Bridge Report:(4323)Japan System Techniques Second quarter of the term ending March 2022

Takeaki Hirabayashi, President and CEO | Japan System Techniques Co., Ltd. (4323) |

|

Company Information

Exchange | TSE 1st Section |

Industry | Information and Communications |

President and CEO | Takeaki Hirabayashi |

HQ Address | Nakanoshima Festival Tower 29F, 2-3-18 Nakanoshima, Kita-ku, Osaka-shi, Osaka |

Year-end | End of March |

Homepage |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥2,489 | 6,161,607 shares | ¥15,336 million | 8.9% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥30.00 | 1.2% | ¥152.37 | 16.3x | ¥1,265.96 | 2.0x |

*The share price is the closing price on December 17, 2021. The number of outstanding shares was taken from the brief report on financial results for the latest term (the number of treasury shares deducted from the number of outstanding shares). ROE and BPS are the actual values as of the end of the previous term.

*EPS and DPS are the figures in the company’s forecasts for the term ending March 2022.

*Figures are rounded to the nearest decimal point.

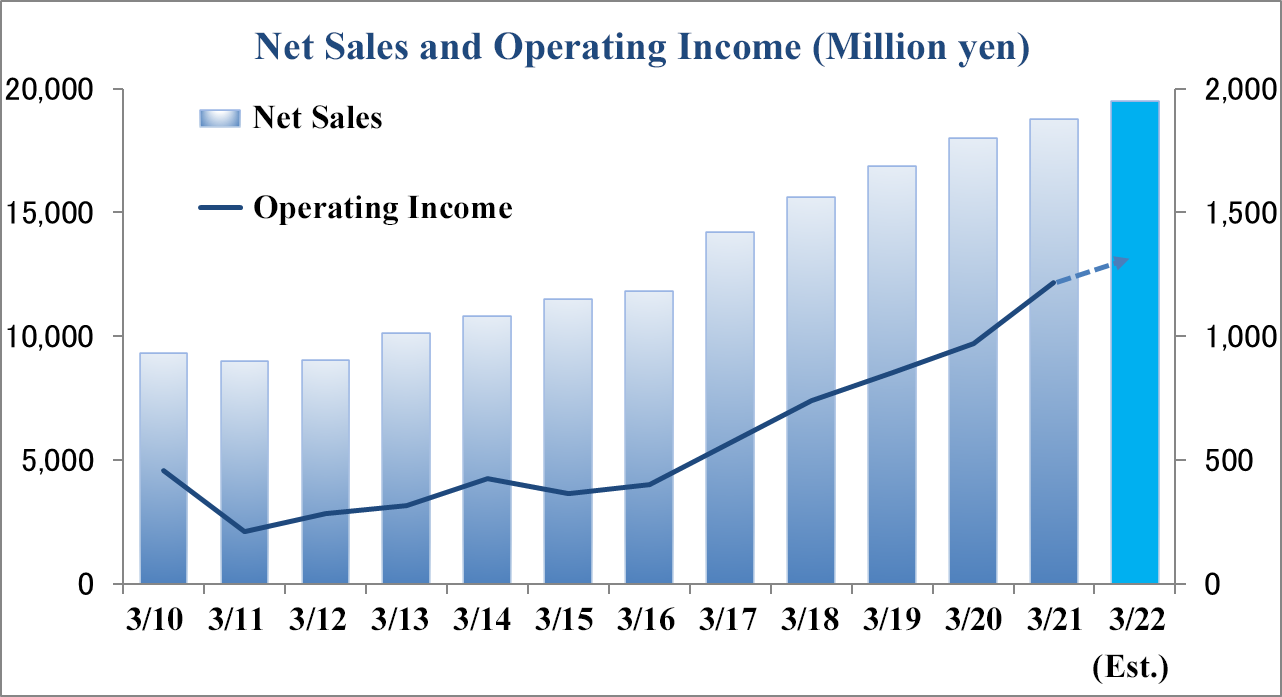

Earnings Trends

Fiscal Year | Net Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

March 2018 Act. | 15,630 | 741 | 785 | 579 | 110.36 | 28.00 |

March 2019 Act. | 16,868 | 856 | 870 | 317 | 60.58 | 28.00 |

March 2020 Act. | 18,019 | 970 | 1,021 | -30 | -5.76 | 28.00 |

March 2021 Act. | 18,789 | 1,216 | 1,310 | 578 | 107.95 | 28.00 |

March 2022 Est. | 19,500 | 1,330 | 1,360 | 820 | 152.37 | 30.00 |

* Unit: million yen. The forecasted values were provided by the company. Net income means the profit attributable to owners of parent hereinafter.

This Bridge Report includes the overview of the financial results of Japan System Techniques in the second quarter of the term ending March 2022, etc.

Table of Contents

Key Points

1. Company Overview

2. Second Quarter of Fiscal Year Ending March 2022 Earnings Results

3. Fiscal Year Ending March 2022 Earnings Forecasts

4. Mid-term Business Scheme

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- The sales in the second quarter of the term ending March 2022 were 10,042 million yen, up 124.9% year on year. As the procurement of hardware was delayed compared with the initial assumption due to the shortage of semiconductors, the sales of the system sales business declined year on year, but the sales of the software business grew year on year, thanks to the resumption of development investments that have been partially suspended by mainly large-scale clients in the wake of the novel coronavirus pandemic, and sales growth was also seen in the GAKUEN business and the medical big data business. Regarding profit, the company posted an operating income of 992 million yen, up 4,313.0% year on year. The profit from the system sales business, which saw a drop in sales, decreased year on year, but the profits from all the other businesses rose, as their sales grew.

- The company’s forecasts for the term ending March 2022 are unchanged, and it is expected that sales will grow 3.8% year on year to 19.5 billion yen and operating income will rise 9.3% year on year to 1,330 million yen. For commissioned development, the company will start up next-generation businesses while expanding profit. For the business of its own brands, including GAKUEN and medical big data, the company plans to conduct R&D of new technologies and products and launch new businesses while improving the brand power of each business and expanding its market share. The dividend plan has not been changed, and the company plans to pay a term-end dividend of 30 yen/share, up 2 yen/share from the previous term.

- Japan System Techniques aims to increase the market capitalization of tradable shares for satisfying the criteria for getting listed on the Prime Market. In addition to the improvement in business performance, the company is expected to strengthen its dividend policy, IR activities, and brand development strategy for the purpose of improving share price evaluation indicators. In addition, the company is apparently planning to improve liquidity by converting non-tradable shares into tradable ones and splitting shares and develop a shareholder benefit system. Their measures for increasing the market capitalization are noteworthy.

