Bridge Report:(4371)Core Concept Technologies Fiscal Year Ended December 2021

CEO Takeshi Kaneko | Core Concept Technologies Inc. (4371) |

|

Company Information

Market | TSE Mothers (TSE Growth Market after April 4th, 2022) |

Industry | Information and telecommunications |

CEO | Takeshi Kaneko |

HQ Address | 11th floor of DaiyaGate Ikebukuro, 1-16-15 Minamiikebukuro, Toshima-ku, Tokyo |

Year-end | December |

Homepage | https://www.cct-inc.co.jp/ |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥9,050 | 3,903,500 shares | ¥35,326 million | 30.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

0.00 | - | ¥154.22 | 58.7x | ¥502.32 | 18.0x |

*The share price is the closing price on March 17. The figures are based on the results in the term ended December 2021.

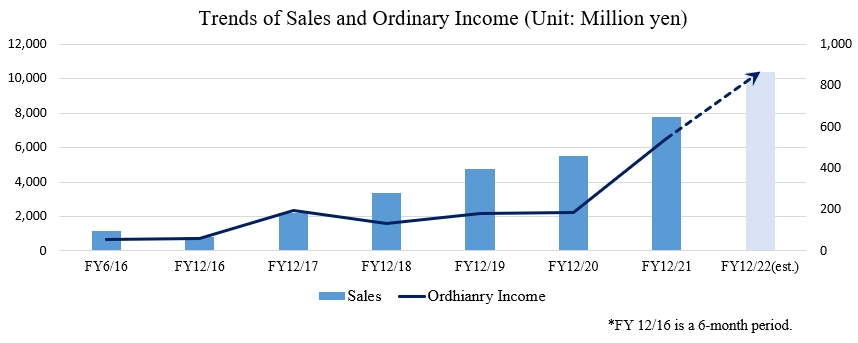

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Dec. 2018 (Act.) | 3,371 | 133 | 132 | 95 | 27.87 | 0.00 |

Dec. 2019 (Act.) | 4,766 | 165 | 183 | 117 | 34.32 | 0.00 |

Dec. 2020 (Act.) | 5,534 | 180 | 188 | 124 | 35.53 | 0.00 |

Dec. 2021 (Act.) | 7,801 | 546 | 546 | 410 | 112.17 | 0.00 |

Dec. 2022 (Forecast) | 10,400 | 852 | 868 | 602 | 154.22 | 0.00 |

*Unit: million-yen, yen. The forecast is from the company. A 1000-for-1 stock split was implemented on November 11, 2020. EPS adjusted retroactively.

This report includes the outline of Core Concept Technologies Inc., the trend of its business performance, and the interview with CEO Kaneko.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year Ended December 2021 Earnings Results

3. Fiscal Year Ending December 2022 Earnings Forecasts

4. Interview with CEO Kaneko

5. Our Views

<Reference: Regarding Corporate Governance>

Key Points

- Core Concept Technologies INC. (CCT) aims to become an IT vendor that overcomes structural problems in the domestic system integration industry through its “DX Support Service” and “IT Personnel Staffing Service”, creating the next generation of the IT industry, and provide new value. Its competitive advantages lie in its manufacturing knowledge, advanced IT technologies, proposal-giving capabilities for DX, and IT Personnel Staffing Support ability. The company aspires to grow through expansion into the industrial domain, horizontal development within the domain, and expanding the target area of development partners.

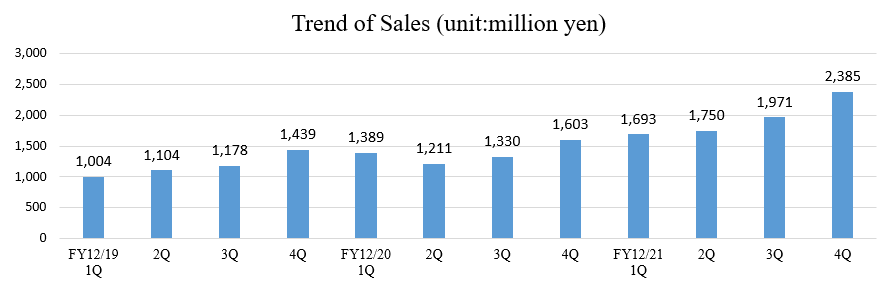

- Sales increased 41.0% year-on-year to 7,801 million yen in the term ended December 2021. The company recorded a significant increase in sales for both DX Support and IT Personnel Staffing Support. Although the effects of the COVID-19 crisis are still present, growth rate recovered significantly from the term ended December 2020, in which growth rate slowed down. Transactions with major companies with sales of 100 billion yen or over expanded due to proactive proposal-giving activities based on the track record of DX Support. The number of major client companies is on the rise due to the continuous expansion of transactions with existing customers. Operating income increased 202.1% year on year to 546 million yen. Costs such as outsourcing and personnel costs increased, too, but they were absorbed by increased sales, resulting in a significant improvement in profit.

- In the term ending December 2022, sales are expected to increase 33.3% year on year to 10.4 billion yen, and operating income is projected to rise 56.1% year on year to 852 million yen. The economic outlook remains uncertain, mainly due to the impact of the spread of the novel coronavirus variant on the domestic economy. However, both DX-related investment and IT personnel staffing demand is forecasted to remain on an upward trend. Although both costs of sales and SG&A will augment, it is expected to be absorbed by the increase in sales. Thus, profit is predicted to increase significantly this term as well. Both gross income margin and operating income margin are forecasted to rise.

- In the DX Support business, the company will expand sales to new customers in the manufacturing industry and increase the orders from super general contractors with which it has already started working with in the construction industry. In the IT Personnel Staffing Service the company will work to steadily expand transactions with existing major system integrators (SIer) and increase new customers. The company will also focus on hiring employees, mainly at the executive’s levels, and strengthening management and delivery systems. The recruitment cost is projected to be 200 million yen this term, while it was 47 million yen in the previous term.

- We asked CEO Takeshi Kaneko about the company's corporate mission, its competitive advantages, and his message to shareholders and investors. He said, "Although we are still a small company, we would like to contribute to our investors while fully establishing our presence and solving social issues. Through continuous dialogue, we would like to realize the vision we aim for together with all our shareholders and investors, and we would very much like to have your support "

- Almost all companies mention "promotion and introduction of DX" in their future initiatives. Yet, the specifics are vague, and the reality is that not many companies have a concrete image of what DX entails for their companies. Under such circumstances, as CEO Kaneko mentioned in his interview, "Human beings cannot make decisions about things that they cannot imagine." Thus, it can be said that the number of companies that are willing to spend a certain amount of money to introduce DX is still very small.

- In its growth strategy, the company is targeting the top 20% of the pyramid of each industry for the time being (in the automotive industry, approximately 800 companies fall into this category). Even the company that CEO Kaneko joined as a fresh graduate, a company that supports corporate transformation with strengths in the manufacturing industry and was one of the top-class companies in Japan, had only about 50 client companies. Therefore, there is a vast untapped market awaiting Core Concept Technologies. We would like to pay attention to the speed at which the company will support the promotion of DX in Japanese companies, armed with leveraging its strengths in its knowledge about manufacturing, cutting-edged IT technology, and proposal capabilities for DX.

