Bridge Report:(4371)Core Concept Technologies the second quarter of the fiscal year ending December 2022

CEO Takeshi Kaneko | Core Concept Technologies Inc. (4371) |

|

Company Information

Market | TSE Growth Market |

Industry | Information and telecommunications |

CEO | Takeshi Kaneko |

HQ Address | 11th floor of DaiyaGate Ikebukuro, 1-16-15 Minamiikebukuro, Toshima-ku, Tokyo |

Year-end | December |

Homepage |

Stock Information

Share Price | Share Outstanding | Market Cap. | ROE (Act.) | Trading Unit | |

¥7,980 | 8,007,000 shares | ¥63,895 million | 30.7% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

0.00 | - | ¥98.33 | 81.2x | ¥502.32 | 31.8x |

*The share price is the closing price on August 25. Share outstanding, DPS, and EPS are from the Summary of Non-Consolidated Financial Results for the Second Quarter of the Fiscal Year Ending December 31, 2022. ROE and BPS are from the previous period. A 2-for-1 stock split was implemented on April 1, 2022. This stock split was taken into account for PBR.

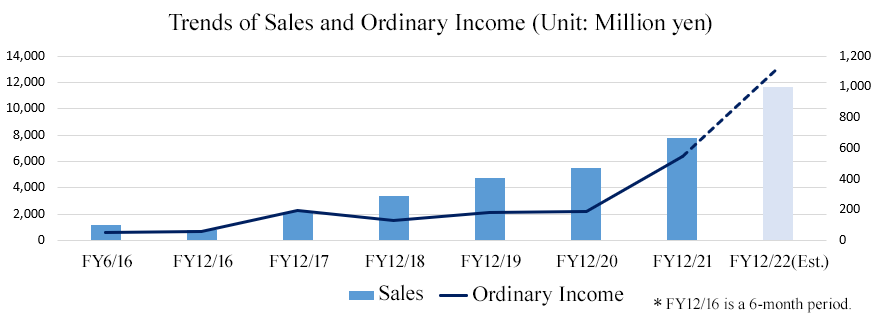

Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Dec. 2018 (Act.) | 3,371 | 133 | 132 | 95 | 13.93 | 0.00 |

Dec. 2019 (Act.) | 4,766 | 165 | 183 | 117 | 17.16 | 0.00 |

Dec. 2020 (Act.) | 5,534 | 180 | 188 | 124 | 17.76 | 0.00 |

Dec. 2021 (Act.) | 7,801 | 546 | 546 | 410 | 56.08 | 0.00 |

Dec. 2022 (Forecast) | 11,622 | 1,105 | 1,126 | 781 | 98.33 | 0.00 |

*Unit: Million-yen, yen. The forecast is from the company. A 1,000-for-1 stock split was implemented on November 11, 2020, and a 2-for-1 stock split was implemented on April 1, 2022. EPS is adjusted retroactively.

This report includes the earnings results of the second quarter of the fiscal year ending December 2022 of Core Concept Technologies Inc.

