| Japan System Techniques Co., Ltd. (4323) |

|

||||||||

Company |

Japan System Techniques Co., Ltd. |

||

Code No. |

4323 |

||

Exchange |

TSE 2nd Section |

||

Industry |

Information, Communications |

||

President |

Takeaki Hirabayashi |

||

HQ Address |

Nakanoshima Festival Tower 29th Floor, Nakanoshima 2-3-18, Kita-ku, Osaka, Japan |

||

Year-end |

March end |

||

Website |

|||

* Share price as of closing on December 24, 2013. Number of shares outstanding as of most recent quarter end excludes treasury shares.

ROE and BPS are based on actual results of the previous term end.

|

||||||||||||||||||||||||

|

|

* Estimates are those of the Company.

|

|

| Key Points |

|

| Company Overview |

|

<Corporate History>

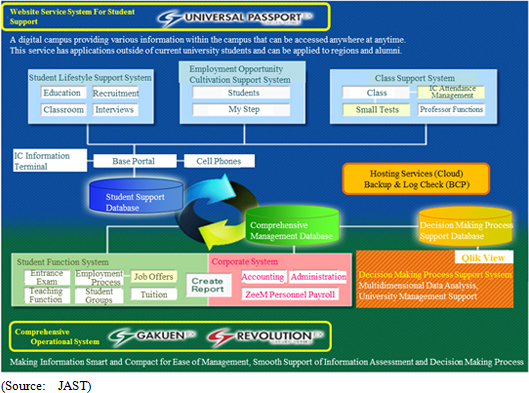

Japan System Techniques (JAST) was established in March 1973. JAST has been providing packaged software to educational institutions since the first half of the 1990s, with the launch of the "GAKUEN Series" of integrated support system packaged software for educational institutions in October 1994, the "GAKUEN REVOLUTION (Operations)" ERP for large universities in August 1998, and the "UNIVERSAL PASSPORT" school related information network web service system in February 2000. JAST was listed on the JASDAQ market in November 2001, and moved to the Second Section of the Tokyo Stock Exchange in February 2003.

<Characteristics>

1. Management Focused upon Corporate Philosophy

With the corporate slogan of "contributing to society through the creation and provision of informational services," JAST's position of full independence by not belonging to any group of companies allows it to constantly take on new technological challenges and perform a wide range of developmental tasks to be provided to various industries, using various technologies and platforms as part of its basic corporate policy.In accordance with this basic policy, JAST endeavors to maximize value for customers, shareholders, employees and society and has established a goal of realizing stable growth by creating a "win-win" relationship with each of the four stakeholder groups. Furthermore, information services for each and every employee that is the driving force of growth is a service provided to customers with the utmost integrity (sincerity). Also, JAST views training of human resources as an area that training investments must be made. This belief in the formation of highly trained "individuals" is a core management philosophy. (Basic Principle of JAST Management Philosophy)

"Cultivating natural nobility comes before artificial rank" (by Mencius): Natural nobility refers to a naturally- granted position with the respect and trust by raising the character, class, virtues, and artificial rank refers to the outward rank, given artificially and politically. While it makes sense that the efforts to cultivate natural nobility lead to be spontaneously given artificial rank as a result, men may confuse themselves with an achievement of natural nobility additionally in case that men would be given artificial rank in first, showed up in their attitudes and actions often times. Cultivating natural nobility comes before artificial rank, but artificial rank doesn't come before natural nobility. 2. Provide Wide Range of Informational Services, Establish the JAST Brand

JAST is able to provide services freely to a wide range of applications due to its independence of large corporate groups which would restrict its business activities.JAST's main business includes the following four segments, but in recent years the Company has endeavored to expand JAST brand services and raise their share of total sales. Specifically, medical information (health insurance claim automated inspection) services, "BankNeo" bank CRM solutions services, and "Kyoto Zen Temple Tour" smartphone applications are amongst the JAST branded products and services created. (Business Segment)

1. Software Business (Individual contracted Software Development) → SIer Side

① Business Application Realm → (Office work processing system)

② Engineering Application Realm → (Control, Technological Systems) ③Event Application Realm → (Sports, Cultural Events Related Systems) Strategic university management system development, sales, implementation support, maintenance

Hardware, software package sales, maintenance, network creation

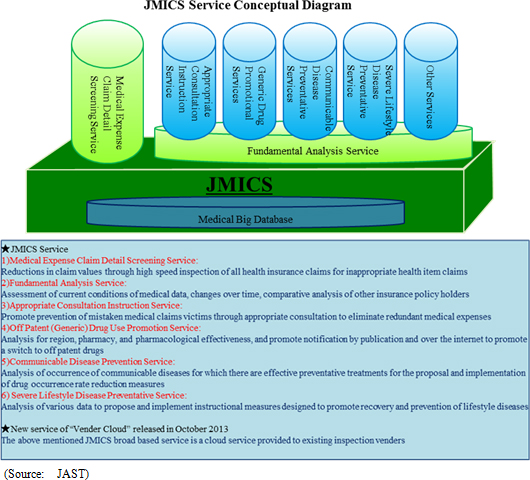

Health insurance claims automated inspection, notification services, data analysis

3. Long Track Record of Business Transactions with Existing Large Corporate Customers, New Clients

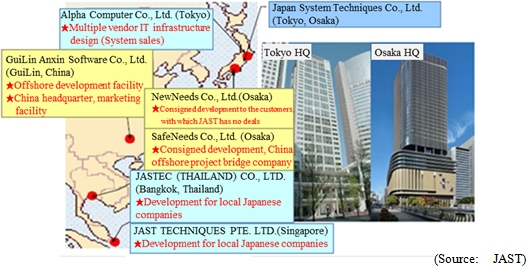

JAST boasts of a long track record with some of Japan's largest corporations including Fujitsu Limited (Direct transactions for 36 years), Panasonic Corporation (31 years), and IHI Corporation (31 years). Furthermore, the business transactions with these major corporations have been conducted directly, without having to go through intermediary companies.Because the transactions have been conducted over long periods of time, JAST has become a "core partner" of many of these companies, and it has been able to secure a relatively stable amount of orders even during periods of economic weakness. At the same time, the concentration of sales to the main eight long term clients had been as high as 80% but has now fallen to 38% currently. Furthermore, the number of new clients has grown as shown in the chart below.  4. Group Facilities Network Deployment

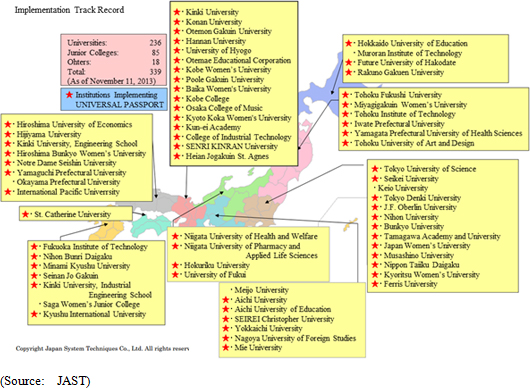

In addition, JAST Medical Insurance Checking System (JMICS) has been spun off as a separate business entity, and JAST acquired 3.66% of the total shares issued by ODK Solutions Co., Ltd. for cooperation designed to expand both companies' businesses in the realm of education in July. 5. Top Market Share of the Domestic University Operational Function Packaged Software, Promote Improvements

The integrated packaged software that provides management reform solutions for universities has been implemented by 339 universities (As of November 11, 2013) since its launch in October 1994, and has come to be regarded highly by the educational institution market. In particular, JAST's packaged software covers a wide range of operational functions in a wide range of applications from large comprehensive universities to smaller junior colleges. Furthermore, simple setting of parameters by universities allows the packaged software to be used flexibly. In other words, this software's lack of any need for customization contributes to reductions in overall user costs, including both implementation and maintenance costs. Moreover, the implementation cost ranges between ¥100,000 to several hundreds of millions of yen. As a strategy for dealing with the declining birthrates and aging population, most all universities are endeavoring to improve their management quality and student services in order to acquire superior students. However, the majority of the some 1,200 nationwide universities, including four year colleges and two year junior colleges, still primarily use systems and packaged software that have to be customized to match main frame technologies. Consequently, JAST's products are superior in both quality and pricing.   6. Other Characteristics

(Human Resources Focused) |

| First Half Fiscal Year March 2014 Earnings Overview |

(2) Segment Business Trends

In addition to the traditional three business segments, the inspection and analysis related services have been added as the medical big data business segment as of the first quarter of the current fiscal year due to its increasing influence in value terms.

Software Business

Service / retail industry is trending favorably, on the back of a recovery in the financial industry. "BankNeo" a data integration package for financial institution which had no sales in September of the previous term, recorded sales of four units in September 2013.

Package Business

Declines in university use program product and SI sales compounded increases in costs arising from next generation product development and business deployment in China, and contributed to a large decline in operating income.

System Sales Business

In addition to the contribution from the favorable earnings of Alpha Computer Co., Ltd., large increases were recorded orders from system integration (SI) projects for public sectors.

Medical Big Data Business

The number of customers of medical information services rose from 17 in September 2012 to 38 in September 2013. Furthermore, the number of health insurance claims processed expanded to 2.40 million per month. In addition to automated check of health insurance claims, the number of insurance policy holder numbers has increased through an expansion in services to include notification services and data analysis.

At the same time, payables declined by a large margin of ¥369 million, while short term debt increased. Consequently, equity ratio increased from 55.0% at the end of March 2013 to 57.1% at the end of the first half.  (4) Topics

JAST maintains a cooperative relationship with ODK Solutions Co., Ltd. (JASDAQ Stock Code: 3839) for mutual data services of university use systems. In order to further strengthen their relationship, JAST purchased 3,000 shares of ODK Solutions in the market.

◎Cooperation with ODK Solutions Co., Ltd. Strengthened JAST's GAKUEN series of products is a strategic management system that offers integration function ranging from corporate office task systems dealing with accounting and administration to educational institution task systems dealing with entrance exam and students' job hunting support upon graduation processes. JAST established a business alliance with ODK Solutions, which provides entrance examination publicity support services and information processing outsourcing services for entrance examinations for the same educational institution clients, one year ago for the collaboration on mutual use of data. Against this backdrop, JAST and ODK Solutions have leveraged their mutual strengths to extract business synergies and to expand their track record through cooperation. Both companies share the common recognition that these efforts serve to raise corporate and shareholder value, and therefore have taken the decision to strengthen their business cooperation. <Details of the Strengthened Business Relationship> Both companies will consider and determine which business fields and realms to cooperate on, in addition to the realm of educational institutions. Furthermore, both companies will promote ongoing consideration of projects outside of the education realm given the considerable potential for cooperation in other fields. |

| Fiscal Year March 2014 Earnings Estimates |

(2) Plans Going Forward

After subtracting the first half ordinary income results from the full year estimates, the ordinary income target for the second half is ¥239 million. This compares with ordinary income of ¥141 million during the second half of the previous fiscal year. While its main customer industry market continues to recover, strong contribution from sales of BankNeo are anticipated and a strong pricing trends and disappearance of opportunity losses and unprofitable projects are keys to achieving the second half targets.

① Policies by Business Segment ◎Software Business ◎Package Sales

Second half ordinary income target is ¥192 million, and compares with ¥167 million recorded during the previous first half. In addition to activities to capture extraordinary subsidy demand, weakness in the Kanto region is expected to be resolved during the second half and to offset the deficiencies seen during the first half. Because next generation products will enter the manufacturing stage, research and development expenses are expected to increase by 2.5 times. "GAKUEN China Version" is expected to be released with sales to Chinese universities expected to be booked.

<Next Generation Product Efforts>

Along with passing of the sixth year since the release of the GAKUEN series and its establishment as the top brand, pricing competition has begun to intensify along with the appearance of competing products. And while high profitability is still maintained, growth in sales has begun to weaken.The next generation product is not merely a simple improvement on existing versions, but is based upon a complete renewal of the function, design, services, and platform of the product. Furthermore, this next generation product is not merely a response to competing products, but it has been developed with optimized functions that take the future environment for universities into full consideration. Basic research for the fundamental concept of the new product was completed during the previous term, and development will be promoted from the current term onwards with additional components and related comprehensive services being considered as well. During fiscal year March 2018, sales of the next generation package version is expected to grow to over ¥2.0 billion and exceed sales of the current version. <China Business Deployment>

As shown in the table below, Japan's university informational services market has reached maturity. Consequently the decision was taken to aggressively deploy business in China based upon the high growth expected in that market.

With regards to the marketing function, a network connected to government and university employees was established as part of efforts to secure sales channels and conduct promotions to information processing departments of universities. The reliability of the JAST product is expected to act as a strong advantage in their marketing efforts in China. An agreement with Huzhou Teachers College (Huzhou City) for information services was signed in May 2013. In this manner, aggressive marketing activities will be conducted based on the formation of business operations in China, and JAST targets the implementation of its software at several universities in fiscal year March 2014. ◎System Sales Business

The second half ordinary income target is ¥2 million, and compares with ¥39 million in the previous second half. Sales to public institutions continue to trend favorably, and the possibility of the achievement of targets is high. JAST will endeavor to exceed its targets.

◎Medical Big Data Business

Second half ordinary income target is -¥20 million, and compares with -¥52 million in the previous second half. While these estimates are likely to be the most difficult of the four segment targets to achieve, efforts will be made to expand sales of this fourth segment and to establish its own brand of services. Its strategy call for achievement multiple objectives including increases in processing numbers, normalization of pricing, achievement of profitability in cloud services, and reduction in development and operational costs.

According to JAST, major research and development investments are expected to end in the current term, with the arrival of the recovery phase for these investments and sales expected to grow to ¥500 million in fiscal year March 2015.  ② Medium to Long Term Earnings Concept

With regards to sales, the establishment and growth of the JAST brand of products and services is expected to contribute to an increase in own brand to consigned business sales ratio to 1 for 1.Consequently, JAST is on a steady path to a recovery to ¥10.0 billion for the first time in four terms. With regards to profits, JAST is expected to endeavor to improve profitability by balancing ongoing investments with profits in its business restructuring efforts through ongoing promotion of its own brand business. |

| Conclusions |

|

A key point of JAST's strategy will be the speed with which it can transform its business model to one which boasts of a higher sales composition of own branded products and services. Disclaimer

This report is intended solely for information purposes, and is not intended as a solicitation to invest in the shares of this company. The information and opinions contained within this report are based on data made publicly available by the Company, and comes from sources that we judge to be reliable. However we cannot guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and or opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration.Copyright(C) 2014, All Rights Reserved by Investment Bridge Co., Ltd. |