Bridge Report:(4394)eXmotion the Fiscal Year November 2019

President Hiroyuki Watanabe | eXmotion Co., Ltd. (4394) |

|

Corporate Information

Market | TSE Mothers |

Industry | Information and communications |

President | Hiroyuki Watanabe |

HQ Address | Osaki Wiz Tower 23F, 2-11-1 Osaki, Shinagawa-Ku, Tokyo |

Year-end | November |

Homepage |

Stock Information

Share Price | Shares Outstanding (Treasury stock excluded) | Total Market Cap | ROE (Act.) | Trading Unit | |

¥915 | 2,797,100 shares | ¥2,559 million | 10.6% | 100 shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥15.00 | 1.6% | ¥34.65 | 26.4x | ¥497.16 | 1.8x |

*The share price is the closing price on March 19. The number of shares outstanding is calculated based on those at the end of the latest quarter excluding the number of treasury stock. ROE and BPS are the values as of the end of the previous term.

Non-consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Nov. 2016 (Act.) | 622 | 123 | 123 | 80 | 43.93 | 1,330.00 |

Nov. 2017 (Act.) | 694 | 125 | 125 | 85 | 45.84 | 1,400.00 |

Nov. 2018 (Act.) | 834 | 145 | 146 | 99 | 38.92 | 28.00 |

Nov. 2019 (Act.) | 976 | 187 | 190 | 140 | 52.42 | 15.00 |

Nov. 2020 (Est.) | 1,035 | 152 | 153 | 96 | 34.65 | 15.00 |

* The estimated values are based on the forecasts made by the Company. (Unit: million yen, yen) EPS has been retroactively revised due to the share splits (1:50 in March 2018 and 1:2 in June 2019).

This report outlines eXmotion Co., Ltd., which is listed in Mothers of Tokyo Stock Exchange, and includes the interview with President Watanabe.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended November 2019 Earnings Results

3. Fiscal Year ending November 2020 Earnings Forecasts

4. Interview with the President Watanabe

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

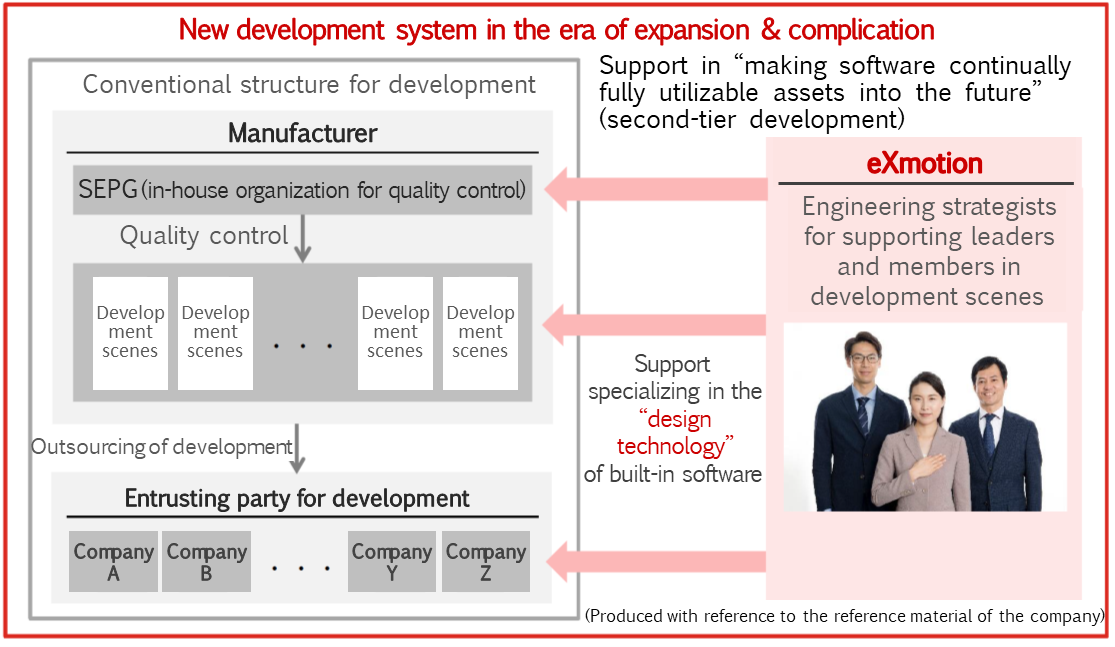

- Through the 4th industrial revolution, equipment is being automated thanks to the advancement of AI and IoT, etc. and software installed for controlling the equipment is becoming larger and more complex. However, we are faced with the shortage of engineers who can use the design technology for solving the problems with large-scale and complex equipment. For example, when it comes to automatic driving, automobile manufacturers are excellent in developing sensor fusion required for automatic driving (which sensor is used to detect an object and how, etc.), but lack the technologies and know-how for developing software for actualizing such functions (what kind of development could tolerate the addition of functions in the future and reduce the number of tests when new functions are added).

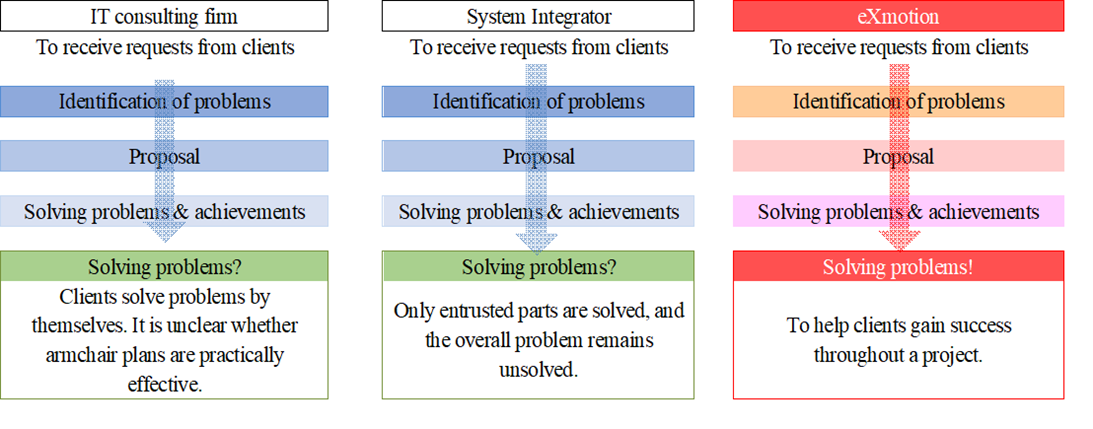

- eXmotion Co., Ltd. is a new-style consulting firm that specializes in the design technology for embedded software required for solving the above-mentioned problem. The consulting service of the company is characterized by the practical one-stop style in which the company demonstrates the solutions it has proposed by itself, directly solving problems, rather than just giving proposals in a conventional way in the development scenes, in a broad range of fields such as robots, digital devices and automobiles.

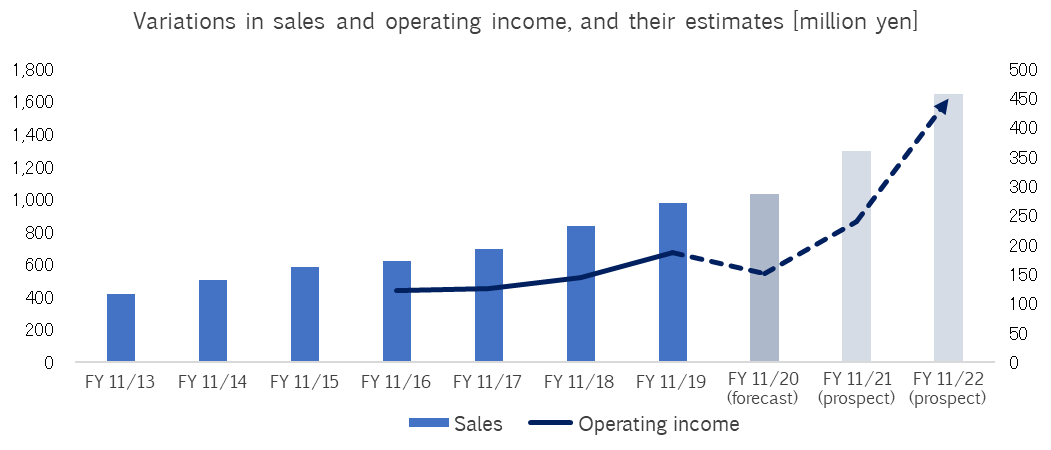

- For the term ended Nov. 2019, sales were 970 million yen, up 17.0% year on year, and operating income was 180 million yen, up 28.5% year on year, both hitting a record high. The term ending Nov. 2020 is recognized as a landing for further growth, and operating income is estimated to decline 18.9% year on year due to the expansion of the existing business and upfront investment for new domains. However, it is forecasted that profit will grow in the following term ending November 2021 and operating income will grow to 450 million yen in the term ending November 2022. We would like to highly evaluate their calm managerial judgment of forming a landing before growth, without being carried away by the favorable performance.

1. Company Overview

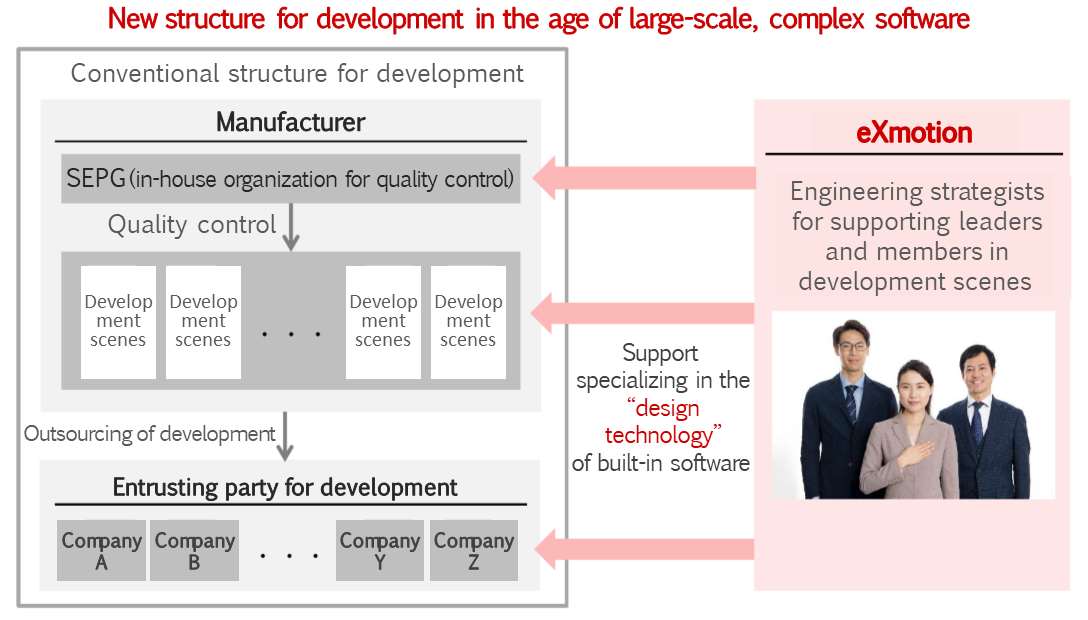

The company offers consulting services specializing in the support for development of embedded software, services and tools for educating and training personnel, etc. The company possesses plenty of experience in the automobile field, where there emerged sudden demand for development of advanced embedded software for the shift from analog to fully digitized systems, automatic driving, AV development, etc. The company sees itself as the “engineering strategist” required for developing software in the automatic driving age. Its business partners are increasing, including two-wheeled vehicles, robots, and medical apparatus.

The corporate name “eXmotion” is a term coined by combining “emotion” and “X (maximum or multiple),” with the hope of “sharing emotional moments with clients by offering services.”

SOLXYZ Co., Ltd. (securities code: 4284), which engages in software development, etc., holds 57.23% of voting rights. It contributes to the revenue of the corporate group, but there are no business transactions between eXmotion and SOLXYZ. The business administration of eXmotion is totally independent of SOLXYZ.

【Corporate ethos: We will contribute to the actualization of a new society with “high-quality software” in the age in which IT will become more important.】

The sections for developing embedded systems are busy with responding to the shift to large-scale, complex systems, and are required to develop efficient embedded systems.

The company set the mission (raison d'etre) to “support each client’s reform and help them achieve success,” and helps client companies reform embedded systems development under the value and code of conduct: “successful experiences in practice and sensations from them enable reform” and the visions (envisaged ideal states): “to share clients’ experiences of reform and success” and “members (employees) can grow together.”

【Business description】

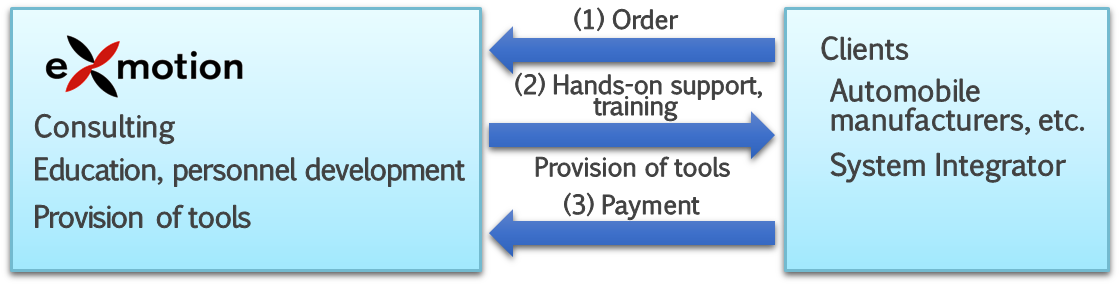

Its business segment is only consulting, but the company engages in education, personnel development, development and sales of tools centered around consulting.

Business chart

(Taken from the reference material of the company)

Consulting

The company offers consulting services specializing in the improvement in the quality of “embedded software,” which is installed in products, such as automobiles, robots, and digital devices. The consulting service of the company is characterized by the practical one-stop style in which the company demonstrates the solutions it has proposed by itself, directly solving problems, rather than just giving proposals in a conventional way.

Specializing in the practical consulting style for “identifying problems, giving proposals, solving problems, and putting proposals into practice” on a one-stop basis

(Produced with reference to the reference material of the company)

Consulting focused on fields where manufacturers face difficulty (software engineering)

The company excels at effective technologies for developing embedded software, with a focus on modeling technologies, and has plenty of experience introducing and implementing model-based development and supporting functional safety, etc. for automobile manufacturers and suppliers in Japan in the automobile field (which accounts for about 87% of total sales) where demand became evident early on for digitization, automatic driving, and development of electric vehicles.

Modeling means a technique to develop a system for abstracting workflow, structures, etc. and grasping the entire picture. The model-based development utilizing the modeling technique is one of the methods for improving the processes of embedded systems development.

For example, when it comes to automatic driving, automobile manufacturers are good at developing sensor fusion for automatic driving (which sensor is used to detect an object and how, etc.), but lack the technologies and know-how to develop software for actualizing such functions. Moreover, as processors and memories became highly functional, software became large-scale and complex, and development needs to be conducted while considering what kind of development could tolerate future addition of functions and reduce the number of tests for adding functions, and appropriate consulting (software engineering) is indispensable. Consulting of the company provides support focused on what manufacturers are not good at not only in the automobile field.

Engineering strategist specializing in “design technology”

(Taken from the reference material of the company)

Education and training of personnel

As for engineering methods used by the company for consulting, the company creates original teaching materials for acquiring skills in-house, utilizes them for introducing techniques at the time of consulting, and sells them to clients as training services for personnel development. In addition, the company offers seminars and training services.

Provision of tools (development and sale)

Some solutions that proved to be effective in consulting are provided as tools so that outside engineers, too, can use them at low cost. At present, the company provides three tools such as “eXquto,” a tool for gauging quality for the C language, which evaluates the quality of design and installation of software, “MODEL EVALUATOR,” a tool for gauging the quality of the MATLAB/Simulink model (quantification and visualization), and “mtrip,” a tool for converting between the architecture design model and the detailed design model.

Major clients

Automobile field | Target products | Automated driving system (ADS), advanced driver-assistance system (ADAS), hybrid electric vehicle (HEV), electric vehicle (EV), fuel cell vehicle (FCV), in-vehicle infotainment (IVI), etc. |

Major clients | Manufacturers: Toyota Motor, Nissan Motor, Honda R&D, SUBARU, etc. Suppliers: DENSO, NSK, Keihin, etc. | |

Other fields | Motorcycles: Yamaha Motor Agricultural machinery: Yanmar Construction machinery: Komatsu Industrial machinery: Panasonic Smart Factory Solutions Railway: Mitsubishi Electric Control Software | |

(Produced with reference to the reference material of the company)

Top 3 clients and records

| Sales in FY 11/18 | Ratio | Sales in FY 11/19 | Ratio |

SUBARU CORPORATION | 303 million yen | 36.4% | 353 million yen | 36.2% |

Honda R&D Co., Ltd. | 136 million yen | 16.4% | 197 million yen | 20.2% |

NEXTY Electronics Corporation | 131 million yen | 15.7% | 89 million yen | 9.2% |

(Produced with reference to the reference material of the company)

【Corporate history】

In Sep. 2008, eXmotion Co., Ltd. was established for the purpose of offering consulting services regarding software development (capital: 9 million yen)

In Mar. 2009, the company released “eXquto,” a tool for gauging the quality of design and installation

In Sep. 2010, the company released “MODEL EVALUATOR,” a tool for gauging the quality of the MATLAB/Simulink model (quantification and visualization)

In Oct. 2010, the company released “mtrip,” a tool for converting between MATLAB and Simulink for the architecture design model and the detailed design model

In Nov. 2013, the company acquired the certifications of ISMS and EMS (as a subsidiary of the SOLXYZ group)

In May 2017, the headquarters was relocated to Osaki, Shinagawa-Ku, Tokyo

In Jul. 2018, the company was listed in Mothers of Tokyo Stock Exchange, obtaining the ISMS certification

2. Fiscal Year ended November 2019 Earnings Results

2-1 Non-consolidated Earnings Results

| FY 11/18 | Ratio to sales | FY 11/19 | Ratio to sales | YoY | Initial forecast | Ratio to forecast |

Sales | 834 | 100.0% | 976 | 100.0% | +17.0% | 993 | -1.8% |

Gross Profit | 373 | 44.8% | 430 | 44.1% | +15.2% | 422 | +1.9% |

SG&A | 227 | 27.3% | 242 | 24.9% | +6.7% | 244 | -0.9% |

Operating income | 145 | 17.5% | 187 | 19.2% | +28.5% | 177 | +5.7% |

Ordinary income | 146 | 17.5% | 190 | 19.5% | +30.0% | 179 | +6.0% |

Net income | 99 | 11.9% | 140 | 14.4% | +41.3% | 121 | +15.2% |

*Unit: million yen.

Sales and operating income hit a record high

Sales were 976 million yen, up 17.0% year on year. The number of consulting transactions increased, as the company met the strong demand for software development in the automobile field, etc. by increasing the number of consulting staff members by 5.

Operating income was 187 million yen, up 28.5% year on year. Cost ratio rose 0.7 points as labor cost augmented due to the increase of consulting staff members, but it was offset by sales growth, and gross profit increased 15.2% year on year to 430 million yen. On the other hand, SG&A expenses augmented 6.7% year on year to 242 million yen, as the costs for personnel and recruitment (a success-fee for mid-career recruitment) grew due to the increase of employees, the expenses for holding general meetings of shareholders were posted, and so on. The reason why the growth rate of net income was high is that the company received the preferential treatment in accordance with the taxation system for facilitating the increase in income (tax burden rati 32.1% in FY 11/18 to 26.2% in FY 11/19).

The amount of orders received increased 23.3% to 992 million yen, and the backlog of orders was 241 million yen, up 7.2% from the end of the previous term.

The number of consulting staff members as of the end of the term was 47, up 4 from the end of the previous term (as 7 people joined the company, while 3 employees retired)

The number of employees as of the end of the term was 58, up 7 from the end of the previous term. Among the 58 employees, 47 employees are consulting staff members. The personnel cost for them is posted as labor cost (351 million yen in FY 11/18 → 430 million yen in FY 11/19) in cost of sales. As the company became better known thanks to the effect of listing, the recruitment of mid-career workers progressed smoothly with even the recruitment of new graduates going smoothly. As of the end of January, the number of consulting staff members was 49, up 2. The company will employ one mid-career worker in February and 2 new graduates in April.

The dividend increased by 2 yen per share virtually

As a term-end dividend, the company paid 15 yen per share (payout rati 28.6%). The dividend virtually increased 2 yen per share, because the company conducted the 2-for-1 stock split on June 1, 2019.

2-2 Trend of the consulting business

While seeing the increase of support for CASE in the automobile field, electronic control of motorcycles, and renewal of legacy systems, the company established solutions for start-up firms and started marketing activities.

Here, CASE stands for “Connected, Autonomous, Shared, and Electric.” In the term ended Nov. 2019, the support for CASE increased significantly, as it is an advanced development item.

Support for CASE in the automobile field

The company continuously received large-scale orders from leading automobile manufacturers, for which the company has provided support for CASE since the previous term, and received more inquiries regarding the support for EV control development and the shift to AUTOSAR*, etc. from suppliers.

Item |

| Achievements |

Support for CASE | Connected (C) | Received orders for development support for infotainment and systems using AI, etc. |

Autonomous (A) | Broadly supported multiple automobile manufacturers in describing requirements, developing architecture, tools, and development processes in an integrated manner | |

Electric (E) | Expanded the support for development of EV control models | |

Increase of new clients | Company A | Service for producing instruction manuals |

Company B | Support for EV control development | |

Company C | Support for shift to AUTOSAR |

*AUTOSAR: Abbreviation of AUTomotive Open System ARchitecture. Global development partnership in the automobile industry launched in 2003. It aims to develop and establish a shared standard software architecture for in-vehicle electronic control units in fields, excluding infotainment.

Regarding “Connected,” the needs for development support is growing, as related software development is becoming more difficult due to the digitization of dashboards (infotainment), including network connection.

As for “Autonomous,” the company supports the development of sensor fusion for automated driving. The company support development, when clients determine how to recognize objects and choose optimal routes through calculations with various sensors, etc. In order to develop embedded software, it is necessary to consider how you should develop software that could add functions later or reduce tests at the time of addition of functions, etc., but automobile manufacturers do not have the know-how to develop such large-scale software, so the support of the company is necessary.

As for “Electric,” the company supports automobile manufacturers in the development of large-scale models for EV control. Other than that, in the automobile field, the company succeeded in increasing the number of clients by 3 companies among automobile manufacturers and suppliers.

Support for electronic control of motorcycles

While enriching the content of support for existing clients (leading motorcycle manufacturers), the company successfully received orders from new clients. The computerization (electronic control) of motorcycles is advancing like the case of automobiles, and there are few motorcycles equipped with a carburetor. It is said that some motorcycles are equipped with not only an antilock brake system (ABS), but also a torque control function for preventing overturning. Since computerization is rapidly advancing, it is difficult for manufacturers to conduct development by themselves, so the business chance of the company is increasing. The company utilizes the know-how nurtured in the automobile field, to operate business in the motorcycle field.

Support for renewal of legacy systems

While existing transactions are increasing, the company launched a flat-rate consulting service to continuously support many clients.

Support for start-up firms

The company developed solutions for start-up firms, and started marketing activities. Through the interviews with VC and start-up firms, they became convinced of the potential of this as a new market. Here, start-up firms mean the start-up firms that engage in software development with the aim of actualizing smart systems.

Most of start-up firms put importance on speed and engage in development with a small number staff of members, so when they enter the phase of mass-production or provision of services, in many cases there emerge problems with the quality of software. When a business is launched, a legendary founder or the like engages in development, but when the business expands and becomes large-scale, it becomes difficult to secure the original quality. eXmotion is good at offering solutions to such a problem. The company has already started supporting one start-up firm, and is talking business with about 2 enterprises.

2-3 Financial position and cash flow (CF)

Financial position

| Nov. 2018 | Nov. 2019 |

| Nov. 2018 | Nov. 2019 |

Cash and deposits | 1,162 | 1,272 | Account payables | 29 | 35 |

Current Assets | 1,286 | 1,421 | Income taxes payable and others | 37 | 31 |

Property, plant and equipment | 22 | 23 | Deposits received | 14 | 29 |

Intangible assets | 30 | 41 | Liabilities | 103 | 122 |

Investments and other assets | 28 | 28 | Net Assets | 1,264 | 1,391 |

Noncurrent assets | 81 | 92 | Total Liabilities, Net Assets | 1,367 | 1,513 |

*Unit: million yen.

Total assets as of the end of the term were 1,513 million yen, up 146 million yen from the end of the previous term. Cash and deposits are dominant in the debit side, while net assets are dominant in the credit side. The company plans to actively discuss M&A of enterprises that possess consulting skills, etc. Capital-to-asset ratio was 91.9% (92.4% at the end of the previous term).

Cash flow (CF)

| FY11/18 | FY11/19 | YoY Change | |

Operating CF (A) | 136 | 147 | +11 | +8.2% |

Investing CF (B) | -23 | -24 | +0 | - |

Financing CF | 794 | -13 | -807 | - |

Cash and Equivalents at Term End | 1,162 | 1,272 | +109 | +9.4% |

*Unit: million yen.

The company secured an operating CF of 147 million yen, as pretax profit was 189 million yen (146 million yen in the previous term), depreciation was 14 million yen (11 million yen in the previous term), corporate tax, etc. were negative 50 million yen (negative 41 million yen in the previous term), and so on. Investing CF is attributable to the acquisition of tangible and intangible assets, etc., while financing CF was due to the issuance of shares and the payment of dividends.

For Reference: variation in ROE

| FY11/17 | FY11/18 | FY11/19 |

ROE [%] | 25.27 | 12.16 | 10.56 |

Net income margin [%] | 12.28 | 11.89 | 14.36 |

Total asset turnover [times] | 1.69 | 0.92 | 0.68 |

Leverage [times] | 1.22 | 1.11 | 1.08 |

*ROE (Return on equity) is obtained by multiplying “net income margin (net income / sales),” “total asset turnover (sales / total assets),” and “leverage (total assets / equity capital, or the reciprocal of capital-to-asset ratio).”

*The above values were calculated based on the data of brief financial reports and securities reports. The total assets and equity capital used for the calculation were the average values of the balances as of the end of the previous term and as of the end of the current term. (Since the capital-to-asset ratio posted in brief financial reports and securities reports is the term-end value, and so its reciprocal does not necessarily equal the above leverage.)

As eXmotion was listed in Mothers of Tokyo Stock Exchange in July 2018, shareholders’ equity grew, decreasing total asset turnover and leverage, but ROE remains high. The company plans to increase its fame through listing and ROE by expanding revenue through the utilization of procured funds.

3. Fiscal Year ending November 2020 Earnings Forecasts

3-1 Non-consolidated Earnings

| FY 11/19 (Act.) | Ratio to sales | FY 11/20 (forecast) | Ratio to sales | YOY |

Sales | 976 | 100.0% | 1,035 | 100.0% | +6.0% |

Gross Profit | 430 | 44.1% | 436 | 42.2% | +1.3% |

SG&A | 242 | 24.9% | 284 | 27.4% | +17.1% |

Operating income | 187 | 19.2% | 152 | 14.7% | -18.9% |

Ordinary income | 190 | 19.5% | 153 | 14.8% | -19.0% |

Net income | 140 | 14.4% | 96 | 9.3% | -30.9% |

*Unit: million yen.

It is estimated that sales will grow 6.0% and operating income will decline 18.9% year on year.

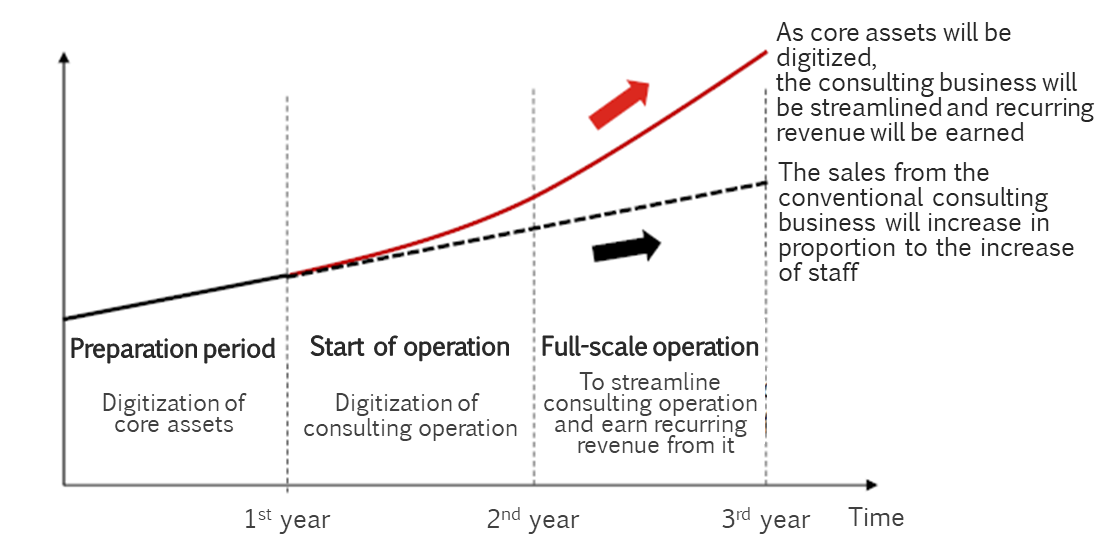

The company plans to carry out two investments, as it will digitize its consulting business and earn recurring revenue from the business and operate business in new fields. As for sales, growth rate will decrease temporarily, because the company will assign the above-mentioned investment-related tasks to some consulting staff members. As for profit, upfront investment will become a burden.

One of the investments is for digitizing the consulting business and earning recurring revenue from it. Some consulting staff members will digitize the outcomes, findings, etc. accumulated so far. Since some consulting staff members are assigned the tasks of digitizing the business and earning recurring revenue from it, the man-hour that contributes to sales will decrease. In addition, the company plans to recruit personnel for putting together and summarizing findings, etc., and it was reflected in the estimated cost of sales. It is expected that there will emerge costs for a charging platform, etc.

The other investment is for human resources in new domains. The company plans to recruit specialists, and the labor cost for several members (who joined the company in January and are formulating business plans) was taken into account when estimating the cost of sales.

As for dividends, the company plans to pay a term-end dividend of 15 yen per share (estimated payout rati 43.3%).

3-2 Business Strategies

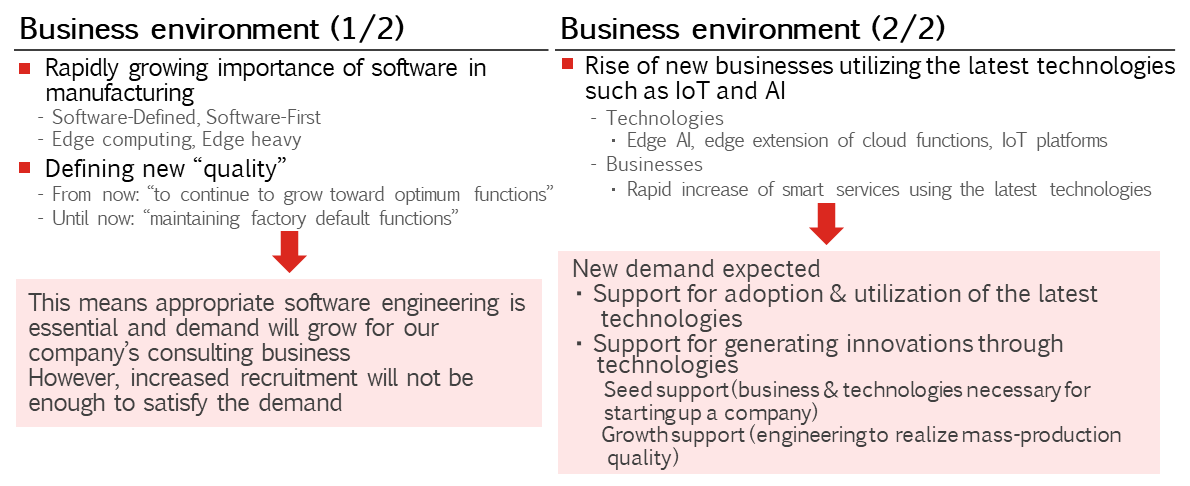

Favorable business environment

Growing importance of software in the manufacturing industry and the new definition of quality

The importance of software in the manufacturing industry is increasing, as symbolized by “Software-Defined” and “Software First.” In addition, “Edge computing,” which enables high-speed and real-time processing of familiar devices, is attracting attention away from the traditional focus on the cloud, and expectations for software controlling devices, or embedded software, are also rising.

Furthermore, while embedded software has become more sophisticated and larger along with the market expansion, the definition of quality has also changed in recent years. This is because there is an increasing assumption that functionality will be improved through updates, whereas in the past, the emphasis was on maintaining functionality at the time of shipment. For example, at “CES 2020” held in January (in Las Vegas, Nevada, USA), Sony unveiled the concept car model “VISION-S,” which it said was a software package that could be updated to improve its functionality. In order to enable these updates to improve functionality, software must be clean, easy to understand, and easy to change. This truly falls within the domain of software engineering, which is the company’s forte. As software development is not limited to automobiles, demand for the company’s services is expected to rise. However, the company believes that its current style of consulting cannot meet the growing demand without hiring more people, which is a challenge.

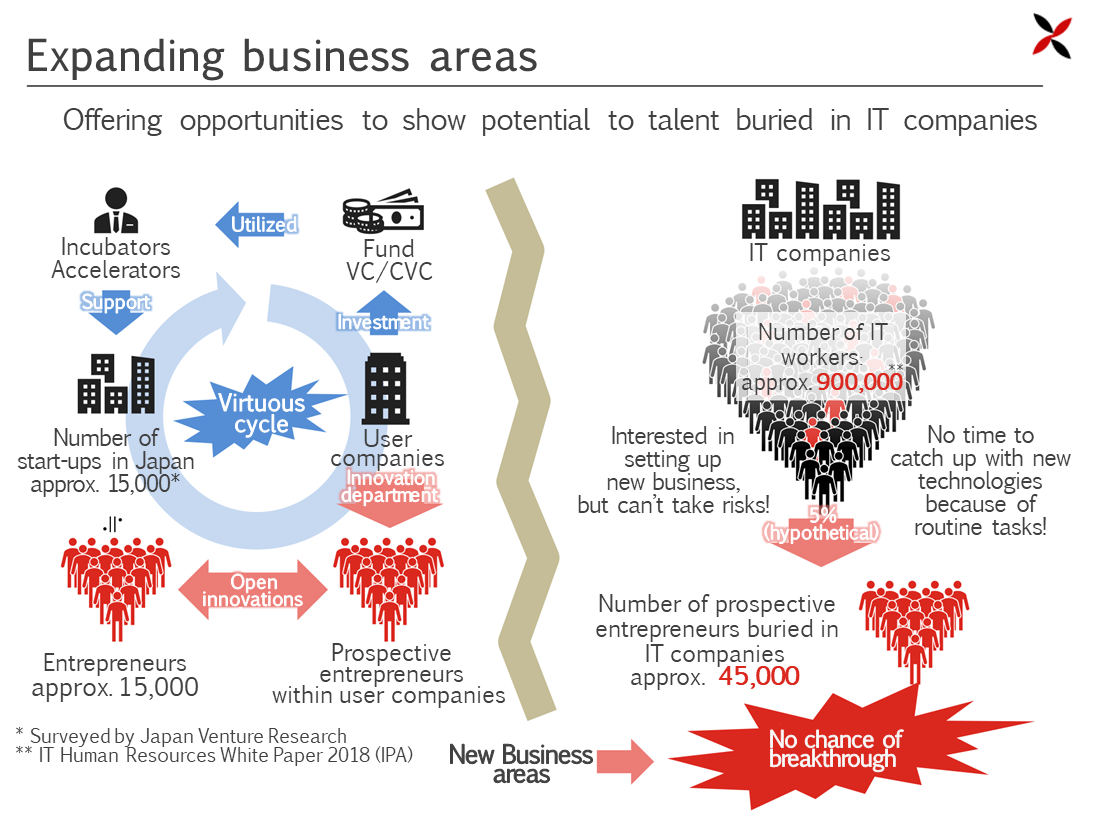

Emergence of new businesses utilizing the latest technologies such as IoT and AI

Nowadays, there is a growing number of smart services based on new technologies such as edge AI, edge extension of cloud functions, and IoT platforms. Currently, the market is dominated by entrepreneurs with the know-how and technology, but it will eventually spread to other companies, etc., creating a demand for the support of the adoption and use of the latest technology and for innovation using technology. This demand is for seed support (business and technology required to start a business) and growth support (engineering to achieve mass production quality), and meeting these demands is close to the company’s current business domain.

Policy

In the above business environment, the company will further promote its existing businesses and carry out investment activities for its further growth.

Further promotion of existing businesses

The company will capture demand in all areas of the automotive and edge domains, as represented by CASE. In addition, the company will enhance contacts with existing customers that it had not been able to adequately follow up on in the past, in order to uncover potential demand and build new solutions. Potential demand is an issue that has not materialized (consulting addresses issues that have materialized), and as part of this, the company has established an in-house customer success team.

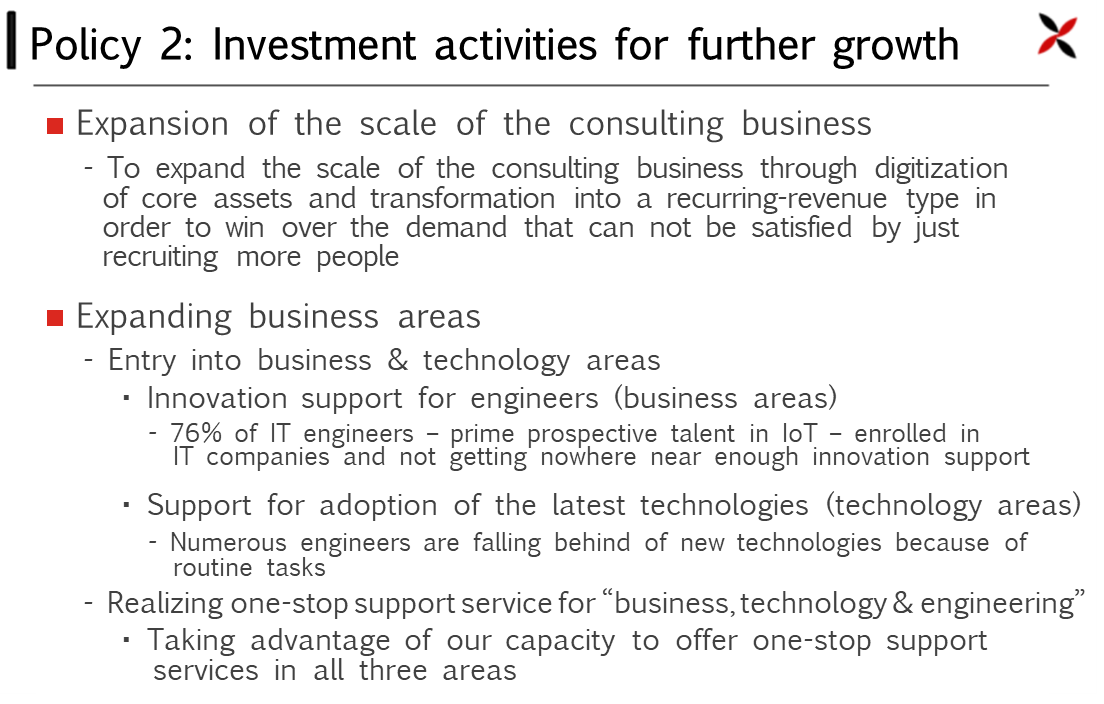

Investment activities for further growth

The company will put efforts in expanding the scale and scope of the consulting business. In the consulting business, it is becoming difficult to meet growing demand by simply hiring more people. Therefore, the company will realize the improvement of “quality” and “speed” of the consulting process without relying on manpower by digitizing the core assets (deliverables, knowledge, etc.) of solutions which have been developed so far, and utilizing them as tools and databases. It will also develop an environment in which some of the core digitalized assets can be used freely by customers.

Further, the company will provide support services for new business creation (innovation) for IT companies in order to expand its business domain. IT companies have not been able to get out of the contract business, despite the fact that 76% of IT engineers, who are prime candidates for IoT talent, are employed. For this reason, the company will support IT engineers in innovation (business domain) and adoption of the latest technology (technology domain). In other words, it is a service that realizes a business idea with technology and also offers engineering to turn it into a product ultimately, and can utilize the know-how of embedded software consulting.

Expansion of the scale of the consulting business

(Taken from the reference material of the company)

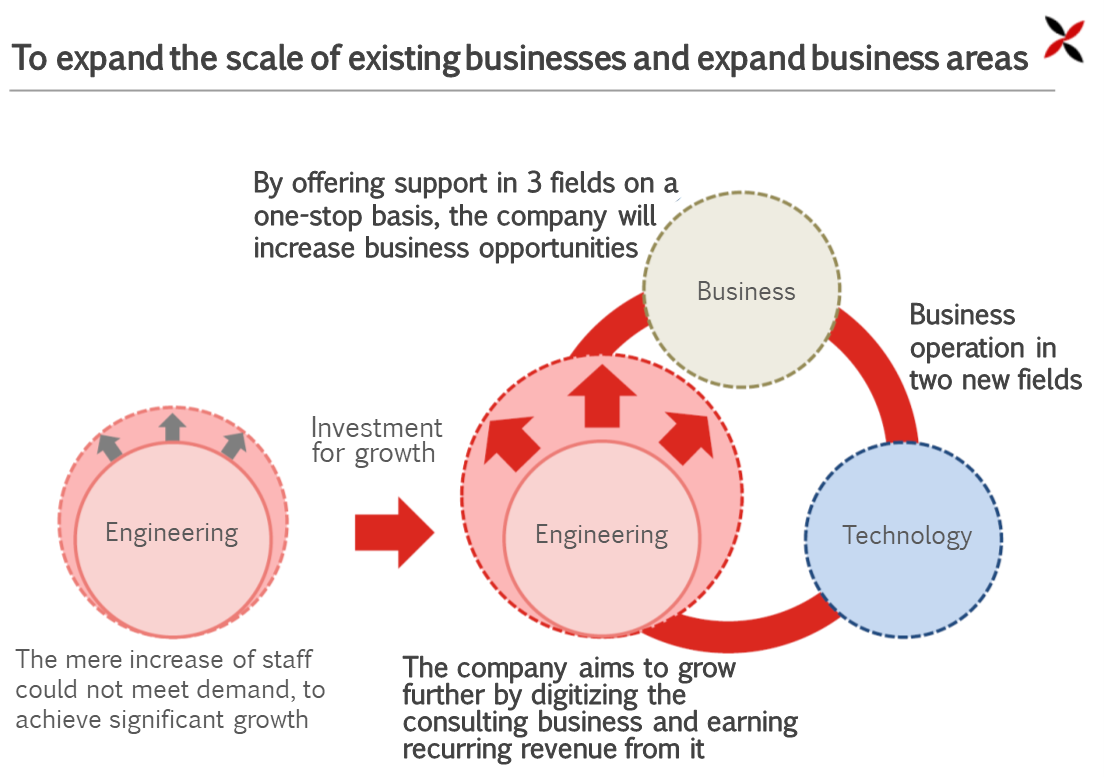

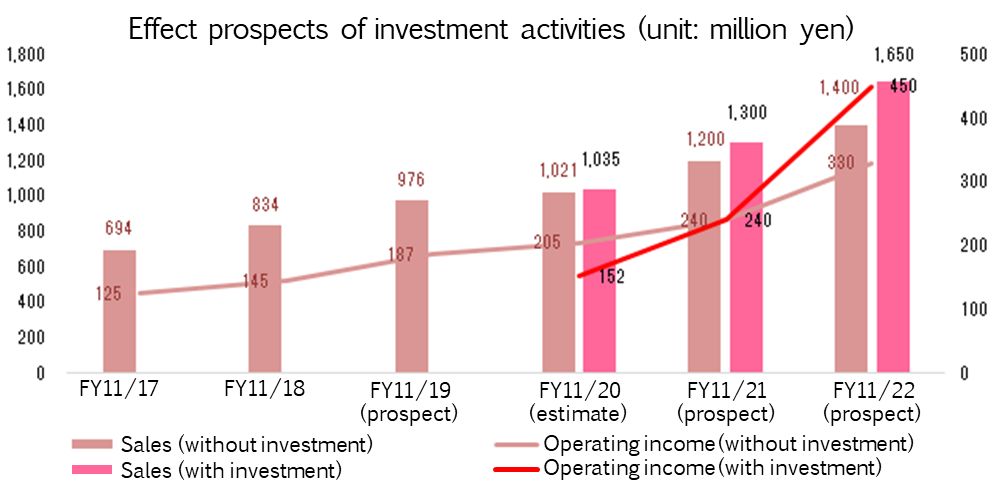

The effects of digitization and promotion of recurring-revenue operation in the existing business (consulting business = engineering) will become evident soon, and they will start contributing to revenue gradually in the term ending November 2021. On the other hand, the new business domain (support for IT enterprises), which will start from scratch, will take a lot of time. So, it has not been taken into account in the numerical plan for the coming 3 years, which will be described later.

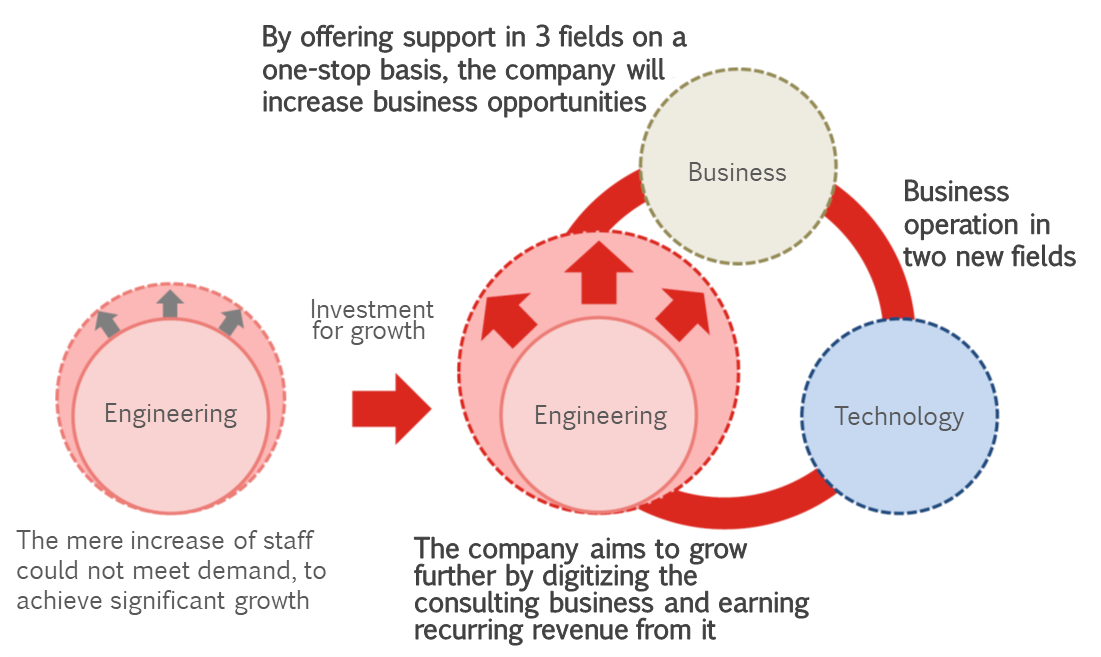

Mid/long-term business image

(Taken from the reference material of the company)

In the medium term, the company will promote its existing business further and expand the scale of the consulting business (engineering) to increase revenue. In the long term, the company will offer three services regarding engineering, business, and technological services on a one-stop basis, and utilize its advantage to expand its business opportunities further.

Numerical plans

| Forecast for FY 11/20 | Prospect for FY 11/21 | Prospect for FY 11/22 | |||

Without investment | With investment | Without investment | With investment | Without investment | With investment | |

Sales | 1,021 | 1,035 | 1,200 | 1,300 | 1,400 | 1,650 |

Operating income | 205 | 152 | 240 | 240 | 330 | 450 |

Sales growth rate | +4.6% | +6.0% | +17.5% | +25.6% | +16.7% | +26.9% |

Profit growth rate | +9.6% | -18.9% | +17.1% | +57.9% | +37.5% | +87.5% |

*Unit: million yen

For FY 11/21 and FY 11/22, the forecasted recruitment of 9 people, including new graduates, for consulting in FY 11/20 and the continuation of such recruitment were taken into account. For “With investment,” the increase in revenue thanks to the productivity improvement through investment activities in FY 11/20 was taken into account.

Due to investment, profit is projected to decline in FY 11/20, but both sales and profit are estimated to grow considerably thanks to the effects of further promotion of the existing business and the expansion of its business scale from FY 11/21.

4. Interview with the President Watanabe

eXmotion Co., Ltd. is a new-style consulting firm specializing in solving problems with embedded software development that is surging with the Fourth Industrial Revolution, particularly in the automobile industry. That is easy to say, and the company has performed well with a high price-earnings ratio, but it’s not easy to imagine the company’s actual business contents in detail. For that reason, we visited the President Watanabe at the headquarters in Osaki (Shinagawa-Ku, Tokyo) and asked him about the company’s business contents and future outlook.

President Hiroyuki Watanabe | President Watanabe was born in December 1962 and graduated from Yokohama National University. After working for companies including OGIS-RI Co., Ltd. (a systems integrator and an affiliate of Osaka Gas with a strong consulting background), he founded eXmotion Co., Ltd. in September 2008 as a specialist in technology consulting. While at OGIS-RI Co., Ltd., he established a consulting style that is backed up by demonstration of new technologies and validation of theories, through such undertakings as the support project to introduce object-oriented technologies in the field of embedded software. He was becoming increasingly convinced of the importance of technology consulting in the manufacturing industry through work, but at the same time was sorely aware of the difficulty of continuing this alongside development works – his primary area. This was the main reason that prompted him to set up the new business.

He is currently the Director of the Japan Embedded Systems Technology Association (JASA). As the Joint Chair of Planning of the Executive Committee of the “ET Robot Contest 2019” (organized by JASA), he supports the running of the contest as one of the leading members of the executive committee. |

4-1 Business contents

Solving problems of developing embedded software that are increasingly larger and more complex

Q: I’d like to start by asking about the business contents. Your company is a consulting firm that supports embedded software development. What does development support consulting actually entail?

A: Let me say that we are talking about “software quality.” The pieces of software produced by our clients do serve their functions, but for example if we take into consideration the “future extendability” and the “ease of fault analysis when problems occur,” they are often not as thoroughly worked out. This means they are ok right now, but they could cost more money and time through development. With the systems becoming more highly functional as well as more compounded, embedded software also is to become ever larger and more complex. So, on top of the conventional development, we are now entering the phase where the second tier of development is necessary.

If you have future extendability and the ease of adding functions embedded, or if you equip products with capacities for an adequate level of performance verification in the development stage before they are produced, it really speeds up the process when you have to extend, add functions or commercialize the products. There are numerous tricks for building good software, but these are often beyond our clients’ reach, so our company says to them: “We can teach you how to use these tricks, or else we can make those parts for you.” This is our business content.

Every piece of software has a 2-tier structure: “the minimum framework required in executing the function” and “the framework that makes a software of enduringly utilizable value as an asset into the future.” Often our clients find it difficult to do this second-tier work. So, our company assists them at this level, so I can understand why people might find it a bit difficult to grasp what we do.

Even designing this first tier isn’t something manufacturers do themselves for the lack of resources and it is mostly outsourced. This type of development system at the manufacturers or the outsourcing contractors is one aimed at designing a piece of software that functions. We devise the mechanisms to create pieces of software that are continually utilizable final assets of a higher level, and also so they can be produced rapidly and at high quality.

Comprehensive supporting service that simultaneously offers practical consulting in development scenes and mid- to long-term training of development team members

Q: Your briefing material describes your company’s business as unique and without competition, as it specializes in its practical consulting style that can address all of the following: “identifying problems ⇒ giving proposals ⇒ solving problems and putting proposals into practice” as a one-stop service. Does this mean your company doesn’t just do consulting, and in fact helps your clients in the actual process of making?

A: That’s right. We could of course just say “this is how you could do it” about the second-tier work, but they wouldn’t be able to do it if they haven’t done it before. So, we tell them “then we’ll demonstrate first so please have a look” and give it a go. Our clients also learn how to do it soon by observing.

Q: I see. So, while most IT consulting companies just offer the advice saying, “here’s how you could do it,” your company actually demonstrates how it’s done. Do you use the development tools for embedded software developed and sold by your company?

A: We sometimes do and sometimes don’t.

Q: Does sales of the tools depend on the clients’ needs? It doesn’t look like your company have a dependence on them. On a slightly different topic, I understand you don’t have a competitor at the moment, but do you envisage other companies entering the field leading to a tough competition in the future? Or you don’t think your company’s business can be easily copied?

A: If someone can enter the field, then they would be various IT consulting companies, systems integrators and software developers, but in reality, I think they would find it difficult. We operate in the area of software engineering. There are myriads of theories but you do need to have the know-how to tame them to ultimately suit the actual site. This is the realm of actual practice, and it’s the realm you can only reach with experience and after having worked on a large number of tasks. So, this can’t be done in a day. Large consulting companies certainly have advantages in their academic areas. However, as well as the academic areas, we also know the non-straightforward nature of real working environments, and our strength is that we can combine these two. Without the knowledge of both, I’d say this is a technologically impossible area to go about just with documents. You can’t put things into practical use straightaway if you only have the areas of academic expertise. I think having the experiences in this practical part gives us the significant lead. This is one reason.

As these are technologically demanding tasks, understandably only really capable people can work on them; and they even have to teach our clients. Having said that, if you simply look at just the business-side of it, consulting is a labor-intensive business and however brilliant this person may be, he/she can only generate one person’s worth of sales. At the other end of the spectrum, there are system integrators and software developing companies, whose sales come from contracted development. They tend to go for bigger sales by having one brilliant person and giving him/her a team of workers and by growing this team bigger. As you know many businesses even take on external contract workers on top of own employees to boost the teams to increase sales. Therefore, this means consulting business is in fact not that juicy for the system integrators and software developing companies, as sales leverage isn’t an option. If they were to do consulting, they will end up with excess staff who can’t do consulting. Right from the beginning, we were focusing on consulting so we have only been recruiting people who can do consulting.

Q: I see, so it would be difficult for existing IT consulting companies, system integrators, software developing companies to enter the field from both the technological and business points of view. I believe it’s a similar story with medical apparatus, troubles with automobiles and two-wheeled vehicles can have a direct consequence on human lives: presumably this makes it difficult for the startup companies with no track record to enter the field as they’d find it tough to attract and train talent.

Am I right in thinking that your company’s employees are almost all consultants? If I remember correctly, the number of employees at the end of the last term was 59, and 47 of those were consultants? There are some engineers also being listed but they aren’t that many.

A: The vast majority of our employees are consulting personnel. As they can deal with all our business cases, we don’t need to outsource anything. Those who are being called engineers are the future consultant candidates, or the consulting trainees. It’s our internal title and they are not the engineers in a normal sense. They could be called the reserve consultants. Perhaps this would be easier to understand. We don’t have employees who only do development works.

Q: Thank you. How long do they need before they can be deployed as part of the workforce? Are the labor costs for the consultants appropriated for SG&A expenses?

A: All labor costs, including those of engineers, are direct costs of sales. The time needed before they can be deployed really depends on the person. Some quick learners might do it in one year, while it may take longer for young people without experience. However, our company doesn’t operate on the basis of a seniority system, so one’s age doesn’t make any difference at all.

Core enterprise within SOLXYZ Group

Q: It is a highly advanced field so consulting itself must be fairly difficult, but your company needs to deal with the practical side as well so it must require a lot of serious efforts from all of you. Moving on, SOLXYZ (securities code: 4284) owns 57%+ of the voting rights, and the President Nagao and one other person are also sitting as one of your company’s directors. Does your company have any other personnel and/or business connections with them?

A: There is no business relationship between us at all. Our company does contribute to the group with dividends and profits, but so far there has been no particular benefit to our company.

Q: President Watanabe, I understand that you used to work on the system development for the manufacturing clients while at OGIS-RI Co., Ltd., which is a System Integrator and an affiliate of Osaka Gas. Is it right that, when you were realizing the importance of consulting and thinking of starting a company specializing in it, the President Nagao (now the President of SOLXYZ and the Chair of the Board of Directors of eXmotion) of SOLXYZ came to your help?

A: I was with a venture company which made private brand PCs for about 9 years as a software engineer. You know, there used to be a lot of venture businesses manufacturing private brand PCs in the era of PC98. I started working on software consulting at OGIS-RI Co., Ltd. after that. These were the pieces of embedded software, or more like they were put inside the manufacturing equipment. As I said earlier, I was working as a software engineer at a PC venture, and embedded software was already my strong area. There wasn’t anyone at OGIS-RI Co., Ltd. who could do the embedded software area well,so I was given the task of consulting in this field as a software engineer. Eventually this division grew bigger and bigger.

Q: Technologically speaking, you have been involved with embedded software from the PC98 era! No wonder you really understand the realities of the manufacturers’ development scenes. And you utilized the technologies and your know-how for consulting at OGIS-RI Co., Ltd. Then what made you think of setting up a new business even though the business there was going well?

A: I knew there was a huge demand for consulting and I felt the need to set up a company only for consulting. However, OGIS-RI Co., Ltd. is a System Integrator and they didn’t have any wish to expand deeper into consulting. I mean, the salaries can’t be the same in the first place. You can’t adopt two drastically different pay scales for consultants and engineers at a System Integrator. So, setting up a new company became an obvious choice, but there was the issue of start-up funds. Before this, I had never thought about going independent or setting up a company. In the process of looking for a sponsor, I met Mr. Nagao, our current Chairman, who told me he was looking for exactly that sort of company as a subsidiary. He was not only able to provide us with capital but also helped us with setting up the company and the indirect departments to lay down the environment in which we could concentrate on our main job. This is why we remain a subsidiary of SOLXYZ. Ever since we’ve been in this kind of relationship and SOLXYZ has never introduced us to new clients as part of business. We don’t do personnel exchanges either.

Q: From the SOLXYZ’s point of view, their investment was a great success as your company contributes back to the group with dividends, etc. to the group results. But it looks as though there’s no need for the investors to be particularly conscious of SOLXYZ when they consider your company?

A: I hear the group does occasionally attract attention as a self-driving brand because our company is part of it.

Q: Ah yes, I guess there are so many listed System Integrators, it would be difficult for a System Integrator to attract attention unless there were some features and topicalities about them.

2-2 Growth Strategy: enriching existing businesses & investment activities for further growth

Q: Let me now ask you about your growth strategy. As your company expects that the business environment will remain favorable, you have listed two points as a policy: “enriching existing businesses” and “investment activities for further growths.”

(Taken from the reference material of the company)

Enriching existing business

Q: In the “enriching existing businesses” category, you have set down the following as concrete measures: winning over demands in the automobile fields (such as CASE) and in all fields of the edge area where demands for development are expected to grow as the software-defined era gains ground; and unearthing potential demands and constructing new solutions by deepening the contact with the existing customers, which you weren’t able to do until now.

A: As an example, when you update the software on the electric cars by Tesla, a dashcam might suddenly be added. Other than this, they also come with all sorts of never-seen-before functions and they are all made possible by the software. They are making software work to add functions afterwards. And not just with Tesla, the value of software in manufactures will keep rising in the future. This is exactly the area we’d excel in, as this will mean how well we could design the software. It’s about how to go about making the software beautiful, straightforward and malleable. I believe the demand for our services will grow exponentially, even outside the automobile area.

Investment activities for further growths

Q: The growing demand from the automobile field and the edge areas are a given, and the demand for software in other fields and areas are also growing. So, would you say with the growing demand for software, the demand for solutions to make them more beautiful, straightforward and malleable, in other words software engineering itself, will also be increasing?

A: You are spot-on there. But with our current consulting style, we wouldn’t be able to cope with the increased demand unless we upsize our workforce. This is an issue I feel strongly I must tackle as a matter of urgency.

As a solution, we are proposing an exit strategy from the labor-intensive business type. This involves digitizing the methods, know-how and knowledge held by each of our consultants. Doing so should enable one consultant’s methods to be imitated easily by others. If you are on your own, your output will be always 1, but let’s make it 1.5 by learning others’ methods.

Further down the road, we will turn this into “stock,” by which we mean “let’s sell the consultants’ methods to the clients.” A consulting service usually means consultants visit actual sites and offer support with great patience and care, but we think there can be a slightly less hands-on business type, where we’d just say to the clients “here’s the instruction manual – please help yourself to complete the rest.” If there are those who can manage to do so, we’d be able to do our work with far less involvement and we would be able to expand our business size without expanding our workforce. We are calling this “stockization.” It would be similar to producing a consulting manual and asking our clients to purchase it.

(Taken from the reference material of the company)

Q: So, this is the “expansion of the scale of the consulting business” mentioned in the briefing material: “it’s not enough just to recruit more to win over the demand, so let’s digitize assets and earn recurring revenue from them to break away from the labor-intensive business type.” But isn’t there a danger that your know-how might be leaked? Also, if the clients become savvy to the point, they can do things themselves, wouldn’t they stop needing consulting? Your company surely wants to always remain in a higher position than your clients, and is this at all possible?

A: We’ll have to carefully judge the limit of how much know-how we can reveal. But there are certain types of expertise that have to be demonstrated in person to be understood, so we would be concentrating on those. In other words, we’ll be actively exposing the parts of know-how that can easily be understood from the outside. As long as the software technologies keep advancing, we can remain in a higher position as well. Having said that, there are of course overwhelmingly more clients that we haven’t worked with yet than those we already have, so we have to think how to respond to the huge demand. The market size is simply enormous.

Q: I see. According to the previous terms’ results, your top two clients accounted for 56% of your company’s sales. The human resource limitation however, meant you couldn’t fully satisfy the demand, and you wished you had more resources as that would make it possible to increase the number of clients at a much faster pace… something like this?

A: That’s right. Also, consulting doesn’t come very cheap. The people who are doing consulting are really very capable people, so we need to pay them what they deserve. Naturally the sales prices tend to be high. From the clients’ point of view, we are quite expensive. So, if they can do away with just buying an instruction manual, that would be much cheaper. There’s a potential for a rapid expansion of our customer base when we start this “instruction manual” business. I’m sure there are lots of potential customers who couldn’t use our services for financial reasons. This of course depends on if we can produce cool manuals in the first place.

Q: It’s great that you are also taking into consideration the advantages of cost from the users’ side. Within the framework of “Investment activities for further growths,” you are also planning to make investments to expand the company’s business areas, aside from asset digitalization and transformation into a recurring-revenue type, which we just talked about.

A: As I mentioned, the business we are in is doing great and there are lots of demand. But, when we ask ourselves if we can just continue to do the same thing, the answer is no. This is because the work we do will become even more indispensable. New start-ups, etc. are sprouting up everywhere and new services being created – we really are in a new era. Furthermore, most these new businesses are only made possible on the basis of software.

Working in the field of software, we also want to be involved in this new territory. We are making good enough money just doing what we already do, but as someone who knows a bit about software, we can’t help but go into this new territory where software is important. I’ll tell you what I think will happen in this new place: many different technologies will come up but not everyone will be able to make use of them immediately; so some people will be asking us “can you teach this bit?”; and new fields will also emerge, and that will surely make other people to ask “can you give us know-how in this area?” We are already carrying out the work to teach technologies and know-how in our current business areas, so we are poised to use this “technology for teaching” in the different fields and the new areas unlike our current fields and areas.

Q: When we talk about the technologies of your company, obviously we immediately think about those related to embedded software, but I realize that you possess the “technology for teaching” as a consulting company. More specifically, what do you envisage from those “different fields and the new areas”?

A: Yes, we are saying we really want to do new businesses using our technology to teach. Exactly in what sort of area we are focusing on right now can be seen from this diagram (see the excerpt from the company’s reference material on the next page.) Sorry, it isn’t very easy to understand. Right now, those so-called big businesses – such as manufacturers, telecommunications companies and railroad companies – are getting ready to bring about new innovations internally. For that reason, they are doing all sorts of things including creating corporate venture capitals and doing tie-ups with startups. On the other end of the spectrum are the IT companies including the so-called System Integrator, who are still stuck in the old mold of per-month-per-worker kind of thinking, contracting the software development works from the companies who are getting ready for the innovations. They simply don’t have anyone to attend to new businesses, and are completely unable to prepare themselves for innovations. But when those user companies eventually turn to insourcing in the future, their work will gradually dry up so they still must be able to come up with new businesses. They may not be able to do it right now but in the future, they absolutely must leave this per-month-per-worker mold behind and start nurturing the new businesses. Bring about innovations, they should get rid of the per-month-per-worker type of thinking, and give rise to even more innovations from there. There are so many System Integrator who can’t generate such cycle. There hasn’t been anyone who’s found a knack for this market yet, so we are thinking of going to get in there.

Q: I was imagining something more like a human resources services that dispatch or introduce IT personnel to the user companies who are trying to bring about innovations, but it sounds like it is more about supporting the innovations themselves and nurturing new businesses?

A: The IT industry is not bringing about innovations, so we feel we want to support that. That industry really hasn’t been able to do the innovations. Yet, there is a great talent in there, who really understands IT. It says the number of IT workers is approximately 900,000 here in this briefing material, and even if we assume only 5% of those are the cream of the crop, there still are 45,000 of them. We believe we can bring about innovations using IT, if we can give slightly more input to these people. Unfortunately, being inside IT companies would prevent them from carrying out such activities, so we will support them as part of our business. Not just causing innovations but it would be great if we can take it further to areas such as new business development.

(Taken from the reference material of the company)

A: System Integrator are essentially engineers, so they do have the necessary technologies to start new businesses. But they are normally only making what they were told to or given, so they have to start by getting used to thinking up this given thing by oneself. This needs training and we’d love to provide this training. So, this is a business to help nurture the select talent who would be able to come up with new businesses, out of the pool of approximately 900,000 workers.

Q: So, you will be offering this service to IT companies such as the System Integrator. And you don’t have to pioneer a new market for it as you have trading relationships with many System Integrator as their embedded software consultant.

A: Innovation needs the initiatives to come up with what you want to do, but this isn’t easy for IT companies because their business normally involves making what their clients ask them to. They are not particularly great at setting themselves tasks and coming up with the solutions as they are just doing the part of constructing the solutions that have been devised. So, we are proposing that we can teach them the part before constructing the solutions, how to devise the solution part itself. It is quite similar to what we are doing with the embedded software business. We are advising on how to design software well there, but here we will instead give advice on how to bring about innovations. We can’t give you too much detail about this yet, but we have invited someone from the appropriate field to come to join us. Currently, all our staff are the specialist software makers and engineers, and we have no specialist in the field of innovation. We need to find a solution here, but we do already have a strategy. The contents of consulting may be different, but at a basic level we are looking to offer something similar to what we do in our embedded software business.

Q: The areas and fields may differ but what you teach is the same – I’m sure the second-tier development your company teaches concerning embedded software must also be a technological innovation in itself. You are teaching how to create a different business that has absolutely nothing to do with one’s existing business and in the new business you are proposing to teach how to generate innovations?

A: That’s correct. This page in the briefing material summarizes this idea (see an excerpt from the company’s reference material below). “Engineering” mentioned here is about how to make the software work well. The scale will be expanded by asset digitization and transformation into a recurring-revenue type. In our new area of business, we will be teaching our clients about the two seeds necessary for innovation – business & technology.

This is why we are making two levels of investments right now towards the expansion of the scale of our existing business and the expansion of our business areas. We have already made a good progress with asset digitization and transformation into a recurring-revenue type for the expansion of existing business, but we had to start from scratch with the expansion of our business areas. We are putting our heads together internally to decide what to do and where to aim. We are imagining of more people coming with us, then like in engineering, expanding the scale. When eventually we can do all three of these things, we’d be invincible I think haha!

Being able to do all these three things means we’d be able to advise on all aspects of the process from initial ideas through technologies to constructing. We don’t think this is simple consulting. There are quite a lot of companies that offer one of these. For example, some companies they would say “we can teach you how to bring about innovation” and they can only help the clients with the bit of coming up with new businesses only. There are far fewer companies who can take that as far as solutions using new technologies, and there simply isn’t anyone who can offer the service beyond this to make it into a software.

(Taken from the reference material of the company)

Q: You are envisaging a unique company that can offer business, technology and engineering as a one-stop service. You have already published the profit planning for FY11/20 through FY11/22: do you think the effect of asset digitizing and transformation into a recurring-revenue type as well as the profits from the new business areas will become apparent by FY11/22?

A: During the current term, our profit will fall because of the investments, but we think the effect will start to be felt from the FY11/21 gradually. When we drew up the plan, we didn’t think we’d be able to build up the structure in just three years, but it actually might be able to start contributing already from this term. At first, we were going to start by building up the structure then pushing the sales up, but now we are thinking of sale what we can already at the same time as building the structure. This probably will push the launch forward. I think we can talk to you more about the progress of digitizing and stockization at the Q2 (Mar-May) financial results briefing. We might also be able to talk about more concrete ideas regarding the new areas.

Q: From the next term onwards, the growth of sales will accelerate because the effect of enriching existing business will start to be felt from then. And the effect of digitizing and transformation into a recurring-revenue type is slowly starting to make a difference, so the sales in FY11/22 will accelerate even further. Do you think it’s reasonable to expect the effect from the new business areas be felt a bit later, as this started from scratch? We are looking forward to your explanation of the progress at the briefing.

A: It is like a two-storied operation: the first floor is the existing businesses receiving a make-over, then the second floor is a completely new business. Knowledge of digitization and transformation into a recurring-revenue type both belong to the first floor as the operational extra. The innovation support for the IT companies is definitely up on the second floor. There are certainly things we won’t know until we have actually tried as this is a new area. But unless we keep doing something, we certainly won’t be finding anything, so we’ll be challenging something new whatever that might be. Even if that doesn’t turn out great, what we will have found there will enable us to go on to the next something. My gut feeling is that we must always operate with the second floor in mind, and it just happens that this term is its first year.

Q: I see. If you are entering a new area, “you won’t find anything unless you keep doing something” and “even the new place doesn’t turn out great, what you will have found there will let you progress to the next.” I’ll remember these. On the other hand, on the first floor front, if you can keep up with the recent pace of recruitment you think you can expect a 25-30% growth for a while, but recruiting is becoming harder and harder so you will make digitizing and transformation into a recurring-revenue type absorb the influence of recruiting difficulties to achieve the same 25-30% growth?

A: It’s true that recruiting is becoming harder. Conventional businesses might start to suffer from some sort of growth slow down because of human resources. Our first-floor strategy is exactly about scale expansion and making a system to counter this potential situation. In the future we are hoping to run scale expansion and new businesses as the double engine.

4-3 Messages for investors

Q: Thank you and finally, could you say something about returns for stockholders and a message to investors please? You mentioned in FY11/20 upfront investments will affect the profit down, but you are still planning to pay out 15 yen per share, which is the same as the last term?

A: In general, we would like to go with stable dividends. This term will see a reduction in profit so the payout ratio will naturally be higher, but regardless of small swings in the profit, we would really want to return something close to the same amount at least. When dividend is increased, we will be looking at a payout ratio of roughly 30% and judging against the financial results.

Q: So, depending on the results, there is a chance that dividend is actually increased? The forecast is that your company will be back on the profit growth trend from the next term onwards, so I’m sure everyone will be waiting expectantly. Your company has a stable operating CF in the black, with a fluid financial structure and high equity ratio. Are you thinking about M&A as an option as a way of utilizing the cash equivalent that occupies a significant part of your asset?

A: We are thinking about it, but we just can’t find the companies to go with… In the consulting business, more people mean bigger size and sales. Just that the level of consulting can be a problem. We need to find the company who can offer similar levels to ours. There are System Integrator who are working hard on their consulting, but if we welcome those who can only do development works, we will end up doing the SI works. So, we are indeed thinking about it, but in reality, it might prove pretty difficult.

Q: I can understand that: as your company is doing something other companies are not able to cope, finding a partner would be pretty difficult. Finally, could you give a message to the stockholders and investors please?

A: In FY 11/19 we managed to generate the highest profit so far, but we are planning a drop in profit in FY 11/20 due to our investments to make the most of the future. We won’t be overjoyed by the highest profit and will be continuing with our growth strategies. And exactly because we managed to make the biggest profit, we were able to make those big investment decisions, but we were unable to receive an all-round approval from the investors and this in turn affected the stock prices negatively after the announcement. With our resolve “to come back stronger and with vengeance,” we are determined to make everyone understand why we needed to make those decisions too, 3 years hence, and finally with the enrichment of existing businesses firmly in our mind, we will continue working on our investment activities for further development.

We are a consulting company, and a consulting company’s job is to help someone who is in trouble. So, we can’t do whatever we want to do freely. On the other hand, new business is about working to create something new by yourselves, which gives it a slightly different angle from consulting. Our new projects are already in motion, and as though new breezes have blown right into us, we are sensing the positive atmosphere that is different from before. We would kindly ask our stockholders and investors to consider these matters as well, and we thank you all for your continued understanding and support.

Q: Often so much is expected of some rapidly growing companies by the market, that they end up pushing themselves too far for too long without allowing themselves the periods where growth is slow. And this excess comes back to haunt them at a later date. I seem to remember there were many of those companies during the IT bubble period, especially ones that got listed in no time after being set up. I think the courage to reconcile oneself with stagnant periods is quite a necessary one and I believe thorough explanations of interim progresses and achieving budgets steadily would become even more important. Our company would be more than happy to assist you in this matter.

Thank you again for your precious time to share with us your insights in great detail today. We wish the President Watanabe and eXmotion Co., Ltd. continued success and prosperity.

5. Conclusions

In principle, the strategy of having a temporary resting place before growth should be evaluated highly, but it seems that they failed to gain understanding as President Watanabe said. However, we can understand their efforts for improving productivity by digitizing their business and earning recurring revenue and the development of new businesses. In addition, from the experience of seeing many start-up firms pushing themselves too much and failing to live up with expectations, we can understand the strategy of having a temporary resting place. Their courage of having a resting place and calm managerial judgment can be evaluated highly.

The most noteworthy part of the comment the president gave during the interview was “We are on the second floor with respect to the support for innovation in IT firms. Some parts remain unclear unless they are put into practice, because this is a new field. However, we cannot find anything, if we do not take a chance. We would like to endeavor to do something new anyway. Even if we fail, we believe that we will find something to utilize for the next step.” Needless to say, it is indispensable to achieve the estimated figures without fail, but in the mid/long term, we think that their down-to-earth business administration will be recognized. We would like to expect that they will give careful explanations on their progress, no matter it is favorable or unfavorable.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 3 external one |

Auditors | 0 auditors, including 0 external ones |

◎ Corporate Governance Report (last updated on March 2, 2020)

Basic Concept

Our company recognizes that it is important to improve our corporate governance in order to increase our corporate value sustainably, and strive to secure the efficiency and soundness of business administration and disclose information timely and appropriately.

Our company transformed into a company with the board of directors, an audit committee, and comptrollers, through the resolution at the annual meeting of shareholders held in February 2017. From the viewpoints of securing management efficiency and maintaining responsible management, we consider that the above-mentioned system is the most appropriate for the scale and business of our company. With the audit committee in which outside directors occupy the majority, the function to oversee business administration from the objective, neutral viewpoint can be exerted, and with the participation of outside directors, the function to supervise business operation of the board of directors can be strengthened, to secure the soundness of business administration.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Our company follows all of the basic principles of the Corporate Governance Code.

This report is intended solely for information purposes, and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2020 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on eXmotion Co., Ltd. (4394) and other companies, or IR related seminars of Bridge Salon, please go to our website at the following URL: https://www.bridge-salon.jp/