Table of Contents

Key Points

1. Company Overview

2. Earnings Results of the Second Quarter of the Fiscal Year Ending December 2022

3. Fiscal Year Ending December 2022 Earnings Forecasts

4. Our Views

<Reference: Regarding Corporate Governance>

Key Points

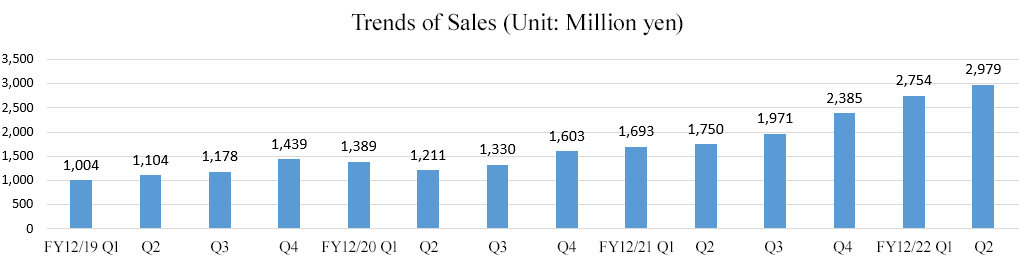

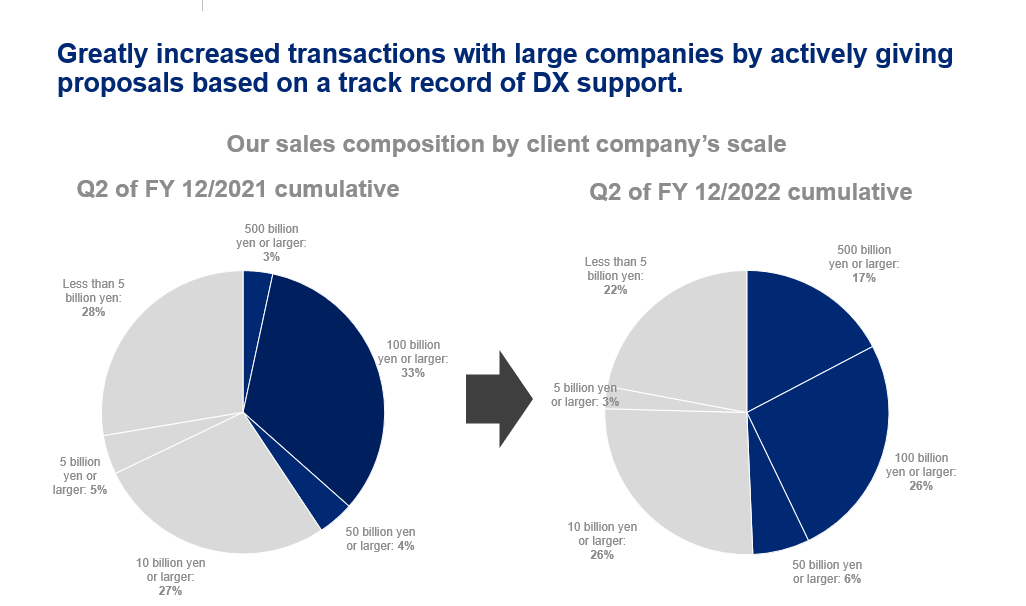

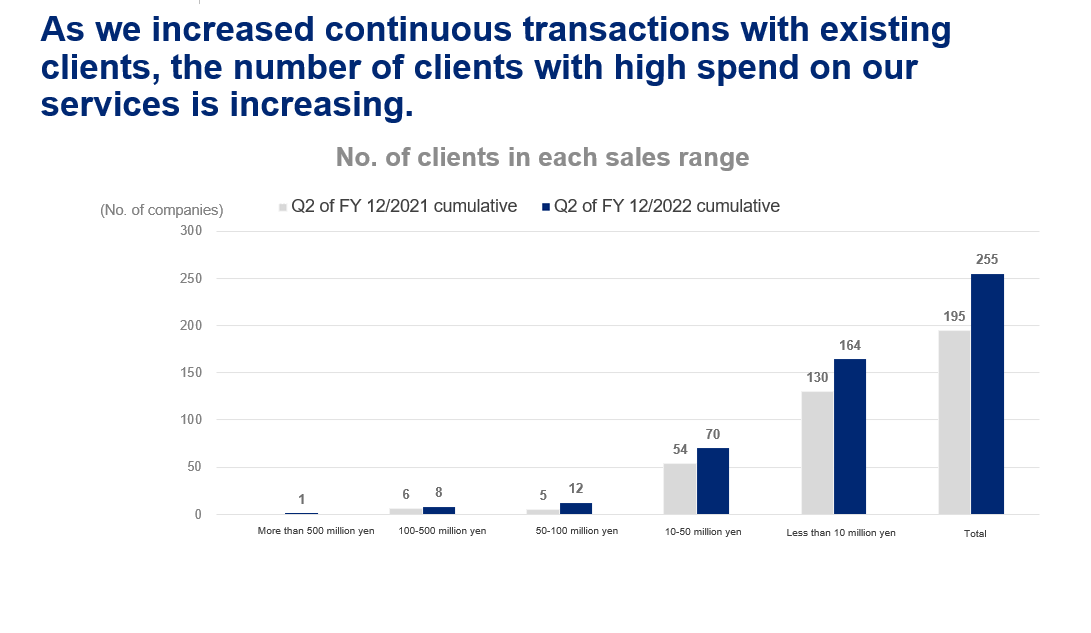

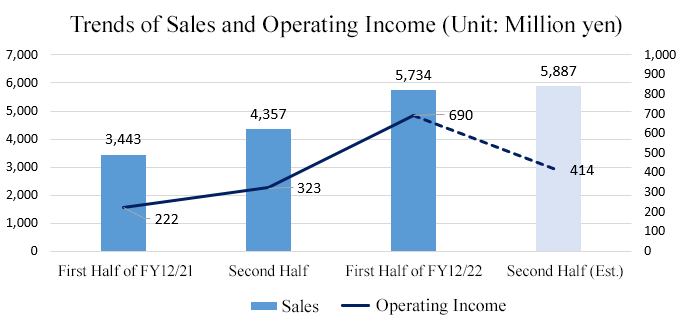

- Sales increased 66.5% year-on-year to 5,734 million yen in the second quarter of term ending December 2022. The company recorded a significant increase in sales for both Support for DX and Support for Staffing of IT Personnel as the company steadily met demand. Transactions with major companies with sales of 50 billion yen or over expanded due to proactive proposal-giving activities based on the track record of DX support. The number of major client companies is on the rise due to the continuous expansion of transactions with existing customers. Operating income increased 209.9% year-on-year to 690 million yen. Costs such as outsourcing and personnel costs increased, too, but they were offset by increased sales, resulting in a significant improvement in profit.

- The company upwardly revised its full-year earnings forecasts. For the term ending December 2022, the company forecasts a 49.0% year-on-year increase in sales to 11,622 million yen and a 102.3% year-on-year increase in operating income to 1,105 million yen. Orders from major customers such as super general contractors and major system integrators have been expanding at a faster pace than planned through the first half, and this trend is expected to continue for the full year. Due to cost augmentation arising from enhanced recruitment and the impact of profit margin fluctuations caused by the phases of large-scale projects, the company expects sales to increase, but profit to drop in the second half.

1. Company Overview

With a mission to create the “next generation of the IT industry,” the company aims to become an IT vendor that provides new value by helping operating companies realize DX by themselves through its “Support for DX” and by overcoming structural problems in the domestic system integration industry through its “Support for Staffing of IT Personnel.” Its strengths and competitive advantages lie in its manufacturing knowledge, advanced IT technology, proposal capabilities for DX and IT development support partners with whom it has built strong relationships of trust. In the future, the company aspires to grow through expansion into the industrial domain, horizontal development within the domain, and expanding the target area of IT development support partners.

1-1 Corporate History Until Listing on the Tokyo Stock Exchange

Takeshi Kaneko (currently Representative Director, President, CEO of Core Concept Technologies Inc.), who was strongly attracted to the potential of IT, joined a venture company advocating the digital transformation of the manufacturing industry after studying information engineering in university. Although he was a new graduate, he was immediately assigned to several projects, and he thrived despite all the hard work he had to do.

Afterwards, he left the company to find another growth opportunity and started working as a consultant for another company, where he further refined his skills to support corporate transformation through IT.

Meanwhile, the venture company that he joined as a fresh graduate opted for civil rehabilitation in the wake of the bankruptcy of Lehman Brothers, the 2008 financial crisis.

Although it went through civil rehabilitation, he had a desire to utilize the knowledge and know-how the venture company possessed for corporate transformation in the manufacturing industry and to create new value in the world. Thus, in September 2009, together with several former colleagues, he established Core Concept Technologies Inc. to utilize IT technology to support customers’ business reforms.

By repeating the daily actions of increasing contacts with clients and sincerely responding to orders and delivering results, the company steadily has built up its track record, accumulated know-how on DX support in the manufacturing and construction industries, and built its current business model.

The company was listed on the TSE Mothers in September 2021 as it achieved its business plan based on careful calculations every term and expanded its business.

Mr. Kaneko’s plan when he took office as CEO in July 2015 was to get listed on the TSE Mothers with annual sales of 5 billion yen and 250 employees in November 2021. The company was able to be listed in September earlier than November, with 243 employees instead of 250, and sales were 5.5 billion yen compared to planned 5 billion yen.

In April 2022, the company got listed on the Growth Market of TSE, due to market reorganization.

1-2 Management Philosophy

Mission | Create the Next-generation of the IT Industry |

Vision | Right AI, Right DX. As an IT company, we will fulfill a valuable role to support and promote our customers’ true digitalization (DX) and strengthen their competitiveness in the coming AI era. |

Action Guidelines | Think Big, Act Together. Let’s step out of the norms and stereotypes and freely develop ideas. If you have the will, you will discover the new value that the world demands.

We are supported by our customers, our employees, and many stakeholders. To translate this concept to our daily activities, we will carry on the spirit of “Act Together.”

We work to realize the value of the idea and concepts that lead to the evolution of the world. |

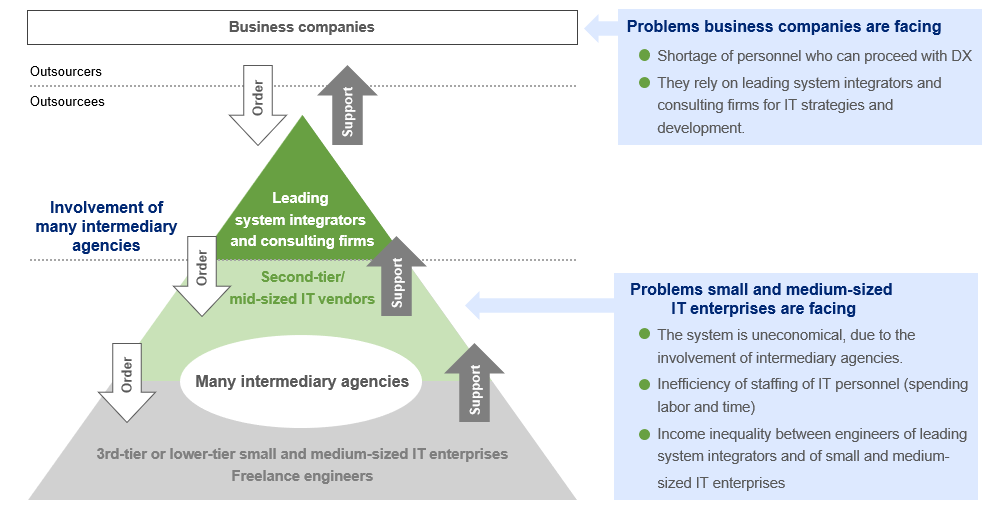

1-3 Business Environment and Industry Structure

The size of IT market of the Japanese private enterprises has been around 12 to 13 trillion yen (according to the securities report of Core Concept Technologies Inc.).

In addition, as pointed out in the Ministry of Economy, Trade and Industry’s “DX Report-Overcoming the IT System Challenges Expected in 2025 and Full- Scale Deployment of DX” published in 2018, while promoting DX to maintain and strengthen competitiveness in all industries is an urgent issue, the human resources capable of promoting DX are not available. The concentration of IT engineers in major system integrators and consulting firms has created a serious business challenge in that operating companies are unable to independently and continuously carry out DX on their own, and are forced to rely on external IT vendors.

In this situation, major system integrators receive most IT-related orders as primary contractors, followed by secondary contractors and tertiary contractors, which form a pyramid-type subcontracting structure. Many small and medium-sized IT companies merely act as providers of human resources that play only a part in system development. As a result, the industry is facing challenges such as “a non-economic situation due to intermediate margins,” “the inefficiency in regard to staffing IT personnel (time and labor intensive)” and “the income gap between engineers in major system integrators and small and medium-sized IT companies.”

Moreover, according to the “Survey on IT Human Resource Supply and Demand (the Ministry of Economy, Trade and Industry, April 2019)”, the supply-demand gap in IT human resource may widen to about 450,000 in 2030 in the medium model. Therefore, it is estimated that the capability of securing engineers will significantly affect the competitiveness of not only IT vendors, but also operating companies.

(Taken from the reference material of the company)

1-4 Business Description

(1) Mission

(1) | Provide comprehensive hands-on support ranging from defining an ideal post-DX state to technical verification, system construction, operation/maintenance and the development of in-house DX, so that operating companies will be able to conduct DX independently and continuously. |

(2) | Eliminate the multitiered subcontracting structure of the IT industry and make it possible for operating companies to staff IT personnel directly. |

(3) | This will expand opportunities for engineers in small and medium-sized IT companies and improve their compensation. |

(4) | To improve the competitiveness of our client companies and development support partners, and eventually the IT competitiveness of Japan as a whole. |

(2) Service Description

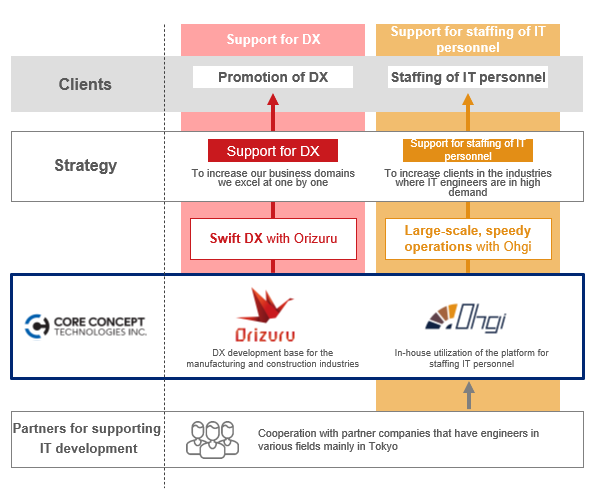

The company offers two services: “Support for DX” and “Support for Staffing of IT Personnel.”

|

|

(Taken from the reference material of the company)

1. Support for DX

CCT’s original DX realization method, “CCT-DX Method (mentioned later)” and the DX development platform, “Orizuru (mentioned later),” which streamlines the construction and operation of a system, are used to support the DX of client companies.

Highly specialized consultants provide comprehensive hands-on support ranging from defining an ideal post-DX state to technical verification, system construction, operation/maintenance and the development of in-house DX. The company’s distinctive feature is that it provides support all processes including in-house DX.

Using the “CCT-DX Method” and the “Orizuru,” the company can clearly show, using dynamic visuals, how the introduction of DX will change its business and operations and improve profitability at the sales stage. In addition, about 70% of the total process is already standardized, so the cost can be kept low, significantly lowering the hurdle for adopting DX. These features are highly appreciated, leading to a high probability of receiving orders.

CCT’s direct DX support business ends when the client company succeeds in bringing its operations in-house. The company holds a different concept of “keeping client companies through operations and maintenance,” which is a different idea of the conventional IT vendors. The attitude that the company truly aims to enhance the competitiveness of client companies also leads to winning customers’ trust, which is a significant differentiator from other companies.

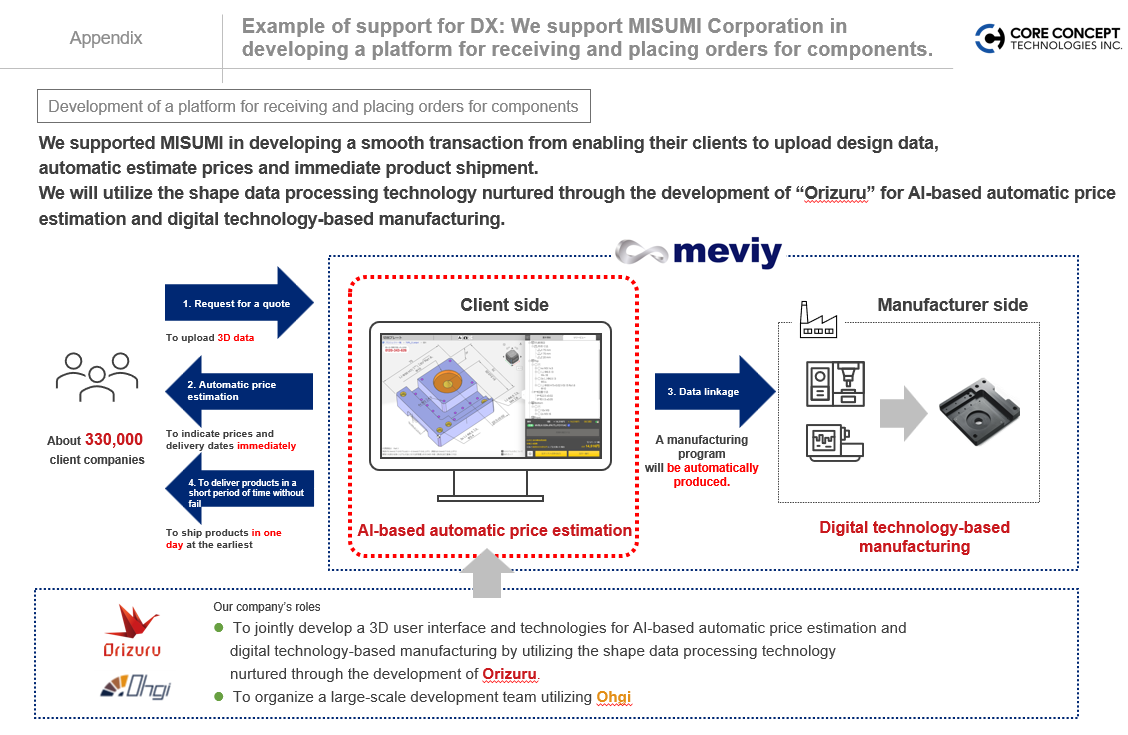

*Actual examples of Support for DX

A representative example is “meviy,” which was jointly developed with MISUMI Group Inc. The two companies have jointly developed a 3D user interface and technologies for AI-based automatic price estimation based on the shape data processing technology developed for Orizuru. The AI algorithm replaces the complex and expertise-required work (drafting drawings, considering production methods while taking into account factory operating conditions, etc., and estimating costs and delivery dates) that takes one to two weeks even for veteran employees to complete, and thus enables instant estimation and the shortening of delivery times without relying on human labor.

(Taken from the reference material of the company)

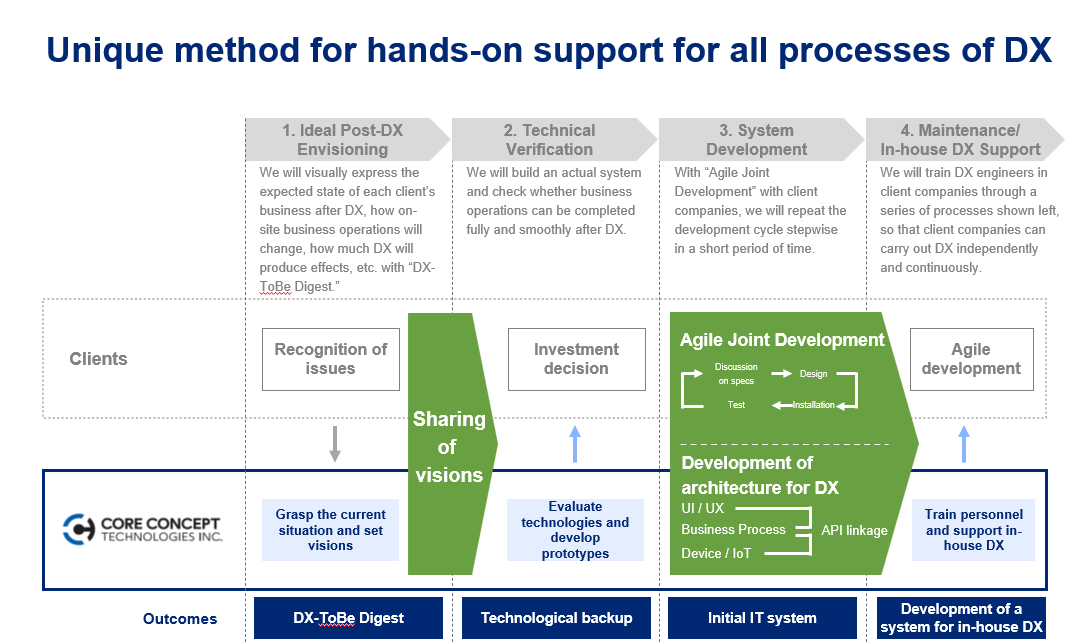

◎The original DX realization method, “CCT-DX Method”

The “CCT-DX Method” consists of the following four steps. The outline and features of each are as follows.

(1) Ideal post-DX Envisioning | (Outline) The grand design of DX is shown in the format of “DX-To Be Digest.”

(Features) Using easy-to-understand visuals to show what the business will look like after DX implementation, how the on-site work will change, and how effective it will be etc. |

(2) Technical Verification | (Outline) Verify whether their work can be fully achieved from the beginning to the end and whether everything will flow smoothly after DX.

(Features) While it is common to verify the concept theoretically or partially with a tool, CCT builds an actual system and verifies it with actual data. |

(3) System Development | (Outline) In stages, CCT proceeds with system development in an “agile format” that shortens the development period.

(Features) Since the development cycle is repeated in a short period together with the client company, it will also contribute to the training of the IT personnel of the client company with a view to subsequent in-house DX. |

(4) Maintenance /In-house DX Support | (Outline) Establish a system that enables the client companies to conduct DX independently and continuously.

(Features) DX personnel of client companies are trained through a series of processes, and after in-house DX, the company’s IT personnel staffing platform, “Ohgi” (mentioned later), is used to support necessary IT engineer staffing tasks. By providing the opportunity to directly secure external IT engineers, CCT believes that transactions in Support for Staffing of IT Personnel will expand. |

(Taken from the reference material of the company)

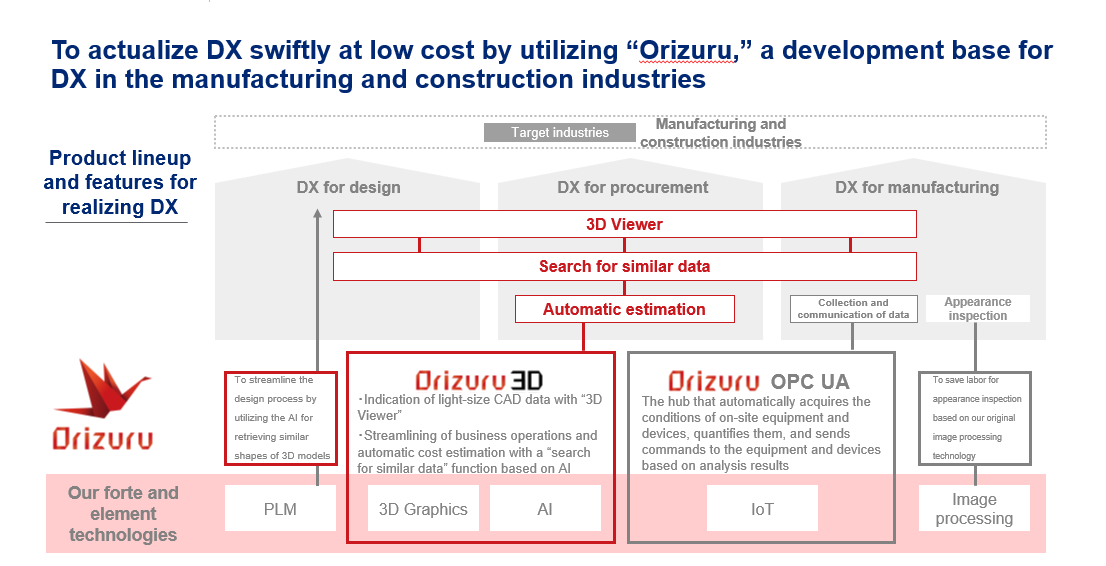

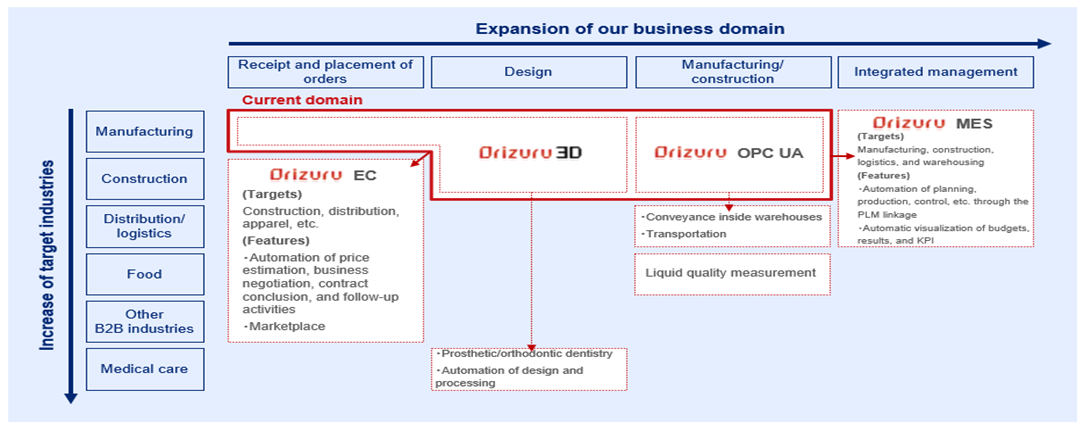

◎DX development platform “Orizuru” for manufacturing and construction industries

“Orizuru (a paper folded crane in Japanese)” consists of a “DX development platform for the manufacturing industry” and a “BIM/CIM development platform for the construction industry” and has two distinctive function groups: “Orizuru OPC UA” and “Orizuru 3D.”

*“Orizuru OPC UA”

A communication platform that enables the collection of original data and automation of various processes necessary for DX realization. It serves as a hub that automatically acquires and numerically grasps the status of on-site facilities and equipment, and automatically issues commands to facilities and equipment based on the analysis results.

*“Orizuru 3D”

It is consisted of “Orizuru 3D Viewer” and “Orizuru 3D Search for Similar Data.” “Orizuru 3D Viewer” can display light 3D CAD data even on a standard browser of low-spec PCs. “Orizuru 3D Search for Similarity Data” uses AI to search for model similarities with high accuracy from vast amounts of past design data, and the know-how of experienced engineers (quotations, manufacturing and defect information, etc.) to achieve operational efficiency and conduct automatic estimation of manufacturing costs.

With the standard functions of “Orizuru,” which are the “automation of data collection from facilities and equipment and command transmission,” “visualization via 3D modeling” and “search for similar data” as a basis, it can be customized to meet the needs of client companies, enabling them to achieve DX quickly and at low cost.

The company plans to gradually expand the standard functions required in other industries besides manufacturing and construction industries.

(Taken from the reference material of the company)

◎Client companies for Support for DX

The company provides support to a wide range of industries, mainly manufacturing and construction.

(Taken from the reference material of the company)

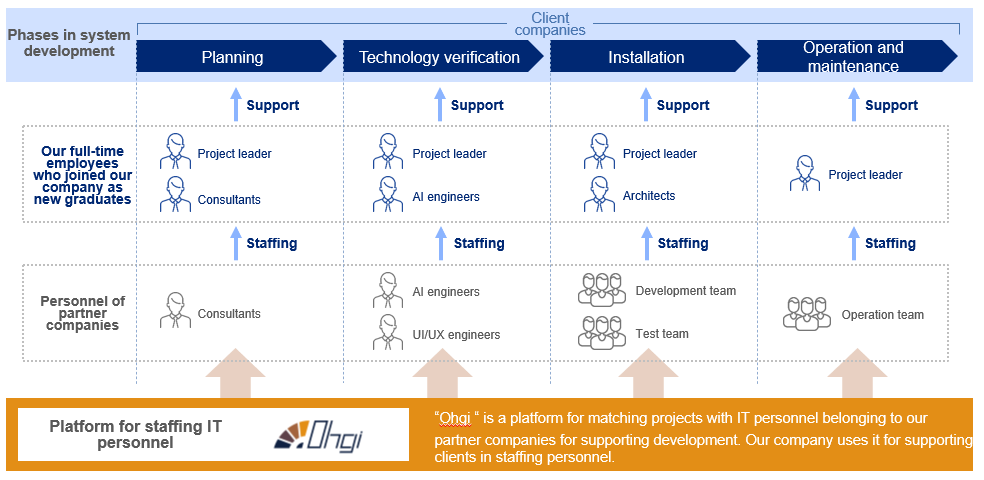

2. Support for Staffing of IT Personnel

Approximately 5,000 IT development support partner companies are registered on “Ohgi,” an IT personnel staffing platform.

CCT provides a one-stop service by utilizing the IT personnel staffing capability of “Ohgi” to help some functions of HR departments, procurement departments, and project managers at various operating companies, major system integrators, and consulting firms.

It secures the necessary IT personnel from partner companies for each phase of system development at the client company. The company’s regular employees serve as project leaders and provide support as a team.

The development support partner companies registered on “Ohgi” are those that the company has visited directly since its establishment and know each other well based on a relationship of trust, making it easy for the company to assign them to projects that it has received, thereby contributing to the reception of more orders.

(Taken from the reference material of the company)

◎Client companies for Support for Staffing of IT Personnel

The company supports the IT personnel staffing for not only the operating companies but also the major system integrators.

(Taken from the reference material of the company)

1-5 Growth Strategy

(Taken from the reference material of the company)

Strategy 1: Introduction of usage fee income (recurring-revenue business) and expansion of the industrial areas of “Orizuru”

Regarding Support for DX, based on a proven track record of providing numerous DX support services to the manufacturing and construction industries, the company will promote initiatives to raise usage fee income by standardizing and expanding the areas that can be reproduced as “Orizuru EC” and “Orizuru MES.”

At the same time, using the standardized “Orizuru” functions, the company will expand the industrial field to include not only the manufacturing and construction industries, but also logistics/warehousing, medical care, and chemicals/food.

(Taken from the reference material of the company)

Strategy 2: Expansion of the customer base and areas and improvement in convenience

The company will expand business with existing major system integrators, start new businesses with system integrators with whom it does not currently have transactions, and expand the area of IT development support partners, which is currently centered in Tokyo, to the Tokyo metropolitan area, including Kanagawa, Saitama, and Chiba, and further to Osaka, Fukuoka, Nagoya, Sendai, and other regions, while also making the functions of “Ohgi” easier to use and more convenient.

Strategy 3: M&A and alliances

The company will expand the scale of its operations by increasing its engineering resources through M&A and by actively collaborating with IT companies that have expertise in new industry areas of DX support.

1-6 Characteristics, Strengths, and Competitiveness

(1) Knowledge of manufacturing and advanced IT technology

Since its establishment, the company has deepened its knowledge of manufacturing, shape recognition and 3D graphics, analysis/simulation, AI, IoT, CAD/CAM, PLM, BIM/CIM, etc., in the manufacturing industry. It has hired and trained mainly IT engineers who have mastered advanced mathematics (linear algebra, geometry, etc.) at graduate schools of science courses and has endeavored to increase the number of engineers that possess manufacturing-related knowledge and advanced IT technology.

Developing a system that incorporates advanced AI and IoT technologies without understanding various physical events and operations other than systems taking place in the manufacturing site would lead to problems such as inconsistency with the operations on the manufacturing floor or even generate unnecessary man-hours.

To address these challenges, the company has a large number of IT engineers who are well versed in the manufacturing industry, which enables it to “make a clear distinction between operations that should use AI and those that should not,” “utilize each company’s unique know-how with AI, based on many years of experience” and “have the ability to flexibly adapt to each company’s diverse range of manufacturer’s facilities by assigning proper personnel.” We believe that these capabilities are its competitive advantages.

(2) Ability to make proposals for DX

As mentioned above, the CCT-DX Method and “Orizuru,” a DX development platform for the manufacturing and construction industries, enable the company to clearly demonstrate on a browser how the introduction of DX will change client companies at the sales stage before concluding a contract. In addition, the implementation of the standardized functions of the DX development platform “Orizuru” also reduces the cost, which significantly lowers the hurdle for DX implementation.

The company’s ability to make DX implementation proposals that are fully convincing to customers in terms of content and cost has been highly evaluated, leading to a high probability of receiving orders. The company is the only one that can make such proposals, giving it a strong competitive advantage.

(3) Support for Staffing of IT Personnel

The company is actively utilizing a wide range of IT development support partners that it has built on its own. The ratio of outsourcing costs to sales is relatively high at around 55-60%. Utilizing external resources can achieve business leverage and reduce outsourcing costs in case of sales decline when the business environment worsens, thus giving it financial resilience that can help avoid the risk of loss.

2. Earnings Results of the Second Quarter of the Fiscal Year Ending December 2022

2-1 Business Results

| FY12/21 Q2 | Ratio to Sales | FY12/22 Q2 | Ratio to Sales | YoY |

Sales | 3,443 | 100.0% | 5,734 | 100.0% | +66.5% |

Gross Profit | 727 | 21.1% | 1,407 | 24.5% | +93.4% |

SG&A | 504 | 14.7% | 716 | 12.5% | +42.0% |

Operating Income | 222 | 6.5% | 690 | 12.0% | +209.9% |

Ordinary Income | 224 | 6.5% | 714 | 12.5% | +218.0% |

Net Income | 146 | 4.3% | 524 | 9.1% | +257.0% |

*Unit: Million yen

Significant increase in both sales and profit

Sales increased 66.5% year-on-year to 5,734 million yen. The company recorded a significant increase in sales for both Support for DX and Support for Staffing of IT Personnel as the company steadily met demand. Transactions with major companies expanded due to proactive proposal-giving activities based on the track record of DX support. The number of major client companies is on the rise due to the continuous expansion of transactions with existing customers.

Operating income increased 209.9% year-on-year to 690 million yen. Outsourcing and personnel costs increased, too, but they were offset by increased sales, resulting in a significant improvement in profit.

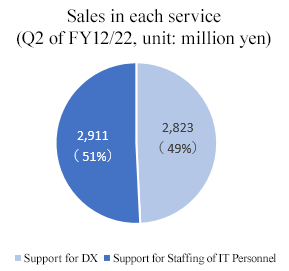

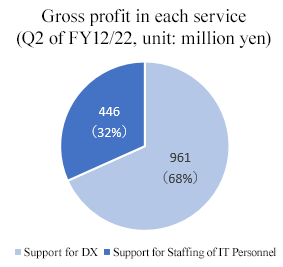

2-2 Trend by Service Domain

| FY12/21 Q2 | Ratio to Sales | FY12/22 Q2 | Ratio to Sales | YoY |

Support for DX | 1,547 | 44.9% | 2,823 | 49.2% | +82.5% |

Support for Staffing of IT Personnel | 1,896 | 55.1% | 2,911 | 50.8% | +53.5% |

Sales | 3,443 | 100.0% | 5,734 | 100.0% | +66.5% |

Support for DX | 486 | 31.4% | 961 | 34.0% | +97.6% |

Support for Staffing of IT Personnel | 241 | 12.7% | 446 | 15.3% | +85.1% |

Gross Profit | 727 | 21.1% | 1,407 | 24.5% | +93.4% |

*Unit: Million yen. The ratio to sales of the gross profit is gross profit margin.

1. Support for DX

Sales and profit increased.

The company is concentrating on expanding sales to new clients in the manufacturing industry and on increasing orders from super general contractors with which it has started transactions in the construction industry, and the company’s increased name recognition following its IPO in September 2021 has also contributed to an increase of inquiries for projects. The number of large-scale projects is on the rise due to ongoing expansion of transactions with existing clients, and the company is also expanding business with large corporations. Gross profit margin increased 2.6 points year-on-year.

2. Support for Staffing of IT Personnel

Sales and profit increased.

The company is concentrating on steadily expanding transactions with existing major system integrators and increasing new clients. Orders are increasing steadily as the company has strengthened its sales force. The company is also expanding its supply capacity through the expansion of development support partners. Gross profit margin increased 2.6 points year-on-year.

(Taken from the reference material of the company)

2-3 Financial Standing and Cash Flows

◎Balance Sheet summary

| End of December 2021 | End of June 2022 | Increase/ decrease |

| End of December 2021 | End of June 2022 | Increase/ decrease |

Current Assets | 3,031 | 3,658 | +626 | Current Liabilities | 1,617 | 1,728 | +110 |

Cash and Deposits | 1,341 | 1,566 | +224 | Accounts Payable | 615 | 760 | +145 |

Accounts Receivable | 1,489 | 1,950 | +461 | Noncurrent Liabilities | 194 | 165 | -28 |

Noncurrent Assets | 741 | 741 | -0 | Total Liabilities | 1,811 | 1,893 | +81 |

Tangible Assets | 272 | 281 | +8 | Net Assets | 1,961 | 2,506 | +544 |

Intangible Assets | 59 | 51 | -8 | Retained Earnings | 977 | 1,501 | +524 |

Investments and Other Assets | 409 | 409 | -0 | Total Liabilities and Net Assets | 3,773 | 4,400 | +626 |

Total Assets | 3,773 | 4,400 | +626 | LT and ST Interest-Bearing Liabilities | 125 | 183 | +58 |

*Unit: Million yen. LT and ST interest-bearing liabilities include lease liabilities.

Total assets increased 626 million yen from the end of the previous term to 4.4 billion yen due to an increase in accounts receivable. Total liabilities augmented 81 million yen from the end of the previous term to 1,893 million yen due to increases in accounts payable, LT and ST interest-bearing liabilities, and other factors.

Net assets increased 544 million yen from the end of the previous term to 2,506 million yen, mainly due to an increase in retained earnings.

Equity ratio rose 4.9% from the end of the previous term to 56.9%.

◎Cash Flows

| FY12/21 Q2 | FY12/22 Q2 | Increase/decrease |

Operating CF | 320 | 190 | -129 |

Investing CF | -35 | -44 | -8 |

Free CF | 284 | 146 | -137 |

Financing CF | -129 | 77 | +207 |

Cash and Equivalents | 461 | 1,566 | +1,104 |

*Unit: Million yen

Financing CF turned positive due to the increase in revenues from the issuance of shares.

The cash position has improved.

2-4 Topics

◎Establishment of a joint venture with MISUMI Group Inc.

DT Dynamics Co., Ltd. was established as a joint venture with MISUMI Group Inc.

The main business of DT Dynamics will be to accelerate system development for MISUMI’s online machine parts procurement service “meviy.”

By combining the know-how of MISUMI, which has been striving to improve the inefficiency in procurement of parts through the development, manufacturing, and sale of over 30 million machine parts, and the technology of Core Concept Technologies, which excels at developing systems for the manufacturing industry by utilizing the advanced 3D data processing technology, the company will further accelerate the system development for meviy, with the aim of achieving further global growth.

By combining MISUMI’s digital strategy with the technological capabilities of Core Concept Technologies, the two companies will contribute to the sustainable development of society through the evolution of existing services and the creation of new value, and by leveraging the strengths of both companies.

MISUMI will hold a 66% stake and Core Concept Technologies a 34% stake. The company was established on September 1, 2022.

◎Takeover of a business of a system for designing and manufacturing molds

The company has decided to acquire the “KATANAVI” business, a navigation system for designing and manufacturing molds of SOLIZE Corporation.

KATANAVI is a business support and production management system for mold design and manufacturing, and its main functions are to support visualization of manufacturing status and thorough work sequencing, data and information transmission, and prevention of work errors through ID authentication and automation.

It has a high affinity with Core Concept Technologies’ DX development platform “Orizuru” for the manufacturing and construction industries, and by taking over contracts with “KATANAVI” user companies, it is expected to attract new customers and contribute to further improvement of its profitability and competitiveness. Therefore, the company has decided to take over the business.

The business transfer is scheduled for October 31, 2022.

3. Fiscal Year Ending December 2022 Earnings Forecasts

◎Earnings Forecasts

| FY 12/21 | Ratio to Sales | FY12/22 (Est.) | Ratio to Sales | YoY | Revision Rate | Progress Rate |

Sales | 7,801 | 100.0% | 11,622 | 100.0% | +49.0% | +11.8% | 49.3% |

Operating Income | 546 | 7.0% | 1,105 | 9.5% | +102.3% | +29.7% | 62.5% |

Ordinary Income | 546 | 7.0% | 1,126 | 9.7% | +106.2% | +29.7% | 63.5% |

Net Income | 410 | 5.3% | 781 | 6.7% | +90.3% | +29.7% | 67.1% |

*Unit: Million yen. The forecast is from the company.

Earnings forecasts revised upwardly

The company upwardly revised its earnings forecasts. Sales are expected to increase 49.0% year-on-year to 11,622 million yen, and operating income is projected to rise 102.3% year-on-year to 1,105 million yen.

Orders from major customers such as super general contractors and major system integrators have been expanding at a faster pace than planned through the first half, and this trend is expected to continue for the full year.

Due to cost augmentation arising from enhanced recruitment and the impact of profit margin fluctuations caused by the phases of large-scale projects, the company expects sales to increase, but profit to drop in the second half.

4. Our Views

In Support for DX, the company is expanding its business domain into the traffic/transportation, distribution, and medical care industries, which have strong affinities with manufacturing and construction. In Support for Staffing of IT Personnel, it is steadily expanding transactions with existing major system integrators and increasing the number of local development support partners.

The expansion of Support for DX has increased the number of projects that can be provided to development support partners, and the expansion of development support partners has increased the capacity to receive orders for Support for DX and Support for Staffing of IT Personnel, thus generating synergies.

As mentioned earlier, no other company has the knowledge of manufacturing and advanced IT technology, as well as a wide range of development support partners that the company has built up on its own. We will continue to pay attention to how far they can go to meet demand by leveraging their competitive advantage.

<Reference: Regarding Corporate Governance>

◎Organization Type and the Composition of Directors and Auditors

Organization type | Company with an audit and supervisory committee |

Directors | 8 directors, including 3 outside ones |

◎Corporate Governance Report

Updated on March 30, 2022

<Basic Policy>

Our basic policy is “to aim for sustainable growth and improvement of corporate value over the medium to long term, and maximize the interests of shareholders,” while understanding the importance of compliance. We are striving to strengthen corporate governance as we recognize that it is essential to put importance on the rights of shareholders, live up to public trust, and achieve sustainable growth and development.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Our company follows all the principles of the corporate governance code.

This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co., Ltd. All Rights Reserved. |