1. Company Overview

Through the “DX Support Service” and the” IT Personnel Staffing Support Service”, the company aims to become an IT vendor that overcomes structural problems in the domestic system integration industry, create the next generation of the IT industry, and provide new value. Its strengths and competitive advantages lie in its manufacturing knowledge, advanced IT technology, proposal capabilities for DX, and IT personnel staffing support capabilities.

1-1 Corporate History Until Listing on the Tokyo Stock Exchange

Takeshi Kaneko (currently Representative Director, President, CEO of Core Concept Technologies Inc.), who was strongly attracted to the potential of IT, joined a venture company advocating the digital transformation of the manufacturing industry after studying information engineering in university. Although he was a new graduate, he was immediately assigned to several projects, and he thrived despite all the hard work he had to do.

After, he left the company to find another growth opportunity and started working as a consultant for another company, where he further refined his skills to support corporate transformation through IT.

Meanwhile, the venture company that he joined as a fresh graduate opt for civil rehabilitation in the wake of the bankruptcy of Lehman Brothers, the 2008 financial crisis.

Although it went through civil rehabilitation, he had a desire to utilize the knowledge and know-how the venture company possessed for corporate transformation in the manufacturing industry and to create new value in the world. Thus, in September 2009, together with several former colleagues, he established Core Concept Technologies Inc. to utilize IT technology to support customers' business reforms.

By repeating the daily actions of increasing contacts with clients and sincerely responding to orders and delivering results, the company steadily build up its track record, accumulate know-how on DX support in the manufacturing and construction industries, and build on its current business model.

The company was listed on the TSE Mothers in September 2021 as it achieved its business plan based on careful calculations every term and expanding its business.

Mr. Kaneko's plan when he took office as CEO in July 2015 was to get listed on the TSE Mothers with annual sales of 5 billion yen and 250 employees in November 2021. The company was able to be listed in September earlier than November, with 243 employees instead of 250, and sales were 5.5 billion yen to 5 billion yen planned.

1-2 Management Philosophy

With the following mission, vision, and action guidelines, Core Concept Technology aims to be an IT vendor that provides new value.

Mission | Create the Next-generation of the IT Industry |

Vision | Right AI, Right DX. As an IT company, we will fulfill a valuable role to support and promote our customers' true digitalization (DX) and strengthen their competitiveness in the coming AI era. |

Action Guidelines | Think Big, Act Together. Let's step out of the norms and stereotypes and freely develop ideas. If you have the will, you will discover the new value that the world demands.

We are supported by our customers, our employees, and many stakeholders. To translate this concept to our daily activities, we will carry on the spirit of "Act Together."

We work to realize the value of the idea and concepts that lead to the evolution of the world. |

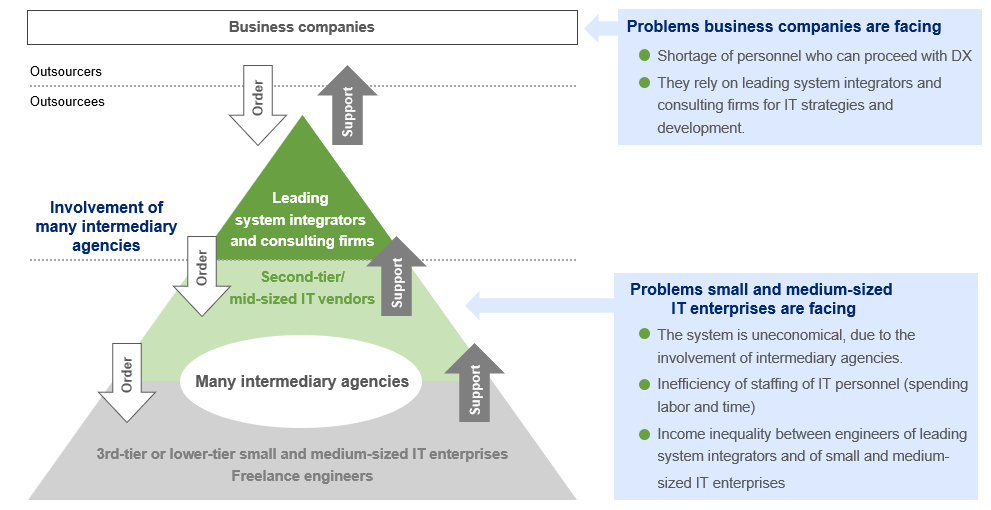

1-4 Business Environment and Industry Structure

The size of the Japanese private enterprises’ IT market has been around 12 to 13 trillion yen (according to the securities report of Core Concept Technologies Inc.).

Major system integrators receive most orders as primary contractors, followed by secondary contractors and tertiary contractors, which form a pyramid-type subcontracting structure.

Many small and medium-sized IT companies merely act as providers of human resources that play only a part in system development. As a result, the industry faces challenges such as “a non-economic situation due to intermediate margins”, “the inefficiency in regard to staffing IT personnel (time and labor intensive)” and “the income gap between engineers in major system integrators and small and medium-sized IT firms”.

In addition, as pointed out in the Ministry of Economy, Trade and Industry's "DX Report - Overcoming the IT System Challenges expected in 2025 and Full- Scale Deployment of DX" published in 2018, while promoting DX to maintain and strengthen competitiveness in all industries is an urgent issue, the human resources capable of promoting DX are not available. The concentration of major system integrators and consulting firms has created a serious business challenge in that operating companies are unable to independently and continuously carry out DX on their own, and are forced to rely on external IT vendors.

Moreover, according to the "Survey on IT Human Resource Supply and Demand (the Ministry of Economy, Trade and Industry, April 2019)", the supply-demand gap in IT human resource may widen to about 450,000 in 2030 in the medium model. Therefore, it is estimated that the capability of securing engineers will significantly affect the competitiveness of not only IT vendors, but also operating companies.

(Taken from the reference material of the company)

1-5 Business Description

(1) Mission

Core Concept Technology aims to be an IT vendor that overcomes the structural problems within the domestic system integration industry as described above, to create” the next generation of the IT industry” as stated in its mission, and to provide new value.

Specifically, the company has set the following goals:

| Provide comprehensive hands-on support ranging from defining an ideal post-DX state to technical verification, system construction, operation/maintenance and the development of in-house DX, so that operating companies will be able to conduct DX independently and continuously.Eliminate the multitiered subcontracting structure of the IT industry and make it possible for operating companies to staff IT personnel directly.This will expand opportunities for engineers in small and medium-sized IT companies and improve their compensation.To improve the competitiveness of our client companies and development supporting partners, and eventually the IT competitiveness of Japan as a whole. |

(2) Service Description

To achieve its vision, the company is engaged in a wide range of support services, including the realization of DX in the manufacturing and construction industries, by fusing consulting capabilities and AI technology, which is its fundamental focus. It also provides support for other industries such as wholesale, retail, and information and communication industries, as well as digitization support, salesforce customization support, and IT engineer staffing support.

