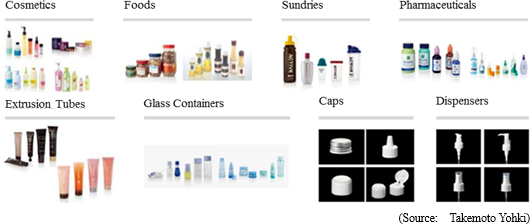

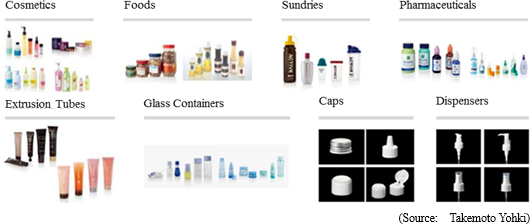

Takemoto Yohki Co., Ltd. plans and designs "standard bottles." A "Standard Bottle" is a term to refer to a packaging container when it is planned and designed in-house and, at the same time, when the mold necessary for manufacturing this packaging container is also owned in-house. Takemoto Yohki's primary customers for standard bottles are companies in the fields of cosmetics and beauty, general and health foods, sundries, chemical and pharmaceuticals. Takemoto boasted of 3,390 molds for various packaging containers as of the end of June 2018. Amongst the unique characteristics of the Company are its high proposal-based marketing capabilities, bountiful stock of molds, wide range of customers, and ability to provide a wide variety of products on a small lot basis in short delivery times. The Company is actively operating business overseas as well. Two subsidiaries are operated in China and one in the United States, Netherland, Thailand and India.

<Corporate History>

Shigeru Takemoto (Grandfather of the current President Emiko Takemoto) started his business under the name of Takemoto Shoten in 1950, amidst the shortages of goods in the post-World War II era, for the recycling of glass products. In 1953, Mr. Takemoto converted his business into a limited company and renamed it Takemoto Yohki Co., Ltd. and began selling glass containers. In 1963, Takemoto started dealing in its signature brand "standard bottles."

A regional sales office was opened in Osaka in 1980. Masahide Takemoto (Currently advisor to the company and the father of Emiko Takemoto) took the helm of the company and explored new markets in the Kansai region, where its main sales had been limited to "custom made" products, with bottle dealers and accessory dealers being separated. In its efforts, the Company leveraged both the "standard bottles" and "one stop product provision." The wide range of products allowed the company to capture demand from customers and expand its sales channels. After the expansion into the Osaka region, a groundbreaking feat back then, the company further expanded into Fukuoka, Sapporo, and Nagoya regions, and succeeded in building its nationwide sales and service coverage network.

| 1984: |

As a means of strengthening its competitive capabilities, Takemoto added the manufacturing function in addition to its trading firm capability and started plastic container processing and printing along with the opening of the Yoshikawa Plant (Yoshikawa City, Saitama Prefecture). |

| 1996: |

Takemoto led the industry by creating a manufacturing and sales subsidiary in China as the starting point of its global strategy. |

| 2004: |

Emiko Takemoto was appointed as representative director and president of the company. The Company is continuing its efforts in increasing its share of the Japanese market and cultivating overseas markets. |

| 12/2014: |

Takemoto Yohki Co., Ltd. listed its shares on the Second Section of the Tokyo Stock Exchange. In June 2017, the company was assigned to the First Section of the Tokyo Stock exchange. |

The Company changed its logos for commemorating the 66th anniversary of the business startup.

The "bamboo" mark was changed from the outlined one to the simple green one. It is said that Takemoto Yohki, which is proceeding with globalization, including the further growth of its business in China, the commencement of manufacturing in India, and the cultivation of the European market, infused the mark with the aim of "going beyond borders and making a leap on the global stage."

<Corporate Motto and Mission Statement>

The dream of the company founder of conducting business in China, the birthplace of container culture, through collaborative partnerships with local companies came to fruition with the launch of business in 1996. The current president Emiko Takemoto also places a high emphasis upon instilling and diffusing both the corporate philosophy and mission to employees through training and various other occasions.

<Market Environment>

As demonstrated in the graph shown below, the market value of the shipments of packaging containers has remained unchanged in recent years, and as the population decline is expected to continue in the future, it is difficult to expect significant growth in the domestic demand.

Having said that, demand for the company's "standard bottles" is expected to keep growing due to the following circumstances:

Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the Internet have contributed to a shortening of the product lifecycle, signaling the end of the era of "mass production, mass sales" and the start of the era of "high-mix low-volume production."

Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the Internet have contributed to a shortening of the product lifecycle, signaling the end of the era of "mass production, mass sales" and the start of the era of "high-mix low-volume production."

Furthermore, Takemoto's customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for "shorter product development periods" and "cost reductions."

Furthermore, Takemoto's customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for "shorter product development periods" and "cost reductions."

Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and more on Standard Bottle products, which can be procured at the required time and in the required volumes.

Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and more on Standard Bottle products, which can be procured at the required time and in the required volumes.

At the same time, companies' shares of the ¥155.8 billion cosmetics and toiletry container market in 2008 were as follows:

The custom bottle segment of the market, where customers own the rights to and bear the cost of metal molds, is estimated to account for 70% to 80% of the total market, with generic bottles accounting for the remaining 20% to 30% of total market. Furthermore, Takemoto Yohki estimates that its Standard Bottle brand of generic bottles account for about 20% of the total generic bottle segment of the market.

The main customers of Company A and Company B, the top two companies with the largest market shares, are large cosmetics companies which make mold investments on their own. Considering this fact, Takemoto Yohki, focused on its proposal-based marketing capabilities, which have been developed over a long time, as its distinctive strength, has established a mass production structure that delivers products speedily and precisely at a low price, also with partner manufacturers. With this structure, the company seeks to expand the sales of products made from molds manufactured by customers.

Takemoto Yohki, a company which possesses both trading and manufacturing capabilities, has an advantage in terms of its product variety while most low market-share companies sell Standard Bottles through trading companies. By realizing cost reduction in development as a manufacturer, the company aims to improve the price competitiveness to increase its market share.

In addition, because standard bottles which require mold investment need continual investment, strong financial capabilities are required. In this aspect, Takemoto Yohki, the only listed company in its industry, holds a major advantage.

This way, the company aims to expand its market share compared with upper and lower competitors. As mentioned below, the sales of products for cosmetics and beauty for the fiscal year December 2017 increased by 7.9% versus those in the previous term, with a higher growth rate than the average in the cosmetic market. The current market share is considered to be higher than the above mentioned 4.2% as of 2008.

◎ A growing overseas market

The cosmetics market in developing nations, primarily in Asia, is rapidly growing.

In five years, the Chinese market has grown in scale by 50%. Surpassing the Japanese market in 2017, India along with other ASEAN countries are expected to experience a high rate of growth as well.

There is a high level of trust in Japanese-made bottles in developing countries which means huge potential for business.

<Business Description>

Takemoto Yohki Co., Ltd. manufactures and sells containers and accessories such as caps and dispensers, for use by customers in the cosmetics and beauty, general and health foods, sundries, chemical and pharmaceuticals industries. The Company does not manufacture mere containers to hold substances; it primarily creates high added-value products while paying close attention to design, function, barriers, safety and environmental issues.

◎ Business Model

◎ Business Model

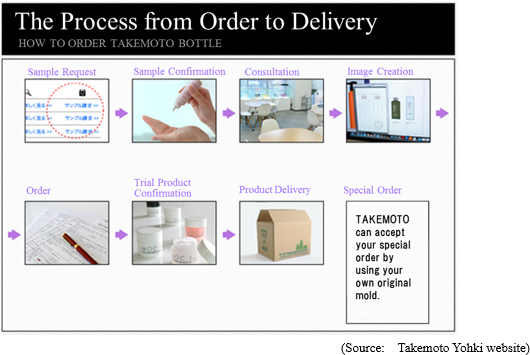

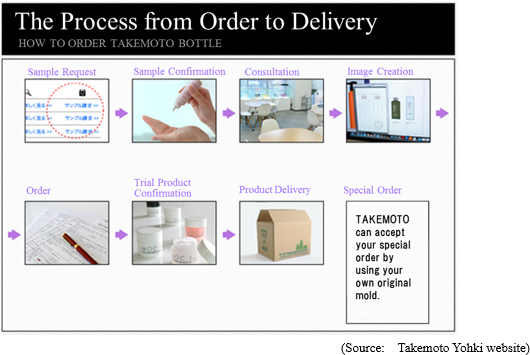

When a cosmetics and toiletry product manufacturer or customer commissions a container manufacturer to produce a unique and differentiated type of container, in most cases the container manufacturer is responsible for design and manufacture of custom-made products while the customer shoulders the cost of creating molds. The time and cost of creating molds, however, is usually a heavy burden when sourcing containers because they take as long as three months and as much as several million yen.

In contrast to the above, Takemoto Yohki creates molds in-house on behalf of the customer. By allowing the customer to choose molds of their preference from a wide range of products, Takemoto manufactures and delivers the desired products. Therefore, the delivery time and development costs of packaging containers are reduced, and customers can purchase only the required amount of containers as needed at that time. In this manner, Takemoto Yohki is able to plan and create its own brand of containers, called

"standard bottles," through this strategy of creating and owning the molds in-house.

As of the end of June 2018, the company boasts 3,390 different types of molds, which is the largest number in the industry, worldwide.

At the same time, Takemoto can offer customized products that match customers' needs by using different caps and other accessory parts, and by changing the color and printing used on the Standard Bottle products. Furthermore, the company maintains inventories of certain products, thus being able to realize short delivery times of a wide variety of products in small lots.

The Company sells its products in Japan, China, the United States, and other regions throughout the world, and the entire Takemoto Yohki group conducted business with more than 4,500 customers in fiscal year December 2017.

Standard Bottle sales comprise approximately 70% of total sales. In addition, the company deals with custom-made products manufactured with molds paid for/owned by customers and also, as a trading company, it purchases products made by other companies.

◎ Production System

◎ Production System

The company has established a global production system that includes 6 bases in Japan, 2 bases in China, 1 base in India, and 1 manufacturing affiliate in the Netherlands. In August 2018, they strengthened the Okayama branch, reinforcing the product supply structure.

Their domestic manufacturing thoroughly meets the needs of their clients, such as small batches and multi-products, short deadlines, stable quality, wide range of product lines, sudden orders, and mass production.

In China, they are concentrating on upgrading their production capabilities and improving product quality.

<ROE Analysis>

In the fiscal year December 2017, equity capital grew through public stock offering, and leverage declined, but ROE remained high, due to the increase in profit rate. The company will endeavor to achieve a stable level of ROE 15% or above over the medium term.

<Characteristics and Strengths>

① Broad Customer Base

Takemoto Yohki boasts of an extremely wide range of clients with some 4,500 customers within and outside Japan. In addition, no single client contributes more than 10% of the total sales and the stable cash flow secured from this client base enables continuous investment into molds. Furthermore, the company's high-quality proposal-based marketing capability contributes to high levels of customer satisfaction and repeat business.

② Bountiful Stock of Molds

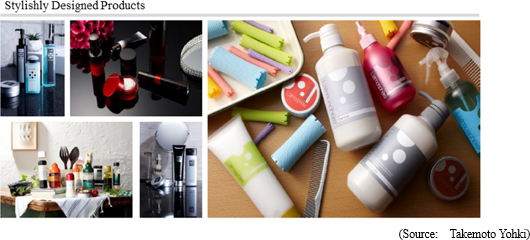

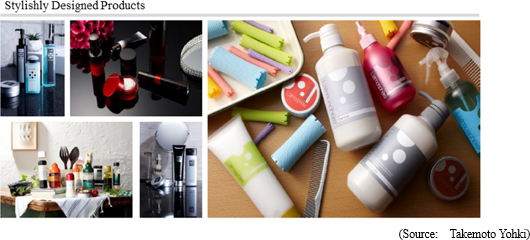

As explained earlier, the bountiful stock of 3,390 molds allows Takemoto Yohki to respond flexibly to customers' needs. In addition, the company is fortifying its product lineup and promoting development of high- added-value- container products with design and functionality taken into consideration. At the same time, efforts are being made to reduce investment burden and risks by standardizing, communizing, and miniaturization.

③ Flexible Product Supply Structure

In addition to 6 bases in Japan and 3 bases overseas (2 in China and 1 in India), the company has recently established a manufacturing affiliate in the Netherlands. Through a production network that cooperates and commplements each other, the company has built a global product supply system capable of delivering a large variety of high-quality products quickly and in small lots.

Moreover, new manufacturing technologies are being introduced aggressively with product cost, strength and quality in mind, in order to respond to customers' needs for customized products.

④ "High Levels of Development and Proposal-Based Marketing"

The high levels of development and proposal-based marketing capabilities are the source of the sustained increase in corporate value and contribute to the establishment of a wide customer base. Through planning, development and technology about 30 staff endeavor to realize various ideas for products, taking into consideration materials, shapes, functionality, and safety. About 1,000 types of Standard Bottle brand products are on display at the Kappabashi Showroom and they reflect the high levels of development and proposal-based marketing capabilities of the company.

By using its Standard Bottle development foundation and its bountiful stock of molds, the company has been offering development proposals to customers while providing them with high-quality original molds with low prices and short delivery times. The Company calls such an endeavor "custom bottle innovation" and has been promoting it more aggressively. In addition, the company is constructing a design laboratory to further strengthen the capability of the proposing development.

⑤ Unique Business Model

Their 3 competitive factors of having a broad and vast client base (stable operating CF), abundant mold stock, and high capabilities in developmental proposals produce synergy and have built a business model unique to Takemoto Yohki.

The "bamboo" mark was changed from the outlined one to the simple green one. It is said that Takemoto Yohki, which is proceeding with globalization, including the further growth of its business in China, the commencement of manufacturing in India, and the cultivation of the European market, infused the mark with the aim of "going beyond borders and making a leap on the global stage."

<Corporate Motto and Mission Statement>

The "bamboo" mark was changed from the outlined one to the simple green one. It is said that Takemoto Yohki, which is proceeding with globalization, including the further growth of its business in China, the commencement of manufacturing in India, and the cultivation of the European market, infused the mark with the aim of "going beyond borders and making a leap on the global stage."

<Corporate Motto and Mission Statement>

The dream of the company founder of conducting business in China, the birthplace of container culture, through collaborative partnerships with local companies came to fruition with the launch of business in 1996. The current president Emiko Takemoto also places a high emphasis upon instilling and diffusing both the corporate philosophy and mission to employees through training and various other occasions.

<Market Environment>

As demonstrated in the graph shown below, the market value of the shipments of packaging containers has remained unchanged in recent years, and as the population decline is expected to continue in the future, it is difficult to expect significant growth in the domestic demand.

The dream of the company founder of conducting business in China, the birthplace of container culture, through collaborative partnerships with local companies came to fruition with the launch of business in 1996. The current president Emiko Takemoto also places a high emphasis upon instilling and diffusing both the corporate philosophy and mission to employees through training and various other occasions.

<Market Environment>

As demonstrated in the graph shown below, the market value of the shipments of packaging containers has remained unchanged in recent years, and as the population decline is expected to continue in the future, it is difficult to expect significant growth in the domestic demand.

Having said that, demand for the company's "standard bottles" is expected to keep growing due to the following circumstances:

Having said that, demand for the company's "standard bottles" is expected to keep growing due to the following circumstances:

Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the Internet have contributed to a shortening of the product lifecycle, signaling the end of the era of "mass production, mass sales" and the start of the era of "high-mix low-volume production."

Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the Internet have contributed to a shortening of the product lifecycle, signaling the end of the era of "mass production, mass sales" and the start of the era of "high-mix low-volume production."

Furthermore, Takemoto's customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for "shorter product development periods" and "cost reductions."

Furthermore, Takemoto's customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for "shorter product development periods" and "cost reductions."

Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and more on Standard Bottle products, which can be procured at the required time and in the required volumes.

At the same time, companies' shares of the ¥155.8 billion cosmetics and toiletry container market in 2008 were as follows:

Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and more on Standard Bottle products, which can be procured at the required time and in the required volumes.

At the same time, companies' shares of the ¥155.8 billion cosmetics and toiletry container market in 2008 were as follows:

The custom bottle segment of the market, where customers own the rights to and bear the cost of metal molds, is estimated to account for 70% to 80% of the total market, with generic bottles accounting for the remaining 20% to 30% of total market. Furthermore, Takemoto Yohki estimates that its Standard Bottle brand of generic bottles account for about 20% of the total generic bottle segment of the market.

The main customers of Company A and Company B, the top two companies with the largest market shares, are large cosmetics companies which make mold investments on their own. Considering this fact, Takemoto Yohki, focused on its proposal-based marketing capabilities, which have been developed over a long time, as its distinctive strength, has established a mass production structure that delivers products speedily and precisely at a low price, also with partner manufacturers. With this structure, the company seeks to expand the sales of products made from molds manufactured by customers.

Takemoto Yohki, a company which possesses both trading and manufacturing capabilities, has an advantage in terms of its product variety while most low market-share companies sell Standard Bottles through trading companies. By realizing cost reduction in development as a manufacturer, the company aims to improve the price competitiveness to increase its market share.

In addition, because standard bottles which require mold investment need continual investment, strong financial capabilities are required. In this aspect, Takemoto Yohki, the only listed company in its industry, holds a major advantage.

This way, the company aims to expand its market share compared with upper and lower competitors. As mentioned below, the sales of products for cosmetics and beauty for the fiscal year December 2017 increased by 7.9% versus those in the previous term, with a higher growth rate than the average in the cosmetic market. The current market share is considered to be higher than the above mentioned 4.2% as of 2008.

◎ A growing overseas market

The cosmetics market in developing nations, primarily in Asia, is rapidly growing.

In five years, the Chinese market has grown in scale by 50%. Surpassing the Japanese market in 2017, India along with other ASEAN countries are expected to experience a high rate of growth as well.

There is a high level of trust in Japanese-made bottles in developing countries which means huge potential for business.

<Business Description>

Takemoto Yohki Co., Ltd. manufactures and sells containers and accessories such as caps and dispensers, for use by customers in the cosmetics and beauty, general and health foods, sundries, chemical and pharmaceuticals industries. The Company does not manufacture mere containers to hold substances; it primarily creates high added-value products while paying close attention to design, function, barriers, safety and environmental issues.

The custom bottle segment of the market, where customers own the rights to and bear the cost of metal molds, is estimated to account for 70% to 80% of the total market, with generic bottles accounting for the remaining 20% to 30% of total market. Furthermore, Takemoto Yohki estimates that its Standard Bottle brand of generic bottles account for about 20% of the total generic bottle segment of the market.

The main customers of Company A and Company B, the top two companies with the largest market shares, are large cosmetics companies which make mold investments on their own. Considering this fact, Takemoto Yohki, focused on its proposal-based marketing capabilities, which have been developed over a long time, as its distinctive strength, has established a mass production structure that delivers products speedily and precisely at a low price, also with partner manufacturers. With this structure, the company seeks to expand the sales of products made from molds manufactured by customers.

Takemoto Yohki, a company which possesses both trading and manufacturing capabilities, has an advantage in terms of its product variety while most low market-share companies sell Standard Bottles through trading companies. By realizing cost reduction in development as a manufacturer, the company aims to improve the price competitiveness to increase its market share.

In addition, because standard bottles which require mold investment need continual investment, strong financial capabilities are required. In this aspect, Takemoto Yohki, the only listed company in its industry, holds a major advantage.

This way, the company aims to expand its market share compared with upper and lower competitors. As mentioned below, the sales of products for cosmetics and beauty for the fiscal year December 2017 increased by 7.9% versus those in the previous term, with a higher growth rate than the average in the cosmetic market. The current market share is considered to be higher than the above mentioned 4.2% as of 2008.

◎ A growing overseas market

The cosmetics market in developing nations, primarily in Asia, is rapidly growing.

In five years, the Chinese market has grown in scale by 50%. Surpassing the Japanese market in 2017, India along with other ASEAN countries are expected to experience a high rate of growth as well.

There is a high level of trust in Japanese-made bottles in developing countries which means huge potential for business.

<Business Description>

Takemoto Yohki Co., Ltd. manufactures and sells containers and accessories such as caps and dispensers, for use by customers in the cosmetics and beauty, general and health foods, sundries, chemical and pharmaceuticals industries. The Company does not manufacture mere containers to hold substances; it primarily creates high added-value products while paying close attention to design, function, barriers, safety and environmental issues.

◎ Business Model

When a cosmetics and toiletry product manufacturer or customer commissions a container manufacturer to produce a unique and differentiated type of container, in most cases the container manufacturer is responsible for design and manufacture of custom-made products while the customer shoulders the cost of creating molds. The time and cost of creating molds, however, is usually a heavy burden when sourcing containers because they take as long as three months and as much as several million yen.

In contrast to the above, Takemoto Yohki creates molds in-house on behalf of the customer. By allowing the customer to choose molds of their preference from a wide range of products, Takemoto manufactures and delivers the desired products. Therefore, the delivery time and development costs of packaging containers are reduced, and customers can purchase only the required amount of containers as needed at that time. In this manner, Takemoto Yohki is able to plan and create its own brand of containers, called "standard bottles," through this strategy of creating and owning the molds in-house.

As of the end of June 2018, the company boasts 3,390 different types of molds, which is the largest number in the industry, worldwide.

At the same time, Takemoto can offer customized products that match customers' needs by using different caps and other accessory parts, and by changing the color and printing used on the Standard Bottle products. Furthermore, the company maintains inventories of certain products, thus being able to realize short delivery times of a wide variety of products in small lots.

◎ Business Model

When a cosmetics and toiletry product manufacturer or customer commissions a container manufacturer to produce a unique and differentiated type of container, in most cases the container manufacturer is responsible for design and manufacture of custom-made products while the customer shoulders the cost of creating molds. The time and cost of creating molds, however, is usually a heavy burden when sourcing containers because they take as long as three months and as much as several million yen.

In contrast to the above, Takemoto Yohki creates molds in-house on behalf of the customer. By allowing the customer to choose molds of their preference from a wide range of products, Takemoto manufactures and delivers the desired products. Therefore, the delivery time and development costs of packaging containers are reduced, and customers can purchase only the required amount of containers as needed at that time. In this manner, Takemoto Yohki is able to plan and create its own brand of containers, called "standard bottles," through this strategy of creating and owning the molds in-house.

As of the end of June 2018, the company boasts 3,390 different types of molds, which is the largest number in the industry, worldwide.

At the same time, Takemoto can offer customized products that match customers' needs by using different caps and other accessory parts, and by changing the color and printing used on the Standard Bottle products. Furthermore, the company maintains inventories of certain products, thus being able to realize short delivery times of a wide variety of products in small lots.

The Company sells its products in Japan, China, the United States, and other regions throughout the world, and the entire Takemoto Yohki group conducted business with more than 4,500 customers in fiscal year December 2017.

Standard Bottle sales comprise approximately 70% of total sales. In addition, the company deals with custom-made products manufactured with molds paid for/owned by customers and also, as a trading company, it purchases products made by other companies.

The Company sells its products in Japan, China, the United States, and other regions throughout the world, and the entire Takemoto Yohki group conducted business with more than 4,500 customers in fiscal year December 2017.

Standard Bottle sales comprise approximately 70% of total sales. In addition, the company deals with custom-made products manufactured with molds paid for/owned by customers and also, as a trading company, it purchases products made by other companies.

◎ Production System

The company has established a global production system that includes 6 bases in Japan, 2 bases in China, 1 base in India, and 1 manufacturing affiliate in the Netherlands. In August 2018, they strengthened the Okayama branch, reinforcing the product supply structure.

Their domestic manufacturing thoroughly meets the needs of their clients, such as small batches and multi-products, short deadlines, stable quality, wide range of product lines, sudden orders, and mass production.

In China, they are concentrating on upgrading their production capabilities and improving product quality.

<ROE Analysis>

◎ Production System

The company has established a global production system that includes 6 bases in Japan, 2 bases in China, 1 base in India, and 1 manufacturing affiliate in the Netherlands. In August 2018, they strengthened the Okayama branch, reinforcing the product supply structure.

Their domestic manufacturing thoroughly meets the needs of their clients, such as small batches and multi-products, short deadlines, stable quality, wide range of product lines, sudden orders, and mass production.

In China, they are concentrating on upgrading their production capabilities and improving product quality.

<ROE Analysis>

In the fiscal year December 2017, equity capital grew through public stock offering, and leverage declined, but ROE remained high, due to the increase in profit rate. The company will endeavor to achieve a stable level of ROE 15% or above over the medium term.

<Characteristics and Strengths>

① Broad Customer Base

Takemoto Yohki boasts of an extremely wide range of clients with some 4,500 customers within and outside Japan. In addition, no single client contributes more than 10% of the total sales and the stable cash flow secured from this client base enables continuous investment into molds. Furthermore, the company's high-quality proposal-based marketing capability contributes to high levels of customer satisfaction and repeat business.

② Bountiful Stock of Molds

As explained earlier, the bountiful stock of 3,390 molds allows Takemoto Yohki to respond flexibly to customers' needs. In addition, the company is fortifying its product lineup and promoting development of high- added-value- container products with design and functionality taken into consideration. At the same time, efforts are being made to reduce investment burden and risks by standardizing, communizing, and miniaturization.

③ Flexible Product Supply Structure

In addition to 6 bases in Japan and 3 bases overseas (2 in China and 1 in India), the company has recently established a manufacturing affiliate in the Netherlands. Through a production network that cooperates and commplements each other, the company has built a global product supply system capable of delivering a large variety of high-quality products quickly and in small lots.

Moreover, new manufacturing technologies are being introduced aggressively with product cost, strength and quality in mind, in order to respond to customers' needs for customized products.

④ "High Levels of Development and Proposal-Based Marketing"

The high levels of development and proposal-based marketing capabilities are the source of the sustained increase in corporate value and contribute to the establishment of a wide customer base. Through planning, development and technology about 30 staff endeavor to realize various ideas for products, taking into consideration materials, shapes, functionality, and safety. About 1,000 types of Standard Bottle brand products are on display at the Kappabashi Showroom and they reflect the high levels of development and proposal-based marketing capabilities of the company.

In the fiscal year December 2017, equity capital grew through public stock offering, and leverage declined, but ROE remained high, due to the increase in profit rate. The company will endeavor to achieve a stable level of ROE 15% or above over the medium term.

<Characteristics and Strengths>

① Broad Customer Base

Takemoto Yohki boasts of an extremely wide range of clients with some 4,500 customers within and outside Japan. In addition, no single client contributes more than 10% of the total sales and the stable cash flow secured from this client base enables continuous investment into molds. Furthermore, the company's high-quality proposal-based marketing capability contributes to high levels of customer satisfaction and repeat business.

② Bountiful Stock of Molds

As explained earlier, the bountiful stock of 3,390 molds allows Takemoto Yohki to respond flexibly to customers' needs. In addition, the company is fortifying its product lineup and promoting development of high- added-value- container products with design and functionality taken into consideration. At the same time, efforts are being made to reduce investment burden and risks by standardizing, communizing, and miniaturization.

③ Flexible Product Supply Structure

In addition to 6 bases in Japan and 3 bases overseas (2 in China and 1 in India), the company has recently established a manufacturing affiliate in the Netherlands. Through a production network that cooperates and commplements each other, the company has built a global product supply system capable of delivering a large variety of high-quality products quickly and in small lots.

Moreover, new manufacturing technologies are being introduced aggressively with product cost, strength and quality in mind, in order to respond to customers' needs for customized products.

④ "High Levels of Development and Proposal-Based Marketing"

The high levels of development and proposal-based marketing capabilities are the source of the sustained increase in corporate value and contribute to the establishment of a wide customer base. Through planning, development and technology about 30 staff endeavor to realize various ideas for products, taking into consideration materials, shapes, functionality, and safety. About 1,000 types of Standard Bottle brand products are on display at the Kappabashi Showroom and they reflect the high levels of development and proposal-based marketing capabilities of the company.

By using its Standard Bottle development foundation and its bountiful stock of molds, the company has been offering development proposals to customers while providing them with high-quality original molds with low prices and short delivery times. The Company calls such an endeavor "custom bottle innovation" and has been promoting it more aggressively. In addition, the company is constructing a design laboratory to further strengthen the capability of the proposing development.

⑤ Unique Business Model

Their 3 competitive factors of having a broad and vast client base (stable operating CF), abundant mold stock, and high capabilities in developmental proposals produce synergy and have built a business model unique to Takemoto Yohki.

By using its Standard Bottle development foundation and its bountiful stock of molds, the company has been offering development proposals to customers while providing them with high-quality original molds with low prices and short delivery times. The Company calls such an endeavor "custom bottle innovation" and has been promoting it more aggressively. In addition, the company is constructing a design laboratory to further strengthen the capability of the proposing development.

⑤ Unique Business Model

Their 3 competitive factors of having a broad and vast client base (stable operating CF), abundant mold stock, and high capabilities in developmental proposals produce synergy and have built a business model unique to Takemoto Yohki.

Sales grew due to increased sales of standard and custom bottles. Depreciation costs were offset, and profit rose.

Sales were ¥7,685 million, up 10.3% year on year. The company captured demand for standard bottles and custom bottles both in Japan and overseas.

Operating profit grew 20.4% to ¥858 million. SG&A expenses also rose 12.1% due to an increase in depreciation costs, but it was offset by the increase in sales.

Both sales and profits exceeded initial estimates.

Sales grew due to increased sales of standard and custom bottles. Depreciation costs were offset, and profit rose.

Sales were ¥7,685 million, up 10.3% year on year. The company captured demand for standard bottles and custom bottles both in Japan and overseas.

Operating profit grew 20.4% to ¥858 million. SG&A expenses also rose 12.1% due to an increase in depreciation costs, but it was offset by the increase in sales.

Both sales and profits exceeded initial estimates.

Due to the promotion of proposals for development and an increase in repeat orders, sales of standard bottles increased in Japan and China.

The sales of custom bottles have decreased slightly overall, but grew in China due to relatively large lot orders.

Due to the promotion of proposals for development and an increase in repeat orders, sales of standard bottles increased in Japan and China.

The sales of custom bottles have decreased slightly overall, but grew in China due to relatively large lot orders.

Through the fortification of the product lineup for standard bottles and sales activities based on proposals for development, sales grew mainly for cosmetics and beauty products. However, sales of repeat food products were sluggish in Japan, and declined slightly.

Through the fortification of the product lineup for standard bottles and sales activities based on proposals for development, sales grew mainly for cosmetics and beauty products. However, sales of repeat food products were sluggish in Japan, and declined slightly.

(Japan)

The demand for cosmetic-related products grew due to the favorable business performance of client companies, and product supply augmented due to increased production capacity in Japan, including the addition of more production-related machinery at the Okayama Plant.

Although manufacturing costs increased due to capital investment and securing the production system, gross profit grew following the increase in production. However, SG&A expenses were higher than expected, and profit fell short of estimates.

(China)

Sales of both standard bottles and custom bottles increased due to proposals for development.

Gross profit rose due to the increased sale of repeat products and the company keeping fixed costs under control. Expenses for raw materials of plastics augmented ¥10 million from the same period in the previous term.

(Other regions)

Despite being affected by yen appreciation, sales in the U.S. grew to ¥135 million thanks to an increase in sales per customer.

In the Netherlands, the company made appearances at exhibitions, causing the number of inquiries to rise, but sales declined nonetheless. They furthered the process of selecting and negotiating with outsourced manufacturers for the purpose of supplying products locally.

Although commercial production has not yet started in India, the company is conducting business talks in advance. Meanwhile, expenses increased due to the employment of additional factory workers.

The India factory was completed in April 2018. After constructing molds, making trial products, and applying for the appropriate permissions, the company started commercial production in July. The factory and molds began depreciating at the start of commercial production.

(Japan)

The demand for cosmetic-related products grew due to the favorable business performance of client companies, and product supply augmented due to increased production capacity in Japan, including the addition of more production-related machinery at the Okayama Plant.

Although manufacturing costs increased due to capital investment and securing the production system, gross profit grew following the increase in production. However, SG&A expenses were higher than expected, and profit fell short of estimates.

(China)

Sales of both standard bottles and custom bottles increased due to proposals for development.

Gross profit rose due to the increased sale of repeat products and the company keeping fixed costs under control. Expenses for raw materials of plastics augmented ¥10 million from the same period in the previous term.

(Other regions)

Despite being affected by yen appreciation, sales in the U.S. grew to ¥135 million thanks to an increase in sales per customer.

In the Netherlands, the company made appearances at exhibitions, causing the number of inquiries to rise, but sales declined nonetheless. They furthered the process of selecting and negotiating with outsourced manufacturers for the purpose of supplying products locally.

Although commercial production has not yet started in India, the company is conducting business talks in advance. Meanwhile, expenses increased due to the employment of additional factory workers.

The India factory was completed in April 2018. After constructing molds, making trial products, and applying for the appropriate permissions, the company started commercial production in July. The factory and molds began depreciating at the start of commercial production.

Current assets increased ¥946 million from the end of the previous term, due to the augmentation of cash and deposits and receivables. Noncurrent assets grew ¥483 million due to the rise in tangible assets. Accordingly, total assets rose ¥1,430 million from the end of the previous term to ¥15,981 million. Total liabilities grew ¥1,150 million to ¥7,828 million due to an increase in long-term debts.

Net assets increased ¥279 million from the end of the previous term to ¥8,152 million due to the rise in retained earnings.

As a result, capital adequacy ratio fell 3.1% to 50.8%.

Current assets increased ¥946 million from the end of the previous term, due to the augmentation of cash and deposits and receivables. Noncurrent assets grew ¥483 million due to the rise in tangible assets. Accordingly, total assets rose ¥1,430 million from the end of the previous term to ¥15,981 million. Total liabilities grew ¥1,150 million to ¥7,828 million due to an increase in long-term debts.

Net assets increased ¥279 million from the end of the previous term to ¥8,152 million due to the rise in retained earnings.

As a result, capital adequacy ratio fell 3.1% to 50.8%.

The surplus of operating CF shrank due to an increase in receivables.

The deficit of investing CF grew as a result of increased spending on acquisition of tangible assets, causing free CF to turn negative.

The income from the issuance of shares that was present in the same period of the previous term has ceased, but the company gained revenue from long-term borrowing, and the surplus of financing CF grew.

The cash position remained almost unchanged from the end of the previous term at ¥2,521 million.

(3) Topics

◎ Progress of mold development

The number of molds of the company is 3,390 as of the end of June 2018.

In Japan, the company outsources the production of molds to outside manufacturers, but the Chinese subsidiary produces molds by itself.

Currently, the mold development sections in Japan and China are recruiting personnel and standardizing mold designs, while developing more functional molds.

The surplus of operating CF shrank due to an increase in receivables.

The deficit of investing CF grew as a result of increased spending on acquisition of tangible assets, causing free CF to turn negative.

The income from the issuance of shares that was present in the same period of the previous term has ceased, but the company gained revenue from long-term borrowing, and the surplus of financing CF grew.

The cash position remained almost unchanged from the end of the previous term at ¥2,521 million.

(3) Topics

◎ Progress of mold development

The number of molds of the company is 3,390 as of the end of June 2018.

In Japan, the company outsources the production of molds to outside manufacturers, but the Chinese subsidiary produces molds by itself.

Currently, the mold development sections in Japan and China are recruiting personnel and standardizing mold designs, while developing more functional molds.

◎ The enlargement of Okayama Factory completed

In response to increasing domestic demand, the company established a production building on the Okayama Plant premises for the purpose of building a production system capable of meeting mass production needs. (Completed in August 2018)

◎ Completion of the India factory

The factory in India has been completed and commercial production started in July 2018. In anticipation of growth in the Indian market, it was constructed in order to capture demand in India (the population of which will grow to become the largest in the world).

The factory also works to meet the increasing demand in Europe, Middle East and ASEAN countries.

◎ Coping with plastic regulations, mainly in EU

In May 2018, the European Commission announced a policy prohibiting the use of disposable plastic products.

However, this is for straws, small spoons, etc., and is not intended to completely do away with plastic products such as packaging containers. It is part of an endeavor to shift to a "recycling-oriented economic system," which aims to achieve economic growth by effectively utilizing limited resources, recycling and reusing them in a sustainable way.

Currently, only about 20% of plastic products in Europe are being recycled, but EU set a goal to raise the recycling rate of packaging waste to 75% by 2030, and the company anticipates that the plastic packaging containers distributed in the EU market will become recyclable by that time.

Specifically, the company anticipates the development of containers that can be easily sorted for recycling, as well as containers made from recycled materials. Moving forward, as they expand more actively into the European market, the company plans to contribute to EU efforts by utilizing the know-how accumulated by developing standard bottles.

◎ The enlargement of Okayama Factory completed

In response to increasing domestic demand, the company established a production building on the Okayama Plant premises for the purpose of building a production system capable of meeting mass production needs. (Completed in August 2018)

◎ Completion of the India factory

The factory in India has been completed and commercial production started in July 2018. In anticipation of growth in the Indian market, it was constructed in order to capture demand in India (the population of which will grow to become the largest in the world).

The factory also works to meet the increasing demand in Europe, Middle East and ASEAN countries.

◎ Coping with plastic regulations, mainly in EU

In May 2018, the European Commission announced a policy prohibiting the use of disposable plastic products.

However, this is for straws, small spoons, etc., and is not intended to completely do away with plastic products such as packaging containers. It is part of an endeavor to shift to a "recycling-oriented economic system," which aims to achieve economic growth by effectively utilizing limited resources, recycling and reusing them in a sustainable way.

Currently, only about 20% of plastic products in Europe are being recycled, but EU set a goal to raise the recycling rate of packaging waste to 75% by 2030, and the company anticipates that the plastic packaging containers distributed in the EU market will become recyclable by that time.

Specifically, the company anticipates the development of containers that can be easily sorted for recycling, as well as containers made from recycled materials. Moving forward, as they expand more actively into the European market, the company plans to contribute to EU efforts by utilizing the know-how accumulated by developing standard bottles.

Earnings forecast revised upward in anticipation of an increase in sales and profits year on year

Reflecting recent favorable performance, the full-year forecast has been revised upward, also due in part to capital investments being pushed into the next term.

Sales are estimated to be ¥15.5 billion, up 9.1% from the previous term. The sales in the Chinese market will increase significantly due to increased orders, but the supply of products to India and the Netherlands will most likely be delayed.

Operating profit is expected to rise 6.6% to ¥1,505 million.

As for mold development, the company is putting a lot of effort into creating products with excellent design and functionality, therefore the company anticipates a slight delay.

The annual dividend forecast remains unchanged at ¥34/share. The estimated payout ratio is 20.7%. The company aims to achieve a payout ratio of 20% or higher.

Earnings forecast revised upward in anticipation of an increase in sales and profits year on year

Reflecting recent favorable performance, the full-year forecast has been revised upward, also due in part to capital investments being pushed into the next term.

Sales are estimated to be ¥15.5 billion, up 9.1% from the previous term. The sales in the Chinese market will increase significantly due to increased orders, but the supply of products to India and the Netherlands will most likely be delayed.

Operating profit is expected to rise 6.6% to ¥1,505 million.

As for mold development, the company is putting a lot of effort into creating products with excellent design and functionality, therefore the company anticipates a slight delay.

The annual dividend forecast remains unchanged at ¥34/share. The estimated payout ratio is 20.7%. The company aims to achieve a payout ratio of 20% or higher.

The company will strengthen trust with customers by working on packaging solutions over the medium-to-long-term. They aim to combine technological innovations with existing products in order to stand out as a brand with superior packaging solutions that address customers' issues. These packaging solutions include "development proposals" that make use of the company's knowledge and know-how; "container proposals" that may or may not include investments in molds; "optimal customization" for coloring, printing, and labeling; and a "customer-oriented production system" that utilizes a just-in-time delivery system.

The company will strengthen trust with customers by working on packaging solutions over the medium-to-long-term. They aim to combine technological innovations with existing products in order to stand out as a brand with superior packaging solutions that address customers' issues. These packaging solutions include "development proposals" that make use of the company's knowledge and know-how; "container proposals" that may or may not include investments in molds; "optimal customization" for coloring, printing, and labeling; and a "customer-oriented production system" that utilizes a just-in-time delivery system.

The company has decided to collaborate with "Container," which has a base in Australia. In the past, the company has not actively worked with makeup containers, but now intend to pursue their development. Their efforts will mainly involve cultivating the overseas market.

The company has decided to collaborate with "Container," which has a base in Australia. In the past, the company has not actively worked with makeup containers, but now intend to pursue their development. Their efforts will mainly involve cultivating the overseas market.

The company will place additional focus on global expansion in areas such as Japan, China, Thailand, Europe, the U.S., and India, whose market is growing particularly fast. For the time being, the company aims to secure transactions with local companies in India while mainly supplying products to Japan and China. In the future, they will manage sales to the domestic market in India. The India base will also serve as a foothold for cultivating new markets in Europe, China, ASEAN countries, and the Middle East.

The company will place additional focus on global expansion in areas such as Japan, China, Thailand, Europe, the U.S., and India, whose market is growing particularly fast. For the time being, the company aims to secure transactions with local companies in India while mainly supplying products to Japan and China. In the future, they will manage sales to the domestic market in India. The India base will also serve as a foothold for cultivating new markets in Europe, China, ASEAN countries, and the Middle East.

In overseas markets, the company will primarily work on strengthening its approach to local companies. They mainly sell to companies dealing in cosmetics, beauty products and toiletries.

In overseas markets, the company will primarily work on strengthening its approach to local companies. They mainly sell to companies dealing in cosmetics, beauty products and toiletries.

As for the development of standard bottles, the company aims to develop 914 molds in the 3 years till 2020, as it created 234 molds in 2016 and 225 molds in 2017. Although the number of developed molds varies from year to year, the company aims to create over 300 molds per year, exceeding the average so far. As for custom bottles, the company will conduct marketing research based on proposals for development to increase transactions for custom bottles, exceeding the previous results: 39 molds in 2016 and 57 molds in 2017, using the keywords: "new molds," "new decorations," "high quality," "mass production," and "short turnaround time."

As for the development of standard bottles, the company aims to develop 914 molds in the 3 years till 2020, as it created 234 molds in 2016 and 225 molds in 2017. Although the number of developed molds varies from year to year, the company aims to create over 300 molds per year, exceeding the average so far. As for custom bottles, the company will conduct marketing research based on proposals for development to increase transactions for custom bottles, exceeding the previous results: 39 molds in 2016 and 57 molds in 2017, using the keywords: "new molds," "new decorations," "high quality," "mass production," and "short turnaround time."

In order to improve the capability of proposing development, the company is constructing a design laboratory (Standout Lab) in Higashi-ueno, near the headquarters. In the design laboratory, which will be completed next term, they will research designs and functions for offering standout (outstanding, excellent) packaging solutions, and, also, this is where theyaim to increase orders early and surely by having clients actually see the prototype production process, including the printing of custom bottles. President Takemoto says that there are no other enterprises that engage in such activities and have such facilities.

(2) Goals for indicators regarding advantages

Setting the following goals about advantages, the company aims to brush up its capabilities further.

In order to improve the capability of proposing development, the company is constructing a design laboratory (Standout Lab) in Higashi-ueno, near the headquarters. In the design laboratory, which will be completed next term, they will research designs and functions for offering standout (outstanding, excellent) packaging solutions, and, also, this is where theyaim to increase orders early and surely by having clients actually see the prototype production process, including the printing of custom bottles. President Takemoto says that there are no other enterprises that engage in such activities and have such facilities.

(2) Goals for indicators regarding advantages

Setting the following goals about advantages, the company aims to brush up its capabilities further.

As the company concentrates on the strengthening of the capability of proposing development, it set the number of IP cases as a KPI.

(3) Future Vision

The company plans to make a total of ¥8,337 million in capital investments over the next three years, with the aim of achieving sales of ¥50 billion and an overseas sales ratio of 50%.

As the company concentrates on the strengthening of the capability of proposing development, it set the number of IP cases as a KPI.

(3) Future Vision

The company plans to make a total of ¥8,337 million in capital investments over the next three years, with the aim of achieving sales of ¥50 billion and an overseas sales ratio of 50%.

◎ Corporate Governance Report

Takemoto Yohki released its latest Corporate Governance Report on March 28, 2018.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

◎ Corporate Governance Report

Takemoto Yohki released its latest Corporate Governance Report on March 28, 2018.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>