1. Company Overview

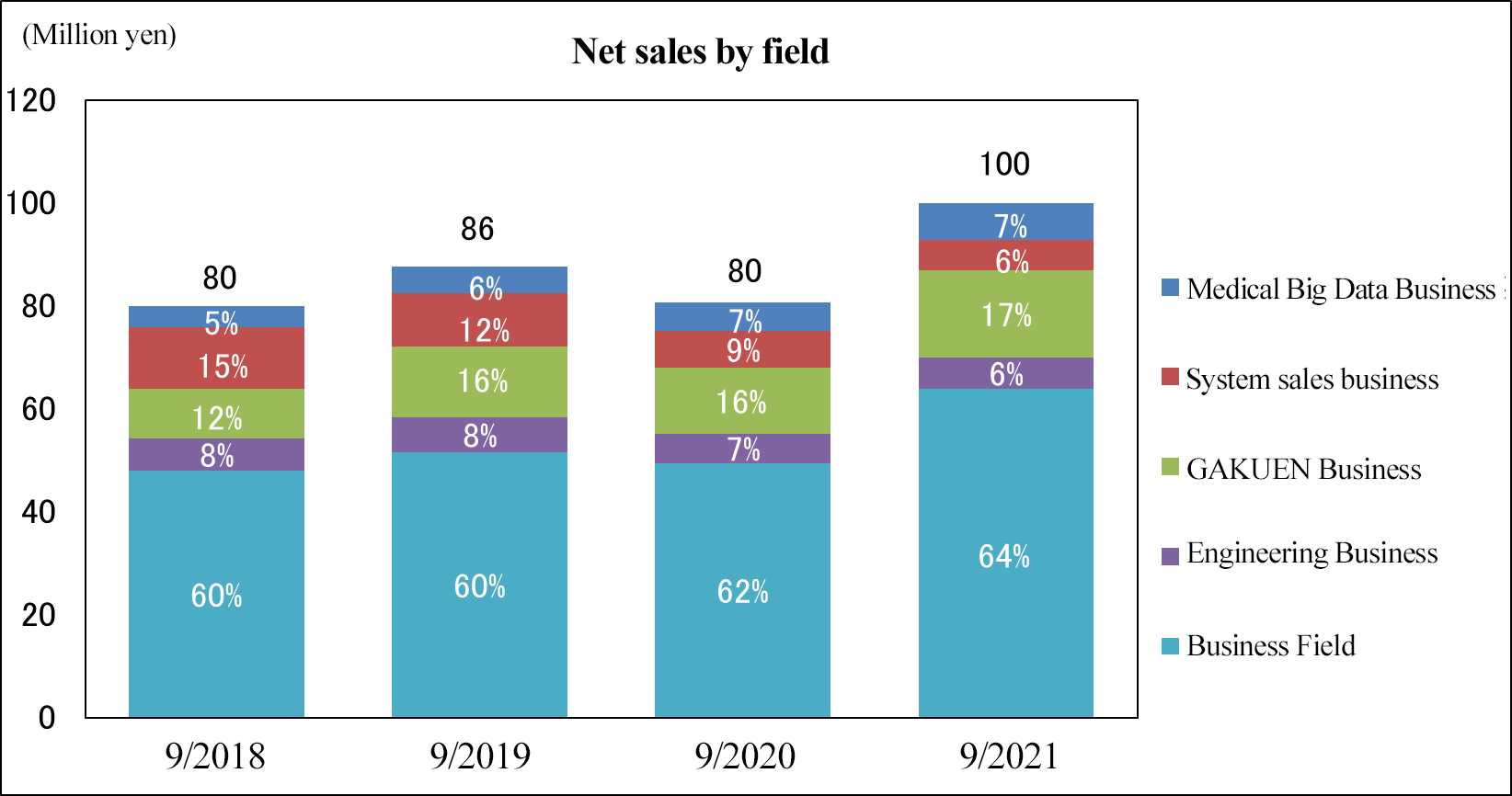

Japan System Techniques operates the software business (accounting for 69.9% of total sales in the first half of the term ending March 2022), the GAKUEN business (accounting for 17.1%), the system sales business (accounting for 5.9%), and the medical big data business (accounting for 7.4%).

<Corporate History>

Japan System Techniques (JAST) was established in March 1973. JAST released a business package for educational institutions, which characterizes the company, in the early 1990, GAKUEN Series, packaged software for an integration system for supporting school office work, in October 1994, GAKUEN REVOLUTION (school affairs), an ERP for large universities, in August 1998, and UNIVERSAL PASSPORT, an integrated web service system, which actualizes an information network among school staff, in February 2000. After getting listed on the JASDAQ market in November 2001, it got listed on the second section of Tokyo Stock Exchange (TSE) in February 2003, and then on the first section of TSE in June 2017. In addition, the company is accelerating its global business operation, as it acquired the Virtual Calibre group in Malaysia as a subsidiary in November 2018 and AG NET PTE. LTD in Singapore as a subsidiary in May 2019.

<Characteristics>

1. Management ethos

Under the mott “Making society a better place by creating and providing new types of IT services,” JAST upholds the basic management policy of always endeavoring to apply the cutting-edge technologies regardless of business category, technical field, platform, etc. and engaging in development in a broad range of fields in a freewheeling manner by keeping a fully independent position without belonging to any corporate groups.

Under this basic policy, the company upholds the ethos of operating business beneficial to four parties: customers, shareholders, employees, and society for fostering win-win relationships, and aims to actualize stable growth by maximizing the value of each party and enhancing the entire corporate value.

The drivers of such growth are each employee’s passion for development of information systems and faithful services for customers. Believing that to obtain these drivers, each employee needs to give top priority to the honing of comprehensive abilities as an independent person, so the company carries out personnel development-oriented management.

(Basic policy in management ethos)

“When you pursue dignity or virtue, a high status will follow.” Only when you have dignity or virtue, you will be conferred a high status. A mere high status will not give you dignity or virtue.

2. Description of business

Software business (commissioned development of software)

Utilizing the forte as a totally independent enterprise, JAST offers various information systems and services in a broad range of fields.

①Business applications

IT services, including the proposing, development, operation, and maintenance of systems for each industry

②Engineering applications

Smart devices, systems embedded in AV equipment, and information/telecommunication systems, such as digital terrestrial television broadcasting and car navigation systems

③Other solutions [JAST brands]

BankNeo, a package for financial institutions

AGHRM®, a solution for developing human resources

mieHR, a personnel data platform

In-house cashless service

Office DX —a face recognition time clock—

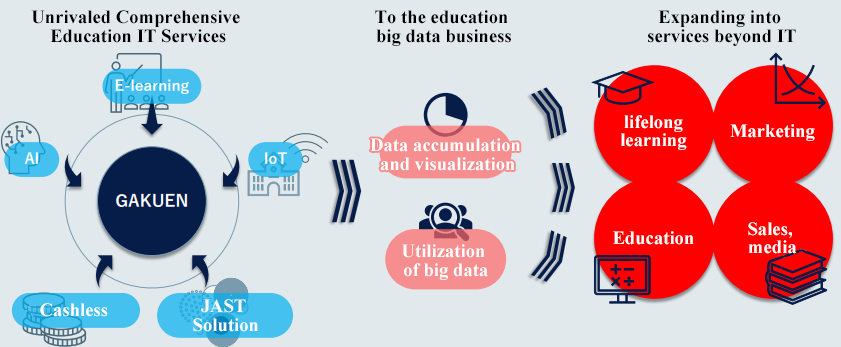

GAKUEN business (Development and sale of a package of software for university management) [JAST brand]

The company offers comprehensive solutions for digital transformation (DX) of education, mainly the GAKUEN series, which is the top educational IT brand developed by fusing clerical systems and portal systems.

① Integrated system for supporting office work in schools: GAKUENRX

② Integrated web service system for universities: UNIVERSAL PASSPORTRX

System sales business (Sale of IT devices and development of information/telecommunication infrastructure)

The company specializes in the educational and public fields, and offers one-stop solutions for ICT infrastructure, covering the development of infrastructure, provision of cloud services, operation, maintenance, and related system integration (SI).

①Design and development of infrastructure

Services of designing and developing hardware and software mainly for system infrastructure

②Sale of system products

Comprehensive support including the proposal for system products, operation, and maintenance

③Cloud services

One-stop services including the analysis of problems with the current environment, proposal for operation, design/development, and support after installation

④ICT consulting

The company offers one-stop services for the client companies' installation of ICT, including the analysis of the current situation, installation, implementation, maintenance, and support.

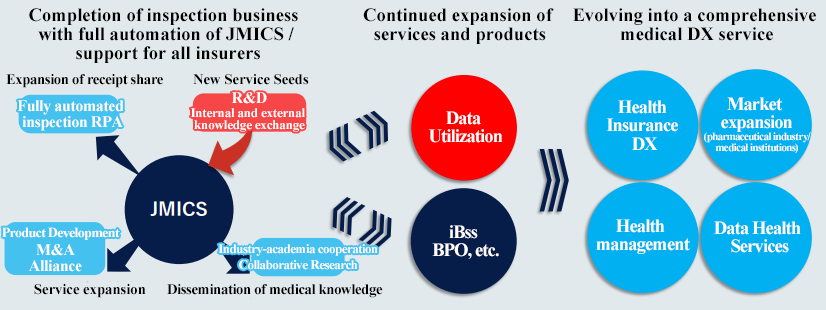

Medical big data business (inspection and analysis of medical data and related services) [JAST brand]

The company operates five healthcare-related businesses, mainly the business of inspection of health insurance claims. It offers one-stop services for promoting the utilization of medical data and the reform of insurers’ business operations.

①JMICS, a system for automatically inspecting health insurance claims

②iBss, a service for supporting insurers’ business operations

③RezeptPlus, a system for managing health insurance claims for welfare systems (the trademark of Fujitsu Japan Limited)

④Data health businessTo offer one-stop services, including the collection of data and the measurement of effects, according to insurers’ problems and purposes

⑤Data utilization business

To anonymize health insurance claims, specific health checkups, etc. and provide clients with data and analysis reports