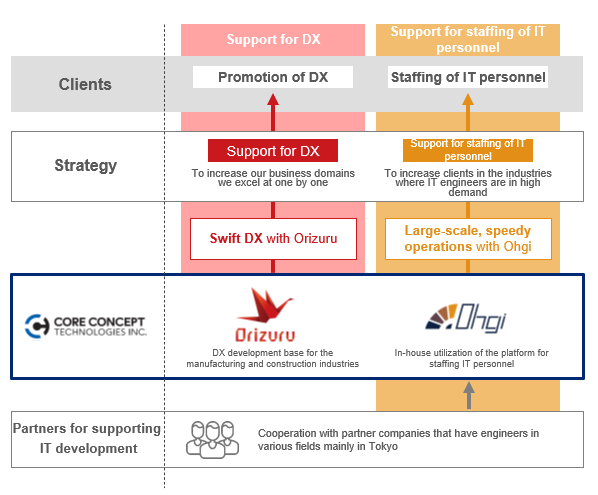

The company's business segment is DX-related business only. There are two core services: “DX Support Service” and “IT Personnel Staffing Support Service”.

(Taken from the reference material of the company)

① DX Support Service

CCT's original DX method, “CCT-DX Method” and the DX development platform and IoT/AI solution, “Orizuru”, which streamlines the construction and operation of a system, are used to support the DX of client companies.

Highly specialized consultants who have experience in various industries provide comprehensive support to customers, from the formulation of the ideal post-DX image to technical verification, system construction, operation/maintenance, and in-house DX.

◎ The original DX Realization method, “CCT-DX Method”

The company utilizes the CCT-DX Method, a proprietary method for providing hands-on support for DX for client companies.

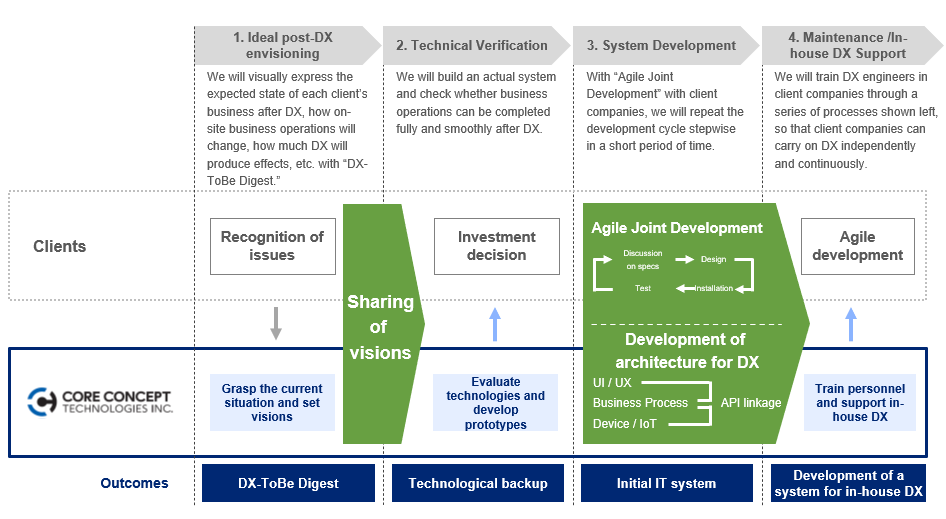

The “CCT-DX Method” consists of the following four steps. The outline and features of each are as follows.

① Ideal post-DX envisioning | (Outline) The grand design of DX is shown in the format of “DX-To Be Digest”.

(Features) Using easy-to-understand visuals to show what the business will look like after DX implementation, how the on-site work will change, and how effective it will be etc. |

② Technical Verification | (Outline) Verify whether their work can be fully achieved from the beginning to the end and whether everything will flow smoothly after DX.

(Features) While it is common to verify the concept theoretically or partially with a tool, CCT builds an actual system and verifies it with actual data. |

③ System Development | (Outline) In stages, CCT proceeds system development in an “agile format” that shortens the development period.

(Features) Since the development cycle is repeated in a short period together with the client company, it will also contribute to the training of the IT personnel of the client company with a view to subsequent in-house DX. |

④ Maintenance /In-house DX Support | (Outline) Establish a system that enables the client companies to conduct DX independently and continuously.

(Features) DX personnel of client companies are trained through a series of processes, and after in-house DX, the company's IT Personnel Staffing Support Service, “Ohgi” (see below), is used to support necessary IT engineer staffing tasks. By providing the opportunity to directly secure external IT engineers, the CCT believes that transactions in IT Personnel Staffing Support Service will expand. |

*DX examples

To order to produce and deliver a certain part in the manufacturing industry, drawings are drawn, the production method is considered while taking into account the factory operating conditions and other factors, followed by cost and delivery date estimation. Generally, this has been considered as a complicated task that can only be done by employees who have long experience in the field.

In a case where three companies place orders, even with experienced employees it will take several days or even one to two weeks to make a quotation through complicated work. Still, the company normally loses two out of the three orders. Hence, although these tasks are complicated, they are also extremely inefficient.

If the high-value-added tasks and decisions made by these experienced employees can be replaced by AI/algorithms, it will be possible to maintain and improve the ability to make quotations continuously and company-wide without relying on individuals.

Using the “CCT-DX Method” and the DX development platform ‘Orizuru (see below)” in the manufacturing and construction industries, the company can clearly show, using dynamic visuals, how the introduction of DX will change its business and operations and improve profitability at the sales stage before the contract is concluded. In addition, about 70% of the total process is already standardized and individual development is unnecessary, so the cost can be kept low, significantly lowering the hurdle for adopting DX. These features are highly appreciated, leading to a high probability of receiving orders.

CCT's direct DX support business ends when the client company succeeds in bringing its operations in-house. The company holds a different concept from the conventional IT vendor's idea of "locking in the customer company through operations and maintenance." The attitude that the company truly aims to enhance the competitiveness of client companies also leads to winning customers' trust, which is a significant differentiator from other companies.

(From the company's website)

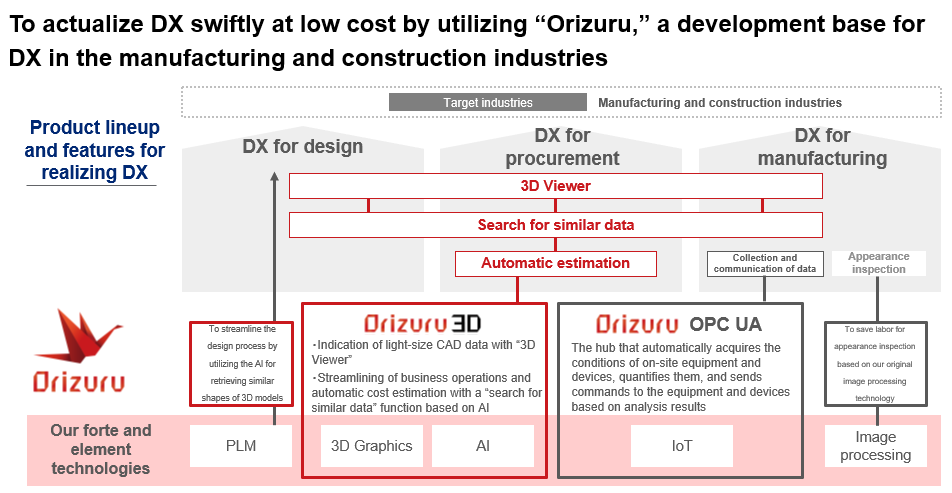

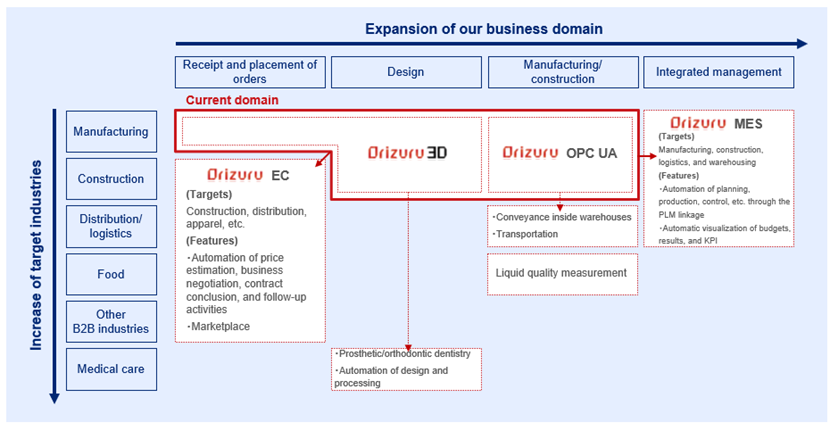

◎ DX development platform “Orizuru” for manufacturing and construction industries

“Orizuru (A paper folded crane in Japanese)” consists of a “DX development platform for the manufacturing industry” and a “BIM/CIM development platform for the construction industry” and has two distinctive function groups: “Orizuru OPC UA” and “Orizuru 3D”.

*” Orizuru OPC UA”

A communication platform that enables the collection of original data and automation of various processes necessary for DX realization. It serves as a hub that automatically acquires and numerically grasps the status of on-site facilities and equipment, and automatically issues instructions to facilities and equipment based on the analysis results.

*” Orizuru 3D”

Consisted of “Orizuru 3D Viewer” and “Orizuru 3D Search for Similarity Data”. “Orizuru 3D Viewer” can display 3D CAD data even on a standard browser of low-spec PCs. “Orizuru 3D Search for Similarity Data” uses AI to search for model similarities with high accuracy from vast amounts of past design data, and the know-how of experienced engineers (on quotations, manufacturing and defect information, etc.) to achieve operational efficiency and conduct automatic manufacturing cost assessments.

Having the standard functions of “Orizuru”, which are the “automation of data collection from facilities and equipment and command transmission” “visualization via 3D modeling” and “similarity search”, it can be customized to meet the needs of client companies, enabling them to achieve DX quickly and at low cost.

The company plans to gradually expand the standard functions required in other industries besides manufacturing and construction industries.

(From the reference material of the company)

◎ Client companies for DX Support Service

The company provides support to a wide range of industries, mainly manufacturing and construction.

(From the reference material of the company)

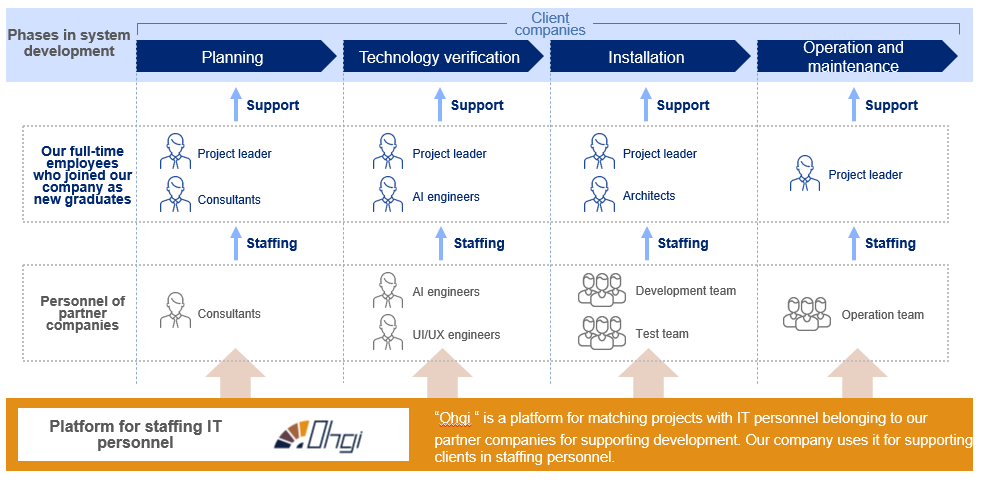

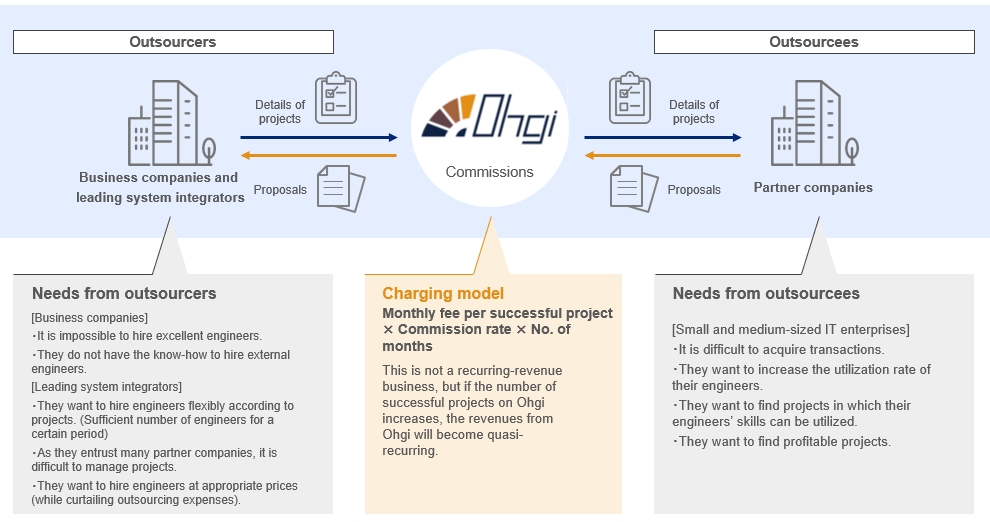

② IT Personnel Staffing Support Service utilizing “Ohgi (see below for detail)”

CCT provides a one-stop service by giving a wide range of IT personnel staffing support through its expertise in project promotion and team management, extensive IT development support partnerships, and “Ohgi”, the IT personnel staffing platform, to help HR departments, procurement departments, and projects at various operating companies, major system integrators, and consulting firms.

It secures the necessary IT personnel from partner companies for each phase of system development at the client company. The company’s professional employees serve as project leaders and provide support as a team. Core Concept Technology's self- developed IT personal staffing platform "Ohgi" is used for this staffing and matching process.

Currently, “Ohgi” is used only in-house, but the company intends to develop it into a platform that will contribute to its growth, in addition to eliminating the multiple contracting structure (see [1-6 Growth Strategy] for details).

(From the reference material of the company)

◎ Client companies for IT Personnel Staffing Support Service

The company supports the IT personal staffing for not only the operating companies but also the major system integrators.

(Taken from the reference material of the company)

◎ IT Development Support Partner

The company is collaborating with partner companies that have engineers in various fields.

To expand the number of excellent subcontractors, the company is constantly reviewing and updating its portfolio.

Currently, the focuses are on IT companies in Tokyo, but it will work to expand the area to the Tokyo metropolitan area and Osaka, Fukuoka, and Nagoya etc.

