Bridge Report:(4248)Takemoto Yohki the Second quarter of Fiscal Year ending December 2020

Emiko Takemoto, President | Takemoto Yohki Co., Ltd. (4248) |

|

Company Information

Exchange | First Section, TSE |

Industry | Chemical (Manufacturing) |

President | Emiko Takemoto |

HQ Address | 2-21-5 Matsugaya, Taito-ku, Tokyo |

Year-end | End of December |

Homepage |

Stock Information

Share Price | Shares Outstanding | Market Cap. | ROE (actual) | Trading Unit | |

¥944 | 12,529,200 shares | ¥11,827 million | 11.8% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (actual) | PBR (actual) |

¥19.00 | 2.0% | ¥87.80 | 10.8 x | ¥732.16 | 1.3 x |

*The share price is the closing price on September 1. DPS and EPS are from the earning result of the second quarter of FY 12/20. ROE and BPS are taken from the financial report of FY 12/19

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS(¥) |

FY12/16 | 12,799 | 1,259 | 1,279 | 836 | 73.65 | 15.00 |

FY12/17 | 14,201 | 1,412 | 1,440 | 986 | 82.29 | 17.00 |

FY 12/18 | 16,022 | 1,630 | 1,762 | 1,211 | 96.72 | 18.50 |

FY 12/19 | 15,196 | 1,538 | 1,575 | 1,043 | 83.31 | 19.00 |

FY 12/20 Est. | 15,500 | 1,600 | 1,600 | 1,100 | 87.80 | 19.00 |

*Estimates are those of the company. 1:2 stock split on January 1st, 2019 was implemented. EPS and DPS have been retroactively adjusted to reflect these splits. The definition for net income is net income attributable to parent company shareholders. The same applies hereinafter.

We hereby present the summary of the Second quarter of Fiscal Year ending December 2020 for Takemoto Yohki Co. Ltd.

Table of Contents

Key Points

1. Company Overview

2. The Second quarter of Fiscal Year ending December 2020 Earnings Results

3. Fiscal Year ending December 2020 Earnings Forecasts

4. Management policies

5. Conclusions

<Reference1: Regarding the mid-term plan >

<Reference2: Regarding Corporate Governance>

Key Points

- The sales for the second quarter of the term ending December 2020 are 7,419 million yen, down 5.4% year on year. In Japan, while the recoil from the increase in demand for cosmetics containers until the first half of the previous term lingered, hygiene-related demand grew due to measures for preventing the spread of COVID-19. In all categories, the company made new transactions, and demand from repeat customers is recovering. In China, sales dropped, falling below the estimate, in the aftermath of the suspension of business activities. Operating income grew 17.9% year on year to 989 million yen. Gross profit rate improved, thanks to the enhancement of productivity through the efforts for in-house production etc. In addition to the reduction of material costs and depreciation, SG&A, mainly personnel expenses, decreased. Sales were almost as estimated, and profit exceeded the estimate considerably.

- There is no revision to the full-year earnings forecast for the term ending December 2020. Sales are estimated to grow 2.0% year on year to 15,500 million yen, while operating income is projected to rise 4.0% year on year to 1,600 million yen. Production activities in Japan, China, and India are ongoing with no hindrance, and products are continuously supplied. The prices of resin materials are dropping and the period of exemption from social insurance premiums in China has been extended. On the other hand, the company recognizes that there are many uncertainties, such as COVID-19 remaining as a global threat, which will not allow us to dispel our anxiety over the future, and as in the field of cosmetics, which account for a significant proportion of sales, in-store sales are restricted and the customers' demand is changing, due to less opportunity for going out. As for dividends, the company plans to pay a total of 19.00 yen/share per year unchanged from the previous term. The estimated payout ratio is 21.6%, as the company aims to achieve a payout ratio of over 20%.

- Seeing the progress rate in each region, business performance in Japan is healthy, but the performance in China and other foreign countries (India, the Netherlands, and the U.S.) has been significantly affected by COVID-19. It is difficult to estimate the future impact of COVID-19, and we have no choice but to wait for the disclosure for the third quarter, but we would like to pay attention to the situation of recovery in China, where the sales composition ratio has increased, and what kinds of changes will be induced by “strengthening WEB marketing (e-commerce),” which was added as an important objective in all regions, excluding India.

1. Company Overview

Takemoto Yohki Co., Ltd. plans and designs “standard bottles.” A “Standard Bottle” is a term to refer to a packaging container when it is planned and designed in-house and, at the same time, when the mold necessary for manufacturing this packaging container is also owned in-house. Takemoto Yohki’s primary customers for standard bottles are companies in the fields of cosmetics and beauty, healthy foods, sundries, chemicals and pharmaceuticals. Takemoto boasted of 3,469 molds for various packaging containers as of the end of June 2020. Amongst the unique characteristics of the company are its high proposal-based marketing capabilities, bountiful stock of molds, wide range of customers, and ability to provide a wide variety of products on a small lot basis in short delivery times. The company is actively operating business overseas as well. Two subsidiaries are operated in China and one in the United States, the Netherlands, Thailand, and India.

【1-1 Corporate History】

Shigeru Takemoto (Grandfather of the current President Emiko Takemoto) started his business under the name of Takemoto Shoten in 1950, amidst the shortages of goods in the post-World War II era, for the recycling of glass products. In 1953, Mr. Takemoto converted his business into a limited company and renamed it Takemoto Yohki Co., Ltd. and began selling glass containers. In 1963, Takemoto started dealing in its signature brand “standard bottles.”A regional sales office was opened in Osaka in 1980. Masahide Takemoto (Currently advisor to the company and the father of Emiko Takemoto) took the helm of the company and explored new markets in the Kansai region, where its main sales had been limited to “custom made” products, with bottle dealers and accessory dealers being separated. In its efforts, the company leveraged both the “standard bottles” and the “one stop shop” concept. The wide range of products allowed the company to capture demand from customers and expand its sales channels. After the expansion into the Osaka region, a groundbreaking feat back then, the company further expanded into Fukuoka, Sapporo, and Nagoya regions, and succeeded in building its nationwide sales and service coverage network.In 1984, as a means of strengthening its competitive capabilities, Takemoto added the manufacturing function in addition to its trading firm capability and started plastic container processing and printing along with the opening of the Yoshikawa Plant (Yoshikawa City, Saitama Prefecture).In 1996, Takemoto led the industry by creating a manufacturing and sales subsidiary in China as the starting point of its global strategy. In 2004 Emiko Takemoto was appointed as the representative director and president of the company. The company is continuing its efforts in increasing its share of the Japanese market and cultivating overseas markets. In 12/2014 Takemoto Yohki Co., Ltd. listed its shares on the Second Section of the Tokyo Stock Exchange. In June 2017, the company was assigned to the First Section of the Tokyo Stock exchange.

【1-2 Corporate Motto and Mission Statement】

Corporate Motto |

Creating bottles with our customers’ hearts in mind |

|

Mission Statement |

Ensuring the safety of our customers’ products and increasing the value and individuality of the contents through packaging containers which are imperative to people’s daily lives |

The company founder’s dream of conducting business in China, the birthplace of the container culture, through collaborative partnerships with local companies came to fruition with the launch of business in 1996. The current president Emiko Takemoto also places a high emphasis upon instilling and diffusing both the corporate philosophy and mission to employees through training and various other occasions.

【1-3 Market Environment】

◎A growing domestic market

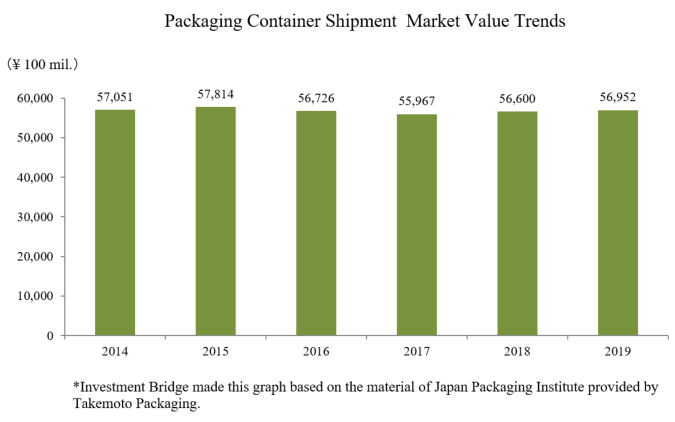

As demonstrated in the graph shown below, the market value of the shipments of packaging containers has remained unchanged in recent years. Since the population decline is expected to continue in the future, it is difficult to expect significant growth in the domestic demand.

◎Growth in the standard bottles market

Having said that, demand for the company’s “standard bottles” is expected to keep growing due to the following circumstances:

* | Maturing of the consumer market, diversification of consumer tastes and expansion in sales over the internet have contributed to a shortening of the product lifecycle, signaling the end of the era of “mass production, mass sales” and the start of the era of “high-mix low-volume production.” |

* | Furthermore, Takemoto’s customers, namely cosmetics and toiletries manufacturers, are undergoing trends that call for “shorter product development periods” and “cost reductions.” |

* | Consequently, customers confronted by these trends are expected to rely less on in-house packaging container development and would gain more benefits by adopting Standard Bottle products, which can be procured at the required time and in the required volumes. |

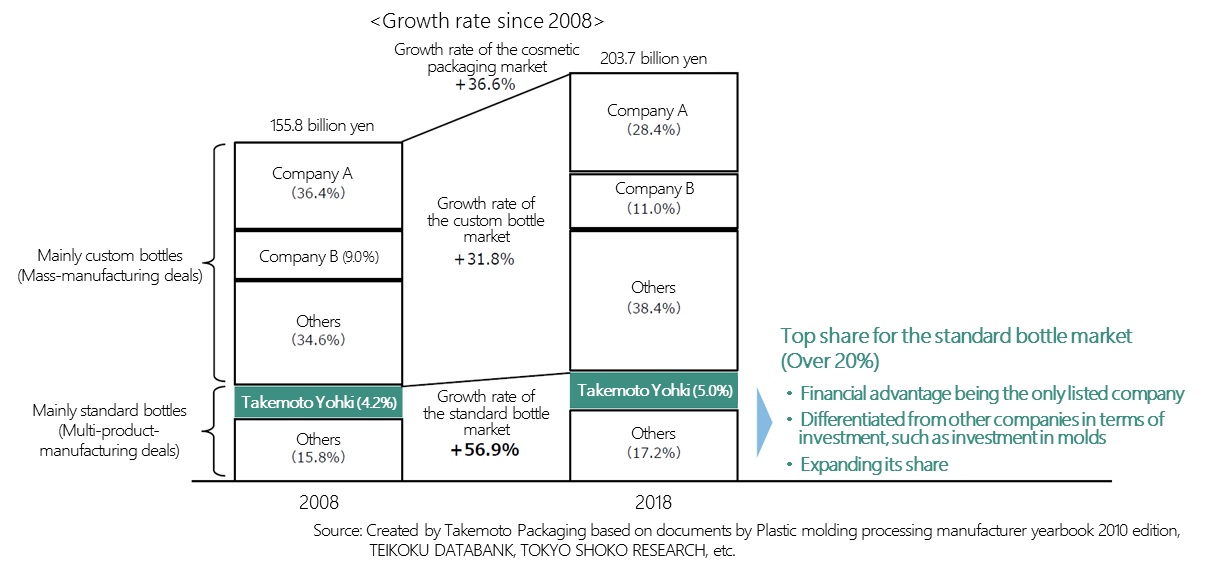

The market trend in cosmetics and toiletry container (estimations are those of the company) is as follows.

(Source: The Company)

The scale of this market has expanded about 37% in the past 10 years. In particular, the market of standard bottles has grown 57% at a higher rate than the entire market, due to the improvement in the convenience and popularities of its products.The ‘custom bottle’ segment of the market, where customers own the rights and bear the cost of metal molds, is estimated to account for around 80% of the total market, with ‘standard bottles’ accounting for the remaining approximately 20% of the total market. Furthermore, the company estimates that its Standard Bottle brand of generic bottles account for over 20% of the top share in the total standard bottle segment of the market.

The main customers of company A and company B, the top two companies with the largest market shares, are large cosmetics companies which invest in their own molds. Considering this fact, Takemoto Yohki, focused on its proposal-based marketing capabilities, which have been developed over a long time as its distinctive strength, and it has established a mass production structure that delivers products speedily and at a low price, while working with reliable partner manufacturers. With this structure, the company is expanding the sales of products made from molds manufactured by them.

Takemoto Yohki, a company which possesses both trading and manufacturing capabilities, has an advantage in terms of its product variety while most low market-share companies sell Standard Bottles through trading companies. In addition, as a manufacturer, the company will work to reduce development costs, thereby improving price competitiveness.In addition, firm financial strength is indispensable for conducting continuous investment for producing standard bottles, which requires the investment in molds. Takemoto Yohki is the only listed company in this field, so it possesses great advantages. With these advantages, the company is expanding its market share.

◎A growing overseas market

The cosmetics market in developing nations, primarily in Asia, is rapidly growing.In five years, the Chinese market has grown in scale by 50%. Surpassing the Japanese market in 2017, India along with other ASEAN countries are expected to experience a high rate of growth as well.There is a high level of trust in Japanese-made bottles in developing countries which means huge potential for business.

Over the past 5 years, the company’s sales have grown in each market as tabulated below.

| FY 12/14 | Share | FY 12/19 | Share | CAGR |

Japan | 8,568 | 77.5% | 11,633 | 76.6% | +6.3% |

China | 2,312 | 20.9% | 3,025 | 19.9% | +5.5% |

Other areas | 180 | 1.6% | 537 | 3.5% | +24.4% |

Total | 11,062 | 100.0% | 15,196 | 100.0% | +6.6% |

*Unit: million yen

The market composition ratio in the future is assumed to be 50% in the Japanese market, 30% in China, and 20% in India, Europe and the United States. We will work to develop the European and American markets with room for expansion and the fast-growing Indian market.

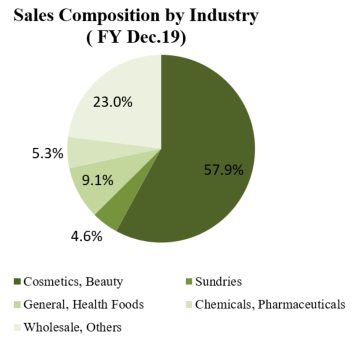

As for the performance for each purpose of use inside and outside Japan, the sales in “the field of cosmetics and beauty,” which has been a growth driver, is estimated to keep growing and account for 63% of the composition ratio in the future.

| FY 12/14 | Share | FY 12/19 | Share | CAGR |

Cosmetic, beauty | 6,472 | 58.5% | 8,802 | 57.9% | +6.3% |

Sundries | 681 | 6.2% | 705 | 4.6% | +0.7% |

Foods, health foods | 972 | 8.8% | 1,385 | 9.1% | +7.3% |

Chemical and pharmaceuticals | 502 | 4.5% | 812 | 5.3% | +10.1% |

Wholesale, others | 2,433 | 22.0% | 3,490 | 23.0% | +7.5% |

Total | 11,062 | 100.0% | 15,196 | 100.0% | +6.6% |

*Unit: million yen

【1-4 Business Description】

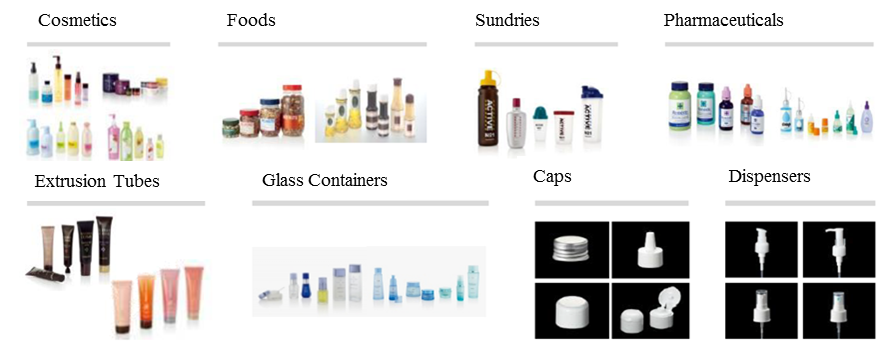

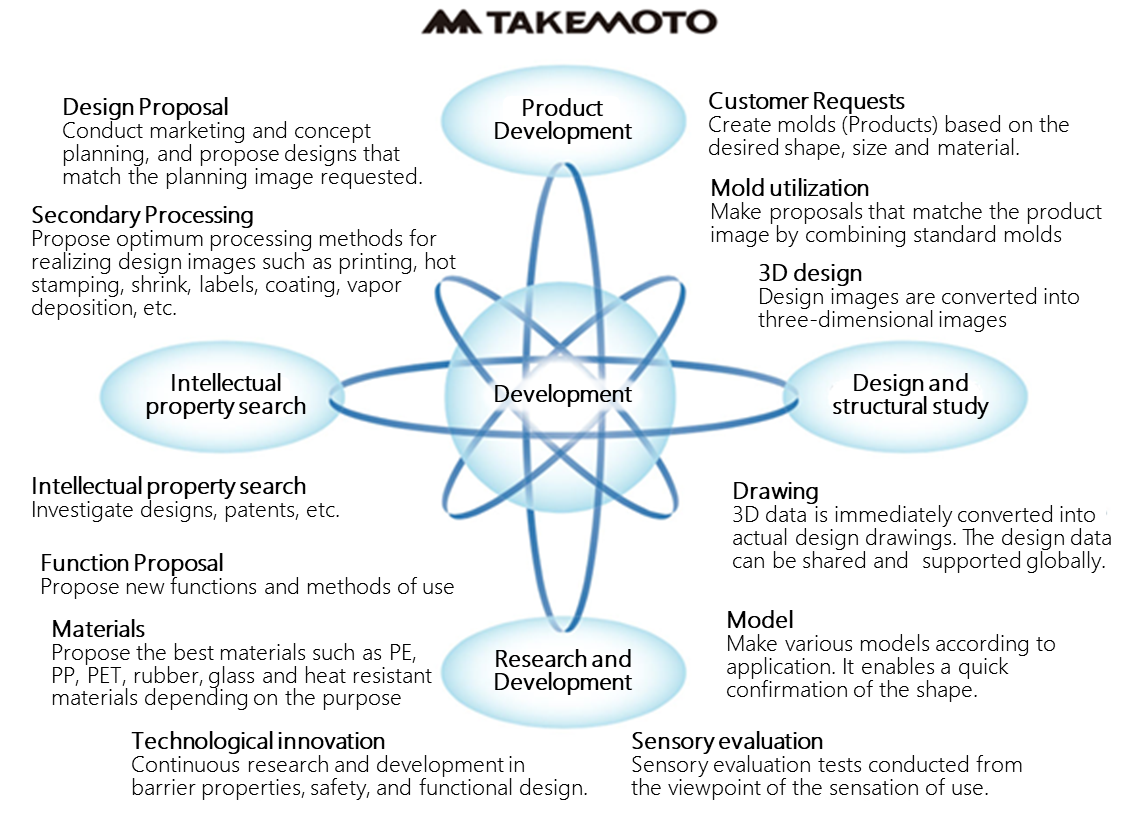

Takemoto Yohki Co., Ltd. manufactures and sells containers and accessories such as caps and dispensers, for use by customers in the cosmetics and beauty, healthy foods, sundries, chemical, and pharmaceuticals industries. The company does not manufacture merely containers to hold substances; it primarily creates high added-value products while paying close attention to design, function, barriers, safety, and environmental issues.

|

|

(Source: The Company)

(Source: The Company)

◎Business Model

When a cosmetics and toiletry product manufacturer or customer commissions a container manufacturer to produce a unique and differentiated type of container, in most cases the container manufacturer is responsible for designing and manufacturing custom-made products while the customer shoulders the cost of creating molds. The time and cost of creating molds, however, is usually a heavy burden when sourcing containers because they may take about three months and cost several million yen.

In contrast to the above, Takemoto Yohki creates molds in-house on behalf of the customer. By allowing the customer to choose molds of its preference from a wide range of products, Takemoto manufactures and delivers the desired products. Therefore, the delivery time and development costs of packaging containers are reduced, and customers can purchase only the required number of containers as needed at that time. In this manner, Takemoto Yohki is able to plan and create its own brand of containers, called “standard bottles,” through this strategy of creating and owning the molds in-house.

As of the end of June 2020, the company boasts 3,469 different types of molds, which is the largest number in the industry, worldwide.At the same time, Takemoto can offer customized products that match customers’ needs by using different caps and other accessory parts, and by changing the color and printing used on the Standard Bottle products. Furthermore, the company maintains inventories of certain products, thus being able to realize short delivery times of a wide variety of products in small lots.

(Source: The Company website)

The company sells its products in Japan, China, the United States, and other regions throughout the world, and the entire Takemoto Yohki group conducted business with about 4,400 customers in fiscal year December 2019.

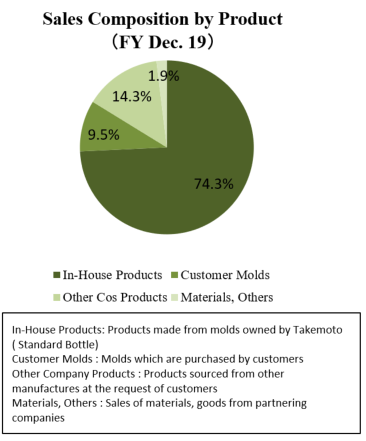

Standard Bottle sales comprise approximately 70% of total sales. In addition, the company deals with custom-made products manufactured with molds paid for/owned by customers and, as a trading company, it purchases products made by other companies.

(Taken from the material of the Company)

◎Production System

The company has established a global production system that includes 6 bases in Japan, 2 bases in China, 1 base in India, and 1 manufacturing affiliate in the Netherlands. In June 2019, the renovation work for the existing building at the Okayama branch was completed, and there are now two buildings for production.Its domestic manufacturing thoroughly meets the needs of its clients, such as small batches and multiple products, short deadlines, stable quality, wide range of product lines, sudden orders, and mass production.In China, the company is concentrating on upgrading its production capabilities and improving product quality.

【1-5 ROE Analysis】

| FY 12/14 | FY 12/15 | FY 12/16 | FY 12/17 | FY 12/18 | FY 12/19 |

ROE (%) | 13.1 | 15.5 | 14.5 | 14.3 | 14.8 | 11.8 |

Net Profit to Sales Ratio | 5.25 | 6.77 | 6.53 | 6.94 | 7.56 | 6.86 |

Asset Turnover Ratio (x) | 1.19 | 1.16 | 1.08 | 1.04 | 1.02 | 0.90 |

Leverage (x) | 2.09 | 1.98 | 2.04 | 1.97 | 1.91 | 1.90 |

The ROE in the term ended December 2019 fell below that in the term ended December 2018, but exceeds 8%, which is the ideal goal among Japanese enterprises. In the medium term, the company aims to keep ROE 15% or over.

【1-6 Characteristics and strengths】

①Broad Customer Base

Takemoto Yohki boasts of an extremely wide range of clients with some 4,400 customers within and outside Japan. In addition, no single client contributes more than 10% of the total sales and the stable cash flow secured from this client base enables continuous investment into molds. Furthermore, the company’s high-quality proposal-based marketing capability contributes to high levels of customer satisfaction and repeat business.

②Bountiful Stock of Molds

As explained earlier, the bountiful stock of 3,469 molds allows Takemoto Yohki to respond flexibly to customers’ needs. In addition, the company is fortifying its product lineup and promoting development of high-added-value container products with design and functionality taken into consideration. At the same time, efforts are being made to reduce investment burden and risks by standardizing, communizing, and miniaturizing.

③Flexible Product Supply Structure and Production Capabilities

There are 6 bases in Japan and 3 bases overseas (2 in China and 1 in India), and the company has recently established a manufacturing affiliate in the Netherlands. Through a production network in which the bases cooperate and complement each other, the company has built a global product supply system capable of delivering a large variety of high-quality products quickly and in small lots.Moreover, new manufacturing technologies are being actively introduced with product cost, strength and quality in mind, in order to respond to customers’ needs for customized products.

④“High Levels of Development and Proposal-Based Marketing”

The high levels of development and proposal-based marketing capabilities are the source of the sustained increase in corporate value and contribute to the establishment of a wide customer base. Through planning, development and technology about 30 staff endeavor to realize various ideas for products, taking materials, shapes, functionality, and safety into consideration. About 1,000 types of Standard Bottle brand products are on display at the Kappabashi Showroom which reflect the high levels of development and proposal-based marketing capabilities of the company.

(Source: The Company)

By using its Standard Bottle development foundation and its bountiful stock of molds, the company has been offering development proposals to customers while providing them with high-quality original molds with low prices and short delivery times. The company calls such an endeavor "custom bottle innovation" and has been promoting it expansively.

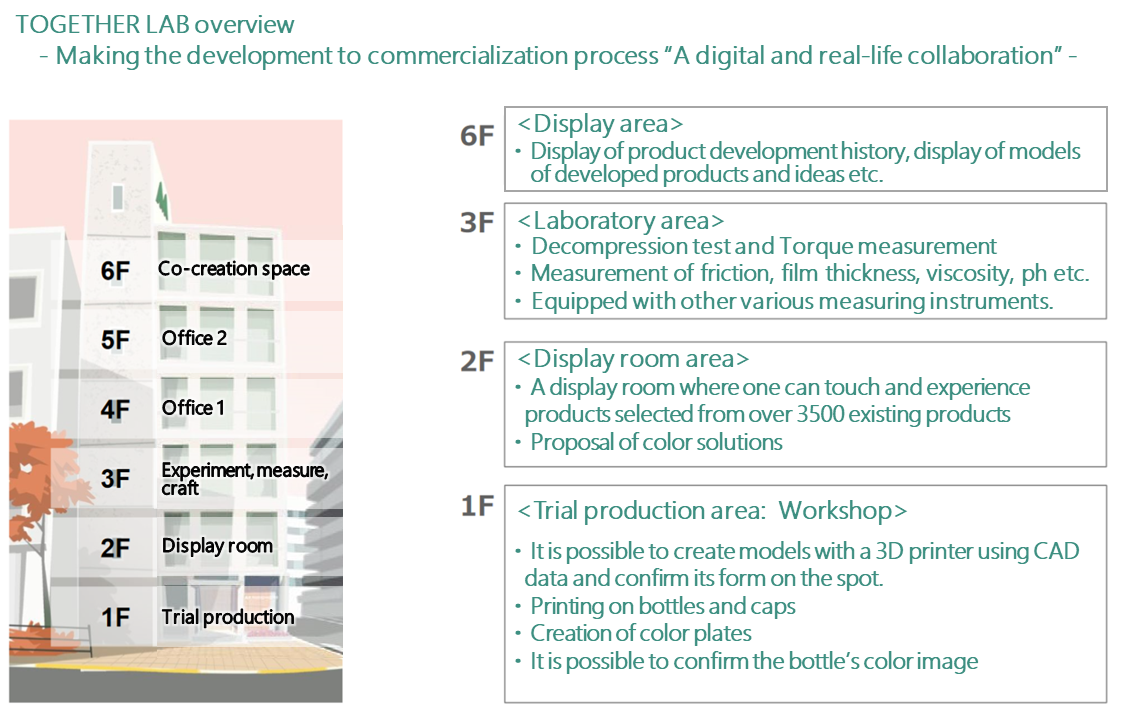

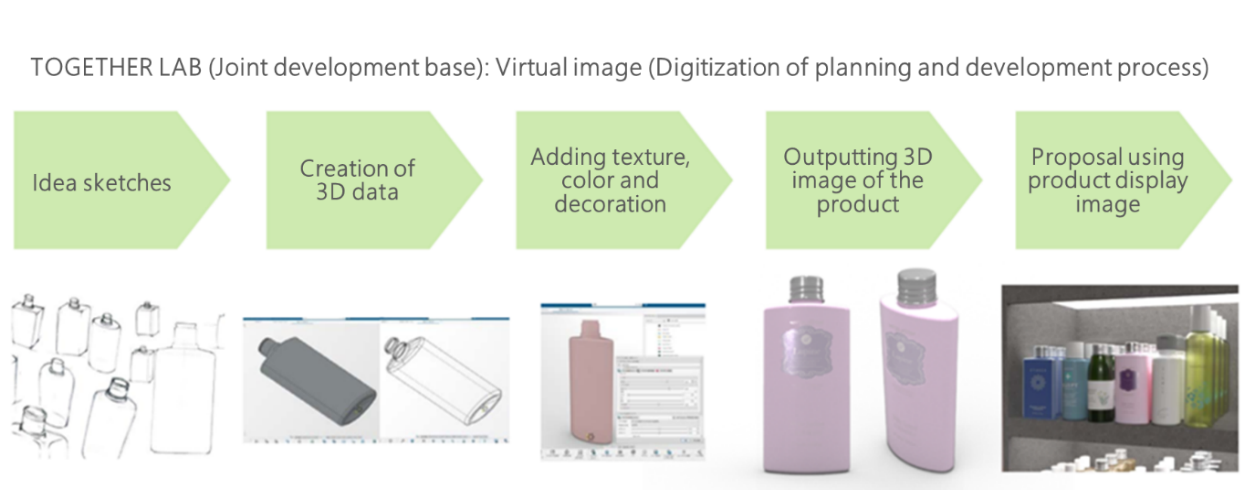

In April 2020, the company started the operation of TOGETHER LAB, including this Custom Bottle Innovation, as a development foothold for swiftly giving form to containers demanded by customers.

(Source: The Company)

In TOGETHER LAB, which means cooperation with clients, the company gives form to ideal containers swiftly by fusing “digital” and “physical” technologies.

In the “digital” field, the company can show a variety of simulation images, ranging from conceptual drawings to illustrations of displayed products, to clients visiting the lab, by using high-quality 3D CAD.

In 3D container simulation, the company offers 3D images from over 20,000 combinations of a bottle and a cap, and simulates plentiful colorations and printing patterns on the screen, to clarify the products imagined by each client.

In the “physical” field, in the prototype production process, clients can check the product's colorations done by air spray using 1,500 kinds of samples, and the actual texture of each container by touching the product.

These functions enable more efficient and higher quality communication with customers than ever before, making it possible to develop a product in line with customers’ development philosophy.

Up until now, it was necessary to repeat the procedure of listening to clients’ requests and resubmitting revised proposals before commencing product development. This restricted the acceleration of processes, but 3D data are linked to mold designs, so it is possible to shorten product development periods considerably.

The company recognizes “TOGETHER LAB” as a “foothold for co-creation and development,” which is aimed at creating three values, “co-creation value: to create together,” “time value: clients can check products with their eyes and hands on site,” and “convenience value: to have discussions and gather information in Tokyo instead of in a factory.”

(Source: The Company)

⑤Four aspects highly evaluated by customers

Based on the above-mentioned “broad and multi-layered customer base,” Takemoto is highly evaluated for its ability to meet customer needs with its high-quality proposal-based marketing capability; abundant mold stock, options for customization, flexible product supply structure and ability to meet production needs.

2. The Second quarter of Fiscal Year ending December 2020 Earnings Results

(1) Earnings Overview

| FY 12/19 2Q | Share | FY 12/20 2Q | Share | YoY | Compared with the plans |

Sales | 7,840 | 100.0% | 7,419 | 100.0% | -5.4% | -0.4% |

Gross profit | 2,428 | 31.0% | 2,522 | 34.0% | +3.8% | - |

SG&A | 1,589 | 20.3% | 1,532 | 20.7% | -3.6% | - |

Operating Income | 839 | 10.7% | 989 | 13.3% | +17.9% | +41.4% |

Ordinary Income | 859 | 11.0% | 999 | 13.5% | +16.3% | +42.8% |

Quarterly Net Income | 565 | 7.2% | 671 | 9.1% | +18.9% | +40.0% |

*Unit: Million yen

Sales decreased, profits increased. Profits are much higher than planned.

The sales for the second quarter of the term ending December 2020 are 7,419 million yen, down 5.4% year on year. In Japan, while the recoil from the increase in demand for cosmetics containers until the first half of the previous term lingered, hygiene-related demand grew due to measures for preventing the spread of COVID-19. In all categories, the company made new transactions, and demand from repeat customers is recovering. In China, sales dropped, falling below the estimate, in the aftermath of the suspension of business activities. Operating income grew 17.9% year on year to 989 million yen. Gross profit rate improved, thanks to the enhancement of productivity through the efforts for in-house production etc. In addition to the reduction of material costs and depreciation, SG&A, mainly personnel expenses, decreased. Sales were almost as estimated, and profit exceeded the estimate considerably

Capital Investment, Depreciation

| FY 12/19 2Q | FY 12/20 2Q |

Depreciation | 540 | 526 |

Capital Investment | 938 | 260 |

Out of which Molds | 236 | 124 |

*Unit: Million yen

Sales by Product Type

| FY 12/19 2Q | Share | FY 12/20 2Q | Share | YoY |

Products Made by the Company (Standard Bottle) | 5,800 | 74.0% | 5,625 | 75.8% | -3.0% |

Products Made with Molds Paid for/Owned by Customers (Custom Bottle) | 743 | 9.5% | 662 | 8.9% | -10.9% |

Products Manufactured by Other Companies | 1,153 | 14.7% | 1,024 | 13.8% | -11.2% |

Materials and others | 143 | 1.8% | 108 | 1.5% | -24.7% |

Total | 7,840 | 100.0% | 7,419 | 100.0% | -5.4% |

*Unit: Million yen

While sales declined, the sales composition ratio of standard bottles increased.

In China, the demand for large lots of custom bottles was strong, and sales were unchanged from the previous term.

Sales by Field Type

| FY 12/19 2Q | Share | FY 12/20 2Q | Share | YoY |

Cosmetic, beauty | 4,636 | 59.1% | 4,110 | 55.4% | -11.4% |

Sundries | 357 | 4.6% | 473 | 6.4% | +32.5% |

Foods, health foods | 691 | 8.8% | 632 | 8.5% | -8.4% |

Chemical and pharmaceuticals | 381 | 4.9% | 428 | 5.8% | +12.1% |

Wholesale, others | 1,773 | 22.6% | 1,775 | 23.9% | +0.1% |

Total | 7,840 | 100.0% | 7,419 | 100.0% | -5.4% |

*Unit: Million yen

The sales of products for cosmetics and beauty, the company's core products, decreased. The decline in sales of products for foods and health foods is substantially attributable to the decline in demand of products for cosmetics. Due to the growth of demand for hygiene-related products, the sales of products for sundries and chemicals & pharmaceuticals increased.

Regional Trends

Sales | FY 12/19 2Q | FY 12/20 2Q | YoY | Compared with the plans |

Japan | 6,131 | 5,856 | -4.5% | +3.5% |

China (JPY base) | 1,714 | 1,559 | -9.0% | -10.4% |

China (RMB base) | 105 | 101 | -4.1% | -6.8% |

Other areas | 110 | 114 | +3.5% | -36.7% |

Operating Income |

|

|

|

|

Japan | 718 | 791 | +10.1% | +41.8% |

China (JPY base) | 213 | 263 | +23.3% | +14.6% |

China (RMB base) | 13 | 17 | +29.9% | +19.2% |

Other areas | -94 | -68 | - | - |

*Unit: Million yen

(Japan)

Sales dropped, but profit grew, both exceeding the estimates.

While the recoil from the increase in demand for cosmetics containers until the first half of the previous term lingered, new transactions increased and the number of orders from repeat customers is recovering. Hygiene-related demand grew due to measures for preventing the spread of COVID-19.

As for profit, the gross profit rate rose thanks to the improvement in productivity through the efforts for in-house production, etc. The prices of resin materials were lower than assumed because oil prices dropped. Accordingly, the company’s burden decreased 16 million yen year on year. Depreciation decreased, due to the postponement of scheduled capital investment.

(China)

Sales dropped, but profit grew. Sales did not reach the estimate, but profit exceeded the estimate.

Due to COVID-19, marketing and manufacturing activities were suspended in early February, causing sales in the first quarter (January to March) to plummet. After the resumption of marketing activities, the decrease in sales shrank thanks to the growth of demand caused by the rebound from the suspension of economic activities and the increase in demand for hygiene-related products.

As for profit, the burden of social insurance premiums decreased by about 30 million yen, due to the policies of the Chinese government. As the prices of resin materials got lower due to the drop in oil price, the company’s burden decreased 22 million yen year on year.

(Other areas)

Sales grew, and loss shrank. Sales fell below the estimate.

*India

The company changed its policy, and now aims to secure sales by enriching the lineup of its original molds, but the procurement of molds was affected by the restriction on imports from China, etc.

As for production systems, they have been in normal operation since mid-June, although COVID-19 has not subsided.

Sales did not reach the estimate, but the company will strive to improve the profit rate by increasing unit prices of products and promoting small lots.

*The Netherlands

Sales did not reach the estimate, but business inquiries from customers increased, and new customers are increasing. The amount of orders received, including those from repeat customers, is growing.

The company plans to implement internet-based marketing strategies.

The company will keep gleaning information on environmental issues. There is no change to the production system of outsourcing manufacturing.

*The USA

The company secured sales to large customers, met demand from repeat customers, and sales have been progressing as planned.

(2) Financial Conditions and Cash Flow

Balance Sheet

| End of December 2019 | End of June 2020 |

| End of December 2019 | End of June 2020 |

Current Assets | 8,198 | 9,774 | Current liabilities | 3,609 | 4,186 |

Cash | 3,413 | 4,871 | Payables | 1,929 | 2,166 |

Receivables | 3,096 | 3,279 | LT Interest Bearing Liabilities | 545 | 706 |

Inventories | 1,473 | 1,378 | Taxes Payable | 162 | 395 |

Noncurrent Assets | 8,667 | 8,281 | Noncurrent liabilities | 4,034 | 4,253 |

Tangible Assets | 7,828 | 7,455 | ST Interest Bearing Liabilities | 3,703 | 3,909 |

Buildings and structures (Net Depreciation) | 3,446 | 3,660 | Total Liabilities | 7,643 | 8,439 |

Intangible Assets | 410 | 390 | Net Assets | 9,221 | 9,615 |

Investment, Others | 427 | 434 | Shareholders’ Equity | 9,155 | 9,709 |

Total assets | 16,865 | 18,055 | Total Liabilities and Net Assets | 16,865 | 18,055 |

*Unit: million yen |

|

| Total Interest-bearing Liabilities | 4,248 | 4,615 |

|

|

| Capital Adequacy Ratio | 54.4% | 53.0% |

Total assets grew 1,190 million yen to 18,055 million yen, due to the increase in cash, etc. Total liabilities increased 796 million yen to 8,439 million yen, due to the increase in accounts payable and interest-bearing debt, etc.

Net assets increased 394 million yen to 9,615 million yen, due to the rise in retained earnings.

As a result, capital adequacy ratio decreased by 1.4% from the end of the previous term and became 53.0%.

◎Cash Flow

| FY 12/19 2Q | FY 12/20 2Q | Increase/Decrease |

Operating Cash Flow | 861 | 1,580 | +719 |

Investing Cash Flow | -888 | -213 | +674 |

Free Cash Flow | -27 | 1,366 | +1,394 |

Financing Cash Flow | -11 | 248 | +259 |

Term End Cash and Equivalents | 2,778 | 4,833 | +2,054 |

*Unit: Million Yen

Operating and free CFs grew, due to the increases in income before income taxes, payables, etc.

Financing CF turned positive, due to the rise in proceeds from long-term loans payable.

The cash position improved.

(3) Topics

◎Progress of mold development

The number of molds of the company is 3,469 as of the end of June 2020.

| The Number of Completed Molds in FY 12/20 2Q | The Number of Holding Molds in FY 12/20 2Q | In Progress | ||||

Standard | Custom | Total | Standard | Custom | Total | ||

Japan | 31 | 11 | 42 | 2,326 | 43 | 8 | 51 |

China | 18 | 11 | 29 | 1,066 | 57 | 15 | 72 |

India | 3 | 7 | 10 | 54 | 43 | 7 | 50 |

Netherlands | - | - | - | 23 | 18 | - | 18 |

Total | 52 | 29 | 81 | 3,469 | 161 | 30 | 191 |

*Unit: Molds. Standard is standard bottle, Custom is custom bottle. Customer exclusive molds are deducted from the number of molds owned by the company.

3. Fiscal Year ending December 2020 Earnings Forecasts

3-1 Earnings Estimates

| FY 12/19 | Ratio to sales | FY 12/20 Est. | Ratio to sales | YoY |

Sales | 15,196 | 100.0% | 15,500 | 100.0% | +2.0% |

Operating Income | 1,538 | 10.1% | 1,600 | 10.3% | +4.0% |

Ordinary Income | 1,575 | 10.4% | 1,600 | 10.3% | +1.6% |

Net Income | 1,043 | 6.9% | 1,100 | 7.1% | +5.4% |

*Unit: Million Yen. Estimates are based on the source from the company.

There is no revision to the full-year earnings forecast, increased sales and profits

There is no revision to the full-year earnings forecast for the term ending December 2020. Sales are estimated to grow 2.0% year on year to 15,500 million yen, while operating income is projected to rise 4.0% year on year to 1,600 million yen. Production activities in Japan, China, and India are ongoing with no hindrance, and products are continuously supplied. The prices of resin materials are dropping and the period of exemption from social insurance premiums in China has been extended. On the other hand, the company recognizes that there are many uncertainties, such as COVID-19 remaining as a global threat, which will not allow us to dispel our anxiety over the future, and as in the field of cosmetics, which account for a significant proportion of sales, in-store sales are restricted and the customers' demand is changing, due to less opportunity for going out. As for dividends, the company plans to pay a total of 19.00 yen/share per year unchanged from the previous term. The estimated payout ratio is 21.6%, as the company aims to achieve a payout ratio of over 20%.

(2) Capital Investment, Depreciation

| FY 12/19 Act. | FY 12/20 Est. | YoY |

Depreciation | 1,077 | 1,140 | +5.8% |

Capital Investment | 1,401 | 1,650 | +17.8% |

Out of which Molds | 289 | 630 | +118.0% |

EBITDA | 2,615 | 2,740 | +4.8% |

*Unit: million yen

(Breakdown of investment)

| Domestic | Share | International | Share | Total | Share |

TOGETHER LAB related | 60 | 3.6% | - | - | 60 | 3.6% |

Machinery equipment (molding machine, multilayer machine, image inspection device, automatic machine, etc.) | 370 | 22.4% | 350 | 21.2% | 720 | 43.6% |

Mold | 270 | 16.4% | 360 | 21.8% | 630 | 38.2% |

Others | 230 | 13.9% | 10 | 0.6% | 240 | 14.5% |

Total | 930 | 56.4% | 720 | 43.6% | 1,650 | 100.0% |

The company is planning capital investment for the purposes of developing standout containers, enriching the product lineup in overseas markets, improving production efficiency, etc.

4. Management policies

The following three points are listed as messages.

(1) Business policies during the COVID-19 crisis, (2) Specific business strategies, (3) Themes for each base

(1) Business policies during the COVID-19 crisis

In this difficult business environment, to achieve the priority theme of 2019, "further strengthening of Standout," the company will further accelerate the already mentioned "sustainability," "strengthening of the development proposal capability," and "achieving outstanding speed." Moreover, the company added "strengthening WEB marketing (e-commerce)" as a priority theme.

(2) Specific business strategies

① Strategy of achieving the synergy between WEB and LAB

The new added "WEB Marketing (E-commerce) Strategy" is based on the concept of a sales function that has "a wide range of local and global contact points" and convenience. The company will provide small quantities and immediate delivery for new customers mainly by handling ready-made inventories and mass-customized products.

On the other hand, "TOGETHER LAB," which started operation in April this year, is positioned as a "foothold for co-creation and development" that creates value together with customers through speedy product development. It is a value creation foothold that focuses on customization and bespoke products, gives form to customer’s ideas and handles inquiries about processes from trial production to mass production..

To meet a wide range of customer needs, the company will minimize the process for the container provision by using the characteristics of these two different resources and fusing the "digital" and "physical" technologies.

② TOGETHER LAB

As introduced in “1-6 Characteristics and Strengths,” TOGETHER LAB can meet customer needs for planning, trial production, and mass production, and promptly give form to ideal containers.

③ Sustainability

As a packaging solution provider, the company will focus on building a new supply chain that takes into consideration the entire product life cycle through initiatives in each aspect: manufacturing, distribution, consumption, and recycling.

(Source: The Company)

The company set the following three milestones as concrete initiatives to address environmental issues.

| Target value | Present value | Achievement rate | Overview |

Biomass plasticization | 150 products | 60 products | 42% | Biomass plastics will be used in 150 container products in inventory by 2025. |

Lighter containers | 100 products | 40 products | 40% | Reducing the weight of 100 container products in inventory by 2025. |

Use of CO2 reduction additives | 100 products | 1 product | 1% | Additives that can reduce CO2 emissions during combustion will be used in 100 container products in inventory by 2025. |

*As of July 2020

④ Strengthening of development proposal capability

The company will continue to improve its development proposal capabilities that anticipate customer needs in line with the three following themes: "individualization," "sustainability," and "safety & security."

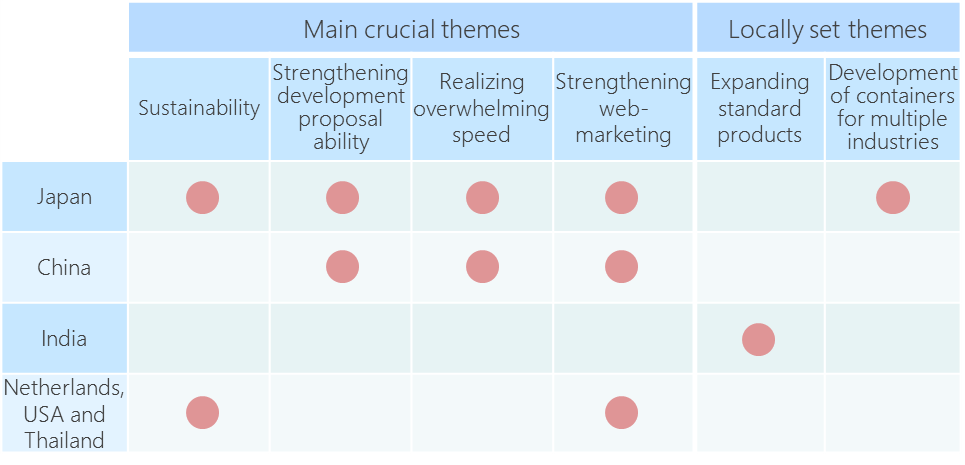

(3) Themes for each base

The efforts of each base are being focused as follows.

(Source: The Company)

5. Conclusions

Looking at the progress rate in each region, business performance in Japan is healthy, but the performance in China and other foreign countries (India, the Netherlands, and the U.S.) has been significantly affected by COVID-19. It is difficult to estimate the future impact of COVID-19, and we have no choice but to wait for the disclosure for the third quarter, but we would like to pay attention to the situation of recovery in China, where the sales composition ratio has increased, and what kinds of changes will be induced by “strengthening WEB marketing (e-commerce),” which was added as an important objective in all regions, excluding India.

*Japan

| FY 12/20 2Q | FY 12/20 (Plan) | Progression |

Net sales | 5,856 | 11,800 | 49.6% |

Operating profit | 791 | 1,300 | 60.8% |

Operating income margin | 13.5% | 11.0% | - |

*China

| FY 12/20 2Q | FY 12/20 (Plan) | Progression |

Net sales | 1,559 | 3,500 | 44.5% |

Operating profit | 263 | 440 | 59.8% |

Operating income margin | 16.9% | 12.6% | - |

*Other areas

| FY 12/20 2Q | FY 12/20 (Plan) | Progression |

Net sales | 114 | 410 | 27.8% |

Operating profit | -68 | -130 | 52.3% |

Operating income margin | - | - | - |

*Unit: million yen

<Reference1:Regarding the mid-term plan>

Considering the changes in the business environment, including the decline in inbound demand, the company revised the mid-term plan (2019-2021) announced in January 2019, and announced the mid-term plan (2020-2022) in January 2020.

(1) Numerical Targets

* Mid-term plan (2019-2021) Numerical targets

| FY 12/19 (Plan) | YoY | FY 12/20 (Plan) | YoY | FY12/21 (Plan) | YoY |

Sales | 16,934 | +5.7% | 17,952 | +6.0% | 19,173 | +6.8% |

Operating Profit | 1,678 | +3.0% | 1,712 | +2.0% | 1,830 | +6.9% |

Operating Profit on Sales | 9.9% | -0.3pt | 9.5% | -0.4pt | 9.5% | 0.0pt |

Ordinary Income | 1,706 | -3.2% | 1,722 | 0.9% | 1,836 | +6.6% |

Net Income | 1,176 | -2.9% | 1,203 | 2.3% | 1,281 | +6.5% |

Depreciation | 1,198 | 17.3% | 1,555 | 29.8% | 1,825 | +17.4% |

Capital Investment | 3,585 | 84.2% | 3,189 | -11.0% | 2,410 | -24.4% |

Out of which Molds | 700 | 47.1% | 759 | 8.4% | 749 | -1.3% |

EBITDA | 2,876 | +8.5% | 3,267 | +13.6% | 3,655 | +11.9% |

* Mid-term plan (2020-2022) Numerical targets

| FY 12/20 (Plan) | YoY | FY 12/21 (Plan) | YoY | FY 12/22 (Plan) | YoY |

Sales | 15,500 | +2.0% | 16,400 | +5.8% | 17,400 | +6.1% |

Operating Profit | 1,600 | +4.0% | 1,750 | +9.4% | 1,850 | +5.7% |

Operating Profit on Sales | 10.3% | +0.2pt | 10.7% | +0.4pt | 10.6% | -0.1pt |

Ordinary Income | 1,600 | +1.6% | 1,750 | +9.4% | 1,850 | +5.7% |

Net Income | 1,100 | +5.4% | 1,200 | +9.1% | 1,275 | +6.3% |

Depreciation | 1,140 | +5.8% | 1,220 | +7.0% | 1,330 | +9.0% |

Capital Investment | 1,650 | +17.8% | 1,600 | -3.0% | 1,850 | +15.6% |

Out of which Molds | 630 | +118.0% | 720 | +14.3% | 550 | -23.6% |

EBITDA | 2,740 | +4.8% | 2,970 | +8.4% | 3,180 | +7.1% |

As of January 2019, it was assumed that (1) demand would grow further from 2018 and the company would enhance its production capacity and (2) new businesses would be launched for coping with environmental issues, etc., but this time, the mid-term plan was formulated based on the following assumptions.

*As for the demand for packaging containers in Japan in 2019, the amount of orders received decreased, especially in the second half of the year, due to the recoil from advanced procurement due to the sense of shortage of containers for cosmetics in 2018 and the drop in demand due to the enactment of EC regulations in China.

*Although the demand for containers is expected to grow gently in 2020, domestic annual sales are estimated to be unchanged from 2019.

*The increase of production footholds will be put off for a while, but the company will continue investment for developing containers for sustainability, enriching the product lineup outside Japan, automation for improving production efficiency, etc.

*In China, there was an inventory adjustment due to the EC regulations in the first half of 2019. Due to the lingering effects of the trade friction between the U.S. and China, the sales in 2020 are estimated to be unchanged from 2019, but the company plans to increase sales in the medium term, by increasing new transactions. To cope with the further growth of demand, the company is thinking of building a third factory in 2022.

*For the markets in the U.S., India, and the Netherlands, the company plans to forge a solid footing and earn sales steadily with business transactions for which the company has received inquiries. The company will make efforts to fortify the system for continuously supplying high-quality products in a stable manner.

(Regional plans and key points)

(Japan)

| FY 12/20 (Plan) | YoY | FY 12/21 (Plan) | YoY | FY 12/22 (Plan) | YoY |

Sales | 11,800 | +0.5% | 12,100 | +2.5% | 12,800 | +5.8% |

Operating Profit | 1,300 | +1.8% | 1,270 | -2.3% | 1,450 | +14.2% |

Operating Profit on Sales | 11.0% | +0.1pt | 10.5% | -0.5pt | 11.4% | +0.9pt |

Under the assumption that domestic demand for containers will increase slightly, the company will continue the development of standard bottles with functionality and design for sustainability. In 2021, it is forecasted that sales will rise slightly, but profit will drop due to the augmentation of expenses.

(China)

| FY 12/20 (Plan) | YoY | FY 12/21 (Plan) | YoY | FY 12/22 (Plan) | YoY |

Sales | 3,500 | +1.8% | 3,700 | +5.7% | 3,900 | +5.4% |

Operating Profit | 440 | +1.4% | 480 | +9.1% | 385 | -19.8% |

Operating Profit on Sales | 12.6% | +0.0pt | 13.0% | +0.4pt | 9.9% | -3.1pt |

It is not possible to predict whether or not the trade friction between the U.S. and China will be settled, but the demand in China is expected to expand breaking away from the negative effects of the EC restrictions. In 2022, it is assumed that the burden of depreciation will augment through the construction of a new factory and profit will decline.

(Others)

| FY 12/20 (Plan) | YoY | FY 12/21 (Plan) | YoY | FY 12/22 (Plan) | YoY |

Sales | 410 | +75.2% | 780 | +90.2% | 940 | +20.5% |

Operating Profit | -130 | - | 0 | - | 30 | - |

Operating Profit on Sales | - | - | - | - | 3.2% | +3.2pt |

In India, it took time to produce clients’ molds, and the full-scale posting of sales was delayed, but the company enriched the lineup of its molds and conducted marketing focused on standard bottles. The company aims to post operating profit in 2021.

(2) Points of the mid-term plan

The company is pursuing “sustainability,” “strengthening of the development proposal capability,” “achieving outstanding speed” and "Strengthen web marketing (E-Commerce)" under the priority theme: “further strengthening of standout features” to “offer outstanding value to customers' products.”

① Sustainability

(The environment surrounding the company)

The EU aims to recycle more than half of the plastic waste in Europe. Regulations in the EU will be implemented from 2021 to ban the use of single-use plastic products throughout the market. Furthermore, 65% of all waste containers and packaging materials will be recycled by 2025, and all plastic containers and packaging materials will be reusable or recyclable in 2030.

Also, Japan has set the following goals under the basic principle "3R + Renewable" in the "Plastic Resource Recycling Strategy."

Reduce | Cumulative 25% regulation in single-use plastics emissions by 2030 |

Recycle and Reuse | Design reusable and recyclable containers by 2025 Recycle and reuse 60% of containers and packaging by 2030 |

Renewable | Double the recycling by 2030 Introduce biomass plastics |

(Corporate measures)

The company is implementing the following actions to realize a circular economy and a low-carbon society.

Raw materials | Development and sale of biodegradable plastic containers since 1991. The company has been selling standard bottles made of glass, metal, paper, etc. since 1995. Also, it has been selling biomass plastic containers made from plants such as sugarcane since 2014. |

Recycle | In 2005, the company began developing and selling containers that can be used repeatedly, and since 2011, it has been developing and selling containers that use recycled raw materials that include PET and PP. |

Innovation | The company started developing and selling single material containers and thin containers (lightweight) since 2000. Since 2008, the company has been developing and selling containers made of materials that reduce CO2 emissions when incinerated. Since 2013, the company has been developing coating technology to improve the barrier properties of containers. |

Recently, the company has recognized the necessity of building a new supply chain while taking into account the entire product life cycle.

② "Strengthening the development proposal capability" and "Achieving outstanding speed”

“TOGETHER LAB” plays an important role here as described in [1-6 Characteristics and Strengths].

The company is working on the fusion of digital and real based on “TOGETHER LAB,” in cooperation with external experts, securing intellectual property through patents, etc.

In particular, “The fusion of digital and real” is what the company is aiming for to accumulate experience and knowledge and share internal information via open access by utilizing digital tools. “The fusion of digital and real” produces many benefits such as “reduction of time from proposal to commercialization,” “digitization of the planning and development process,” “creation of added value by accumulating data and experiments,” “improvement of operating efficiency,” “strengthening responsiveness to overseas clients,” and “utilization of the simulation for design, quality, and production.” The company believes that these benefits will enable it to strengthen competitiveness further through “acceleration,” “response improvement” and “enhanced creativity for added value.”

③ WEB Marketing (E-commerce) Strategy

Under the concept of sales functions with “a broad range of local and global contact points” and convenience, the company will provide small quantities and immediate delivery for new customers mainly by handling ready-made inventories and mass-customized products.

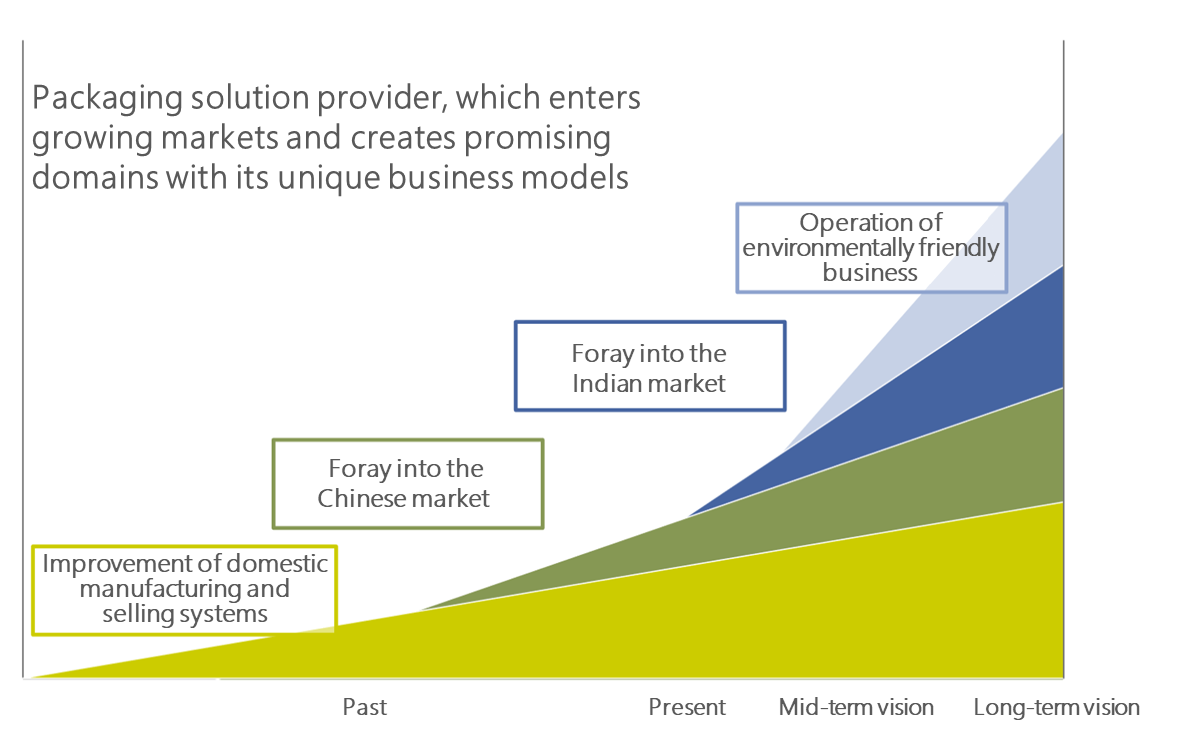

(Future vision)

The company aims for further growth by promoting full deployment in the Chinese and Indian markets and developing eco-friendly

business.

(Source: The Company)

<Reference2: Regarding Corporate Governance>

◎ “Organization type”

Organization Structure | Company with audit and supervisory committees |

Directors | 7 directors of whom 4 are outside directors |

◎Corporate Governance Related Report

Last update date: March 30, 2020.

<Basic policy>

“Creating bottles with our customers’ hearts in mind” is our “corporate motto,” and our mission is ensuring the safety of our customers’ products of various substances and contents and increasing their value and individuality through the provision of packaging containers, which are imperative to people’s daily lives. In order to realize this management philosophy, increase medium- to long-term corporate value, and ensure the soundness and transparency of corporate activities, we will work on enhancing corporate governance in accordance with the following basic policies.

(1) Ensuring shareholders rights and equality

We will promptly disclose information in compliance with relevant laws and regulations to ensure substantial equality for all shareholders and ensure the rights of shareholders.

(2) Appropriate collaboration with stakeholders other than shareholders

In order to increase corporate value over the medium to long term, we will practice appropriate collaboration not only with shareholders but also with stakeholders such as customers, business partners, employees, and local communities. To become a good corporate citizen, the Board of Directors and the management team are complying with laws and regulations, striving to achieve the corporate philosophy and employee code of conduct, and working for fair and clear business operation based on our management philosophy.

(3) Ensuring appropriate information disclosure and transparency

We recognize that proper and accurate information disclosure is imperative for continuing corporate activities with the understanding of various stakeholders. In addition to timely and appropriate disclosure based on laws and regulations, we will proactively disseminate information on the operational status of the Group’s business through our website and business reports.

(4) Responsibilities of the Board of Directors

We recognize that the decision-making function and supervisory function of the Board of Directors need to be effectively utilized in order to control all risks that threaten business continuity and reduce and resolve undesirable events.

We have selected a company with an audit and supervisory committee under the companies act. The audit and supervisory committee, which consists of outside directors, plays a role in management supervision and strives to achieve highly transparent management.

(5) Dialogue with shareholders

We recognize that in order to achieve sustainable growth and in order to strengthen our corporate values it is important to conduct constructive dialogue with shareholders and reflect their opinions and requests with regard to management.

In implementing the capital policy, we ensure proper procedures and provide sufficient explanations to shareholders so as not to unduly harm existing shareholders.

In order for shareholders and investors to gain an understanding of our management strategies and plans, the department in charge of IR plays a central role and provides venues for dialogue.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

[Supplementary Principle 1-2-4 Electronic Exercising of Voting Rights to Shareholder’s Meeting/English Translation of Convocation of Notice] [Supplementary Principle 3-1-2 Disclosure and Provision of Information in English] | Our company made it possible to exercise voting rights via the Internet from the 69th annual meeting of shareholders held in March 2020, and participated in the platform for exercising electronic voting rights, but do not produce convocation notices and financial statements in English. We recognize the necessity to provide information in English for investors outside Japan and establishing an environment in which it is easy to exercise voting rights in accordance with the state of the shareholding structure of corporate investors, etc. In the future, we will consider translating the Convocation of Notice and other documents while taking the ratio of overseas investors in shareholders into account. |

[Supplementary Principle 4-11-3 Evaluating Effectiveness of Board of Directors] | The board of directors will have regular meetings once a month and when deemed necessary will hold adequate meetings to decide and report important matters related to the execution of operations. Moreover, the board of directors will actively discuss issues in managerial strategies, governance and administration, as well as exchange opinions on the management situation of the board of directors. However, the Board of Directors’ effectiveness has yet to be evaluated. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

[Principle 1-4 So-called strategically held shares] | Our company will retain shares of clients if we conclude that building a stable and long-term business relationship or collaborating would contribute to improving the mid- to long-term value of our company. Currently, strategically held shares account for less than 0.1% of the company’s total assets, so the financial impact is extremely low. The strategically held shares, which place high importance in funds, are being examined by the Board of Directors to determine the necessity and the sense in continuing to retain them. As for shares that have begun to lose their strategic importance, we will open dialogues with our business partners and work to reduce the number of such shares. In terms of exercising voting rights on them, judgment on the vote will be made from the perspective of whether it will contribute to improving the mid- to long-term value of said company and our company. |

This report is intended solely for information purposes, and, it is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the company, and they come from sources that we consider to be reliable. However, we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and/or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020, Investment Bridge Co., Ltd. All Rights Reserved. |