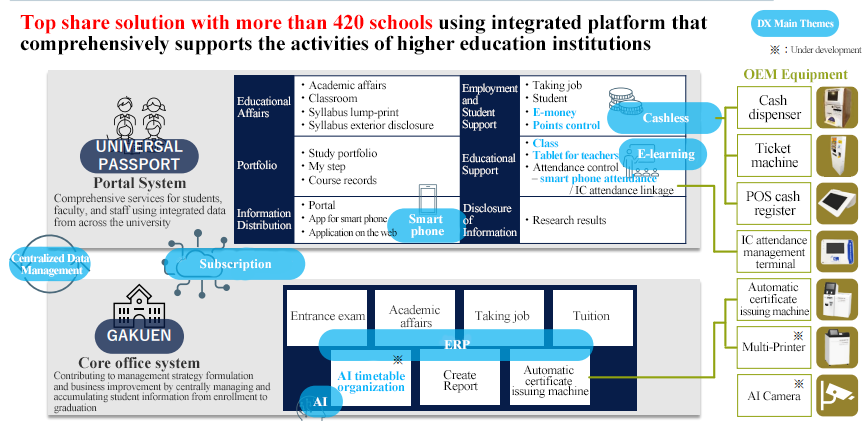

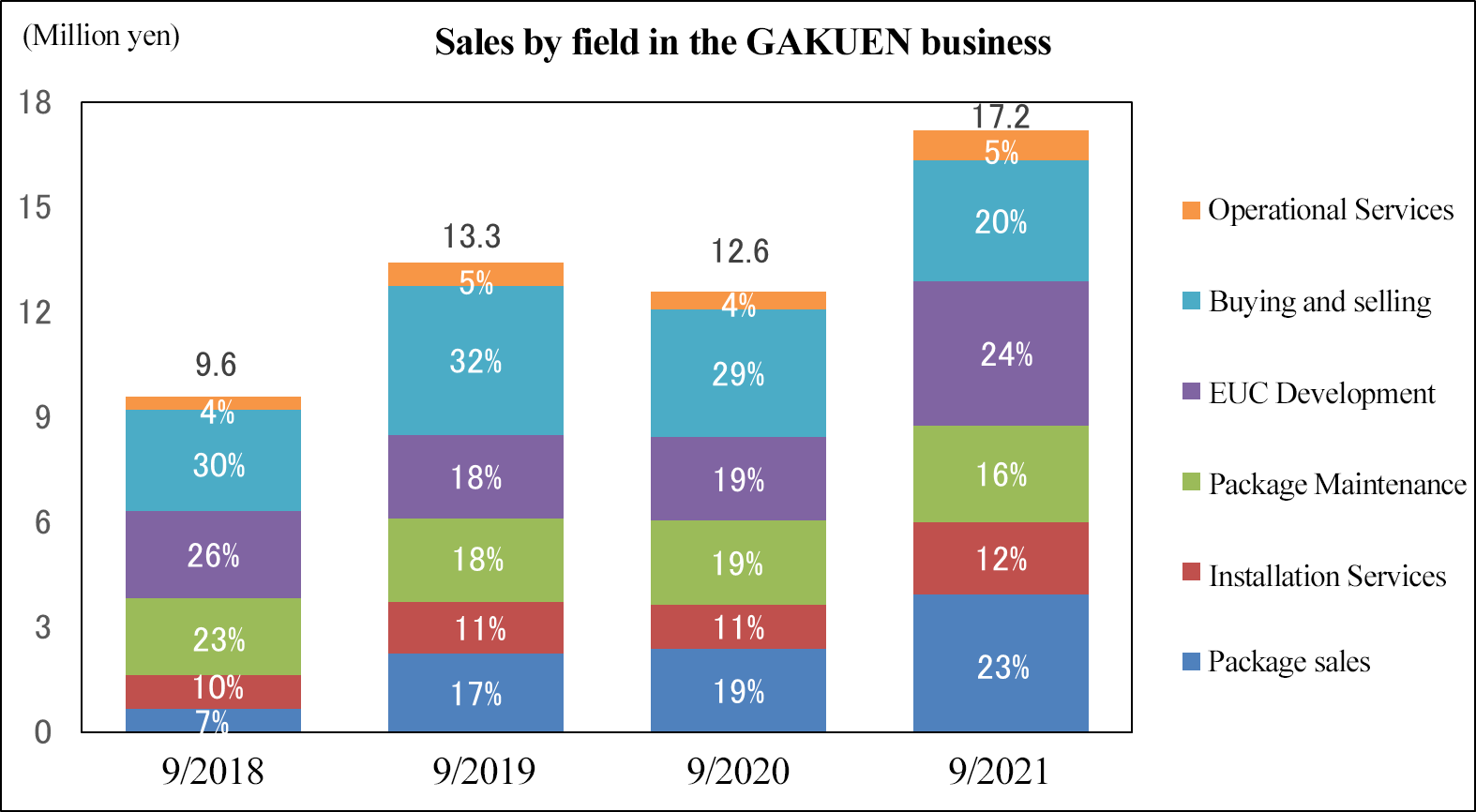

3. JAST brand: GAKUEN

GAKUEN is a comprehensive business package that offers college management reform solutions, and occupies the largest market share, as it has been adopted by 420 schools since the release in October 1994. It comprehensively supports the activities of higher educational institutions and is highly evaluated in the educational market. As a characteristic, it is possible to respond to the needs from individual colleges just by setting parameters, because it covers major operations of colleges ranging from large universities and small junior colleges from all aspects. Namely, customization is unnecessary, so users can reduce the total cost for installation, operation, and maintenance. The price per transaction ranges broadly from several hundreds of thousands of yen to several hundreds of millions of yen according to scale.

As the number of children is decreasing, colleges are improving services for students and management quality to secure excellent students. However, most of an estimated 1,200 universities and junior colleges are said to use a package compatible with mainframe providers’ systems and customization. The company has competitive advantages in quality and prices.

In addition, its services have evolved from support for office work into comprehensive IT services for colleges, including operation services, OEM equipment, such as KIOSK terminals, BCP measures, support for training of students, and support for management strategies. Sales are classified into the following categories.

Category | Description |

Sale of packages | Revenues from sale of an integrated package for school management |

Installation service | Revenues from consulting for installation of a package |

Package maintenance | Revenues from a package maintenance contract |

EUC development | Revenues from commissioned development of individual systems related to package sale |

Procurement and sale | Revenues from the procurement and sale of hardware and other companies’ products |

Operation services | Revenues from the support for system operation |

(Taken from the reference material for briefing financial results of the company)

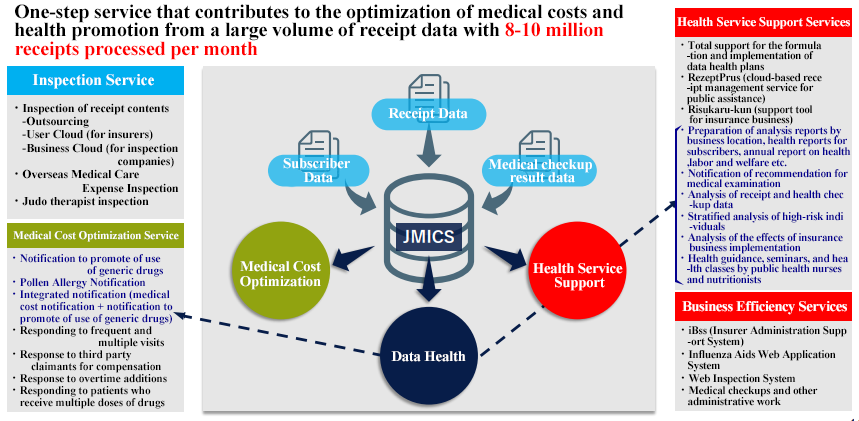

4. JAST brand: JMICS

JMICS is a one-stop service that contributes to the optimization of medical costs and health enhancement with enormous data of 8-10 million health insurance claims per month. By checking health insurance claims, the company accumulates their information regularly and develops the base for medical information. In addition, by adding information on the results of health checkups, subscribers, etc., the company is expected to promote the insurance business with the database. It offers a wide array of services, including inspection, optimization of medical expenses, support for insurance business, and streamlining of paperwork.

(Taken from the reference material for briefing financial results of the company)

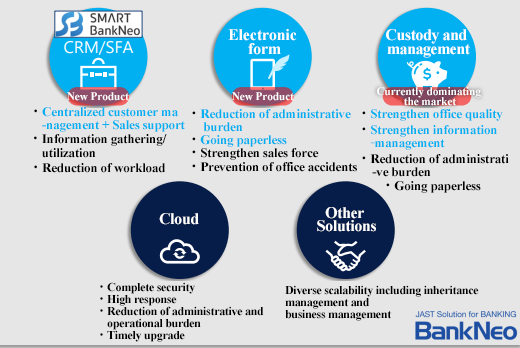

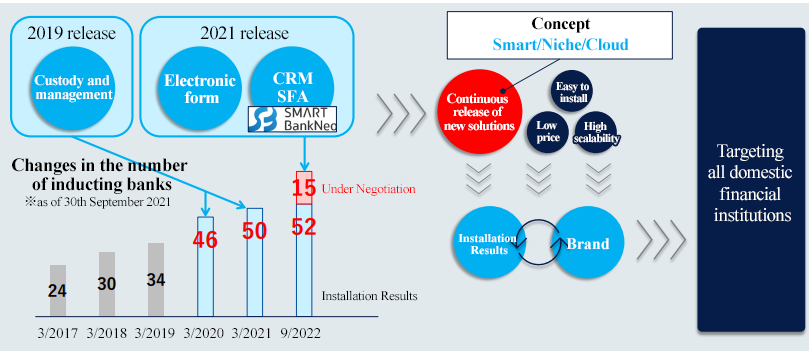

5. JAST brand: BankNeo

BankNeo is an integrated package for promoting the DX of financial institutions with plenty of smart and niche solutions utilizing installability and scalability. It has been adopted by many financial institutions throughout Japan. Its features include installability, which allows users to start small, scalability after installation, plenty of knowledge accumulated for over 30 years, and the lineup of services meeting customer needs.

(Taken from the reference material for briefing financial results of the company)

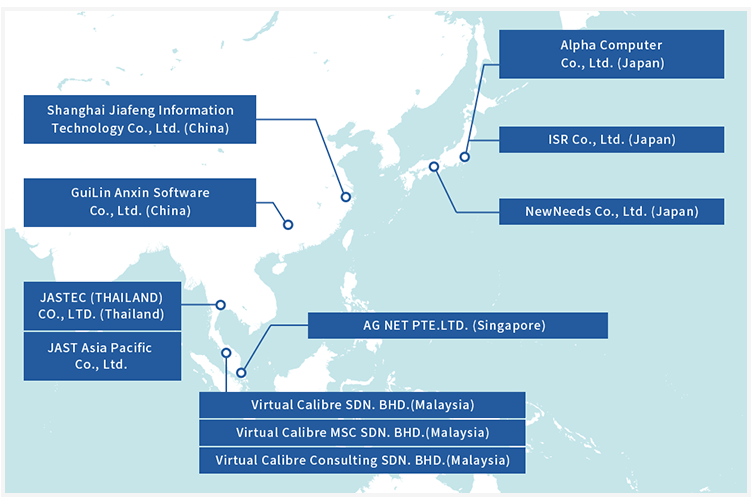

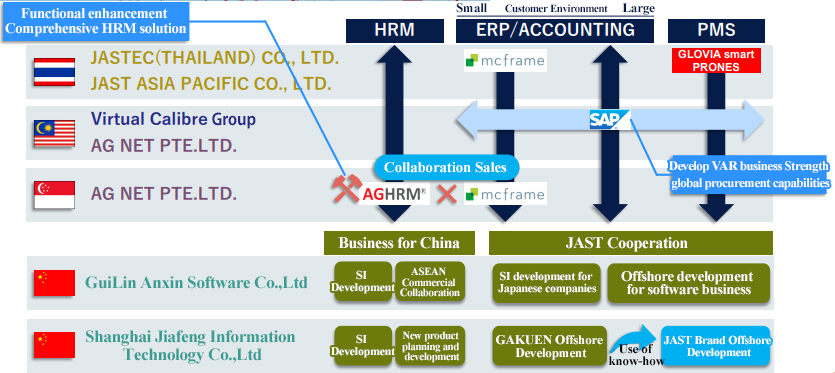

6. Footholds and global business expansion of the JAST Group

As a characteristic, the company has two headquarters in Osaka and Tokyo, and has established overseas footholds from early on. In August 2006, the company acquired all shares of Alpha Computer, Ltd., which has the experience of selling system equipment, etc. to mainly large universities in the Tokyo Metropolitan Area, to expand its business in the educational field, mainly the market targeted at colleges. Then, it became possible to operate large-scale system integration (SI) business for colleges, to provide packages, information devices, networks, etc. with consistency.

In addition, the company spun off JMICS (a medical information service), and acquired 3.66% of the total number of outstanding shares of ODK Solutions Co., Ltd. in July 2013, and formed a capital alliance, with the aim of mutually expanding their businesses in the educational field. In May 2016, the company acquired ISR Co., Ltd., which is a general software developer operating system solution business in a broad range of fields, as a subsidiary. It is expected to contribute to the business expansion in Tokyo and the strengthening of SI services.

In November 2017, the company increased investment in Co-well Co., Ltd. and strengthened cooperation with it. Then, the company became able to expand global outsourcing in Japan and Vietnam, develop packaged products, recruit and train IT engineers, and so on in cooperation. In April 2018, JAST Asia Pacific Co., Ltd. was established in Thailand, while the company’s capital contribution ratio being 99.97%. In October 2018, the company acquired the shares of the three companies belonging to the corporate group of Virtual Calibre, which is an independent system consulting company in Malaysia, (Virtual Calibre SDN. BHD., Virtual Calibre MSC SDN. BHD., and Virtual Calibre Consulting SDN. BHD.) and made them consolidated subsidiaries. In May 2019, the company acquired AG NET PTE. LTD in Singapore as a consolidated subsidiary, to make inroads into the human resource management (HRM) field. The company aims to further expand its business in ASEAN regions.

(Taken from the reference material for briefing financial results of the company)

2. Second Quarter of Fiscal Year Ending March 2022 Earnings Results

(1) Consolidated results

| 2Q of FY 3/21 | Ratio to Sales | 2Q of FY 3/22 | Ratio to Sales | YoY |

Sales | 8,042 | 100.0% | 10,042 | 100.0% | +24.9% |

Gross Profit | 1,775 | 22.1% | 2,719 | 27.1% | +53.2% |

SG&A | 1,752 | 21.8% | 1,726 | 17.2% | -1.5% |

Operating Income | 23 | 0.3% | 992 | 9.9% | +4,313.0% |

Ordinary Income | 58 | 0.7% | 1,004 | 10.0% | +1,731.0% |

Profit Attributable to Owners of Parent | -309 | -3.8% | 686 | 6.8% | - |

*Unit: Million yen

*Figures include reference figures calculated by Investment Bridge Co.; Ltd. Actual results may differ (applies to all tables in this report).

Sales and operating income grew 24.9% and 4,313.0%, respectively, year on year.

The sales in the second quarter of the term ending March 2022 were 10,042 million yen, up 24.9% year on year. The sales of the system sales business declined, because the sale of devices to colleges, which are their main customers, decreased year on year, as the procurement of hardware was delayed compared with the initial assumption due to the global shortage of semiconductors. On the other hand, the sales of the software business rose year on year, thanks to the resumption of large clients’ development investments that were partially suspended in the wake of the spread of the novel coronavirus, and sales growth was also seen in the GAKUEN business, where GAKUEN RX and GAKUEN UNIVERSAL PASSPORT RX, the new series of the highly profitable program products (PPs) for colleges, performed well, and in the medical big data business, where the service of automatically checking health insurance claims, which slowed down somewhat in the same period of the previous term, recovered.

Regarding profit, operating income rose 4,313.0% year on year to 992 million yen. The profit from the system sales business, which saw a drop in sales, decreased year on year, but the profits from all the other businesses rose, as their sales grew. Profitability improved, as there were no longer effects of unprofitable commissioned development projects in the same period of the previous term in the software business and the medical big data business offered more highly profitable services, including analysis and notification services, cloud services for managing health insurance claims for welfare, and support for insurers’ business operations. Gross profit margin rose 5 points from the previous term to 27.1%, and the ratio of SG&A to sales decreased 4.6 points from the previous term. As a result, operating income margin rose 9.6 points from the previous term to 9.9%. In non-operating revenues, the income from subsidies decreased year on year, so ordinary income rose 1,731.0% year on year to 1,004 million yen, showing a lower growth rate than operating income. On the other hand, profit attributable to owners of parent increased significantly to 686 million yen, because the impairment loss of goodwill, etc. related to AG, which is a consolidated subsidiary in Singapore, was posted in the same period of the previous term, but not posted in the first half of the current term.

Through the application of the revenue recognition standard, sales and cost of sales decreased 25 million yen and 110 million yen, respectively, while operating income, ordinary income, and net income before taxes and other adjustments each increased 85 million yen.

(2) Trends by segment

| 2Q of FY 3/21 | Composition Ratio | 2Q of FY 3/22 | Composition Ratio | YoY |

Software Business | 5,543 | 68.9% | 6,986 | 69.6% | +26.0% |

GAKUEN Business | 1,266 | 15.8% | 1,721 | 17.1% | +35.9% |

System Sales Business | 698 | 8.7% | 593 | 5.9% | -15.0% |

Medical Big Data Business | 534 | 6.6% | 740 | 7.4% | +38.6% |

Consolidated Sales | 8,042 | 100.0% | 10,042 | 100.0% | +24.9% |

Software Business | -192 | - | 429 | 43.3% | - |

GAKUEN Business | 174 | - | 498 | 50.3% | +185.8% |

System Sales Business | 68 | - | 2 | 0.2% | -97.1% |

Medical Big Data Business | -36 | - | 61 | 6.2% | - |

Adjustment | 8 | - | 1 | - | - |

Consolidated Operating Income | 23 | - | 992 | - | 4,313.0% |

*Unit: Million yen

◎ Software business (Commissioned development of software)

Sales were 6,986 million yen, up 26.0% year on year, and profit was 429 million yen (a loss of 192 million yen in the same period of the previous term), as there were no longer effects of unprofitable projects of commissioned development, which caused sluggish performance in the same period of the previous term, some development projects suspended by large clients in the wake of the spread of the novel coronavirus were resumed, the license for BankNeo, an integrated information system for financial institutions, sold well, and the business performance in ASEAN countries recovered, improving profitability.

Through the application of the revenue recognition standard, sales declined 60 million yen, and profit rose 6 million yen.

◎ GAKUEN business (Development and sale of college management software packages and related services)

Sales were 1,721 million yen, up 35.9% year on year, and profit was 498 million yen, up 185.8% year on year, as there was demand for replacement of the old series of existing clients with the new series GAKUEN RX and GAKUEN UNIVERSAL PASSPORT RX of the highly profitable program products (PPs) for colleges, the company increased new clients for this series earlier than planned, and the amount of orders for EUC (commissioned development of related systems) increased following the installation of them. The ratios of sales of package sales, EUC development, etc. increased.