(3) Sales Channels

About 50% of the company’s orders come from first-tier contracting from operating companies, and about 50% come from second-tier contracting from the major system integrators and consulting firms. Because of its strength in knowledge of manufacturing and accumulated factory management and construction related IT technologies, the company is mainly a first-tier contractor for the manufacturing and construction industries, but it is also actively seeking second-tier contracts in order to expand its business domain and secure stable orders in other industries. Although the company sometimes competes with major system integrators and consulting firms for DX orders, Core Concept Technology is often recognized for its technological and IT personnel capabilities, so it is working to promote DX at client companies in cooperation with an awareness of “collaboration, not competition”.

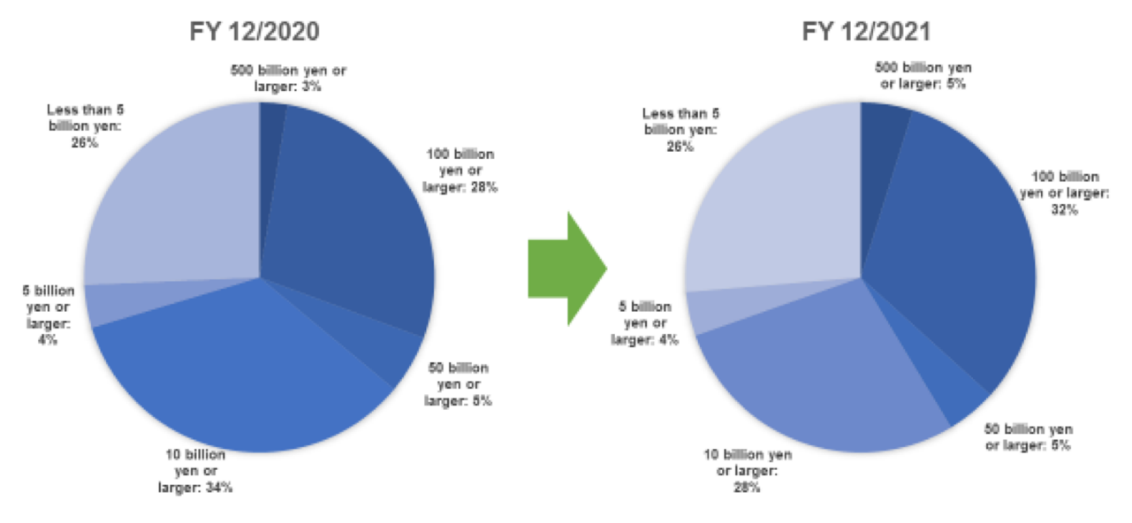

(4) Attributes of Client Companies

The sales composition of client companies by size is dominated by large and midsize companies, with approximately 40% having sales of 100 billion yen or more and approximately 30% having sales of 10 billion yen or more but less than 100 billion yen.

By end-user industry, the manufacturing, construction, wholesale, retail, and information and communication industries account for 70 to 80% of the total.

(From the reference material of the company)

1-6 Growth Strategy

(1) Three Strategies

Strategy 1: Provide a “Reproducible DX methodology and a DX functional platform” that allows client companies to realize in-house DX

Further refine the "CCT-DX Method," a methodology for the customers’ in-house DX realization.

In addition, by expanding the functions of “Orizuru”, which has DX functions for each industry, the DX support domains will be expanded from the current manufacturing and construction industries to distribution/logistics, medical, food, and other industries where horizontal development is easier.

(From the reference material of the company)

Strategy 2: Provide a system for operating companies to staff IT personnel directly

Through providing the IT personal staffing platform “Ohgi” to the client companies, CCT aims to uplift it to a widely used matching platform in the IT field.

After matching is settled on “Ohgi”, the company aims to establish a charging model which collects commission for each transaction, solving the issues for both parties.

◎ “Ohgi”(A folding fan in Japanese) ; A Platform for staffing IT personnel

A platform for matching the system development projects at client companies with IT personnel belonging to CCT's development support partners.

Originally, this system was used by CCT for its own purposes, but in order to make it usable to the external users as well, the company added a function for registering projects, a chat function for users to communicate with each other, and a search function for personnel and projects based on various criteria, and released it in February 2021 as a platform for staffing IT personnel.

In a multi-tiered contracting structure, the first-tier subcontractor requests personnel from the second-tier subcontractor, the second-tier subcontractor requests personnel from the third-tier subcontractor, and the third-tier subcontractor makes a proposal in response to the request. Next, moving back up from a third-tier contractor to a second-tier contractor and from them to a first contractor happens and this "matching" process requires an average of three days to one week.

On the other hand, with "Ohgi", this "matching" can be done in about 10 minutes, and the process can move immediately to the meeting coordination process. For clients, such as business corporations and leading system integrators, “Ohgi” significantly shortens the time required to place orders and reduces costs, while for small and medium-sized IT companies that receive orders, “Ohgi” provides the benefits of receiving orders and improving the utilization rate of engineers.

The company charges the amount of "(contracted monthly amount )x (commission rate) x (number of contract months)”. Although it is not a pure recurring-revenue business, as the number of contracts expands on “Ohgi”, it will yield quasi-recurring-revenues and generate stable income.

It is also a platform for realizing the elimination of the multi-tiered contracting structure which is a challenge for the domestic IT industry.

(From the reference material of the company)

Strategy 3: Expanding IT development support partnerships as a population of “Ohgi” registered companies

Expand the area of the IT development support partnerships which is currently concentrated in Tokyo, to the Tokyo metropolitan area such as Kanagawa, Saitama, and Chiba, and furthermore to Osaka, Fukuoka, Nagoya, and Sendai.

By implementing and pursuing synergies between these three strategies, the company believes that it can grow its sales to a 100-billion-yen scale.

1-7 Characteristics, Strengths, and Competitiveness

(1)Knowledge of manufacturing and advanced IT technology

Since its establishment, the company has deepened its knowledge of manufacturing, shape recognition and 3D graphics, analysis/simulation, AI, IoT, CAD/CAM, PLM, BIM/CIM, etc., in the manufacturing industry. It has hired and trained mainly IT engineers who have mastered advanced mathematics (linear algebra, geometry, etc.) and has endeavored to increase the number of engineers that possess manufacturing-related knowledge and advanced IT technology.

Developing a system that incorporates advanced AI and IoT technologies without understanding physical events and operations taking place in the manufacturing site would lead to problems such as not fitting in with the operations on the manufacturing floor or even generate unnecessary man-hours.

In addition, the smart factory solutions provided by European companies that have taken the lead in the so-called Industry 4.0 are limited in the scope of customization, making it impossible to automatically link with existing old equipment that exists in many Japanese manufacturing plants, or there is a drastic need to change the operations for adaptation. This means that the unique know-how of each company's experienced engineers cannot be utilized.

To address these challenges, the company believes that “using advanced IT technology is not the goal of DX, but the means to an end”. In addition, the company has a large number of engineers who are well versed in the manufacturing industry, which enables it to "make a clear distinction between operations that should use AI and those that should not", "utilize each company's unique know-how with AI, based on many years of experience" and "have the ability to adapt to each company's diverse range of manufacturer's equipment”. The company believes that these capabilities are competitive advantages.

This comprehensive capability of having the " knowledge of manufacturing” multiplied by “AI/IoT technology” multiplied by “ability to customize to each facility etc.” makes it possible to provide "highly effective smart factory solutions that can be used immediately onsite while inheriting each company's unique know- how”.

This advantage in manufacturing can also be utilized in the building and construction industry. Therefore BIM/CIM development is also a specialty of the company.

(2) Ability to make proposals for DX

As mentioned above, the CCT-DX Method and “Orizuru”, a DX development platform for the manufacturing and construction industries, enable the company to clearly demonstrate how the introduction of DX will change the company at the sales stage before concluding a contract. In addition, the implementation of the standardized functions of the DX development platform "Orizuru" also reduces the cost, which significantly lowers the hurdle for DX implementation.

The company's ability to make DX implementation proposals that are fully convincing to customers in terms of content and cost has been highly evaluated, leading to a high probability of orders. The company is the only one that can make such proposals, giving it a strong competitive advantage.

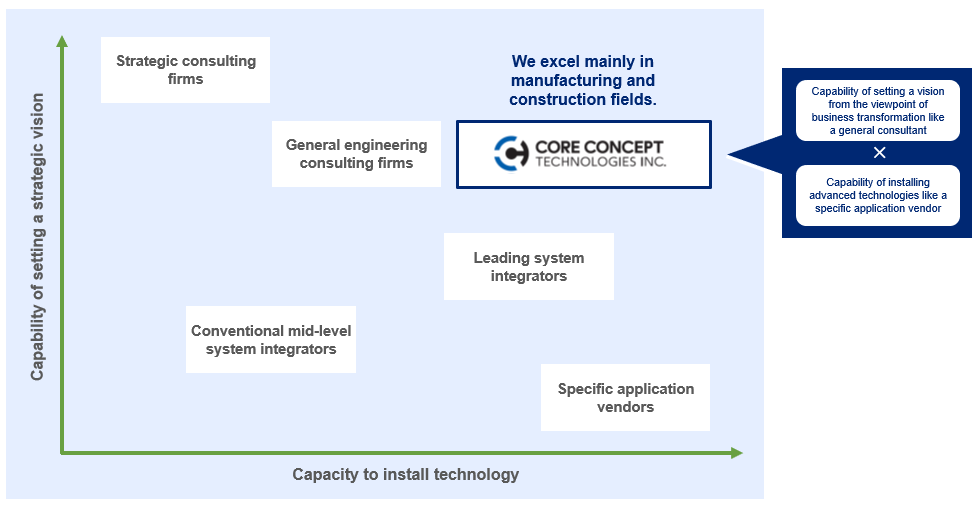

(3) Unique Positioning

The company has built a unique position by leveraging its "ability to create a vision from a business transformation perspective on par with general consulting firms" and "ability to implement with advanced technology on par with specific application vendors”.

(From the reference material of the company)

(4) IT Personnel Staffing Support

The company is actively utilizing a wide range of development support partners that it has built on its own. The ratio of outsourcing costs to sales is relatively high at around 55-60%. Utilizing external resources achieves business leverage and maintains financial resilience that can help avoid the risk of loss by reducing outsourcing costs in case of sales decline due to the business environment deteriorations.

2. Fiscal Year Ended December 2021 Earnings Results

2-1 Business Results

| FY12/21 | Ratio to Sales | FY12/22 | Ratio to Sales | YoY | Forecast Ratio |

Sales | 5,534 | 100.0% | 7,801 | 100.0% | +41.0% | +2% |

Gross Income | 1,119 | 20.2% | 1,797 | 23.0% | +60.6% | - |

SG&A | 938 | 17.0% | 1,250 | 16.0% | +33.3% | - |

Operating Income | 180 | 3.3% | 546 | 7.0% | +202.1% | +2.1% |

Ordinary Income | 188 | 3.4% | 546 | 7.0% | +189.7% | +2.1% |

Net Income | 124 | 2.3% | 410 | 5.3% | +228.8% | +11.5% |

*Unit: million yen. Forecast ratio is based on the revised forecasts announced in November 2021.

Significant increase in both sales and profit.

Sales increased 41.0% year on year to 7,801 million yen, with significant increase in sales for both DX Support and IT Personnel Staffing Support. Although the effects of COVID-19 still remains, the growth rate recovered significantly from the term ended December 2020, when the growth rate slowed down.

Transactions with major companies with sales of 100 billion yen or more expanded due to proactive proposal activities based on the DX Support performance. The number of major client companies is on the rise due to the continuous expansion of transactions with existing customers.

Operating income increased 202.1% year on year to 546 million yen. Costs such as outsourcing costs and personnel costs also increased, but they were absorbed by the increased sales, resulting in a significant improvement in profits.

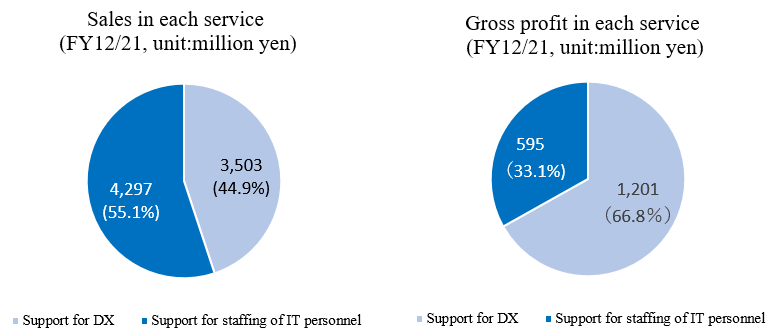

2-2 Trend by Service Domain

| FY12/20 | Ratio to Sales | FY12/21 | Ratio to Sales | YoY |

DX Support | 2,747 | 49.6% | 3,503 | 44.9% | +27.5% |

IT Personnel Staffing Support | 2,786 | 50.3% | 4,297 | 55.1% | +54.2% |

Sales | 5,534 | 100.0% | 7,801 | 100.0% | +41.0% |

DX Support | 765 | 27.8% | 1,201 | 34.3% | +57.0% |

IT Personnel Staffing Support | 354 | 12.7% | 595 | 13.8% | +68.1% |

Gross Income | 1,119 | 20.2% | 1,797 | 23.0% | +60.6% |

*Unit: million yen. The Ratio to sales of the gross income is gross income margin.

① DX Support

Sales and profit increased.

Proposals for companies that are proactive in DX-related investment have been successful, and the company received large orders from new customers. Gross income margin increased 6.5 points year on year.

② IT Personnel Staffing Support

Sales and profit increased.

In addition to expanding transactions with existing customers, the company increased new customers. Gross income margin increased 1.1 points year on year.

2-3 Financial Standing and Cash Flows

◎ Balance Sheet summary

| End of December 2020 | End of December 2021 | Increase/ decrease |

| End of December 2020 | End of December 2021 | Increase/ decrease |

Current Assets | 1,488 | 3,031 | +1,543 | Current Liabilities | 1,218 | 1,617 | +399 |

Cash and Deposits | 307 | 1,341 | +1,034 | Accounts Payable | 361 | 615 | +253 |

Accounts Receivable | 1,092 | 1,489 | +396 | Noncurrent Liabilities | 249 | 194 | -55 |

Noncurrent Assets | 696 | 741 | +45 | Total Liabilities | 1,467 | 1,811 | +343 |

Tangible Assets | 269 | 272 | +2 | Net Assets | 716 | 1,961 | +1,245 |

Intangible Assets | 72 | 59 | -13 | Retained Earnings | 566 | 977 | +410 |

Investments and Other Assets | 353 | 409 | +55 | Total Liabilities and Net Assets | 2,184 | 3,773 | +1,589 |

Total Assets | 2,184 | 3,773 | +1,589 | LT and ST Interest-Bearing Liabilities | 422 | 127 | -295 |

*Unit: million yen. LT and ST interest-bearing liabilities include lease liabilities

Total assets increased 1,589 million yen from the end of the previous term to 3,773 million yen due to a rise in cash and equivalents attributable to the capital increase. Total liabilities augmented 343 million yen from the end of the previous term to 1,811 million yen due to increased accounts payables and decreased long- and short-term interest-bearing liabilities.

Net assets rose 1,245 million yen from the end of the previous term to 1,961 million yen due to an increase in capital stock and capital reserve attributable to the capital increase and the rise in retained earnings.

Equity ratio rose 19.3% from the end of the previous term to 52.0%.

◎ Cash Flows

| FY12/20 | FY12/21 | Increase/decrease |

Operating CF | 136 | 581 | +445 |

Investing CF | -112 | -67 | +45 |

Free CF | 23 | 514 | +491 |

Financing CF | -103 | 519 | +622 |

Cash and Equivalents | 307 | 1,341 | +1,034 |

*Unit: million yen.

Financing CF turned positive due to the increase in revenues from the issuance of shares.

The cash position has improved.

2-4 Topics

◎ Implementing a stock split

On February 25, 2022, the company announced that it would implement a 2-for-1 stock split.

The reference date was March 31, 2022.

By lowering the amount per investment unit, the liquidity of the company's stocks will rise, increasing the market capitalization and market capitalization of the shares in circulation, thus the investor base will further expand.

3. Fiscal Year Ending December 2022 Earnings Forecasts

3-1 Earnings Forecasts

| FY 12/21 | Ratio to Sales | FY12/22 (Est.) | Ratio to Sales | YoY |

Sales | 7,801 | 100.0% | 10,400 | 100.0% | +33.3% |

Gross Income | 1,797 | 23.0% | 2,464 | 23.7% | +37.2% |

SG&A | 1,250 | 16.0% | 1,612 | 15.5% | +28.9% |

Operating Income | 546 | 7.0% | 852 | 8.2% | +56.1% |

Ordinary Income | 546 | 7.0% | 868 | 8.3% | +59.1% |

Net Income | 410 | 5.3% | 602 | 5.8% | +46.7% |

*Unit: million yen. The forecasted values were provided by the company. The SG&A of FY12/22 was calculated by Investment Bridge based on the reference material of the company.

Significant increase in sales and profits in this term as well.

Sales are expected to increase 33.3% year to year to 10.4 billion yen, and operating income is projected to rise 56.1% year to year to 852 million yen.

3-2 Major Efforts

In DX Support, the company will expand sales to new customers in the manufacturing industry, while for the construction industry it will seek to increase orders from super general contractors with which it has begun doing business.

In the IT Personnel Staffing Support Service, it will work to steadily expand transactions with existing major system integrators and explore new customers.

Focus on hiring employees, especially at the executive level, to strengthen management and delivery systems. The company plans to spend 200 million yen on recruitment this fiscal year, compared to 47 million yen in the previous fiscal year.

4. Interview with CEO Kaneko

We asked CEO Takeshi Kaneko about his company’s corporate mission, its competitive advantages, and to share his message toward shareholders and investors.

Q: “First, please share your company’s corporate mission, and corporate social responsibility, as well as your views on social issues that should be solved.”

I believe that digital technology is an indispensable and powerful tool for a company to achieve social recognition and survive.

We provide DX Support for this purpose but we also have to contribute to the improvement of the competitiveness of industries, rather than simply respond to our customers’ requests.

Our vision is "Right AI, Right DX," and we believe that AI is a tool and DX is corporate transformation itself, and we want to be an organization that can commit to and deliver results by skillfully using AI as a tool to promote DX. We provide DX support as part of our business to improve the additional value of the companies and the industry. Making this kind of contribution is the raison d'être of our company.

Another is a contribution to the IT industry workforce.

For consultants and engineers, it is important not only to satisfy customers, but also to feel a sense of personal growth and a solid sense of fulfillment. To achieve this, the IT industry itself needs to be even more attractive. At the same time, there are problems with the labor-intensive subcontracting pyramid structure, such as the inability to break out of subcontracting even after a certain age and career, and the low level of salaries. As the IT industry grows, this is becoming more and more pronounced, and we believe that these issues need to be resolved.

“IT Personnel Staffing Support Service” leads to the establishment of an environment where workers in the IT industry can contribute to the industry’s development with peace of mind.

We believe that our social raison d'etre is to improve the environment for not only our employees, but also for the employees of our partner companies who work with us, so that they can follow a solid career path and enrich their own lives.

As I mentioned earlier, we believe that the value we provide to the society is two-fold: in “DX support”, we help companies and industries improve their competitiveness, and in “IT Personnel Staffing Support”, we help create a brighter world and future for people involved in IT.

Q: “Please tell us what your action guideline means by “Think Big, Act Together”. I would also like to ask how the CEO's philosophy, mission, and action guidelines are being disseminated to the current 240 employees.”

“Think Big" is exactly what DX is all about: taking away common sense and stereotypes, and finding new value by freely throwing ideas at them.

“Act Together” is a mindset to recognize that we are all supported by our customers, employees, and many stakeholders, and to link the concept to our day-to-day behavior.

These two are our action guideline to create a better future.

I believe that human beings can only physically realize within the limits of what we can imagine for ourselves. Therefore, if we want to produce something better, our vision must always be big. This is "Think Big.

However, it takes a certain amount of effort and time to realize the concept. We are a venture company, not a large organization, so we are at a disadvantage in this respect. But as a group that is always striving for the better, we should fight not individually but as a group, to create a future that resonates with our customers, gain the support of our partner companies. Recently we have even involved our competitors and are trying to make it happen. This is "Act Together”.

We have taken "Think Big, Act Together" one step further and incorporated it into our daily activities in our "CCT WAY.

The "CCT WAY" defines three keywords: "Ownership", "Customer's Rule" and "Logic Passion", and we are working to disseminate them to all employees through group training and other means.

“Ownership" encourages proactive behavior, in which you are the one who comes up with the ideas and takes the initiative when visiting a client, not the one who is at the beck and call of the client. At the same time, it embodies the meaning of facing everything as your own issue.

On the other hand, the "customer's rule" is important because the downside of this is that it can be intrusive. It is our customers who decide and evaluate. In other words, we educate employees that it is our customers who set rules, and help them acknowledge that customer-oriented approach is the starting point. Customers decide, but we remain proactive, not passive. These are the two elements that establish our guideline for the behavior of individuals.

While we are a company pursuing results as a group with “Act Together,” we need to be aware of our own mindset in the group as well.

In order for a third party to resonate with the message, it must be conveyed in a logical manner so that the intent is understood. However, even if the intention is understood, each person has his or her own position. The president, the administrative manager, and the sales manager may differ in their judgment as to whether the same content is acceptable or not. Although we communicate logically, it is also necessary in a group to understand the feelings and position of the other party and to make slight modifications to the content of the message and make suggestions. This is "logic passion”.

“Ownership”, “Customers Rule” and “Logic Passion”. We stand on these three elements to enhance employees’ behaviors with “Think Big, Act Together” in mind.

We formulated “Think Big, Act Together” in the third year after our company’s establishment, with the aim of becoming a respectable company with IPO in sight, since our company was now on a stable track.

The “CCT WAY” was established about three years ago. Since the number of younger employees has increased considerably, we decided that it was necessary to break down the "Think Big, Act Together" concept even further and incorporate it into our daily business activities.

Q: “Next, please share your company’s strengths and competitive advantages.”

What our customers highly appreciate is our ability to show a clear vision in the negotiation phase of where they will be in three years with our DX support, using dynamic visual materials before they sign a contract.

DX is an innovative solution on something that is not currently available for each customer. I don’t think people can decide on something they can’t even imagine. Indeed, a picture is worth a thousand words.

In addition, today, when it comes to proposals, the appealing method is generally paper-based explanations, but this is also an extremely poor and weak method from the perspective of an imperfect reality; i.e., the future. Human beings will smile when they experience something with their five senses and realize how good it is, and they will decide to implement it. To get people to expect something that is not yet a reality, it is important to make efforts to convey the texture in a way that is easy to understand, and I believe that visual appeal is the most important way to do this.

Run the actual system, use actual data, and show it at the pre-contracting phase. Our company continuously make these efforts more than any other companies.

If you can embody in front what it will look like in three years from now, before signing the contract, it allows you to make a specific decision to whether what you see is what you want or need.

We present the system and explain that introducing DX in this way will solve these problems, change the current operations to this form, and increase profit.

If you are currently in charge of the practice, you will have some idea of what you are looking for, and the feedback we receive from you will change.

Once we present precise information to customers, the responses will be something like “I didn’t know this can be done,” or “This is the challenge we are facing, and only veterans have the skill to provide estimates” or “We are constantly consulting with factories to determine production plans, but would your system allow us to do this, too?”. From here we can identify their specific needs in what they have been wanting to do but have not yet realized.

Then the contours of the issue to be solved can be drawn out from the relatively initial meeting. We then make a proposal to solve the current issue using our own products.

Based on our accumulated experience, approximately 70% of the functions implemented as standard features in our product "Orizuru" can be realized without any additional burden or effort on the customer.

For the remaining 30%which is the portion that needs to be customized for the customer, we propose a cost for the difference in man-hours. The customer already has some idea of what the finished product will look like, so they can make a decision based on their own understanding of their needs.

We are the only company capable of proposing DX at a cost and content that is satisfactory to our clients, using our proprietary DX implementation method "CCT-DX Method" and DX development platform "Orizuru". This style of proposal fits the current times and leads to a high percentage of orders.

We believe this is our greatest competitive advantage.

Q: “Next, I would like to ask you about your company’s growth strategy. What is the most important points in your quest for significant future sales?”

First, DX Support Service will be reconfigured and expanded by industry.

We will start with projects that are industry-specific, such as Manufacturing DX, Construction DX, Distribution DX and so on, after a certain number of records have been established for each industry. By reconfiguring “Orizuru” into standard functions specific to each industry, horizontal development within that industry will proceed smoothly and quickly.

Targeting the top 20% of the pyramid. The top 20% in the automobile industry in Japan for example, has about 800 companies.

The top 20% of the construction industry has about 200 general contractors under the six super general contractors that can become our target.

In the distribution industry, there are four companies with sales of over 1 trillion yen such as Yamato Transport and Sagawa Express, and dozens of companies with sales of hundreds of billions of yen.

The next step is to expand the scope of the industry, such as medical care, while promoting horizontal development within the industry for those where cases that have been established to a certain extent. By overlapping these two axes, we can increase the scale of our business by dozens of times.

For the IT Personnel Staffing Support, we will promote our area strategy. We now cover about half of Tokyo, but we haven’t expanded into the Tokyo Metropolitan area yet. For other regions, we have bases in Osaka and Fukuoka, but have not yet started building an IT personnel network there.

Nevertheless, we have been able to attract a large number of personnel in our current situation. Half of Tokyo still remains. There are also large markets in the Tokyo metropolitan area, including Kanagawa, Saitama, and Chiba. Osaka, Fukuoka, and Nagoya are next. These areas account for roughly 50% of Japan's total market. After that are Sendai, Hokkaido, and Hiroshima.

With this area expansion strategy, we will also expand our engineer network dozens of times over from the current level. In the IT staffing business, we will also seek to monetize the staffing platform "Ohgi”.

DX is growing gross through a two-axis strategy of industrial area expansion and horizontal expansion, while the IT personnel network is expanding its area nationwide. Since each has the potential of several dozen times, and furthermore, the projections are reasonable and consistent, we believe that there is an extremely large room for significant sales expansion.

Q: “Finally, what is your message to your shareholders and investors.”

The word “Together” in the “Think Big, Act Together” concept I mentioned earlier, certainly includes stakeholders such as shareholders and investors.

We will always manage our business with our investors in mind. We also want to be a company that clearly understands and recognizes the dynamics and rules of capitalism, and utilize it to grow our company and contribute to the society. To this end, we recognize that the dialogue with our shareholders and investors are our extremely important initiative.

We are still a small company, but we will make every effort to be of service to our investors, while fully demonstrating our presence and solving social issues.

Through close dialogues, we strive to realize our vision together with our shareholders and investors, and we hope you will support us in this endeavor.

5. Our Views

In order to write the Bridge Report, we refer to the explanatory documents of various companies, and almost all of them mention the promotion and adoption of DX in addition to M&A strategies when describing their future measures. This is natural as it is pointed out in the report of the Ministry of Economy, Trade and Industry that promoting DX to maintain and strengthen competitiveness in all industries is an urgent issue. Yet, when it comes to what to do specifically, there are many cases where even the outline is ambiguous and cannot be understood from the outside. It seems that there are not many companies that can concretely imagine what kind of DX is necessary for their companies.

Under such circumstances, as CEO Kaneko mentioned in his interview, " People cannot decide on something they can’t even imagine " Thus, only a few companies are willing to pay the cost to venture into DX.

In its growth strategy, the company is targeting the top 20% of the pyramids of each industry for the foreseeable future (in the automotive industry, about 800 companies fall into this category). Even the company CEO Kaneko joined as a fresh graduate, which was supporting company innovation with their strength in the manufacturing industry and was one of the top-class companies in Japan, had about 50 client companies, meaning that there is a vast untapped market awaiting Core Concept Technologies.

We would like to pay attention to how the company will leverage its strengths in "knowledge of manufacturing and cutting-edge IT technology" and "ability to make proposals for DX " to help Japanese companies to achieve their business goals at any speed.

<Reference: Regarding Corporate Governance>

◎ Organization Type and the Composition of Directors and Auditors

Organization type | Company with an audit and supervisory committee |

Directors | 8 directors, including 3 outside ones |

◎ Corporate Governance Report

Updated on September 22, 2021

<Basic Policy>

Our basic policy is "to aim for sustainable growth and improvement of corporate value over the medium to long term, and maximize the interests of shareholders," while understanding the importance of compliance. We are striving to strengthen corporate governance as we recognize that it is essential to put importance on the rights of shareholders, live up to public trust, and achieve sustainable growth and development.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Our company follows all the principles of the corporate governance code.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |