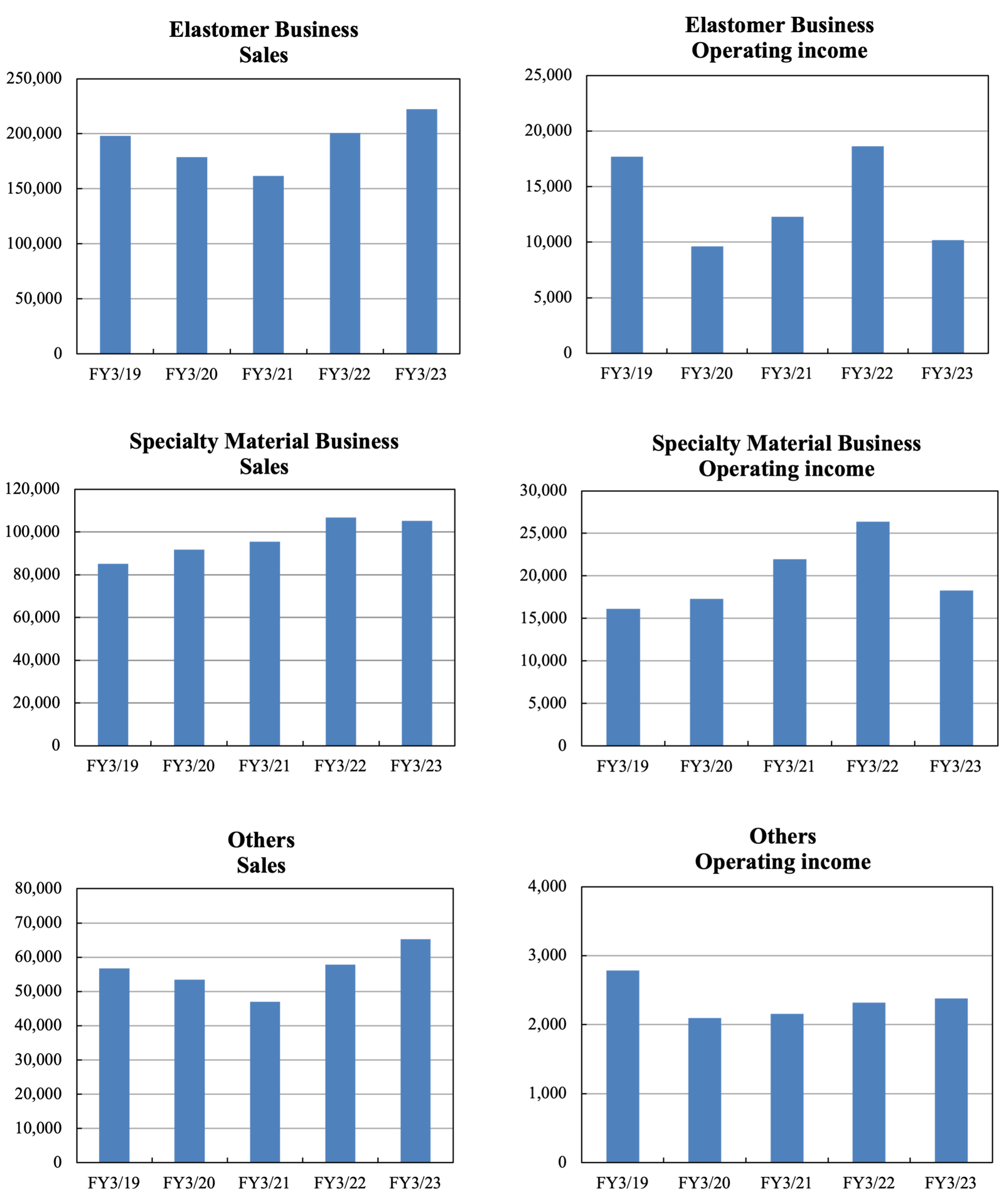

*Both are results for the fiscal year ended March 2023. Composition ratio is before elimination and company-wide.

Elastomer Business

Elastomers are “high molecular compounds that have rubber-like elastic properties,” an example of which is synthetic rubber. As described in the corporate history section of this report, in 1959 Zeon became the first company in Japan to mass-produce synthetic rubber, which became the foundation underlying all of Zeon’s businesses. This business includes the segments of synthetic rubbers, synthetic latices, and chemicals products (Petroleum resins, thermoplastic elastomers) businesses.

1) Synthetic Rubbers Business

<Example of final product: Tires>

Zeon provides the world’s leading tire manufacturers with the world’s highest-quality synthetic rubber for use in tires. Among the various types of synthetic rubber manufactured are styrene butadiene rubber (SBR), which promotes superior abrasion resistance, aging resistance and mechanical strength properties, butadiene rubber (BR), which includes a superior balance between elasticity, wear and low-temperature properties, and isoprene rubber (IR), which features similar properties as natural rubber but with higher quality stability. It is expected that the demand for S-SBR for fuel-efficient tires, which was developed by improving the characteristics of SBR, will grow rapidly. In order to increase the supplying capacity for coping with it, the first line of Singapore Factory started operation in September 2013, and the second line in April 2016. The supplying capacity of Singapore Factory is now 70,000 tons.

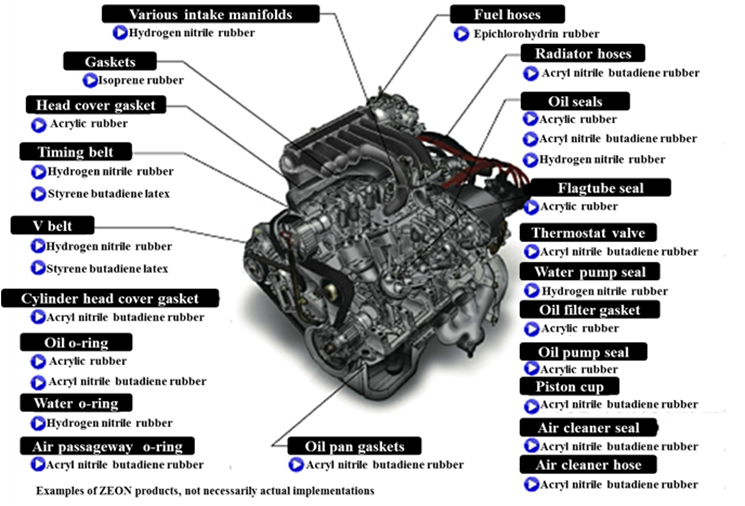

<Example of product: Automobile Parts>

(Source: the company)

Radiator hoses, fuel hoses, fan belts, oil seals, and various other car engine parts use specialty synthetic rubber that has superior oil resistance and heat deterioration-resistant qualities.

Zeon is the world’s number one manufacturer of specialty synthetic rubber and features high quality levels and high market share of specialty synthetic rubber automobile parts. In particular, Zeon’s Zetpol® hydrogenated nitrile rubber, used for timing belts, displays superior heat and oil resistance and mechanical strength characteristic and claims high share of the worldwide market.

Furthermore, a new grade of Zetpol® has vastly improved the performance of products using the original versions of Zetpol®.

Products using the new grade of Zetpol® are heat resistant at temperatures that exceed the limits for the original version of Zetpol® by 10 degrees centigrade, thereby extending the life of seals and gaskets, and are in strong demand for use in next generation bio-fuel engines. The new grade of Zetpol® is well suited to extrusion processing which is being leveraged to expand its usage in various hoses. Products using Zetpol® have also been well received by customers and are being used increasingly as a replacement material for more expensive competitive rubber in Japan, Asia, Europe, and North America.

2) Synthetic Latices Business

Synthetic latex is liquid rubber that synthetic rubber dispersed in water. It is used to manufacture gloves, paper coating, textile processing, adhesives, paints, and cosmetic puffs, etc. Zeon has high share of NBR latex used in cosmetic puffs in the world.

3) Chemicals Business

Zeon produces C5 fraction by its unique in-house GPI method, and turn it into materials for adhesive tapes and hot melt adhesive traffic paint binder and a wide variety of other products.

Specialty Materials Business

Zeon deals in high value-added materials and parts that are created using its unique technologies including polymer design and processing technologies.

This is composed of the specialty plastics business, including optical plastics and optical films, the specialty chemicals business, including specialty chemicals, battery materials, electronic materials and polymerized toners, and the medical devices business.

1) Specialty materials Business

◎ Optical plastics and optical films

Cyclo olefin polymer is thermoplastic polymer developed using raw material extracted from C5 fraction using GPI methods and synthesized with Zeon’s own unique technologies. The commercial products are ZEONEX® and ZEONOR®.

ZEONEX® leverages its high transparency, low water absorption, low absorptive and chemical resistance properties for use in camera and projector lenses and other optical applications and in medical use containers including syringes and vials.

ZEONOR® leverages its high transparency, transferability, and heat resistance properties for use as transparent general use engineering plastics used in light guide plates, automobile parts, semiconductor containers and a wide range of other product applications.

ZeonorFilm® is the world's first optical film by the melt extrusion method from the cyclo olefin polymer. It is excellent in optical properties, low water absorption / low moisture permeability, high heat resistance, low outgassing, and dimensional stability. It is used in a wide range of applications such as displays for LCD TV, smartphones, tablets, and OLED displays.

(Source: the company)

“Diagonally-stretched optical film” is also Zeon’s world first development.

The OELD application as anti-reflection film is progressing, and demand for small- to medium-sized flat panel display applications is growing. The company’s optical films are produced in 3 bases: Takaoka city, Toyama prefecture, Himi city, Toyama prefecture, and Tsuruga city, Fukui prefecture.

ZEOCOAT® is organic insulation material used in electronic devices such as cellphones, smartphones, and LCD televisions.

ZEOCOAT® was successful in improving both the picture quality and reliability of displays because of its high transparency, extremely low water absorption and low gas generation properties. Zeon will aggressively expand its marketing efforts for OELDs, which will be thinner displays than LCD, thin-film transistors using new semiconductors, and flexible displays.

2) High Performance Chemicals Business

◎ Battery Materials

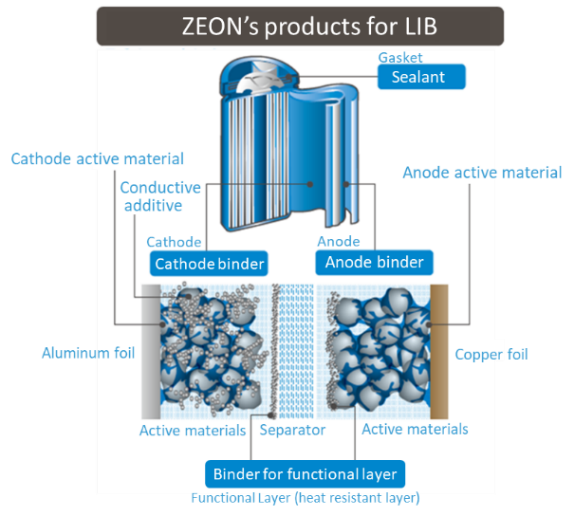

Zeon provides materials for Li-ion battery in this segment; anode / cathode binders, binder for functional layer (heat resistant separator), and sealant. Currently, Li-ion batteries are widely used as a power source for mobile devices such as smartphone and notebook computers and there is a strong demand for batteries with higher capacity.

Adoption for electric vehicles, including hybrid and plug-in hybrid cars, and industrial power sources (such as smart grids, etc.) is expanding, since it is lightweight and compact and can store a lot of energy. On the other hand, there was a problem that lifetime tends to decrease under high temperature usage. The company has advanced the function of Li-ion battery binder and succeeded in developing an aqueous cathode binder, which greatly contributes to longer battery life. In addition, Zeon succeeded in commercializing anode binder, which can raise the storage capacity of Li-ion battery by 5% to 15%. Furthermore, as part of its efforts to expand the product lineup while paying attention to environmental burdens, the company embarked on full-scale development of adhesive slurry for separator coating designed as an aqueous product.

The company believes that its binders and sealants for the cathode, anode, and functional layer (heat-resistant separator) will contribute to the improvement of the five major performance parameters of lithium-ion batteries: durability, capacity, productivity, safety, and quick charge, and thus contribute to the popularization of electric vehicles.

Recognizing the potential of lithium-ion batteries and working on them earlier than any other company, ZEON continuously proposes specialty materials for further generalizing new material functions and developing new batteries that meet needs in automobile applications, such as quick charging, as the top innovator in the market of lithium-ion battery binders.

(Source: the company)

◎ Specialty Chemicals

Zeon deals in specialty chemicals that use derivatives from C5 fraction, such as synthesized fragrances for cosmetics and flavor used in foods, characteristic solvents, and plant growth regulator.

The Company holds the world’s top share of the synthesized fragrances in green note. They provide a wide range of specialty products including ingredients for intermediary bodies used in medical and agricultural chemicals, alternative solvents to CFCs, cleaning agents, urethane expanding agent, and functional ether agents.

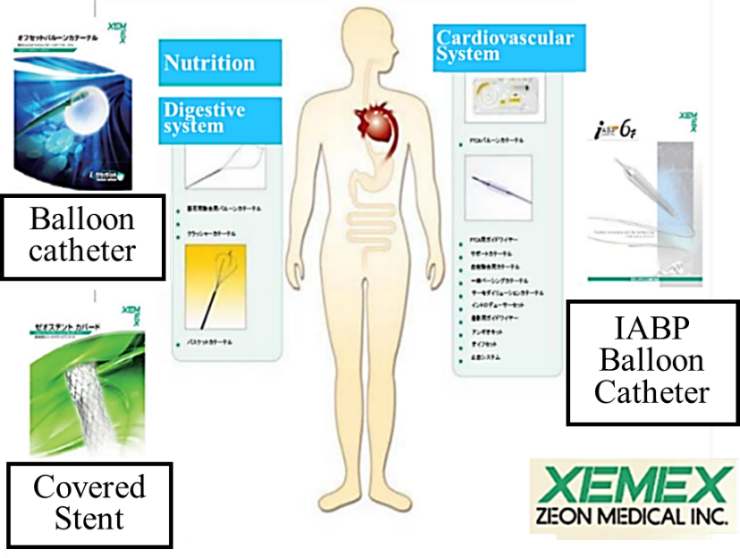

3) Medical Devices Business

Along with the start of development of artificial kidneys in 1974, Zeon aggressively promoted its medical device business. In 1989, a subsidiary Zeon Medical Inc. was established to conduct development, manufacturing, sales, and all other functions of the medical field for the Zeon Group. Zeon has shown bountiful development track record both in gastroenterology and cardiovascular area.

“The Offset Balloon Catheter” as a means of differentiation in the gallstone removal process and with Japan’s first biliary covered stent “Zeostent Covered in the area of gastroenterology products, and the world’s smallest diameter “XEMEX IABP Balloon PLUS” as a device to aid the heartbeat at times of acute myocardial infarction in the area of cardiovascular products.

(Source: the company)

Currently Zeon is focusing efforts in the development of the biliary stone removal devices that eliminate pain. Zeon has a lineup of products for extracting biliary stones ranging from extremely large stones to sludge and sand with products such as XEMEX Crusher Catheter, XEMEX Basket Catheter NT, Extraction Balloon Catheter, and is aiming at a 50% share of the gallstone removal market.In March 2016, the Company launched the world’s first optical sensor FFR device as a type of guide wire. Because it uses an optical fiber sensor, mistaken readings of blood pressure measurements rarely occur. The operability as a guide wire has also gained a high evaluation.

* FFR: fractional flow reserve ratio for quantitatively evaluating the severity of lesions and determining treatment strategies in diagnosing and treating coronary arteries.

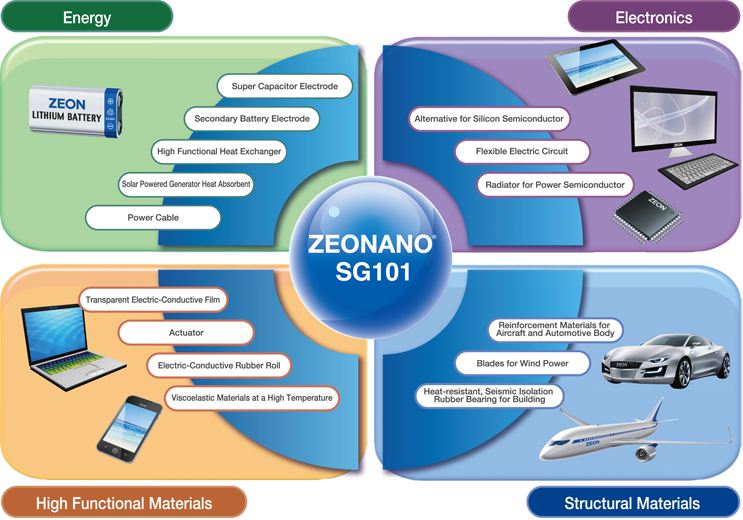

【New Specialty Materials Development: ~Carbon Nano Tube (CNT)~ 】

Aggressive R&D activities have allowed Zeon to launch various new materials into the market, and particularly high expectation is in the development of “single-wall carbon nanotubes (CNT)”.

1) What is Single-Walled CNT?

Carbon Nanotubes (CNTs) are cylindrical nanostructure formed by hexagonal lattice of carbon atoms. In 1993, Sumio Iijima, Ph.D., head of the Applied Nanotube Research Center of the National Institute of Advanced Industrial Science and Technology (AIST), discovered this structure for the first time in the world and named Carbon Nanotubes (CNTs). CNTs are categorized into single-walled and multiple-walled CNTs. Multiple-walled CNT is relatively easy to manufacture and the developments for commercial applications already started.

At the same time, single-walled CNT exhibits the following properties and is superior to multiple-walled CNT:- 20 times stronger than steel- 10 times more heat conductive than copper- Half as dense as aluminum- 10 times the electron mobility of silicon- lightweight but highly flexible- has extremely high electric-and heat-conductivity properties

Possible CNT applications are electrical conductivity assistance agent in Li-ion batteries, transparent conductive film used in electronic paper and ultra-thin touch panel because of its high elasticity and strength, and as a thermal interface material. Because of its ability to absorb a wide spectrum of light, practical applications of single-walled CNT are being promoted in the area of electromagnetic wave absorbing materials for use in a wide range of fields including energy, electronics, structural materials, and other specialty materials.

(Source: Homepage of Zeon Nano Technology Co., Ltd.)

Conventional single-walled CNT has several major issues including high levels of impurities, low levels of productivity and high manufacturing costs, which are about several tens of thousands to hundreds of thousands of yen per gram.

2) Zeon’s Efforts and Position

Against this backdrop, the company aims at establishing technologies that are necessary for the commercialization of new products using single-walled CNT developed in Japan with its numerous superior qualities in response to the worldwide social demands to realize a low-carbon society.

3) Future Endeavors

Having established the mass production technology based on the super growth method, Zeon completed the CNT production facility and started mass production, the first in the world in November 2015 in its Tokuyama plant at Shunan-city, Yamaguchi Prefecture.

Zeon is the only company in the world that has established mass production technologies for single-wall CNT. Companies around the world request for its product samples. Consequently, shipments of samples have already begun. Zeon has also begun to propose practical applications of this product.

Developing a technology for suppressing lithium dendrites with the sheets based on carbon nanotubes is expected to contribute to significant improvement in the life of lithium metal electrodes (negative electrodes) and to accelerating the practical application of high energy density and large capacity lithium metal electrodes (negative electrodes) (from the company's press release on January 25, 2022).

At the same time, single-wall CNT is a type of nanomaterial that is extremely small and fiber shape. Therefore, there is a concern that it may have some impact upon biological processes depending upon its size and shape. Currently, the AIST is conducting standardization of the evaluation process, and activities for the OECD endpoint measurement are being conducted, with global standardization and legal and regulatory aspects being considered.

Other Business

The combination liquid for Reaction Injection Molding (RIM) using the ingredient dicyclopentadiene (DCPD) as a raw material.

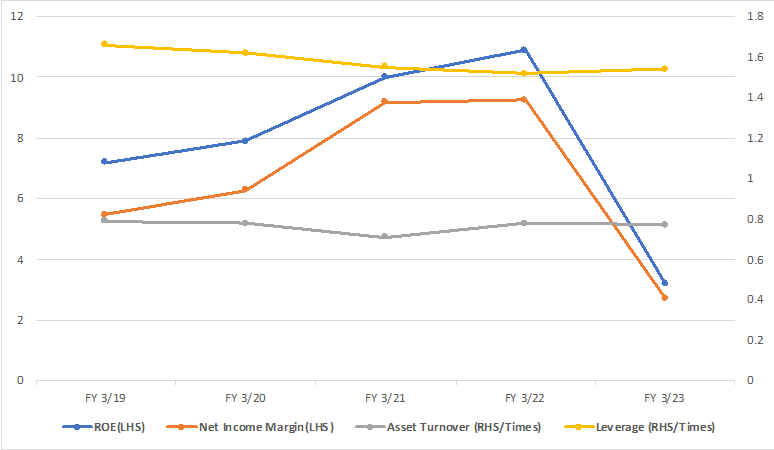

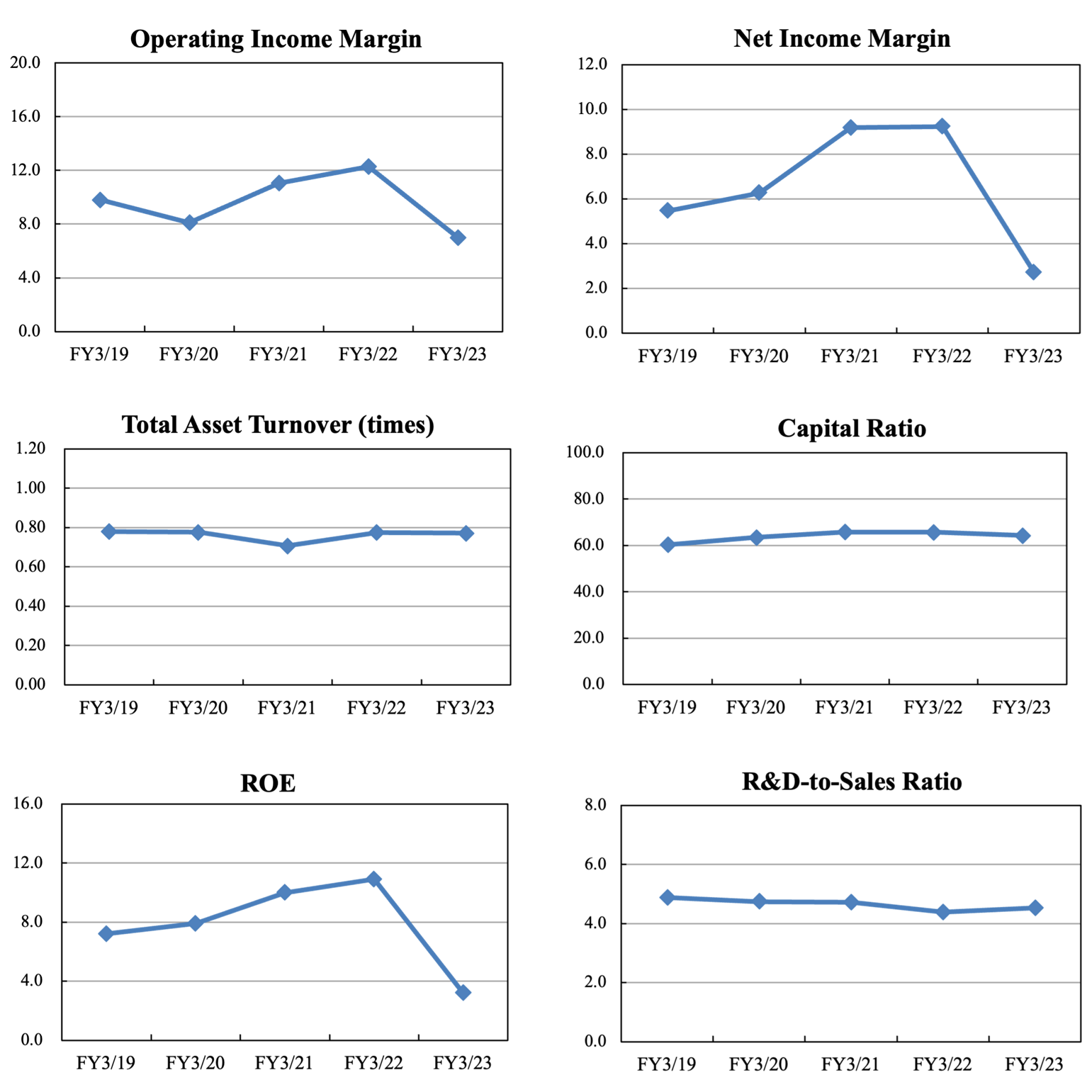

[1-4 ROE Analysis]

| FY Mar. 16 | FY Mar. 17 | FY Mar. 18 | FY Mar. 19 | FY Mar. 20 | FY Mar. 21 | FY Mar. 22 | FY Mar. 23 |

ROE (%) | 8.6 | 10.3 | 5.3 | 7.2 | 7.9 | 10.0 | 10.9 | 3.2 |

Net income margin (%) | 6.12 | 8.05 | 3.92 | 5.47 | 6.27 | 9.18 | 9.24 | 2.72 |

Total asset turnover (times) | 0.75 | 0.72 | 0.78 | 0.79 | 0.78 | 0.71 | 0.78 | 0.77 |

Leverage (x) | 1.86 | 1.77 | 1.71 | 1.66 | 1.62 | 1.55 | 1.52 | 1.54 |

ROE exceeded 10% in the fiscal years ended March 2021 and March 2022. In the fiscal year ended March 2023, however, the demand environment deteriorated, so net income margin shrank and ROE was at a low level. In addition to recovery of demand and profitability improvement in the future, we would like to expect medium- and long-term increase in profitability based mainly on growth in the Specialty Materials segment.

*Prepared by Investment Bridge Co., Ltd. based on the disclosed material.

[1-5 Characteristics and Strengths]

1. World’s Leading Creative Technology Development Capability

The GPB method used to manufacture butadiene from C4 fraction is the most important development in Japan’s postwar history of chemicals and is licensed to 49 plants in 19 countries around the world.

In addition, the Mizushima Plant is the world’s only plant with GPI method to extract high-purity isoprene and other effective substances from C5 fraction. This Zeon’s GPI method is a completely unique technology, which is not provided to other companies.

These two technologies represent the creative technological capabilities that are among the strengths of Zeon. They also are highly regarded and have received numerous awards in the global markets. Regarding technologies, Zeon has received 54 awards since 1960 including the GPB and GPI methods, in addition to 28 awards since 1982 for its environment conservation and safety efforts.

2. High Worldwide Share

Zetpol®, ZEONEX®, and ZEONOR® are representative of the products born from Zeon’s highly creative technologies, which have allowed it to acquire high shares of worldwide markets. In addition, their Leaf alcohol for in cosmetics and food flavorings and NBR latex for cosmetic puffs have the world’s top share.

3. R&D Structure that Continues to Yield Creative Technologies

Zeon seeks to conduct R&D activities based upon its basic corporate philosophy of "contributing to society by continuously creating the world's No.1 products and businesses based on innovative and original technologies that are unique to ZEON, even in niche markets, in fields in which ZEON excels, and that no one else can imitate, and that are friendly to the earth."

The Company’s main R&D center is in Kawasaki City, Kanagawa Prefecture. Zeon has also established the Precision Optics Laboratory and Medical Laboratory at the Takaoka Plant, the Specialty Chemical Product Research Facility at the Yonezawa Plant, the Toner Research Facility at the Tokuyama Plant and C5 Chemicals Laboratory at the Mizushima Plant for more efficient R&D activities to be conducted closer to the manufacturing sites. The technical support bases are in the U.S., Germany, Singapore, and China.

New research and development initiatives have also been launched, including the establishment of the Emergence Promotion Center, which specializes in new businesses and technologies, and is taking on the challenge of sustainable research and development, including efforts to address the SDGs, which are to be attained by 2030.

2. First Half of the Fiscal Year ending March 2024 Earnings Results

[2-1 Consolidated Earnings]

| FY 3/23 1H | Ratio to sales | FY 3/24 1H | Ratio to sales | YoY | Compared with forecast |

Sales | 197,417 | 100.0% | 185,442 | 100.0% | -6.1% | +0.2% |

Gross Profit | 61,695 | 31.3% | 49,928 | 26.9% | -19.1% | - |

SG&A | 41,511 | 21.0% | 40,467 | 21.8% | -2.5% | - |

Operating Income | 20,184 | 10.2% | 9,461 | 5.1% | -53.1% | -14.0% |

Ordinary Income | 24,400 | 12.4% | 13,034 | 7.0% | -46.6% | -10.1% |

Quarterly Net Income | 17,419 | 8.8% | 10,359 | 5.6% | -40.5% | -1.3% |

*Unit: million yen.

Both sales and profit declined YoY

Sales were 185.4 billion yen, down 6.1% year on year, and operating income went down 53.1% year on year to 9.4 billion yen. The Elastomer Business saw declines in both sales and profit. The synthetic rubber segment was affected by the economic slowdown in China, and demand for adhesive tapes in the segment of chemical products recovered only slowly. The demand for gloves subsided, affecting the synthetic latex segment. Both sales and profit shrank in the Specialty Materials Business. Regarding specialty plastics, while shipments of large-sized films and resins for optical applications were on an increasing trend, the volume of shipments of small- and medium-sized films and resins for medical and other applications was low. The performance of specialty chemicals was affected by the delayed posting for battery materials at some overseas affiliates.

With an increase in gain on foreign exchange as non-operating income, ordinary income decreased 46.6% year on year to 13 billion yen. Quarterly net income stood at 10.3 billion yen, down 40.5% year on year.

[2-2 Trends by Business Segments]

◎First Half

| FY 3/23 1H | Composition ratio | FY 3/24 1H | Composition ratio | YoY |

Sales |

|

|

|

|

|

Elastomer Business | 111,412 | 56.4% | 104,731 | 56.5% | -6.0% |

Specialty Materials Business | 56,562 | 28.7% | 51,409 | 27.7% | -9.1% |

Other Business | 31,611 | 16.0% | 31,463 | 17.0% | -0.5% |

Adjustment | -2,169 | - | -2,160 | - | - |

Total | 197,417 | 100.0% | 185,442 | 100.0% | -6.1% |

Operating Income |

|

|

|

|

|

Elastomer Business | 9,331 | 8.4% | 3,644 | 3.5% | -60.9% |

Specialty materials Business | 11,636 | 20.6% | 6,592 | 12.8% | -43.3% |

Other Business | 719 | 2.3% | 1,399 | 4.4% | +94.6% |

Adjustment | -1,502 | - | -2,174 | - | - |

Total | 20,184 | 10.2% | 9,461 | 5.1% | -53.1% |

*Unit: million Yen. Composition of operating profit as % of operating profit on sales.

*Prepared based on disclosed materials by Investment Bridge Co., Ltd.

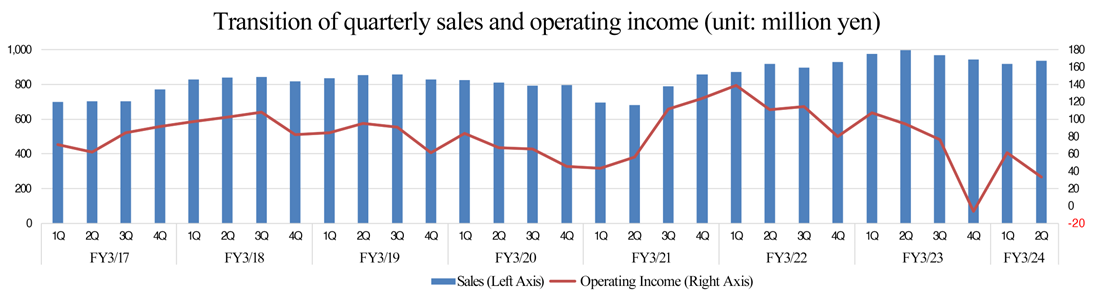

[2-3 Quarterly Trends]

| 1Q FY 3/23 | 2Q | 3Q | 4Q | 1Q FY 3/24 | 2Q | 3Q | 4Q |

Sales | 97,576 | 99,841 | 96,788 | 94,409 | 91,927 | 93,515 |

|

|

Operating Income | 10,726 | 9,458 | 7,651 | -656 | 6,114 | 3,347 |

|

|

*Unit: million Yen.

From the previous quarter (the first quarter of the fiscal year March 2024), sales grew 1.7%, but profit shrank 45.3%.

◎Segment

| 1Q FY 3/23 | 2Q | 3Q | 4Q | 1Q FY 3/24 | 2Q | 3Q | 4Q |

Sales |

|

|

|

|

|

|

|

|

Elastomer Business | 53,547 | 57,865 | 55,921 | 54,897 | 52,218 | 52,513 |

|

|

Specialty materials Business | 30,076 | 26,486 | 24,941 | 23,853 | 25,196 | 26,213 |

|

|

Other Business | 15,099 | 16,512 | 16,853 | 16,806 | 15,374 | 16,089 |

|

|

Operating Income |

|

|

|

|

|

|

|

|

Elastomer Business | 4,058 | 5,273 | 2,878 | -2,025 | 2,464 | 1,180 |

|

|

Specialty materials Business | 6,981 | 4,655 | 4,905 | 1,755 | 3,998 | 2,594 |

|

|

Other Business | 422 | 297 | 686 | 976 | 637 | 762 |

|

|

*Unit: million Yen

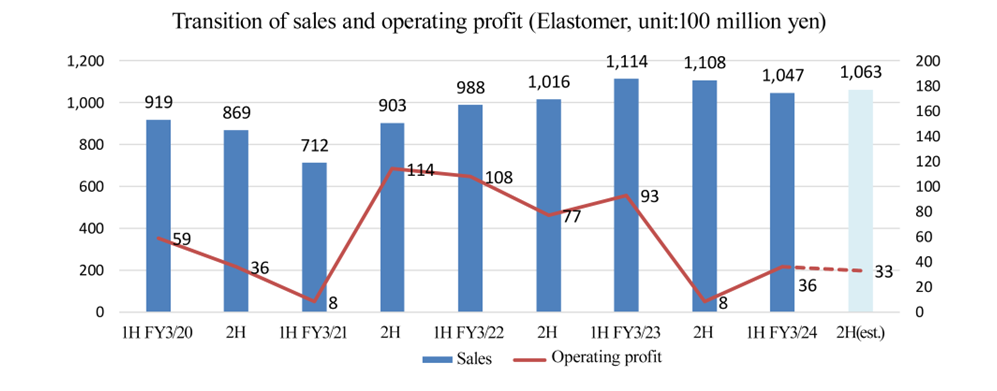

【Elastomers】

Quarter-on-quarter increase in sales but decrease in profit.

While the volume of synthetic rubber shipped increased, shipments of latex and chemical products fell in volume. Profit dropped due to such factors as the decline in market prices, increased selling, general and administrative expenses of synthetic rubber products, and the drop of the unit price of the fixed cost of chemical products.

*Synthetic Rubber

Sales leveled off because the selling price went down due to the decline in raw material prices. Profit shrank owing to the increased periodic maintenance cost for overseas affiliates and the reversal of inventory-related expenses in the first quarter.

*Latex

Demand for gloves was on par with that in fiscal 2022, and profit rose owing to the decline in raw material prices.

*Chemical Products

Sales grew because the composition of items shipped was changed. The company adjusted the selling prices with the aim of increasing the shipment volume. Profit shrank due to the reversal of inventory-related expenses in the first quarter.

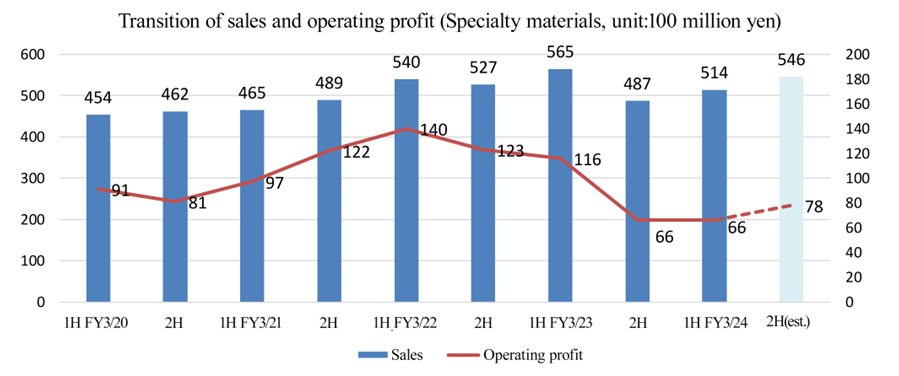

【Specialty Materials】

Sales increased and profit decreased quarter on quarter

Although sales increased owing to an increase in the volume of large-sized films and optical resins shipped, profit declined because shipments of small- and medium-sized films and resins for medical and other applications were on a downward trend.

*Specialty resin

Sales went up on a year-on-year and quarter-on-quarter basis because shipments of large-sized films and optical resins recovered in volume. On the other hand, profit fell both year on year and quarter on quarter due to a low shipment volume of small- and medium-sized films and resins for medical and other applications.

*Specialty chemicals

Both sales and profit declined year on year due in part to the delay in posting for battery materials at overseas affiliates. Meanwhile, sales and profit grew on a quarter-on-quarter basis owing to the improved utilization at customers.

◎Trends in shipment volume by item

* Battery materials

In the second quarter (July to September), shipments grew in volume by 26% year on year and by 29% quarter on quarter, and the shipment volume went down 1% for the first half (April – September).

The volume of battery materials for electric vehicles shipped were up 22% year on year and 34% quarter on quarter. The company saw growth both year on year and quarter on quarter owing to the gradual recovery of the utilization at customers in China.

The volume of shipments for consumer product and other industries rose 50% year on year and 7% quarter on quarter. Although the shipment volume of battery materials for mobile devices bottomed out due to production adjustment by customers in China, it is on an upward trend, resulting in year-on-year and quarter-on-quarter increases in shipment volume.

* Optical plastics

In the second quarter (July – September), the shipment volume declined 15% year on year, 6% quarter on quarter, and 8% for the first half (April – September).

Shipments of products for optical applications rose in volume by 9% year on year and by 34% quarter on quarter. The volume of shipments increased both year on year and quarter on quarter because some of the customers eased inventory adjustment. While demand is rising gradually, whether the upward trend will continue is not clear and therefore we need to pay close attention.

Shipments of products for medical and other applications decreased in volume by 22% year on year and by 16% quarter on quarter. The shipment volume fell on a year-on-year and quarter-on-quarter basis partly because of the adjustment on shipments following the periodic maintenance of the Mizushima Plant, the stagnation of the semiconductor market, and inventory adjustment by some of the customers.

* Optical films

In the second quarter, (July – September), the volume of shipments increased 91% year on year, 1% quarter on quarter, and 22% for the first half (April – September).

Shipments of small- and medium-sized product industries fell in volume by 27% year on year and by 14% quarter on quarter. The declining number of tablet devices and laptop computers produced and the delay in the start of manufacturing of new models of smartphones resulted in decreases in shipment volume on a year-on-year and quarter-on-quarter basis.

The volume of shipments for large product industries went up 177% year on year and 4% quarter on quarter. Demand was on the rise after production adjustment by television manufacturers in the second quarter of the fiscal year ended March 2023, contributing to increasing ZEION’s shipment volume both year on year and quarter on quarter.

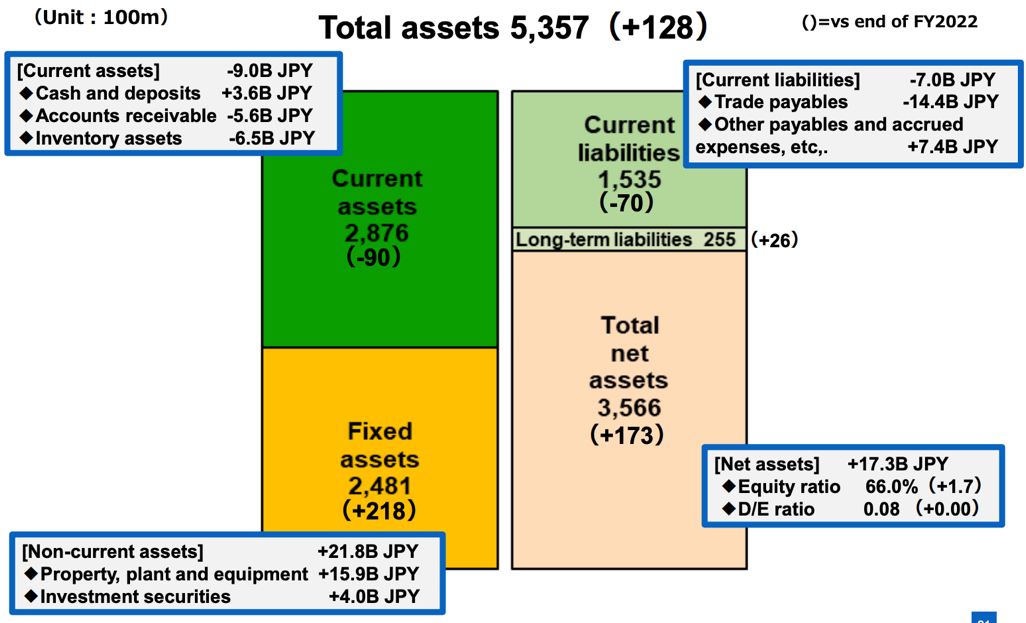

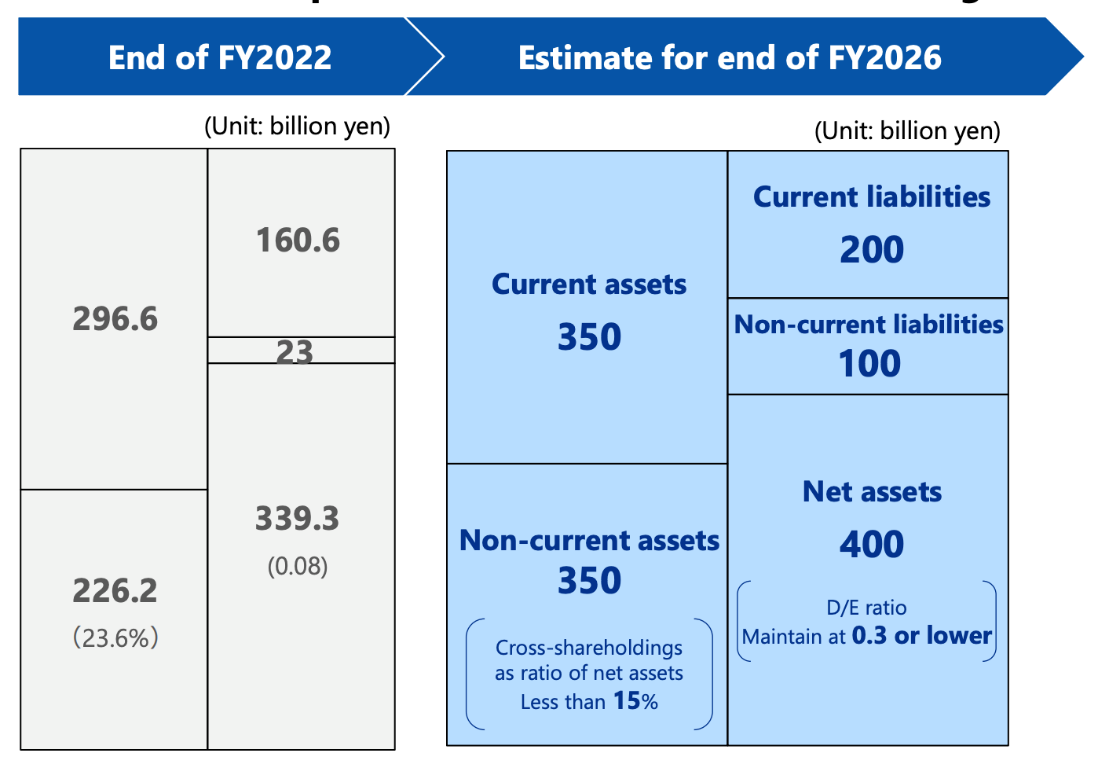

[2-4 Financial standing and cash flows]

◎Main Balance Sheet

| End of 3/23 | End of 9/23 | Increase/ decrease |

| End of 3/23 | End of 9/23 | Increase/ decrease |

Current Assets | 296,631 | 287,620 | -9,011 | Current liabilities | 160,587 | 153,542 | -7,045 |

Cash | 30,082 | 33,669 | +3,587 | Payables | 86,781 | 72,349 | -14,432 |

Receivables | 83,594 | 88,530 | +4,936 | ST Interest-Bearing Liabilities | 27,960 | 28,960 | +1,000 |

Inventories | 127,452 | 120,954 | -6,498 | Non-current liabilities | 22,973 | 25,540 | +2,567 |

Non-current Assets | 226,237 | 248,701 | +22,464 | LT Interest-Bearing Liabilities | - | - | - |

Tangible Assets | 113,924 | 129,789 | +15,865 | Total Liabilities | 183,560 | 179,081 | -4,479 |

Intangible Assets | 4,442 | 5,155 | +713 | Net Asset | 339,308 | 356,609 | +17,301 |

Investment, Others | 107,871 | 113,217 | +5,346 | Capital | 336,310 | 353,507 | +17,197 |

Total assets | 522,868 | 535,691 | +12,823 | Total Liabilities and Net Assets | 522,868 | 535,691 | +12,823 |

*Unit: million yen. Receivables include electronically booked receivables; likewise, payables include electronically booked payables.

Total assets increased 12.8 billion yen from the end of the previous term due to increases in tangible assets, investments, and other assets.

Total liabilities decreased 4.4 billion yen from the end of the previous term due to decreases in payables.

Net assets increased 17.3 billion yen from the end of the previous term due to increases in valuation difference on available-for-sale securities and foreign currency translation adjustments.

As a result, the equity ratio increased by 1.7 points from the end of the previous fiscal year to 66.0 %, and the D/E ratio was 0.08, same as the end of the previous period.

3. Fiscal Year ending March 2024 Earnings Forecasts

[3-1 Earnings Forecast]

| FY 3/23 | Ratio to Sales | FY3/24 (Est) | Ratio to Sales | YoY | Initial Forecast | Previous Forecast |

Sales | 388,614 | 100.0% | 380,000 | 100.0% | -2.2% | 399,000 | 394,000 |

Operating Income | 27,179 | 7.0% | 20,500 | 5.4% | -24.6% | 24,000 | 27,500 |

Ordinary Income | 31,393 | 8.1% | 25,000 | 6.6% | -20.4% | 26,000 | 31,500 |

Net Income | 10,569 | 2.7% | 27,500 | 7.2% | +160.2% | 19,000 | 23,500 |

*Unit: million yen.

Revised down, lower revenue and operating profit expected; net profit revised up.

For the fiscal year March 2024, the company projects that sales will shrink 2.2% year on year to 380 billion yen and operating income will drop 24.6% year on year to 20.5 billion yen. The forecasts for both sales and operating income were revised downwardly from the previous ones (issued in July). As of the previous revision, the earnings forecast for the second half of the fiscal year March 2024 was left as forecasted at the beginning of the term. After careful consideration, the company has projected that the overall sales quantity will be lower than the forecast because of the adverse impacts that the deteriorating market environment due to uncertain factors, such as the trend of the Chinese economy, has on its business, including delayed recovery of demand for the mainstay products in the Elastomer Business and the Specialty Materials Business. Regarding the consolidated earnings forecast, therefore, sales, operating income, and ordinary income are expected to fall below the forecasts previously issued. On the other hand, gain on sale of investment securities (extraordinary income) booked will allow net income to exceed the previous forecast.

The amount of dividends remains unrevised, with the expected year-end dividend standing at 20 yen/share and the expected annual dividend going up by 4 yen to 40 yen/share. The dividend amount is projected to increase for the 14th consecutive year from fiscal 2010. Payout ratio is to be 30.7%.

[3-2 Trends by Business Segments]

| FY3/23 | FY3/24(Est) | YoY | Previous Forecast |

Sales |

|

|

|

|

Elastomer Business | 222,230 | 211,000 | -5.1% | 217,000 |

Specialty materials Business | 105,356 | 106,000 | +0.6% | 113,000 |

Sales Total | 388,614 | 380,000 | -2.2% | 394,000 |

Operating Income |

|

|

|

|

Elastomer Business | 10,184 | 6,900 | -32.2% | 8,600 |

Specialty materials Business | 18,296 | 14,400 | -21.3% | 18,000 |

Operating Income Total | 27,179 | 20,500 | -24.6% | 27,500 |

*Unit: million yen.

Business Environment in the Second Half

(1) Elastomer Business

* Synthetic rubber

It is expected that the segment will be affected by the downturn of the Chinese economy.

*Latex

Demand for gloves is projected to be on par with that in the first half of the term, and the company will propel forward structural reform of its business.

*Chemical Products

While the volume of products shipped is expected to increase, the rate of increase will be low.

(2) Specialty materials

* Optical plastics

Optical resins, especially ones for medical and other applications, will be affected by customers’ inventory adjustment and the downturn in the semiconductor market.

* Optical films

The amount of production at customers has been revised downwardly regarding optical films for tablet devices and laptop computers.

* Battery materials

While recovery of demand will be slower than the initial forecast, demand is expected to rebound on a continuous basis.

The foreign exchange rates and market conditions as premises for the forecasts are as follows:

1 U.S. dollar = 140 yen, 1 euro = 150 yen, domestically produced naphtha = 63,000 yen, and Asian butadiene = 800 U.S. dollars.

4. Conclusions

Operating income increased significantly from the previous quarter (the fourth quarter of the fiscal year ended March 2023) owing in part to the reversal of loss on valuation of inventory based on the lower-of-cost-or-market rule in the first quarter, and the forecasts for the first half of the term and the full fiscal year were revised upwardly on the premise that the forecast for the second half is left unrevised because the company is currently giving careful consideration. In the second half, however, there was no transient factor like in the first quarter, and the company took into account factors in deterioration of the outlook for the second half, which caused it to revise the full-year forecast downwardly. The company saw a quicker recovery in the Elastomer Business than initially expected, but the rate of recovery is seemingly getting slow due partly to the economic downturn in China. We reported in the previous bridge report that we would like to keep an eye on the future situation regarding the trend of demand resulting from the economic slowdown in China, and this has become a reality. In the Specialty Materials Business, while sales of large-sized films were on the rise, one of the factors in the downward revision to the forecast is that production at customers was reduced regarding small- and medium-sized films.

Although ZEON’s business stalled under immediate circumstances, the medium- and long-term business development and outlook will not be affected significantly. With regard to lithium-ion batteries for electric vehicles for which ZEON provides materials, the company sees recovery after inventory adjustment by customers in the second quarter and the market is expected to boom considerably. Furthermore, regarding cyclo olefin polymer (COP) whose characteristics are valued for optical and medical applications, the currently sluggish sales are transient and the future outlook is promising.

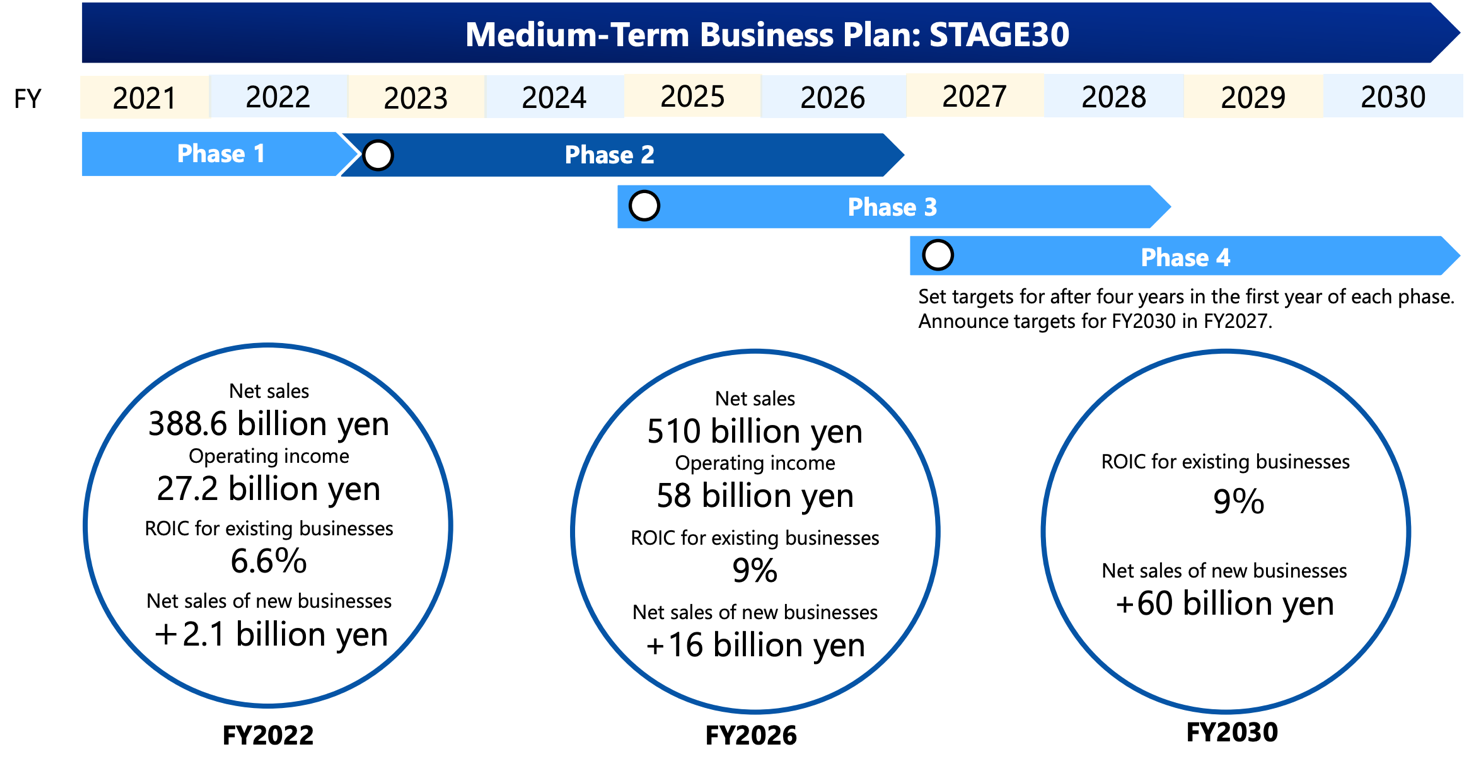

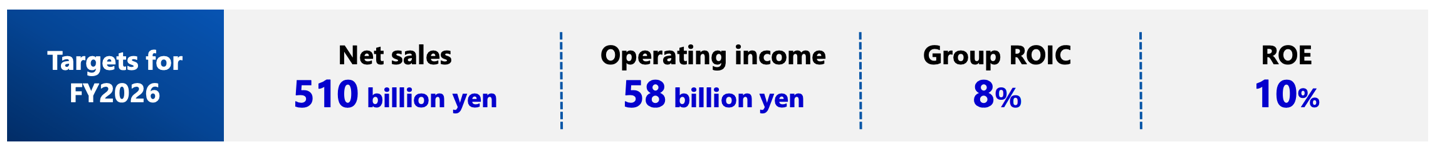

In regard to the ongoing medium-term management plan that has reached the second phase, the company has made no change in it. If ZEON attains the profit level that it is aiming at by the end of the fiscal year March 2027, the Earnings per Share (EPS) will be around 200 yen. While the economy and the market are on a downward trend in the short term, it is expected that the company continues to grow over the medium- and long-term run. We would like to think highly of the company’s proactive shareholder returns as demonstrated by the increase in dividends for the 14th consecutive year.

The share price is currently at a low level as a reaction to the financial results of the first half of the term, falling far below the BPS (1,591.79 yen). Given medium- and long-term business development and the profit target as set in the medium-term management plan, there is seemingly ample room for reconsideration.

<Reference 1: Medium-term Management Plan>

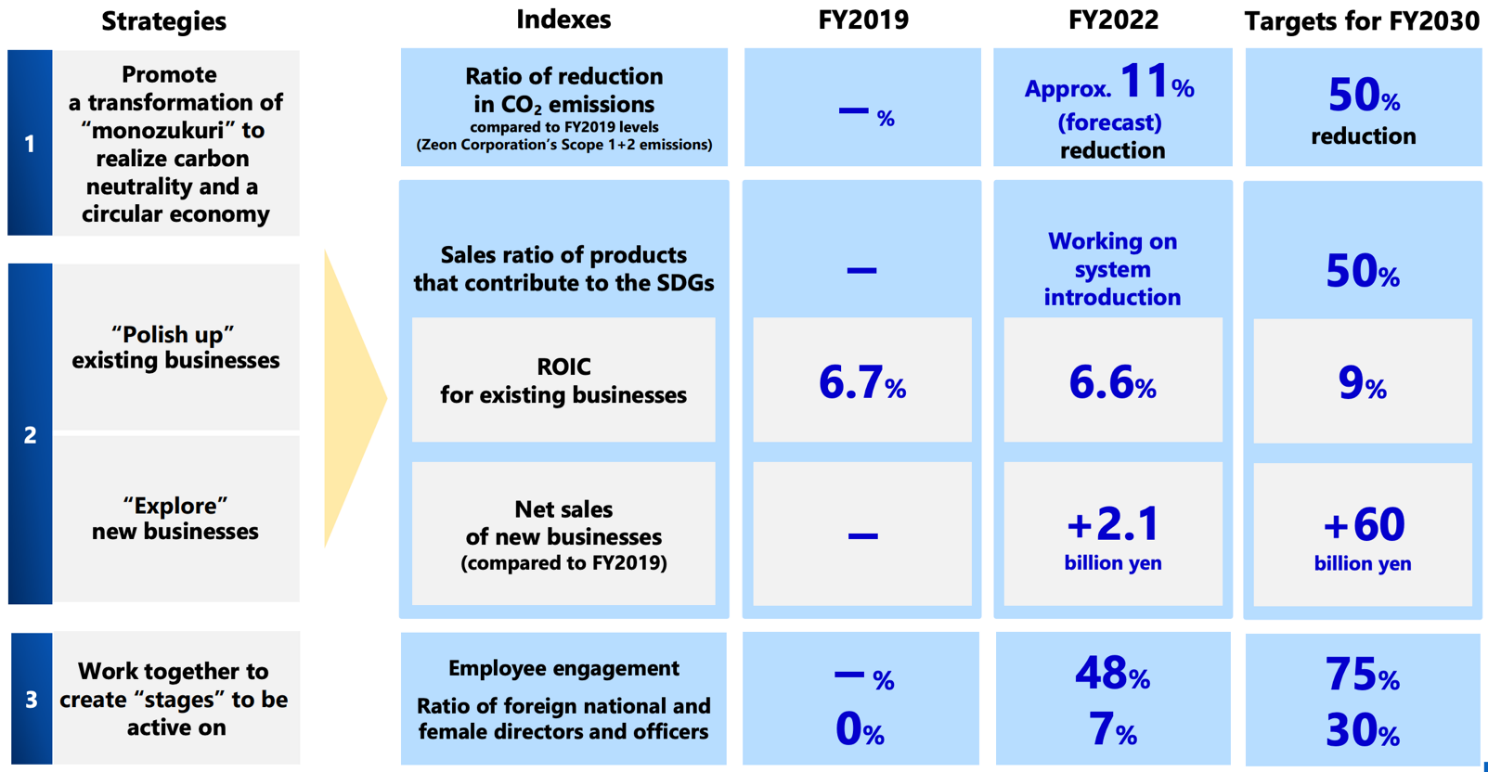

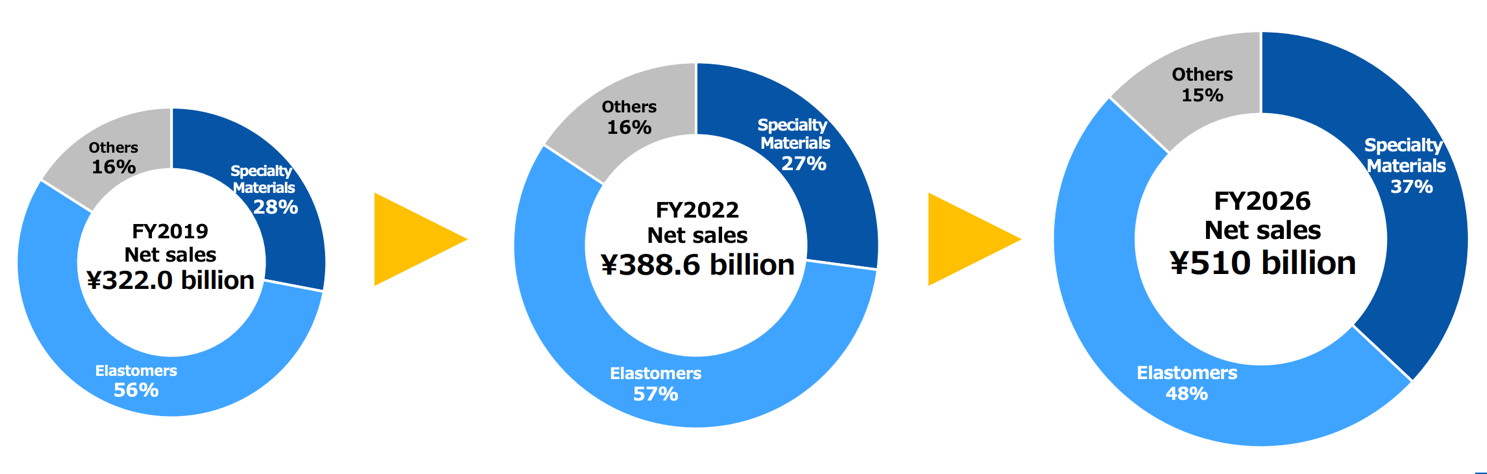

The company is promoting its Medium-Term Business Plan, “STAGE 30,” which began in the fiscal year ended March 2022. Having completed “Phase 1” of the plan in the fiscal year March 2023, the company has entered “Phase 2” of the business plan, which will end in the fiscal year March 2027.

[1-1-1 Overview of the New Medium-term Management Plan]

The corporate philosophy is to contribute to the preservation of the earth and the prosperity of human race.

Zeon’s mission befits the company name’s origin, which is acquiring raw materials from the earth and prospering for eternity. The company’s mission is to contribute to a sustainable planet and a safe and comfortable life for people by providing unique technologies, products, and services.

Based on this mission, the company set its vision for 2030 to be a company that meets the expectations of society and the aspirations of employees.

Furthermore, the company has listed three specific action guidelines for all employees to focus on: “Let’s try first,” “Let’s connect,” and “Let’s polish up.”

Zeon will focus on achieving nine of the SDGs’ target to be a company that meets society’s expectations.

[1-1-2 Overview of the Medium-Term Business Plan - Phases and Performance Targets]

[1-2-1 Progress of Phase 1]

[1-2-2 Explanation of Progress of Phase 1 for Each Corporate Strategy]

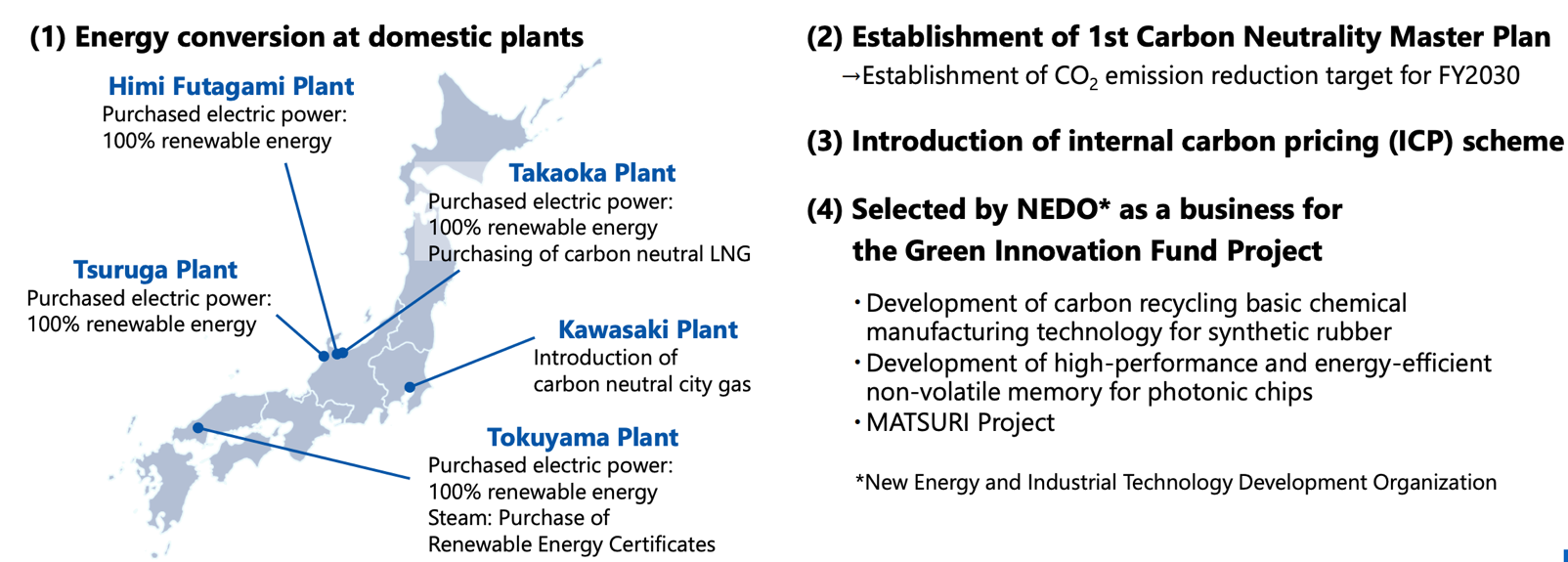

(1)Promote a Transformation of “monozukuri” to Realize Carbon Neutrality and a Circular Economy

(2) “Polish up” existing businesses, “explore” new businesses, and developing digital infrastructure to create value for customers

“Polish up” existing businesses①

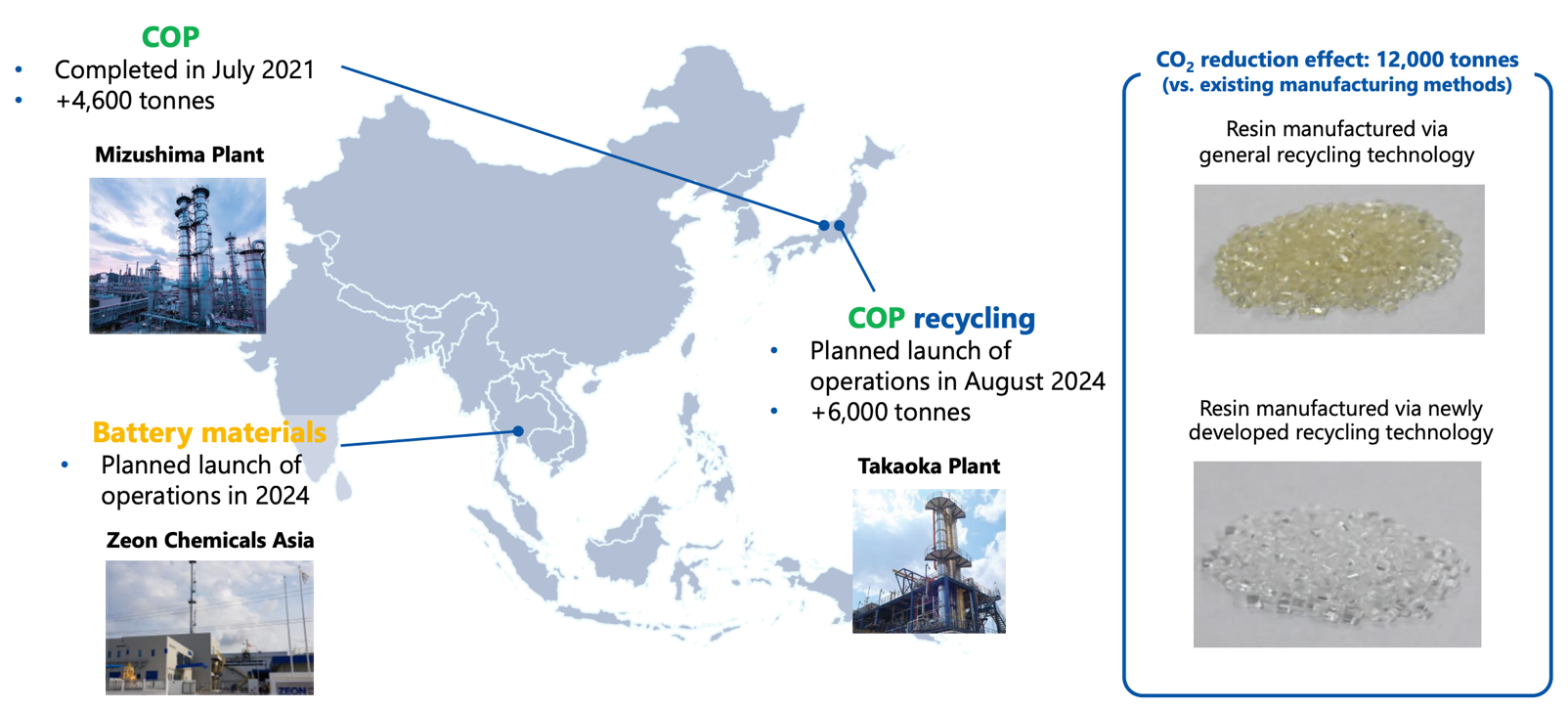

The company is improving its capacities to enhance the manufacturing of COP* and battery materials. *Cyclo Olefin Polymers

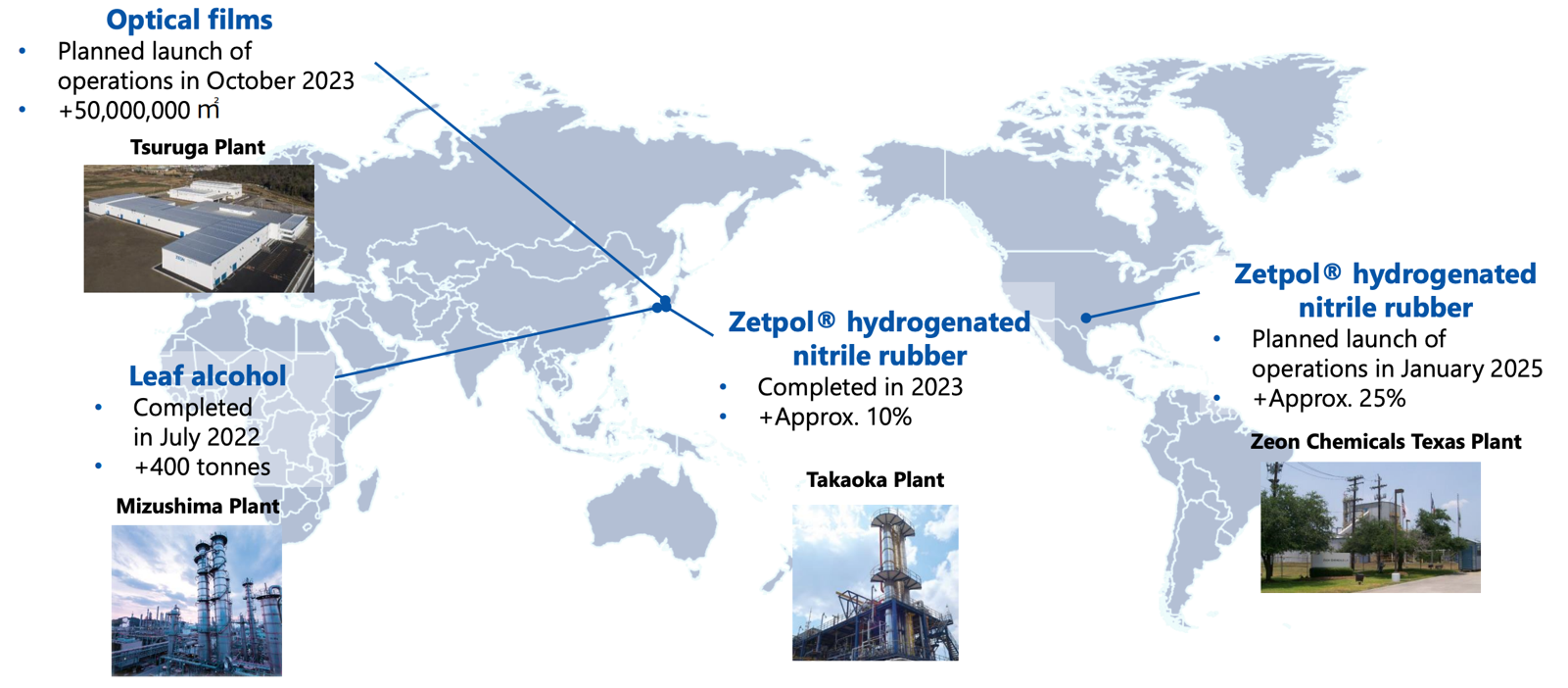

“Polish up” existing businesses②

The company is aggressively expanding the capacity for its differentiated product range to ensure the survival of the existing SBUs (Strategic Business Units).

(Source: the company)

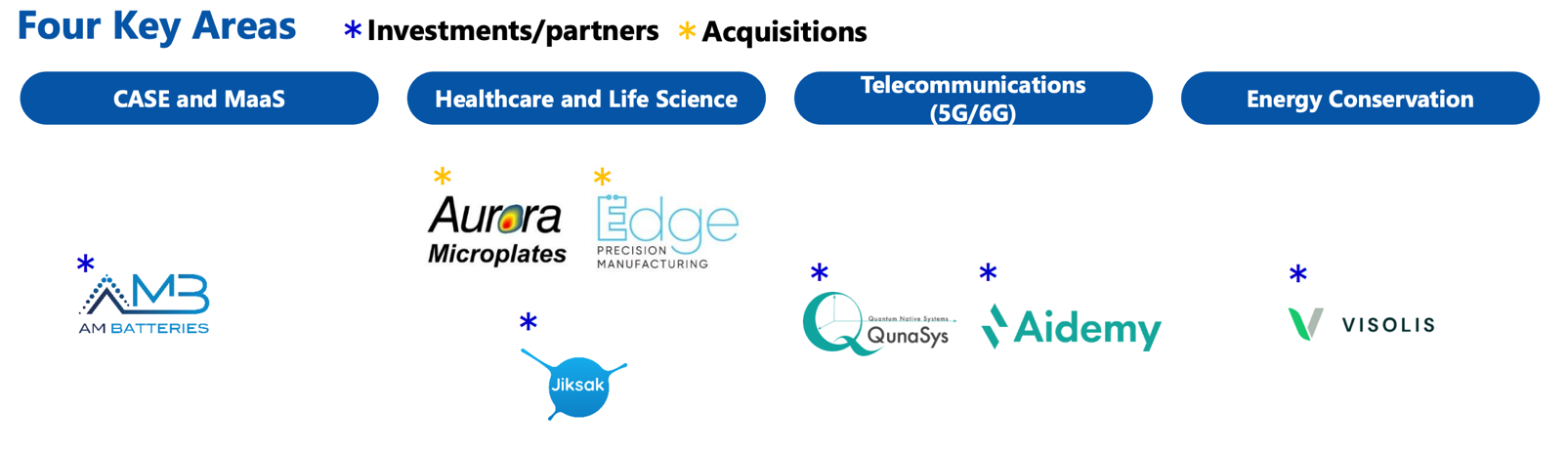

“Explore” new businesses

Among the four key areas of the company, Telecommunication drove a 2.1 billion yen increase in net sales of new business.

It also promoted external collaboration in each area, including the acquisition of two companies in the “Healthcare/Life Science” area to achieve further growth.

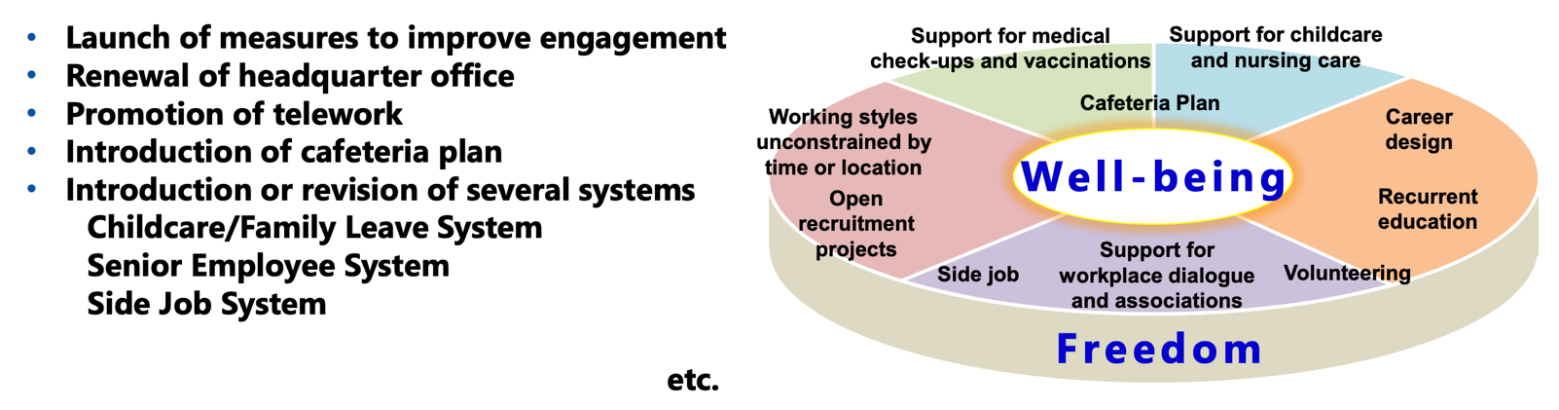

(3)Work together to create “stages” to be active on

The company proceeded with the development of workplace systems and environments to provide more choices in life.

[1-3-1 Overview of Phase 2 of the Medium-Term Business Plan]

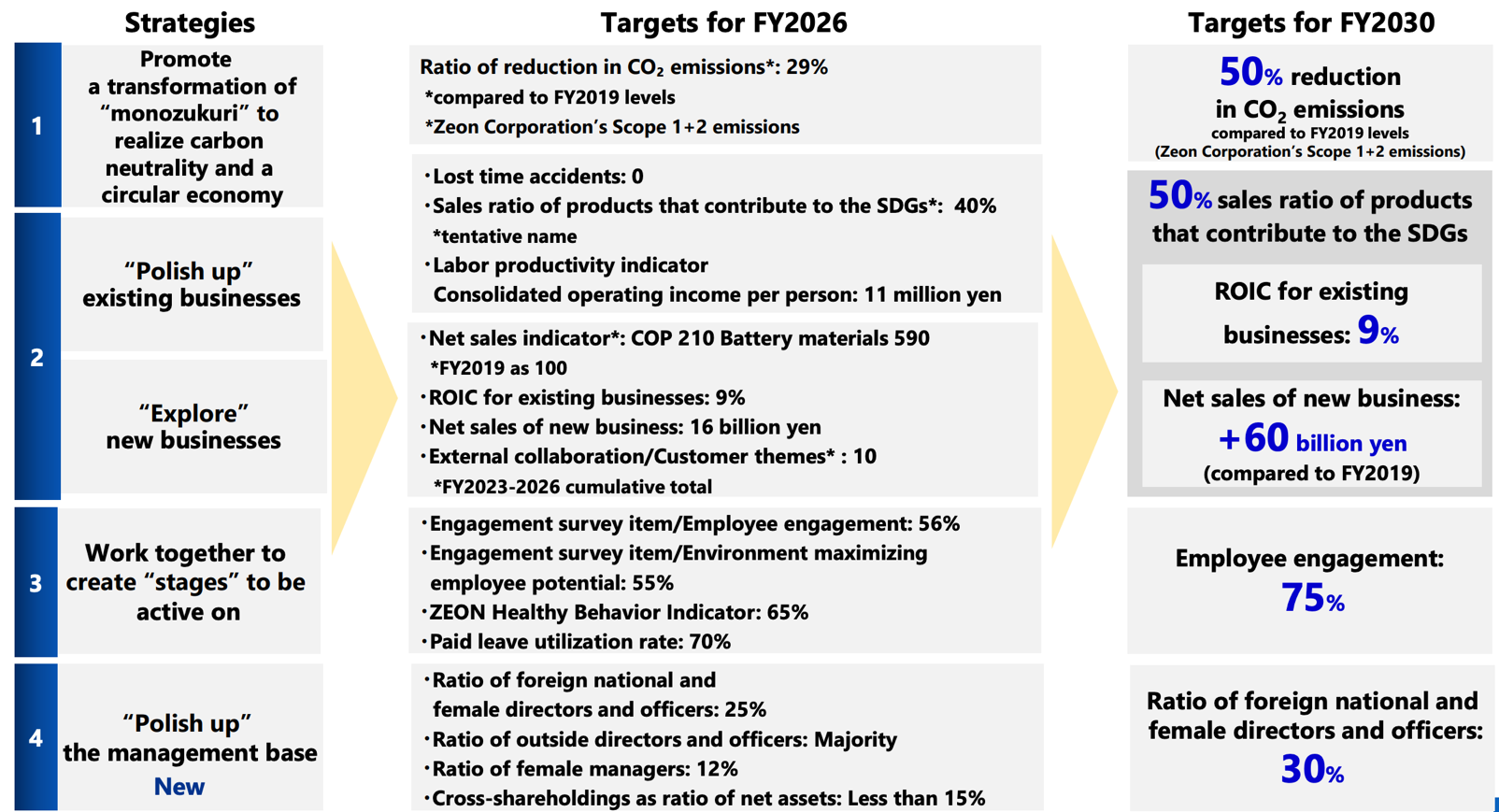

Phase 1 was positioned as a “run-up period” amid a sluggish external environment. Although no clear quantitative targets were set, progress was seen in each corporate strategy as planning and execution proceeded simultaneously. In Phase 2, without changing the vision for 2030, “A company that lives up to societal expectations and aspirations of employees,” it set performance targets for the fiscal year March 2027, with an emphasis on profitability. The company was meticulous about quantifying and defining the target values for the fiscal year 2026, which is the final year of this phase. The company intends to roll out interim targets and measures every two years to achieve the targets for the fiscal year 2030. Additionally, in the overall strategy, there is a policy to establish a “polished management base” and further enhance governance.

New name for the Medium-Term Plan: “STAGE 30”

[1-3-2 Company-wide Strategy in Phase 2 of the Medium-term Business Plan]

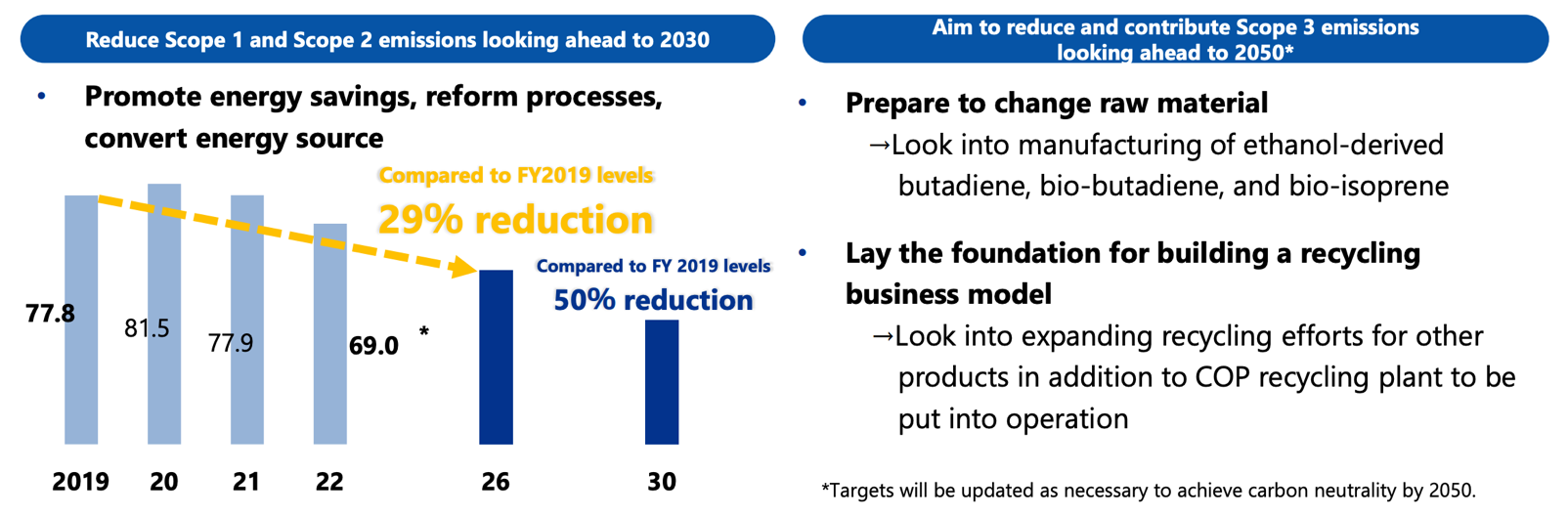

(1) Promote a Shift to “Manufacturing” to Realize Carbon Neutrality and a Circular Economy

Reduce Scope 1 and Scope 2 CO2 emissions for 2030.

Looking ahead to 2050, to contribute to the reduction of Scope 3 emissions.

* 729,000 tons when calculated based on GHG protocol

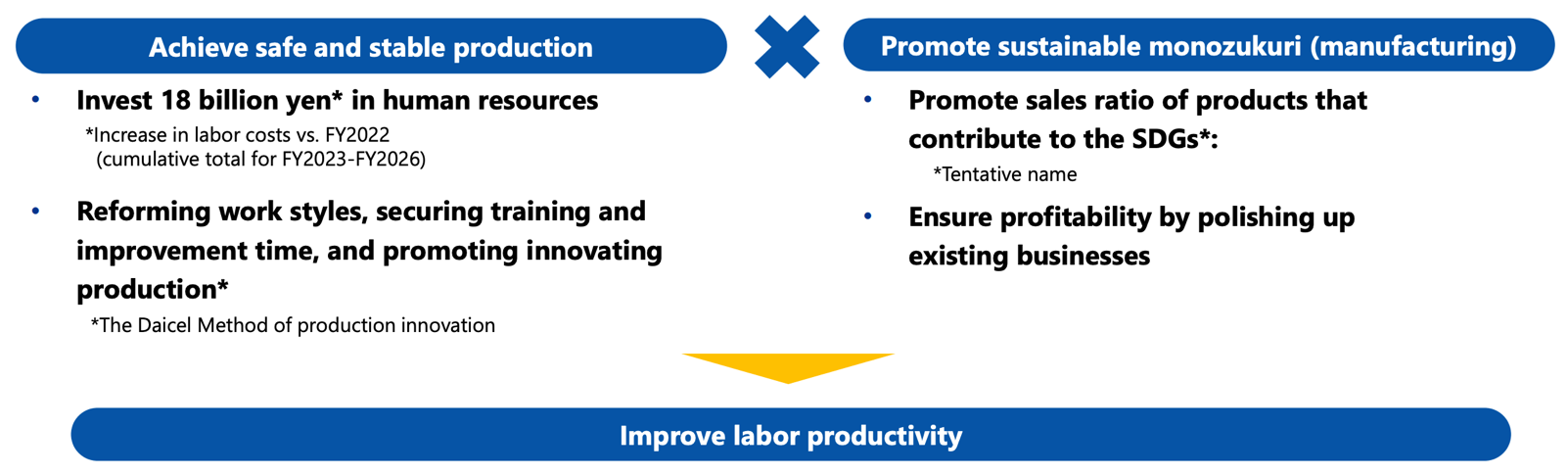

(2) Promoting a Shift to “Manufacturing” to Realize Carbon Neutrality and a Circular Economy

+ “Polishing up” existing businesses + “Exploring” new businesses

Achieving safe and stable production and promoting sustainable manufacturing.

These will improve labor productivity.

(3) “Polishing up” existing businesses

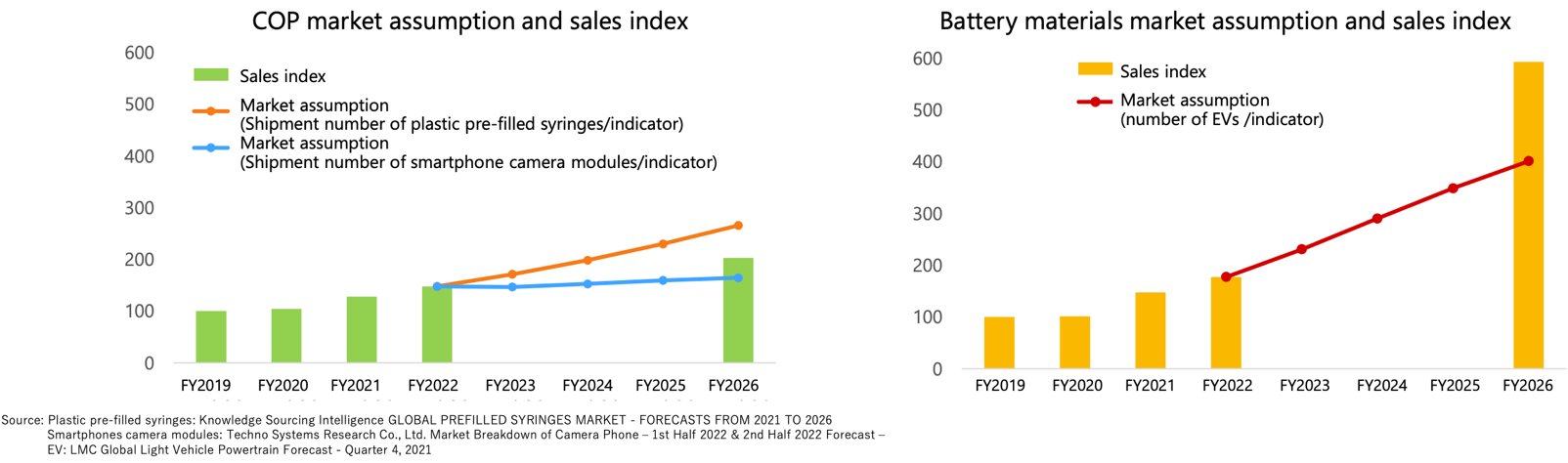

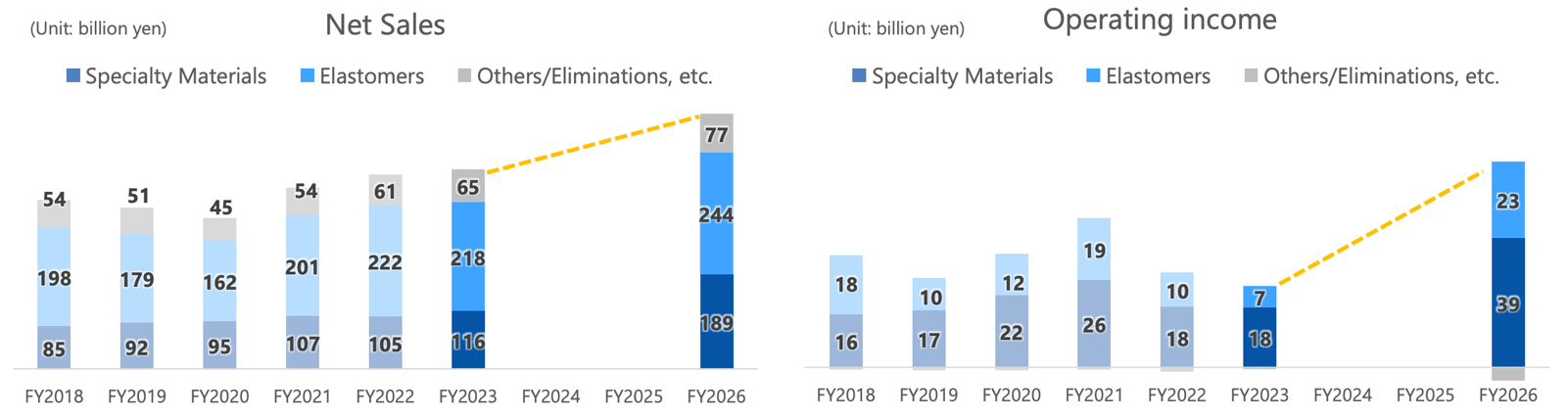

(1) COP will grow steadily in mainstay optical and medical applications, and battery materials will steadily take advantage of the growth of the global EV market.

Investment Plans for Business Expansion are Ongoing.

The company is currently engaged in production system improvement for battery materials in Europe and North America, and although the areas have not been disclosed, it is considering strengthening the resilience of COPs. By establishing a production system based on local production for local consumption, they aim to promptly and appropriately meet customer needs and expand sales.

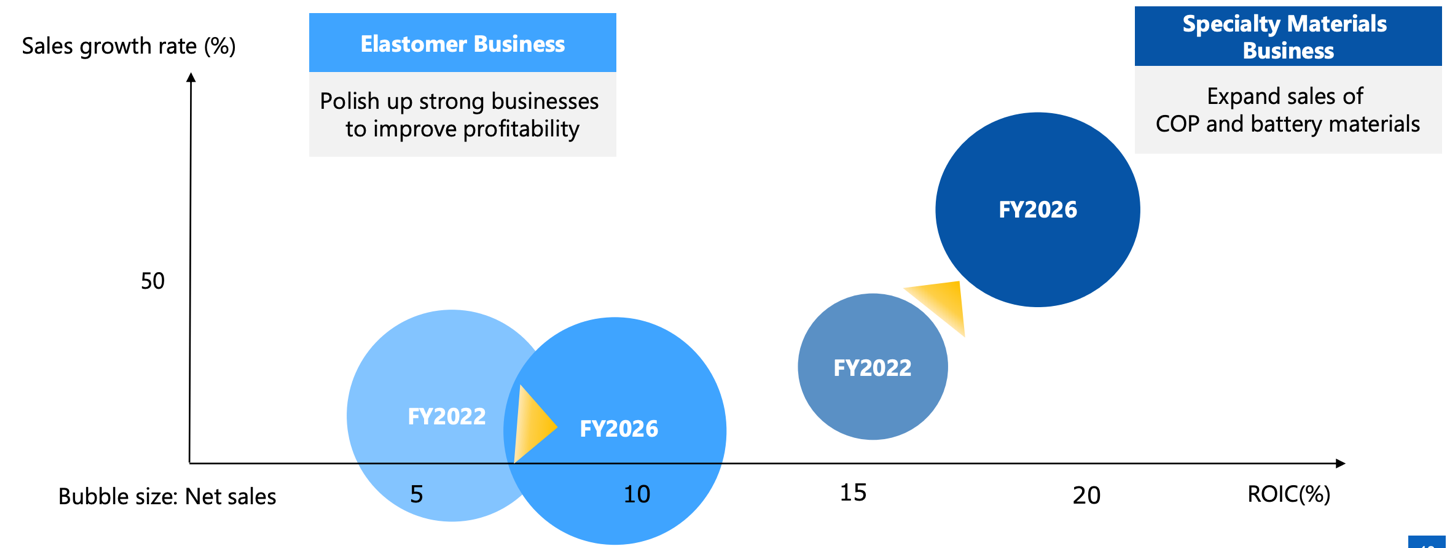

(2) Polishing up business efficiency based on cost of capital and ROIC

(3) COP is expected to grow steadily in its mainstay optical and medical applications, while battery materials are expected to steadily take advantage of the growth of the global EV market, thereby expanding the sales ratio of the Specialty Materials Business.

Elastomer Business: Promoting structural reforms with a focus on efficiency

Specialty Materials Business: Expanding sales of COP and battery materials

(4) “Explore” new businesses

Expanding the net sales of new business mainly in four key areas, namely “CASE and MaaS,” “Healthcare/Life Science,” “Telecommunications (5G/6G),” and “Energy Conservation”

■Strengthening resources and mechanisms to ensure that CVC and M&A are spread throughout the company

■Bringing manufacturing, sales, and technology together to release new products to new markets

(5) Work together to create “stages” to be active on

Creating a working environment where employees can work healthily and enthusiastically.

Promoting initiatives for health-oriented management | ●Efforts to reduce the risk of lifestyle-related diseases through the introduction of the ZEON Healthy Behavior Indicator (*) (*) ZEON Healthy Behavior Indicato Percentage of participants who achieved at least 2 of the 3 actions (BMI baseline maintenance, physical activity habits, and non-smoking) to reduce the risk of lifestyle-related diseases |

Operating a personnel system that allows people to demonstrate their “individuality” | ●Transforming the human resources management system to draw out individual strengths and foster growth ●Adopting and integrating a new personnel system for managerial positions centered around “duties” |

Instilling the DI & B concept | ●Creating an organizational culture that supports the expression of individuality through the promotion of Diversity, Inclusion, and Belonging (DI&B) ●Leadership education that leverages diverse talents |

(6) “Polish” a Management Base (new)

Target values for the fiscal year March 2027

“Polishing” Corporate Governance.

Strengthening Governance | ●Strengthening the linkage of executives’ compensation to the medium-term plan ●Appointing diverse and independent executives ●Reducing strategically-held shares |

Developing diverse human resources for future management

| ●Starting the operation of the new personnel system for managers ●Promoting the training of managers and candidates for managers ●Diversifying career opportunities |

Polishing up Capital Efficiency | ●Advanced financial management to support aggressive business investment |

[1-3-3 Phase 2 of the Medium-Term Business Plan, Financial Targets]

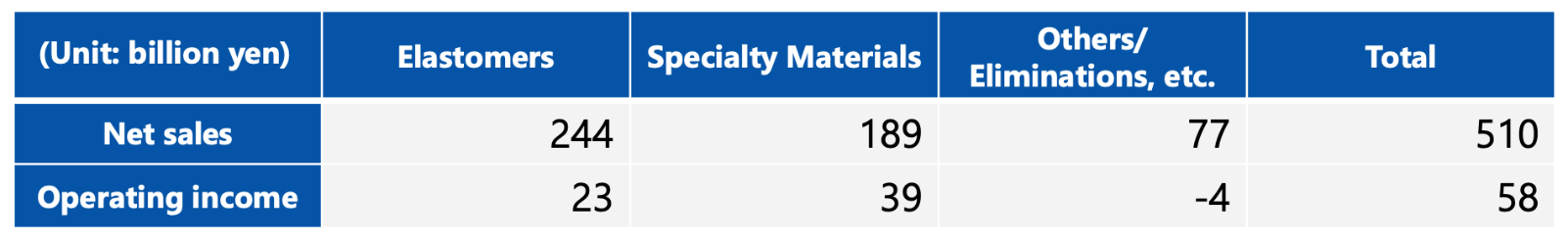

(1) Performance Target

Target values for the fiscal year March 2027

Targets in Each Segment

The company intends to expand the operating income from elastomers, mainly by improving the profitability of synthetic rubber.

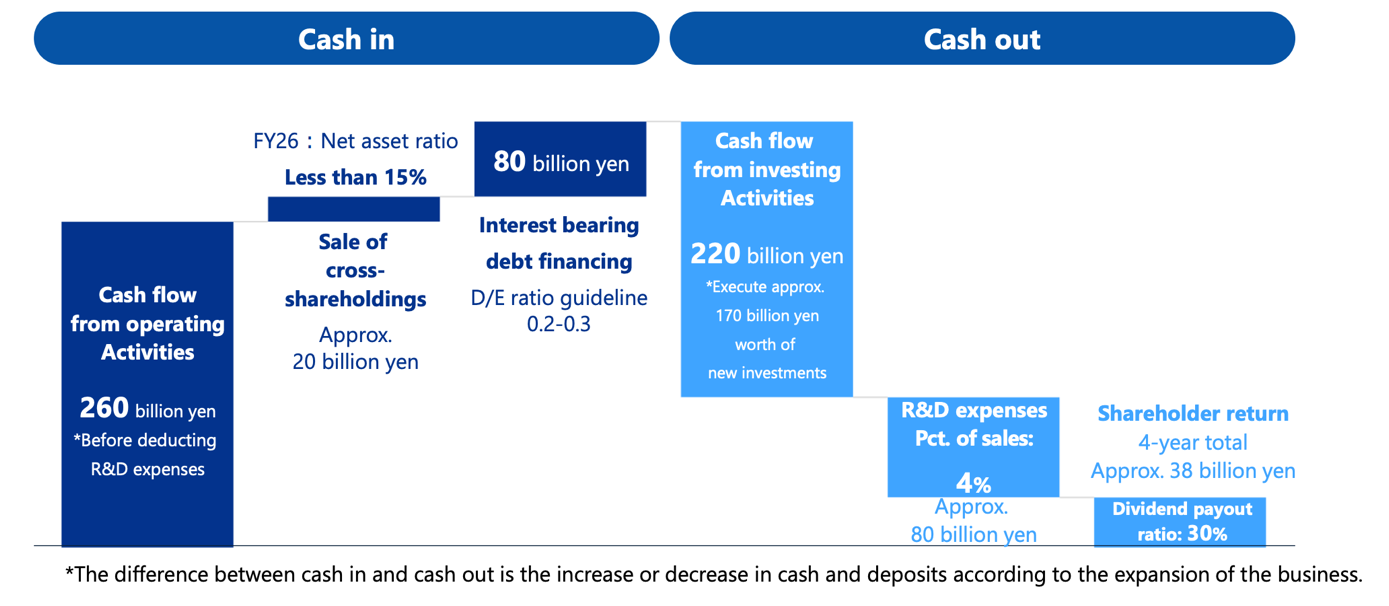

(2) Cash Flow Allocation

■Making aggressive investments and conducting R&D to expand enhanced businesses and new businesses while increasing shareholder returns

■Optimizing the capital structure and improving capital efficiency by using funds from the sale of strategically-held shares and interest-bearing debt as resources

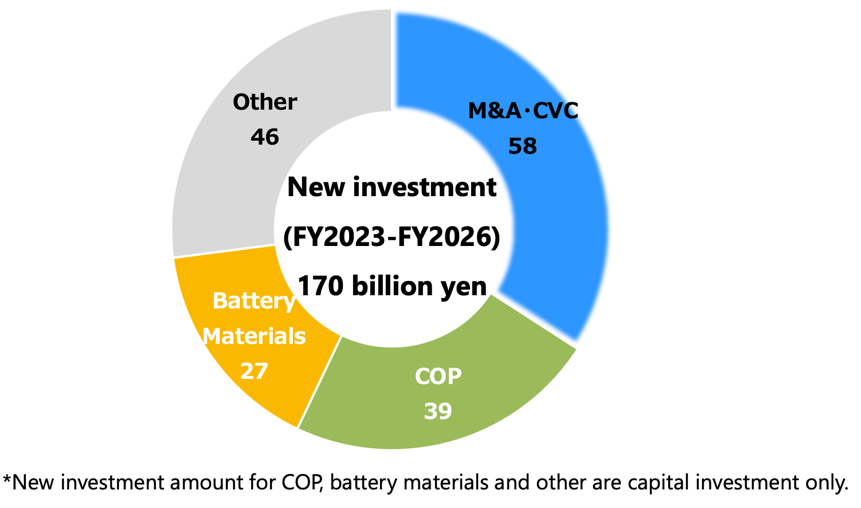

(3) Investment Plan

■Concentrating new investments on differentiated products such as COP and battery materials, and new businesses

■Plans to invest approximately 220 billion yen, including approximately 170 billion yen in new investments and 50 billion yen in maintenance and replacement of existing businesses in the period from FY 3/2024 to FY 3/2027

(4) Shareholder Return

■Aim to increase shareholder returns in line with profit growth

・Maintaining stable and consistent dividends

・Maintaining a dividend payout ratio of 30% or higher

・Purchasing treasury shares flexibly, based on market conditions, capital needs, and other factors

(5) Capital Structure

■D/E ratio will rise (maintained at 0.3 or lower) with the increased use of interest-bearing debt and enhanced shareholder returns

■Optimizing the capital structure to enhance corporate value over the medium to long-term

・Procuring more funds with interest-bearing debt to support aggressive investment and optimize the capital structure

・Controlling financial discipline to a level that keeps the single A rating

・Reducing strategically-held shares and improving asset efficiency

<Reference 2: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with auditors |

Directors | 11 directors, including 5 external ones |

Auditors | 5 auditors, including 3 external ones |

Through the press release on April 26, 2023, they announced the addition of two candidates for new outside directors.

◎ Corporate Governance Report

Last update date: :July, 7, 2023

Basic policy

Our company respects the interests of a broad range of stakeholders, including shareholders, and aims to earn revenue and continuously improve our corporate value while adjusting the relations of interests. To do so, we will make continuous efforts to establish a system for realizing efficient, sound business administration through corporate governance.

In addition, we will make decisions and execute business operations swiftly after clarifying the functions and roles of each institution and each in-company organization by developing internal control systems. We will properly monitor and disclose its progress and results and strive to improve the transparency of our business administration.

Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)

(All principles are based on the Code revised in June 2021, including the content for the prime market)

Our company follows the principles of the corporate governance code.

Disclosure Based on the Principles of the Corporate Governance Code (Excerpt)

Principles | Disclosure content |

【Principle 1-4 The so-called strategically held shares】 | ・Before strategically holding shares of any other companies, we consider carefully if the strategically held shares of a company strengthen the relationship between us and our business partners, the society and other stakeholders and will eventually enhance our corporate value in a medium- to long-term perspective. ・Based on the examination of appropriateness carried out in fiscal 2022, we judged, at the meeting of the board of directors held on December 28, 2022, that it was appropriate to hold the shares in all of the companies. We, however, decided to reduce the number of shares in some of the companies from the perspective of financial strategy optimization, and we will sell all the shares in six listed companies by the end of the current term and have already sold some shares in the six companies. The sale value of the shares is 4,816 million yen in total; however, share prices increased toward the end of the fiscal year, causing the amount booked on the consolidated balance sheet to stand at 80,295 million yen (which makes up 23.66% of the consolidated net assets). ・In the second phase of the medium-term management plan, STAGE30, which was initiated in fiscal 2023, we hold up “brush up the management base” as one of the company-wide strategies and will raise our corporate value while attaching weight to enhancement of the governance structure. Regarding the financial strategies, we have set a target for fiscal 2026 which is that the shares we strategically hold account for less than 15% of the consolidated net assets, and we intend to reduce the number of shares we hold in order to achieve the target. ・We will determine when to exercise our voting right of strategically held shares based on a medium- to long-term viewpoint on enhancement of the corporate value of the company that we invest in. |

[Supplementary Principle 4-11-1 Concept of Balance, Diversity, and Scale of the Board of Directors] | -The Board of Directors shall consist of diverse directors with different backgrounds such as knowledge, experience, and expertise. As the scale of the board should be appropriate for sufficient deliberation and prompt and rational decision-making, the number of directors shall be limited to 15 or less based on the provisions of the Articles of Incorporation.

-In order to appropriately reflect the opinions of personnel with abundant experience and insight, such as outside corporate managers and those who possess experience in public administration, in the company’s management policy and to ensure the effectiveness of independent and objective management supervision by the Board of Directors, we will appoint multiple independent outside directors who will not be involved in business execution. -For a list of the skills that the Board of Directors should possess in light of the Company's management strategy and the combination of skills that each Director possesses and that the Company specifically expects him/her to demonstrate (so-called skills matrix), please refer to Reference documents for the General Meeting of Shareholders in the “Notice of Convocation of the Ordinary General Meeting of Shareholders” ().https://www.zeon.co.jp/ir/stock/meeting/ |

Principle 5-1 Policy on constructive dialogue with shareholders | ・In our company, the IR and SR Department is in charge of interacting with our shareholders, and the Director of Administration manages the office. ・The IR and SR Dept. appropriately exchanges information with the related departments within our company and provides precise and unbiased information to our shareholders. ・Our company will continuously strive to enrich methods of dialogue other than individual interviews, such as holding information sessions for investors on a quarterly basis, improving explanatory materials for our financial results disclosed on our website and participating in company information sessions for individual investors. ・The IR and SR Dept. collates and analyzes opinions obtained through interaction with our shareholders when necessary and report them to the Representative Director. ・Our company thoroughly manages unreleased important facts in accordance with the “Insider Trading and Timely Disclosure Management Rules”, and communicates with our shareholders to prevent information leak. |

This report is intended solely for information purposes and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness, or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |

For back numbers of Bridge Reports on ZEON CORPORATION(4205)and Bridge Salon (IR seminar), please go to our website at the following URL. www.bridge-salon.jp

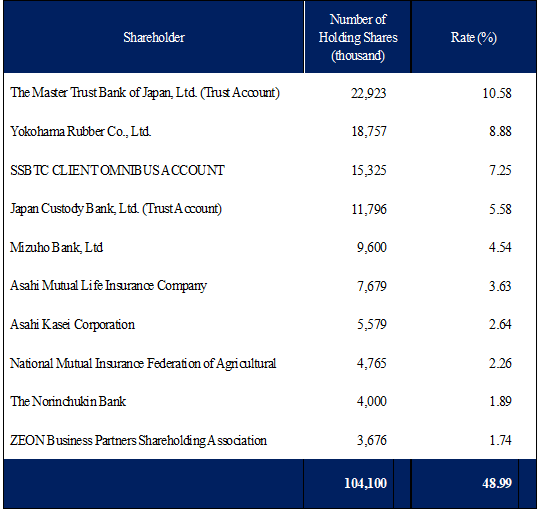

<Major Shareholders>

*Total number of shares issued at the end of the term common stock 229,513,656 shares

As of Mar 31, 2023

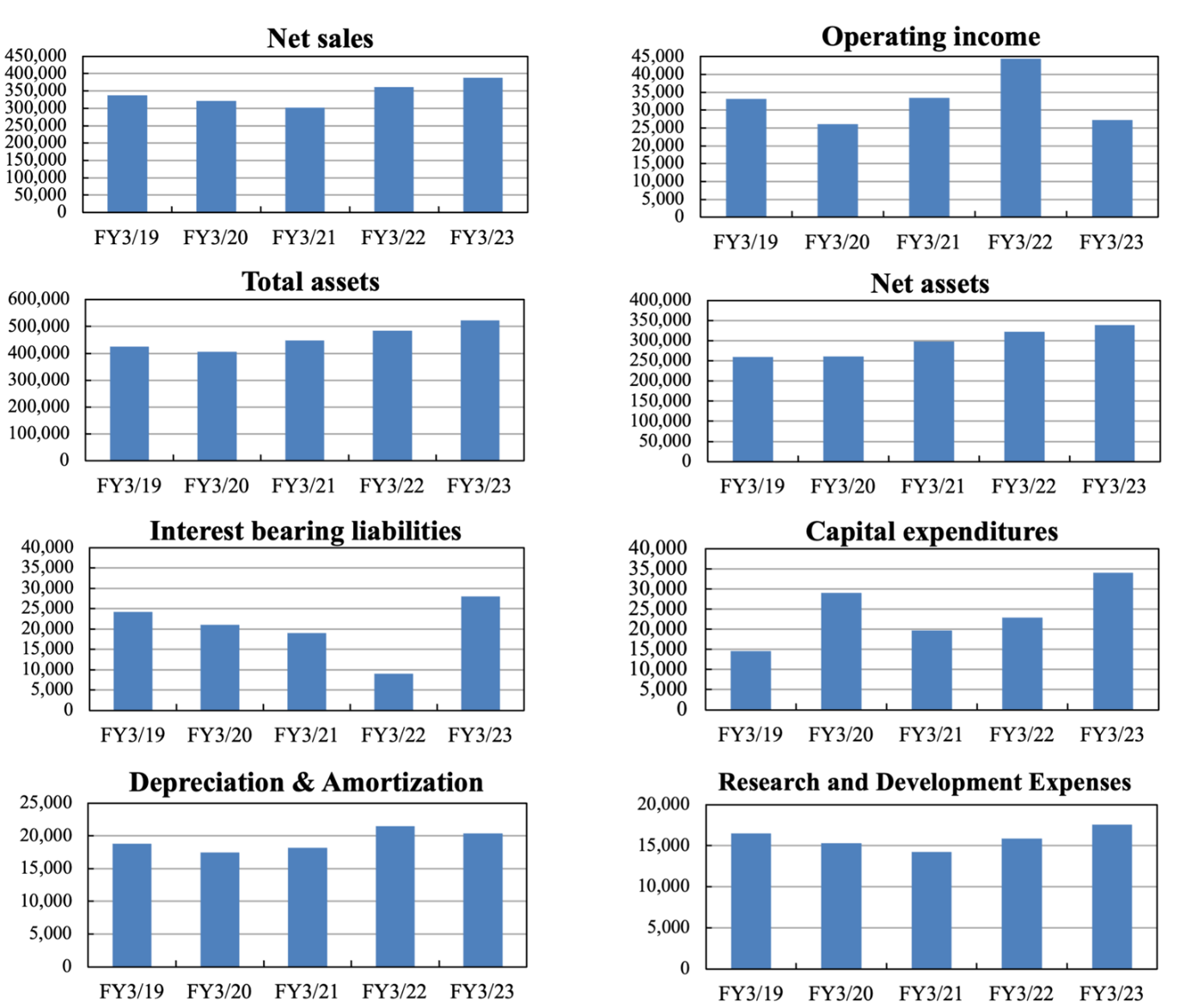

<Selected Financial Data>

| FY3/19 | FY3/20 | FY3/21 | FY3/22 | FY3/23 |

Net sales | 337,499 | 321,966 | 301,961 | 361,730 | 388,614 |

Gross profit | 96,742 | 91,911 | 97,552 | 120,358 | 109,643 |

Operating income | 33,147 | 26,104 | 33,408 | 44,432 | 27,179 |

Ordinary income | 36,319 | 28,744 | 38,668 | 49,468 | 31,393 |

Net income | 18,458 | 20,201 | 27,716 | 33,413 | 10,569 |

EPS (JPY) | 84.1 | 92.4 | 126.7 | 153.2 | 49.9 |

DPS (JPY) | 19.00 | 21.00 | 22.00 | 28.00 | 36.00 |

Total assets | 424,937 | 405,131 | 448,821 | 484,660 | 522,868 |

Net assets | 259,156 | 260,358 | 298,246 | 321,836 | 339,308 |

Interest bearing liabilities | 24,125 | 20,960 | 18,960 | 8,960 | 27,960 |

Capital expenditures | 14,640 | 29,088 | 19,645 | 22,902 | 34,045 |

Depreciation &Amortization | 18,780 | 17,448 | 18,154 | 21,469 | 20,382 |

R&D Expenses | 16,480 | 15,274 | 14,258 | 15,869 | 17,580 |

(Units: Million Yen)

<Financial Summary>

| FY3/19 | FY3/20 | FY3/21 | FY3/22 | FY3/23 |

Operating Income Margin | 9.8 | 8.1 | 11.1 | 12.3 | 7.0 |

Net Income Margin | 5.5 | 6.3 | 9.2 | 9.2 | 2.7 |

Total Asset Turnover (times) | 0.78 | 0.78 | 0.71 | 0.78 | 0.77 |

Capital Ratio | 60.3 | 63.5 | 65.8 | 65.7 | 64.3 |

ROE | 7.2 | 7.9 | 10.0 | 10.9 | 3.2 |

R&D-to-Sales Ratio | 4.9 | 4.7 | 4.7 | 4.4 | 4.5 |

(Unit: %)

<Segment Information>

| FY3/19 | FY3/20 | FY3/21 | FY3/22 | FY3/23 |

Sales |

|

|

|

|

|

Elastomer Business | 198,087 | 178,847 | 161,626 | 200,566 | 222,230 |

Specialty Materials Business | 85,142 | 91,749 | 95,465 | 106,791 | 105,356 |

Others | 56,733 | 53,473 | 46,977 | 57,822 | 65,270 |

Eliminations and corporate assets | -2,463 | -2,103 | -2,107 | -3,449 | -4,242 |

Consolidated | 337,499 | 321,966 | 301,961 | 361,730 | 388,614 |

Operating income |

|

|

|

|

|

Elastomer Business | 17,691 | 9,642 | 12,283 | 18,623 | 10,184 |

Specialty Materials Business | 16,115 | 17,311 | 21,960 | 26,360 | 18,296 |

Others | 2,786 | 2,098 | 2,156 | 2,318 | 2,381 |

Eliminations and corporate assets | -3,446 | -2,948 | -2,991 | -2,868 | -3,682 |

Consolidated | 33,147 | 26,104 | 33,408 | 44,432 | 27,179 |

Total assets |

|

|

|

|

|

Elastomer Business | 209,089 | 189,618 | 195,856 | 223,375 | 234,261 |

Specialty Materials Business | 89,402 | 101,425 | 118,840 | 118,724 | 134,490 |

Others | 32,907 | 31,193 | 30,006 | 42,008 | 41,778 |

Eliminations and corporate assets | 93,539 | 82,895 | 104,119 | 100,553 | 112,339 |

Consolidated | 424,937 | 405,131 | 448,821 | 484,660 | 522,868 |

Depreciation & Amortization |

|

|

|

|

|

Elastomer Business | 8,864 | 8,432 | 8,211 | 8,846 | 8,475 |

Specialty Materials Business | 6,793 | 6,089 | 7,362 | 10,208 | 9,574 |

Others | 302 | 312 | 263 | 243 | 268 |

Eliminations and corporate assets | 2,822 | 2,616 | 2,318 | 2,170 | 2,065 |

Consolidated | 18,780 | 17,448 | 18,154 | 21,469 | 20,382 |

Capital Expenditure |

|

|

|

|

|

Elastomer Business | 5,744 | 7,792 | 7,440 | 9,493 | 8,527 |

Specialty Materials Business | 6,234 | 17,965 | 10,111 | 10,596 | 18,220 |

Others | 359 | 95 | 47 | 291 | 764 |

Eliminations and corporate assets | 2,303 | 3,236 | 2,047 | 2,521 | 6,534 |

Consolidated | 14,640 | 29,088 | 19,645 | 22,902 | 34,045 |

(Units: Million Yen)