Through the application of the revenue recognition standard, sales increased 47 million yen and profit increased 45 million yen.

◎ System sales business (Sale of IT devices and development of information/telecommunication infrastructure)

Sales were 593 million yen, down 15.0% year on year, and segment profit was 2 million yen, down 97.1% year on year, as the sale of devices for colleges, which are their mainstay, declined because the procurement of hardware was delayed compared with the initial assumption due to the global shortage of semiconductors.

Through the application of the revenue recognition standard, sales decreased 110 million yen and segment profit declined 9 million yen.

◎ Medical big data business (Inspection and analysis of medical data and related services)

Sales were 740 million yen, up 38.6% year on year, and segment profit was 61 million yen (a loss of 36 million yen in the same period of the previous term), as the service of automatically checking health insurance claims, which was somewhat sluggish in the same period of the previous term due to the decrease of visitors to medical institutions during the novel coronavirus pandemic, recovered, and the company strived to increase profitability by improving profitable services, including analysis, notification, cloud services for managing health insurance claims for welfare, and support for insurers’ business operations.

Through the application of the revenue recognition standard, sales grew 98 million yen and segment profit rose 42 million yen.

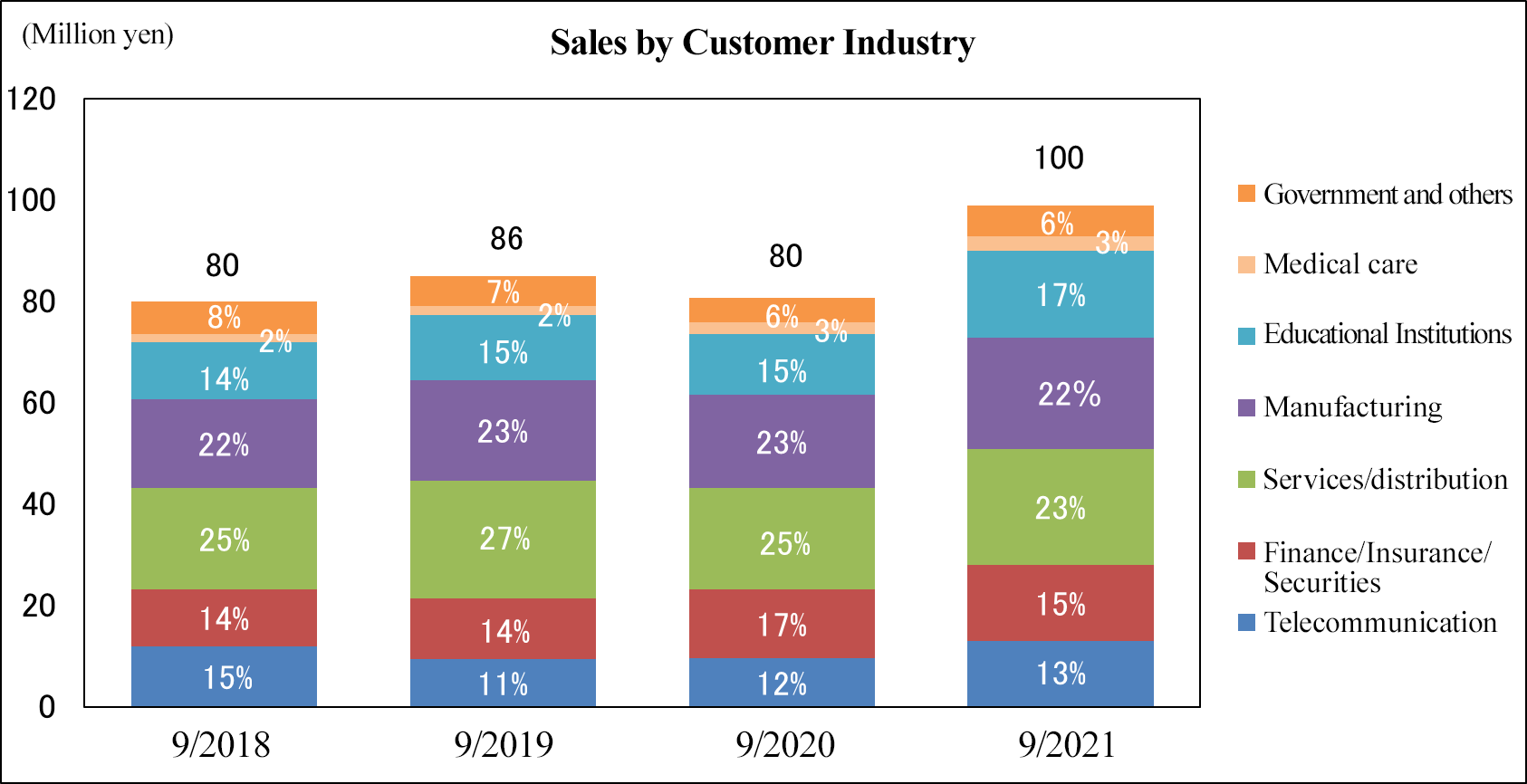

In the first half of the term ending March 2022, the ratios of sales in the fields of finance/securities/insurance, services/distribution, manufacturing, etc. declined, while the ratios of sales in the fields of telecommunication, educational institutions, etc. increased.

Regarding the sales from major clients, the sales of top four client companies accounted for 32.1%, down from 33.5% in the same period of the previous term, while the ratios of sales from educational institutions, including colleges, the agencies for the GAKUEN business, and overseas energy-related public enterprises increased to 14.7% (13.9% in the same period of the previous term), 3.9% (3.6% in the same period of the previous term), and 3.8% (2.7% in the same period of the previous term), respectively.

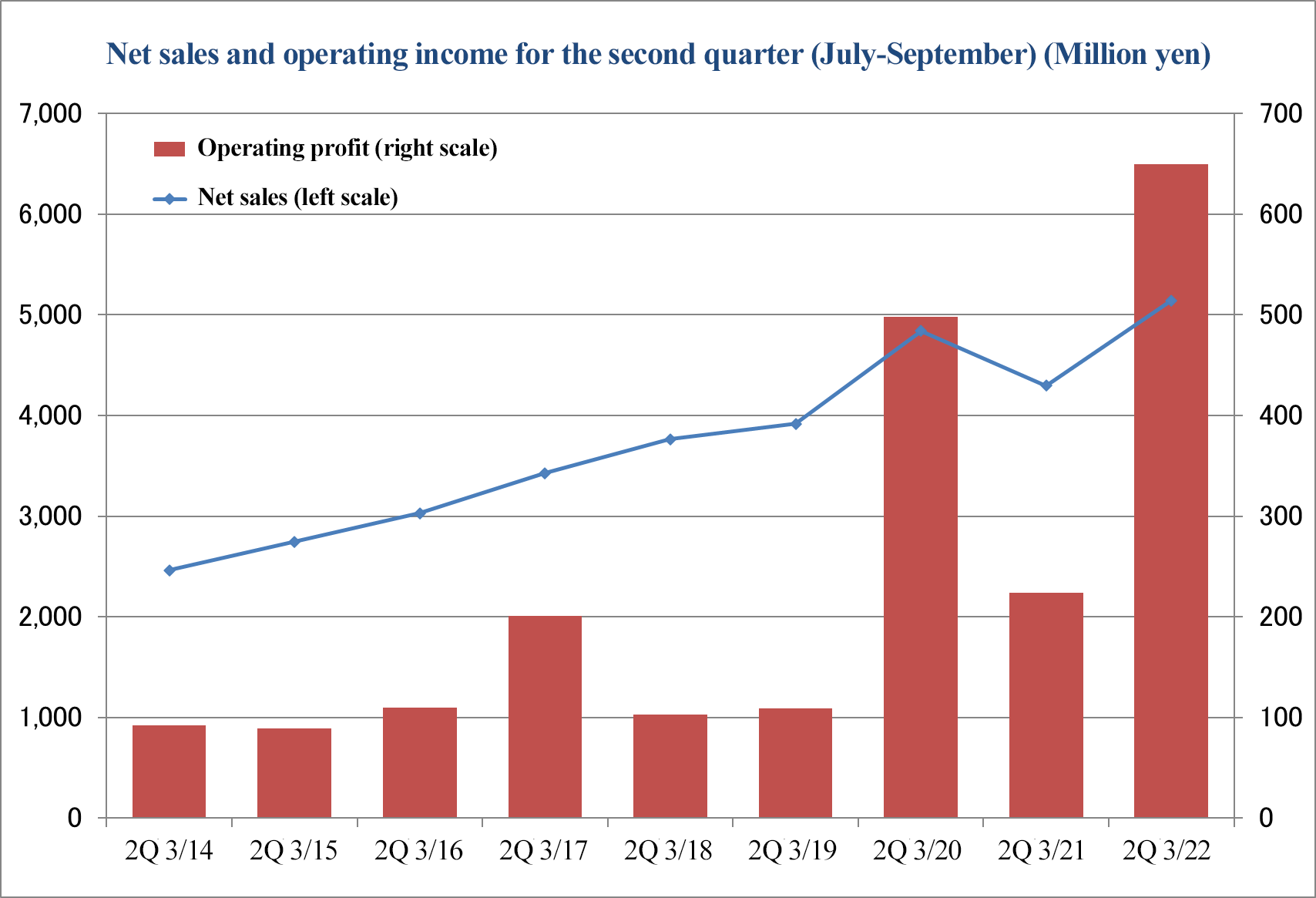

(3) Variation in performance in the second quarter (Jul. to Sep.)

The sales and operating income in the second quarter (Jul. to Sep.) of the current term were both at high level compared to the past same quarter.

(4) Financial Conditions and Cash Flow (CF)

Financial Conditions

| March 2021 | September 2021 |

| March 2021 | September 2021 |

Cash And Deposits | 4,854 | 6,260 | Accounts Payable | 1,021 | 1,008 |

Trade Receivables | 3,953 | 4,205 | ST Interest Bearing Liabilities | 410 | 8 |

Inventories | 715 | 327 | Advances Received and Contract Liabilities | 605 | 1,076 |

Current Assets | 9,696 | 11,102 | LT Interest Bearing Liabilities | - | - |

Tangible Noncurrent Assets | 542 | 568 | Liabilities | 6,011 | 6,011 |

Intangible Noncurrent Assets | 378 | 371 | Net Assets | 6,850 | 5,565 |

Investments, Others | 2,243 | 2,170 | Total Liabilities, Net Assets | 12,861 | 14,212 |

Noncurrent Assets | 3,165 | 3,110 | Total Interest-Bearing Liabilities | 410 | 8 |

*Unit: Million yen

*Interest-bearing liabilities = Debts

The total assets as of the end of September 2021 stood at 14,212 million yen, up 1,351 million yen from the end of the previous term. The main factors in the increase in total assets are the rise in trade receivables collected due to business performance linkage and the growth of cash and deposits through the issuance of new shares through the exercise of share acquisition rights and the retirement of treasury shares. The major factors in the increase in total liabilities and net assets are the capital and capital surplus increased through the exercise of share acquisition rights, while short-term debts decreased. Capital-to-asset ratio increased 7.6 points from the end of the previous term to 60.6%. Interest-bearing liabilities decreased 402 million yen from the end of the previous term to 8 million yen. Through the application of the revenue recognition standard, the initial balance of retained earnings increased 81 million yen.

Cash Flow | 2Q of FY 3/21 | 2Q of FY 3/22 | YoY | |

Operating Cash Flow (A) | 1,271 | 838 | -432 | -34.0% |

Investing Cash Flow (B) | -66 | -57 | 9 | - |

Free Cash Flow (A + B) | 1,205 | 781 | -423 | -35.2% |

Financing Cash Flow | -552 | 592 | 1,145 | - |

Cash and Equivalents at Term End | 4,526 | 6,259 | 1,733 | +38.3% |

*Unit: Million yen

Regarding cash flows, the cash inflow from operating activities decreased, due to the shrinkage of drop in accounts payable, despite the rise in net income before taxes and other adjustments, the decline in inventory assets, etc. The cash outflow from investing activities decreased, due to the decline in expenditure for acquiring investment securities, but free cash flow dropped. On the other hand, financing cash flow turned positive, thanks to the revenues from the issuance of new shares and the retirement of treasury shares. The term-end cash position increased 38.3% from the end of the previous term.

(5) Topics

◎ Software business

• Released the new product SMART BankNeo on May 20, 2021.

• Released Office DX—Face recognition time clock on October 14, 2021.

• Started collaborative development of a system for supporting the improvement in marketing efficiency with Explorer Consulting Co., Ltd. on October 18, 2021.

◎ GAKUEN business

• Released a service of supporting DX by linking college affairs systems and the textbook selection database in cooperation with Dai Nippon Printing Co., Ltd. on July 21, 2021.

◎ Medical big data business

• Released a novel coronavirus information dashboard service in cooperation with Data 4C’s K.K. and Mr. Masayoshi Soma, the head of Kyoundo Hospital of Sasaki Foundation on April 28, 2021.

• Published an interim report on joint research into the novel coronavirus with Keio University and RIKEN on May 7, 2021.

◎ Other

• Established JAST Health Insurance Association on July 1, 2021.

• Completed the exercise of the second share acquisition right with a provision on exercise price revisions on September 22, 2021.

• Submitted and released a plan for listing on the Prime Market on November 24, 2021.

3. Fiscal Year Ending March 2022 Earnings Forecasts

(1) Full-year earnings forecasts

| FY 3/21 (Act.) | Ratio to Total Sales | FY 3/22 (Est.) | Ratio to Total Sales | YoY |

Sales | 18,789 | 100.0% | 19,500 | 100.0% | +3.8% |

Operating Income | 1,216 | 6.5% | 1,330 | 6.8% | +9.3% |

Ordinary Income | 1,310 | 7.0% | 1,360 | 7.0% | +3.8% |

Profit Attributable to Owners of Parent | 578 | 3.1% | 820 | 4.2% | +41.7% |

*Unit: Million yen

Sales and operating income are expected to grow 3.8% and 9.3%, respectively, from the previous term.

The company set the annual policy of “dominating the market by triggering innovation for the future society and creating high value-added businesses.” In the commissioned development business, which is their mainstay, the company will start up next-generation businesses while expanding profit. In its own brand business, including GAKUEN, medical big data, and BankNeo, the company will strive to improve the power of each brand and expand its market share, conduct R&D of new technologies and products, and launch new businesses. In addition, the company will keep forming alliances and engaging in globalization. For R&D, the company will work on both product development and creation of new business seeds, and generate synergy by sharing knowledge among brands and SI business.

As of the end of the first half, the company’s forecasts for the term ending March 2022 are unchanged, and it is expected that sales will grow 3.8% year on year to 19.5 billion yen and operating income will rise 9.3% year on year to 1,330 million yen. Although general administrative costs and expenses for promoting new businesses are projected to augment, the expansion of the software business, the improvement in profitability, and the brand business (GAKUEN, medical big data, and BankNeo) will contribute to the growth of sales and profit. In addition, the lineup of RX products in the GAKUEN business will be completed and R&D will decrease, resulting in a rise in profit. It is assumed that the ratio of operating income to sales will increase 0.3% year on year to 6.8%. Profit attributable to owners of parent is expected to grow, as there will be no longer impairment loss of goodwill or the like of AG, which is a consolidated subsidiary in Singapore.

The dividend plan has not been changed, and the company plans to pay a term-end dividend of 30 yen/share, up 2 yen/share from the previous term.

(2) Investment plans

| FY 3/18 | FY 3/19 | FY 3/20 | FY 3/21 | Forecast for FY 3/22 |

Software Business | 64 | 54 | 112 | 150 | Increase |

GAKUEN Business | 274 | 332 | 245 | 159 | Decrease |

Medical Big Data Business | 98 | 65 | 45 | 50 | Slight increase |

Other | 20 | 39 | 38 | 39 | Slight increase |

Total R&D Cost | 458 | 492 | 442 | 339 | Decrease |

*Unit: Million yen.

The R&D cost in the software business is forecast to augment from the previous term. For BankNeo, the company will invest in development of cloud services and new products, and for other software, the company will invest in face recognition solutions, new product development, and upgrade of AGHRM. The R&D cost in the GAKUEN business is projected to decline from the previous term. As the RX product lineup will be completed, the company will invest in the enrichment of peripheral solutions. The R&D cost in the medical big data business is forecast to increase slightly from the previous term. The company will invest for expanding data utilization services and strengthening BtoBtoC products. The R&D cost in other businesses, too, is projected to increase slightly. The company will invest in new product development, research on new technologies, and collaborative research on the novel coronavirus. Total R&D cost is forecast to decline from the previous term, but the number of investment projects is expected to increase. The company will allocate funds to the development of next-generation products and research on new technologies.

(3) Variation in backlog of orders

Term Business | Sep. 2018 | Mar. 2019 | Sep. 2019 | Mar. 2020 | Sep. 2020 | Mar. 2021 | Sep. 2021 |

Software | 2,066 | 2,455 | 2,336 | 2,706 | 2,749 | 2,635 | 2,822 |

GAKUEN | 1,346 | 1,084 | 1,079 | 1,109 | 2,559 | 1,994 | 2,164 |

System Sales | 302 | 435 | 457 | 472 | 556 | 440 | 559 |

Medical BD | 563 | 619 | 549 | 532 | 782 | 693 | 901 |

Total Backlog of Orders | 4,278 | 4,595 | 4,423 | 4,819 | 6,646 | 5,761 | 6,446 |

*Unit: Million yen

The backlog of orders as of the end of the previous term was dealt with, and sales grew in the first half, but the company still has abundant backlog of orders.

