Bridge Report:(4319)TAC second quarter of the Fiscal Year ending March 2023

Toshio Tada, President | TAC Co., Ltd. (4319) |

|

Company Information

Exchange | TSE Standard Market |

Industry | Service |

President | Toshio Tada |

HQ Address | Kanda-Misaki-cho 3-2-18, Chiyoda-ku, Tokyo |

Year-end | March |

Homepage |

Stock Information

Share Price | Number of shares issued | Total market cap | ROE(Act.) | Trading Unit | |

203 yen | 18,504,000 shares | 3,756 million yen | 7.4% | 100 shares | |

DPS(Est.) | Dividend yield (Est.) | EPS(Est.) | PER(Est.) | BPS(Act.) | PBR(Act.) |

6.00 yen | 3.0% | 21.62 yen | 9.4 x | 333.22 yen | 0.6 x |

*The share price is the closing price on November 18th. Number of shares issued, DPS, EPS are from the financial results for the second quarter of the fiscal year ending March 2023. ROE and BPS are based on the actual results of the previous term end.

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2019 Act | 20,474 | 340 | 409 | 309 | 16.74 | 8.00 |

March 2020 Act | 20,331 | 162 | 260 | 103 | 5.58 | 5.00 |

March 2021 Act | 19,749 | 404 | 646 | 405 | 21.92 | 5.00 |

March 2022 Act | 20,471 | 413 | 442 | 444 | 24.05 | 6.00 |

March 2023 Est | 20,450 | 650 | 608 | 400 | 21.62 | 6.00 |

*Unit: Million yen. Forecasts are based on company estimates. These values are on an accrual basis. Net income is profit attributable to owners of parent (the same applies for net income hereinafter).

We present this Bridge Report reviewing financial results for the second quarter of the Fiscal Year ending March 2023 and other information about TAC.

Index

Key Points

1. Company Overview

2. Second Quarter of the Fiscal Year ending March 2023 Earnings Results

3. Fiscal Year ending March 2023 Earnings Estimates

4. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Sales and operating profit declined year on year in the second quarter of the term ending March 2023. Sales on a cash basis declined 5.2% year on year to 10,419 million yen. Sales on an accrual basis decreased 3.5% year on year to 10,762 million yen. Cost of sales dropped 4.4% year on year, but SG&A expenses rose 1.5% year on year, resulting in a 15.2% YoY decline in operating profit on an accrual basis to 941 million yen. Net profit fell 20.7% year on year to 614 million yen.

- For the term ending March 2023, the company left its forecast unchanged. The company expects sales on a cash basis to increase 2.0% year on year to 20,550 million yen, sales on an accrual basis to decline 0.1% year on year to 20,450 million yen, and operating profit to rise 57.3% year on year to 650 million yen. The company expects a significant increase in profit due to rent reductions through optimization of classroom floor area and aggressive implementation of web marketing. The company plans to pay a dividend of 6.00 yen/share, like in the previous fiscal year. Payout ratio is expected to be 27.8%.

- Although the impact of the eighth wave of the novel coronavirus infection is a concern, there will be no movement restrictions this term for the first time in three years, and the company's past countermeasures against the virus are expected to have a positive effect. In addition to publications for various qualifications, we are also looking forward to seeing their endeavors in new genres, such as the publication of a series of study workbooks, “Children’s Workbooks: To Think by Themselves" series, a new practical study course for the era for people who will live to the age of 100, and a sponsorship agreement with the exponentially growing professional e-sports team "Shinobism Gaming."

1. Company Overview

TAC Co., Ltd. is known as the “TAC, The Certification School” where university students and working people come to study to increase their chances of passing tests for various certifications and qualifications. The Company operates schools throughout Japan that educate students and adults in academic fields necessary to pass certification and Public Officer tests to become Certified Public Accountants, Certified Public Tax Accountants, Real Estate Appraisers, Labor and Social Security Attorney, Bar Examination, Judicial Scriveners, and other professional occupations. In addition, TAC also provides various training programs for corporate clients and conducts publishing business as well.

TAC Group (8 Consolidated Subsidiaries, 1 Equity Method Affiliated Company, 1 Non-Consolidated Subsidiary / not accounted for by Equity Method)

Company Type | Segment | Company Name | Business Description |

Consolidated Subsidiaries | Personal Education | TAC General Property Management Co., Ltd. TAC INFORMATION TECHNOLOGY (Dalian)Co., Ltd. Online School Co., Ltd. | School classroom building contracts, maintenance work Dalian operation center (Administrative task, instruction material monitoring check) Online instruction membership system over the Internet |

Corporate Training | LUAC Co., Ltd. | Insurance related corporate training | |

Publishing | Waseda Management Publishing Co., Ltd.

| “W Seminar” brand publishing business Marketing advertising related to the publishing business | |

Manpower Business | TAC Profession Bank Co., Ltd | Human Resources introduction (headhunting), worker dispatch, job advertising business | |

Medical Office Staffing Kansai Co., Ltd | Health insurance claims, medical-related staff dispatch business | ||

Kubo Medical Office Support Co., Ltd. | Health insurance claim inspection, filing services | ||

Equity Method Affiliated Company |

| Professional Network Co., Ltd. | Publishing of web magazines for professionals |

Non-Consolidated Subsidiary / not accounted for by Equity Method |

| Technological and Commercial Modern Education (Dalian) Co., Ltd. | Corporate training for Japanese Bookkeeping, IT Specialist |

*As of the end of September 2022.

【1-1 Corporate History】

TAC was established in December 1980 as a school providing instruction to people seeking to obtain certifications and qualifications through examinations, including courses for the Certified Public Accountant, Bookkeeping, and Certified Public Tax Accountant. In October 2001, TAC listed its shares on the Over-The-Counter Market, and later moved its shares to the Second Section of the Tokyo Stock Exchange in January 2003 and then to the First Section in March 2004. TAC acquired KSS Co., Ltd. (formerly known as Waseda Management Publishing), which conducts certification and qualification acquisition support services including the provision of preparatory courses for Bar Examination, Judicial Scrivener, Patent Attorney, Level-1 Civil Service (Government officials in the Main Career Track), Special Personnel of the MOFA*, in September 2009. Through the addition of this company, TAC has been able to fortify its strengths in the accounting area by adding certification preparatory courses in the legal area, and to round out its service lineup with courses in the Public Officer area. In December 2013, the Company formed a collaborative agreement that included the sharing of capital with Zoshinkai Publishers Co., Ltd. for work in the development of a correspondence course education service for elementary, junior and senior high school students. Furthermore, other M&A activities were conducted in June 2014 to enter into the medical billing area.

【1-2 Strengths】

(1) Detailed Response to Changes, Revisions in Examination System, Laws

Since the founding of the Company, TAC instructors have made revisions to the text materials used in its courses every year, and this ability to respond to changes and revisions in the examination and legal systems is a distinguishing feature and strength of TAC. For a company like TAC with sales approaching 20.0 billion yen, absorbing the costs of updating text materials on an annual basis is possible. However, new entrants and smaller players in the market have a much more difficult time absorbing the costs of updating teaching materials. Other strengths of TAC include its knowhow and efficiency accumulated over the history of its operations in providing the most updated information to the students of its courses.

(2) Full-Scale Lineup and Active Course Development

TAC has risen to become the top player in the industry through its active efforts to develop courses in new areas, including those targeting university students, and it has become the first company within its industry to list its shares. Along with the acquisition of W Seminar’s certification and qualification acquisition support business in 2009, TAC has been able to fortify its weakness in the areas of legal and Public Officer related courses. Consequently, the Company now boasts of a strong business model comprised of the three main cornerstones of accounting (Certified Public Accountant, Certified Public Tax Accountant and Bookkeeping), legal, and Public Officer related certification and qualification acquisition support courses.

(3) Providing Innovative Services with a Focus upon Students

Innovative services are yet another strength of TAC. TAC was the first school in the certification and qualification acquisition support services market to introduce educational media and enable students to choose which instructor they would like to study under. This corporate focus upon satisfying the needs of students is reflected in the quality of the text materials offered and has contributed to the establishment of a strong brand reputation as “TAC, The Certification School.”

【1-3 ROE Analysis】

| FY 3/16 | FY 3/17 | FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 | FY 3/22 |

ROE(%) | 4.8 | 10.3 | 8.6 | 5.7 | 1.9 | 7.2 | 7.4 |

Net profit Margin (%) | 1.07 | 2.40 | 2.11 | 1.51 | 0.51 | 2.05 | 2.17 |

Asset Turnover | 0.93 | 0.94 | 0.96 | 0.95 | 0.97 | 0.97 | 0.98 |

Leverage | 4.81 | 4.60 | 4.27 | 4.00 | 3.81 | 3.60 | 3.49 |

2. Second Quarter of the Fiscal Year ended March 2023 Earnings Results

Regarding Sales

In the certification and qualification acquisition support business conducted by the company, students applying for courses pay the entire amount of tuition fees (sales on a cash basis), which are booked on the liabilities side of the balance sheet as tuition advance. Then, these tuition advances are switched to sales every month that the educational services were provided to the student (sales on an accrual basis). Sales booked on the balance sheet represents sales on an accrual basis, and the company gives priority to the increase in sales on a cash basis as a key management indicator.

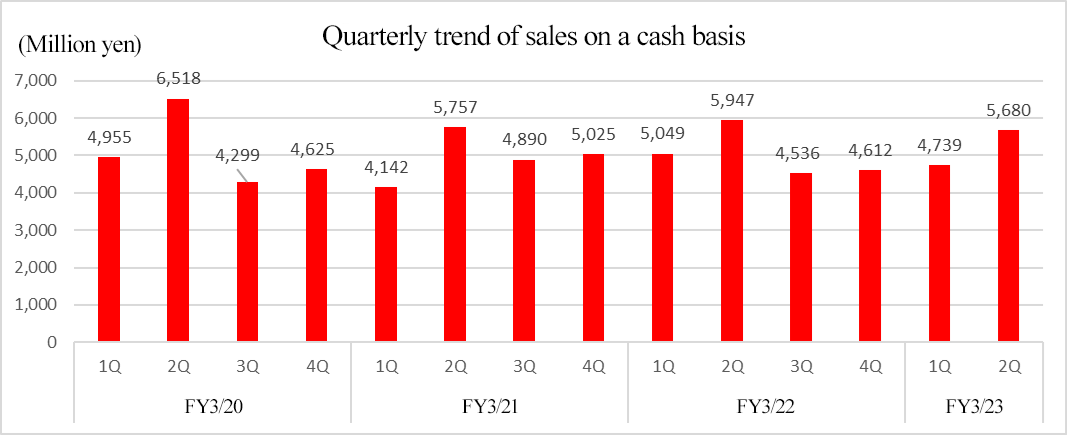

Regarding Seasonal Characteristics

The company’s quarterly trends are as follows. Sales on a cash basis (tuition advance pre-adjustment sales) refers to sales after aggregating tuitions, and sales on an accrual basis (tuition advance post-adjustment sales) refers to sales after allocating tuitions to the period in which the company provides education services.

Examinations for the company’s main certification courses, such as Certified Public Accountants and Certified Public Tax Accountant, are held from spring to fall (Q1 to Q3), and applications for courses for mainly university students, such as public officer courses, are concentrated in the spring and summer (Q1 to Q2). Therefore, applications (sales on a cash basis) in the fourth quarter tend to be less than in other quarters.

On the other hand, operating expenses, such as rent, instructor fees, and advertising expenses, are booked in a fixed amount each month, so there is no quarterly bias.

(1) Consolidated Earnings

| FY 3/22 2Q | Share | FY 3/23 2Q | Share | YoY Change |

Sales on a cash basis | 10,997 | 98.6% | 10,419 | 96.8% | -5.2% |

Sales on an accrual basis | 11,156 | 100.0% | 10,762 | 100.0% | -3.5% |

Gross profit | 4,758 | 42.7% | 4,643 | 43.1% | -2.4% |

SG&A | 3,647 | 32.7% | 3,701 | 34.4% | 1.5% |

Operating profit | 1,111 | 10.0% | 941 | 8.8% | -15.2% |

Ordinary profit | 1,154 | 10.4% | 925 | 8.6% | -19.9% |

Net profit | 775 | 7.0% | 614 | 5.7% | -20.7% |

*Units: Million yen. Net profit is net profit attributable to owners of parent (the same applies for net profit hereinafter).

Decrease in sales and fall into deficit

Sales and operating profit declined year on year in the second quarter of the term ending March 2023. Sales on a cash basis declined 5.2% year on year to 10,419 million yen. Sales on an accrual basis decreased 3.5% year on year to 10,762 million yen. Cost of sales dropped 4.4% year on year, but SG&A expenses rose 1.5% year on year, resulting in a 15.2% YoY decline in operating profit on an accrual basis to 941 million yen. Net profit fell 20.7% year on year to 614 million yen.

(2) Business Segment Trends

Sales on a cash basis by Business Segment

| FY 3/22 2Q | Share | FY 3/23 2Q | Share | YoY Change |

Personal Education | 6,110 | 55.5% | 5,632 | 54.1% | -7.8% |

Corporate Training | 2,306 | 21.0% | 2,367 | 22.7% | 2.7% |

Publishing | 2,306 | 21.0% | 2,130 | 20.4% | -7.6% |

Manpower Business | 302 | 2.8% | 315 | 3.0% | 4.4% |

Elimination of intersegment transactions | -28 | -0.3% | -26 | -0.2% | - |

Consolidated Sales | 10,997 | 100.0% | 10,419 | 100.0% | -5.2% |

*Units: Million yen

Operating profit on a cash basis by Business Segment

| FY 3/22 2Q | Profit ratio | FY 3/23 2Q | Profit ratio | YoY Change |

Personal Education | 235 | 3.9% | -22 | - | - |

Corporate Training | 612 | 26.6% | 618 | 26.1% | 0.9% |

Publishing | 654 | 28.4% | 587 | 27.6% | -10.1% |

Manpower Business | 73 | 24.4% | 82 | 26.2% | 11.9% |

Corporate expenses | -624 | - | -667 | - | - |

Consolidated Operating profit | 952 | 8.6% | 599 | 5.7% | -37.1% |

*Units: Million yen

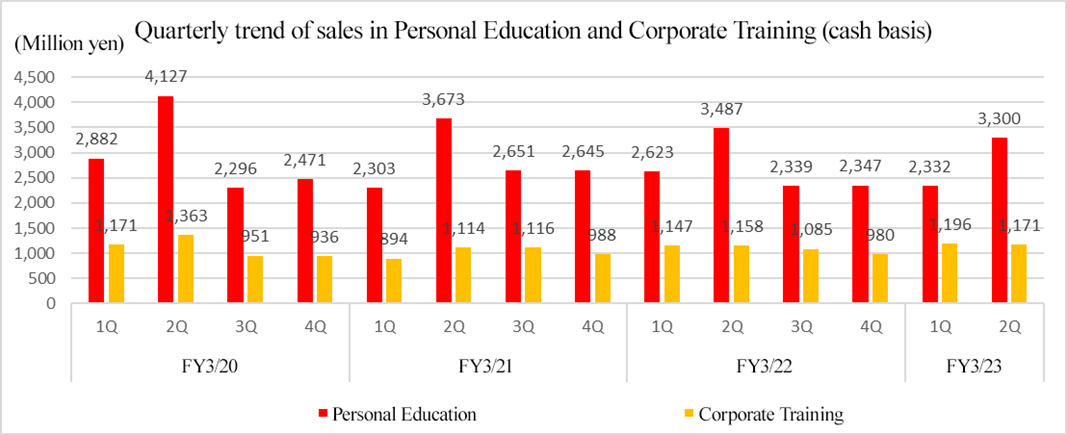

【Personal Education】

Decrease in sales and fall into deficit

Increase in sales | IT Specialist courses, Certified Public Tax Accountant courses, Small & Medium (S&M) Enterprise Management Consultant courses, Architects and Building Engineers courses, Patent Attorney courses, Judicial Scrivener courses, etc. |

Although the situation surrounding the novel coronavirus has settled down for the most part, overall sales on a cash basis declined due to the weak enrollment in courses mainly for students like in the first quarter of the fiscal year. Regarding the performance of each course, the IT Specialist courses performed well due to the high demand for DX, and the number of applications for the Certified Public Tax Accountant courses, which has been healthy since the previous year, continued to do well after the main examination in August. Other courses that exceeded the performance in the previous year include courses for S&M Enterprise Management Consultant, Architects and Building Engineers, Patent Attorney, Judicial Scrivener, and Electricity-related qualifications. On the other hand, the Certified Public Accountant courses, which are attended by mainly students, did not do well, especially in the entry level, and the Public Officer courses, which are attended by mainly students, continued to do poorly like in the first quarter. Other courses such as Bookkeeping courses, Real Estate Transaction Agent courses, and Real Estate Appraiser courses saw lower sales than those in the previous year. In terms of costs, total operating expenses, combined with instructor fees, subcontracting costs for the production of teaching materials, and rents, were 5,654 million yen (down 3.8% year on year).

As a result, sales on a cash basis in the Personal Education Business totaled 5,632 million yen (down 7.8% year on year), and the company posted an operating loss on a cash basis of 22 million yen (an operating profit of 235 million yen in the same period of the previous year).

【Corporate Training】

Sales grew, and profit rose.

Increase in sales | University seminars, commissioned training, etc. |

The demand for corporate training continues to be high, thanks to the promotion of DX in enterprises. There is both demand for training utilizing web conferencing systems as well as for the conventional face-to-face style as the novel coronavirus crisis subsides, along with some cases where both types of training are used depending on the content of the training. Regarding the performance in each field, demand was strong in the information and international fields, while the financial and real estate fields, which had performed well in the first quarter, saw a slight decline in the second quarter. The sales of university seminars increased from the previous year due to new bookings along with the return of students to university campuses. The sales of the affiliated school business, whose main customers are individuals in rural areas, declined 13.8% year on year, while the sales of commissioned training for local governments increased 16.7% year on year, and content provision to local vocational schools has been on a recovery trend since the second quarter. In terms of costs, operating expenses, including instructor fees and personnel expenses related to sales, were 1,749 million yen (up 3.3% year on year).

As a result, sales on a cash basis in the Corporate Training Business totaled 2,367 million yen (up 2.7% year on year), and operating profit on a cash basis totaled 618 million yen (up 0.9% year on year).

【Publishing】

Sales and profit decreased

Increase in sales | IT Specialist, Property Manager, S&M Enterprise Management Consultants, etc. |

The corporate group's publishing business is conducted under two brands: "TAC Publishing Sales" operated by the company and "W Seminar" ("W Publishing") operated by its subsidiary, Waseda Management Publishing, Co., Ltd. The publishing business declined from the previous year, largely due to the impact of a decline in the demand from housebound consumers. In the area of books for certification examinations, TAC Publishing Sales's books for IT Specialist, Property Manager, and S&M Enterprise Management. Consultants performed well, while those for Bookkeeping, FP, Real Estate Transaction Agent, and Licensed Electrical Engineer were sluggish. In addition, sales of travel guides and general books, and W Publishing's Certified Administrative Procedures Legal Specialist, Judicial Scrivener, and other publications performed well. In terms of costs, overall operating expenses were 1,542 million yen (down 6.6% year on year).

As a result, the publishing business recorded sales of 2,130 million yen (down 7.6% year on year) and an operating profit of 587 million yen (down 10.1% year on year).

【Manpower Business】

Sales and profit rose

In the accounting-related human resources business handled by the subsidiary TAC Profession Bank Co., Ltd., demand for accounting-related human resources from tax accounting firms, auditing firms, and private companies continued to be strong, resulting in continued strong advertising and personnel placement revenues from the first quarter. The dispatch business of medical office staffing and nurses, handled by Medical Office Staffing Kansai Co., Ltd., posted larger sales than the previous year, partly due to an increase in workload caused by the revision of medical service fees, which takes place once every two years.

As a result, sales of the Manpower Business totaled 315 million yen (up 4.4% year on year), and operating profit amounted to 82 million yen (up 11.9% year on year).

(3) Trend by Certification Category

The company adopted the "Accounting Standards for Revenue Recognition" and other standards in the previous fiscal year, and in the term ending March 2023, the amount equivalent to expected product returns is directly deducted from net sales for transactions in the publishing business in which there is a possibility of return of goods. The amount equivalent to such returns is calculated based on an overall estimate based on past sales returns, etc., and the deductions for each field are not known. Therefore, the total sales in "2Q of FY 3/2022" and "2Q of FY 3/2023" in the table below do not match the sales in the quarterly consolidated profit-and-loss statements.

Sales on an accrual basis by Certification Category

| FY 3/22 2Q | Share | FY 3/23 2Q | Share | YoY Change |

Finance, Accounting | 2,180 | 19.9% | 1,971 | 18.6% | -9.6% |

Management, Taxation | 1,694 | 15.5% | 1,767 | 16.7% | 4.3% |

Financial Service, Real Estate | 2,771 | 25.3% | 2,614 | 24.7% | -5.6% |

Law | 649 | 5.9% | 638 | 6.0% | -1.7% |

Public Officer, Labor | 2,271 | 20.7% | 2,118 | 20.0% | -6.8% |

IT, International | 778 | 7.1% | 845 | 8.0% | 8.6% |

Medical, Welfare | 148 | 1.4% | 148 | 1.4% | -0.3% |

Others | 460 | 4.2% | 485 | 4.6% | 5.4% |

Total | 10,955 | 100.0% | 10,588 | 100.0% | -3.3% |

*Unit: Million yen

【Market Overview】

The number of students in the second quarter of the term ending March 2023 totaled 125,549 (down 4.5% from the second quarter of the previous fiscal year), of which 74,422 were individual students (down 4.9% or 3,836 students) and 51,127 were corporate students (down 3.8% or 2,029 students).

【Overview of each domain】

In terms of courses for individual students and corporate clients, the sales of IT Specialist courses increased 29.9% from the previous consolidated cumulative second quarter, Government officials (Main Career Track & Ministry of Foreign Affairs of Japan) courses increased 26.9%, and Licensed Strata Management Consultant courses increased 6.9%, etc. On the other hand, the sales of Bookkeeping courses dropped 20.3% from the previous consolidated cumulative second quarter, Real Estate Transaction Agent courses declined 13.4%, and FP courses fell 18.2%. In terms of corporate students, the sales of correspondence-style training declined from the previous year as telecommuting work decreased, the sales of university seminars increased 3.6% from the previous consolidated cumulative second quarter as students returned to universities, the sales of affiliated schools declined 5.0%, and the sales of commissioned training increased 13.7%.

(4) Student Number Trends

| FY 3/22 2Q | Share | FY 3/23 2Q | Share | YoY Change |

Individual | 78,258 | 59.6% | 74,422 | 59.3% | -4.9% |

Corporate | 53,156 | 40.4% | 51,127 | 40.7% | -3.8% |

Total | 131,414 | 100.0% | 125,549 | 100.0% | -4.5% |

*Units: Person

Number of students by Certification Category

| FY 3/22 2Q | Share | FY 3/23 2Q | Share | YoY Change |

Finance and Accounting | 19,469 | 14.8% | 16,475 | 13.1% | -15.4% |

Management and Taxation | 17,348 | 13.2% | 16,730 | 13.3% | -3.6% |

Financial Service and Real Estate | 38,856 | 29.6% | 34,725 | 27.7% | -10.6% |

Law | 6,456 | 4.9% | 6,240 | 5.0% | -3.3% |

Public Officer and Labor | 31,308 | 23.8% | 31,245 | 24.9% | -0.2% |

IT and International/ Medical and Welfare/ Others | 17,977 | 13.7% | 20,134 | 16.0% | 12.0% |

Total | 131,414 | 100.0% | 125,549 | 100.0% | -4.5% |

*Units: Person

(5) Financial Conditions and Cash Flow

◎Main Balance Sheet Items

| End of March 2022 | End of September 2022 |

| End of March 2022 | End of September 2022 |

Cash and deposits | 5,716 | 6,856 | Notes and Accounts Payable - trade | 515 | 440 |

Notes and Accounts Receivable - trade | 3,581 | 4,087 | Provision for Loss on Abandonment of Sales Return | 302 | 264 |

Inventories | 796 | 702 | Advances Received | 5,943 | 5,669 |

Current Assets | 11,679 | 12,300 | Asset Retirement Obligation | 776 | 715 |

Property, Plant and Equipment | 5,113 | 5,061 | Interest Bearing Liabilities | 5,095 | 5,471 |

Intangible Assets | 202 | 195 | Liabilities | 15,209 | 14,748 |

Investments and Other Assets | 4,389 | 3,926 | Net Assets | 6,174 | 6,736 |

Non-current Assets | 9,705 | 9,184 | Total Liabilities, Net Assets | 21,384 | 21,484 |

*Units: Million yen

Current assets increased 620 million yen from the end of the previous period, mainly due to an increase in cash and deposits. Fixed assets decreased 520 million yen year on year due largely to a decrease in guarantee deposits. Total assets increased 99 million yen to 21,484 million yen.

Despite an increase in interest-bearing debt, total liabilities declined 461 million yen year on year to 14,748 million yen, largely due to a decrease in advances received.

Net assets grew 561 million yen to 6,736 million yen, due to the rise in retained earnings, etc. As a result, capital-to-asset ratio rose 2.5 points from the end of the previous fiscal year to 31.3%.

3. Fiscal Year ending March 2023 Earnings Estimates

(1) Consolidated Earnings

| FY 3/22 Act. | Share | FY 3/23 Est | Share | YoY Change |

Sales on a cash basis | 20,146 | 98.4% | 20,550 | 100.5% | +2.0% |

Sales on an accrual basis | 20,471 | 100.0% | 20,450 | 100.0% | -0.1% |

Gross profit | 7,814 | 38.2% | - | - | - |

SG&A | 7,401 | 36.2% | - | - | - |

Operating profit | 413 | 2.0% | 650 | 3.2% | +57.3% |

Ordinary profit | 442 | 2.2% | 608 | 3.0% | +37.4% |

Net profit | 444 | 2.2% | 400 | 2.0% | -10.1% |

*Units: Million yen. Estimates are those of the company.

No change in earnings forecast

The previous forecast remains unchanged for the fiscal year ending March 2023. Sales on a cash basis are expected to increase 2.0% year on year to 20,550 million yen, Sales on an accrual basis are expected to decline 0.1% year on year to 20,450 million yen, and operating profit are expected to rise 57.3% year on year to 650 million yen, respectively. The company plans to increase sales by appropriate control of rent by optimization of classroom floor space and actively implementing web marketing. A dividend is to be 6.00 yen/share as previous fiscal year. The dividend payout ratio will be 27.8%.

4. Conclusions

Although the impact of the eighth wave of the novel coronavirus infection is a concern, there will be no movement restrictions this term for the first time in three years, and the company's past countermeasures against the virus are expected to have a positive effect. In addition to publications for various qualifications, we are also looking forward to seeing their endeavors in new genres, such as the publication of a series of study workbooks, “Children’s Workbooks: To Think by Themselves" series, a new practical study course for the era for people who will live to the age of 100, and a sponsorship agreement with the exponentially growing professional e-sports team "Shinobism Gaming."

<Reference: Regarding Corporate Governance>

◎Operating type, and the composition of directors and auditors

Operating type | Company with Audit and Supervisory Committee |

Directors who are not members of the Audit and Supervisory Committee | 12 directors, including 2 external ones |

Directors who are members of the Audit and Supervisory Committee | 3 auditors, including 3external ones |

◎Corporate Governance Report

Updated on June 28, 2022

<Basic Policy>

The company's basic policy regarding corporate governance is to put importance on prompt decision-making. The company currently has ten internal directors. On the other hand, the company also assigned five outside directors to properly maintain the corporate governance and the legal compliance system required as a public company, and it operates them to function efficiently.

Japan is rapidly shifting from a mature industrial society to a knowledge society. In the knowledge society, knowledgeable specialists (professionals) are required in various fields, and the areas of their participation are expanding. "Professional" is derived from the word “profess” = "declare in front of God." Thus, in medieval Europe, knowledgeable specialists such as priests, doctors, accountants, and teachers were professionals who made a vow to God when employed. Since the company started the business of training Certified Public Accountants, it has been in charge of training many professionals required in modern times on behalf of universities.

The group has received support from a wide range of customers (university students, working people, and corporations) through its bases and media, with the management philosophy of "cultivating the professionals that society needs" and "being deeply involved in personal growth." The company aims to be a strong player in the education services and human resource training and supply markets. It believes that the most basic proposition required of a joint-stock company, "increasing shareholder value," can be achieved only by having a support base by its customers, who are stakeholders.

That kind of professionals' self-discipline is part of the organizational culture in the group's corporate governance. The directors of the company themselves also aspire to regulate themselves as "management professionals." The Companies Act stipulates that the term of each director shall be one year (two years for directors belonging to the audit and supervisory committee), and shareholders judge whether respective directors have served as “professionals in business administration” in each term at a general meeting of shareholders. Our company adopted the organizational structure as a company with an audit and supervisory committee, and strives to enhance the functions to oversee and audit business management and comply with laws and regulations thoroughly, with the aim of achieving highly transparent business management.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

The company has not followed the following principles in the Corporate Governance Code for the reasons described in the table below.

Principles | Reasons for not implementing the principles |

Supplementary principle 1-2 (4) | The great majority of our shareholders consist of individual Japanese shareholders, and the respective ratios of institutional and overseas investors are limited. At the present moment, therefore, our company does not use any electronic voting platforms, etc. or translate notices of convocation of shareholders’ meetings into English; however, we will consider working on them if the ratio of institutional or overseas investors increases in the future.

|

Supplementary Principle 2-4 (1) | Our company bases its assessments and appointments of core personnel on the individual’s abilities, regardless of their personal attributes. Therefore, there are no numerical targets based on personal attributes. Moreover, most of our business activities are conducted in Japan, and we do not have any appointment history of foreigners for the management positions. However, in terms of the appointment of core personnel, our company bases its assessments and appointments on individuals’ personal abilities, regardless of their attributes, thus, we consider an appointment whenever there is an appropriate person in accordance with our company’s future business development. Our company is actively employing mid-career employees in addition to the new graduate, with the aim to develop diverse human resources and establish a vibrant organization.

|

Supplementary Principle 4-11 (1) | Our company, with the aim to execute our company group’s management efficiently and effectively, to contribute to the company’s sustainable growth, and to maximize its corporate value, follows its policy to have the Board of the directors composed of diverse members with different backgrounds in abilities, knowledge, and experience. Furthermore, the upper limit of the number of the Directors is set at 15, with up to four Directors who also serves as the member of the audit and supervisory committee, as stated in the Articles of Incorporation, for a quick decision-making process. Moreover, we will discuss a disclosure of the skills matrix as our task in the future. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Our company’s policies pertaining to each principle whose disclosure is required by the Corporate Governance Code are as follows (except the principles stated in the above “Reasons for Non-compliance with the Principles of the Corporate Governance Code.”)

Principles | Disclosure |

Supplementary Principle 3-1 (3) | As initiatives for sustainability, our company is working on promoting paperless business operations, implementing Cool Biz and Warm Biz, and reducing CO2 emissions through saving air conditioning energy, in terms of the environment. Further, in the social aspect, our company promotes acquiring accounting knowledge required for businesspersons, and carries out events such as Bookkeeping Championship Tournament with the aim to contribute to the development of companies and Japan’s entire economy. Our company’s management philosophy is to “contribute to the society through our development of profession.” Our company runs educational service business to support students and working adults obtaining national qualifications, etc., and our development of educational contents including textbooks and development of curricula is nothing but an investment in intellectual properties. In addition, developing professions is indispensable for the educational content development, we require our employees to acquire the Official Business Skills Test in Bookkeeping, third grade, and encourage acquiring various qualifications, and proactively provide support for tuition for that purpose.

|

Principle 5-1 | Our company has established a department devoted to dealing with inquiries from investors including shareholders (IR Office). We appropriately handle each and every inquiry, except for any information that is deemed to be highly likely to go against the regulations for insider trading.

|

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on TAC Co., Ltd. (4319) and other companies and to see IR related seminars of Bridge Salon, please go to our website at the following url: www.bridge-salon.jp/