Bridge Report:(4425)Kudan term ended March 2022

Kudan Inc. (4425) |

|

Corporate Information

Exchange | TSE Growth |

Industry | Information and communications |

Managing Director & CEO | Daiu Ko |

Address | 2-10-15 Shibuya, Shibuya-ku Tokyo |

Year-end | March |

URL |

Stock Information

Share Price | Shares Outstanding | Total market cap | ROE Act. | Trading Unit | |

¥2,501 | 8,230,067 shares | ¥20,583 million | -213.9% | 100 shares | |

DPS Est. | Dividend yield Est. | EPS Est. | PER Est. | BPS Act. | PBR Act. |

0.00 | - | ¥-39.95 | - | ¥77.52 | 32.3x |

*The share price is the closing price on July 15. Each value is taken from the financial results of term ended March 2022.

Earnings Trend

Fiscal Year | Sales | Operating Income | Ordinary Income | Net Income | EPS | DPS |

Mar. 2019 (Actual) | 376 | 123 | 103 | 103 | 15.35 | 0.00 |

Mar. 2020 (Actual) | 456 | 9 | -12 | -29 | -4.17 | 0.00 |

Mar. 2021 (Actual) | 127 | -451 | -1,575 | -1,608 | -214.97 | 0.00 |

Mar. 2022 (Actual) | 271 | -433 | -681 | -2,237 | -283.74 | 0.00 |

Mar. 2023 (Estimate) | 500 | -350 | -300 | -315 | -39.95 | 0.00 |

*Unit: yen, million yen. Net income is profit attributable to owners of the parent. Hereinafter the same shall apply. The earnings forecasts are that of the company.

This report briefly describes Kudan Inc., the financial results of term ended March 2022, growth strategies, and earnings forecasts.

Table of Contents

Key Points

1. Company Overview

2. Fiscal Year ended March 2022 Earnings Results

3. Fiscal Year ending March 2023 Earnings Forecasts

4. Growth Strategy

5. Conclusions

<Reference: Regarding Corporate Governance>

Key Points

- Kudan Inc. is a company that carries out research and development of deep technology specializing in the algorithms for artificial perception (AP), which corresponds to the “eyes” of machines (computers and robots). Its strengths and characteristics include the capability of flexibly responding to the growth of diverse demand, which is expected in the future, and a group of professionals in AP. The company has secured a firm position based on the alliance with Artisense Corporation, which is led by Professor Daniel Cremers, who has produced globally recognized research results as a pioneer in self-driving technologies.

- By underpinning a variety of advanced technologies in addition to the applications whose applied development has already progressed, AP technologies are expected to be applied and integrated in many fields, and put into practice faster than expected. In such a market environment, the company will fuse AP technologies with AI and IoT, and cultivate applicable domains in a multistage manner. In addition, the company will accelerate and expand clients’ commercialization, operate the solution business, and expand business. To do so, the company carried out financing.

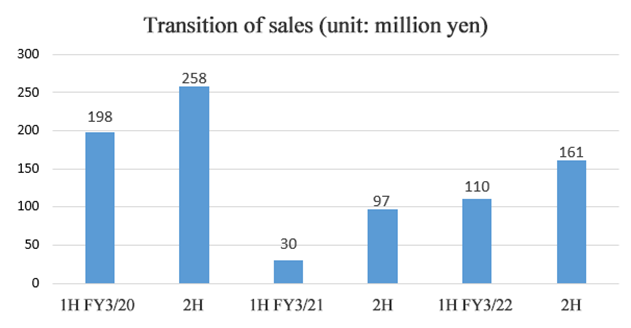

- In the term ended March 2022, sales rose 112.7% year on year to 271 million yen. Sales grew, thanks to the increase of orders in a broad range of fields and the progress of the development in existing projects for clients’ commercialization. The sales without the application of the new revenue recognition standards were 296 million yen, almost in line with the initial forecast (300-350 million yen). An operating loss of 433 million yen was posted. SGA augmented 14.2% year on year to 557 million yen, due to the global expansion of systems and the acquisition of Artisense Corporation as a consolidated subsidiary in January 2022. An ordinary loss of 681 million yen was posted. An equity-method investment loss of 403 million yen due to the inclusion of the interim profit/loss of Artisense Corporation was posted in the section of non-operating expenses.

- For the term ending March 2023, sales are expected to grow 83.8% year on year to 500 million yen. Sales are projected to grow considerably this term, too, due to the increase and enlargement of evaluation and development projects. Operating and ordinary losses are forecast to be 350 million yen and 300 million yen, respectively. The costs of Artisense Corporation, which were taken into account for only 3 months in the previous term, will be included for the full year this term, so the cost of sales and SGA will augment year on year, but the company will improve its cost structure by the end of the term. As non-operating revenues, the company is expected to receive R&D subsidies in the U.K. and Germany.

- In the term ending March 2023, the company will grow sales by increasing and enlarging projects while maintaining the portfolio composed of mainly evaluation and development projects, and shift to a revenue structure for moving into the black while achieving cost synergy through the acquisition of Artisense Corporation as a subsidiary. The company will accelerate sales growth from all aspects of regions (Asia and other foreign countries), products (support for development and packaged products directly linked to clients’ commercialization) and channels (sales partners), shift to a revenue model by realizing clients’ commercialization, and establish a base for expanding revenues from the term ending March 2024.

- As the company fortified its already-established global cutting-edge position and competitive advantage, by acquiring Artisense Corporation as a 100% subsidiary, its product pipeline has become richer. It is noteworthy that not only projects with a high possibility of commercialization, but also projects with a low or medium possibility of commercialization increased steadily from one year ago and also from half a year ago. Furthermore, the AP and SLAM of the company are core technologies in the fields of “robotics” and “metaverse,” which are expected to expand rapidly, so there will emerge pipelines in a broader range of fields.

- In July 2022, Whale Dynamic, which develops self-driving technologies in China, announced the start of application of products for autonomous driving equipped with Kudan 3D-Lidar SLAM and the receipt of orders for projects in major cities in China. We expect that they will release two products this term as scheduled, and pay attention to the status of their pipelines.

1. Company Overview

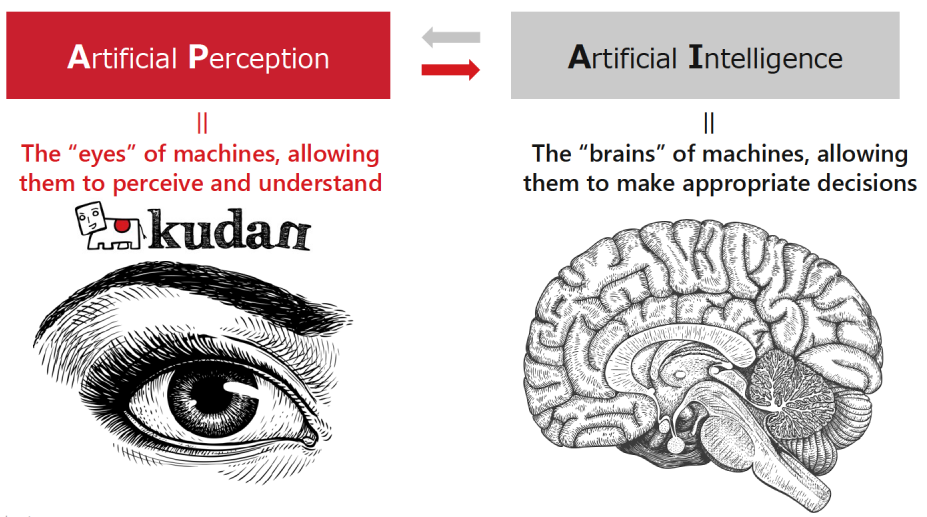

Kudan Inc. is a company that carries out R&D of deep technology (or deep tech), specializing in algorithms for artificial perception (AP) which acts as the eyes of machines, such as computers and robots. Working in pairs with artificial intelligence (AI), which serves as the brain of machines, to complement each other as deep tech, AP helps machines evolve to function autonomously. The company operates business based on its unique milestone model focused on deep tech that has impact on a wide range of industries through highly sophisticated technological innovations.

【1-1 Corporate history】

Mr. Tomohiro Ohno, currently serving as a Managing Director, became convinced of the future prospects and growth potential of the AP technology when working at Andersen Consulting (currently Accenture PLC) and set up Kudan Limited in the United Kingdom in January 2011, at which he pursued his own research and development on the Simultaneous Localization and Mapping (SLAM) technology that provides a basis for the AP technology.

In November 2014, he established Kudan Inc. with the aim of extending the administrative department through business expansion while moving further ahead with his research and development. The company started offering evaluation software for demonstration of the Kudan SLAM technology in December 2016 and officially began to provide Kudan SLAM in the term ended March 2018.

It got listed on the Market of the High-Growth and Emerging Stocks (Mothers) of the Tokyo Stock Exchange (TSE) in December 2018.

In April 2022, the company got listed on the Growth Market of TSE, through the market reclassification.

Consisting of four inside directors, Managing Director & CEO Daiu Ko, who joined the company after working for Toyota Motor Corporation and McKinsey & Company, Managing Director Tomohiro Ohno, Kohei Nakayama, a director and CFO, and Mr. Ken Iizuka, CVC and a director in charge of new business, Kudan’s management team places a heavy emphasis on swiftness.