(4) Progress of results in the second quarter toward the full-year forecasts

| 2Q of FY 3/22 | Full-year Forecasts for FY 3/22 | Progress Rate |

Sales | 10,042 | 19,500 | 51.5% |

Operating Income | 992 | 1,330 | 74.6% |

Ordinary Income | 1,004 | 1,360 | 73.8% |

Quarterly (annual) Net Income | 686 | 820 | 83.7% |

*Unit: Million yen.

The progress rates of sales and incomes in the second quarter toward the full-year forecasts for the term ending March 2022 are over 50%. Considering that sales and incomes tend to be larger in the fourth quarter, it can be said that their business is performing quite healthily toward the full-year forecasts for the current term.

(5) Policy for expanding market capitalization

As Tokyo Stock Exchange, Inc. plans to change the market classification in April 2022, JAST applied for selection of the Prime Market on November 24, 2021. However, the market capitalization of tradable shares of the company did not satisfy the criteria for listing on the said market as of the reference date for transition (June 30, 2021), so the company produced a plan for compliance with the criteria for listing on the new market. From now on, the company will implement some measures for growing its business performance and improving share price evaluation indicators, with the aim of expanding the market capitalization of tradable shares. In the aspect of demand, the company will strive to increase EPS by growing its business performance (the goals in the mid-term plan for the tern ending March 2026: sales of 30 billion yen and an ordinary income of 3 billion yen) and improve share price evaluation indicators, including PER, through its dividend policy, enhanced IR activities, brand development strategy (PR activities), etc. In the aspect of supply, the company plans to increase the ratio of tradable shares by rising the supply of tradable shares. In addition, the company will consider the improvement of liquidity by converting non-tradable shares into tradable ones and splitting shares, and the establishment of a shareholder benefit program.

4. Mid-term Business Scheme

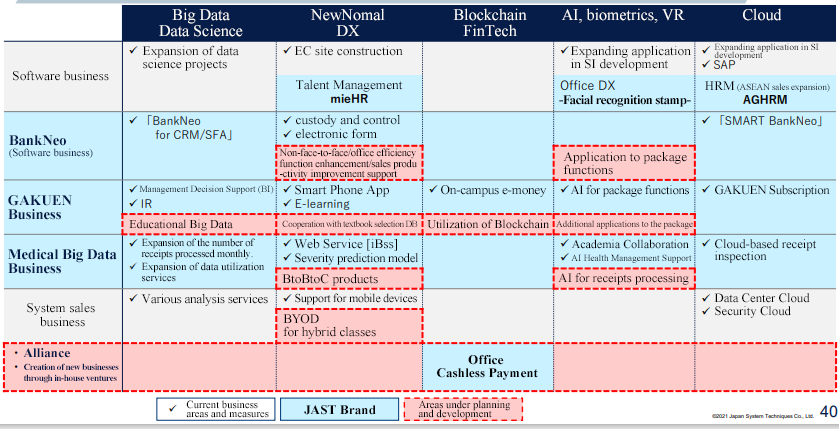

[JAST-style DX scheme]

The digital transformation (DX) in our society and lifestyles is progressing rapidly, to actualize the new normal through work innovation, change in values, BCP measures, etc., to respond to the changes in the capital market, including SDGs/TCFD/ESG and the changes in our mindsets about ideal enterprises, and to cope with the changes in the industry, including the expected problems in 2025, the establishment of the Digital Agency, and the enactment of related laws. Under these circumstances, the company will promote the following DX actively with the aim of improving market value and corporate identity.

JAST-style DX Scheme | |

Business DX | Business Administration DX |

-Software business: Co-creation DX -GAKUEN business: Educational DX -BankNeo business: Financial DX -Medical big data business: Medical DX -New/derivative business: Office DX, etc. | -Integration of in-house systems -Shift to paperless systems and W/F -Health-oriented management: system development and data utilization -Office DX and workstyle improvement for the new normal |

Market Value and CI | |

-Initiatives for SDGs/TCFD/ESG -Prime Market of Tokyo Stock Exchange -To evolve from a system integrator into a DX facilitator for “ushering in a new era” | |

[Software business]

In the software business, which is their mainstay, the company will redefine its business portfolio and promote Co-creation DX for ushering in a new era.

Solutions | To expand its products and market with next brand solutions, including mieHR and face recognition. |

SI | To expand the business domains with high added value, and apply the knowledge obtained through projects to solutions and services. |

Services | To operate business with high added value based on data science and consulting. |

[BankNeo (software business)]

To dominate the market with smart and niche solutions and evolve its service from customer relationship management (CRM) specializing in local banks, Shinkin banks, and credit unions into financial DX targeted at the entire market.

(Taken from the reference material for briefing financial results of the company)

[GAKUEN business]

With the brands the company has nurtured so far, the company will evolve from a pioneer in educational IT into an educational DX facilitator and make inroads into not only IT industries and markets, but also other ones.

(Taken from the reference material for briefing financial results of the company)

[Medical big data business]

With the system of processing an outstanding number of health insurance claims, the company will develop it into a pioneer in data health business. In addition, the company will evolve its service into a medical DX service by expanding business models, including alliances, industry-academia cooperation, and BtoC business.

(Taken from the reference material for briefing financial results of the company)

[Global strategy]

The company will apply ASEAN solutions broadly, energize synergy, and establish a foundation for further business expansion.

(Taken from the reference material for briefing financial results of the company)

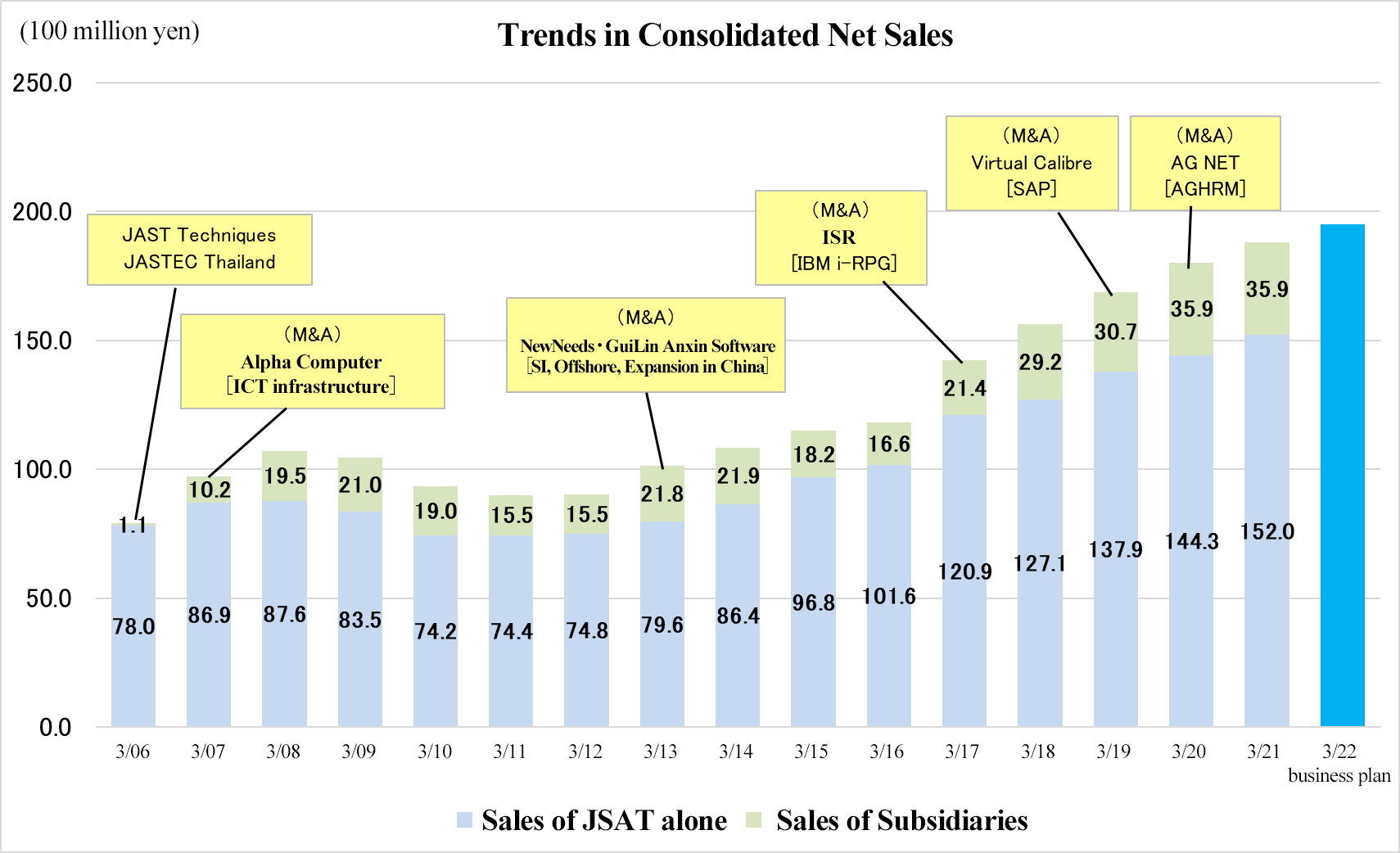

[M&A/group expansion strategies]

While improving its non-consolidated performance, the company has been expanding business results by conducting M&A. The company will keep creating new markets inside Japan by combining the IT technologies of JAST with other technologies in the same or other industry and implementing M&A inside and outside Japan for expanding its products and domains and exerting synergetic effects.

[Strategies for adapting to new fields and forming alliances]

The company will adapt to more fields by, for example, forming alliances.

(Taken from the reference material for briefing financial results of the company)

[ESG management and initiatives for SDGs]

The company implements effective measures while linking its business and management strategies with ESG and SDGs.

ESG Management | |||

Environment | Social | Governance | |

◆ Environmental measures in offices and data centers ◆ Reduction of environmental burdens through business operation improvement, including the shift to paperless systems, and DX | ◆ Contribution to social issues through product development ◆ Improvement in safety, productivity, and work balance through workstyle reform | ◆ Adaptation to the new corporate governance code ◆ Operation training, etc. for improving BCP ◆ To continue security measures, in-house education, and training | |

SDGs | |||

<All businesses of JAST>◆ To support the reform of the industrial structure with ICT ◆ To help establish co-creation and collaboration systems and reform ecosystems | Goal 9: Industry, innovation and infrastructure | ||

<GAKUEN business> ◆ Support for learning activities based on ICT and technologies ◆ Support for improvement in learning quality based on educational big data | Goal 9: Industry, innovation and infrastructure Goal 4: Quality education | ||

◆ Contribution to the prevention of aggravation and good medical practice ◆ Measures for tackling healthcare issues on infections, etc. through collaborative research | Goal 9: Industry, innovation and infrastructure Goal 3: Good health and well-being | ||

<Health-oriented management> ◆ To encourage employees to undertake regular/complete health checkups ◆ To eliminate prolonged work | Goal 8: Decent work and economic growth Goal 3: Good health and well-being | ||

<Office DX> ◆ Environmental measures in offices, data centers, etc. | Goal 13: Climate action Goal 7: Affordable and clean energy | ||

<HR strategy (growth strategy)> ◆ Enrichment of in-house training systems/operation of in-house certification ◆ To implement an internship program | Goal 4: Quality education | ||

<HR strategy (recruitment strategy)> ◆ Recruitment and fair treatment regardless of race, nationality, sex, etc. | Goal 5: Gender equality Goal 10: Reduced inequalities Goal 8: Decent work and economic growth | ||

5. Conclusions

In the first half of the term ending March 2022, operating income increased 969 million yen year on year, showing a surprising financial result. In the GAKUEN business, the healthy sales of the new series GAKUEN RX and GAKUEN UNIVERSAL PASSPORT RX of the highly profitable program products (PPs) for colleges contributed. In the medical big data business, the service of automatically checking health insurance claims recovered, and highly profitable services, including analysis and notification services, cloud services for managing health insurance claims for welfare, and support for insurers’ business operations, expanded, which contributed to the improvement in profitability. In the software business, which was sluggish in the previous term, the sales of the license of BankNeo, which is an information integration system for financial institutions, was favorable and the business in ASEAN countries grew rapidly. Under these circumstances, the progress rates of incomes in the first half toward the full-year forecasts exceed over 70%. In the third quarter, it is unlikely that the business environment will worsen suddenly. The business performance in the third quarter is noteworthy, to check how much the company will be able to increase profit to achieve the revised annual forecasts.

Japan System Techniques aims to increase the market capitalization of tradable shares for satisfying the criteria for getting listed on the Prime Market. In addition to the improvement in business performance, the company is expected to strengthen its dividend policy, IR activities, and brand development strategy for the purpose of improving share price evaluation indicators. In addition, the company is apparently planning to improve liquidity by converting non-tradable shares into tradable ones and splitting shares and develop a shareholder benefit system. It is noteworthy whether they will implement concrete measures for expanding the market capitalization speedily.

Furthermore, the company plans to announce a new mid-term management plan at the time of the session for briefing financial results in the current term. We look forward to seeing what kind of mid-term management plan will be produced. In the second half of the current term, the company is expected to start measures that allude to the next mid-term management plan. We would also like to pay attention to following news releases on M&A, alliances, etc.

<Reference: Regarding Corporate Governance>

◎ Organization type and the composition of directors and auditors

Organization type | Company with audit and supervisory board |

Directors | 8 directors, including 3 outside ones |

Auditors | 3 auditors, including 2 outside ones |

◎ Corporate Governance Report

Last update date: November 29, 2021

<Reasons for Non-compliance with the Principles of the Corporate Governance Code (Excerpts)>

Principles | Reasons for not implementing the principles |

【Principle 1-2. Exercise of shareholders’ rights at general shareholders’ meetings】 <Supplementary Principle 1-2-4> | Our company strives to foster an environment in which shareholders, including institutional and overseas investors, can easily exercise their voting rights. We began to allow electronic exercise of the voting rights via the internet in the general shareholders’ meeting held in June 2020. We currently use an electronic voting system for appointing a shareholder registry administrator and will discuss whether we should use an electronic voting rights exercise platform. We provide English translations of convocation notices in a narrow sense, and we will consider expanding the range of documents to be translated into English, such as reference material, considering the growing proportion of overseas investors in our company. We post English versions of the earnings briefings and major items to disclose on our website to facilitate overseas investors’ understanding of our business conditions. |

<Disclosure Based on the Principles of the Corporate Governance Code (Excerpts)>

Principles | Disclosure contents |

【Principle 1-4. Strategically held shares】 | Our policies on strategically held shares and standards for exercise of voting rights for the shares are as follows: -Policies on strategically held shares In principle, our company does not hold cross-held shares. When we hold shares on the grounds of business alliances and for other rational business reasons, we will regularly check that the shares are held according to the purpose. -Examination of the appropriateness of strategically held shares Once a year, our Board of Directors carefully discusses and examines whether the purpose of individual strategically held shares is appropriate and whether the benefits and risks of holding the shares are worth our company’s cost of capital. -Standards regarding exercise of the voting rights for strategically held shares Regarding our specific standards for exercise of the voting rights for strategically held shares, we appropriately exercise the voting rights with respect to each proposal by judging whether doing so will benefit all our shareholders while considering such factors as the business conditions of the company whose shares we strategically hold from the perspective of medium- and long-term improvement of the company’s value and in reference to proxy advisers’ standards. |

【Principle 2-4. Ensuring corporate diversity, including empowerment of women】 | <Supplementary principle 2-4-1> At the moment, our company has not set any target value for such items as assignment of workers to key positions; however, we have never discriminated on the grounds of race, nationality, or gender, or for any other reasons for recruiting, or we have not given our employees unequal treatment. As of the date when we submitted this report, mid-career hires accounted for about 17% of our employees in administrative positions, indicating our proactive employment of mid-career workers, and we believe that the percentage will continue to rise. Furthermore, we have developed internal programs and systems that enable diverse work styles, including a childcare leave program both male and female employees can take, company dormitories for those who have moved from afar to work at our company, a post-retirement employment system, and a re-employment system. We believe that these will contribute to ensuring diversity. |

<Supplementary principle 3-1-3> | Our company considers initiatives for sustainability are important business issue. In addition, we have formulated and published our SDGs Declaration to contribute to the attainment of the Sustainable Development Goals (SDGs) put forward by the United Nations. Pursuing our corporate philosophy: “Making society a better place by creating and providing new types of IT services,” our company is making efforts to realize our business concept of being beneficial to four parties, which are our customers, shareholders, employees, and society. We believe that the corporate philosophy and concept we have embraced will result in a sustainable society and our business of creating and providing Information and Communication Technology (ICT) services and solutions itself is contributing to settling social issues that are getting more complicated. In addition, our company has incorporated efforts at the seven principles and seven core subjects of an international standard ISO26000 through our regular business into business management as our approach to corporate social responsibility (CSR). We have also earned the certificate of ISO14001, another international standard related to environmental management systems, and turn the PDCA cycle continuously, through which we continue to address our business issues and make improvement about them. Please visit our website regarding the relationship between our key issues and the SDGs (https://www.jast.jp/corporate/sdgs/). At the same time, we endeavor to disclose and offer detailed information on such matters as investment in human capital and intellectual property in an understandable manner via our website and other means while keeping in mind the consistency with our business strategies and issues so that allocation of management resources, including the aforementioned, and implementation of the strategies regarding our business portfolio will contribute to our sustainable corporate growth. |

【Principle 5-1. Policies on constructive dialogue with shareholders】 | Our company strives to contribute to our sustainable business growth and medium- and long-term improvement in our corporate value through constructive dialogue with our shareholders. Regarding establishment of a system for facilitating constructive dialogue with shareholders, we accurately and certainly share information among the departments that support dialogue with shareholders by appointing officers who supervise the department in charge of investor relations and the corporate planning department to be officers supervising dialogue with shareholders. We also create opportunities in which our president himself can have direct dialogue with the shareholders through financial results briefings and explanatory meetings designed for individual investors. In addition, we endeavor to prevent insider information from being leaked during dialogue with the shareholders. |

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |