| Takemoto Yohki Co., Ltd. (4248) |

|

||||||||||

Company |

Takemoto Yohki Co., Ltd. |

||

Code No. |

4248 |

||

Exchange |

Second Section, TSE |

||

Industry |

Chemical (Manufacturing) |

||

President |

Emiko Takemoto |

||

HQ |

2-21-5 Matsugaya, Taito-ku, Tokyo |

||

Year-end |

End December |

||

URL |

|||

* Stock price as of closing on April 10, 2015. Number of shares at the end of the most recent quarter excluding treasury shares.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company. A 10 for 1 stock split was performed on September 12, 2014 and EPS and dividends have been

retroactively adjusted to reflect this split.

We present this Bridge Report reviewing the company overview, the fiscal year December 2014 business performance and future growth strategy for Takemoto Yohki Co., Ltd.

|

| Key Points |

|

| Company Overview |

|

<Corporate History>

Shigeru Takemoto (Grandfather of the current President Emiko Takemoto) started his business under the name of Takemoto Shoten in 1950, amidst the shortages of goods in the post World War II era, for the recycling of glass products. In 1953, Mr. Takemoto converted his business into a limited company and renamed it Takemoto Yohki Co., Ltd. and began manufacturing glass containers. In 1963, Takemoto started dealing in its signature brand "Standard Bottles."A regional sales office was opened in Osaka in 1980. Masahide Takemoto (Currently advisor to the Company and the father of Emiko Takemoto) took the helm of the Company and explored new markets in the Kansai region, where its main sales had been limited to "custom made" products, with bottle dealers and accessory dealers being separated. In its efforts, the Company leveraged both the "Standard Bottles" and "one stop product provision." The wide range of products allowed the Company to capture demand from customers and expand its sales channels. After the expansion into the Osaka region, a groundbreaking feat back then, the Company further expanded into Fukuoka, Sapporo, and Nagoya regions, and succeeded in building its nationwide sales and service coverage network.

<Market Environment>

As demonstrated in the graph shown below, the market value of the shipments of packaging containers has trended sideways in recent years, and the outlook for declines in the Japanese population is expected to limit any increases in demand within Japan in the future.

Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the Internet have contributed to a shortening of the product lifecycle, signaling the end of the era of "mass production, mass sales" and the start of the era of "high-mix low-volume production." Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the Internet have contributed to a shortening of the product lifecycle, signaling the end of the era of "mass production, mass sales" and the start of the era of "high-mix low-volume production." Furthermore, Takemoto's customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for "shorter product development periods" and "cost reductions." Furthermore, Takemoto's customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for "shorter product development periods" and "cost reductions." Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and more on Standard Bottle products, which can be procured both on time and in the required volumes. Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and more on Standard Bottle products, which can be procured both on time and in the required volumes. <Business Description>

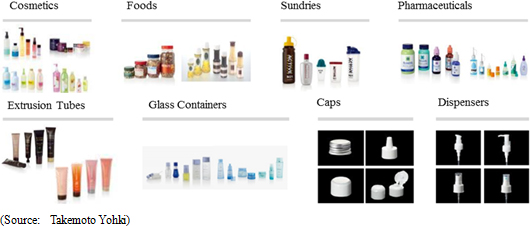

Takemoto Yohki Co., Ltd. manufactures and sells containers and accessories such as caps and dispensers, for use by customers in the cosmetics and beauty, general and health foods, sundries, and chemical and pharmaceuticals industries. The Company does not manufacture mere containers to hold substances; it primarily creates high value-added products while paying close attention to design, function, barriers, safety, and environmental issues.

Business Model Business ModelIn contrast to the above, Takemoto Yohki creates molds in-house on behalf of the customer. Having allowed the customer to choose molds of its preference from a wide range of products, Takemoto manufactures and delivers the products. Therefore, the delivery time and development costs of packaging containers are reduced and customers can purchase only the required amount of containers as needed at the time. In this manner, Takemoto Yohki is able to plan and create its own brand of containers, which it calls "Standard Bottles," through this strategy of creating and owning the molds in-house. Takemoto owned 2,704 molds as of end December 2014 and boasts of the industry's largest collection of molds. At the same time, Takemoto can offer customized products that match customers' needs by using different caps and other accessory parts, and by changing the color and printing used on the Standard Bottle products. Furthermore, the Company boasts of inventories of 1,213 types of products, helping it to realize short delivery times of a wide variety of products in small lots.  Standard Bottle sales comprise approximately 70% of total sales. In addition, the Company deals in products made from molds manufactured by customers and, as part of its trading firm function, purchases products made by other companies.   |

| Characteristics and Strengths |

|

① Broad Customer Base

Takemoto Yohki boasts of an extremely wide range of clients with some 4,603 customers within and outside Japan. The stable cash flow derived from this strong customer base enables Takemoto to make sustained investments in product molds. Furthermore, the Company's high quality proposal-based marketing capability contributes to high levels of customer satisfaction and repeat business.

② Bountiful Stock of Molds

As explained earlier, the bountiful stock of 2,704 product molds allows Takemoto Yohki to respond flexibly to customers' needs. In addition, the Company is fortifying its product lineup and promoting development of high-value- added container products with design and functionality taken into consideration. At the same time, efforts are being made to reduce investment burden and risks by standardizing, communizing, and miniaturization.

③ Flexible Product Supply Structure

Takemoto has built a structure that can supply a wide range of products in small volumes and in short delivery times through its manufacturing network of 7 plants within Japan and 2 in overseas markets. Moreover, new manufacturing technologies are being introduced aggressively with product cost, strength and quality in mind, and in order to respond to customers' needs for customized products.

④ "High Levels of Development and Proposal-Based Marketing"

The high levels of development and proposal-based marketing capabilities are the source of the sustained increase in corporate value and contribute to the establishment of a wide customer base. About forty planning, development and technology staff endeavor to realize various ideas for products taking material, shape, functionality, and safety into consideration. About 1,000 types of Standard Bottle brand products are on display at the Kappabashi Showroom and reflect the high levels of development and proposal-based marketing capabilities of the Company.

|

| Fiscal Year December 2014 Earnings Review |

Increases in Sales and Profits, Both Exceeding Estimates

Sales rose by 10.4% year-on-year to ¥11.062 billion on the back of large increases in new orders from within Japan. Increases in plastic raw materials pricing, minimum wage in China and amortization and depreciation expenses contributed to a 0.7% point year-on-year decline in gross profit margin. At the same time, effective control of sales, general and administrative expenses allowed operating profit to rise 15.9% year-on-year to ¥877 million. A ¥60 million year-on-year decline in foreign exchange translation gains led current profits to grow by 8.1% year-on-year to ¥879 million. At the same time, increases in taxes caused net profit to fall by 1.8% year-on-year to ¥581 million.

|

| Fiscal Year December 2015 Earnings Estimates |

Continued Growth in Sales and Profits

Takemoto Yohki calls for sales to rise by 4.9% year-on-year to ¥11.605 billion on the back of the contribution of new molds made during 2014 from the operations both in Japan and China. Operating profit is expected to rise by 18.5% year-on-year to ¥1.040 billion due to the successful ability of the higher sales to absorb higher materials expenses caused by increased use of materials due to expanded production, as well as higher labor expenses within and outside of Japan. Control of sales, general and administrative expenses is expected to allow operating profit margin to rise by 1.1% points year-on-year to 9.0%. Both sales and profits are expected to expand form the second half of the coming term. Dividends of ¥12.00 per share at the end of both the interim and full year periods are expected to be paid, for a combined total full year dividend of ¥24.00. A dividend payout ratio of 20.3% is anticipated, slightly above the dividend payout ratio target of 20%.

|

| Midterm Business Plan |

(1) Main Points

<Sales>

Sales are expected to continue to grow on the back of aggressive investments in new molds in both Japan and China. In addition to the United States and Thailand, where the Company already has presence, Takemoto is also considering the establishment of facilities in India and Europe with a long-term view to cultivating those markets.

<Operating Profit>

While investments to expand manufacturing capacity and to cultivate human resources will be made to expand sales, Takemoto Yohki will endeavor to maintain operating profit margin of 9%.

<Mold Investments>

In addition to aggressive investments in molds for product marketing in Japan and China, Takemoto Yohki expects to make investments in molds for the United States and Thailand markets. The number of new molds created by the entire group, including those for Japan and China, are expected to rise from 203 during fiscal year December 2014 to 500.

<Numerical Targets>

As a management benchmark, Takemoto maintains a long-term ROE target of over 15%. However it will reduce this target over the midterm to 12.5% in order to give priority to capital investments.

New Product Development New Product Development Increasing Market Share Increasing Market Share Strategy Regarding Larger Competitors Strategy Regarding Larger CompetitorsThe customers of the top two companies with overwhelming share of the market include large cosmetics companies that conduct their own investments in molds. Takemoto Yohki will leverage its differentiating factor of proposal capabilities to cultivate the cooperation of partnering manufacturers and create a high volume production structure to enable fast and reliable delivery of inexpensive products.  Strategy Regarding Smaller Competitors Strategy Regarding Smaller CompetitorsBecause the majority of sales of Standard Bottle brand products are sold to customers through trading firms, Takemoto Yohki has a competitive edge in terms of its wide range of product lineup. Furthermore, Takemoto Yohki expects to raise its market share by increasing its price competitiveness through efforts to reduce development costs as a manufacturer.    |

| Interview with President Emiko Takemoto |

|

We asked President Emiko Takemoto about the Company's future strategy and efforts to strengthen its development and proposal marketing capabilities, which are the source of the Company's corporate value, in addition for her message to investors. <Increase Share of the Domestic Market>

While it is difficult to envision any significant growth in the packaging and container market, the latent growth potential for Takemoto Yohki is still large due to its relatively low share of the market. Takemoto Yohki will further improve its development and proposal marketing functions to expand both its own products (Standard Bottles) and molds manufactured for clients. While it is difficult to envision any significant growth in the packaging and container market, the latent growth potential for Takemoto Yohki is still large due to its relatively low share of the market. Takemoto Yohki will further improve its development and proposal marketing functions to expand both its own products (Standard Bottles) and molds manufactured for clients. The bountiful track record of development will be leveraged in proposal-based marketing activities to major cosmetic companies and other customers in the mold market as a means of "differentiating" Takemoto Yohki from its competitors. At the same time, standardization of molds and use of common products will be used to "provide low cost" (products) and increase its share. Over the midterm, increases in sales of molds made for customers are expected to reduce the ratio of in-house molds from 72% to 62%. The bountiful track record of development will be leveraged in proposal-based marketing activities to major cosmetic companies and other customers in the mold market as a means of "differentiating" Takemoto Yohki from its competitors. At the same time, standardization of molds and use of common products will be used to "provide low cost" (products) and increase its share. Over the midterm, increases in sales of molds made for customers are expected to reduce the ratio of in-house molds from 72% to 62%.<Overseas Market Business Scale Expansion>

There are no overseas packaging container manufacturers that boast of the same volume of in-house products as Takemoto Yohki. And while striking a balance between sales and mold investments is difficult, Takemoto Yohki can adequately leverage its competitive advantage of this bountiful collection of in-house products to strengthen its position in the overseas market. There are no overseas packaging container manufacturers that boast of the same volume of in-house products as Takemoto Yohki. And while striking a balance between sales and mold investments is difficult, Takemoto Yohki can adequately leverage its competitive advantage of this bountiful collection of in-house products to strengthen its position in the overseas market. From the current term, development of molds in China will exceed that in Japan, and the number of molds that have been developed in China will be increased from the current level of 720 to the level similar to that of Japan (1,984). From the current term, development of molds in China will exceed that in Japan, and the number of molds that have been developed in China will be increased from the current level of 720 to the level similar to that of Japan (1,984). A foundation to capture growth in China has been established as an integral part of the overseas strategy. Furthermore, know-how established within Japan will be implemented in China to further fortify the business there. A foundation to capture growth in China has been established as an integral part of the overseas strategy. Furthermore, know-how established within Japan will be implemented in China to further fortify the business there. Investments for the growth of other overseas markets will be based on the China model. While each market has its own unique tastes and trends, Takemoto Yohki believes it can adequately respond to these various needs with its existing extensive collection of product molds. Investments for the growth of other overseas markets will be based on the China model. While each market has its own unique tastes and trends, Takemoto Yohki believes it can adequately respond to these various needs with its existing extensive collection of product molds. The Company is also making efforts in cultivating personnel that can contribute to the global expansion strategy. The Company is also making efforts in cultivating personnel that can contribute to the global expansion strategy.<Development Proposal Fortification>

The source of our corporate value is our high level of development and proposal marketing capability. Therefore, we will continue making efforts in strengthening this capability. The source of our corporate value is our high level of development and proposal marketing capability. Therefore, we will continue making efforts in strengthening this capability. A total of about forty of Takemoto Yohki staff are employed in the Planning Development and Technology Departments and are involved in new product development. The tastes and interests of these individuals play a role to a certain extent in producing good products, but the ability to overcome fear of failure and willingness "to participate in the process" of producing products is important. A total of about forty of Takemoto Yohki staff are employed in the Planning Development and Technology Departments and are involved in new product development. The tastes and interests of these individuals play a role to a certain extent in producing good products, but the ability to overcome fear of failure and willingness "to participate in the process" of producing products is important. Leveraging the strength of the ability to manufacture our own molds in-house, we provide an environment where our staff can conduct new product development through the process of trial and error. Leveraging the strength of the ability to manufacture our own molds in-house, we provide an environment where our staff can conduct new product development through the process of trial and error. Amidst these sustained efforts, our Company is steadily accumulating know-how and we are on our way to establishing a system that can create hit products without relying excessively upon the skills of individual staff. Amidst these sustained efforts, our Company is steadily accumulating know-how and we are on our way to establishing a system that can create hit products without relying excessively upon the skills of individual staff. Furthermore, the fact that we employ a large number of female development staff that can provide feedback and opinions from the consumer perspective in the development of container products for cosmetics is another characteristic of our Company. We will continue cultivating female staff as an important part of our workforce. Furthermore, the fact that we employ a large number of female development staff that can provide feedback and opinions from the consumer perspective in the development of container products for cosmetics is another characteristic of our Company. We will continue cultivating female staff as an important part of our workforce.<A Message to Investors>

During recent years our sales have been trending sideways or gradually increasing, but we expect to enter a period of higher growth from the current term forward. During recent years our sales have been trending sideways or gradually increasing, but we expect to enter a period of higher growth from the current term forward. The ability to supply products that respond to customers' diverse needs within Japan has enabled our Company to steadily increase sales, and preparations for the expansion of molds development in China are being conducted. Consequently the path to higher growth both inside and outside of Japan is now in clear sight. The ability to supply products that respond to customers' diverse needs within Japan has enabled our Company to steadily increase sales, and preparations for the expansion of molds development in China are being conducted. Consequently the path to higher growth both inside and outside of Japan is now in clear sight. We ask for the support of investors over the intermediate to long term in our efforts to take on global business challenges based upon the theme of "the Company cannot evolve without taking on new challenges." We ask for the support of investors over the intermediate to long term in our efforts to take on global business challenges based upon the theme of "the Company cannot evolve without taking on new challenges." |

| Conclusion |

|

While Takemoto Yohki's actual ROE has been commented on earlier in this report for reference sake, it is expected to remain above 10% during the coming term. In addition, the high levels of operating profit margin, capital efficiency and overall profitability stand out amongst this peer group. The PER and PBR valuations, on the other hand, appear to be low relative to this peer group. Amidst these trends, attention should be directed towards Takemoto's progress in its midterm business plan in addition to its near- and mid- term earnings. A possible reason for the low valuations despite the Company's favorable factors could be its low brand recognition and lack of understanding of its midterm business plan. Therefore a more active dispersion of information about the Company could help to rectify these issues.  <Disclaimer>

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2015, Investment Bridge Co., Ltd. All Rights Reserved. |