【1-2 Corporate philosophy】

Kudan’s corporate philosophy is “to stand alone, and dare to create what is new and different.”The philosophy guides the company into avoiding following suit and daring to challenge the generally accepted wisdom. Embracing the philosophy, the company aims to expand its business and research and development, raise shareholder interests, and become a one-of-a-kind company in the market by formulating policies that enable them to stand out from all other companies.

While adopting a corporate vision to “Eyes to the All Machines,” Kudan aims to become a player that offers technology essential for full autonomy and automation, goals that all kinds of machines and devices will strive to reach.

【1-3 Market environment】

In recent years, the increasing needs for automation of operations in every industry and advancement of hardware technology, including sensors and semiconductors complementary to algorithms, have been rapidly spreading and practically utilizing the AP algorithms.In addition, the impact of the spread of COVID-19 has resulted in soaring demand for saving labor and working remotely for operations that require neither human interaction nor group work in all the industries. The growth of demand for automation technology, such as robotics, autonomous driving, and drones, is significant particularly in the fields of logistics, manufacturing, construction, retail, etc.

The material for the 10th meeting for discussing new governance models for realizing Society 5.0 held on October 6, 2020 by the Ministry of Economy, Trade and Industry (METI), which was titled “Reference material 2: Case studies for estimating the economic impact of advanced technology,” provides estimates for the economic impact of Internet of Things (IoT), artificial intelligence (AI), autonomous driving systems, and drones as follows:

Technology/device | Economic impact |

IoT | Real GDP boosted by the increase in use of IoT and AI is estimated at 132 trillion yen in 2030. The number of people in employment in 2030 when use of IoT and AI is promoted is facilitated further is estimated to be 63 million, up 7,390,000 compared to the number of people employed when use of IoT and Ai is not promoted. |

AI | GDP in 2030 is expected to be 9.8% (11.2 trillion dollars) to 14% (15.7 trillion dollars) higher with an impact of AI than without. |

Autonomous driving systems | It is projected that the passenger economy (*) will stand at 800 billion dollars in 2035 and 7 trillion dollars in 2050 globally when autonomous cars are put into practice. The economic impact is broken down into Mobility as a Service (MaaS) for consumers (3.7 trillion dollars), MaaS for businesses (3.0 trillion dollars), and newly emerging driverless vehicle services (0.2 trillion dollars). *The passenger economy: economic and social value realized by level-5 fully autonomous cars |

Drones | The market scale of the drone business in Japan is forecasted to be 193.2 billion yen in FY 2020, up 37% from the year before, and reach 642.7 billion yen in FY 2025 (about 3.3 times larger than that of FY 2020). Drone services were the strongest market in FY 2019 with a 68% year-on-year increase to 60.9 billion yen followed by the drone body market that grew 37% year on year to 47.5 billion yen and the drone peripheral services market which showed a 46% year-on-year rise to 32.6 billion yen. These three markets are expected to continue booming, with the market scales for FY 2025 are estimated at 442.6 billion yen (about 7.3 times greater than that of FY 2019) for the services market, 122.9 billion yen (about 2.6 times greater than that of FY 2019) for the body market, and 77.1 billion yen (about 2.4 times greater than that of FY 2019) for the peripheral services market, respectively, in descending order. |

*Created with reference to “Reference material 2: Case studies for estimating the economic impact of advanced technology” used at the 10th meeting for discussing new governance models for realizing Society 5.0 as posted on METI’s website. The red and bold parts were provided by Investment Bridge Co., Ltd.

The company expects that the applications of AP and fusion of it with AI and IoT will result in strong markets of both applications and technology.

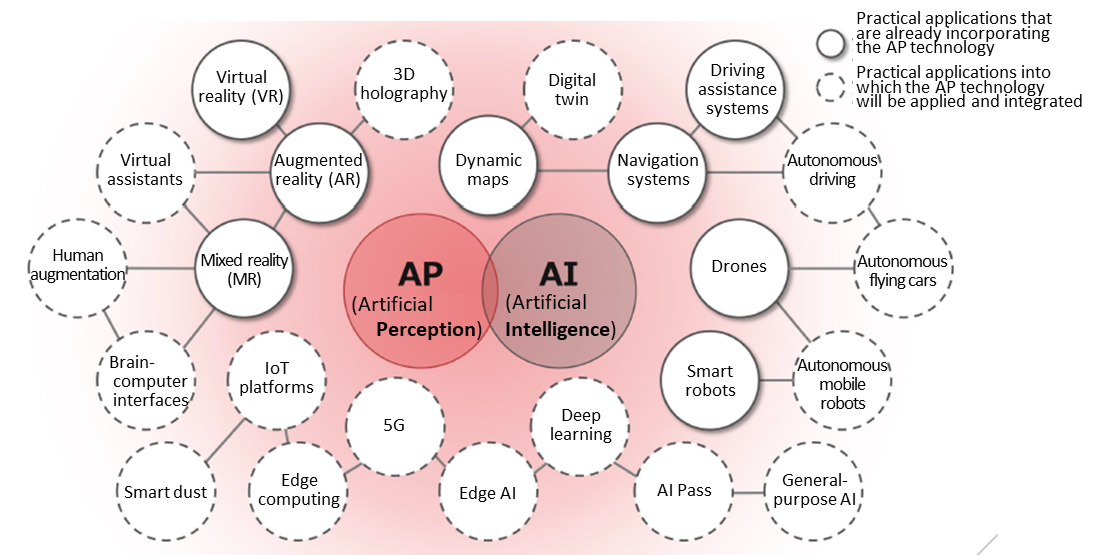

(Taken from the reference material of the company)

【1-4 Business content】

Kudan has issued a license for Kudan SLAM, a software for integrating such algorithms as SLAM, that is the mission-critical technology of AP, into hardware, and grants it to customers.It is essential to learn about AP (Artificial Perception) and SLAM to understand the business and technological superiority of Kudan. Below are descriptions of AP and SLAM.

<What is AP?>

Artificial perception (AP) is a technology put forward by Kudan Group that is carrying out research and development thereof.Following the recent advancement of AI, a technology that substitutes the human brain, machines such as computers and robots, which have worked only under the instruction and command of humans for many years, are believed to evolve to function autonomously independently of people’s control.

The technologies crucial for this evolution are AI that is the brain with which machines can make decisions and AP, one of the advanced technologies that acts as the eyes of machines with which they can perceive their surroundings.

Coordinating and complementing mutually with AI which is the brain, AP as the eyes helps machines (robots and computers) work and function autonomously.

(Taken from the reference material of the company)

As mentioned above, AP is a technology that imparts advanced visual capabilities to machines just like the human eye.

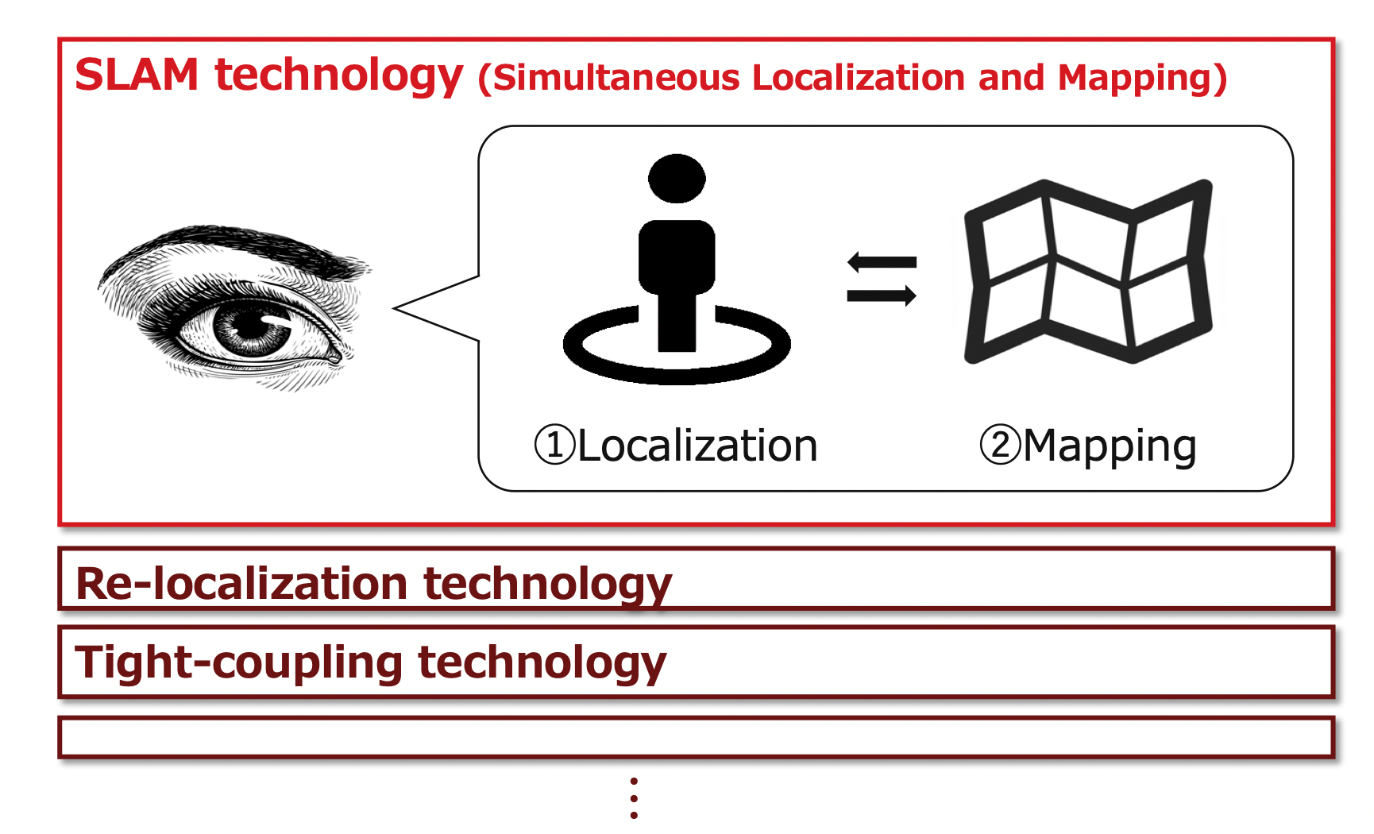

What plays a central role to enable AP to fully demonstrate the required capabilities, is SLAM.

<What is SLAM?>

SLAM is a technology for each computer to concurrently “estimate the self-location (localization: checking where you are)” and “produce a three-dimensional map (mapping: checking your surroundings)” in the real environment based on data input from external sensors, such as cameras and lidar.

It is possible to record how you have travelled in a new environment while producing a map (tracking) and recognize where you are based on a previously produced map (re-localization).

(Taken from the reference material of the company)

Taking a car applied with the SLAM technology as an example, the technology localizes the car based on a computer program of mathematically processing the distance that the car has travelled, camera images, and sensor information provided by Lidar, which is a sensor using laser light, and outputting three-dimensional information (such as the direction, distance, and size) and kinesthesia (such as the location and movement) on a real-time and precise basis and, at the same time, makes a three-dimensional map based on data on the surroundings amassed by the sensors.

In the case of cars, SLAM enables drivers to obtain basic information for safe travel by car by using a three-dimensional map drawn from time to time by the technology while driving cars, even if they have no information in advance on road conditions (such as the location of cars driving in the front, back, left, and right of their cars, how fast the cars in all directions drive, the road width, and the number of road lanes).

Differing from GPS, which detects a position with external radio waves, and beacons, it recognizes the self-position in a stand-alone manner, so it can be used in a broader range of environments, situations, and cases.

SLAM is the most critical technology for AP, and what are extremely important are precision and processing speed when it comes to ensuring the safety in autonomous cars. Such technological issues have been pointed out as obstacles to using SLAM for general purposes.

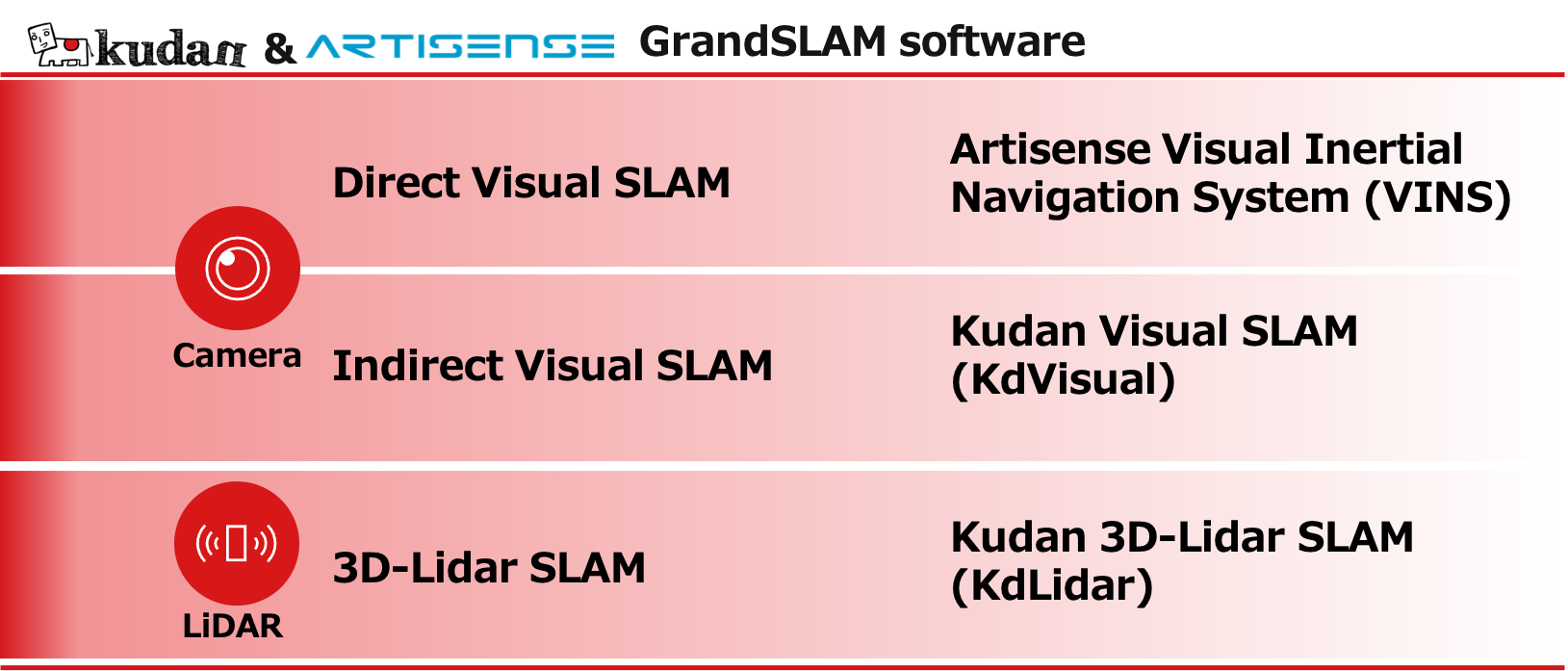

In this regard, GrandSLAM offered by the Kudan Group is comprised of three different SLAM algorithms, each of which has its own unique strengths.

Kudan Indirect Visual SLAM, for example, is capable of processing information over 10 times faster with less processing power than the most prominent open-source software of camera-based SLAM technology. Compared to other solutions that can generally give only centimeter-level localization precision, such as 5 cm, the precision of Kudan Indirect Visual SLAM can be as small as millimeters.

By combining these algorithms, etc., the company aims to further improve the function with higher speed and higher precision both indoors and outdoors, using multiple sensors, such as cameras and Lidar, together by integrating the systems through clock synchronization between the sensors (a process called tight coupling).

This technological superiority has been enhanced further by the acquisition of Artisense Corporation as its subsidiary as mentioned later.

Kudan began offering Kudan Indirect Visual SLAM under the name of Kudan SLAM in the term ended March 2018. Then, it started to provide Kudan 3D-Lidar SLAM in March 2020. The company has been striving to broaden the customer base in the following three areas:

Area | Example customers |

Augmented reality (AR) and virtual reality (VR) application area | Optical sensor manufacturers, optical equipment manufacturers, mixed reality (MR) glasses manufacturers, telecommunications equipment manufacturers, electrical equipment manufacturers, e-commerce platforms, computer games producers etc. |

Robotics and IoT area | Optical equipment manufacturers, heavy industrial and industrial robot manufacturers, electrical equipment manufacturers, transportation equipment manufacturers, signal processing internet protocols (IPs), etc. |

Application area targeting cars and maps | Car components manufacturers, digital map companies, spatial information consulting companies, etc. |

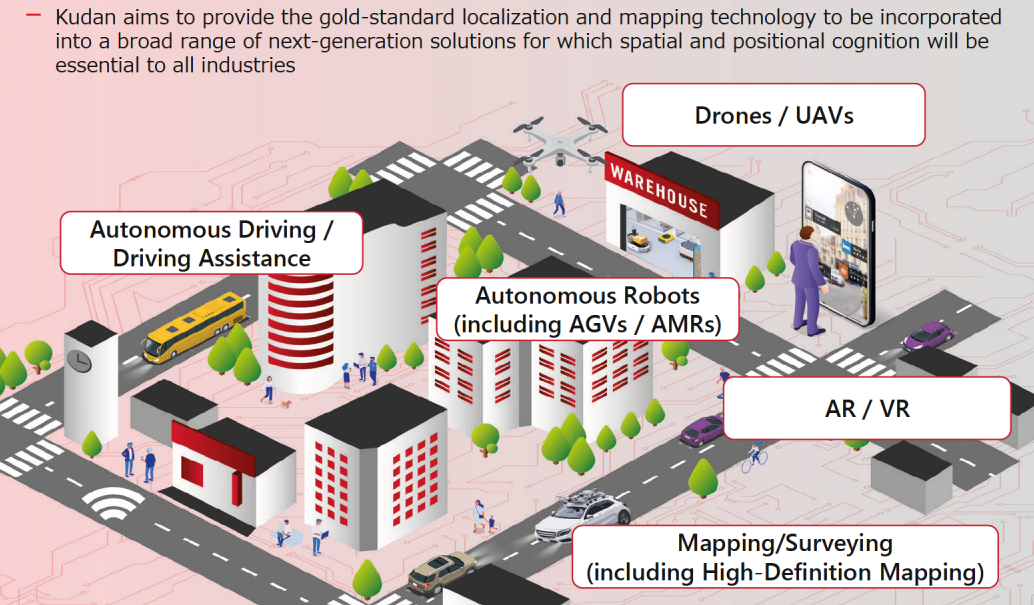

<Growing number of fields in which AP can play roles>

Using one of the existing technologies called computer vision (a set of base technologies of sensor and image processing mainly on a two-dimensional basis) as the foundation after reconstructing it, Kudan has developed its own unique AP technology.

As AP is the base technology necessary for every kind of device that uses cameras and three-dimensional sensors, the company expects that it will be the base technology adopted to diverse next-generation solutions on a cross-cutting basis.

It has been a technology essential for automatic control of all autonomous machines as robotics in a broad sense, including industrial robots, domestic robots, next-generation mobility such as cars, and flying machines such as drones, just to name a few.

It will also be required for spatial perception in AR and VR that will serve as user interfaces of next-generation computers.In addition, the technology will be applied to an extremely wide range of purposes as the base technology for next-generation digital maps, dynamic maps (a dynamic mapping system that swiftly reflects the conditions of the reality environment), digital twin (information on the virtual space synchronized with the reality environment on a real time basis), and the like.

(Taken from the reference material of the company)

【1-5 Business strategies】

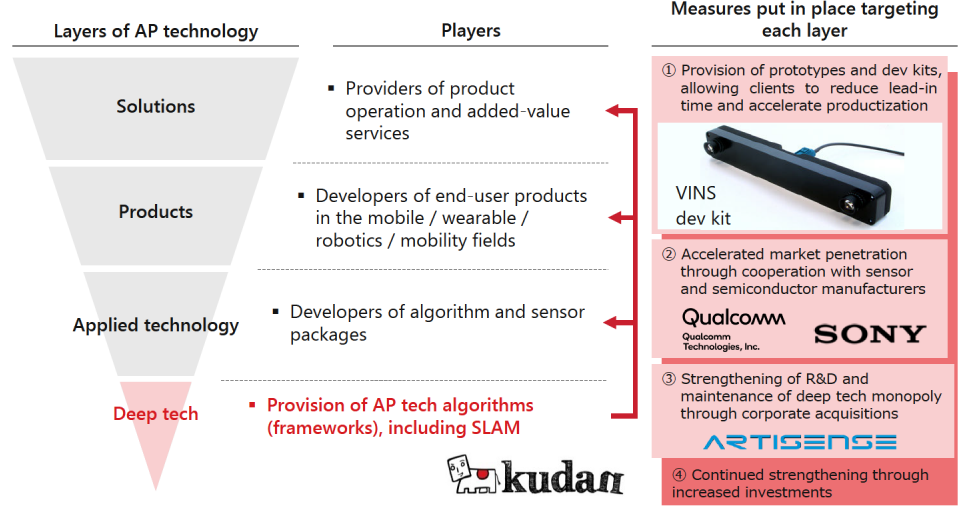

Kudan focuses on carrying out research and development and offering AP algorithms, such as SLAM, which is a deep tech that is equivalent to the base technology locating at the lowest level of the AP technology pyramid, under solutions, finished products, and application technology of various industries.Kudan’s business strategy is aimed at maintaining and further increasing its monopolistic market share as a special and independent company in the AP market by forging alliances on a global basis with multifarious players of all the levels of the pyramid, which are solutions, finished products, and application technology, and enticing them as customers while maintaining its position without relying on any specific company in terms of business development and finance.

(Taken from the reference material of the company)

<Acquisition of Artisense Corporation as a subsidiary and business alliance therewith>

One of the most noteworthy points of the Kudan Group’s business strategies is the acquisition of Artisense Corporation (whose headquarters are based in the United States) as a subsidiary and a business alliance with the company.

(Overview of Artisense Corporation)

With such fields as autonomous driving, robotics, AR and VR, and drones being its application areas, Artisense Corporation provides AP algorithms that perceive the space and location, taking pride in its capability of putting camera-based visual SLAM into practice on a commercial level.

Artisense Corporation was founded in 2016 jointly by Professor Daniel Cremers, who has delivered the world’s best research results as the leader of the Technical University of Munich (TUM) that has a world-leading research group in AI and computer vision and as a leading expert on the autonomous driving technology, and Mr. Andrej Kulikov, a serial entrepreneur.

The Artisense Group consists of three global companies, which are the parent company that is based in Silicon Valley, California, U.S., a German company engaging in research and development in collaboration with TUM and the European auto industry, and a Japanese company devoted to business development in the Asian region.

Artisense conducts research and development on AI and computer vision and offers technology related thereto in the field of the spatial and location perception technology, in which Kudan operates business, and the strength of its direct visual SLAM, in particular, lies in the algorithms developed through approaches different from those taken by Kudan.

(Purposes of the acquisition of Artisense Corporation as a subsidiary)

Although Artisense Corporation is a direct competitor, Kudan entered into a contract with it in January 2020 for gradually getting its shares with the intention of acquiring it as a subsidiary.

By grouping together leading companies in the increasingly oligopolistic field of artificial perception (AP) technology, Kudan aims to consolidate its position as one of the world's largest forces in the field of artificial perception and SLAM, and to secure an overwhelming market share by increasing its competitive advantage and growth potential.

In addition, the technological collaboration between the two companies is expected to solidify their footing by securing IP (intellectual property) for future technologies, and synergistically improve performance by complementing the technologies in which each company excels, thereby realizing advanced spatial and positional recognition in more complex environments.

Kudan concluded a business alliance with Artisense in May 2020.Specifically, in research and development, Kudan aims to develop and put into practice its unique GrandSLAM, an algorithm that is as most sophisticated as one can theoretically think of by achieving a breakthrough with integration of the direct SLAM that Artisense uniquely possesses as a next-generation technology into Kudan’s indirect SLAM, or into Kudan’s Lidar SLAM technology, and Artisense’s deep learning-based AI technology called Deep Feature.

By realizing such breakthroughs through industry-leading technology commercialization, Kudan believes that it can further promote technology-driven market growth in areas of automated driving, robotics, AR/VR, and drones.

These efforts are not just limited to research and development, but are already leading to a number of projects on a global scale, backed by world-class technology, including the following.

Regarding business development, the company will further enhance its sales structure globally in Asia, including Japan and China, Europe, and North America.

As mentioned earlier, it also strives for dramatic medium- and long-term growth through such efforts as to forge ahead with further development and investment in deep tech, as well as to retain and enrich researchers and engineers specializing in SLAM, whose recruitment will be more difficult because the number of such experts is believed to become limited, enrich personnel engaging in business development in global sales locations, invest in partner companies for expanding product and solution development, and develop and put into practice GrandSLAM.

The purposes and achievements of the merger and acquisition so far are as follows:

Purpose | Overview |

| Achievements |

To secure experts whose number is getting small | -Prof. Daniel Cremers of Artisense is an internationally respected authority on research into AI and autonomous driving systems.

-About 20 leading engineers are engaged in research and development under Prof. Cremers. | ⇒ | Successfully retained existing human resources. Continuously secured engineers from TUM’s pool of top engineering talent. Together with Kudan, they form a team of 30 top engineers. |

To secure next-generation technologies | -Direct SLAM, which is more similar to human perception.

-Integrating SLAM with deep learning, which will be essential for putting finished products into practice. | ⇒ | Successfully made next-generation technology into products and launched them onto the market.

Verified the effectiveness in the market through multiple PoC (*) projects. |

*PoC

PoC stands for Proof of Concept, which is verification and demonstration in a preliminary step before prototype development with the aim of verifying new concepts, theories, principles, and ideas.

(Process of the subsidiary acquisition)

The share transfer agreement entered into in January 2020 stipulates that Kudan acquires all the shares of Artisense held by the seller not in a lump in an early stage but through three closing steps.The contract was so designed to provide Artisense’s officers and employees, who are the members of the seller, with stronger incentives to continuously getting involved in the operations of Artisense and improvement of its business performance, as well as to control the risks that Kudan will face, by designing a step-by-step acquisition. In addition, the agreement allows to motivate the seller to continuously improve Artisense’s business performance by flexibly adjusting the third closing date and payment of the acquisition to the business result of a certain period.

After Artisense became an equity-method affiliate of Kudan through the first closing (January 2020, acquisition of approximately 1.49 million shares, or 12.0% of the total outstanding shares) and the second closing (July 2020, acquisition of approximately 3.23 million shares, or 26.0% of the total outstanding shares), the gradual integration of the companies has progressed smoothly. Against this background, the third closing, which was scheduled to take place by December 2022, took place in December 2021, making the company a wholly owned subsidiary.

【1-6 Competitive superiority】

(1)Technological features

Kudan believes that its AP technology has enormous advantages in taking in not only the existing demand for product development but also demand for research and development on highly novel and complex future technologies, because the AP technology can help the company strategically take in technological demand fueled by continuous advancement and wider applications of the technology in mid-/long-term.

According to the company, the AP technology has the following five features.

Kudan can flexibly fulfill future demand, which is expected to grow and be diverse, by combining their sophisticated and flexible research and development capabilities that they cultivated by focusing on the AP field:

Feature | Overview |

(1) Uniqueness of the algorithms | The Kudan Group possesses diverse families of technologies that consist of uniquely developed algorithms.

Regarding how to perceive image feature points (fairly noticeable local areas in an image) that provide the basis for perceiving three-dimensional geometric structures at an advanced level, for example, the company has developed a unique, high-speed and greatly precise method by integrating and hybridizing a high-speed perception method and a highly precise and stable perception method. Furthermore, the density of feature points perceiving within an image can be adjusted flexibly to optimize the precision of perceiving three-dimensional structure (a set of three-dimensional feature points) and the processing speed, according to the practical application environment. In addition, a wide range of unique mathematical models that guarantee the feasibility of the technology are integrated, including optimized calculation that increases the precision of a group of three-dimensional feature points perceived sequentially in a three-dimensional manner, and a high-speed matching method with already-known, stored data. |

(2) Flexibility and powerful performance | The uniqueness of the algorithms allows high-speed processing (with a light calculation load) as well as realizes great perception precision (which means that deviation from a true value is slight) and robustness (which indicates that the technology performs stably regardless of the environment and conditions in which it is used). In addition, the AP technology will be able to deliver strong performance that is optimized for a myriad of practical applications as it is designed in a manner that allows users to make detailed adjustments to the perception precision, robustness, processing speed, data size, and other individual functions according to the conditions under which the technology is used and required specifications. |

(3) Flexibility in sensor use | As limiting the number of sensors can narrow the scope of applications of the AP technology, the Kudan Group’s technology is designed to be compatible with various sensors. Specifically, it can function with a variety of cameras, the technology can be adjusted flexibly according to the number of cameras (such as monocular cameras, binocular cameras, and multiple cameras), and the data read format of optical sensors (such as whether to read data sequentially or simultaneously). Besides cameras, the technology can also be combined with a multitude of sensors, including three-dimensional sensors (such as Lidar and Time of Flight (ToF)), internal sensors (such as inertial measurement unit (IMU) and machine odometry), and position sensors (such as the Global Positioning System (GPS) and Beacon), which will allow advanced application of the technology while taking advantage of the strengths of each sensor. |

(4) Flexibility in arithmetic processing environments | Flexibility in arithmetic processing platforms is also an important factor for applying the AP technology to a wider range of fields. As the Kudan Group’s technology can work in multifarious arithmetic processing environments, it can be compatible with all kinds of processor designs and thus can speed up calculation processes by optimizing the software according to the kind of processor used (such as a central processing unit (CPU), a digital signal processor (DSP), and a graphics processing unit (GPU)). It can also function in a wide range of system environments through porting a software to major operating systems (such as Linux, Windows, MacOS, iOS, and Android). |

(5) Flexibility in using part of the function | Complex fusion with other technologies is necessary for advanced applications of the AP technology. Parts of the function (software modules) of the Kudan Group’s technology can be selected so that they are flexibly integrated into customers’ existing software. The degree of dependence on processor designs (the degree of abstraction of software) of each part (software module) of the technology’s function varies, and therefore it can be optimized flexibly either at a semiconductor level (with a lower abstraction degree) or at a software application level (with a higher abstraction degree). |

(2)Group of experts on AP

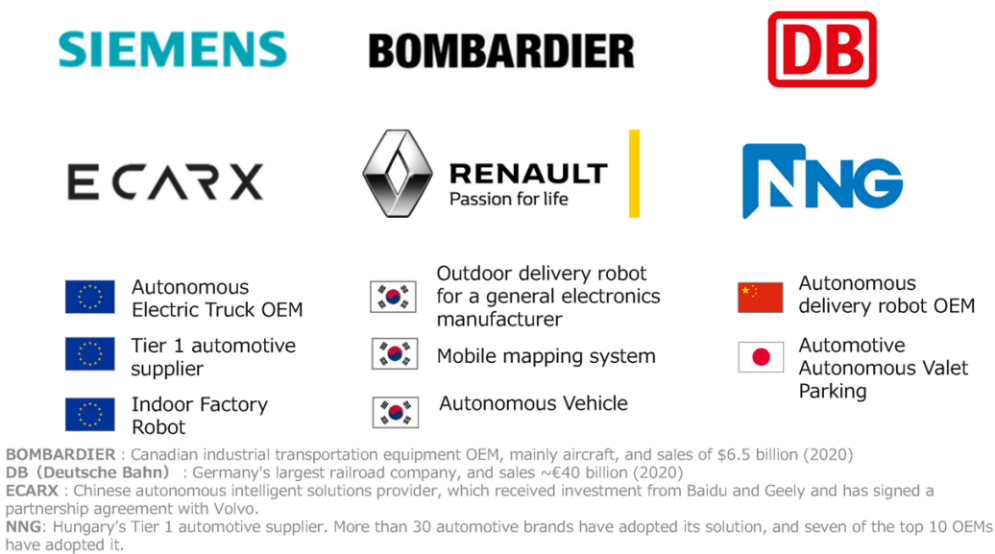

Kudan has laid a firm technological and business foundation as a group of experts in AP.Many of Kudan’s existing customers are companies in Fortune 2000 that lists global good-standing companies, which indicates that Kudan has been highly acclaimed by world’s innovative companies.

(3)Outstanding business achievements and customer awareness

Companies specializing in SLAM and ones whose core technology is SLAM are decreasing in number due to successive mergers and acquisitions by big tech companies.

Under these circumstances, Kudan and Artisense pull far ahead of other companies in terms of the range of technologies that they offer, business results that they have delivered, and customer awareness.

【1-7 Business model】

(1) Acceleration and expansion of customer commercialization

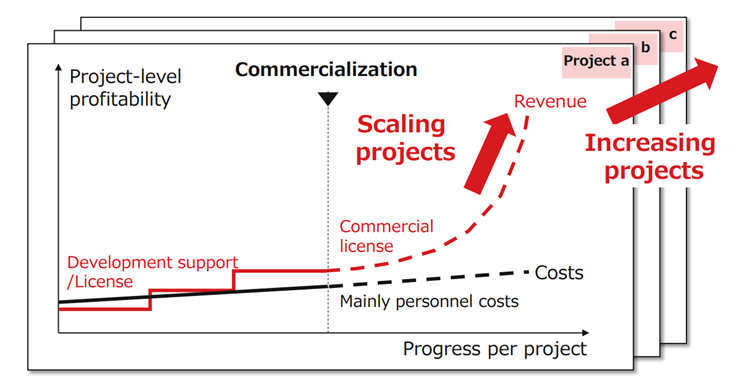

In the evaluation and development phase, Kudan generates revenue from algorithms’ customization, addition of new functions, technological consulting services, etc. through joint research and development, as well as by granting the license for the algorithms of Kudan SLAM.

The algorithm license is comprised of the development license and the product license, and the type of license granted will be changed from the development license to the product license according to the progress achieved by each customer with commercialization of its product under development.

Based on such calculations as the cost of a product multiplied by the quantity of products, the company expects that revenue from the product license will rise dramatically as products covered by the license spread out.

Considering that “the quality of the portfolio of projects” is the most important for achieving the above, the company has engaged in the reshuffling of the customer portfolio from the term before the previous term, and produced some achievements.

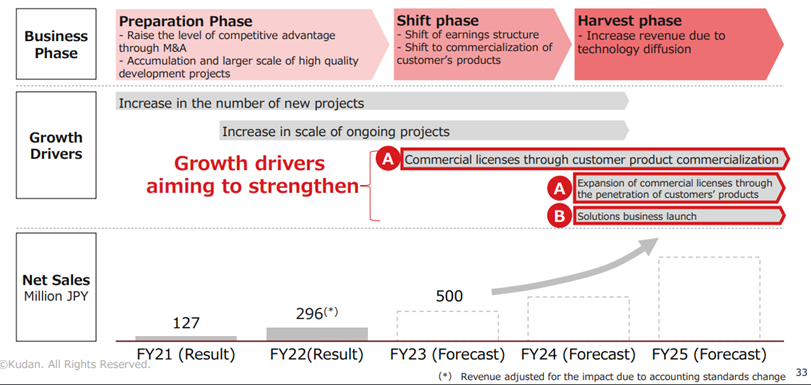

Up until now, the company has been in the “preparation phase,” in which they obtain evaluation and development licenses and earn sales according to the progress of the development milestones from support for development in client companies, to achieve a certain level of monetization and growth, but as the provision of products for autonomous driving equipped with Kudan 3D-Lidar SLAM technology started in China (which will be described later), the company will proceed to the “conversion phase,” in which the company will receive revenues from product licenses after clients’ commercialization and change its revenue structure, and then to the “reaping phase,” in which the company will expand sales steeply by accelerating or expanding clients’ commercialization and yielding revenues from product licenses, at an accelerated pace.

In addition to expanding its existing AP business, the company aims to enhance deep tech and raise the number of application areas through increased merger and acquisition activity.

(Taken from the reference material of the company)

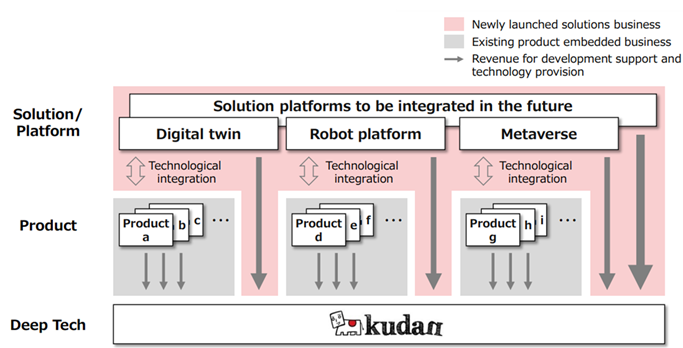

(2) Operation of the solution business

As the company will proceed from the “preparation phase” to the “conversion phase” to the “reaping phase,” it will not only incorporate its technology into individual products, but also concentrate on the provision of new solutions, including the synchronization of multiple products and the expansion of purposes of use based on Kudan technology. Recognizing clients’ commercialization as a foothold for the solution business and expecting synergy in the solution business for clients’ commercialization, the company aims to increase earning opportunities.

It is assumed that their services will be offered in the fields of digital twins, robot platforms, and metaverse.

(Taken from the reference material of the company)

2. Fiscal Year ended March 2022 Earnings Results

【2-1 Overview of the consolidated results】

| FY 3/21 | Ratio to sales | FY 3/22 | Ratio to sales | YoY |

Sales | 127 | 100.0% | 271 | 100.0% | +112.7% |

Gross Profit | 37 | 29.3% | 124 | 45.8% | +233.2% |

SG&A | 488 | 382.1% | 557 | 205.1% | +14.2% |

Operating Income | -451 | - | -433 | - | - |

Ordinary Income | -1,575 | - | -681 | - | - |

Net Income | -1,608 | - | -2,237 | - | - |

*Unit: million yen

Sales are increasing due to higher revenue, expansion of project orders, and progress in the development phase of existing projects

In the term ended March 2022, sales increased 112.7% YoY to 271 million yen. Sales grew due to the expansion of the Lidar SLAM and Artisense SLAM technology lineup and the effect of the customer portfolio reshuffling implemented from the previous term, as well as the increasing of orders for a broad range of fields and progress of the development in existing projects for clients' commercialization. The sales without the application of the new revenue recognition standards were 296 million yen, almost in line with the initial forecast (300-350 million yen).

An operating loss of 433 million yen was posted. SGA augmented 14.2% year on year to 557 million yen, due to the global expansion of systems and the acquisition of Artisense Corporation as a consolidated subsidiary in January 2022.

An ordinary loss of 681 million yen was posted. An equity-method investment loss of 403 million yen due to the inclusion of the interim profit/loss of Artisense Corporation was posted in the section of non-operating expenses.

Net loss of 2,237 million yen was posted. As a one-time integration cost due to the early consolidation of Artisense as a subsidiary, the company recorded 1,474 million yen in R&D investment expenses as a one-time impairment loss in the term ended March 2022. As a result, the company believes that the burden of future goodwill amortization expenses has been eliminated, enabling it to return to profitability early in the future.

【2-2 Financial standing and cash flows】

◎ Balance sheet indicating major items

| End of Mar. 2021 | End of Mar. 2022 | Increase/ decrease |

| End of Mar. 2021 | End of Mar. 2022 | Increase/ decrease |

Current Assets | 1,359 | 754 | -605 | Current Liabilities | 81 | 125 | +43 |

Cash and deposits | 1,230 | 604 | -626 | ST Interest-Bearing Debts | - | - | - |

Noncurrent Assets | 180 | 15 | -164 | Noncurrent Liabilities | - | 6 | +6 |

Tangible Assets | 0 | 0 | 0 | LT Interest-Bearing Debts | - | - | - |

Investment, Other Assets | 180 | 15 | -164 | Total Liabilities | 81 | 132 | +50 |

Investment Securities | 1 | 0 | -1 | Net Assets | 1,458 | 637 | -820 |

Total Assets | 1,540 | 770 | -770 | Capital | 1,620 | 897 | -722 |

|

|

|

| Retained Earnings | -1,755 | -2,382 | -626 |

|

|

|

| Total Liabilities and Net Assets | 1,540 | 770 | -770 |

*Unit: million yen

Total assets decreased 770 million yen from the end of the previous fiscal year to 770 million yen due to a decrease in cash and deposits. Net assets decreased by 820 million yen to 637 million yen due to a decrease in retained earnings.As a result, the equity ratio decreased by 11.6 points from the end of the previous fiscal year to 82.8%.

◎ Cash Flow

| FY 3/21 | FY 3/22 | Increase/decrease |

Operating Cash Flow | -349 | -514 | -165 |

Investing Cash Flow | -705 | -137 | +568 |

Free Cash Flow | -1,055 | -652 | +402 |

Financing Cash Flow | 1,777 | 9 | -1,768 |

Cash and equivalents | 1,230 | 604 | -626 |

*Unit: million yen

The positive balance in financing CF narrowed due to a decrease in revenue from stock issuance year on year. The cash position declined.

【2-3 Topics】

(1) Completion of acquisition of Artisense Corporation as a 100% subsidiary

As the stepwise business integration with Artisense Corporation progressed steadily, they conducted the third closing earlier than schedule, it was scheduled to be conducted by December 2022, and the acquisition was completed on December 10, 2021. Then, Artisense Corporation became a 100% subsidiary (62.6% of shares were acquired at an acquisition price of 1.75 billion yen).

Regarding the evaluation of additionally acquired shares, an impairment loss was posted for the total amount based on the conservative earnings forecast, like the results for the term ended March 2021. Consequently, there will be no goodwill amortization.

Since the company acquired additional shares by issuing new shares, the increase in shareholders’ equity and a decline due to the impairment loss coincided, so this transaction causes no change in shareholders’ equity. Expenses for investment in R&D were posted at once in that term, but future costs will be curtailed, while the company will fully integrate their management systems. The company believes that its contribution to profit will become apparent at the time of sales growth in the future.

As Artisense Corporation became a subsidiary, the interim profit/loss of Artisense Corporation during a period from July to December 2021, including the impairment loss on borrowings from Kudan and the purchase of stock options held by employees of Artisense Corporation, was posted as “equity-method investment loss.” There will be no expenses in this item.

Since Artisense Corporation became a 100% subsidiary in December 2021, its sales and expenses have been posted in the consolidated financial statements of Kudan since January 2022.

In the medium/long term, they aim to start growing sales earlier than scheduled and expand its scale by completing management integration.

(2) A Chinese business partner released a product for autonomous driving equipped with Kudan’s 3D-Lidar SLAM technology.

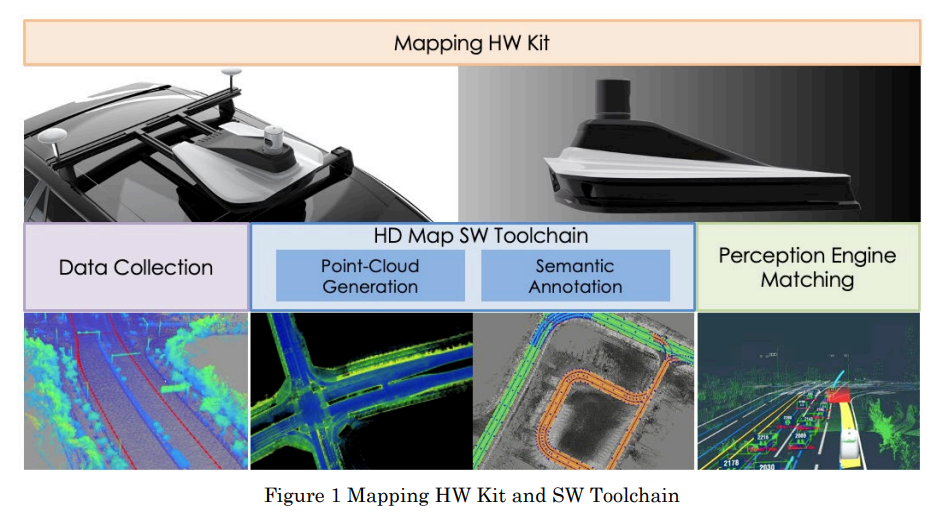

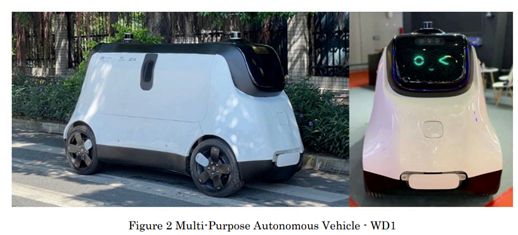

In July 2022, Whale Dynamic Co., Ltd., which is a business partner of Kudan and develops automatic driving solutions in China, released an autonomous delivery vehicle equipped with Kudan’s 3D-Lidar SLAM technology and a set of tools for producing an HD map.

Kudan and Whale Dynamic have already received orders in a project for selling these products in major cities in China, and plan to cooperate in further expanding sales in the Chinese market and accelerating sales to the global market.

(Current situation of automatic driving)

The automatic driving-related market is forecast to keep growing in the coming 10 years. In particular, social needs for unmanned delivery are rapidly growing, due to urbanization, the aging of society, the advent of e-commerce, the shortage of delivery staff in some countries, etc. However, in urban roads with complex traffic conditions, currently available autonomous delivery vehicles and robots are still ineffective.

(Regarding the commercialization)

Against the above-mentioned backdrop, Kudan and Whale Dynamic formed a technological alliance in 2021, and have been developing products that would lead the autonomous driving market. With the Kudan SLAM technology, whose precision and robustness were proved even in a varied environment, including urban public roads, it became possible to produce HD maps accurately and grasp the accurate locations of delivery vehicles in service.

◎Products released this time

| It is possible to produce high-density point-cloud data, and produce a semantic HD map at a centimeter precision level. The produced HD maps are compatible with a variety of formats, and can be applied to various applications in the automatic driving field. |

| It can run autonomously as a fully electric vehicle on public roads in urban areas, and carry out daily routine. It can be used for a broad range of purposes, thanks to its refined design, meticulous operational scenario design, and results of a variety of road tests. |

| Freely customizable demonstration vehicle developed so that enterprises offering autonomous driving services and developers and researchers of academic institutions can demonstrate automatic driving technologies. It is compatible with the concurrent operation of manual and autonomous driving modes, and practical automatic driving tests can be conducted at an affordable cost in a short period of time. |

(Taken from the reference material of the company)

The company has received an order from a client, and the effects of the partnership and the release of products on performance are projected to be minor. If the effects are expected to become stronger due to the increase of orders from clients, etc., the company will disclose them swiftly.

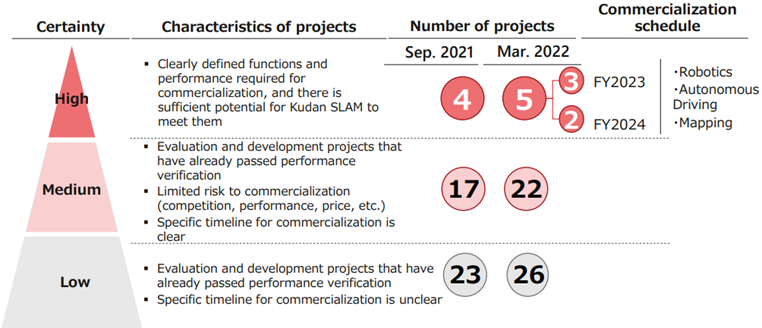

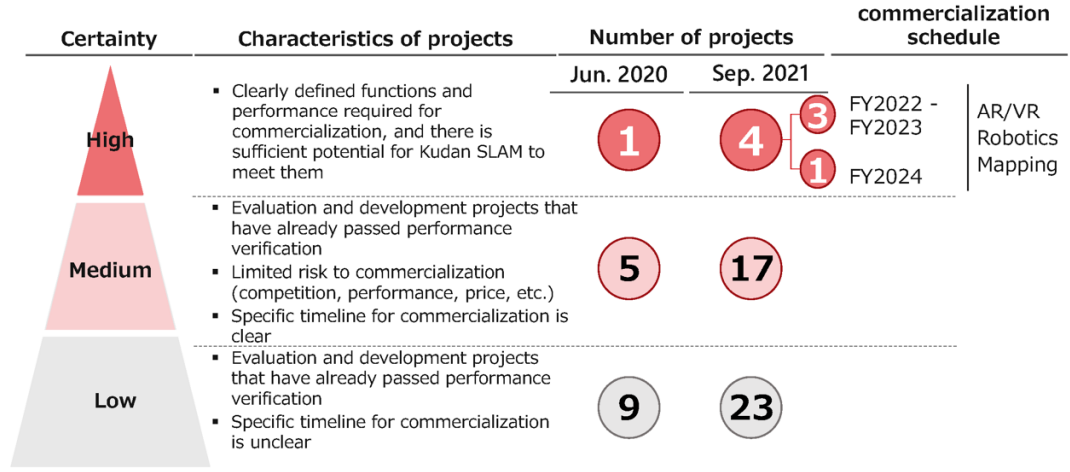

(3) Trend of the number of projects and prospects for commercialization by customers

Between the end of June 2020 and the end of September 2021 before the acquisition of Artisense Corporation as a group company, the number of ongoing projects for commercialization after performance tests increased from 15 to 44. As of the end of March 2022, it stood at 53.

In particular, they succeeded in upgrading projects with a low or medium feasibility level to projects with a medium or high feasibility level.

One out of the three projects in FY 3/2023 shown in the figure below is the above-mentioned commercialization in China. The remaining two projects in FY 3/2023 and two projects in FY 3/2024 are highly feasible, and these projects are progressing actively.

The company expects that it will proceed from “the preparation phase” to “the conversion phase” to “the reaping phase” at an accelerated pace, as the Chinese project and subsequent projects for commercialization turn out to be successful.

(Taken from the reference material of the company)

<Reference: From the previous report>

(Taken from the reference material of the company)

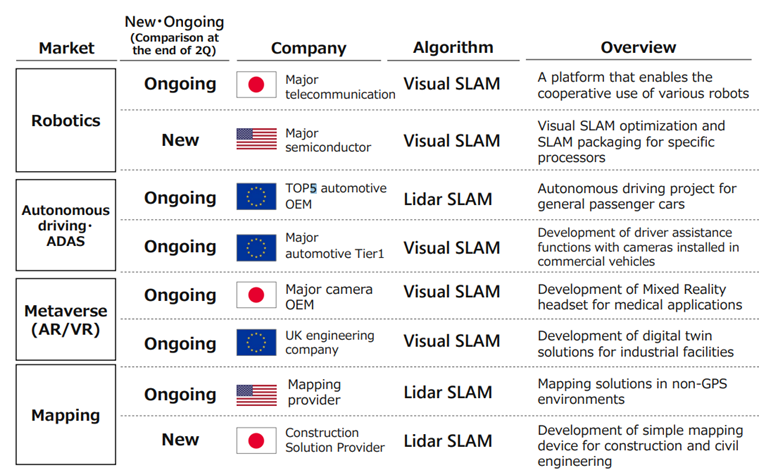

As shown below, the number of promising projects for commercialization of customers’ products is increasing in the areas of automated driving, ADAS, AR/VR, robotics, and mapping.

(Taken from the reference material of the company)

The company mentioned the following three reasons for the increase of projects.

① R&D: Adaptation to market needs by adding functions, improving performance, and expanding the technology lineup

For both Visual SLAM and Lidar SLAM, the company is efficiently developing and progressing projects by focusing on development items for which there is a high demand in the target domain and where it is easy to gain a competitive advantage.

By enhancing wheel odometry in KdVisual and improving accuracy in KdLidar, the company is now able to respond to customer projects with more specific product realization timelines.

In addition, the launch of Artisense SLAM has led to further project wins, especially in outdoor robotics projects. Moreover, in robotics, the ease of integration through the Robot Operating System (ROS) allows for a wider range of projects to be handled.

② Business development: Expansion of sales channels and the technology lineup by expanding partners and strengthening relationships

Through partnerships with sensor OEMs, processor OEMs, and technology trading companies, the company has been able to expand its channels for developing projects for which Kudan/Artisense SLAM is a good fit, and is making progress in effectively developing these projects.

It is also possible to develop solutions that combine SLAM and other areas through partnerships and collaborations with engineering companies.

③ Market environment: Increasing market needs for both Visual SLAM and Lidar SLAMThe adoption of Visual SLAM is being accelerated by the increasing number of development projects for autonomous industrial robots and by OEMs which are developing automated transport robots using SLAM with magnetic tape and 2D-Lidar, which are conventional technologies.In addition, the 3D-Lidar market is maturing due to price reduction, and as a result, the need for 3D-Lidar-based SLAM solutions is increasing.

(4) Financing for accelerating growth

Financing will be conducted for accelerating the progress from “the preparation phase” to “the conversion phase” to “the reaping phase.”

For details, please refer to “4. Growth Strategy.”

(5) Highlights of R&D and business development

Major R&D and business development projects in growing fields are as follows.

Robotics | Started and proceeded with development projects by leveraging partners *R&D Visual: Enhancement of stability in response to the changes in the environment, etc.

*Business development Improvement in popularity, undertaking of projects, etc. through collaborative marketing with technological trading companies, Intel, NVIDIA, etc. |

Automatic driving/ADAS | Continued and expanded large-scale projects. *R&D Visual: Improvement in performance with fish-eye lenses, etc.

*Business development Cooperation with automatic driving-related enterprises in China, etc. |

Mapping | Proceeded with existing projects for clients’ commercialization, and commenced multiple projects for developing new simple mapping devices. *R&D Lida Addition of SLAM functions using multiple lidar devices, etc.

*Business development Progress of development for commercializing simple mapping devices using KdLidar inside and outside Japan by the end of this fiscal year, etc. |

Metaverse (AR/VR) | Proceeded with development projects in cooperation with camera-related OEMs and expanded business in the indoor position recognition and industrial AR fields. *R&D Visual: Improvement in stability of position recognition against the changes in outdoor landscapes, etc.

*Business development Progress of evaluation and development projects in cooperation with several leading camera and camera sensor OEMs, etc. |

(6) Disclosure of a white paper introducing the concept of metaverses and new trends due to stepwise development

In February 2022, the company released a white paper titled “World beyond metaverse-‘mechanization of human beings’ and ‘humanization of machines’ that would be achieved by artificial perception.”

This white paper describes the concept of metaverse, which attracted attention as a significant global trend, from a comprehensive viewpoint, suggests new trends due to the stepwise development of metaverse and possibilities, and mentions the strategic position of the artificial perception (SLAM) technology owned by the company.

https://contents.xj-storage.jp/xcontents/AS02977/b76b909a/7ad3/4426/9b83/22ae43d56c1c/140120220224594901.pdf

(Points)

☆ | “Mechanization of human beings” and “humanization of machines” are two major technological trends. |

☆ | Metaverse has been based on AR/VR, which corresponds to “mechanization of human beings,” but it can be based on robots, which corresponds to “humanization of machines.” |

☆ | These two metaverses will be integrated mainly through “the combination of the human space and the mechanical space,” which is the core technology. |

☆ | To actualize it, space combination in the fields of AR/VR and robotics is required, so Kudan’s technologies that are highly independent and versatile are essential. |

☆ | As the demand for the metaverse will become a tailwind, Kudan’s artificial perception/SLAM technology is the core technology in the metaverse for “combining real and digital spaces,” and will integrate the metaverse and robotics. |

☆ | By offering a versatile technology compatible with the two metaverses, the company will incorporate the growth of demand for the metaverse into its own growth. |

3. Fiscal Year ending March 2023 Earnings Forecasts

【3-1 Earnings forecasts】

| FY 3/22 | Ratio to sales | FY 3/23 Est. | Ratio to sales | YoY |

Sales | 271 | 100.0% | 500 | 100.0% | +83.8% |

Operating Income | -433 | - | -350 | - | - |

Ordinary Income | -681 | - | -300 | - | - |

Net Income | -2,237 | - | -315 | - | - |

*Unit: million yen. The forecasts were those released by the company.

Expect significant increase in revenue due to accumulation and larger scale of mainly evaluation and development projects.

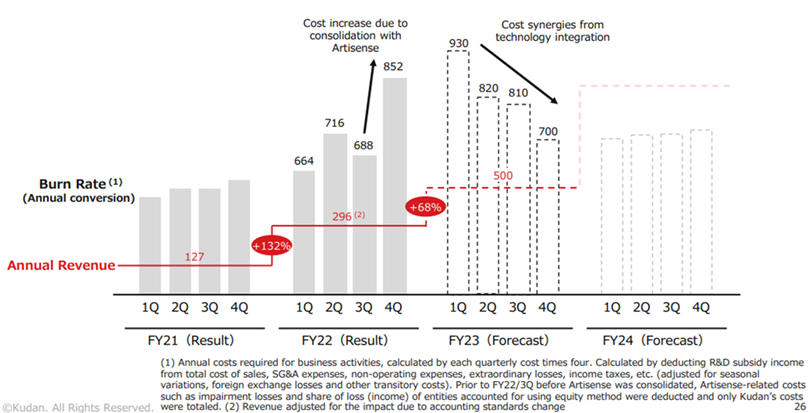

For the term ending March 2023, sales are expected to grow 83.8% year on year to 500 million yen. Sales are projected to grow considerably this term, too, due to the increase and enlargement of evaluation and development projects. Operating and ordinary losses are forecast to be 350 million yen and 300 million yen, respectively. The costs of Artisense Corporation, which were taken into account for only 3 months in the previous term, will be included for the full year this term, so the cost of sales and SGA will augment year on year, but the company will improve its cost structure by the end of the term. As non-operating revenues, the company is expected to receive R&D subsidies in the U.K. and Germany.

(Regarding the improvement in the cost structure)

By the fourth quarter of the term ending March 2023, the loss-making structure will be improved significantly, due to the cost synergy through the technological integration with Artisense Corporation (significant streamlining of development through the sharing of architecture, modules, etc.), and the company plans to secure a revenue structure for earning profit.

(Taken from the reference material of the company)

【3-2 Outlooks and initiatives】

In the term ending March 2023, the company will maintain the portfolio composed of mainly evaluation and development projects, grow sales by accumulating and enlarging projects, and shift to a revenue structure for earning profit while exerting cost synergy through the acquisition of Artisense Corporation as a subsidiary.

The company will accelerate sales growth from all aspects of regions (Asia and other foreign countries), products (support for development and packaged products directly linked to clients’ commercialization) and channels (sales partners), shift to a revenue model by realizing clients’ commercialization, and establish a base for expanding revenues from the term ending March 2024.

4. Growth Strategy

There is no change to the policy of shifting to a revenue structure for earning profit and a revenue model through clients’ commercialization, for the purpose of expanding revenues from the term ending March 2024.

By strengthening the growth driver through the switch from “monetization at the project level” to “monetization at the business level,” the company aims to shift from “the preparation phase” to “the conversion phase” to “the reaping phase”.

They are expected to earn revenues according to the progress of clients’ commercialization. At the time of start of commercialization, they will earn revenues of several millions to tens of millions of yen per project, and revenues of hundreds of millions of yen per project in parallel with the growth of product sales.

(Taken from the reference material of the company)

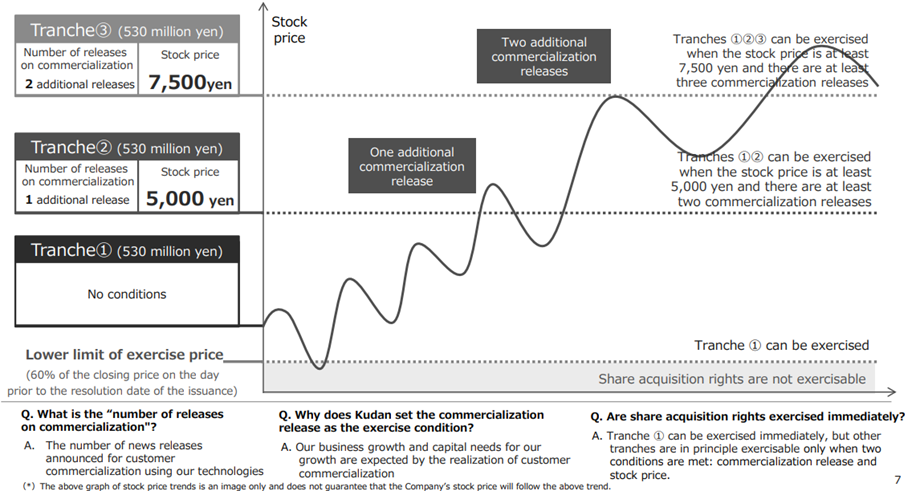

To implement this growth strategy, the company issued share acquisition rights in July 2022.

(Outline of financing)

Financing is based on Tranches 1, 2, and 3 of share acquisition rights. Their outlines, conditions, etc. are as follows.

Share acquisition right | Amount to be procured | Condition |

Tranche 1 | About 530 million yen | Initial exercise price: 2,069 yen |

Tranche 2 | About 530 million yen | Initial exercise price: 5,000 yen. The right can be exercised only after the client’s commercialization has been announced once or more while the base share price is 5,000 yen or higher. |

Tranche 3 | About 530 million yen | Initial exercise price: 7,500 yen. The right can be exercised only after the client’s commercialization has been announced twice or more while the base share price is 7,500 yen or higher. (A total of two, combined with the first one of Tranche 2) |

For Tranche 1, the company will issue share acquisition rights for accelerating the commercialization of Whale Dynamic in China and clients.

For Tranches 2 and 3, the number of announcements of commercialization of clients’ products based on Kudan’s technologies after the commercialization of Whale Dynamic in China is included in the condition, because the actualization of clients’ commercialization is expected to lead to the demand for funds for growing businesses and enterprises.

Even after the exercise of share acquisition rights, dilution rate is 5.29%, thanks to the stepwise fund procurement in parallel with growth. Since the number of shares is fixed, dilution rate will not rise. Due to the stepwise setting of share price conditions, it is possible to procure funds while minimizing dilution for maintaining shareholder value.

(Taken from the reference material of the company)

(Purposes of use of funds)

Purpose of use | Amount [100 million yen] | Scheduled period for spending funds |

To improve engineers and the business development system for accelerating and expanding clients’ commercialization | 7.8 | July 2022 to March 2026 |

Development of solutions and platforms and business investment through the solution business | 8.0 | July 2022 to March 2026 |

Total | 15.8 | - |

5. Conclusions

As the company fortified its already-established global cutting-edge position and competitive advantage, by acquiring Artisense Corporation as a 100% subsidiary, its product pipeline has become richer. It is noteworthy that not only projects with a high possibility of commercialization, but also projects with a low or medium possibility of commercialization increased steadily from one year ago and also from half a year ago. Furthermore, the AP and SLAM of the company are core technologies in the fields of “robotics” and “metaverse,” which are expected to expand rapidly, so there will emerge pipelines in a broader range of fields. First, in addition to the one Whale Dynamic commercialization project in China that achieved commercialization this fiscal year, we expect the release of the remaining two projects that are scheduled, and we will closely monitor the status of the pipeline.

<Reference: Regarding Corporate Governance>

◎ Organizational form and compositions of directors and auditors

Organizational form | Company with audit and supervisory committee |

Directors | 8 directors, including 4 outside ones |

Auditors | - |

◎ Corporate Governance Report

Last updated on June. 24, 2022

<Basic Policy>

Our company recognizes that it is indispensable to establish corporate governance, in order to improve our corporate value, maximize the profits of shareholders, and foster good relationships with stakeholders.

Under this recognition, the Managing Directors, other Directors, and employees of our company will strive to tighten corporate governance by understanding their respective roles and developing and operating internal control systems.

<Reasons for not following the principles of the corporate governance code>

We follow all the basic principles of the corporate governance code.

| This report is not intended for soliciting or promoting investment activities or offering any advice on investment or the like, but for providing information only. The information included in this report was taken from sources considered reliable by our company. Our company will not guarantee the accuracy, integrity, or appropriateness of information or opinions in this report. Our company will not assume any responsibility for expenses, damages or the like arising out of the use of this report or information obtained from this report. All kinds of rights related to this report belong to Investment Bridge Co., Ltd. The contents, etc. of this report may be revised without notice. Please make an investment decision on your own judgment. Copyright(C) Investment Bridge Co.,Ltd. All Rights Reserved. |