Bridge Report:(4394)eXmotion Fiscal Year ended November 2020

President Hiroyuki Watanabe | eXmotion Co., Ltd. (4394) |

|

Corporate Information

Market | TSE Mothers |

Industry | Information and communications |

President | Hiroyuki Watanabe |

HQ Address | Osaki Wiz Tower 23F, 2-11-1 Osaki, Shinagawa-Ku, Tokyo |

Year-end | November |

Homepage |

Stock Information

Share Price | Shares Outstanding (Treasury stock excluded) | Total Market Cap | ROE (Act.) | Trading Unit | |

¥1,423 | 2,907,645shares | ¥4,137million | 4.8% | 100shares | |

DPS (Est.) | Dividend Yield (Est.) | EPS (Est.) | PER (Est.) | BPS (Act.) | PBR (Act.) |

¥15.00 | 1.1% | ¥33.82 | 42.1x | ¥493.04 | 2.9x |

*The share price is the closing price on February 19. The number of shares outstanding is calculated based on those at the end of the latest quarter excluding the number of treasury stock. ROE and BPS are the values as of the end of the term FY ended Nov.2020.

Non-consolidated Earnings Trends

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Nov. 2016 (Act.) | 622 | 123 | 123 | 80 | 43.93 | 1,330.00 |

Nov. 2017 (Act.) | 694 | 125 | 125 | 85 | 45.84 | 1,400.00 |

Nov. 2018 (Act.) | 834 | 145 | 146 | 99 | 45.58 | 28.00 |

Nov. 2019 (Act.) | 976 | 187 | 190 | 140 | 52.42 | 15.00 |

Nov. 2020 (Act.) | 877 | 89 | 100 | 68 | 24.10 | 15.00 |

Nov. 2021 (Est.) | 1,042 | 142 | 143 | 98 | 33.82 | 15.00 |

* The estimated values are based on the forecasts made by the Company. Each share was split at a ratio of 1:50 in March 2018 and at 1:2 in June 2019 (EPS was revised retrospectively).

*Unit: million yen, yen

This Bridge Report reports eXmotion Co., Ltd.’s financial results for Fiscal Year ended November 2020 and future outlooks for Fiscal Year ending November 2021.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended November 2020 Earnings Results

3. Progress with Investment Activities

4. Fiscal Year ending November 2021 Earnings Forecasts

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- In the term ended Nov. 2020, sales and operating income dropped 10.1% and 52.4%, respectively, from the previous term. The decline in sales is not only because of the adverse impact of COVID-19 in the first half of this term, but also because eXmotion reduced the recruitment of mid-career workers in order to brace itself for an economic downturn due to the COVID-19 pandemic. A burden was imposed by rising operating expenses due to accelerated investment activities and an increase of personnel with the aim of business expansion in both the existing and new domains of business.

- For the term ending Nov. 2021, sales and operating income are projected to grow 18.9% and 59.8%, respectively, from the previous term. The company will reinforce the Consulting Business. It aims to shift to aggressive consulting services for enhancing the value that it delivers. In addition, it plans to maintain a high repeat rate and transform its business into a recurring revenue-based one by selling knowledge to the open market using their product “Eureka Box” in order to provide value on a continuing basis. The company will also embark on aggressive public relations activities centering on video streaming services. It will begin offering support regarding new social issues as well. Its program for developing young workforce, called “DeruQui,” discovers and develops new human resources that will engage in digital transformation (DX) and innovation. The estimate for the year-end dividend remains unchanged and a dividend of 15 yen per share is to be paid.

- Sales and profits fell in the term ended Nov. 2020 because of not only the adverse impact of COVID-19 in the first half, but also a failure to get a satisfactory number of orders for the second half due to the decreased mid-career recruitment. The impact of the COVID-19 crisis, however, is expected to become weaker in the future. In the automobile industry, which includes eXmotion’s major customers, investment related to CASE (Connected, Autonomous, Shared/Services, and Electric) is one of the most important issues. In the company’s mainstay Consulting Business, investment was smaller temporarily, but demand associated with CASE will certainly get stronger than ever before. The company is receiving an increasing number of inquiries from industries other than the automobile industry, which indicates that eXmotion’s customer base is growing below the surface. The share price is rebounding at a slow speed in the wake of the spread of COVID-19, but earnings per share (EPS) is estimated to be 90-100 yen on the premise that the company achieves its mid-term earnings forecasts. The value is considered to be fairly low even with the V-shaped recovery in the term ending Nov. 2021 taken into account.

1. Company Overview

The company offers consulting services specializing in the support for development of embedded software, services and tools for educating and training personnel, etc. The company possesses plenty of experience in the automobile field, where there emerged sudden demand for development of advanced embedded software for the shift from analog to fully digitized systems, automatic driving, EV development, etc. The company sees itself as the “engineering strategist” required for developing software in the automatic driving age. Its business partners are increasing, including two-wheeled vehicles, robots, and medical apparatus.

The corporate name “eXmotion” is a term coined by combining “emotion” and “X (maximum or multiple),” with the hope of “sharing emotional moments with clients by offering services.”

SOLXYZ Co., Ltd. (securities code: 4284), which engages in software development, etc., holds 55.03% of shares outstanding. It contributes to the revenue of the corporate group, but there are no business transactions between eXmotion and SOLXYZ. The business administration of eXmotion is totally independent of SOLXYZ.

【Corporate ethos: We will contribute to the actualization of a new society with “high-quality software” in the age in which IT will become more important.】

The sections for developing embedded systems are busy with responding to the shift to large-scale, complex systems, and are required to develop efficient embedded systems.

The company set the mission (raison d'etre) to “support each client’s reform and help them achieve success,” and helps client companies reform embedded system development under the value and code of conduct: “successful experiences in practice and sensations from them enable reform” and the visions (envisaged ideal states): “to share clients’ experiences of reform and success” and “members (employees) can grow together.”

【Business description】

Its business segment is only consulting, but the company engages in education, personnel development, development and sales of tools centered around consulting.

Consulting

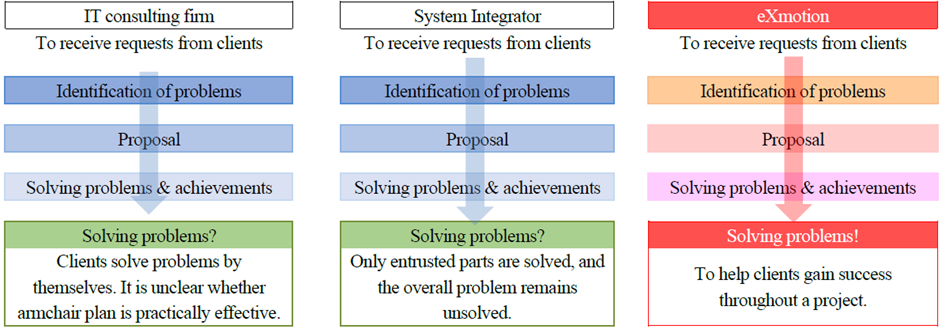

The company offers consulting services specializing in the improvement in the quality of “embedded software,” which is installed in products, such as automobiles, robots, and digital devices. The consulting service of the company is characterized by the practical one-stop style in which the company demonstrates the solutions it has proposed by itself, directly solving problems, rather than just giving proposals in a conventional way.

Specializing in the practical consulting style for “identifying problems, giving proposals, solving problems, and putting proposals into practice” on a one-stop basis

(Produced with reference to the reference material of the company)

Consulting focused on fields where manufacturers face difficulty (software engineering)

The company excels at effective technologies for developing embedded software, with a focus on modeling technologies, and has plenty of experience introducing and implementing model-based development and supporting functional safety, etc. for automobile manufacturers and suppliers in Japan in the automobile field (which accounts for about 90% of total sales) where demand became evident early on for digitization, automatic driving, and development of electric vehicles.

Modeling means a technique to develop a system for abstracting workflow, structures, etc. and grasping the entire picture. The model-based development utilizing the modeling technique is one of the methods for improving the processes of embedded system development.

For example, when it comes to automatic driving, automobile manufacturers are good at developing sensor fusion for automatic driving (which sensor is used to detect an object and how, etc.), but lack the technologies and know-how to develop software for actualizing such functions. Moreover, as processors and memories became highly functional, software became large-scale and complex, and development needs to be conducted while considering what kind of development could tolerate future addition of functions and reduce the number of tests for adding functions, and appropriate consulting (software engineering) is indispensable. Consulting of the company provides support focused on what manufacturers are not good at not only in the automobile field.

Education and training of personnel

As for engineering methods used by the company for consulting, the company creates original teaching materials for acquiring skills in-house, utilizes them for introducing techniques at the time of consulting, and sells them to clients as training services for personnel development. In addition, the company offers seminars and training services.

Provision of tools (development and sale)

Some solutions that proved to be effective in consulting are provided as tools so that outside engineers, too, can use them at low cost. At present, the company provides three tools such as “eXquto,” a tool for gauging quality for the C language, which evaluates the quality of design and installation of software, “MODEL EVALUATOR,” a tool for gauging the quality of the MATLAB/Simulink model (quantification and visualization), and “mtrip,” a tool for converting between the architecture design model and the detailed design model.

2. Fiscal Year ended November 2020 Earnings Results

2-1 Non-consolidated Earnings Results for 4Q (September to November)

| 4Q of FY 11/19 (Sep. to Nov.) | Ratio to sales | 4Q of FY 11/20 (Sep. to Nov.) | Ratio to sales | YoY |

Sales | 271 | 100.0% | 239 | 100.0% | -12.0% |

Gross Profit | 99 | 36.5% | 93 | 39.1% | -5.7% |

SG&A | 60 | 22.3% | 61 | 25.8% | +2.0% |

Operating income | 38 | 14.3% | 31 | 13.3% | -17.7% |

Ordinary income | 38 | 14.3% | 39 | 16.3% | +0.2% |

Net income | 35 | 13.2% | 26 | 11.1% | -26.2% |

*Unit: million yen.

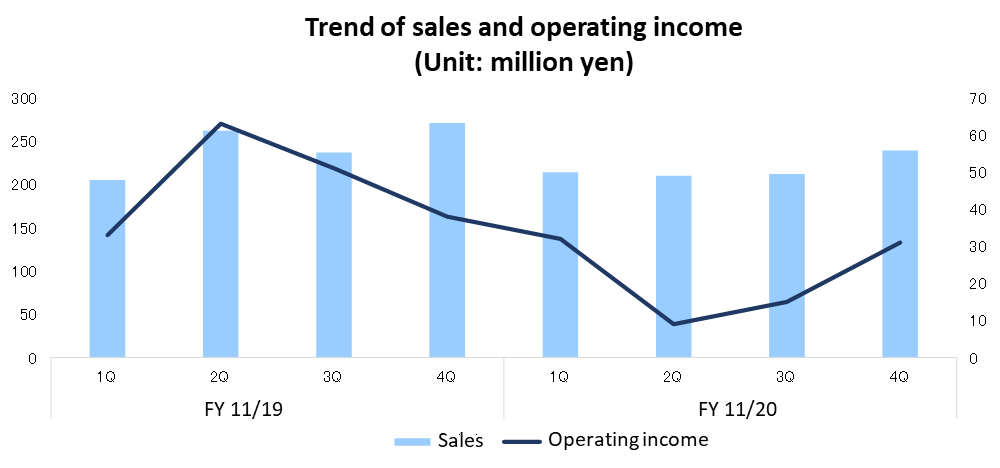

Sales decreased 12.0% year on year, and operating income declined 17.7% year on year

Sales went down 12.0% to 239 million yen, operating income dropped 17.7% to 31 million yen, ordinary income rose 0.2% to 39 million yen, and net income fell 26.2% to 26 million yen, all compared with the same period in the previous term. The influence of the measures taken by some of the company’s customers against COVID-19 died down in the second quarter of this term, and business performance has been recovering since the third quarter.

2-2 Non-consolidated Earnings Results for FY 11/20 (cumulative)

| FY 11/19 | Ratio to sales | FY 11/20 | Ratio to sales | YoY | Company’s forecast | Ratio to forecast |

Sales | 976 | 100.0% | 877 | 100.0% | -10.1% | 865 | +1.4% |

Gross Profit | 430 | 44.1% | 350 | 39.9% | -18.6% | - | - |

SG&A | 242 | 24.9% | 260 | 29.7% | +7.5% | - | - |

Operating income | 187 | 19.2% | 89 | 10.2% | -52.4% | 76 | +16.8% |

Ordinary income | 190 | 19.5% | 100 | 11.4% | -47.3% | 87 | +14.8% |

Net income | 140 | 14.4% | 68 | 7.8% | -51.4% | 60 | +14.4% |

*Unit: million yen.

Sales and operating income fell 10.1% and 52.4%, respectively, year on year

As for sales, a decline in the operating rate due to the measures that some of the company’s customers implemented against the COVID-19 pandemic decreased earnings in the second quarter. Some projects were suspended and some training services slated to be offered were postponed as well. Business performance has been recovering since the third quarter, being in line with the forecasts that the company revised in October.

Regarding profits, accelerated investment activities resulted in a 18.6% drop in gross profit. SG&A expenses rose slightly following an increase of workers aimed at business expansion, and operating income, ordinary income, and net income went down 52.4%, 47.3%, and 51.4%, respectively. Each profit exceeded the company’s forecasts.

Regarding order receipts, staying at the same level as in the previous term, the order backlog as of the end of the current term stood at 230 million yen and showed a steady growth.

In recruitment activities, the company continued to be attentive to hiring work-ready mid-career workers while paying close attention to the economic trends amid the spread of COVID-19. Through online round-table discussion and interviews, the company has given unofficial job offers to three students mainly from informatics-related faculties, who are expected to graduate in March 2021. The number of consulting staff as of the end of the term was 52 (six workers newly joined the company and a worker retired, which increased the total number of staff by five from the previous term).

The company accelerated investment activities and made investment ahead of schedule. In the existing domains, it focused on preparations for transforming its Consulting Business into a recurring revenue-based business. Meanwhile, for the new domains, the company will break fresh ground in business and technology domains.

Although sales and profits went down, the dividend is to be 15.00 yen per share, unchanged from the previous term.

2-3 Situation in the Existing Business

The impact of COVID-19 was enormous in the second quarter. Although business performance has been recovering since then, both sales and profits declined because of the company’s acceleration of investment activities and the reduced mid-career recruitment. In the Consulting Business, eXmotion began to offer services online, which has enabled it not only to provide consulting services amid the COVID-19 crisis but also to offer efficient support to customers in distance. Services of providing support in relation to CASE for next-generation vehicles showed a steady growth in the automobile industry. Demand got stronger for support regarding the model-based systems engineering (MBSE) in all industries. In the education business, the company made a shift from face-to-face education and training to online ones, which has allowed them to resume training programs and receive new orders since the summer.

2-4 Financial position and cash flow (CF)

Financial position

| Nov. 2019 | Nov. 2020 |

| Nov. 2019 | Nov. 2020 |

Cash and deposits | 1,272 | 1,320 | Liabilities | 122 | 77 |

Current Assets | 1,421 | 1,428 | Net Assets | 1,391 | 1,433 |

Noncurrent assets | 92 | 83 | Total Liabilities, Net Assets | 1,513 | 1,511 |

*Unit: million yen.

Net assets at the end of the term stood at 1,511 million yen, down 2 million yen from the end of the previous term. The liquidity on hand ratio was about 18 months, indicating that the company’s cash and deposits were ample. With the equity ratio remaining high at 94.8% (which took 13th place in the NEXT 1000 equity ratio rankings: The Nihon Keizai Shimbun as of July 28), the company continues to maintain soundness of business management.

Cash flow (CF)

| FY11/19 | FY11/20 | YoY Change | |

Operating CF (A) | 147 | 85 | -61 | -42.0% |

Investing CF (B) | -24 | -12 | 12 | - |

Free CF(A+B) | 123 | 73 | -49 | -40.3% |

Financing CF | -13 | -25 | -11 | - |

Cash and Equivalents at Term End | 1,272 | 1,320 | 47 | +3.8% |

*Unit: million yen.

The balance of cash and equivalents at the end of the term ended Nov. 2020 grew 47 million yen from the end of the previous term to 1,320 million yen.

The free CF stood at 73 million yen, down 49 million yen from the previous term.

3. Progress with Investment Activities

3-1 Existing Realms

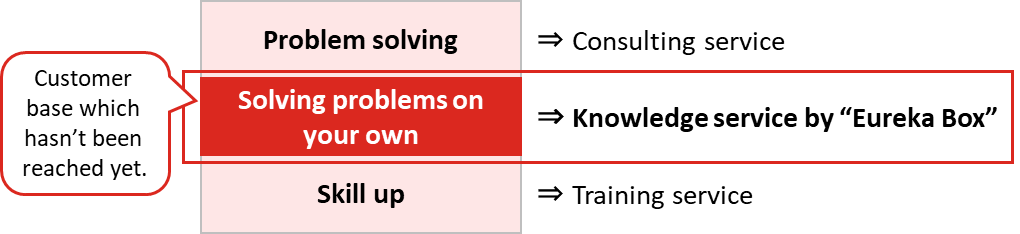

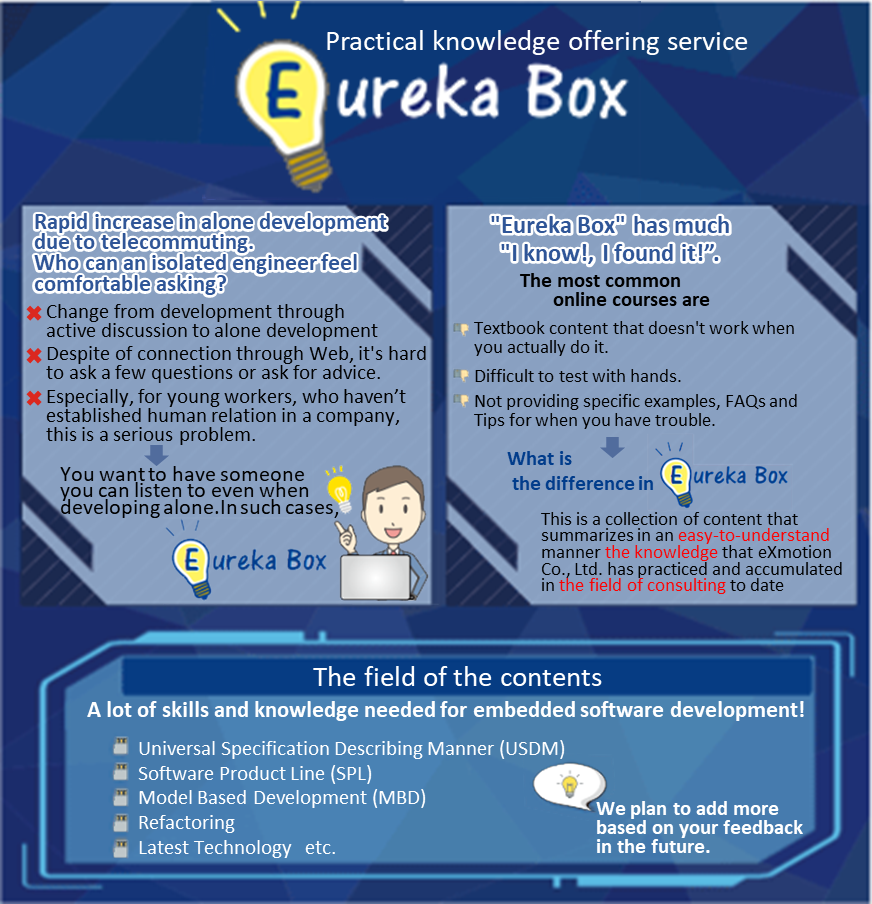

With the aim of scaling up the Consulting Business by digitizing the core assets and transforming them into recurring revenue-based business, the company launched “Eureka Box,” a service of offering practical knowledge. It released the beta version of the program at ET & IoT Digital 2020 held in November after it completed in-house implementation of the program in the summer and the program’s effect was verified by outside collaborators. Account creation for free of charge begun from December 10. The company will also scale up the Consulting Business. Endeavoring to continuously provide value and transform its business into a recurring revenue-based one, the company will cultivate customer bases that it did not reach out to before.

(From the Company’s material)

(From the Company’s HP)

Furthermore, in cooperation with DENSO Corporation, eXmotion is fostering an open development environment that allow everyone to easily develop new services using connected cars. Details were released in December in a keynote speech given at ET & IoT Digital 2020 (see the illustration below, which is posted on eXmotion’s website).

(From the Company’s HP)

3-2 New Domains

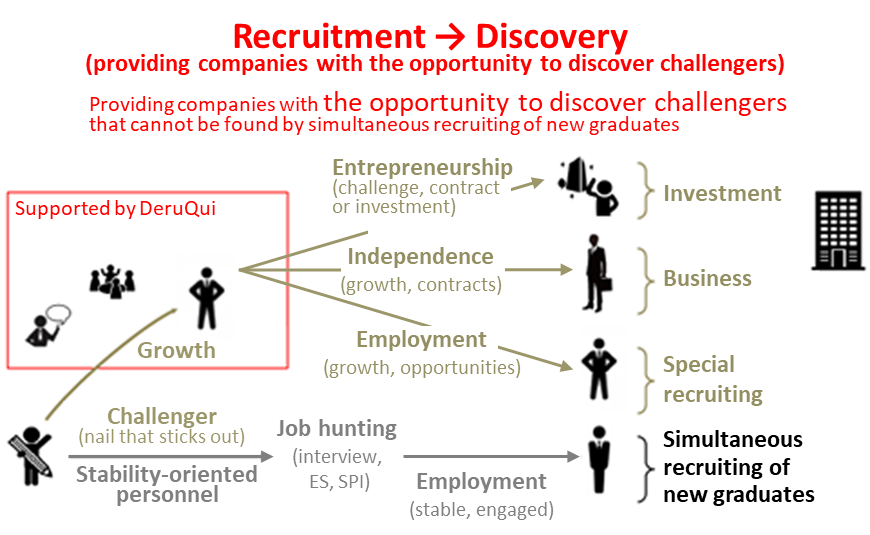

The company’s investment activities are aimed at making a new entry into the business and technology domains. For the business realm, it has developed a system of finding innovators and supporting their growth and devised a method of operating the system online, which is called “DeruQui,” a program that discovers and develops young workforce in Generation Z. Sponsored by three corporations for a fee for a proof-of-concept (PoC) project of a student-oriented version, “DeruQui” was highly evaluated. The company is diligently preparing for releasing another version that targets corporations which is a program for finding and developing human resources engaging in digital transformation (DX) and new businesses.

Regarding the technology realm, on the other hand, the company has prepared teaching materials containing basic knowledge of the latest technology used in embedding systems and developing edge computing platforms, and it is using them internally. The company plans to provide each material as the contents of “Eureka Box.”

“DeruQui,” a program that discovers and develops young workforce in Generation Z

(From the Company’s material)

4. Fiscal Year ending November 2021 Earnings Forecasts

4-1 Non-consolidated full year Earnings

| FY 11/20 (Act.) | Ratio to sales | FY 11/21 (forecast) | Ratio to sales | YOY |

Sales | 877 | 100.0% | 1,042 | 100.0% | +18.9% |

Operating income | 89 | 10.2% | 142 | 13.6% | +59.8% |

Ordinary income | 100 | 11.4% | 143 | 13.7% | +43.2% |

Net income | 68 | 7.8% | 98 | 9.4% | +44.4% |

*Unit: million yen.

Sales and operating income are expected to increase 18.9% and 59.8%, respectively, year on year.

The company forecasts that sales will increase 18.9% year on year to 1,042 million yen and operating income will go up 59.8% year on year to 142 million yen for the term ending Nov. 2021. It will reinforce the Consulting Business. Aiming to improve the value that it delivers, the company strives not only to expand and intensify solutions and technologies to offer, but also to make a shift from passive consulting focusing on solving issues to aggressive consulting in which the company is involved even in the phase of identifying issues. The company also intends to transform its business into a recurring revenue-based one by maintaining a high repeat rate and selling knowledge externally using “Eureka Box” in order to provide value on a continuing basis. It will begin aggressive public relations activities with a focus on video streaming services, as well as endeavor to further facilitate risk hedge and digitization of new business opportunities amid the COVID-19 crisis and improve quality. In addition, it will begin offering support regarding new social issues. Its “DeruQui,” young workforce development program, will find and develop new human resources engaging in DX and innovation. Through the service of providing practical knowledge with “Eureka Box,” the company will help engineers working from home horn their skills, which has become one of the serious issues emerging due to the spread of telecommuting.

The dividend estimate remains unchanged, and the amount of a year-end dividend is to be 15 yen per share.

4-2 Business Plan

Business environment

■Change in the business model in the manufacturing industry

■New social issues brought by the COVID-19 pandemic

-Companies are hampered by shortages of workers for DX and innovation-Development of young engineers has become an issue

Provides high value-added support needed even for in-house manufacturing of software. Provides solutions to new social issues by taking advantage of eXmotion’s strengths. |

① Reinforcement of the Consulting Business

■Improvement of the value to deliver

-The COVID-19 crisis exposed weaknesses of the Consulting Business, eXmotion’s core business

・The business style of offering solutions to issues originating in individual troubles that customers suffer from depends highly on customers’ circumstances, which makes it difficult for eXmotion to run business stably-Increase the value to deliver in the consulting services through aggressive consulting in which eXmotion is involved even in identifying issues

・eXmotion aims for stable business management that is less dependent on customers’ circumstances through improvement of the value that it offers by addressing more significant issues, and through consulting services led by the company■Continuous provision of value

-Stably operate business by maintaining a high repeat purchase rate

-Transform business into a recurring revenue-based one by selling knowledge externally with “Eureka Box”

・eXmotion digitalizes its core assets and transforms them into recurring revenue-based ones and scales up the Consulting Business in order to take in demand that cannot be fulfilled only by increasing the number of staff

② Risk hedge and discovery of new business opportunities amid the COVID-19 crisis

■Further digitization and quality improvement

-eXmotion facilitates knowledge sharing within its company by using “Eureka Box” internally

■Start of aggressive public relations activities centering on video streaming services

-eXmotion will secure its fan base and prospects for new customers through enhancement of video streaming services, including “Eureka Box”

-eXmotion aims to increase its presence and seize new business opportunities by proactively using YouTube

-eXmotion endeavors to improve the quality of videos that it releases, streamline the process of video production, and reduce time and effort required for the service by using part of its office as a studio

③ Launch of support services for new social issues

■Discovery and development of new human resources engaging in DX and innovation

-The services are differentiated from other similar services with the following points:

・Long-term continuity・Escort by mentors■Development of young workers, which has become a serious issue due to the spread of telecommuting

-Provides practical knowledge with “Eureka Box”

-Offers knowledge and help workers improve their skills through steady efforts, such as exercises and practices

-eXmotion helps develop novice engineers who will play pivotal roles in industries by offering a new program, the Next-generation Engineer Development Course

④ Growth of new businesses and further enhancement of profitability

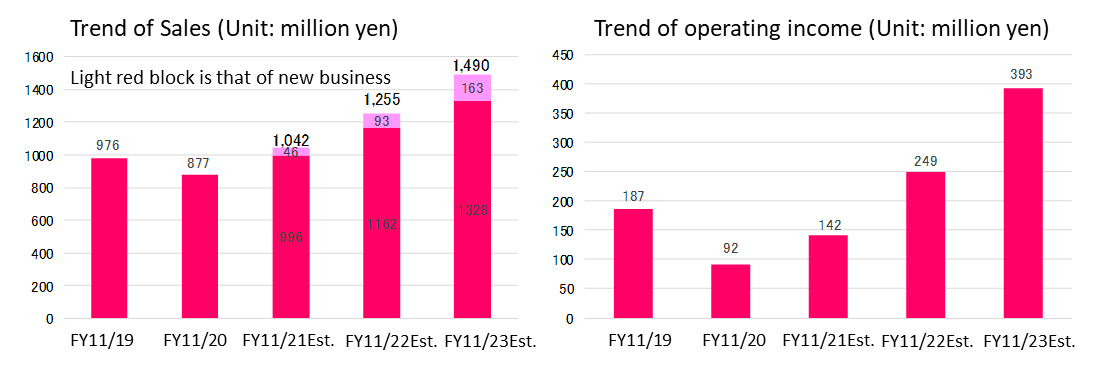

■The three-year plan to expand revenue is about to be a year behind schedule of the original plan drawn up in the previous term because of the company’s attentive recruitment of consulting staff while paying attention to the economic trends affected by the spread of COVID-19

■The continuing COVID-19 pandemic is estimated to have limited impact on eXmotion, and both sales and profits grew in the Consulting Business, due to the personnel increase

■eXmotion aims for a business model that does not depend on the number of staff members by growing new businesses through investment made since the term ended Nov. 2020

The forecasts for the terms ending Nov. 2022 and Nov. 2023 are based on the premise that recruitment of the same scale as the plan for term ending Nov. 2021 to recruit nine workers as consulting staff, including new graduates, is continuously attained and revenue is expanded as a result of steady growth of new businesses.

(Produced by Investment Bridge with reference to the material given by the company)

5. Conclusions

Sales and profits fell in the term ended Nov. 2020 because of not only the adverse impact of COVID-19 in the first half, but also a failure to get a satisfactory number of orders for the second half due to the decreased mid-career recruitment. The impact of the COVID-19 pandemic, however, is expected to become weaker in the future. In the automobile industry, which includes eXmotion’s major customers, investment related to CASE is one of the most important issues. In the company’s mainstay Consulting Business, investment was smaller temporarily, but demand associated with CASE will certainly get stronger than ever before, because business performance in the automobile industry began to show robust recovery in the period from October to December. The company is receiving an increasing number of inquiries from industries other than the automobile industry when investment made in the automobile industry was low, which indicates that eXmotion’s customer base is growing below the surface. The share price is rebounding at a slow speed in the wake of the spread of COVID-19, but EPS is estimated to be 90-100 yen on the premise that the company meets its mid-term earnings forecasts. The value is considered to be fairly low even with the V-shaped recovery in the term ending Nov. 2021 taken into account.

<Reference: Regarding Corporate Governance>

◎ Organization type, and the composition of directors and auditors

Organization type | Company with audit and supervisory committee |

Directors | 8 directors, including 3 external one |

Auditors | 3 auditors, including 2 external ones |

◎ Corporate Governance Report (last updated on July 13, 2020)

Basic Concept

Our company recognizes that it is important to improve our corporate governance in order to increase our corporate value sustainably, and strive to secure the efficiency and soundness of business administration and disclose information timely and appropriately.

<Reasons for Non-compliance with the Principles of the Corporate Governance Code>

Our company follows all of the basic principles of the Corporate Governance Code.

This report is intended solely for information purposes and is not intended as a solicitation for investment. The information and opinions contained within this report are made by our company based on data made publicly available, and the information within this report comes from sources that we judge to be reliable. However, we cannot wholly guarantee the accuracy or completeness of the data. This report is not a guarantee of the accuracy, completeness or validity of said information and opinions, nor do we bear any responsibility for the same. All rights pertaining to this report belong to Investment Bridge Co., Ltd., which may change the contents thereof at any time without prior notice. All investment decisions are the responsibility of the individual and should be made only after proper consideration. Copyright(C) 2021 Investment Bridge Co., Ltd. All Rights Reserved. |

To view back numbers of Bridge Reports on eXmotion Co., Ltd. (4394) and other companies, or IR related seminars of Bridge Salon, please go to our website at the following URL. URL: https://www.bridge-salon.jp/