Bridge Report: (4312) Cybernet Systems

Reiko Yasue, President & CEO | Cybernet Systems Co., Ltd. (4312) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Information and communications |

President | Reiko Yasue, |

HQ Address | FUJISOFT Bldg. 3 Kanda-neribeicho, Chiyoda-ku, Tokyo |

Year-end | December |

Homepage |

Stock Information

Share Price | Number of shares issued (excluding treasury shares) | Total market cap | ROE(Act.) | Trading Unit | |

¥620 | 31,158,269 shares | 19,318 million | - | 100 shares | |

DPS(Est.) | Dividend yield (Est.) | EPS(Est.) | PER(Est.) | BPS(Act.) | PBR(Act.) |

¥15.38 | 2.5% | ¥30.75 | 20.2 x | ¥408.80 | 1.5 x |

*The share price is the closing price on February 26.

*The number of shares issued was calculated by subtracting the treasury shares from the number of outstanding shares at the end of the latest quarter.

Consolidated Earnings

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS (¥) | DPS (¥) |

December 2015(Act.) | 15,518 | 851 | 1,003 | 463 | 14.87 | 13.80 |

December 2016(Act.) | 16,031 | 1,027 | 1,001 | 462 | 14.83 | 13.00 |

December 2017(Act.) | 17,987 | 1,504 | 1,639 | 937 | 30.09 | 15.05 |

December 2018(Act.) | 19,719 | 1,502 | 1,684 | -656 | - | 16.52 |

December 2019(Est.) | 20,000 | 1,520 | 1,608 | 958 | 30.75 | 15.38 |

* Forecast by the Company. From FY 2016, net income is profit attributable to owners of parent (the same applies for net income hereinafter).

*(Unit: ¥mn)

This Bridge Report presents Cybernet Systems’s fiscal year December 2018 earnings results, and fiscal year December 2019 earnings forecasts, etc.

Table of Contents

Key Points

1.Company Overview

2.Fiscal Year ended December 2018 Earnings Results

3.Fiscal Year ending December 2019 Earnings Forecasts

4.Conclusions

Reference: Regarding Corporate Governance

Key points

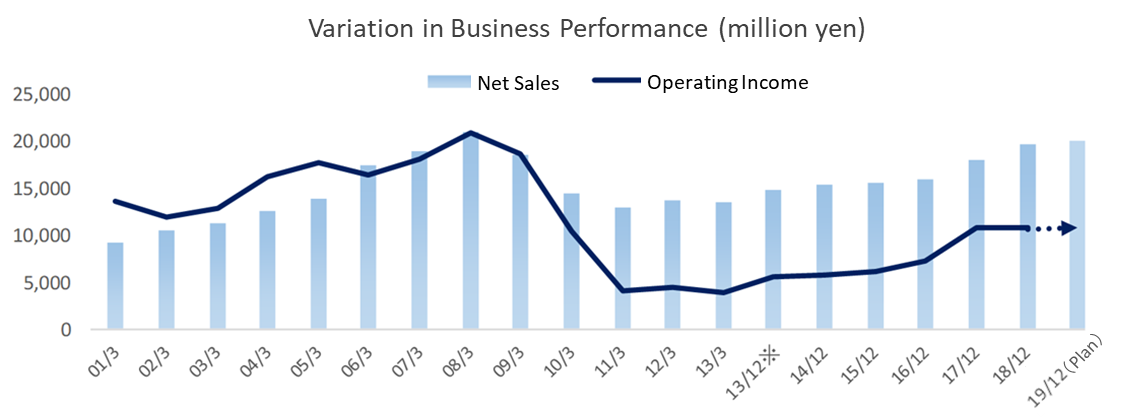

- In Fiscal year 2018, sales increased 9.6% year on year and operating income decreased 0.2% year on year. The sales of IT solution services grew 18.8% year on year due to the strong performance of security products, while the sales of CAE solution services rose 9.6% year on year, mainly in MCAE (its core field), optical design and MBD fields. The sales of the Company’s sales subsidiaries also grew, mainly in optical software. However, the operating income margin dropped due to a change in the sales composition, a rise in research and development costs, etc. The Company recorded losses at the end of the term due to impairment losses.

- For Fiscal year 2019, sales are expected to rise 1.4% year on year and operating income is estimated to increase 1.2% year on year. The estimates were made conservatively, considering that sales in the fourth quarter (October-December) in the previous term on a non-consolidated basis increased only 3.8% year on year (4.1% decrease on a consolidated basis due to OEM in the term before the previous term). The Company will continue to invest in human resources, IT and business inside and outside Japan. The full-term dividend is to be 15.38 yen/share (interim and term-end dividends are both to be 7.69 yen/share).

- At the general meeting of shareholders, which was held on March 8, 2019, and the following Board of Directors’ meeting, the current Vice President Reiko Yasue took up the president’s position. The Company aims for its further growth through reconstruction of the Group’s governance system and strengthening of overseas business. Therefore, regarding the medium-term business plan (second phase) aimed at achieving sales of 30 billion yen and an operating income margin of over 10% by the final term of Fiscal year 2020, the Company will withdraw the quantitative targets temporarily, while continuing to put efforts based on the basic policy.

1.Company Overview

With “Computer Aided Engineering (CAE) Solution” and “IT Solution” as two pillars of the business, Cybernet supports the manufacturing of goods, “Monozukuri.” CAE includes virtual designing and experimentation (simulation) on a computer. In the process of product development, CAE helps achieve high quality, shorten the development period, and reduce development cost. It is also environmentally friendly as it reduces waste materials generated by trial production. The Company is engaged in a license sales and maintenance service of more than 50 kinds of globally recognized software provided by more than 20 companies as well as an agency service to approximately 2,000 companies in the fields of automobiles, machinery, electric machinery and 500 research institutions and universities.

The Group is composed of the Company and its 14 consolidated subsidiaries. Its business is operated in North America, the UK, France, Germany, Belgium, and Asia. Among the main consolidated subsidiaries, there are 3 development subsidiaries: Sigmetrix, L.L.C., US (calculation of the permissible range of variation in a dimension set at the time of design), which develops and sells tolerance analysis (the permissible range of variation in a dimension set at the time of design) software with technical support; Waterloo Maple Inc., Canada for formula manipulation systems; and Noesis Solutions NV, Belgium, which develops and sells the Process Integration and Design Optimization (PIDO) tools with technical support. The Group also has 3 distributor subsidiaries of CAE Solutions: CYBERNET SYSTEMS (SHANGHAI) CO., LTD.,Shanghai, CYBERNET SYSTEMS TAIWAN CO., LTD., Taiwan (57% ownership), and CYFEM Inc., South Korea (65% ownership).

1-1 Corporate Philosophy

Cybernet’s corporate philosophy is “We will contribute to the advancement of our customers and society by providing solutions that generate high satisfaction through enhanced value-added and high-quality services.” With its corporate message of “Energy for your Innovation,” Cybernet aims to become the “First Contact Company” for customers, that always walks with them and that they trust.

1-2 Business Description

Cybernet’s business is divided into CAE Solution Services providing CAE solutions and related technical services, and IT Solution Services providing IT solutions and data solutions. CAE Solution Services account for over 80% of the entire business of the Group.

1-2-1 CAE Solution Services

In addition to Distributor Business and Vendor Business, both of which sell CAE software and hardware for analysis and simulation in conjunction with a Computer Aided Design (CAD) system, CAE Solution Services manage Consulting Business that provides solutions to respond to advanced demands from customers, design of electronic circuits and boards, model-based development (MBD, to be described later), engineering (consignment) services such as PIDO, and user education and support services such as holding seminars, user conferences, and case presentations.

6 CAE application areas and development/sales subsidiaries

The trend in this segment is described separately in the 6 application areas in which the Company (non-consolidated) utilizes CAE, as well as in development subsidiaries and sales subsidiaries.

6 CAE application areas:

1) Mechanical CAE (MCAE)

After completing the designing process using CAD, it provides software and services that support analysis of structure, heat transfer, electromagnetic, and thermal fluid. The main product is the multiphysics (multiple physical forces) analysis tool “ANSYS,” a product of ANSYS, Inc. (US)

2) Optical Design

It provides optical analysis such as lens design, illumination analysis, optical communication system analysis and measurement tools related to organic EL and optical member characteristics, and solutions and services. Main products include “CODE V” (optical design evaluation program) and “LightTools” (analytical software for lighting design) manufactured by Synopsys, Inc. (US)

3) Electronic Design Automation (EDA)

It provides software that automates electronic devices and semiconductors, and operation proposal/design analysis services in the process through design, analysis and manufacture/installation of a printed-circuit board (PCB). Main products include “Xpedition Enterprise” and “HyperLynx” manufactured by Mentor Graphics, Inc. (US)

4) Model Based Development (MBD)

MBD is a design methodology that implements a development process of plan, design, and verification based on formula models. Major products are provided by Maplesoft, a subsidiary of the Group. The products include the STEM computing platform “Maple” and the system-level modeling and simulation tool “MapleSim.”

5) Test and Measurement, Others

In the area of test and measurement, the Company provides Flat Panel Display (FPD) Inspection System developed by the Company itself. In the area of others, it provides products of the Group: 3D tolerance management tools (optimization of cost and quality based on variation evaluation of sizes and sites of assembly parts) and optimized design support tools (analysis automation, robust control/reliability evaluation, application of quality engineering, etc.), as well as CAE technical education services.

Development subsidiaries

The 3 development subsidiaries are Sigmetrix, L.L.C. (US), which develops, sells and provides technical support for the 3D tolerance analysis software “CETOL 6σ;” Waterloo Maple Inc. (Canada), which develops, sells and provides technical support for the formula manipulation software “Maple” to formulate (visualize) various physical phenomena and 1D CAE software “MapleSim;” and Noesis Solutions NV (Belgium), which develops, sells and provides technical support for “Optimus” for Process Integration and Design Optimization (PIDO).

Sales subsidiaries

The 4 sales subsidiaries are CYBERNET SYSTEMS TAIWAN CO., LTD. (Taiwan), CYBERNET SYSTEMS (SHANGHAI) CO., LTD. (Shanghai), CYFEM Inc. (Korea), of CAE Solutions and CYBERNET SYSTEMS MALAYSIA SDN.BHD.(Malaysia), which was established in November 2018.

1-2-2 IT Solution Services

IT Solution Services are composed of IT Solution Business and Data Solution Business. As for the IT Solution Business, the Company offers a wide range of solutions that support various companies’ IT infrastructures including Symantec’s endpoint security products that prevent computer virus infections and information leaks in the servers and client PCs, as well as “SKYSEA Client View” (SKY Inc.) and “QND Advance” (Quality Software Inc.) designed for IT asset management solutions, database development support and application performance management.

Meanwhile, in the Data Solution Business, the Company offers digital solutions that support manufacturing of goods, including visualization solutions which visualize CAE analysis data plainly as well as AR (Augmented Reality)/VR (Virtual Reality), and big data. AR related solutions include AR application development tools and AR content distribution systems. VR related solutions include VR design review support systems and 3D application composite display software. The big data related solutions include the Company’s original big data visualization tool “BIGDAT @ Viewer (big data viewer).”

In addition, the Company provides services such as operation consulting, introduction support, and user education support, according to the customers’ environment.

Composition Ratio of Net Sales for FY 2018 (Consolidated)

By business | |

CAE | 80.9% |

Development subsidiaries | 19.1% |

By region | |

Japan | 78.8% |

North America | 6.9% |

Asia | 9.8% |

Europe | 4.3% |

Others | 0.2% |

By sales form | |

Distributor | 71.6% |

Vender (in-house) | 15.7% |

Service | 12.7% |

Net Sales by Application Area (Non-consolidated)

| FY Dec. 14 | FY Dec. 15 | FY Dec. 16 | FY Dec. 17 | FY Dec. 18 | Composition Ratio | YoY |

MCAE | 5,306 | 5,462 | 5,653 | 6,281 | 6,937 | 44.1% | +10.4% |

Optical Design | 2,482 | 2,530 | 2,602 | 2,756 | 2,975 | 18.9% | +7.9% |

EDA | 902 | 391 | 399 | 520 | 382 | 2.4% | -26.5% |

MBD | 611 | 734 | 872 | 936 | 1,027 | 6.5% | +9.7% |

Test and Measurement | 59 | 141 | 62 | 143 | 132 | 0.8% | -7.4% |

Others | 271 | 350 | 344 | 413 | 371 | 2.4% | -10.3% |

CAE Total | 9,631 | 9,611 | 9,935 | 11,053 | 11,827 | 75.2% | +7.0% |

IT Solution | 1,557 | 1,819 | 2,043 | 2,263 | 2,771 | 17.6% | +22.4% |

Data Solution | 1,103 | 900 | 975 | 1,015 | 1,130 | 7.2% | +11.3% |

IT Total | 2,660 | 2,720 | 3,019 | 3,279 | 3,902 | 24.8% | +19.0% |

Total | 12,294 | 12,331 | 12,955 | 14,332 | 15,729 | 100.0% | +9.7% |

*Unit: ¥mn

Sales by Category of Industry (Non-consolidated)

| FY Dec. 14 | FY Dec. 15 | FY Dec. 16 | FY Dec. 17 | FY Dec. 18 | Composition Ratio | YoY |

Electrical Equipment | 4,217 | 4,257 | 4,129 | 4,612 | 4,679 | 29.8% | +1.5% |

Machinery & Precision Machinery | 1,873 | 1,898 | 2,094 | 2,232 | 2,419 | 15.4% | +8.4% |

Transportation Equipment | 1,512 | 1,579 | 1,779 | 2,036 | 2,295 | 14.6% | +12.7% |

Other Manufacturing Industry | 1,311 | 1,344 | 1,619 | 1,778 | 2,014 | 12.8% | +13.3% |

Education Institution/Government and Municipal Offices | 1,465 | 1,147 | 1,118 | 1,224 | 1,356 | 8.6% | +10.8% |

Information and Communication | 555 | 758 | 841 | 794 | 876 | 5.6% | +10.3% |

Other Manufacturing Industry | 1,357 | 1,345 | 1,370 | 1,653 | 2,087 | 13.3% | +26.2% |

Total | 12,294 | 12,331 | 12,955 | 14,332 | 15,729 | 100.0% | +9.7% |

*Unit: ¥mn

2.Fiscal Year ended December 2018 Earnings Results

2-1 Consolidated results

| FY Dec. 17 | Ratio to sales | FY Dec. 18 | Ratio to sales | YoY | Forecast | Compared with the initial forecasts |

Sales | 17,987 | 100.0% | 19,719 | 100.0% | 9.6% | 19,510 | +1.1% |

Gross profit | 7,707 | 42.9% | 7,904 | 40.1% | +2.6% | 8,389 | -5.8% |

SG & A expenses | 6,203 | 34.5% | 6,402 | 32.5% | +3.2% | 6,828 | -6.2% |

Operating Income | 1,504 | 8.4% | 1,502 | 7.6% | -0.2% | 1,561 | -3.8% |

Ordinary Income | 1,639 | 9.1% | 1,684 | 8.5% | +2.8% | 1,709 | -1.4% |

Net Income | 937 | 5.2% | -656 | - | - | 1,029 | - |

*Figures include reference figures calculated by Investment Bridge Co., Ltd. Actual results may differ (same applies to all tables in this report).

*Unit: ¥mn

Sales increased 9.6% year on year, with operating income down 0.2% year on year

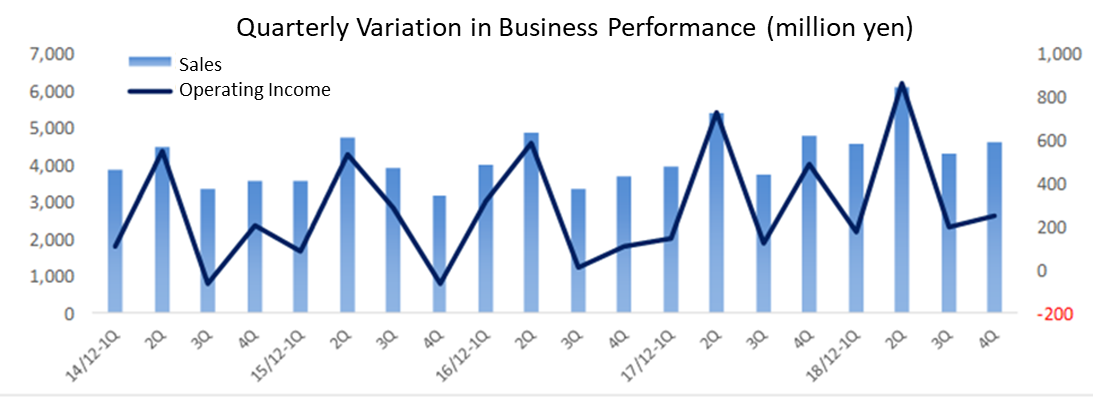

Sales were 19,719 million yen, up 9.6% year on year. The sales of IT solution services grew 18.8% year on year due to the strong performance of Symantec products, while the sales of CAE solution services rose 9.6% year on year, mainly in MCAE (Mechanical CAE), which is the core field, Optical design, which includes a program for evaluating optical design, and MBD (Model Based Development) including 1D CAE tools. Sales of mainly optical software grew at the Company’s sales subsidiaries in China and South Korea, but development subsidiaries in Canada and the U.S. struggled.

Operating income was 1,502 million yen, down 0.2% year on year. The growth of gross profit rate was sluggish with only 2.6% rise year on year, as cost rate increased 2.8 points due to a rise in the sales composition ratio for products with relatively high cost rates in the MCAE field and IT solution services. On the other hand, SG&A expenses augmented 3.2% year on year due to the increased spending for research and development of the image diagnostic support software for endoscopy and MBSE (a development method to manage the entire development process ranging from demand analysis to examination based on a model), as well as the costs incurred throughout the fiscal year for a subsidiary that started its operation in November 2017 in South Korea.

Non-operating income/loss improved due to a foreign exchange gain of 51 million yen (loss of 33 million yen in the previous term), but the Company recorded a net loss of 656 million yen as a result of extraordinary losses amounting to 2,060 million yen, including impairment losses (1,701 million yen) of goodwill of subsidiaries in Canada and Belgium, and increased income taxes, due to reversed deferred tax assets. Operating income before amortization of goodwill, on which the Company puts greater emphasis, dropped 5.4% year on year to 1,692 million yen (estimate: 1,833 million yen). EBITDA decreased 3.5% year on year to 1,991 million yen, but exceeded the estimated value (1,949 million yen).

Differences between initial forecasts and results of operating & ordinary incomes

Although sales exceeded the initial forecasts, operating and ordinary incomes fell below the estimates due to a rise in the sales composition ratio of IT solution services with high cost rates and stagnant growth of development subsidiaries, while SG&A expenses were less than the forecast as personnel expenses fell below the estimate because the number of recruitments did not meet the target. The failure of the subsidiaries to obtain contracts for OEM, which are highly profitable and can be recorded as a lump sum, adversely affected their performance.

Term-end dividend will be distributed as planned

There is no change in the amount of the term-end dividend. Considering the impairment losses disclosed this time as extraordinary and non-cash expenditures, the Company plans to pay 8.26 yen/share as planned, which will amount to 16.52 yen/share for the full term.

2-2 Trend by segment

| FY Dec. 17 | Composition Ratio/Profit Margin | FY Dec. 18 | Composition Ratio/Profit Margin | YoY |

CAE Solution Services | 14,910 | 82.0% | 16,345 | 80.8% | +9.6% |

IT Solution Services | 3,262 | 18.0% | 3,874 | 19.2% | +18.8% |

Adjustments | -185 | - | -501 | - | - |

Consolidated sales | 17,987 | - | 19,719 | - | +9.6% |

CAE Solution Services | 2,732 | 18.3% | 2,687 | 16.4% | -1.6% |

IT Solution Services | 324 | 10.0% | 396 | 10.2% | +22.2% |

Adjustments | -1,553 | - | -1,583 | - | - |

Consolidated operating income(Operating income margin) | 1,504 | 8.4% | 1,502 | 7.6% | -0.2% |

*Unit: ¥mn

CAE Solution Services

Sales were 16,345 million yen, up 9.6% year on year, and operating income was 2,687 million yen, down 1.6% year on year. While sales increased mainly in MCAE, optical design and MBD, operating income declined due to a drop in profitability in the MCAE caused by the change in the product mix, increased research and development expenses related to MBSE, weak performance of development subsidiaries due to failure to obtain contracts for large-scale OEM, which can be recorded as a lump sum, and the costs incurred for a subsidiary in South Korea for the full fiscal year.

In the MCAE (non-consolidated sales were 6,937 million yen, up 10.4% year on year), the sales of new licenses for the product (multiphysics analysis tool) of ANSYS, Inc. in the U.S., which is the mainstay, increased mainly in the fields of electrical equipment and machinery & precision machinery, and renewal of maintenance contracts also progressed. The sales of engineering service, too, grew thanks to the increase in demand for model reduction (to 1D model) and analysis automation in the field of electrical equipment industry.

In the Optical design (sales were 2,975 million yen, up 7.9% year on year), the core product “CODE V” (a program for evaluating optical design) of Synopsys, Inc. in the U.S. saw the steady license sales and progress of renewal of maintenance contracts due to accelerated development of Asian companies within Japan. On the other hand, “LightTools” (analytical software for lighting design) of Synopsys, Inc. in the U.S. saw the healthy progress of renewal of maintenance contracts, but its license sales declined.

In the EDA (Electronic Design Automation) (sales were 382 million yen, down 26.5% year on year), the sales of the engineering service specialized in the EMC task (responding to standards and regulations to prevent malfunction caused by noise created by electrical equipment, etc.) increased, but the electronic circuit board design solutions, such as “Xpedition Enterprise” and “Hyper Lynx” of Mentor Graphics, Inc. in the U.S., witnessed the decreases in the sales.

In the MBD (sales were 1,027 million yen, up 9.7% year on year), the sales of new licenses of 1D CAE Tool (analysis and design support tool used in the upstream stage, whereas 3D CAE tool is used in the downstream stage), which is a product of the Group, increased mainly in the fields of machinery & precision machinery and electrical equipment and the renewal of maintenance contracts progressed, due to the growth of needs for measures against the heat problem. As for the engineering service of MBD, the sales related to EV grew, as there are an increasing number of projects about automated driving and MBSE, as a result of active development investments made in the automobile industry.

In the field of tests and measurement (sales were 132 million yen, down 7.4% year on year), the high-precision scattering measurement devices, which contribute to improved precision of the analytical software for lighting design through measurement of the parts of medical apparatus and research of advanced materials in the electrical industry, saw increased sales, but the system for automatically testing flat panel displays (FPDs), which was developed by the company and is considered profitable, saw declined sales. In other fields (sales were 371 million yen, down 10.3% year on year), the renewal of maintenance contracts for the optimal design support tool and the three-dimensional tolerance management tool, which are both products of the Group, progressed, but the sales of licenses declined.

Fourth quarter (October-December) Sales by Application Area (Non-consolidated)

| 4Q Dec. 17 | Component ratio | 4Q Dec. 18 | Component ratio | YoY |

MCAE | 1,483 | 42.9% | 1,591 | 44.3% | +7.3% |

Optical Design | 385 | 11.1% | 406 | 11.3% | +5.6% |

EDA | 246 | 7.1% | 95 | 2.6% | -61.2% |

MBD | 323 | 9.3% | 355 | 9.9% | +9.9% |

Test and Measurement | 22 | 0.6% | 17 | 0.5% | -22.5% |

Others | 123 | 3.6% | 85 | 2.4% | -30.7% |

Total | 2,584 | 74.7% | 2,552 | 71.1% | -1.3% |

*Unit: ¥mn

The sales of MCAE, optical design and MBD were healthy, stagnant growth in the sales of EDA brought the overall CAE solution sales down by 1.3% year on year.

Development subsidiaries

The sales of WATERLOO MAPLE INC. (Canada), which develops, sells and technically supports the formula manipulation software “Maple,” which converts (visualize) various physical phenomena into mathematical expressions, and the 1D CAE software, MapleSim, decreased 15.3% year on year on a local currency basis (down 16.0% on the yen basis). The sales grew in Japan and Europe, but declined in North America and China.

The sales of Noesis Solutions NV (Belgium), which develops, sells and technically supports PIDO (Process Integration Design Optimization) tool “Optimus,” dropped 3.4% year on year on a local currency basis (up 0.6% on yen basis). Its sales increased in North America and China, but decreased in Japan and Europe.

The sales of Sigmetrix L.L.C. (U.S.), which develops, sells and technically supports the 3D tolerance analysis software (yield calculation software) “CETOL 6σ,” declined 7.2% year on year on a local currency basis (down 8.8% on yen basis). Its sales augmented in Europe, but dropped in other regions.

Sales subsidiaries

The sales of CYBERNET SYSTEMS (SHANGHAI) CO., LTD. (Shanghai) of CAE Solutions increased 22.1% year on year on a local currency basis (up 23.5% on yen basis). The sales of CYBERNET SYSTEMS TAIWAN CO., LTD. (Taiwan) also rose 30.8% year on year on a local currency basis (up 30.8% on yen basis). In both the companies, the sales of optical software and products of ANSYS Inc. (multiphysics analysis tools), which are the core products, were steady. CYFEM Inc. (South Korea), which started its operation in November 2017, also saw the increase in sales of optical software, which is its core product.

IT solution service

Sales were 3,874 million yen, up 18.8% year on year, and operating income was 396 million yen, up 22.2% year on year. In the IT solutions, the sales of security-related solutions, such as the products of Symantec, and IT asset management tools, including “SKYSEA Client View” (SKY. Inc.) and “QND Advance” (Quality Soft Inc.), increased. In the Data solution, the sales of virtual design review for VR products and the service of undertaking the development of task support systems using MR devices rose. Also, the company obtained approval for the image diagnostic support software for endoscopy earlier than expected in December 2018.

Net Sales by Category of Industry (non-consolidated)

The non-consolidated sales for the full fiscal year were 15,729 million yen, up 9.7% year on year. There were double-digit increases in the sales, i.e.,13.3% year on year in the Other manufacturing (2,014 million yen, accounting for 12.8% of total sales), 12.7% year on year in the Transportation equipment (2,295 million yen, accounting for 14.6% of total sales), and 10.8% year on year in the Education institution/government and municipal offices (1,356 million yen, accounting for 8.6% of total sales). The sales in the Machinery & precision machinery also rose 8.4% year on year (2,419 million yen, accounting for 15.4%), but the sales in the Electrical equipment were increased only 1.5% year on year (4,679 million yen, accounting for 29.8%). Also, the sales increased 10.3% year on year in the Information and communications (876 million yen, accounting for 5.6%) and 26.2% year on year in others (2,087 million yen, accounting for 13.3%).

Net Sales by Category of Industry (non-consolidated)

| 4Q Dec. 17 | Component ratio | 4Q Dec. 18 | Component ratio | YoY | |

Electrical equipment | 965 | 27.9% | 965 | 26.9% | +0.0% | |

Machinery & Precision Machinery | 509 | 14.7% | 527 | 14.7% | +3.5% | |

Transportation equipment | 717 | 20.7% | 660 | 18.4% | -7.9% | |

Other manufacturing industry | 443 | 12.8% | 515 | 14.4% | +16.4% | |

Education institution/government and municipal offices | 227 | 6.6% | 249 | 6.9% | +9.4% | |

Information and Communications | 151 | 4.4% | 185 | 5.2% | +22.4% | |

Others | 443 | 12.8% | 486 | 13.6% | +9.6% | |

Total | 3,458 | 100.0% | 3,590 | 100.0% | +3.8% | |

*Unit: ¥mn

Transportation equipment decreased 7.9% year on year, for full fiscal year up 12.7%, and Machinery & Precision Machinery only increased 3.5% year on year, for full fiscal year up 8.4%.

Sales by contracts (non-consolidated)

The sales by contracts for the full fiscal year were 13,646 million yen, up 8.9% year on year. It consists of sales amounting to 5,118 million yen (up 11.1% year on year) from new contracts that will lead to renewal of contracts from the next term onward, and 8,527 million yen (up 7.7% year on year) from renewal of contracts. The fourth quarter saw a decrease in new contracts and renewal of contracts, and their sales augmented only by 2.8% year on year.

Sales by license contract in the 4Q from October to December Sales by license contract in the full fiscal year

| 4Q Dec. 17 | Component ratio | 4Q Dec. 18 | Component ratio | YoY |

| FY Dec. 17 | Component ratio | FY Dec. 18 | Component ratio | YoY |

New contracts | 1,247 | 42.8% | 1,298 | 43.3% | +4.0% | New contracts | 4,606 | 36.8% | 5,118 | 37.5% | +11.1% |

Renewal of contracts | 1,666 | 57.2% | 1,698 | 56.7% | +1.9% | Renewal of contracts | 7,918 | 63.2% | 8,527 | 62.5% | +7.7% |

Total | 2,914 | 100.0% | 2,997 | 100.0% | +2.8% | Total | 12,525 | 100.0% | 13,646 | 100.0% | +8.9% |

* Unit: ¥mn

2-3 Balance Sheet and Cash Flow Statement

Balance sheet

| End of Dec. 17 | End of Dec. 18 |

| End of Dec. 17 | End of Dec. 18 |

Cash and deposits | 2,890 | 4,467 | Trade payables | 1,255 | 1,391 |

Trade receivables | 4,604 | 4,570 | Advance received | 2,028 | 1,995 |

Securities | 5,200 | 4,000 | Net defined benefit liability | 1,327 | 1,327 |

Short-term loan receivable | 2,905 | 3,086 | Liabilities | 6,675 | 6,349 |

Intangible assets | 2,569 | 322 | Net assets | 14,211 | 12,867 |

Total assets | 20,887 | 19,217 | Total liabilities, net assets | 20,887 | 19,217 |

*Unit: ¥mn

Total assets at the end of the term were 19,217 million yen, down 1,670 million yen from the end of the previous term. Goodwill fell 1,810 million yen (of which 1,536 million yen was of impairment, 190 million yen was of amortization, and 83 million yen was due to foreign exchange) on the debit side, and net assets dropped 1,344 million yen on the credit side. Capital-to-asset ratio was 66.3% (67.6% at the end of the previous term).

Cash flow statement

| FY Dec. 17 | FY Dec. 18 | YoY | |

Operating Cash Flow (A) | 1,493 | 1,236 | -256 | -17.2% |

Investing Cash Flow (B) | -273 | -308 | -35 | - |

Financing Cash Flow | -434 | -523 | -88 | - |

Cash, Equivalents at the end of term | 7,993 | 8,378 | +384 | +4.8% |

*Unit: ¥mn

3. Fiscal Year Ending December 2019 Earnings Forecasts

3-1Consolidated Earnings

| FY Dec. 18 Act. | Composition Ratio | FY Dec. 19 Est. | Composition Ratio | YoY |

Sales | 19,719 | 100.0% | 20,000 | 100.0% | +1.4% |

Operating Income | 1,502 | 7.6% | 1,520 | 7.6% | +1.2% |

Ordinary Income | 1,684 | 8.5% | 1,608 | 8.0% | -4.6% |

Net Income | -656 | - | 958 | 4.8% | - |

*Unit: ¥mn

Sales is estimated to increase by 1.4% year on year and operating income is estimated to increase by 1.2% year on year.

The sales of transportation equipment on a non-consolidated basis decreased year on year in the fourth quarter and the sales growth of electrical equipment and machinery & precision machinery slowed down, allowing only 3.8% increase in the non-consolidated sales year on year (4.1% decrease on a consolidated basis due to OEM in the term before the previous term). Therefore, the estimates are made conservatively in consideration of these results.

Although sales are expected to reach only 20 billion yen, up 1.4% year on year, the company will continue to invest in human resources inside and outside Japan. Operating income is projected to be 1,520 million yen, up 1.2% year on year, as the company expects that the cost of investment in human resources will be offset by sales growth and absence of amortization of goodwill (which amounted to 190 million yen in FY 2018). However, this projection considers a decline in foreign exchange gains and subsidies (which were 102 million yen in FY 2018).

In the medium-term business plan (second phase), which was started in FY 2018, the company was aiming to achieve net sales of 30 billion yen and an operating income margin of over 10% in the final term of FY 2020, but it withdrew these targets temporarily considering the difficulties in achieving the plan in overseas business.

The company will pay interim and term-end dividends of 7.69 yen/share each, for a total annual dividend of 15.38 yen/share (payout rati 50%).

3-2 Basic Policy for the Medium-Term Business Plan

The Group will carry out business operations under the following new basic policies for the medium-term business plan, for its stable and continuous medium-to-long-term growth.

Setting “Energy for your innovation” as our motto, continue to provide cutting edge solutions and service in scientific computing and engineering domain to build up the system to achieve continuous revenue and profit growth.

・Enhance management system foundation for the medium-to-long term to further enhance base earnings capability

・Rebuild group governance system for enhancing business management

・Promote diversity management, including utilization of further female, senior and global human resources

・Make a proactive investment for CAE solutions, AI, and security domain.

・Enhance overseas sales including ASEAN

3-3 Change of Representative Director

At the 34th general meeting of shareholders, which was held on March 8, 2019, and the following Board of Directors’ meeting, the current representative director and executive vice president Reiko Yasue took the post of the representative director, president and CEO. Under the new management structure, the company aims for its further growth through reconstruction of the Group’s governance system and strengthening of overseas business.

Ms. Yasue was born in 1968. She graduated from Department of Mathematics in College of Liberal Arts at Tsuda University in March 1991, and joined Nagoya Research Institute, Panasonic Information Systems Co., Ltd. (current Panasonic Advanced Technology Development Co., Ltd.). Later, she worked for Unwired Planet, Motorola, Inc., SEVEN Networks, Inc. and Qualcomm, Inc., before she finally joined FUJISOFT, Inc. in July 2009. She successively held the posts of executive operating officer/general manager of Global Business Division and managing executive officer/general manager of Global Business Division. She was transferred to Cybernet Systems Co., Ltd., where she served as executive vice president in January 2018. In March 2018, she became representative director and executive vice president.

4. Conclusion

Summary of FY 2018

The sales were healthy mainly for ANSYS and the field of optics. New customers, who will contribute to increased orders for maintenance contracts in FY 2019, were successfully acquired. Overseas, new customers were acquired in the sales subsidiaries in China and Taiwan, and the sales grew for mainly ANSYS and the field of optics. Close coordination with Japan led to favorable results for both subsidiaries, and the proposal capability, which is the strength of Cybernet Systems Co., Ltd. was highly regarded. The Company plans to enhance the support system further in the future. On the other hand, with regard to development subsidiaries, the expansion of sales to business firms mainly in North America did not progress at the expected rate due to failure of the subsidiary in Canada to acquire contracts for large-scale OEM, which can be recorded as a lump sum.

In the business of IT solutions, which is another pillar, the sales of security-related solutions increased. Symantec Inc. played a significant role for the sales growth by recommending Cybernet Systems Co., Ltd. with comprehensive support capabilities.

Conservative forecast for FY 2019

Sales grew steadily in FY 2018, but the trend changed over the second half of the term as the automobile and electric equipment industries, which are the main business partners, started to restrict their investments. As for automobiles, the company is observing closely to what extent the budget will be spent in March, which is the end of the fiscal year for clients, while the company expects continued investments in advanced fields. Therefore, the forecast for FY 2019 was made carefully by taking these risk factors into consideration. While the increase of maintenance contracts is anticipated as new customers were acquired in the previous term, the growth is expected to slow down.

Continue to invest in IT, human resources and business

The company plans to continue investing in IT, human resources and business, while the direction of the medium-term business plan (second phase) remains unchanged, as it was stated under the basic policy for the medium-term business plan. As for IT investment, the company considers the fact that investments for improving profitability and productivity were insufficient as regrettable, and so it will strengthen the core system, introduce a production management system and realize a work schedule that increases efficiency in the process of working at home, going straight to the client sight and back, etc. With regard to investment in human resources, the company will increase its participation in the overseas subsidiaries, by sending employees not only from the business division, but also from the management division. In Japan, it will encourage employment of new graduates and engineers for enhancement of development capabilities. Also, as part of diversity management, a female managing executive officer, who served as director in the subsidiaries of China and Taiwan and is currently the representative director of the subsidiary in South Korea, will become a member of the Board of Directors in March. As for business investment, it will continue to invest around the same amount as the previous term (100 million yen) in MBSE in CAE solution services. It will make an organization of MBSE within the development subsidiary in Canada, which will be controlled directly from Japan. The image diagnostic support software for endoscopy equipped with AI obtained approval earlier than expected in December 2018. The company will put more efforts in the medical field as well in the future (it will come under IT solution services when classified by segment and data solution services when grouped by application area).

Strengthening of business in ASEAN

Outside Japan, the company plans to enhance its operation in ASEAN while supporting the business in North America. As part of this, it established a subsidiary in Malaysia in November 2018. It will start its operation in March. The company says director Tsuneki of Cybernet Systems Co., Ltd., concurrently serves as president of the subsidiary in Malaysia, and Cybernet Systems Co., Ltd. will actively participate in the operation of the subsidiary. As its clients will be Japanese and locals and some have already been covered by the subsidiary in Taiwan, the subsidiary in Malaysia has to focus on having a strong grip on existing clients rather than attracting new ones. The company will pay attention to Thailand and Singapore in the future.

We have high hopes for the new growth strategy led by President Reiko Yasuda, who has experience working in Panasonic Advanced Technology Development Co., Ltd., which has its strength in automotive solution services, and foreign companies such as Unwired Planet, Motorola, Inc., SEVEN Networks, Inc., and Qualcomm, Inc.

Reference: Regarding Corporate Governance

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 7 directors, including 2 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report

The Latest Update: March11, 2019

Basic Policy

Our company will thoroughly observe all applicable laws and regulations in all corporate activities and take actions that conform to social ethics as we have set forth in the “Cybernet Group Compliance Policy Guidelines” (hereinafter referred to as “Cybernet Policy Guidelines”). This is our basic attitude towards all shareholders. In addition, we respect the Cybernet Policy Guidelines as our company’s basic policy in regard to corporate governance and we strive to ensure the soundness of our management, clarify accountability, and disclose impartial and timely information. We are also aiming to expedite management decisions and improve supervisory functions of business execution, as well as endeavoring to create organizations with effective risk management and screening functions.

<Reasons for Non-Compliance with the Principles of the Corporate Governance Code (Excerpts)>

We have implemented all the principles of corporate governance code.

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

[Principle 3-1 Appropriate information disclosure and securement of transparency]

(1) Management philosophy, management strategy and management plan

The company puts up its “Corporate Philosophy” and “Medium-Term Business Plan Basic Policies” on its website. Please access to the links below to view them.

(Corporate Philosophy)

http://www.cybernet.jp/company/about/philosophy/

(Medium-Term Business Plan Basic Policies)

http://www.cybernet.jp/company/policy/midterm/

Principle 5-1 Policy on constructive interaction with shareholders

The Company has established a department in charge of IR, and the director in charge of that department is working as the director in charge of the administrative department to design an organic collaboration within the administration department. In addition, the department will report IR activity to the representative director or director in charge once a quarter. Furthermore, regarding the management of insider information, please refer to the following “V.2 (3) Disclosure Policy” and the “Information Disclosure Standard (Disclosure Policy)” listed on our website via the URL below.

(Information Disclosure Standard (Disclosure Policy))

http://www.cybernet.jp/ir/ir_policy/standard/

The Company’s main IR activities are as follows:

1) Financial results briefing (once a year)

2) Medium-Term Business Plan briefing (once a year)

3) General shareholders meeting (once a year)

4) Briefing for individual investors (irregular)

5) Personal meetings for institutional investors

6) Information provision by e-mail

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.

Copyright(C) 2019 Investment Bridge Co., Ltd. All Rights Reserved.